Deck 6: The Theory of Tariffs and Quotas

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/71

Play

Full screen (f)

Deck 6: The Theory of Tariffs and Quotas

1

High tariffs on intermediate inputs

A)increase the effective rate of protection on final goods.

B)have no impact on the effective rate of protection on final goods.

C)decrease the effective rate of protection on final goods.

D)lower the nominal rate of protection on final goods.

A)increase the effective rate of protection on final goods.

B)have no impact on the effective rate of protection on final goods.

C)decrease the effective rate of protection on final goods.

D)lower the nominal rate of protection on final goods.

C

2

Nominal rates of protection

A)are always greater than effective rates of protection.

B)are always smaller than effective rates of protection.

C)refer to the tariffs placed on intermediate goods used to make the final good or service.

D)cannot be negative.

A)are always greater than effective rates of protection.

B)are always smaller than effective rates of protection.

C)refer to the tariffs placed on intermediate goods used to make the final good or service.

D)cannot be negative.

D

3

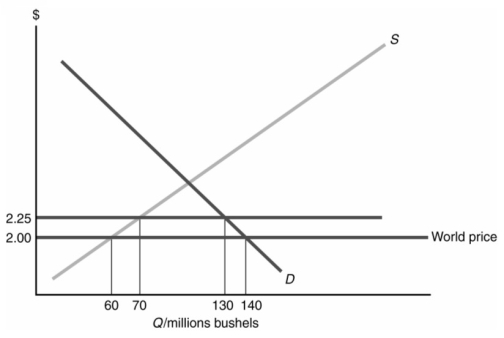

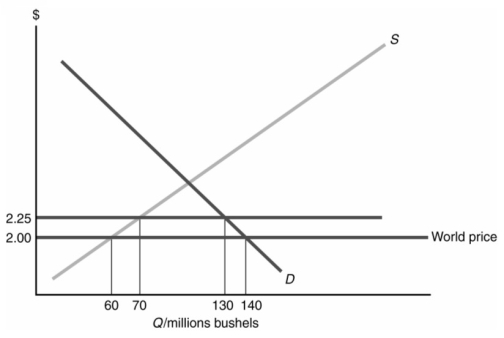

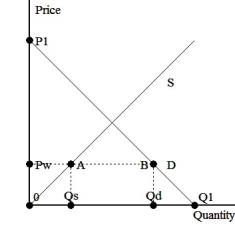

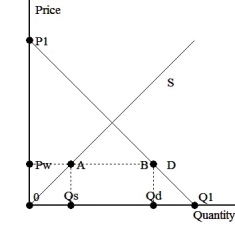

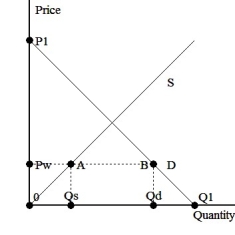

Figure 6.1

Based on Figure 6.1,suppose the government puts a tariff of $0.25 per bushel on soybean imports.How much will the tariff reduce imports?

A)Imports will decrease by 10 million bushels.

B)Imports will decrease by 20 million bushels.

C)Imports will decrease by 60 million bushels.

D)Imports will not change after the tariff.

Based on Figure 6.1,suppose the government puts a tariff of $0.25 per bushel on soybean imports.How much will the tariff reduce imports?

A)Imports will decrease by 10 million bushels.

B)Imports will decrease by 20 million bushels.

C)Imports will decrease by 60 million bushels.

D)Imports will not change after the tariff.

B

4

Efficiency losses are

A)deadweight losses caused by consumers being prevented by tariffs from buying products at the world price, products that they value more highly than that price.

B)the total loss in consumer surplus from a tariff.

C)the increase in producer surplus that is created by a tariff.

D)the deadweight loss that is created because domestic firms have to charge higher prices to produce units of output than foreign firms would have to charge.

A)deadweight losses caused by consumers being prevented by tariffs from buying products at the world price, products that they value more highly than that price.

B)the total loss in consumer surplus from a tariff.

C)the increase in producer surplus that is created by a tariff.

D)the deadweight loss that is created because domestic firms have to charge higher prices to produce units of output than foreign firms would have to charge.

Unlock Deck

Unlock for access to all 71 flashcards in this deck.

Unlock Deck

k this deck

5

Average tariff rates are highest for

A)high-income countries.

B)middle-income countries.

C)low-income countries.

D)industrialized countries.

A)high-income countries.

B)middle-income countries.

C)low-income countries.

D)industrialized countries.

Unlock Deck

Unlock for access to all 71 flashcards in this deck.

Unlock Deck

k this deck

6

Based on Scenario 6.1 above,if a tariff of 20 percent is placed on imports of dining room tables,the effective rate of protection is

A)20 percent.

B)25 percent.

C)30 percent.

D)40 percent.

A)20 percent.

B)25 percent.

C)30 percent.

D)40 percent.

Unlock Deck

Unlock for access to all 71 flashcards in this deck.

Unlock Deck

k this deck

7

Which of the following is FALSE?

A)Consumer surplus increases after a tariff is placed on imports.

B)Producer surplus increases after a tariff is imposed.

C)Government revenue increases after a tariff is imposed.

D)Deadweight losses result from tariffs.

A)Consumer surplus increases after a tariff is placed on imports.

B)Producer surplus increases after a tariff is imposed.

C)Government revenue increases after a tariff is imposed.

D)Deadweight losses result from tariffs.

Unlock Deck

Unlock for access to all 71 flashcards in this deck.

Unlock Deck

k this deck

8

Producer surplus is equal to the area

A)under the demand curve and above the supply curve.

B)above the supply curve and below the price line.

C)under the supply curve.

D)under the demand curve and above the price line.

A)under the demand curve and above the supply curve.

B)above the supply curve and below the price line.

C)under the supply curve.

D)under the demand curve and above the price line.

Unlock Deck

Unlock for access to all 71 flashcards in this deck.

Unlock Deck

k this deck

9

Consumer surplus is equal to the area

A)under the demand curve and above the supply curve.

B)above the supply curve and below the price line.

C)under the demand curve.

D)under the demand curve and above the price line.

A)under the demand curve and above the supply curve.

B)above the supply curve and below the price line.

C)under the demand curve.

D)under the demand curve and above the price line.

Unlock Deck

Unlock for access to all 71 flashcards in this deck.

Unlock Deck

k this deck

10

Suppose a manufacturer of software develops a new computer program that sells for $50.The $50 cost includes $0.25 for the CD it is stored on,$5 for the labor of the company software programmers,and $1.75 for packaging materials and transportation costs.Value added by the software company is

A)$49.75.

B)$48.25.

C)$48.

D)$44.75.

A)$49.75.

B)$48.25.

C)$48.

D)$44.75.

Unlock Deck

Unlock for access to all 71 flashcards in this deck.

Unlock Deck

k this deck

11

In a small country,the net national cost of tariff protection is equal to the reduction in consumer surplus minus

A)the increase in government revenue and the increase in producer surplus.

B)the increase in government revenue.

C)the increase in producer surplus.

D)the efficiency loss and the consumption side loss.

A)the increase in government revenue and the increase in producer surplus.

B)the increase in government revenue.

C)the increase in producer surplus.

D)the efficiency loss and the consumption side loss.

Unlock Deck

Unlock for access to all 71 flashcards in this deck.

Unlock Deck

k this deck

12

In order for large countries to successfully use tariffs to increase well-being,

A)they must have significant market power .

B)the deadweight loss created by the tariff must be greater than the government revenue the tariff generates.

C)domestic production must increase more significantly than for the small country case.

D)domestic consumption and imports must decrease more significantly than in the small country case.

A)they must have significant market power .

B)the deadweight loss created by the tariff must be greater than the government revenue the tariff generates.

C)domestic production must increase more significantly than for the small country case.

D)domestic consumption and imports must decrease more significantly than in the small country case.

Unlock Deck

Unlock for access to all 71 flashcards in this deck.

Unlock Deck

k this deck

13

Which of the following would be a deadweight loss from a tariff?

A)The shift of consumer surplus to government

B)The increase in producer surplus

C)The decrease in consumer surplus

D)The decrease in consumer surplus due to a drop in consumption

A)The shift of consumer surplus to government

B)The increase in producer surplus

C)The decrease in consumer surplus

D)The decrease in consumer surplus due to a drop in consumption

Unlock Deck

Unlock for access to all 71 flashcards in this deck.

Unlock Deck

k this deck

14

Which of the following is NOT correct about the effects of a tariff on an imported product?

A)Tariffs benefit domestic producers by raising price and domestic output.

B)Tariffs increase government revenue.

C)Tariffs mean higher prices and less consumption for consumers of the product.

D)Tariffs increase the efficiency of how resources are allocated.

A)Tariffs benefit domestic producers by raising price and domestic output.

B)Tariffs increase government revenue.

C)Tariffs mean higher prices and less consumption for consumers of the product.

D)Tariffs increase the efficiency of how resources are allocated.

Unlock Deck

Unlock for access to all 71 flashcards in this deck.

Unlock Deck

k this deck

15

Large countries can improve their welfare by levying a tariff if it does NOT

A)reduce rent seeking elsewhere in the economy.

B)create a deadweight loss.

C)lead to retaliation by the nation's trading partners.

D)increase domestic production of the good.

A)reduce rent seeking elsewhere in the economy.

B)create a deadweight loss.

C)lead to retaliation by the nation's trading partners.

D)increase domestic production of the good.

Unlock Deck

Unlock for access to all 71 flashcards in this deck.

Unlock Deck

k this deck

16

Tariffs reallocate income from

A)consumers to producers.

B)producers to consumers.

C)government to producers.

D)consumers to foreigners.

A)consumers to producers.

B)producers to consumers.

C)government to producers.

D)consumers to foreigners.

Unlock Deck

Unlock for access to all 71 flashcards in this deck.

Unlock Deck

k this deck

17

The production side efficiency loss of a tariff is caused by

A)higher profits gained by foreign producers.

B)the expansion of relative inefficient domestic production.

C)the contraction of domestic consumption.

D)the increase in government revenue.

A)higher profits gained by foreign producers.

B)the expansion of relative inefficient domestic production.

C)the contraction of domestic consumption.

D)the increase in government revenue.

Unlock Deck

Unlock for access to all 71 flashcards in this deck.

Unlock Deck

k this deck

18

Based on Scenario 6.1 above,if a tariff of 20 percent is placed on imports of dining room tables,and another tariff of 50 percent is placed on imports of wood and parts,then the effective rate of protection on tables made in the United States is

A)70 percent.

B)50 percent.

C)20 percent.

D)12.5 percent.

A)70 percent.

B)50 percent.

C)20 percent.

D)12.5 percent.

Unlock Deck

Unlock for access to all 71 flashcards in this deck.

Unlock Deck

k this deck

19

Based on Scenario 6.1 above,value added in the United States is

A)$500.

B)$600.

C)$400.

D)$300.

A)$500.

B)$600.

C)$400.

D)$300.

Unlock Deck

Unlock for access to all 71 flashcards in this deck.

Unlock Deck

k this deck

20

Which of the following is a FALSE statement about issues/negotiations in the Doha Development agenda?

A)It is intended to deal with economic development issues and trade barriers facing developing countries that were not adequately addressed in the Uruguay Round.

B)Many developing countries are upset with the levels of tariffs and other barriers that industrialized countries use to protect agriculture, clothing and textiles.

C)Industrialized countries want developing countries to reduce their tariffs, which on average are higher than the rates of richer countries.

D)Developing countries don't use tariffs, and they want higher income countries to follow their model.

A)It is intended to deal with economic development issues and trade barriers facing developing countries that were not adequately addressed in the Uruguay Round.

B)Many developing countries are upset with the levels of tariffs and other barriers that industrialized countries use to protect agriculture, clothing and textiles.

C)Industrialized countries want developing countries to reduce their tariffs, which on average are higher than the rates of richer countries.

D)Developing countries don't use tariffs, and they want higher income countries to follow their model.

Unlock Deck

Unlock for access to all 71 flashcards in this deck.

Unlock Deck

k this deck

21

Why is the Doha Round called the Doha Development Round?

Unlock Deck

Unlock for access to all 71 flashcards in this deck.

Unlock Deck

k this deck

22

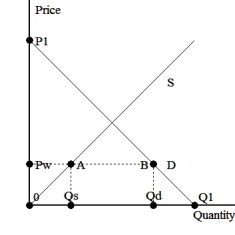

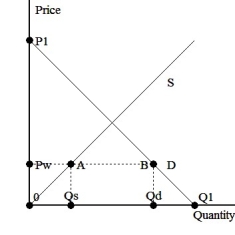

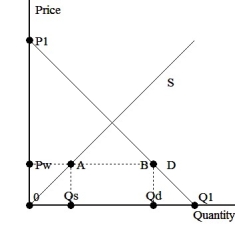

The graph above shows domestic supply and demand with trade in a SMALL country.With trade,this country can purchase at the world price,Pw.

Suppose that this country imposes a $5 per unit tariff on this good.Which of the following is true?

A)The domestic price will rise by $5.

B)Consumers will be better off.

C)There will not be deadweight losses due to this tariff, since it is a small country.

D)Producers will not increase domestic production.

Unlock Deck

Unlock for access to all 71 flashcards in this deck.

Unlock Deck

k this deck

23

The graph above shows domestic supply and demand with trade.With trade,this country can purchase at the world price,Pw.

Which of the following areas represents consumer surplus with trade?

A)Pw-A-0

B)Pw-B-Qd-0

C)P1-B-Pw

D)P1-B-A-0

Unlock Deck

Unlock for access to all 71 flashcards in this deck.

Unlock Deck

k this deck

24

The graph above shows domestic supply and demand with trade.With trade,this country can purchase at the world price,Pw.

Which of the following areas represents producer surplus with trade?

A)Pw-A-0

B)Pw-B-Qd-0

C)P1-B-Pw

D)P1-B-A-0

Unlock Deck

Unlock for access to all 71 flashcards in this deck.

Unlock Deck

k this deck

25

Deadweight losses are the only potential cost associated with tariffs,which is why they are preferred to quotas.

Unlock Deck

Unlock for access to all 71 flashcards in this deck.

Unlock Deck

k this deck

26

Since the mid-1980s,tariff rates in most nations have risen.

Unlock Deck

Unlock for access to all 71 flashcards in this deck.

Unlock Deck

k this deck

27

The graph above shows domestic supply and demand with trade in a SMALL country.With trade,this country can purchase at the world price,Pw.

Suppose that this country imposes a $5 per unit tariff on this good.Which of the following will NOT occur?

A)Government revenue will increase.

B)Domestic consumers will be worse off.

C)Domestic producers will be better off.

D)The gains to the winners will exceed the losses to the losers from the tariff.

Unlock Deck

Unlock for access to all 71 flashcards in this deck.

Unlock Deck

k this deck

28

Relative to the domestic market without trade,when the country is able to import from abroad at a price less than the domestic price,which of the following will NOT occur?

A)The country will be worse off.

B)CS + PS will increase.

C)Producer surplus will decrease.

D)Consumer surplus will increase.

A)The country will be worse off.

B)CS + PS will increase.

C)Producer surplus will decrease.

D)Consumer surplus will increase.

Unlock Deck

Unlock for access to all 71 flashcards in this deck.

Unlock Deck

k this deck

29

Tariff revenue is an important source of operating revenue for many governments of high income countries.

Unlock Deck

Unlock for access to all 71 flashcards in this deck.

Unlock Deck

k this deck

30

Nontariff barriers to trade are less transparent than tariffs.

Unlock Deck

Unlock for access to all 71 flashcards in this deck.

Unlock Deck

k this deck

31

How is the Agreement on Textiles and Clothing impacting trade today?

Unlock Deck

Unlock for access to all 71 flashcards in this deck.

Unlock Deck

k this deck

32

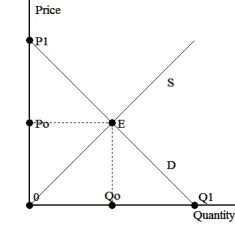

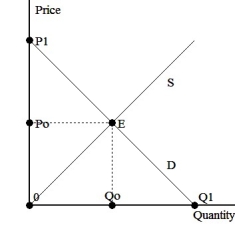

The graph above shows supply and demand in the domestic market without trade.Consumer surplus without trade is represented by area

A)P1-E-Po

B)P1-E-0

C)Po-E-0

D)P1-E-Qo

Unlock Deck

Unlock for access to all 71 flashcards in this deck.

Unlock Deck

k this deck

33

What has been the most significant obstacle to progress in the Doha Round?

Unlock Deck

Unlock for access to all 71 flashcards in this deck.

Unlock Deck

k this deck

34

If the effective rate of protection is greater than the nominal rate of protection,there must be tariffs on intermediate products.

Unlock Deck

Unlock for access to all 71 flashcards in this deck.

Unlock Deck

k this deck

35

Based on Figure 6.1,how much revenue will the government raise from a $0.25 per bushel tariff on soybean imports?

A)The government will raise $2.5 million.

B)The government will raise $5 million.

C)The government will raise $15 million.

D)The government will raise $32.5 million.

E)The government will see no increase in income; because the country is small, foreign firms will simply not serve it after the tariff is imposed.

A)The government will raise $2.5 million.

B)The government will raise $5 million.

C)The government will raise $15 million.

D)The government will raise $32.5 million.

E)The government will see no increase in income; because the country is small, foreign firms will simply not serve it after the tariff is imposed.

Unlock Deck

Unlock for access to all 71 flashcards in this deck.

Unlock Deck

k this deck

36

Based on Figure 6.1,given a tariff of $0.25 per bushel on soybean imports,how much will domestic production increase?

A)Domestic firms will increase output by 10 million bushels.

B)Domestic firms will increase output by 20 million bushels.

C)Domestic firms will increase output by 70 million bushels.

D)Domestic firms' production will not be changed by the tariff.

A)Domestic firms will increase output by 10 million bushels.

B)Domestic firms will increase output by 20 million bushels.

C)Domestic firms will increase output by 70 million bushels.

D)Domestic firms' production will not be changed by the tariff.

Unlock Deck

Unlock for access to all 71 flashcards in this deck.

Unlock Deck

k this deck

37

The rules for respecting property rights as they relate to trade were negotiated during the Uruguay Round (1986-1994)and culminated in the Trade-Related Aspects of Intellectual Property Rights (TRIPS)agreement.

Unlock Deck

Unlock for access to all 71 flashcards in this deck.

Unlock Deck

k this deck

38

The new GATS and TRIPS are separate agreements negotiated within the WTO framework as part of the Uruguay Round that apply to

A)services and transportation.

B)agriculture and textiles.

C)services and intellectual property.

D)textiles and transportation.

A)services and transportation.

B)agriculture and textiles.

C)services and intellectual property.

D)textiles and transportation.

Unlock Deck

Unlock for access to all 71 flashcards in this deck.

Unlock Deck

k this deck

39

The graph above shows supply and demand in the domestic market without trade.Producer surplus without trade is represented by area

A)P1-E-Po

B)P1-E-0

C)Po-E-0

D)P1-E-Qo

Unlock Deck

Unlock for access to all 71 flashcards in this deck.

Unlock Deck

k this deck

40

Which of the following is FALSE?

A)Tariffs are a relatively easy tax to administer and often form an important part of revenue for low-income countries.

B)Taxes on income, sales, and property require more complex accounting systems than do tariffs.

C)Low-income countries often have large informal markets with the sales of many goods and services not being recorded, which makes it difficult to apply many kinds of taxes.

D)Tariffs are not an attractive tax option for most low-income countries, so they mostly rely on quota licenses for revenue.

A)Tariffs are a relatively easy tax to administer and often form an important part of revenue for low-income countries.

B)Taxes on income, sales, and property require more complex accounting systems than do tariffs.

C)Low-income countries often have large informal markets with the sales of many goods and services not being recorded, which makes it difficult to apply many kinds of taxes.

D)Tariffs are not an attractive tax option for most low-income countries, so they mostly rely on quota licenses for revenue.

Unlock Deck

Unlock for access to all 71 flashcards in this deck.

Unlock Deck

k this deck

41

What are some of the long-run costs of tariffs?

Unlock Deck

Unlock for access to all 71 flashcards in this deck.

Unlock Deck

k this deck

42

Developing countries have identified which key issues as important to them in current trade talks?

Unlock Deck

Unlock for access to all 71 flashcards in this deck.

Unlock Deck

k this deck

43

The graph above shows a small country that can import at the world price of Pw.Suppose that the government imposes a tariff of $T per unit (and suppose that this does not raise the domestic price so much that there will be no trade.

Use the graph above to illustrate the effects of the tariff.Show the new areas of consumer surplus,producer surplus,and government revenue,and the deadweight losses due to the tariff.Who wins and who loses from the tariff?

Unlock Deck

Unlock for access to all 71 flashcards in this deck.

Unlock Deck

k this deck

44

Over time,quotas usually lead to larger deadweight losses than tariffs.

Unlock Deck

Unlock for access to all 71 flashcards in this deck.

Unlock Deck

k this deck

45

In which way are tariffs different from quotas?

A)They reduce the volume of imported products.

B)They raise the price of the imported products to consumers.

C)They increase the domestic quantity supplied of the product.

D)They raise government revenue.

A)They reduce the volume of imported products.

B)They raise the price of the imported products to consumers.

C)They increase the domestic quantity supplied of the product.

D)They raise government revenue.

Unlock Deck

Unlock for access to all 71 flashcards in this deck.

Unlock Deck

k this deck

46

Carefully explain how the imposition of a tariff is different for a large country (that can affect the world price)than a small country.

Unlock Deck

Unlock for access to all 71 flashcards in this deck.

Unlock Deck

k this deck

47

In the case of a small country,producer surplus

A)increases more with a tariff than with an equivalent quota.

B)increases more with a quota than with an equivalent tariff.

C)is not changed by tariffs or quotas.

D)increases the same amount with tariffs and equivalent quotas.

A)increases more with a tariff than with an equivalent quota.

B)increases more with a quota than with an equivalent tariff.

C)is not changed by tariffs or quotas.

D)increases the same amount with tariffs and equivalent quotas.

Unlock Deck

Unlock for access to all 71 flashcards in this deck.

Unlock Deck

k this deck

48

An increase in domestic demand for a product protected by a quota results in an increase in producer surplus for domestic firms,while for a tariff it would result in more imports.

Unlock Deck

Unlock for access to all 71 flashcards in this deck.

Unlock Deck

k this deck

49

In economic terms,tariffs are preferred to quotas because

A)domestic manufacturers gain more producer surplus.

B)there is less loss of consumer surplus.

C)quotas create a greater production inefficiency.

D)given the way quotas are usually administered, tariffs cause a smaller net national welfare loss.

A)domestic manufacturers gain more producer surplus.

B)there is less loss of consumer surplus.

C)quotas create a greater production inefficiency.

D)given the way quotas are usually administered, tariffs cause a smaller net national welfare loss.

Unlock Deck

Unlock for access to all 71 flashcards in this deck.

Unlock Deck

k this deck

50

Which of the following is NOT an expected benefit of reducing nontariff barriers to trade?

A)Fewer firms to compete with

B)Lower prices for many goods

C)Increase in the volume of exports and imports

D)Improved overall economic welfare

A)Fewer firms to compete with

B)Lower prices for many goods

C)Increase in the volume of exports and imports

D)Improved overall economic welfare

Unlock Deck

Unlock for access to all 71 flashcards in this deck.

Unlock Deck

k this deck

51

In the case of a small country,consumer surplus

A)decreases less with a tariff than with an equivalent quota.

B)decreases less with a quota than with an equivalent tariff.

C)decreases the same with tariffs and equivalent quotas.

D)increases more with quotas.

A)decreases less with a tariff than with an equivalent quota.

B)decreases less with a quota than with an equivalent tariff.

C)decreases the same with tariffs and equivalent quotas.

D)increases more with quotas.

Unlock Deck

Unlock for access to all 71 flashcards in this deck.

Unlock Deck

k this deck

52

Nontariff measures are generally much more difficult to eliminate than tariffs and quotas because they are embedded more deeply in national economic policies.

Unlock Deck

Unlock for access to all 71 flashcards in this deck.

Unlock Deck

k this deck

53

Which type of restriction on quantity of imports is the most transparent?

A)Quota

B)Licensing requirements

C)Voluntary export restraints

D)Government procurement policies

A)Quota

B)Licensing requirements

C)Voluntary export restraints

D)Government procurement policies

Unlock Deck

Unlock for access to all 71 flashcards in this deck.

Unlock Deck

k this deck

54

Carefully explain why tariffs create deadweight losses.

Unlock Deck

Unlock for access to all 71 flashcards in this deck.

Unlock Deck

k this deck

55

Draw a graph showing the effects of imposing a tariff in the small country case.Describe the results,using the concepts of producer surplus,consumer surplus and deadweight loss.Specifically address the effects on consumers,producers,government revenue and overall national well-being,connecting those effects to areas of your graph.

Unlock Deck

Unlock for access to all 71 flashcards in this deck.

Unlock Deck

k this deck

56

Intellectual property rights protection is a critical issue for the pharmaceutical industry among others.

Unlock Deck

Unlock for access to all 71 flashcards in this deck.

Unlock Deck

k this deck

57

Both tariffs and quotas lead to a decrease in imports,a decrease in domestic consumption,and an increase in domestic production.

Unlock Deck

Unlock for access to all 71 flashcards in this deck.

Unlock Deck

k this deck

58

What do developing countries want regarding agriculture in the Doha Round?

Unlock Deck

Unlock for access to all 71 flashcards in this deck.

Unlock Deck

k this deck

59

Which of the following is FALSE?

A)At the end of the twentieth century, more and more traded goods and services incorporated specialized knowledge and unique ideas.

B)Pharmaceuticals, computer hardware, telecommunications equipment, and other high technology products are valuable because of the innovation and research they incorporate.

C)Developing countries usually strongly advocate the protection of intellectual property rights.

D)The protection given to creators and innovators varied greatly internationally until standardization began with the signing of the TRIPs agreement.

A)At the end of the twentieth century, more and more traded goods and services incorporated specialized knowledge and unique ideas.

B)Pharmaceuticals, computer hardware, telecommunications equipment, and other high technology products are valuable because of the innovation and research they incorporate.

C)Developing countries usually strongly advocate the protection of intellectual property rights.

D)The protection given to creators and innovators varied greatly internationally until standardization began with the signing of the TRIPs agreement.

Unlock Deck

Unlock for access to all 71 flashcards in this deck.

Unlock Deck

k this deck

60

A real cost of tariffs and quotas that is difficult to measure is that they

A)encourage rent seeking.

B)shift income from consumers to producers.

C)limit the quantity of imports.

D)reduce wages.

A)encourage rent seeking.

B)shift income from consumers to producers.

C)limit the quantity of imports.

D)reduce wages.

Unlock Deck

Unlock for access to all 71 flashcards in this deck.

Unlock Deck

k this deck

61

If politicians decide to proceed with protection,why might economists prefer tariffs to quotas? Explain at least three reasons.

Unlock Deck

Unlock for access to all 71 flashcards in this deck.

Unlock Deck

k this deck

62

The graph above shows a small country that can import at the world price of Pw and currently imports (Qd-Qs).Suppose that the government imposes quota of 80% of the current import amount (and suppose that this does not raise the domestic price so much that there will be no trade).

Use the graph above to illustrate the effects of the quota.Show the new areas of consumer surplus,producer surplus,and any other relevant areas,and the deadweight losses due to the quota.Who wins and who loses from the tariff?

Unlock Deck

Unlock for access to all 71 flashcards in this deck.

Unlock Deck

k this deck

63

What is the name of the agreement related to intellectual property rights?

Unlock Deck

Unlock for access to all 71 flashcards in this deck.

Unlock Deck

k this deck

64

Describe intellectual property rights.What agreements have been reached regarding their protection? What are the benefits and the costs of protecting intellectual property rights?

Unlock Deck

Unlock for access to all 71 flashcards in this deck.

Unlock Deck

k this deck

65

Give an example of an industry that would seek intellectual property rights protection because its product incorporates innovation and research.

Unlock Deck

Unlock for access to all 71 flashcards in this deck.

Unlock Deck

k this deck

66

When did intellectual property rights become part of trade agreements?

Unlock Deck

Unlock for access to all 71 flashcards in this deck.

Unlock Deck

k this deck

67

Internationally,the TRIPS agreement is uniformly regarded as a positive step for world prosperity.

Unlock Deck

Unlock for access to all 71 flashcards in this deck.

Unlock Deck

k this deck

68

Give an example of a nontariff measure that could reduce the quantity of imports or exports.

Unlock Deck

Unlock for access to all 71 flashcards in this deck.

Unlock Deck

k this deck

69

What are the three major types of quotas?

Unlock Deck

Unlock for access to all 71 flashcards in this deck.

Unlock Deck

k this deck

70

Use a graph to demonstrate why quotas are likely to cause increased deadweight losses over time.

Unlock Deck

Unlock for access to all 71 flashcards in this deck.

Unlock Deck

k this deck

71

What is Joseph Stiglitz's main criticism regarding intellectual property rights protection?

Unlock Deck

Unlock for access to all 71 flashcards in this deck.

Unlock Deck

k this deck