Deck 20: Short Term Financial Planning

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/105

Play

Full screen (f)

Deck 20: Short Term Financial Planning

1

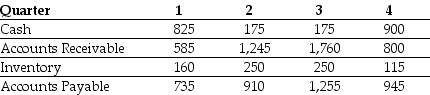

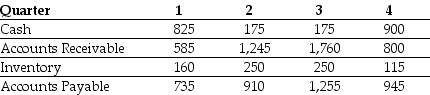

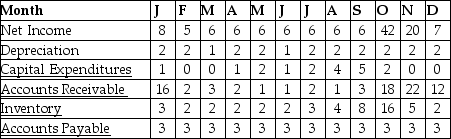

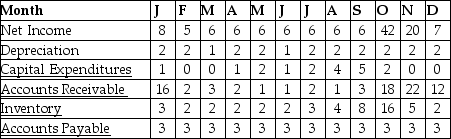

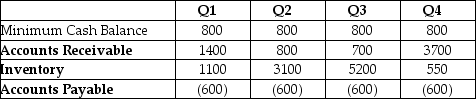

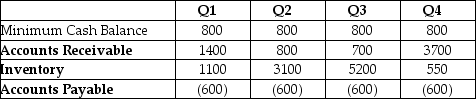

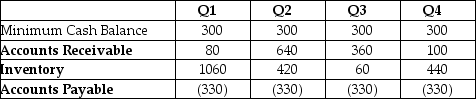

Use the table for the question(s) below.

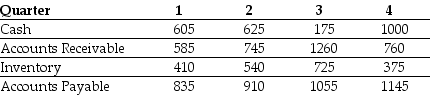

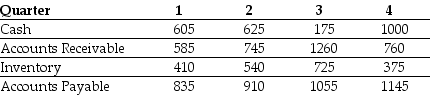

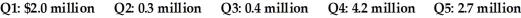

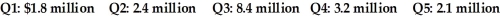

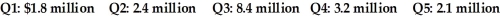

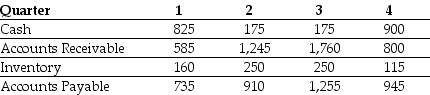

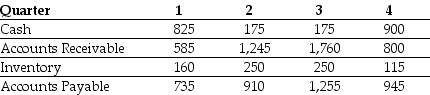

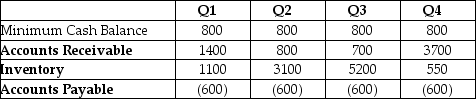

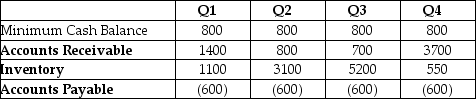

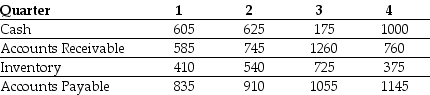

The quarterly working capital levels for Fancy Weddings, Inc are presented in the following table (in $ millions):

In which quarter(s)are Fancy's seasonal working capital needs the smallest?

A) 1

B) 2

C) 3

D) 4

E) 3 and 4

The quarterly working capital levels for Fancy Weddings, Inc are presented in the following table (in $ millions):

In which quarter(s)are Fancy's seasonal working capital needs the smallest?

A) 1

B) 2

C) 3

D) 4

E) 3 and 4

2

2

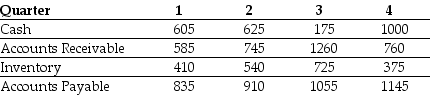

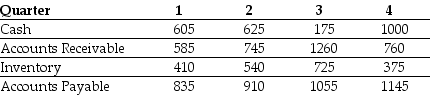

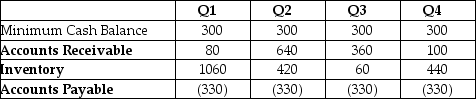

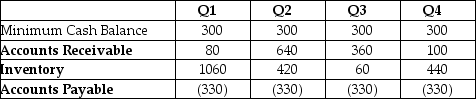

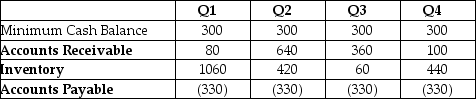

Use the table for the question(s) below.

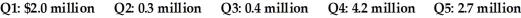

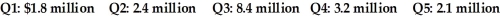

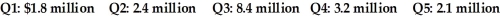

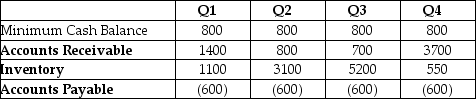

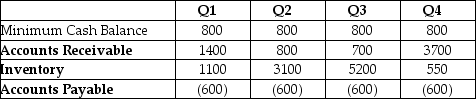

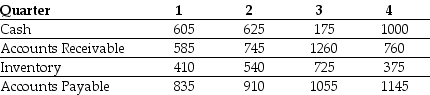

The quarterly working capital levels for Hasbeen Toys are presented in the following table (in $ millions):

In which quarter(s)are Hasbeen's seasonal working capital needs the smallest?

A) 4

B) 2

C) 3

D) 1

E) 3 and 4

The quarterly working capital levels for Hasbeen Toys are presented in the following table (in $ millions):

In which quarter(s)are Hasbeen's seasonal working capital needs the smallest?

A) 4

B) 2

C) 3

D) 1

E) 3 and 4

1

3

Occasionally,a company will encounter circumstances in which cash flows are temporarily negative for an unexpected reason.We refer to such a situation as

A) a liquidity shock.

B) a negative cash flow shock.

C) a negative liquidity shock.

D) a cash crunch.

E) a margin squeeze.

A) a liquidity shock.

B) a negative cash flow shock.

C) a negative liquidity shock.

D) a cash crunch.

E) a margin squeeze.

a negative cash flow shock.

4

How does seasonality lead to short-term financing needs?

Unlock Deck

Unlock for access to all 105 flashcards in this deck.

Unlock Deck

k this deck

5

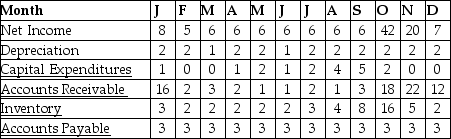

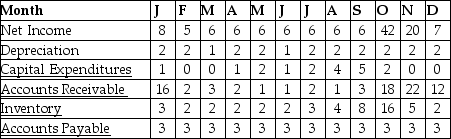

Use the table for the question(s) below.

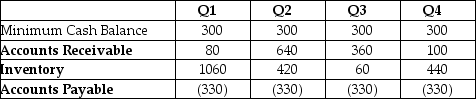

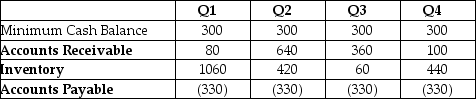

DressUp! is a clothing retailer specializing in costumery. The financial forecast for a year is shown in the table above. All figures are in thousands of dollars.

During which of the following months are the firm's working capital needs the greatest?

A) April

B) June

C) September

D) October

E) November

DressUp! is a clothing retailer specializing in costumery. The financial forecast for a year is shown in the table above. All figures are in thousands of dollars.

During which of the following months are the firm's working capital needs the greatest?

A) April

B) June

C) September

D) October

E) November

Unlock Deck

Unlock for access to all 105 flashcards in this deck.

Unlock Deck

k this deck

6

Which of the following companies is most likely to have the greatest need for short-term financial planning?

A) a company that mines sand for use in glass-making

B) a company that manufactures condiments such as ketchup

C) a company that produces advertisements for roadside billboards

D) a company that provides catering services for weddings

E) a utility company that provides electricity

A) a company that mines sand for use in glass-making

B) a company that manufactures condiments such as ketchup

C) a company that produces advertisements for roadside billboards

D) a company that provides catering services for weddings

E) a utility company that provides electricity

Unlock Deck

Unlock for access to all 105 flashcards in this deck.

Unlock Deck

k this deck

7

When a company analyzes its short-term financing needs,it typically examines cash flows at

A) monthly intervals.

B) yearly intervals.

C) quarterly intervals.

D) weekly intervals.

E) daily intervals.

A) monthly intervals.

B) yearly intervals.

C) quarterly intervals.

D) weekly intervals.

E) daily intervals.

Unlock Deck

Unlock for access to all 105 flashcards in this deck.

Unlock Deck

k this deck

8

Which of the following companies has the smallest need for short-term financial planning?

A) a company that produces Christmas decorations

B) a toy manufacturer

C) a company that makes condiments such as ketchup

D) a company that provides catering services for weddings

E) a retailer that sells bathing suits

A) a company that produces Christmas decorations

B) a toy manufacturer

C) a company that makes condiments such as ketchup

D) a company that provides catering services for weddings

E) a retailer that sells bathing suits

Unlock Deck

Unlock for access to all 105 flashcards in this deck.

Unlock Deck

k this deck

9

Use the table for the question(s) below.

The quarterly working capital levels for Hasbeen Toys are presented in the following table (in $ millions):

In which quarter(s)are Hasbeen's seasonal working capital needs the greatest?

A) 4

B) 2

C) 3

D) 1

E) 1 and 2

The quarterly working capital levels for Hasbeen Toys are presented in the following table (in $ millions):

In which quarter(s)are Hasbeen's seasonal working capital needs the greatest?

A) 4

B) 2

C) 3

D) 1

E) 1 and 2

Unlock Deck

Unlock for access to all 105 flashcards in this deck.

Unlock Deck

k this deck

10

Use the information for the question(s) below.

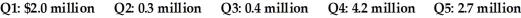

Glenside Industries is a domestic machinery manufacturer which specializes in the production of snowblowers. The above figures show the anticipated sales over the next four quarters. Glenside carries inventory equal to 25% of next quarter's sales, has accounts payable of 15% of next quarter's sales, and accounts receivable of 23% of this quarter's sales.

If its net income is 10% of sales,in which quarter(s)is it expected that Glenside's seasonal working capital needs will be the greatest?

A) Q1

B) Q2

C) Q3

D) Q4

E) Q5

Glenside Industries is a domestic machinery manufacturer which specializes in the production of snowblowers. The above figures show the anticipated sales over the next four quarters. Glenside carries inventory equal to 25% of next quarter's sales, has accounts payable of 15% of next quarter's sales, and accounts receivable of 23% of this quarter's sales.

If its net income is 10% of sales,in which quarter(s)is it expected that Glenside's seasonal working capital needs will be the greatest?

A) Q1

B) Q2

C) Q3

D) Q4

E) Q5

Unlock Deck

Unlock for access to all 105 flashcards in this deck.

Unlock Deck

k this deck

11

How does seasonality create fluctuations in a firm's net income over a year?

A) Cost of goods sold will rise and fall along with sales, while administrative and other costs will remain relatively steady.

B) Cost of goods sold will rise when sales fall, and vice versa, while administrative and other costs will remain relatively steady.

C) Cost of goods sold, along with administrative and other costs, will rise when sales fall, and vice versa.

D) Cost of goods sold, along with administrative and other costs, will rise and fall along with sales.

E) Cost of goods sold, along with administrative and other costs, will remain relatively steady.

A) Cost of goods sold will rise and fall along with sales, while administrative and other costs will remain relatively steady.

B) Cost of goods sold will rise when sales fall, and vice versa, while administrative and other costs will remain relatively steady.

C) Cost of goods sold, along with administrative and other costs, will rise when sales fall, and vice versa.

D) Cost of goods sold, along with administrative and other costs, will rise and fall along with sales.

E) Cost of goods sold, along with administrative and other costs, will remain relatively steady.

Unlock Deck

Unlock for access to all 105 flashcards in this deck.

Unlock Deck

k this deck

12

Which of the following firms is likely to have the highest short-term financing needs?

A) a pharmaceutical manufacturer

B) a grocery store

C) an electric utility

D) a toy store

E) an internet service provider

A) a pharmaceutical manufacturer

B) a grocery store

C) an electric utility

D) a toy store

E) an internet service provider

Unlock Deck

Unlock for access to all 105 flashcards in this deck.

Unlock Deck

k this deck

13

Use the information for the question(s) below.

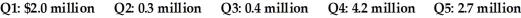

Azamel Cosmetics specializes in cosmetics which have high levels of UV protection. The above figures show the anticipated sales over the next four quarters. Azamel carries inventory equal to 30% of next quarter's sales, has accounts payable of 20% of next quarter's sales, and accounts receivable of 25% of this quarter's sales.

If its net income is 12% of sales,in which quarter(s)is it expected that Azamel's seasonal working capital needs will be the greatest?

A) Q1

B) Q2

C) Q3

D) Q4

E) Q5

Azamel Cosmetics specializes in cosmetics which have high levels of UV protection. The above figures show the anticipated sales over the next four quarters. Azamel carries inventory equal to 30% of next quarter's sales, has accounts payable of 20% of next quarter's sales, and accounts receivable of 25% of this quarter's sales.

If its net income is 12% of sales,in which quarter(s)is it expected that Azamel's seasonal working capital needs will be the greatest?

A) Q1

B) Q2

C) Q3

D) Q4

E) Q5

Unlock Deck

Unlock for access to all 105 flashcards in this deck.

Unlock Deck

k this deck

14

Which of the following are the three reasons that firms need short-term financing?

A) seasonalities, market frictions, and positive cash flow shocks

B) seasonalities, funding risk, and market frictions

C) negative cash flow shocks, positive cash flow shocks, and seasonalities

D) market frictions, negative cash flow shocks, and funding risk

E) positive cash flow shocks, negative cash flow shocks, and market frictions

A) seasonalities, market frictions, and positive cash flow shocks

B) seasonalities, funding risk, and market frictions

C) negative cash flow shocks, positive cash flow shocks, and seasonalities

D) market frictions, negative cash flow shocks, and funding risk

E) positive cash flow shocks, negative cash flow shocks, and market frictions

Unlock Deck

Unlock for access to all 105 flashcards in this deck.

Unlock Deck

k this deck

15

Use the information for the question(s) below.

Azamel Cosmetics specializes in cosmetics which have high levels of UV protection. The above figures show the anticipated sales over the next four quarters. Azamel carries inventory equal to 30% of next quarter's sales, has accounts payable of 20% of next quarter's sales, and accounts receivable of 25% of this quarter's sales.

If its net income is 12% of sales,in which quarter(s)is it expected that Azamel's seasonal working capital needs will be the smallest?

A) Q1

B) Q2

C) Q3

D) Q4

E) Q5

Azamel Cosmetics specializes in cosmetics which have high levels of UV protection. The above figures show the anticipated sales over the next four quarters. Azamel carries inventory equal to 30% of next quarter's sales, has accounts payable of 20% of next quarter's sales, and accounts receivable of 25% of this quarter's sales.

If its net income is 12% of sales,in which quarter(s)is it expected that Azamel's seasonal working capital needs will be the smallest?

A) Q1

B) Q2

C) Q3

D) Q4

E) Q5

Unlock Deck

Unlock for access to all 105 flashcards in this deck.

Unlock Deck

k this deck

16

How can positive cash flow shocks affect short-term financing needs?

Unlock Deck

Unlock for access to all 105 flashcards in this deck.

Unlock Deck

k this deck

17

Use the information for the question(s) below.

Glenside Industries is a domestic machinery manufacturer which specializes in the production of snowblowers. The above figures show the anticipated sales over the next four quarters. Glenside carries inventory equal to 25% of next quarter's sales, has accounts payable of 15% of next quarter's sales, and accounts receivable of 23% of this quarter's sales.

If its net income is 10% of sales,in which quarter(s)is it expected that Glenside's seasonal working capital needs will be the smallest?

A) Q1

B) Q2

C) Q3

D) Q4

E) Q5

Glenside Industries is a domestic machinery manufacturer which specializes in the production of snowblowers. The above figures show the anticipated sales over the next four quarters. Glenside carries inventory equal to 25% of next quarter's sales, has accounts payable of 15% of next quarter's sales, and accounts receivable of 23% of this quarter's sales.

If its net income is 10% of sales,in which quarter(s)is it expected that Glenside's seasonal working capital needs will be the smallest?

A) Q1

B) Q2

C) Q3

D) Q4

E) Q5

Unlock Deck

Unlock for access to all 105 flashcards in this deck.

Unlock Deck

k this deck

18

Use the table for the question(s) below.

DressUp! is a clothing retailer specializing in costumery. The financial forecast for a year is shown in the table above. All figures are in thousands of dollars.

During which of the following months does the firm have surplus cash?

A) April

B) June

C) September

D) October

E) November

DressUp! is a clothing retailer specializing in costumery. The financial forecast for a year is shown in the table above. All figures are in thousands of dollars.

During which of the following months does the firm have surplus cash?

A) April

B) June

C) September

D) October

E) November

Unlock Deck

Unlock for access to all 105 flashcards in this deck.

Unlock Deck

k this deck

19

Firms need short-term financing to deal with seasonal working capital requirements,negative cash flow shocks,or positive cash flow shocks.

Unlock Deck

Unlock for access to all 105 flashcards in this deck.

Unlock Deck

k this deck

20

Use the table for the question(s) below.

The quarterly working capital levels for Fancy Weddings, Inc are presented in the following table (in $ millions):

In which quarter(s)are Fancy's seasonal working capital needs the greatest?

A) 1

B) 2

C) 3

D) 4

E) 1 and 2

The quarterly working capital levels for Fancy Weddings, Inc are presented in the following table (in $ millions):

In which quarter(s)are Fancy's seasonal working capital needs the greatest?

A) 1

B) 2

C) 3

D) 4

E) 1 and 2

Unlock Deck

Unlock for access to all 105 flashcards in this deck.

Unlock Deck

k this deck

21

Use the table for the question(s) below.

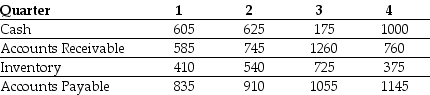

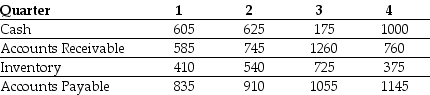

The data above shows the net working capital requirements for Blunderstone Shoes, a company that makes waterproof boots. All figures are in thousands of dollars.

What are Blunderstone's temporary working capital requirements in the third quarter?

A) $2,700,000

B) $3,400,000

C) $5,450,000

D) $6,100,000

E) $1,750,000

The data above shows the net working capital requirements for Blunderstone Shoes, a company that makes waterproof boots. All figures are in thousands of dollars.

What are Blunderstone's temporary working capital requirements in the third quarter?

A) $2,700,000

B) $3,400,000

C) $5,450,000

D) $6,100,000

E) $1,750,000

Unlock Deck

Unlock for access to all 105 flashcards in this deck.

Unlock Deck

k this deck

22

Bradford Maintenance,a firm that provides lawn care services,has some seasonal variations in its cash flow needs,since much of the demand for its services is in the summer months.It uses long-term sources of funds to finance its assets such as its fleet of vehicles and lawn-care equipment and for the permanent funds that it must have at all times.For its peak seasonal needs it uses some short-term debt.What best describes the financial policy being followed by Bradford?

A) matching

B) conservative

C) integrated

D) seasonal

E) aggressive

A) matching

B) conservative

C) integrated

D) seasonal

E) aggressive

Unlock Deck

Unlock for access to all 105 flashcards in this deck.

Unlock Deck

k this deck

23

Use the table for the question(s) below.

The quarterly working capital levels for Hasbeen Toys are presented in the following table (in $ millions):

The temporary working capital needs for Hasbeen Toys in quarter 3 is closest to:

A) $845 million

B) $0 million

C) $770 million

D) $340 million

E) $660 million

The quarterly working capital levels for Hasbeen Toys are presented in the following table (in $ millions):

The temporary working capital needs for Hasbeen Toys in quarter 3 is closest to:

A) $845 million

B) $0 million

C) $770 million

D) $340 million

E) $660 million

Unlock Deck

Unlock for access to all 105 flashcards in this deck.

Unlock Deck

k this deck

24

How can the application of the matching principle increase firm value?

Unlock Deck

Unlock for access to all 105 flashcards in this deck.

Unlock Deck

k this deck

25

Which short-term financing policy states that short-term cash needs should be financed with short-term debt and long-term cash needs should be financed with long-term sources of funds?

A) aggressive policy

B) evergreen credit

C) matching principle

D) conservatism principle

E) duration policy

A) aggressive policy

B) evergreen credit

C) matching principle

D) conservatism principle

E) duration policy

Unlock Deck

Unlock for access to all 105 flashcards in this deck.

Unlock Deck

k this deck

26

Use the table for the question(s) below.

The data above shows the net working capital requirements for Blunderstone Shoes, a company that makes waterproof boots. All figures are in thousands of dollars.

What can be considered the firm's permanent working capital?

A) $2,700,000

B) $3,300,000

C) $4,100,000

D) $4,450,000

E) $4,850,000

The data above shows the net working capital requirements for Blunderstone Shoes, a company that makes waterproof boots. All figures are in thousands of dollars.

What can be considered the firm's permanent working capital?

A) $2,700,000

B) $3,300,000

C) $4,100,000

D) $4,450,000

E) $4,850,000

Unlock Deck

Unlock for access to all 105 flashcards in this deck.

Unlock Deck

k this deck

27

Which of the following statements regarding how a firm should finance its cash needs is true?

A) Permanent working capital should be financed by long-term sources of funds, while temporary working capital should be financed by short-term sources of funds.

B) Permanent working capital should be financed by short-term sources of funds, while temporary working capital should be financed by long-term sources of funds.

C) Both permanent working capital and temporary working capital should be financed by short-term sources of funds.

D) Both permanent working capital and temporary working capital should be financed by long-term sources of funds.

E) Permanent working capital should be financed by long-term sources of funds, while temporary working capital should only be paid for with cash.

A) Permanent working capital should be financed by long-term sources of funds, while temporary working capital should be financed by short-term sources of funds.

B) Permanent working capital should be financed by short-term sources of funds, while temporary working capital should be financed by long-term sources of funds.

C) Both permanent working capital and temporary working capital should be financed by short-term sources of funds.

D) Both permanent working capital and temporary working capital should be financed by long-term sources of funds.

E) Permanent working capital should be financed by long-term sources of funds, while temporary working capital should only be paid for with cash.

Unlock Deck

Unlock for access to all 105 flashcards in this deck.

Unlock Deck

k this deck

28

Use the table for the question(s) below.

The quarterly working capital levels for Hasbeen Toys are presented in the following table (in $ millions):

The temporary working capital needs for Hasbeen Toys in quarter 1 is closest to:

A) $0 million

B) $340 million

C) $770 million

D) $845 million

E) $640 million

The quarterly working capital levels for Hasbeen Toys are presented in the following table (in $ millions):

The temporary working capital needs for Hasbeen Toys in quarter 1 is closest to:

A) $0 million

B) $340 million

C) $770 million

D) $845 million

E) $640 million

Unlock Deck

Unlock for access to all 105 flashcards in this deck.

Unlock Deck

k this deck

29

Use the table for the question(s) below.

The data above shows the net working capital requirements for Blunderstone Shoes, a company that makes waterproof boots. All figures are in thousands of dollars.

What are Blunderstone's temporary working capital requirements in the fourth quarter?

A) $2,700,000

B) $3,400,000

C) $5,450,000

D) $4,450,000

E) $1,750,000

The data above shows the net working capital requirements for Blunderstone Shoes, a company that makes waterproof boots. All figures are in thousands of dollars.

What are Blunderstone's temporary working capital requirements in the fourth quarter?

A) $2,700,000

B) $3,400,000

C) $5,450,000

D) $4,450,000

E) $1,750,000

Unlock Deck

Unlock for access to all 105 flashcards in this deck.

Unlock Deck

k this deck

30

Use the table for the question(s) below.

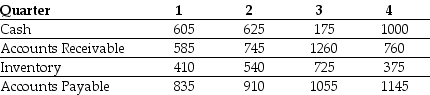

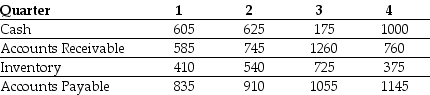

The data above shows the net working capital requirements for Flinder's Camping, a company that makes tents. All figures are in thousands of dollars.

What are Flinder's temporary working capital needs in the fourth quarter?

A) $390,000

B) $510,000

C) $720,000

D) $120,000

E) $650,000

The data above shows the net working capital requirements for Flinder's Camping, a company that makes tents. All figures are in thousands of dollars.

What are Flinder's temporary working capital needs in the fourth quarter?

A) $390,000

B) $510,000

C) $720,000

D) $120,000

E) $650,000

Unlock Deck

Unlock for access to all 105 flashcards in this deck.

Unlock Deck

k this deck

31

Use the table for the question(s) below.

The quarterly working capital levels for Hasbeen Toys are presented in the following table (in $ millions):

The permanent working capital needs for Hasbeen Toys is closest to:

A) $1,100 million

B) $2,435 million

C) $1,275 million

D) $770 million

E) $640 million

The quarterly working capital levels for Hasbeen Toys are presented in the following table (in $ millions):

The permanent working capital needs for Hasbeen Toys is closest to:

A) $1,100 million

B) $2,435 million

C) $1,275 million

D) $770 million

E) $640 million

Unlock Deck

Unlock for access to all 105 flashcards in this deck.

Unlock Deck

k this deck

32

Since permanent working capital is invested in short-term assets,it should be financed with short-term sources of funds.

Unlock Deck

Unlock for access to all 105 flashcards in this deck.

Unlock Deck

k this deck

33

According to the matching principle,short-term needs for funds should be financed by short-term sources of funds; long-term need for funds should be financed by long-term sources of funds.

Unlock Deck

Unlock for access to all 105 flashcards in this deck.

Unlock Deck

k this deck

34

What is permanent working capital?

A) the amount that a firm must keep invested in its short-term assets to support its continuing operations

B) the difference between the actual level of investment in short-term assets and the amount that a firm must keep invested in its short-term assets to support its continuing operations

C) the amount that a firm keeps invested in its short-term assets to support its continuing operations which is financed by short-term debt

D) the amount that a firm keeps invested in its short-term assets to support its continuing operations which is financed by long-term debt

E) the amount that a firm keeps invested in its short-term assets which is financed by debt

A) the amount that a firm must keep invested in its short-term assets to support its continuing operations

B) the difference between the actual level of investment in short-term assets and the amount that a firm must keep invested in its short-term assets to support its continuing operations

C) the amount that a firm keeps invested in its short-term assets to support its continuing operations which is financed by short-term debt

D) the amount that a firm keeps invested in its short-term assets to support its continuing operations which is financed by long-term debt

E) the amount that a firm keeps invested in its short-term assets which is financed by debt

Unlock Deck

Unlock for access to all 105 flashcards in this deck.

Unlock Deck

k this deck

35

Which of the following best describes a conservative financing policy?

A) financing part or all of the permanent working capital with short-term debt

B) financing part or all of the permanent working capital with long-term debt

C) financing part or all of the temporary working capital with short-term debt

D) financing part or all of the temporary working capital with long-term debt

E) financing part or all of the temporary working capital with equity

A) financing part or all of the permanent working capital with short-term debt

B) financing part or all of the permanent working capital with long-term debt

C) financing part or all of the temporary working capital with short-term debt

D) financing part or all of the temporary working capital with long-term debt

E) financing part or all of the temporary working capital with equity

Unlock Deck

Unlock for access to all 105 flashcards in this deck.

Unlock Deck

k this deck

36

Use the table for the question(s) below.

The data above shows the net working capital requirements for Flinder's Camping, a company that makes tents. All figures are in thousands of dollars.

What are Flinder's temporary working capital needs in the quarter in which they are greatest?

A) $390,000

B) $510,000

C) $720,000

D) $1,111,000

E) $650,000

The data above shows the net working capital requirements for Flinder's Camping, a company that makes tents. All figures are in thousands of dollars.

What are Flinder's temporary working capital needs in the quarter in which they are greatest?

A) $390,000

B) $510,000

C) $720,000

D) $1,111,000

E) $650,000

Unlock Deck

Unlock for access to all 105 flashcards in this deck.

Unlock Deck

k this deck

37

What is temporary working capital?

A) the amount that a firm must keep invested in its short-term assets to support its continuing operations

B) the difference between the actual level of investment in short-term assets and the amount that a firm must keep invested in its short-term assets to support its continuing operations

C) the amount that a firm keeps invested in its short-term assets to support its continuing operations which are financed by short-term debt

D) the amount that a firm keeps invested in its short-term assets to support its continuing operations which are financed by long-term debt

E) the amount that a firm keeps invested in its short-term assets which is financed by debt

A) the amount that a firm must keep invested in its short-term assets to support its continuing operations

B) the difference between the actual level of investment in short-term assets and the amount that a firm must keep invested in its short-term assets to support its continuing operations

C) the amount that a firm keeps invested in its short-term assets to support its continuing operations which are financed by short-term debt

D) the amount that a firm keeps invested in its short-term assets to support its continuing operations which are financed by long-term debt

E) the amount that a firm keeps invested in its short-term assets which is financed by debt

Unlock Deck

Unlock for access to all 105 flashcards in this deck.

Unlock Deck

k this deck

38

Which of the following best describes an aggressive financing policy?

A) financing part or all of the permanent working capital with short-term debt

B) financing part or all of the permanent working capital with long-term debt

C) financing part or all of the temporary working capital with short-term debt

D) financing part or all of the temporary working capital with long-term debt

E) financing part or all of the temporary working capital with equity

A) financing part or all of the permanent working capital with short-term debt

B) financing part or all of the permanent working capital with long-term debt

C) financing part or all of the temporary working capital with short-term debt

D) financing part or all of the temporary working capital with long-term debt

E) financing part or all of the temporary working capital with equity

Unlock Deck

Unlock for access to all 105 flashcards in this deck.

Unlock Deck

k this deck

39

Use the table for the question(s) below.

The data above shows the net working capital requirements for Flinder's Camping, a company that makes tents. All figures are in thousands of dollars.

What can be considered the firm's permanent working capital?

A) $390,000

B) $510,000

C) $720,000

D) $1,030,000

E) $640,000

The data above shows the net working capital requirements for Flinder's Camping, a company that makes tents. All figures are in thousands of dollars.

What can be considered the firm's permanent working capital?

A) $390,000

B) $510,000

C) $720,000

D) $1,030,000

E) $640,000

Unlock Deck

Unlock for access to all 105 flashcards in this deck.

Unlock Deck

k this deck

40

Why should permanent working capital be financed with long-term sources of funds?

Unlock Deck

Unlock for access to all 105 flashcards in this deck.

Unlock Deck

k this deck

41

Which of the following is a committed line of credit with no fixed maturity?

A) a bridge loan

B) evergreen credit

C) a promissory note

D) a blanket lien

E) discount loan

A) a bridge loan

B) evergreen credit

C) a promissory note

D) a blanket lien

E) discount loan

Unlock Deck

Unlock for access to all 105 flashcards in this deck.

Unlock Deck

k this deck

42

Which of the following best describes a loan where the firm must pay interest on the loan and pay back the principal in one lump sum at the end of the loan?

A) single, end-of-period payment loan

B) promissory note

C) bridge loan

D) committed line of credit

E) uncommitted line of credit

A) single, end-of-period payment loan

B) promissory note

C) bridge loan

D) committed line of credit

E) uncommitted line of credit

Unlock Deck

Unlock for access to all 105 flashcards in this deck.

Unlock Deck

k this deck

43

Which of the following best describes a bank loan arrangement where a bank agrees to lend a firm any amount up to a stated maximum in an informal agreement which does not legally bind the bank to provide the funds?

A) single, end-of-period payment loan

B) bridge loan

C) committed line of credit

D) uncommitted line of credit

E) revolving line of credit

A) single, end-of-period payment loan

B) bridge loan

C) committed line of credit

D) uncommitted line of credit

E) revolving line of credit

Unlock Deck

Unlock for access to all 105 flashcards in this deck.

Unlock Deck

k this deck

44

Conway's Roofing Services is offered a $1 million line of credit for three months at an APR of 8%.The bank requires that the firm keep an amount equal to 12% of the loan principal in a non-interest-earning account with the bank as long as the loan remains outstanding.What is the actual three-month interest rate paid,expressed as an EAR?

A) 9.41%

B) 24.40%

C) 60.30%

D) 80.40%

E) 31.45%

A) 9.41%

B) 24.40%

C) 60.30%

D) 80.40%

E) 31.45%

Unlock Deck

Unlock for access to all 105 flashcards in this deck.

Unlock Deck

k this deck

45

An uncommitted line of credit is obtained through a nonbinding,informal agreement.

Unlock Deck

Unlock for access to all 105 flashcards in this deck.

Unlock Deck

k this deck

46

Gemini Real Estate is offered a $2 million line of credit for four months at an APR of 9%.This loan has a loan origination fee of 1.5%.What is the actual four-month interest rate paid,expressed as an EAR?

A) 4.57%

B) 9.68%

C) 12.44%

D) 14.34%

E) 11.14%

A) 4.57%

B) 9.68%

C) 12.44%

D) 14.34%

E) 11.14%

Unlock Deck

Unlock for access to all 105 flashcards in this deck.

Unlock Deck

k this deck

47

Ahab's Army Surplus has a commited line of credit with a maximum of $1.2 million and interest rate of 3.5% (EAR).The loan has a commitment fee of 0.45% (EAR).If the firm borrows $900,000 at the start of the year and repays it at the end of the year,what is the total cost of the loan?

A) $42,000

B) $35,550

C) $43,350

D) $32,850

E) $31,500

A) $42,000

B) $35,550

C) $43,350

D) $32,850

E) $31,500

Unlock Deck

Unlock for access to all 105 flashcards in this deck.

Unlock Deck

k this deck

48

Jim's Electrical is offered a $400,000 line of credit for six months at an APR of 9%.The bank requires that the firm keep an amount equal to 5% of the loan principal in a non-interest-earning account with the bank as long as the loan remains outstanding.What is the actual six-month interest rate paid,expressed as an EAR?

A) 3.2%

B) 5.0%

C) 9.70%

D) 24.3%

E) 27.6%

A) 3.2%

B) 5.0%

C) 9.70%

D) 24.3%

E) 27.6%

Unlock Deck

Unlock for access to all 105 flashcards in this deck.

Unlock Deck

k this deck

49

If the benefit of a lower rate from short-term debt is offset by the risk that the firm will have to refinance at a higher rate,why would a firm choose an aggressive financing policy?

Unlock Deck

Unlock for access to all 105 flashcards in this deck.

Unlock Deck

k this deck

50

Bhupinder's Bakery has a one-year $300,000 line of credit at an interest rate of 6% (EAR).The loan has a loan origination fee of 1%.What is the actual interest rate paid?

A) 7%

B) 6.7%

C) 7.07%

D) 7.14%

E) 6%

A) 7%

B) 6.7%

C) 7.07%

D) 7.14%

E) 6%

Unlock Deck

Unlock for access to all 105 flashcards in this deck.

Unlock Deck

k this deck

51

Strata Services has a three month $450,000 line of credit at an APR of 8%.The loan has a loan origination fee of 1.5%.What is the actual three-month interest rate paid expressed as an EAR?

A) 9.8%

B) 9.5%

C) 14.75%

D) 8.24%

E) 15%

A) 9.8%

B) 9.5%

C) 14.75%

D) 8.24%

E) 15%

Unlock Deck

Unlock for access to all 105 flashcards in this deck.

Unlock Deck

k this deck

52

A petroleum exploration company takes a short-term bank loan in order to finance the purchase of several truck-mounted,vibroseis shakers,which have unexpectedly come onto the market at a good price.Once the purchase is made,the company will obtain long-term financing.Which of the following best describes the short-term loan the company has taken?

A) a single, end-of-period payment loan

B) a promissory note

C) a bridge loan

D) an uncommitted line of credit

E) evergreen credit

A) a single, end-of-period payment loan

B) a promissory note

C) a bridge loan

D) an uncommitted line of credit

E) evergreen credit

Unlock Deck

Unlock for access to all 105 flashcards in this deck.

Unlock Deck

k this deck

53

Katie's Karate Dojo has a commited line of credit with a maximum of $350,000 and interest rate of 6% (EAR).The loan has a commitment fee of 0.5% (EAR).If the firm borrows $300,000 at the start of the year and repays it at the end of the year,what is the total cost of the loan?

A) $18,000

B) $18,250

C) $19,500

D) $21,250

E) $21,000

A) $18,000

B) $18,250

C) $19,500

D) $21,250

E) $21,000

Unlock Deck

Unlock for access to all 105 flashcards in this deck.

Unlock Deck

k this deck

54

Bandolier Bicycles has a commited line of credit with a maximum of $450,000 and interest rate of 4% (EAR).The loan has a commitment fee of 0.3% (EAR).If the firm borrows $375,000 at the start of the year and repays it at the end of the year,what is the total cost of the loan?

A) $15,225

B) $15,000

C) $18,225

D) $18,000

E) $16,125

A) $15,225

B) $15,000

C) $18,225

D) $18,000

E) $16,125

Unlock Deck

Unlock for access to all 105 flashcards in this deck.

Unlock Deck

k this deck

55

How can a conservative financing policy reduce firm value?

Unlock Deck

Unlock for access to all 105 flashcards in this deck.

Unlock Deck

k this deck

56

Which of the following bank loan arrangements is typically accompanied by a requirement that the firm maintain a minimum level of deposits with the lending bank and restricts the level of the borrowing firm's working capital?

A) single, end-of-period payment loan

B) bridge loan

C) committed line of credit

D) uncommitted line of credit

E) discount loan

A) single, end-of-period payment loan

B) bridge loan

C) committed line of credit

D) uncommitted line of credit

E) discount loan

Unlock Deck

Unlock for access to all 105 flashcards in this deck.

Unlock Deck

k this deck

57

ABX Corp.is offered a $1.4 million line of credit for nine months at an APR of 7.5%.This loan has a loan origination fee of 1%.What is the actual nine-month interest rate paid,expressed as an EAR?

A) 7.50%

B) 7.57%

C) 6.69%

D) 8.92%

E) 9.02%

A) 7.50%

B) 7.57%

C) 6.69%

D) 8.92%

E) 9.02%

Unlock Deck

Unlock for access to all 105 flashcards in this deck.

Unlock Deck

k this deck

58

Pipeline Pharmaceuticals has a one-year $2 million line of credit at an interest rate of 5% (EAR).The loan has a loan origination fee of 2%.What is the actual interest rate paid?

A) 7%

B) 7.14%

C) 5%

D) 7.1%

E) 5.9%

A) 7%

B) 7.14%

C) 5%

D) 7.1%

E) 5.9%

Unlock Deck

Unlock for access to all 105 flashcards in this deck.

Unlock Deck

k this deck

59

Stuart Mining is offered a $4,000,000 line of credit for three months at an APR of 6%.The bank requires that the firm keep an amount equal to 10% of the loan principal in an account with the bank as long as the loan remains outstanding.This account pays 2% APR with quarterly compounding.What is the actual three-month interest paid on this loan?

A) 1.6%

B) 6.6%

C) 12.6%

D) 14.6%

E) 60.9%

A) 1.6%

B) 6.6%

C) 12.6%

D) 14.6%

E) 60.9%

Unlock Deck

Unlock for access to all 105 flashcards in this deck.

Unlock Deck

k this deck

60

The prime rate is the rate banks charge all but their largest customers,who can negotiate a sub-prime rate.

Unlock Deck

Unlock for access to all 105 flashcards in this deck.

Unlock Deck

k this deck

61

A firm issues six-month commercial paper with a $1 million face value and receives $970,000.What is the EAR the firm is paying for these funds?

A) 6%

B) 3%

C) 3.09%

D) 6.18%

E) 6.28%

A) 6%

B) 3%

C) 3.09%

D) 6.18%

E) 6.28%

Unlock Deck

Unlock for access to all 105 flashcards in this deck.

Unlock Deck

k this deck

62

Luther Industries is offered a $1 million dollar loan for four months at an APR of 9%.If this loan has an origination fee of 1%,then the effective annual rate (EAR)for this loan is closest to:

A) 12.0%

B) 12.6%

C) 4.1%

D) 13.8%

E) 7.5%

A) 12.0%

B) 12.6%

C) 4.1%

D) 13.8%

E) 7.5%

Unlock Deck

Unlock for access to all 105 flashcards in this deck.

Unlock Deck

k this deck

63

Commercial paper is rated by credit rating agencies.

Unlock Deck

Unlock for access to all 105 flashcards in this deck.

Unlock Deck

k this deck

64

A firm issues three-month commercial paper with a $1,000,000 face value and pays an EAR of 7.4%.What is the amount the firm receives?

A) $976,484

B) $981,836

C) $931,099

D) $982,318

E) $991,026

A) $976,484

B) $981,836

C) $931,099

D) $982,318

E) $991,026

Unlock Deck

Unlock for access to all 105 flashcards in this deck.

Unlock Deck

k this deck

65

What is the maximum maturity of commercial paper?

A) 60 days

B) 90 days

C) 180 days

D) one year

E) 270 days

A) 60 days

B) 90 days

C) 180 days

D) one year

E) 270 days

Unlock Deck

Unlock for access to all 105 flashcards in this deck.

Unlock Deck

k this deck

66

What are loan origination fees and what effect does it have on the loan?

Unlock Deck

Unlock for access to all 105 flashcards in this deck.

Unlock Deck

k this deck

67

Commercial paper is usually a more expensive source of funds than a short-term bank loan.

Unlock Deck

Unlock for access to all 105 flashcards in this deck.

Unlock Deck

k this deck

68

The interest on commercial paper is typically paid by selling it at an initial discount.

Unlock Deck

Unlock for access to all 105 flashcards in this deck.

Unlock Deck

k this deck

69

A firm issues four-month commercial paper with a $500,000 face value and pays an EAR of 8.26%.What is the amount the firm receives?

A) $455,092

B) $487,306

C) $486,946

D) $490,177

E) $461,851

A) $455,092

B) $487,306

C) $486,946

D) $490,177

E) $461,851

Unlock Deck

Unlock for access to all 105 flashcards in this deck.

Unlock Deck

k this deck

70

A short-term bank loan that is often used until a firm can arrange for long-term financing is called

A) a committed line of credit.

B) a short-term mortgage loan.

C) a bridge loan.

D) a single, end-of-period-payment loan.

E) evergreen credit

A) a committed line of credit.

B) a short-term mortgage loan.

C) a bridge loan.

D) a single, end-of-period-payment loan.

E) evergreen credit

Unlock Deck

Unlock for access to all 105 flashcards in this deck.

Unlock Deck

k this deck

71

A firm issues two-month commercial paper with a $200,000 face value and receives $196,000.What is the EAR the firm is paying for these funds?

A) 12.5%

B) 12.6%

C) 12.9%

D) 12%

E) 12.2%

A) 12.5%

B) 12.6%

C) 12.9%

D) 12%

E) 12.2%

Unlock Deck

Unlock for access to all 105 flashcards in this deck.

Unlock Deck

k this deck

72

What are compensating balance and what effect does it have on the loan?

Unlock Deck

Unlock for access to all 105 flashcards in this deck.

Unlock Deck

k this deck

73

A firm issues three-month commercial paper with a $250,000 face value and receives $244,000.What is the EAR the firm is paying for these funds?

A) 10.2%

B) 9.8%

C) 9.6%

D) 10%

E) 9.4%

A) 10.2%

B) 9.8%

C) 9.6%

D) 10%

E) 9.4%

Unlock Deck

Unlock for access to all 105 flashcards in this deck.

Unlock Deck

k this deck

74

A firm issues four-month commercial paper with a $450,000 face value and receives $442,000.What is the EAR the firm is paying for these funds?

A) 7.4%

B) 5.4%

C) 5.5%

D) 7.1%

E) 5.3%

A) 7.4%

B) 5.4%

C) 5.5%

D) 7.1%

E) 5.3%

Unlock Deck

Unlock for access to all 105 flashcards in this deck.

Unlock Deck

k this deck

75

Pembina Properties issues commercial paper with a face value of $450,000 and a maturity of three months.The firm receives $442,000 when it sells the paper.If the prime rate is 9% APR compounded quarterly,how much interest savings did Pembina realize by using commercial paper?

A) $1,945

B) $9,945

C) $8,000

D) $31,780

E) $1,625

A) $1,945

B) $9,945

C) $8,000

D) $31,780

E) $1,625

Unlock Deck

Unlock for access to all 105 flashcards in this deck.

Unlock Deck

k this deck

76

A written,legally binding agreement that obligates the bank to lend a firm any amount up to a stated maximum,regardless of the financial condition of the firm (unless the firm is bankrupt)as long as the firm satisfies any restrictions in the agreement is called

A) a bridge loan.

B) a single, end-of-period-payment loan.

C) a short-term mortgage loan.

D) a committed line of credit.

E) an uncommitted line of credit.

A) a bridge loan.

B) a single, end-of-period-payment loan.

C) a short-term mortgage loan.

D) a committed line of credit.

E) an uncommitted line of credit.

Unlock Deck

Unlock for access to all 105 flashcards in this deck.

Unlock Deck

k this deck

77

A firm issues one-month commercial paper with a $500,000 face value and receives $495,000.What is the EAR the firm is paying for these funds?

A) 12.8%

B) 1.01%

C) 12.12%

D) 12%

E) 13.12%

A) 12.8%

B) 1.01%

C) 12.12%

D) 12%

E) 13.12%

Unlock Deck

Unlock for access to all 105 flashcards in this deck.

Unlock Deck

k this deck

78

What are commitment fees and what effect does it have on the loan?

Unlock Deck

Unlock for access to all 105 flashcards in this deck.

Unlock Deck

k this deck

79

A firm issues six-month commercial paper with $100,000 face value and pays an EAR of 6.7%.What is the amount the firm receives?

A) $93,197

B) $93,720

C) $94,994

D) $96,759

E) $96,809

A) $93,197

B) $93,720

C) $94,994

D) $96,759

E) $96,809

Unlock Deck

Unlock for access to all 105 flashcards in this deck.

Unlock Deck

k this deck

80

Luther Industries is offered a $1 million loan for four months at an APR of 9%.If Luther's bank requires that the firm maintain a compensating balance equal to 10% of the loan amount in a non-interest-earning account,then the effective annual rate EAR for this loan is closest to:

A) 10.3%

B) 12.6%

C) 14.4%

D) 71.5%

E) 21.1%

A) 10.3%

B) 12.6%

C) 14.4%

D) 71.5%

E) 21.1%

Unlock Deck

Unlock for access to all 105 flashcards in this deck.

Unlock Deck

k this deck