Deck 20: Fiscal Policy and Monetary Policy

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/223

Play

Full screen (f)

Deck 20: Fiscal Policy and Monetary Policy

1

When tax revenue exceed the government's outlays, the budget

A)has a deficit and the national debt is increasing.

B)is balanced and the national debt is decreasing.

C)has a surplus and the national debt is decreasing.

D)has a surplus and the national debt is increasing.

E)None of the above because by law tax revenue cannot exceed the government's expenditures.

A)has a deficit and the national debt is increasing.

B)is balanced and the national debt is decreasing.

C)has a surplus and the national debt is decreasing.

D)has a surplus and the national debt is increasing.

E)None of the above because by law tax revenue cannot exceed the government's expenditures.

C

2

When the government's expenditures exceed its tax revenue, the budget

A)has a deficit and the national debt is increasing.

B)is balanced and the national debt is increasing.

C)has a surplus and the national debt is increasing.

D)has a deficit and the national debt is decreasing.

E)None of the above because by law the government's expenditures cannot exceed its tax revenue.

A)has a deficit and the national debt is increasing.

B)is balanced and the national debt is increasing.

C)has a surplus and the national debt is increasing.

D)has a deficit and the national debt is decreasing.

E)None of the above because by law the government's expenditures cannot exceed its tax revenue.

A

3

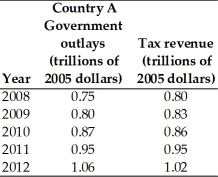

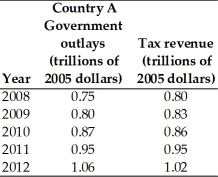

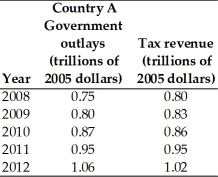

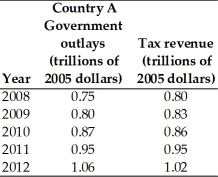

The table above gives a nation's government outlays and tax revenue for 2008 through 2012.

During which years, if any, did the country have a balanced budget?

A)2008 and 2009

B)2012 only

C)2011 only

D)2010 and 2012

E)all except 2011

C

4

The table above gives a nation's government outlays and tax revenue for 2008 through 2012.

During which years did the country have a budget surplus?

A)2008 and 2009

B)2012 only

C)2011 only

D)2010 and 2012

E)all except 2011

Unlock Deck

Unlock for access to all 223 flashcards in this deck.

Unlock Deck

k this deck

5

The government collects tax revenue of $100 million and has $105 million in outlays. The budget balance is a

A)surplus of $5 million.

B)deficit of $5 million.

C)surplus of $105 million.

D)deficit of $105 million.

E)surplus of $100 million and a deficit of $105 million.

A)surplus of $5 million.

B)deficit of $5 million.

C)surplus of $105 million.

D)deficit of $105 million.

E)surplus of $100 million and a deficit of $105 million.

Unlock Deck

Unlock for access to all 223 flashcards in this deck.

Unlock Deck

k this deck

6

The government collects tax revenue of $100 million and has $105 million in outlays. The budget balance is a

A)surplus of $5 million.

B)deficit of $5 million.

C)surplus of $105 million.

D)deficit of $105 million.

E)surplus of $100 million and a deficit of $105 million.

A)surplus of $5 million.

B)deficit of $5 million.

C)surplus of $105 million.

D)deficit of $105 million.

E)surplus of $100 million and a deficit of $105 million.

Unlock Deck

Unlock for access to all 223 flashcards in this deck.

Unlock Deck

k this deck

7

The table above gives a nation's government outlays and tax revenue for 2008 through 2012.

During which years did the country have a budget deficit?

A)2008 and 2009

B)2012 only

C)2011 only

D)2010 and 2012

E)all except 2011

Unlock Deck

Unlock for access to all 223 flashcards in this deck.

Unlock Deck

k this deck

8

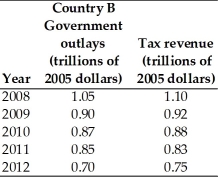

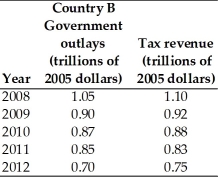

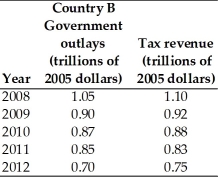

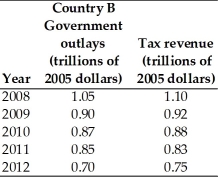

The above table gives the government outlays and tax revenues from 2008 through 2012 for two countries. In 2010 country A had a ________ and country B had a ________.

A)budget deficit; budget deficit

B)budget deficit; budget surplus

C)balanced budget; budget deficit

D)budget surplus; budget surplus

E)budget surplus; budget deficit

Unlock Deck

Unlock for access to all 223 flashcards in this deck.

Unlock Deck

k this deck

9

When tax revenue ________ outlays is negative, then the government has a budget ________.

A)minus; surplus

B)divided by; surplus

C)minus; deficit

D)plus; deficit

E)plus; surplus

A)minus; surplus

B)divided by; surplus

C)minus; deficit

D)plus; deficit

E)plus; surplus

Unlock Deck

Unlock for access to all 223 flashcards in this deck.

Unlock Deck

k this deck

10

When tax revenue ________ outlays is positive, then the government has a budget ________.

A)minus; surplus

B)divided by; surplus

C)minus; deficit

D)plus; deficit

E)plus; surplus

A)minus; surplus

B)divided by; surplus

C)minus; deficit

D)plus; deficit

E)plus; surplus

Unlock Deck

Unlock for access to all 223 flashcards in this deck.

Unlock Deck

k this deck

11

When tax revenues equal government outlays, the situation is referred to as

A)a balanced budget.

B)an equivalent budget.

C)an equal budget.

D)an equilibrium budget.

E)a legal budget.

A)a balanced budget.

B)an equivalent budget.

C)an equal budget.

D)an equilibrium budget.

E)a legal budget.

Unlock Deck

Unlock for access to all 223 flashcards in this deck.

Unlock Deck

k this deck

12

The government has a budget surplus if

A)there is no national debt.

B)tax revenue is greater than outlays.

C)government outlays are greater than tax revenue.

D)the budget is balanced.

E)a fiscal stimulus is being used to combat a recession.

A)there is no national debt.

B)tax revenue is greater than outlays.

C)government outlays are greater than tax revenue.

D)the budget is balanced.

E)a fiscal stimulus is being used to combat a recession.

Unlock Deck

Unlock for access to all 223 flashcards in this deck.

Unlock Deck

k this deck

13

When tax revenues minus outlays is i. positive, the government has a budget surplus.

Ii. negative, the government has a budget deficit.

Iii. zero, the government has a balanced budget.

A)i, ii, and iii

B)i and ii only

C)ii and iii only

D)i only

E)iii only

Ii. negative, the government has a budget deficit.

Iii. zero, the government has a balanced budget.

A)i, ii, and iii

B)i and ii only

C)ii and iii only

D)i only

E)iii only

Unlock Deck

Unlock for access to all 223 flashcards in this deck.

Unlock Deck

k this deck

14

When government outlays exceed tax revenue, the situation is called a budget

A)with a negative balance.

B)deficit.

C)surplus.

D)debt.

E)with no balance.

A)with a negative balance.

B)deficit.

C)surplus.

D)debt.

E)with no balance.

Unlock Deck

Unlock for access to all 223 flashcards in this deck.

Unlock Deck

k this deck

15

The above table gives the government outlays and tax revenues from 2008 through 2012 for two countries. In 2011 country A had a ________ and country B had a ________.

A)budget deficit; budget deficit

B)balanced budge; budget surplus

C)balanced budget; budget deficit

D)budget surplus; budget surplus

E)budget surplus; balanced budget

Unlock Deck

Unlock for access to all 223 flashcards in this deck.

Unlock Deck

k this deck

16

If the federal government has a budget deficit, then it is definitely the case that

A)the tax revenue exceed government outlays.

B)the tax revenue and government outlays are equal.

C)the tax revenue is falling and government outlays are rising.

D)government outlays exceed tax revenue.

E)the tax revenue is rising and government outlays are falling.

A)the tax revenue exceed government outlays.

B)the tax revenue and government outlays are equal.

C)the tax revenue is falling and government outlays are rising.

D)government outlays exceed tax revenue.

E)the tax revenue is rising and government outlays are falling.

Unlock Deck

Unlock for access to all 223 flashcards in this deck.

Unlock Deck

k this deck

17

If the federal government has a budget surplus, then it is definitely the case that

A)tax revenue exceeds government outlays.

B)tax revenue and government outlays are equal.

C)the tax revenue is falling and government outlays are rising.

D)government outlays exceed tax revenue.

E)the tax revenue is rising and government outlays are falling.

A)tax revenue exceeds government outlays.

B)tax revenue and government outlays are equal.

C)the tax revenue is falling and government outlays are rising.

D)government outlays exceed tax revenue.

E)the tax revenue is rising and government outlays are falling.

Unlock Deck

Unlock for access to all 223 flashcards in this deck.

Unlock Deck

k this deck

18

In the United States for the year 2012, the federal government had a ________ so the national debt was ________.

A)budget deficit; increasing

B)balanced budget; not changing

C)budget surplus; decreasing

D)budget deficit; decreasing

E)budget surplus; increasing

A)budget deficit; increasing

B)balanced budget; not changing

C)budget surplus; decreasing

D)budget deficit; decreasing

E)budget surplus; increasing

Unlock Deck

Unlock for access to all 223 flashcards in this deck.

Unlock Deck

k this deck

19

When the government's outlays equal its tax revenue, then the budget

A)is in deficit.

B)is in surplus.

C)is balanced.

D)could be either in surplus or deficit.

E)is legal only because expenditures equal tax revenues.

A)is in deficit.

B)is in surplus.

C)is balanced.

D)could be either in surplus or deficit.

E)is legal only because expenditures equal tax revenues.

Unlock Deck

Unlock for access to all 223 flashcards in this deck.

Unlock Deck

k this deck

20

The federal budget

A)is required to balance by law.

B)can have a surplus but not a deficit.

C)can have a deficit but not a surplus.

D)can have a deficit or a surplus but cannot be balanced.

E)can have a deficit, a surplus, or a balance.

A)is required to balance by law.

B)can have a surplus but not a deficit.

C)can have a deficit but not a surplus.

D)can have a deficit or a surplus but cannot be balanced.

E)can have a deficit, a surplus, or a balance.

Unlock Deck

Unlock for access to all 223 flashcards in this deck.

Unlock Deck

k this deck

21

If a change in the tax laws leads to a $100 billion decrease in tax revenue, then aggregate demand

A)increases by $100 billion.

B)increases by less than $100 billion.

C)increases by more than $100 billion.

D)decreases by $100 billion.

E)decreases by more than $100 billion.

A)increases by $100 billion.

B)increases by less than $100 billion.

C)increases by more than $100 billion.

D)decreases by $100 billion.

E)decreases by more than $100 billion.

Unlock Deck

Unlock for access to all 223 flashcards in this deck.

Unlock Deck

k this deck

22

A $100 million decrease in government expenditure on goods and services leads to an even larger decrease in aggregate demand because of

A)induced changes in consumption expenditures.

B)automatic fiscal policy.

C)induced changes in aggregate supply.

D)discretionary fiscal policy.

E)the reinforcing effect of monetary policy.

A)induced changes in consumption expenditures.

B)automatic fiscal policy.

C)induced changes in aggregate supply.

D)discretionary fiscal policy.

E)the reinforcing effect of monetary policy.

Unlock Deck

Unlock for access to all 223 flashcards in this deck.

Unlock Deck

k this deck

23

Discretionary fiscal policy is defined as fiscal policy

A)left to the discretion of military authorities.

B)initiated by an act of Congress.

C)initiated by a Presidential proclamation.

D)triggered by the state of the economy.

E)with multiplier effects.

A)left to the discretion of military authorities.

B)initiated by an act of Congress.

C)initiated by a Presidential proclamation.

D)triggered by the state of the economy.

E)with multiplier effects.

Unlock Deck

Unlock for access to all 223 flashcards in this deck.

Unlock Deck

k this deck

24

If tax revenue is $230 billion and the government's outlays are $235 billion, then the budget

A)deficit is $5 billion, and government debt will remain the same.

B)surplus is $5 billion, and government debt will increase by $5 billion.

C)deficit is $5 billion, and government debt will increase by $5 billion.

D)deficit is $5 billion, and government debt will decrease by $5 billion.

E)surplus is $230 billion, and the budget deficit is $235 billion.

A)deficit is $5 billion, and government debt will remain the same.

B)surplus is $5 billion, and government debt will increase by $5 billion.

C)deficit is $5 billion, and government debt will increase by $5 billion.

D)deficit is $5 billion, and government debt will decrease by $5 billion.

E)surplus is $230 billion, and the budget deficit is $235 billion.

Unlock Deck

Unlock for access to all 223 flashcards in this deck.

Unlock Deck

k this deck

25

In 2009, Congress passed tax laws to reduce income tax rates for some taxpayers. This action is called

A)a discretionary fiscal policy.

B)a discretionary revenue policy.

C)an automatic fiscal policy.

D)an annual tax policy.

E)induced tax policy.

A)a discretionary fiscal policy.

B)a discretionary revenue policy.

C)an automatic fiscal policy.

D)an annual tax policy.

E)induced tax policy.

Unlock Deck

Unlock for access to all 223 flashcards in this deck.

Unlock Deck

k this deck

26

The national debt can only be reduced if

A)the federal budget is in deficit.

B)the federal budget is in surplus.

C)there are no tax multiplier effects.

D)the economy has a deflationary gap.

E)the economy has an inflationary gap.

A)the federal budget is in deficit.

B)the federal budget is in surplus.

C)there are no tax multiplier effects.

D)the economy has a deflationary gap.

E)the economy has an inflationary gap.

Unlock Deck

Unlock for access to all 223 flashcards in this deck.

Unlock Deck

k this deck

27

The national debt is

A)tax revenue minus government outlays.

B)government outlays minus tax revenue.

C)the amount borrowed by the government to finance past budget deficits.

D)the amount lent by the government of past budget surpluses.

E)the excess of this year's budget surplus minus this year's budget deficit.

Unlock Deck

Unlock for access to all 223 flashcards in this deck.

Unlock Deck

k this deck

28

The national debt is the amount

A)by which government tax revenue exceed outlays in a given year.

B)of debt outstanding that arises from past budget deficits.

C)by which government outlays exceed tax revenue in a given year.

D)of government outlays summed over time.

E)of all future entitlement spending.

Unlock Deck

Unlock for access to all 223 flashcards in this deck.

Unlock Deck

k this deck

29

The government expenditure multiplier is used to determine the

A)extra scrutiny government action receives.

B)amount aggregate demand is affected by a change in government expenditure.

C)amount aggregate supply is affected by a change in government expenditure.

D)amount private consumption is decreased by government expenditure.

E)extent to which automatic stabilizers must be changed in order to avoid recessions.

A)extra scrutiny government action receives.

B)amount aggregate demand is affected by a change in government expenditure.

C)amount aggregate supply is affected by a change in government expenditure.

D)amount private consumption is decreased by government expenditure.

E)extent to which automatic stabilizers must be changed in order to avoid recessions.

Unlock Deck

Unlock for access to all 223 flashcards in this deck.

Unlock Deck

k this deck

30

If the government reduces expenditure on goods and services by $30 billion, then aggregate demand

A)decreases by more than $30 billion and real GDP decreases.

B)decreases by $30 billion and real GDP decreases.

C)increases by $30 billion and real GDP increases.

D)increases and potential GDP increases.

E)increases by more than $30 billion and real GDP increases.

A)decreases by more than $30 billion and real GDP decreases.

B)decreases by $30 billion and real GDP decreases.

C)increases by $30 billion and real GDP increases.

D)increases and potential GDP increases.

E)increases by more than $30 billion and real GDP increases.

Unlock Deck

Unlock for access to all 223 flashcards in this deck.

Unlock Deck

k this deck

31

When the government's outlays exceed its tax revenue, the national debt

A)shrinks thanks to the budget surplus.

B)grows to finance the budget deficit.

C)shrinks thanks to the budget deficit.

D)grows to finance the budget surplus.

E)does not change because it has nothing to do with government outlays and tax revenue.

A)shrinks thanks to the budget surplus.

B)grows to finance the budget deficit.

C)shrinks thanks to the budget deficit.

D)grows to finance the budget surplus.

E)does not change because it has nothing to do with government outlays and tax revenue.

Unlock Deck

Unlock for access to all 223 flashcards in this deck.

Unlock Deck

k this deck

32

If government expenditure on goods and services increase by $100 billion, then aggregate demand

A)increases by $100 billion.

B)increases by less than $100 billion.

C)increases by more than $100 billion.

D)remains unchanged.

E)decreases by more than $100 billion.

A)increases by $100 billion.

B)increases by less than $100 billion.

C)increases by more than $100 billion.

D)remains unchanged.

E)decreases by more than $100 billion.

Unlock Deck

Unlock for access to all 223 flashcards in this deck.

Unlock Deck

k this deck

33

Discretionary fiscal policy is a fiscal policy action, such as

A)an interest rate cut, initiated by an act of Congress.

B)an increase in payments to the unemployed, initiated by the state of the economy.

C)a tax cut, initiated by an act of Congress.

D)a decrease in tax receipts, initiated by the state of the economy.

E)an increase in the quantity of money.

A)an interest rate cut, initiated by an act of Congress.

B)an increase in payments to the unemployed, initiated by the state of the economy.

C)a tax cut, initiated by an act of Congress.

D)a decrease in tax receipts, initiated by the state of the economy.

E)an increase in the quantity of money.

Unlock Deck

Unlock for access to all 223 flashcards in this deck.

Unlock Deck

k this deck

34

If government expenditures on goods and services increases by $20 billion, then aggregate demand

A)increases by $20 billion.

B)increases by more than $20 billion.

C)decreases by $20 billion.

D)decreases by more than $20 billion.

E)increases by less than $20 billion.

A)increases by $20 billion.

B)increases by more than $20 billion.

C)decreases by $20 billion.

D)decreases by more than $20 billion.

E)increases by less than $20 billion.

Unlock Deck

Unlock for access to all 223 flashcards in this deck.

Unlock Deck

k this deck

35

The magnitude of the government expenditure multiplier is ________ the magnitude of the tax multiplier.

A)greater than

B)equal to

C)less than

D)not comparable to

E)greater than for expansionary policy and less than for contractionary policy

A)greater than

B)equal to

C)less than

D)not comparable to

E)greater than for expansionary policy and less than for contractionary policy

Unlock Deck

Unlock for access to all 223 flashcards in this deck.

Unlock Deck

k this deck

36

When the government's outlays equal its tax revenue, the budget

A)has a deficit and the national debt is increasing.

B)is balanced and the national debt is not changing.

C)has a surplus and the national debt is increasing.

D)has a deficit and the national debt is decreasing.

E)has a surplus and the national debt is decreasing.

A)has a deficit and the national debt is increasing.

B)is balanced and the national debt is not changing.

C)has a surplus and the national debt is increasing.

D)has a deficit and the national debt is decreasing.

E)has a surplus and the national debt is decreasing.

Unlock Deck

Unlock for access to all 223 flashcards in this deck.

Unlock Deck

k this deck

37

The magnitude of the tax multiplier is smaller than the magnitude of the government expenditure multiplier because

A)a change in taxes does not change expenditures.

B)an increase in taxes decreases expenditures.

C)a decrease in government expenditure decreases tax revenue.

D)a change in taxes does not change expenditures by as much as the same size change in government expenditure.

E)a change in taxes creates additional induced taxes.

A)a change in taxes does not change expenditures.

B)an increase in taxes decreases expenditures.

C)a decrease in government expenditure decreases tax revenue.

D)a change in taxes does not change expenditures by as much as the same size change in government expenditure.

E)a change in taxes creates additional induced taxes.

Unlock Deck

Unlock for access to all 223 flashcards in this deck.

Unlock Deck

k this deck

38

If government expenditure on goods and services increase by $10 billion, then aggregate demand

A)increases by $10 billion.

B)increases by $10 billion multiplied by the government expenditure multiplier.

C)increases by $10 billion multiplied by the tax multiplier.

D)decreases by $10 billion.

E)decreases by $10 billion multiplied by the government expenditure multiplier.

A)increases by $10 billion.

B)increases by $10 billion multiplied by the government expenditure multiplier.

C)increases by $10 billion multiplied by the tax multiplier.

D)decreases by $10 billion.

E)decreases by $10 billion multiplied by the government expenditure multiplier.

Unlock Deck

Unlock for access to all 223 flashcards in this deck.

Unlock Deck

k this deck

39

Since 2000, the U.S. government has generally had a government budget ________ and so the national debt has ________.

A)surplus; decreased

B)surplus; increased

C)deficit; decreased

D)deficit; increased

E)deficit; not changed

A)surplus; decreased

B)surplus; increased

C)deficit; decreased

D)deficit; increased

E)deficit; not changed

Unlock Deck

Unlock for access to all 223 flashcards in this deck.

Unlock Deck

k this deck

40

The tax multiplier is the

A)magnification effect of a change in taxes on aggregate demand.

B)magnification effect of a change in taxes on the budget deficit.

C)magnification effect of a change in taxes on government expenditures.

D)magnification effect of a change in taxes on aggregate supply.

E)magnification effect of a change in taxes on the national debt.

A)magnification effect of a change in taxes on aggregate demand.

B)magnification effect of a change in taxes on the budget deficit.

C)magnification effect of a change in taxes on government expenditures.

D)magnification effect of a change in taxes on aggregate supply.

E)magnification effect of a change in taxes on the national debt.

Unlock Deck

Unlock for access to all 223 flashcards in this deck.

Unlock Deck

k this deck

41

Which of the following is an example of a fiscal stimulus?

A)decrease in government expenditure on goods and services

B)decrease in transfer payments

C)increase in taxes

D)decrease in taxes

E)none of the above

A)decrease in government expenditure on goods and services

B)decrease in transfer payments

C)increase in taxes

D)decrease in taxes

E)none of the above

Unlock Deck

Unlock for access to all 223 flashcards in this deck.

Unlock Deck

k this deck

42

When comparing a $100 billion increase in government expenditure to a $100 billion decrease in tax revenue, the effect of the increase in government expenditure on aggregate demand is

A)greater than the effect of the tax decrease.

B)equal to the effect of the tax decrease.

C)less than the effect of the tax decrease.

D)positive whereas the effect of the tax decrease is negative.

E)negative whereas the effect of the tax decrease is positive.

A)greater than the effect of the tax decrease.

B)equal to the effect of the tax decrease.

C)less than the effect of the tax decrease.

D)positive whereas the effect of the tax decrease is negative.

E)negative whereas the effect of the tax decrease is positive.

Unlock Deck

Unlock for access to all 223 flashcards in this deck.

Unlock Deck

k this deck

43

In order to help the economy recover from a recession using fiscal policy, the government can ________ so that aggregate demand increases.

A)cut taxes

B)raise taxes

C)cut government expenditure on goods and services

D)raise interest rates

E)decrease the quantity of money

A)cut taxes

B)raise taxes

C)cut government expenditure on goods and services

D)raise interest rates

E)decrease the quantity of money

Unlock Deck

Unlock for access to all 223 flashcards in this deck.

Unlock Deck

k this deck

44

The government expenditure multiplier and the tax multiplier are

A)identical in size.

B)different in size and the tax multiplier is larger.

C)different in size and the government expenditure multiplier is larger.

D)not comparable because the government expenditure multiplier applies to aggregate demand and the tax multiplier applies to aggregate supply.

E)not comparable because the government expenditure multiplier applies to aggregate supply and the tax multiplier applies to aggregate demand.

A)identical in size.

B)different in size and the tax multiplier is larger.

C)different in size and the government expenditure multiplier is larger.

D)not comparable because the government expenditure multiplier applies to aggregate demand and the tax multiplier applies to aggregate supply.

E)not comparable because the government expenditure multiplier applies to aggregate supply and the tax multiplier applies to aggregate demand.

Unlock Deck

Unlock for access to all 223 flashcards in this deck.

Unlock Deck

k this deck

45

If government expenditure increases by $200 billion and taxes simultaneously increase by $200 billion, then aggregate demand

A)remains the same.

B)decreases no matter what happens to aggregate supply.

C)increases no matter what happens to aggregate supply.

D)increases only if aggregate supply increases.

E)increases only if aggregate supply decreases.

A)remains the same.

B)decreases no matter what happens to aggregate supply.

C)increases no matter what happens to aggregate supply.

D)increases only if aggregate supply increases.

E)increases only if aggregate supply decreases.

Unlock Deck

Unlock for access to all 223 flashcards in this deck.

Unlock Deck

k this deck

46

Suppose the economy is in an equilibrium in which real GDP is less than potential GDP. To increase real GDP, the government can use a fiscal stimulus of

A)increasing taxes only.

B)decreasing government expenditure only.

C)decreasing taxes and/or increasing government expenditure.

D)decreasing government expenditure and simultaneously increasing taxes.

E)increasing the quantity of money.

A)increasing taxes only.

B)decreasing government expenditure only.

C)decreasing taxes and/or increasing government expenditure.

D)decreasing government expenditure and simultaneously increasing taxes.

E)increasing the quantity of money.

Unlock Deck

Unlock for access to all 223 flashcards in this deck.

Unlock Deck

k this deck

47

If the economy is in an equilibrium with real GDP less than potential GDP, a fiscal stimulus could move the economy toward potential GDP by simultaneously ________ taxes and ________ government expenditures on goods and services.

A)raising; increasing

B)raising; decreasing

C)cutting; increasing

D)cutting; decreasing

E)raising; not changing

A)raising; increasing

B)raising; decreasing

C)cutting; increasing

D)cutting; decreasing

E)raising; not changing

Unlock Deck

Unlock for access to all 223 flashcards in this deck.

Unlock Deck

k this deck

48

The balanced budget multiplier is

A)equal to zero because taxes and government expenditure are changed to leave the budget balanced.

B)misnamed because it does not leave the budget balanced.

C)greater than zero and less than the government expenditure multiplier.

D)greater than zero and greater than the government expenditure multiplier.

E)less than zero, that is, it is negative.

A)equal to zero because taxes and government expenditure are changed to leave the budget balanced.

B)misnamed because it does not leave the budget balanced.

C)greater than zero and less than the government expenditure multiplier.

D)greater than zero and greater than the government expenditure multiplier.

E)less than zero, that is, it is negative.

Unlock Deck

Unlock for access to all 223 flashcards in this deck.

Unlock Deck

k this deck

49

The balanced budget multiplier applies when a $50 billion increase in government expenditure is financed by a $50 billion ________ in tax revenue and the balanced budget multiplier shows that in this case there is ________ effect on aggregate demand.

A)decrease; no

B)decrease; a positive

C)increase; no

D)increase; a positive

E)increase; a negative

A)decrease; no

B)decrease; a positive

C)increase; no

D)increase; a positive

E)increase; a negative

Unlock Deck

Unlock for access to all 223 flashcards in this deck.

Unlock Deck

k this deck

50

If the government uses fiscal policy to close a recessionary gap, government

A)expenditure must be increased by more than the gap because of the government expenditure multiplier.

B)taxes must be cut by more than the gap because of the tax multiplier.

C)expenditure can be increased by less than the gap because of the government expenditure multiplier.

D)taxes can be raised by less than the gap because of the tax multiplier.

E)taxes must be raised by more than the gap because of the tax multiplier.

A)expenditure must be increased by more than the gap because of the government expenditure multiplier.

B)taxes must be cut by more than the gap because of the tax multiplier.

C)expenditure can be increased by less than the gap because of the government expenditure multiplier.

D)taxes can be raised by less than the gap because of the tax multiplier.

E)taxes must be raised by more than the gap because of the tax multiplier.

Unlock Deck

Unlock for access to all 223 flashcards in this deck.

Unlock Deck

k this deck

51

The balanced budget multiplier is

A)positive because the magnitude of government expenditure multiplier is larger than the magnitude of tax multiplier.

B)negative because the magnitude of government expenditure multiplier is larger than the magnitude of the tax multiplier.

C)positive because the magnitude of government expenditure multiplier is smaller than the magnitude of tax multiplier.

D)equal to zero.

E)negative because the magnitude of the tax multiplier is larger than the magnitude of the government expenditure multiplier.

A)positive because the magnitude of government expenditure multiplier is larger than the magnitude of tax multiplier.

B)negative because the magnitude of government expenditure multiplier is larger than the magnitude of the tax multiplier.

C)positive because the magnitude of government expenditure multiplier is smaller than the magnitude of tax multiplier.

D)equal to zero.

E)negative because the magnitude of the tax multiplier is larger than the magnitude of the government expenditure multiplier.

Unlock Deck

Unlock for access to all 223 flashcards in this deck.

Unlock Deck

k this deck

52

Ignoring any supply-side effects, if government expenditure on goods and services decrease by $10 billion and taxes decrease by $10 billion, then real GDP ________ and the price level ________.

A)increases; rises

B)increases; falls

C)decreases; rises

D)decreases; falls

E)does not change; does not change

A)increases; rises

B)increases; falls

C)decreases; rises

D)decreases; falls

E)does not change; does not change

Unlock Deck

Unlock for access to all 223 flashcards in this deck.

Unlock Deck

k this deck

53

Ignoring any supply-side effects, to close a recessionary gap of $100 billion with a government expenditure multiplier of 5, the government could

A)increase government expenditure on goods and services by $100 billion.

B)increase government expenditure on goods and services by $20 billion.

C)raise taxes by $100 billion.

D)raise taxes by more than $20 billion.

E)decrease government expenditure on goods and services by $20 billion.

A)increase government expenditure on goods and services by $100 billion.

B)increase government expenditure on goods and services by $20 billion.

C)raise taxes by $100 billion.

D)raise taxes by more than $20 billion.

E)decrease government expenditure on goods and services by $20 billion.

Unlock Deck

Unlock for access to all 223 flashcards in this deck.

Unlock Deck

k this deck

54

To eliminate a recessionary gap, the government can ________ government expenditures on goods and services or ________ taxes.

A)increase; increase

B)increase; decrease

C)decrease; increase

D)decrease; decrease

E)increase; not change

A)increase; increase

B)increase; decrease

C)decrease; increase

D)decrease; decrease

E)increase; not change

Unlock Deck

Unlock for access to all 223 flashcards in this deck.

Unlock Deck

k this deck

55

If federal taxes are cut by $10 billion, aggregate demand

A)increases by $10 billion.

B)increases by $10 billion multiplied by the government expenditure multiplier.

C)increases by $10 billion multiplied by the tax multiplier.

D)decreases by $10 billion.

E)decreases by $10 billion multiplied by the tax multiplier.

A)increases by $10 billion.

B)increases by $10 billion multiplied by the government expenditure multiplier.

C)increases by $10 billion multiplied by the tax multiplier.

D)decreases by $10 billion.

E)decreases by $10 billion multiplied by the tax multiplier.

Unlock Deck

Unlock for access to all 223 flashcards in this deck.

Unlock Deck

k this deck

56

The balanced budget multiplier is based on the point that the ________ multiplier is larger than the ________ multiplier so that an equal increase in government expenditure and taxes ________ aggregate demand.

A)tax; expenditure; does not change

B)expenditure; tax; does not change

C)expenditure; tax; decreases

D)expenditure; tax; increases

E)tax; expenditure; decreases

A)tax; expenditure; does not change

B)expenditure; tax; does not change

C)expenditure; tax; decreases

D)expenditure; tax; increases

E)tax; expenditure; decreases

Unlock Deck

Unlock for access to all 223 flashcards in this deck.

Unlock Deck

k this deck

57

Ignoring any supply-side effects, if government expenditure on goods and services increase by $10 billion and taxes increase by $10 billion, then real GDP ________ and the price level ________.

A)increases; rises

B)increases; falls

C)decreases; rises

D)decreases; falls

E)does not change; does not change

A)increases; rises

B)increases; falls

C)decreases; rises

D)decreases; falls

E)does not change; does not change

Unlock Deck

Unlock for access to all 223 flashcards in this deck.

Unlock Deck

k this deck

58

If the economy is in equilibrium with real GDP less than potential GDP, there is ________ gap and a fiscal policy that ________ is appropriate.

A)an inflationary; increases aggregate demand

B)an inflationary; decreases aggregate demand

C)a recessionary; increases aggregate demand

D)a recessionary; decreases aggregate demand

E)a recessionary; increases potential GDP

A)an inflationary; increases aggregate demand

B)an inflationary; decreases aggregate demand

C)a recessionary; increases aggregate demand

D)a recessionary; decreases aggregate demand

E)a recessionary; increases potential GDP

Unlock Deck

Unlock for access to all 223 flashcards in this deck.

Unlock Deck

k this deck

59

An economy is at a short-run equilibrium as illustrated in the above figure. An appropriate fiscal policy option to move the economy to full employment is to

A)increase government expenditure and move the economy to a full-employment equilibrium at point c.

B)increase tax rates and move the economy to a full-employment equilibrium at point c.

C)increase government expenditure and move the economy to a full-employment equilibrium at point b.

D)increase tax rates and move the economy to a full-employment equilibrium at point b.

E)lower the interest rate by increasing the quantity of money and move the economy to a full-employment equilibrium at point b.

Unlock Deck

Unlock for access to all 223 flashcards in this deck.

Unlock Deck

k this deck

60

Ignoring any supply-side effects, suppose the government is considering cutting taxes by $100 billion or increasing government expenditures on goods and services by $100 billion. Then

A)both policies would increase aggregate demand by the same amount.

B)both policies would increase aggregate demand but the tax cut has a smaller effect.

C)both policies would increase aggregate demand but the increase in government expenditure has a smaller effect.

D)the tax cut would decrease aggregate demand and the increase in government expenditure would increase aggregate demand.

E)the tax cut would increase aggregate demand and the increase in government expenditure would decrease aggregate demand.

A)both policies would increase aggregate demand by the same amount.

B)both policies would increase aggregate demand but the tax cut has a smaller effect.

C)both policies would increase aggregate demand but the increase in government expenditure has a smaller effect.

D)the tax cut would decrease aggregate demand and the increase in government expenditure would increase aggregate demand.

E)the tax cut would increase aggregate demand and the increase in government expenditure would decrease aggregate demand.

Unlock Deck

Unlock for access to all 223 flashcards in this deck.

Unlock Deck

k this deck

61

An example of automatic fiscal policy is

A)Congress passing a tax rate reduction package.

B)the federal government expanding spending at the Department of Education.

C)expenditure for unemployment compensation increasing as economic growth slows.

D)the Federal Reserve reducing interest rates as economic growth slows.

E)a change in taxes that has no multiplier effect.

A)Congress passing a tax rate reduction package.

B)the federal government expanding spending at the Department of Education.

C)expenditure for unemployment compensation increasing as economic growth slows.

D)the Federal Reserve reducing interest rates as economic growth slows.

E)a change in taxes that has no multiplier effect.

Unlock Deck

Unlock for access to all 223 flashcards in this deck.

Unlock Deck

k this deck

62

Automatic stabilizers are defined as

A)actions taken by the President without Congressional consent to stabilize the economy.

B)actions taken by an act of Congress to stabilize the economy.

C)policy that stabilizes without the need for action by the government.

D)discretionary policy taken to stabilize the economy.

E)policy that has no multiplier effects.

A)actions taken by the President without Congressional consent to stabilize the economy.

B)actions taken by an act of Congress to stabilize the economy.

C)policy that stabilizes without the need for action by the government.

D)discretionary policy taken to stabilize the economy.

E)policy that has no multiplier effects.

Unlock Deck

Unlock for access to all 223 flashcards in this deck.

Unlock Deck

k this deck

63

In order for the United States to use discretionary fiscal policy to deal with a recessionary gap,

A)the public must elect members of Congress that understand economics.

B)the President and Congress must agree on which taxes to hike.

C)time must pass in order for Congress to decide what taxes and government programs to change.

D)the President's and Congress's economic advisors must agree on the proper government programs to slash.

E)since 2002, the President has been given the authority to make up to a 10 percentage point change in government expenditure programs.

A)the public must elect members of Congress that understand economics.

B)the President and Congress must agree on which taxes to hike.

C)time must pass in order for Congress to decide what taxes and government programs to change.

D)the President's and Congress's economic advisors must agree on the proper government programs to slash.

E)since 2002, the President has been given the authority to make up to a 10 percentage point change in government expenditure programs.

Unlock Deck

Unlock for access to all 223 flashcards in this deck.

Unlock Deck

k this deck

64

In an expansion, federal tax receipts increase proportionally more than real GDP without the need for any government policy. This increase is an example of

A)discretionary monetary policy.

B)automatic monetary policy.

C)automatic fiscal policy.

D)discretionary fiscal policy.

E)the effect of deficit spending.

A)discretionary monetary policy.

B)automatic monetary policy.

C)automatic fiscal policy.

D)discretionary fiscal policy.

E)the effect of deficit spending.

Unlock Deck

Unlock for access to all 223 flashcards in this deck.

Unlock Deck

k this deck

65

An increase in government expenditure can ________ potential GDP and an increase in taxes can ________ potential GDP.

A)increase; increase

B)increase; never change

C)decrease; decrease

D)never change; never change

E)increase; decrease

A)increase; increase

B)increase; never change

C)decrease; decrease

D)never change; never change

E)increase; decrease

Unlock Deck

Unlock for access to all 223 flashcards in this deck.

Unlock Deck

k this deck

66

If a tax cut increases people's labor supply, then

A)tax cuts increase potential GDP.

B)tax cuts decrease aggregate demand.

C)tax cuts decrease potential GDP because the real wage rate falls.

D)tax cuts cannot affect aggregate demand.

E)Both answers B and C are correct.

A)tax cuts increase potential GDP.

B)tax cuts decrease aggregate demand.

C)tax cuts decrease potential GDP because the real wage rate falls.

D)tax cuts cannot affect aggregate demand.

E)Both answers B and C are correct.

Unlock Deck

Unlock for access to all 223 flashcards in this deck.

Unlock Deck

k this deck

67

The supply-side effects show that a tax cut on labor income ________ employment and ________ potential GDP.

A)increases; increases

B)increases; does not change

C)increases; decreases

D)decreases; increases

E)decreases; decreases

A)increases; increases

B)increases; does not change

C)increases; decreases

D)decreases; increases

E)decreases; decreases

Unlock Deck

Unlock for access to all 223 flashcards in this deck.

Unlock Deck

k this deck

68

Fiscal policies that move the economy toward potential GDP without a change in policy are called

A)routine stabilizers.

B)automatic stabilizers.

C)spending stabilizers.

D)economic stabilizers.

E)GDP stabilizers.

A)routine stabilizers.

B)automatic stabilizers.

C)spending stabilizers.

D)economic stabilizers.

E)GDP stabilizers.

Unlock Deck

Unlock for access to all 223 flashcards in this deck.

Unlock Deck

k this deck

69

The use of discretionary fiscal policy is hampered by i. difficulty of estimating the level of potential GDP.

Ii. lack of accuracy of economic forecasts.

Iii. the small impact tax cuts and increases in government expenditure have on aggregate demand.

A)i only

B)ii only

C)iii only

D)i and ii

E)i, ii, and iii

Ii. lack of accuracy of economic forecasts.

Iii. the small impact tax cuts and increases in government expenditure have on aggregate demand.

A)i only

B)ii only

C)iii only

D)i and ii

E)i, ii, and iii

Unlock Deck

Unlock for access to all 223 flashcards in this deck.

Unlock Deck

k this deck

70

If a tax cut increases aggregate demand more than aggregate supply, real GDP ________ and the price level ________.

A)increases; rises

B)increases; falls

C)decreases; rises

D)decreases; falls

E)increases; does not change

A)increases; rises

B)increases; falls

C)decreases; rises

D)decreases; falls

E)increases; does not change

Unlock Deck

Unlock for access to all 223 flashcards in this deck.

Unlock Deck

k this deck

71

There are four limitations to the effectiveness of discretionary fiscal policy. Which item below is NOT one of these limitations?

A)shrinking area of law-maker discretion

B)law-making time lag

C)estimating potential GDP

D)fiscal multiplier

E)economic forecasting

A)shrinking area of law-maker discretion

B)law-making time lag

C)estimating potential GDP

D)fiscal multiplier

E)economic forecasting

Unlock Deck

Unlock for access to all 223 flashcards in this deck.

Unlock Deck

k this deck

72

An income tax hike

A)increases potential GDP.

B)increases employment.

C)decreases potential GDP.

D)Both answers A and B are correct.

E)Both answers B and C are correct.

A)increases potential GDP.

B)increases employment.

C)decreases potential GDP.

D)Both answers A and B are correct.

E)Both answers B and C are correct.

Unlock Deck

Unlock for access to all 223 flashcards in this deck.

Unlock Deck

k this deck

73

Which of the following is a limitation of discretionary fiscal policy?

I. law-making lags

Ii. estimating potential GDP

Iii. income gap

A)i only

B)ii only

C)iii only

D)i and ii

E)i, ii, and iii

I. law-making lags

Ii. estimating potential GDP

Iii. income gap

A)i only

B)ii only

C)iii only

D)i and ii

E)i, ii, and iii

Unlock Deck

Unlock for access to all 223 flashcards in this deck.

Unlock Deck

k this deck

74

Government expenditure ________ change potential GDP and taxes ________ change potential GDP.

A)can; can

B)cannot; can

C)can; cannot

D)cannot; cannot

E)None of the above answers is correct.

A)can; can

B)cannot; can

C)can; cannot

D)cannot; cannot

E)None of the above answers is correct.

Unlock Deck

Unlock for access to all 223 flashcards in this deck.

Unlock Deck

k this deck

75

Automatic changes in tax revenues and expenditures that occur as a result of fluctuations in real GDP are referred to as automatic

A)taxes and expenditure.

B)discretionary taxes and expenditure.

C)government.

D)stabilizers.

E)discretionary policy.

A)taxes and expenditure.

B)discretionary taxes and expenditure.

C)government.

D)stabilizers.

E)discretionary policy.

Unlock Deck

Unlock for access to all 223 flashcards in this deck.

Unlock Deck

k this deck

76

Which of the following is an example of an automatic fiscal policy action?

A)increased unemployment payments resulting from higher unemployment

B)an increase in spending on defense goods resulting from increased world tensions

C)an increase in the tax rate resulting from a desire to shrink the budget deficit

D)a decrease in the tax rate resulting from an effort to increase aggregate demand to combat a recession

E)None of the above answers are correct.

A)increased unemployment payments resulting from higher unemployment

B)an increase in spending on defense goods resulting from increased world tensions

C)an increase in the tax rate resulting from a desire to shrink the budget deficit

D)a decrease in the tax rate resulting from an effort to increase aggregate demand to combat a recession

E)None of the above answers are correct.

Unlock Deck

Unlock for access to all 223 flashcards in this deck.

Unlock Deck

k this deck

77

An increase in income taxes ________ employment and ________ potential GDP.

A)increases; increases

B)increases; does not change

C)decreases; decreases

D)does not change; does not change

E)increases; decreases

A)increases; increases

B)increases; does not change

C)decreases; decreases

D)does not change; does not change

E)increases; decreases

Unlock Deck

Unlock for access to all 223 flashcards in this deck.

Unlock Deck

k this deck

78

The law-making time lag is best described as the time that it takes

A)Congress to realize that new laws must be passed to change taxes or spending.

B)a newly passed law to become the norm in daily lives.

C)the President to sign a bill sent from Congress.

D)a jury to render a verdict.

E)Congress to pass laws needed to change taxes or spending.

A)Congress to realize that new laws must be passed to change taxes or spending.

B)a newly passed law to become the norm in daily lives.

C)the President to sign a bill sent from Congress.

D)a jury to render a verdict.

E)Congress to pass laws needed to change taxes or spending.

Unlock Deck

Unlock for access to all 223 flashcards in this deck.

Unlock Deck

k this deck

79

A reason why discretionary fiscal policy might move the economy away from potential GDP instead of toward potential GDP is that

A)economic forecasts consistently underestimate the impact of fiscal policy.

B)it is difficult to know whether real GDP is above or below potential GDP.

C)during a recession, politicians prefer increases in government spending over decreasing taxes.

D)government programs automatically move real GDP away from potential GDP.

E)government programs are always expansionary.

A)economic forecasts consistently underestimate the impact of fiscal policy.

B)it is difficult to know whether real GDP is above or below potential GDP.

C)during a recession, politicians prefer increases in government spending over decreasing taxes.

D)government programs automatically move real GDP away from potential GDP.

E)government programs are always expansionary.

Unlock Deck

Unlock for access to all 223 flashcards in this deck.

Unlock Deck

k this deck

80

Looking at the supply-side effects on aggregate supply shows that a tax hike on labor income

A)weakens the incentive to work.

B)decreases potential GDP.

C)increases potential GDP because people work more to pay the higher taxes.

D)Both answers A and B are correct.

E)None of the above is correct.

A)weakens the incentive to work.

B)decreases potential GDP.

C)increases potential GDP because people work more to pay the higher taxes.

D)Both answers A and B are correct.

E)None of the above is correct.

Unlock Deck

Unlock for access to all 223 flashcards in this deck.

Unlock Deck

k this deck