Deck 24: Standard Cost Systems

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/14

Play

Full screen (f)

Deck 24: Standard Cost Systems

1

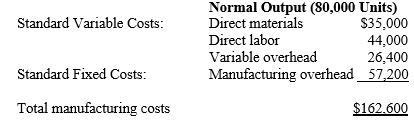

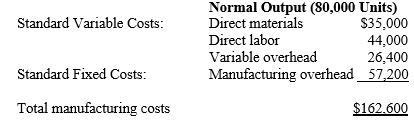

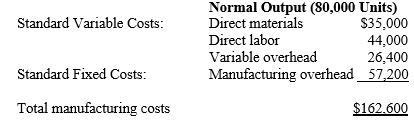

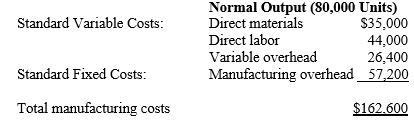

The following budget for the 80,000-unit normal production level was prepared by the Montgomery Corporation for September:

During September, the Production Department actually produced 90,000 units at a total manufacturing cost of $165,000.

During September, the Production Department actually produced 90,000 units at a total manufacturing cost of $165,000.

-Refer to the above data. Which of the following is not an accurate budgeted amount for an output level of 90,000 units?

A) Total overhead cost, $86,900

B) Total manufacturing costs, $183,150

C) Direct materials, $39,375

D) Direct labor, $49,500

During September, the Production Department actually produced 90,000 units at a total manufacturing cost of $165,000.

During September, the Production Department actually produced 90,000 units at a total manufacturing cost of $165,000.-Refer to the above data. Which of the following is not an accurate budgeted amount for an output level of 90,000 units?

A) Total overhead cost, $86,900

B) Total manufacturing costs, $183,150

C) Direct materials, $39,375

D) Direct labor, $49,500

Total manufacturing costs, $183,150

2

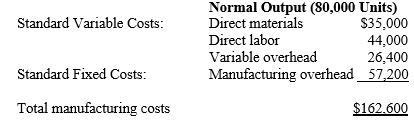

The following budget for the 80,000-unit normal production level was prepared by the Montgomery Corporation for September:

During September, the Production Department actually produced 90,000 units at a total manufacturing cost of $165,000.

During September, the Production Department actually produced 90,000 units at a total manufacturing cost of $165,000.

-Refer to the above data. A summary of Montgomery's performance in September would not show:

A) Actual total costs under budget by $1,000.

B) Total costs of $175,775 budgeted for 90,000 units.

C) Actual total costs under budget by $10,775.

D) Overhead applied to production of $64,350.

During September, the Production Department actually produced 90,000 units at a total manufacturing cost of $165,000.

During September, the Production Department actually produced 90,000 units at a total manufacturing cost of $165,000.-Refer to the above data. A summary of Montgomery's performance in September would not show:

A) Actual total costs under budget by $1,000.

B) Total costs of $175,775 budgeted for 90,000 units.

C) Actual total costs under budget by $10,775.

D) Overhead applied to production of $64,350.

Actual total costs under budget by $1,000.

3

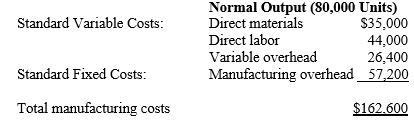

The following budget for the 80,000-unit normal production level was prepared by the Montgomery Corporation for September:

During September, the Production Department actually produced 90,000 units at a total manufacturing cost of $165,000.

During September, the Production Department actually produced 90,000 units at a total manufacturing cost of $165,000.

-Refer to the above data. The cost-volume relationship used to prepare the flexible budget for this department includes:

A) Manufacturing overhead cost of $1.00 (rounded) per unit.

B) Fixed cost of $0.65 (rounded) per unit.

C) Total cost of $1.90 (rounded) per unit.

D) Variable costs of $1.32 (rounded) per unit.

During September, the Production Department actually produced 90,000 units at a total manufacturing cost of $165,000.

During September, the Production Department actually produced 90,000 units at a total manufacturing cost of $165,000.-Refer to the above data. The cost-volume relationship used to prepare the flexible budget for this department includes:

A) Manufacturing overhead cost of $1.00 (rounded) per unit.

B) Fixed cost of $0.65 (rounded) per unit.

C) Total cost of $1.90 (rounded) per unit.

D) Variable costs of $1.32 (rounded) per unit.

Variable costs of $1.32 (rounded) per unit.

4

Under standard cost procedures, any differences between actual costs and standard costs are:

A) Ignored until the end of the fiscal period, when they are shown in footnotes to the income statement.

B) Recorded in variance accounts.

C) Added to or subtracted from the standard cost amount immediately.

D) Treated as extraordinary production gains or losses.

A) Ignored until the end of the fiscal period, when they are shown in footnotes to the income statement.

B) Recorded in variance accounts.

C) Added to or subtracted from the standard cost amount immediately.

D) Treated as extraordinary production gains or losses.

Unlock Deck

Unlock for access to all 14 flashcards in this deck.

Unlock Deck

k this deck

5

If the actual number of direct labor hours used exceeds the standard direct labor hours allowed, this indicates:

A) An unfavorable labor efficiency variance.

B) A favorable labor efficiency variance.

C) An unfavorable labor rate variance.

D) An unfavorable total labor variance.

A) An unfavorable labor efficiency variance.

B) A favorable labor efficiency variance.

C) An unfavorable labor rate variance.

D) An unfavorable total labor variance.

Unlock Deck

Unlock for access to all 14 flashcards in this deck.

Unlock Deck

k this deck

6

Matson Company incurred actual direct labor costs of $70,500 in April for 6,000 direct labor hours, although the standard labor cost for output produced was only $67,200 (6,400 hours at $10.50 per hour).

-Refer to the above data. Matson's labor rate variance for April is:

A) $7,500 unfavorable.

B) $8,000 unfavorable.

C) $4,200 favorable.

D) $3,300 unfavorable.

-Refer to the above data. Matson's labor rate variance for April is:

A) $7,500 unfavorable.

B) $8,000 unfavorable.

C) $4,200 favorable.

D) $3,300 unfavorable.

Unlock Deck

Unlock for access to all 14 flashcards in this deck.

Unlock Deck

k this deck

7

Matson Company incurred actual direct labor costs of $70,500 in April for 6,000 direct labor hours, although the standard labor cost for output produced was only $67,200 (6,400 hours at $10.50 per hour).

-Refer to the above data. Matson's labor efficiency variance for April is:

A) $3,300 unfavorable.

B) $7,500 unfavorable.

C) $4,700 favorable.

D) $4,200 favorable.

-Refer to the above data. Matson's labor efficiency variance for April is:

A) $3,300 unfavorable.

B) $7,500 unfavorable.

C) $4,700 favorable.

D) $4,200 favorable.

Unlock Deck

Unlock for access to all 14 flashcards in this deck.

Unlock Deck

k this deck

8

Matson Company incurred actual direct labor costs of $70,500 in April for 6,000 direct labor hours, although the standard labor cost for output produced was only $67,200 (6,400 hours at $10.50 per hour).

-Refer to the above data. The journal entry to record direct labor costs relating to work performed in April includes:

A) A debit to Work-in-Process Inventory for $70,500.

B) A credit to Labor Rate Variance for $7,500.

C) A credit to Labor Efficiency Variance for $4,200.

D) A credit to Direct Labor for $67,200.

-Refer to the above data. The journal entry to record direct labor costs relating to work performed in April includes:

A) A debit to Work-in-Process Inventory for $70,500.

B) A credit to Labor Rate Variance for $7,500.

C) A credit to Labor Efficiency Variance for $4,200.

D) A credit to Direct Labor for $67,200.

Unlock Deck

Unlock for access to all 14 flashcards in this deck.

Unlock Deck

k this deck

9

Smith's actual manufacturing costs for May totaled $72,000, whereas budgeted manufacturing costs (at standard) were $80,000. A comparison of the budgeted costs and actual amounts:

A) Is not significant unless the budgeted and actual figures are based upon the same level of production.

B) Demonstrates that Smith's Manufacturing Department operated very efficiently during May.

C) Indicates that production cost per unit was 10% below budgeted cost per unit.

D) Indicates that Smith produced only 90% of the number of units budgeted for production in May.

A) Is not significant unless the budgeted and actual figures are based upon the same level of production.

B) Demonstrates that Smith's Manufacturing Department operated very efficiently during May.

C) Indicates that production cost per unit was 10% below budgeted cost per unit.

D) Indicates that Smith produced only 90% of the number of units budgeted for production in May.

Unlock Deck

Unlock for access to all 14 flashcards in this deck.

Unlock Deck

k this deck

10

When standard costs are used in a cost accounting system, the transfer of units from the Finished Goods Inventory to the Cost of Goods Sold account involves:

A) A debit to the Cost of Goods Sold account for the actual cost of units transferred.

B) A credit to the Finished Goods Inventory account for the standard cost of units transferred.

C) Recording a cost variance for the difference between the actual and standard cost of units transferred.

D) The elimination of any cost variances relating to units sold.

A) A debit to the Cost of Goods Sold account for the actual cost of units transferred.

B) A credit to the Finished Goods Inventory account for the standard cost of units transferred.

C) Recording a cost variance for the difference between the actual and standard cost of units transferred.

D) The elimination of any cost variances relating to units sold.

Unlock Deck

Unlock for access to all 14 flashcards in this deck.

Unlock Deck

k this deck

11

Serene Sound produces a high quality audio tape used in the recording industry. Serene allocates variable overhead to production at a rate of $12 per batch manufactured. The company's monthly fixed overhead costs average $72,000. An average of 500 batches per month is considered normal. During June, Serene produced 450 batches of audio tape and incurred actual overhead costs of $79,500.

-Compute the following amounts:

a) Total overhead applied to production in June amounted to $__________.

b) Total overhead budgeted in June for the 450 batches manufactured amounted to $__________.

c) Serene's overhead spending variance was $__________ (favorable/unfavorable).

d) Serene's overhead volume variance was $__________ (favorable/unfavorable).

-Compute the following amounts:

a) Total overhead applied to production in June amounted to $__________.

b) Total overhead budgeted in June for the 450 batches manufactured amounted to $__________.

c) Serene's overhead spending variance was $__________ (favorable/unfavorable).

d) Serene's overhead volume variance was $__________ (favorable/unfavorable).

Unlock Deck

Unlock for access to all 14 flashcards in this deck.

Unlock Deck

k this deck

12

Serene Sound produces a high quality audio tape used in the recording industry. Serene allocates variable overhead to production at a rate of $12 per batch manufactured. The company's monthly fixed overhead costs average $72,000. An average of 500 batches per month is considered normal. During June, Serene produced 450 batches of audio tape and incurred actual overhead costs of $79,500.

- In the space provided, prepare the journal entry to dispose of any over- or under-applied overhead directly to cost of goods sold.

- In the space provided, prepare the journal entry to dispose of any over- or under-applied overhead directly to cost of goods sold.

Unlock Deck

Unlock for access to all 14 flashcards in this deck.

Unlock Deck

k this deck

13

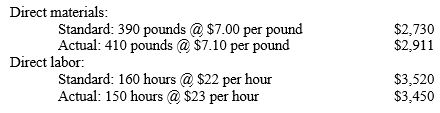

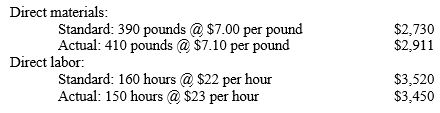

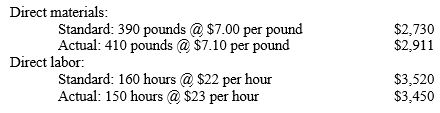

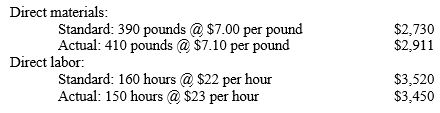

Job no. 007 involved the production of 100 units of product JR. The total standard and actual costs for materials and direct labor on this job are shown below:

-Compute the following cost variances for job no. 007. Indicate whether each variance is favorable (F) or unfavorable (U).

a) Materials price variance: $__________

b) Materials quantity variance: $__________

c) Labor rate variance: $__________

d) Labor efficiency variance: $__________

a. Materials price variance: $__________

b. Materials quantity variance: $__________

c. Labor rate variance: $__________

d. Labor efficiency variance: $__________

-Compute the following cost variances for job no. 007. Indicate whether each variance is favorable (F) or unfavorable (U).

a) Materials price variance: $__________

b) Materials quantity variance: $__________

c) Labor rate variance: $__________

d) Labor efficiency variance: $__________

a. Materials price variance: $__________

b. Materials quantity variance: $__________

c. Labor rate variance: $__________

d. Labor efficiency variance: $__________

Unlock Deck

Unlock for access to all 14 flashcards in this deck.

Unlock Deck

k this deck

14

Job no. 007 involved the production of 100 units of product JR. The total standard and actual costs for materials and direct labor on this job are shown below:

- In the space below, provide the journal entry to record the cost of direct materials used on job no. 007.

- In the space below, provide the journal entry to record the cost of direct materials used on job no. 007.

Unlock Deck

Unlock for access to all 14 flashcards in this deck.

Unlock Deck

k this deck