Deck 11: Managerial Decisions in Competitive Markets

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

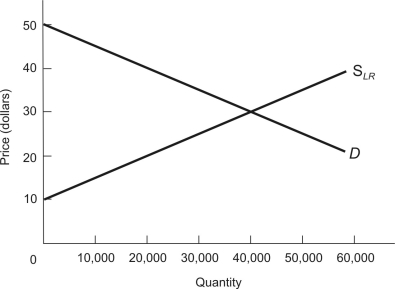

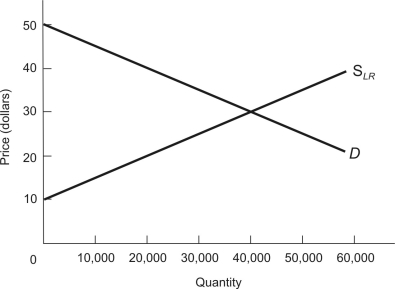

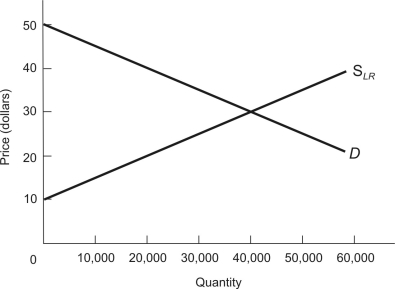

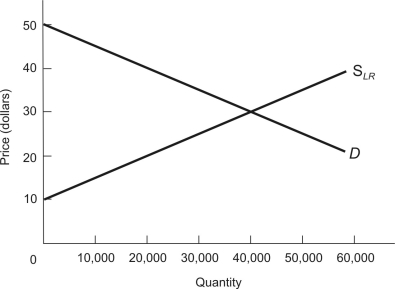

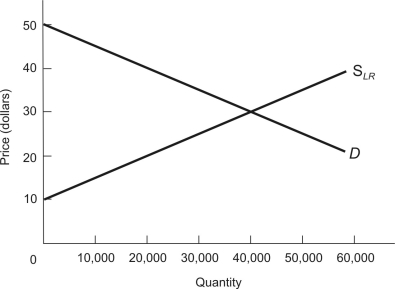

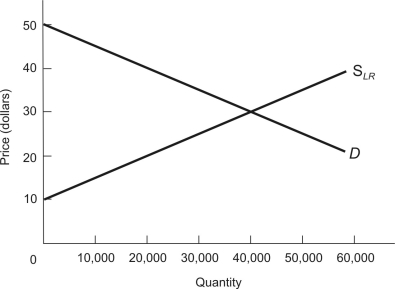

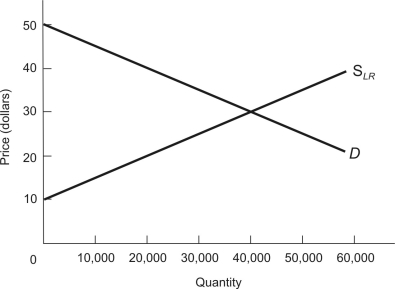

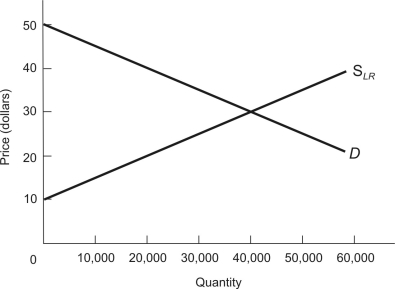

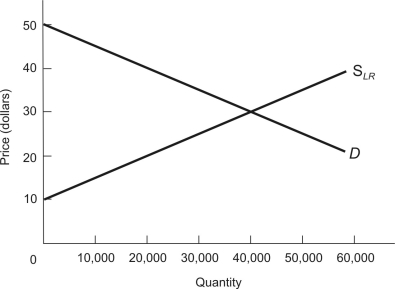

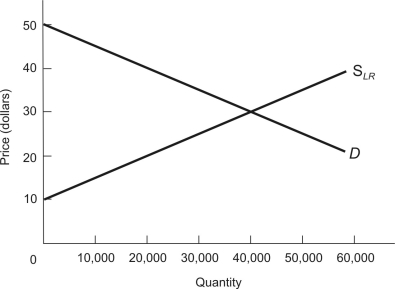

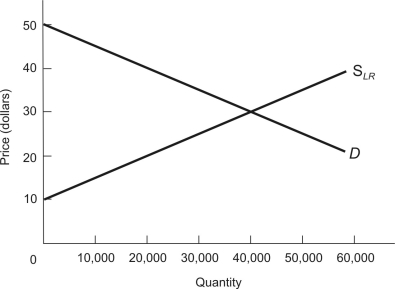

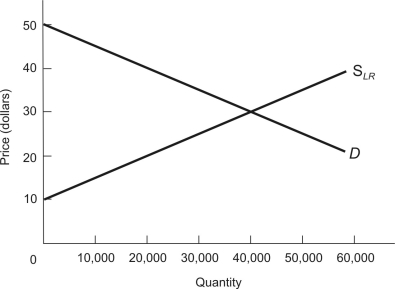

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/58

Play

Full screen (f)

Deck 11: Managerial Decisions in Competitive Markets

1

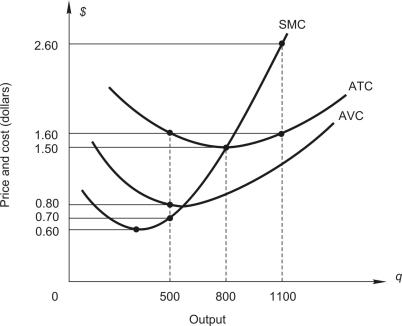

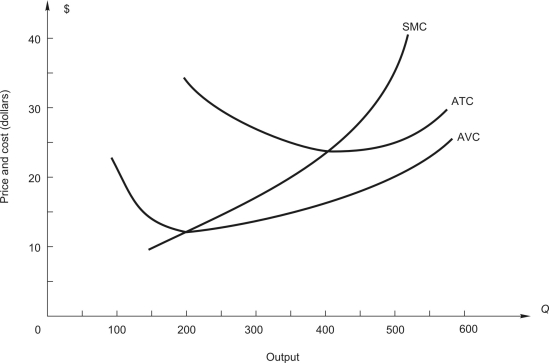

refer to the following figure:

The figure above shows cost curves for a perfectly competitive firm.

The figure above shows cost curves for a perfectly competitive firm.

-A profit-maximizing firm will break even when market price is:

A) $ 0.60

B) $ 0.80

C) $1.50

D) $1.60

The figure above shows cost curves for a perfectly competitive firm.

The figure above shows cost curves for a perfectly competitive firm.-A profit-maximizing firm will break even when market price is:

A) $ 0.60

B) $ 0.80

C) $1.50

D) $1.60

$1.50

2

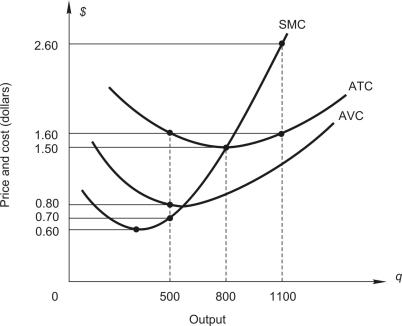

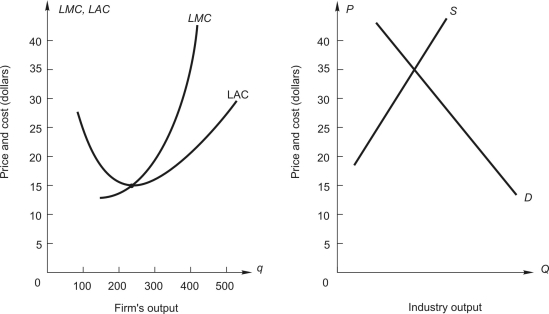

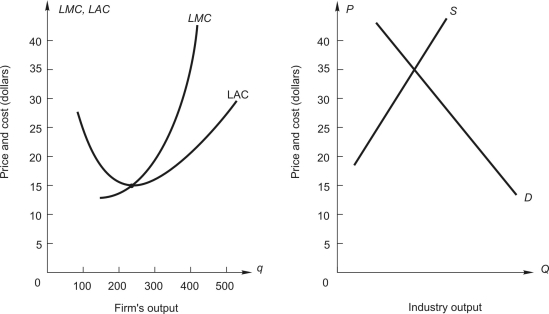

refer to the following figure:

The graph on the left shows long-run average and marginal cost for a typical firm in a perfectly competitive industry. The graph on the right shows demand and long-run supply for an increasing-cost industry.

The graph on the left shows long-run average and marginal cost for a typical firm in a perfectly competitive industry. The graph on the right shows demand and long-run supply for an increasing-cost industry.

-How much profit will the firm earn?

A) zero

B) $2,600

C) $3,100

D) $3,750

E) $6,000

The graph on the left shows long-run average and marginal cost for a typical firm in a perfectly competitive industry. The graph on the right shows demand and long-run supply for an increasing-cost industry.

The graph on the left shows long-run average and marginal cost for a typical firm in a perfectly competitive industry. The graph on the right shows demand and long-run supply for an increasing-cost industry.-How much profit will the firm earn?

A) zero

B) $2,600

C) $3,100

D) $3,750

E) $6,000

$6,000

3

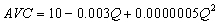

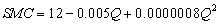

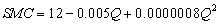

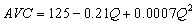

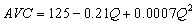

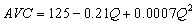

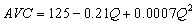

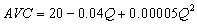

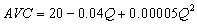

refer to the following:

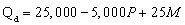

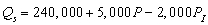

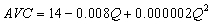

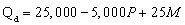

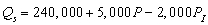

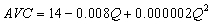

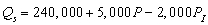

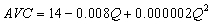

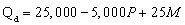

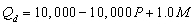

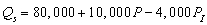

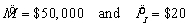

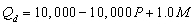

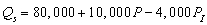

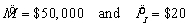

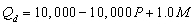

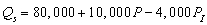

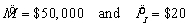

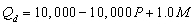

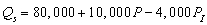

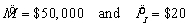

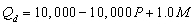

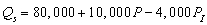

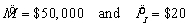

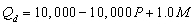

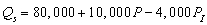

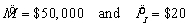

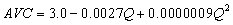

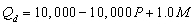

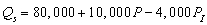

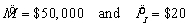

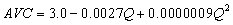

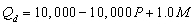

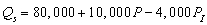

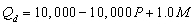

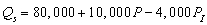

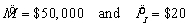

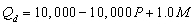

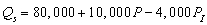

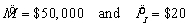

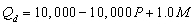

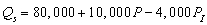

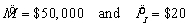

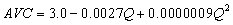

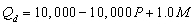

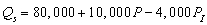

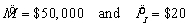

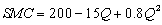

A consulting company estimated market demand and supply in a perfectly competitive industry and obtained the following results:

where P is price, M is income, and

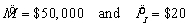

where P is price, M is income, and  is the price of a key input. The forecasts for the next year are

is the price of a key input. The forecasts for the next year are  = $15,000 and

= $15,000 and  = $20. Average variable cost is estimated to be

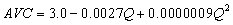

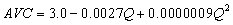

= $20. Average variable cost is estimated to be  Total fixed cost will be $6,000 next year.

Total fixed cost will be $6,000 next year.

-What is the firm's minimum average variable cost?

A) $ 2

B) $ 6

C) $ 8

D) $20

A consulting company estimated market demand and supply in a perfectly competitive industry and obtained the following results:

where P is price, M is income, and

where P is price, M is income, and  is the price of a key input. The forecasts for the next year are

is the price of a key input. The forecasts for the next year are  = $15,000 and

= $15,000 and  = $20. Average variable cost is estimated to be

= $20. Average variable cost is estimated to be  Total fixed cost will be $6,000 next year.

Total fixed cost will be $6,000 next year.-What is the firm's minimum average variable cost?

A) $ 2

B) $ 6

C) $ 8

D) $20

$ 6

4

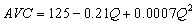

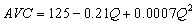

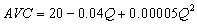

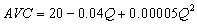

refer to the following:

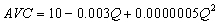

A consulting company estimated market demand and supply in a perfectly competitive industry and obtained the following results:

where P is price, M is income, and

where P is price, M is income, and  is the price of a key input. The forecasts for the next year are

is the price of a key input. The forecasts for the next year are  = $15,000 and

= $15,000 and  = $20. Average variable cost is estimated to be

= $20. Average variable cost is estimated to be  Total fixed cost will be $6,000 next year.

Total fixed cost will be $6,000 next year.

-What is the profit-maximizing output choice for the firm?

A) 3,000 units

B) 4,000 units

C) 5,000 units

D) 6,000 units

A consulting company estimated market demand and supply in a perfectly competitive industry and obtained the following results:

where P is price, M is income, and

where P is price, M is income, and  is the price of a key input. The forecasts for the next year are

is the price of a key input. The forecasts for the next year are  = $15,000 and

= $15,000 and  = $20. Average variable cost is estimated to be

= $20. Average variable cost is estimated to be  Total fixed cost will be $6,000 next year.

Total fixed cost will be $6,000 next year.-What is the profit-maximizing output choice for the firm?

A) 3,000 units

B) 4,000 units

C) 5,000 units

D) 6,000 units

Unlock Deck

Unlock for access to all 58 flashcards in this deck.

Unlock Deck

k this deck

5

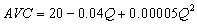

refer to the following:

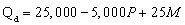

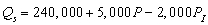

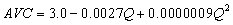

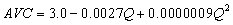

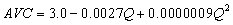

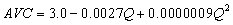

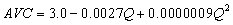

Consider a competitive industry and a price-taking firm that produces in that industry. The market demand and supply functions are estimated to be:

Demand: Supply:

Supply:  where Q is quantity, P is the price of the product, M is income, and

where Q is quantity, P is the price of the product, M is income, and  is the input price. The manager of the perfectly competitive firm uses time-eries data to obtain the following forecasted values of M and

is the input price. The manager of the perfectly competitive firm uses time-eries data to obtain the following forecasted values of M and  for 2009:

for 2009:

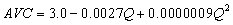

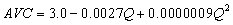

The manager also estimates the average variable cost function to be

The manager also estimates the average variable cost function to be

Total fixed costs will be $2,000 in 2009.

Total fixed costs will be $2,000 in 2009.

-What is the price forecast for 2009?

A) $2

B) $2.50

C) $2.75

D) $3

E) none of the above

Consider a competitive industry and a price-taking firm that produces in that industry. The market demand and supply functions are estimated to be:

Demand:

Supply:

Supply:  where Q is quantity, P is the price of the product, M is income, and

where Q is quantity, P is the price of the product, M is income, and  is the input price. The manager of the perfectly competitive firm uses time-eries data to obtain the following forecasted values of M and

is the input price. The manager of the perfectly competitive firm uses time-eries data to obtain the following forecasted values of M and  for 2009:

for 2009: The manager also estimates the average variable cost function to be

The manager also estimates the average variable cost function to be Total fixed costs will be $2,000 in 2009.

Total fixed costs will be $2,000 in 2009.-What is the price forecast for 2009?

A) $2

B) $2.50

C) $2.75

D) $3

E) none of the above

Unlock Deck

Unlock for access to all 58 flashcards in this deck.

Unlock Deck

k this deck

6

refer to the following:

Consider a competitive industry and a price-taking firm that produces in that industry. The market demand and supply functions are estimated to be:

Demand: Supply:

Supply:  where Q is quantity, P is the price of the product, M is income, and

where Q is quantity, P is the price of the product, M is income, and  is the input price. The manager of the perfectly competitive firm uses time-eries data to obtain the following forecasted values of M and

is the input price. The manager of the perfectly competitive firm uses time-eries data to obtain the following forecasted values of M and  for 2009:

for 2009:

The manager also estimates the average variable cost function to be

The manager also estimates the average variable cost function to be

Total fixed costs will be $2,000 in 2009.

Total fixed costs will be $2,000 in 2009.

-Average variable cost reaches its minimum value of _____ units of output.

A) 1,000

B) 1,500

C) 2,000

D) 2,500

Consider a competitive industry and a price-taking firm that produces in that industry. The market demand and supply functions are estimated to be:

Demand:

Supply:

Supply:  where Q is quantity, P is the price of the product, M is income, and

where Q is quantity, P is the price of the product, M is income, and  is the input price. The manager of the perfectly competitive firm uses time-eries data to obtain the following forecasted values of M and

is the input price. The manager of the perfectly competitive firm uses time-eries data to obtain the following forecasted values of M and  for 2009:

for 2009: The manager also estimates the average variable cost function to be

The manager also estimates the average variable cost function to be Total fixed costs will be $2,000 in 2009.

Total fixed costs will be $2,000 in 2009.-Average variable cost reaches its minimum value of _____ units of output.

A) 1,000

B) 1,500

C) 2,000

D) 2,500

Unlock Deck

Unlock for access to all 58 flashcards in this deck.

Unlock Deck

k this deck

7

refer to the following:

Consider a competitive industry and a price-taking firm that produces in that industry. The market demand and supply functions are estimated to be:

Demand: Supply:

Supply:  where Q is quantity, P is the price of the product, M is income, and

where Q is quantity, P is the price of the product, M is income, and  is the input price. The manager of the perfectly competitive firm uses time-eries data to obtain the following forecasted values of M and

is the input price. The manager of the perfectly competitive firm uses time-eries data to obtain the following forecasted values of M and  for 2009:

for 2009:

The manager also estimates the average variable cost function to be

The manager also estimates the average variable cost function to be

Total fixed costs will be $2,000 in 2009.

Total fixed costs will be $2,000 in 2009.

-The minimum value of average variable cost is $_____.

A) $0.50

B) $0.75

C) $0.975

D) $1.00

E) $2.15

Consider a competitive industry and a price-taking firm that produces in that industry. The market demand and supply functions are estimated to be:

Demand:

Supply:

Supply:  where Q is quantity, P is the price of the product, M is income, and

where Q is quantity, P is the price of the product, M is income, and  is the input price. The manager of the perfectly competitive firm uses time-eries data to obtain the following forecasted values of M and

is the input price. The manager of the perfectly competitive firm uses time-eries data to obtain the following forecasted values of M and  for 2009:

for 2009: The manager also estimates the average variable cost function to be

The manager also estimates the average variable cost function to be Total fixed costs will be $2,000 in 2009.

Total fixed costs will be $2,000 in 2009.-The minimum value of average variable cost is $_____.

A) $0.50

B) $0.75

C) $0.975

D) $1.00

E) $2.15

Unlock Deck

Unlock for access to all 58 flashcards in this deck.

Unlock Deck

k this deck

8

refer to the following:

Consider a competitive industry and a price-taking firm that produces in that industry. The market demand and supply functions are estimated to be:

Demand: Supply:

Supply:  where Q is quantity, P is the price of the product, M is income, and

where Q is quantity, P is the price of the product, M is income, and  is the input price. The manager of the perfectly competitive firm uses time-eries data to obtain the following forecasted values of M and

is the input price. The manager of the perfectly competitive firm uses time-eries data to obtain the following forecasted values of M and  for 2009:

for 2009:

The manager also estimates the average variable cost function to be

The manager also estimates the average variable cost function to be

Total fixed costs will be $2,000 in 2009.

Total fixed costs will be $2,000 in 2009.

-The manager _____ produce since _____________.

A) should; $3 > $0.975

B) should; $2.75 > $0.75

C) should not; $2 < $2.15

D) should not; $0.50 < $1.00

Consider a competitive industry and a price-taking firm that produces in that industry. The market demand and supply functions are estimated to be:

Demand:

Supply:

Supply:  where Q is quantity, P is the price of the product, M is income, and

where Q is quantity, P is the price of the product, M is income, and  is the input price. The manager of the perfectly competitive firm uses time-eries data to obtain the following forecasted values of M and

is the input price. The manager of the perfectly competitive firm uses time-eries data to obtain the following forecasted values of M and  for 2009:

for 2009: The manager also estimates the average variable cost function to be

The manager also estimates the average variable cost function to be Total fixed costs will be $2,000 in 2009.

Total fixed costs will be $2,000 in 2009.-The manager _____ produce since _____________.

A) should; $3 > $0.975

B) should; $2.75 > $0.75

C) should not; $2 < $2.15

D) should not; $0.50 < $1.00

Unlock Deck

Unlock for access to all 58 flashcards in this deck.

Unlock Deck

k this deck

9

refer to the following:

Consider a competitive industry and a price-taking firm that produces in that industry. The market demand and supply functions are estimated to be:

Demand: Supply:

Supply:  where Q is quantity, P is the price of the product, M is income, and

where Q is quantity, P is the price of the product, M is income, and  is the input price. The manager of the perfectly competitive firm uses time-eries data to obtain the following forecasted values of M and

is the input price. The manager of the perfectly competitive firm uses time-eries data to obtain the following forecasted values of M and  for 2009:

for 2009:

The manager also estimates the average variable cost function to be

The manager also estimates the average variable cost function to be

Total fixed costs will be $2,000 in 2009.

Total fixed costs will be $2,000 in 2009.

-The marginal cost function is:

A) SMC = 3.0 - 0.0027Q + 0.0000009Q2

B) SMC = 3.0 - 0.00135Q + 0.00000045Q2

C) SMC = 3.0Q -0.0027Q2 + 0.0000009Q3

D) SMC = 3.0 - 0.0054Q + 0.0000018Q2

E) none of the above

Consider a competitive industry and a price-taking firm that produces in that industry. The market demand and supply functions are estimated to be:

Demand:

Supply:

Supply:  where Q is quantity, P is the price of the product, M is income, and

where Q is quantity, P is the price of the product, M is income, and  is the input price. The manager of the perfectly competitive firm uses time-eries data to obtain the following forecasted values of M and

is the input price. The manager of the perfectly competitive firm uses time-eries data to obtain the following forecasted values of M and  for 2009:

for 2009: The manager also estimates the average variable cost function to be

The manager also estimates the average variable cost function to be Total fixed costs will be $2,000 in 2009.

Total fixed costs will be $2,000 in 2009.-The marginal cost function is:

A) SMC = 3.0 - 0.0027Q + 0.0000009Q2

B) SMC = 3.0 - 0.00135Q + 0.00000045Q2

C) SMC = 3.0Q -0.0027Q2 + 0.0000009Q3

D) SMC = 3.0 - 0.0054Q + 0.0000018Q2

E) none of the above

Unlock Deck

Unlock for access to all 58 flashcards in this deck.

Unlock Deck

k this deck

10

refer to the following:

Consider a competitive industry and a price-taking firm that produces in that industry. The market demand and supply functions are estimated to be:

Demand: Supply:

Supply:  where Q is quantity, P is the price of the product, M is income, and

where Q is quantity, P is the price of the product, M is income, and  is the input price. The manager of the perfectly competitive firm uses time-eries data to obtain the following forecasted values of M and

is the input price. The manager of the perfectly competitive firm uses time-eries data to obtain the following forecasted values of M and  for 2009:

for 2009:

The manager also estimates the average variable cost function to be

The manager also estimates the average variable cost function to be

Total fixed costs will be $2,000 in 2009.

Total fixed costs will be $2,000 in 2009.

-The optimal level of production for the firm is

A) 1,000

B) 1,500

C) 2,000

D) 2,500

E) none of the above

Consider a competitive industry and a price-taking firm that produces in that industry. The market demand and supply functions are estimated to be:

Demand:

Supply:

Supply:  where Q is quantity, P is the price of the product, M is income, and

where Q is quantity, P is the price of the product, M is income, and  is the input price. The manager of the perfectly competitive firm uses time-eries data to obtain the following forecasted values of M and

is the input price. The manager of the perfectly competitive firm uses time-eries data to obtain the following forecasted values of M and  for 2009:

for 2009: The manager also estimates the average variable cost function to be

The manager also estimates the average variable cost function to be Total fixed costs will be $2,000 in 2009.

Total fixed costs will be $2,000 in 2009.-The optimal level of production for the firm is

A) 1,000

B) 1,500

C) 2,000

D) 2,500

E) none of the above

Unlock Deck

Unlock for access to all 58 flashcards in this deck.

Unlock Deck

k this deck

11

Deep Check

-The profit (loss) is

A) $2,600

B) $2,000

C) $4,000

D) $3,250

E) none of the above

-The profit (loss) is

A) $2,600

B) $2,000

C) $4,000

D) $3,250

E) none of the above

Unlock Deck

Unlock for access to all 58 flashcards in this deck.

Unlock Deck

k this deck

12

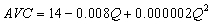

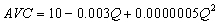

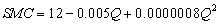

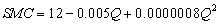

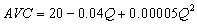

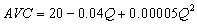

use the following data for a competitive industry and a price-taking firm that operates in this market.

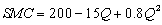

Bartech, Inc. is a firm operating in a competitive market. The manager of Bartech forecasts product price to be $28 in 2009. Bartech's average variable cost function in 2005 is estimated to be

Bartech expects to face fixed costs of $12,000 in 2009.

Bartech expects to face fixed costs of $12,000 in 2009.

-At what level of output will Bartech's average variable cost reach its minimum value?

A) 2,000 units

B) 3,000 units

C) 4,000 units

D) 5,000 units

E) 6,000 units

Bartech, Inc. is a firm operating in a competitive market. The manager of Bartech forecasts product price to be $28 in 2009. Bartech's average variable cost function in 2005 is estimated to be

Bartech expects to face fixed costs of $12,000 in 2009.

Bartech expects to face fixed costs of $12,000 in 2009.-At what level of output will Bartech's average variable cost reach its minimum value?

A) 2,000 units

B) 3,000 units

C) 4,000 units

D) 5,000 units

E) 6,000 units

Unlock Deck

Unlock for access to all 58 flashcards in this deck.

Unlock Deck

k this deck

13

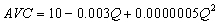

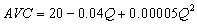

use the following data for a competitive industry and a price-taking firm that operates in this market.

Bartech, Inc. is a firm operating in a competitive market. The manager of Bartech forecasts product price to be $28 in 2009. Bartech's average variable cost function in 2005 is estimated to be

Bartech expects to face fixed costs of $12,000 in 2009.

Bartech expects to face fixed costs of $12,000 in 2009.

-What is the minimum average variable cost?

A) $0

B) $5.50

C) $6.00

D) $6.50

E) $7.00

Bartech, Inc. is a firm operating in a competitive market. The manager of Bartech forecasts product price to be $28 in 2009. Bartech's average variable cost function in 2005 is estimated to be

Bartech expects to face fixed costs of $12,000 in 2009.

Bartech expects to face fixed costs of $12,000 in 2009.-What is the minimum average variable cost?

A) $0

B) $5.50

C) $6.00

D) $6.50

E) $7.00

Unlock Deck

Unlock for access to all 58 flashcards in this deck.

Unlock Deck

k this deck

14

suppose that the 2009 price forecast is drastically revised downward to $5.

-What is Bartech's profit-maximizing (or loss-minimizing) output for 2009?

A) 0 units

B) 1,000 units

C) 2,000 units

D) 3,000 units

E) 4,000 units

-What is Bartech's profit-maximizing (or loss-minimizing) output for 2009?

A) 0 units

B) 1,000 units

C) 2,000 units

D) 3,000 units

E) 4,000 units

Unlock Deck

Unlock for access to all 58 flashcards in this deck.

Unlock Deck

k this deck

15

Use the following information

Radon Research Corporation (RRC) is one of 24 firms in Albuquerque testing homes for dangerous levels of radon gas. There is a standard test that all testing companies use. The manager of RRC wants to know the number of homes to test in 2009 in order to maximize the firm's profit. The manager forecasted a price of $160 for radon tests in 2009.

The firm's marginal cost was estimated as

where Q is the number of tests performed each week. RRC's fixed cost will be $250 per week.

where Q is the number of tests performed each week. RRC's fixed cost will be $250 per week.

-The weekly profit (loss) at RRC in 2009 will be

A) $121

B) $320

C) $86 -$61

D)-$121

Radon Research Corporation (RRC) is one of 24 firms in Albuquerque testing homes for dangerous levels of radon gas. There is a standard test that all testing companies use. The manager of RRC wants to know the number of homes to test in 2009 in order to maximize the firm's profit. The manager forecasted a price of $160 for radon tests in 2009.

The firm's marginal cost was estimated as

where Q is the number of tests performed each week. RRC's fixed cost will be $250 per week.

where Q is the number of tests performed each week. RRC's fixed cost will be $250 per week.-The weekly profit (loss) at RRC in 2009 will be

A) $121

B) $320

C) $86 -$61

D)-$121

Unlock Deck

Unlock for access to all 58 flashcards in this deck.

Unlock Deck

k this deck

16

Use the following information

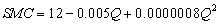

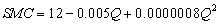

Sport Tee Corporation manufactures T-shirts bearing the logos of professional baseball and football teams. The wholesale market for sport T-shirts is perfectly competitive? The manager forecasts the wholesale price of T-shirts next year to be $7.00. The firm's estimated marginal cost is

where Q is the number of T-shirts produced and sold each month. Sport Tee Corporation will have a fixed cost of $2,000 per month.

where Q is the number of T-shirts produced and sold each month. Sport Tee Corporation will have a fixed cost of $2,000 per month.

-Average variable cost at Sport Tee is

A) 12 - 0.01Q + 0.0000024Q2

B) 12 - 0.0025Q + 0.000000266Q2

C) 12 - 0.0001Q + 0.000001Q2

D) 12Q - 0.0025Q2 + 0.000000266Q3

E) none of the above

Sport Tee Corporation manufactures T-shirts bearing the logos of professional baseball and football teams. The wholesale market for sport T-shirts is perfectly competitive? The manager forecasts the wholesale price of T-shirts next year to be $7.00. The firm's estimated marginal cost is

where Q is the number of T-shirts produced and sold each month. Sport Tee Corporation will have a fixed cost of $2,000 per month.

where Q is the number of T-shirts produced and sold each month. Sport Tee Corporation will have a fixed cost of $2,000 per month.-Average variable cost at Sport Tee is

A) 12 - 0.01Q + 0.0000024Q2

B) 12 - 0.0025Q + 0.000000266Q2

C) 12 - 0.0001Q + 0.000001Q2

D) 12Q - 0.0025Q2 + 0.000000266Q3

E) none of the above

Unlock Deck

Unlock for access to all 58 flashcards in this deck.

Unlock Deck

k this deck

17

Use the following information

Sport Tee Corporation manufactures T-shirts bearing the logos of professional baseball and football teams. The wholesale market for sport T-shirts is perfectly competitive? The manager forecasts the wholesale price of T-shirts next year to be $7.00. The firm's estimated marginal cost is

where Q is the number of T-shirts produced and sold each month. Sport Tee Corporation will have a fixed cost of $2,000 per month.

where Q is the number of T-shirts produced and sold each month. Sport Tee Corporation will have a fixed cost of $2,000 per month.

-To maximize profit how many T-shirts should be produced and sold each month?

A) 1,000

B) 2,000

C) 3,000

D) 4,000

E) 5,000

Sport Tee Corporation manufactures T-shirts bearing the logos of professional baseball and football teams. The wholesale market for sport T-shirts is perfectly competitive? The manager forecasts the wholesale price of T-shirts next year to be $7.00. The firm's estimated marginal cost is

where Q is the number of T-shirts produced and sold each month. Sport Tee Corporation will have a fixed cost of $2,000 per month.

where Q is the number of T-shirts produced and sold each month. Sport Tee Corporation will have a fixed cost of $2,000 per month.-To maximize profit how many T-shirts should be produced and sold each month?

A) 1,000

B) 2,000

C) 3,000

D) 4,000

E) 5,000

Unlock Deck

Unlock for access to all 58 flashcards in this deck.

Unlock Deck

k this deck

18

Use the following information

Sport Tee Corporation manufactures T-shirts bearing the logos of professional baseball and football teams. The wholesale market for sport T-shirts is perfectly competitive? The manager forecasts the wholesale price of T-shirts next year to be $7.00. The firm's estimated marginal cost is

where Q is the number of T-shirts produced and sold each month. Sport Tee Corporation will have a fixed cost of $2,000 per month.

where Q is the number of T-shirts produced and sold each month. Sport Tee Corporation will have a fixed cost of $2,000 per month.

-At the profit-maximizing level of output total revenue will be

A) $10,000

B) $15,000

C) $20,000

D) $25,000

E) $35,000

Sport Tee Corporation manufactures T-shirts bearing the logos of professional baseball and football teams. The wholesale market for sport T-shirts is perfectly competitive? The manager forecasts the wholesale price of T-shirts next year to be $7.00. The firm's estimated marginal cost is

where Q is the number of T-shirts produced and sold each month. Sport Tee Corporation will have a fixed cost of $2,000 per month.

where Q is the number of T-shirts produced and sold each month. Sport Tee Corporation will have a fixed cost of $2,000 per month.-At the profit-maximizing level of output total revenue will be

A) $10,000

B) $15,000

C) $20,000

D) $25,000

E) $35,000

Unlock Deck

Unlock for access to all 58 flashcards in this deck.

Unlock Deck

k this deck

19

Use the following information

Sport Tee Corporation manufactures T-shirts bearing the logos of professional baseball and football teams. The wholesale market for sport T-shirts is perfectly competitive? The manager forecasts the wholesale price of T-shirts next year to be $7.00. The firm's estimated marginal cost is

where Q is the number of T-shirts produced and sold each month. Sport Tee Corporation will have a fixed cost of $2,000 per month.

where Q is the number of T-shirts produced and sold each month. Sport Tee Corporation will have a fixed cost of $2,000 per month.

-Monthly profit will be

A)-$2,000

B)-$1,150

C) $4,250

D) $3,400

E) $2,250

Sport Tee Corporation manufactures T-shirts bearing the logos of professional baseball and football teams. The wholesale market for sport T-shirts is perfectly competitive? The manager forecasts the wholesale price of T-shirts next year to be $7.00. The firm's estimated marginal cost is

where Q is the number of T-shirts produced and sold each month. Sport Tee Corporation will have a fixed cost of $2,000 per month.

where Q is the number of T-shirts produced and sold each month. Sport Tee Corporation will have a fixed cost of $2,000 per month.-Monthly profit will be

A)-$2,000

B)-$1,150

C) $4,250

D) $3,400

E) $2,250

Unlock Deck

Unlock for access to all 58 flashcards in this deck.

Unlock Deck

k this deck

20

Use the following information

Sport Tee Corporation manufactures T-shirts bearing the logos of professional baseball and football teams. The wholesale market for sport T-shirts is perfectly competitive? The manager forecasts the wholesale price of T-shirts next year to be $7.00. The firm's estimated marginal cost is

where Q is the number of T-shirts produced and sold each month. Sport Tee Corporation will have a fixed cost of $2,000 per month.

where Q is the number of T-shirts produced and sold each month. Sport Tee Corporation will have a fixed cost of $2,000 per month.

-A perfectly competitive firm's demand is ____________ elastic and equal to ____________ which is equal to ____________.

Sport Tee Corporation manufactures T-shirts bearing the logos of professional baseball and football teams. The wholesale market for sport T-shirts is perfectly competitive? The manager forecasts the wholesale price of T-shirts next year to be $7.00. The firm's estimated marginal cost is

where Q is the number of T-shirts produced and sold each month. Sport Tee Corporation will have a fixed cost of $2,000 per month.

where Q is the number of T-shirts produced and sold each month. Sport Tee Corporation will have a fixed cost of $2,000 per month.-A perfectly competitive firm's demand is ____________ elastic and equal to ____________ which is equal to ____________.

Unlock Deck

Unlock for access to all 58 flashcards in this deck.

Unlock Deck

k this deck

21

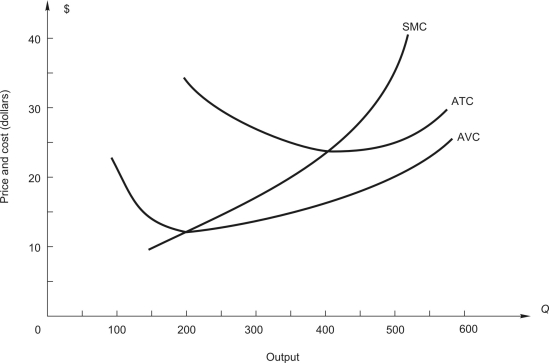

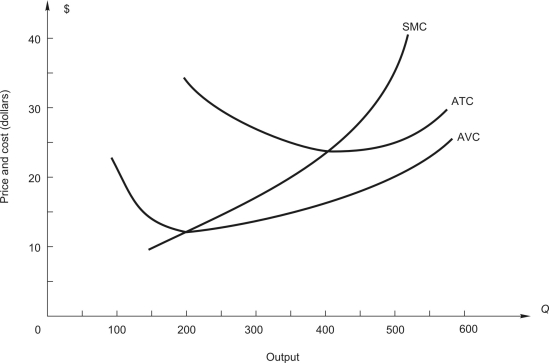

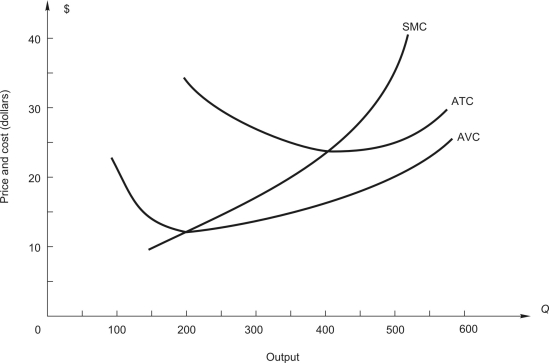

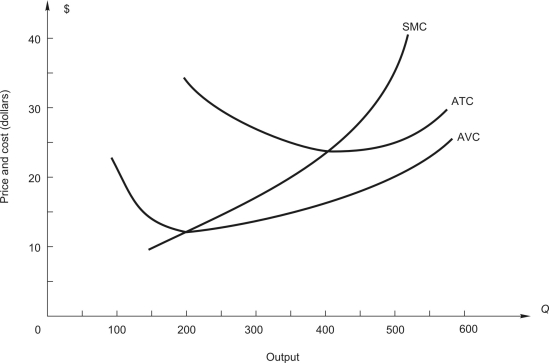

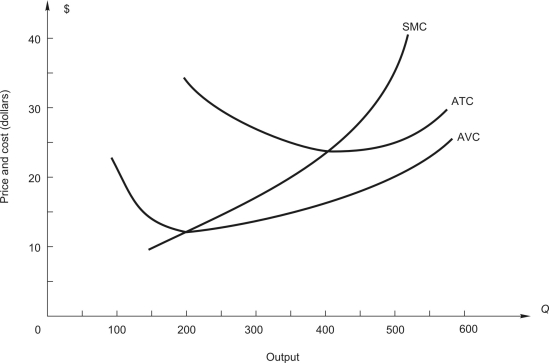

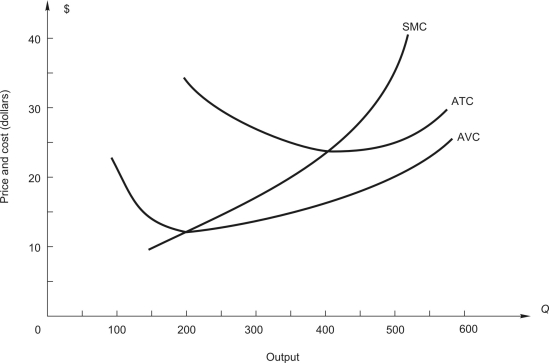

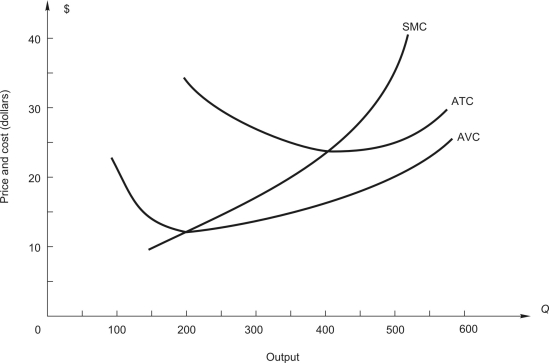

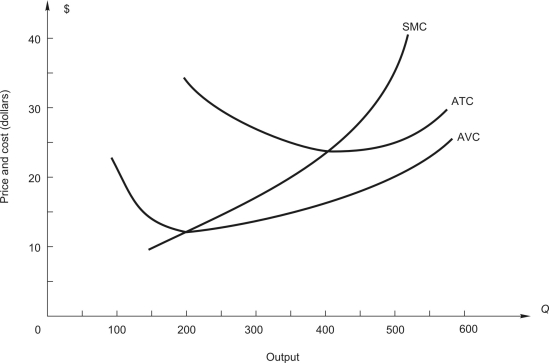

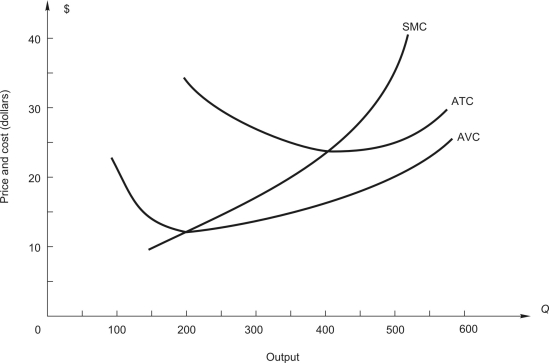

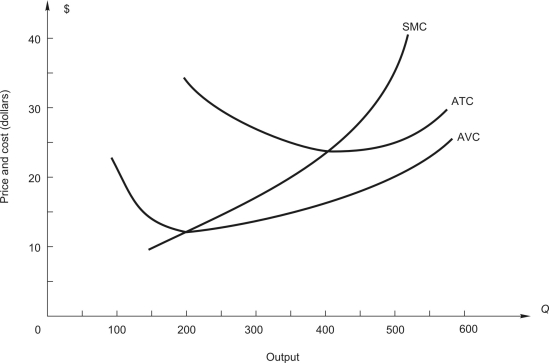

Use the following graph on a competitive firm's short-run cost curves to answer this question.

The price of the product is $35.

-The firm produces ____________ units of output. Total revenue is $____________ and total cost is $____________.

The price of the product is $35.

-The firm produces ____________ units of output. Total revenue is $____________ and total cost is $____________.

Unlock Deck

Unlock for access to all 58 flashcards in this deck.

Unlock Deck

k this deck

22

Use the following graph on a competitive firm's short-run cost curves to answer this question.

The price of the product is $35.

-The firm makes a profit (loss) of $____________.

The price of the product is $20.

The price of the product is $35.

-The firm makes a profit (loss) of $____________.

The price of the product is $20.

Unlock Deck

Unlock for access to all 58 flashcards in this deck.

Unlock Deck

k this deck

23

Use the following graph on a competitive firm's short-run cost curves to answer this question.

The price of the product is $35.

-The firm produces ______ units of output. Total revenue is $____________ and total cost is $____________.

The price of the product is $35.

-The firm produces ______ units of output. Total revenue is $____________ and total cost is $____________.

Unlock Deck

Unlock for access to all 58 flashcards in this deck.

Unlock Deck

k this deck

24

Use the following graph on a competitive firm's short-run cost curves to answer this question.

The price of the product is $35.

-The firm makes a profit (loss) of $____________.

The price of the product is $35.

-The firm makes a profit (loss) of $____________.

Unlock Deck

Unlock for access to all 58 flashcards in this deck.

Unlock Deck

k this deck

25

Use the following graph on a competitive firm's short-run cost curves to answer this question.

The price of the product is $35.

-The firm's total revenue at a price of $20 covers all of its variable cost, and the firm has $____________ left to apply toward paying its ________________________. If the firm shuts down and produces nothing it would lose an amount equal to its _________________

The price of the product is $35.

-The firm's total revenue at a price of $20 covers all of its variable cost, and the firm has $____________ left to apply toward paying its ________________________. If the firm shuts down and produces nothing it would lose an amount equal to its _________________

Unlock Deck

Unlock for access to all 58 flashcards in this deck.

Unlock Deck

k this deck

26

Use the following graph on a competitive firm's short-run cost curves to answer this question.

The price of the product is $35.

-At any price below (approximately) $_________, the firm would shut down.

The price of the product is $35.

-At any price below (approximately) $_________, the firm would shut down.

Unlock Deck

Unlock for access to all 58 flashcards in this deck.

Unlock Deck

k this deck

27

In long-run competitive equilibrium, product price equals __________________ and also equals __________________. Thus, economic profit equals $___________, however, firms have not incentive to exit the industry because each firm earns enough revenue to cover all its explicit costs of operation and pay its owners an amount equal to ______________________________.

Unlock Deck

Unlock for access to all 58 flashcards in this deck.

Unlock Deck

k this deck

28

Firms in a perfectly competitive industry are earning an economic profit.

-Product price will ___________ because ______________________________.

-Product price will ___________ because ______________________________.

Unlock Deck

Unlock for access to all 58 flashcards in this deck.

Unlock Deck

k this deck

29

Firms in a perfectly competitive industry are earning an economic profit.

-After long-run competitive equilibrium comes about there will be ___________ (fewer, more, the same number of) firms in the industry and the industry will produce __________ (less, more, the same amount of) output.

-After long-run competitive equilibrium comes about there will be ___________ (fewer, more, the same number of) firms in the industry and the industry will produce __________ (less, more, the same amount of) output.

Unlock Deck

Unlock for access to all 58 flashcards in this deck.

Unlock Deck

k this deck

30

Firms in a perfectly competitive industry are earning an economic profit.

-In long-run competitive equilibrium each firm will earn ___________ economic profit.

-In long-run competitive equilibrium each firm will earn ___________ economic profit.

Unlock Deck

Unlock for access to all 58 flashcards in this deck.

Unlock Deck

k this deck

31

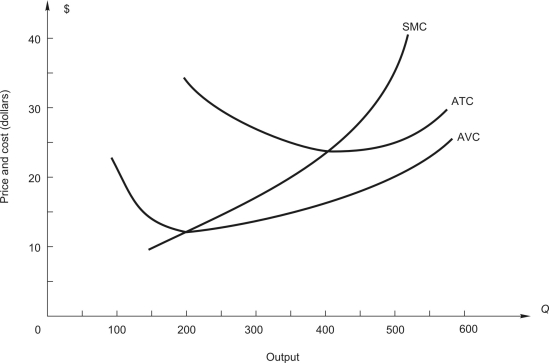

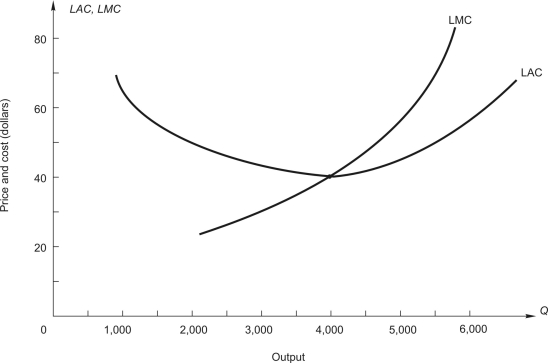

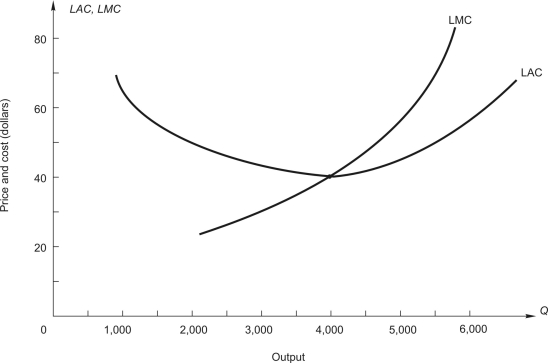

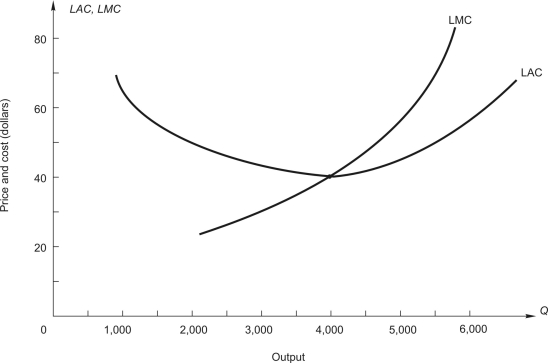

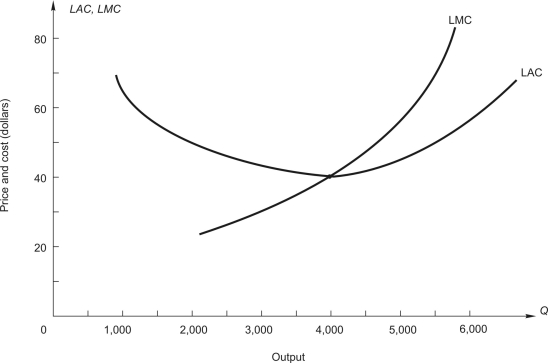

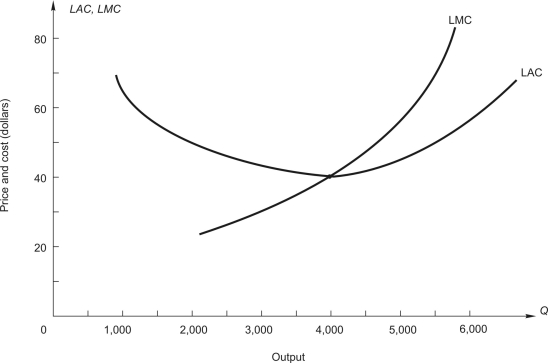

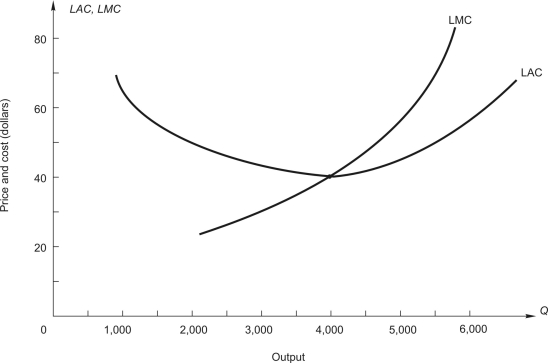

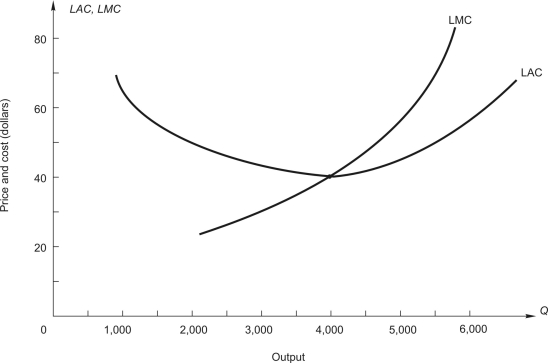

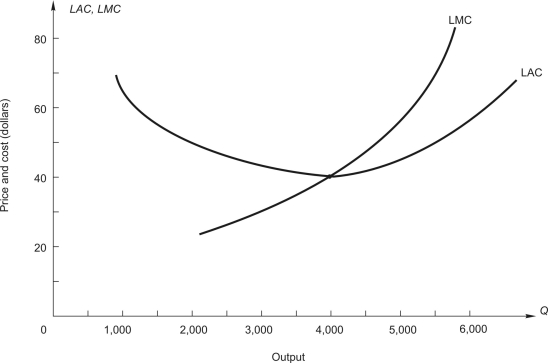

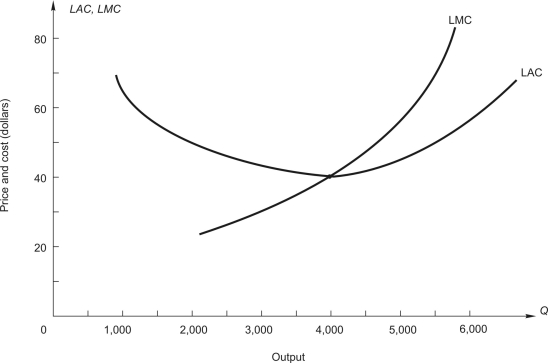

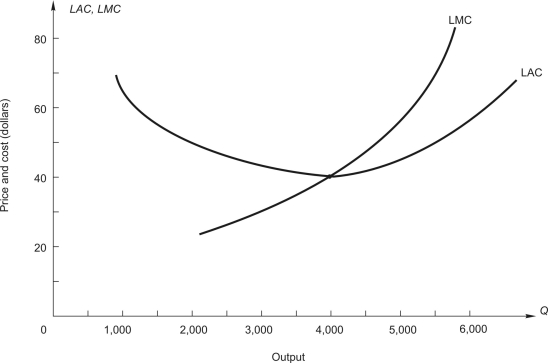

The following graph showing a perfectly competitive firm's long-run cost curves.

-If price is $70, the firm will produce __________ units of output.

-If price is $70, the firm will produce __________ units of output.

Unlock Deck

Unlock for access to all 58 flashcards in this deck.

Unlock Deck

k this deck

32

The following graph showing a perfectly competitive firm's long-run cost curves.

-If price is $70, total revenue will be $__________ and total cost will be $__________.

-If price is $70, total revenue will be $__________ and total cost will be $__________.

Unlock Deck

Unlock for access to all 58 flashcards in this deck.

Unlock Deck

k this deck

33

The following graph showing a perfectly competitive firm's long-run cost curves.

-If price is $70, the firm makes $__________ economic profit.

-If price is $70, the firm makes $__________ economic profit.

Unlock Deck

Unlock for access to all 58 flashcards in this deck.

Unlock Deck

k this deck

34

The following graph showing a perfectly competitive firm's long-run cost curves.

-In long-run competitive equilibrium, the firm will produce __________ units of output and sell them at a price of $________ if this is a constant cost industry.

-In long-run competitive equilibrium, the firm will produce __________ units of output and sell them at a price of $________ if this is a constant cost industry.

Unlock Deck

Unlock for access to all 58 flashcards in this deck.

Unlock Deck

k this deck

35

The following graph showing a perfectly competitive firm's long-run cost curves.

-In long-run equilibrium, the firm's economic profit is $_________.

-In long-run equilibrium, the firm's economic profit is $_________.

Unlock Deck

Unlock for access to all 58 flashcards in this deck.

Unlock Deck

k this deck

36

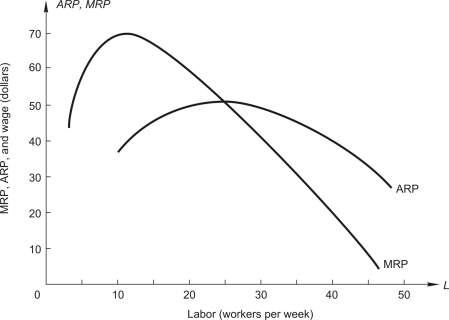

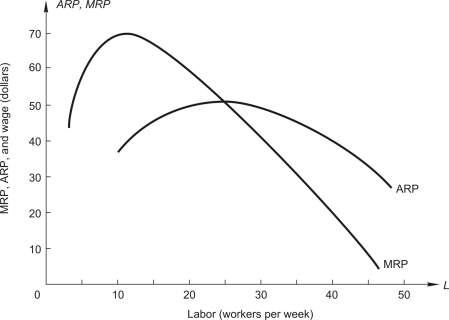

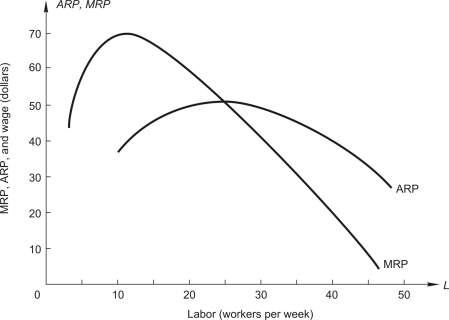

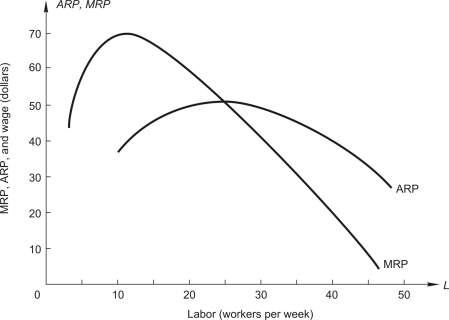

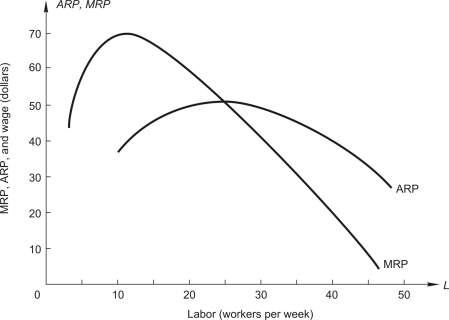

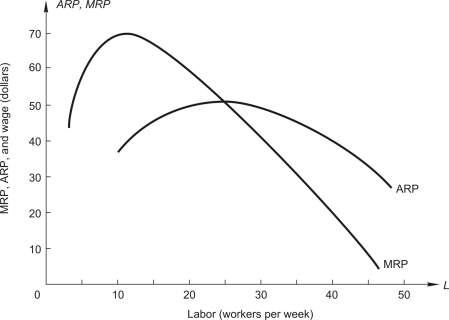

The following figure shows a competitive firm's ARP and MRP curves.

-If the wage rate is $20, how many workers will the firm hire? ________.

-If the wage rate is $20, how many workers will the firm hire? ________.

Unlock Deck

Unlock for access to all 58 flashcards in this deck.

Unlock Deck

k this deck

37

The following figure shows a competitive firm's ARP and MRP curves.

-If the wage rate is $30, how many workers will the firm hire? ________.

-If the wage rate is $30, how many workers will the firm hire? ________.

Unlock Deck

Unlock for access to all 58 flashcards in this deck.

Unlock Deck

k this deck

38

The following figure shows a competitive firm's ARP and MRP curves.

-If the wage is $60, how many workers will the firm hire? ________. How much output will the firm produce? ________.

-If the wage is $60, how many workers will the firm hire? ________. How much output will the firm produce? ________.

Unlock Deck

Unlock for access to all 58 flashcards in this deck.

Unlock Deck

k this deck

39

A perfectly competitive firm in the short run will

-Produce the output at which _____________________ equals __________________ and make an economic profit if price exceeds __________________.

-Produce the output at which _____________________ equals __________________ and make an economic profit if price exceeds __________________.

Unlock Deck

Unlock for access to all 58 flashcards in this deck.

Unlock Deck

k this deck

40

A perfectly competitive firm in the short run will

-Produce the output at which __________________ equals __________________ and make a loss if price is between __________________ and __________________.

-Produce the output at which __________________ equals __________________ and make a loss if price is between __________________ and __________________.

Unlock Deck

Unlock for access to all 58 flashcards in this deck.

Unlock Deck

k this deck

41

A perfectly competitive firm in the short run will

-Shut down if price is below ________________________ and make a loss of __________________.

-Shut down if price is below ________________________ and make a loss of __________________.

Unlock Deck

Unlock for access to all 58 flashcards in this deck.

Unlock Deck

k this deck

42

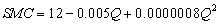

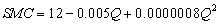

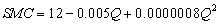

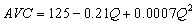

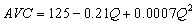

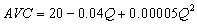

A competitive firm estimates its average variable cost function to be .  The firm's total fixed cost is $3,500.

The firm's total fixed cost is $3,500.

-The marginal cost function associated with this average variable cost function is

SMC =__________________________.

The firm's total fixed cost is $3,500.

The firm's total fixed cost is $3,500.-The marginal cost function associated with this average variable cost function is

SMC =__________________________.

Unlock Deck

Unlock for access to all 58 flashcards in this deck.

Unlock Deck

k this deck

43

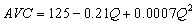

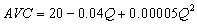

A competitive firm estimates its average variable cost function to be .  The firm's total fixed cost is $3,500.

The firm's total fixed cost is $3,500.

-AVC reaches its minimum at ______units of output. Minimum AVC is $_________.

The firm's total fixed cost is $3,500.

The firm's total fixed cost is $3,500.-AVC reaches its minimum at ______units of output. Minimum AVC is $_________.

Unlock Deck

Unlock for access to all 58 flashcards in this deck.

Unlock Deck

k this deck

44

A competitive firm estimates its average variable cost function to be .  The firm's total fixed cost is $3,500.

The firm's total fixed cost is $3,500.

-Suppose the price of the product is P = $125. The firm should produce _________ units of output. The firm earns a profit (loss) of $__________________.

The firm's total fixed cost is $3,500.

The firm's total fixed cost is $3,500.-Suppose the price of the product is P = $125. The firm should produce _________ units of output. The firm earns a profit (loss) of $__________________.

Unlock Deck

Unlock for access to all 58 flashcards in this deck.

Unlock Deck

k this deck

45

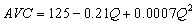

A competitive firm estimates its average variable cost function to be .  The firm's total fixed cost is $3,500.

The firm's total fixed cost is $3,500.

-Suppose the price of the product is P = $115. The firm should now produce _________ units of output. Its profit (loss) will be $_________.

The firm's total fixed cost is $3,500.

The firm's total fixed cost is $3,500.-Suppose the price of the product is P = $115. The firm should now produce _________ units of output. Its profit (loss) will be $_________.

Unlock Deck

Unlock for access to all 58 flashcards in this deck.

Unlock Deck

k this deck

46

A competitive firm estimates its average variable cost function to be .  The firm's total fixed cost is $3,500.

The firm's total fixed cost is $3,500.

-Suppose the price of the product falls to P = $100. The firm should produce _________ units of output. Its profit (loss) will be $____________.

The firm's total fixed cost is $3,500.

The firm's total fixed cost is $3,500.-Suppose the price of the product falls to P = $100. The firm should produce _________ units of output. Its profit (loss) will be $____________.

Unlock Deck

Unlock for access to all 58 flashcards in this deck.

Unlock Deck

k this deck

47

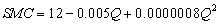

A competitive firm has estimated its average variable cost function as

Its total fixed cost is $500.

Its total fixed cost is $500.

-The marginal cost function associated with this AVC function is

SMC = ________________.

Its total fixed cost is $500.

Its total fixed cost is $500.-The marginal cost function associated with this AVC function is

SMC = ________________.

Unlock Deck

Unlock for access to all 58 flashcards in this deck.

Unlock Deck

k this deck

48

A competitive firm has estimated its average variable cost function as

Its total fixed cost is $500.

Its total fixed cost is $500.

-AVC reaches its minimum at _________ units of output at which AVC = $__________.

The forecasted price is P = $23.60.

Its total fixed cost is $500.

Its total fixed cost is $500.-AVC reaches its minimum at _________ units of output at which AVC = $__________.

The forecasted price is P = $23.60.

Unlock Deck

Unlock for access to all 58 flashcards in this deck.

Unlock Deck

k this deck

49

A competitive firm has estimated its average variable cost function as

Its total fixed cost is $500.

Its total fixed cost is $500.

-To maximize its profit the firm should produce ___________ units of output. Profit (loss) is $____________.

Suppose the forecasted price is P = $14.94.

Its total fixed cost is $500.

Its total fixed cost is $500.-To maximize its profit the firm should produce ___________ units of output. Profit (loss) is $____________.

Suppose the forecasted price is P = $14.94.

Unlock Deck

Unlock for access to all 58 flashcards in this deck.

Unlock Deck

k this deck

50

A competitive firm has estimated its average variable cost function as

Its total fixed cost is $500.

Its total fixed cost is $500.

-To maximize its profit, the firm should produce ___________ units of output. Profit (loss) is $__________.

Suppose the forecasted price is P = $10.

Its total fixed cost is $500.

Its total fixed cost is $500.-To maximize its profit, the firm should produce ___________ units of output. Profit (loss) is $__________.

Suppose the forecasted price is P = $10.

Unlock Deck

Unlock for access to all 58 flashcards in this deck.

Unlock Deck

k this deck

51

A competitive firm has estimated its average variable cost function as

Its total fixed cost is $500.

Its total fixed cost is $500.

-The firm should produce ____________ units of output for a profit (loss) of $____________.

Its total fixed cost is $500.

Its total fixed cost is $500.-The firm should produce ____________ units of output for a profit (loss) of $____________.

Unlock Deck

Unlock for access to all 58 flashcards in this deck.

Unlock Deck

k this deck

52

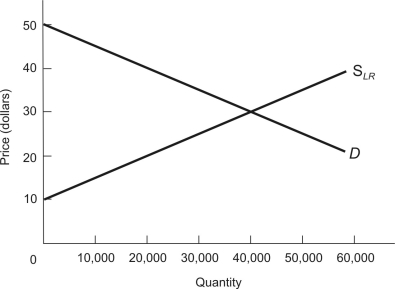

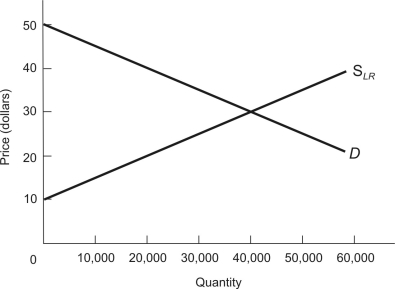

The figure below shows a long-run industry supply curve (SLR) and the demand curve (D) facing the competitive industry. The firms in this industry employ inputs of varying quality and productivity.

-The long-run marginal cost of producing the 20,000th unit of output is $________.

-The long-run marginal cost of producing the 20,000th unit of output is $________.

Unlock Deck

Unlock for access to all 58 flashcards in this deck.

Unlock Deck

k this deck

53

The figure below shows a long-run industry supply curve (SLR) and the demand curve (D) facing the competitive industry. The firms in this industry employ inputs of varying quality and productivity.

-If the firms in this industry produce a total industry output of 20,000 units, every firm produces at the minimum long-run average cost of $_______ per unit and earns $________ of economic profit.

-If the firms in this industry produce a total industry output of 20,000 units, every firm produces at the minimum long-run average cost of $_______ per unit and earns $________ of economic profit.

Unlock Deck

Unlock for access to all 58 flashcards in this deck.

Unlock Deck

k this deck

54

The figure below shows a long-run industry supply curve (SLR) and the demand curve (D) facing the competitive industry. The firms in this industry employ inputs of varying quality and productivity.

-In long-run competitive equilibrium, the industry will produce ________ units of the good and sell these units at the market-clearing price of $______ per unit.

-In long-run competitive equilibrium, the industry will produce ________ units of the good and sell these units at the market-clearing price of $______ per unit.

Unlock Deck

Unlock for access to all 58 flashcards in this deck.

Unlock Deck

k this deck

55

The figure below shows a long-run industry supply curve (SLR) and the demand curve (D) facing the competitive industry. The firms in this industry employ inputs of varying quality and productivity.

-The long-run marginal cost at the equilibrium output in part c is $_______, and the long-run average cost at the equilibrium output is $_______.

-The long-run marginal cost at the equilibrium output in part c is $_______, and the long-run average cost at the equilibrium output is $_______.

Unlock Deck

Unlock for access to all 58 flashcards in this deck.

Unlock Deck

k this deck

56

The figure below shows a long-run industry supply curve (SLR) and the demand curve (D) facing the competitive industry. The firms in this industry employ inputs of varying quality and productivity.

-"The firms employing the superior inputs have lower costs than their rivals, but they still cannot earn any profit." Is this statement true or false?

-"The firms employing the superior inputs have lower costs than their rivals, but they still cannot earn any profit." Is this statement true or false?

Unlock Deck

Unlock for access to all 58 flashcards in this deck.

Unlock Deck

k this deck

57

The figure below shows a long-run industry supply curve (SLR) and the demand curve (D) facing the competitive industry. The firms in this industry employ inputs of varying quality and productivity.

-Total producer surplus in long-run competitive equilibrium is $_________ for this industry.

-Total producer surplus in long-run competitive equilibrium is $_________ for this industry.

Unlock Deck

Unlock for access to all 58 flashcards in this deck.

Unlock Deck

k this deck

58

The figure below shows a long-run industry supply curve (SLR) and the demand curve (D) facing the competitive industry. The firms in this industry employ inputs of varying quality and productivity.

-______________________ get the producer surplus calculated in part f.

-______________________ get the producer surplus calculated in part f.

Unlock Deck

Unlock for access to all 58 flashcards in this deck.

Unlock Deck

k this deck