Deck 9: Parity and Other Option Relationships

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/19

Play

Full screen (f)

Deck 9: Parity and Other Option Relationships

1

A company is forecasted to pay dividends of $0.90,$1.20,and $1.45 in 3,6,and 9 months,respectively.Given interest rates of 5.5%,how much dollar impact will dividends have on option prices? (Assume a 9-month option.)

A) $3.45

B) $3.90

C) $4.22

D) $4.50

A) $3.45

B) $3.90

C) $4.22

D) $4.50

A

2

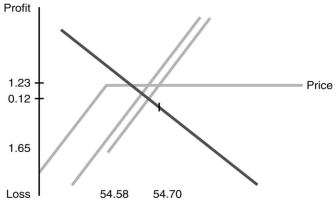

Jillo,Inc.stock is selling for $54.70 per share.Calls and puts with a $55.00 strike and 40 days until expiration are selling for $1.65 and $1.23,respectively.Draw a profit and loss graph illustrating the arbitrage.

3

Put options with strikes of $70,$75,and $85 have option premiums of $6.00,$8.50,and $11.00,respectively.Using strike price convexity,which option premium,if any,is not possible?

A) P (70)

B) P (75)

C) P (85)

D) All are possible

A) P (70)

B) P (75)

C) P (85)

D) All are possible

B

4

Call options with strikes of $30,$35,and $40 have option premiums of $1.50,$1.70,and $2.00,respectively.Using strike price convexity,which option premium,if any,is not possible?

A) C (30)

B) C (35)

C) C (40)

D) All are possible

A) C (30)

B) C (35)

C) C (40)

D) All are possible

Unlock Deck

Unlock for access to all 19 flashcards in this deck.

Unlock Deck

k this deck

5

The price of a stock is $52.00.Lacking additional information,what is your forecasted difference between a put option and a call option on this stock? Assume 38 days to expiration and 6.0% interest.

A) $0.16

B) $0.32

C) $0.48

D) $0.64

A) $0.16

B) $0.32

C) $0.48

D) $0.64

Unlock Deck

Unlock for access to all 19 flashcards in this deck.

Unlock Deck

k this deck

6

Consider the case of an exchange option in which the underlying stock is Eli Lilly and Company with a current price of $56.00 per share.The strike asset is Merck,with a per share price of $52.00.Interest rates are 5% and the 3-month call option is trading for $7.00.What is the price of the put?

A) $3.00

B) $4.00

C) $7.00

D) $11.00

A) $3.00

B) $4.00

C) $7.00

D) $11.00

Unlock Deck

Unlock for access to all 19 flashcards in this deck.

Unlock Deck

k this deck

7

The spot exchange rate in dollars per euro is $1.31.Dollar denominated interest rates are 4.0% and euro denominated interest rates are 3.0%.What is the difference in call and put option prices given a 2-year option and a $1.34 strike price?

A) -$0.1041

B) -$0.0652

C) $0.1233

D) $0.1546

A) -$0.1041

B) -$0.0652

C) $0.1233

D) $0.1546

Unlock Deck

Unlock for access to all 19 flashcards in this deck.

Unlock Deck

k this deck

8

The price of a non-dividend paying stock is $55 per share.A 6-month,at the money call option is trading for $1.89.If the interest rate is 6.5%,what is the likely price of a European put at the same strike and expiration?

A) $0.05

B) $0.13

C) $0.56

D) $0.88

A) $0.05

B) $0.13

C) $0.56

D) $0.88

Unlock Deck

Unlock for access to all 19 flashcards in this deck.

Unlock Deck

k this deck

9

Explain in simple terms why a call option on a non-dividend paying stock should never be exercised early.

Unlock Deck

Unlock for access to all 19 flashcards in this deck.

Unlock Deck

k this deck

10

Which of the following options will NOT be exercised early?

A) Put on a dividend paying stock

B) Call on a dividend paying stock

C) Put on a non-dividend paying stock

D) Call on a non-dividend paying stock

A) Put on a dividend paying stock

B) Call on a dividend paying stock

C) Put on a non-dividend paying stock

D) Call on a non-dividend paying stock

Unlock Deck

Unlock for access to all 19 flashcards in this deck.

Unlock Deck

k this deck

11

Put-call parity allows a discussion of option pricing relationships without actually pricing an option.Have the class list all the possible pricing relationships they can recall.Add to the list until reasonably complete.Follow up this exercise by listing puts and calls,while asking students to state if certain premiums are possible.

Unlock Deck

Unlock for access to all 19 flashcards in this deck.

Unlock Deck

k this deck

12

All else being equal,explain why American options are at least as valuable as European options.

Unlock Deck

Unlock for access to all 19 flashcards in this deck.

Unlock Deck

k this deck

13

The spot exchange rate of dollars per euro is 0.95.Dollar and euro interest rates are 7.0% and 6.0%,respectively.The price of a $0.93 strike 6-month call option is $0.08.What is the price of the put?

A) $0.016

B) $0.032

C) $0.056

D) $0.078

A) $0.016

B) $0.032

C) $0.056

D) $0.078

Unlock Deck

Unlock for access to all 19 flashcards in this deck.

Unlock Deck

k this deck

14

The 6-month call and put premiums are $0.114 and $0.098,respectively,with a $0.94 strike.Dollar and euro interest rates are 7.0% and 6.0%,respectively.What spot exchange rate is implied by this data?

A) $0.98 dollars per euro

B) $1.02 dollars per euro

C) $1.05 dollars per euro

D) $1.09 dollars per euro

A) $0.98 dollars per euro

B) $1.02 dollars per euro

C) $1.05 dollars per euro

D) $1.09 dollars per euro

Unlock Deck

Unlock for access to all 19 flashcards in this deck.

Unlock Deck

k this deck

15

Rankin Corp.common stock is priced at $74.20 per share.The company just paid its $1.10 quarterly dividend.Interest rates are 6.0%.A $70.00 strike European call,maturing in 6 months,sells for $6.50.How much arbitrage profit/loss is made by shorting the European call,which is priced at $2.50?

A) $0.12 loss

B) $0.12 gain

C) $0.36 loss

D) $0.36 gain

A) $0.12 loss

B) $0.12 gain

C) $0.36 loss

D) $0.36 gain

Unlock Deck

Unlock for access to all 19 flashcards in this deck.

Unlock Deck

k this deck

16

Using the synthetic long stock strategy,explain the difference in call and put prices.

Unlock Deck

Unlock for access to all 19 flashcards in this deck.

Unlock Deck

k this deck

17

Jafee Corp.common stock is priced at $36.50 per share.The company just paid its $0.50 quarterly dividend.Interest rates are 6.0%.A $35.00 strike European call,maturing in 6 months,sells for $3.20.What is the price of a 6-month,$35.00 strike put option?

A) $1.20

B) $1.64

C) $2.04

D) $2.38

A) $1.20

B) $1.64

C) $2.04

D) $2.38

Unlock Deck

Unlock for access to all 19 flashcards in this deck.

Unlock Deck

k this deck

18

The necessary condition for early exercise is that we prefer to receive something sooner rather than later.With a dividend paying call and a non-dividend paying put,what do we receive?

Unlock Deck

Unlock for access to all 19 flashcards in this deck.

Unlock Deck

k this deck

19

Jillo,Inc.stock is selling for $54.70 per share.Calls and puts with a $55 strike and 40 days until expiration are selling for $1.65 and $1.23,respectively.What potential arbitrage profit exists?

A) $0.12

B) $0.24

C) $0.36

D) $0.48

A) $0.12

B) $0.24

C) $0.36

D) $0.48

Unlock Deck

Unlock for access to all 19 flashcards in this deck.

Unlock Deck

k this deck