Deck 15: Non-Current Liabilities

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/16

Play

Full screen (f)

Deck 15: Non-Current Liabilities

1

A variable interest rate changes as market rates change.

True

2

Bond prices are quoted as a percentage of the face value of the bonds.

True

3

A non-current note is always secured.

False

4

The amount that must be invested today at current interest rates in order to receive a specified sum of money at a specified date is the present value.

Unlock Deck

Unlock for access to all 16 flashcards in this deck.

Unlock Deck

k this deck

5

When bonds are issued at face value, the market interest rate is equal to the contractual interest rate.

Unlock Deck

Unlock for access to all 16 flashcards in this deck.

Unlock Deck

k this deck

6

Bonds with a higher contractual interest rate than the market rate for similar bonds will probably sell at a discount.

Unlock Deck

Unlock for access to all 16 flashcards in this deck.

Unlock Deck

k this deck

7

When a note payable is repaid with blended payments, the same amount of principal is repaid with each payment.

Unlock Deck

Unlock for access to all 16 flashcards in this deck.

Unlock Deck

k this deck

8

The portion of a non-current note that will be repaid within the next year is shown as a current liability on the balance sheet.

Unlock Deck

Unlock for access to all 16 flashcards in this deck.

Unlock Deck

k this deck

9

The total cost of borrowing on a 10 year, 4%, $1,000 bond that is sold for $970 is:

A) $370.

B) $400.

C) $430.

D) $970.

A) $370.

B) $400.

C) $430.

D) $970.

Unlock Deck

Unlock for access to all 16 flashcards in this deck.

Unlock Deck

k this deck

10

Bonds with a face value of $1,000,000 and a carrying value of $975,000 are retired at 99, after paying semi-annual interest. The gain or loss is:

A) $15,000 loss.

B) $10,000 loss.

C) $10,000 gain.

D) $15,000 gain.

A) $15,000 loss.

B) $10,000 loss.

C) $10,000 gain.

D) $15,000 gain.

Unlock Deck

Unlock for access to all 16 flashcards in this deck.

Unlock Deck

k this deck

11

If bonds payable are issued at a discount, the contractual interest rate is:

A) higher than the market rate of interest.

B) lower than the market rate of interest.

C) equal to the market rate of interest.

D) changed to reflect the market rate of interest.

A) higher than the market rate of interest.

B) lower than the market rate of interest.

C) equal to the market rate of interest.

D) changed to reflect the market rate of interest.

Unlock Deck

Unlock for access to all 16 flashcards in this deck.

Unlock Deck

k this deck

12

Castaway Corporation borrows $300,000 and signs a 6%, 5 year note. Monthly payments will include a fixed amount of principal, plus interest on the unpaid balance. The first payment will be:

A) $5,000.

B) $6,500.

C) $18,000.

D) $23,000.

A) $5,000.

B) $6,500.

C) $18,000.

D) $23,000.

Unlock Deck

Unlock for access to all 16 flashcards in this deck.

Unlock Deck

k this deck

13

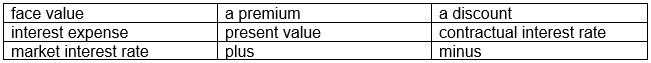

Select the appropriate word or phrase from the table to complete the following statements correctly:

Select the appropriate word or phrase from the table to complete the following statements correctly:a. When the market rate exceeds the contractual interest rate, bonds will sell at _________________________________.

b. Cash paid to bondholders each period is calculated by multiplying the _________________________ by the __________________________.

c. When bonds are issued at a discount, the total cost of borrowing will equal the sum of the periodic interest payments _______________ the discount.

d. The carrying value of the bond moves towards the _____________________.

Unlock Deck

Unlock for access to all 16 flashcards in this deck.

Unlock Deck

k this deck

14

On Jan 1, 2013, Dawson Corporation borrows $300,000 and signs a 5-year, 6% note payable. Blended monthly payments of $5,800 are required, beginning Feb 1, 2013.

a. Record the journal entry for Dawson on January 1.

b. Record the journal entry for Dawson on February 1.

a. Record the journal entry for Dawson on January 1.

b. Record the journal entry for Dawson on February 1.

Unlock Deck

Unlock for access to all 16 flashcards in this deck.

Unlock Deck

k this deck

15

What are two advantages of debt over equity financing?

Unlock Deck

Unlock for access to all 16 flashcards in this deck.

Unlock Deck

k this deck

16

At what amount do bonds trade at on the market?

Unlock Deck

Unlock for access to all 16 flashcards in this deck.

Unlock Deck

k this deck