Deck 9: Money, The Federal Reserve, and Global Financial Markets

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/184

Play

Full screen (f)

Deck 9: Money, The Federal Reserve, and Global Financial Markets

1

Money is:

A) the same as income.

B) all financial assets.

C) any asset used to make purchases.

D) the sum of assets minus debts.

A) the same as income.

B) all financial assets.

C) any asset used to make purchases.

D) the sum of assets minus debts.

any asset used to make purchases.

2

Double coincidence of wants is avoided if money is used as a:

A) medium of exchange.

B) measure of value.

C) standard of deferred payment.

D) store of value

A) medium of exchange.

B) measure of value.

C) standard of deferred payment.

D) store of value

medium of exchange.

3

The main disadvantage of using money as a store of value is that:

A) other assets provide greater anonymity than cash.

B) barter is a more efficient way to conduct transactions than using money.

C) unlike other assets, money serves as a medium of exchange.

D) other assets pay relatively higher rates of interest than money.

A) other assets provide greater anonymity than cash.

B) barter is a more efficient way to conduct transactions than using money.

C) unlike other assets, money serves as a medium of exchange.

D) other assets pay relatively higher rates of interest than money.

other assets pay relatively higher rates of interest than money.

4

When money is the basic measure of economic value, it serves as:

A) bank reserves.

B) a medium of exchange.

C) a unit of account.

D) a store of value.

A) bank reserves.

B) a medium of exchange.

C) a unit of account.

D) a store of value.

Unlock Deck

Unlock for access to all 184 flashcards in this deck.

Unlock Deck

k this deck

5

The three functions of money are:

A) spending for consumption, investment, and government purchases.

B) measuring balance of payments, exchange rates, and interest rates.

C) implementing monetary policy, fiscal policy, and structural policy.

D) serving as a medium of exchange, unit of account, and store of value.

A) spending for consumption, investment, and government purchases.

B) measuring balance of payments, exchange rates, and interest rates.

C) implementing monetary policy, fiscal policy, and structural policy.

D) serving as a medium of exchange, unit of account, and store of value.

Unlock Deck

Unlock for access to all 184 flashcards in this deck.

Unlock Deck

k this deck

6

When money is used to purchase goods and services, it serves as a:

A) double coincidence of wants.

B) store of value.

C) medium of exchange.

D) unit of account.

A) double coincidence of wants.

B) store of value.

C) medium of exchange.

D) unit of account.

Unlock Deck

Unlock for access to all 184 flashcards in this deck.

Unlock Deck

k this deck

7

When a baker exchanges a pie for dollars, this is an example of dollars serving as:

A) barter.

B) a medium of exchange.

C) a unit of account.

D) a store of value.

A) barter.

B) a medium of exchange.

C) a unit of account.

D) a store of value.

Unlock Deck

Unlock for access to all 184 flashcards in this deck.

Unlock Deck

k this deck

8

Any asset used to make purchases is:

A) the same as income.

B) a bond.

C) money.

D) a deposit.

A) the same as income.

B) a bond.

C) money.

D) a deposit.

Unlock Deck

Unlock for access to all 184 flashcards in this deck.

Unlock Deck

k this deck

9

Money serves as a medium of exchange when:

A) it is used to purchase goods and services.

B) there is direct trade of goods and services.

C) it is a basic measure of economic value.

D) it is a means of holding wealth.

A) it is used to purchase goods and services.

B) there is direct trade of goods and services.

C) it is a basic measure of economic value.

D) it is a means of holding wealth.

Unlock Deck

Unlock for access to all 184 flashcards in this deck.

Unlock Deck

k this deck

10

The M1 measure of money consists of the sum of:

A) currency, checking deposits, and travelers' checks.

B) currency and travelers' checks.

C) currency, checking deposits, and savings deposits.

D) checking deposits and travelers' checks.

A) currency, checking deposits, and travelers' checks.

B) currency and travelers' checks.

C) currency, checking deposits, and savings deposits.

D) checking deposits and travelers' checks.

Unlock Deck

Unlock for access to all 184 flashcards in this deck.

Unlock Deck

k this deck

11

When the price of a pizza is quoted in dollars, this is an example of dollars serving as:

A) barter.

B) a medium of exchange.

C) a unit of account.

D) a store of value.

A) barter.

B) a medium of exchange.

C) a unit of account.

D) a store of value.

Unlock Deck

Unlock for access to all 184 flashcards in this deck.

Unlock Deck

k this deck

12

Finding both parties to a trade who have something the other party wishes to trade for is called a:

A) unit of account.

B) store of value.

C) medium of exchange.

D) double coincidence of wants.

A) unit of account.

B) store of value.

C) medium of exchange.

D) double coincidence of wants.

Unlock Deck

Unlock for access to all 184 flashcards in this deck.

Unlock Deck

k this deck

13

The direct trade of goods and services for other goods and services is called:

A) financial intermediation.

B) diversification.

C) barter.

D) using a medium of exchange.

A) financial intermediation.

B) diversification.

C) barter.

D) using a medium of exchange.

Unlock Deck

Unlock for access to all 184 flashcards in this deck.

Unlock Deck

k this deck

14

Which of the following is the best example of money used as a medium of exchange?

A) In a prisoner of war camp cigarettes are traded for socks, candy and/or food, even by nonsmokers.

B) A plumber unclogs a drain for a carpenter, who repairs broken steps for the plumber.

C) A farmer stores $100 dollar bills in a strong box under the floor in a barn.

D) Prices of products in a store in Mexico are marked in terms of U.S. dollars.

A) In a prisoner of war camp cigarettes are traded for socks, candy and/or food, even by nonsmokers.

B) A plumber unclogs a drain for a carpenter, who repairs broken steps for the plumber.

C) A farmer stores $100 dollar bills in a strong box under the floor in a barn.

D) Prices of products in a store in Mexico are marked in terms of U.S. dollars.

Unlock Deck

Unlock for access to all 184 flashcards in this deck.

Unlock Deck

k this deck

15

When your grandfather keeps a bundle of $100 dollar bills behind a brick in the basement, this is an example of dollars serving as:

A) bank reserves.

B) a medium of exchange.

C) a unit of account.

D) a store of value.

A) bank reserves.

B) a medium of exchange.

C) a unit of account.

D) a store of value.

Unlock Deck

Unlock for access to all 184 flashcards in this deck.

Unlock Deck

k this deck

16

If you post your car on eBay with a Buy-It-Now price of $1,800, you are using money as:

A) bank reserves.

B) a medium of exchange.

C) a unit of account.

D) a store of value.

A) bank reserves.

B) a medium of exchange.

C) a unit of account.

D) a store of value.

Unlock Deck

Unlock for access to all 184 flashcards in this deck.

Unlock Deck

k this deck

17

Money serves as a basic yardstick for measuring economic value (a unit of account), allowing:

A) people to hold their wealth in a liquid form.

B) governments to restrict the issuance of private monies.

C) easy comparison of the relative prices of goods and services.

D) goods and services to be exchanged with a double coincidence of wants.

A) people to hold their wealth in a liquid form.

B) governments to restrict the issuance of private monies.

C) easy comparison of the relative prices of goods and services.

D) goods and services to be exchanged with a double coincidence of wants.

Unlock Deck

Unlock for access to all 184 flashcards in this deck.

Unlock Deck

k this deck

18

If you put a $20 bill in the pocket of your winter coat at the beginning of spring so that you will be surprised when you find it again next winter, you are using money as:

A) bank reserves.

B) a medium of exchange.

C) a unit of account.

D) a store of value.

A) bank reserves.

B) a medium of exchange.

C) a unit of account.

D) a store of value.

Unlock Deck

Unlock for access to all 184 flashcards in this deck.

Unlock Deck

k this deck

19

If you use $1,000 to purchase silver bullion, which you plan to keep in a safe, you are using money as:

A) bank reserves.

B) a medium of exchange.

C) a unit of account.

D) a store of value.

A) bank reserves.

B) a medium of exchange.

C) a unit of account.

D) a store of value.

Unlock Deck

Unlock for access to all 184 flashcards in this deck.

Unlock Deck

k this deck

20

The specialization in production made possible by the use of money to avoid barter is an illustration of the:

A) scarcity principle.

B) principle of comparative advantage.

C) cost-benefit principle.

D) principle of increasing opportunity cost.

A) scarcity principle.

B) principle of comparative advantage.

C) cost-benefit principle.

D) principle of increasing opportunity cost.

Unlock Deck

Unlock for access to all 184 flashcards in this deck.

Unlock Deck

k this deck

21

The components of M2 that are not also in M1:

A) sum to an amount that is smaller than the sum of the components of M1.

B) pay lower rates of interest than do the components of M1.

C) are not usable for making payments.

D) are usable for making payments, but at a greater cost or inconvenience than currency or checks.

A) sum to an amount that is smaller than the sum of the components of M1.

B) pay lower rates of interest than do the components of M1.

C) are not usable for making payments.

D) are usable for making payments, but at a greater cost or inconvenience than currency or checks.

Unlock Deck

Unlock for access to all 184 flashcards in this deck.

Unlock Deck

k this deck

22

Cash and similar assets held to meet depositor withdrawals or payments are called:

A) deposits.

B) bank reserves.

C) checking accounts.

D) money.

A) deposits.

B) bank reserves.

C) checking accounts.

D) money.

Unlock Deck

Unlock for access to all 184 flashcards in this deck.

Unlock Deck

k this deck

23

Savings deposits are ______ the M1 measure of money and ______ the M2 measure of money.

A) included in; excluded from

B) included in; included in

C) excluded from; excluded from

D) excluded from; included in

A) included in; excluded from

B) included in; included in

C) excluded from; excluded from

D) excluded from; included in

Unlock Deck

Unlock for access to all 184 flashcards in this deck.

Unlock Deck

k this deck

24

All of the following are considered money in the United States EXCEPT:

A) credit cards.

B) currency.

C) travelers' checks.

D) checking account balances.

A) credit cards.

B) currency.

C) travelers' checks.

D) checking account balances.

Unlock Deck

Unlock for access to all 184 flashcards in this deck.

Unlock Deck

k this deck

25

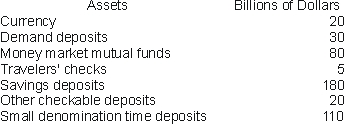

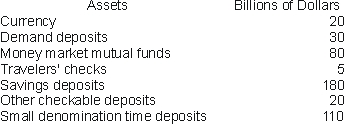

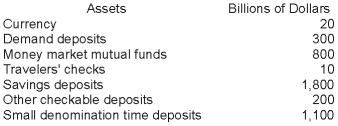

Based on the following information, the value of the M1 measure of the money supply is ______ and the value of the M2 measure of the money supply is ______.

A) $55 billion; $425 billion

B) $75 billion; $445 billion

C) $255 billion; $445 billion

D) $445 billion; $445 billion

A) $55 billion; $425 billion

B) $75 billion; $445 billion

C) $255 billion; $445 billion

D) $445 billion; $445 billion

Unlock Deck

Unlock for access to all 184 flashcards in this deck.

Unlock Deck

k this deck

26

Banks hold reserves:

A) to earn interest.

B) to increase profits.

C) only because the government requires them to hold reserves.

D) to meet depositor withdrawals and payments.

A) to earn interest.

B) to increase profits.

C) only because the government requires them to hold reserves.

D) to meet depositor withdrawals and payments.

Unlock Deck

Unlock for access to all 184 flashcards in this deck.

Unlock Deck

k this deck

27

Credit card balances are not considered to be money primarily because they:

A) are rarely used to make purchases.

B) are not part of people's wealth.

C) are an asset used in making transactions.

D) do not represent an obligation to pay someone else.

A) are rarely used to make purchases.

B) are not part of people's wealth.

C) are an asset used in making transactions.

D) do not represent an obligation to pay someone else.

Unlock Deck

Unlock for access to all 184 flashcards in this deck.

Unlock Deck

k this deck

28

Liabilities of the commercial banking system include:

A) reserves and loans.

B) deposits.

C) reserves and deposits.

D) loans and deposits.

A) reserves and loans.

B) deposits.

C) reserves and deposits.

D) loans and deposits.

Unlock Deck

Unlock for access to all 184 flashcards in this deck.

Unlock Deck

k this deck

29

One hundred percent reserve banking refers to a situation in which banks' reserves equal 100 percent of their:

A) loans.

B) deposits.

C) profits.

D) income.

A) loans.

B) deposits.

C) profits.

D) income.

Unlock Deck

Unlock for access to all 184 flashcards in this deck.

Unlock Deck

k this deck

30

M1 differs from M2 in that:

A) M1 includes currency and balances held in checking accounts, which are not included in M2.

B) M2 includes savings deposits, small-denomination time deposits, and money market mutual funds that are not included in M1.

C) M1 is a broader measure of the money supply than M2.

D) the assets in M2 are more liquid than the assets in M1.

A) M1 includes currency and balances held in checking accounts, which are not included in M2.

B) M2 includes savings deposits, small-denomination time deposits, and money market mutual funds that are not included in M1.

C) M1 is a broader measure of the money supply than M2.

D) the assets in M2 are more liquid than the assets in M1.

Unlock Deck

Unlock for access to all 184 flashcards in this deck.

Unlock Deck

k this deck

31

The M2 measure of money consists of the sum of:

A) savings deposits, small time deposits, and money market mutual funds.

B) currency, checking and savings deposits, and small time deposits.

C) currency, checking and savings deposits.

D) M1, savings deposits, small time deposits, and money market mutual funds.

A) savings deposits, small time deposits, and money market mutual funds.

B) currency, checking and savings deposits, and small time deposits.

C) currency, checking and savings deposits.

D) M1, savings deposits, small time deposits, and money market mutual funds.

Unlock Deck

Unlock for access to all 184 flashcards in this deck.

Unlock Deck

k this deck

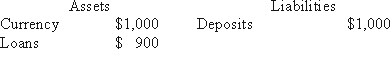

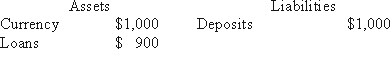

32

The consolidated balance sheet of the all banks in Macroland is presented below:  Based on this balance sheet the banking system of Macroland can be described as a(n) ________ banking system.

Based on this balance sheet the banking system of Macroland can be described as a(n) ________ banking system.

A) barter

B) government-insured

C) fractional-reserve

D) 100-percent-reserve

Based on this balance sheet the banking system of Macroland can be described as a(n) ________ banking system.

Based on this balance sheet the banking system of Macroland can be described as a(n) ________ banking system.A) barter

B) government-insured

C) fractional-reserve

D) 100-percent-reserve

Unlock Deck

Unlock for access to all 184 flashcards in this deck.

Unlock Deck

k this deck

33

Checking deposit are ______ the M1 measure of money and ______ the M2 measure of money.

A) included in; excluded from

B) included in; included in

C) excluded from; excluded from

D) excluded from; included in

A) included in; excluded from

B) included in; included in

C) excluded from; excluded from

D) excluded from; included in

Unlock Deck

Unlock for access to all 184 flashcards in this deck.

Unlock Deck

k this deck

34

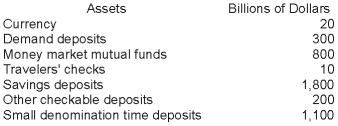

Based on the following information, the value of the M1 measure of the money supply is ______ and the value of the M2 measure of the money supply is ______.

A) $530 billion; $3,700 billion

B) $330 billion; $4,230 billion

C) $520 billion; $4,320 billion

D) $530 billion; $4,230 billion

A) $530 billion; $3,700 billion

B) $330 billion; $4,230 billion

C) $520 billion; $4,320 billion

D) $530 billion; $4,230 billion

Unlock Deck

Unlock for access to all 184 flashcards in this deck.

Unlock Deck

k this deck

35

Money market mutual funds are ______ the M1 measure of money and ______ the M2 measure of money.

A) included in; excluded from

B) included in; included in

C) excluded from; excluded from

D) excluded from; included in

A) included in; excluded from

B) included in; included in

C) excluded from; excluded from

D) excluded from; included in

Unlock Deck

Unlock for access to all 184 flashcards in this deck.

Unlock Deck

k this deck

36

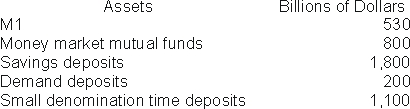

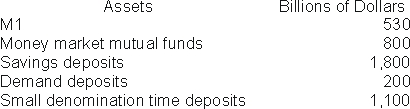

Based on the following information, compute the value of the M2 measure of the money supply.

A) $2,900 billion

B) $4,520 billion

C) $3,900 billion

D) $4,230 billion

A) $2,900 billion

B) $4,520 billion

C) $3,900 billion

D) $4,230 billion

Unlock Deck

Unlock for access to all 184 flashcards in this deck.

Unlock Deck

k this deck

37

The amount of money in the United States is determined by:

A) the Federal Reserve.

B) the combined behavior of commercial banks and the public, as well as actions of the Federal Reserve.

C) the public

D) the combined behavior of commercial banks and the public.

A) the Federal Reserve.

B) the combined behavior of commercial banks and the public, as well as actions of the Federal Reserve.

C) the public

D) the combined behavior of commercial banks and the public.

Unlock Deck

Unlock for access to all 184 flashcards in this deck.

Unlock Deck

k this deck

38

In a fractional-reserve banking system the reserve/deposit ratio equals:

A) more than 100 percent.

B) currency held by the public divided by deposits.

C) 100 percent.

D) less than 100 percent.

A) more than 100 percent.

B) currency held by the public divided by deposits.

C) 100 percent.

D) less than 100 percent.

Unlock Deck

Unlock for access to all 184 flashcards in this deck.

Unlock Deck

k this deck

39

Assets of the commercial banking system include:

A) reserves and loans.

B) deposits.

C) reserves and deposits.

D) loans and deposits.

A) reserves and loans.

B) deposits.

C) reserves and deposits.

D) loans and deposits.

Unlock Deck

Unlock for access to all 184 flashcards in this deck.

Unlock Deck

k this deck

40

Bank reserves are:

A) currency and customer checking deposits.

B) currency, customer checking and savings deposits.

C) any asset used to purchase goods and services.

D) cash and similar assets held to meet depositor withdrawals or payments.

A) currency and customer checking deposits.

B) currency, customer checking and savings deposits.

C) any asset used to purchase goods and services.

D) cash and similar assets held to meet depositor withdrawals or payments.

Unlock Deck

Unlock for access to all 184 flashcards in this deck.

Unlock Deck

k this deck

41

Commercial banks create new money:

A) when they increase their desired reserve/deposit ratio.

B) by issuing checks.

C) through multiple rounds of lending.

D) when they buy government bonds from the Federal Reserve.

A) when they increase their desired reserve/deposit ratio.

B) by issuing checks.

C) through multiple rounds of lending.

D) when they buy government bonds from the Federal Reserve.

Unlock Deck

Unlock for access to all 184 flashcards in this deck.

Unlock Deck

k this deck

42

When an individual deposits currency into a checking account:

A) bank reserves increase, which allows banks to lend more and increases the money supply.

B) bank reserves decrease, which reduces the amount banks can lend and reduces the growth of the money supply.

C) bank reserves are unchanged.

D) bank liabilities increase, which reduces the amount banks can lend and reduces the growth of the money supply.

A) bank reserves increase, which allows banks to lend more and increases the money supply.

B) bank reserves decrease, which reduces the amount banks can lend and reduces the growth of the money supply.

C) bank reserves are unchanged.

D) bank liabilities increase, which reduces the amount banks can lend and reduces the growth of the money supply.

Unlock Deck

Unlock for access to all 184 flashcards in this deck.

Unlock Deck

k this deck

43

If the public switches from using cash for most transactions to using checks instead, then all else equal, the money supply will:

A) increase.

B) decrease.

C) not change.

D) either increase or decrease.

A) increase.

B) decrease.

C) not change.

D) either increase or decrease.

Unlock Deck

Unlock for access to all 184 flashcards in this deck.

Unlock Deck

k this deck

44

If the actual reserve/deposit ratio equals 8% and the desired reserve/deposit ratio for this bank is 10%, the bank should:

A) do nothing because this is a profitable situation.

B) stop making loans.

C) send the extra reserves to the central bank.

D) make more loans in order to earn interest.

A) do nothing because this is a profitable situation.

B) stop making loans.

C) send the extra reserves to the central bank.

D) make more loans in order to earn interest.

Unlock Deck

Unlock for access to all 184 flashcards in this deck.

Unlock Deck

k this deck

45

When the actual reserve/deposit ratio is less than the desired reserve/deposit ratio banks:

A) do nothing because this is a profitable situation.

B) stop making loans.

C) send the extra reserves to the central bank.

D) make more loans in order to earn interest.

A) do nothing because this is a profitable situation.

B) stop making loans.

C) send the extra reserves to the central bank.

D) make more loans in order to earn interest.

Unlock Deck

Unlock for access to all 184 flashcards in this deck.

Unlock Deck

k this deck

46

If the actual reserve/deposit ratio equals 15% and the desired reserve/deposit ratio for this bank is 10%, the bank should:

A) do nothing because this is a profitable situation.

B) stop making loans.

C) request that customers withdraw deposits from the bank.

D) make more loans in order to earn interest.

A) do nothing because this is a profitable situation.

B) stop making loans.

C) request that customers withdraw deposits from the bank.

D) make more loans in order to earn interest.

Unlock Deck

Unlock for access to all 184 flashcards in this deck.

Unlock Deck

k this deck

47

If bank reserves are 200, the public holds 400 in currency, and the desired reserve/deposit ratio is 0.25, the deposits are ______ and the money supply is _____.

A) 200; 600

B) 400; 800

C) 600; 1,000

D) 800; 1,200

A) 200; 600

B) 400; 800

C) 600; 1,000

D) 800; 1,200

Unlock Deck

Unlock for access to all 184 flashcards in this deck.

Unlock Deck

k this deck

48

If the Central Bank of Macroland puts an additional 1,000 dollars of currency into the economy, the public deposits all currency into the banking system, and banks have a desired reserve/deposit ratio of 0.20, then the banks will eventually make new loans totaling ______ and the money supply will increase by _______.

A) $1,000; $1,000

B) $4,000; $4,000

C) $4,000; $5,000

D) $1,000; $5,000

A) $1,000; $1,000

B) $4,000; $4,000

C) $4,000; $5,000

D) $1,000; $5,000

Unlock Deck

Unlock for access to all 184 flashcards in this deck.

Unlock Deck

k this deck

49

In Macroland there is $10,000,000 in currency. The public holds half of the currency and banks hold the rest as reserves. If banks' desired reserve/deposit ratio is 10%, deposits in Macroland equal ______ and the money supply equals _______.

A) $50,000,000; $60,000,000

B) $55,000,000; $55,000,000

C) $50,000,000; $55,000,000

D) $100,000,000; $100,000,000

A) $50,000,000; $60,000,000

B) $55,000,000; $55,000,000

C) $50,000,000; $55,000,000

D) $100,000,000; $100,000,000

Unlock Deck

Unlock for access to all 184 flashcards in this deck.

Unlock Deck

k this deck

50

If the Central Bank of Macroland puts an additional 1,000 dollars of currency into the economy, the public deposits all currency into the banking system, and banks have a desired reserve/deposit ratio of 0.10, then the banks will eventually make new loans totaling ______ and the money supply will increase by _______.

A) $1,000; $1,000

B) $9,000; $9,000

C) $9,000; $10,000

D) $1,000; $9,000

A) $1,000; $1,000

B) $9,000; $9,000

C) $9,000; $10,000

D) $1,000; $9,000

Unlock Deck

Unlock for access to all 184 flashcards in this deck.

Unlock Deck

k this deck

51

In Macroland there is $1,000,000 in currency that can either be held by the public as currency or deposited into banks. Banks' desired reserve/deposit ratio is 10%. If the public of Macroland decides to hold more currency, increasing the proportion they hold from 50% to 75%, the money supply in Macroland will ______.

A) increase.

B) decrease.

C) remain the same.

D) either increase or decrease.

A) increase.

B) decrease.

C) remain the same.

D) either increase or decrease.

Unlock Deck

Unlock for access to all 184 flashcards in this deck.

Unlock Deck

k this deck

52

After the Federal Reserve increases reserves in the banking system, banks create new deposits through multiple rounds of lending and accepting deposits until the:

A) Federal Reserve requires them to stop.

B) deposit insurance limit is reached.

C) actual reserve/deposit ratio is greater than the desired reserve/deposit ratio.

D) actual reserve/deposit ratio is equal to the desired reserve/deposit ratio.

A) Federal Reserve requires them to stop.

B) deposit insurance limit is reached.

C) actual reserve/deposit ratio is greater than the desired reserve/deposit ratio.

D) actual reserve/deposit ratio is equal to the desired reserve/deposit ratio.

Unlock Deck

Unlock for access to all 184 flashcards in this deck.

Unlock Deck

k this deck

53

When the actual reserve/deposit ratio exceeds the desired reserve/deposit ratio banks:

A) do nothing because this is a profitable situation.

B) stop making loans.

C) send the extra reserves to the central bank.

D) make more loans.

A) do nothing because this is a profitable situation.

B) stop making loans.

C) send the extra reserves to the central bank.

D) make more loans.

Unlock Deck

Unlock for access to all 184 flashcards in this deck.

Unlock Deck

k this deck

54

If the desired reserve/deposit ratio equals 0.10, then every dollar of currency in bank reserves supports ______ of deposits and the money supply, while every dollar of currency held by the public contributes ______ to the money supply.

A) $1; $10

B) $0.10; $1

C) $1; $0.10

D) $10; $1

A) $1; $10

B) $0.10; $1

C) $1; $0.10

D) $10; $1

Unlock Deck

Unlock for access to all 184 flashcards in this deck.

Unlock Deck

k this deck

55

When a bank makes a loan by crediting the borrower's checking account balance with an amount equal to the loan:

A) money is created.

B) the bank gains new reserves.

C) the bank immediately loses reserves.

D) the Fed has made an open-market purchase.

A) money is created.

B) the bank gains new reserves.

C) the bank immediately loses reserves.

D) the Fed has made an open-market purchase.

Unlock Deck

Unlock for access to all 184 flashcards in this deck.

Unlock Deck

k this deck

56

The money supply will increase by a multiple of the increase in bank reserves created by the central bank unless:

A) there is fractional reserve banking.

B) there is 100 percent reserve banking.

C) the public holds no currency.

D) banks' desired reserve/deposit ratio is 0.20.

A) there is fractional reserve banking.

B) there is 100 percent reserve banking.

C) the public holds no currency.

D) banks' desired reserve/deposit ratio is 0.20.

Unlock Deck

Unlock for access to all 184 flashcards in this deck.

Unlock Deck

k this deck

57

In Macroland there is $12,000,000 in currency. The public holds half of the currency and banks hold the rest as reserves. If banks' desired reserve/deposit ratio is 12.5%, deposits in Macroland equal ______ and the money supply equals _______.

A) $48,000,000; $75,000,000

B) $54,000,000; $54,000,000

C) $48,000,000; $54,000,000

D) $96,000,000; $96,000,000

A) $48,000,000; $75,000,000

B) $54,000,000; $54,000,000

C) $48,000,000; $54,000,000

D) $96,000,000; $96,000,000

Unlock Deck

Unlock for access to all 184 flashcards in this deck.

Unlock Deck

k this deck

58

If banks' desired reserve ratio increases from 0.10 to 0.15, the public still desires to hold the same amount of currency, and the Fed takes no actions, the money supply will:

A) increase.

B) decrease.

C) not change.

D) either increase or decrease.

A) increase.

B) decrease.

C) not change.

D) either increase or decrease.

Unlock Deck

Unlock for access to all 184 flashcards in this deck.

Unlock Deck

k this deck

59

Bank reserves divided by bank deposits is called:

A) fractional reserve banking.

B) the asset/liability ratio.

C) 100% reserve banking.

D) the reserve/deposit ratio.

A) fractional reserve banking.

B) the asset/liability ratio.

C) 100% reserve banking.

D) the reserve/deposit ratio.

Unlock Deck

Unlock for access to all 184 flashcards in this deck.

Unlock Deck

k this deck

60

There is $5,000,000 of currency in Econland, all held by banks as reserves. The public does not hold any currency. If the banks' desired reserve/deposit ratio is 0.25, then the money supply equals:

A) $5,000,000

B) $6,250,000

C) $10,000,000

D) $20,000,000

A) $5,000,000

B) $6,250,000

C) $10,000,000

D) $20,000,000

Unlock Deck

Unlock for access to all 184 flashcards in this deck.

Unlock Deck

k this deck

61

The seven Fed governors, the president of the Federal Reserve Bank of New York, and four of the presidents of the other regional Federal Reserve Banks constitute the:

A) National Monetary Commission.

B) Board of Governors.

C) Federal Open Market Committee.

D) Federal Reserve System.

A) National Monetary Commission.

B) Board of Governors.

C) Federal Open Market Committee.

D) Federal Reserve System.

Unlock Deck

Unlock for access to all 184 flashcards in this deck.

Unlock Deck

k this deck

62

The money supply is 2,000 of which 500 is currency held by the public. Bank reserves are 150. The existing reserve/deposit ratio equals:

A) 0.05

B) 0.10

C) 0.15

D) 0.20

A) 0.05

B) 0.10

C) 0.15

D) 0.20

Unlock Deck

Unlock for access to all 184 flashcards in this deck.

Unlock Deck

k this deck

63

In an open-market purchase the Federal Reserve ______ government bonds from the public and the supply of bank reserves ______.

A) buys; increases

B) buys; decreases

C) sells; decreases

D) sells; increases

A) buys; increases

B) buys; decreases

C) sells; decreases

D) sells; increases

Unlock Deck

Unlock for access to all 184 flashcards in this deck.

Unlock Deck

k this deck

64

If the desired reserve/deposit ratio is 0.25 and the banking system receives an additional $10 million in reserves, bank deposits will increase by:

A) $10 million.

B) $250 million.

C) $40 million.

D) $4 million.

A) $10 million.

B) $250 million.

C) $40 million.

D) $4 million.

Unlock Deck

Unlock for access to all 184 flashcards in this deck.

Unlock Deck

k this deck

65

The central bank of the United States is:

A) Bank of America.

B) Bank of the United States.

C) the U.S. Treasury.

D) the Federal Reserve System.

A) Bank of America.

B) Bank of the United States.

C) the U.S. Treasury.

D) the Federal Reserve System.

Unlock Deck

Unlock for access to all 184 flashcards in this deck.

Unlock Deck

k this deck

66

The seven leaders of the Federal Reserve System headquartered in Washington, D.C. constitute the:

A) Federal Reserve Bank of Washington, D.C.

B) Federal Open Market Committee.

C) Federal Economic Advisory Board.

D) Board of Governors.

A) Federal Reserve Bank of Washington, D.C.

B) Federal Open Market Committee.

C) Federal Economic Advisory Board.

D) Board of Governors.

Unlock Deck

Unlock for access to all 184 flashcards in this deck.

Unlock Deck

k this deck

67

The Board of Governors consists of ______ governors appointed for staggered ______ terms.

A) 5; 12-year

B) 5; 14-year

C) 7; 12-year

D) 7; 14-year

A) 5; 12-year

B) 5; 14-year

C) 7; 12-year

D) 7; 14-year

Unlock Deck

Unlock for access to all 184 flashcards in this deck.

Unlock Deck

k this deck

68

If a bank's desired reserve/deposit ratio is 0.33 and it has deposit liabilities of $100 million and reserves of $50 million, it:

A) has too few reserves and will reduce its lending.

B) has too many reserves and will increase its lending.

C) has the correct amount of reserves and outstanding loans.

D) should increase the amount of its reserves.

A) has too few reserves and will reduce its lending.

B) has too many reserves and will increase its lending.

C) has the correct amount of reserves and outstanding loans.

D) should increase the amount of its reserves.

Unlock Deck

Unlock for access to all 184 flashcards in this deck.

Unlock Deck

k this deck

69

The Federal Reserve consists of ______ regional banks, ______ governors on the Board of Governors, and ______ voting members of the Federal Open Market Committee.

A) 7; 12; 12

B) 12; 7; 12

C) 12; 7; 19

D) 14; 7; 21

A) 7; 12; 12

B) 12; 7; 12

C) 12; 7; 19

D) 14; 7; 21

Unlock Deck

Unlock for access to all 184 flashcards in this deck.

Unlock Deck

k this deck

70

The Federal Reserve System first began operations in:

A) 1789.

B) 1865.

C) 1914.

D) 1934

A) 1789.

B) 1865.

C) 1914.

D) 1934

Unlock Deck

Unlock for access to all 184 flashcards in this deck.

Unlock Deck

k this deck

71

The most important, most convenient, and most flexible way in which the Federal Reserve affects the supply of bank reserves is through:

A) conducting open-market operations.

B) changing the Federal Reserve discount rate.

C) changing bank reserve requirement ratios.

D) changing interest rates.

A) conducting open-market operations.

B) changing the Federal Reserve discount rate.

C) changing bank reserve requirement ratios.

D) changing interest rates.

Unlock Deck

Unlock for access to all 184 flashcards in this deck.

Unlock Deck

k this deck

72

The two main responsibilities of the Federal Reserve System are to ______ and to ______.

A) apprehend counterfeiters; regulate the stock market

B) enable banks to make affordable mortgages; control the exchange rate of the U.S. dollar

C) insure bank deposits; print currency

D) conduct monetary policy; oversee financial markets

A) apprehend counterfeiters; regulate the stock market

B) enable banks to make affordable mortgages; control the exchange rate of the U.S. dollar

C) insure bank deposits; print currency

D) conduct monetary policy; oversee financial markets

Unlock Deck

Unlock for access to all 184 flashcards in this deck.

Unlock Deck

k this deck

73

The money supply is 1,500 of which 500 is currency held by the public. Bank reserves are 200. The existing reserve/deposit ratio equals:

A) 0.05

B) 0.10

C) 0.15

D) 0.20

A) 0.05

B) 0.10

C) 0.15

D) 0.20

Unlock Deck

Unlock for access to all 184 flashcards in this deck.

Unlock Deck

k this deck

74

The money supply in Econland is 1,000, and currency held by the public equals bank reserves. The desired reserve/deposit ratio is 0.25. Bank reserves equal _____.

A) 200

B) 250

C) 500

D) 800

A) 200

B) 250

C) 500

D) 800

Unlock Deck

Unlock for access to all 184 flashcards in this deck.

Unlock Deck

k this deck

75

When the Fed sells government securities, the banks':

A) reserves will increase and lending will expand, causing an increase in the money supply.

B) reserves will decrease and lending will contract, causing a decrease in the money supply.

C) reserve requirements will increase and lending will contract, causing a decrease in the money supply.

D) reserves/deposit ratio will increase and lending will expand, causing an increase in the money supply.

A) reserves will increase and lending will expand, causing an increase in the money supply.

B) reserves will decrease and lending will contract, causing a decrease in the money supply.

C) reserve requirements will increase and lending will contract, causing a decrease in the money supply.

D) reserves/deposit ratio will increase and lending will expand, causing an increase in the money supply.

Unlock Deck

Unlock for access to all 184 flashcards in this deck.

Unlock Deck

k this deck

76

In an open-market sale the Federal Reserve ______ government bonds and the supply of bank reserves ____.

A) buys; increases

B) buys; decreases

C) sells; increases

D) sells; decreases

A) buys; increases

B) buys; decreases

C) sells; increases

D) sells; decreases

Unlock Deck

Unlock for access to all 184 flashcards in this deck.

Unlock Deck

k this deck

77

The most important tool of monetary policy is:

A) reserve requirement ratios.

B) the discount rate.

C) open-market operations.

D) market interest rates.

A) reserve requirement ratios.

B) the discount rate.

C) open-market operations.

D) market interest rates.

Unlock Deck

Unlock for access to all 184 flashcards in this deck.

Unlock Deck

k this deck

78

If bank reserves are 200, the public holds 400 in currency, and the desired reserve/deposit ratio is 0.20, the deposits are ______ and the money supply is _____.

A) 200; 600

B) 400; 800

C) 600; 1,000

D) 1,000; 1,400

A) 200; 600

B) 400; 800

C) 600; 1,000

D) 1,000; 1,400

Unlock Deck

Unlock for access to all 184 flashcards in this deck.

Unlock Deck

k this deck

79

The Federal Open Market Committee makes decisions about ______ policy.

A) monetary

B) fiscal

C) banking

D) deposit insurance

A) monetary

B) fiscal

C) banking

D) deposit insurance

Unlock Deck

Unlock for access to all 184 flashcards in this deck.

Unlock Deck

k this deck

80

The Federal Reserve System is:

A) a group of twelve commercial banks.

B) the central bank of the United States.

C) the agency of the U.S. government that insures commercial bank deposits.

D) the branch of the U.S. Treasury that keeps the U.S. gold reserves.

A) a group of twelve commercial banks.

B) the central bank of the United States.

C) the agency of the U.S. government that insures commercial bank deposits.

D) the branch of the U.S. Treasury that keeps the U.S. gold reserves.

Unlock Deck

Unlock for access to all 184 flashcards in this deck.

Unlock Deck

k this deck