Deck 16: External Costs and Environmental Policy

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/100

Play

Full screen (f)

Deck 16: External Costs and Environmental Policy

1

Suppose that a paper producer dumps its waste into a local river.Explain why this situation is inefficient.

Firms maximize profit by taking into account the marginal cost of production.As long as the marginal cost represents the true opportunity cost of the resources used in production,the outcome is efficient.However,if a firm is dumping its waste into a river,and is not taking the cost of this resource into account,it will produce too much of the good.

2

Water pollution is not an example of an external cost.

False

3

Once a firm is forced to consider an external cost,the price of its product will ________ and output will ________.

A) increase; decrease

B) increase; increase

C) decrease; decrease

D) decrease; increase

A) increase; decrease

B) increase; increase

C) decrease; decrease

D) decrease; increase

increase; decrease

4

Reductions in pollution from a specific starting level of existing pollution is called

A) abatement.

B) the EPA.

C) command and control.

D) usage tax.

A) abatement.

B) the EPA.

C) command and control.

D) usage tax.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

5

Which of the following would be classified as an external cost?

A) As more firms began hiring computer programmers, the salaries of computer programmers increased and therefore the firm's cost of production increased.

B) You eat too much pizza and end up with a stomach ache.

C) You are not able to study at night because there is so much noise coming from the dorm room next to yours.

D) When you purchase a prescription drug you are not made fully aware of all the possible side effects that may result from taking the drug.

A) As more firms began hiring computer programmers, the salaries of computer programmers increased and therefore the firm's cost of production increased.

B) You eat too much pizza and end up with a stomach ache.

C) You are not able to study at night because there is so much noise coming from the dorm room next to yours.

D) When you purchase a prescription drug you are not made fully aware of all the possible side effects that may result from taking the drug.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

6

Jason and Lauren live in the countryside 30 minutes from a large city in Virginia.They moved there because they wanted to enjoy the fresh air.After a year of living in their house,the 200 acres that surround their house were zoned for an industrial property.A paper mill was built in the area and now emits strong gases that can be smelled from miles away.The paper mill's emission of gases is an example of a(n)

A) public good.

B) good that imposes an external cost.

C) good that provides an external benefit.

D) efficient good.

A) public good.

B) good that imposes an external cost.

C) good that provides an external benefit.

D) efficient good.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

7

Give an example of an external cost and explain why the outcome is inefficient.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

8

Comment on the following statement: "The socially optimal amount of pollution is zero."

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

9

Consumers,not producers,gain from pollution abatement.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

10

Pollution abatement results in benefits that exceed the costs to society.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

11

Economically speaking,it would be socially optimal to chose the level of pollution where the marginal abatement cost is considerably less than the marginal benefit.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

12

Which of the following is an example of an external cost?

A) a loud, crying baby in a public restaurant

B) emissions of methane into the atmosphere

C) a homeowner who likes to mow the lawn at 7 a.m. on Saturday morning

D) all of the above

A) a loud, crying baby in a public restaurant

B) emissions of methane into the atmosphere

C) a homeowner who likes to mow the lawn at 7 a.m. on Saturday morning

D) all of the above

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

13

If,while producing goods and services,a factory is producing pollution and not incurring the cost of this pollution,then a(n)________ exists.

A) government failure

B) market failure

C) acceptable outcome

D) none of the above

A) government failure

B) market failure

C) acceptable outcome

D) none of the above

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

14

The optimum level of pollution abatement is where the marginal benefit is greater than the marginal cost.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

15

An external cost of production is

A) a cost incurred by someone other than the producer.

B) the production cost borne by a producer.

C) the result of the sum of private and social cost.

D) another word for a tax.

A) a cost incurred by someone other than the producer.

B) the production cost borne by a producer.

C) the result of the sum of private and social cost.

D) another word for a tax.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

16

If a producer is imposing an external cost on society,the best response would be to

A) lower the producer's taxes to offset pollution.

B) increase the production.

C) internalize the externality.

D) subsidize the producer.

A) lower the producer's taxes to offset pollution.

B) increase the production.

C) internalize the externality.

D) subsidize the producer.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

17

The government imposes taxes on firms which generate external costs in an effort to

A) make it easier for economists to measure external costs.

B) lead to a zero level of output.

C) force decision makers to consider the full costs of their actions.

D) lower the firms' costs of production.

A) make it easier for economists to measure external costs.

B) lead to a zero level of output.

C) force decision makers to consider the full costs of their actions.

D) lower the firms' costs of production.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

18

Markets which have external costs will produce ________ output than the socially efficient level whereas markets which have external benefits will produce ________ output than the socially efficient level.

A) less; less

B) more; more

C) more; less

D) less; more

A) less; less

B) more; more

C) more; less

D) less; more

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

19

Recall the Application about determining the optimal level of methane abatement to answer the following question(s).

Recall the Application.What does the optimal level of methane abatement depend on?

A) the level at which the polluting firms are able to maximize their profits

B) the total cost of abatement

C) the marginal benefit of abatement

D) It is not possible to determine an optimal level of methane.

Recall the Application.What does the optimal level of methane abatement depend on?

A) the level at which the polluting firms are able to maximize their profits

B) the total cost of abatement

C) the marginal benefit of abatement

D) It is not possible to determine an optimal level of methane.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

20

Based on society's perspective,what are the benefits from pollution abatement?

A) better health

B) increased enjoyment of the natural environment

C) lower production costs

D) all of the above

A) better health

B) increased enjoyment of the natural environment

C) lower production costs

D) all of the above

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

21

A pollution tax lowers the price of the good or service produced by the polluting firm in a competitive market.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

22

When the government imposes a tax on a firm that generates external costs,the tax is

A) always borne entirely by the firm.

B) always borne entirely by the consumer.

C) usually borne by both the firm and the consumer.

D) borne only by the government.

A) always borne entirely by the firm.

B) always borne entirely by the consumer.

C) usually borne by both the firm and the consumer.

D) borne only by the government.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

23

A power plant is emitting nitrogen oxides,a contributing factor in acid rain and in urban smog.If the power plant is taxed on the emission of nitrogen oxides,we can expect the amount of energy produced by the power plant to decrease.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

24

In a market characterized by external benefits,the market equilibrium is not socially optimal.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

25

The idea behind the pollution tax equal to the external cost per unit of pollution is to

A) increase the social benefit to be above the marginal cost.

B) internalize the externality.

C) allow the firm to evade external costs.

D) drive polluting firms out of developed countries.

A) increase the social benefit to be above the marginal cost.

B) internalize the externality.

C) allow the firm to evade external costs.

D) drive polluting firms out of developed countries.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

26

A tax or charge equal to the external cost per unit of pollution is called abatement.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

27

Taxes on a firm's external costs

A) are designed to encourage more production.

B) are meant to force some firms out of business.

C) are simply meant to force decision makers to consider the full costs of their actions.

D) are designed primarily as a way to raise money so that the government can compensate the victims of the spillover.

A) are designed to encourage more production.

B) are meant to force some firms out of business.

C) are simply meant to force decision makers to consider the full costs of their actions.

D) are designed primarily as a way to raise money so that the government can compensate the victims of the spillover.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

28

A company earns $200,000 in profit.The total costs paid by the firm are $800,000.Production of the goods contaminates the river and small lakes,which reduces the profits of salmon fishermen by $90,000.The external cost to society of the company's production is

A) $90,000.

B) $110,000.

C) $200,000.

D) $600,000.

A) $90,000.

B) $110,000.

C) $200,000.

D) $600,000.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

29

Comment on the following statement: "When an external cost is present and a firm does not factor this cost into its decisions,the firm is likely to produce a level of output that is lower than the efficient level."

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

30

In essence,a pollution tax places a price on the right to pollute.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

31

When the government taxes a firm that generates an external cost,the profit-maximizing firm will produce

A) more units of output than before the tax was imposed.

B) the same number of units of output as before the tax was imposed.

C) fewer units of output than before the tax was imposed.

D) either more or fewer units of output than before the tax was imposed.

A) more units of output than before the tax was imposed.

B) the same number of units of output as before the tax was imposed.

C) fewer units of output than before the tax was imposed.

D) either more or fewer units of output than before the tax was imposed.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

32

If a tax is placed on the output of perfectly competitive firm that imposes external costs on society,the firm's marginal cost curve will shift ________ and the market supply curve will shift to the ________.

A) down; left

B) down; right

C) up; right

D) up; left

A) down; left

B) down; right

C) up; right

D) up; left

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

33

Recall the Application about how to wash carbon out of the air to answer the following question(s).

Recall the Application.Assume a firm that produces CO₂ has a marginal cost of abatement of $45 per ton and faces a carbon tax of $35 per ton.If the cost of carbon washing is $25 per ton,the firm could save ________ per ton and emit ________ carbon into the atmosphere by using a carbon washing machine.

A) $20; less

B) $20; more

C) $10; less

D) $10; more

Recall the Application.Assume a firm that produces CO₂ has a marginal cost of abatement of $45 per ton and faces a carbon tax of $35 per ton.If the cost of carbon washing is $25 per ton,the firm could save ________ per ton and emit ________ carbon into the atmosphere by using a carbon washing machine.

A) $20; less

B) $20; more

C) $10; less

D) $10; more

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

34

The study of external costs is a major concern of

A) labor economics.

B) international economics.

C) environmental economics.

D) macroeconomists.

A) labor economics.

B) international economics.

C) environmental economics.

D) macroeconomists.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

35

The social cost of production is the sum of the private cost and external cost.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

36

What role can the government play in correcting for external costs?

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

37

What is an external cost?

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

38

When will firms produce an output level that is above the socially efficient level?

A) when there are external costs of production equal to marginal benefits

B) when there are internal costs of production and firms do not have to account for them

C) when there are external costs of production and firms do not have to account for them

D) when there are external costs of production and firms have account for them

A) when there are external costs of production equal to marginal benefits

B) when there are internal costs of production and firms do not have to account for them

C) when there are external costs of production and firms do not have to account for them

D) when there are external costs of production and firms have account for them

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

39

If the government taxes a firm that is generating an external cost,the price of the firm's product will ________ and output will ________.

A) increase; decrease

B) increase; increase

C) decrease; decrease

D) decrease; increase

A) increase; decrease

B) increase; increase

C) decrease; decrease

D) decrease; increase

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

40

For which of the following goods would the imposition of a tax most likely improve the efficiency of the market outcome?

A) the production of a good with external benefits

B) the production of a rival good with no external costs

C) the production of a good with external costs

D) the production of a public good

A) the production of a good with external benefits

B) the production of a rival good with no external costs

C) the production of a good with external costs

D) the production of a public good

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

41

Under a traditional pollution regulation,the government tells each firm how much pollution to abate and what abatement techniques to implement.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

42

Taxes on external costs are unlike other taxes because they

A) distort the incentives of the firms being taxed.

B) move the allocation of resources closer to the social optimum.

C) lead to a large deadweight loss.

D) raise revenue for the government.

A) distort the incentives of the firms being taxed.

B) move the allocation of resources closer to the social optimum.

C) lead to a large deadweight loss.

D) raise revenue for the government.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

43

Suppose that a paper producer is dumping waste into a nearby river.The government imposes a tax to correct for this external cost.What will be the effects of this pollution tax on the market for paper in a competitive market?

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

44

If we compare the effects of a pollution tax with those of a command-and-control policy,production cost will be

A) the same under a command-and-control policy and a pollution tax.

B) higher under a command-and-control policy than they would be under a pollution tax.

C) less under a command-and-control policy than they would be under a pollution tax.

D) none of the above

A) the same under a command-and-control policy and a pollution tax.

B) higher under a command-and-control policy than they would be under a pollution tax.

C) less under a command-and-control policy than they would be under a pollution tax.

D) none of the above

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

45

In most cases,taxation is more likely to be inefficient than regulation because taxation corrects for only external costs at a higher overall cost to society.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

46

One advantage that a command-and-control policy has over a pollution tax is that

A) we will be able to accurately predict the amount of pollution that will occur.

B) it generates a lower level of pollution at a lower cost.

C) it encourages firms to use the most efficient abatement methods possible.

D) it will lower the prices of products produced by polluting firms.

A) we will be able to accurately predict the amount of pollution that will occur.

B) it generates a lower level of pollution at a lower cost.

C) it encourages firms to use the most efficient abatement methods possible.

D) it will lower the prices of products produced by polluting firms.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

47

Command-and-control policies are more effective than pollution taxes.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

48

Under a command-and-control policy,there is no incentive to develop better abatement techniques.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

49

Comment on the following statement: "Taxes on pollution are typically used to eliminate the pollution generated."

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

50

Which of the following is a problem that occurs with command-and-control policies?

A) They lead to increased pollution.

B) They decrease the firm's incentives to develop more efficient abatement technologies.

C) An abatement technology that is efficient for one firm may be inefficient for others.

D) B and C are correct.

A) They lead to increased pollution.

B) They decrease the firm's incentives to develop more efficient abatement technologies.

C) An abatement technology that is efficient for one firm may be inefficient for others.

D) B and C are correct.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

51

A command-and-control policy causes firms to use inefficient abatement technologies,so production costs will be higher than they would be under a pollution tax.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

52

Command-and-control policies mandate

A) the use of a particular abatement control technology.

B) the level of output that the firm can produce.

C) the price that the firm can charge for its output.

D) the level of output and the price the firm can charge for its output.

A) the use of a particular abatement control technology.

B) the level of output that the firm can produce.

C) the price that the firm can charge for its output.

D) the level of output and the price the firm can charge for its output.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

53

The least costly method for reducing pollution would be to have all firms lower their levels of emissions by the same amount.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

54

Under the command-and-control regulation,the supply curve for the polluting good will shift downward by a larger amount than it would with a tax regulation.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

55

One advantage of command-and-control policy is its power to reduce the prices of the goods produced by polluting firms.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

56

Why would a firm continue to pollute even when it is fined (taxed)for doing so?

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

57

In most cases,pollution taxes are more efficient than command-and-control policies at achieving a desired reduction in the level of pollution because

A) they can reduce the level of pollution at a lower cost to society.

B) the market price and quantity are not affected.

C) they make the firm pay for the pollution that they generate.

D) all of the above

A) they can reduce the level of pollution at a lower cost to society.

B) the market price and quantity are not affected.

C) they make the firm pay for the pollution that they generate.

D) all of the above

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

58

Recall the Application about reducing pollution generated from international shipping to answer the following question(s).

According to the Application,3% of global CO₂ emissions come from international shipping.What tool did the policy analysts use for comparing the cost of alternative reduction methods?

A) They computed the average marginal cost of each method.

B) They computed the marginal abatement cost of each method.

C) They computed the total marginal cost of each method.

D) The analysts were unable to compare the costs of alternative reduction methods.

According to the Application,3% of global CO₂ emissions come from international shipping.What tool did the policy analysts use for comparing the cost of alternative reduction methods?

A) They computed the average marginal cost of each method.

B) They computed the marginal abatement cost of each method.

C) They computed the total marginal cost of each method.

D) The analysts were unable to compare the costs of alternative reduction methods.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

59

If the government were to limit the release of air pollution produced by a chemical company to 20,000 units,this policy would be considered a

A) command-and-control policy.

B) subsidy.

C) market-based solution.

D) tax.

A) command-and-control policy.

B) subsidy.

C) market-based solution.

D) tax.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

60

Suppose there are only two tire manufacturers in an area,and they generate the same amount of carbon emission pollution per hour.The only difference is that firm 1 is a low-cost firm and firm 2 is a high-cost firm.What would we expect if the government were to use a uniform abatement policy?

A) The demand for tires will increase.

B) The quantity of tires produced will increase.

C) The uniform abatement policy is likely to be inefficient.

D) The uniform abatement policy is likely to be efficient.

A) The demand for tires will increase.

B) The quantity of tires produced will increase.

C) The uniform abatement policy is likely to be inefficient.

D) The uniform abatement policy is likely to be efficient.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

61

When one firm sells its pollution permit to another firm,

A) the total amount of pollution generated rises.

B) both firms benefit.

C) the government determines the price of the permit.

D) all of the above

A) the total amount of pollution generated rises.

B) both firms benefit.

C) the government determines the price of the permit.

D) all of the above

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

62

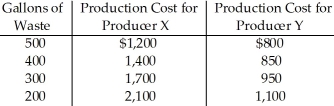

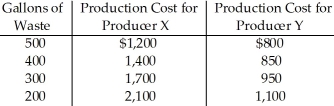

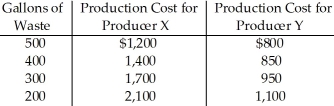

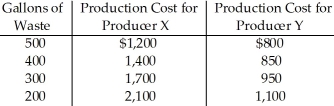

Table 16.1

Producers X and Y dump waste into a local river.Table 16.1 shows the production costs each firm faces at different levels of waste.For Producer Y,the marginal cost of reducing waste from 500 gallons to 400 gallons is

A) $850.

B) $800.

C) $100.

D) $50.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

63

When dealing with a pollution problem,pollution permits are more efficient than taxes or command-and-control policies because

A) firms with low costs of abatement can buy more permits.

B) the government will generate more revenue from the sale of permits than through a pollution tax.

C) firms with high costs of abatement can buy more permits.

D) a pollution permit system will lead to all firms producing less pollution.

A) firms with low costs of abatement can buy more permits.

B) the government will generate more revenue from the sale of permits than through a pollution tax.

C) firms with high costs of abatement can buy more permits.

D) a pollution permit system will lead to all firms producing less pollution.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

64

In markets where external costs exist,efficiency cannot be enhanced by the creation of marketable pollution permits.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

65

Under a system of marketable pollution permits,the ________ amount of permits supplied,the ________ the equilibrium price charged for each permit:

A) higher; higher

B) higher; lower

C) lower; lower

D) It cannot be determined.

A) higher; higher

B) higher; lower

C) lower; lower

D) It cannot be determined.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

66

Table 16.1

Producers X and Y dump waste into a local river.Table 16.1 shows the production costs each firm faces at different levels of waste.For Producer X,the marginal cost of reducing waste from 500 gallons to 400 gallons is

A) $1,400.

B) $300.

C) $240.

D) $200.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

67

List two reasons why command-and-control policies may be inefficient.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

68

One advantage of pollution permits over pollution taxes is

A) pollution permits allow firms to choose their profit-maximizing level of pollution while taxes do not.

B) pollution permits generate more revenue for the government than do pollution taxes.

C) the government can set a maximum level of pollution using pollution permits.

D) none of the above

A) pollution permits allow firms to choose their profit-maximizing level of pollution while taxes do not.

B) pollution permits generate more revenue for the government than do pollution taxes.

C) the government can set a maximum level of pollution using pollution permits.

D) none of the above

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

69

The ability of marketable pollution permits to efficiently lower the level of pollution is dependent on the initial allocation of the permits.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

70

Tradable pollution permits

A) will be sold by firms that have relatively low abatement costs.

B) reduce the level of pollution to zero.

C) are likely to lead to a higher total level of pollution in an area.

D) cause each firm to reduce the level of pollution it generates by the same amount.

A) will be sold by firms that have relatively low abatement costs.

B) reduce the level of pollution to zero.

C) are likely to lead to a higher total level of pollution in an area.

D) cause each firm to reduce the level of pollution it generates by the same amount.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

71

A company earns $70,000 in profit if it is allowed to dump untreated waste in the river and only $40,000 in profit if it is forced to treat the waste before dumping it into the river.The local fishermen earn $35,000 in profit if the river is polluted and $55,000 in profit if the river is not polluted.The fishermen would be willing to pay the company up to ________ not to pollute the river,and the company would be willing to accept a minimum of ________ if it agrees not to pollute the river.

A) $15,000; $30,000

B) $20,000; $30,000

C) $30,000; $20,000

D) $20,000; $5,000

A) $15,000; $30,000

B) $20,000; $30,000

C) $30,000; $20,000

D) $20,000; $5,000

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

72

A market for pollution permits can efficiently allocate the right to pollute.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

73

Another name for marketable pollution permits is a cap-and-trade system.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

74

Once the tradable pollution permits have been issued to firms,

A) each firm will reduce the level of pollution it generates.

B) the government determines the price of the permits.

C) firms with the highest cost of pollution abatement will have the greatest willingness to pay for the permits.

D) firms with very low pollution abatement costs will purchase more permits.

A) each firm will reduce the level of pollution it generates.

B) the government determines the price of the permits.

C) firms with the highest cost of pollution abatement will have the greatest willingness to pay for the permits.

D) firms with very low pollution abatement costs will purchase more permits.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

75

How does the outcome of a command-and-control policy compare with the outcome of a pollution tax?

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

76

Table 16.1

Producers X and Y dump waste into a local river.Table 16.1 shows the production costs each firm faces at different levels of waste.The government in the area has created a set of pollution permits.Each permit allows a producer to dump 100 gallons of waste.If the government issues an equal number of pollution permits to each producer,

A) neither producer will want to sell its permits at a price of $300.

B) Producer X will be more willing to sell its permits than will Producer Y.

C) both producers would be willing to sell all permits at a price of $50.

D) Producer Y will be more willing to sell its permits than will Producer X.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

77

Table 16.1

Producers X and Y dump waste into a local river.Table 16.1 shows the production costs each firm faces at different levels of waste.The marginal cost of reducing waste

A) is equal for both producers.

B) is higher for Producer Y.

C) falls as the level of waste dumped falls.

D) is higher for Producer X.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

78

Which of the following is a more efficient way to lower pollution than a command-and-control policy?

A) production subsidies

B) antitrust policy

C) marketable pollution permits

D) cost regulation

A) production subsidies

B) antitrust policy

C) marketable pollution permits

D) cost regulation

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

79

What is a command-and-control policy?

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

80

Which of the following is a way that the government runs a system of marketable pollution permits?

A) picks a target pollution level

B) oversupplies the market with permits

C) prohibits the trading of permits

D) all of the above

A) picks a target pollution level

B) oversupplies the market with permits

C) prohibits the trading of permits

D) all of the above

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck