Deck 15: Fiscal Policy

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/201

Play

Full screen (f)

Deck 15: Fiscal Policy

1

When the federal government is running a budget deficit:

A) government tax revenues exceed government expenditures.

B) government expenditures exceed government tax revenues.

C) the economy must be in an economic recession.

D) the size of the national debt will decline.

A) government tax revenues exceed government expenditures.

B) government expenditures exceed government tax revenues.

C) the economy must be in an economic recession.

D) the size of the national debt will decline.

B

2

Fiscal policy is concerned with:

A) encouraging businesses to invest.

B) regulation of net exports.

C) changes in government spending and/or tax revenues.

D) expanding and contracting the money supply.

A) encouraging businesses to invest.

B) regulation of net exports.

C) changes in government spending and/or tax revenues.

D) expanding and contracting the money supply.

C

3

A government spending and taxation policy to achieve macroeconomic goals is known as:

A) countercyclical policy.

B) fiscal policy.

C) monetary policy.

D) a balanced budget.

A) countercyclical policy.

B) fiscal policy.

C) monetary policy.

D) a balanced budget.

B

4

Suppose the economy is on the classical range of the aggregate supply curve and has a problem with inflation.According to Keynesian theory,which of the following is an appropriate discretionary fiscal policy to use in this situation?

A) A reduction in the money supply.

B) Less government regulation.

C) Increase federal spending.

D) Higher taxes.

A) A reduction in the money supply.

B) Less government regulation.

C) Increase federal spending.

D) Higher taxes.

Unlock Deck

Unlock for access to all 201 flashcards in this deck.

Unlock Deck

k this deck

5

The Keynesian analysis of fiscal policy argues that:

A) fiscal policy should generally be expansionary except during periods of economic recession.

B) fiscal policy should generally be restrictive except during inflationary booms.

C) the federal budget should be balanced annually except during war.

D) the federal budget should be used to maintain aggregate demand at a level consistent with full employment.

A) fiscal policy should generally be expansionary except during periods of economic recession.

B) fiscal policy should generally be restrictive except during inflationary booms.

C) the federal budget should be balanced annually except during war.

D) the federal budget should be used to maintain aggregate demand at a level consistent with full employment.

Unlock Deck

Unlock for access to all 201 flashcards in this deck.

Unlock Deck

k this deck

6

If an economy were experiencing a high rate of unemployment as the result of insufficient aggregate demand,a Keynesian economist would favor:

A) a reduction in taxes coupled with a reduction in government expenditures of equal size.

B) an increase in government expenditures coupled with an increase in taxes of equal size.

C) a reduction in taxes, without any offsetting reduction in government expenditures.

D) maintenance of a balanced budget.

A) a reduction in taxes coupled with a reduction in government expenditures of equal size.

B) an increase in government expenditures coupled with an increase in taxes of equal size.

C) a reduction in taxes, without any offsetting reduction in government expenditures.

D) maintenance of a balanced budget.

Unlock Deck

Unlock for access to all 201 flashcards in this deck.

Unlock Deck

k this deck

7

Expansionary fiscal policy consists of:

A) increasing government spending.

B) increasing payroll taxes to finance health care.

C) decreasing government spending.

D) raising the minimum wage.

A) increasing government spending.

B) increasing payroll taxes to finance health care.

C) decreasing government spending.

D) raising the minimum wage.

Unlock Deck

Unlock for access to all 201 flashcards in this deck.

Unlock Deck

k this deck

8

When an economy is operating below its potential capacity,Keynesian economists argue that:

A) taxes should be raised if the government is currently running a budget deficit.

B) taxes should be lowered but only if the government is running a budget surplus.

C) the government should cut taxes and/or increase spending in order to stimulate aggregate demand.

D) all of the above.

A) taxes should be raised if the government is currently running a budget deficit.

B) taxes should be lowered but only if the government is running a budget surplus.

C) the government should cut taxes and/or increase spending in order to stimulate aggregate demand.

D) all of the above.

Unlock Deck

Unlock for access to all 201 flashcards in this deck.

Unlock Deck

k this deck

9

Changes in government spending and/or taxes as the result of legislation,is called:

A) open market operations of the Federal Reserve.

B) discretionary fiscal policy.

C) balanced budget operations.

D) discretionary monetary policy.

A) open market operations of the Federal Reserve.

B) discretionary fiscal policy.

C) balanced budget operations.

D) discretionary monetary policy.

Unlock Deck

Unlock for access to all 201 flashcards in this deck.

Unlock Deck

k this deck

10

Which of the following statements is true?

A) Fiscal policy is the manipulation of the nation's money supply to influence the nation's output, employment and price level.

B) Discretionary fiscal policy is the deliberate use of changes in government spending and taxes to stabilize the economy.

C) The tax multiplier is the change in aggregate demand resulting from an initial change in government spending.

D) A budget deficit exists when government tax revenues exceed government spending.

A) Fiscal policy is the manipulation of the nation's money supply to influence the nation's output, employment and price level.

B) Discretionary fiscal policy is the deliberate use of changes in government spending and taxes to stabilize the economy.

C) The tax multiplier is the change in aggregate demand resulting from an initial change in government spending.

D) A budget deficit exists when government tax revenues exceed government spending.

Unlock Deck

Unlock for access to all 201 flashcards in this deck.

Unlock Deck

k this deck

11

If the marginal propensity to consume (MPC)is 0.75,and if policy makers wish to increase real GDP by $300 million,then by how much would they have to change taxes?

A) -$300 million.

B) -$200 million.

C) -100 million.

D) -$50 million.

A) -$300 million.

B) -$200 million.

C) -100 million.

D) -$50 million.

Unlock Deck

Unlock for access to all 201 flashcards in this deck.

Unlock Deck

k this deck

12

An expansionary fiscal policy may include:

A) increases in government spending.

B) discretionary increases in transfer payments.

C) reductions in taxes.

D) All of the above.

A) increases in government spending.

B) discretionary increases in transfer payments.

C) reductions in taxes.

D) All of the above.

Unlock Deck

Unlock for access to all 201 flashcards in this deck.

Unlock Deck

k this deck

13

A balanced budget is present when:

A) the economy is at full employment.

B) the actual level of aggregate spending equals the planned level of spending.

C) public sector spending equals private sector spending.

D) government revenues equal government expenditures.

A) the economy is at full employment.

B) the actual level of aggregate spending equals the planned level of spending.

C) public sector spending equals private sector spending.

D) government revenues equal government expenditures.

Unlock Deck

Unlock for access to all 201 flashcards in this deck.

Unlock Deck

k this deck

14

Contractionary fiscal policy is deliberate government action to influence aggregate demand and the level of real GDP through:

A) expanding and contracting the money supply.

B) encouraging business to expand or contract investment.

C) regulating net exports.

D) decreasing government spending or increasing taxes.

A) expanding and contracting the money supply.

B) encouraging business to expand or contract investment.

C) regulating net exports.

D) decreasing government spending or increasing taxes.

Unlock Deck

Unlock for access to all 201 flashcards in this deck.

Unlock Deck

k this deck

15

Which of the following is an example of expansionary fiscal policy?

A) Increase taxes.

B) Decrease government spending.

C) Increase government spending.

D) Increase taxes and decrease government spending equally.

A) Increase taxes.

B) Decrease government spending.

C) Increase government spending.

D) Increase taxes and decrease government spending equally.

Unlock Deck

Unlock for access to all 201 flashcards in this deck.

Unlock Deck

k this deck

16

Suppose that the economy is operating in full-employment equilibrium along the vertical section of the aggregate supply curve.If the aggregate demand curve is reduced by $100 billion in order for the price level to decline by 5 percent,and if the marginal propensity to consume (MPC)is 0.75,then what change in taxes would generate the desired price reduction?

A) $300 billion.

B) -$75 billion.

C) -$33.3 billion.

D) -$25 billion.

A) $300 billion.

B) -$75 billion.

C) -$33.3 billion.

D) -$25 billion.

Unlock Deck

Unlock for access to all 201 flashcards in this deck.

Unlock Deck

k this deck

17

If the marginal propensity to consume (MPC)is 0.75,and if the goal is to increase real GDP by $400 million,then by how much would government spending have to change to generate this increase in real GDP?

A) $140 million.

B) $100 million.

C) $200 million.

D) $400 million.

A) $140 million.

B) $100 million.

C) $200 million.

D) $400 million.

Unlock Deck

Unlock for access to all 201 flashcards in this deck.

Unlock Deck

k this deck

18

Keynesian analysis stresses that a tax cut that increases the government's budget deficit or reduces its budget surplus:

A) is appropriate during a period of inflation.

B) will increase the money supply.

C) will stimulate aggregate supply and, thereby, promote employment.

D) will stimulate aggregate demand and, thereby, promote employment.

A) is appropriate during a period of inflation.

B) will increase the money supply.

C) will stimulate aggregate supply and, thereby, promote employment.

D) will stimulate aggregate demand and, thereby, promote employment.

Unlock Deck

Unlock for access to all 201 flashcards in this deck.

Unlock Deck

k this deck

19

The government is pursuing an expansionary policy if it:

A) decreases its spending and increases its tax revenues.

B) increases its spending or increases its tax revenues.

C) decreases its spending or reduces its tax revenues.

D) increases its spending and/or reduces its tax revenues.

A) decreases its spending and increases its tax revenues.

B) increases its spending or increases its tax revenues.

C) decreases its spending or reduces its tax revenues.

D) increases its spending and/or reduces its tax revenues.

Unlock Deck

Unlock for access to all 201 flashcards in this deck.

Unlock Deck

k this deck

20

Fiscal policy is government action to influence aggregate demand and in turn to influence the level of real GDP and the price level,through:

A) expanding and contracting the money supply.

B) regulation of net exports.

C) changes in government spending and/or tax revenues.

D) encouraging businesses to invest.

A) expanding and contracting the money supply.

B) regulation of net exports.

C) changes in government spending and/or tax revenues.

D) encouraging businesses to invest.

Unlock Deck

Unlock for access to all 201 flashcards in this deck.

Unlock Deck

k this deck

21

If your income increases from $30,000 to $35,000 and your consumption increases from $11,000 to $12,000,your marginal propensity to consume (MPC)is:

A) 0.2.

B) 0.4.

C) 0.5.

D) 0.8.

E) 1.0.

A) 0.2.

B) 0.4.

C) 0.5.

D) 0.8.

E) 1.0.

Unlock Deck

Unlock for access to all 201 flashcards in this deck.

Unlock Deck

k this deck

22

If the marginal propensity to consume (MPC)is 0.80,and if policy makers wish to increase real GDP $200 billion,then by how much would they have to change taxes?

A) -$240 million.

B) -$200 million.

C) -$180 million.

D) -$50 million.

A) -$240 million.

B) -$200 million.

C) -$180 million.

D) -$50 million.

Unlock Deck

Unlock for access to all 201 flashcards in this deck.

Unlock Deck

k this deck

23

The fraction of each added dollar of income that is used for consumption is called the:

A) average propensity to consumer (APC).

B) autonomous consumption rate (ACR).

C) marginal consumption propensity (MCP).

D) marginal propensity to consume (MPC).

A) average propensity to consumer (APC).

B) autonomous consumption rate (ACR).

C) marginal consumption propensity (MCP).

D) marginal propensity to consume (MPC).

Unlock Deck

Unlock for access to all 201 flashcards in this deck.

Unlock Deck

k this deck

24

Assume that we want to drive our economy out of recession by generating a $400 billion change in real GDP.The MPC is 0.80.Which of the following policy prescriptions would generate the targeted $400 billion change in income?

A) $120 billion increase in government spending and $50 billion increase in tax revenue.

B) $140 billion increase in government spending and $70 billion increase in tax revenue.

C) $160 billion increase in government spending and $120 billion increase in tax revenue.

D) $220 billion increase in government spending and $100 billion increase in tax revenue.

E) $400 billion increase in government spending and $300 billion increase in tax revenue.

A) $120 billion increase in government spending and $50 billion increase in tax revenue.

B) $140 billion increase in government spending and $70 billion increase in tax revenue.

C) $160 billion increase in government spending and $120 billion increase in tax revenue.

D) $220 billion increase in government spending and $100 billion increase in tax revenue.

E) $400 billion increase in government spending and $300 billion increase in tax revenue.

Unlock Deck

Unlock for access to all 201 flashcards in this deck.

Unlock Deck

k this deck

25

The ratio of a change in consumption to a change in income is the:

A) consumption function.

B) propensity to consume.

C) average propensity to consume.

D) extra propensity to consume.

E) marginal propensity to consume.

A) consumption function.

B) propensity to consume.

C) average propensity to consume.

D) extra propensity to consume.

E) marginal propensity to consume.

Unlock Deck

Unlock for access to all 201 flashcards in this deck.

Unlock Deck

k this deck

26

Assume the marginal propensity to consume (MPC)is 0.75 and the economy is in recession with real GDP $1 trillion below full-employment real GDP.To achieve full employment,aggregate demand (AD)must be increased $2 trillion.Following discretionary fiscal policy,government spending should be increased:

A) $0.25 trillion.

B) $1 trillion.

C) $0.5 trillion.

D) $2 trillion.

A) $0.25 trillion.

B) $1 trillion.

C) $0.5 trillion.

D) $2 trillion.

Unlock Deck

Unlock for access to all 201 flashcards in this deck.

Unlock Deck

k this deck

27

If your income increases from $40,000 to $48,000 and your consumption increases from $35,000 to $39,000,your marginal propensity to consume (MPC)is:

A) 0.20.

B) 0.40.

C) 0.50.

D) 0.80.

E) 1.00.

A) 0.20.

B) 0.40.

C) 0.50.

D) 0.80.

E) 1.00.

Unlock Deck

Unlock for access to all 201 flashcards in this deck.

Unlock Deck

k this deck

28

The nation has its own MPC.When national income increases from $300 billion to $400 billion,national consumption increases from $300 billion to $360 billion.At Y = $400 billion,the MPC is:

A) 0.2.

B) 0.5.

C) 0.6.

D) 0.67.

E) 1.33.

A) 0.2.

B) 0.5.

C) 0.6.

D) 0.67.

E) 1.33.

Unlock Deck

Unlock for access to all 201 flashcards in this deck.

Unlock Deck

k this deck

29

To combat a recession,Keynesian fiscal policy recommends:

A) An increase in taxes.

B) An increase in government spending.

C) An increase in taxes and a decrease in government purchases to balance the budget.

D) A reduction in both taxes and government spending.

A) An increase in taxes.

B) An increase in government spending.

C) An increase in taxes and a decrease in government purchases to balance the budget.

D) A reduction in both taxes and government spending.

Unlock Deck

Unlock for access to all 201 flashcards in this deck.

Unlock Deck

k this deck

30

The change in consumption divided by a change in income is defined as:

A) the marginal propensity to consume.

B) autonomous consumption.

C) the consumption function.

D) Keynes' absolute income hypothesis.

E) transitory consumption.

A) the marginal propensity to consume.

B) autonomous consumption.

C) the consumption function.

D) Keynes' absolute income hypothesis.

E) transitory consumption.

Unlock Deck

Unlock for access to all 201 flashcards in this deck.

Unlock Deck

k this deck

31

Which of the following would be an appropriate discretionary fiscal policy to use when the economy is in a recession?

A) Increased government spending.

B) Higher taxes.

C) A balanced-budget reduction in both spending and taxes.

D) An expansion in the money supply.

A) Increased government spending.

B) Higher taxes.

C) A balanced-budget reduction in both spending and taxes.

D) An expansion in the money supply.

Unlock Deck

Unlock for access to all 201 flashcards in this deck.

Unlock Deck

k this deck

32

The marginal propensity to consume is:

A) the change in income divided by the change in consumption.

B) consumption spending divided by income.

C) income divided by consumption spending.

D) the change in consumption divided by the change in income.

E) the change in consumption divided by income.

A) the change in income divided by the change in consumption.

B) consumption spending divided by income.

C) income divided by consumption spending.

D) the change in consumption divided by the change in income.

E) the change in consumption divided by income.

Unlock Deck

Unlock for access to all 201 flashcards in this deck.

Unlock Deck

k this deck

33

Assume the economy is in recession and real GDP is below full employment.The marginal propensity to consume (MPC)is 0.50,and the government follows Keynesian economics by using expansionary fiscal policy to increase aggregate demand (total spending).If an increase of $1,000 billion aggregate demand can restore full employment,the government should:

A) increase spending by $250 billion.

B) decrease spending by $500 billion.

C) increase spending by $1,000 billion.

D) increase spending by $500 billion.

A) increase spending by $250 billion.

B) decrease spending by $500 billion.

C) increase spending by $1,000 billion.

D) increase spending by $500 billion.

Unlock Deck

Unlock for access to all 201 flashcards in this deck.

Unlock Deck

k this deck

34

Assume the economy is in recession and real GDP is below full employment.The marginal propensity to consume (MPC)is 0.75,and the government follows Keynesian economics by using expansionary fiscal policy to increase aggregate demand (total spending).If an increase of $1,000 billion aggregate demand can restore full employment,the government should:

A) increase spending by $250 billion.

B) decrease spending by $750 billion.

C) increase spending by $1,000 billion.

D) increase spending by $750 billion.

A) increase spending by $250 billion.

B) decrease spending by $750 billion.

C) increase spending by $1,000 billion.

D) increase spending by $750 billion.

Unlock Deck

Unlock for access to all 201 flashcards in this deck.

Unlock Deck

k this deck

35

The change in consumption divided by a change in income is called the:

A) consumption function.

B) marginal propensity to consume.

C) marginal propensity to spend.

D) spending function.

E) changing propensity to consume.

A) consumption function.

B) marginal propensity to consume.

C) marginal propensity to spend.

D) spending function.

E) changing propensity to consume.

Unlock Deck

Unlock for access to all 201 flashcards in this deck.

Unlock Deck

k this deck

36

If your income increases from $33,000 to $41,000 and your consumption increases from $8,000 to $12,000,your marginal propensity to consume (MPC)is:

A) 0.2.

B) 0.4.

C) 0.5.

D) 0.8.

E) 1.0.

A) 0.2.

B) 0.4.

C) 0.5.

D) 0.8.

E) 1.0.

Unlock Deck

Unlock for access to all 201 flashcards in this deck.

Unlock Deck

k this deck

37

The marginal propensity to consume (MPC)is computed as the change in:

A) consumption divided by the change in savings.

B) consumption divided by the change in income.

C) consumption divided by the change in GDP.

D) None of the above.

A) consumption divided by the change in savings.

B) consumption divided by the change in income.

C) consumption divided by the change in GDP.

D) None of the above.

Unlock Deck

Unlock for access to all 201 flashcards in this deck.

Unlock Deck

k this deck

38

The marginal propensity to consume (MPC)is computed as the change in consumption divided by the change in:

A) GDP.

B) income.

C) saving.

D) none of the above.

A) GDP.

B) income.

C) saving.

D) none of the above.

Unlock Deck

Unlock for access to all 201 flashcards in this deck.

Unlock Deck

k this deck

39

Assume the economy is in recession and real GDP is below full employment.The marginal propensity to consume (MPC)is 0.90,and the government follows Keynesian economics by using expansionary fiscal policy to increase aggregate demand (total spending).If an increase of $1,000 billion aggregate demand can restore full employment,the government should:

A) increase spending by $100 billion.

B) decrease spending by $790 billion.

C) increase spending by $1,000 billion.

D) increase spending by $250 billion.

A) increase spending by $100 billion.

B) decrease spending by $790 billion.

C) increase spending by $1,000 billion.

D) increase spending by $250 billion.

Unlock Deck

Unlock for access to all 201 flashcards in this deck.

Unlock Deck

k this deck

40

If the MPC is 0.80,and if the goal is to increase real GDP by $200 million,then by how much would government spending have to change to generate this increase in real GDP?

A) $240 million.

B) $200 million.

C) $180 million.

D) $40 million.

A) $240 million.

B) $200 million.

C) $180 million.

D) $40 million.

Unlock Deck

Unlock for access to all 201 flashcards in this deck.

Unlock Deck

k this deck

41

If the marginal propensity to save (MPS)is 0.50,the value of the spending multiplier is:

A) 1.

B) 2.

C) 4.

D) 9.

A) 1.

B) 2.

C) 4.

D) 9.

Unlock Deck

Unlock for access to all 201 flashcards in this deck.

Unlock Deck

k this deck

42

The spending multiplier is:

A) 1 / (1 - MPC).

B) 1 - MPC.

C) MPC.

D) MPC / (1 - MPC).

A) 1 / (1 - MPC).

B) 1 - MPC.

C) MPC.

D) MPC / (1 - MPC).

Unlock Deck

Unlock for access to all 201 flashcards in this deck.

Unlock Deck

k this deck

43

If the marginal propensity to consume (MPC)is 0.50,the value of the spending multiplier is:

A) 5.

B) 1.

C) 2.

D) 5.

A) 5.

B) 1.

C) 2.

D) 5.

Unlock Deck

Unlock for access to all 201 flashcards in this deck.

Unlock Deck

k this deck

44

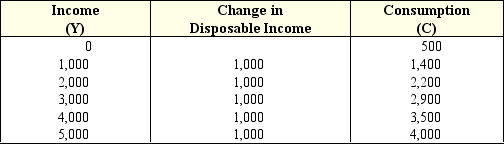

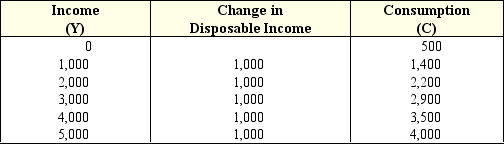

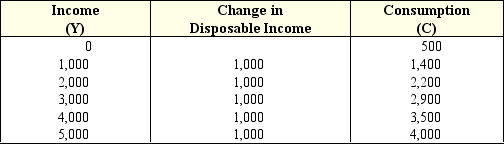

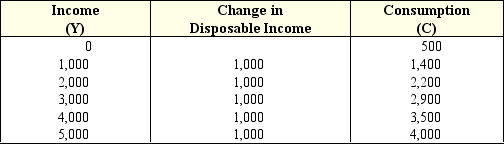

Exhibit 15-1 Disposable income and consumption data

In Exhibit 15-1,when disposable income (Y)is increased from $1,000 to $2,000,the marginal propensity to consume is:

A) 0.2.

B) 0.6.

C) 0.8.

D) 1.0.

E) 1.25.

In Exhibit 15-1,when disposable income (Y)is increased from $1,000 to $2,000,the marginal propensity to consume is:

A) 0.2.

B) 0.6.

C) 0.8.

D) 1.0.

E) 1.25.

Unlock Deck

Unlock for access to all 201 flashcards in this deck.

Unlock Deck

k this deck

45

Exhibit 15-1 Disposable income and consumption data

In Exhibit 15-1,when disposable income (Y)is increased from $0 to $1,000 to $2,000,the marginal propensity to consume:

A) is 1.

B) decreases from 0.9 to 0.8.

C) decreases from 0.8 to 0.7.

D) increases from 0.8 to 0.9.

E) is negative.

In Exhibit 15-1,when disposable income (Y)is increased from $0 to $1,000 to $2,000,the marginal propensity to consume:

A) is 1.

B) decreases from 0.9 to 0.8.

C) decreases from 0.8 to 0.7.

D) increases from 0.8 to 0.9.

E) is negative.

Unlock Deck

Unlock for access to all 201 flashcards in this deck.

Unlock Deck

k this deck

46

As the marginal propensity to consume (MPC)increases,the spending multiplier:

A) increases.

B) decreases.

C) remains constant.

D) becomes undefinable.

A) increases.

B) decreases.

C) remains constant.

D) becomes undefinable.

Unlock Deck

Unlock for access to all 201 flashcards in this deck.

Unlock Deck

k this deck

47

The marginal propensity to consume measures the ratio of the:

A) average amount of our income that we spend.

B) average amount of our savings that we spend.

C) change in consumer spending to a change in money holdings.

D) change in consumer spending to a change in interest rates.

E) change in consumer spending to a change in income.

A) average amount of our income that we spend.

B) average amount of our savings that we spend.

C) change in consumer spending to a change in money holdings.

D) change in consumer spending to a change in interest rates.

E) change in consumer spending to a change in income.

Unlock Deck

Unlock for access to all 201 flashcards in this deck.

Unlock Deck

k this deck

48

If the marginal propensity to consume (MPC)is 0.75,a $50 decrease in government spending,other things being equal,would cause equilibrium real GDP to:

A) increase by $50.

B) decrease by $50.

C) increase by $200.

D) decrease by $200.

A) increase by $50.

B) decrease by $50.

C) increase by $200.

D) decrease by $200.

Unlock Deck

Unlock for access to all 201 flashcards in this deck.

Unlock Deck

k this deck

49

If the marginal propensity to consume (MPC)is 0.96,the value of the spending multiplier is:

A) 25.

B) 40.

C) 96.

D) 100.

A) 25.

B) 40.

C) 96.

D) 100.

Unlock Deck

Unlock for access to all 201 flashcards in this deck.

Unlock Deck

k this deck

50

The ratio of the change in GDP to an initial change in aggregate spending is the:

A) spending multiplier.

B) permanent income rate.

C) marginal expenditure rate.

D) marginal propensity to consume.

A) spending multiplier.

B) permanent income rate.

C) marginal expenditure rate.

D) marginal propensity to consume.

Unlock Deck

Unlock for access to all 201 flashcards in this deck.

Unlock Deck

k this deck

51

If the marginal propensity to save (MPS)is 0.25,the value of the spending multiplier is:

A) 1.

B) 2.

C) 4.

D) 9.

A) 1.

B) 2.

C) 4.

D) 9.

Unlock Deck

Unlock for access to all 201 flashcards in this deck.

Unlock Deck

k this deck

52

Mathematically,the value of the spending multiplier in terms of the marginal propensity to consume (MPC)is given by the formula:

A) MPC - 1.

B) (MPC - 1)/MPC.

C) 1/MPC.

D) 1/(1 - MPC).

A) MPC - 1.

B) (MPC - 1)/MPC.

C) 1/MPC.

D) 1/(1 - MPC).

Unlock Deck

Unlock for access to all 201 flashcards in this deck.

Unlock Deck

k this deck

53

If the marginal propensity to save (MPS)is 0.10,the value of the spending multiplier is:

A) 1.

B) 9.

C) 10.

D) 90.

A) 1.

B) 9.

C) 10.

D) 90.

Unlock Deck

Unlock for access to all 201 flashcards in this deck.

Unlock Deck

k this deck

54

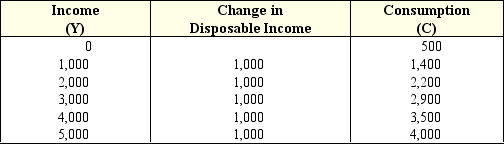

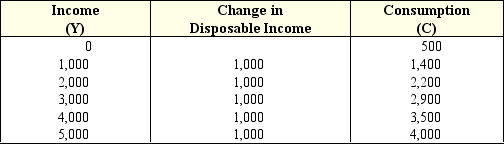

Exhibit 15-1 Disposable income and consumption data

In Exhibit 15-1,when disposable income is increased from $2,000 to $3,000 to $4,000,

A) total consumption increases by $1,000.

B) the marginal propensity to consume remains constant.

C) the marginal propensity to consume increases from 0.6 to 0.7.

D) the marginal propensity to consume decreases from 0.8 to 0.7.

E) the marginal propensity to consume decreases from 0.7 to 0.6.

In Exhibit 15-1,when disposable income is increased from $2,000 to $3,000 to $4,000,

A) total consumption increases by $1,000.

B) the marginal propensity to consume remains constant.

C) the marginal propensity to consume increases from 0.6 to 0.7.

D) the marginal propensity to consume decreases from 0.8 to 0.7.

E) the marginal propensity to consume decreases from 0.7 to 0.6.

Unlock Deck

Unlock for access to all 201 flashcards in this deck.

Unlock Deck

k this deck

55

If the marginal propensity to consume (MPC)is 0.75,the value of the spending multiplier is:

A) 0.

B) 1.

C) 4.

D) 5.

A) 0.

B) 1.

C) 4.

D) 5.

Unlock Deck

Unlock for access to all 201 flashcards in this deck.

Unlock Deck

k this deck

56

As the marginal propensity to consume (MPC)decreases,the spending multiplier:

A) increases.

B) decreases.

C) remains constant.

D) becomes undefinable.

A) increases.

B) decreases.

C) remains constant.

D) becomes undefinable.

Unlock Deck

Unlock for access to all 201 flashcards in this deck.

Unlock Deck

k this deck

57

If the marginal propensity to consume (MPC)is 0.80,the value of the spending multiplier is:

A) 2.

B) 5.

C) 8.

D) 10.

A) 2.

B) 5.

C) 8.

D) 10.

Unlock Deck

Unlock for access to all 201 flashcards in this deck.

Unlock Deck

k this deck

58

When households' marginal propensity to consume (MPC)increases,the size of the spending multiplier:

A) also increases.

B) decreases.

C) remains unchanged.

D) reacts unpredictably.

A) also increases.

B) decreases.

C) remains unchanged.

D) reacts unpredictably.

Unlock Deck

Unlock for access to all 201 flashcards in this deck.

Unlock Deck

k this deck

59

The formula to compute the spending multiplier is:

A) 1/(MPC + MPS).

B) 1/(1 - MPC).

C) 1/(1 - MPS).

D) 1/(C + I).

A) 1/(MPC + MPS).

B) 1/(1 - MPC).

C) 1/(1 - MPS).

D) 1/(C + I).

Unlock Deck

Unlock for access to all 201 flashcards in this deck.

Unlock Deck

k this deck

60

The spending multiplier is defined as:

A) the ratio of the change in equilibrium real GDP to the initial change in spending.

B) the change in initial spending divided by the change in personal income.

C) 1/(marginal propensity to consume).

D) 1/(1 - marginal propensity to save).

A) the ratio of the change in equilibrium real GDP to the initial change in spending.

B) the change in initial spending divided by the change in personal income.

C) 1/(marginal propensity to consume).

D) 1/(1 - marginal propensity to save).

Unlock Deck

Unlock for access to all 201 flashcards in this deck.

Unlock Deck

k this deck

61

If the MPC = 1,the spending multiplier is:

A) infinite.

B) zero.

C) 10.

D) 100.

E) 1.

A) infinite.

B) zero.

C) 10.

D) 100.

E) 1.

Unlock Deck

Unlock for access to all 201 flashcards in this deck.

Unlock Deck

k this deck

62

Mathematically,the value of the tax multiplier in terms of the marginal propensity to consume (MPC)is given by the formula:

A) MPC - 1.

B) (MPC - 1)/MPC.

C) 1/MPC.

D) 1-[1/(1 - MPC)].

A) MPC - 1.

B) (MPC - 1)/MPC.

C) 1/MPC.

D) 1-[1/(1 - MPC)].

Unlock Deck

Unlock for access to all 201 flashcards in this deck.

Unlock Deck

k this deck

63

Assume the marginal propensity to consume (MPC)is 0.75 and the government increases taxes by $250 billion.The aggregate demand curve will shift to the:

A) left by $1,000 billion.

B) right by $1,000 billion.

C) left by $750 billion.

D) right by $750 billion.

A) left by $1,000 billion.

B) right by $1,000 billion.

C) left by $750 billion.

D) right by $750 billion.

Unlock Deck

Unlock for access to all 201 flashcards in this deck.

Unlock Deck

k this deck

64

The equation for the spending multiplier is:

A) 1 / (1 - MPC).

B) 1 - MPC.

C) 1 - (MPC - MPS).

D) MPC/MPS.

E) none of the above.

A) 1 / (1 - MPC).

B) 1 - MPC.

C) 1 - (MPC - MPS).

D) MPC/MPS.

E) none of the above.

Unlock Deck

Unlock for access to all 201 flashcards in this deck.

Unlock Deck

k this deck

65

Assume the marginal propensity to consume (MPC)is 0.80 and the government cuts taxes by $100 billion.The aggregate demand curve will shift to the:

A) right by $80 billion.

B) left by $200 billion.

C) right by $400 billion.

D) left by $400 billion.

E) None of the above.

A) right by $80 billion.

B) left by $200 billion.

C) right by $400 billion.

D) left by $400 billion.

E) None of the above.

Unlock Deck

Unlock for access to all 201 flashcards in this deck.

Unlock Deck

k this deck

66

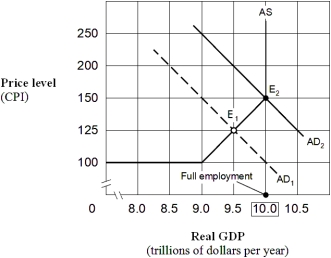

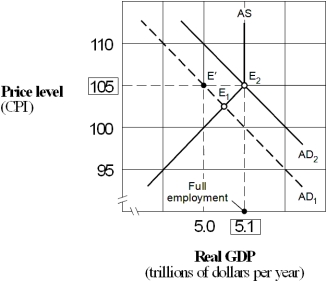

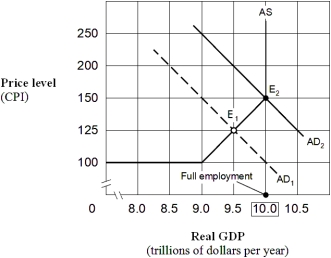

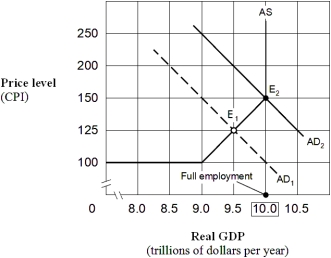

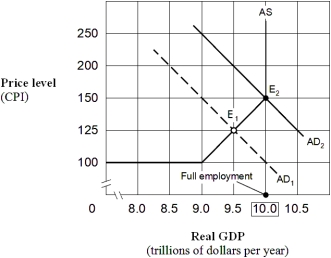

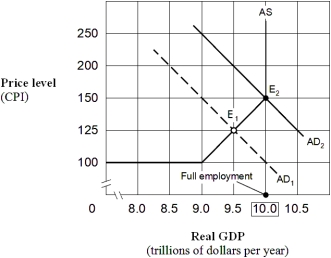

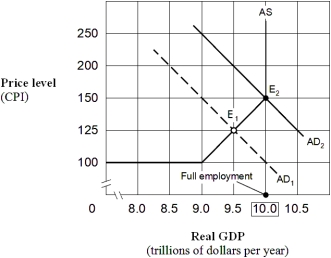

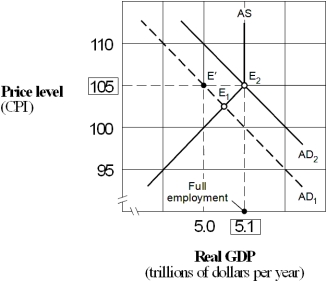

Exhibit 15-3 Aggregate demand and supply model

Beginning at equilibrium E₁ in Exhibit 15-3,when the government increases spending or cuts taxes the economy will experience:

A) an inflationary recession.

B) stagflation.

C) cost-push inflation.

D) demand-pull inflation.

Beginning at equilibrium E₁ in Exhibit 15-3,when the government increases spending or cuts taxes the economy will experience:

A) an inflationary recession.

B) stagflation.

C) cost-push inflation.

D) demand-pull inflation.

Unlock Deck

Unlock for access to all 201 flashcards in this deck.

Unlock Deck

k this deck

67

Assume the marginal propensity to consume (MPC)is 0.75 and the government cuts taxes by $250 billion.The aggregate demand curve will shift to the:

A) right by $1,000 billion.

B) right by $750 billion.

C) left by $1,000 billion.

D) left by $750 billion.

A) right by $1,000 billion.

B) right by $750 billion.

C) left by $1,000 billion.

D) left by $750 billion.

Unlock Deck

Unlock for access to all 201 flashcards in this deck.

Unlock Deck

k this deck

68

When the MPC gets smaller,the spending multiplier:

A) gets larger.

B) gets smaller.

C) stays the same.

D) gets smaller at low real GDP, and larger at high real GDP.

E) gets larger at low real GDP, and smaller at high real GDP.

A) gets larger.

B) gets smaller.

C) stays the same.

D) gets smaller at low real GDP, and larger at high real GDP.

E) gets larger at low real GDP, and smaller at high real GDP.

Unlock Deck

Unlock for access to all 201 flashcards in this deck.

Unlock Deck

k this deck

69

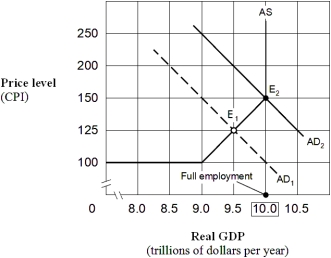

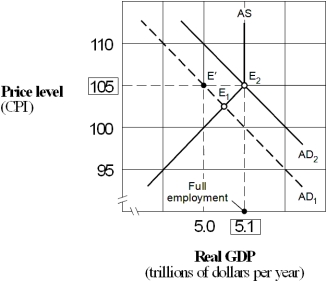

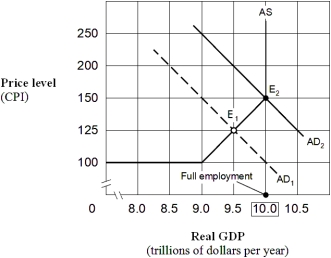

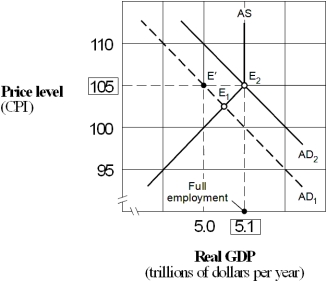

Exhibit 15-2 Aggregate demand and supply model

Suppose the economy in Exhibit 15-2 is in equilibrium at point E₁ and the marginal propensity to consume (MPC)is 0.75.Following Keynesian economics,the federal government can move the economy to full employment at point E₂ by:

A) decreasing government tax revenue by $100 billion.

B) decreasing government tax revenue by $750 billion.

C) increasing government tax revenue by $100 billion.

D) increasing government tax revenue by approximately $33 billion.

E) decreasing government tax revenue by approximately $33 billion.

Suppose the economy in Exhibit 15-2 is in equilibrium at point E₁ and the marginal propensity to consume (MPC)is 0.75.Following Keynesian economics,the federal government can move the economy to full employment at point E₂ by:

A) decreasing government tax revenue by $100 billion.

B) decreasing government tax revenue by $750 billion.

C) increasing government tax revenue by $100 billion.

D) increasing government tax revenue by approximately $33 billion.

E) decreasing government tax revenue by approximately $33 billion.

Unlock Deck

Unlock for access to all 201 flashcards in this deck.

Unlock Deck

k this deck

70

An increase in government spending by $100 would,if the MPC = 0.90,result in an increase in real GDP by:

A) $1,000.

B) $9,000.

C) $900.

D) $190.

E) inadequate information is given.

A) $1,000.

B) $9,000.

C) $900.

D) $190.

E) inadequate information is given.

Unlock Deck

Unlock for access to all 201 flashcards in this deck.

Unlock Deck

k this deck

71

Given full-employment output = $2,800,equilibrium real GDP = $2,500,and MPS = 0.25,which of the following changes would most likely bring the economy to a full-employment level of real GDP?

A) $300 decrease in taxes.

B) $75 increase in government spending.

C) $75 decrease in taxes.

D) $300 increase in government spending.

E) $75 decrease in government spending.

A) $300 decrease in taxes.

B) $75 increase in government spending.

C) $75 decrease in taxes.

D) $300 increase in government spending.

E) $75 decrease in government spending.

Unlock Deck

Unlock for access to all 201 flashcards in this deck.

Unlock Deck

k this deck

72

Exhibit 15-3 Aggregate demand and supply model

Suppose the economy in Exhibit 15-3 is in equilibrium at point E₁,and the marginal propensity to consume (MPC)is 0.75.Following Keynesian economics,to restore full employment,the government should cut taxes by:

A) $0.20 trillion.

B) $1 trillion.

C) $0.5 trillion.

D) $0.25 trillion.

Suppose the economy in Exhibit 15-3 is in equilibrium at point E₁,and the marginal propensity to consume (MPC)is 0.75.Following Keynesian economics,to restore full employment,the government should cut taxes by:

A) $0.20 trillion.

B) $1 trillion.

C) $0.5 trillion.

D) $0.25 trillion.

Unlock Deck

Unlock for access to all 201 flashcards in this deck.

Unlock Deck

k this deck

73

Exhibit 15-3 Aggregate demand and supply model

Suppose the economy in Exhibit 15-3 is in equilibrium at point E₁,and the marginal propensity to consume (MPC)is 0.80.Following Keynesian economics,to restore full employment,the government should cut taxes by:

A) $0.20 trillion.

B) $250 billion.

C) $0.50 trillion.

D) $1 trillion.

Suppose the economy in Exhibit 15-3 is in equilibrium at point E₁,and the marginal propensity to consume (MPC)is 0.80.Following Keynesian economics,to restore full employment,the government should cut taxes by:

A) $0.20 trillion.

B) $250 billion.

C) $0.50 trillion.

D) $1 trillion.

Unlock Deck

Unlock for access to all 201 flashcards in this deck.

Unlock Deck

k this deck

74

Exhibit 15-3 Aggregate demand and supply model

Suppose the economy in Exhibit 15-3 is in equilibrium at point E₁ and the marginal propensity to consume (MPC)is 0.80.Following Keynesian economics,to restore full employment,the government should increase its spending by:

A) $200 billion.

B) $250 billion.

C) $500 billion.

D) $1 trillion.

Suppose the economy in Exhibit 15-3 is in equilibrium at point E₁ and the marginal propensity to consume (MPC)is 0.80.Following Keynesian economics,to restore full employment,the government should increase its spending by:

A) $200 billion.

B) $250 billion.

C) $500 billion.

D) $1 trillion.

Unlock Deck

Unlock for access to all 201 flashcards in this deck.

Unlock Deck

k this deck

75

Assume the marginal propensity to consume (MPC)is 0.80 and the government increases taxes by $100 billion.The aggregate demand curve will shift to the:

A) left by $80 billion.

B) right by $200 billion.

C) right by $400 billion.

D) left by $400 billion.

A) left by $80 billion.

B) right by $200 billion.

C) right by $400 billion.

D) left by $400 billion.

Unlock Deck

Unlock for access to all 201 flashcards in this deck.

Unlock Deck

k this deck

76

Exhibit 15-2 Aggregate demand and supply model

Suppose the economy in Exhibit 15-2 is in equilibrium at point E₁ and the marginal propensity to consume (MPC)is 0.75.Following Keynesian economics,the federal government can move the economy to full employment at point E₂ by:

A) decreasing government spending by $750 billion.

B) decreasing government spending by $100 billion.

C) increasing government spending by $25 billion.

D) decreasing government spending by $25 billion.

E) None of the above.

Suppose the economy in Exhibit 15-2 is in equilibrium at point E₁ and the marginal propensity to consume (MPC)is 0.75.Following Keynesian economics,the federal government can move the economy to full employment at point E₂ by:

A) decreasing government spending by $750 billion.

B) decreasing government spending by $100 billion.

C) increasing government spending by $25 billion.

D) decreasing government spending by $25 billion.

E) None of the above.

Unlock Deck

Unlock for access to all 201 flashcards in this deck.

Unlock Deck

k this deck

77

If MPC = 0.9,equilibrium real GDP is $1,000,and full-employment real GDP is $2,000,then how much should government spending change to bring about full employment?

A) +1,000.

B) -100.

C) +900.

D) +100.

E) -0.9.

A) +1,000.

B) -100.

C) +900.

D) +100.

E) -0.9.

Unlock Deck

Unlock for access to all 201 flashcards in this deck.

Unlock Deck

k this deck

78

If MPC = 0.80,how much should government spending change to increase real GDP by $500?

A) -100.

B) +80.

C) -80.

D) +500.

E) +100.

A) -100.

B) +80.

C) -80.

D) +500.

E) +100.

Unlock Deck

Unlock for access to all 201 flashcards in this deck.

Unlock Deck

k this deck

79

Assume that an economy's real GDP multiplier is 4.If this economy is in equilibrium at $2,000 billion,then which one of the following actions will bring it to a full-employment equilibrium of $1,500 billion?

A) $500 billion spending cut.

B) $500 billion spending increase.

C) $125 billion spending cut.

D) $125 billion spending increase.

E) $2,000 billion spending cut.

A) $500 billion spending cut.

B) $500 billion spending increase.

C) $125 billion spending cut.

D) $125 billion spending increase.

E) $2,000 billion spending cut.

Unlock Deck

Unlock for access to all 201 flashcards in this deck.

Unlock Deck

k this deck

80

If the MPC = .75,the spending multiplier is:

A) 4.

B) 5.

C) 1.33.

D) 1.20.

E) .25.

A) 4.

B) 5.

C) 1.33.

D) 1.20.

E) .25.

Unlock Deck

Unlock for access to all 201 flashcards in this deck.

Unlock Deck

k this deck