Deck 15: The Influence of Monetary and Fiscal Policy on Aggregate Demand

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/223

Play

Full screen (f)

Deck 15: The Influence of Monetary and Fiscal Policy on Aggregate Demand

1

According to liquidity-preference theory, when would the money-supply curve shift right?

A) if government spending increased

B) only if the Bank of Canada chose to increase the money supply

C) if the interest rate increased

D) if the price level fell or the interest rate decreased

A) if government spending increased

B) only if the Bank of Canada chose to increase the money supply

C) if the interest rate increased

D) if the price level fell or the interest rate decreased

B

2

The wealth effect helps explain the downward slope of the aggregate-demand curve. How important is this effect and why?

A) It is relatively important in Canada because expenditures on consumer durables is very responsive to changes in wealth.

B) It is relatively important in Canada because consumption spending is a large part of GDP.

C) It is relatively unimportant in Canada because money holdings are a small part of consumer wealth.

D) It is relatively unimportant in Canada because it takes a large change in wealth to make a significant change in interest rates.

A) It is relatively important in Canada because expenditures on consumer durables is very responsive to changes in wealth.

B) It is relatively important in Canada because consumption spending is a large part of GDP.

C) It is relatively unimportant in Canada because money holdings are a small part of consumer wealth.

D) It is relatively unimportant in Canada because it takes a large change in wealth to make a significant change in interest rates.

C

3

Over what period of time is the liquidity-preference theory most relevant, and what does it suppose?

A) short run; it supposes that the price level adjusts to bring money supply and money demand into balance

B) short run; it supposes that the interest rate adjusts to bring money supply and money demand into balance

C) long run; it supposes that the price level adjusts to bring money supply and money demand into balance

D) long run; it supposes that the interest rate adjusts to bring money supply and money demand into balance

A) short run; it supposes that the price level adjusts to bring money supply and money demand into balance

B) short run; it supposes that the interest rate adjusts to bring money supply and money demand into balance

C) long run; it supposes that the price level adjusts to bring money supply and money demand into balance

D) long run; it supposes that the interest rate adjusts to bring money supply and money demand into balance

B

4

For the Canadian economy, what is the least important of the three reasons for the downward slope of the aggregate-demand curve?

A) wealth effect

B) interest-rate effect

C) exchange-rate effect

D) real-wage effect

A) wealth effect

B) interest-rate effect

C) exchange-rate effect

D) real-wage effect

Unlock Deck

Unlock for access to all 223 flashcards in this deck.

Unlock Deck

k this deck

5

The theory of liquidity preference assumes that the nominal supply of money is determined by which of the following?

A) the level of real GDP

B) the rate of inflation

C) government spending

D) the central bank

A) the level of real GDP

B) the rate of inflation

C) government spending

D) the central bank

Unlock Deck

Unlock for access to all 223 flashcards in this deck.

Unlock Deck

k this deck

6

Which statement does NOT accurately explain the slope of the aggregate-demand curve?

A) When interest rates fall, Sleepwell Hotels decides to build some new hotels.

B) The exchange rate falls, so French restaurants in Paris buy more Canadian beef.

C) Janet feels wealthier because of the price drop, so she decides to landscape her backyard.

D) With prices down and wages fixed by contract, Safe Well Servicing decides to lay off workers.

A) When interest rates fall, Sleepwell Hotels decides to build some new hotels.

B) The exchange rate falls, so French restaurants in Paris buy more Canadian beef.

C) Janet feels wealthier because of the price drop, so she decides to landscape her backyard.

D) With prices down and wages fixed by contract, Safe Well Servicing decides to lay off workers.

Unlock Deck

Unlock for access to all 223 flashcards in this deck.

Unlock Deck

k this deck

7

What is the difference between the effects of fiscal policy and the effects of monetary policy?

A) Monetary policy can affect long-term growth while fiscal policy cannot.

B) Fiscal policy can affect the short-term price level while monetary policy cannot.

C) Fiscal policy can affect long-term growth while monetary policy cannot.

D) Monetary policy can affect the short-term level of output while fiscal policy cannot.

A) Monetary policy can affect long-term growth while fiscal policy cannot.

B) Fiscal policy can affect the short-term price level while monetary policy cannot.

C) Fiscal policy can affect long-term growth while monetary policy cannot.

D) Monetary policy can affect the short-term level of output while fiscal policy cannot.

Unlock Deck

Unlock for access to all 223 flashcards in this deck.

Unlock Deck

k this deck

8

Which reason for the downward slope of the aggregate demand curve would likely be more important for a small closed economy?

A) wealth effect

B) interest-rate effect

C) exchange-rate effect

D) real-wage effect

A) wealth effect

B) interest-rate effect

C) exchange-rate effect

D) real-wage effect

Unlock Deck

Unlock for access to all 223 flashcards in this deck.

Unlock Deck

k this deck

9

If expected inflation is constant and the nominal interest rate increased 3 percentage points, what would happen to the real interest rate?

A) It would increase 3 percentage points.

B) It would increase, but by fewer than 3 percentage points.

C) It would decrease, but by fewer than 3 percentage points.

D) It would decrease by 3 percentage points.

A) It would increase 3 percentage points.

B) It would increase, but by fewer than 3 percentage points.

C) It would decrease, but by fewer than 3 percentage points.

D) It would decrease by 3 percentage points.

Unlock Deck

Unlock for access to all 223 flashcards in this deck.

Unlock Deck

k this deck

10

What does liquidity refer to?

A) the relation between the price and interest rate of an asset

B) the risk of an asset relative to its selling price

C) the ease with which an asset is converted into a medium of exchange

D) the sensitivity of investment spending to changes in the interest rate

A) the relation between the price and interest rate of an asset

B) the risk of an asset relative to its selling price

C) the ease with which an asset is converted into a medium of exchange

D) the sensitivity of investment spending to changes in the interest rate

Unlock Deck

Unlock for access to all 223 flashcards in this deck.

Unlock Deck

k this deck

11

If expected inflation is constant and the nominal interest rate increases, how does the real interest rate change?

A) It increases by more than the change in the nominal interest rate.

B) It increases by the change in the nominal interest rate.

C) It decreases by the change in the nominal interest rate.

D) It decreases by more than the change in the nominal interest rate.

A) It increases by more than the change in the nominal interest rate.

B) It increases by the change in the nominal interest rate.

C) It decreases by the change in the nominal interest rate.

D) It decreases by more than the change in the nominal interest rate.

Unlock Deck

Unlock for access to all 223 flashcards in this deck.

Unlock Deck

k this deck

12

Which of the following is the most liquid asset?

A) capital goods

B) stocks and bonds with a low risk

C) real estate

D) funds in a chequing account

A) capital goods

B) stocks and bonds with a low risk

C) real estate

D) funds in a chequing account

Unlock Deck

Unlock for access to all 223 flashcards in this deck.

Unlock Deck

k this deck

13

What is characteristic of aggregate demand in Canada?

A) The real exchange-rate effect is nonexistent.

B) The interest-rate effect is relatively small.

C) The wealth effect is the most important.

D) The interest-rate effect is relatively large.

A) The real exchange-rate effect is nonexistent.

B) The interest-rate effect is relatively small.

C) The wealth effect is the most important.

D) The interest-rate effect is relatively large.

Unlock Deck

Unlock for access to all 223 flashcards in this deck.

Unlock Deck

k this deck

14

According to the liquidity-preference theory, equilibrium in the money market is achieved by adjustments in which of the following?

A) price level

B) interest rate

C) exchange rate

D) expenditure

A) price level

B) interest rate

C) exchange rate

D) expenditure

Unlock Deck

Unlock for access to all 223 flashcards in this deck.

Unlock Deck

k this deck

15

According to liquidity-preference theory, what is the shape of the money-supply curve?

A) upward sloping

B) downward sloping

C) vertical

D) horizontal

A) upward sloping

B) downward sloping

C) vertical

D) horizontal

Unlock Deck

Unlock for access to all 223 flashcards in this deck.

Unlock Deck

k this deck

16

Which of Keynes's theories does liquidity preference refer to?

A) the effects of changes in money demand and supply on interest rates

B) the effects of changes in money demand and supply on exchange rates

C) the effects of changes in money demand and supply on expenditure

D) the effects of changes in money demand and supply on real wealth

A) the effects of changes in money demand and supply on interest rates

B) the effects of changes in money demand and supply on exchange rates

C) the effects of changes in money demand and supply on expenditure

D) the effects of changes in money demand and supply on real wealth

Unlock Deck

Unlock for access to all 223 flashcards in this deck.

Unlock Deck

k this deck

17

When the Bank of Canada buys government bonds, how do the reserves of the banking system change and what happens to the money supply?

A) The reserves increase, so the money supply increases.

B) The reserves increase, so the money supply decreases.

C) The reserves decrease, so the money supply increases.

D) The reserves decrease, so the money supply decreases.

A) The reserves increase, so the money supply increases.

B) The reserves increase, so the money supply decreases.

C) The reserves decrease, so the money supply increases.

D) The reserves decrease, so the money supply decreases.

Unlock Deck

Unlock for access to all 223 flashcards in this deck.

Unlock Deck

k this deck

18

Which statement is NOT a reason the aggregate-demand curve slopes downward?

A) As the price level increases, real wages decline.

B) As the price level increases, real wealth declines.

C) As the price level increases, the interest rate increases.

D) As the price level increases, the exchange rate increases.

A) As the price level increases, real wages decline.

B) As the price level increases, real wealth declines.

C) As the price level increases, the interest rate increases.

D) As the price level increases, the exchange rate increases.

Unlock Deck

Unlock for access to all 223 flashcards in this deck.

Unlock Deck

k this deck

19

According to liquidity-preference theory, what action taken by the Bank of Canada would shift the money-supply curve?

A) if the Bank of Canada engaged in arbitrage

B) if the Bank of Canada changed the inflation rate

C) if the Bank of Canada changed the exchange rate

D) if the Bank of Canada engaged in open-market transactions

A) if the Bank of Canada engaged in arbitrage

B) if the Bank of Canada changed the inflation rate

C) if the Bank of Canada changed the exchange rate

D) if the Bank of Canada engaged in open-market transactions

Unlock Deck

Unlock for access to all 223 flashcards in this deck.

Unlock Deck

k this deck

20

According to the theory of liquidity preference, how is the money supply affected by the interest rate?

A) inversely

B) negatively

C) not affected

D) directly

A) inversely

B) negatively

C) not affected

D) directly

Unlock Deck

Unlock for access to all 223 flashcards in this deck.

Unlock Deck

k this deck

21

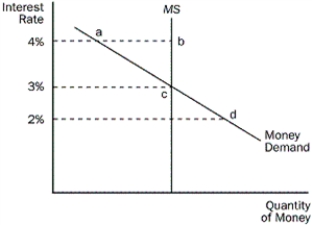

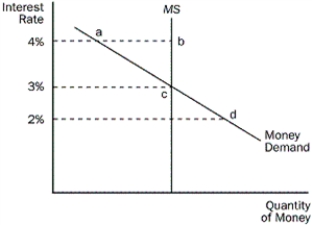

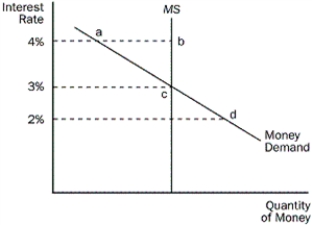

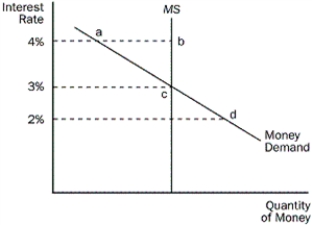

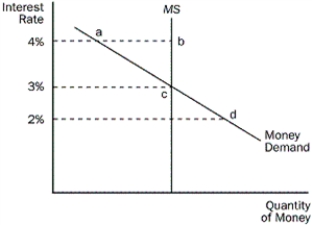

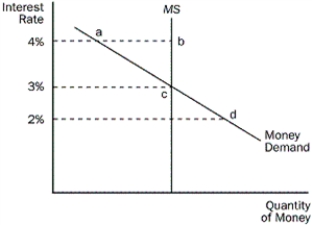

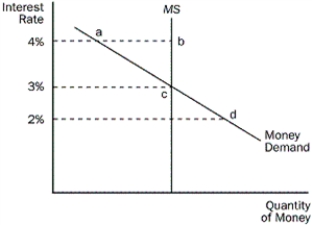

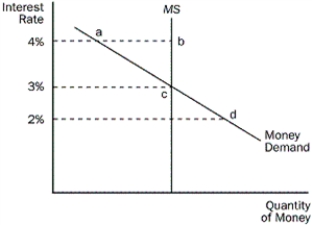

Figure 15-1

Refer to the Figure 15-1. What is most likely to happen if the interest rate is equal to 4?

A) There is excess demand for money, and the interest rate will fall.

B) There is excess supply of money, and the interest rate will rise.

C) There is excess demand for money, and the interest rate will rise.

D) There is an excess supply of money, and the interest rate will fall.

Refer to the Figure 15-1. What is most likely to happen if the interest rate is equal to 4?

A) There is excess demand for money, and the interest rate will fall.

B) There is excess supply of money, and the interest rate will rise.

C) There is excess demand for money, and the interest rate will rise.

D) There is an excess supply of money, and the interest rate will fall.

Unlock Deck

Unlock for access to all 223 flashcards in this deck.

Unlock Deck

k this deck

22

Figure 15-1

Refer to the Figure 15-1. What will happen if the current interest rate is 2 percent?

A) There will be excess money supply.

B) People will sell more bonds, which drives interest rates up.

C) People will buy more bonds, which drives interest rates up...

D) People will sell more bonds, which drives the interest rates down.

Refer to the Figure 15-1. What will happen if the current interest rate is 2 percent?

A) There will be excess money supply.

B) People will sell more bonds, which drives interest rates up.

C) People will buy more bonds, which drives interest rates up...

D) People will sell more bonds, which drives the interest rates down.

Unlock Deck

Unlock for access to all 223 flashcards in this deck.

Unlock Deck

k this deck

23

Figure 15-1

Refer to the Figure 15-1. At which interest rate is there an excess money demand?

A) 2 percent

B) 3 percent

C) 4 percent

D) 5 percent

Refer to the Figure 15-1. At which interest rate is there an excess money demand?

A) 2 percent

B) 3 percent

C) 4 percent

D) 5 percent

Unlock Deck

Unlock for access to all 223 flashcards in this deck.

Unlock Deck

k this deck

24

According to liquidity-preference theory, what is the opportunity cost of holding money?

A) the interest rate on bonds

B) the inflation rate

C) the cost of currency exchange

D) the difference between the inflation rate and the interest rate on bonds

A) the interest rate on bonds

B) the inflation rate

C) the cost of currency exchange

D) the difference between the inflation rate and the interest rate on bonds

Unlock Deck

Unlock for access to all 223 flashcards in this deck.

Unlock Deck

k this deck

25

If there is excess money supply, what will people do and what happens to the interest rate?

A) People will deposit more into interest-bearing accounts, and the interest rate will fall.

B) People will deposit more into interest-bearing accounts, and the interest rate will rise.

C) People will withdraw money from interest-bearing accounts, and the interest rate will fall.

D) People will withdraw money from interest-bearing accounts, and the interest rate will rise.

A) People will deposit more into interest-bearing accounts, and the interest rate will fall.

B) People will deposit more into interest-bearing accounts, and the interest rate will rise.

C) People will withdraw money from interest-bearing accounts, and the interest rate will fall.

D) People will withdraw money from interest-bearing accounts, and the interest rate will rise.

Unlock Deck

Unlock for access to all 223 flashcards in this deck.

Unlock Deck

k this deck

26

When does the opportunity cost of holding money decrease or increase, and how does people's desire to hold money change?

A) The opportunity cost of holding money decreases when the interest rate increases, so people desire to hold more money.

B) The opportunity cost of holding money decreases when the interest rate increases, so people desire to hold less money.

C) The opportunity cost of holding money increases when the interest rate increases, so people desire to hold more money.

D) The opportunity cost of holding money increases when the interest rate increases, so people desire to hold less money.

A) The opportunity cost of holding money decreases when the interest rate increases, so people desire to hold more money.

B) The opportunity cost of holding money decreases when the interest rate increases, so people desire to hold less money.

C) The opportunity cost of holding money increases when the interest rate increases, so people desire to hold more money.

D) The opportunity cost of holding money increases when the interest rate increases, so people desire to hold less money.

Unlock Deck

Unlock for access to all 223 flashcards in this deck.

Unlock Deck

k this deck

27

When the interest rate increases, how do the opportunity cost of holding money and the quantity of money demanded change?

A) The opportunity cost of holding money increases, so the quantity of money demanded increases.

B) The opportunity cost of holding money increases, so the quantity of money demanded decreases.

C) The opportunity cost of holding money decreases, so the quantity of money demanded increases.

D) The opportunity cost of holding money decreases, so the quantity of money demanded decreases.

A) The opportunity cost of holding money increases, so the quantity of money demanded increases.

B) The opportunity cost of holding money increases, so the quantity of money demanded decreases.

C) The opportunity cost of holding money decreases, so the quantity of money demanded increases.

D) The opportunity cost of holding money decreases, so the quantity of money demanded decreases.

Unlock Deck

Unlock for access to all 223 flashcards in this deck.

Unlock Deck

k this deck

28

According to liquidity-preference theory, if the quantity of money supplied is greater than the quantity demanded, what will happen to the interest rate and the quantity of money demanded?

A) The interest rate will increase, and the quantity of money demanded will decrease.

B) The interest rate will increase, and the quantity of money demanded will increase.

C) The interest rate will decrease, and the quantity of money demanded will decrease.

D) The interest rate will decrease, and the quantity of money demanded will increase.

A) The interest rate will increase, and the quantity of money demanded will decrease.

B) The interest rate will increase, and the quantity of money demanded will increase.

C) The interest rate will decrease, and the quantity of money demanded will decrease.

D) The interest rate will decrease, and the quantity of money demanded will increase.

Unlock Deck

Unlock for access to all 223 flashcards in this deck.

Unlock Deck

k this deck

29

If there is excess money demand, what will people do and what happens to the interest rate?

A) People will deposit more into interest-bearing accounts, and the interest rate will fall.

B) People will deposit more into interest-bearing accounts, and the interest rate will rise.

C) People will withdraw money from interest-bearing accounts, and the interest rate will fall.

D) People will withdraw money from interest-bearing accounts, and the interest rate will rise.

A) People will deposit more into interest-bearing accounts, and the interest rate will fall.

B) People will deposit more into interest-bearing accounts, and the interest rate will rise.

C) People will withdraw money from interest-bearing accounts, and the interest rate will fall.

D) People will withdraw money from interest-bearing accounts, and the interest rate will rise.

Unlock Deck

Unlock for access to all 223 flashcards in this deck.

Unlock Deck

k this deck

30

In recent years, what has been the predominant method used by the Bank of Canada to alter the money supply?

A) bank reserves

B) the monetary growth rate

C) the exchange rate

D) the bank rate

A) bank reserves

B) the monetary growth rate

C) the exchange rate

D) the bank rate

Unlock Deck

Unlock for access to all 223 flashcards in this deck.

Unlock Deck

k this deck

31

Figure 15-1

Refer to the Figure 15-1. At an interest rate of 4 percent, how much is the excess money demand or supply?

A) There is an excess money demand equal to the distance between a and b.

B) There is an excess money demand equal to the distance between b and c.

C) There is an excess money supply equal to the distance between b and a.

D) There is an excess money supply equal to the distance between c and b.

Refer to the Figure 15-1. At an interest rate of 4 percent, how much is the excess money demand or supply?

A) There is an excess money demand equal to the distance between a and b.

B) There is an excess money demand equal to the distance between b and c.

C) There is an excess money supply equal to the distance between b and a.

D) There is an excess money supply equal to the distance between c and b.

Unlock Deck

Unlock for access to all 223 flashcards in this deck.

Unlock Deck

k this deck

32

According to liquidity-preference theory, why is the money-demand curve downward sloping?

A) because interest rates rise as the Bank of Canada reduces the quantity of money demanded

B) because interest rates fall as the Bank of Canada reduces the supply of money

C) because people will want to hold less money as the cost of doing so falls

D) because people will want to hold more money as the cost of doing so falls

A) because interest rates rise as the Bank of Canada reduces the quantity of money demanded

B) because interest rates fall as the Bank of Canada reduces the supply of money

C) because people will want to hold less money as the cost of doing so falls

D) because people will want to hold more money as the cost of doing so falls

Unlock Deck

Unlock for access to all 223 flashcards in this deck.

Unlock Deck

k this deck

33

If at some interest rate the quantity of money demanded is greater than the quantity of money supplied, what will people desire to do and what will happen to the interest rate?

A) People will sell interest-bearing assets, causing the interest rate to decrease.

B) People will sell interest-bearing assets, causing the interest rate to increase.

C) People will buy interest-bearing assets, causing the interest rate to decrease.

D) People will buy interest-bearing assets, causing the interest rate to increase.

A) People will sell interest-bearing assets, causing the interest rate to decrease.

B) People will sell interest-bearing assets, causing the interest rate to increase.

C) People will buy interest-bearing assets, causing the interest rate to decrease.

D) People will buy interest-bearing assets, causing the interest rate to increase.

Unlock Deck

Unlock for access to all 223 flashcards in this deck.

Unlock Deck

k this deck

34

According to the theory of liquidity preference, which variable adjusts to balance the supply and demand for money?

A) interest rate

B) exchange rate

C) quantity of output

D) price level

A) interest rate

B) exchange rate

C) quantity of output

D) price level

Unlock Deck

Unlock for access to all 223 flashcards in this deck.

Unlock Deck

k this deck

35

If at some interest rate the quantity of money supplied is greater than the quantity of money demanded, what will people desire to do and what happens to the interest rate?

A) People will sell interest-bearing assets, causing the interest rate to decrease.

B) People will sell interest-bearing assets, causing the interest rate to increase.

C) People will buy interest-bearing assets, causing the interest rate to decrease.

D) People will buy interest-bearing assets, causing the interest rate to increase.

A) People will sell interest-bearing assets, causing the interest rate to decrease.

B) People will sell interest-bearing assets, causing the interest rate to increase.

C) People will buy interest-bearing assets, causing the interest rate to decrease.

D) People will buy interest-bearing assets, causing the interest rate to increase.

Unlock Deck

Unlock for access to all 223 flashcards in this deck.

Unlock Deck

k this deck

36

According to liquidity-preference theory, if the quantity of money demanded is greater than the quantity supplied, what will happen to the interest rate and the quantity of money demanded?

A) The interest rate will increase, and the quantity of money demanded will decrease.

B) The interest rate will increase, and the quantity of money demanded will increase.

C) The interest rate will decrease, and the quantity of money demanded will decrease.

D) The interest rate will decrease, and the quantity of money demanded will increase.

A) The interest rate will increase, and the quantity of money demanded will decrease.

B) The interest rate will increase, and the quantity of money demanded will increase.

C) The interest rate will decrease, and the quantity of money demanded will decrease.

D) The interest rate will decrease, and the quantity of money demanded will increase.

Unlock Deck

Unlock for access to all 223 flashcards in this deck.

Unlock Deck

k this deck

37

When the interest rate decreases, what happens to the opportunity cost of holding money and the quantity of money demanded?

A) The opportunity cost of holding money increases, so the quantity of money demanded increases.

B) The opportunity cost of holding money increases, so the quantity of money demanded decreases.

C) The opportunity cost of holding money decreases, so the quantity of money demanded increases.

D) The opportunity cost of holding money decreases, so the quantity of money demanded decreases.

A) The opportunity cost of holding money increases, so the quantity of money demanded increases.

B) The opportunity cost of holding money increases, so the quantity of money demanded decreases.

C) The opportunity cost of holding money decreases, so the quantity of money demanded increases.

D) The opportunity cost of holding money decreases, so the quantity of money demanded decreases.

Unlock Deck

Unlock for access to all 223 flashcards in this deck.

Unlock Deck

k this deck

38

Why do people primarily own or hold money?

A) because it has a guaranteed nominal return

B) because it can be invested for a guaranteed real return

C) because it can be used directly to buy goods and services

D) because it functions as a unit of account

A) because it has a guaranteed nominal return

B) because it can be invested for a guaranteed real return

C) because it can be used directly to buy goods and services

D) because it functions as a unit of account

Unlock Deck

Unlock for access to all 223 flashcards in this deck.

Unlock Deck

k this deck

39

In which situation do people want to hold less money?

A) when the price level and the interest rate increases

B) when the price level and the interest rate decreases

C) when the price level increases and the interest rate decreases

D) when the price level decreases and the interest rate increases

A) when the price level and the interest rate increases

B) when the price level and the interest rate decreases

C) when the price level increases and the interest rate decreases

D) when the price level decreases and the interest rate increases

Unlock Deck

Unlock for access to all 223 flashcards in this deck.

Unlock Deck

k this deck

40

In which situation do people want to hold more money?

A) when the price level and the interest rate increases

B) when the price level and the interest rate decreases

C) when the price level increases and the interest rate decreases

D) when the price level decreases and the interest rate increases

A) when the price level and the interest rate increases

B) when the price level and the interest rate decreases

C) when the price level increases and the interest rate decreases

D) when the price level decreases and the interest rate increases

Unlock Deck

Unlock for access to all 223 flashcards in this deck.

Unlock Deck

k this deck

41

Which statement is consistent with the short-run economic theories studied?

A) In the short run, output is determined by the amount of capital, labour, and technology; the interest rate adjusts to balance the supply and demand for money; and the price level adjusts to balance the supply and demand for loanable funds.

B) In the short run, output is determined by the amount of capital, labour, and technology; the interest rate adjusts to balance the supply and demand for loanable funds; and the price level adjusts to balance the supply and demand for money.

C) In the short run, output responds to the aggregate demand for goods and services; the interest rate adjusts to balance the supply and demand for money; and the price level is stuck.

D) In the short run, output responds to the aggregate demand for goods and services; the interest rate adjusts to balance the supply and demand for loanable funds; and the price level adjusts to balance the supply and demand for money.

A) In the short run, output is determined by the amount of capital, labour, and technology; the interest rate adjusts to balance the supply and demand for money; and the price level adjusts to balance the supply and demand for loanable funds.

B) In the short run, output is determined by the amount of capital, labour, and technology; the interest rate adjusts to balance the supply and demand for loanable funds; and the price level adjusts to balance the supply and demand for money.

C) In the short run, output responds to the aggregate demand for goods and services; the interest rate adjusts to balance the supply and demand for money; and the price level is stuck.

D) In the short run, output responds to the aggregate demand for goods and services; the interest rate adjusts to balance the supply and demand for loanable funds; and the price level adjusts to balance the supply and demand for money.

Unlock Deck

Unlock for access to all 223 flashcards in this deck.

Unlock Deck

k this deck

42

Assume the money market is initially in equilibrium. If the price level increases, according to liquidity-preference theory, what is in excess and for how long?

A) The supply of money is in excess until the interest rate increases.

B) The supply of money is in excess until the interest rate decreases.

C) The demand for money is in excess until the interest rate increases.

D) The demand for money is in excess until the interest rate decreases.

A) The supply of money is in excess until the interest rate increases.

B) The supply of money is in excess until the interest rate decreases.

C) The demand for money is in excess until the interest rate increases.

D) The demand for money is in excess until the interest rate decreases.

Unlock Deck

Unlock for access to all 223 flashcards in this deck.

Unlock Deck

k this deck

43

According to the theory of liquidity preference, what does an increase in the price level cause the interest rate and investment to do?

A) It causes both the interest rate and investment to rise.

B) It causes both the interest rate and investment to fall.

C) It causes the interest rate to rise and investment to fall.

D) It causes the interest rate to fall and investment to rise.

A) It causes both the interest rate and investment to rise.

B) It causes both the interest rate and investment to fall.

C) It causes the interest rate to rise and investment to fall.

D) It causes the interest rate to fall and investment to rise.

Unlock Deck

Unlock for access to all 223 flashcards in this deck.

Unlock Deck

k this deck

44

Which of the following is an effect of an increase in the interest rate?

A) People put more money in their savings accounts.

B) Foreign citizens decide to buy fewer Canadian bonds.

C) Firms decide to purchase new machinery.

D) People decide to increase residential investment.

A) People put more money in their savings accounts.

B) Foreign citizens decide to buy fewer Canadian bonds.

C) Firms decide to purchase new machinery.

D) People decide to increase residential investment.

Unlock Deck

Unlock for access to all 223 flashcards in this deck.

Unlock Deck

k this deck

45

Which statement is consistent with the long-run theories studied?

A) In the long run, output responds to the aggregate demand and supply of goods and services; the interest rate adjusts to balance the supply and demand for money; and the price level adjusts to balance the supply and demand for loanable funds.

B) In the long run, output is determined by the amount of capital, labour, and technology; the interest rate adjusts to balance the supply and demand for loanable funds; and the price level adjusts to balance the supply and demand for money.

C) In the long run, output is determined by the amount of capital, labour, and technology; the interest rate adjusts to balance the supply and demand for loanable funds; and the price level is stuck.

D) In the long run, output responds to the aggregate demand for goods and services; the interest rate adjusts to balance the supply and demand for loanable funds; and the price level adjusts to balance the supply and demand for money.

A) In the long run, output responds to the aggregate demand and supply of goods and services; the interest rate adjusts to balance the supply and demand for money; and the price level adjusts to balance the supply and demand for loanable funds.

B) In the long run, output is determined by the amount of capital, labour, and technology; the interest rate adjusts to balance the supply and demand for loanable funds; and the price level adjusts to balance the supply and demand for money.

C) In the long run, output is determined by the amount of capital, labour, and technology; the interest rate adjusts to balance the supply and demand for loanable funds; and the price level is stuck.

D) In the long run, output responds to the aggregate demand for goods and services; the interest rate adjusts to balance the supply and demand for loanable funds; and the price level adjusts to balance the supply and demand for money.

Unlock Deck

Unlock for access to all 223 flashcards in this deck.

Unlock Deck

k this deck

46

According to liquidity-preference theory, if the price level increases, how do the equilibrium interest rate and the aggregate quantity of goods change?

A) The interest rate and the quantity demanded rise.

B) The interest rate rises and the quantity demanded falls.

C) The interest rate falls and the quantity demanded rises.

D) The interest rate and the quantity demanded fall.

A) The interest rate and the quantity demanded rise.

B) The interest rate rises and the quantity demanded falls.

C) The interest rate falls and the quantity demanded rises.

D) The interest rate and the quantity demanded fall.

Unlock Deck

Unlock for access to all 223 flashcards in this deck.

Unlock Deck

k this deck

47

Which of the following is an effect of an increase in the interest rate?

A) It induces firms to invest more.

B) It induces households to increase consumption.

C) It shifts money demand to the right.

D) It leads to the appreciation of the exchange rate.

A) It induces firms to invest more.

B) It induces households to increase consumption.

C) It shifts money demand to the right.

D) It leads to the appreciation of the exchange rate.

Unlock Deck

Unlock for access to all 223 flashcards in this deck.

Unlock Deck

k this deck

48

What is the variable that balances the money demand and supply in the liquidity-preference and the classical theories?

A) the interest rate in both theories

B) the price level in both theories

C) the interest rate in the liquidity-preference theory and the price level in the classical theory

D) the price level in the liquidity-preference theory and the interest rate in the classical theory

A) the interest rate in both theories

B) the price level in both theories

C) the interest rate in the liquidity-preference theory and the price level in the classical theory

D) the price level in the liquidity-preference theory and the interest rate in the classical theory

Unlock Deck

Unlock for access to all 223 flashcards in this deck.

Unlock Deck

k this deck

49

According to liquidity-preference theory, if the price level increases, in which direction does the demand curve shift, and how does the interest rate change?

A) The demand curve shifts right, so the interest rate increases.

B) The demand curve shifts right, so the interest rate decreases.

C) The demand curve shifts left, so the interest rate decreases.

D) The demand curve shifts left, so the interest rate increases.

A) The demand curve shifts right, so the interest rate increases.

B) The demand curve shifts right, so the interest rate decreases.

C) The demand curve shifts left, so the interest rate decreases.

D) The demand curve shifts left, so the interest rate increases.

Unlock Deck

Unlock for access to all 223 flashcards in this deck.

Unlock Deck

k this deck

50

According to the theory of liquidity preference, what does a decrease in the price level cause the interest rate and investment to do?

A) It causes both the interest rate and investment to rise.

B) It causes both the interest rate and investment to fall.

C) It causes the interest rate to rise and investment to fall.

D) It causes the interest rate to fall and investment to rise.

A) It causes both the interest rate and investment to rise.

B) It causes both the interest rate and investment to fall.

C) It causes the interest rate to rise and investment to fall.

D) It causes the interest rate to fall and investment to rise.

Unlock Deck

Unlock for access to all 223 flashcards in this deck.

Unlock Deck

k this deck

51

According to liquidity-preference theory, how does a decrease in the price level affect the interest rate and output demanded, respectively?

A) The interest rate increases, and output demanded increases.

B) The interest rate increases, and output demanded decreases.

C) The interest rate decreases, and output demanded increases.

D) The interest rate decreases, and output demanded decreases.

A) The interest rate increases, and output demanded increases.

B) The interest rate increases, and output demanded decreases.

C) The interest rate decreases, and output demanded increases.

D) The interest rate decreases, and output demanded decreases.

Unlock Deck

Unlock for access to all 223 flashcards in this deck.

Unlock Deck

k this deck

52

Which theory is the most appropriate to analyze the effects of interest rate changes in the short run?

A) the aggregate-demand and aggregate-supply theory

B) the classical theory

C) the liquidity-preference theory

D) the general theory of employment

A) the aggregate-demand and aggregate-supply theory

B) the classical theory

C) the liquidity-preference theory

D) the general theory of employment

Unlock Deck

Unlock for access to all 223 flashcards in this deck.

Unlock Deck

k this deck

53

According to the liquidity-preference theory, how does an increase in the price level affect the interest rate?

A) It increases the money demand and the interest rate.

B) It lowers the money demand and the interest rate.

C) It increases the money demand and lowers the interest rate.

D) It lowers the money demand and increases the interest rate.

A) It increases the money demand and the interest rate.

B) It lowers the money demand and the interest rate.

C) It increases the money demand and lowers the interest rate.

D) It lowers the money demand and increases the interest rate.

Unlock Deck

Unlock for access to all 223 flashcards in this deck.

Unlock Deck

k this deck

54

Assume the money market is initially in equilibrium. If the price level decreases, according to liquidity-preference theory, what is in excess and for how long?

A) The supply of money is in excess until the interest rate increases.

B) The supply of money is in excess until the interest rate decreases.

C) The demand for money is in excess until the interest rate increases.

D) The demand for money is in excess until the interest rate decreases.

A) The supply of money is in excess until the interest rate increases.

B) The supply of money is in excess until the interest rate decreases.

C) The demand for money is in excess until the interest rate increases.

D) The demand for money is in excess until the interest rate decreases.

Unlock Deck

Unlock for access to all 223 flashcards in this deck.

Unlock Deck

k this deck

55

Which of the following shifts money demand to the right?

A) an increase in the price level and the interest rate

B) an increase in the price level and a decrease in the interest rate

C) a decrease in the interest rate but not a change in the price level

D) an increase in the price level but not a change in the interest rate

A) an increase in the price level and the interest rate

B) an increase in the price level and a decrease in the interest rate

C) a decrease in the interest rate but not a change in the price level

D) an increase in the price level but not a change in the interest rate

Unlock Deck

Unlock for access to all 223 flashcards in this deck.

Unlock Deck

k this deck

56

Which of the following shifts money demand to the right?

A) an increase in the price level

B) a decrease in the price level

C) an increase in the interest rate

D) a decrease in the interest rate

A) an increase in the price level

B) a decrease in the price level

C) an increase in the interest rate

D) a decrease in the interest rate

Unlock Deck

Unlock for access to all 223 flashcards in this deck.

Unlock Deck

k this deck

57

Which of the following shifts money demand to the left?

A) an increase in the price level

B) a decrease in the price level

C) an increase in the interest rate

D) a decrease in the interest rate

A) an increase in the price level

B) a decrease in the price level

C) an increase in the interest rate

D) a decrease in the interest rate

Unlock Deck

Unlock for access to all 223 flashcards in this deck.

Unlock Deck

k this deck

58

According to liquidity-preference theory, other things being equal, what does a higher price level lead households to do in the short run?

A) increase residential investment

B) decrease the amount of cash they want to hold

C) buy bonds

D) decrease consumption

A) increase residential investment

B) decrease the amount of cash they want to hold

C) buy bonds

D) decrease consumption

Unlock Deck

Unlock for access to all 223 flashcards in this deck.

Unlock Deck

k this deck

59

According to which theory do changes in the interest rate bring the money market into equilibrium?

A) purchasing-power parity theory

B) aggregate-demand and aggregate-supply theory

C) liquidity-preference theory

D) classical theory

A) purchasing-power parity theory

B) aggregate-demand and aggregate-supply theory

C) liquidity-preference theory

D) classical theory

Unlock Deck

Unlock for access to all 223 flashcards in this deck.

Unlock Deck

k this deck

60

According to liquidity-preference theory, how does an increase in the price level affect the interest rate and output demanded, respectively?

A) The interest rate increases, and output demanded increases.

B) The interest rate increases, and output demanded decreases.

C) The interest rate decreases, and output demanded increases.

D) The interest rate decreases, and output demanded decreases.

A) The interest rate increases, and output demanded increases.

B) The interest rate increases, and output demanded decreases.

C) The interest rate decreases, and output demanded increases.

D) The interest rate decreases, and output demanded decreases.

Unlock Deck

Unlock for access to all 223 flashcards in this deck.

Unlock Deck

k this deck

61

If the Bank of Canada conducts open-market purchases, how do the money supply and the aggregate demand change?

A) The money supply increases, and aggregate demand shifts right.

B) The money supply increases, and aggregate demand shifts left.

C) The money supply decreases, and aggregate demand shifts right.

D) The money supply decreases, and aggregate demand shifts left.

A) The money supply increases, and aggregate demand shifts right.

B) The money supply increases, and aggregate demand shifts left.

C) The money supply decreases, and aggregate demand shifts right.

D) The money supply decreases, and aggregate demand shifts left.

Unlock Deck

Unlock for access to all 223 flashcards in this deck.

Unlock Deck

k this deck

62

Which statement best describes the interest-rate effect?

A) As the money supply increases, money demand decreases, the interest rate falls, so spending rises.

B) As the money supply increases, money demand decreases, the interest rate rises, so spending falls.

C) As the price level increases, money demand increases, the interest rate falls, so spending rises.

D) As the price level increases, money demand increases, the interest rate rises, so spending falls.

A) As the money supply increases, money demand decreases, the interest rate falls, so spending rises.

B) As the money supply increases, money demand decreases, the interest rate rises, so spending falls.

C) As the price level increases, money demand increases, the interest rate falls, so spending rises.

D) As the price level increases, money demand increases, the interest rate rises, so spending falls.

Unlock Deck

Unlock for access to all 223 flashcards in this deck.

Unlock Deck

k this deck

63

If the interest rate is above a central bank's target, what should the central bank do?

A) buy bonds to increase the money supply

B) buy bonds to decrease the money supply

C) sell bonds to increase the money supply

D) sell bonds to decrease the money supply

A) buy bonds to increase the money supply

B) buy bonds to decrease the money supply

C) sell bonds to increase the money supply

D) sell bonds to decrease the money supply

Unlock Deck

Unlock for access to all 223 flashcards in this deck.

Unlock Deck

k this deck

64

Which of the following shifts aggregate demand to the right?

A) an increase in the price level

B) an increase in the money supply

C) a decrease in the price level

D) a decrease in the money supply

A) an increase in the price level

B) an increase in the money supply

C) a decrease in the price level

D) a decrease in the money supply

Unlock Deck

Unlock for access to all 223 flashcards in this deck.

Unlock Deck

k this deck

65

The economy is in long-run equilibrium. Suppose that automatic teller machines become cheaper and more convenient to use, and as a result the demand for money falls. Other things being equal, what would we expect will happen to the price level and real GDP in the short and long run?

A) In the short run, the price level and real GDP would rise, but in the long run they would both be unaffected.

B) In the short run, the price level and real GDP would rise, but in the long run the price level would rise and real GDP would be unaffected.

C) In the short run, the price level and real GDP would fall, but in the long run they would both be unaffected.

D) In the short run, the price level and real GDP would fall, but in the long run the price level would fall and real GDP would be unaffected.

A) In the short run, the price level and real GDP would rise, but in the long run they would both be unaffected.

B) In the short run, the price level and real GDP would rise, but in the long run the price level would rise and real GDP would be unaffected.

C) In the short run, the price level and real GDP would fall, but in the long run they would both be unaffected.

D) In the short run, the price level and real GDP would fall, but in the long run the price level would fall and real GDP would be unaffected.

Unlock Deck

Unlock for access to all 223 flashcards in this deck.

Unlock Deck

k this deck

66

Which of the following shifts aggregate demand to the right?

A) an increase in the bank rate

B) a decrease in the price level

C) a decrease in the money supply

D) a decrease in interest rates

A) an increase in the bank rate

B) a decrease in the price level

C) a decrease in the money supply

D) a decrease in interest rates

Unlock Deck

Unlock for access to all 223 flashcards in this deck.

Unlock Deck

k this deck

67

How does a monetary injection by the Bank of Canada affect interest rates and aggregate demand?

A) It increases interest rates and increases aggregate demand.

B) It increases interest rates and decreases aggregate demand.

C) It decreases interest rates and decreases aggregate demand.

D) It decreases interest rates and increases aggregate demand.

A) It increases interest rates and increases aggregate demand.

B) It increases interest rates and decreases aggregate demand.

C) It decreases interest rates and decreases aggregate demand.

D) It decreases interest rates and increases aggregate demand.

Unlock Deck

Unlock for access to all 223 flashcards in this deck.

Unlock Deck

k this deck

68

If a central bank targets the interest rate, what does this imply?

A) The central bank can then set the money supply at whatever value it wants.

B) The central bank must increase the money supply if the interest rate is above its target.

C) The central bank must decrease the money supply if the interest rate is above its target.

D) The central bank must not change the money supply.

A) The central bank can then set the money supply at whatever value it wants.

B) The central bank must increase the money supply if the interest rate is above its target.

C) The central bank must decrease the money supply if the interest rate is above its target.

D) The central bank must not change the money supply.

Unlock Deck

Unlock for access to all 223 flashcards in this deck.

Unlock Deck

k this deck

69

Which statement describes the interest-rate effect?

A) A higher price level leads to higher money demand, higher money demand leads to higher interest rates, and a higher interest rate increases the quantity of goods and services demanded.

B) A higher price level leads to higher money demand, higher money demand leads to lower interest rates, and a higher interest rate reduces the quantity of goods and services demanded.

C) A lower price level leads to lower money demand, lower money demand leads to higher interest rates, and a lower interest rate reduces the quantity of goods and services demanded.

D) A lower price level leads to lower money demand, lower money demand leads to lower interest rates, and a lower interest rate increases the quantity of goods and services demanded.

A) A higher price level leads to higher money demand, higher money demand leads to higher interest rates, and a higher interest rate increases the quantity of goods and services demanded.

B) A higher price level leads to higher money demand, higher money demand leads to lower interest rates, and a higher interest rate reduces the quantity of goods and services demanded.

C) A lower price level leads to lower money demand, lower money demand leads to higher interest rates, and a lower interest rate reduces the quantity of goods and services demanded.

D) A lower price level leads to lower money demand, lower money demand leads to lower interest rates, and a lower interest rate increases the quantity of goods and services demanded.

Unlock Deck

Unlock for access to all 223 flashcards in this deck.

Unlock Deck

k this deck

70

In the short run, what effect does an increase in the money supply have on interest rates and aggregate demand?

A) It causes interest rates to increase and aggregate demand to shift right.

B) It causes interest rates to increase and aggregate demand to shift left.

C) It causes interest rates to decrease and aggregate demand to shift right.

D) It causes interest rates to decrease and aggregate demand to shift left.

A) It causes interest rates to increase and aggregate demand to shift right.

B) It causes interest rates to increase and aggregate demand to shift left.

C) It causes interest rates to decrease and aggregate demand to shift right.

D) It causes interest rates to decrease and aggregate demand to shift left.

Unlock Deck

Unlock for access to all 223 flashcards in this deck.

Unlock Deck

k this deck

71

How does an increase in the interest rate affect the demand for goods and services?

A) It increases the cost of borrowing and people consume more.

B) It decreases the cost of borrowing and people consume more.

C) It increases the cost of borrowing and people consume less.

D) It decreases the cost of borrowing and people consume less.

A) It increases the cost of borrowing and people consume more.

B) It decreases the cost of borrowing and people consume more.

C) It increases the cost of borrowing and people consume less.

D) It decreases the cost of borrowing and people consume less.

Unlock Deck

Unlock for access to all 223 flashcards in this deck.

Unlock Deck

k this deck

72

How do open-market sales affect the price level and real GDP?

A) They increase the price level and real GDP.

B) They decrease the price level and real GDP.

C) They increase the price level and decrease real GDP.

D) They decrease the price level and increase real GDP.

A) They increase the price level and real GDP.

B) They decrease the price level and real GDP.

C) They increase the price level and decrease real GDP.

D) They decrease the price level and increase real GDP.

Unlock Deck

Unlock for access to all 223 flashcards in this deck.

Unlock Deck

k this deck

73

If the Bank of Canada conducts open-market sales, how do the money supply and the aggregate demand change?

A) The money supply increases, and aggregate demand shifts right.

B) The money supply increases, and aggregate demand shifts left.

C) The money supply decreases, and aggregate demand shifts right.

D) The money supply decreases, and aggregate demand shifts left.

A) The money supply increases, and aggregate demand shifts right.

B) The money supply increases, and aggregate demand shifts left.

C) The money supply decreases, and aggregate demand shifts right.

D) The money supply decreases, and aggregate demand shifts left.

Unlock Deck

Unlock for access to all 223 flashcards in this deck.

Unlock Deck

k this deck

74

When a central bank sets a target for the interest rate, what does it commit itself to?

A) revealing its target to the public

B) adjusting the demand for money in order to make the equilibrium in the money market hit that target

C) adjusting the money supply in order to meet the interest-rate target

D) having to make open-market sales

A) revealing its target to the public

B) adjusting the demand for money in order to make the equilibrium in the money market hit that target

C) adjusting the money supply in order to meet the interest-rate target

D) having to make open-market sales

Unlock Deck

Unlock for access to all 223 flashcards in this deck.

Unlock Deck

k this deck

75

Which of the following shifts aggregate demand to the left?

A) an increase in the price level

B) an increase in the money supply

C) a decrease in the price level

D) a decrease in the money supply

A) an increase in the price level

B) an increase in the money supply

C) a decrease in the price level

D) a decrease in the money supply

Unlock Deck

Unlock for access to all 223 flashcards in this deck.

Unlock Deck

k this deck

76

What is the main reason the aggregate-demand curve slopes downward?

A) As the price level increases, money demand increases, interest rates increase, and investment decreases.

B) As the price level increases, money demand increases, interest rates decrease, and investment increases.

C) As the price level decreases, money demand increases, interest rates increase, and investment increases.

D) As the price level decreases, money demand increases, interest rates decrease, and investment decreases.

A) As the price level increases, money demand increases, interest rates increase, and investment decreases.

B) As the price level increases, money demand increases, interest rates decrease, and investment increases.

C) As the price level decreases, money demand increases, interest rates increase, and investment increases.

D) As the price level decreases, money demand increases, interest rates decrease, and investment decreases.

Unlock Deck

Unlock for access to all 223 flashcards in this deck.

Unlock Deck

k this deck

77

In the short run, a decrease in the money supply causes interest rates and aggregate demand to do what?

A) It causes interest rates to increase and aggregate demand to shift right.

B) It causes interest rates to increase and aggregate demand to shift left.

C) It causes interest rates to decrease and aggregate demand to shift right.

D) It causes interest rates to decrease and aggregate demand to shift left.

A) It causes interest rates to increase and aggregate demand to shift right.

B) It causes interest rates to increase and aggregate demand to shift left.

C) It causes interest rates to decrease and aggregate demand to shift right.

D) It causes interest rates to decrease and aggregate demand to shift left.

Unlock Deck

Unlock for access to all 223 flashcards in this deck.

Unlock Deck

k this deck

78

How does the interest rate change when the price level falls and when the money supply falls?

A) The interest rate rises both when the price level falls and when the money supply falls.

B) The interest rate rises when the price level falls and falls when the money supply falls.

C) The interest rate falls when the price level falls and rises when the money supply falls.

D) The interest rate falls both when the price level falls and when the money supply falls.

A) The interest rate rises both when the price level falls and when the money supply falls.

B) The interest rate rises when the price level falls and falls when the money supply falls.

C) The interest rate falls when the price level falls and rises when the money supply falls.

D) The interest rate falls both when the price level falls and when the money supply falls.

Unlock Deck

Unlock for access to all 223 flashcards in this deck.

Unlock Deck

k this deck

79

How do open-market purchases affect the price level and real GDP?

A) They increase the price level and real GDP.

B) They decrease the price level and real GDP.

C) They increase the price level and decrease real GDP.

D) They decrease the price level and increase real GDP.

A) They increase the price level and real GDP.

B) They decrease the price level and real GDP.

C) They increase the price level and decrease real GDP.

D) They decrease the price level and increase real GDP.

Unlock Deck

Unlock for access to all 223 flashcards in this deck.

Unlock Deck

k this deck

80

According to liquidity preference theory, when do people demand fewer goods and services?

A) when the price level or interest rate increase

B) when the price level or interest rate decrease

C) when the price level increases or the interest rate decreases

D) when the price level decreases or the interest rate increases

A) when the price level or interest rate increase

B) when the price level or interest rate decrease

C) when the price level increases or the interest rate decreases

D) when the price level decreases or the interest rate increases

Unlock Deck

Unlock for access to all 223 flashcards in this deck.

Unlock Deck

k this deck