Deck 2: Systems Design: Job-Order Costing

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/112

Play

Full screen (f)

Deck 2: Systems Design: Job-Order Costing

1

Depreciation is always considered a product cost for external financial reporting purposes in a manufacturing firm.

False

2

Sunk costs are irrelevant in making decisions.

True

3

Variable costs are costs whose per unit costs vary as the activity level rises and falls.

False

4

All the following costs should be considered direct costs of providing delivery room services to a particular mother and her baby: the costs of drugs administered in the operating room,the attending physician's fees,and a portion of the liability insurance carried by the hospital to cover the delivery room.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

5

All costs incurred in a merchandising firm are considered to be period costs.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

6

The cost of rent for a manufacturing plant is generally considered to be a:

A) choice a.

B) choice b.

C) choice c.

D) choice d.

A) choice a.

B) choice b.

C) choice c.

D) choice d.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

7

Manufacturing overhead combined with direct materials is known as conversion cost.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

8

A cost that differs from one month to another is known as a differential cost.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

9

Advertising costs are considered product costs for external financial reports since they are incurred in order to promote specific products.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

10

The following costs should be considered by a law firm to be indirect costs of defending a particular client in court: rent on the law firm's offices,the law firm's receptionist's wages,the costs of heating the law firm's offices,and the depreciation on the personal computer in the office of the attorney who has been assigned the client.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

11

On a per unit basis,a fixed cost varies inversely with the level of activity.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

12

Property taxes and insurance premiums paid on a factory building are examples of manufacturing overhead.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

13

In a manufacturing company,goods available for sale equals the sum of the cost of goods manufactured and the beginning finished goods inventory.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

14

The inventory accounts reported on the balance sheet of a manufacturing company will differ from those of a merchandising company.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

15

The cost of fire insurance for a manufacturing plant is generally considered to be a:

A) product cost.

B) period cost.

C) variable cost.

D) all of the answers are correct.

A) product cost.

B) period cost.

C) variable cost.

D) all of the answers are correct.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

16

Each of the following would be a period cost except:

A) the salary of the company president's secretary.

B) the cost of a general accounting office.

C) depreciation of a machine used in manufacturing.

D) sales commissions.

A) the salary of the company president's secretary.

B) the cost of a general accounting office.

C) depreciation of a machine used in manufacturing.

D) sales commissions.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

17

All the following would typically be considered indirect costs of manufacturing a particular Boeing 747 to be delivered to Singapore Airlines: electricity to run production equipment,the factory manager's salary,and the cost of the General Electric jet engines installed on the aircraft.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

18

Opportunity costs are always recorded as expenses in the accounts of an organization.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

19

If the ending inventory of finished goods is understated,net income will be overstated.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

20

The corporate controller's salary would be considered a(n):

A) manufacturing cost.

B) product cost.

C) administrative cost.

D) selling expense.

A) manufacturing cost.

B) product cost.

C) administrative cost.

D) selling expense.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

21

Manufacturing overhead consists of:

A) all manufacturing costs.

B) all manufacturing costs,except direct materials and direct labour.

C) indirect materials but not indirect labour.

D) indirect labour but not indirect materials.

A) all manufacturing costs.

B) all manufacturing costs,except direct materials and direct labour.

C) indirect materials but not indirect labour.

D) indirect labour but not indirect materials.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

22

Direct materials are a part of:

A) choice a.

B) choice b.

C) choice c.

D) choice d.

A) choice a.

B) choice b.

C) choice c.

D) choice d.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

23

Last month,when 10,000 units of a product were manufactured,the cost per unit was $60.At this level of activity,variable costs are 50% of total unit costs.If 10,500 units are manufactured next month and cost behaviour patterns remain unchanged,the total cost of goods manufactured will be?

A) $585,000.

B) $600,000.

C) $615,000.

D) $630,000.

A) $585,000.

B) $600,000.

C) $615,000.

D) $630,000.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

24

Which of the following should NOT be included as part of manufacturing overhead at a company that makes office furniture?

A) Sheet steel in a file cabinet made by the company.

B) Manufacturing equipment depreciation.

C) Idle time for direct labour.

D) Taxes on a factory building.

A) Sheet steel in a file cabinet made by the company.

B) Manufacturing equipment depreciation.

C) Idle time for direct labour.

D) Taxes on a factory building.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

25

Rossiter Company failed to record a credit sale at the end of the year,although the reduction in finished goods inventories was correctly recorded when the goods were shipped to the customer.Which one of the following statements is correct?

A) Accounts receivable was not affected,inventory was not affected,sales were understated,and cost of goods sold was understated.

B) Accounts receivable was understated,inventory was overstated,sales were understated,and cost of goods sold was overstated.

C) Accounts receivable was not affected,inventory was understated,sales were understated,and cost of goods sold was understated.

D) Accounts receivable was understated,inventory was not affected,sales were understated,and cost of goods sold was not affected.

A) Accounts receivable was not affected,inventory was not affected,sales were understated,and cost of goods sold was understated.

B) Accounts receivable was understated,inventory was overstated,sales were understated,and cost of goods sold was overstated.

C) Accounts receivable was not affected,inventory was understated,sales were understated,and cost of goods sold was understated.

D) Accounts receivable was understated,inventory was not affected,sales were understated,and cost of goods sold was not affected.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

26

Micro Computer Company has set up a toll-free telephone line for customer inquiries regarding computer hardware produced by the company.The cost of this toll-free line would be classified as which of the following?

A) Product cost.

B) Manufacturing overhead.

C) Direct labour.

D) Period cost.

A) Product cost.

B) Manufacturing overhead.

C) Direct labour.

D) Period cost.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

27

Last month,when 10,000 units of a product were manufactured,the cost per unit was $60.At this level of activity,variable costs are 50% of total unit costs.If 10,500 units are manufactured next month and cost behaviour patterns remain unchanged the?

A) total variable cost will remain unchanged.

B) fixed costs will increase in total.

C) variable cost per unit will increase.

D) total cost per unit will decrease.

A) total variable cost will remain unchanged.

B) fixed costs will increase in total.

C) variable cost per unit will increase.

D) total cost per unit will decrease.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

28

Variable cost:

A) increases on a per unit basis as the number of units produced increases.

B) remains constant on a per unit basis as the number of units produced increases.

C) remains the same in total as production increases.

D) decreases on a per unit basis as the number of units produced increases.

A) increases on a per unit basis as the number of units produced increases.

B) remains constant on a per unit basis as the number of units produced increases.

C) remains the same in total as production increases.

D) decreases on a per unit basis as the number of units produced increases.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

29

Which of the following would be considered a product cost for external financial reporting purposes?

A) Cost of a warehouse used to store finished goods.

B) Cost of guided public tours through the company's facilities.

C) Cost of travel necessary to sell the manufactured product.

D) Cost of sand spread on the factory floor to absorb oil from manufacturing machines.

A) Cost of a warehouse used to store finished goods.

B) Cost of guided public tours through the company's facilities.

C) Cost of travel necessary to sell the manufactured product.

D) Cost of sand spread on the factory floor to absorb oil from manufacturing machines.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

30

Which of the following statements is true?

A) An indirect cost can be easily traced to an individual cost object.

B) An indirect cost is one incurred to support a number of cost objects.

C) A direct cost cannot be easily and economically traced to a cost object.

D) The determination of a cost object is nor relevant to the traceability of costs.

A) An indirect cost can be easily traced to an individual cost object.

B) An indirect cost is one incurred to support a number of cost objects.

C) A direct cost cannot be easily and economically traced to a cost object.

D) The determination of a cost object is nor relevant to the traceability of costs.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

31

Within the relevant range,the difference between variable costs and fixed costs is:

A) variable costs per unit fluctuate and fixed costs per unit remain constant.

B) variable costs per unit are constant and fixed costs per unit fluctuate.

C) both total variable costs and total fixed costs are constant.

D) both total variable costs and total fixed costs fluctuate.

A) variable costs per unit fluctuate and fixed costs per unit remain constant.

B) variable costs per unit are constant and fixed costs per unit fluctuate.

C) both total variable costs and total fixed costs are constant.

D) both total variable costs and total fixed costs fluctuate.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

32

Transportation costs incurred by a manufacturing company to ship its product to its customers would be classified as which of the following?

A) Product cost.

B) Manufacturing overhead.

C) Period cost.

D) Administrative cost.

A) Product cost.

B) Manufacturing overhead.

C) Period cost.

D) Administrative cost.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

33

Which of the following would NOT be treated as a product cost for external financial reporting purposes?

A) Depreciation on a factory building.

B) Salaries of factory workers.

C) Indirect labour in the factory.

D) Advertising expenses.

A) Depreciation on a factory building.

B) Salaries of factory workers.

C) Indirect labour in the factory.

D) Advertising expenses.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

34

An opportunity cost is:

A) the difference in total costs which results from selecting one alternative instead of another.

B) the potential benefit forgone by selecting one alternative instead of another.

C) a cost which may be saved by not adopting an alternative.

D) a cost which may be shifted to the future with little or no effect on current operations.

A) the difference in total costs which results from selecting one alternative instead of another.

B) the potential benefit forgone by selecting one alternative instead of another.

C) a cost which may be saved by not adopting an alternative.

D) a cost which may be shifted to the future with little or no effect on current operations.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

35

The wages of factory maintenance personnel would usually be considered to be:

A) choice a.

B) choice b.

C) choice c.

D) choice d.

A) choice a.

B) choice b.

C) choice c.

D) choice d.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

36

The salary of the president of a manufacturing company would be classified as which of the following?

A) Product cost.

B) Period cost.

C) Manufacturing overhead.

D) Direct labour.

A) Product cost.

B) Period cost.

C) Manufacturing overhead.

D) Direct labour.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

37

Which of the following statements regarding fixed costs is incorrect?

A) Expressing fixed costs on a per unit basis usually is the best approach for decision-making.

B) Fixed costs expressed on a per unit basis will react inversely with changes in activity.

C) Assumptions by accountants regarding the behaviour of fixed costs rest heavily on the concept of the relevant range.

D) Fixed costs frequently represent long-term investments in property,plant,and equipment.

A) Expressing fixed costs on a per unit basis usually is the best approach for decision-making.

B) Fixed costs expressed on a per unit basis will react inversely with changes in activity.

C) Assumptions by accountants regarding the behaviour of fixed costs rest heavily on the concept of the relevant range.

D) Fixed costs frequently represent long-term investments in property,plant,and equipment.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

38

If the cost of goods sold is greater than the cost of goods manufactured,then:

A) work in process inventory has decreased during the period.

B) finished goods inventory has increased during the period.

C) total manufacturing costs must be greater than cost of goods manufactured.

D) finished goods inventory has decreased during the period.

A) work in process inventory has decreased during the period.

B) finished goods inventory has increased during the period.

C) total manufacturing costs must be greater than cost of goods manufactured.

D) finished goods inventory has decreased during the period.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

39

The term differential cost refers to:

A) a difference in cost between any two alternatives.

B) the potential benefit forgone by selecting one alternative instead of another.

C) a cost which does not entail any dollar outlay but which is relevant to the decision-making process.

D) a cost which continues to be incurred even though there is no activity.

A) a difference in cost between any two alternatives.

B) the potential benefit forgone by selecting one alternative instead of another.

C) a cost which does not entail any dollar outlay but which is relevant to the decision-making process.

D) a cost which continues to be incurred even though there is no activity.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

40

For a manufacturing company,which of the following is an example of a period rather than a product cost?

A) Depreciation of factory equipment.

B) Wages of salespersons.

C) Wages of machine operators.

D) Insurance on factory equipment.

A) Depreciation of factory equipment.

B) Wages of salespersons.

C) Wages of machine operators.

D) Insurance on factory equipment.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

41

Using the following data,calculate the beginning work in process inventory.  The beginning work in process inventory is:

The beginning work in process inventory is:

A) $15.

B) $20.

C) $25.

D) $55.

The beginning work in process inventory is:

The beginning work in process inventory is:A) $15.

B) $20.

C) $25.

D) $55.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

42

Mueller Company reported the following data for the year just ended:  The beginning work in process inventory was:

The beginning work in process inventory was:

A) $100,000.

B) $300,000.

C) $500,000.

D) $1,300,000.

The beginning work in process inventory was:

The beginning work in process inventory was:A) $100,000.

B) $300,000.

C) $500,000.

D) $1,300,000.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

43

Using the following data for January,calculate the cost of goods manufactured:  The cost of goods manufactured was:

The cost of goods manufactured was:

A) $78,000.

B) $79,000.

C) $80,000.

D) $89,000.

The cost of goods manufactured was:

The cost of goods manufactured was:A) $78,000.

B) $79,000.

C) $80,000.

D) $89,000.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

44

Green Company's costs for the month of August were as follows: direct materials,$27,000;direct labour,$34,000;sales salaries,$14,000;indirect labour,$10,000;indirect materials,$15,000;general corporate administrative cost,$12,000;taxes on manufacturing facility,$2,000;and rent on factory,$17,000.The beginning work in process inventory was $16,000 and the ending work in process inventory was $9,000.What was the cost of goods manufactured for the month?

A) $105,000.

B) $112,000.

C) $132,000.

D) $138,000.

A) $105,000.

B) $112,000.

C) $132,000.

D) $138,000.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

45

Conversion cost consists of which of the following?

A) Manufacturing overhead cost.

B) Direct materials and direct labour costs.

C) Direct labour cost.

D) Direct labour and manufacturing overhead costs.

A) Manufacturing overhead cost.

B) Direct materials and direct labour costs.

C) Direct labour cost.

D) Direct labour and manufacturing overhead costs.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

46

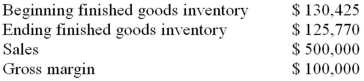

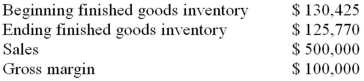

Last month a manufacturing company had the following operating results:  What was the cost of goods manufactured for the month?

What was the cost of goods manufactured for the month?

A) $411,000.

B) $412,000.

C) $413,000.

D) $463,000.

What was the cost of goods manufactured for the month?

What was the cost of goods manufactured for the month?A) $411,000.

B) $412,000.

C) $413,000.

D) $463,000.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

47

A manufacturing company prepays its insurance coverage for a three-year period.The premium for the three years is $2,700 and is paid at the beginning of the first year.Eighty percent of the premium applies to manufacturing operations and 20% applies to selling and administrative activities.What amounts should be considered product and period costs respectively for the first year of coverage?

A) choice a.

B) choice b.

C) choice c.

D) choice d.

A) choice a.

B) choice b.

C) choice c.

D) choice d.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

48

Which of the following costs is often important in decision making,but is omitted from conventional accounting records?

A) Fixed cost.

B) Sunk cost.

C) Opportunity cost.

D) Indirect cost.

A) Fixed cost.

B) Sunk cost.

C) Opportunity cost.

D) Indirect cost.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

49

The Lyons Company's cost of goods manufactured was $120,000 when its sales were $360,000 and its gross margin was $220,000.If the ending inventory of finished goods was $30,000,the beginning inventory of finished goods must have been:

A) $20,000.

B) $50,000.

C) $110,000.

D) $150,000.

A) $20,000.

B) $50,000.

C) $110,000.

D) $150,000.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

50

The following information was provided by Wilson Company for the year just ended:  The cost of goods manufactured for the year was:

The cost of goods manufactured for the year was:

A) $314,725.

B) $325,000.

C) $333,275.

D) $334,275.

The cost of goods manufactured for the year was:

The cost of goods manufactured for the year was:A) $314,725.

B) $325,000.

C) $333,275.

D) $334,275.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

51

Williams Company's direct labour cost is 25% of its conversion cost.If the manufacturing overhead cost for the last period was $45,000 and the direct materials cost was $25,000,the direct labour cost was:

A) $15,000.

B) $20,000.

C) $33,333.

D) $60,000.

A) $15,000.

B) $20,000.

C) $33,333.

D) $60,000.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

52

Which one of the following costs should NOT be considered a direct cost of serving a particular customer who orders a customized personal computer by phone directly from the manufacturer?

A) The cost of the hard disk drive installed in the computer.

B) The cost of shipping the computer to the customer.

C) The cost of leasing a machine on a monthly basis that automatically tests hard disk drives before they are installed in computers.

D) The cost of packaging the computer for shipment.

A) The cost of the hard disk drive installed in the computer.

B) The cost of shipping the computer to the customer.

C) The cost of leasing a machine on a monthly basis that automatically tests hard disk drives before they are installed in computers.

D) The cost of packaging the computer for shipment.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

53

Which one of the following costs should NOT be considered an indirect cost of serving a particular customer at a Dairy Queen fast food outlet?

A) The cost of the hamburger patty in the burger they ordered.

B) The wages of the employee who takes the customer's order.

C) The cost of heating and lighting the kitchen.

D) The salary of the outlet's manager.

A) The cost of the hamburger patty in the burger they ordered.

B) The wages of the employee who takes the customer's order.

C) The cost of heating and lighting the kitchen.

D) The salary of the outlet's manager.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

54

The sequence of major activities that every organization carries out to fulfill its mission is known as:

A) the manufacturing process.

B) product planning and development.

C) the value chain.

D) marketing.

A) the manufacturing process.

B) product planning and development.

C) the value chain.

D) marketing.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

55

During the month of May,Bennett Manufacturing Company purchased $43,000 of raw materials.Total manufacturing overhead was$27,000 and the total manufacturing costs were $106,000.Assuming a beginning inventory of raw materials of $8,000 and an ending inventory of raw materials of $6,000,direct labour was:

A) $34,000.

B) $36,000.

C) $38,000.

D) $45,000.

A) $34,000.

B) $36,000.

C) $38,000.

D) $45,000.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

56

Prime cost consists of direct materials combined with:

A) direct labour.

B) manufacturing overhead.

C) indirect materials.

D) cost of goods manufactured.

A) direct labour.

B) manufacturing overhead.

C) indirect materials.

D) cost of goods manufactured.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

57

The gross margin for Cushing Company for the first quarter of last year was $325,000 when sales were $700,000.The beginning inventory of finished goods was $60,000 and the ending inventory of finished goods was $85,000.The cost of goods manufactured for the first quarter would have been:

A) $350,000.

B) $375,000.

C) $400,000.

D) $485,000.

A) $350,000.

B) $375,000.

C) $400,000.

D) $485,000.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

58

When a decision is made among a number of alternatives,the potential benefit that is lost by choosing one alternative over another is the:

A) realized cost.

B) opportunity cost.

C) conversion cost.

D) accrued cost.

A) realized cost.

B) opportunity cost.

C) conversion cost.

D) accrued cost.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

59

During the month of June,Reardon Company incurred $17,000 of direct labour,$8,500 of manufacturing overhead and purchased $15,000 of raw materials.Between the beginning and the end of the month,the raw materials inventory increased by $2,000,the finished goods inventory increased by $1,500,and the work in process inventory decreased by $3,000.The cost of goods manufactured would be:

A) $38,500.

B) $40,500.

C) $41,500.

D) $43,500.

A) $38,500.

B) $40,500.

C) $41,500.

D) $43,500.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

60

Which of the following major activities of a business will result in product costs?

A) Marketing.

B) Customer support.

C) General administrative.

D) Manufacturing.

A) Marketing.

B) Customer support.

C) General administrative.

D) Manufacturing.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

61

Delta Merchandising,Inc.has provided the following information for the year just ended:  The ending inventory for the company at year end was:

The ending inventory for the company at year end was:

A) $9,950.

B) $14,050.

C) $24,500.

D) $65,450.

The ending inventory for the company at year end was:

The ending inventory for the company at year end was:A) $9,950.

B) $14,050.

C) $24,500.

D) $65,450.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

62

The following account balances has been extracted from Jimbob Co.'s general ledger:  What was the total of nonmanufacturing costs?

What was the total of nonmanufacturing costs?

A) $150,000.

B) $160,000.

C) $180,000.

D) $230,000.

What was the total of nonmanufacturing costs?

What was the total of nonmanufacturing costs?A) $150,000.

B) $160,000.

C) $180,000.

D) $230,000.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

63

The cost of goods manufactured for the year (in thousands of dollars)was:

A) $460.

B) $500.

C) $520.

D) $530.

A) $460.

B) $500.

C) $520.

D) $530.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

64

The following account balances has been extracted from Jimbob Co.'s general ledger:  What was the total of manufacturing costs?

What was the total of manufacturing costs?

A) $400,000.

B) $510,000.

C) $560,000.

D) $740,000.

What was the total of manufacturing costs?

What was the total of manufacturing costs?A) $400,000.

B) $510,000.

C) $560,000.

D) $740,000.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

65

The following inventory valuation errors were discovered by Knox Corporation's new controller just after the annual financial statements were published at the end of Year 3. > The Year 3 ending inventory was understated by $17,000.

> The Year 2 ending inventory was understated by $61,000.

> The Year 1 ending inventory was overstated by $23,000.

The net income for Knox in each of these years was: Assuming there were no income taxes and no corrections were made prior to the discovery of the errors after the end of year 3,the net income in each year should be adjusted to:

Assuming there were no income taxes and no corrections were made prior to the discovery of the errors after the end of year 3,the net income in each year should be adjusted to:

A) choice a.

B) choice b.

C) choice c.

D) choice d.

> The Year 2 ending inventory was understated by $61,000.

> The Year 1 ending inventory was overstated by $23,000.

The net income for Knox in each of these years was:

Assuming there were no income taxes and no corrections were made prior to the discovery of the errors after the end of year 3,the net income in each year should be adjusted to:

Assuming there were no income taxes and no corrections were made prior to the discovery of the errors after the end of year 3,the net income in each year should be adjusted to:

A) choice a.

B) choice b.

C) choice c.

D) choice d.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

66

The cost of the raw materials used in production during the year (in thousands of dollars)was:

A) $40.

B) $120.

C) $160.

D) $180.

A) $40.

B) $120.

C) $160.

D) $180.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

67

Gabel Inc.is a merchandising company.Last month the company's merchandise purchases totalled $63,000.The company's beginning merchandise inventory was $13,000 and its ending merchandise inventory was $15,000.What was the company's cost of goods sold for the month?

A) $61,000.

B) $63,000.

C) $65,000.

D) $91,000.

A) $61,000.

B) $63,000.

C) $65,000.

D) $91,000.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

68

The net income for the year (in thousands of dollars)was:

A) $150.

B) $200.

C) $250.

D) $490.

A) $150.

B) $200.

C) $250.

D) $490.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

69

The following account balances has been extracted from Jimbob Co.'s general ledger:  What was the total of manufacturing overhead?

What was the total of manufacturing overhead?

A) $110,000.

B) $160,000.

C) $400,000.

D) $740,000.

What was the total of manufacturing overhead?

What was the total of manufacturing overhead?A) $110,000.

B) $160,000.

C) $400,000.

D) $740,000.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

70

The cost of the raw materials used in production during the year (in thousands of dollars)was:

A) $90.

B) $150.

C) $160.

D) $190.

A) $90.

B) $150.

C) $160.

D) $190.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

71

The cost of goods sold for the year (in thousands of dollars)was:

A) $500.

B) $580.

C) $660.

D) $700.

A) $500.

B) $580.

C) $660.

D) $700.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

72

The cost of goods sold for the year (in thousands of dollars)was:

A) $500.

B) $540.

C) $650.

D) $670.

A) $500.

B) $540.

C) $650.

D) $670.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

73

An accounting course is taught in two classes per week for one hour and fifty minutes each.The classes are held in a building with 36 classrooms that are used for a variety of courses.There are 15 other courses taught in the Accounting Department at this university.If the cost object is the accounting course,which of the following is a direct cost?

A) The course Instructor's salary for teaching the course (he only teaches this one course).

B) The property taxes on the land and classroom building.

C) The salary of the building's custodian.

D) The Accounting Department's secretary salary.

A) The course Instructor's salary for teaching the course (he only teaches this one course).

B) The property taxes on the land and classroom building.

C) The salary of the building's custodian.

D) The Accounting Department's secretary salary.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

74

The following information was provided by Grand Company for the year just ended:  The cost of goods manufactured for the year was:

The cost of goods manufactured for the year was:

A) $95,345.

B) $104,655.

C) $395,345.

D) $404,655.

The cost of goods manufactured for the year was:

The cost of goods manufactured for the year was:A) $95,345.

B) $104,655.

C) $395,345.

D) $404,655.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

75

The following information was provided by Jimbob Co.for the year just ended:  What was beginning finished goods inventory?

What was beginning finished goods inventory?

A) $100,000.

B) $200,000.

C) $300,000.

D) $400,000.

What was beginning finished goods inventory?

What was beginning finished goods inventory?A) $100,000.

B) $200,000.

C) $300,000.

D) $400,000.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

76

The cost of goods manufactured for the year (in thousands of dollars)was:

A) $500.

B) $540.

C) $570.

D) $590.

A) $500.

B) $540.

C) $570.

D) $590.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

77

The beginning balance of the Raw Materials inventory account for May was $27,500.The ending balance for May was $28,750 and $128,900 of raw materials were used during the month.The materials purchased during the month cost:

A) $127,650.

B) $130,150.

C) $131,300.

D) $157,650.

A) $127,650.

B) $130,150.

C) $131,300.

D) $157,650.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

78

An accounting course is taught in two classes per week for one hour and fifty minutes each.The classes are held in a building with 36 classrooms that are used for a variety of courses.The building has an advanced monitoring system which allows electricity costs to be determined for each classroom and for each course.If the cost object is the accounting course,which of the following is an indirect cost?

A) The course Instructor's salary for teaching the course (he only teaches this one course).

B) The cost of the preparation of the exam papers for this course.

C) The salary of the building's custodian.

D) The electricity cost for the course.

A) The course Instructor's salary for teaching the course (he only teaches this one course).

B) The cost of the preparation of the exam papers for this course.

C) The salary of the building's custodian.

D) The electricity cost for the course.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

79

During January,the cost of goods manufactured was $93,000.The beginning finished goods inventory was $16,000 and the ending finished goods inventory was $20,000.What was the cost of goods sold for the month?

A) $89,000.

B) $93,000.

C) $97,000.

D) $129,000.

A) $89,000.

B) $93,000.

C) $97,000.

D) $129,000.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

80

Haack Inc.is a merchandising company.Last month the company's cost of goods sold was $84,000.The company's beginning merchandise inventory was $20,000 and its ending merchandise inventory was $18,000.What was the total amount of the company's merchandise purchases for the month?

A) $82,000.

B) $84,000.

C) $86,000.

D) $122,000.

A) $82,000.

B) $84,000.

C) $86,000.

D) $122,000.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck