Deck 14: Capital Budgeting and Cost Analysis

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/12

Play

Full screen (f)

Deck 14: Capital Budgeting and Cost Analysis

1

Match each one of the examples below with one of the stages of the capital budgeting decision model.

-Issuing corporate stock for the funds to purchase new equipment

A) Identify projects and uncertainties

B) Analyze available information

C) Determine practical options

D) Make decisions by choosing one from among the practical options

E) Implement the decision, monitor, follow-up, and evaluate performance, and learn

-Issuing corporate stock for the funds to purchase new equipment

A) Identify projects and uncertainties

B) Analyze available information

C) Determine practical options

D) Make decisions by choosing one from among the practical options

E) Implement the decision, monitor, follow-up, and evaluate performance, and learn

Implement the decision, monitor, follow-up, and evaluate performance, and learn

2

Match each one of the examples below with one of the stages of the capital budgeting decision model.

-Learning how to effectively operate Machine 8 only takes 15 minutes

A) Identify projects and uncertainties

B) Analyze available information

C) Determine practical options

D) Make decisions by choosing one from among the practical options

E) Implement the decision, monitor, follow-up, and evaluate performance, and learn

-Learning how to effectively operate Machine 8 only takes 15 minutes

A) Identify projects and uncertainties

B) Analyze available information

C) Determine practical options

D) Make decisions by choosing one from among the practical options

E) Implement the decision, monitor, follow-up, and evaluate performance, and learn

Analyze available information

3

Match each one of the examples below with one of the stages of the capital budgeting decision model.

-The need to reduce the costs to process the vegetables used in producing goulash

A) Identify projects and uncertainties

B) Analyze available information

C) Determine practical options

D) Make decisions by choosing one from among the practical options

E) Implement the decision, monitor, follow-up, and evaluate performance, and learn

-The need to reduce the costs to process the vegetables used in producing goulash

A) Identify projects and uncertainties

B) Analyze available information

C) Determine practical options

D) Make decisions by choosing one from among the practical options

E) Implement the decision, monitor, follow-up, and evaluate performance, and learn

Identify projects and uncertainties

4

Match each one of the examples below with one of the stages of the capital budgeting decision model.

-Monitoring the costs to operate a new machine

A) Identify projects and uncertainties

B) Analyze available information

C) Determine practical options

D) Make decisions by choosing one from among the practical options

E) Implement the decision, monitor, follow-up, and evaluate performance, and learn

-Monitoring the costs to operate a new machine

A) Identify projects and uncertainties

B) Analyze available information

C) Determine practical options

D) Make decisions by choosing one from among the practical options

E) Implement the decision, monitor, follow-up, and evaluate performance, and learn

Unlock Deck

Unlock for access to all 12 flashcards in this deck.

Unlock Deck

k this deck

5

Match each one of the examples below with one of the stages of the capital budgeting decision model.

-Percentage of defective merchandise considered too high

A) Identify projects and uncertainties

B) Analyze available information

C) Determine practical options

D) Make decisions by choosing one from among the practical options

E) Implement the decision, monitor, follow-up, and evaluate performance, and learn

-Percentage of defective merchandise considered too high

A) Identify projects and uncertainties

B) Analyze available information

C) Determine practical options

D) Make decisions by choosing one from among the practical options

E) Implement the decision, monitor, follow-up, and evaluate performance, and learn

Unlock Deck

Unlock for access to all 12 flashcards in this deck.

Unlock Deck

k this deck

6

Match each one of the examples below with one of the stages of the capital budgeting decision model.

-Will introducing the new product substantially upgrade our image as a producer of quality products?

A) Identify projects and uncertainties

B) Analyze available information

C) Determine practical options

D) Make decisions by choosing one from among the practical options

E) Implement the decision, monitor, follow-up, and evaluate performance, and learn

-Will introducing the new product substantially upgrade our image as a producer of quality products?

A) Identify projects and uncertainties

B) Analyze available information

C) Determine practical options

D) Make decisions by choosing one from among the practical options

E) Implement the decision, monitor, follow-up, and evaluate performance, and learn

Unlock Deck

Unlock for access to all 12 flashcards in this deck.

Unlock Deck

k this deck

7

Match each one of the examples below with one of the stages of the capital budgeting decision model.

-Research indicates there are five machines on the market capable of producing our product at a competitive cost.

A) Identify projects and uncertainties

B) Analyze available information

C) Determine practical options

D) Make decisions by choosing one from among the practical options

E) Implement the decision, monitor, follow-up, and evaluate performance, and learn

-Research indicates there are five machines on the market capable of producing our product at a competitive cost.

A) Identify projects and uncertainties

B) Analyze available information

C) Determine practical options

D) Make decisions by choosing one from among the practical options

E) Implement the decision, monitor, follow-up, and evaluate performance, and learn

Unlock Deck

Unlock for access to all 12 flashcards in this deck.

Unlock Deck

k this deck

8

Match each one of the examples below with one of the stages of the capital budgeting decision model.

-Use of the internal rate of return for each alternative

A) Identify projects and uncertainties

B) Analyze available information

C) Determine practical options

D) Make decisions by choosing one from among the practical options

E) Implement the decision, monitor, follow-up, and evaluate performance, and learn

-Use of the internal rate of return for each alternative

A) Identify projects and uncertainties

B) Analyze available information

C) Determine practical options

D) Make decisions by choosing one from among the practical options

E) Implement the decision, monitor, follow-up, and evaluate performance, and learn

Unlock Deck

Unlock for access to all 12 flashcards in this deck.

Unlock Deck

k this deck

9

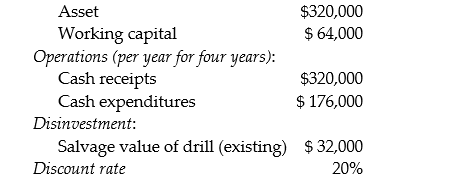

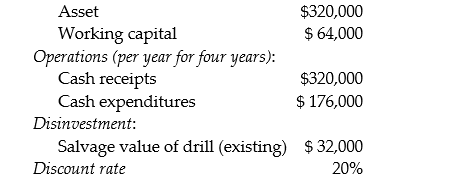

Explore Water Company drills small commercial water wells. The company is in the process of analyzing the purchase of a new drill. Information on the proposal is provided below.

Initial investment:

What is the net present value of the investment? Assume there is no recovery of working capital.

A) $84,724

B) $372,672

C) $20,672

D) $(124,280)

Initial investment:

What is the net present value of the investment? Assume there is no recovery of working capital.

A) $84,724

B) $372,672

C) $20,672

D) $(124,280)

Unlock Deck

Unlock for access to all 12 flashcards in this deck.

Unlock Deck

k this deck

10

Gulf Coast Parks Department is considering a new capital investment. The following information is available on the investment. The cost of the machine will be $432,576. The annual cost savings if the new machine is acquired will be $120,000. The machine will have a 5-year life, at which time the terminal disposal value is expected to be zero. Gulf Coast Parks Department is assuming no tax consequences. What is the internal rate of return for Gulf Coast Parks Department?

A) 16%

B) 10%

C) 12%

D) 14%

A) 16%

B) 10%

C) 12%

D) 14%

Unlock Deck

Unlock for access to all 12 flashcards in this deck.

Unlock Deck

k this deck

11

Gulf Coast Parks Department is considering a new capital investment. The following information is available on the investment. The cost of the machine will be $72,096. The annual cost savings if the new machine is acquired will be $20,000. The machine will have a 5-year life, at which time the terminal disposal value is expected to be zero. Gulf Coast Parks is assuming no tax consequences. Gulf Coast Parks has a 10% required rate of return. What is the payback period on this investment?

A) 3 years

B) 5 years

C) 4.2 years

D) 3.6 years

A) 3 years

B) 5 years

C) 4.2 years

D) 3.6 years

Unlock Deck

Unlock for access to all 12 flashcards in this deck.

Unlock Deck

k this deck

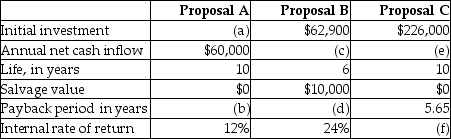

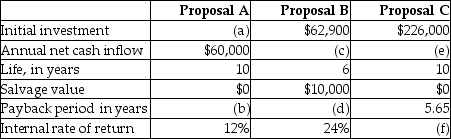

12

Supply the missing data for each of the following proposals:

Unlock Deck

Unlock for access to all 12 flashcards in this deck.

Unlock Deck

k this deck