Deck 12: Game Theory

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

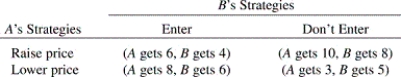

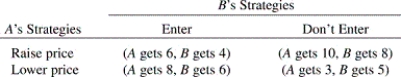

Question

Question

Question

Question

Question

Question

Question

Question

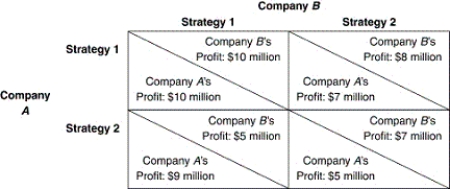

Question

Question

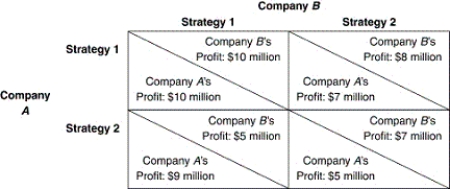

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/28

Play

Full screen (f)

Deck 12: Game Theory

1

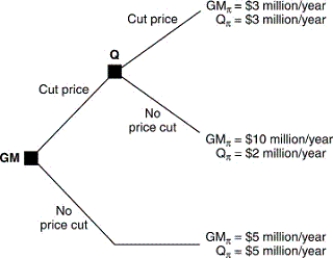

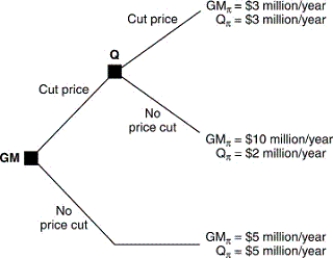

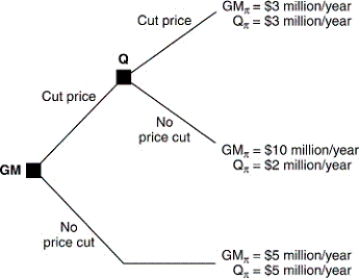

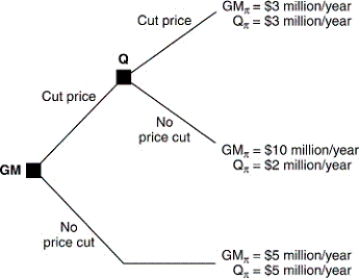

Consider the following decision tree.This tree illustrates hypothetical payoffs to General Mills (GM)and Quaker Oats (Q)if they engage in a price war.

If GM cuts prices,the greatest potential gain is:

A) $5 million per year.

B) $10 million per year.

C) $2 million per year.

D) $3 million per year.

E) none of the above.

If GM cuts prices,the greatest potential gain is:

A) $5 million per year.

B) $10 million per year.

C) $2 million per year.

D) $3 million per year.

E) none of the above.

A

2

The difference between game trees and decision trees is:

A) that game trees are not useful in strategic situations.

B) that decision trees describe actions that depend on the behavior of rivals.

C) that game trees have interactive payoffs.

D) that decision trees are a function of many individuals and the state of nature.

E) none of the above.

A) that game trees are not useful in strategic situations.

B) that decision trees describe actions that depend on the behavior of rivals.

C) that game trees have interactive payoffs.

D) that decision trees are a function of many individuals and the state of nature.

E) none of the above.

C

3

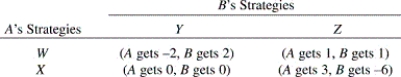

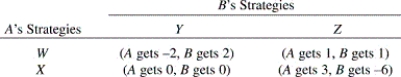

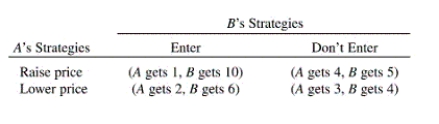

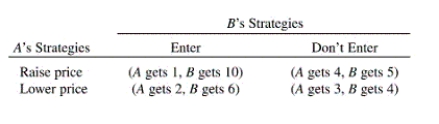

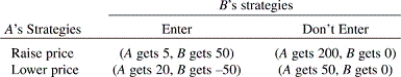

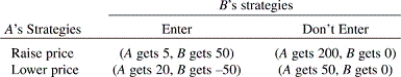

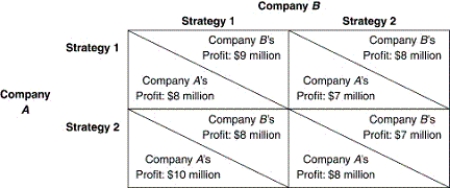

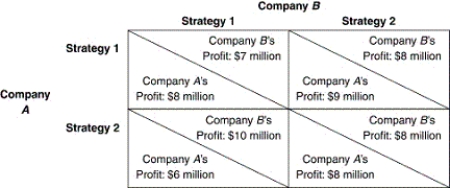

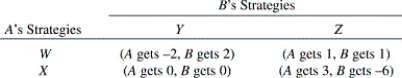

Which pair of strategies would competing firms A and B choose given this payoff matrix?

A) W, Y.

B) W, Z.

C) X, Y.

D) X, Z.

E) Either X, Y or W, Z.

A) W, Y.

B) W, Z.

C) X, Y.

D) X, Z.

E) Either X, Y or W, Z.

C

4

If player 1 has a dominant strategy,then player 2:

A) must also have a dominant strategy.

B) may or may not have a dominant strategy, but will always lead to a Nash equilibrium.

C) may or may not have a dominant strategy.

D) will not be able to reach an optimal solution to the game.

E) will block this dominant strategy and force player 1 to another strategy.

A) must also have a dominant strategy.

B) may or may not have a dominant strategy, but will always lead to a Nash equilibrium.

C) may or may not have a dominant strategy.

D) will not be able to reach an optimal solution to the game.

E) will block this dominant strategy and force player 1 to another strategy.

Unlock Deck

Unlock for access to all 28 flashcards in this deck.

Unlock Deck

k this deck

5

By definition,a Nash equilibrium in a duopoly is the situation in which each player:

A) plays a dominant strategy.

B) plays the best strategy given the other's strategies.

C) gets the highest possible payoff.

D) gets the highest payoff possible without lowering the opponent's payoff.

E) is happy with the outcome.

A) plays a dominant strategy.

B) plays the best strategy given the other's strategies.

C) gets the highest possible payoff.

D) gets the highest payoff possible without lowering the opponent's payoff.

E) is happy with the outcome.

Unlock Deck

Unlock for access to all 28 flashcards in this deck.

Unlock Deck

k this deck

6

Potential entrant E threatens to enter incumbent I's market and I threatens to lower price to P should E enter.It is crucial for E to believe I's threat that:

A) P > I's average total cost.

B) P > I's average variable cost.

C) P is low enough to discourage E.

D) I could conceivably charge P without E's threat.

E) I's profit with P and no entry are better than expected profits with entry.

A) P > I's average total cost.

B) P > I's average variable cost.

C) P is low enough to discourage E.

D) I could conceivably charge P without E's threat.

E) I's profit with P and no entry are better than expected profits with entry.

Unlock Deck

Unlock for access to all 28 flashcards in this deck.

Unlock Deck

k this deck

7

Game theory is useful for understanding oligopoly behavior because:

A) there are so many firms in an oligopoly that all are price takers.

B) firms must differentiate their products if they are to remain in business.

C) firms recognize that because there are only a few firms mutual interdependence is important.

D) without it firms would not be able to maintain cartel agreements.

E) it allows firms to develop greater monopoly power.

A) there are so many firms in an oligopoly that all are price takers.

B) firms must differentiate their products if they are to remain in business.

C) firms recognize that because there are only a few firms mutual interdependence is important.

D) without it firms would not be able to maintain cartel agreements.

E) it allows firms to develop greater monopoly power.

Unlock Deck

Unlock for access to all 28 flashcards in this deck.

Unlock Deck

k this deck

8

A Nash equilibrium occurs when:

A) each player has a dominant strategy.

B) each player receives the same final payoff.

C) each player believes it is doing the best it can given the behavior of rivals.

D) there is no dominant strategy for any player.

E) payoffs are independent of the actions taken by rivals.

A) each player has a dominant strategy.

B) each player receives the same final payoff.

C) each player believes it is doing the best it can given the behavior of rivals.

D) there is no dominant strategy for any player.

E) payoffs are independent of the actions taken by rivals.

Unlock Deck

Unlock for access to all 28 flashcards in this deck.

Unlock Deck

k this deck

9

A dominant strategy is one that:

A) beats all others, regardless of the opponent's choice.

B) beats all others, given the opponent's choice.

C) is beaten by all others, regardless of the opponent's choice.

D) is beaten by all others, given the opponent's choice.

E) beats at least one other, given the opponent's choice.

A) beats all others, regardless of the opponent's choice.

B) beats all others, given the opponent's choice.

C) is beaten by all others, regardless of the opponent's choice.

D) is beaten by all others, given the opponent's choice.

E) beats at least one other, given the opponent's choice.

Unlock Deck

Unlock for access to all 28 flashcards in this deck.

Unlock Deck

k this deck

10

In a two-player game in which each player has four options,how many outcomes can there be?

A) 1.

B) 4.

C) 8.

D) 16.

E) 64.

A) 1.

B) 4.

C) 8.

D) 16.

E) 64.

Unlock Deck

Unlock for access to all 28 flashcards in this deck.

Unlock Deck

k this deck

11

Getting to a Nash equilibrium requires:

A) each knowing the opponent's payoffs and cooperation.

B) knowing the opponent's payoffs but not cooperation.

C) cooperation but not knowing the opponent's payoffs.

D) neither cooperation nor knowing the opponent's payoffs.

E) either cooperation or knowing the opponent's payoffs, depending on the game.

A) each knowing the opponent's payoffs and cooperation.

B) knowing the opponent's payoffs but not cooperation.

C) cooperation but not knowing the opponent's payoffs.

D) neither cooperation nor knowing the opponent's payoffs.

E) either cooperation or knowing the opponent's payoffs, depending on the game.

Unlock Deck

Unlock for access to all 28 flashcards in this deck.

Unlock Deck

k this deck

12

Useful strategies to deter entry include:

A) increasing advertising.

B) increasing prices.

C) decreasing capacity.

D) increasing capacity.

E) a and d

A) increasing advertising.

B) increasing prices.

C) decreasing capacity.

D) increasing capacity.

E) a and d

Unlock Deck

Unlock for access to all 28 flashcards in this deck.

Unlock Deck

k this deck

13

Consider the following decision tree.This tree illustrates hypothetical payoffs to General Mills (GM)and Quaker Oats (Q)if they engage in a price war.If GM cuts prices and Quaker Oats follows this behavior:

A) GM loses $10 million.

B) Quaker Oats loses $10 million.

C) GM loses $2 million.

D) Quaker Oats loses $2 million.

E) both firms gain $3 million.

A) GM loses $10 million.

B) Quaker Oats loses $10 million.

C) GM loses $2 million.

D) Quaker Oats loses $2 million.

E) both firms gain $3 million.

Unlock Deck

Unlock for access to all 28 flashcards in this deck.

Unlock Deck

k this deck

14

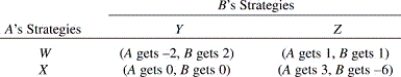

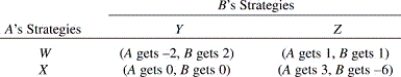

Given the following payoff matrix,what will A's profits be?

A) 1.

B) 2.

C) 3.

D) 4.

E) Unknown until B's action is observed.

A) 1.

B) 2.

C) 3.

D) 4.

E) Unknown until B's action is observed.

Unlock Deck

Unlock for access to all 28 flashcards in this deck.

Unlock Deck

k this deck

15

Radio City promises if you can find a lower advertised price for anything you bought at Radio City,anywhere in town within 30 days,it will return the difference plus 20%.A sophisticated game theoretic analysis suggests Radio City may be:

A) losing money in the long run.

B) colluding with other stores.

C) using a commitment to threaten competitors.

D) preempting competitors.

E) using price leadership.

A) losing money in the long run.

B) colluding with other stores.

C) using a commitment to threaten competitors.

D) preempting competitors.

E) using price leadership.

Unlock Deck

Unlock for access to all 28 flashcards in this deck.

Unlock Deck

k this deck

16

Given the following payoff matrix,who has a dominant strategy?

A) It depends on what the other player does.

B) Both players have it.

C) Neither player has it.

D) A does; B doesn't.

E) B does; A doesn't.

A) It depends on what the other player does.

B) Both players have it.

C) Neither player has it.

D) A does; B doesn't.

E) B does; A doesn't.

Unlock Deck

Unlock for access to all 28 flashcards in this deck.

Unlock Deck

k this deck

17

If a firm has a dominant strategy:

A) its optimal strategy depends on the play of rivals.

B) its optimal strategy is always the same, even if payoffs change.

C) it is determined by the behavior of only one key rival.

D) it receives the same profits regardless of the strategy of rivals.

E) its optimal strategy is independent of the play of rivals.

A) its optimal strategy depends on the play of rivals.

B) its optimal strategy is always the same, even if payoffs change.

C) it is determined by the behavior of only one key rival.

D) it receives the same profits regardless of the strategy of rivals.

E) its optimal strategy is independent of the play of rivals.

Unlock Deck

Unlock for access to all 28 flashcards in this deck.

Unlock Deck

k this deck

18

Which pair of strategies would cooperative cartel members A and B choose given this payoff matrix?

A) W, Y.

B) W, Z.

C) X, Y.

D) X, Z.

E) Either X, Y or W, Z.

A) W, Y.

B) W, Z.

C) X, Y.

D) X, Z.

E) Either X, Y or W, Z.

Unlock Deck

Unlock for access to all 28 flashcards in this deck.

Unlock Deck

k this deck

19

A feasible strategy set is:

A) all actions with a nonzero probability of occurring.

B) only actions that have a 50% or greater probability of occurring.

C) actions that result in positive profits for the firm.

D) actions that a decision maker is willing to take.

E) the one outcome that the decision maker chooses.

A) all actions with a nonzero probability of occurring.

B) only actions that have a 50% or greater probability of occurring.

C) actions that result in positive profits for the firm.

D) actions that a decision maker is willing to take.

E) the one outcome that the decision maker chooses.

Unlock Deck

Unlock for access to all 28 flashcards in this deck.

Unlock Deck

k this deck

20

A player in a game theoretic model is:

A) anyone working for a firm that is operating strategically.

B) a decision-making entity at a firm involved in a strategic game.

C) a firm that is operating as a perfect competitor.

D) a monopolist who produces a unique product with no close substitutes.

E) a stockholder at a firm involved in a strategic game.

A) anyone working for a firm that is operating strategically.

B) a decision-making entity at a firm involved in a strategic game.

C) a firm that is operating as a perfect competitor.

D) a monopolist who produces a unique product with no close substitutes.

E) a stockholder at a firm involved in a strategic game.

Unlock Deck

Unlock for access to all 28 flashcards in this deck.

Unlock Deck

k this deck

21

Strategic foresight is the ability to make decisions today that are rational based on:

A) complete uncertainty about the future.

B) our best information about what will happen in the future.

C) what we know only about behavior in the past.

D) information that we have only about our own behavior in the past.

E) incorrect information about the past.

A) complete uncertainty about the future.

B) our best information about what will happen in the future.

C) what we know only about behavior in the past.

D) information that we have only about our own behavior in the past.

E) incorrect information about the past.

Unlock Deck

Unlock for access to all 28 flashcards in this deck.

Unlock Deck

k this deck

22

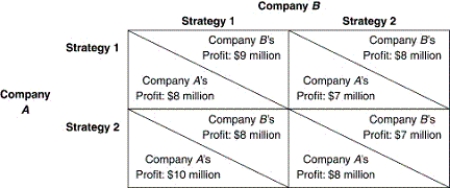

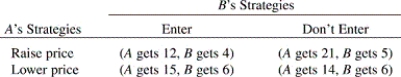

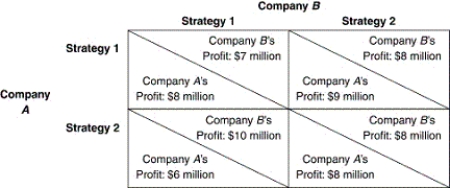

Refer to the accompanying payoff matrix.Which of the following is a Nash equilibrium?

A) Company A chooses Strategy 1 and Company B chooses Strategy 1.

B) Company A chooses Strategy 1 and Company B chooses Strategy 2.

C) Company A chooses Strategy 2 and Company B chooses Strategy 2.

D) Company A chooses Strategy 2 and Company B chooses Strategy 1.

E) None of the above.

A) Company A chooses Strategy 1 and Company B chooses Strategy 1.

B) Company A chooses Strategy 1 and Company B chooses Strategy 2.

C) Company A chooses Strategy 2 and Company B chooses Strategy 2.

D) Company A chooses Strategy 2 and Company B chooses Strategy 1.

E) None of the above.

Unlock Deck

Unlock for access to all 28 flashcards in this deck.

Unlock Deck

k this deck

23

How many Nash equilibria are there in this payoff matrix?

A) 0.

B) 1.

C) 2.

D) 3.

E) 4.

A) 0.

B) 1.

C) 2.

D) 3.

E) 4.

Unlock Deck

Unlock for access to all 28 flashcards in this deck.

Unlock Deck

k this deck

24

Refer to the accompanying payoff matrix.Which of the following is a Nash equilibrium?

A) Company A chooses Strategy 1 and Company B chooses Strategy 1.

B) Company A chooses Strategy 1 and Company B chooses Strategy 2.

C) Company A chooses Strategy 2 and Company B chooses Strategy 2.

D) Company A chooses Strategy 2 and Company B chooses Strategy 1.

E) None of the above.

A) Company A chooses Strategy 1 and Company B chooses Strategy 1.

B) Company A chooses Strategy 1 and Company B chooses Strategy 2.

C) Company A chooses Strategy 2 and Company B chooses Strategy 2.

D) Company A chooses Strategy 2 and Company B chooses Strategy 1.

E) None of the above.

Unlock Deck

Unlock for access to all 28 flashcards in this deck.

Unlock Deck

k this deck

25

How many Nash equilibria are there in this payoff matrix?

A) 0.

B) 1.

C) 2.

D) 3.

E) 4.

A) 0.

B) 1.

C) 2.

D) 3.

E) 4.

Unlock Deck

Unlock for access to all 28 flashcards in this deck.

Unlock Deck

k this deck

26

Refer to the accompanying matrix.Which of the following is a Nash equilibrium?

A) Company A chooses Strategy 1 and Company B chooses Strategy 1.

B) Company A chooses Strategy 1 and Company B chooses Strategy 2.

C) Company A chooses Strategy 2 and Company B chooses Strategy 2.

D) Company A chooses Strategy 2 and Company B chooses Strategy 1.

E) None of the above.

A) Company A chooses Strategy 1 and Company B chooses Strategy 1.

B) Company A chooses Strategy 1 and Company B chooses Strategy 2.

C) Company A chooses Strategy 2 and Company B chooses Strategy 2.

D) Company A chooses Strategy 2 and Company B chooses Strategy 1.

E) None of the above.

Unlock Deck

Unlock for access to all 28 flashcards in this deck.

Unlock Deck

k this deck

27

A most-favored-customer clause:

A) is a commitment but not a threat.

B) is a threat but not a commitment.

C) is both a threat and a commitment.

D) is neither a threat nor a commitment.

E) could be either a threat or a commitment depending on the terms.

A) is a commitment but not a threat.

B) is a threat but not a commitment.

C) is both a threat and a commitment.

D) is neither a threat nor a commitment.

E) could be either a threat or a commitment depending on the terms.

Unlock Deck

Unlock for access to all 28 flashcards in this deck.

Unlock Deck

k this deck

28

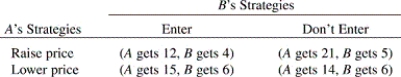

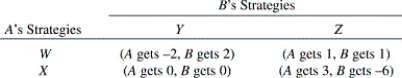

Suppose that firm A finds itself facing the following payoff matrix in its rivalry with firm B:

A threatens to play strategy W.This threat is:

A) credible because the Nash equilibrium occurs where A plays W and B plays Z.

B) credible because the joint optimal solution occurs where A plays W and B plays Z.

C) not credible because A's dominant strategy is to play X.

D) credible because A's dominant strategy is to play W.

E) not credible because B will never play strategy Z.

A threatens to play strategy W.This threat is:

A) credible because the Nash equilibrium occurs where A plays W and B plays Z.

B) credible because the joint optimal solution occurs where A plays W and B plays Z.

C) not credible because A's dominant strategy is to play X.

D) credible because A's dominant strategy is to play W.

E) not credible because B will never play strategy Z.

Unlock Deck

Unlock for access to all 28 flashcards in this deck.

Unlock Deck

k this deck