Deck 7: Financial Assets

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/17

Play

Full screen (f)

Deck 7: Financial Assets

1

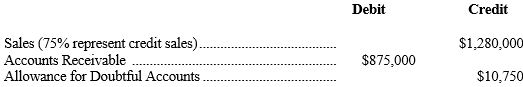

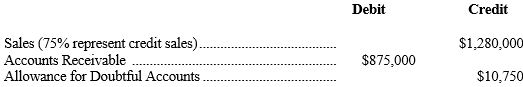

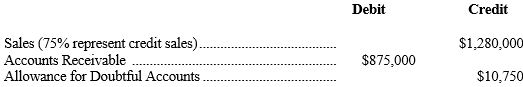

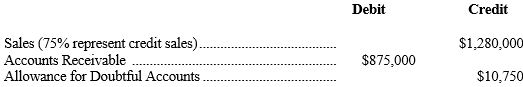

At the end of the month, the unadjusted trial balance of Four Star Company included the following accounts:

-Refer to the above data. If the income statement method of estimating uncollectible accounts expense is followed, and uncollectible accounts expense is estimated to be 2% of net credit sales, the net realizable value of Four Star accounts receivable at the end of the month is:

A) $855,800.

B) $845,050.

C) $19,200

D) $1,250,050

-Refer to the above data. If the income statement method of estimating uncollectible accounts expense is followed, and uncollectible accounts expense is estimated to be 2% of net credit sales, the net realizable value of Four Star accounts receivable at the end of the month is:

A) $855,800.

B) $845,050.

C) $19,200

D) $1,250,050

$845,050.

2

At the end of the month, the unadjusted trial balance of Four Star Company included the following accounts:

-Refer to the above data. If Four Star uses the balance sheet approach in estimating uncollectible accounts, and aging the accounts receivable indicates the estimated uncollectible portion to be $24,000, the uncollectible accounts expense for the month is:

A) $24,000.

B) $13,250.

C) $34,750.

D) $10,750.

-Refer to the above data. If Four Star uses the balance sheet approach in estimating uncollectible accounts, and aging the accounts receivable indicates the estimated uncollectible portion to be $24,000, the uncollectible accounts expense for the month is:

A) $24,000.

B) $13,250.

C) $34,750.

D) $10,750.

$13,250.

3

Which of the following items is reported in neither the income statement nor the statement of cash flows?

A) Sale of marketable securities at a loss.

B) Sale of marketable securities at a gain.

C) Balance in the allowance for doubtful accounts.

D) Investment of excess cash in marketable securities.

A) Sale of marketable securities at a loss.

B) Sale of marketable securities at a gain.

C) Balance in the allowance for doubtful accounts.

D) Investment of excess cash in marketable securities.

Balance in the allowance for doubtful accounts.

4

Fair value is the balance sheet valuation standard for:

A) Investments in all financial assets.

B) Investments in marketable securities.

C) Investments in capital stock of any corporation.

D) Stockholders' equity of any publicly traded corporation.

A) Investments in all financial assets.

B) Investments in marketable securities.

C) Investments in capital stock of any corporation.

D) Stockholders' equity of any publicly traded corporation.

Unlock Deck

Unlock for access to all 17 flashcards in this deck.

Unlock Deck

k this deck

5

Cash equivalents:

A) Include amounts of cash available through an unused line of credit.

B) Are investments in the publicly traded stocks and bonds of large corporations.

C) Are usually included in the term "cash" in the balance sheet and the statement of cash flows.

D) Is another term for financial assets.

A) Include amounts of cash available through an unused line of credit.

B) Are investments in the publicly traded stocks and bonds of large corporations.

C) Are usually included in the term "cash" in the balance sheet and the statement of cash flows.

D) Is another term for financial assets.

Unlock Deck

Unlock for access to all 17 flashcards in this deck.

Unlock Deck

k this deck

6

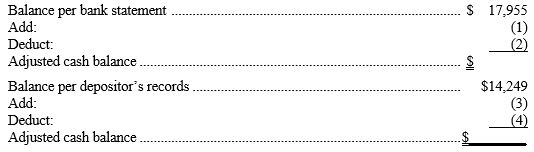

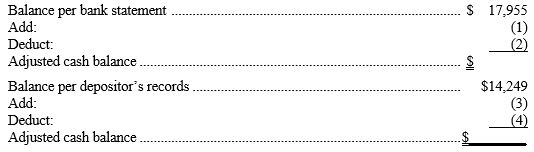

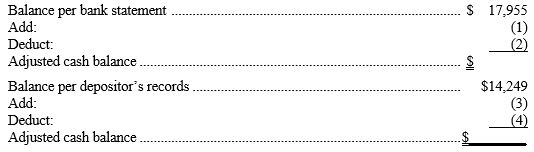

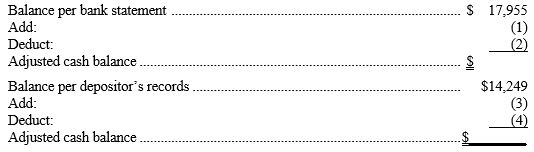

Shown below is a partially completed bank reconciliation for Hubbard Transport at August 31, as well as additional data necessary to answer the questions that follow.

HUBBARD TRANSPORT

Bank Reconciliation

August 31, Year 1

Additional information

Additional information

a) Outstanding checks: no. 729, $1,253; no. 747, $245; no. 752, $781.

b) Check no. 742 (for repairs) was written for $398 but erroneously recorded in Hubbard's records as $839.

c) Deposits in transit, $2,254.

d) Note collected by the bank and credited to Hubbard's account, $4,800.

e) NSF check of C. Craig, one of Hubbard's customers, $1,525.

f) Bank service charge for August, $35.

-In Hubbard's completed bank reconciliation at August 31, what dollar amount should be deducted from the balance per bank statement (indicated by 2 above)?

A)$2,254.

B) $2,279.

C) $1,525.

D) $4,800.

HUBBARD TRANSPORT

Bank Reconciliation

August 31, Year 1

Additional information

Additional informationa) Outstanding checks: no. 729, $1,253; no. 747, $245; no. 752, $781.

b) Check no. 742 (for repairs) was written for $398 but erroneously recorded in Hubbard's records as $839.

c) Deposits in transit, $2,254.

d) Note collected by the bank and credited to Hubbard's account, $4,800.

e) NSF check of C. Craig, one of Hubbard's customers, $1,525.

f) Bank service charge for August, $35.

-In Hubbard's completed bank reconciliation at August 31, what dollar amount should be deducted from the balance per bank statement (indicated by 2 above)?

A)$2,254.

B) $2,279.

C) $1,525.

D) $4,800.

Unlock Deck

Unlock for access to all 17 flashcards in this deck.

Unlock Deck

k this deck

7

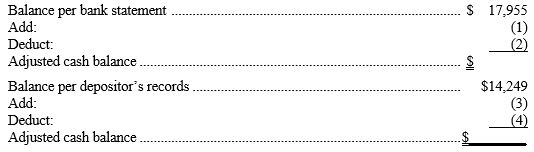

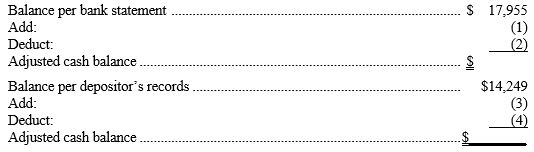

Shown below is a partially completed bank reconciliation for Hubbard Transport at August 31, as well as additional data necessary to answer the questions that follow.

HUBBARD TRANSPORT

Bank Reconciliation

August 31, Year 1

Additional information

Additional information

a) Outstanding checks: no. 729, $1,253; no. 747, $245; no. 752, $781.

b) Check no. 742 (for repairs) was written for $398 but erroneously recorded in Hubbard's records as $839.

c) Deposits in transit, $2,254.

d) Note collected by the bank and credited to Hubbard's account, $4,800.

e) NSF check of C. Craig, one of Hubbard's customers, $1,525.

f) Bank service charge for August, $35.

-In Hubbard's completed bank reconciliation at August 31, what dollar amount should be added to the balance per depositor's records (indicated by 3 above)?

A) $4,800.

B) $2,254.

C) $5,241.

D) $6,766.

HUBBARD TRANSPORT

Bank Reconciliation

August 31, Year 1

Additional information

Additional informationa) Outstanding checks: no. 729, $1,253; no. 747, $245; no. 752, $781.

b) Check no. 742 (for repairs) was written for $398 but erroneously recorded in Hubbard's records as $839.

c) Deposits in transit, $2,254.

d) Note collected by the bank and credited to Hubbard's account, $4,800.

e) NSF check of C. Craig, one of Hubbard's customers, $1,525.

f) Bank service charge for August, $35.

-In Hubbard's completed bank reconciliation at August 31, what dollar amount should be added to the balance per depositor's records (indicated by 3 above)?

A) $4,800.

B) $2,254.

C) $5,241.

D) $6,766.

Unlock Deck

Unlock for access to all 17 flashcards in this deck.

Unlock Deck

k this deck

8

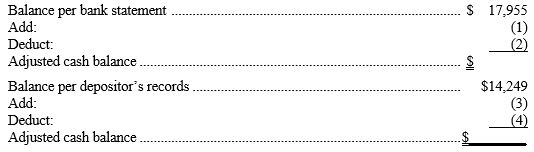

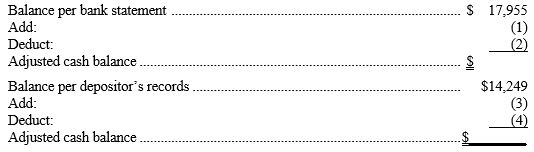

Shown below is a partially completed bank reconciliation for Hubbard Transport at August 31, as well as additional data necessary to answer the questions that follow.

HUBBARD TRANSPORT

Bank Reconciliation

August 31, Year 1

Additional information

Additional information

a) Outstanding checks: no. 729, $1,253; no. 747, $245; no. 752, $781.

b) Check no. 742 (for repairs) was written for $398 but erroneously recorded in Hubbard's records as $839.

c) Deposits in transit, $2,254.

d) Note collected by the bank and credited to Hubbard's account, $4,800.

e) NSF check of C. Craig, one of Hubbard's customers, $1,525.

f) Bank service charge for August, $35.

-In Hubbard's completed bank reconciliation at August 31, what dollar amount should be deducted from the balance per depositor's records (indicated by 4 above)?

A) $2,254.

B) $2,001.

C) $1,525.

D) $1,560.

HUBBARD TRANSPORT

Bank Reconciliation

August 31, Year 1

Additional information

Additional informationa) Outstanding checks: no. 729, $1,253; no. 747, $245; no. 752, $781.

b) Check no. 742 (for repairs) was written for $398 but erroneously recorded in Hubbard's records as $839.

c) Deposits in transit, $2,254.

d) Note collected by the bank and credited to Hubbard's account, $4,800.

e) NSF check of C. Craig, one of Hubbard's customers, $1,525.

f) Bank service charge for August, $35.

-In Hubbard's completed bank reconciliation at August 31, what dollar amount should be deducted from the balance per depositor's records (indicated by 4 above)?

A) $2,254.

B) $2,001.

C) $1,525.

D) $1,560.

Unlock Deck

Unlock for access to all 17 flashcards in this deck.

Unlock Deck

k this deck

9

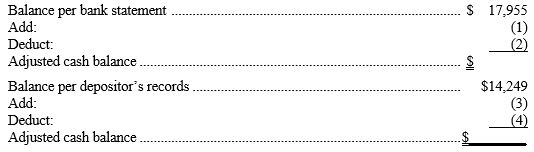

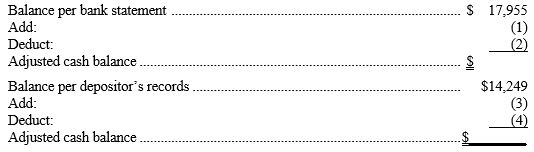

Shown below is a partially completed bank reconciliation for Hubbard Transport at August 31, as well as additional data necessary to answer the questions that follow.

HUBBARD TRANSPORT

Bank Reconciliation

August 31, Year 1

Additional information

Additional information

a) Outstanding checks: no. 729, $1,253; no. 747, $245; no. 752, $781.

b) Check no. 742 (for repairs) was written for $398 but erroneously recorded in Hubbard's records as $839.

c) Deposits in transit, $2,254.

d) Note collected by the bank and credited to Hubbard's account, $4,800.

e) NSF check of C. Craig, one of Hubbard's customers, $1,525.

f) Bank service charge for August, $35.

-Hubbard Transport k.eeps $500 cash on hand in addition to this checking account and has no other bank accounts or cash equivalents. What amount should appear as Cash in Hubbard's August 31 balance sheet?

A) $18,430.

B) $17,955.

C) $14,249.

D) Some other amount.

HUBBARD TRANSPORT

Bank Reconciliation

August 31, Year 1

Additional information

Additional informationa) Outstanding checks: no. 729, $1,253; no. 747, $245; no. 752, $781.

b) Check no. 742 (for repairs) was written for $398 but erroneously recorded in Hubbard's records as $839.

c) Deposits in transit, $2,254.

d) Note collected by the bank and credited to Hubbard's account, $4,800.

e) NSF check of C. Craig, one of Hubbard's customers, $1,525.

f) Bank service charge for August, $35.

-Hubbard Transport k.eeps $500 cash on hand in addition to this checking account and has no other bank accounts or cash equivalents. What amount should appear as Cash in Hubbard's August 31 balance sheet?

A) $18,430.

B) $17,955.

C) $14,249.

D) Some other amount.

Unlock Deck

Unlock for access to all 17 flashcards in this deck.

Unlock Deck

k this deck

10

Shown below is a partially completed bank reconciliation for Hubbard Transport at August 31, as well as additional data necessary to answer the questions that follow.

HUBBARD TRANSPORT

Bank Reconciliation

August 31, Year 1

Additional information

Additional information

a) Outstanding checks: no. 729, $1,253; no. 747, $245; no. 752, $781.

b) Check no. 742 (for repairs) was written for $398 but erroneously recorded in Hubbard's records as $839.

c) Deposits in transit, $2,254.

d) Note collected by the bank and credited to Hubbard's account, $4,800.

e) NSF check of C. Craig, one of Hubbard's customers, $1,525.

f) Bank service charge for August, $35.

-The necessary adjustment to Hubbard Transport's accounting records as of August 31 includes a net:

A) Increase to Cash of $5,241.

B) Increase to Cash of $3,240.

C) Increase to Cash of $3,681.

D) Decrease to Cash of $35.

HUBBARD TRANSPORT

Bank Reconciliation

August 31, Year 1

Additional information

Additional informationa) Outstanding checks: no. 729, $1,253; no. 747, $245; no. 752, $781.

b) Check no. 742 (for repairs) was written for $398 but erroneously recorded in Hubbard's records as $839.

c) Deposits in transit, $2,254.

d) Note collected by the bank and credited to Hubbard's account, $4,800.

e) NSF check of C. Craig, one of Hubbard's customers, $1,525.

f) Bank service charge for August, $35.

-The necessary adjustment to Hubbard Transport's accounting records as of August 31 includes a net:

A) Increase to Cash of $5,241.

B) Increase to Cash of $3,240.

C) Increase to Cash of $3,681.

D) Decrease to Cash of $35.

Unlock Deck

Unlock for access to all 17 flashcards in this deck.

Unlock Deck

k this deck

11

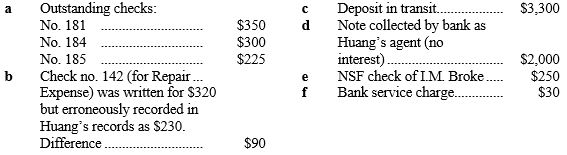

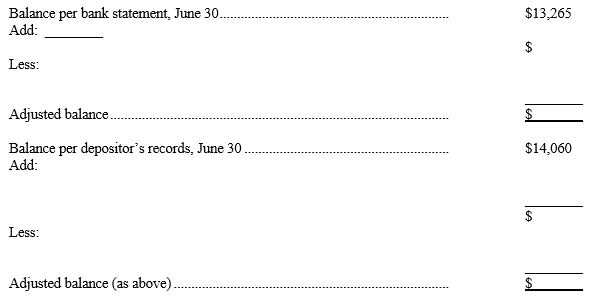

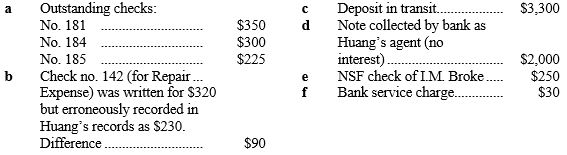

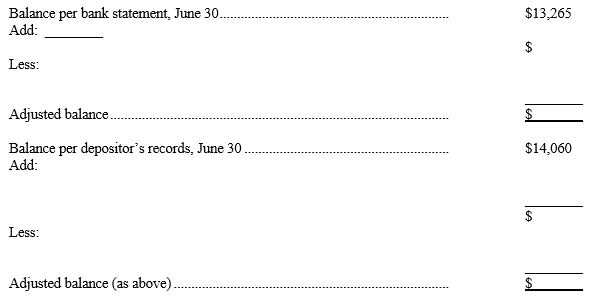

You are to complete the June 30 bank reconciliation for Huang, Inc. using the following information:

HUANG, INC.

HUANG, INC.

Bank Reconciliation

June 30, Year 1

HUANG, INC.

HUANG, INC.Bank Reconciliation

June 30, Year 1

Unlock Deck

Unlock for access to all 17 flashcards in this deck.

Unlock Deck

k this deck

12

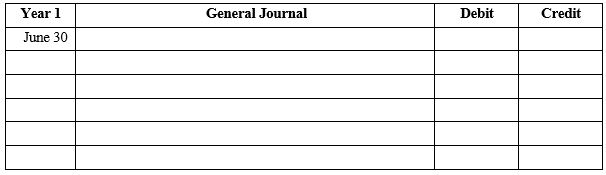

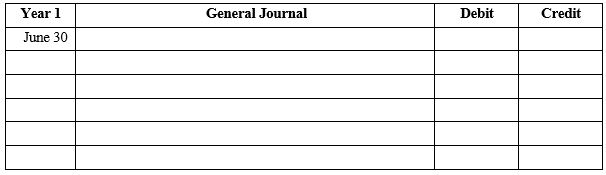

Prepare the journal entry to correct Huang's records as of June 30. (Explanations may be omitted; one compound journal entry is acceptable.)

Unlock Deck

Unlock for access to all 17 flashcards in this deck.

Unlock Deck

k this deck

13

After aging its accounts receivable at December 31, Howland Company estimates that $68,000 of the $835,000 outstanding accounts receivable will prove uncollectible. The Allowance for Doubtful Accounts has a debit balance of $6,200 prior to adjustment. In the space provided, prepare the adjusting entry required by Howland in this situation:

Unlock Deck

Unlock for access to all 17 flashcards in this deck.

Unlock Deck

k this deck

14

At year-end, Atkins Company applies the income statement approach in estimating uncollectible accounts expense and determines such expense to be 2% of net sales. At December 31 of the current year, accounts receivable total $600,000, and Allowance for Doubtful Accounts has a credit balance of $4,200 prior to adjustment. Net sales for the current year were $2,300,000. Compute the net realizable value of accounts receivable to be reported in Atkin's December 31 balance sheet.

Unlock Deck

Unlock for access to all 17 flashcards in this deck.

Unlock Deck

k this deck

15

During the year, Brown Corporation's average accounts receivable were $316,000. The current-year income statement reported net sales of $2,010,000, uncollectible accounts expense of $118,000, and net income of $982,000. Using 365 days to a year, compute the average number of days Brown waits to collect its accounts receivable. (Round answer to the nearest day, if necessary.)

Unlock Deck

Unlock for access to all 17 flashcards in this deck.

Unlock Deck

k this deck

16

At September 30, the Cash account in the general ledger of Breen Construction shows a balance of $13,221. However, the bank statement shows a balance of $16,720 at the same date. The only reconciling items consist of a bank service charge of $42, outstanding checks totaling $4,744, a deposit in transit, and an error in recording check no. 529. Check no. 529 was written in the amount of $772 but was recorded as $727 in Breen's accounting records.

-Refer to the above data. What is the adjusted cash balance in the September 30 bank reconciliation?

-Refer to the above data. What is the adjusted cash balance in the September 30 bank reconciliation?

Unlock Deck

Unlock for access to all 17 flashcards in this deck.

Unlock Deck

k this deck

17

At September 30, the Cash account in the general ledger of Breen Construction shows a balance of $13,221. However, the bank statement shows a balance of $16,720 at the same date. The only reconciling items consist of a bank service charge of $42, outstanding checks totaling $4,744, a deposit in transit, and an error in recording check no. 529. Check no. 529 was written in the amount of $772 but was recorded as $727 in Breen's accounting records.

-Refer to the above data. What is the amount of the deposit in transit?

-Refer to the above data. What is the amount of the deposit in transit?

Unlock Deck

Unlock for access to all 17 flashcards in this deck.

Unlock Deck

k this deck