Deck 17: Uncertainty

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/112

Play

Full screen (f)

Deck 17: Uncertainty

1

Although he is very poor,Al plays the million-dollar lottery every day because he is certain that one day he will win.Al makes this calculation based upon

A) the frequency of past outcomes.

B) subjective probability.

C) knowledge of all possible outcomes.

D) tossing a coin.

A) the frequency of past outcomes.

B) subjective probability.

C) knowledge of all possible outcomes.

D) tossing a coin.

B

2

Expected value represents the average of all outcomes if one were to undertake the risky event many times over and over again.

True

The expected value is not expected on any one outcome,because it represents the average of many outcomes.

The expected value is not expected on any one outcome,because it represents the average of many outcomes.

3

Sarah buys little stuffed animals for $5 each.They come in different varieties.If the producer stops making (retires)a certain variety,a stuffed animal of that variety will be worth $100; otherwise it is worth $0.There is 50% chance that any variety will be retired.What is the value to Sarah of knowing ahead of time whether a variety will be retired?

A) $50

B) $5

C) $2.50

D) $0

A) $50

B) $5

C) $2.50

D) $0

C

4

Explain why the variance of an investment is a useful measure of the risk associated with it.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

5

If there are 10,000 people in your age bracket,and 10 of them died last year,an insurance company believes that the probability of someone in that age bracket dying this year would be

A) 0.

B) )001.

C) )0001.

D) 1,000.

A) 0.

B) )001.

C) )0001.

D) 1,000.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

6

On any given day we know a salesman can earn $0 with a 30% probability,$100 with a 20% probability or $300 with 40% probability.His expected earnings equal

A) $0.

B) $140.

C) $300.

D) It cannot be determined from the available information.

A) $0.

B) $140.

C) $300.

D) It cannot be determined from the available information.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

7

All else held constant,as the variance of a payoff increases,the

A) expected value of the payoff increases.

B) risk of the payoff increases.

C) expected value of the payoff decreases.

D) risk of the payoff decreases.

A) expected value of the payoff increases.

B) risk of the payoff increases.

C) expected value of the payoff decreases.

D) risk of the payoff decreases.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

8

If a payout is certain to occur,then the variance of that payout equals

A) zero.

B) one.

C) the expected value.

D) the expected value squared.

A) zero.

B) one.

C) the expected value.

D) the expected value squared.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

9

On any given day,a salesman can earn $0 with a 20% probability,$100 with a 40% probability,or $300 with a 20% probability.Calculate the expected value and variance of his earnings,and interpret.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

10

On any given day,a salesman can earn $0 with a 30% probability,$100 with a 20% probability,or $300 with a 50% probability.His expected earnings equal

A) $0.

B) $100.

C) $150.

D) $170.

A) $0.

B) $100.

C) $150.

D) $170.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

11

Sarah buys little stuffed animals for $5 each.They come in different varieties.If the producer stops making (retires)a certain variety,a stuffed animal of that variety will be worth $100; otherwise it is worth $0.There is 50% chance that any variety will be retired.When Sarah buys her next stuffed animal,the expected profit is

A) $50.

B) $47.50.

C) $45.00.

D) $0.

A) $50.

B) $47.50.

C) $45.00.

D) $0.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

12

A lottery game pays $500 with .001 probability and $0 otherwise.The variance of the payout is

A) 15.8.

B) 249.50.

C) 249.75.

D) 499.

A) 15.8.

B) 249.50.

C) 249.75.

D) 499.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

13

For a given expected value,the smaller the standard deviation of the expected value,the larger the risk.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

14

Your friend Diana tells you that she thinks that her favorite softball team has a 70% chance of winning the next game because that is exactly the winning rate of her team in the last two seasons.This is an example of a(n)

A) objective probability.

B) subjective probability.

C) risk-averse statement.

D) Friedman-Savage preference.

A) objective probability.

B) subjective probability.

C) risk-averse statement.

D) Friedman-Savage preference.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

15

On any given day,a salesman can earn $0 with a 20% probability,$100 with a 40% probability,or $300 with a 20% probability.His expected earnings equal

A) $0.

B) $100 because that is the most likely outcome.

C) $100 because that is what he will earn on average.

D) $200 because that is what he will earn on average.

A) $0.

B) $100 because that is the most likely outcome.

C) $100 because that is what he will earn on average.

D) $200 because that is what he will earn on average.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

16

You draw colored balls out of a bag.You draw a red ball 30% of the time and a blue ball 70% of the time.For each draw,the blue outcome and the red outcome are

A) mutually exclusive.

B) exhaustive.

C) Both A and B.

D) None of the above.

A) mutually exclusive.

B) exhaustive.

C) Both A and B.

D) None of the above.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

17

Your friend Dimitre tells you that he thinks that his favorite basketball team has a 70% chance of winning the next game.This is an example of a(n)

A) objective probability.

B) subjective probability.

C) risk-averse statement.

D) Friedman-Savage preference.

A) objective probability.

B) subjective probability.

C) risk-averse statement.

D) Friedman-Savage preference.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

18

Expected value represents

A) the actual payment one expects to receive.

B) the average of all payments one would receive if one undertook the risky event many times.

C) the payment one receives if he or she makes the correct decision.

D) the payment that is most likely to occur.

A) the actual payment one expects to receive.

B) the average of all payments one would receive if one undertook the risky event many times.

C) the payment one receives if he or she makes the correct decision.

D) the payment that is most likely to occur.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

19

Assume the following.In location A yearly temperatures range from -30°F to 100°F and in location B yearly temperatures range from 55°F to 75°F.In both locations the average yearly temperature equals 65°F.We can conclude that

A) temperature in location A has a higher variance.

B) temperature in location B has a higher standard deviation.

C) temperature in location A has a lower standard deviation.

D) temperatures in both locations have the same standard deviation but different variances.

A) temperature in location A has a higher variance.

B) temperature in location B has a higher standard deviation.

C) temperature in location A has a lower standard deviation.

D) temperatures in both locations have the same standard deviation but different variances.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

20

People in a certain group have a 0.3% chance of dying this year.If a person in this group buys a life insurance policy for $3,300 that pays $1,000,000 to her family if she dies this year and $0 otherwise,what is the expected value of a policy to the insurance company?

A) $0

B) $300

C) $3,000

D) $3,300

A) $0

B) $300

C) $3,000

D) $3,300

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

21

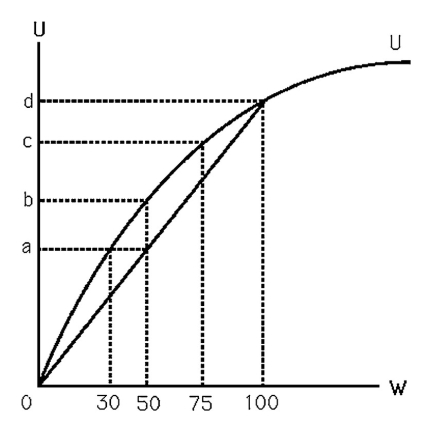

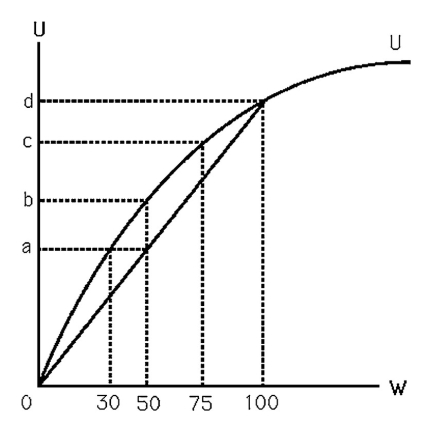

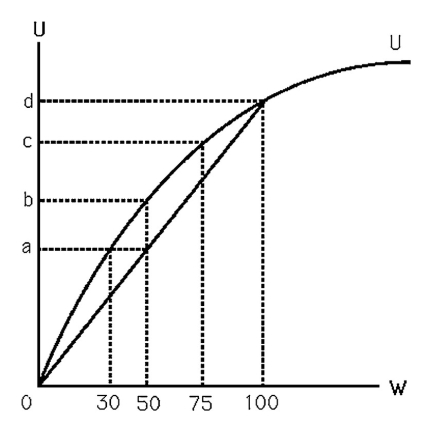

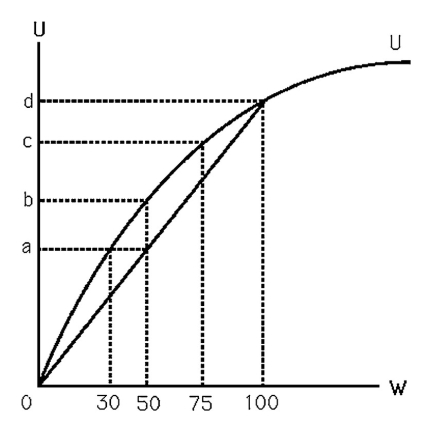

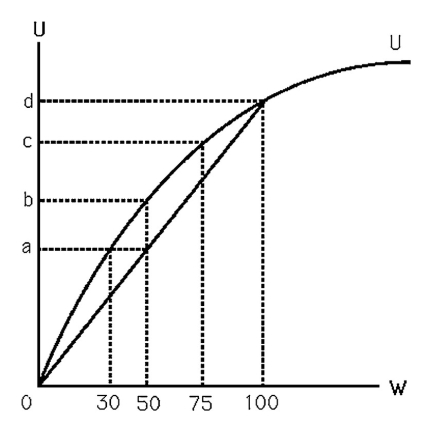

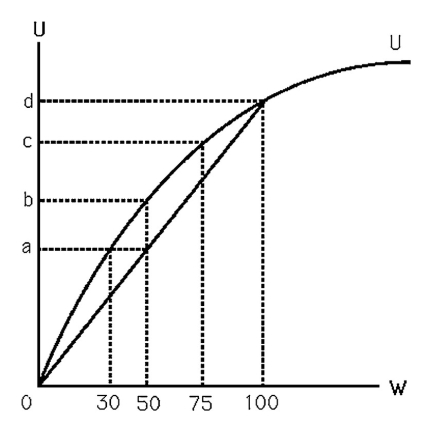

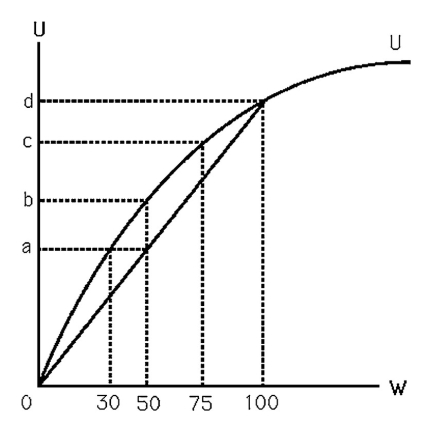

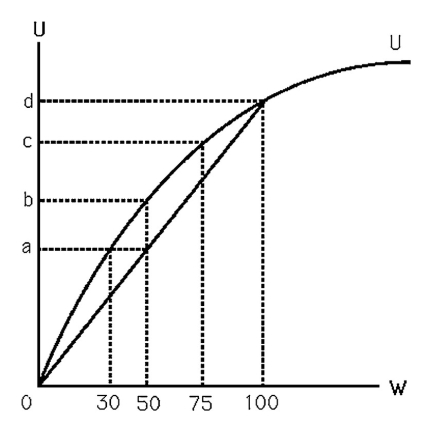

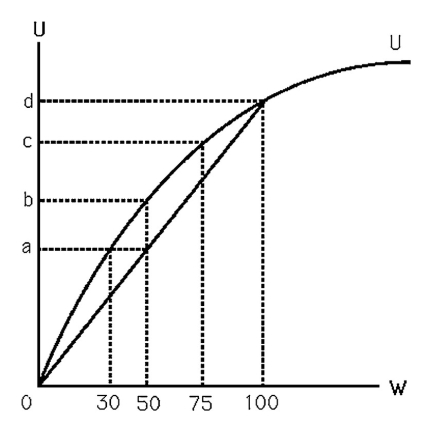

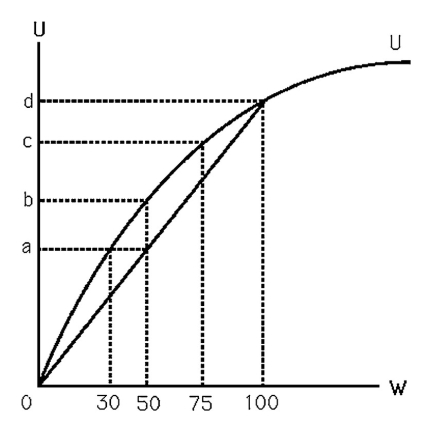

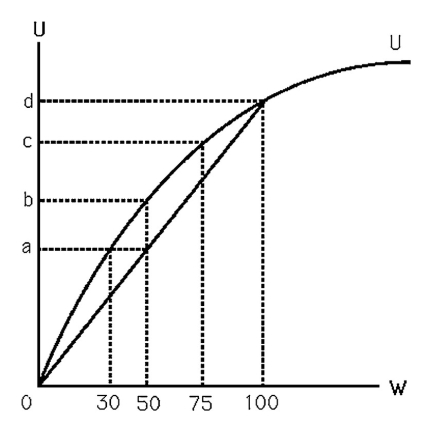

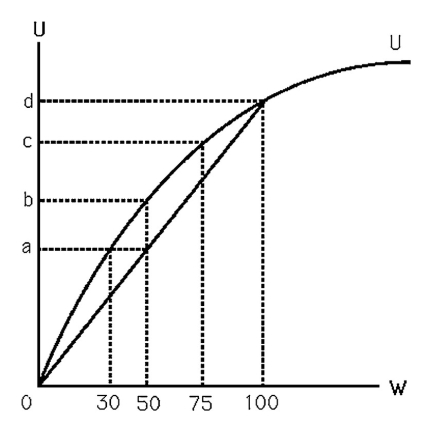

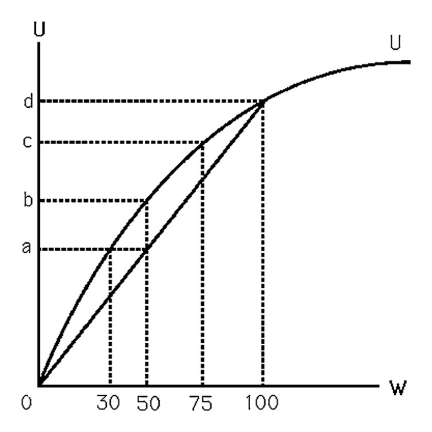

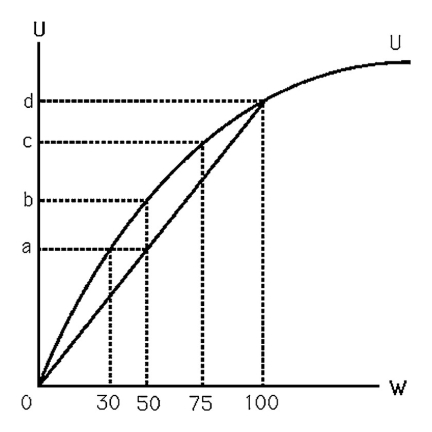

The above figure shows Bob's utility function.He currently has $100 of wealth,but there is a 50% chance that it could all be stolen.Bob's expected wealth is

A) $0.

B) $50.

C) $75.

D) $100.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

22

The above figure shows Bob's utility function.He currently has $100 of wealth,but there is a 50% chance that it could all be stolen.Living with this risk gives Bob the same expected utility as if there was no chance of theft and his wealth was

A) $0.

B) $20.

C) $30.

D) $50.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

23

The above figure shows Bob's utility function.He currently has $100 of wealth,but there is a 50% chance that it could all be stolen.Bob is

A) risk averse.

B) risk neutral.

C) risk loving.

D) risk premium.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

24

The above figure shows Bob's utility function.He currently has $100 of wealth,but there is a 50% chance that it could all be stolen.Bob's expected utility is

A) a.

B) b.

C) c.

D) d.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

25

The above figure shows Bob's utility function.He currently has $100 of wealth,but there is a 50% chance that it could all be stolen.Bob will buy theft insurance to cover the full $100

A) as long as it does not cost more than $25.

B) as long as it does not cost more than $50.

C) as long as it does not cost more than $70.

D) at any price.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

26

If a person is risk neutral,then she

A) is indifferent about playing a fair game.

B) will pay a premium to avoid a fair game.

C) has a horizontal utility function.

D) has zero marginal utility of wealth.

A) is indifferent about playing a fair game.

B) will pay a premium to avoid a fair game.

C) has a horizontal utility function.

D) has zero marginal utility of wealth.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

27

The above figure shows Bob's utility function.He currently has $100 of wealth,but there is a 50% chance that it could all be stolen.Bob is risk averse because

A) his utility function is convex.

B) he has negative marginal utility of wealth.

C) he is willing to pay a premium to avoid a risky situation.

D) All of the above.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

28

John derives more utility from having $1,000 than from having $100.From this,we can conclude that John

A) is risk averse.

B) is risk loving.

C) is risk neutral.

D) has a positive marginal utility of wealth.

A) is risk averse.

B) is risk loving.

C) is risk neutral.

D) has a positive marginal utility of wealth.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

29

John's utility from an additional dollar increases more when he has $1,000 than when he has $10,000.From this,we can conclude that John

A) is risk averse.

B) is risk loving.

C) is risk neutral.

D) has a negative marginal utility of wealth.

A) is risk averse.

B) is risk loving.

C) is risk neutral.

D) has a negative marginal utility of wealth.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

30

If a person is entertained by gambling,then

A) she is not risk averse.

B) she does not understand the concept of a fair game.

C) she may gamble even if it is an unfair game.

D) she will definitely not buy automobile insurance.

A) she is not risk averse.

B) she does not understand the concept of a fair game.

C) she may gamble even if it is an unfair game.

D) she will definitely not buy automobile insurance.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

31

Sarah buys little stuffed animals for $5 each.They come in different varieties.If the producer stops making (retires)a certain variety,a stuffed animal of that variety will be worth $100; otherwise it is worth $0.There is 25% chance that any variety will be retired.For the purchase of an individual animal,what is the value to Sarah of knowing ahead of time whether or not that variety will be retired?

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

32

For a risk-neutral person,the expected utility associated with various levels of wealth

A) is above the person's utility function.

B) is below the person's utility function.

C) is equal to the person's utility function.

D) does not exist.

A) is above the person's utility function.

B) is below the person's utility function.

C) is equal to the person's utility function.

D) does not exist.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

33

Which of the following games involving the roll of a single die is a fair bet?

A) Bet $1 and receive $1 if 3 or 4 comes up.

B) Bet $1 and receive $1 if 3, 4, or 5 comes up.

C) Bet $1 and receive $4 if 6 comes up.

D) None of the bets is a fair bet.

A) Bet $1 and receive $1 if 3 or 4 comes up.

B) Bet $1 and receive $1 if 3, 4, or 5 comes up.

C) Bet $1 and receive $4 if 6 comes up.

D) None of the bets is a fair bet.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

34

The above figure shows Bob's utility function.He currently has $100 of wealth,but there is a 50% chance that it could all be stolen.To reduce the chance of theft to zero,Bob is willing to pay

A) $20.

B) $50.

C) $70.

D) $80.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

35

The above figure shows Bob's utility function.He currently has $100 of wealth,but there is a 50% chance that it could all be stolen.Over and above the price of fair insurance,what is the risk premium Bob would pay to eliminate the chance of theft?

A) $0

B) $20

C) $30

D) $50

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

36

The above figure shows Bob's utility function.He currently has $100 of wealth,but there is a 50% chance that it could all be stolen.The midpoint of the chord that runs from zero and intersects the utility function where wealth is 100,represents Bob's

A) risk premium.

B) expected utility of receiving $50 with certainty.

C) expected utility of receiving $0 50% of the time and $100 50% of the time.

D) risk neutrality.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

37

The above figure shows Bob's utility function.He currently has $100 of wealth,but there is a 50% chance that it could all be stolen.Bob is risk averse because

A) his utility function is concave.

B) he has diminishing marginal utility of wealth.

C) he is willing to pay a premium to avoid a risky situation.

D) All of the above.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

38

The above figure shows Bob's utility function.He currently has $100 of wealth,but there is a 50% chance that it could all be stolen.What is the most Bob would pay for insurance that would replace his $100 should it be stolen?

A) $30

B) $50

C) $70

D) $75

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

39

A risk-preferring person is willing to pay

A) a risk premium.

B) a fee to make a fair bet.

C) to obtain decreasing marginal utility.

D) None of the above.

A) a risk premium.

B) a fee to make a fair bet.

C) to obtain decreasing marginal utility.

D) None of the above.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

40

The above figure shows Bob's utility function.He currently has $100 of wealth,but there is a 50% chance that it could all be stolen.If Bob could keep $50 with certainty,his utility would be

A) a.

B) b.

C) c.

D) d.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

41

What type of risk behavior does the person exhibit who is willing to pay $5 for the chance to bet $60 on a game where 20% of the time the bet returns $100,and 80% of the time returns $50? Explain.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

42

The Friedman-Savage utility function can explain why

A) people buy automobile insurance.

B) somebody becomes addicted to gambling.

C) people become more risk averse as their wealth increases.

D) people place small bets to have a chance at winning a large amount.

A) people buy automobile insurance.

B) somebody becomes addicted to gambling.

C) people become more risk averse as their wealth increases.

D) people place small bets to have a chance at winning a large amount.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

43

A person that is risk averse

A) exhibits decreasing marginal utility of wealth.

B) exhibits increasing marginal utility of wealth.

C) always engages in fair bets.

D) loves lotteries.

A) exhibits decreasing marginal utility of wealth.

B) exhibits increasing marginal utility of wealth.

C) always engages in fair bets.

D) loves lotteries.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

44

Searching the internet for information to help select a product that is more reliable is most likely to be done by a

A) risk-averse person.

B) risk-neutral person.

C) risk-preferring person.

D) This cannot be determined with the information provided.

A) risk-averse person.

B) risk-neutral person.

C) risk-preferring person.

D) This cannot be determined with the information provided.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

45

A fair game is a game in which the chances are 50-50 that you win or lose.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

46

Which of the following is a fair bet based on the toss of an unbiased coin?

A) head: receive $5, tail: lose $5

B) head: receive $2, tail: lose $3

C) head: receive $0.5, tail: lose $1

D) head: lose $3, tail: lose $3

A) head: receive $5, tail: lose $5

B) head: receive $2, tail: lose $3

C) head: receive $0.5, tail: lose $1

D) head: lose $3, tail: lose $3

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

47

Bob's utility function is shown in the above figure.He currently has $100 worth of property,but there is a 50% chance that all of it will be stolen.An insurance company offers to reimburse Bob for his loss if the money is stolen.What is the most that Bob would pay for such a policy? Explain.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

48

Bob invests $50 in an investment that has a 50% chance of being worth $100 and a 50% chance of being worth $0.From this information we can conclude that Bob is NOT

A) risk loving.

B) risk neutral.

C) risk averse.

D) rational.

A) risk loving.

B) risk neutral.

C) risk averse.

D) rational.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

49

A risk-averse person's expected utility function is

A) decreasing.

B) convex.

C) concave.

D) a straight line.

A) decreasing.

B) convex.

C) concave.

D) a straight line.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

50

If a person willingly plays an unfair game that is not in his favor,he is risk loving.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

51

Catherine is risk-averse.When faced with a choice between a gamble and a certain level of wealth she will

A) always prefer the gamble.

B) always prefer the certain level of wealth.

C) prefer the gamble if the expected utility from it is higher than the utility from the certain level of wealth.

D) prefer the certain level of wealth if the expected utility from the gamble is higher than the utility of the certain level of wealth.

A) always prefer the gamble.

B) always prefer the certain level of wealth.

C) prefer the gamble if the expected utility from it is higher than the utility from the certain level of wealth.

D) prefer the certain level of wealth if the expected utility from the gamble is higher than the utility of the certain level of wealth.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

52

If a person is risk averse,then she has negative marginal utility of wealth.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

53

Bob invests $25 in an investment that has a 50% chance of being worth $100 and a 50% chance of being worth $0.From this information we can conclude that Bob is

A) risk loving.

B) risk neutral.

C) risk averse.

D) Any one of the three above.

A) risk loving.

B) risk neutral.

C) risk averse.

D) Any one of the three above.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

54

Steven currently has wealth of $10,000.He is risk averse about losing any of his wealth,but risk loving about adding to his wealth.Draw his utility function.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

55

The above figure shows Bob's utility function,which is

A) concave.

B) convex.

C) linear.

D) L-shaped.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

56

A rational person maximizes

A) risk.

B) return.

C) expected utility.

D) return variance.

A) risk.

B) return.

C) expected utility.

D) return variance.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

57

Bob invests $75 in an investment that has a 50% chance of being worth $100 and a 50% chance of being worth $0.From this information we can conclude that Bob is

A) risk loving.

B) risk neutral.

C) risk averse.

D) irrational.

A) risk loving.

B) risk neutral.

C) risk averse.

D) irrational.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

58

For the utility function U = Wa,what values of "a" correspond to being risk averse,risk neutral,and risk loving?

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

59

Johnny owns a house that would cost $100,000 to replace should it ever be destroyed by fire.There is a 0.1% chance that the house could be destroyed during the course of a year.Johnny's utility function is

U = W0.5.How much would fair insurance cost that completely replaces the house if destroyed by fire? Assuming that Johnny has no other wealth,how much would Johnny be willing to pay for such an insurance policy? Why the difference?

U = W0.5.How much would fair insurance cost that completely replaces the house if destroyed by fire? Assuming that Johnny has no other wealth,how much would Johnny be willing to pay for such an insurance policy? Why the difference?

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

60

Describe how the risk premium for a person with a convex utility function is determined.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

61

Many people do not fully insure against risk because

A) they are risk averse.

B) the insurance companies are all crooks.

C) the insurance offered is less than fair.

D) the insurance offered is more than fair.

A) they are risk averse.

B) the insurance companies are all crooks.

C) the insurance offered is less than fair.

D) the insurance offered is more than fair.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

62

Buying a diversified mutual stock fund allows you to

A) completely avoid all types of risk.

B) avoid only random, unsystematic risk.

C) avoid only systematic risk.

D) avoid risk only when all the stock prices are perfectly correlated.

A) completely avoid all types of risk.

B) avoid only random, unsystematic risk.

C) avoid only systematic risk.

D) avoid risk only when all the stock prices are perfectly correlated.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

63

If global warming began to cause random world-wide damage to crops,insurance companies

A) would insure against specific crop failures.

B) would not insure against specific crop failures.

C) would be indifferent between insuring or not.

D) would find themselves facing prosecution for ignoring the problem for so long.

A) would insure against specific crop failures.

B) would not insure against specific crop failures.

C) would be indifferent between insuring or not.

D) would find themselves facing prosecution for ignoring the problem for so long.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

64

Which of the following helps to reduce risk?

A) Abstain from risk taking.

B) Obtain more information.

C) Diversify.

D) All of the above.

A) Abstain from risk taking.

B) Obtain more information.

C) Diversify.

D) All of the above.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

65

A stock mutual fund's primary advantage is to allow

A) investors to diversify away systematic risk.

B) investors to diversify away all risk.

C) investors to diversify away idiosyncratic risk.

D) the rich to avoid taxes.

A) investors to diversify away systematic risk.

B) investors to diversify away all risk.

C) investors to diversify away idiosyncratic risk.

D) the rich to avoid taxes.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

66

Suppose a blackjack gambler approaches an insurance company and seeks to purchase an insurance policy that his next trip to Reno,NV will not net $10,000.The insurance company

A) will sell her an insurance policy because the proposal entails uncertainty not risk.

B) will sell her an insurance policy because the proposal entails risk not uncertainty.

C) will not sell her an insurance policy because the proposal entails uncertainty not risk.

D) will not sell her an insurance policy because the proposal entails risk not uncertainty.

A) will sell her an insurance policy because the proposal entails uncertainty not risk.

B) will sell her an insurance policy because the proposal entails risk not uncertainty.

C) will not sell her an insurance policy because the proposal entails uncertainty not risk.

D) will not sell her an insurance policy because the proposal entails risk not uncertainty.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

67

In terms of the stock market,systematic risk refers to the fact that

A) some stocks have higher returns than others.

B) some stocks' returns have a higher variance than others.

C) all stock prices are correlated with the health of the economy.

D) most stock prices are perfectly negatively correlated.

A) some stocks have higher returns than others.

B) some stocks' returns have a higher variance than others.

C) all stock prices are correlated with the health of the economy.

D) most stock prices are perfectly negatively correlated.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

68

Which of the following losses to an individual would an insurance company NOT cover?

A) The person's automobile is stolen.

B) Fire destroys the person's home.

C) The person's father dies.

D) The person's country is invaded.

A) The person's automobile is stolen.

B) Fire destroys the person's home.

C) The person's father dies.

D) The person's country is invaded.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

69

What is one reason the federal government might "bail out" farmers in flood prone areas of the country?

A) Such flooding is not diversifiable and therefore only non-profit entities, such as the federal government, can cover the risks.

B) Such flooding is diversifiable, but insurance company CEOs are more concerned with their stockholder wealth than the well-being of farmers.

C) Such flooding is diversifiable, but the market for such insurance policies cannot clear without the assistance of the International Community.

D) Such flooding is known to happen on a regular basis and therefore there is no "risk" to be insured against.

A) Such flooding is not diversifiable and therefore only non-profit entities, such as the federal government, can cover the risks.

B) Such flooding is diversifiable, but insurance company CEOs are more concerned with their stockholder wealth than the well-being of farmers.

C) Such flooding is diversifiable, but the market for such insurance policies cannot clear without the assistance of the International Community.

D) Such flooding is known to happen on a regular basis and therefore there is no "risk" to be insured against.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

70

A stock mutual fund is generally

A) less risky than buying individual stocks.

B) more risky than buying individual stocks.

C) just as risky as buying individual stocks.

D) a way for the rich to avoid taxes.

A) less risky than buying individual stocks.

B) more risky than buying individual stocks.

C) just as risky as buying individual stocks.

D) a way for the rich to avoid taxes.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

71

Suppose a senior college football player approaches an insurance company and seeks to purchase an insurance policy against him receiving a career-ending injury.The insurance company

A) will sell him an insurance policy because the proposal entails uncertainty not risk.

B) will sell him an insurance policy because the proposal entails risk not uncertainty.

C) will not sell him an insurance policy because the proposal entails uncertainty not risk.

D) will not sell him an insurance policy because the proposal entails risk not uncertainty.

A) will sell him an insurance policy because the proposal entails uncertainty not risk.

B) will sell him an insurance policy because the proposal entails risk not uncertainty.

C) will not sell him an insurance policy because the proposal entails uncertainty not risk.

D) will not sell him an insurance policy because the proposal entails risk not uncertainty.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

72

One reason health insurance is very expensive is because

A) it is likely a nearly fair insurance policy.

B) it is subject to manipulation through market power.

C) the government doesn't regulate the industry enough.

D) it is likely an unfair insurance policy.

A) it is likely a nearly fair insurance policy.

B) it is subject to manipulation through market power.

C) the government doesn't regulate the industry enough.

D) it is likely an unfair insurance policy.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

73

After Hurricane Katrina,there was considerable public outrage that many of the properties were not insured against flooding although they were insured against wind damage.What might explain these different approaches to insurance?

A) The risk of wind damage is potentially diversifiable, but the risk of flooding is not.

B) The risk of flood damage is potentially diversifiable, but the risk of wind damage is not.

C) predatory insurance policies

D) Neither the risk of wind damage or the risk of flooding is diversifiable.

A) The risk of wind damage is potentially diversifiable, but the risk of flooding is not.

B) The risk of flood damage is potentially diversifiable, but the risk of wind damage is not.

C) predatory insurance policies

D) Neither the risk of wind damage or the risk of flooding is diversifiable.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

74

Suppose a patent applicant approaches an insurance company and seeks to purchase an insurance policy that her patent will not net $1m in the next three years.The insurance company

A) will sell her an insurance policy because the proposal entails uncertainty not risk.

B) will sell her an insurance policy because the proposal entails risk not uncertainty.

C) will not sell her an insurance policy because the proposal entails uncertainty not risk.

D) will not sell her an insurance policy because the proposal entails risk not uncertainty.

A) will sell her an insurance policy because the proposal entails uncertainty not risk.

B) will sell her an insurance policy because the proposal entails risk not uncertainty.

C) will not sell her an insurance policy because the proposal entails uncertainty not risk.

D) will not sell her an insurance policy because the proposal entails risk not uncertainty.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

75

The ability of diversification to reduce risk

A) is greater the more negatively correlated the two events are.

B) is greater the more positively correlated the two events are.

C) is greater the more uncorrelated the two events are.

D) is greater the more risk averse the individual is.

A) is greater the more negatively correlated the two events are.

B) is greater the more positively correlated the two events are.

C) is greater the more uncorrelated the two events are.

D) is greater the more risk averse the individual is.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

76

A person is betting a coin will come up heads or tails.The coin always lands on one of these two outcomes.This person can bet to

A) eliminate only the systematic risk.

B) eliminate only the random risk.

C) eliminate all risk.

D) All of the above.

A) eliminate only the systematic risk.

B) eliminate only the random risk.

C) eliminate all risk.

D) All of the above.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

77

Insurance companies do not cover losses that would

A) happen to all of the policyholders at once.

B) happen with a very low probability.

C) happen to just a handful of policyholders.

D) happen with uncertainty.

A) happen to all of the policyholders at once.

B) happen with a very low probability.

C) happen to just a handful of policyholders.

D) happen with uncertainty.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

78

Farmers who purchase insurance against crop failures tend to be pooled with farmers far away.Why might this be the case?

A) The weather in a single geographic area represents idiosyncratic risk, which is diversifiable.

B) The weather in a single geographic area represents systematic risk, which is not diversifiable.

C) The weather in far-flung geographic areas represents systematic risk, which is not diversifiable.

D) The weather in far-flung geographic areas are commonly positively correlated.

A) The weather in a single geographic area represents idiosyncratic risk, which is diversifiable.

B) The weather in a single geographic area represents systematic risk, which is not diversifiable.

C) The weather in far-flung geographic areas represents systematic risk, which is not diversifiable.

D) The weather in far-flung geographic areas are commonly positively correlated.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

79

If fair insurance is offered to a risk-averse person,she will

A) buy enough insurance to eliminate all risk.

B) not buy any insurance because it is overpriced.

C) not buy any insurance since the marginal utility of the amount of the payment is positive.

D) buy enough insurance to cover about half of the possible loss.

A) buy enough insurance to eliminate all risk.

B) not buy any insurance because it is overpriced.

C) not buy any insurance since the marginal utility of the amount of the payment is positive.

D) buy enough insurance to cover about half of the possible loss.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

80

If two events are perfectly positively correlated,then

A) diversification is not necessary since there is no risk.

B) diversification eliminates all risk.

C) diversification does not reduce risk at all.

D) diversification only cuts the risk in half.

A) diversification is not necessary since there is no risk.

B) diversification eliminates all risk.

C) diversification does not reduce risk at all.

D) diversification only cuts the risk in half.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck