Deck 12: Fiscal Policy

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/273

Play

Full screen (f)

Deck 12: Fiscal Policy

1

Which of the following fiscal policy actions would be appropriate if the economy is experiencing an inflationary gap?

A)an increase in government spending

B)an increase in taxes

C)a decrease in interest rates

D)an increase in the money supply

A)an increase in government spending

B)an increase in taxes

C)a decrease in interest rates

D)an increase in the money supply

an increase in taxes

2

When the government deliberately alters its level of spending and/or taxes in order to achieve specific national economic goals, it is exercising

A)monetary policy.

B)discretionary fiscal policy.

C)a Ricardian policy.

D)a laissez-faire policy.

A)monetary policy.

B)discretionary fiscal policy.

C)a Ricardian policy.

D)a laissez-faire policy.

discretionary fiscal policy.

3

Discretionary fiscal policy is

A)automatic changes in government expenditures and interest rates that achieve certain national economic goals.

B)deliberate changes in government expenditures or taxes in order to achieve certain national economic goals.

C)used to achieve full employment by changing monetary growth targets.

D)changes in support for research and education in order to achieve certain national economic goals.

A)automatic changes in government expenditures and interest rates that achieve certain national economic goals.

B)deliberate changes in government expenditures or taxes in order to achieve certain national economic goals.

C)used to achieve full employment by changing monetary growth targets.

D)changes in support for research and education in order to achieve certain national economic goals.

deliberate changes in government expenditures or taxes in order to achieve certain national economic goals.

4

When television commentators refer to "tax and spend" policy, they are referring to

A)fiscal policy.

B)monetary policy.

C)the Federal Reserve policy.

D)automatic stabilizers.

A)fiscal policy.

B)monetary policy.

C)the Federal Reserve policy.

D)automatic stabilizers.

Unlock Deck

Unlock for access to all 273 flashcards in this deck.

Unlock Deck

k this deck

5

According to traditional Keynesian economics, expansionary fiscal policy initiated by the federal government

A)is never appropriate.

B)is an appropriate way to prevent recessions and depressions.

C)is an appropriate way to slow down an over-heated economy.

D)will always fail due to crowding out effects.

A)is never appropriate.

B)is an appropriate way to prevent recessions and depressions.

C)is an appropriate way to slow down an over-heated economy.

D)will always fail due to crowding out effects.

Unlock Deck

Unlock for access to all 273 flashcards in this deck.

Unlock Deck

k this deck

6

Which of the following is an example of a discretionary fiscal policy action?

A)increasing government spending to deal with a recession

B)a decrease in tax revenues as taxpayers' incomes decrease

C)increasing the minimum wage rate

D)raising regulations in the health care industry

A)increasing government spending to deal with a recession

B)a decrease in tax revenues as taxpayers' incomes decrease

C)increasing the minimum wage rate

D)raising regulations in the health care industry

Unlock Deck

Unlock for access to all 273 flashcards in this deck.

Unlock Deck

k this deck

7

Suppose the economy is experiencing a recessionary gap at the current level of GDP. Which of the following fiscal policy actions would be most appropriate given this recessionary gap?

A)decreasing interest rates

B)increasing the money supply

C)decreasing taxes

D)a simultaneous and equal reduction in taxes and reduction in government spending

A)decreasing interest rates

B)increasing the money supply

C)decreasing taxes

D)a simultaneous and equal reduction in taxes and reduction in government spending

Unlock Deck

Unlock for access to all 273 flashcards in this deck.

Unlock Deck

k this deck

8

Fiscal policy refers to the

A)manipulation of the money supply in order to increase the amount of paper currency in circulation.

B)adjustment of government spending and taxes in order to achieve certain national economic goals.

C)adjustment of national income data to account for price level changes.

D)changing the way unemployment data is calculated so as to make it appear that unemployment is lower than it actually is.

A)manipulation of the money supply in order to increase the amount of paper currency in circulation.

B)adjustment of government spending and taxes in order to achieve certain national economic goals.

C)adjustment of national income data to account for price level changes.

D)changing the way unemployment data is calculated so as to make it appear that unemployment is lower than it actually is.

Unlock Deck

Unlock for access to all 273 flashcards in this deck.

Unlock Deck

k this deck

9

Fiscal policy is defined as

A)the design of a tax system to transfer income from the rich to the poor.

B)the use of Congressional power to pursue social and political goals.

C)the discretionary changing of government expenditures and/or taxes to achieve national economic goals.

D)the use of the taxing power of the government to redistribute wealth in a socially acceptable manner.

A)the design of a tax system to transfer income from the rich to the poor.

B)the use of Congressional power to pursue social and political goals.

C)the discretionary changing of government expenditures and/or taxes to achieve national economic goals.

D)the use of the taxing power of the government to redistribute wealth in a socially acceptable manner.

Unlock Deck

Unlock for access to all 273 flashcards in this deck.

Unlock Deck

k this deck

10

Which of the following would shift the aggregate demand curve to the right?

A)an increase in government spending

B)an increase in taxes

C)an increase in interest rates

D)an increase in input prices

A)an increase in government spending

B)an increase in taxes

C)an increase in interest rates

D)an increase in input prices

Unlock Deck

Unlock for access to all 273 flashcards in this deck.

Unlock Deck

k this deck

11

Which of the following represent expansionary fiscal policy?

A)a reduction in government spending

B)an increase in average individual income tax rates

C)a cut in corporate income tax rates

D)an increase in marginal individual income tax rates

A)a reduction in government spending

B)an increase in average individual income tax rates

C)a cut in corporate income tax rates

D)an increase in marginal individual income tax rates

Unlock Deck

Unlock for access to all 273 flashcards in this deck.

Unlock Deck

k this deck

12

Fiscal policy involves which of the following?

A)tax policy

B)interest rates

C)buying and selling government-agency bonds

D)none of the above

A)tax policy

B)interest rates

C)buying and selling government-agency bonds

D)none of the above

Unlock Deck

Unlock for access to all 273 flashcards in this deck.

Unlock Deck

k this deck

13

Fiscal policy to solve short-run economic problems supports the Keynesian notion of

A)there being no government role in the economy.

B)an active government role in the economy.

C)the need for autocratic rule.

D)the long-run nature of the economy.

A)there being no government role in the economy.

B)an active government role in the economy.

C)the need for autocratic rule.

D)the long-run nature of the economy.

Unlock Deck

Unlock for access to all 273 flashcards in this deck.

Unlock Deck

k this deck

14

Which of the following is an example of fiscal policy?

A)a reduction in the federal funds rate.

B)a reduction in the money supply.

C)a reduction in lump-sum taxes.

D)an increase in the physical stock of capital.

A)a reduction in the federal funds rate.

B)a reduction in the money supply.

C)a reduction in lump-sum taxes.

D)an increase in the physical stock of capital.

Unlock Deck

Unlock for access to all 273 flashcards in this deck.

Unlock Deck

k this deck

15

An increase in government spending would cause which of the following to happen?

A)The aggregate demand curve would shift to the right.

B)The aggregate demand curve would shift to the left.

C)The aggregate supply curve would shift to the right.

D)The aggregate supply curve would shift to the left.

A)The aggregate demand curve would shift to the right.

B)The aggregate demand curve would shift to the left.

C)The aggregate supply curve would shift to the right.

D)The aggregate supply curve would shift to the left.

Unlock Deck

Unlock for access to all 273 flashcards in this deck.

Unlock Deck

k this deck

16

Typical goals for fiscal policy are

A)high employment and price stability.

B)high prices for consumers and low prices for businesses.

C)running high deficits and raising consumer prices.

D)increasing the money supply so the government can spend more.

A)high employment and price stability.

B)high prices for consumers and low prices for businesses.

C)running high deficits and raising consumer prices.

D)increasing the money supply so the government can spend more.

Unlock Deck

Unlock for access to all 273 flashcards in this deck.

Unlock Deck

k this deck

17

Which of the following is a discretionary fiscal policy action?

A)an increase in the amount of unemployment compensation because more people become unemployed

B)a progressive tax system that leads to an increase in income tax revenues during an economic boom

C)a deliberate tax cut when the economy experiences high unemployment

D)an increase in Supplemental Security Income payments when more people become eligible for the benefits

A)an increase in the amount of unemployment compensation because more people become unemployed

B)a progressive tax system that leads to an increase in income tax revenues during an economic boom

C)a deliberate tax cut when the economy experiences high unemployment

D)an increase in Supplemental Security Income payments when more people become eligible for the benefits

Unlock Deck

Unlock for access to all 273 flashcards in this deck.

Unlock Deck

k this deck

18

All the following actions represent fiscal policy EXCEPT

A)a reduction in the money supply by the Federal Reserve.

B)an increase in government spending.

C)a reduction in individual income tax rates.

D)an increase in corporate income tax rates.

A)a reduction in the money supply by the Federal Reserve.

B)an increase in government spending.

C)a reduction in individual income tax rates.

D)an increase in corporate income tax rates.

Unlock Deck

Unlock for access to all 273 flashcards in this deck.

Unlock Deck

k this deck

19

Which of the following is NOT a fiscal policy action?

A)increasing government expenditures on military hardware

B)decreasing government spending on the arts

C)raising the quantity of money in circulation

D)lowering income tax rates

A)increasing government expenditures on military hardware

B)decreasing government spending on the arts

C)raising the quantity of money in circulation

D)lowering income tax rates

Unlock Deck

Unlock for access to all 273 flashcards in this deck.

Unlock Deck

k this deck

20

Fiscal policy is implemented by

A)the central bank.

B)private businesses.

C)the Internal Revenue Service.

D)the federal government.

A)the central bank.

B)private businesses.

C)the Internal Revenue Service.

D)the federal government.

Unlock Deck

Unlock for access to all 273 flashcards in this deck.

Unlock Deck

k this deck

21

Discretionary fiscal policy is best described as

A)a deliberate attempt to cause the economy to move to full employment and price stability more quickly than it might otherwise.

B)a deliberate attempt to improve the functioning of free markets.

C)an automatic change in income transfer payments to keep the economy at full employment.

D)the design of a tax system that automatically stabilizes economic activity over time.

A)a deliberate attempt to cause the economy to move to full employment and price stability more quickly than it might otherwise.

B)a deliberate attempt to improve the functioning of free markets.

C)an automatic change in income transfer payments to keep the economy at full employment.

D)the design of a tax system that automatically stabilizes economic activity over time.

Unlock Deck

Unlock for access to all 273 flashcards in this deck.

Unlock Deck

k this deck

22

Fiscal policy involves discretionary changes in

A)interest rates.

B)exchange rates.

C)income tax rates.

D)the rate of growth of the quantity of money in circulation.

A)interest rates.

B)exchange rates.

C)income tax rates.

D)the rate of growth of the quantity of money in circulation.

Unlock Deck

Unlock for access to all 273 flashcards in this deck.

Unlock Deck

k this deck

23

According to traditional Keynesian analysis, fiscal policy operates by

A)informing consumers and business people about its plans for the economy so they will know how to adjust their behavior.

B)indirectly affecting aggregate demand through its effect on interest rates.

C)directly affecting aggregate demand.

D)directly affecting aggregate supply.

A)informing consumers and business people about its plans for the economy so they will know how to adjust their behavior.

B)indirectly affecting aggregate demand through its effect on interest rates.

C)directly affecting aggregate demand.

D)directly affecting aggregate supply.

Unlock Deck

Unlock for access to all 273 flashcards in this deck.

Unlock Deck

k this deck

24

To close a recessionary gap through fiscal policy, the government should

A)decrease government spending in order to increase aggregate supply.

B)increase government spending in order to increase aggregate demand.

C)reduce taxes in order to stimulate investment, and thus increase aggregate supply.

D)increase government spending and taxes in order to both increase aggregate demand and aggregate supply.

A)decrease government spending in order to increase aggregate supply.

B)increase government spending in order to increase aggregate demand.

C)reduce taxes in order to stimulate investment, and thus increase aggregate supply.

D)increase government spending and taxes in order to both increase aggregate demand and aggregate supply.

Unlock Deck

Unlock for access to all 273 flashcards in this deck.

Unlock Deck

k this deck

25

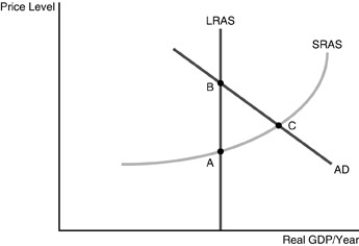

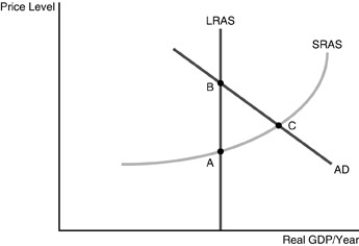

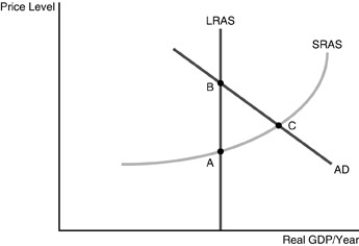

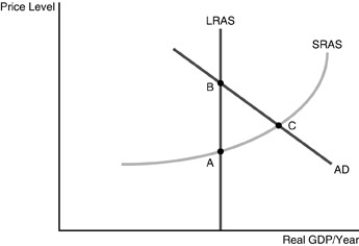

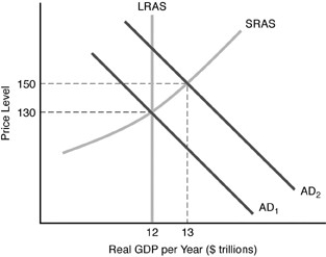

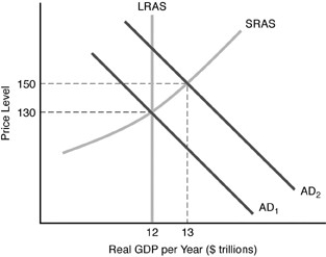

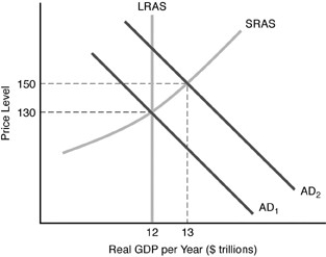

Refer to the above figure. If the economy is currently at point C, then an increase in taxes will lead to

A)an increase in the price and an increase in real GDP.

B)an increase in the price and a decrease in real GDP.

C)a decrease in the price and a decrease in real GDP.

D)a decrease in the price and an increase in real GDP.

Unlock Deck

Unlock for access to all 273 flashcards in this deck.

Unlock Deck

k this deck

26

Fiscal policy includes all of the following EXCEPT

A)changing taxes.

B)changing government spending.

C)policies that influence aggregate demand.

D)policies that influence the rate of growth of the quantity of money in circulation.

A)changing taxes.

B)changing government spending.

C)policies that influence aggregate demand.

D)policies that influence the rate of growth of the quantity of money in circulation.

Unlock Deck

Unlock for access to all 273 flashcards in this deck.

Unlock Deck

k this deck

27

If the economy is experiencing an inflationary gap and the government wants to accelerate the adjustment to the long-run equilibrium, it should

A)reduce aggregate demand by cutting government spending or raising taxes.

B)reduce aggregate demand by increasing government spending or cutting taxes.

C)increase aggregate supply by cutting government spending or raising taxes.

D)increase aggregate supply by increasing government spending or lowering taxes.

A)reduce aggregate demand by cutting government spending or raising taxes.

B)reduce aggregate demand by increasing government spending or cutting taxes.

C)increase aggregate supply by cutting government spending or raising taxes.

D)increase aggregate supply by increasing government spending or lowering taxes.

Unlock Deck

Unlock for access to all 273 flashcards in this deck.

Unlock Deck

k this deck

28

Refer to the above figure. Suppose the economy is at point A. By the proper use of fiscal policy, the government can

A)boost taxes to shift LRAS through point A.

B)increase government spending to get the economy to point B.

C)raise income tax rates to get the economy to point C.

D)reduce government spending to get the economy to point D.

Unlock Deck

Unlock for access to all 273 flashcards in this deck.

Unlock Deck

k this deck

29

Which of the following actions could be undertaken if the government wants to reduce an inflationary gap?

A)Increase taxes and reduce government spending.

B)Reduce taxes and increase government spending.

C)Increase taxes and increase government spending.

D)Reduce taxes and reduce government spending.

A)Increase taxes and reduce government spending.

B)Reduce taxes and increase government spending.

C)Increase taxes and increase government spending.

D)Reduce taxes and reduce government spending.

Unlock Deck

Unlock for access to all 273 flashcards in this deck.

Unlock Deck

k this deck

30

An example of fiscal policy is

A)a reduction in government spending.

B)a reduction in investment spending by the private sector.

C)an increase in autonomous spending by consumers.

D)an increase in Social Security spending by the elderly.

A)a reduction in government spending.

B)a reduction in investment spending by the private sector.

C)an increase in autonomous spending by consumers.

D)an increase in Social Security spending by the elderly.

Unlock Deck

Unlock for access to all 273 flashcards in this deck.

Unlock Deck

k this deck

31

If the economy is operating on the long-run aggregate supply curve, then expansionary fiscal policy will

A)generate higher prices in the short run, but will induce aggregate supply to increase in the long run.

B)generate an increase in real GDP and higher prices in both the short run and the long run.

C)generate an increase in real GDP without higher prices in the short run, but then real GDP will return to its long-run level, and the price level will increase.

D)generate an increase in real GDP and higher prices in the short run, but then real GDP will decrease to its long-run level, and the price level will increase some more.

A)generate higher prices in the short run, but will induce aggregate supply to increase in the long run.

B)generate an increase in real GDP and higher prices in both the short run and the long run.

C)generate an increase in real GDP without higher prices in the short run, but then real GDP will return to its long-run level, and the price level will increase.

D)generate an increase in real GDP and higher prices in the short run, but then real GDP will decrease to its long-run level, and the price level will increase some more.

Unlock Deck

Unlock for access to all 273 flashcards in this deck.

Unlock Deck

k this deck

32

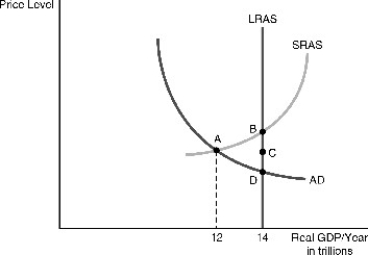

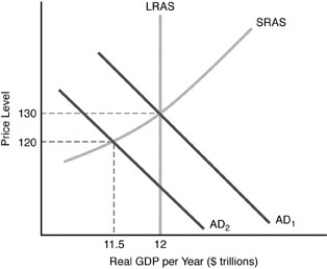

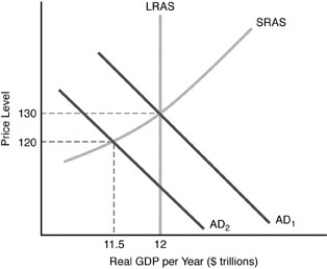

Refer to the above figure. Suppose the economy is operating at point A. There is a recessionary gap of ________, which can be closed by ________.

A)$3 trillion; increasing government spending by $1 trillion

B)$1 trillion; expansionary fiscal policy that shifts the short-run aggregate supply curve through point C

C)$2 trillion; expansionary fiscal policy that generates another $2 trillion in total spending

D)$2 trillion; an increase in government spending of $14 trillion

Unlock Deck

Unlock for access to all 273 flashcards in this deck.

Unlock Deck

k this deck

33

Suppose the government increases lump-sum taxes. This causes

A)disposable income to decrease, which causes consumption spending to decrease and aggregate demand to decrease.

B)government spending to decrease, which causes aggregate demand to decrease.

C)consumption spending to decrease and spending on imports to increase. The effect on aggregate demand depends on whether domestic spending or spending on imports decreased the most.

D)disposable income to decrease, which causes aggregate supply to decrease.

A)disposable income to decrease, which causes consumption spending to decrease and aggregate demand to decrease.

B)government spending to decrease, which causes aggregate demand to decrease.

C)consumption spending to decrease and spending on imports to increase. The effect on aggregate demand depends on whether domestic spending or spending on imports decreased the most.

D)disposable income to decrease, which causes aggregate supply to decrease.

Unlock Deck

Unlock for access to all 273 flashcards in this deck.

Unlock Deck

k this deck

34

Refer to the above figure. Suppose that the economy was originally at point A, and then it reached point C by means of a fiscal policy action. Which of the following is correct?

A)Point C is a short-run equilibrium that could have been attained through a tax cut, but in the long run the economy will end up at point B.

B)Point C is both a short-run equilibrium and a long-run equilibrium that could have been attained through an increase in government spending.

C)Point C is a long-run equilibrium that could have been attained through a tax increase, although reaching this point first required a short-run equilibrium at point B.

D)Point C is a short-run equilibrium that could have been attained through a reduction in government spending, but in the long run the economy will end up at point B.

Unlock Deck

Unlock for access to all 273 flashcards in this deck.

Unlock Deck

k this deck

35

Keynes believed that the way to prevent recessions and depressions was to

A)reduce spending when there is a recessionary gap.

B)only change tax rates as a means of regulating the economy.

C)maximize the crowding out effect.

D)increase aggregate demand through expansionary fiscal policy.

A)reduce spending when there is a recessionary gap.

B)only change tax rates as a means of regulating the economy.

C)maximize the crowding out effect.

D)increase aggregate demand through expansionary fiscal policy.

Unlock Deck

Unlock for access to all 273 flashcards in this deck.

Unlock Deck

k this deck

36

Which of the following actions could be undertaken if the government wants to close a recessionary gap?

A)Increase taxes and reduce government spending.

B)Reduce taxes and increase government spending.

C)Increase taxes and increase government spending.

D)Reduce taxes and reduce government spending.

A)Increase taxes and reduce government spending.

B)Reduce taxes and increase government spending.

C)Increase taxes and increase government spending.

D)Reduce taxes and reduce government spending.

Unlock Deck

Unlock for access to all 273 flashcards in this deck.

Unlock Deck

k this deck

37

Other things being equal, a reduction in taxes will

A)lead to a reduction in the long run aggregate supply curve as businesses enjoy greater profits.

B)influence the short run aggregate supply curve but not the aggregate demand curve.

C)lead to a corresponding reduction in interest rates increasing the crowding out effect.

D)cause an increase in aggregate demand due to increases in consumption, investment, or net exports.

A)lead to a reduction in the long run aggregate supply curve as businesses enjoy greater profits.

B)influence the short run aggregate supply curve but not the aggregate demand curve.

C)lead to a corresponding reduction in interest rates increasing the crowding out effect.

D)cause an increase in aggregate demand due to increases in consumption, investment, or net exports.

Unlock Deck

Unlock for access to all 273 flashcards in this deck.

Unlock Deck

k this deck

38

Refer to the above figure. Suppose the U.S. economy is currently operating at point C. Which of the following actions would you recommend to the president of the United States?

A)Reduce taxes to stimulate investment, consumption and net exports.

B)Increase government spending while holding taxes constant.

C)Engage in contractionary fiscal policy by reducing government spending.

D)Reduce the interest rate to stimulate investment minimizing the crowding out effect.

Unlock Deck

Unlock for access to all 273 flashcards in this deck.

Unlock Deck

k this deck

39

Refer to the above figure. If the economy is currently operating at point C, then there is

A)a stable long-run equilibrium situation.

B)a recessionary gap.

C)an inflationary gap.

D)unemployment.

Unlock Deck

Unlock for access to all 273 flashcards in this deck.

Unlock Deck

k this deck

40

The discretionary change of government expenditures or taxes to achieve national economic goals is

A)a direct expenditure upset.

B)Ricardian-equivalence theorem.

C)supply-side economics.

D)fiscal policy.

A)a direct expenditure upset.

B)Ricardian-equivalence theorem.

C)supply-side economics.

D)fiscal policy.

Unlock Deck

Unlock for access to all 273 flashcards in this deck.

Unlock Deck

k this deck

41

Which of the following fiscal policy actions would definitely cause a reduction in the size of an inflationary gap?

A)cuts in taxes and increases in government spending

B)increases in government spending

C)increases in taxes

D)cuts in taxes

A)cuts in taxes and increases in government spending

B)increases in government spending

C)increases in taxes

D)cuts in taxes

Unlock Deck

Unlock for access to all 273 flashcards in this deck.

Unlock Deck

k this deck

42

Suppose there currently is an inflationary gap. What could the government do to bring the overall price level down?

A)nothing

B)Reduce government spending.

C)Increase government spending.

D)Reduce the nation's aggregate supply.

A)nothing

B)Reduce government spending.

C)Increase government spending.

D)Reduce the nation's aggregate supply.

Unlock Deck

Unlock for access to all 273 flashcards in this deck.

Unlock Deck

k this deck

43

Expansionary fiscal policy is used to

A)combat inflation.

B)combat recessions.

C)encourage private saving.

D)make businesses more efficient.

A)combat inflation.

B)combat recessions.

C)encourage private saving.

D)make businesses more efficient.

Unlock Deck

Unlock for access to all 273 flashcards in this deck.

Unlock Deck

k this deck

44

Discretionary fiscal policy is so named because it

A)is undertaken at the order of the nation's central bank.

B)occurs automatically as the nation's level of GDP changes.

C)involves specific changes in taxes and government spending undertaken by Congress and the president.

D)involves secret advice given by the Council of Economic Advisers to the president.

A)is undertaken at the order of the nation's central bank.

B)occurs automatically as the nation's level of GDP changes.

C)involves specific changes in taxes and government spending undertaken by Congress and the president.

D)involves secret advice given by the Council of Economic Advisers to the president.

Unlock Deck

Unlock for access to all 273 flashcards in this deck.

Unlock Deck

k this deck

45

In the short run, if the government attempts to increase aggregate demand, it should

A)increase government spending and reduce taxes.

B)decrease government spending and increase taxes.

C)shift the long-run aggregate supply curve to the right.

D)shift the short-run aggregate supply curve to the right.

A)increase government spending and reduce taxes.

B)decrease government spending and increase taxes.

C)shift the long-run aggregate supply curve to the right.

D)shift the short-run aggregate supply curve to the right.

Unlock Deck

Unlock for access to all 273 flashcards in this deck.

Unlock Deck

k this deck

46

When the government cuts taxes or increases government spending

A)the long-run aggregate supply curve shifts to the left.

B)the short-run aggregate supply curve shifts to the left.

C)the aggregate demand curve shifts to the left.

D)the aggregate demand curve shifts to the right.

A)the long-run aggregate supply curve shifts to the left.

B)the short-run aggregate supply curve shifts to the left.

C)the aggregate demand curve shifts to the left.

D)the aggregate demand curve shifts to the right.

Unlock Deck

Unlock for access to all 273 flashcards in this deck.

Unlock Deck

k this deck

47

Which one of the following is TRUE about the effects of fiscal policy?

A)A decrease government spending will increase aggregate supply.

B)A tax change does not have any direct or indirect effects on aggregate demand.

C)A decrease in government spending will decrease aggregate demand.

D)An increase in government spending will reduce aggregate demand.

A)A decrease government spending will increase aggregate supply.

B)A tax change does not have any direct or indirect effects on aggregate demand.

C)A decrease in government spending will decrease aggregate demand.

D)An increase in government spending will reduce aggregate demand.

Unlock Deck

Unlock for access to all 273 flashcards in this deck.

Unlock Deck

k this deck

48

The government might engage in expansionary fiscal policy if it wanted to

A)reduce the price level.

B)reduce real GDP.

C)shift the aggregate demand curve to the left.

D)reduce the level of unemployment.

A)reduce the price level.

B)reduce real GDP.

C)shift the aggregate demand curve to the left.

D)reduce the level of unemployment.

Unlock Deck

Unlock for access to all 273 flashcards in this deck.

Unlock Deck

k this deck

49

Contractionary fiscal policy will most likely

A)involve cutting taxes.

B)raise real GDP.

C)reduce the price level.

D)involve increasing government spending.

A)involve cutting taxes.

B)raise real GDP.

C)reduce the price level.

D)involve increasing government spending.

Unlock Deck

Unlock for access to all 273 flashcards in this deck.

Unlock Deck

k this deck

50

In the short run, expansionary fiscal policy usually will

A)increase the price level and increase real GDP.

B)increase the price level and decrease real GDP.

C)decrease the price level and increase real GDP.

D)decrease the price level and decrease real GDP.

A)increase the price level and increase real GDP.

B)increase the price level and decrease real GDP.

C)decrease the price level and increase real GDP.

D)decrease the price level and decrease real GDP.

Unlock Deck

Unlock for access to all 273 flashcards in this deck.

Unlock Deck

k this deck

51

If there is a deliberate change in taxes and spending, it is called

A)a recessionary gap.

B)an inflationary gap.

C)discretionary fiscal policy.

D)discretionary monetary policy.

A)a recessionary gap.

B)an inflationary gap.

C)discretionary fiscal policy.

D)discretionary monetary policy.

Unlock Deck

Unlock for access to all 273 flashcards in this deck.

Unlock Deck

k this deck

52

Which of the following conditions describes a recessionary gap?

A)The short-run equilibrium level of real GDP is above the long-run level of real GDP.

B)The short-run equilibrium level of real GDP is below the long-run level of real GDP.

C)The actual interest rate is above the equilibrium interest rate.

D)The actual interest rate is below the equilibrium interest rate.

A)The short-run equilibrium level of real GDP is above the long-run level of real GDP.

B)The short-run equilibrium level of real GDP is below the long-run level of real GDP.

C)The actual interest rate is above the equilibrium interest rate.

D)The actual interest rate is below the equilibrium interest rate.

Unlock Deck

Unlock for access to all 273 flashcards in this deck.

Unlock Deck

k this deck

53

An example of expansionary fiscal policy could be

A)to reduce the nation's money supply.

B)to reduce taxes.

C)to reduce government spending.

D)to reduce interest rates.

A)to reduce the nation's money supply.

B)to reduce taxes.

C)to reduce government spending.

D)to reduce interest rates.

Unlock Deck

Unlock for access to all 273 flashcards in this deck.

Unlock Deck

k this deck

54

How might fiscal policy be used to correct an inflationary gap?

A)The exchange rate would be adjusted to encourage imports.

B)The exchange rate would be adjusted to discourage imports.

C)The interest rate would be adjusted to encourage saving.

D)Taxes would be increased to reduce aggregate demand.

A)The exchange rate would be adjusted to encourage imports.

B)The exchange rate would be adjusted to discourage imports.

C)The interest rate would be adjusted to encourage saving.

D)Taxes would be increased to reduce aggregate demand.

Unlock Deck

Unlock for access to all 273 flashcards in this deck.

Unlock Deck

k this deck

55

Fiscal policy

A)uses the tools of taxation and spending in an effort to address inflation and unemployment.

B)uses the tool of business regulation to increase economic efficiency.

C)uses the tool of interest rates to stimulate private savings.

D)uses the tool of the exchange rate to discourage imports.

A)uses the tools of taxation and spending in an effort to address inflation and unemployment.

B)uses the tool of business regulation to increase economic efficiency.

C)uses the tool of interest rates to stimulate private savings.

D)uses the tool of the exchange rate to discourage imports.

Unlock Deck

Unlock for access to all 273 flashcards in this deck.

Unlock Deck

k this deck

56

Which of the following fiscal policy actions would definitely cause an increase in the size of a recessionary gap?

A)increases in taxes and cuts in government spending

B)cuts in taxes

C)increases in taxes and increases in government spending

D)cuts in taxes and increases in government spending

A)increases in taxes and cuts in government spending

B)cuts in taxes

C)increases in taxes and increases in government spending

D)cuts in taxes and increases in government spending

Unlock Deck

Unlock for access to all 273 flashcards in this deck.

Unlock Deck

k this deck

57

How might fiscal policy be used to correct a recessionary gap?

A)The exchange rate would be adjusted to encourage imports.

B)The exchange rate would be adjusted to discourage imports.

C)Government spending would be adjusted to increase aggregate demand.

D)Business operations would be regulated by the government to become more efficient.

A)The exchange rate would be adjusted to encourage imports.

B)The exchange rate would be adjusted to discourage imports.

C)Government spending would be adjusted to increase aggregate demand.

D)Business operations would be regulated by the government to become more efficient.

Unlock Deck

Unlock for access to all 273 flashcards in this deck.

Unlock Deck

k this deck

58

Which of the following is NOT related to fiscal policy?

A)passage of new securities laws

B)decreasing marginal tax rates

C)reducing the budget deficit

D)increasing government expenditures

A)passage of new securities laws

B)decreasing marginal tax rates

C)reducing the budget deficit

D)increasing government expenditures

Unlock Deck

Unlock for access to all 273 flashcards in this deck.

Unlock Deck

k this deck

59

The changing of government expenditures or taxes to achieve national economic goals is

A)discretionary fiscal policy.

B)automatic fiscal policy.

C)recessionary fiscal policy.

D)inflationary fiscal policy.

A)discretionary fiscal policy.

B)automatic fiscal policy.

C)recessionary fiscal policy.

D)inflationary fiscal policy.

Unlock Deck

Unlock for access to all 273 flashcards in this deck.

Unlock Deck

k this deck

60

Suppose the economy has a high level of unemployment. This would imply

A)that the government should engage in expansionary fiscal policy and increase the tax rate.

B)that the economy is operating to the left of the LRAS curve and that government spending could be increased to reduce unemployment.

C)that fiscal policy has been ineffective and should be abandoned.

D)that the economy is operating on the SRAS curve and that government spending could be decreased to reduce unemployment.

A)that the government should engage in expansionary fiscal policy and increase the tax rate.

B)that the economy is operating to the left of the LRAS curve and that government spending could be increased to reduce unemployment.

C)that fiscal policy has been ineffective and should be abandoned.

D)that the economy is operating on the SRAS curve and that government spending could be decreased to reduce unemployment.

Unlock Deck

Unlock for access to all 273 flashcards in this deck.

Unlock Deck

k this deck

61

In 2009, Congress passed a bill that involved government spending increases and tax cuts with the purpose of stimulating the U.S. economy. This policy is an example of

A)an automatic stabilizer.

B)contractionary fiscal policy.

C)expansionary fiscal policy.

D)expansionary monetary policy.

A)an automatic stabilizer.

B)contractionary fiscal policy.

C)expansionary fiscal policy.

D)expansionary monetary policy.

Unlock Deck

Unlock for access to all 273 flashcards in this deck.

Unlock Deck

k this deck

62

What does research tell us about the impact of Ricardian equivalence effects on the economy?

A)There is no evidence of any impact of Ricardian equivalence effects.

B)Ricardian equivalence effects have a huge impact on aggregate demand.

C)There is a very small impact on both aggregate demand and aggregate supply.

D)Ricardian equivalence effects may exist, but their magnitudes are unclear.

A)There is no evidence of any impact of Ricardian equivalence effects.

B)Ricardian equivalence effects have a huge impact on aggregate demand.

C)There is a very small impact on both aggregate demand and aggregate supply.

D)Ricardian equivalence effects may exist, but their magnitudes are unclear.

Unlock Deck

Unlock for access to all 273 flashcards in this deck.

Unlock Deck

k this deck

63

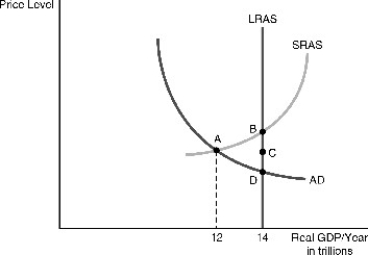

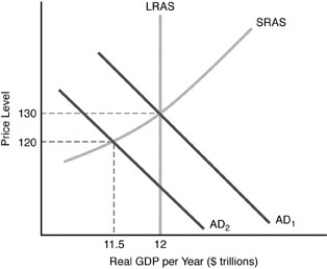

Refer to the above figure. If the relevant aggregate demand curve is AD₂, what is the current economic situation?

A)inflationary gap

B)recessionary gap

C)equilibrium

D)overemployment

Unlock Deck

Unlock for access to all 273 flashcards in this deck.

Unlock Deck

k this deck

64

Refer to the above figure. If the relevant aggregate demand curve was AD₂, the government could do all of the following to close the existing gap EXCEPT

A)increase government spending on roads.

B)reduce marginal tax rates.

C)reduce corporate taxes.

D)reduce defense spending.

Unlock Deck

Unlock for access to all 273 flashcards in this deck.

Unlock Deck

k this deck

65

Refer to the above figure. Suppose the relevant aggregate demand curve is AD₂. If the government wants to use fiscal policy to close the existing gap, it should

A)increase taxes.

B)decrease taxes.

C)increase the money supply.

D)increase government spending.

Unlock Deck

Unlock for access to all 273 flashcards in this deck.

Unlock Deck

k this deck

66

Discretionary Fiscal policy

A)is the use of government spending and tax policies to influence economic growth and inflation.

B)is the use of regulation to influence economic growth and inflation.

C)is the purchase and sale of Treasury securities to influence economic growth and inflation.

D)is the conversion of nominal data to real data.

A)is the use of government spending and tax policies to influence economic growth and inflation.

B)is the use of regulation to influence economic growth and inflation.

C)is the purchase and sale of Treasury securities to influence economic growth and inflation.

D)is the conversion of nominal data to real data.

Unlock Deck

Unlock for access to all 273 flashcards in this deck.

Unlock Deck

k this deck

67

Which one of the following is an example of discretionary fiscal policy used to correct a recessionary gap?

A)a tax decrease passed into law by Congress

B)an increase in the money supply by the Federal Reserve

C)a decrease in government expenditures approved by Congress

D)an agreement among major banks to raise interest rates

A)a tax decrease passed into law by Congress

B)an increase in the money supply by the Federal Reserve

C)a decrease in government expenditures approved by Congress

D)an agreement among major banks to raise interest rates

Unlock Deck

Unlock for access to all 273 flashcards in this deck.

Unlock Deck

k this deck

68

Refer to the above figure. Suppose the relevant aggregate demand curve is AD₂. If the government wants to use discretionary fiscal policy to close the existing gap, it should

A)decrease taxes.

B)increase taxes.

C)increase the money supply.

D)decrease government spending.

Unlock Deck

Unlock for access to all 273 flashcards in this deck.

Unlock Deck

k this deck

69

Refer to the above figure. If the relevant aggregate demand curve is AD₁, then the economy is experiencing

A)an inflationary gap.

B)a recessionary gap.

C)a deflationary gap.

D)full employment.

Unlock Deck

Unlock for access to all 273 flashcards in this deck.

Unlock Deck

k this deck

70

Refer to the above figure. If the relevant aggregate demand curve is AD₂, what is the current economic situation?

A)inflationary gap

B)recessionary gap

C)equilibrium

D)overemployment

Unlock Deck

Unlock for access to all 273 flashcards in this deck.

Unlock Deck

k this deck

71

Explain how fiscal policy can correct a contractionary gap.

Unlock Deck

Unlock for access to all 273 flashcards in this deck.

Unlock Deck

k this deck

72

Which one of the following is an example of discretionary fiscal policy used to correct an inflationary gap?

A)a tax increase passed into law by Congress

B)decrease in the money supply by the Federal Reserve

C)an increase in government expenditures approved by Congress

D)an agreement among major banks to lower interest rates

A)a tax increase passed into law by Congress

B)decrease in the money supply by the Federal Reserve

C)an increase in government expenditures approved by Congress

D)an agreement among major banks to lower interest rates

Unlock Deck

Unlock for access to all 273 flashcards in this deck.

Unlock Deck

k this deck

73

Government spending conducted for the purpose of achieving full employment, price stability, or economic growth is an example of

A)monetary policy.

B)interest-rate policy.

C)exchange-rate policy.

D)fiscal policy.

A)monetary policy.

B)interest-rate policy.

C)exchange-rate policy.

D)fiscal policy.

Unlock Deck

Unlock for access to all 273 flashcards in this deck.

Unlock Deck

k this deck

74

When the current short-run equilibrium is to the right of the long-run aggregate supply, appropriate discretionary fiscal policy used to address this problem would be to

A)increase taxes.

B)decrease taxes.

C)increase government spending.

D)decrease the discount rate.

A)increase taxes.

B)decrease taxes.

C)increase government spending.

D)decrease the discount rate.

Unlock Deck

Unlock for access to all 273 flashcards in this deck.

Unlock Deck

k this deck

75

What is discretionary fiscal policy and what is its purpose?

Unlock Deck

Unlock for access to all 273 flashcards in this deck.

Unlock Deck

k this deck

76

Suppose the current level of real GDP is below the full-employment level of real GDP. Which of the following represents a fiscal policy action that could be implemented to reduce the size of this recessionary gap?

A)Increase government spending.

B)Decrease interest rates.

C)Increase the money supply.

D)all of the above

A)Increase government spending.

B)Decrease interest rates.

C)Increase the money supply.

D)all of the above

Unlock Deck

Unlock for access to all 273 flashcards in this deck.

Unlock Deck

k this deck

77

Which of the following statements about fiscal policy is TRUE?

A)Real Gross Domestic Product (GDP)can be increased above its long-run equilibrium only in the short run.

B)Real Gross Domestic Product (GDP)can never be increased above its long-run equilibrium, even for a brief period of time.

C)Government can shift the aggregate demand curve inward by increasing spending.

D)Government can shift the aggregate demand curve outward by reducing spending.

A)Real Gross Domestic Product (GDP)can be increased above its long-run equilibrium only in the short run.

B)Real Gross Domestic Product (GDP)can never be increased above its long-run equilibrium, even for a brief period of time.

C)Government can shift the aggregate demand curve inward by increasing spending.

D)Government can shift the aggregate demand curve outward by reducing spending.

Unlock Deck

Unlock for access to all 273 flashcards in this deck.

Unlock Deck

k this deck

78

Suppose the government believes the economy is operating beyond the full-employment real GDP. What kind of fiscal policy could it pursue?

Unlock Deck

Unlock for access to all 273 flashcards in this deck.

Unlock Deck

k this deck

79

The fiscal policy of the United States is

A)summarized in the budget of the U.S. federal government.

B)the sum of the budgets of each state and municipality.

C)published in the Federal Reserve Bank's Annual Report.

D)announced by the President in his State of the Union message.

A)summarized in the budget of the U.S. federal government.

B)the sum of the budgets of each state and municipality.

C)published in the Federal Reserve Bank's Annual Report.

D)announced by the President in his State of the Union message.

Unlock Deck

Unlock for access to all 273 flashcards in this deck.

Unlock Deck

k this deck

80

Tax policy conducted for the purpose of achieving full employment, price stability, or economic growth is an example of

A)monetary policy.

B)interest-rate policy.

C)exchange-rate policy.

D)discretionary fiscal policy.

A)monetary policy.

B)interest-rate policy.

C)exchange-rate policy.

D)discretionary fiscal policy.

Unlock Deck

Unlock for access to all 273 flashcards in this deck.

Unlock Deck

k this deck