Deck 3: Activity-Based Costing and Other Cost Management Tools

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/22

Play

Full screen (f)

Deck 3: Activity-Based Costing and Other Cost Management Tools

1

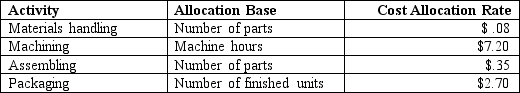

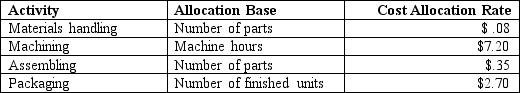

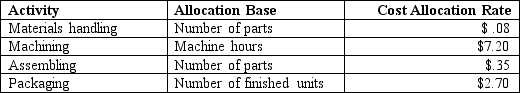

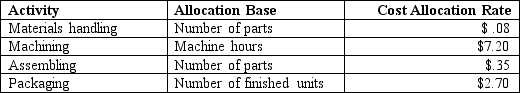

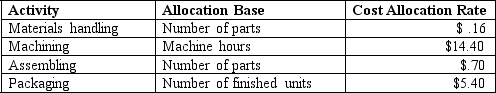

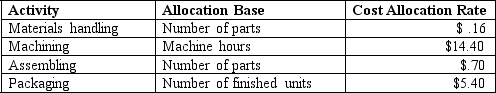

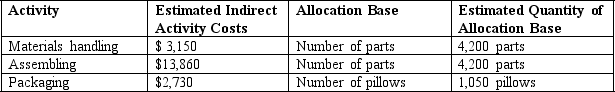

Brannon Company manufactures ceiling fans and uses an activity-based costing system. Each ceiling fan consists of 20 separate parts totaling $95 in direct materials, and requires 2.5 hours of machine time to produce. Additional information follows:

- What is the cost of materials handling per ceiling fan?

A) $1.60

B) $7.20

C) $6.00

D) $5.00

- What is the cost of materials handling per ceiling fan?

A) $1.60

B) $7.20

C) $6.00

D) $5.00

$1.60

2

Brannon Company manufactures ceiling fans and uses an activity-based costing system. Each ceiling fan consists of 20 separate parts totaling $95 in direct materials, and requires 2.5 hours of machine time to produce. Additional information follows:

-What is the cost of machining per ceiling fan?

A) $18.00

B) $180.00

C) $ 30.00

D) $144.00

-What is the cost of machining per ceiling fan?

A) $18.00

B) $180.00

C) $ 30.00

D) $144.00

$18.00

3

Brannon Company manufactures ceiling fans and uses an activity-based costing system. Each ceiling fan consists of 20 separate parts totaling $95 in direct materials, and requires 2.5 hours of machine time to produce. Additional information follows:

- What is the cost of assembling per ceiling fan?

A) $87.50

B) $7.00

C) $7.50

D) $35.00

- What is the cost of assembling per ceiling fan?

A) $87.50

B) $7.00

C) $7.50

D) $35.00

$7.00

4

Brannon Company manufactures ceiling fans and uses an activity-based costing system. Each ceiling fan consists of 20 separate parts totaling $95 in direct materials, and requires 2.5 hours of machine time to produce. Additional information follows:

-What is the number of finished ceiling fans?

A) 250

B) 100

C) 20

D) Cannot be determined from the information given

-What is the number of finished ceiling fans?

A) 250

B) 100

C) 20

D) Cannot be determined from the information given

Unlock Deck

Unlock for access to all 22 flashcards in this deck.

Unlock Deck

k this deck

5

Brannon Company manufactures ceiling fans and uses an activity-based costing system. Each ceiling fan consists of 20 separate parts totaling $95 in direct materials, and requires 2.5 hours of machine time to produce. Additional information follows:

-What is the total manufacturing cost per ceiling fan?

A) $125.75

B) $121.13

C) $115.32

D) $124.30

-What is the total manufacturing cost per ceiling fan?

A) $125.75

B) $121.13

C) $115.32

D) $124.30

Unlock Deck

Unlock for access to all 22 flashcards in this deck.

Unlock Deck

k this deck

6

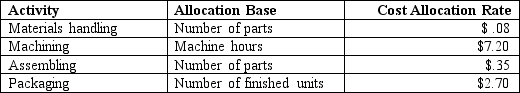

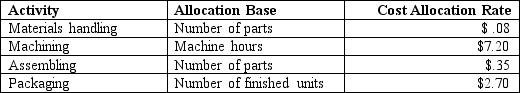

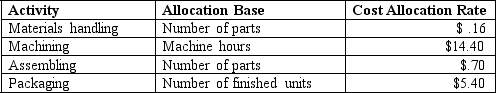

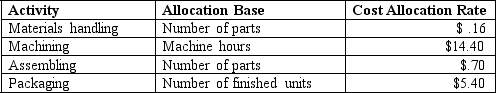

Kenney Company uses activity-based costing to account for its manufacturing process. Kenney Company produces tires and each tire has $.50 of direct materials, includes 20 parts and requires 2 hours of machine time. Additional information follows:

-What is the cost of materials handling per tire?

A) $5.60

B) $16.00

C) $1.60

D) $3.20

-What is the cost of materials handling per tire?

A) $5.60

B) $16.00

C) $1.60

D) $3.20

Unlock Deck

Unlock for access to all 22 flashcards in this deck.

Unlock Deck

k this deck

7

Kenney Company uses activity-based costing to account for its manufacturing process. Kenney Company produces tires, and each tire has $.50 of direct materials, includes 20 parts and requires 2 hours of machine time. Additional information follows:

-What is the cost of machining per tire?

A) $28.80

B) $26.40

C) $25.80

D) $29.50

-What is the cost of machining per tire?

A) $28.80

B) $26.40

C) $25.80

D) $29.50

Unlock Deck

Unlock for access to all 22 flashcards in this deck.

Unlock Deck

k this deck

8

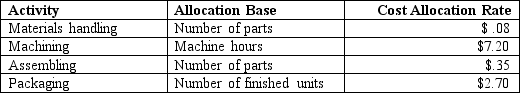

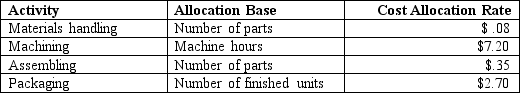

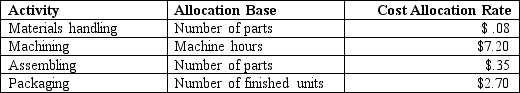

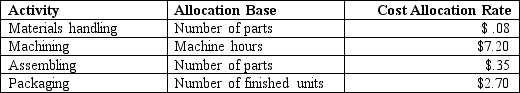

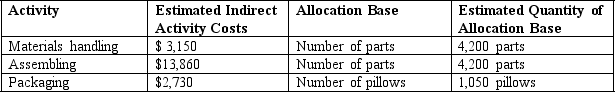

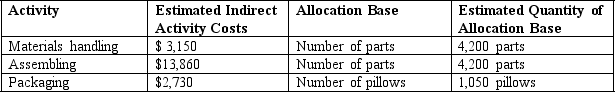

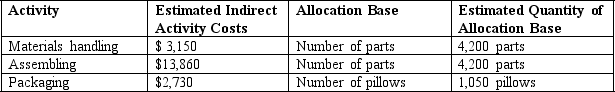

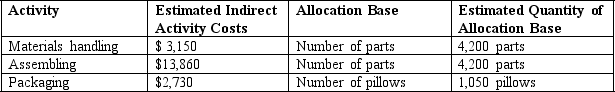

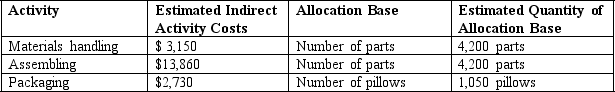

Sleep Tight Company manufactures pillows using an activity-based costing system. The following information is provided for the month of June:

Each pillow consists of 4 parts, and the total direct materials cost per pillow is $3.50.

-

What is the total cost of materials handling and assembling for each pillow?

A) $15.40

B) $16.20

C) $18.80

D) $13.20

Each pillow consists of 4 parts, and the total direct materials cost per pillow is $3.50.

-

What is the total cost of materials handling and assembling for each pillow?

A) $15.40

B) $16.20

C) $18.80

D) $13.20

Unlock Deck

Unlock for access to all 22 flashcards in this deck.

Unlock Deck

k this deck

9

Sleep Tight Company manufactures pillows using an activity-based costing system. The following information is provided for the month of June:

Each pillow consists of 4 parts and the total direct materials cost per pillow is $3.50.

Each pillow consists of 4 parts and the total direct materials cost per pillow is $3.50.

-

What is the total manufacturing cost per pillow?

A) $16.20

B) $22.30

C) $18.50

D) $26.50

Each pillow consists of 4 parts and the total direct materials cost per pillow is $3.50.

Each pillow consists of 4 parts and the total direct materials cost per pillow is $3.50.-

What is the total manufacturing cost per pillow?

A) $16.20

B) $22.30

C) $18.50

D) $26.50

Unlock Deck

Unlock for access to all 22 flashcards in this deck.

Unlock Deck

k this deck

10

Sleep Tight Company manufactures pillows using an activity-based costing system. The following information is provided for the month of June:

Each pillow consists of 4 parts and the total direct materials cost per pillow is $3.50.

Each pillow consists of 4 parts and the total direct materials cost per pillow is $3.50.

-

If the cost to purchase the same pillow from a supplier is $21.00, what should Sleep Tight do to maximize profits?

A) Continue to manufacture the pillow.

B) Since the cost to manufacture the pillow is also $21.00, the company would make the same profit whether it bought the pillow or manufactured it.

C) Purchase the pillow from the supplier.

D) Close down the business.

Each pillow consists of 4 parts and the total direct materials cost per pillow is $3.50.

Each pillow consists of 4 parts and the total direct materials cost per pillow is $3.50.-

If the cost to purchase the same pillow from a supplier is $21.00, what should Sleep Tight do to maximize profits?

A) Continue to manufacture the pillow.

B) Since the cost to manufacture the pillow is also $21.00, the company would make the same profit whether it bought the pillow or manufactured it.

C) Purchase the pillow from the supplier.

D) Close down the business.

Unlock Deck

Unlock for access to all 22 flashcards in this deck.

Unlock Deck

k this deck

11

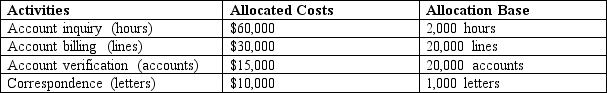

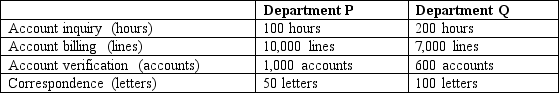

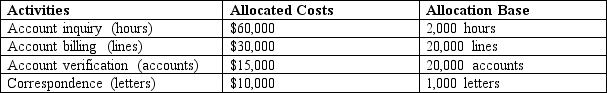

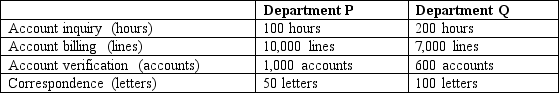

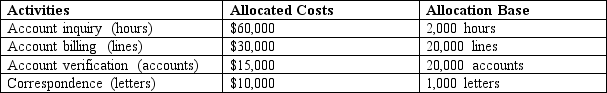

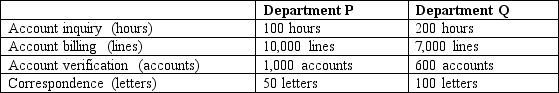

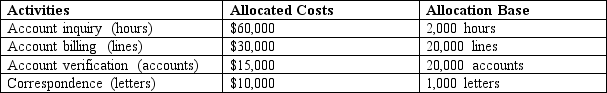

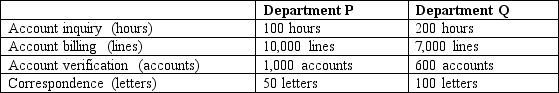

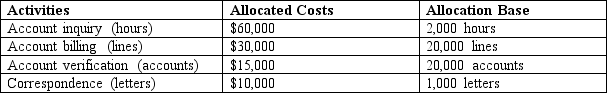

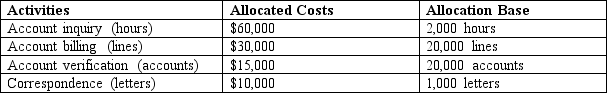

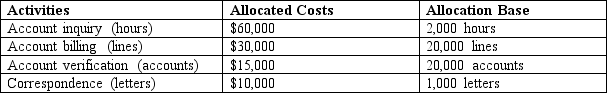

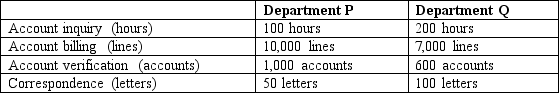

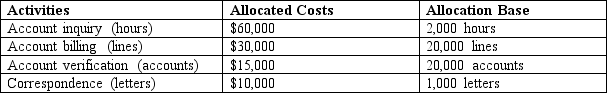

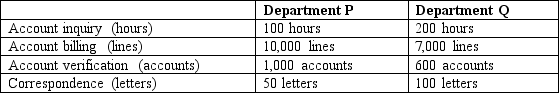

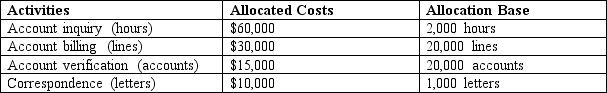

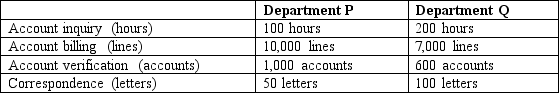

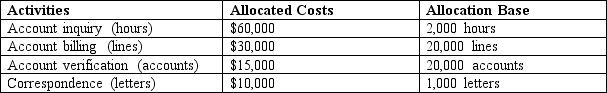

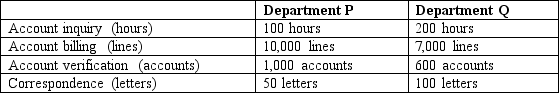

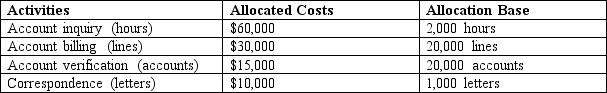

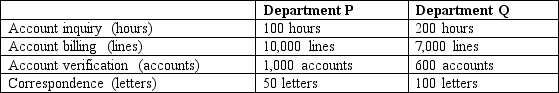

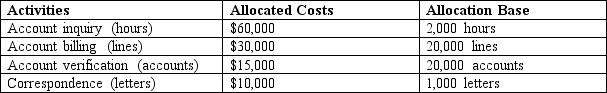

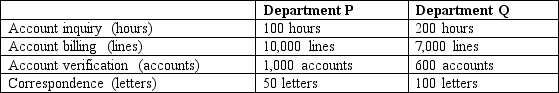

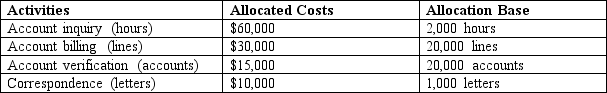

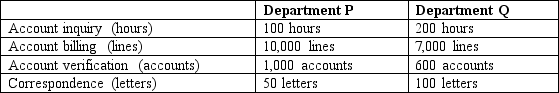

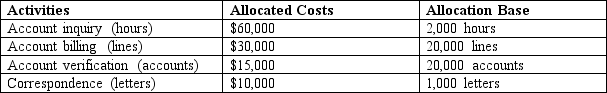

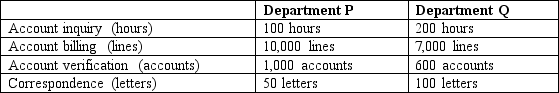

Pitt Jones Company had the following activities, allocated costs, and allocation bases:

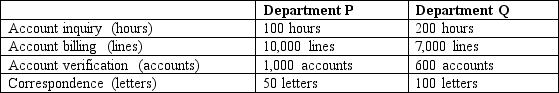

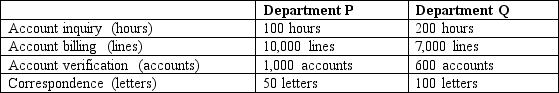

The above activities are used by departments P and Q:

The above activities are used by departments P and Q:

- What is the cost per driver unit for the account inquiry activity?

A) $0.75

B) $30.00

C) $10.00

D) $1.50

The above activities are used by departments P and Q:

The above activities are used by departments P and Q:

- What is the cost per driver unit for the account inquiry activity?

A) $0.75

B) $30.00

C) $10.00

D) $1.50

Unlock Deck

Unlock for access to all 22 flashcards in this deck.

Unlock Deck

k this deck

12

Pitt Jones Company had the following activities, allocated costs, and allocation bases:

The above activities are used by departments P and Q:

The above activities are used by departments P and Q:

- What is the cost per driver unit for the account billing activity?

A) $1.50

B) $30.00

C) $1.60

D) $1.43

The above activities are used by departments P and Q:

The above activities are used by departments P and Q:

- What is the cost per driver unit for the account billing activity?

A) $1.50

B) $30.00

C) $1.60

D) $1.43

Unlock Deck

Unlock for access to all 22 flashcards in this deck.

Unlock Deck

k this deck

13

Pitt Jones Company had the following activities, allocated costs, and allocation bases:

The above activities are used by departments P and Q:

The above activities are used by departments P and Q:

- What is the cost per driver unit for the account verification activity?

A) $30.00

B) $0.50

C) $2.25

D) $0.75

The above activities are used by departments P and Q:

The above activities are used by departments P and Q:

- What is the cost per driver unit for the account verification activity?

A) $30.00

B) $0.50

C) $2.25

D) $0.75

Unlock Deck

Unlock for access to all 22 flashcards in this deck.

Unlock Deck

k this deck

14

Pitt Jones Company had the following activities, allocated costs, and allocation bases:

The above activities are used by departments P and Q:

The above activities are used by departments P and Q:

-What is the cost per driver unit for the correspondence activity?

A) $10.00

B) $30.50

C) $25.00

D) $.75

The above activities are used by departments P and Q:

The above activities are used by departments P and Q:

-What is the cost per driver unit for the correspondence activity?

A) $10.00

B) $30.50

C) $25.00

D) $.75

Unlock Deck

Unlock for access to all 22 flashcards in this deck.

Unlock Deck

k this deck

15

Pitt Jones Company had the following activities, allocated costs, and allocation bases:

The above activities are used by departments P and Q:

The above activities are used by departments P and Q:

- How much of the account inquiry cost will be assigned to Department Q?

A) $2,000

B) $6,500

C) $3,000

D) $6,000

The above activities are used by departments P and Q:

The above activities are used by departments P and Q:

- How much of the account inquiry cost will be assigned to Department Q?

A) $2,000

B) $6,500

C) $3,000

D) $6,000

Unlock Deck

Unlock for access to all 22 flashcards in this deck.

Unlock Deck

k this deck

16

Pitt Jones Company had the following activities, allocated costs, and allocation bases:

The above activities are used by departments P and Q:

The above activities are used by departments P and Q:

- How much of the correspondence cost will be assigned to Department P?

A) $500

B) $1,200

C) $2,500

D) $800

The above activities are used by departments P and Q:

The above activities are used by departments P and Q:

- How much of the correspondence cost will be assigned to Department P?

A) $500

B) $1,200

C) $2,500

D) $800

Unlock Deck

Unlock for access to all 22 flashcards in this deck.

Unlock Deck

k this deck

17

Pitt Jones Company had the following activities, allocated costs, and allocation bases:

The above activities are used by departments P and Q:

The above activities are used by departments P and Q:

- How much of the account verification costs will be assigned to Department P?

A) $800

B) $2,500

C) $750

D) $1,500

The above activities are used by departments P and Q:

The above activities are used by departments P and Q:

- How much of the account verification costs will be assigned to Department P?

A) $800

B) $2,500

C) $750

D) $1,500

Unlock Deck

Unlock for access to all 22 flashcards in this deck.

Unlock Deck

k this deck

18

Quality Stereo Company has provided the following information regarding its activity-based costing system:

.Purchasing department costs are allocated based on purchase orders and the cost allocation rate is $75 per purchase order.

.Assembly department costs are allocated based on the number of parts used and the cost allocation rate is $1.00 per part.

.Packaging department costs are allocated based on the number of units produced and the allocation rate is $2.00 per unit produced.

Each stereo produced has 50 parts and the direct materials cost per unit is $70. Quality Stereo has an order for 1,000 stereos which will require 50 purchase orders. What is the selling price per unit assuming that Quality Stereo adds a 20% markup to total cost?

A) $66.90

B) $146.40

C) $148.50

D) $150.90

.Purchasing department costs are allocated based on purchase orders and the cost allocation rate is $75 per purchase order.

.Assembly department costs are allocated based on the number of parts used and the cost allocation rate is $1.00 per part.

.Packaging department costs are allocated based on the number of units produced and the allocation rate is $2.00 per unit produced.

Each stereo produced has 50 parts and the direct materials cost per unit is $70. Quality Stereo has an order for 1,000 stereos which will require 50 purchase orders. What is the selling price per unit assuming that Quality Stereo adds a 20% markup to total cost?

A) $66.90

B) $146.40

C) $148.50

D) $150.90

Unlock Deck

Unlock for access to all 22 flashcards in this deck.

Unlock Deck

k this deck

19

Crump Manufacturing has provided the following information regarding its activity-based costing system:

.Purchasing department costs are allocated based on purchase orders and the cost allocation rate is $52 per purchase order.

.Assembly department costs are allocated based on the number of machine hours and the cost allocation rate is $27 per machine hour.

.Inspection department costs are allocated based on the number of inspection hours and the allocation rate is $39 per inspection hour.

Each unit produced has a direct materials cost of $70 and a direct labor cost of $65. Crump has an

Order for 500 units which will require 40 purchase orders, 750 machine hours, and 50 inspection hours.

- What is the selling price per unit assuming that Crump adds a 40% markup to total cost?

A) $183.56

B) $354.20

C) $256.98

D) $67.98

.Purchasing department costs are allocated based on purchase orders and the cost allocation rate is $52 per purchase order.

.Assembly department costs are allocated based on the number of machine hours and the cost allocation rate is $27 per machine hour.

.Inspection department costs are allocated based on the number of inspection hours and the allocation rate is $39 per inspection hour.

Each unit produced has a direct materials cost of $70 and a direct labor cost of $65. Crump has an

Order for 500 units which will require 40 purchase orders, 750 machine hours, and 50 inspection hours.

- What is the selling price per unit assuming that Crump adds a 40% markup to total cost?

A) $183.56

B) $354.20

C) $256.98

D) $67.98

Unlock Deck

Unlock for access to all 22 flashcards in this deck.

Unlock Deck

k this deck

20

Crump Manufacturing has provided the following information regarding its activity-based costing system:

.Purchasing department costs are allocated based on purchase orders and the cost allocation rate is $52 per purchase order.

.Assembly department costs are allocated based on the number of machine hours and the cost allocation rate is $27 per machine hour.

.Inspection department costs are allocated based on the number of inspection hours and the allocation rate is $39 per inspection hour.

Each unit produced has a direct materials cost of $70 and a direct labor cost of $65. Crump has an

Order for 500 units which will require 40 purchase orders, 750 machine hours, and 50 inspection hours.

- What is Crump's operating income from the order if the units are sold for $225 each?

A) $22,670

B) $20,720

C) $45,000

D) $88,220

.Purchasing department costs are allocated based on purchase orders and the cost allocation rate is $52 per purchase order.

.Assembly department costs are allocated based on the number of machine hours and the cost allocation rate is $27 per machine hour.

.Inspection department costs are allocated based on the number of inspection hours and the allocation rate is $39 per inspection hour.

Each unit produced has a direct materials cost of $70 and a direct labor cost of $65. Crump has an

Order for 500 units which will require 40 purchase orders, 750 machine hours, and 50 inspection hours.

- What is Crump's operating income from the order if the units are sold for $225 each?

A) $22,670

B) $20,720

C) $45,000

D) $88,220

Unlock Deck

Unlock for access to all 22 flashcards in this deck.

Unlock Deck

k this deck

21

of the following pertains to a just-in-time production system?

A) It will have fewer processing departments.

B) It will produce goods in smaller batches than a traditional production system.

C) It will require higher inventory levels.

D) It will require longer setup times than a traditional production system.

A) It will have fewer processing departments.

B) It will produce goods in smaller batches than a traditional production system.

C) It will require higher inventory levels.

D) It will require longer setup times than a traditional production system.

Unlock Deck

Unlock for access to all 22 flashcards in this deck.

Unlock Deck

k this deck

22

Which of the following pertains to a just-in-time production system?

A) It will have fewer processing departments.

B) It will produce goods in smaller batches than a traditional production system.

C) It will require higher inventory levels.

D) It will require longer setup times than a traditional production system.

A) It will have fewer processing departments.

B) It will produce goods in smaller batches than a traditional production system.

C) It will require higher inventory levels.

D) It will require longer setup times than a traditional production system.

Unlock Deck

Unlock for access to all 22 flashcards in this deck.

Unlock Deck

k this deck