Deck 16: The Public Sector

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/127

Play

Full screen (f)

Deck 16: The Public Sector

1

Total government spending (federal,state,and local)sums to approximately:

A) 10 percent of the U.S. economy.

B) 20 percent of the U.S. economy.

C) one-third of the U.S. economy.

D) one-half of the U.S. economy.

A) 10 percent of the U.S. economy.

B) 20 percent of the U.S. economy.

C) one-third of the U.S. economy.

D) one-half of the U.S. economy.

C

2

Since 1970,the composition of federal expenditures has:

A) been virtually unchanged, but federal spending as a share of GDP has declined substantially.

B) been virtually unchanged, but federal spending as a share of GDP has increased sharply.

C) shifted away from national defense and toward spending on income security.

D) shifted away from income security income transfers and toward spending on national defense.

A) been virtually unchanged, but federal spending as a share of GDP has declined substantially.

B) been virtually unchanged, but federal spending as a share of GDP has increased sharply.

C) shifted away from national defense and toward spending on income security.

D) shifted away from income security income transfers and toward spending on national defense.

C

3

Total U.S.government expenditures as a percentage of GDP were largest during which of the following periods of time?

A) The Great Depression.

B) World War II.

C) The Vietnam War.

D) The Energy Crisis of the mid- and late-1970s.

A) The Great Depression.

B) World War II.

C) The Vietnam War.

D) The Energy Crisis of the mid- and late-1970s.

B

4

Which of the following countries devote the smallest percentage of its GDP to taxes?

A) The United Kingdom.

B) Sweden.

C) Germany.

D) The United States.

A) The United Kingdom.

B) Sweden.

C) Germany.

D) The United States.

Unlock Deck

Unlock for access to all 127 flashcards in this deck.

Unlock Deck

k this deck

5

Currently,total government expenditures in the United States have totaled about:

A) one-tenth of GDP.

B) one-fifth of GDP.

C) one-third of GDP.

D) one-half of GDP.

A) one-tenth of GDP.

B) one-fifth of GDP.

C) one-third of GDP.

D) one-half of GDP.

Unlock Deck

Unlock for access to all 127 flashcards in this deck.

Unlock Deck

k this deck

6

Which of the following countries had the lowest level of government expenditures as a share of GDP?

A) Sweden.

B) Japan.

C) United States.

D) Italy.

A) Sweden.

B) Japan.

C) United States.

D) Italy.

Unlock Deck

Unlock for access to all 127 flashcards in this deck.

Unlock Deck

k this deck

7

The income security program category for federal government outlays includes spending for:

A) Social Security.

B) Medicare.

C) Welfare.

D) Unemployment compensation.

E) All of the above.

A) Social Security.

B) Medicare.

C) Welfare.

D) Unemployment compensation.

E) All of the above.

Unlock Deck

Unlock for access to all 127 flashcards in this deck.

Unlock Deck

k this deck

8

Which of the following categories accounted for the largest percentage of total federal government expenditures in recent years?

A) Income security.

B) National defense.

C) Education and health.

D) Interest on the national debt.

A) Income security.

B) National defense.

C) Education and health.

D) Interest on the national debt.

Unlock Deck

Unlock for access to all 127 flashcards in this deck.

Unlock Deck

k this deck

9

Currently,total government expenditures in the United States:

A) are over one third of GDP.

B) fell by half, to 10 percent of GDP.

C) nearly doubled to one half of GDP.

D) nearly tripled to about 60 percent of GDP.

A) are over one third of GDP.

B) fell by half, to 10 percent of GDP.

C) nearly doubled to one half of GDP.

D) nearly tripled to about 60 percent of GDP.

Unlock Deck

Unlock for access to all 127 flashcards in this deck.

Unlock Deck

k this deck

10

After 1970,the share of federal spending allocated to national defense:

A) declined sharply, while the share allocated to income security increased substantially.

B) rose sharply, while the share allocated to income security declined substantially.

C) was relatively constant, while the share allocated to income security declined modestly.

D) declined modestly, while the share allocated to income security was relatively constant.

A) declined sharply, while the share allocated to income security increased substantially.

B) rose sharply, while the share allocated to income security declined substantially.

C) was relatively constant, while the share allocated to income security declined modestly.

D) declined modestly, while the share allocated to income security was relatively constant.

Unlock Deck

Unlock for access to all 127 flashcards in this deck.

Unlock Deck

k this deck

11

Which of the following categories accounted for the third largest percentage of total federal government expenditures?

A) Education and health.

B) National defense.

C) Income security.

D) Interest on the national debt.

A) Education and health.

B) National defense.

C) Income security.

D) Interest on the national debt.

Unlock Deck

Unlock for access to all 127 flashcards in this deck.

Unlock Deck

k this deck

12

Measured as a share of the economy,government expenditures:

A) have been between 10 and 15 percent of the U.S. economy since 1930.

B) have been between 20 and 25 percent of the U.S. economy since 1930.

C) rose from less than 10 percent in 1929 to over 35 percent currently.

D) declined from more than 50 percent in 1929 to approximately 25 percent currently.

A) have been between 10 and 15 percent of the U.S. economy since 1930.

B) have been between 20 and 25 percent of the U.S. economy since 1930.

C) rose from less than 10 percent in 1929 to over 35 percent currently.

D) declined from more than 50 percent in 1929 to approximately 25 percent currently.

Unlock Deck

Unlock for access to all 127 flashcards in this deck.

Unlock Deck

k this deck

13

Government expenditures as a share of the U.S.economy are:

A) the largest in the world.

B) the smallest in the world.

C) smaller than most Western European countries.

D) larger than Canada, France, and the United Kingdom but slightly smaller than Germany and Italy.

A) the largest in the world.

B) the smallest in the world.

C) smaller than most Western European countries.

D) larger than Canada, France, and the United Kingdom but slightly smaller than Germany and Italy.

Unlock Deck

Unlock for access to all 127 flashcards in this deck.

Unlock Deck

k this deck

14

Currently,total private sector expenditures in the United States:

A) remained close to one third of GDP.

B) fell by half to 50 percent of GDP.

C) fell by half to about 60 percent of GDP.

D) remained close to 70 percent of GDP.

A) remained close to one third of GDP.

B) fell by half to 50 percent of GDP.

C) fell by half to about 60 percent of GDP.

D) remained close to 70 percent of GDP.

Unlock Deck

Unlock for access to all 127 flashcards in this deck.

Unlock Deck

k this deck

15

Which of the following taxes contributed the greatest percentage of total federal government tax revenues in recent years?

A) Individual income taxes.

B) Corporate income taxes.

C) Social Security taxes.

D) Excise taxes.

A) Individual income taxes.

B) Corporate income taxes.

C) Social Security taxes.

D) Excise taxes.

Unlock Deck

Unlock for access to all 127 flashcards in this deck.

Unlock Deck

k this deck

16

Which of the following categories accounted for the lowest percent of the total federal government expenditures in recent years?

A) Income security.

B) National defense.

C) Education and health.

D) Interest on the national debt.

A) Income security.

B) National defense.

C) Education and health.

D) Interest on the national debt.

Unlock Deck

Unlock for access to all 127 flashcards in this deck.

Unlock Deck

k this deck

17

How does total taxes as a percentage of GDP in the United States compare to those of Western European countries,such as the United Kingdom,Germany,and Sweden?

A) U.S. taxation is smaller.

B) U.S. taxation is about the same.

C) U.S. taxation is slightly larger.

D) U.S. taxation is substantially larger.

A) U.S. taxation is smaller.

B) U.S. taxation is about the same.

C) U.S. taxation is slightly larger.

D) U.S. taxation is substantially larger.

Unlock Deck

Unlock for access to all 127 flashcards in this deck.

Unlock Deck

k this deck

18

In which of the following countries are taxes (measured as a percentage of GDP)the lowest?

A) Canada.

B) France.

C) Sweden.

D) The United States.

A) Canada.

B) France.

C) Sweden.

D) The United States.

Unlock Deck

Unlock for access to all 127 flashcards in this deck.

Unlock Deck

k this deck

19

Which of the following is the largest source of revenue for the federal government?

A) corporate income tax

B) payroll tax

C) personal income tax

D) user charges

A) corporate income tax

B) payroll tax

C) personal income tax

D) user charges

Unlock Deck

Unlock for access to all 127 flashcards in this deck.

Unlock Deck

k this deck

20

Since 1929,total government taxes as a percentage of GDP:

A) climbed from 10 percent to over 35 percent.

B) remained close to 30 percent.

C) climbed from 30 percent to about 50 percent.

D) climbed from 15 percent to about 50 percent.

A) climbed from 10 percent to over 35 percent.

B) remained close to 30 percent.

C) climbed from 30 percent to about 50 percent.

D) climbed from 15 percent to about 50 percent.

Unlock Deck

Unlock for access to all 127 flashcards in this deck.

Unlock Deck

k this deck

21

The primary source of revenue at the federal level is:

A) the corporate income tax.

B) the personal income tax.

C) property taxes.

D) sales taxes.

E) customs duties.

A) the corporate income tax.

B) the personal income tax.

C) property taxes.

D) sales taxes.

E) customs duties.

Unlock Deck

Unlock for access to all 127 flashcards in this deck.

Unlock Deck

k this deck

22

Which of the following is a regressive tax?

A) A state tax of 5 percent of income.

B) A local sales tax of 5 percent.

C) The federal individual income tax.

D) A federal flat tax of 30 percent.

A) A state tax of 5 percent of income.

B) A local sales tax of 5 percent.

C) The federal individual income tax.

D) A federal flat tax of 30 percent.

Unlock Deck

Unlock for access to all 127 flashcards in this deck.

Unlock Deck

k this deck

23

A tax where the percentage of income paid in taxes is the same regardless of the size of the income is a:

A) proportional tax.

B)

B) regressive tax.

C) progressive tax.

D) mix of a and

A) proportional tax.

B)

B) regressive tax.

C) progressive tax.

D) mix of a and

Unlock Deck

Unlock for access to all 127 flashcards in this deck.

Unlock Deck

k this deck

24

When the tax structure of a nation is progressive,as incomes increase,the tax rate:

A) declines.

B) remains the same.

C) increases.

D) is proportional.

A) declines.

B) remains the same.

C) increases.

D) is proportional.

Unlock Deck

Unlock for access to all 127 flashcards in this deck.

Unlock Deck

k this deck

25

The benefits-received principle of taxation is most evident in:

A) progressive tax rates.

B) excise taxes on gasoline.

C) the personal income tax.

D) the corporate income tax.

A) progressive tax rates.

B) excise taxes on gasoline.

C) the personal income tax.

D) the corporate income tax.

Unlock Deck

Unlock for access to all 127 flashcards in this deck.

Unlock Deck

k this deck

26

Which of the following is an example of a progressive tax?

A) The excise tax on cigarettes.

B) The federal tax on gasoline.

C) The federal personal income tax.

D) All of the above.

A) The excise tax on cigarettes.

B) The federal tax on gasoline.

C) The federal personal income tax.

D) All of the above.

Unlock Deck

Unlock for access to all 127 flashcards in this deck.

Unlock Deck

k this deck

27

Suppose fairness is defined as those who receive the greatest benefits from government should pay the most in taxes,then which of the following taxation systems would be consistent with this notion of fairness?

A) User fees for national parks.

B) Gasoline taxes to fund highway maintenance.

C) A tax on the poor to finance food stamps and other low-income assistance programs.

D) All of the above are consistent.

A) User fees for national parks.

B) Gasoline taxes to fund highway maintenance.

C) A tax on the poor to finance food stamps and other low-income assistance programs.

D) All of the above are consistent.

Unlock Deck

Unlock for access to all 127 flashcards in this deck.

Unlock Deck

k this deck

28

Suppose fairness is defined as those with the highest incomes can afford to pay a greater proportion of their income in taxes.Then which of the following taxation systems would be consistent with this notion of fairness?

A) A true flax tax.

B) A flat sales tax on consumption purchases.

C) A progressive tax on income.

D) A fixed federal tax of $5,000 that everyone pays regardless of income status.

A) A true flax tax.

B) A flat sales tax on consumption purchases.

C) A progressive tax on income.

D) A fixed federal tax of $5,000 that everyone pays regardless of income status.

Unlock Deck

Unlock for access to all 127 flashcards in this deck.

Unlock Deck

k this deck

29

Which of the following can be classified as a regressive tax?

A) Federal corporate income tax.

B) Federal personal income tax.

C) Federal gasoline tax.

D) All of the above.

A) Federal corporate income tax.

B) Federal personal income tax.

C) Federal gasoline tax.

D) All of the above.

Unlock Deck

Unlock for access to all 127 flashcards in this deck.

Unlock Deck

k this deck

30

If a person is concerned that an additional $1,000 income will move him/her into a new tax bracket,that person is worried about the:

A) proportional rate.

B) regressive tax rate.

C) marginal tax rate.

D) flat tax rate.

A) proportional rate.

B) regressive tax rate.

C) marginal tax rate.

D) flat tax rate.

Unlock Deck

Unlock for access to all 127 flashcards in this deck.

Unlock Deck

k this deck

31

At the federal level,the single most important tax,accounting for slightly less than half of revenue,is the:

A) corporate income tax.

B) personal income tax.

C) estate tax.

D) property tax.

E) sales tax.

A) corporate income tax.

B) personal income tax.

C) estate tax.

D) property tax.

E) sales tax.

Unlock Deck

Unlock for access to all 127 flashcards in this deck.

Unlock Deck

k this deck

32

A tax that is structured so that people pay the same percentage of their income in taxes is called a(n):

A) flat tax.

B) regressive tax.

C) progressive tax.

D) excise tax.

A) flat tax.

B) regressive tax.

C) progressive tax.

D) excise tax.

Unlock Deck

Unlock for access to all 127 flashcards in this deck.

Unlock Deck

k this deck

33

Sharon pays a tax of $4,000 on her income of $40,000,while Brad pays a tax of $1,000 on his income of $20,000.This tax is:

A) regressive.

B) progressive.

C) proportional.

D) a flat tax.

A) regressive.

B) progressive.

C) proportional.

D) a flat tax.

Unlock Deck

Unlock for access to all 127 flashcards in this deck.

Unlock Deck

k this deck

34

"It would be an undue hardship to require people whose income is below $15,000 per year to pay income taxes." This statement reflects which of the following principles for a tax?

A) Benefits-received.

B) Inexpensive-to-collect.

C) Ability-to-pay.

D) Fairness of contribution.

A) Benefits-received.

B) Inexpensive-to-collect.

C) Ability-to-pay.

D) Fairness of contribution.

Unlock Deck

Unlock for access to all 127 flashcards in this deck.

Unlock Deck

k this deck

35

"He who pays a tax should receive the benefit from the expenditure financed by the tax." This statement reflects which of the following principles for a tax?

A) Fairness of contribution.

B) Ability-to-pay.

C) Benefits-received.

D) Inexperience-to-collect.

A) Fairness of contribution.

B) Ability-to-pay.

C) Benefits-received.

D) Inexperience-to-collect.

Unlock Deck

Unlock for access to all 127 flashcards in this deck.

Unlock Deck

k this deck

36

The social security tax is a:

A) progressive tax at all income levels.

B) regressive tax above a certain income level.

C) proportional tax at all income levels.

D) none of the above.

A) progressive tax at all income levels.

B) regressive tax above a certain income level.

C) proportional tax at all income levels.

D) none of the above.

Unlock Deck

Unlock for access to all 127 flashcards in this deck.

Unlock Deck

k this deck

37

A tax is regressive if it collects a:

A) larger amount as income rises.

B) constant amount as income rises.

C) smaller fraction of income as income falls.

D) smaller fraction of income as income rises.

A) larger amount as income rises.

B) constant amount as income rises.

C) smaller fraction of income as income falls.

D) smaller fraction of income as income rises.

Unlock Deck

Unlock for access to all 127 flashcards in this deck.

Unlock Deck

k this deck

38

Which of the following answers best reflects the ability-to-pay philosophy of taxation?

A) Property tax.

B) Progressive income tax.

C) Excise tax on gasoline.

D) Excise tax on cigarettes.

A) Property tax.

B) Progressive income tax.

C) Excise tax on gasoline.

D) Excise tax on cigarettes.

Unlock Deck

Unlock for access to all 127 flashcards in this deck.

Unlock Deck

k this deck

39

Suppose George's income is $10,000 and he pays a tax of $1,000,but Laura's income is $50,000 and she pays a tax of $4,000.Such a tax is:

A) regressive.

B) progressive.

C) proportional.

D) flat.

A) regressive.

B) progressive.

C) proportional.

D) flat.

Unlock Deck

Unlock for access to all 127 flashcards in this deck.

Unlock Deck

k this deck

40

Generally,most economists feel that a sales tax is:

A) regressive.

B) proportional.

C) progressive.

D) fair.

A) regressive.

B) proportional.

C) progressive.

D) fair.

Unlock Deck

Unlock for access to all 127 flashcards in this deck.

Unlock Deck

k this deck

41

Which of the following statements is false?

A) The largest source of state and local governments tax revenue is sales and excise taxes.

B) The largest source of federal government tax revenue is individual income taxes.

C) A sales tax on food is a regressive tax.

D) A proportional tax is equal to a fixed dollar amount.

A) The largest source of state and local governments tax revenue is sales and excise taxes.

B) The largest source of federal government tax revenue is individual income taxes.

C) A sales tax on food is a regressive tax.

D) A proportional tax is equal to a fixed dollar amount.

Unlock Deck

Unlock for access to all 127 flashcards in this deck.

Unlock Deck

k this deck

42

Exhibit 16-3 Income for two persons

In Exhibit 16-3,if the income tax system is currently proportional,we know that:

A) Meredith would probably prefer a progressive income tax system while Hillary would probably prefer a regressive income tax system.

B) Meredith and Hillary would both probably prefer a regressive income tax system.

C) Meredith and Hillary would both probably prefer a progressive income tax system.

D) Meredith would probably prefer a regressive income tax system while Hillary would probably prefer a progressive income tax system.

E) Meredith would probably prefer a progressive income tax system while Hillary would probably prefer a head tax.

In Exhibit 16-3,if the income tax system is currently proportional,we know that:

A) Meredith would probably prefer a progressive income tax system while Hillary would probably prefer a regressive income tax system.

B) Meredith and Hillary would both probably prefer a regressive income tax system.

C) Meredith and Hillary would both probably prefer a progressive income tax system.

D) Meredith would probably prefer a regressive income tax system while Hillary would probably prefer a progressive income tax system.

E) Meredith would probably prefer a progressive income tax system while Hillary would probably prefer a head tax.

Unlock Deck

Unlock for access to all 127 flashcards in this deck.

Unlock Deck

k this deck

43

When the government levies a tax where everyone is taxed the same fixed percentage of their incomes,this tax is known as a(n):

A) regressive tax.

B) progressive tax.

C) proportional tax.

D) excise tax.

E) luxury tax.

A) regressive tax.

B) progressive tax.

C) proportional tax.

D) excise tax.

E) luxury tax.

Unlock Deck

Unlock for access to all 127 flashcards in this deck.

Unlock Deck

k this deck

44

If a person is taxed $100 on an income of $1,000,taxed $200 on an income of $2,000,and taxed $300 on an income of $3,000,this person is paying a:

A) progressive tax.

B) poll tax.

C) regressive tax.

D) excise tax.

E) proportional tax.

A) progressive tax.

B) poll tax.

C) regressive tax.

D) excise tax.

E) proportional tax.

Unlock Deck

Unlock for access to all 127 flashcards in this deck.

Unlock Deck

k this deck

45

A tax system in which the tax rate on everyone's first $10,000 of income is 10 percent,the tax rate on everyone's second $10,000 of income is 15 percent,and the tax rate on all income over $20,000 is 25 percent is a(n):

A) proportional tax.

B) equitable tax.

C) head tax.

D) unit tax.

E) progressive tax.

A) proportional tax.

B) equitable tax.

C) head tax.

D) unit tax.

E) progressive tax.

Unlock Deck

Unlock for access to all 127 flashcards in this deck.

Unlock Deck

k this deck

46

If a person is taxed $100 on an income of $1,000,taxed $180 on an income of $2,000,and taxed $220 on an income of $3,000,this person is paying a:

A) progressive tax.

B) poll tax.

C) proportional tax.

D) regressive tax.

E) retro tax.

A) progressive tax.

B) poll tax.

C) proportional tax.

D) regressive tax.

E) retro tax.

Unlock Deck

Unlock for access to all 127 flashcards in this deck.

Unlock Deck

k this deck

47

Exhibit 16-1 Income for two persons

In Exhibit 16-1,if the income tax system is progressive,then:

A) Elaine and Daniel will face the same tax rate and will have tax bills the same size.

B) Elaine and Daniel will face the same tax rate but have tax bills that are different sizes.

C) Elaine will face a higher tax rate and will have a larger tax bill than Daniel.

D) Elaine will face a lower tax rate and will have a smaller tax bill than Daniel.

E) Elaine will face a lower tax rate but will have a larger tax bill than Daniel.

In Exhibit 16-1,if the income tax system is progressive,then:

A) Elaine and Daniel will face the same tax rate and will have tax bills the same size.

B) Elaine and Daniel will face the same tax rate but have tax bills that are different sizes.

C) Elaine will face a higher tax rate and will have a larger tax bill than Daniel.

D) Elaine will face a lower tax rate and will have a smaller tax bill than Daniel.

E) Elaine will face a lower tax rate but will have a larger tax bill than Daniel.

Unlock Deck

Unlock for access to all 127 flashcards in this deck.

Unlock Deck

k this deck

48

If a tax rate falls as a person's income rises,the tax is a:

A) proportional tax.

B) progressive tax.

C) regressive tax.

D) poll tax.

E) constant tax.

A) proportional tax.

B) progressive tax.

C) regressive tax.

D) poll tax.

E) constant tax.

Unlock Deck

Unlock for access to all 127 flashcards in this deck.

Unlock Deck

k this deck

49

Exhibit 16-2 Income and taxes for two persons

In Exhibit 16-2,we can tell that the tax shown here is:

A) a poll tax.

B) proportional.

C) progressive.

D) equitable.

E) regressive.

In Exhibit 16-2,we can tell that the tax shown here is:

A) a poll tax.

B) proportional.

C) progressive.

D) equitable.

E) regressive.

Unlock Deck

Unlock for access to all 127 flashcards in this deck.

Unlock Deck

k this deck

50

Exhibit 16-1 Income for two persons

In Exhibit 16-1,if the income tax system is proportional,then:

A) Elaine and Daniel will face the same tax rate and will have tax bills the same size.

B) Elaine and Daniel will face the same tax rate but Elaine's tax bill will be larger.

C) Elaine will face a higher tax rate and will have a larger tax bill than Daniel.

D) Elaine will face a lower tax rate and will have a smaller tax bill than Daniel.

E) Elaine will face a lower tax rate but will have a larger tax bill than Daniel.

In Exhibit 16-1,if the income tax system is proportional,then:

A) Elaine and Daniel will face the same tax rate and will have tax bills the same size.

B) Elaine and Daniel will face the same tax rate but Elaine's tax bill will be larger.

C) Elaine will face a higher tax rate and will have a larger tax bill than Daniel.

D) Elaine will face a lower tax rate and will have a smaller tax bill than Daniel.

E) Elaine will face a lower tax rate but will have a larger tax bill than Daniel.

Unlock Deck

Unlock for access to all 127 flashcards in this deck.

Unlock Deck

k this deck

51

A tax whose impact varies inversely with the income of the person taxed,and poor people have a higher percentage of their income taxed than rich people,is known as a:

A) regressive tax.

B) progressive tax.

C) proportional tax.

D) flat tax.

E) tax holiday.

A) regressive tax.

B) progressive tax.

C) proportional tax.

D) flat tax.

E) tax holiday.

Unlock Deck

Unlock for access to all 127 flashcards in this deck.

Unlock Deck

k this deck

52

If a person is taxed $1,000 on an income of $10,000,taxed $2,000 on an income of $20,000,and taxed $3,000 on an income of $30,000,this person is paying a:

A) progressive tax.

B) regressive tax.

C) proportional tax.

D) poll tax.

E) excise tax.

A) progressive tax.

B) regressive tax.

C) proportional tax.

D) poll tax.

E) excise tax.

Unlock Deck

Unlock for access to all 127 flashcards in this deck.

Unlock Deck

k this deck

53

The federal personal income tax was designed to be a:

A) progressive tax.

B) regressive tax.

C) proportional tax.

D) poll tax.

E) payroll tax.

A) progressive tax.

B) regressive tax.

C) proportional tax.

D) poll tax.

E) payroll tax.

Unlock Deck

Unlock for access to all 127 flashcards in this deck.

Unlock Deck

k this deck

54

When a tax is regressive,as a person's income rises,the tax rate:

A) stays the same.

B) decreases.

C) increases.

D) increase and then decreases.

E) decreases and then increases.

A) stays the same.

B) decreases.

C) increases.

D) increase and then decreases.

E) decreases and then increases.

Unlock Deck

Unlock for access to all 127 flashcards in this deck.

Unlock Deck

k this deck

55

Exhibit 16-3 Income for two persons

In Exhibit 16-3,if the income tax system is currently proportional,we know that:

A) Meredith has a larger tax bill than Hillary, although they pay the same tax rate.

B) Meredith has a larger tax bill than Hillary and pays a higher tax rate.

C) Hillary has a larger tax bill than Meredith, although they pay the same tax rate.

D) Hillary has a larger tax bill than Meredith and pays a higher tax rate.

E) Meredith and Hillary's tax bills are equal.

In Exhibit 16-3,if the income tax system is currently proportional,we know that:

A) Meredith has a larger tax bill than Hillary, although they pay the same tax rate.

B) Meredith has a larger tax bill than Hillary and pays a higher tax rate.

C) Hillary has a larger tax bill than Meredith, although they pay the same tax rate.

D) Hillary has a larger tax bill than Meredith and pays a higher tax rate.

E) Meredith and Hillary's tax bills are equal.

Unlock Deck

Unlock for access to all 127 flashcards in this deck.

Unlock Deck

k this deck

56

A tax is proportional if,as a person's income rises,the:

A) tax rate is constant.

B) tax rate falls.

C) tax rate rises.

D) amount of the tax is constant.

E) amount of the tax falls.

A) tax rate is constant.

B) tax rate falls.

C) tax rate rises.

D) amount of the tax is constant.

E) amount of the tax falls.

Unlock Deck

Unlock for access to all 127 flashcards in this deck.

Unlock Deck

k this deck

57

When the tax rate is constant when a person's income rises,the tax is a:

A) regressive tax.

B) poll tax.

C) progressive tax.

D) constant tax.

E) proportional tax.

A) regressive tax.

B) poll tax.

C) progressive tax.

D) constant tax.

E) proportional tax.

Unlock Deck

Unlock for access to all 127 flashcards in this deck.

Unlock Deck

k this deck

58

Exhibit 16-3 Income for two persons

In Exhibit 16-3,if the income tax system is currently progressive,we know that:

A) Meredith has a larger tax bill than Hillary, although they pay the same tax rate.

B) Hillary has a larger tax bill than Meredith, although they pay the same tax rate.

C) Meredith has a larger tax bill than Hillary and pays a higher tax rate.

D) Hillary has a larger tax bill than Meredith and pays a higher tax rate.

E) Meredith and Hillary's tax bills are equal.

In Exhibit 16-3,if the income tax system is currently progressive,we know that:

A) Meredith has a larger tax bill than Hillary, although they pay the same tax rate.

B) Hillary has a larger tax bill than Meredith, although they pay the same tax rate.

C) Meredith has a larger tax bill than Hillary and pays a higher tax rate.

D) Hillary has a larger tax bill than Meredith and pays a higher tax rate.

E) Meredith and Hillary's tax bills are equal.

Unlock Deck

Unlock for access to all 127 flashcards in this deck.

Unlock Deck

k this deck

59

Consider two people,Sandy Ross,who earns $25,000,and Gary Belcher,who earns $50,000.If the flat-tax rate is 20 percent,then:

A) the government collects a total of $20,000.

B) Gary pays twice the tax amount Sandy pays.

C) Gary pays three times the tax amount Sandy pays.

D) Gary and Sandy pay exactly the same tax amount.

E) Gary pays $15,000 in taxes.

A) the government collects a total of $20,000.

B) Gary pays twice the tax amount Sandy pays.

C) Gary pays three times the tax amount Sandy pays.

D) Gary and Sandy pay exactly the same tax amount.

E) Gary pays $15,000 in taxes.

Unlock Deck

Unlock for access to all 127 flashcards in this deck.

Unlock Deck

k this deck

60

If a person is taxed $100 on an income of $1,000,taxed $220 on an income of $2,000,and taxed $390 on an income of $3,000,this person is paying a:

A) progressive tax.

B) poll tax.

C) regressive tax.

D) excise tax.

E) proportional tax.

A) progressive tax.

B) poll tax.

C) regressive tax.

D) excise tax.

E) proportional tax.

Unlock Deck

Unlock for access to all 127 flashcards in this deck.

Unlock Deck

k this deck

61

Which of the following statements is true?

A) Sales, excise, and flat-rate taxes violate the ability-to-pay principle of taxation fairness because each results in a greater burden on the poor than the rich.

B) Government failure may occur if voters are rationally ignorant.

C) Government failure may occur because of special-interest group political pressure.

D) All of the above.

A) Sales, excise, and flat-rate taxes violate the ability-to-pay principle of taxation fairness because each results in a greater burden on the poor than the rich.

B) Government failure may occur if voters are rationally ignorant.

C) Government failure may occur because of special-interest group political pressure.

D) All of the above.

Unlock Deck

Unlock for access to all 127 flashcards in this deck.

Unlock Deck

k this deck

62

Suppose a person with an income of $20,000 pays a tax of $2,000.If the tax is progressive,then how large of a tax will a person with an income of $40,000 pay?

A) Exactly $2,000.

B) Between $2,000 and $4,000.

C) Exactly $4,000.

D) More than $4,000.

A) Exactly $2,000.

B) Between $2,000 and $4,000.

C) Exactly $4,000.

D) More than $4,000.

Unlock Deck

Unlock for access to all 127 flashcards in this deck.

Unlock Deck

k this deck

63

Some cities finance their airports with a departure tax: every person leaving the city by plane is charged a small fixed dollar amount that is used to help pay for building and running the airport.The departure tax follows the:

A) benefits-received principle.

B) ability-to-pay principle.

C) flat-rate taxation principle.

D) public-choice principle.

A) benefits-received principle.

B) ability-to-pay principle.

C) flat-rate taxation principle.

D) public-choice principle.

Unlock Deck

Unlock for access to all 127 flashcards in this deck.

Unlock Deck

k this deck

64

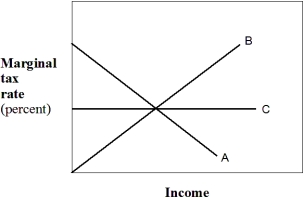

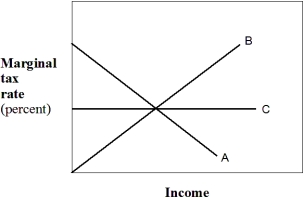

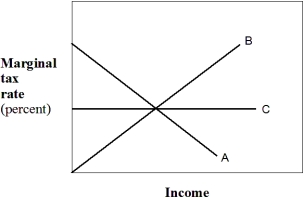

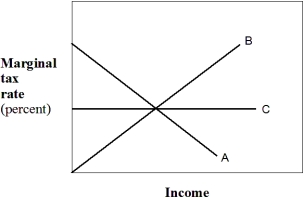

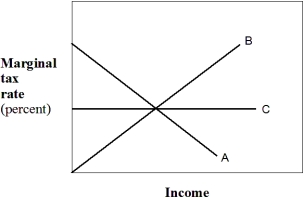

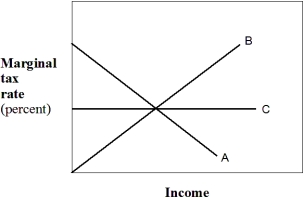

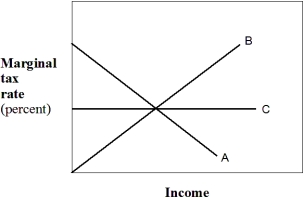

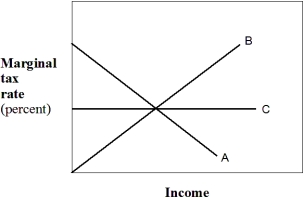

Exhibit 16-4 Marginal tax rate lines

In Exhibit 16-4,line C represents a:

A) regressive tax.

B) progressive tax.

C) proportional tax.

D) ability-to-pay tax.

In Exhibit 16-4,line C represents a:

A) regressive tax.

B) progressive tax.

C) proportional tax.

D) ability-to-pay tax.

Unlock Deck

Unlock for access to all 127 flashcards in this deck.

Unlock Deck

k this deck

65

A tax for which the rate varies directly with the income of the person taxed is known as a(n):

A) regressive tax.

B) progressive tax.

C) proportional tax.

D) flat tax.

E) excise tax.

A) regressive tax.

B) progressive tax.

C) proportional tax.

D) flat tax.

E) excise tax.

Unlock Deck

Unlock for access to all 127 flashcards in this deck.

Unlock Deck

k this deck

66

Which of the following U.S.taxes is the most consistent with the ability-to-pay principle?

A) The excise tax on gasoline.

B) The federal income tax.

C) State sales taxes.

D) The Social Security payroll tax.

A) The excise tax on gasoline.

B) The federal income tax.

C) State sales taxes.

D) The Social Security payroll tax.

Unlock Deck

Unlock for access to all 127 flashcards in this deck.

Unlock Deck

k this deck

67

Consider two people,Sandy Smith,who earns $25,000,and Gary Carver,who earns $50,000.If the government has decided to tax everyone's first $25,000 at 20 percent and everyone's second $25,000 at 40 percent,then Gary pays:

A) $10,000 in taxes and Sandy pays $5,000 in taxes.

B) $10,000 in taxes and Sandy pays $10,000 in taxes.

C) $15,000 in taxes and Sandy pays $5,000 in taxes.

D) $15,000 in taxes and Sandy pays $10,000 in taxes.

E) $17,000 in taxes and Sandy pays $5,000 in taxes.

A) $10,000 in taxes and Sandy pays $5,000 in taxes.

B) $10,000 in taxes and Sandy pays $10,000 in taxes.

C) $15,000 in taxes and Sandy pays $5,000 in taxes.

D) $15,000 in taxes and Sandy pays $10,000 in taxes.

E) $17,000 in taxes and Sandy pays $5,000 in taxes.

Unlock Deck

Unlock for access to all 127 flashcards in this deck.

Unlock Deck

k this deck

68

Exhibit 16-4 Marginal tax rate lines

In Exhibit 16-4,line B represents a:

A) regressive tax.

B) progressive tax.

C) proportional tax.

D) flat tax.

In Exhibit 16-4,line B represents a:

A) regressive tax.

B) progressive tax.

C) proportional tax.

D) flat tax.

Unlock Deck

Unlock for access to all 127 flashcards in this deck.

Unlock Deck

k this deck

69

A tax is structured so that the tax as a percentage of income declines as the level of income increases is called a(n):

A) flat tax.

B) regressive tax.

C) progressive tax.

D) excise tax.

A) flat tax.

B) regressive tax.

C) progressive tax.

D) excise tax.

Unlock Deck

Unlock for access to all 127 flashcards in this deck.

Unlock Deck

k this deck

70

A tax where wealthy people pay a larger percentage of their income than poor people is known as a(n):

A) excise tax.

B) flat tax.

C) proportional tax.

D) progressive tax.

E) regressive tax.

A) excise tax.

B) flat tax.

C) proportional tax.

D) progressive tax.

E) regressive tax.

Unlock Deck

Unlock for access to all 127 flashcards in this deck.

Unlock Deck

k this deck

71

A progressive tax means the percentage of income paid as taxes:

A) increases as income increases.

B) decreases as income increases.

C) remains the same as income increases.

D) none of the above.

A) increases as income increases.

B) decreases as income increases.

C) remains the same as income increases.

D) none of the above.

Unlock Deck

Unlock for access to all 127 flashcards in this deck.

Unlock Deck

k this deck

72

Consider two people,Sandy Smith,who earns $25,000,and Gary Carver,who earns $50,000.If the government has decided to tax everyone's first $25,000 at 20 percent and everyone's second $25,000 at 40 percent,then:

A) Gary and Sandy both pay taxes of the same percentage of total income.

B) Gary and Sandy pay the same amount of taxes.

C) Gary pays twice the tax amount Sandy pays.

D) Gary pays three times the tax amount Sandy pays.

E) Sandy does not pay taxes.

A) Gary and Sandy both pay taxes of the same percentage of total income.

B) Gary and Sandy pay the same amount of taxes.

C) Gary pays twice the tax amount Sandy pays.

D) Gary pays three times the tax amount Sandy pays.

E) Sandy does not pay taxes.

Unlock Deck

Unlock for access to all 127 flashcards in this deck.

Unlock Deck

k this deck

73

Which of the following statements is true?

A) A sales tax on food is a regressive tax.

B) The largest source of federal government tax revenue is individual income taxes.

C) The largest source of state and local governments tax revenue is sales and excise taxes.

D) All of the above are true.

E) None of the above are true.

A) A sales tax on food is a regressive tax.

B) The largest source of federal government tax revenue is individual income taxes.

C) The largest source of state and local governments tax revenue is sales and excise taxes.

D) All of the above are true.

E) None of the above are true.

Unlock Deck

Unlock for access to all 127 flashcards in this deck.

Unlock Deck

k this deck

74

Which of the following can be classified as a regressive tax?

A) Excise tax.

B) Sales tax.

C) Gasoline tax.

D) All of the above.

A) Excise tax.

B) Sales tax.

C) Gasoline tax.

D) All of the above.

Unlock Deck

Unlock for access to all 127 flashcards in this deck.

Unlock Deck

k this deck

75

Jose pays a tax of $24,000 on his income of $60,000,while Richard pays a tax of $3,000 on his income of $30,000.This tax is:

A) a flat tax.

B) progressive.

C) proportional.

D) regressive.

A) a flat tax.

B) progressive.

C) proportional.

D) regressive.

Unlock Deck

Unlock for access to all 127 flashcards in this deck.

Unlock Deck

k this deck

76

Exhibit 16-4 Marginal tax rate lines

In Exhibit 16-4,line A represents a(n):

A) regressive tax.

B) progressive tax.

C) proportional tax.

D) ability-to-pay tax.

In Exhibit 16-4,line A represents a(n):

A) regressive tax.

B) progressive tax.

C) proportional tax.

D) ability-to-pay tax.

Unlock Deck

Unlock for access to all 127 flashcards in this deck.

Unlock Deck

k this deck

77

Sales and excise taxes are:

A) progressive.

B) proportional.

C) regressive.

D) fixed-revenue.

A) progressive.

B) proportional.

C) regressive.

D) fixed-revenue.

Unlock Deck

Unlock for access to all 127 flashcards in this deck.

Unlock Deck

k this deck

78

Jan has an income of $30,000 and pays $4,500 in taxes.When Jan's income rises to $40,000,her tax bill rises to $6,500.What is Jan's marginal tax rate?

A) 5 percent.

B) 15 percent.

C) 16.25 percent.

D) 20 percent.

A) 5 percent.

B) 15 percent.

C) 16.25 percent.

D) 20 percent.

Unlock Deck

Unlock for access to all 127 flashcards in this deck.

Unlock Deck

k this deck

79

Which of the following statements is true?

A) The most important source of revenue to the federal government is personal income taxes.

B) The most important source of revenue to state governments are sales and property taxes.

C) The most important source of revenue to local governments are local property taxes.

D) The taxation burden, measured by taxes as a percentage of GDP, is lighter in the United States than in most other advanced industrial countries.

E) All of the above.

A) The most important source of revenue to the federal government is personal income taxes.

B) The most important source of revenue to state governments are sales and property taxes.

C) The most important source of revenue to local governments are local property taxes.

D) The taxation burden, measured by taxes as a percentage of GDP, is lighter in the United States than in most other advanced industrial countries.

E) All of the above.

Unlock Deck

Unlock for access to all 127 flashcards in this deck.

Unlock Deck

k this deck

80

Exhibit 16-4 Marginal tax rate lines

In Exhibit 16-4,if A represents state and local taxes and B represents federal income taxes,what is the result of imposing both types of taxes?

A) regressive tax.

B) progressive tax.

C) proportional tax.

D) ability-to-pay tax.

In Exhibit 16-4,if A represents state and local taxes and B represents federal income taxes,what is the result of imposing both types of taxes?

A) regressive tax.

B) progressive tax.

C) proportional tax.

D) ability-to-pay tax.

Unlock Deck

Unlock for access to all 127 flashcards in this deck.

Unlock Deck

k this deck