Deck 14: Activity-Based Management and Performance Measurementreward

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

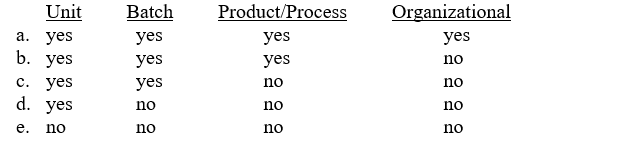

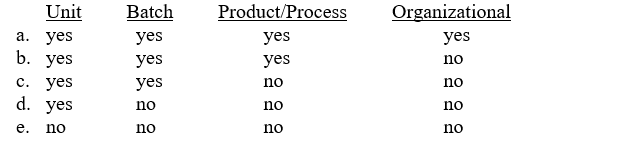

Question

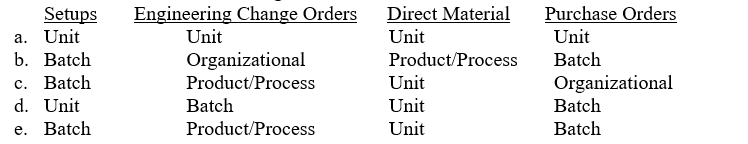

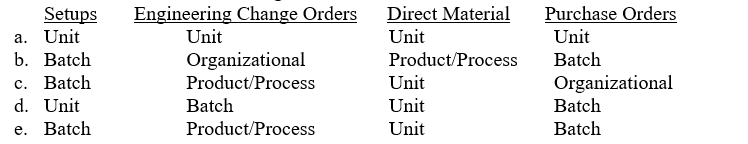

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

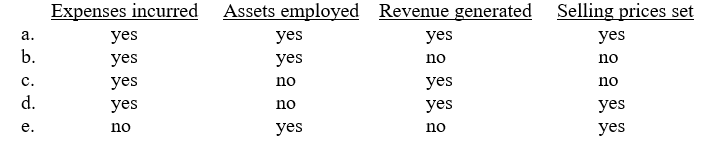

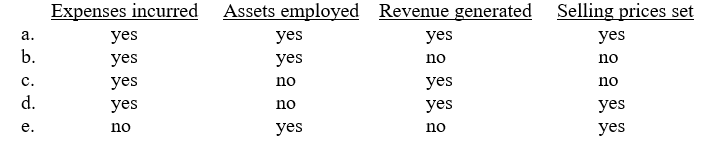

Question

Question

Question

Question

Question

Question

Question

Question

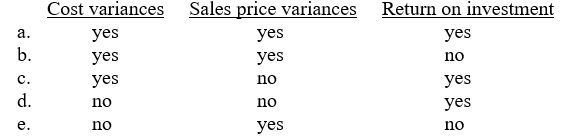

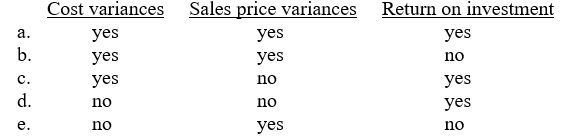

Question

Question

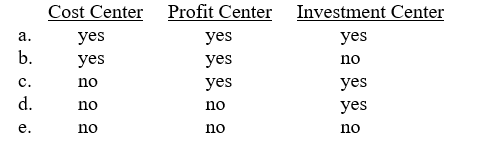

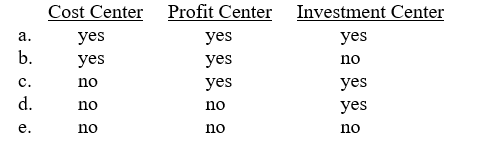

Question

Question

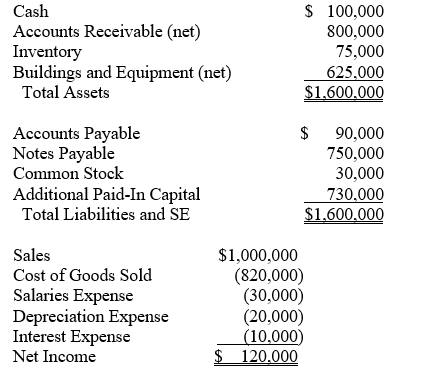

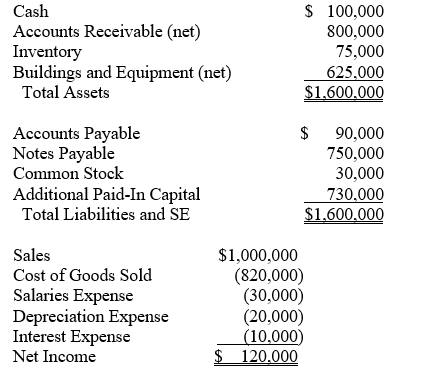

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/114

Play

Full screen (f)

Deck 14: Activity-Based Management and Performance Measurementreward

1

Identifying valued-added and non-value-added business activities is a key part of

A) budgeting.

B) activity-based management.

C) strategic management.

D) productions and operations management.

E) activity-based costing.

A) budgeting.

B) activity-based management.

C) strategic management.

D) productions and operations management.

E) activity-based costing.

activity-based management.

2

Activity-based management

A) helps in identifying key value creating activities and related costs.

B) is important in all organizations.

C) is not really needed if there is a good budgeting system in place.

D) assists in reengineering business operations.

E) both a and d

A) helps in identifying key value creating activities and related costs.

B) is important in all organizations.

C) is not really needed if there is a good budgeting system in place.

D) assists in reengineering business operations.

E) both a and d

both a and d

3

When traditional means of allocating overhead do not generate reasonable products or services cost, companies can use

A) budgeting.

B) activity-based management.

C) strategic management.

D) productions and operations management.

E) activity-based costing.

A) budgeting.

B) activity-based management.

C) strategic management.

D) productions and operations management.

E) activity-based costing.

activity-based costing.

4

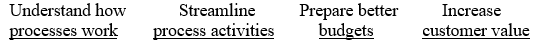

The goal of activity-based management is to

?

A)

B)

C)

D)

E)

?

A)

B)

C)

D)

E)

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

5

Any repetitive function performed to fulfill a business function is called a(an)

A) value-added activity.

B) profit center.

C) activity.

D) cost center.

E) non-value added activity.

A) value-added activity.

B) profit center.

C) activity.

D) cost center.

E) non-value added activity.

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

6

A process map is a visual representation of

A) the value-added steps and average times in completing a process.

B) the non-value-added steps and average times in completing a process.

C) the value-added and the business-value-added steps and average times in completing a process.

D) all the steps and times in completing a process.

E) the flow of a production unit through the manufacturing plant.

A) the value-added steps and average times in completing a process.

B) the non-value-added steps and average times in completing a process.

C) the value-added and the business-value-added steps and average times in completing a process.

D) all the steps and times in completing a process.

E) the flow of a production unit through the manufacturing plant.

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

7

For an activity to be value-added,

A) it must be performed for every transaction.

B) customers must be willing to pay for it.

C) it must make the organization function more effectively.

D) managers must measure and reward it.

E) all of the above.

A) it must be performed for every transaction.

B) customers must be willing to pay for it.

C) it must make the organization function more effectively.

D) managers must measure and reward it.

E) all of the above.

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

8

Activities that are considered a key part of an organization's business but for which consumers are not willing to pay are called

A) negative cost drivers.

B) value-added activities.

C) non-value-added activities.

D) business value-added activities.

E) business non-value-added activities.

A) negative cost drivers.

B) value-added activities.

C) non-value-added activities.

D) business value-added activities.

E) business non-value-added activities.

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

9

During holiday periods, Consolidated Department Store wraps numerous small gifts and stocks them for sale. From the customers' perspective, the gift wrapping is a(an)

A) value-added activity.

B) unnecessary activity.

C) business-value-added-activity.

D) cost driver.

E) non-value added activity.

A) value-added activity.

B) unnecessary activity.

C) business-value-added-activity.

D) cost driver.

E) non-value added activity.

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

10

Hildebrand's Inc. posts a security guard to check receipts for purchases as customers leave the store. From the customers' perspective, this activity

A) is value-added.

B) is non-value added.

C) creates a standard cost.

D) indicates that the store is an investment center.

E) is necessary so that Hildebrand can prepare a process map.

A) is value-added.

B) is non-value added.

C) creates a standard cost.

D) indicates that the store is an investment center.

E) is necessary so that Hildebrand can prepare a process map.

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

11

The process of invoicing customers for amounts owed is a

A) value-added activity.

B) performance measurement activity.

C) non-value added activity.

D) business-value-added activity.

E) both c and d.

A) value-added activity.

B) performance measurement activity.

C) non-value added activity.

D) business-value-added activity.

E) both c and d.

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

12

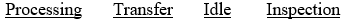

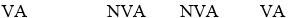

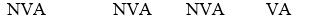

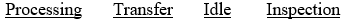

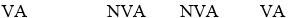

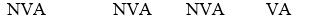

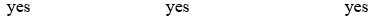

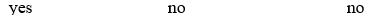

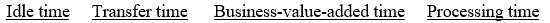

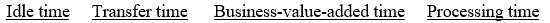

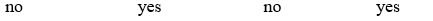

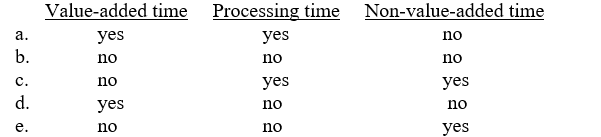

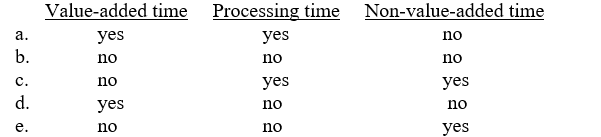

The time spent in an organization can be classified in one of four ways. Which types of time are generally classified as value-added (VA) and which are generally classified as non-value-added (NVA)?

A)

B)

C)

D)

E)

A)

B)

C)

D)

E)

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

13

It takes ten minutes for Robbin Co. to assemble one ceiling fan in its production facility. This time is

A)

B)

C)

D)

E)

A)

B)

C)

D)

E)

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

14

The time it takes Giang Corp. to move raw material from its storage facility to its production facility is

A)

B)

C)

D)

E)

A)

B)

C)

D)

E)

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

15

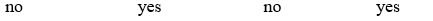

Because Atkinson Corp. did not receive the raw material it ordered on a timely basis, management was forced to close its production facility for one week. This time is Idle time Non-value-added time Business-value-added time

A) yes no no

B) No no no

C) yes yes yes

D) no yes yes

E) Yes yes no

A) yes no no

B) No no no

C) yes yes yes

D) no yes yes

E) Yes yes no

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

16

An employee at the North Carolina Recliner Company checks each recliner for product defects. This time is

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

17

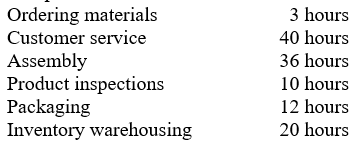

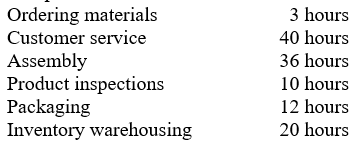

Zama Inc. manufactures shampoo. The following activities are performed weekly as a part of operations:

In a week, how many hours are spent on each of the following types of activities?

Value-added activities Non-value-added activities

A) 12 hours 109 hours

B) 48 hours 73 hours

C) 51 hours 70 hours

D) 58 hours 63 hours

E) 88 hours 33 hours

In a week, how many hours are spent on each of the following types of activities?

Value-added activities Non-value-added activities

A) 12 hours 109 hours

B) 48 hours 73 hours

C) 51 hours 70 hours

D) 58 hours 63 hours

E) 88 hours 33 hours

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

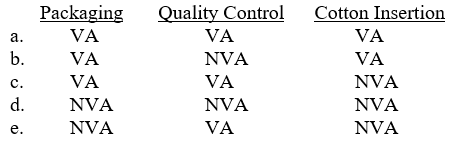

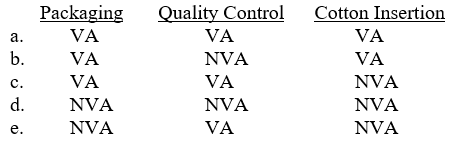

18

Lehigh Pharmaceuticals packages one of its products in tamper-proof containers and performs quality control inspections on the product. Prior to sealing, Lehigh inserts cotton in the containers. For Lehigh, would these activities generally be classified as value-added (VA) or non-value-added (NVA)?

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

19

Which of the following would not be a cost driver for workers' compensation insurance?

A) Number of accidents in previous years

B) Quality of health, safety, and environmental training programs

C) Employees' years of experience

D) Amount of required overtime hours for a twelve-month period

E) Employees' marital status

A) Number of accidents in previous years

B) Quality of health, safety, and environmental training programs

C) Employees' years of experience

D) Amount of required overtime hours for a twelve-month period

E) Employees' marital status

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

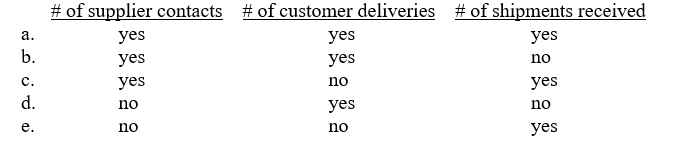

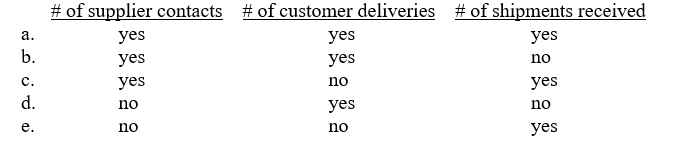

20

Cost drivers for the purchasing activity would usually include which of the following?

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

21

Traditionally, cost drivers were viewed only at the

A) unit level.

B) batch level.

C) product/process level.

D) organizational level.

E) activity level.

A) unit level.

B) batch level.

C) product/process level.

D) organizational level.

E) activity level.

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

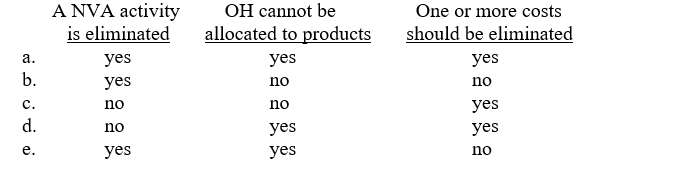

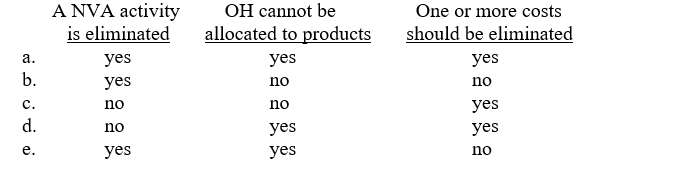

22

If a cost driver is eliminated,

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

23

Theoretically, which of the following levels of costs should be used to assign costs to products?

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

24

How would each of the following costs be classified?

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

25

Building depreciation is an example of a(a)

A) unit level cost.

B) batch level cost.

C) product/process level cost.

D) organizational level cost.

E) activity level cost.

A) unit level cost.

B) batch level cost.

C) product/process level cost.

D) organizational level cost.

E) activity level cost.

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

26

DeMaris Corp. must calibrate its equipment before each production run. Each calibration costs $3,000. During 2010, DeMaris calibrated its equipment six times and produced 720,000 units of product: 120,000 of Product X in two production runs and 600,000 units of Product Y in four production runs. The calibration cost per unit for X and Y is

Product X Product Y

A) $0.050 $0.020

B) $0.020 $0.050

C) $0.025 $0.025

D) $0.025 $0.005

E) $0.005 $0.025

Product X Product Y

A) $0.050 $0.020

B) $0.020 $0.050

C) $0.025 $0.025

D) $0.025 $0.005

E) $0.005 $0.025

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

27

An overhead allocation method that collects costs by cost driver categories and attaches those costs to products using multiple cost drivers is called

A) budgeting.

B) activity-based management.

C) strategic management.

D) value-added accounting.

E) activity-based costing.

A) budgeting.

B) activity-based management.

C) strategic management.

D) value-added accounting.

E) activity-based costing.

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

28

Activity-based costing

A) is often used in companies with highly automated processes.

B) accumulates and classifies overhead costs based on the underlying cost behavior.

C) is often used by companies producing heterogeneous products in large quantities.

D) indicates that low-volume, specialty items are usually more costly than high-volume, easy to produce items.

E) all of the above

A) is often used in companies with highly automated processes.

B) accumulates and classifies overhead costs based on the underlying cost behavior.

C) is often used by companies producing heterogeneous products in large quantities.

D) indicates that low-volume, specialty items are usually more costly than high-volume, easy to produce items.

E) all of the above

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

29

Activity-based costing would be most useful in a company that

A) manufactures standardized products, such as bricks.

B) has recently implemented a responsibility accounting system.

C) makes many kinds of products in significantly different volumes.

D) is showing profits for high-volume, easy-to-make products.

E) has relatively low overhead costs.

A) manufactures standardized products, such as bricks.

B) has recently implemented a responsibility accounting system.

C) makes many kinds of products in significantly different volumes.

D) is showing profits for high-volume, easy-to-make products.

E) has relatively low overhead costs.

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

30

Use the following information to answer questions

Donnelly Corp. manufactures two products. The company's budgeted total overhead for 2011 is $350,000; of this amount, $276,000 relates to utilities and depreciation on automated equipment. In 2011, Donnelly expects to produce 200,000 of X and 300,000 units of Y. It takes 3.0 and 1.5 direct labor hours to produce one unit of X and Y, respectively. However, relative to the automated equipment, Product X requires 10 minutes per unit and Product Y requires 1 minute per unit. Product X and Y have unit contribution margins of $5 and $4, respectively.

-If overhead is applied on a direct labor hour basis, what is Donnelly's predetermined overhead rate for 2011 (rounded to the nearest cent)?

A) $0.15 per DLH

B) $0.33 per DLH

C) $0.26 per DLH

D) $0.55 per DLH

E) $0.70 per DLH

Donnelly Corp. manufactures two products. The company's budgeted total overhead for 2011 is $350,000; of this amount, $276,000 relates to utilities and depreciation on automated equipment. In 2011, Donnelly expects to produce 200,000 of X and 300,000 units of Y. It takes 3.0 and 1.5 direct labor hours to produce one unit of X and Y, respectively. However, relative to the automated equipment, Product X requires 10 minutes per unit and Product Y requires 1 minute per unit. Product X and Y have unit contribution margins of $5 and $4, respectively.

-If overhead is applied on a direct labor hour basis, what is Donnelly's predetermined overhead rate for 2011 (rounded to the nearest cent)?

A) $0.15 per DLH

B) $0.33 per DLH

C) $0.26 per DLH

D) $0.55 per DLH

E) $0.70 per DLH

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

31

Use the following information to answer questions

Donnelly Corp. manufactures two products. The company's budgeted total overhead for 2011 is $350,000; of this amount, $276,000 relates to utilities and depreciation on automated equipment. In 2011, Donnelly expects to produce 200,000 of X and 300,000 units of Y. It takes 3.0 and 1.5 direct labor hours to produce one unit of X and Y, respectively. However, relative to the automated equipment, Product X requires 10 minutes per unit and Product Y requires 1 minute per unit. Product X and Y have unit contribution margins of $5 and $4, respectively.

-If Donnelly decided to assign the automation-related overhead costs to products based on production time, what would be the automation overhead cost per unit for Product X and Product Y?

Product X Product Y

A) $0.15 $0.15

B) $0.45 $0.15

C) $0.55 $0.55

D) $0.79 $0.26

E) $1.20 $0.12

Donnelly Corp. manufactures two products. The company's budgeted total overhead for 2011 is $350,000; of this amount, $276,000 relates to utilities and depreciation on automated equipment. In 2011, Donnelly expects to produce 200,000 of X and 300,000 units of Y. It takes 3.0 and 1.5 direct labor hours to produce one unit of X and Y, respectively. However, relative to the automated equipment, Product X requires 10 minutes per unit and Product Y requires 1 minute per unit. Product X and Y have unit contribution margins of $5 and $4, respectively.

-If Donnelly decided to assign the automation-related overhead costs to products based on production time, what would be the automation overhead cost per unit for Product X and Product Y?

Product X Product Y

A) $0.15 $0.15

B) $0.45 $0.15

C) $0.55 $0.55

D) $0.79 $0.26

E) $1.20 $0.12

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

32

Use the following information to answer questions

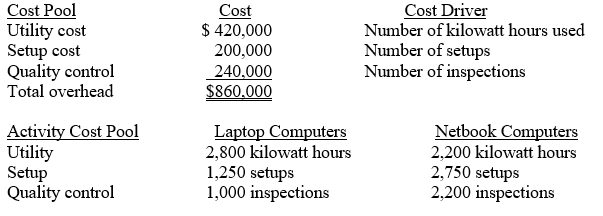

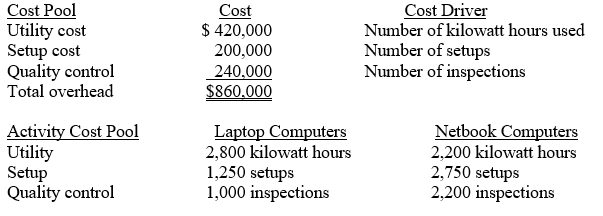

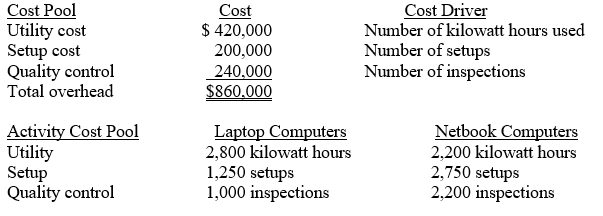

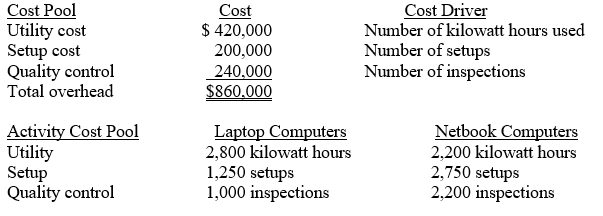

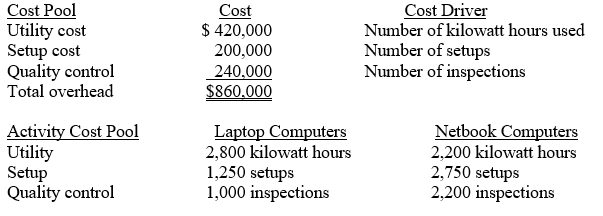

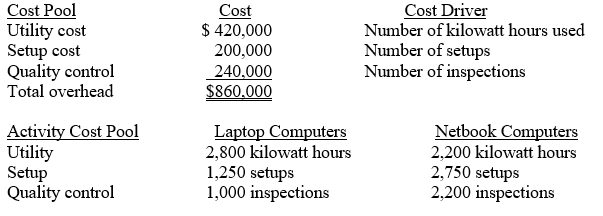

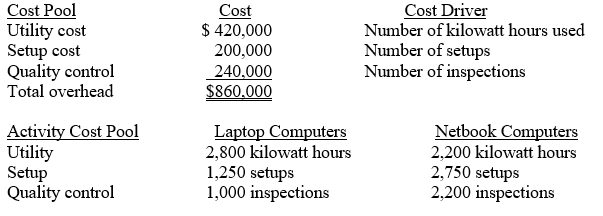

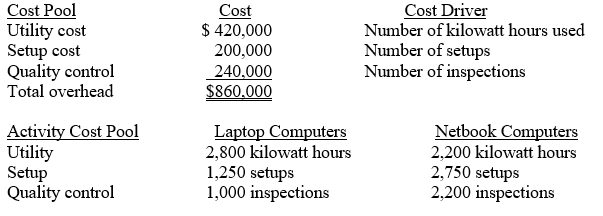

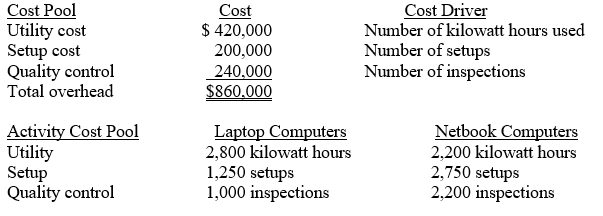

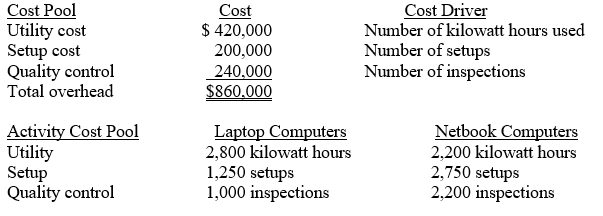

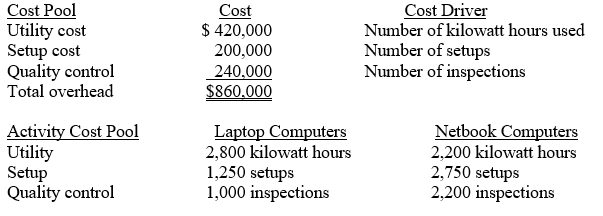

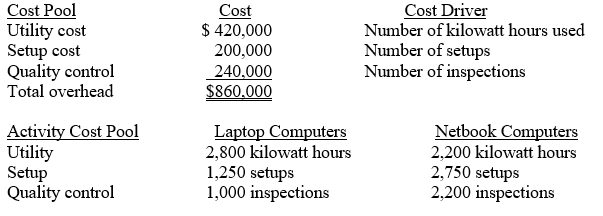

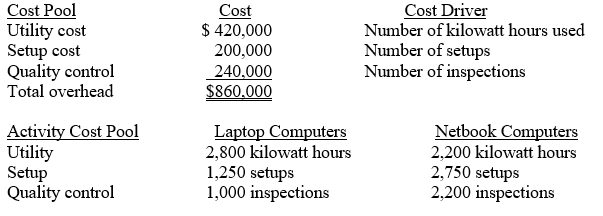

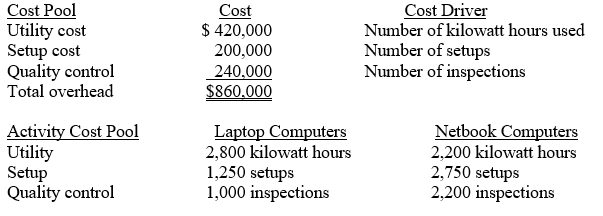

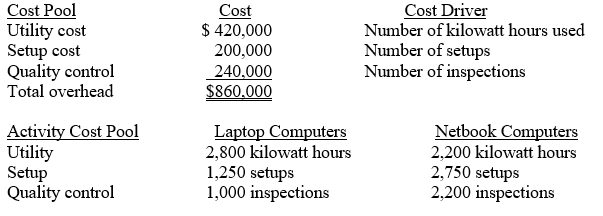

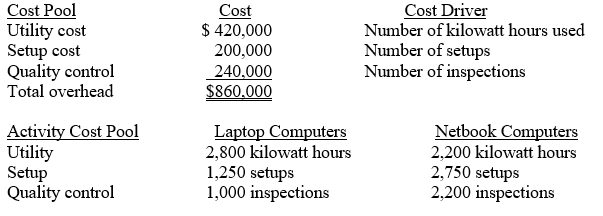

Rather Corp. produces two types of computers: laptops and netbooks. Overhead cost pools and activity information for the year are as follows:

-Assume overhead is assigned using direct labor hours (DLHs). DLHs for laptop and netbook computers were, respectively, 11,450 DLHs and 10,050 DLHs. What amount of overhead cost assigned to laptop computers?

A) $113,000

B) $175,000

C) $225,000

D) $402,000

E) $458,000

Rather Corp. produces two types of computers: laptops and netbooks. Overhead cost pools and activity information for the year are as follows:

-Assume overhead is assigned using direct labor hours (DLHs). DLHs for laptop and netbook computers were, respectively, 11,450 DLHs and 10,050 DLHs. What amount of overhead cost assigned to laptop computers?

A) $113,000

B) $175,000

C) $225,000

D) $402,000

E) $458,000

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

33

Use the following information to answer questions

Rather Corp. produces two types of computers: laptops and netbooks. Overhead cost pools and activity information for the year are as follows:

-Assume overhead is assigned using direct labor hours (DLHs). DLHs for laptop and netbook computers were, respectively, 11,450 DLHs and 10,050 DLHs. What amount of overhead cost assigned to netbook computers?

A) $113,000

B) $175,000

C) $225,000

D) $402,000

E) $458,000

Rather Corp. produces two types of computers: laptops and netbooks. Overhead cost pools and activity information for the year are as follows:

-Assume overhead is assigned using direct labor hours (DLHs). DLHs for laptop and netbook computers were, respectively, 11,450 DLHs and 10,050 DLHs. What amount of overhead cost assigned to netbook computers?

A) $113,000

B) $175,000

C) $225,000

D) $402,000

E) $458,000

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

34

Use the following information to answer questions

Rather Corp. produces two types of computers: laptops and netbooks. Overhead cost pools and activity information for the year are as follows:

-Assume that activity-based costing is used to assign overhead costs to computers. What amount of utility cost would be assigned to laptop computers?

A) $184,800

B) $196,326

C) $223,674

D) $235,200

E) none of the above

Rather Corp. produces two types of computers: laptops and netbooks. Overhead cost pools and activity information for the year are as follows:

-Assume that activity-based costing is used to assign overhead costs to computers. What amount of utility cost would be assigned to laptop computers?

A) $184,800

B) $196,326

C) $223,674

D) $235,200

E) none of the above

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

35

Use the following information to answer questions

Rather Corp. produces two types of computers: laptops and netbooks. Overhead cost pools and activity information for the year are as follows:

-Assume that activity-based costing is used to assign overhead costs to computers. What amount of utility cost would be assigned to netbook computers?

A) $184,800

B) $196,326

C) $223,674

D) $235,200

E) none of the above

Rather Corp. produces two types of computers: laptops and netbooks. Overhead cost pools and activity information for the year are as follows:

-Assume that activity-based costing is used to assign overhead costs to computers. What amount of utility cost would be assigned to netbook computers?

A) $184,800

B) $196,326

C) $223,674

D) $235,200

E) none of the above

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

36

Use the following information to answer questions

Rather Corp. produces two types of computers: laptops and netbooks. Overhead cost pools and activity information for the year are as follows:

-Assume that activity-based costing is used to assign overhead costs to computers. What amount of setup cost would be assigned to laptop computers if twice as many laptops were made as netbooks?

A) $ 62,500

B) $ 66.667

C) $133,333

D) $137,500

E) none of the above

Rather Corp. produces two types of computers: laptops and netbooks. Overhead cost pools and activity information for the year are as follows:

-Assume that activity-based costing is used to assign overhead costs to computers. What amount of setup cost would be assigned to laptop computers if twice as many laptops were made as netbooks?

A) $ 62,500

B) $ 66.667

C) $133,333

D) $137,500

E) none of the above

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

37

Use the following information to answer questions

Rather Corp. produces two types of computers: laptops and netbooks. Overhead cost pools and activity information for the year are as follows:

-Assume that activity-based costing is used to assign overhead costs to computers. What amount of setup cost would be assigned to laptop computers if twice as many laptops were made as netbooks?

A) $ 62,500

B) $ 66.667

C) $133,333

D) $137,500

E) none of the above

Rather Corp. produces two types of computers: laptops and netbooks. Overhead cost pools and activity information for the year are as follows:

-Assume that activity-based costing is used to assign overhead costs to computers. What amount of setup cost would be assigned to laptop computers if twice as many laptops were made as netbooks?

A) $ 62,500

B) $ 66.667

C) $133,333

D) $137,500

E) none of the above

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

38

Use the following information to answer questions

Rather Corp. produces two types of computers: laptops and netbooks. Overhead cost pools and activity information for the year are as follows:

-Assume that activity-based costing is used to assign overhead costs to computers. What amount of quality control cost would be assigned to laptop computers if laptops generally have one-fourth as many defects as netbooks?

A) $ 48,000

B) $ 75,000

C) $165,000

D) $192,000

E) none of the above

Rather Corp. produces two types of computers: laptops and netbooks. Overhead cost pools and activity information for the year are as follows:

-Assume that activity-based costing is used to assign overhead costs to computers. What amount of quality control cost would be assigned to laptop computers if laptops generally have one-fourth as many defects as netbooks?

A) $ 48,000

B) $ 75,000

C) $165,000

D) $192,000

E) none of the above

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

39

Use the following information to answer questions

Rather Corp. produces two types of computers: laptops and netbooks. Overhead cost pools and activity information for the year are as follows:

-Assume that activity-based costing is used to assign overhead costs to computers. What amount of setup cost would be assigned to netbook computers if laptops generally have one-fourth as many defects as netbooks?

A) $ 48,000

B) $ 75,000

C) $165,000

D) $192,000

E) none of the above

Rather Corp. produces two types of computers: laptops and netbooks. Overhead cost pools and activity information for the year are as follows:

-Assume that activity-based costing is used to assign overhead costs to computers. What amount of setup cost would be assigned to netbook computers if laptops generally have one-fourth as many defects as netbooks?

A) $ 48,000

B) $ 75,000

C) $165,000

D) $192,000

E) none of the above

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

40

Use the following information to answer questions

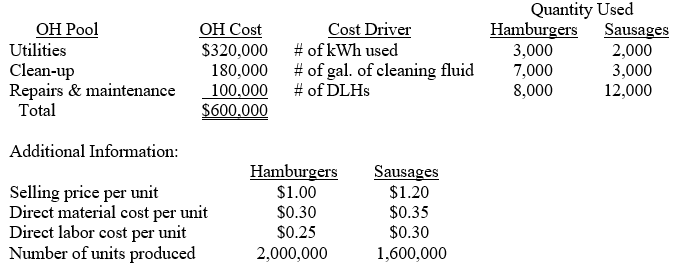

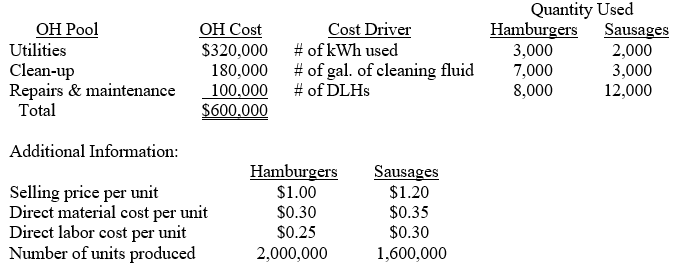

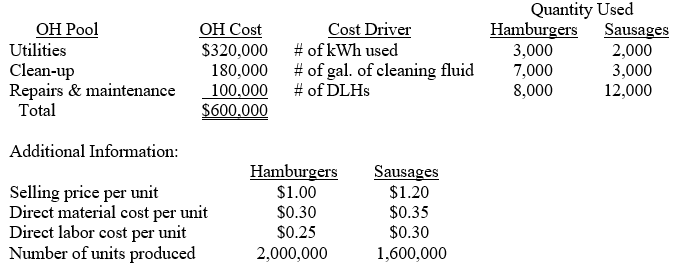

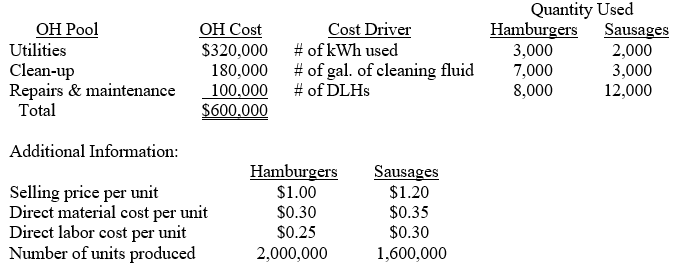

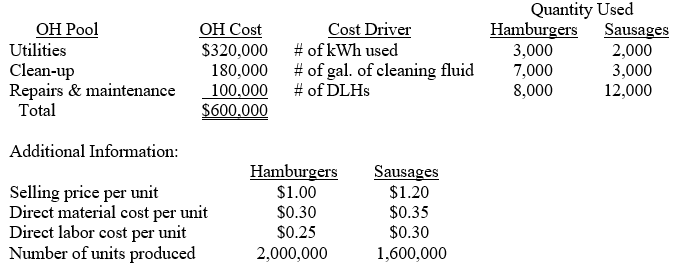

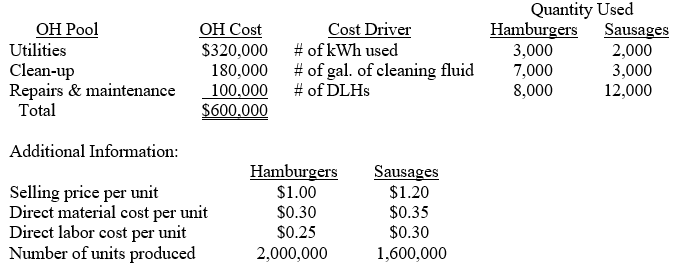

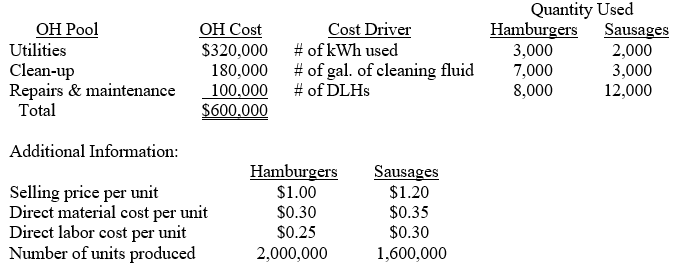

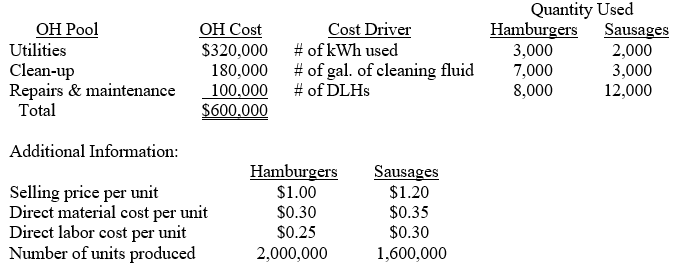

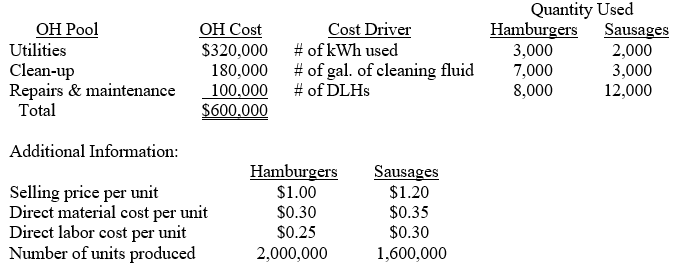

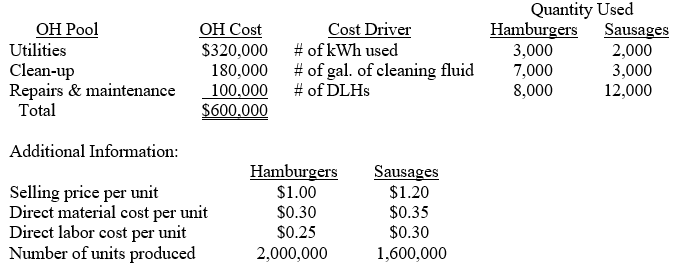

Woller Meat Packing produces frozen hamburgers and sausages. During 2010, the company incurred $600,000 of overhead. Overhead costs and their related cost drivers are as follows:

-If Woller uses direct labor hours to assign overhead to products, how much overhead will be assigned to each product (rounded to the nearest cent)?

Hamburgers Sausages

A) $0.12 $0.23

B) $0.17 $0.17

C) $0.25 $0.30

D) $0.30 $0.38

E) $0.55 $0.65

Woller Meat Packing produces frozen hamburgers and sausages. During 2010, the company incurred $600,000 of overhead. Overhead costs and their related cost drivers are as follows:

-If Woller uses direct labor hours to assign overhead to products, how much overhead will be assigned to each product (rounded to the nearest cent)?

Hamburgers Sausages

A) $0.12 $0.23

B) $0.17 $0.17

C) $0.25 $0.30

D) $0.30 $0.38

E) $0.55 $0.65

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

41

Use the following information to answer questions

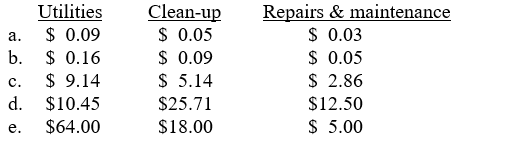

Woller Meat Packing produces frozen hamburgers and sausages. During 2010, the company incurred $600,000 of overhead. Overhead costs and their related cost drivers are as follows:

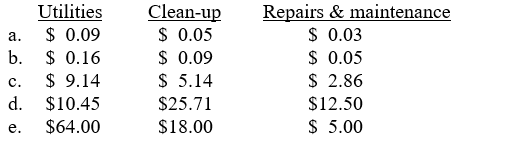

-If Woller uses activity-based costing, what are the overhead rates for each type of overhead cost?

Woller Meat Packing produces frozen hamburgers and sausages. During 2010, the company incurred $600,000 of overhead. Overhead costs and their related cost drivers are as follows:

-If Woller uses activity-based costing, what are the overhead rates for each type of overhead cost?

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

42

Use the following information to answer questions

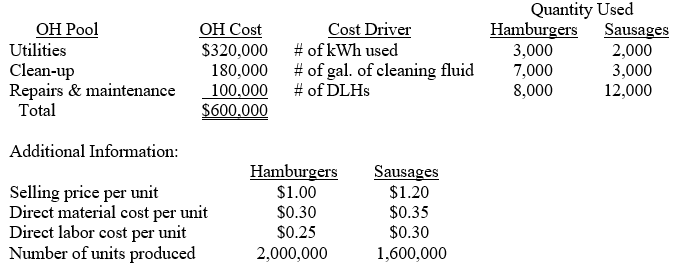

Woller Meat Packing produces frozen hamburgers and sausages. During 2010, the company incurred $600,000 of overhead. Overhead costs and their related cost drivers are as follows:

-If Woller uses activity-based costing, how much total overhead should be assigned to hamburgers?

A) $126,000

B) $128,000

C) $198,000

D) $242,000

E) $358,000

Woller Meat Packing produces frozen hamburgers and sausages. During 2010, the company incurred $600,000 of overhead. Overhead costs and their related cost drivers are as follows:

-If Woller uses activity-based costing, how much total overhead should be assigned to hamburgers?

A) $126,000

B) $128,000

C) $198,000

D) $242,000

E) $358,000

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

43

Use the following information to answer questions

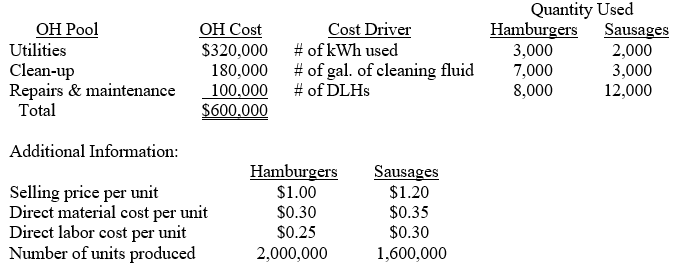

Woller Meat Packing produces frozen hamburgers and sausages. During 2010, the company incurred $600,000 of overhead. Overhead costs and their related cost drivers are as follows:

-If Woller uses activity-based costing, how much total overhead should be assigned to sausages?

A) $126,000

B) $128,000

C) $198,000

D) $242,000

E) $358,000

Woller Meat Packing produces frozen hamburgers and sausages. During 2010, the company incurred $600,000 of overhead. Overhead costs and their related cost drivers are as follows:

-If Woller uses activity-based costing, how much total overhead should be assigned to sausages?

A) $126,000

B) $128,000

C) $198,000

D) $242,000

E) $358,000

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

44

Use the following information to answer questions

Woller Meat Packing produces frozen hamburgers and sausages. During 2010, the company incurred $600,000 of overhead. Overhead costs and their related cost drivers are as follows:

-If Woller uses activity-based costing, what is the per-unit profit margin for hamburgers (round to the nearest cent)?

A) $0.27

B) $0.39

C) $0.45

D) $0.82

E) $1.04

Woller Meat Packing produces frozen hamburgers and sausages. During 2010, the company incurred $600,000 of overhead. Overhead costs and their related cost drivers are as follows:

-If Woller uses activity-based costing, what is the per-unit profit margin for hamburgers (round to the nearest cent)?

A) $0.27

B) $0.39

C) $0.45

D) $0.82

E) $1.04

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

45

Use the following information to answer questions

Woller Meat Packing produces frozen hamburgers and sausages. During 2010, the company incurred $600,000 of overhead. Overhead costs and their related cost drivers are as follows:

-If Woller uses activity-based costing, what is the per-unit profit margin for sausages (round to the nearest cent)?

A) $0.27

B) $0.40

C) $0.45

D) $0.82

E) $1.04

Woller Meat Packing produces frozen hamburgers and sausages. During 2010, the company incurred $600,000 of overhead. Overhead costs and their related cost drivers are as follows:

-If Woller uses activity-based costing, what is the per-unit profit margin for sausages (round to the nearest cent)?

A) $0.27

B) $0.40

C) $0.45

D) $0.82

E) $1.04

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

46

Activity-based costing

A) reduces overhead costs.

B) provides more accurate product costs.

C) streamlines production activities.

D) increases profit margin per unit.

E) all of the above.

A) reduces overhead costs.

B) provides more accurate product costs.

C) streamlines production activities.

D) increases profit margin per unit.

E) all of the above.

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

47

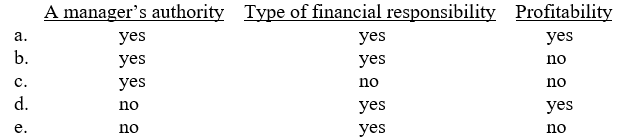

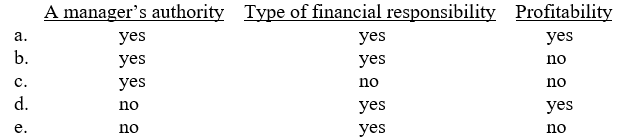

Responsibility centers are classified based on

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

48

In determining performance in a cost center, actual costs incurred should be compared to

A) budgeted costs at the budgeted level of activity.

B) budgeted costs at the actual level of activity.

C) standard costs at the budgeted level of activity.

D) allocated costs at the actual level of activity.

E) none of the above.

A) budgeted costs at the budgeted level of activity.

B) budgeted costs at the actual level of activity.

C) standard costs at the budgeted level of activity.

D) allocated costs at the actual level of activity.

E) none of the above.

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

49

Wilson's Catering budgeted total variable costs of $19,800 for six people working 40 hours per week over a five-week period. At the end of the five weeks, Wilson's had incurred $21,000 of actual expenses and employees had worked 1,300 hours. In determining performance in controlling costs for the period, the company was

A) $450 under budget.

B) $450 over budget.

C) $1,200 under budget.

D) $1,200 over budget.

E) none of the above.

A) $450 under budget.

B) $450 over budget.

C) $1,200 under budget.

D) $1,200 over budget.

E) none of the above.

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

50

In a profit center, managers have control over

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

51

Use the following information to answer questions

Dexter PC estimates sales of 20,000 tool kits at $35 per tool kit in June. During June, 15,000 tool kits were sold for total revenue of $705,000.

-What is the sales price variance?

A) $5,000 favorable

B) $5,000 unfavorable

C) $180,000 favorable

D) $180,000 unfavorable

E) cannot be determined because the selling price per unit is not known

Dexter PC estimates sales of 20,000 tool kits at $35 per tool kit in June. During June, 15,000 tool kits were sold for total revenue of $705,000.

-What is the sales price variance?

A) $5,000 favorable

B) $5,000 unfavorable

C) $180,000 favorable

D) $180,000 unfavorable

E) cannot be determined because the selling price per unit is not known

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

52

Use the following information to answer questions

Dexter PC estimates sales of 20,000 tool kits at $35 per tool kit in June. During June, 15,000 tool kits were sold for total revenue of $705,000.

-What is the sales volume variance?

A) $175,000 favorable

B) $175,000 unfavorable

C) $180,000 favorable

D) $180,000 unfavorable

E) none of the above

Dexter PC estimates sales of 20,000 tool kits at $35 per tool kit in June. During June, 15,000 tool kits were sold for total revenue of $705,000.

-What is the sales volume variance?

A) $175,000 favorable

B) $175,000 unfavorable

C) $180,000 favorable

D) $180,000 unfavorable

E) none of the above

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

53

Use the following information to answer questions

Faust Corporation manufactures cleaning fluid. During 2010, Faust's salespeople sold 1,700,000 bottles of cleaning fluid at $1.80 per bottle. Faust budgeted that salespeople would sell 1,600,000 bottles of cleaning fluid at $1.90 per bottle.

-What is Faust's sales price variance?

A) $ 20,000 favorable

B) $170,000 favorable

C) $170,000 unfavorable

D) $190,000 favorable

E) $190,000 unfavorable

Faust Corporation manufactures cleaning fluid. During 2010, Faust's salespeople sold 1,700,000 bottles of cleaning fluid at $1.80 per bottle. Faust budgeted that salespeople would sell 1,600,000 bottles of cleaning fluid at $1.90 per bottle.

-What is Faust's sales price variance?

A) $ 20,000 favorable

B) $170,000 favorable

C) $170,000 unfavorable

D) $190,000 favorable

E) $190,000 unfavorable

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

54

Use the following information to answer questions

Faust Corporation manufactures cleaning fluid. During 2010, Faust's salespeople sold 1,700,000 bottles of cleaning fluid at $1.80 per bottle. Faust budgeted that salespeople would sell 1,600,000 bottles of cleaning fluid at $1.90 per bottle.

-What is Faust's sales volume variance?

A) $ 20,000 favorable

B) $ 20,000 unfavorable

C) $170,000 favorable

D) $190,000 favorable

E) $190,000 unfavorable

Faust Corporation manufactures cleaning fluid. During 2010, Faust's salespeople sold 1,700,000 bottles of cleaning fluid at $1.80 per bottle. Faust budgeted that salespeople would sell 1,600,000 bottles of cleaning fluid at $1.90 per bottle.

-What is Faust's sales volume variance?

A) $ 20,000 favorable

B) $ 20,000 unfavorable

C) $170,000 favorable

D) $190,000 favorable

E) $190,000 unfavorable

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

55

An investment center manager's performance can be evaluated on the basis of

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

56

Return on investment is calculated as

A) sales divided by total assets.

B) sales divided by stockholders' equity.

C) income divided by assets.

D) income divided by stockholders' equity.

E) (income plus interest) divided by net assets.

A) sales divided by total assets.

B) sales divided by stockholders' equity.

C) income divided by assets.

D) income divided by stockholders' equity.

E) (income plus interest) divided by net assets.

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

57

The Du Pont model can be used to measure performance in which of the following types of responsibility center?

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

58

The formula for the Du Pont model is

A) (income ÷ assets) x (income ÷ sales).

B) (income ÷ revenues) x (revenues ÷ assets).

C) (income ÷ revenues) x (revenues ÷ stockholders' equity).

D) (revenues ÷ income) x (income ÷ assets).

E) (income ÷ stockholders' equity) x (stockholders' equity ÷ net assets).

A) (income ÷ assets) x (income ÷ sales).

B) (income ÷ revenues) x (revenues ÷ assets).

C) (income ÷ revenues) x (revenues ÷ stockholders' equity).

D) (revenues ÷ income) x (income ÷ assets).

E) (income ÷ stockholders' equity) x (stockholders' equity ÷ net assets).

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

59

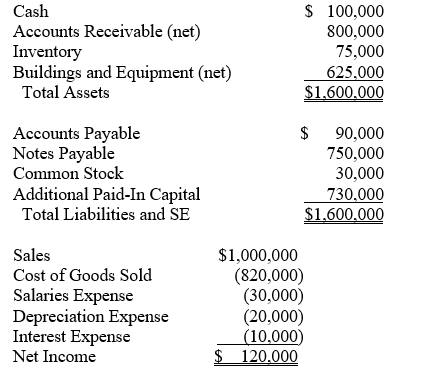

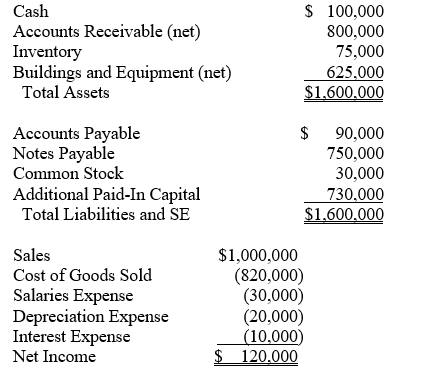

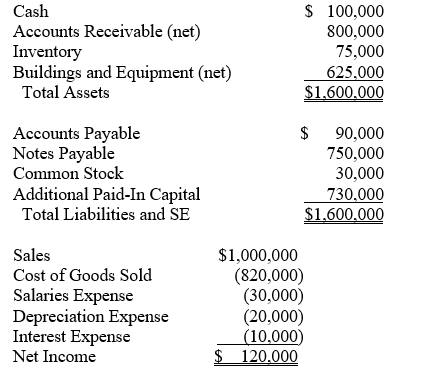

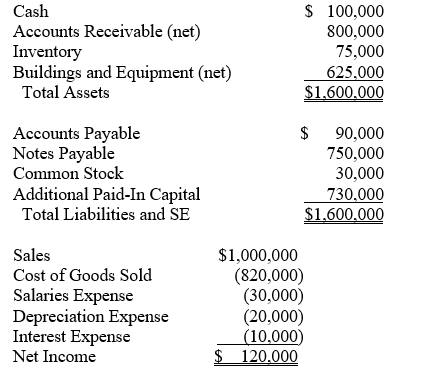

Use the following information to answer questions

Following are Greyson Corporation's 2010 year-end balance sheet and 2010 income statements.

?

-What is Greyson's 2010 profit margin?

A) 6%

B) 12%

C) 15%

D) 18%

E) 19%

Following are Greyson Corporation's 2010 year-end balance sheet and 2010 income statements.

?

-What is Greyson's 2010 profit margin?

A) 6%

B) 12%

C) 15%

D) 18%

E) 19%

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

60

Use the following information to answer questions

Following are Greyson Corporation's 2010 year-end balance sheet and 2010 income statements.

?

-What is Greyson's 2010 asset turnover ratio?

A) 12.0%

B) 19.2%

C) 62.5%

D) 120.0%

E) 160.0%

Following are Greyson Corporation's 2010 year-end balance sheet and 2010 income statements.

?

-What is Greyson's 2010 asset turnover ratio?

A) 12.0%

B) 19.2%

C) 62.5%

D) 120.0%

E) 160.0%

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

61

Use the following information to answer questions

Following are Greyson Corporation's 2010 year-end balance sheet and 2010 income statements.

?

-What is Greyson's 2010 return on investment?

A) 7.5%

B) 12.0%

C) 19.2%

D) 28.8%

E) 62.5%

Following are Greyson Corporation's 2010 year-end balance sheet and 2010 income statements.

?

-What is Greyson's 2010 return on investment?

A) 7.5%

B) 12.0%

C) 19.2%

D) 28.8%

E) 62.5%

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

62

Use the following information to answer questions

Seguin Corp. just invested $3,750,000 in new blu-ray technology. Revenues realized from the investment during the period were $3,125,000 and expenses were $2,500,000.

-What is Seguin Corp's return on investment in the blu-ray technology (round to the nearest whole percentage)?

A) 17%

B) 20%

C) 67%

D) 83%

E) 600%

Seguin Corp. just invested $3,750,000 in new blu-ray technology. Revenues realized from the investment during the period were $3,125,000 and expenses were $2,500,000.

-What is Seguin Corp's return on investment in the blu-ray technology (round to the nearest whole percentage)?

A) 17%

B) 20%

C) 67%

D) 83%

E) 600%

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

63

Use the following information to answer questions

Seguin Corp. just invested $3,750,000 in new blu-ray technology. Revenues realized from the investment during the period were $3,125,000 and expenses were $2,500,000.

-What is the profit margin for the new technology?

A) 17%

B) 20%

C) 80%

D) 125%

E) 500%

Seguin Corp. just invested $3,750,000 in new blu-ray technology. Revenues realized from the investment during the period were $3,125,000 and expenses were $2,500,000.

-What is the profit margin for the new technology?

A) 17%

B) 20%

C) 80%

D) 125%

E) 500%

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

64

Use the following information to answer questions

Seguin Corp. just invested $3,750,000 in new blu-ray technology. Revenues realized from the investment during the period were $3,125,000 and expenses were $2,500,000.

-What is the asset turnover for the new technology (round to the nearest whole percentage)?

A) 17%

B) 67%

C) 83%

D) 120%

E) 150%

Seguin Corp. just invested $3,750,000 in new blu-ray technology. Revenues realized from the investment during the period were $3,125,000 and expenses were $2,500,000.

-What is the asset turnover for the new technology (round to the nearest whole percentage)?

A) 17%

B) 67%

C) 83%

D) 120%

E) 150%

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

65

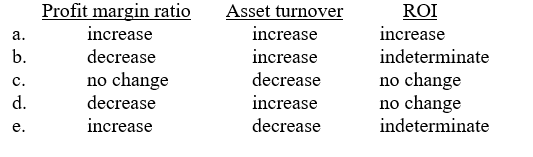

A organizational unit is evaluated on the basis of ROI. If the unit's sales and expenses both increase by $20,000, how will the following measures be affected?

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

66

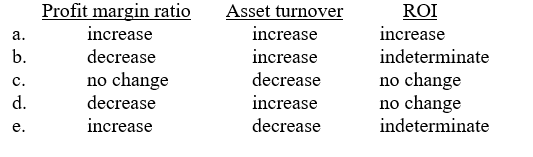

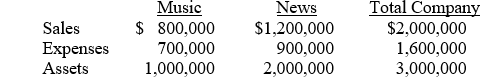

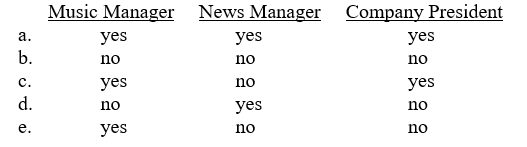

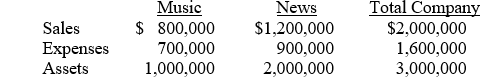

Sanchez Broadcasting is comprised of two investment centers: Music and News. Each division's performance is evaluated on the basis of return on investment. Expected operations for 2011 follow:

?

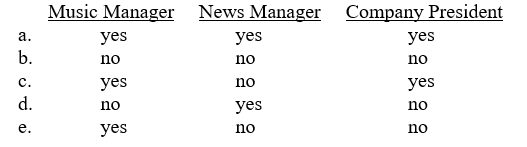

A new project costing $500,000 is being considered. It would generate $70,000 in 2011. The project is an investment that is available to both the Music and News managers. Which of the following individuals would be in favor of investing in the new project?

?

A new project costing $500,000 is being considered. It would generate $70,000 in 2011. The project is an investment that is available to both the Music and News managers. Which of the following individuals would be in favor of investing in the new project?

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

67

Balanced scorecards

A) should indicate specific measurements to assess the organization's progress only toward its long-run objectives.

B) generally include categories that focus on customers, internal processes, financial, and learning and growth.

C) focus exclusively on internal processes and do not consider customer satisfaction.

D) should contain the most statistically reliable measurements that can be developed for every category.

E) contain financial, rather than nonfinancial, measurements at lower levels of an organization.

A) should indicate specific measurements to assess the organization's progress only toward its long-run objectives.

B) generally include categories that focus on customers, internal processes, financial, and learning and growth.

C) focus exclusively on internal processes and do not consider customer satisfaction.

D) should contain the most statistically reliable measurements that can be developed for every category.

E) contain financial, rather than nonfinancial, measurements at lower levels of an organization.

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

68

A balanced scorecard

A) is only concerned about short-run, financial performance measures.

B) emphasizes the need for constant assessment of an organization's process toward its long-run goals and objectives.

C) focuses on financial, non-quantitative, and qualitative measures.

D) provides a numerical score for benchmarking purposes after each evaluation process.

E) both b and c

A) is only concerned about short-run, financial performance measures.

B) emphasizes the need for constant assessment of an organization's process toward its long-run goals and objectives.

C) focuses on financial, non-quantitative, and qualitative measures.

D) provides a numerical score for benchmarking purposes after each evaluation process.

E) both b and c

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

69

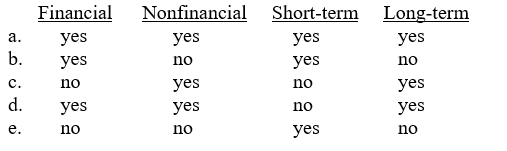

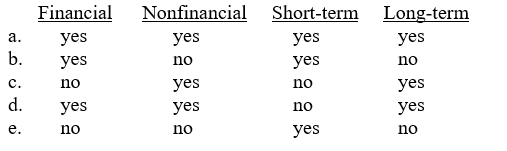

A balance scorecard will contain measures that are

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

70

Which of the following would most likely be used in evaluating the internal business processes of a manufacturing company?

A) Number of defects

B) Number of customer complaints

C) Percentage of employee retention

D) Percentage of new customers

E) all of the above

A) Number of defects

B) Number of customer complaints

C) Percentage of employee retention

D) Percentage of new customers

E) all of the above

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

71

Comparing an organization's products, processes, or services against those of organizations who have been proven "best in class" is called

A) illegal access.

B) benchmarking.

C) insider trading.

D) activity-based management.

E) strategic management.

A) illegal access.

B) benchmarking.

C) insider trading.

D) activity-based management.

E) strategic management.

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

72

An issue to consider when designing a performance reward system is that it

A) reflect performance measurements that have been used in the past.

B) be tied to individual and, if appropriate, group performance.

C) encourage only a short-term perspective about the organization.

D) focus exclusively on financial incentives.

E) focus exclusively on nonfinancial incentives.

A) reflect performance measurements that have been used in the past.

B) be tied to individual and, if appropriate, group performance.

C) encourage only a short-term perspective about the organization.

D) focus exclusively on financial incentives.

E) focus exclusively on nonfinancial incentives.

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

73

Short-term objectives

A) are typically measured with non-financial performance measures.

B) cannot be measured for cost centers.

C) are commonly measured with traditional financial performance measures.

D) focus on actions and efforts that will enhance market position and customer satisfaction.

E) are measured by comparing an organization's products against those of organizations who have been proven to be "best in class."

A) are typically measured with non-financial performance measures.

B) cannot be measured for cost centers.

C) are commonly measured with traditional financial performance measures.

D) focus on actions and efforts that will enhance market position and customer satisfaction.

E) are measured by comparing an organization's products against those of organizations who have been proven to be "best in class."

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

74

The right to buy a company's stock at a future date at a guaranteed price, such as the current market price, is a(an)

A) stock option.

B) call.

C) IRA.

D) 401(k) plan.

E) put.

A) stock option.

B) call.

C) IRA.

D) 401(k) plan.

E) put.

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

75

Over the past four years, Denise Smart was granted the right to buy 1,000 shares of her company's $20 par-value common stock at $65 per share. The price of the common stock is currently $48 per share. Smart's stock options are considered

A) worthless.

B) short-term losses.

C) underwater.

D) sunk investments.

E) none of the above.

A) worthless.

B) short-term losses.

C) underwater.

D) sunk investments.

E) none of the above.

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

76

A primary goal of activity-based management in a manufacturing company is to streamline production processes.

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

77

A process map provides information about how an activity affects various functional areas in an organization.

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

78

Value-added activities increase a product or service's worth to an organization.

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

79

Non-value-added activities are unnecessary from an organization's point of view.

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

80

Business-value-added activities provide value to the organization and its customers.

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck