Deck 18: Extension 18 A: Rights Offerings

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/4

Play

Full screen (f)

Deck 18: Extension 18 A: Rights Offerings

1

To finance the construction of a new plant,Pietersen Corporation must raise an additional $10,000,000 of equity capital through the sale of common stock.The firm currently has an EPS of $5.40 and a P/E ratio of 10,with 1,200,000 shares outstanding.If the firm wants its ex-rights price to be $50,what subscription price must it set on the new shares?

A)$29.55

B)$33.78

C)$39.28

D)$41.80

E)$50.00

A)$29.55

B)$33.78

C)$39.28

D)$41.80

E)$50.00

$33.78

2

Ritzer Company has 1,000,000 shares of stock outstanding that sell for $90 per share.The company wants to sell stock via a rights offering.The new issue will be used to raise $8 million of new equity,and existing shareholders will receive one right per share held.Theoretically,if the subscription price is $80, (1)how many new shares must be sold, (2)how many rights per share of new stock will be required, (3)what will the value of each right be,and (4)what will the stock price be after the rights offering has been completed?

C

Ending value of stock = $90 -$0.91 = $89.09.

Ending value of stock = $90 -$0.91 = $89.09.

3

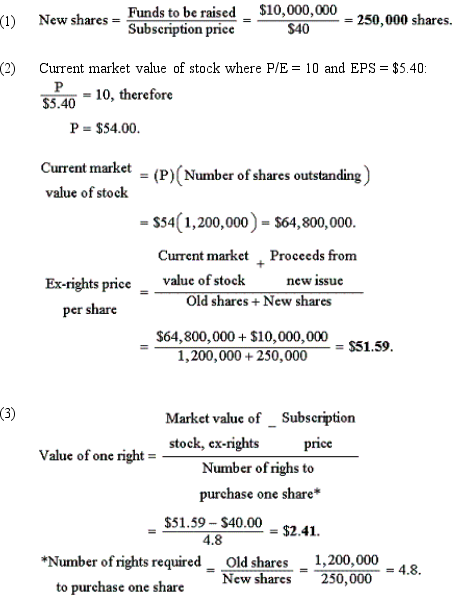

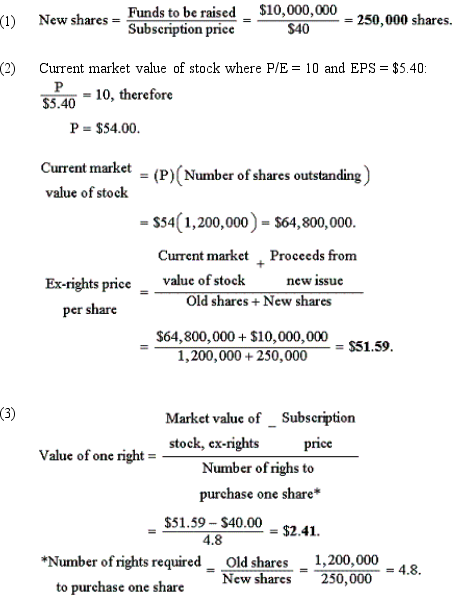

Pietersen Corporation must raise an additional $10,000,000 of equity capital through the sale of common stock in order to finance the construction of a new plant.The firm currently has an EPS of $5.40 and a P/E ratio of 10,with 1,200,000 shares outstanding.The firm will offer new shares to its current stockholders at $40 per share.Find (1)the number of new shares to be issued, (2)the ex-rights price of the stock (assuming that the new market value of the stock will simply be the proceeds of the new issue plus the current value of equity,divided by new shares outstanding),and (3)the value of one right.

D

4

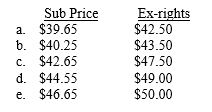

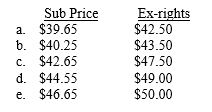

There are 10,000,000 shares outstanding of O'Connell Co.'s stock,which now sells for $50 per share.The company plans to raise $100 million as new equity by selling common stock.Since the preemptive right is in the corporate charter,rights will be used.Management has decided that the rights should be worth $1 each: Such a price would assure that most stockholders would either exercise or sell their rights rather than just letting them expire,yet a careless failure to use the rights would not impose too severe a hardship on anyone.What subscription price should O'Connell set for its offering to obtain the desired price of the rights,and what will be the ex-rights stock price (Me),assuming the theoretical relationships hold? (Hint: N = Number of old shares/Number of new shares; Number of new shares = Dollars to be raised/Subscription price per share.)

Unlock Deck

Unlock for access to all 4 flashcards in this deck.

Unlock Deck

k this deck