Deck 19: The International Financial System

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

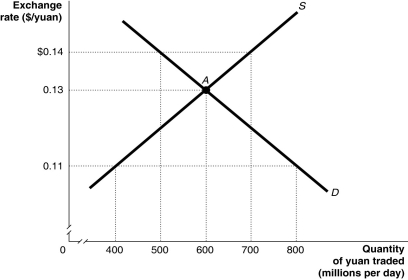

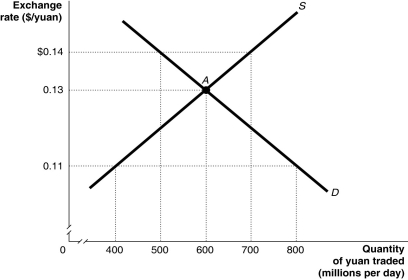

Question

Question

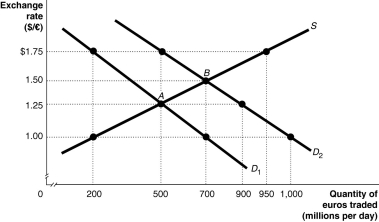

Question

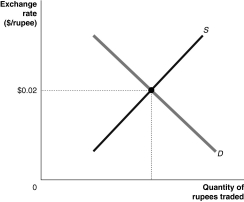

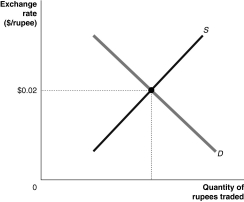

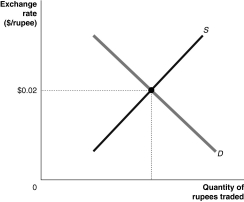

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/132

Play

Full screen (f)

Deck 19: The International Financial System

1

If currencies around the world are based on the gold standard,and the EU lowers the amount of gold for which the euro will trade,then holding all else constant,

A) the euro will depreciate against the dollar.

B) the euro will appreciate against the dollar.

C) the value of the euro relative to the dollar will stay constant.

D) the value of U.S. exports to EU countries in terms of the euro will decrease.

A) the euro will depreciate against the dollar.

B) the euro will appreciate against the dollar.

C) the value of the euro relative to the dollar will stay constant.

D) the value of U.S. exports to EU countries in terms of the euro will decrease.

the euro will depreciate against the dollar.

2

In the United States today,the Federal Reserve will give you ________ in exchange for $1.

A) 1/35 of an ounce of gold

B) $1 worth of gold (based on the market price of an ounce of gold at the time you redeem the gold)

C) 1 ounce of gold

D) no gold

A) 1/35 of an ounce of gold

B) $1 worth of gold (based on the market price of an ounce of gold at the time you redeem the gold)

C) 1 ounce of gold

D) no gold

no gold

3

The Bretton Woods exchange rate system was a

A) floating exchange rate system.

B) managed float exchange rate system.

C) fixed exchange rate system.

D) flexible exchange rate system.

A) floating exchange rate system.

B) managed float exchange rate system.

C) fixed exchange rate system.

D) flexible exchange rate system.

fixed exchange rate system.

4

Fluctuating exchange rates can alter a multinational firm's profits and losses. The U.S.corporation,Motorola,produces cell phones and sells cell phones in Mexico. If the dollar appreciates against the peso,then Motorola's revenues from these operations should ________ and its costs from these operations should ________.

A) rise; fall

B) rise; rise

C) fall; fall

D) fall; rise

A) rise; fall

B) rise; rise

C) fall; fall

D) fall; rise

Unlock Deck

Unlock for access to all 132 flashcards in this deck.

Unlock Deck

k this deck

5

Under the Bretton Woods exchange rate system,the U.S.government agreed to buy or sell gold at a fixed price of ________ per ounce.

A) $1

B) $35

C) $100

D) $400

A) $1

B) $35

C) $100

D) $400

Unlock Deck

Unlock for access to all 132 flashcards in this deck.

Unlock Deck

k this deck

6

You decide to work in London for the next 5 years,accumulate some savings,then move back to the United States and convert your savings from British pounds to dollars. At the time of your move,economists predict that consumers in the United States have lost their affinity for British products,and expect that this declining preference for British products will continue for the next decade. How should this influence your decision to work and save in London?

A) You should be discouraged as the declining U.S. preference for British goods should increase the value of the pound to the dollar and decrease the value of your savings when converted to dollars.

B) You should be discouraged as the declining U.S. preference for British goods should decrease the value of the pound to the dollar and decrease the value of your savings when converted to dollars.

C) You should be encouraged as the declining U.S. preference for British goods should decrease the value of the pound to the dollar and raise the value of your savings when converted to dollars.

D) You should be encouraged as the declining U.S. preference for British goods should increase the value of the pound to the dollar and raise the value of your savings when converted to dollars.

A) You should be discouraged as the declining U.S. preference for British goods should increase the value of the pound to the dollar and decrease the value of your savings when converted to dollars.

B) You should be discouraged as the declining U.S. preference for British goods should decrease the value of the pound to the dollar and decrease the value of your savings when converted to dollars.

C) You should be encouraged as the declining U.S. preference for British goods should decrease the value of the pound to the dollar and raise the value of your savings when converted to dollars.

D) You should be encouraged as the declining U.S. preference for British goods should increase the value of the pound to the dollar and raise the value of your savings when converted to dollars.

Unlock Deck

Unlock for access to all 132 flashcards in this deck.

Unlock Deck

k this deck

7

During what period of time did the United States most consistently adhere to the gold standard?

A) from the nineteenth century until the 1930s

B) from the eighteenth century until the nineteenth century

C) from 1914 until 1929

D) from 1944 until 1980

A) from the nineteenth century until the 1930s

B) from the eighteenth century until the nineteenth century

C) from 1914 until 1929

D) from 1944 until 1980

Unlock Deck

Unlock for access to all 132 flashcards in this deck.

Unlock Deck

k this deck

8

Under the Bretton Woods exchange rate system,________ could sell their dollars to the American government in exchange for gold.

A) foreign central banks

B) American citizens

C) foreign citizens

D) all of the above

A) foreign central banks

B) American citizens

C) foreign citizens

D) all of the above

Unlock Deck

Unlock for access to all 132 flashcards in this deck.

Unlock Deck

k this deck

9

U.S.dollars can currently be exchanged for gold by foreign central banks,but not by U.S.citizens.

Unlock Deck

Unlock for access to all 132 flashcards in this deck.

Unlock Deck

k this deck

10

The ________ in the United States is best described as a managed float exchange rate system.

A) earliest used exchange rate system

B) current exchange rate system

C) exchange rate system used prior to the great depression

D) exchange rate system set up at the end of World War II

A) earliest used exchange rate system

B) current exchange rate system

C) exchange rate system used prior to the great depression

D) exchange rate system set up at the end of World War II

Unlock Deck

Unlock for access to all 132 flashcards in this deck.

Unlock Deck

k this deck

11

When the value of a currency is determined ________,the exchange rate system is defined as managed float.

A) only by supply and demand

B) by its issuing government

C) mostly by supply and demand, but with occasional government intervention

D) by its issuing government, with occasional readjustments in value

A) only by supply and demand

B) by its issuing government

C) mostly by supply and demand, but with occasional government intervention

D) by its issuing government, with occasional readjustments in value

Unlock Deck

Unlock for access to all 132 flashcards in this deck.

Unlock Deck

k this deck

12

Under the Bretton Woods system,U.S.dollars were redeemable for ________ only if the dollars were presented by a foreign central bank?

A) silver

B) foreign currency

C) gold

D) U.S. Treasury bonds

A) silver

B) foreign currency

C) gold

D) U.S. Treasury bonds

Unlock Deck

Unlock for access to all 132 flashcards in this deck.

Unlock Deck

k this deck

13

The ________ system of currency exchange set up in 1944.

A) gold standard

B) Bretton Woods

C) managed float

D) flexible

A) gold standard

B) Bretton Woods

C) managed float

D) flexible

Unlock Deck

Unlock for access to all 132 flashcards in this deck.

Unlock Deck

k this deck

14

Foreign currency prices of the U.S.dollar are currently determined by a managed float exchange rate system.

Unlock Deck

Unlock for access to all 132 flashcards in this deck.

Unlock Deck

k this deck

15

When the value of a currency is determined ________,the exchange rate system is defined as a floating exchange rate system.

A) only by supply and demand

B) by its issuing government

C) mostly by supply and demand, but with occasional government intervention

D) by its issuing government, with occasional readjustments in value

A) only by supply and demand

B) by its issuing government

C) mostly by supply and demand, but with occasional government intervention

D) by its issuing government, with occasional readjustments in value

Unlock Deck

Unlock for access to all 132 flashcards in this deck.

Unlock Deck

k this deck

16

Airbus is a passenger aircraft manufacturer based in Europe,but like the rest of the global aerospace industry,conducts is business in U.S.dollars.Suppose Airbus sells an aircraft to Air France,and Air France pays Airbus in U.S.dollars. If the value of the U.S.dollar falls relative to the euro,Airbus's profits in Europe will ________ because it will receive ________ when it converts the dollars it earns from the sale into euros.

A) rise; more

B) rise; less

C) fall; more

D) fall; less

A) rise; more

B) rise; less

C) fall; more

D) fall; less

Unlock Deck

Unlock for access to all 132 flashcards in this deck.

Unlock Deck

k this deck

17

The United States abandoned the ________ because the government wanted to rapidly expand the money supply in response to the Great Depression.

A) gold standard

B) Bretton Woods system

C) managed float

D) floating exchange rate system

A) gold standard

B) Bretton Woods system

C) managed float

D) floating exchange rate system

Unlock Deck

Unlock for access to all 132 flashcards in this deck.

Unlock Deck

k this deck

18

Under a floating exchange rate,the exchange rate

A) will change whenever the price of gold changes.

B) is controlled by central bank intervention.

C) is determined by the interaction of supply of the currency and demand for the currency.

D) is pegged against the euro.

A) will change whenever the price of gold changes.

B) is controlled by central bank intervention.

C) is determined by the interaction of supply of the currency and demand for the currency.

D) is pegged against the euro.

Unlock Deck

Unlock for access to all 132 flashcards in this deck.

Unlock Deck

k this deck

19

The Bretton Woods system of fixed exchange rates was set up in

A) the 1890s.

B) the 1920s.

C) the 1940s.

D) the 1970s.

A) the 1890s.

B) the 1920s.

C) the 1940s.

D) the 1970s.

Unlock Deck

Unlock for access to all 132 flashcards in this deck.

Unlock Deck

k this deck

20

Under the gold standard,the government must have enough gold to back up any

A) increase in money demand.

B) increase in the money supply.

C) change in its currency's exchange rate.

D) foreign currency deposits in its central bank.

A) increase in money demand.

B) increase in the money supply.

C) change in its currency's exchange rate.

D) foreign currency deposits in its central bank.

Unlock Deck

Unlock for access to all 132 flashcards in this deck.

Unlock Deck

k this deck

21

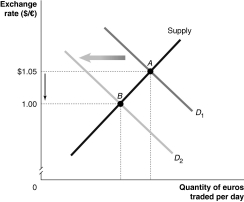

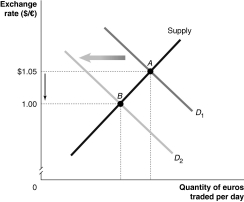

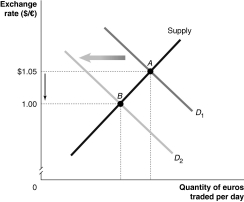

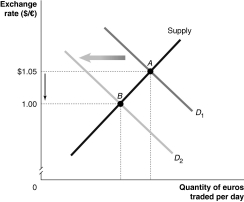

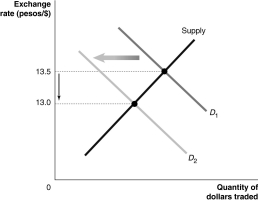

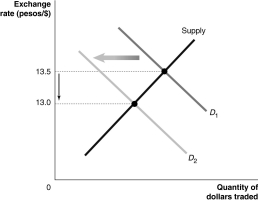

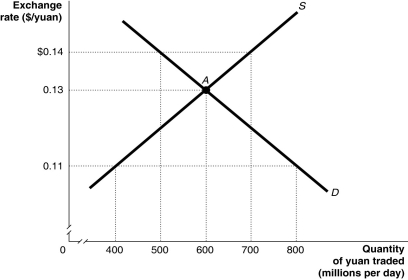

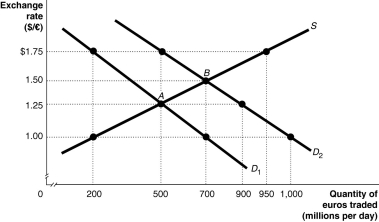

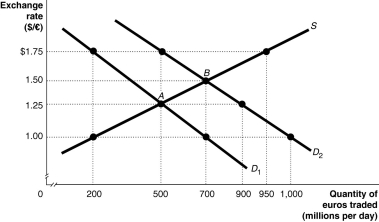

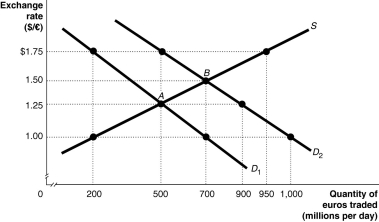

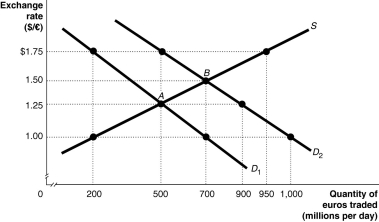

Figure 30-1

Refer to Figure 30-1. Which of the following would cause the change depicted in the figure above?

A) U.S. productivity falls relative to European productivity.

B) Americans increase their preferences for goods produced in the EU relative to American goods.

C) The European Union increases its quotas on Italian wine.

D) The price level of goods produced in the EU decreases relative to the price level of goods produced in the United States.

Refer to Figure 30-1. Which of the following would cause the change depicted in the figure above?

A) U.S. productivity falls relative to European productivity.

B) Americans increase their preferences for goods produced in the EU relative to American goods.

C) The European Union increases its quotas on Italian wine.

D) The price level of goods produced in the EU decreases relative to the price level of goods produced in the United States.

Unlock Deck

Unlock for access to all 132 flashcards in this deck.

Unlock Deck

k this deck

22

Figure 30-1

Refer to Figure 30-1. Which of the following would cause the change depicted in the figure above?

A) European productivity rises relative to American productivity.

B) Americans decrease their preferences for goods produced in the EU relative to American goods.

C) The European Union increases its quotas on German wristwatches.

D) The price level of goods produced in the EU increases relative to the price level of goods produced in the United States.

Refer to Figure 30-1. Which of the following would cause the change depicted in the figure above?

A) European productivity rises relative to American productivity.

B) Americans decrease their preferences for goods produced in the EU relative to American goods.

C) The European Union increases its quotas on German wristwatches.

D) The price level of goods produced in the EU increases relative to the price level of goods produced in the United States.

Unlock Deck

Unlock for access to all 132 flashcards in this deck.

Unlock Deck

k this deck

23

All else being equal,if the rate of growth in productivity in Spain is greater than the rate of growth in productivity in the United States,the euro

A) will decrease in value relative the U.S. dollar.

B) will increase in value relative to the U.S. dollar.

C) will nominally appreciate against the dollar, but its real value relative to the dollar will remain unchanged.

D) will nominally depreciate against the dollar, but its real value relative to the dollar will remain unchanged.

A) will decrease in value relative the U.S. dollar.

B) will increase in value relative to the U.S. dollar.

C) will nominally appreciate against the dollar, but its real value relative to the dollar will remain unchanged.

D) will nominally depreciate against the dollar, but its real value relative to the dollar will remain unchanged.

Unlock Deck

Unlock for access to all 132 flashcards in this deck.

Unlock Deck

k this deck

24

If inflation in Mexico is lower than it is in the United States,

A) the purchasing power of the peso in buying Mexican goods will fall relative to the dollar.

B) the value of the dollar will rise in the long run.

C) the value of the peso will rise in the long run.

D) the purchasing power of the dollar in buying American goods will rise relative to the peso.

A) the purchasing power of the peso in buying Mexican goods will fall relative to the dollar.

B) the value of the dollar will rise in the long run.

C) the value of the peso will rise in the long run.

D) the purchasing power of the dollar in buying American goods will rise relative to the peso.

Unlock Deck

Unlock for access to all 132 flashcards in this deck.

Unlock Deck

k this deck

25

All of the following are considered among the four most important determinants in explaining exchange rate fluctuations in the long run except

A) tariffs and quotas.

B) preferences for domestic and foreign goods.

C) interest rates.

D) relative rates of productivity growth across countries.

A) tariffs and quotas.

B) preferences for domestic and foreign goods.

C) interest rates.

D) relative rates of productivity growth across countries.

Unlock Deck

Unlock for access to all 132 flashcards in this deck.

Unlock Deck

k this deck

26

If the average productivity of Indian firms is rising more quickly than the average productivity of American firms,which of the following would you expect to see? (India's currency is the rupee.)

A) a decrease in the value of the rupee relative to the dollar

B) an increase in the prices of Indian products

C) an increase in the quantity demanded of Indian products relative to American products

D) All of the above are correct.

A) a decrease in the value of the rupee relative to the dollar

B) an increase in the prices of Indian products

C) an increase in the quantity demanded of Indian products relative to American products

D) All of the above are correct.

Unlock Deck

Unlock for access to all 132 flashcards in this deck.

Unlock Deck

k this deck

27

How will the exchange rate (foreign currency per dollar)respond to a decrease in the relative rate of productivity growth in the United States in the long run?

A) Exchange rates will rise.

B) Exchange rates will fall.

C) Exchange rates will be unaffected by changes in the relative rate of productivity growth in the United States, both in the short run and in the long run.

D) The exchange rate will be affected in the short run, but not in the long run.

A) Exchange rates will rise.

B) Exchange rates will fall.

C) Exchange rates will be unaffected by changes in the relative rate of productivity growth in the United States, both in the short run and in the long run.

D) The exchange rate will be affected in the short run, but not in the long run.

Unlock Deck

Unlock for access to all 132 flashcards in this deck.

Unlock Deck

k this deck

28

What is the connection between the gold held at the Fort Knox Bullion Depository in Kentucky and the U.S.money supply?

Unlock Deck

Unlock for access to all 132 flashcards in this deck.

Unlock Deck

k this deck

29

If one U.S.dollar could be exchanged for one Australian dollar in 1970,and one U.S.dollar can now be exchanged for 0.98 Australian dollars,which of the following is true?

A) The U.S. dollar gained value against the Australian dollar.

B) The Australian dollar lost value against the U.S. dollar.

C) The Australian dollar gained value against the U.S. dollar.

D) Both A and C are true.

A) The U.S. dollar gained value against the Australian dollar.

B) The Australian dollar lost value against the U.S. dollar.

C) The Australian dollar gained value against the U.S. dollar.

D) Both A and C are true.

Unlock Deck

Unlock for access to all 132 flashcards in this deck.

Unlock Deck

k this deck

30

What factors are most important for determining exchange rate fluctuations in the long run?

A) relative price levels across countries

B) relative rates of productivity growth across countries

C) preferences for domestic and foreign goods across countries

D) All of the above are correct.

A) relative price levels across countries

B) relative rates of productivity growth across countries

C) preferences for domestic and foreign goods across countries

D) All of the above are correct.

Unlock Deck

Unlock for access to all 132 flashcards in this deck.

Unlock Deck

k this deck

31

Exchange rates under the Bretton Woods system were determined by relative supplies of gold held by countries within the system.

Unlock Deck

Unlock for access to all 132 flashcards in this deck.

Unlock Deck

k this deck

32

The currency adopted by most countries in ________ is referred to as the euro.

A) Western Europe

B) Eastern Europe

C) Europe and Asia

D) Southern Europe and Northern Africa

A) Western Europe

B) Eastern Europe

C) Europe and Asia

D) Southern Europe and Northern Africa

Unlock Deck

Unlock for access to all 132 flashcards in this deck.

Unlock Deck

k this deck

33

During the height of the financial crisis in 2008,the value of the U.S.dollar ________ relative to the Canadian dollar.

A) appreciated by about 12 percent

B) appreciated by more than 30 percent

C) depreciated by more than 40 percent

D) depreciated by more than 60 percent

A) appreciated by about 12 percent

B) appreciated by more than 30 percent

C) depreciated by more than 40 percent

D) depreciated by more than 60 percent

Unlock Deck

Unlock for access to all 132 flashcards in this deck.

Unlock Deck

k this deck

34

What is the difference between a fixed exchange rate system and a managed float exchange rate system?

Unlock Deck

Unlock for access to all 132 flashcards in this deck.

Unlock Deck

k this deck

35

An increase in the value of the U.S.dollar relative to the Canadian dollar would be ________ for Canadian owners of U.S.houses who wish to sell those houses,and ________ for Canadian manufacturers operating factories in the United States that export their products back to Canada.

A) good news; good news

B) good news; bad news

C) bad news; good news

D) bad news; bad news

A) good news; good news

B) good news; bad news

C) bad news; good news

D) bad news; bad news

Unlock Deck

Unlock for access to all 132 flashcards in this deck.

Unlock Deck

k this deck

36

U.S.currency continues to be backed by the gold standard to this day.

Unlock Deck

Unlock for access to all 132 flashcards in this deck.

Unlock Deck

k this deck

37

Which of the following would decrease the value of the dollar in the long run?

A) a decrease in inflation in the United States relative to other countries

B) a decrease in the demand for American goods relative to goods from other countries

C) an increase in U.S. tariffs on foreign goods

D) a decrease in the supply of dollars on the foreign exchange market

A) a decrease in inflation in the United States relative to other countries

B) a decrease in the demand for American goods relative to goods from other countries

C) an increase in U.S. tariffs on foreign goods

D) a decrease in the supply of dollars on the foreign exchange market

Unlock Deck

Unlock for access to all 132 flashcards in this deck.

Unlock Deck

k this deck

38

The Bretton Woods system was established in 1944 and remained in place until the early 1970s.

Unlock Deck

Unlock for access to all 132 flashcards in this deck.

Unlock Deck

k this deck

39

From late 2001 to 2011,the ________ in the value of the U.S.dollar resulted in a more than 40 percent ________ in the price of a house in the United States when measured in Canadian dollars.

A) increase; increase

B) increase; reduction

C) decline; increase

D) decline; reduction

A) increase; increase

B) increase; reduction

C) decline; increase

D) decline; reduction

Unlock Deck

Unlock for access to all 132 flashcards in this deck.

Unlock Deck

k this deck

40

How will the exchange rate (foreign currency per dollar)respond to an increase in preference for imported goods in the United States in the long run?

A) Exchange rates will rise.

B) Exchange rates will fall.

C) Exchange rates will be unaffected by changes in the relative rate of productivity growth in the United States, both in the short run and in the long run.

D) The exchange rate will be affected in the short run, but not in the long run.

A) Exchange rates will rise.

B) Exchange rates will fall.

C) Exchange rates will be unaffected by changes in the relative rate of productivity growth in the United States, both in the short run and in the long run.

D) The exchange rate will be affected in the short run, but not in the long run.

Unlock Deck

Unlock for access to all 132 flashcards in this deck.

Unlock Deck

k this deck

41

A currency pegged at a value above the market equilibrium exchange rate is

A) overvalued.

B) undervalued.

C) achieving purchasing power parity.

D) depreciating in value relative to its pegged currency.

A) overvalued.

B) undervalued.

C) achieving purchasing power parity.

D) depreciating in value relative to its pegged currency.

Unlock Deck

Unlock for access to all 132 flashcards in this deck.

Unlock Deck

k this deck

42

If the implied exchange rate between Big Mac prices in the United States and the Philippines is 68 pesos per dollar,but the actual exchange rate between the United States and the Philippines is 43 pesos per dollar,which of the following would you expect to see?

A) a depreciation of the dollar

B) a decrease in the demand for Philippine pesos

C) a decrease in the demand for dollars

D) an appreciation of the Philippine pesos

A) a depreciation of the dollar

B) a decrease in the demand for Philippine pesos

C) a decrease in the demand for dollars

D) an appreciation of the Philippine pesos

Unlock Deck

Unlock for access to all 132 flashcards in this deck.

Unlock Deck

k this deck

43

If the purchasing power of the dollar is less than the purchasing power of the British pound,purchasing power parity predicts that the exchange rate will

A) increase if the exchange rate is greater than 1 pound per dollar.

B) decrease if the exchange rate is less than 1 pound per dollar.

C) be equal to the relative purchasing power across the currencies in the long run.

D) All of the above are correct.

A) increase if the exchange rate is greater than 1 pound per dollar.

B) decrease if the exchange rate is less than 1 pound per dollar.

C) be equal to the relative purchasing power across the currencies in the long run.

D) All of the above are correct.

Unlock Deck

Unlock for access to all 132 flashcards in this deck.

Unlock Deck

k this deck

44

The year in which euro coins and paper currency were introduced and participating "euro zone" countries withdrew old domestic currencies from circulation was

A) 2007

B) 2002

C) 1999

D) 1995

A) 2007

B) 2002

C) 1999

D) 1995

Unlock Deck

Unlock for access to all 132 flashcards in this deck.

Unlock Deck

k this deck

45

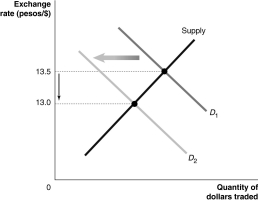

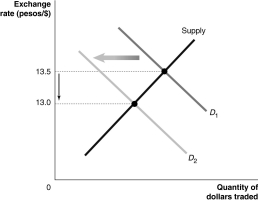

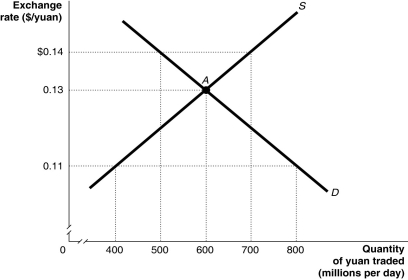

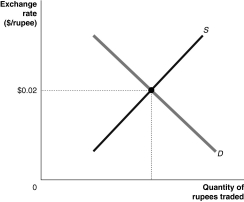

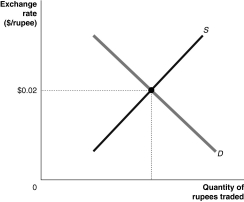

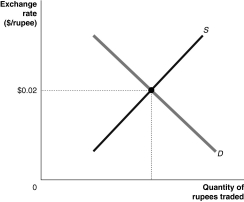

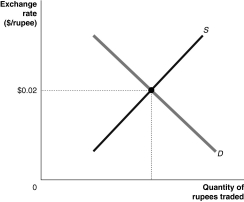

Figure 30-2

Refer to Figure 30-2. Which of the following would cause the change depicted in the figure above?

A) An increase in investment in infrastructure causes U.S. productivity to rise relative to Mexican productivity.

B) A growing preference for Margaritas causes U.S. consumers to increase their preferences for Mexican tequila relative to American-produced alcohol.

C) Dumping accusations result in the United States placing tariffs on produce imported from Mexico.

D) A contractionary monetary policy causes a decrease in the price level of U.S. goods relative to Mexican goods.

Refer to Figure 30-2. Which of the following would cause the change depicted in the figure above?

A) An increase in investment in infrastructure causes U.S. productivity to rise relative to Mexican productivity.

B) A growing preference for Margaritas causes U.S. consumers to increase their preferences for Mexican tequila relative to American-produced alcohol.

C) Dumping accusations result in the United States placing tariffs on produce imported from Mexico.

D) A contractionary monetary policy causes a decrease in the price level of U.S. goods relative to Mexican goods.

Unlock Deck

Unlock for access to all 132 flashcards in this deck.

Unlock Deck

k this deck

46

Figure 30-2

Refer to Figure 30-2. Which of the following would cause the change depicted in the figure above?

A) Lack of investment in infrastructure causes Mexican productivity to fall relative to American productivity.

B) A possibility of diseased poultry in Mexico causes U.S. consumers to decrease their preferences for Mexican-raised chickens relative to U.S.-raised chickens.

C) A new trade agreement with Mexico results in the United States removing all tariffs on sugar imported from Mexico.

D) An expansionary monetary policy in Mexico causes an increase in the price level of Mexican goods relative to U.S. goods.

Refer to Figure 30-2. Which of the following would cause the change depicted in the figure above?

A) Lack of investment in infrastructure causes Mexican productivity to fall relative to American productivity.

B) A possibility of diseased poultry in Mexico causes U.S. consumers to decrease their preferences for Mexican-raised chickens relative to U.S.-raised chickens.

C) A new trade agreement with Mexico results in the United States removing all tariffs on sugar imported from Mexico.

D) An expansionary monetary policy in Mexico causes an increase in the price level of Mexican goods relative to U.S. goods.

Unlock Deck

Unlock for access to all 132 flashcards in this deck.

Unlock Deck

k this deck

47

Purchasing power parity is the theory that,in the long run,exchange rates move to equalize

A) nominal interest rates across countries.

B) real GDP across countries.

C) corporate profits across countries.

D) the relative purchasing power of currencies across countries.

A) nominal interest rates across countries.

B) real GDP across countries.

C) corporate profits across countries.

D) the relative purchasing power of currencies across countries.

Unlock Deck

Unlock for access to all 132 flashcards in this deck.

Unlock Deck

k this deck

48

If,at the current exchange rate between the dollar and the South African rand of 6.92 rand per dollar,the rand is "undervalued," how do you expect demand and supply in the foreign exchange markets to respond?

A) The demand for the dollar will fall, while the supply of the rand will rise.

B) The demand for the dollar will rise, while the supply of the rand will fall.

C) The supply of the dollar will rise, while the demand for the rand will rise.

D) The supply of the dollar will rise, while the demand for the rand will fall.

A) The demand for the dollar will fall, while the supply of the rand will rise.

B) The demand for the dollar will rise, while the supply of the rand will fall.

C) The supply of the dollar will rise, while the demand for the rand will rise.

D) The supply of the dollar will rise, while the demand for the rand will fall.

Unlock Deck

Unlock for access to all 132 flashcards in this deck.

Unlock Deck

k this deck

49

A Big Mac costs $4.07 in the United States and 8.63 zlotys in Poland.If the exchange rate is 3 zlotys per dollar,purchasing power parity predicts that

A) the dollar will appreciate as the demand for dollars rises in the long run.

B) the dollar will appreciate as the supply of dollars falls in the long run.

C) the dollar will depreciate as the demand for dollars falls in the long run.

D) the dollar will depreciate as the supply of dollars rises in the long run.

A) the dollar will appreciate as the demand for dollars rises in the long run.

B) the dollar will appreciate as the supply of dollars falls in the long run.

C) the dollar will depreciate as the demand for dollars falls in the long run.

D) the dollar will depreciate as the supply of dollars rises in the long run.

Unlock Deck

Unlock for access to all 132 flashcards in this deck.

Unlock Deck

k this deck

50

With a common currency such as the euro,

A) trade barriers between countries using the currency are increased.

B) individual countries using the currency are no longer able to run independent monetary policies.

C) the prices of goods across countries using the currency must always be the same, regardless of consumer preferences for goods across countries.

D) individual countries using the currency are no longer able to run independent fiscal policies.

A) trade barriers between countries using the currency are increased.

B) individual countries using the currency are no longer able to run independent monetary policies.

C) the prices of goods across countries using the currency must always be the same, regardless of consumer preferences for goods across countries.

D) individual countries using the currency are no longer able to run independent fiscal policies.

Unlock Deck

Unlock for access to all 132 flashcards in this deck.

Unlock Deck

k this deck

51

By 2011,________ members of the European Union were using the euro as their currency.

A) 12

B) 17

C) 27

D) 57

A) 12

B) 17

C) 27

D) 57

Unlock Deck

Unlock for access to all 132 flashcards in this deck.

Unlock Deck

k this deck

52

The "Big Mac Theory of Exchange Rates" tests the accuracy of purchasing power parity theory.In July 2011,The Economist reported that the average price of a Big Mac in the United States was $4.07.In Japan,the average price of a Big Mac at that time was 320 yen.What is the "implied exchange rate" between the yen and the dollar?

A) 0.013 yen per dollar

B) 78.62 yen per dollar

C) 127.18 yen per dollar

D) 130.24 yen per dollar

A) 0.013 yen per dollar

B) 78.62 yen per dollar

C) 127.18 yen per dollar

D) 130.24 yen per dollar

Unlock Deck

Unlock for access to all 132 flashcards in this deck.

Unlock Deck

k this deck

53

If the exchange rate between the U.S.dollar and the Mexican peso (pesos per dollar)is less than the relative purchasing power between the two countries,which of the following would be true?

A) There are opportunities for profit by purchasing goods in the United States and then selling them in Mexico.

B) Purchasing power parity predicts that the value of the dollar will fall as traders take advantage of arbitrage opportunities.

C) Purchasing power parity predicts that the dollar is overvalued as traders take advantage of arbitrage opportunities.

D) There are no arbitrage opportunities for which traders can take advantage.

A) There are opportunities for profit by purchasing goods in the United States and then selling them in Mexico.

B) Purchasing power parity predicts that the value of the dollar will fall as traders take advantage of arbitrage opportunities.

C) Purchasing power parity predicts that the dollar is overvalued as traders take advantage of arbitrage opportunities.

D) There are no arbitrage opportunities for which traders can take advantage.

Unlock Deck

Unlock for access to all 132 flashcards in this deck.

Unlock Deck

k this deck

54

If,at the current exchange rate between the dollar and the South African rand of 6.92 rand per dollar,the dollar is "undervalued," how do you expect demand and supply in the foreign exchange markets to respond?

A) The demand for the dollar will rise, while the supply of the rand will fall.

B) The demand for the dollar will fall, while the supply of the rand will rise.

C) The supply of the dollar will fall, while the demand for the rand will fall.

D) The supply of the dollar will fall, while the demand for the rand will rise.

A) The demand for the dollar will rise, while the supply of the rand will fall.

B) The demand for the dollar will fall, while the supply of the rand will rise.

C) The supply of the dollar will fall, while the demand for the rand will fall.

D) The supply of the dollar will fall, while the demand for the rand will rise.

Unlock Deck

Unlock for access to all 132 flashcards in this deck.

Unlock Deck

k this deck

55

A Big Mac costs $4.07 in the United States and 8.63 zlotys in Poland.If the exchange rate is 3 zlotys per dollar,purchasing power parity predicts that

A) the dollar is undervalued.

B) the dollar is overvalued.

C) the zloty is overvalued.

D) both the zloty and dollar are undervalued.

A) the dollar is undervalued.

B) the dollar is overvalued.

C) the zloty is overvalued.

D) both the zloty and dollar are undervalued.

Unlock Deck

Unlock for access to all 132 flashcards in this deck.

Unlock Deck

k this deck

56

All of the following explain why purchasing power parity does not completely explain long-run fluctuations in exchange rates except

A) not all goods and services produced in any country are traded internationally.

B) consumer preferences for goods and services differ across countries.

C) some countries impose barriers to trade.

D) most countries have free markets with little, if any, government regulation.

A) not all goods and services produced in any country are traded internationally.

B) consumer preferences for goods and services differ across countries.

C) some countries impose barriers to trade.

D) most countries have free markets with little, if any, government regulation.

Unlock Deck

Unlock for access to all 132 flashcards in this deck.

Unlock Deck

k this deck

57

A Big Mac costs $4.07 in the United States and 8.63 zlotys in Poland.If the exchange rate is 3 zlotys per dollar,what is the dollar cost of a Big Mac in Poland?

A) $2.12

B) $2.88

C) $6.36

D) $12.21

A) $2.12

B) $2.88

C) $6.36

D) $12.21

Unlock Deck

Unlock for access to all 132 flashcards in this deck.

Unlock Deck

k this deck

58

If the purchasing power of a dollar is less than the purchasing power of the euro,purchasing power parity would predict that

A) in the short run, exchange rates will move to equalize the purchasing power of the dollar and the euro.

B) in the long run, exchange rates will move to equalize the purchasing power of the dollar and the euro.

C) in the long run, interest rates will move to equalize the purchasing power of the dollar and the euro.

D) in the short run, interest rates will move to equalize the purchasing power of the dollar and the euro.

A) in the short run, exchange rates will move to equalize the purchasing power of the dollar and the euro.

B) in the long run, exchange rates will move to equalize the purchasing power of the dollar and the euro.

C) in the long run, interest rates will move to equalize the purchasing power of the dollar and the euro.

D) in the short run, interest rates will move to equalize the purchasing power of the dollar and the euro.

Unlock Deck

Unlock for access to all 132 flashcards in this deck.

Unlock Deck

k this deck

59

If a country's currency ________ the dollar,its exchange rate is fixed.

A) is exchanged in currency markets for

B) depreciates against

C) is pegged to

D) has a floating exchange rate value which is equal to

A) is exchanged in currency markets for

B) depreciates against

C) is pegged to

D) has a floating exchange rate value which is equal to

Unlock Deck

Unlock for access to all 132 flashcards in this deck.

Unlock Deck

k this deck

60

Pegging a country's exchange rate to the dollar can be advantageous in all of the following situations except

A) if the country has extensive trade with the United States.

B) if investors believe the dollar to be more stable than the domestic country's currency.

C) if a country wishes to conduct independent monetary policy.

D) if imports are a significant fraction of the goods the country's consumers buy.

A) if the country has extensive trade with the United States.

B) if investors believe the dollar to be more stable than the domestic country's currency.

C) if a country wishes to conduct independent monetary policy.

D) if imports are a significant fraction of the goods the country's consumers buy.

Unlock Deck

Unlock for access to all 132 flashcards in this deck.

Unlock Deck

k this deck

61

In Thailand in the late 1990s,there was pressure for the value of the baht to decline as foreign investors began to

A) sell off investments they had made in Thailand and traded in their baht for dollars.

B) sell off investments they had made in Thailand and traded in their dollars for baht.

C) increase their investments in Thailand and exchanged their baht for dollars.

D) increase their investments in Thailand and exchanged their dollars for baht.

A) sell off investments they had made in Thailand and traded in their baht for dollars.

B) sell off investments they had made in Thailand and traded in their dollars for baht.

C) increase their investments in Thailand and exchanged their baht for dollars.

D) increase their investments in Thailand and exchanged their dollars for baht.

Unlock Deck

Unlock for access to all 132 flashcards in this deck.

Unlock Deck

k this deck

62

When foreign investors in Thailand began to realize that Thailand could not maintain its peg to the dollar indefinitely,they began to ________ in Thailand and exchange ________ .This change in investment by foreigners is termed capital flight.

A) purchase more investments; dollars for baht to purchase these investments

B) sell off their investments; the baht they received for dollars

C) sell off their investments; the dollars they received for baht

D) purchase more investments; baht for dollars to purchase these investments

A) purchase more investments; dollars for baht to purchase these investments

B) sell off their investments; the baht they received for dollars

C) sell off their investments; the dollars they received for baht

D) purchase more investments; baht for dollars to purchase these investments

Unlock Deck

Unlock for access to all 132 flashcards in this deck.

Unlock Deck

k this deck

63

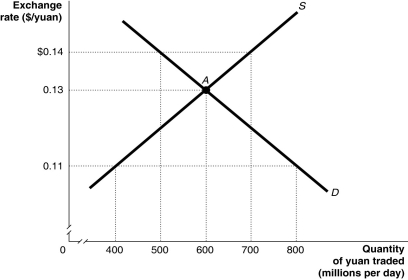

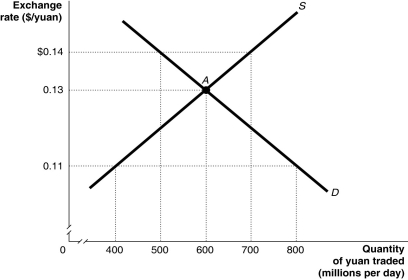

Figure 30-5

Refer to Figure 30-5. Suppose the pegged exchange rate is $0.14/yuan and U.S.consumers increase their demand for Chinese products. Using the figure above,this would

A) increase the surplus of Chinese yuan.

B) decrease the surplus of Chinese yuan.

C) decrease the shortage of Chinese yuan.

D) increase the shortage of Chinese yuan.

Refer to Figure 30-5. Suppose the pegged exchange rate is $0.14/yuan and U.S.consumers increase their demand for Chinese products. Using the figure above,this would

A) increase the surplus of Chinese yuan.

B) decrease the surplus of Chinese yuan.

C) decrease the shortage of Chinese yuan.

D) increase the shortage of Chinese yuan.

Unlock Deck

Unlock for access to all 132 flashcards in this deck.

Unlock Deck

k this deck

64

Figure 30-5

Refer to Figure 30-5. The Chinese government pegs the yuan to the dollar,at one of the specified exchange rates on the graph,such that it overvalues its currency.Using the figure above,this would generate a

A) a shortage of yuan equal to 500 million.

B) a shortage of yuan equal to 100 million.

C) a surplus of yuan equal to 200 million.

D) a surplus of yuan equal to 700 million.

Refer to Figure 30-5. The Chinese government pegs the yuan to the dollar,at one of the specified exchange rates on the graph,such that it overvalues its currency.Using the figure above,this would generate a

A) a shortage of yuan equal to 500 million.

B) a shortage of yuan equal to 100 million.

C) a surplus of yuan equal to 200 million.

D) a surplus of yuan equal to 700 million.

Unlock Deck

Unlock for access to all 132 flashcards in this deck.

Unlock Deck

k this deck

65

Figure 30-4

Refer to Figure 30-4. The equilibrium exchange rate is originally at A,$1.25/euro.Suppose the European Central Bank pegs its currency at $1.00/euro.Speculators expect that the value of the euro will rise and this shifts the demand curve for euro to D₂.If the European Central Bank abandons the peg,the equilibrium exchange rate would be

A) $1.00/euro.

B) $1.25/euro.

C) $1.50/euro.

D) $1.75/euro.

Refer to Figure 30-4. The equilibrium exchange rate is originally at A,$1.25/euro.Suppose the European Central Bank pegs its currency at $1.00/euro.Speculators expect that the value of the euro will rise and this shifts the demand curve for euro to D₂.If the European Central Bank abandons the peg,the equilibrium exchange rate would be

A) $1.00/euro.

B) $1.25/euro.

C) $1.50/euro.

D) $1.75/euro.

Unlock Deck

Unlock for access to all 132 flashcards in this deck.

Unlock Deck

k this deck

66

Figure 30-3

Refer to Figure 30-3. At what level should the Indian government peg its currency to the dollar to make U.S.imports cheaper in India?

A) greater than $.02/rupee

B) less than $.02/rupee

C) equal to $.02/rupee

D) $1/rupee

Refer to Figure 30-3. At what level should the Indian government peg its currency to the dollar to make U.S.imports cheaper in India?

A) greater than $.02/rupee

B) less than $.02/rupee

C) equal to $.02/rupee

D) $1/rupee

Unlock Deck

Unlock for access to all 132 flashcards in this deck.

Unlock Deck

k this deck

67

The Latvian currency,the lat,is pegged to the euro at a rate of 0.71 lats to the euro.At the pegged exchange rate,how many euros would be exchanged for one lat?

A) 0.29

B) 0.71

C) 1.41

D) 1.71

A) 0.29

B) 0.71

C) 1.41

D) 1.71

Unlock Deck

Unlock for access to all 132 flashcards in this deck.

Unlock Deck

k this deck

68

Actions taken by investors who sell a country's currency in anticipation of buying it back later at a lower price is known as

A) purchasing power parity.

B) currency arbitrage.

C) destabilizing speculation.

D) exchange rate manipulation.

A) purchasing power parity.

B) currency arbitrage.

C) destabilizing speculation.

D) exchange rate manipulation.

Unlock Deck

Unlock for access to all 132 flashcards in this deck.

Unlock Deck

k this deck

69

Figure 30-3

Refer to Figure 30-3. If the Indian government pegs its currency to the dollar at a value above $.02/rupee,we would say the currency is

A) undervalued.

B) overvalued.

C) parity valued.

D) equilibrium valued.

Refer to Figure 30-3. If the Indian government pegs its currency to the dollar at a value above $.02/rupee,we would say the currency is

A) undervalued.

B) overvalued.

C) parity valued.

D) equilibrium valued.

Unlock Deck

Unlock for access to all 132 flashcards in this deck.

Unlock Deck

k this deck

70

Compared to a situation in which there is no change in the value of the dollar relative to the peso,in which of the following situations would you be worse off?

A) you borrow 10,000 pesos, you earn income in dollars, the dollar appreciates against the peso, you must pay back the loan in pesos

B) you borrow $10,000, you earn income in pesos, the dollar depreciates against the peso, you must pay back the loan in dollars

C) you borrow $10,000, you earn income in pesos, the dollar appreciates against the peso, you must pay back the loan in dollars

D) you borrow 10,000 pesos, you earn income in pesos, the dollar depreciates against the peso, you must pay back the loan in pesos

A) you borrow 10,000 pesos, you earn income in dollars, the dollar appreciates against the peso, you must pay back the loan in pesos

B) you borrow $10,000, you earn income in pesos, the dollar depreciates against the peso, you must pay back the loan in dollars

C) you borrow $10,000, you earn income in pesos, the dollar appreciates against the peso, you must pay back the loan in dollars

D) you borrow 10,000 pesos, you earn income in pesos, the dollar depreciates against the peso, you must pay back the loan in pesos

Unlock Deck

Unlock for access to all 132 flashcards in this deck.

Unlock Deck

k this deck

71

Figure 30-4

Refer to Figure 30-4. The equilibrium exchange rate is at A,$1.25/euro.Suppose the European Central Bank pegs its currency at $1.00/euro.At the pegged exchange rate,

A) there is a shortage of euro equal to 500 million.

B) there is a surplus of euro equal to 300 million.

C) there is a shortage of euro equal to 200 million.

D) there is a surplus of euro equal to 700 million.

Refer to Figure 30-4. The equilibrium exchange rate is at A,$1.25/euro.Suppose the European Central Bank pegs its currency at $1.00/euro.At the pegged exchange rate,

A) there is a shortage of euro equal to 500 million.

B) there is a surplus of euro equal to 300 million.

C) there is a shortage of euro equal to 200 million.

D) there is a surplus of euro equal to 700 million.

Unlock Deck

Unlock for access to all 132 flashcards in this deck.

Unlock Deck

k this deck

72

All of the following actions were taken by the Thai government to help Thailand maintain its peg against the dollar in the 1990s except

A) borrowing dollars from the International Monetary Fund in exchange for baht.

B) buying baht on the foreign exchange market to support higher demand for the baht.

C) increasing domestic interest rates to attract more foreign investors.

D) imposing restrictions on exports to the United States to prevent too many dollars from entering the economy.

A) borrowing dollars from the International Monetary Fund in exchange for baht.

B) buying baht on the foreign exchange market to support higher demand for the baht.

C) increasing domestic interest rates to attract more foreign investors.

D) imposing restrictions on exports to the United States to prevent too many dollars from entering the economy.

Unlock Deck

Unlock for access to all 132 flashcards in this deck.

Unlock Deck

k this deck

73

The Danish currency,the krone,is pegged to the euro at a rate of 7.43 kroner (kroner is the plural of krone)to the euro.At the pegged exchange rate,how many euros would be exchanged for one krone?

A) 0.135

B) 1.00

C) 2.48

D) 7.43

A) 0.135

B) 1.00

C) 2.48

D) 7.43

Unlock Deck

Unlock for access to all 132 flashcards in this deck.

Unlock Deck

k this deck

74

Figure 30-3

Refer to Figure 30-3. If the Indian government pegs its currency to the dollar at a value below $.02/rupee,we would say the currency is

A) undervalued.

B) overvalued.

C) parity valued.

D) equilibrium valued.

Refer to Figure 30-3. If the Indian government pegs its currency to the dollar at a value below $.02/rupee,we would say the currency is

A) undervalued.

B) overvalued.

C) parity valued.

D) equilibrium valued.

Unlock Deck

Unlock for access to all 132 flashcards in this deck.

Unlock Deck

k this deck

75

Figure 30-5

Refer to Figure 30-5. Suppose the Chinese government decides to abandon pegging the yuan to the dollar at a rate which overvalues the yuan.Using the figure above,the equilibrium exchange rate would be ________ and Chinese exports to the United States would ________ in price.

A) $0.11/yuan; decrease

B) $0.14/yuan; increase

C) $0.13/yuan; increase

D) $0.13/yuan; decrease

Refer to Figure 30-5. Suppose the Chinese government decides to abandon pegging the yuan to the dollar at a rate which overvalues the yuan.Using the figure above,the equilibrium exchange rate would be ________ and Chinese exports to the United States would ________ in price.

A) $0.11/yuan; decrease

B) $0.14/yuan; increase

C) $0.13/yuan; increase

D) $0.13/yuan; decrease

Unlock Deck

Unlock for access to all 132 flashcards in this deck.

Unlock Deck

k this deck

76

If a country sets a pegged exchange rate that is below the equilibrium exchange rate,how can the country maintain the peg?

A) by purchasing surplus domestic currency at the pegged rate

B) by selling surplus domestic currency at the pegged rate

C) by purchasing surplus domestic currency at the equilibrium exchange rate

D) by decreasing the pegged exchange rate

A) by purchasing surplus domestic currency at the pegged rate

B) by selling surplus domestic currency at the pegged rate

C) by purchasing surplus domestic currency at the equilibrium exchange rate

D) by decreasing the pegged exchange rate

Unlock Deck

Unlock for access to all 132 flashcards in this deck.

Unlock Deck

k this deck

77

Figure 30-4

Refer to Figure 30-4.The equilibrium exchange rate is at A,$1.25/euro.Suppose the European Central Bank pegs its currency at $1.00/euro.Speculators expect that the value of the euro will rise and this shifts the demand curve for euro to D₂. After the shift,

A) there is a shortage of euro equal to 1,000 million.

B) there is a surplus of euro equal to 400 million.

C) there is a shortage of euro equal to 800 million.

D) there is a surplus of euro equal to 500 million.

Refer to Figure 30-4.The equilibrium exchange rate is at A,$1.25/euro.Suppose the European Central Bank pegs its currency at $1.00/euro.Speculators expect that the value of the euro will rise and this shifts the demand curve for euro to D₂. After the shift,

A) there is a shortage of euro equal to 1,000 million.

B) there is a surplus of euro equal to 400 million.

C) there is a shortage of euro equal to 800 million.

D) there is a surplus of euro equal to 500 million.

Unlock Deck

Unlock for access to all 132 flashcards in this deck.

Unlock Deck

k this deck

78

Figure 30-3

Refer to Figure 30-3. Which of the following is true?

A) U.S imports are more expensive at exchange rates greater than $.02/rupee than at the equilibrium exchange rate.

B) The rupee is overvalued at exchange rates less than $.02/rupee.

C) To achieve an exchange rate greater than $.02/rupee, the Reserve Bank of India must buy surplus dollars with rupees.

D) Indian exports to the United States are more expensive at exchange rates greater than $.02/rupee than at the equilibrium exchange rate.

Refer to Figure 30-3. Which of the following is true?

A) U.S imports are more expensive at exchange rates greater than $.02/rupee than at the equilibrium exchange rate.

B) The rupee is overvalued at exchange rates less than $.02/rupee.

C) To achieve an exchange rate greater than $.02/rupee, the Reserve Bank of India must buy surplus dollars with rupees.

D) Indian exports to the United States are more expensive at exchange rates greater than $.02/rupee than at the equilibrium exchange rate.

Unlock Deck

Unlock for access to all 132 flashcards in this deck.

Unlock Deck

k this deck

79

Firms in Thailand that had ________ while the baht was pegged to the dollar faced interest payments that were higher than they had planned once the Thai government abandoned the peg because the baht had been pegged ________ the equilibrium exchange rate for the baht.

A) borrowed dollars; above

B) borrowed baht; above

C) borrowed dollars; below

D) borrowed baht; below

A) borrowed dollars; above

B) borrowed baht; above

C) borrowed dollars; below

D) borrowed baht; below

Unlock Deck

Unlock for access to all 132 flashcards in this deck.

Unlock Deck

k this deck

80

During the Chinese experience with pegging the yuan to the dollar,the yuan was ________.As a result,there was a ________ of dollars on the market,and the Chinese government had to purchase dollars to maintain the peg.

A) overvalued; shortage

B) undervalued; surplus

C) overvalued; surplus

D) undervalued; shortage

A) overvalued; shortage

B) undervalued; surplus

C) overvalued; surplus

D) undervalued; shortage

Unlock Deck

Unlock for access to all 132 flashcards in this deck.

Unlock Deck

k this deck