Deck 16: Business Strategy

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

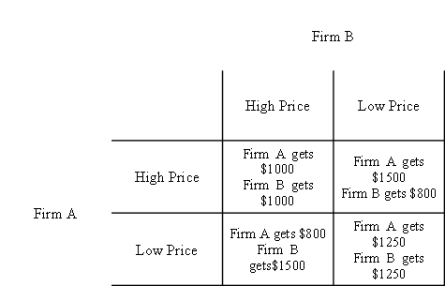

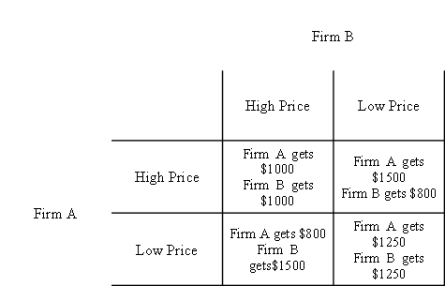

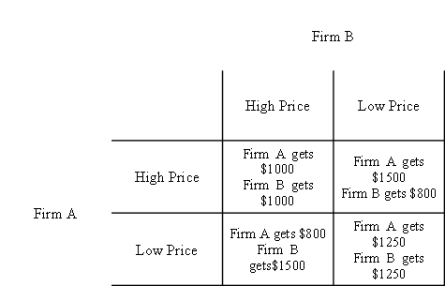

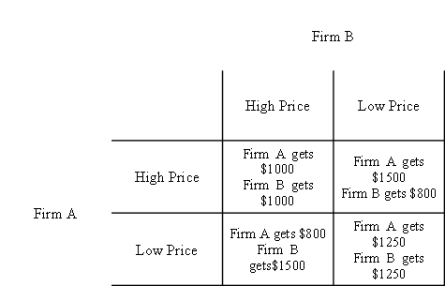

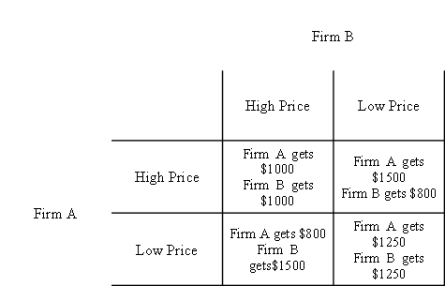

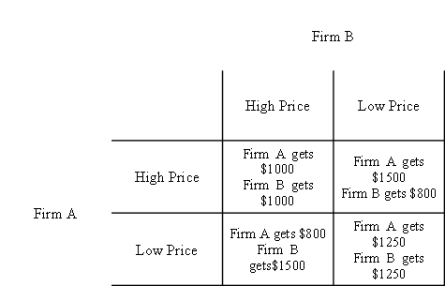

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/184

Play

Full screen (f)

Deck 16: Business Strategy

1

When oligopolists cooperate, they end up producing a total quantity that is closer to the social optimum.

False

2

When prisoners' dilemma games are repeated over and over, sometimes the threat of penalty causes both parties to cooperate.

True

3

In a competitive market, strategic interactions among the firms are not important.

True

4

When deciding whether the market is an oligopoly or not, there is no magical number of firms that defines an oligopoly.

Unlock Deck

Unlock for access to all 184 flashcards in this deck.

Unlock Deck

k this deck

5

Total profit for an oligopolist is more than that of a perfectly competitive firm.

Unlock Deck

Unlock for access to all 184 flashcards in this deck.

Unlock Deck

k this deck

6

The story of the prisoners' dilemma contains a general lesson that applies to any group trying to maintain cooperation among its members.

Unlock Deck

Unlock for access to all 184 flashcards in this deck.

Unlock Deck

k this deck

7

If all the oligopolists in a market collude to form a cartel, total profit for the cartel is less than that of a monopolist.

Unlock Deck

Unlock for access to all 184 flashcards in this deck.

Unlock Deck

k this deck

8

Oligopolies can end up looking like competitive firms if the number of firms is large and they do not cooperate.

Unlock Deck

Unlock for access to all 184 flashcards in this deck.

Unlock Deck

k this deck

9

In markets characterised by oligopoly collusive agreements will always prevail.

Unlock Deck

Unlock for access to all 184 flashcards in this deck.

Unlock Deck

k this deck

10

An oligopoly is a market with a few sellers, each offering a similar or identical product.

Unlock Deck

Unlock for access to all 184 flashcards in this deck.

Unlock Deck

k this deck

11

A deadweight loss to society always occurs in a market when the price is higher than the marginal cost.

Unlock Deck

Unlock for access to all 184 flashcards in this deck.

Unlock Deck

k this deck

12

Oligopolies would like to act like a monopoly but self-interest often drives them closer to competition.

Unlock Deck

Unlock for access to all 184 flashcards in this deck.

Unlock Deck

k this deck

13

In the case of oligopoly markets, self-interest prevents cooperation and leads to an inferior outcome for the parties involved.

Unlock Deck

Unlock for access to all 184 flashcards in this deck.

Unlock Deck

k this deck

14

Larger cartels have a greater probability of reaching the monopoly outcome than do smaller cartels.

Unlock Deck

Unlock for access to all 184 flashcards in this deck.

Unlock Deck

k this deck

15

When an oligopolist decreases production, it is likely that the output effect is less than the price effect.

Unlock Deck

Unlock for access to all 184 flashcards in this deck.

Unlock Deck

k this deck

16

A cartel is a group of firms that act in unison.

Unlock Deck

Unlock for access to all 184 flashcards in this deck.

Unlock Deck

k this deck

17

In the absence of price-fixing, a monopoly will make more total profit than an oligopoly operating in an identical market.

Unlock Deck

Unlock for access to all 184 flashcards in this deck.

Unlock Deck

k this deck

18

The game that oligopolists play in trying to reach the monopoly outcome is similar to the game that the two prisoners play in the prisoners' dilemma.

Unlock Deck

Unlock for access to all 184 flashcards in this deck.

Unlock Deck

k this deck

19

In the prisoner's dilemma game, the dominant strategy is for each player to not confess.

Unlock Deck

Unlock for access to all 184 flashcards in this deck.

Unlock Deck

k this deck

20

Perfect competition occurs when there are many firms in a market offering differentiated products.

Unlock Deck

Unlock for access to all 184 flashcards in this deck.

Unlock Deck

k this deck

21

If duopolists individually pursue their own self-interest when deciding how much to produce, the price they are able to charge for their product will be equal to the monopoly price.

Unlock Deck

Unlock for access to all 184 flashcards in this deck.

Unlock Deck

k this deck

22

If both countries agree on a certain level of arms in an arms race game, social welfare will decrease if both countries keep their end of the bargain.

Unlock Deck

Unlock for access to all 184 flashcards in this deck.

Unlock Deck

k this deck

23

Game theory is necessary for understanding competitive markets.

Unlock Deck

Unlock for access to all 184 flashcards in this deck.

Unlock Deck

k this deck

24

Games that are played more than once generally make collusive arrangements harder to enforce.

Unlock Deck

Unlock for access to all 184 flashcards in this deck.

Unlock Deck

k this deck

25

In a prisoners' dilemma, cooperation between the prisoners is easy to maintain and is individually rational.

Unlock Deck

Unlock for access to all 184 flashcards in this deck.

Unlock Deck

k this deck

26

If firms meet to coordinate their prices or their output levels, this is known as collusion.

Unlock Deck

Unlock for access to all 184 flashcards in this deck.

Unlock Deck

k this deck

27

A dominant strategy is the best strategy for a player to follow regardless of the strategies pursued by other players.

Unlock Deck

Unlock for access to all 184 flashcards in this deck.

Unlock Deck

k this deck

28

If duopolists individually pursue their own self-interest when deciding how much to produce, the price they are able to charge for their product will be less than the monopoly price.

Unlock Deck

Unlock for access to all 184 flashcards in this deck.

Unlock Deck

k this deck

29

Monopolistic competition describes a market structure in which there is one firm.

Unlock Deck

Unlock for access to all 184 flashcards in this deck.

Unlock Deck

k this deck

30

One economic example of prisoner's dilemma is overuse of a common resource like an oil-deposit.

Unlock Deck

Unlock for access to all 184 flashcards in this deck.

Unlock Deck

k this deck

31

The typical firm in the Australian economy has some degree of market power, but cannot be considered a monopoly firm.

Unlock Deck

Unlock for access to all 184 flashcards in this deck.

Unlock Deck

k this deck

32

If both countries agree on a certain level of arms in an arms race game, social welfare will increase if both countries keep their end of the bargain.

Unlock Deck

Unlock for access to all 184 flashcards in this deck.

Unlock Deck

k this deck

33

When an oligopoly market is in Nash equilibrium a firm will choose its best pricing strategy, given the strategies that it observes other firms taking.

Unlock Deck

Unlock for access to all 184 flashcards in this deck.

Unlock Deck

k this deck

34

Arming a country is a dominant strategy for each country is in an arms race.

Unlock Deck

Unlock for access to all 184 flashcards in this deck.

Unlock Deck

k this deck

35

Society will always be better off if the prisoners' dilemma game is repeated numerous times in an oligopoly market

Unlock Deck

Unlock for access to all 184 flashcards in this deck.

Unlock Deck

k this deck

36

The simple tit-for-tat strategy has been able to dominate many more complex strategies in repeated prisoners' dilemma games.

Unlock Deck

Unlock for access to all 184 flashcards in this deck.

Unlock Deck

k this deck

37

It is individually irrational for players to cooperate in the prisoner's dilemma game because cooperation is not the dominant strategy.

Unlock Deck

Unlock for access to all 184 flashcards in this deck.

Unlock Deck

k this deck

38

The prisoners' dilemma provides insights into how easy it is to maintain cooperation.

Unlock Deck

Unlock for access to all 184 flashcards in this deck.

Unlock Deck

k this deck

39

It is sometimes possible to achieve cooperation in repeated games by threatening to punish defectors.

Unlock Deck

Unlock for access to all 184 flashcards in this deck.

Unlock Deck

k this deck

40

When an oligopoly market is in Nash equilibrium, firms will not act as profit maximisers.

Unlock Deck

Unlock for access to all 184 flashcards in this deck.

Unlock Deck

k this deck

41

The general term for market structures that fall somewhere in between monopoly and perfect competition is:

A) oligopoly markets

B) monopolistically competitive markets

C) incomplete markets

D) imperfectly competitive markets

A) oligopoly markets

B) monopolistically competitive markets

C) incomplete markets

D) imperfectly competitive markets

Unlock Deck

Unlock for access to all 184 flashcards in this deck.

Unlock Deck

k this deck

42

Oligopoly markets are characterised by:

A) the universal existence of collusive agreements

B) a fall in collective profits if a cartel is organised

C) the pursuit of self-interest by profit-maximising firms always maximising collective profits

D) a conflict between cooperation and self-interest

A) the universal existence of collusive agreements

B) a fall in collective profits if a cartel is organised

C) the pursuit of self-interest by profit-maximising firms always maximising collective profits

D) a conflict between cooperation and self-interest

Unlock Deck

Unlock for access to all 184 flashcards in this deck.

Unlock Deck

k this deck

43

Suppose a firm makes a product whose price decreases as the output increases. The firm is in a market with many other firms. It is most likely that the firm:

A) is a monopoly

B) makes a product that is identical to the other firms, hence is in a competitive market

C) makes a similar product to others, hence is in a monopolistically competitive market

D) makes zero economic profit in the long run

A) is a monopoly

B) makes a product that is identical to the other firms, hence is in a competitive market

C) makes a similar product to others, hence is in a monopolistically competitive market

D) makes zero economic profit in the long run

Unlock Deck

Unlock for access to all 184 flashcards in this deck.

Unlock Deck

k this deck

44

Markets with only a few sellers, each offering a product similar or identical to the others, are typically referred to as:

A) monopolistically competitive markets

B) oligopoly markets

C) monopoly markets

D) competitive markets

A) monopolistically competitive markets

B) oligopoly markets

C) monopoly markets

D) competitive markets

Unlock Deck

Unlock for access to all 184 flashcards in this deck.

Unlock Deck

k this deck

45

Because each oligopolist cares about its profit rather than the collective profit of all the oligopolists together:

A) they are unable to maintain monopoly power

B) they are able to maximise their individual profits

C) society is worse off

D) all of the above are true

A) they are unable to maintain monopoly power

B) they are able to maximise their individual profits

C) society is worse off

D) all of the above are true

Unlock Deck

Unlock for access to all 184 flashcards in this deck.

Unlock Deck

k this deck

46

The typical firm in the Australian economy is classed as:

A) perfectly competitive

B) an oligopolist

C) imperfectly competitive

D) government-owned

A) perfectly competitive

B) an oligopolist

C) imperfectly competitive

D) government-owned

Unlock Deck

Unlock for access to all 184 flashcards in this deck.

Unlock Deck

k this deck

47

An imperfectly market that has only two firms is called:

A) a duopoly

B) a split monopoly

C) a triopoly

D) a binary market

A) a duopoly

B) a split monopoly

C) a triopoly

D) a binary market

Unlock Deck

Unlock for access to all 184 flashcards in this deck.

Unlock Deck

k this deck

48

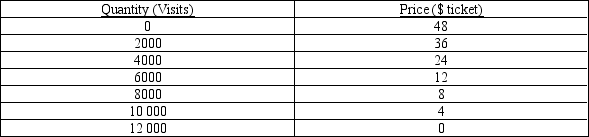

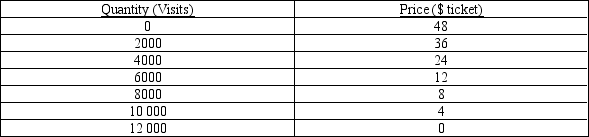

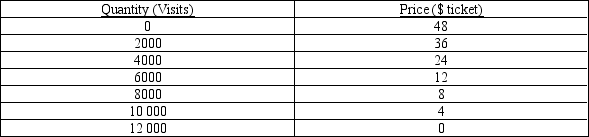

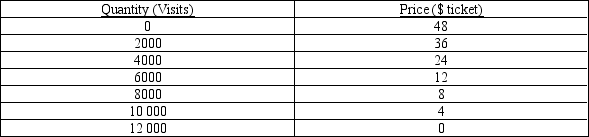

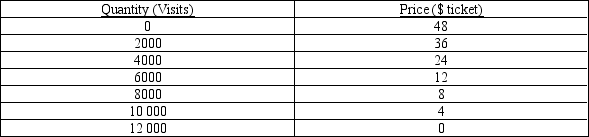

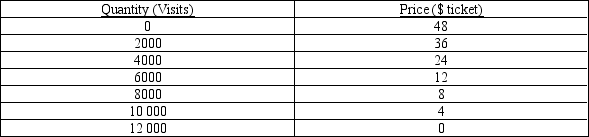

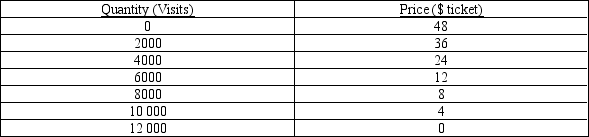

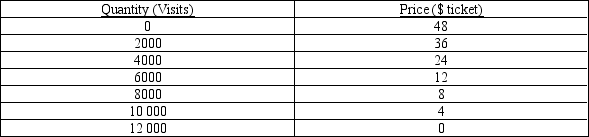

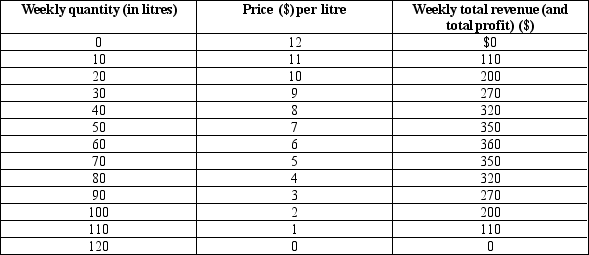

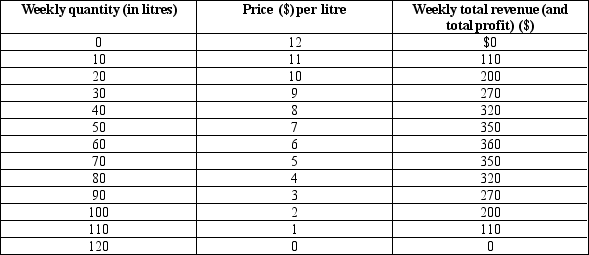

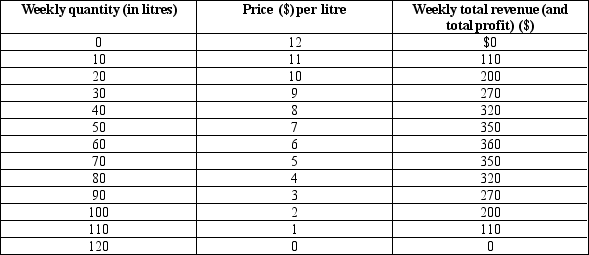

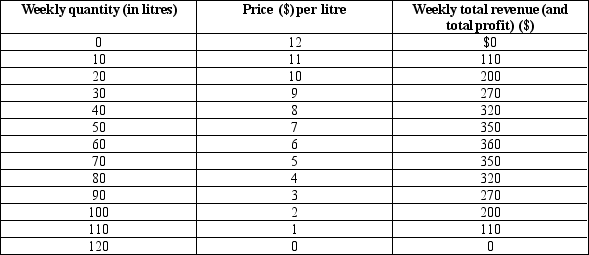

Table 16-1

The table below shows the total demand for viewing a rare penguin species at a local reserve. Ecotour companies have to build discreet viewing hides for tourists to view the penguins. Each ecotour company has to pay a fixed fee of $10 000 for the right to build on the reserve. Assume that hides can be supplied to tourists at zero marginal cost. Tickets are sold to tourists to use the viewing hides.

Any firm can change tickets by steps of 1000 only. Prices for missing quantities are the exact midpoint between two adjacent prices.

Any firm can change tickets by steps of 1000 only. Prices for missing quantities are the exact midpoint between two adjacent prices.

Refer to Table 16-1. Assume that there are two ecotourist companies operating in this market. If they are able to collude on the price of tickets to sell, what price will they charge, and how many tickets will they collectively sell?

A) $24 2000

B) $24 4000

C) $12 2000

D) $12 4000

The table below shows the total demand for viewing a rare penguin species at a local reserve. Ecotour companies have to build discreet viewing hides for tourists to view the penguins. Each ecotour company has to pay a fixed fee of $10 000 for the right to build on the reserve. Assume that hides can be supplied to tourists at zero marginal cost. Tickets are sold to tourists to use the viewing hides.

Any firm can change tickets by steps of 1000 only. Prices for missing quantities are the exact midpoint between two adjacent prices.

Any firm can change tickets by steps of 1000 only. Prices for missing quantities are the exact midpoint between two adjacent prices.Refer to Table 16-1. Assume that there are two ecotourist companies operating in this market. If they are able to collude on the price of tickets to sell, what price will they charge, and how many tickets will they collectively sell?

A) $24 2000

B) $24 4000

C) $12 2000

D) $12 4000

Unlock Deck

Unlock for access to all 184 flashcards in this deck.

Unlock Deck

k this deck

49

The best way for oligopolists to increase their profits is to:

A) agree to limit production

B) increase production to increase the size of the market

C) decrease prices to gain larger market share

D) operate according to their own self-interest

A) agree to limit production

B) increase production to increase the size of the market

C) decrease prices to gain larger market share

D) operate according to their own self-interest

Unlock Deck

Unlock for access to all 184 flashcards in this deck.

Unlock Deck

k this deck

50

One key difference between an oligopoly market and a competitive market is that oligopolistic firms:

A) are interdependent while competitive firms are not

B) sell completely unrelated products while competitive firms do not

C) sell their product at a price equal to marginal cost while competitive firms do not

D) are price takers while competitive firms are not

A) are interdependent while competitive firms are not

B) sell completely unrelated products while competitive firms do not

C) sell their product at a price equal to marginal cost while competitive firms do not

D) are price takers while competitive firms are not

Unlock Deck

Unlock for access to all 184 flashcards in this deck.

Unlock Deck

k this deck

51

Table 16-1

The table below shows the total demand for viewing a rare penguin species at a local reserve. Ecotour companies have to build discreet viewing hides for tourists to view the penguins. Each ecotour company has to pay a fixed fee of $10 000 for the right to build on the reserve. Assume that hides can be supplied to tourists at zero marginal cost. Tickets are sold to tourists to use the viewing hides.

Any firm can change tickets by steps of 1000 only. Prices for missing quantities are the exact midpoint between two adjacent prices.

Any firm can change tickets by steps of 1000 only. Prices for missing quantities are the exact midpoint between two adjacent prices.

Refer to Table 16-1. Assume that there are two profit-maximising ecotourist companies operating in this market. Further assume that they are not able to collude on price and quantity of the tickets they sell. How many tickets will be by each firms when this market reaches a Nash equilibrium?

A) 1000

B) 2000

C) 3000

D) 4000

The table below shows the total demand for viewing a rare penguin species at a local reserve. Ecotour companies have to build discreet viewing hides for tourists to view the penguins. Each ecotour company has to pay a fixed fee of $10 000 for the right to build on the reserve. Assume that hides can be supplied to tourists at zero marginal cost. Tickets are sold to tourists to use the viewing hides.

Any firm can change tickets by steps of 1000 only. Prices for missing quantities are the exact midpoint between two adjacent prices.

Any firm can change tickets by steps of 1000 only. Prices for missing quantities are the exact midpoint between two adjacent prices.Refer to Table 16-1. Assume that there are two profit-maximising ecotourist companies operating in this market. Further assume that they are not able to collude on price and quantity of the tickets they sell. How many tickets will be by each firms when this market reaches a Nash equilibrium?

A) 1000

B) 2000

C) 3000

D) 4000

Unlock Deck

Unlock for access to all 184 flashcards in this deck.

Unlock Deck

k this deck

52

Firms in industries that have competitors but, at the same time, do not face so much competition that they are price takers, are operating in either a(n):

A) oligopoly or perfectly competitive market

B) oligopoly or monopolistically competitive market

C) oligopoly or monopoly market

D) monopoly or monopolistically competitive market

A) oligopoly or perfectly competitive market

B) oligopoly or monopolistically competitive market

C) oligopoly or monopoly market

D) monopoly or monopolistically competitive market

Unlock Deck

Unlock for access to all 184 flashcards in this deck.

Unlock Deck

k this deck

53

As a group, oligopolists would always be better off if they would act collectively:

A) as a single monopolist

B) as a single competitor

C) as if they were each seeking to maximise their own profit

D) in a manner that would prohibit collusive agreements

A) as a single monopolist

B) as a single competitor

C) as if they were each seeking to maximise their own profit

D) in a manner that would prohibit collusive agreements

Unlock Deck

Unlock for access to all 184 flashcards in this deck.

Unlock Deck

k this deck

54

Table 16-1

The table below shows the total demand for viewing a rare penguin species at a local reserve. Ecotour companies have to build discreet viewing hides for tourists to view the penguins. Each ecotour company has to pay a fixed fee of $10 000 for the right to build on the reserve. Assume that hides can be supplied to tourists at zero marginal cost. Tickets are sold to tourists to use the viewing hides.

Any firm can change tickets by steps of 1000 only. Prices for missing quantities are the exact midpoint between two adjacent prices.

Any firm can change tickets by steps of 1000 only. Prices for missing quantities are the exact midpoint between two adjacent prices.

Refer to Table 16-1. Assume that there are two profit-maximising ecotourist companies operating in this market. Further assume that they are able to collude on the price of the tickets they sell. As part of their collusive agreement, they decide to take an equal share of the market. How much profit will each company make?

A) $96 000

B) $86 000

C) $48 000

D) $38 000

The table below shows the total demand for viewing a rare penguin species at a local reserve. Ecotour companies have to build discreet viewing hides for tourists to view the penguins. Each ecotour company has to pay a fixed fee of $10 000 for the right to build on the reserve. Assume that hides can be supplied to tourists at zero marginal cost. Tickets are sold to tourists to use the viewing hides.

Any firm can change tickets by steps of 1000 only. Prices for missing quantities are the exact midpoint between two adjacent prices.

Any firm can change tickets by steps of 1000 only. Prices for missing quantities are the exact midpoint between two adjacent prices.Refer to Table 16-1. Assume that there are two profit-maximising ecotourist companies operating in this market. Further assume that they are able to collude on the price of the tickets they sell. As part of their collusive agreement, they decide to take an equal share of the market. How much profit will each company make?

A) $96 000

B) $86 000

C) $48 000

D) $38 000

Unlock Deck

Unlock for access to all 184 flashcards in this deck.

Unlock Deck

k this deck

55

An important characteristic of an oligopoly market structure is that:

A) there are a large number of firms in the industry that produce identical products

B) products typically sell where price is equal to the marginal cost of production

C) the actions of one seller can have a large impact on the profitability of other sellers

D) the actions of one seller can have no impact on the profitability of other sellers because the market is so large

A) there are a large number of firms in the industry that produce identical products

B) products typically sell where price is equal to the marginal cost of production

C) the actions of one seller can have a large impact on the profitability of other sellers

D) the actions of one seller can have no impact on the profitability of other sellers because the market is so large

Unlock Deck

Unlock for access to all 184 flashcards in this deck.

Unlock Deck

k this deck

56

Table 16-1

The table below shows the total demand for viewing a rare penguin species at a local reserve. Ecotour companies have to build discreet viewing hides for tourists to view the penguins. Each ecotour company has to pay a fixed fee of $10 000 for the right to build on the reserve. Assume that hides can be supplied to tourists at zero marginal cost. Tickets are sold to tourists to use the viewing hides.

Any firm can change tickets by steps of 1000 only. Prices for missing quantities are the exact midpoint between two adjacent prices.

Any firm can change tickets by steps of 1000 only. Prices for missing quantities are the exact midpoint between two adjacent prices.

Refer to Table 16-1. If there is only one ecotourist company in this market, what ticket-price would it charge for its hides to maximise its profit?

A) $36

B) $24

C) $12

D) $8

The table below shows the total demand for viewing a rare penguin species at a local reserve. Ecotour companies have to build discreet viewing hides for tourists to view the penguins. Each ecotour company has to pay a fixed fee of $10 000 for the right to build on the reserve. Assume that hides can be supplied to tourists at zero marginal cost. Tickets are sold to tourists to use the viewing hides.

Any firm can change tickets by steps of 1000 only. Prices for missing quantities are the exact midpoint between two adjacent prices.

Any firm can change tickets by steps of 1000 only. Prices for missing quantities are the exact midpoint between two adjacent prices.Refer to Table 16-1. If there is only one ecotourist company in this market, what ticket-price would it charge for its hides to maximise its profit?

A) $36

B) $24

C) $12

D) $8

Unlock Deck

Unlock for access to all 184 flashcards in this deck.

Unlock Deck

k this deck

57

If there are many firms participating in a market, the market is either:

A) an oligopoly or perfectly competitive

B) an oligopoly or monopolistically competitive

C) perfectly competitive or monopolistically competitive

D) all of the above are possible

A) an oligopoly or perfectly competitive

B) an oligopoly or monopolistically competitive

C) perfectly competitive or monopolistically competitive

D) all of the above are possible

Unlock Deck

Unlock for access to all 184 flashcards in this deck.

Unlock Deck

k this deck

58

Crude oil is supplied to the world market primarily by a few Middle Eastern countries. Such a market is an example of which of the following? (i) a monopoly market

(ii) an oligopoly market

(iii) an imperfectly competitive market

A) (i) and (ii)

B) (ii) and (iii)

C) (i) and (iii)

D) (i) only

(ii) an oligopoly market

(iii) an imperfectly competitive market

A) (i) and (ii)

B) (ii) and (iii)

C) (i) and (iii)

D) (i) only

Unlock Deck

Unlock for access to all 184 flashcards in this deck.

Unlock Deck

k this deck

59

Monopolistically competitive firms are typically characterised by:

A) many firms selling identical products

B) a few firms selling similar or identical products

C) a few firms selling highly different products

D) many firms selling similar, but not identical products

A) many firms selling identical products

B) a few firms selling similar or identical products

C) a few firms selling highly different products

D) many firms selling similar, but not identical products

Unlock Deck

Unlock for access to all 184 flashcards in this deck.

Unlock Deck

k this deck

60

If identical products are sold by firms participating in a market, the market is which of the following? (i) perfectly competitive

(ii) an oligopoly

(iii) monopolistically competitive

A) (i) or (ii)

B) (ii) or (iii)

C) (i) or (iii)

D) (i) only

(ii) an oligopoly

(iii) monopolistically competitive

A) (i) or (ii)

B) (ii) or (iii)

C) (i) or (iii)

D) (i) only

Unlock Deck

Unlock for access to all 184 flashcards in this deck.

Unlock Deck

k this deck

61

An agreement among firms over production and price is called:

A) collusion

B) conspiracy

C) multinational corporation

D) trade arrangement

A) collusion

B) conspiracy

C) multinational corporation

D) trade arrangement

Unlock Deck

Unlock for access to all 184 flashcards in this deck.

Unlock Deck

k this deck

62

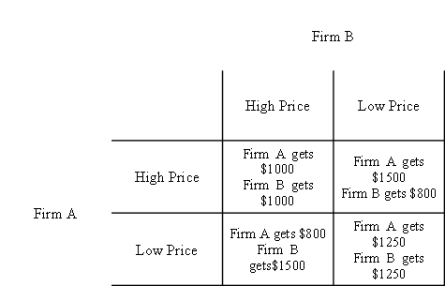

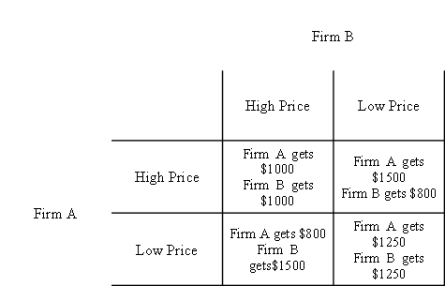

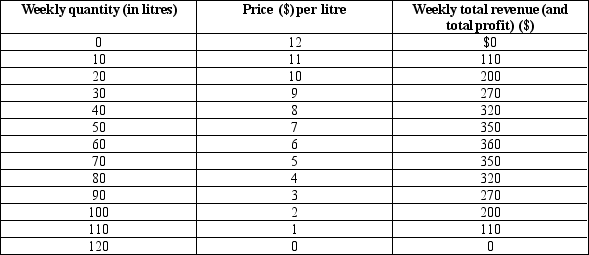

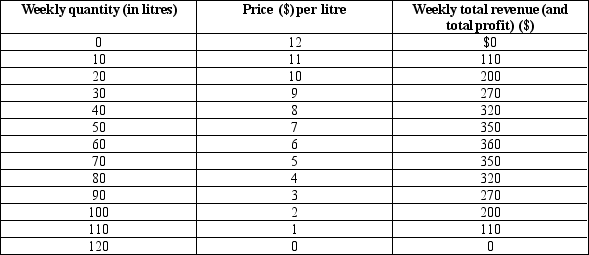

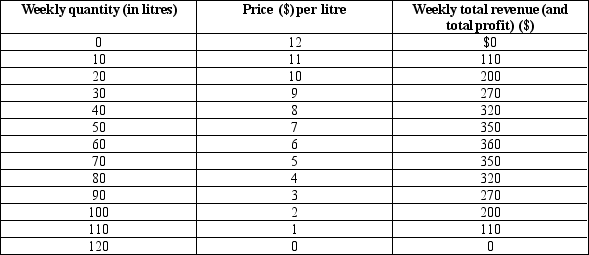

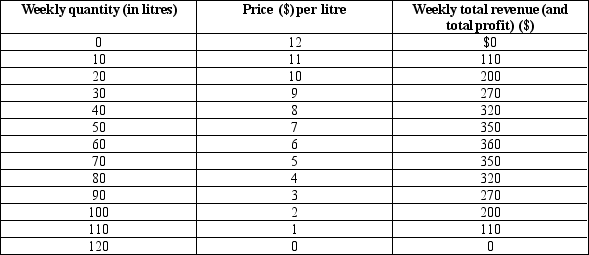

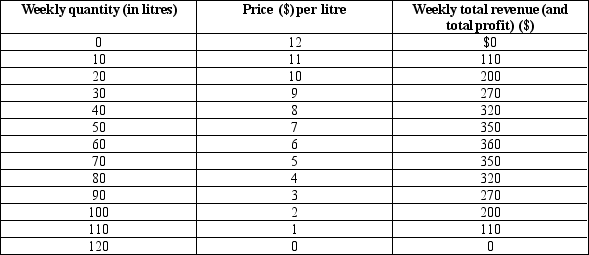

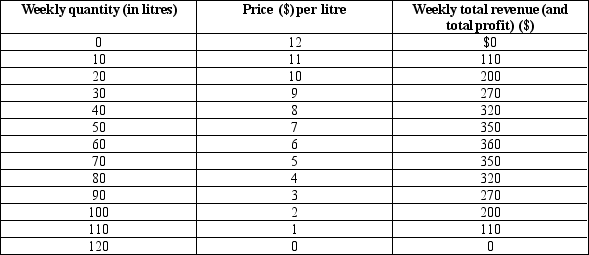

Table 16-3

Imagine a small town in which only two residents, Robert and John, own wells that produce water for safe drinking. Each Saturday, Robert and John work together to decide how many litres of water to pump, bring the water to town, and sell it at whatever price the market will bear. To keep things simple, suppose that Robert and John can pump as much water as they want without cost; therefore, the marginal cost of water equals zero.

The weekly town demand schedule and total revenue schedule for water are shown in the table.

Refer to Table 16-3. Suppose the town enacts new anti-trust laws that prohibit Robert and John from operating as a monopolist. What will the new price of water end up being once the Nash equilibrium is reached?

A) $6

B) $5

C) $4

D) $3

Imagine a small town in which only two residents, Robert and John, own wells that produce water for safe drinking. Each Saturday, Robert and John work together to decide how many litres of water to pump, bring the water to town, and sell it at whatever price the market will bear. To keep things simple, suppose that Robert and John can pump as much water as they want without cost; therefore, the marginal cost of water equals zero.

The weekly town demand schedule and total revenue schedule for water are shown in the table.

Refer to Table 16-3. Suppose the town enacts new anti-trust laws that prohibit Robert and John from operating as a monopolist. What will the new price of water end up being once the Nash equilibrium is reached?

A) $6

B) $5

C) $4

D) $3

Unlock Deck

Unlock for access to all 184 flashcards in this deck.

Unlock Deck

k this deck

63

Table 16-2

In the following duopoly game, the two firms can either set the price of their product high or low. If one firm's price is lower than the other, most of the market will buy from them. This will increase the low-price firm's profit at the expense of the other firm. The game is represented in the table below.

Refer to Table 16-2. The Nash equilibrium for this game is for:

A) both firms to sell the product at a low price

B) both firms to sell the product at a high price

C) firm A to sell at a low price and for firm B to sell at a high price

D) firm A to sell at a high price and for firm B to sell at a low price

In the following duopoly game, the two firms can either set the price of their product high or low. If one firm's price is lower than the other, most of the market will buy from them. This will increase the low-price firm's profit at the expense of the other firm. The game is represented in the table below.

Refer to Table 16-2. The Nash equilibrium for this game is for:

A) both firms to sell the product at a low price

B) both firms to sell the product at a high price

C) firm A to sell at a low price and for firm B to sell at a high price

D) firm A to sell at a high price and for firm B to sell at a low price

Unlock Deck

Unlock for access to all 184 flashcards in this deck.

Unlock Deck

k this deck

64

Assuming that oligopolists do not have the opportunity to collude, once they have reached the Nash equilibrium, it:

A) is always in their best interest to supply more to the market

B) is always in their best interest to leave supply unchanged

C) is always in their best interest to supply less to the market

D) may be in their best interest to do any of the above, depending on market conditions

A) is always in their best interest to supply more to the market

B) is always in their best interest to leave supply unchanged

C) is always in their best interest to supply less to the market

D) may be in their best interest to do any of the above, depending on market conditions

Unlock Deck

Unlock for access to all 184 flashcards in this deck.

Unlock Deck

k this deck

65

It can be difficult for an oligopoly to maintain a cartel because:

A) there are laws that prohibit competing firms from making collusive agreements

B) it is difficult to enforce many cartel agreements

C) many cartel members can improve their profit by individually cheating on the agreement

D) all of the above are true

A) there are laws that prohibit competing firms from making collusive agreements

B) it is difficult to enforce many cartel agreements

C) many cartel members can improve their profit by individually cheating on the agreement

D) all of the above are true

Unlock Deck

Unlock for access to all 184 flashcards in this deck.

Unlock Deck

k this deck

66

In what type of market do the actions of any one seller have a significant impact on the profits of all other sellers?

A) a monopoly

B) an oligopoly

C) perfect competition

D) monopolistic competition

A) a monopoly

B) an oligopoly

C) perfect competition

D) monopolistic competition

Unlock Deck

Unlock for access to all 184 flashcards in this deck.

Unlock Deck

k this deck

67

As the number of firms in an oligopoly market:

A) decreases, the market approaches a cartel equilibrium

B) increases, the market approaches a competitive market equilibrium

C) decreases, the market approaches a competitive market equilibrium

D) increases, the market approaches a monopoly market equilibrium

A) decreases, the market approaches a cartel equilibrium

B) increases, the market approaches a competitive market equilibrium

C) decreases, the market approaches a competitive market equilibrium

D) increases, the market approaches a monopoly market equilibrium

Unlock Deck

Unlock for access to all 184 flashcards in this deck.

Unlock Deck

k this deck

68

*Each firm reasons that the monopoly price ($24) earns them $48 000 each (2000 tickets each). If one of them increases output by 1000, the price drops to $18 (midpoint). At 5000 tickets, the firm that drops its price earns 3000 x $18 000 = $54 000. The other firm earns

$36 000. The NE is for both firms to increase output to 3000.

Refer to Table 16-1. Assume that there are two profit-maximising ecotourist companies operating in this market. Further assume that they are not able to collude on the price and quantity of tickets they sell. What price will the tickets be sold at when this market reaches a Nash equilibrium?

A) $12

B) $18

C) $24

D) from the information given in the table, we can't determine price in a Nash equilibrium

$36 000. The NE is for both firms to increase output to 3000.

Refer to Table 16-1. Assume that there are two profit-maximising ecotourist companies operating in this market. Further assume that they are not able to collude on the price and quantity of tickets they sell. What price will the tickets be sold at when this market reaches a Nash equilibrium?

A) $12

B) $18

C) $24

D) from the information given in the table, we can't determine price in a Nash equilibrium

Unlock Deck

Unlock for access to all 184 flashcards in this deck.

Unlock Deck

k this deck

69

When oligopoly firms maximise profit, the output effect:

A) can be larger or smaller than the price effect

B) must dominate the price effect

C) must balance with the price effect

D) must be smaller than the price effect

A) can be larger or smaller than the price effect

B) must dominate the price effect

C) must balance with the price effect

D) must be smaller than the price effect

Unlock Deck

Unlock for access to all 184 flashcards in this deck.

Unlock Deck

k this deck

70

OPEC is an example of a:

A) cartel

B) collective

C) international free trade agreement

D) coalition

A) cartel

B) collective

C) international free trade agreement

D) coalition

Unlock Deck

Unlock for access to all 184 flashcards in this deck.

Unlock Deck

k this deck

71

*Each firm reasons that the monopoly price ($24) earns them $48 000 each (2000 tickets each). If one of them increases output by 1000, the price drops to $18 (midpoint). At 5000 tickets, the firm that drops its price earns 3000 x $18 000 = $54 000. The other firm earns

$36 000. The NE is for both firms to increase output to 3000.

Refer to Table 16-1. Assume that there are two profit-maximising ecotourist companies operating in this market. Further assume that they are not able to collude on the price and quantity of tickets they sell. How much profit will each firm earn when this market reaches a Nash equilibrium?

A) $0

B) $26 000

C) $36 000

D) each firm will incur economic losses in a Nash equilibrium

$36 000. The NE is for both firms to increase output to 3000.

Refer to Table 16-1. Assume that there are two profit-maximising ecotourist companies operating in this market. Further assume that they are not able to collude on the price and quantity of tickets they sell. How much profit will each firm earn when this market reaches a Nash equilibrium?

A) $0

B) $26 000

C) $36 000

D) each firm will incur economic losses in a Nash equilibrium

Unlock Deck

Unlock for access to all 184 flashcards in this deck.

Unlock Deck

k this deck

72

Table 16-3

Imagine a small town in which only two residents, Robert and John, own wells that produce water for safe drinking. Each Saturday, Robert and John work together to decide how many litres of water to pump, bring the water to town, and sell it at whatever price the market will bear. To keep things simple, suppose that Robert and John can pump as much water as they want without cost; therefore, the marginal cost of water equals zero.

The weekly town demand schedule and total revenue schedule for water are shown in the table.

Refer to Table 16-3. Since Robert and John operate as a profit-maximising monopoly in the market for water, what price will they charge to sell 80 litres of water?

A) $4

B) $9

C) $12

D) none of the above; the price is arbitrary when dealing with a monopoly market

Imagine a small town in which only two residents, Robert and John, own wells that produce water for safe drinking. Each Saturday, Robert and John work together to decide how many litres of water to pump, bring the water to town, and sell it at whatever price the market will bear. To keep things simple, suppose that Robert and John can pump as much water as they want without cost; therefore, the marginal cost of water equals zero.

The weekly town demand schedule and total revenue schedule for water are shown in the table.

Refer to Table 16-3. Since Robert and John operate as a profit-maximising monopoly in the market for water, what price will they charge to sell 80 litres of water?

A) $4

B) $9

C) $12

D) none of the above; the price is arbitrary when dealing with a monopoly market

Unlock Deck

Unlock for access to all 184 flashcards in this deck.

Unlock Deck

k this deck

73

Table 16-3

Imagine a small town in which only two residents, Robert and John, own wells that produce water for safe drinking. Each Saturday, Robert and John work together to decide how many litres of water to pump, bring the water to town, and sell it at whatever price the market will bear. To keep things simple, suppose that Robert and John can pump as much water as they want without cost; therefore, the marginal cost of water equals zero.

The weekly town demand schedule and total revenue schedule for water are shown in the table.

Refer to Table 16-3. The socially efficient level of water supplied to the market would be:

A) 60 litres

B) 80 litres

C) 100 litres

D) 120 litres

Imagine a small town in which only two residents, Robert and John, own wells that produce water for safe drinking. Each Saturday, Robert and John work together to decide how many litres of water to pump, bring the water to town, and sell it at whatever price the market will bear. To keep things simple, suppose that Robert and John can pump as much water as they want without cost; therefore, the marginal cost of water equals zero.

The weekly town demand schedule and total revenue schedule for water are shown in the table.

Refer to Table 16-3. The socially efficient level of water supplied to the market would be:

A) 60 litres

B) 80 litres

C) 100 litres

D) 120 litres

Unlock Deck

Unlock for access to all 184 flashcards in this deck.

Unlock Deck

k this deck

74

Table 16-2

In the following duopoly game, the two firms can either set the price of their product high or low. If one firm's price is lower than the other, most of the market will buy from them. This will increase the low-price firm's profit at the expense of the other firm. The game is represented in the table below.

Refer to Table 16-2. What is the profit firm B will earn if it plays its dominant strategy:

A) $1000 if firm B has a high price and $1500 if firm B has a low price

B) $1000 if firm B has a high price and $800 if firm B has a low price

C) $800 if firm B has a high price and $1250 if firm B has a low price

D) $800 if firm B has a high price and $1500 if firm B has a low price

In the following duopoly game, the two firms can either set the price of their product high or low. If one firm's price is lower than the other, most of the market will buy from them. This will increase the low-price firm's profit at the expense of the other firm. The game is represented in the table below.

Refer to Table 16-2. What is the profit firm B will earn if it plays its dominant strategy:

A) $1000 if firm B has a high price and $1500 if firm B has a low price

B) $1000 if firm B has a high price and $800 if firm B has a low price

C) $800 if firm B has a high price and $1250 if firm B has a low price

D) $800 if firm B has a high price and $1500 if firm B has a low price

Unlock Deck

Unlock for access to all 184 flashcards in this deck.

Unlock Deck

k this deck

75

Table 16-2

In the following duopoly game, the two firms can either set the price of their product high or low. If one firm's price is lower than the other, most of the market will buy from them. This will increase the low-price firm's profit at the expense of the other firm. The game is represented in the table below.

Refer to Table 16-2. What is the profit firm A will earn if it plays its dominant strategy:

A) $1000 if firm B has a high price and $1500 if firm B has a low price

B) $1000 if firm B has a high price and $800 if firm B has a low price

C) $800 if firm B has a high price and $1250 if firm B has a low price

D) $800 if firm B has a high price and $1500 if firm B has a low price

In the following duopoly game, the two firms can either set the price of their product high or low. If one firm's price is lower than the other, most of the market will buy from them. This will increase the low-price firm's profit at the expense of the other firm. The game is represented in the table below.

Refer to Table 16-2. What is the profit firm A will earn if it plays its dominant strategy:

A) $1000 if firm B has a high price and $1500 if firm B has a low price

B) $1000 if firm B has a high price and $800 if firm B has a low price

C) $800 if firm B has a high price and $1250 if firm B has a low price

D) $800 if firm B has a high price and $1500 if firm B has a low price

Unlock Deck

Unlock for access to all 184 flashcards in this deck.

Unlock Deck

k this deck

76

Table 16-3

Imagine a small town in which only two residents, Robert and John, own wells that produce water for safe drinking. Each Saturday, Robert and John work together to decide how many litres of water to pump, bring the water to town, and sell it at whatever price the market will bear. To keep things simple, suppose that Robert and John can pump as much water as they want without cost; therefore, the marginal cost of water equals zero.

The weekly town demand schedule and total revenue schedule for water are shown in the table.

Refer to Table 16-3. As long as Robert and John operate as a profit-maximising monopoly, what will their weekly revenue be?

A) $270

B) $320

C) $350

D) $360

Imagine a small town in which only two residents, Robert and John, own wells that produce water for safe drinking. Each Saturday, Robert and John work together to decide how many litres of water to pump, bring the water to town, and sell it at whatever price the market will bear. To keep things simple, suppose that Robert and John can pump as much water as they want without cost; therefore, the marginal cost of water equals zero.

The weekly town demand schedule and total revenue schedule for water are shown in the table.

Refer to Table 16-3. As long as Robert and John operate as a profit-maximising monopoly, what will their weekly revenue be?

A) $270

B) $320

C) $350

D) $360

Unlock Deck

Unlock for access to all 184 flashcards in this deck.

Unlock Deck

k this deck

77

Table 16-3

Imagine a small town in which only two residents, Robert and John, own wells that produce water for safe drinking. Each Saturday, Robert and John work together to decide how many litres of water to pump, bring the water to town, and sell it at whatever price the market will bear. To keep things simple, suppose that Robert and John can pump as much water as they want without cost; therefore, the marginal cost of water equals zero.

The weekly town demand schedule and total revenue schedule for water are shown in the table.

Refer to Table 16-3. If the market for water was perfectly competitive instead of monopolistic, how many litres of water would be produced and sold?

A) 70

B) 90

C) 110

D) 120

Imagine a small town in which only two residents, Robert and John, own wells that produce water for safe drinking. Each Saturday, Robert and John work together to decide how many litres of water to pump, bring the water to town, and sell it at whatever price the market will bear. To keep things simple, suppose that Robert and John can pump as much water as they want without cost; therefore, the marginal cost of water equals zero.

The weekly town demand schedule and total revenue schedule for water are shown in the table.

Refer to Table 16-3. If the market for water was perfectly competitive instead of monopolistic, how many litres of water would be produced and sold?

A) 70

B) 90

C) 110

D) 120

Unlock Deck

Unlock for access to all 184 flashcards in this deck.

Unlock Deck

k this deck

78

Some companies have competitors but do not face much competition; in this case they are not price takers. Economists call this situation:

A) imperfect competition

B) an oligopoly

C) a duopoly

D) monopolistic competition

A) imperfect competition

B) an oligopoly

C) a duopoly

D) monopolistic competition

Unlock Deck

Unlock for access to all 184 flashcards in this deck.

Unlock Deck

k this deck

79

There are two types of markets in which firms face some competition, yet are still able to have some control over the prices of their products. The names given to these market structures are:

A) oligopoly and duopoly

B) imperfect competition and monopolistic competition

C) duopoly and imperfect competition

D) monopolistic competition and oligopoly

A) oligopoly and duopoly

B) imperfect competition and monopolistic competition

C) duopoly and imperfect competition

D) monopolistic competition and oligopoly

Unlock Deck

Unlock for access to all 184 flashcards in this deck.

Unlock Deck

k this deck

80

Table 16-2

In the following duopoly game, the two firms can either set the price of their product high or low. If one firm's price is lower than the other, most of the market will buy from them. This will increase the low-price firm's profit at the expense of the other firm. The game is represented in the table below.

Refer to Table 16-2. If the two firms wanted to achieve the optimal level of profit they would:

A) both sell at a low price

B) both sell at a high price

C) collude to let firm A sell at a low price and firm B to sell at a high price

D) collude to let firm A sell at a high price and firm B to sell at a low price

In the following duopoly game, the two firms can either set the price of their product high or low. If one firm's price is lower than the other, most of the market will buy from them. This will increase the low-price firm's profit at the expense of the other firm. The game is represented in the table below.

Refer to Table 16-2. If the two firms wanted to achieve the optimal level of profit they would:

A) both sell at a low price

B) both sell at a high price

C) collude to let firm A sell at a low price and firm B to sell at a high price

D) collude to let firm A sell at a high price and firm B to sell at a low price

Unlock Deck

Unlock for access to all 184 flashcards in this deck.

Unlock Deck

k this deck