Deck 3: Financial Statements Analysis and Financial Models

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/88

Play

Full screen (f)

Deck 3: Financial Statements Analysis and Financial Models

1

A total asset turnover measure of 0.84 means that a firm has $0.84 in

A)sales for every $1 in total assets.

B)total assets for every $1 in sales.

C)total assets for every $1 in total equity.

D)total assets for every $1 in cash.

E)long-term assets for every $1 in total assets.

A)sales for every $1 in total assets.

B)total assets for every $1 in sales.

C)total assets for every $1 in total equity.

D)total assets for every $1 in cash.

E)long-term assets for every $1 in total assets.

sales for every $1 in total assets.

2

Which one of the following statements is correct concerning ratio analysis?

A)Ratios cannot be used for comparison purposes over extended periods of time.

B)Ratios do not address the problem of size differences among firms.

C)Only a very limited number of ratios can be used for analytical purposes.

D)Each ratio has a specific formula that is used consistently by all analysts.

E)A single ratio is often computed differently by different individuals.

A)Ratios cannot be used for comparison purposes over extended periods of time.

B)Ratios do not address the problem of size differences among firms.

C)Only a very limited number of ratios can be used for analytical purposes.

D)Each ratio has a specific formula that is used consistently by all analysts.

E)A single ratio is often computed differently by different individuals.

A single ratio is often computed differently by different individuals.

3

Which cash coverage ratio would a lender prefer its borrower have?

A)−1.5

B)−0.5

C)0

D)0.5

E)1.5

A)−1.5

B)−0.5

C)0

D)0.5

E)1.5

1.5

4

On a common-size income statement,depreciation will be

A)omitted since it is a noncash expense.

B)added back to convert net income to cash flows.

C)expressed as a percentage of total assets.

D)expressed as a percentage of sales.

E)expressed as a percentage of gross fixed assets.

A)omitted since it is a noncash expense.

B)added back to convert net income to cash flows.

C)expressed as a percentage of total assets.

D)expressed as a percentage of sales.

E)expressed as a percentage of gross fixed assets.

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

5

If Textile Cloth stockholders want to know how much net profit the firm is making on a percentage basis on their investment in that firm,the shareholders should refer to the

A)profit margin.

B)return on assets.

C)return on equity.

D)equity multiplier.

E)EV multiple.

A)profit margin.

B)return on assets.

C)return on equity.

D)equity multiplier.

E)EV multiple.

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

6

A common-size balance sheet will express accounts receivable as a percentage of

A)sales.

B)current assets.

C)net working capital.

D)total assets.

E)total owners' equity.

A)sales.

B)current assets.

C)net working capital.

D)total assets.

E)total owners' equity.

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

7

All of the following are financial leverage ratios except the

A)current ratio.

B)cash coverage ratio.

C)total debt ratio.

D)times interest earned ratio.

E)equity multiplier.

A)current ratio.

B)cash coverage ratio.

C)total debt ratio.

D)times interest earned ratio.

E)equity multiplier.

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

8

Which one of the following statements is correct if a firm has an accounts receivable turnover measure of 10?

A)It takes the firm 36.5 days to pay its creditors.

B)It takes the firm 36.5 days to sell its inventory and collect payment from the sale.

C)It takes the firm 36.5 days to collect payment for a sale.

D)The firm has 10 times more in accounts receivable than it does in cash.

E)It takes an average of 10 days to collect payment from the firm's customers.

A)It takes the firm 36.5 days to pay its creditors.

B)It takes the firm 36.5 days to sell its inventory and collect payment from the sale.

C)It takes the firm 36.5 days to collect payment for a sale.

D)The firm has 10 times more in accounts receivable than it does in cash.

E)It takes an average of 10 days to collect payment from the firm's customers.

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

9

A supplier,who requires payment this week,should be most concerned about which one of its customer's ratios?

A)Current ratio

B)Debt-equity ratio

C)Cash ratio

D)Quick ratio

E)Total debt ratio

A)Current ratio

B)Debt-equity ratio

C)Cash ratio

D)Quick ratio

E)Total debt ratio

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

10

Assume J.K.Lumber increases its operating efficiency such that costs decrease while sales remain constant.As a result,given all else constant,the

A)equity multiplier will decrease.

B)return on assets will decrease.

C)profit margin will decline.

D)return on equity will increase.

E)total asset turnover will increase.

A)equity multiplier will decrease.

B)return on assets will decrease.

C)profit margin will decline.

D)return on equity will increase.

E)total asset turnover will increase.

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

11

Financial ratios that measure a firm's ability to pay its bills over the short run without undue stress are often referred to as

A)asset management ratios.

B)liquidity measures.

C)leverage ratios.

D)profitability ratios.

E)utilization ratios.

A)asset management ratios.

B)liquidity measures.

C)leverage ratios.

D)profitability ratios.

E)utilization ratios.

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

12

From a cash flow position,which one of the following ratios best measures a firm's ability to pay the interest on its debts?

A)Times interest earned ratio

B)Cash coverage ratio

C)Cash ratio

D)Quick ratio

E)Debt-equity ratio

A)Times interest earned ratio

B)Cash coverage ratio

C)Cash ratio

D)Quick ratio

E)Debt-equity ratio

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

13

The lower a firm's inventory turnover,the

A)longer it takes the firm to collect payment on its sales.

B)faster the firm collects payment on its sales.

C)faster the firm sells its inventory.

D)longer inventory sits on the firm's shelves.

E)smaller the amount of inventory held by the firm.

A)longer it takes the firm to collect payment on its sales.

B)faster the firm collects payment on its sales.

C)faster the firm sells its inventory.

D)longer inventory sits on the firm's shelves.

E)smaller the amount of inventory held by the firm.

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

14

The quick ratio is calculated as

A)current assets divided by current liabilities.

B)current assets minus inventory,divided by current liabilities.

C)net working capital divided by current liabilities.

D)cash on hand divided by current liabilities.

E)current liabilities divided by current assets.

A)current assets divided by current liabilities.

B)current assets minus inventory,divided by current liabilities.

C)net working capital divided by current liabilities.

D)cash on hand divided by current liabilities.

E)current liabilities divided by current assets.

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

15

If Brewster's produces a return on assets of 14 percent and also a return on equity of 14 percent,then the firm

A)has no net working capital.

B)is using its assets as efficiently as possible.

C)has no debt of any kind.

D)also has a current ratio of 14.

E)has an equity multiplier of 1.4.

A)has no net working capital.

B)is using its assets as efficiently as possible.

C)has no debt of any kind.

D)also has a current ratio of 14.

E)has an equity multiplier of 1.4.

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

16

A common-size income statement expresses dividends as 3.6 percent.This means that dividends represent 3.6 percent of

A)net income.

B)total assets.

C)sales.

D)taxable earnings.

E)total owners' equity.

A)net income.

B)total assets.

C)sales.

D)taxable earnings.

E)total owners' equity.

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

17

EBITDA is the abbreviation for earnings before

A)insurance,taxes,depreciation,and accounting expenses.

B)interest,taxes,depreciation,and accrued expenses.

C)insurance,taxes,depreciation,and accrued expenses.

D)interest,taxes,depreciation,and amortization.

E)interest,taxes,and deferred accounting overhead.

A)insurance,taxes,depreciation,and accounting expenses.

B)interest,taxes,depreciation,and accrued expenses.

C)insurance,taxes,depreciation,and accrued expenses.

D)interest,taxes,depreciation,and amortization.

E)interest,taxes,and deferred accounting overhead.

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

18

A firm has a total debt ratio of 0.47.This means the firm has $0.47 in debt for every

A)$.53 in equity.

B)$1.47 in total assets.

C)$1.53 in total assets.

D)$1 in total equity.

E)$1.47 in total equity.

A)$.53 in equity.

B)$1.47 in total assets.

C)$1.53 in total assets.

D)$1 in total equity.

E)$1.47 in total equity.

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

19

A decrease in which one of the following accounts increases a firm's current ratio as well as its quick ratio?

A)Accounts payable

B)Cash

C)Accounts receivable

D)Inventory

E)Fixed assets

A)Accounts payable

B)Cash

C)Accounts receivable

D)Inventory

E)Fixed assets

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

20

Which one of these best measures a firm's long-run ability to meet its obligations?

A)Cash ratio

B)Total asset turnover

C)EV multiple

D)Return on equity

E)Equity multiplier

A)Cash ratio

B)Total asset turnover

C)EV multiple

D)Return on equity

E)Equity multiplier

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

21

Ratio analysis works best when evaluating the financial statements of two firms

A)in the same industry but located in different countries.

B)of differing sizes in the same industry.

C)with one being in a single line of business while the other is a conglomerate.

D)of the same size in differing industries.

E)when both are conglomerates with varying lines of business.

A)in the same industry but located in different countries.

B)of differing sizes in the same industry.

C)with one being in a single line of business while the other is a conglomerate.

D)of the same size in differing industries.

E)when both are conglomerates with varying lines of business.

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

22

Which ratio calculates the amount of sales generated by each $1 of debt and equity invested in the firm?

A)Total asset turnover

B)Return on equity

C)Return on assets

D)Equity multiplier

E)DuPont identity

A)Total asset turnover

B)Return on equity

C)Return on assets

D)Equity multiplier

E)DuPont identity

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

23

Which ratio computes the amount of net income generated by each $1 of sales?

A)EV multiple

B)Return on assets

C)Return on equity

D)Profit margin

E)Price-earnings ratio

A)EV multiple

B)Return on assets

C)Return on equity

D)Profit margin

E)Price-earnings ratio

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

24

The amount shareholders are willing to pay for each $1 per share of annual earnings a firm generates is indicated by the

A)equity multiplier.

B)return on equity.

C)price-earnings ratio.

D)DuPont identity.

E)return on assets.

A)equity multiplier.

B)return on equity.

C)price-earnings ratio.

D)DuPont identity.

E)return on assets.

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

25

The return on equity can be calculated as

A)Profit margin × 1 / Capital intensity ratio × Equity multiplier

B)Return on assets × b

C)Profit margin × Total asset turnover × Debt-equity ratio

D)Profit margin × 1 / Equity multiplier × (1 + Debt-equity ratio)

E)Return on assets × Debt-equity ratio

A)Profit margin × 1 / Capital intensity ratio × Equity multiplier

B)Return on assets × b

C)Profit margin × Total asset turnover × Debt-equity ratio

D)Profit margin × 1 / Equity multiplier × (1 + Debt-equity ratio)

E)Return on assets × Debt-equity ratio

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

26

Which one of these measures a firm's operating and asset use efficiency as well as its financial leverage?

A)Equity multiplier

B)Capital intensity ratio

C)DuPont identity

D)Profit margin

E)Return on assets

A)Equity multiplier

B)Capital intensity ratio

C)DuPont identity

D)Profit margin

E)Return on assets

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

27

Which one of these is calculated as: 365 / (Cost of goods sold / Inventory)?

A)Total asset turnover

B)Inventory turnover

C)Days sales in receivables

D)Days sales in inventory

E)Capital intensity ratio

A)Total asset turnover

B)Inventory turnover

C)Days sales in receivables

D)Days sales in inventory

E)Capital intensity ratio

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

28

If a firm decreases its operating costs,all else constant,then

A)the profit margin increases while the cash coverage ratio decreases.

B)the return on assets increases while the return on equity decreases.

C)both the return on assets and the return on equity increase.

D)both the profit margin and the equity multiplier increase.

E)the total asset turnover rate decreases while the profit margin increases.

A)the profit margin increases while the cash coverage ratio decreases.

B)the return on assets increases while the return on equity decreases.

C)both the return on assets and the return on equity increase.

D)both the profit margin and the equity multiplier increase.

E)the total asset turnover rate decreases while the profit margin increases.

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

29

The only difference between Joe's and Moe's is that Joe's has old,fully depreciated equipment.Moe's just purchased all new equipment that will be depreciated over 8 years.Assuming all else equal,

A)Joe's will have a lower profit margin.

B)Joe's will have a lower return on equity.

C)Moe's will have a higher net income.

D)Moe's will have a lower profit margin.

E)Moe's will have a higher return on assets.

A)Joe's will have a lower profit margin.

B)Joe's will have a lower return on equity.

C)Moe's will have a higher net income.

D)Moe's will have a lower profit margin.

E)Moe's will have a higher return on assets.

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

30

Ratios that measure how efficiently a firm uses its assets to generate sales are known as ________ ratios.

A)profitability

B)long-term solvency

C)short-term solvency

D)utilization

E)market value

A)profitability

B)long-term solvency

C)short-term solvency

D)utilization

E)market value

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

31

Firms with high enterprise value multiples are most apt to have

A)high growth opportunities.

B)low market-to-book ratios.

C)low profit margins.

D)low inventory turnover rates.

E)a low price-earnings ratio.

A)high growth opportunities.

B)low market-to-book ratios.

C)low profit margins.

D)low inventory turnover rates.

E)a low price-earnings ratio.

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

32

The return on equity can be calculated as

A)Profit margin × 1 / Total asset turnover × Equity multiplier

B)Return on assets × Profit margin

C)Profit margin × Capital intensity ratio × Debt-equity ratio

D)Profit margin × 1 / Equity multiplier × (1 + Debt-equity ratio)

E)Return on assets × (1 + Debt-equity ratio)

A)Profit margin × 1 / Total asset turnover × Equity multiplier

B)Return on assets × Profit margin

C)Profit margin × Capital intensity ratio × Debt-equity ratio

D)Profit margin × 1 / Equity multiplier × (1 + Debt-equity ratio)

E)Return on assets × (1 + Debt-equity ratio)

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

33

Last year,Bennett's had a PE ratio of 5.4.This year,the PE ratio is 4.9.Based on this information,it can be stated with absolute certainty that

A)the price per share increased.

B)the earnings per share decreased.

C)either the price per share,the earnings per share,or both,changed.

D)investors are receiving a lower rate of return this year.

E)investors are paying a lower price for each share of stock purchased.

A)the price per share increased.

B)the earnings per share decreased.

C)either the price per share,the earnings per share,or both,changed.

D)investors are receiving a lower rate of return this year.

E)investors are paying a lower price for each share of stock purchased.

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

34

Which of the following represent problems encountered when comparing the financial statements of one firm with those of another firm?

I.The firms may have unrelated lines of business.

II.The operations of the two firms may vary geographically.

III.The firms may use differing accounting methods.

IV.The two firms may be regulated differently.

A)I and II only

B)II and III only

C)I,III,and IV only

D)I,II,and III only

E)I,II,III,and IV

I.The firms may have unrelated lines of business.

II.The operations of the two firms may vary geographically.

III.The firms may use differing accounting methods.

IV.The two firms may be regulated differently.

A)I and II only

B)II and III only

C)I,III,and IV only

D)I,II,and III only

E)I,II,III,and IV

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

35

The enterprise value estimates the

A)current market value of a firm's entire outstanding shares of common and preferred stock.

B)cash required to purchase all of a firm's outstanding stock and pay off the interest-bearing debt.

C)current market value of all a firm's outstanding debt.

D)relationship between the current market value and the book value of a firm.

E)total current market value of a firm's outstanding shares of common stock.

A)current market value of a firm's entire outstanding shares of common and preferred stock.

B)cash required to purchase all of a firm's outstanding stock and pay off the interest-bearing debt.

C)current market value of all a firm's outstanding debt.

D)relationship between the current market value and the book value of a firm.

E)total current market value of a firm's outstanding shares of common stock.

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

36

Which ratio measures the number of times a firm lends money to customers,collects that money,and relends it within a year?

A)Total asset turnover

B)Days' sales in receivables

C)Total debt ratio

D)Receivables turnover

E)Quick ratio

A)Total asset turnover

B)Days' sales in receivables

C)Total debt ratio

D)Receivables turnover

E)Quick ratio

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

37

Assume a firm is operating at full capacity.Which one of these accounts is least apt to vary directly with sales?

A)Inventory

B)Cash

C)Long-term debt

D)Accounts payable

E)Fixed assets

A)Inventory

B)Cash

C)Long-term debt

D)Accounts payable

E)Fixed assets

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

38

Which portion of the DuPont identity measures the financial leverage employed by a firm?

A)Both the profit margin and the equity multiplier

B)Equity multiplier

C)Total asset turnover

D)Both the capital intensity ratio and the total asset turnover

E)Both the capital intensity ratio and the debt-equity ratio

A)Both the profit margin and the equity multiplier

B)Equity multiplier

C)Total asset turnover

D)Both the capital intensity ratio and the total asset turnover

E)Both the capital intensity ratio and the debt-equity ratio

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

39

Enterprise value is computed as

A)Price per share × Shares outstanding - Cash

B)Market capitalization + Market value of interest-bearing debt - Cash

C)Market capitalization - Market value of interest-bearing debt

D)Price per share × Number of shares outstanding

E)Market capitalization + Market value of all debt - Cash

A)Price per share × Shares outstanding - Cash

B)Market capitalization + Market value of interest-bearing debt - Cash

C)Market capitalization - Market value of interest-bearing debt

D)Price per share × Number of shares outstanding

E)Market capitalization + Market value of all debt - Cash

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

40

Yesterday,ABC stock sold for $28 a share.Today,the overall market fell,and ABC stock is now selling for $22 a share.Which of these ratios for ABC will be affected by this market reaction? Assume all else is held constant.

A)Enterprise value multiple and price-earnings ratio

B)Earnings per share and price-earnings ratio

C)Return on equity and return on assets

D)Return on book equity and market-to-book ratio

E)Price-earnings ratio and return on book equity

A)Enterprise value multiple and price-earnings ratio

B)Earnings per share and price-earnings ratio

C)Return on equity and return on assets

D)Return on book equity and market-to-book ratio

E)Price-earnings ratio and return on book equity

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

41

The internal rate of growth is based on the assumption that

A)no dividends are paid.

B)no external funding of any type is obtained.

C)the return on equity is held constant.

D)the only additional outside capital obtained is long-term debt.

E)the debt-equity ratio is held constant.

A)no dividends are paid.

B)no external funding of any type is obtained.

C)the return on equity is held constant.

D)the only additional outside capital obtained is long-term debt.

E)the debt-equity ratio is held constant.

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

42

A firm has sales of $3,900,net income of $1,304,total assets of $4,200,and total equity of $2,850.Interest expense is $80.What is the common-size statement value of the interest expense?

A)1.90%

B)5.10%

C)2.05%

D)8.18%

E)6.13%

A)1.90%

B)5.10%

C)2.05%

D)8.18%

E)6.13%

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

43

If a non-dividend-paying firm bases its growth assumptions on the sustainable rate of growth and shows positive net income,then the pro forma statement must reflect

A)an increase in fixed assets irrespective of the firm's current operating capacity.

B)an increase in both sales and the debt-equity ratio.

C)both an increase in the total asset turnover and in the equity multiplier.

D)a constant debt-equity ratio and an increase in retained earnings.

E)increases in fixed assets,the debt-equity ratio,and the number of shares outstanding.

A)an increase in fixed assets irrespective of the firm's current operating capacity.

B)an increase in both sales and the debt-equity ratio.

C)both an increase in the total asset turnover and in the equity multiplier.

D)a constant debt-equity ratio and an increase in retained earnings.

E)increases in fixed assets,the debt-equity ratio,and the number of shares outstanding.

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

44

When creating pro forma statements,the changes in the liabilities and owners' equity sections depend primarily on the firm's

A)financing policies.

B)interest rates and financing policies.

C)dividend and financing policies.

D)retained earnings policies.

E)rate of sales growth.

A)financing policies.

B)interest rates and financing policies.

C)dividend and financing policies.

D)retained earnings policies.

E)rate of sales growth.

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

45

Blue Mountain Foods has net fixed assets of $89,700 and current assets of $38,400,of which $21,400 is inventory.What is the common-size statement value of inventory?

A)23.86%

B)18.56%

C)16.71%

D)55.73%

E)24.71%

A)23.86%

B)18.56%

C)16.71%

D)55.73%

E)24.71%

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

46

For a dividend paying firm,how is the projected addition to retained earnings calculated using the percentage of sales approach?

A)Net income × (1 - Retention ratio)

B)Net income × (1 - Dividend payout ratio)

C)(Cash dividends / Net income)× (New sales / Old sales)

D)(Retained earnings / Sales)× (New Sales / Old Sales)

E)Net income × (New Sales / Old Sales)

A)Net income × (1 - Retention ratio)

B)Net income × (1 - Dividend payout ratio)

C)(Cash dividends / Net income)× (New sales / Old sales)

D)(Retained earnings / Sales)× (New Sales / Old Sales)

E)Net income × (New Sales / Old Sales)

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

47

The Golden Slipper has sales of $487,900,EBIT of $128,650,taxes of 35 percent,interest paid of $12,400,and a dividend payout ratio of 40 percent.What is the common-size ratio of the addition to retained earnings?

A)10.31%

B)9.29%

C)14.43%

D)11.74%

E)6.87%

A)10.31%

B)9.29%

C)14.43%

D)11.74%

E)6.87%

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

48

The sustainable rate of growth can be increased by

A)decreasing the equity multiplier.

B)increasing the profit margin.

C)decreasing the debt-equity ratio.

D)increasing the dividend payout ratio.

E)increasing the capital intensity ratio.

A)decreasing the equity multiplier.

B)increasing the profit margin.

C)decreasing the debt-equity ratio.

D)increasing the dividend payout ratio.

E)increasing the capital intensity ratio.

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

49

Financial planning,when properly executed

A)helps ensure that adequate financing is in place to support the desired level of growth.

B)ensures that the primary goals of senior management are fully achieved.

C)reduces the necessity of daily management oversight of the business operations.

D)ignores the normal restraints encountered by a firm.

E)eliminates the need to plan more than 1 year in advance.

A)helps ensure that adequate financing is in place to support the desired level of growth.

B)ensures that the primary goals of senior management are fully achieved.

C)reduces the necessity of daily management oversight of the business operations.

D)ignores the normal restraints encountered by a firm.

E)eliminates the need to plan more than 1 year in advance.

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

50

Which one of these combinations will provide sufficient information to determine the sustainable growth rate of a firm?

A)Profit margin,total asset turnover,and the price-earnings ratio

B)Profit margin,dividend payout ratio,debt-equity ratio,and total asset turnover

C)Return on assets and the retention ratio

D)Return on assets,capital intensity ratio,and the retention ratio

E)Profit margin,total asset turnover,return on assets,and debt-equity ratio

A)Profit margin,total asset turnover,and the price-earnings ratio

B)Profit margin,dividend payout ratio,debt-equity ratio,and total asset turnover

C)Return on assets and the retention ratio

D)Return on assets,capital intensity ratio,and the retention ratio

E)Profit margin,total asset turnover,return on assets,and debt-equity ratio

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

51

A firm has a debt-equity ratio of 0.36.What is the total debt ratio?

A)0.26

B)0.29

C)0.67

D)0.71

E)0.74

A)0.26

B)0.29

C)0.67

D)0.71

E)0.74

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

52

A firm has sales of $215,600,costs of $124,800,interest paid of $3,600,and depreciation of $11,400.The tax rate is 34 percent.What is the value of the cash coverage ratio?

A)24.22 times

B)17.06 times

C)21.06 times

D)25.22 times

E)16.47 times

A)24.22 times

B)17.06 times

C)21.06 times

D)25.22 times

E)16.47 times

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

53

Les' Motors has sales of $482,800,cost of goods sold of $297,400,inventory of $169,600,and accounts receivable of $52,900.How many days,on average,does it take the firm to sell its inventory and collect payment on that sale?

A)265.27 days

B)185.20 days

C)248.14 days

D)138.22 days

E)284.67 days

A)265.27 days

B)185.20 days

C)248.14 days

D)138.22 days

E)284.67 days

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

54

Burnside's has accounts receivable of $42,600,inventory of $97,200,sales of $614,200,and cost of goods sold of $298,400.How long does it take the firm to sell its inventory and collect payment on the sale?

A)107.14 days

B)136.06 days

C)127.78 days

D)144.21 days

E)115.52 days

A)107.14 days

B)136.06 days

C)127.78 days

D)144.21 days

E)115.52 days

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

55

Vaun's Pet Store paid $24,300 in interest and $32,000 in dividends last year.The times interest earned ratio is 4.1,and the depreciation expense is $126,200.What is the value of the cash coverage ratio?

A)8.77 times

B)5.19 times

C)7.75 times

D)9.29 times

E)8.20 times

A)8.77 times

B)5.19 times

C)7.75 times

D)9.29 times

E)8.20 times

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

56

Jessica's Boutique has cash of $687,accounts receivable of $1,419,accounts payable of $1,308,and inventory of $2,609.What is the value of the quick ratio?

A).53 times

B)3.60 times

C).48 times

D)1.84 times

E)1.61 times

A).53 times

B)3.60 times

C).48 times

D)1.84 times

E)1.61 times

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

57

Jensen's Boats has sales of $416,800,cost of goods sold of $234,600,depreciation of $41,200,and selling and general costs of $37,900.The firm has a loan balance of $92,400 with an interest rate of 6.7 percent.What is the value of EBITDA?

A)$103,100

B)$121,600

C)$144,300

D)$185,500

E)$162,900

A)$103,100

B)$121,600

C)$144,300

D)$185,500

E)$162,900

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

58

When creating pro forma statements,the external financing need will increase if you

A)increase the corporate tax rate.

B)decrease the dividend payout ratio.

C)increase the plowback ratio.

D)decrease the rate of sales growth.

E)decrease the projected level of sales.

A)increase the corporate tax rate.

B)decrease the dividend payout ratio.

C)increase the plowback ratio.

D)decrease the rate of sales growth.

E)decrease the projected level of sales.

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

59

A firm has total debt of $2,200 and a debt-equity ratio of 0.32.What is the value of the total assets?

A)$2,904

B)$4,675

C)$9,075

D)$6,875

E)$7,225

A)$2,904

B)$4,675

C)$9,075

D)$6,875

E)$7,225

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

60

Lancaster Bakery has net fixed assets of $329,700,current assets of $87,200,a price-earnings ratio of 12.8,a debt-equity ratio of 0.42,and earnings per share of $1.97.What is the market-to-book ratio if there are 36,000 shares of stock outstanding?

A)3.09 times

B)2.79 times

C)2.24 times

D)3.46 times

E)3.80 times

A)3.09 times

B)2.79 times

C)2.24 times

D)3.46 times

E)3.80 times

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

61

Cellar Wines has a debt-equity ratio of 0.54,sales of $728,700,net income of $94,900,and total debt of $382,000.What is the return on equity?

A)16.67%

B)9.05%

C)10.75%

D)15.50%

E)13.42%

A)16.67%

B)9.05%

C)10.75%

D)15.50%

E)13.42%

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

62

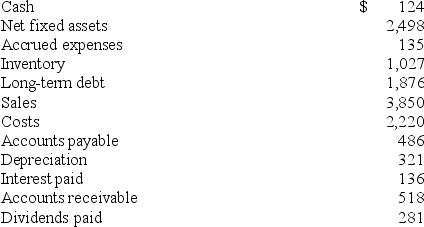

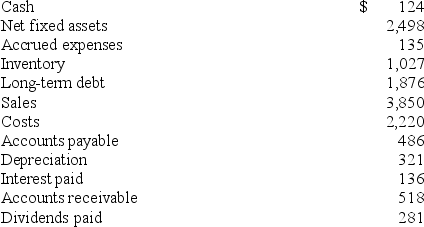

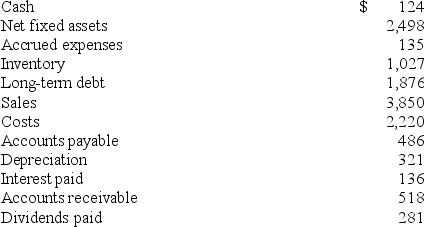

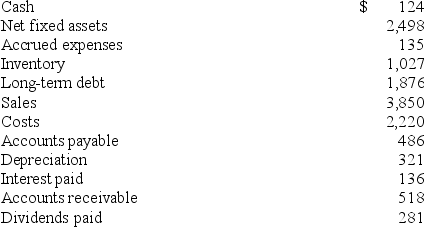

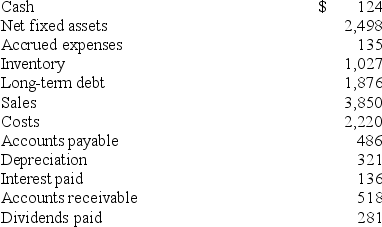

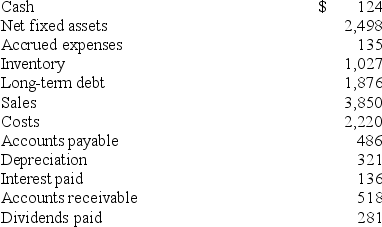

You have obtained the following information for Blue Bell Farms.The tax rate is 34 percent.

What is the days' sales in receivables?

A)35.17 days

B)46.17 days

C)48.30 days

D)49.11 days

E)36.01 days

What is the days' sales in receivables?

A)35.17 days

B)46.17 days

C)48.30 days

D)49.11 days

E)36.01 days

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

63

Patti's has net income of $87,300,a price-earnings ratio of 11.8,and earnings per share of $1.13.How many shares of stock are outstanding?

A)6,547 shares

B)38,690 shares

C)77,257 shares

D)93,590 shares

E)8,750 shares

A)6,547 shares

B)38,690 shares

C)77,257 shares

D)93,590 shares

E)8,750 shares

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

64

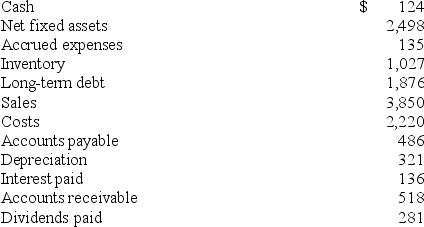

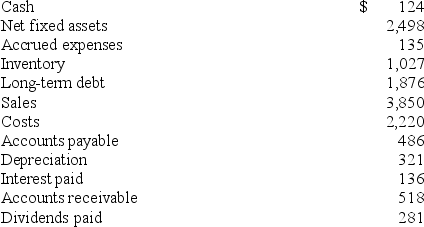

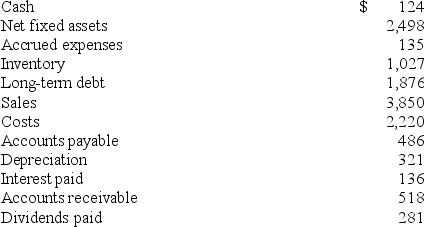

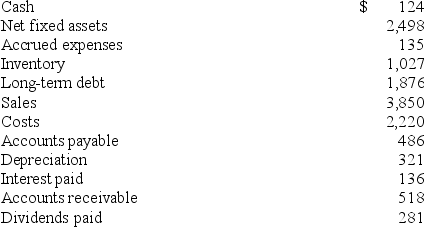

You have obtained the following information for Blue Bell Farms.The tax rate is 34 percent.

What is the equity multiplier?

A)2.31 times

B)1.93 times

C)2.50 times

D)2.08 times

E)1.59 times

What is the equity multiplier?

A)2.31 times

B)1.93 times

C)2.50 times

D)2.08 times

E)1.59 times

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

65

Western Wear has net working capital of $5,200,net fixed assets of $128,000,sales of $114,000,and current liabilities of $9,800.From each $1 in total assets,the firm generates sales of

A)$1.25

B)$1.52

C)$0.80

D)$0.66

E)$1.29

A)$1.25

B)$1.52

C)$0.80

D)$0.66

E)$1.29

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

66

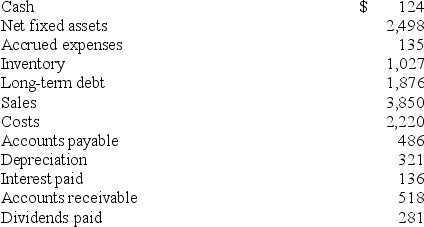

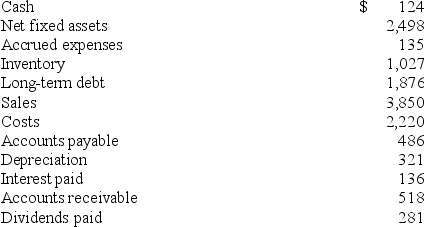

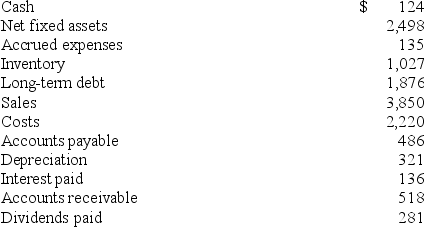

You have obtained the following information for Blue Bell Farms.The tax rate is 34 percent.

What is the debt-equity ratio?

A)0.75 times

B)1.33 times

C)1.50 times

D)0.98 times

E)1.22 times

What is the debt-equity ratio?

A)0.75 times

B)1.33 times

C)1.50 times

D)0.98 times

E)1.22 times

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

67

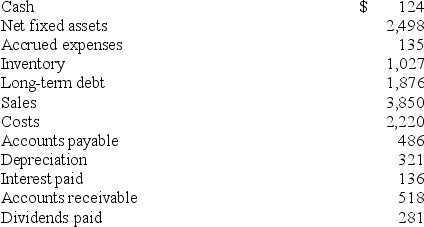

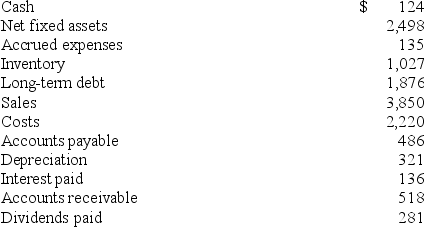

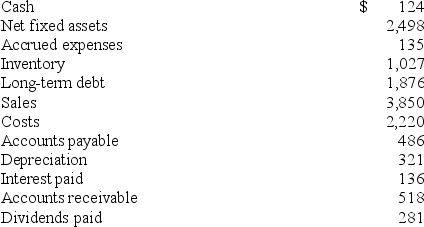

You have obtained the following information for Blue Bell Farms.The tax rate is 34 percent.

What is the total asset turnover?

A)0.86 times

B)1.17 times

C)1.39 times

D)0.92 times

E)1.05 times

What is the total asset turnover?

A)0.86 times

B)1.17 times

C)1.39 times

D)0.92 times

E)1.05 times

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

68

Marcel's has a debt-equity ratio of 0.32,a capital intensity ratio of 1.02,and a profit margin of 6.7 percent.What is the return on equity?

A)8.67%

B)7.89%

C)13.13%

D)14.57%

E)12.47%

A)8.67%

B)7.89%

C)13.13%

D)14.57%

E)12.47%

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

69

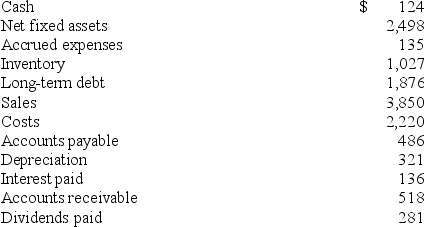

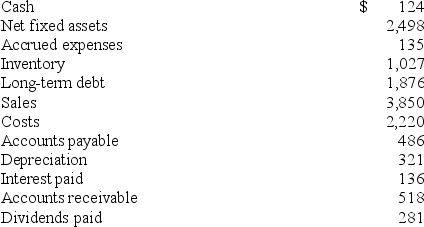

You have obtained the following information for Blue Bell Farms.The tax rate is 34 percent.

What is the cash coverage ratio?

A)7.90 times

B)12.04 times

C)11.99 times

D)9.63 times

E)13.67 times

What is the cash coverage ratio?

A)7.90 times

B)12.04 times

C)11.99 times

D)9.63 times

E)13.67 times

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

70

You have obtained the following information for Blue Bell Farms.The tax rate is 34 percent.

What is the times interest earned ratio?

A)9.78 times

B)7.29 times

C)8.63 times

D)8.33 times

E)9.63 times

What is the times interest earned ratio?

A)9.78 times

B)7.29 times

C)8.63 times

D)8.33 times

E)9.63 times

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

71

You have obtained the following information for Blue Bell Farms.The tax rate is 34 percent.

What is the return on equity?

A)46.36%

B)42.74%

C)25.12%

D)18.42%

E)6.67%

What is the return on equity?

A)46.36%

B)42.74%

C)25.12%

D)18.42%

E)6.67%

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

72

You have obtained the following information for Blue Bell Farms.The tax rate is 34 percent.

What is the profit margin?

A)20.11%

B)4.58%

C)9.78%

D)7.30%

E)14.29%

What is the profit margin?

A)20.11%

B)4.58%

C)9.78%

D)7.30%

E)14.29%

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

73

Southern Markets has a profit margin of 4.2 percent,a return on assets of 9.7 percent,and a debt-equity ratio of 0.51.What is the return on equity?

A)18.33%

B)13.49%

C)11.28%

D)14.65%

E)16.16%

A)18.33%

B)13.49%

C)11.28%

D)14.65%

E)16.16%

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

74

Nelson Farms has 6,500 shares of stock outstanding,with a market value of $13.30 a share,and $31,000 of long-term debt,bearing an interest rate of 7.1 percent.Current assets consist of $1,600 in cash,$15,700 in accounts receivable,and $42,900 in inventory.Accounts payable are $11,300.What is the firm's enterprise value?

A)$121,600

B)$115,850

C)$157,600

D)$184,250

E)$117,450

A)$121,600

B)$115,850

C)$157,600

D)$184,250

E)$117,450

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

75

Supra's has sales of $919,800,total assets of $949,200,a profit margin of 7.3 percent,and a total debt ratio of 0.48.What is the return on equity?

A)14.74%

B)13.60%

C)8.71%

D)10.22%

E)16.49%

A)14.74%

B)13.60%

C)8.71%

D)10.22%

E)16.49%

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

76

Rosario's has sales of $219,600,total debt of $54,800,total equity of $109,400,and a profit margin of 7.2 percent.What is the return on assets?

A)6.21%

B)9.63%

C)7.39%

D)8.37%

E)7.97%

A)6.21%

B)9.63%

C)7.39%

D)8.37%

E)7.97%

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

77

The Cycle Shop has sales of $372,400 and a profit margin of 6.1 percent.There are 12,000 shares of stock outstanding with a market price per share of $8.64.What is the price-earnings ratio?

A)8.47

B)3.59

C)9.09

D)4.56

E)3.64

A)8.47

B)3.59

C)9.09

D)4.56

E)3.64

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

78

A firm has 4,250 shares of stock outstanding with a market value of $16.65 a share,$64,800 of long-term debt with an interest rate of 7.5 percent,$21,900 of short-term debt,cash on hand of $5,200,sales of $213,000,costs of $126,200,and depreciation of $13,400.The tax rate is 35 percent.What is the enterprise value multiple?

A)1.50 times

B)1.67 times

C)2.33 times

D)2.18 times

E)1.92 times

A)1.50 times

B)1.67 times

C)2.33 times

D)2.18 times

E)1.92 times

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

79

You have obtained the following information for Blue Bell Farms.The tax rate is 34 percent.

What is the quick ratio?

A)1.03 times

B)1.26 times

C)0.96 times

D)0.82 times

E)1.08 times

What is the quick ratio?

A)1.03 times

B)1.26 times

C)0.96 times

D)0.82 times

E)1.08 times

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

80

A firm has 21,000 shares of stock outstanding,sales of $927,000,a profit margin of 4.8 percent,a price-earnings ratio of 6.2,and a book value per share of $5.80.What is the market-to-book ratio?

A)1.67 times

B)3.98 times

C)4.27 times

D)3.29 times

E)2.26 times

A)1.67 times

B)3.98 times

C)4.27 times

D)3.29 times

E)2.26 times

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck