Deck 18: Governmental Entities: Other Governmental Funds and Account Groups

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/31

Play

Full screen (f)

Deck 18: Governmental Entities: Other Governmental Funds and Account Groups

1

Capital projects funds of a governmental entity record the receipt and payment of cash for all the entity's plant assets other than those financed by the general fund.

False

2

Proceeds from the issuance of general obligation bonds of a governmental entity are recorded in a debt service fund.

False

3

Special assessment bonds may be issued by a governmental entity to finance construction projects prior to the collection of special assessments receivable from benefited property owners.

True

4

Bonds issued to finance a plant asset construction project of a governmental entity are recorded as a liability in a capital projects fund.

Unlock Deck

Unlock for access to all 31 flashcards in this deck.

Unlock Deck

k this deck

5

The purpose of debt service funds is to account for the accumulation of resources for the payment of principal and interest on all long-term debt of a governmental entity.

Unlock Deck

Unlock for access to all 31 flashcards in this deck.

Unlock Deck

k this deck

6

All plant assets of a governmental entity are recorded in a voluntarily maintained general capital assets account group.

Unlock Deck

Unlock for access to all 31 flashcards in this deck.

Unlock Deck

k this deck

7

Typically, a Special Assessments Receivable ledger account is included in the accounting records of a governmental entity's special revenue fund.

Unlock Deck

Unlock for access to all 31 flashcards in this deck.

Unlock Deck

k this deck

8

The Unreserved and Undesignated Fund Balance ledger account of a capital projects fund is credited for interest revenue on that fund's investments.

Unlock Deck

Unlock for access to all 31 flashcards in this deck.

Unlock Deck

k this deck

9

An Investment in General Capital Assets ledger account is debited in the journal entry to record depreciation of plant assets accounted for in a governmental entity's voluntarily maintained general capital assets account group.

Unlock Deck

Unlock for access to all 31 flashcards in this deck.

Unlock Deck

k this deck

10

A note to the financial statements of a governmental entity must be used to disclose changes in the entity's general capital assets during a fiscal year.

Unlock Deck

Unlock for access to all 31 flashcards in this deck.

Unlock Deck

k this deck

11

Special assessment bonds for which a governmental entity is obligated in some manner are disclosed only in a note to the governmental entity's financial statements.

Unlock Deck

Unlock for access to all 31 flashcards in this deck.

Unlock Deck

k this deck

12

Which of the following accounting units of a governmental entity might voluntarily use encumbrance accounting?

A) Capital projects fund

B) Debt service fund

C) General capital assets account group

D) General long-term debt account group

E) All of the foregoing

A) Capital projects fund

B) Debt service fund

C) General capital assets account group

D) General long-term debt account group

E) All of the foregoing

Unlock Deck

Unlock for access to all 31 flashcards in this deck.

Unlock Deck

k this deck

13

Part of the proceeds of a governmental entity's general obligation bonds was used to pay for the cost of a new city hall as soon as construction was completed. The remainder of the proceeds was transferred to repay the bonds. Journal entries to record these transactions are needed in:

A) The general fund and the voluntarily maintained general long-term debt account group

B) The general fund, the general long-term debt account group, and a debt service fund

C) A trust fund, a debt service fund, and the voluntarily maintained general capital assets account group

D) The general long-term debt account group, a debt service fund, the general capital assets account group, and a capital projects fund

A) The general fund and the voluntarily maintained general long-term debt account group

B) The general fund, the general long-term debt account group, and a debt service fund

C) A trust fund, a debt service fund, and the voluntarily maintained general capital assets account group

D) The general long-term debt account group, a debt service fund, the general capital assets account group, and a capital projects fund

Unlock Deck

Unlock for access to all 31 flashcards in this deck.

Unlock Deck

k this deck

14

In a governmental entity's capital projects fund, proceeds of general obligation bonds issued to finance the project are credited to:

A) Appropriations

B) Unreserved and Undesignated Fund Balance

C) Bonds Payable

D) Some other ledger account or accounts

A) Appropriations

B) Unreserved and Undesignated Fund Balance

C) Bonds Payable

D) Some other ledger account or accounts

Unlock Deck

Unlock for access to all 31 flashcards in this deck.

Unlock Deck

k this deck

15

Interest on general obligation bonds payable is recorded in a debt service fund:

A) At the end of the fiscal year if the interest due date does not coincide with the end of the fiscal year

B) When bonds are issued

C) When legally payable

D) When paid

A) At the end of the fiscal year if the interest due date does not coincide with the end of the fiscal year

B) When bonds are issued

C) When legally payable

D) When paid

Unlock Deck

Unlock for access to all 31 flashcards in this deck.

Unlock Deck

k this deck

16

Cash obtained by a governmental entity from property tax revenues was transferred for the eventual payment of principal and interest on general obligation bonds. The bonds had been issued when land had been acquired several years ago for a city park. When the cash was transferred, a journal entry was not recorded in the:

A) Debt service fund

B) General capital assets account group (voluntarily maintained)

C) General long-term debt account group (voluntarily maintained)

D) General fund

A) Debt service fund

B) General capital assets account group (voluntarily maintained)

C) General long-term debt account group (voluntarily maintained)

D) General fund

Unlock Deck

Unlock for access to all 31 flashcards in this deck.

Unlock Deck

k this deck

17

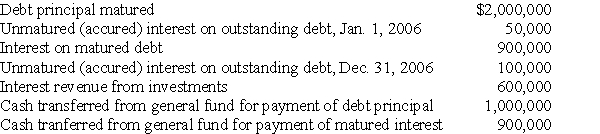

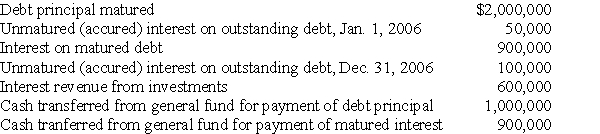

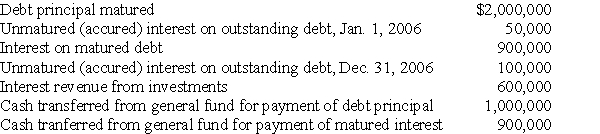

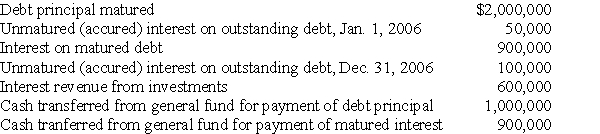

The following events relate to the City of Willow's debt service funds, which occurred during the fiscal year ended December 31, 2003:

All principal and interest amounts payable in 2006 were paid on time.

All principal and interest amounts payable in 2006 were paid on time.

-The total amount of expenditures that Willow's debt service funds recognize for the year ended December 31, 2006, is:

A) $900,000

B) $950,000

C) $2,900,000

D) $2,950,000

E) Some other amount

All principal and interest amounts payable in 2006 were paid on time.

All principal and interest amounts payable in 2006 were paid on time.-The total amount of expenditures that Willow's debt service funds recognize for the year ended December 31, 2006, is:

A) $900,000

B) $950,000

C) $2,900,000

D) $2,950,000

E) Some other amount

Unlock Deck

Unlock for access to all 31 flashcards in this deck.

Unlock Deck

k this deck

18

The following events relate to the City of Willow's debt service funds, which occurred during the fiscal year ended December 31, 2003:

All principal and interest amounts payable in 2006 were paid on time.

All principal and interest amounts payable in 2006 were paid on time.

-The total amount of revenues that Willow's debt service funds recognize for the year ended December 31, 2006, is:

A) $600,000

B) $1,600,000

C) $1,900,000

D) $2,500,000

E) Some other amount

All principal and interest amounts payable in 2006 were paid on time.

All principal and interest amounts payable in 2006 were paid on time.-The total amount of revenues that Willow's debt service funds recognize for the year ended December 31, 2006, is:

A) $600,000

B) $1,600,000

C) $1,900,000

D) $2,500,000

E) Some other amount

Unlock Deck

Unlock for access to all 31 flashcards in this deck.

Unlock Deck

k this deck

19

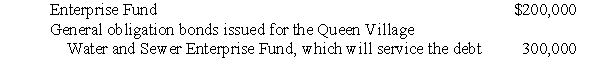

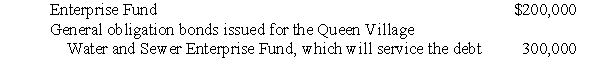

Queen Village issued the following bonds during the fiscal year ended June 30, 2006:

Revenue bonds to be repaid from admission fees collected by the Queen Village Zoo

The amount of these bonds to be accounted for in Queen Village's voluntarily maintained General Long-Term Debt Account Group is:

The amount of these bonds to be accounted for in Queen Village's voluntarily maintained General Long-Term Debt Account Group is:

A) $0

B) $200,000

C) $300,000

D) $500,000

Revenue bonds to be repaid from admission fees collected by the Queen Village Zoo

The amount of these bonds to be accounted for in Queen Village's voluntarily maintained General Long-Term Debt Account Group is:

The amount of these bonds to be accounted for in Queen Village's voluntarily maintained General Long-Term Debt Account Group is:A) $0

B) $200,000

C) $300,000

D) $500,000

Unlock Deck

Unlock for access to all 31 flashcards in this deck.

Unlock Deck

k this deck

20

On December 31, 2006, Dingle Township paid a contractor $2,000,000 for the total cost of a new fire station built in 2006 on township-owned land. Financing was by means of $1,500,000 general obligation bonds that were issued at face amount on December 31, 2006, and $500,000 transferred from the General Fund on that date.

-The amounts to be reported in Dingle Township's financial statements for the Capital Project Fund are:

A) Revenues, $1,500,000; Expenditures, $1,500,000

B) Revenues, $1,500,000; Other financing sources, $500,000; Expenditures, $2,000,000

C) Revenues, $2,000,000; Expenditures, $2,000,000

D) Other financing sources, $2,000,000; Expenditures, $2,000,000

-The amounts to be reported in Dingle Township's financial statements for the Capital Project Fund are:

A) Revenues, $1,500,000; Expenditures, $1,500,000

B) Revenues, $1,500,000; Other financing sources, $500,000; Expenditures, $2,000,000

C) Revenues, $2,000,000; Expenditures, $2,000,000

D) Other financing sources, $2,000,000; Expenditures, $2,000,000

Unlock Deck

Unlock for access to all 31 flashcards in this deck.

Unlock Deck

k this deck

21

On December 31, 2006, Dingle Township paid a contractor $2,000,000 for the total cost of a new fire station built in 2006 on township-owned land. Financing was by means of $1,500,000 general obligation bonds that were issued at face amount on December 31, 2006, and $500,000 transferred from the General Fund on that date.

-To be reported in Dingle Township's financial statements for the General Fund is (are):

A) Expenditures, $500,000

B) Other financing uses, $500,000

C) Revenues, $1,500,000; Expenditures, $2,000,000

D) Revenues, $1,500,000; Other financing uses, $2,000,000

-To be reported in Dingle Township's financial statements for the General Fund is (are):

A) Expenditures, $500,000

B) Other financing uses, $500,000

C) Revenues, $1,500,000; Expenditures, $2,000,000

D) Revenues, $1,500,000; Other financing uses, $2,000,000

Unlock Deck

Unlock for access to all 31 flashcards in this deck.

Unlock Deck

k this deck

22

Fred Bosin donated land and a building to Palma City in 2006. Bosin's cost of the land and building was $100,000. Accumulated depreciation of the building on the date of the gift amounted to $60,000. Current fair value of the land and building on the date of the gift was $300,000. In a journal entry for the voluntarily maintained general capital assets account group, the total amount to be recorded for the donated plant assets is:

A) $300,000

B) $100,000

C) $40,000

D) $0

A) $300,000

B) $100,000

C) $40,000

D) $0

Unlock Deck

Unlock for access to all 31 flashcards in this deck.

Unlock Deck

k this deck

23

A special revenue fund of a governmental entity is an example of a(n):

A) Governmental fund

B) Proprietary fund

C) Internal service fund

D) Fiduciary fund

A) Governmental fund

B) Proprietary fund

C) Internal service fund

D) Fiduciary fund

Unlock Deck

Unlock for access to all 31 flashcards in this deck.

Unlock Deck

k this deck

24

Which of the following funds of a governmental entity might voluntarily use a general capital assets account group to account for plant assets with which the fund is associated?

A) Internal service

B) Enterprise

C) Special revenue

D) Trust

E) None of the foregoing

A) Internal service

B) Enterprise

C) Special revenue

D) Trust

E) None of the foregoing

Unlock Deck

Unlock for access to all 31 flashcards in this deck.

Unlock Deck

k this deck

25

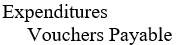

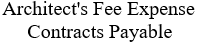

The appropriate journal entry (explanation and amount omitted) for a capital projects fund's entering into a contract with an architect is:

A)

B)

C)

D) None of the foregoing

A)

B)

C)

D) None of the foregoing

Unlock Deck

Unlock for access to all 31 flashcards in this deck.

Unlock Deck

k this deck

26

Among the activities of Wilburtown for the fiscal year beginning July 1, 2005, and ending June 30, 2006, were the following; Wilburton uses encumbrance accounting:

Unlock Deck

Unlock for access to all 31 flashcards in this deck.

Unlock Deck

k this deck

27

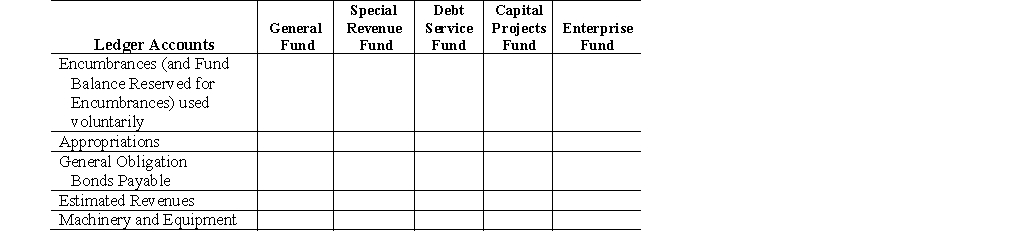

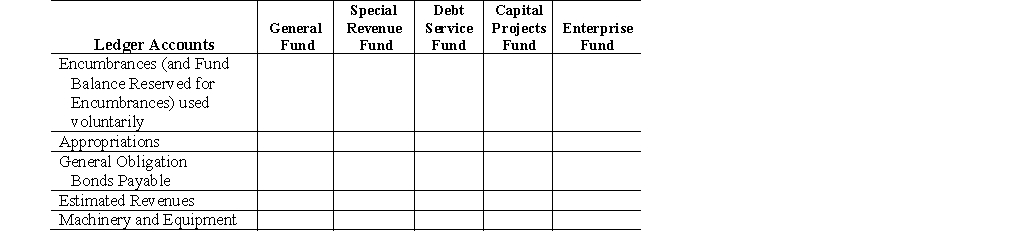

Indicate for each of the ledger accounts listed below, by a check mark in the appropriate column or columns, the funds of a governmental entity in which each account generally is used:

Unlock Deck

Unlock for access to all 31 flashcards in this deck.

Unlock Deck

k this deck

28

St. Charles Township had the following transactions and events, among others, during the fiscal year ended June 30, 2006 (the township uses account groups):

(1) On June 30, 2006, the township paid the first serial maturity of $80,000 on 6% general obligation bonds that had been issued at face amount of $400,000 on June 30, 2005, to mature serially June 30, 2006 through 2010. Accrued interest on the bonds also was paid on June 30, 2006. There was no fiscal agent.

(2) Special Revenue Fund expenditures on July 26, 2005, included $11,100 applicable to purchase orders of $10,900 issued in the fiscal year ended June 30, 2005. The township uses encumbrance accounting.

(3) On June 28, 2006, the State Revenue Department informed St. Charles Township that its share of a state-collected, locally shared tax was $340,000.

Prepare journal entries for the foregoing transactions and events of St. Charles Township for the year ended June 30, 2006. Omit explanations, but identify by initials the fund or account group (GF, DSF, GCAAG, etc.) in which each journal entry is recorded.

(1) On June 30, 2006, the township paid the first serial maturity of $80,000 on 6% general obligation bonds that had been issued at face amount of $400,000 on June 30, 2005, to mature serially June 30, 2006 through 2010. Accrued interest on the bonds also was paid on June 30, 2006. There was no fiscal agent.

(2) Special Revenue Fund expenditures on July 26, 2005, included $11,100 applicable to purchase orders of $10,900 issued in the fiscal year ended June 30, 2005. The township uses encumbrance accounting.

(3) On June 28, 2006, the State Revenue Department informed St. Charles Township that its share of a state-collected, locally shared tax was $340,000.

Prepare journal entries for the foregoing transactions and events of St. Charles Township for the year ended June 30, 2006. Omit explanations, but identify by initials the fund or account group (GF, DSF, GCAAG, etc.) in which each journal entry is recorded.

Unlock Deck

Unlock for access to all 31 flashcards in this deck.

Unlock Deck

k this deck

29

During your audit of the financial statements of Larrabee County on June 30, 2006, you discovered the following errors:

(1) The Accounts Receivable ledger account of the General Fund included $6,900 receivable from the county's Enterprise Fund for the Enterprise Fund's disposal of excess supplies on the General Fund's behalf. A Payable to General Fund ledger account with a balance of $6,900 was included in the accounting records of the Enterprise Fund.

(1) The Accounts Receivable ledger account of the General Fund included $6,900 receivable from the county's Enterprise Fund for the Enterprise Fund's disposal of excess supplies on the General Fund's behalf. A Payable to General Fund ledger account with a balance of $6,900 was included in the accounting records of the Enterprise Fund.

(2) During the year ended June 30, 2006, obsolete equipment with a carrying amount (residual value) of $18,700 was disposed of for $4,800. In addition, new equipment was acquired for $120,000. Both transactions were recorded only in the General Fund in the General Property ledger account, which had a debit balance of $115,200 on June 30, 2006. All items of equipment had been acquired from general fund revenues.

(3) During the year ended June 30, 2006, land with a current fair value of $650,000 was donated to Larrabee County for use as an industrial park. No journal entry had been prepared for the donation of the land.

Prepare journal entries on June 30, 2006, to correct the foregoing errors in all affected funds and voluntarily maintained account groups of Larrabee County. Omit explanations, but identify by initials (GF, DSF, GCAAG, etc.) the fund or account group in which each journal entry is recorded.

(1) The Accounts Receivable ledger account of the General Fund included $6,900 receivable from the county's Enterprise Fund for the Enterprise Fund's disposal of excess supplies on the General Fund's behalf. A Payable to General Fund ledger account with a balance of $6,900 was included in the accounting records of the Enterprise Fund.

(1) The Accounts Receivable ledger account of the General Fund included $6,900 receivable from the county's Enterprise Fund for the Enterprise Fund's disposal of excess supplies on the General Fund's behalf. A Payable to General Fund ledger account with a balance of $6,900 was included in the accounting records of the Enterprise Fund.(2) During the year ended June 30, 2006, obsolete equipment with a carrying amount (residual value) of $18,700 was disposed of for $4,800. In addition, new equipment was acquired for $120,000. Both transactions were recorded only in the General Fund in the General Property ledger account, which had a debit balance of $115,200 on June 30, 2006. All items of equipment had been acquired from general fund revenues.

(3) During the year ended June 30, 2006, land with a current fair value of $650,000 was donated to Larrabee County for use as an industrial park. No journal entry had been prepared for the donation of the land.

Prepare journal entries on June 30, 2006, to correct the foregoing errors in all affected funds and voluntarily maintained account groups of Larrabee County. Omit explanations, but identify by initials (GF, DSF, GCAAG, etc.) the fund or account group in which each journal entry is recorded.

Unlock Deck

Unlock for access to all 31 flashcards in this deck.

Unlock Deck

k this deck

30

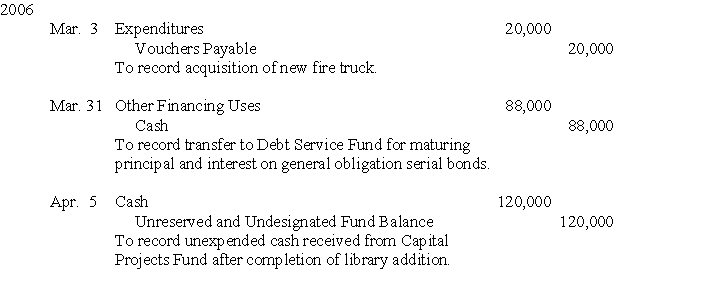

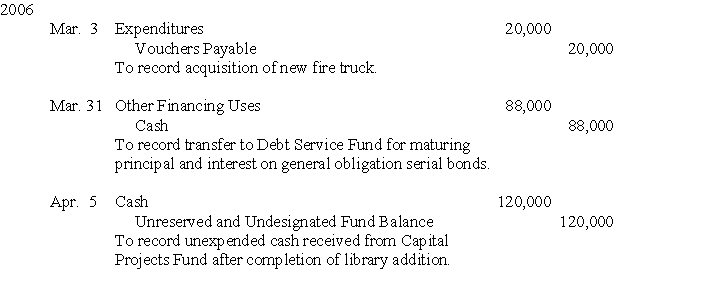

The following journal entries were included in the accounting records of the Farmville Township General Fund for the fiscal year ending June 30, 2006:

Prepare related journal entries (omit explanations) in other funds or voluntarily maintained account groups of Farmville Township. Identify the funds or account groups in headings for the entries.

Prepare related journal entries (omit explanations) in other funds or voluntarily maintained account groups of Farmville Township. Identify the funds or account groups in headings for the entries.

Prepare related journal entries (omit explanations) in other funds or voluntarily maintained account groups of Farmville Township. Identify the funds or account groups in headings for the entries.

Prepare related journal entries (omit explanations) in other funds or voluntarily maintained account groups of Farmville Township. Identify the funds or account groups in headings for the entries.

Unlock Deck

Unlock for access to all 31 flashcards in this deck.

Unlock Deck

k this deck

31

In a classroom discussion of accounting standards for the voluntarily maintained general capital assets account group of a governmental entity, student Raul questioned the logic of recording depreciation on plant assets accounted for in that accounting unit. Said Raul: "The general capital assets account group is not a fund; therefore, it has no need to make memorandum journal entries for depreciation."

Do you agree with student Raul? Explain.

Do you agree with student Raul? Explain.

Unlock Deck

Unlock for access to all 31 flashcards in this deck.

Unlock Deck

k this deck