Deck 23: Futures, Swaps, and Risk Management

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/56

Play

Full screen (f)

Deck 23: Futures, Swaps, and Risk Management

1

If you purchased one S&P 500 Index futures contract at a price of 1,550 and closed your position when the index futures was 1,547, you incurred:

A)a loss of $1,500.

B)a gain of $1,500.

C)a loss of $750.

D)a gain of $750.

E)None of the options

A)a loss of $1,500.

B)a gain of $1,500.

C)a loss of $750.

D)a gain of $750.

E)None of the options

C

Explanation: (-$15500 + $1547) × 250 = - $750.

Explanation: (-$15500 + $1547) × 250 = - $750.

2

Which one of the following stock index futures has a multiplier of $100 times the index value

A)Russell 2000

B)FTSE 100

C)S&P Mid-Cap

D)DAX-30

E)Russell 2000 and S&P Mid-Cap

A)Russell 2000

B)FTSE 100

C)S&P Mid-Cap

D)DAX-30

E)Russell 2000 and S&P Mid-Cap

A

Explanation: The multiplier is used to calculate contract settlements.See Table 23.1.

Explanation: The multiplier is used to calculate contract settlements.See Table 23.1.

3

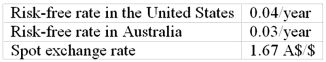

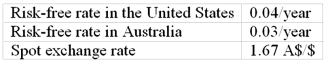

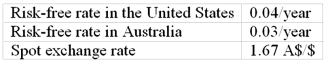

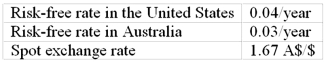

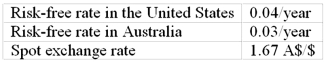

Consider the following:  If the market futures price is 1.69 A$/$, how could you arbitrage

If the market futures price is 1.69 A$/$, how could you arbitrage

A)Borrow Australian dollars in Australia, convert them to dollars, lend the proceeds in the United States, and enter futures positions to purchase Australian dollars at the current futures price.

B)Borrow U.S.dollars in the United States, convert them to Australian dollars, lend the proceeds in Australia, and enter futures positions to sell Australian dollars at the current futures price.

C)Borrow U.S.dollars in the United States and invest them in the U.S.and enter futures positions to purchase Australian dollars at the current futures price.

D)Borrow Australian dollars in Australia and invest them there, then convert back to U.S.dollars at the spot price.

E)There is no arbitrage opportunity.

If the market futures price is 1.69 A$/$, how could you arbitrage

If the market futures price is 1.69 A$/$, how could you arbitrageA)Borrow Australian dollars in Australia, convert them to dollars, lend the proceeds in the United States, and enter futures positions to purchase Australian dollars at the current futures price.

B)Borrow U.S.dollars in the United States, convert them to Australian dollars, lend the proceeds in Australia, and enter futures positions to sell Australian dollars at the current futures price.

C)Borrow U.S.dollars in the United States and invest them in the U.S.and enter futures positions to purchase Australian dollars at the current futures price.

D)Borrow Australian dollars in Australia and invest them there, then convert back to U.S.dollars at the spot price.

E)There is no arbitrage opportunity.

A

Explanation: 0.5988(1.04) - 0.5917(1.03) = 0.013301; when this relationship is positive; action a will result in arbitrage profits.

Explanation: 0.5988(1.04) - 0.5917(1.03) = 0.013301; when this relationship is positive; action a will result in arbitrage profits.

4

Which one of the following stock index futures has a multiplier of 50 Hong Kong dollars times the index

A)FTSE 100

B)Hang Seng

C)Nikkei

D)DAX-30

E)FTSE 100 and Hang Seng

A)FTSE 100

B)Hang Seng

C)Nikkei

D)DAX-30

E)FTSE 100 and Hang Seng

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

5

Which one of the following stock index futures has a multiplier of $250 times the index value

A)Russell 2000

B)S&P 500 Index

C)Nikkei

D)DAX-30

E)NASDAQ 100

A)Russell 2000

B)S&P 500 Index

C)Nikkei

D)DAX-30

E)NASDAQ 100

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

6

Which one of the following stock index futures has a multiplier of 10 euros times the index

A)CAC 40

B)Hang Seng

C)Nikkei

D)DAX-30

E)CAC 40 and Hang Seng

A)CAC 40

B)Hang Seng

C)Nikkei

D)DAX-30

E)CAC 40 and Hang Seng

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

7

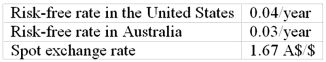

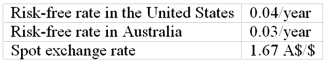

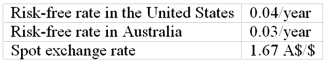

Consider the following:  Assume the current market futures price is 1.66 A$/$.You borrow 167,000 A$ and convert the proceeds to U.S.dollars and invest them in the U.S.at the risk-free rate.You simultaneously enter a contract to purchase 170,340 A$ at the current futures prices (maturity of 1 year).What would be your profit (loss)

Assume the current market futures price is 1.66 A$/$.You borrow 167,000 A$ and convert the proceeds to U.S.dollars and invest them in the U.S.at the risk-free rate.You simultaneously enter a contract to purchase 170,340 A$ at the current futures prices (maturity of 1 year).What would be your profit (loss)

A)Profit of 630 A$

B)Loss of 2300 A$

C)Profit of 2300 A$

D)Loss of 630 A$

Assume the current market futures price is 1.66 A$/$.You borrow 167,000 A$ and convert the proceeds to U.S.dollars and invest them in the U.S.at the risk-free rate.You simultaneously enter a contract to purchase 170,340 A$ at the current futures prices (maturity of 1 year).What would be your profit (loss)

Assume the current market futures price is 1.66 A$/$.You borrow 167,000 A$ and convert the proceeds to U.S.dollars and invest them in the U.S.at the risk-free rate.You simultaneously enter a contract to purchase 170,340 A$ at the current futures prices (maturity of 1 year).What would be your profit (loss)A)Profit of 630 A$

B)Loss of 2300 A$

C)Profit of 2300 A$

D)Loss of 630 A$

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

8

If you took a short position in two S&P 500 futures contracts at a price of 1,510 and closed the position when the index futures was 1,492, you incurred

A)a gain of $9,000.

B)a loss of $9,000.

C)a loss of $18,000.

D)a gain of $18,000.

E)None of the options

A)a gain of $9,000.

B)a loss of $9,000.

C)a loss of $18,000.

D)a gain of $18,000.

E)None of the options

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

9

Which one of the following stock index futures has a multiplier of $100 times the index value

A)CAC 40

B)S&P 500 Index

C)Nikkei

D)DAX-30

E)NASDAQ 100

A)CAC 40

B)S&P 500 Index

C)Nikkei

D)DAX-30

E)NASDAQ 100

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

10

Consider the following:  If the futures market price is 1.63 A$/$, how could you arbitrage

If the futures market price is 1.63 A$/$, how could you arbitrage

A)Borrow Australian dollars in Australia, convert them to dollars, lend the proceeds in the United States, and enter futures positions to purchase Australian dollars at the current futures price.

B)Borrow U.S.dollars in the United States, convert them to Australian dollars, lend the proceeds in Australia, and enter futures positions to sell Australian dollars at the current futures price.

C)Borrow U.S.dollars in the United States and invest them in the U.S.and enter futures positions to purchase Australian dollars at the current futures price.

D)Borrow Australian dollars in Australia and invest them there, then convert back to U.S.dollars at the spot price.

E)There is no arbitrage opportunity.

If the futures market price is 1.63 A$/$, how could you arbitrage

If the futures market price is 1.63 A$/$, how could you arbitrageA)Borrow Australian dollars in Australia, convert them to dollars, lend the proceeds in the United States, and enter futures positions to purchase Australian dollars at the current futures price.

B)Borrow U.S.dollars in the United States, convert them to Australian dollars, lend the proceeds in Australia, and enter futures positions to sell Australian dollars at the current futures price.

C)Borrow U.S.dollars in the United States and invest them in the U.S.and enter futures positions to purchase Australian dollars at the current futures price.

D)Borrow Australian dollars in Australia and invest them there, then convert back to U.S.dollars at the spot price.

E)There is no arbitrage opportunity.

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

11

Which one of the following stock index futures has a multiplier of $100 times the index value

A)Russell 2000

B)FTSE 100

C)Nikkei

D)NASDAQ 100

E)Russell 2000 and NASDAQ 100

A)Russell 2000

B)FTSE 100

C)Nikkei

D)NASDAQ 100

E)Russell 2000 and NASDAQ 100

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

12

If a stock index futures contract is overpriced, you would exploit this situation by

A)selling both the stock index futures and the stocks in the index.

B)selling the stock index futures and simultaneously buying the stocks in the index.

C)buying both the stock index futures and the stocks in the index.

D)buying the stock index futures and selling the stocks in the index.

E)None of the options

A)selling both the stock index futures and the stocks in the index.

B)selling the stock index futures and simultaneously buying the stocks in the index.

C)buying both the stock index futures and the stocks in the index.

D)buying the stock index futures and selling the stocks in the index.

E)None of the options

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

13

Which one of the following stock index futures has a multiplier of $10 times the index value

A)Russell 2000

B)Dow Jones Industrial Average

C)Nikkei

D)DAX-30

E)NASDAQ 100

A)Russell 2000

B)Dow Jones Industrial Average

C)Nikkei

D)DAX-30

E)NASDAQ 100

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

14

Foreign exchange futures markets are __________ and the foreign exchange forward markets are __________.

A)informal; formal

B)formal; formal

C)formal; informal

D)informal; informal

E)organized; unorganized

A)informal; formal

B)formal; formal

C)formal; informal

D)informal; informal

E)organized; unorganized

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

15

Consider the following:  What should be the proper futures price for a 1-year contract

What should be the proper futures price for a 1-year contract

A)1.703 A$/$

B)1.654 A$/$

C)1.638 A$/$

D)1.778 A$/$

E)1.686 A$/$

What should be the proper futures price for a 1-year contract

What should be the proper futures price for a 1-year contractA)1.703 A$/$

B)1.654 A$/$

C)1.638 A$/$

D)1.778 A$/$

E)1.686 A$/$

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

16

Suppose that the risk-free rates in the United States and in the United Kingdom are 4% and 6%, respectively.The spot exchange rate between the dollar and the pound is $1.60/BP.What should the futures price of the pound for a one-year contract be to prevent arbitrage opportunities, ignoring transactions costs

A)$1.60/BP

B)$1.70/BP

C)$1.66/BP

D)$1.63/BP

E)$1.57/BP

A)$1.60/BP

B)$1.70/BP

C)$1.66/BP

D)$1.63/BP

E)$1.57/BP

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

17

Which of the following is(are) example(s) of interest rate futures contracts

A)Corporate bonds

B)Treasury bonds

C)Eurodollars

D)Treasury bonds and Eurodollars

E)Corporate bonds and Treasury bonds

A)Corporate bonds

B)Treasury bonds

C)Eurodollars

D)Treasury bonds and Eurodollars

E)Corporate bonds and Treasury bonds

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

18

Suppose that the risk-free rates in the United States and in Japan are 5.25% and 4.5%, respectively.The spot exchange rate between the dollar and the yen is $0.008828/yen.What should the futures price of the yen for a one-year contract be to prevent arbitrage opportunities, ignoring transactions costs

A)$0.009999/yen

B)$0.009981/yen

C)$0.008981/yen

D)$0.008891/yen

A)$0.009999/yen

B)$0.009981/yen

C)$0.008981/yen

D)$0.008891/yen

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

19

Which one of the following stock index futures has a multiplier of 25 euros times the index

A)FTSE 100

B)Hang Seng

C)Nikkei

D)DAX-30

E)FTSE 100 and Hang Seng

A)FTSE 100

B)Hang Seng

C)Nikkei

D)DAX-30

E)FTSE 100 and Hang Seng

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

20

Suppose that the risk-free rates in the United States and in the United Kingdom are 5% and 4%, respectively.The spot exchange rate between the dollar and the pound is $1.80/BP.What should the futures price of the pound for a one-year contract be to prevent arbitrage opportunities, ignoring transactions costs

A)$1.62/BP

B)$1.72/BP

C)$1.82/BP

D)$1.92/BP

A)$1.62/BP

B)$1.72/BP

C)$1.82/BP

D)$1.92/BP

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

21

If you sold S&P 500 Index futures contract at a price of 950 and closed your position when the index futures was 947, you incurred:

A)a loss of $1,500.

B)a gain of $1,500.

C)a loss of $750.

D)a gain of $750.

E)None of the options

A)a loss of $1,500.

B)a gain of $1,500.

C)a loss of $750.

D)a gain of $750.

E)None of the options

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

22

The value of a futures contract for storable commodities can be determined by the _______ and the model __________ consistent with parity relationships.

A)CAPM; will be

B)CAPM; will not be

C)APT; will not be

D)APT; will be

E)CAPM and APT; will be

A)CAPM; will be

B)CAPM; will not be

C)APT; will not be

D)APT; will be

E)CAPM and APT; will be

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

23

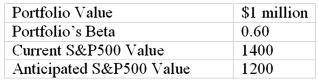

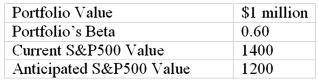

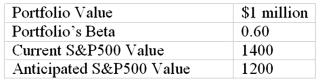

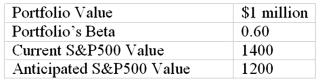

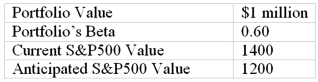

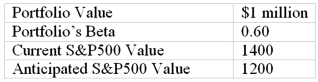

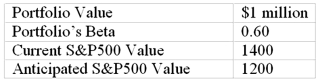

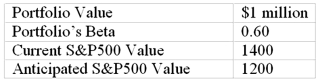

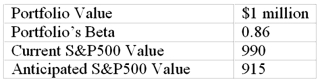

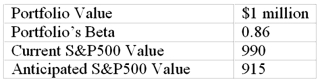

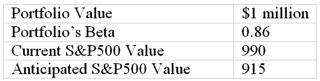

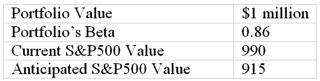

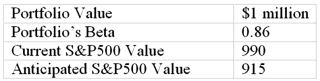

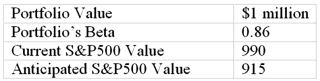

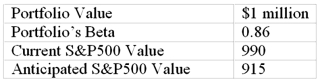

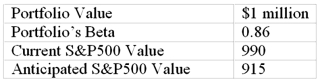

You are given the following information about a portfolio you are to manage.For the long-term you are bullish, but you think the market may fall over the next month.  For a 200-point drop in the S&P 500, by how much does the value of the futures position change

For a 200-point drop in the S&P 500, by how much does the value of the futures position change

A)$200,000

B)$50,000

C)$250,000

D)$500,000

E)$100,000

For a 200-point drop in the S&P 500, by how much does the value of the futures position change

For a 200-point drop in the S&P 500, by how much does the value of the futures position changeA)$200,000

B)$50,000

C)$250,000

D)$500,000

E)$100,000

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

24

Credit risk in the swap market

A)is extensive.

B)is limited to the difference between the values of the fixed rate and floating rate obligations.

C)is equal to the total value of the payments that the floating rate payer was obligated to make.

D)is extensive and equal to the total value of the payments that the floating rate payer was obligated to make.

E)None of the options

A)is extensive.

B)is limited to the difference between the values of the fixed rate and floating rate obligations.

C)is equal to the total value of the payments that the floating rate payer was obligated to make.

D)is extensive and equal to the total value of the payments that the floating rate payer was obligated to make.

E)None of the options

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

25

You are given the following information about a portfolio you are to manage.For the long-term you are bullish, but you think the market may fall over the next month.  How many contracts should you buy or sell to hedge your position Allow fractions of contracts in your answer.

How many contracts should you buy or sell to hedge your position Allow fractions of contracts in your answer.

A)sell 1.714

B)buy 1.714

C)sell 4.236

D)buy 4.236

E)sell 11.235

How many contracts should you buy or sell to hedge your position Allow fractions of contracts in your answer.

How many contracts should you buy or sell to hedge your position Allow fractions of contracts in your answer.A)sell 1.714

B)buy 1.714

C)sell 4.236

D)buy 4.236

E)sell 11.235

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

26

Which two indices had the lowest correlation between them during the 2008-2012 period

A)S&P and DJIA; the correlation was 0.979

B)S&P and NASDAQ 100; the correlation was 0.928

C)DJIA and Russell 2000 the correlation was 0.908

D)S&P and Russell 2000; the correlation was 0.948

E)NASDAQ 100 and DJIA; the correlation was 0.876

A)S&P and DJIA; the correlation was 0.979

B)S&P and NASDAQ 100; the correlation was 0.928

C)DJIA and Russell 2000 the correlation was 0.908

D)S&P and Russell 2000; the correlation was 0.948

E)NASDAQ 100 and DJIA; the correlation was 0.876

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

27

In the equation Profits = a + b × ($/₤ exchange rate), b is a measure of

A)the firm's beta when measured in terms of the foreign currency.

B)the ratio of the firm's beta in terms of dollars to the firm's beta in terms of pounds.

C)the sensitivity of profits to the exchange rate.

D)the sensitivity of the exchange rate to profits.

E)the frequency with which the exchange rate changes.

A)the firm's beta when measured in terms of the foreign currency.

B)the ratio of the firm's beta in terms of dollars to the firm's beta in terms of pounds.

C)the sensitivity of profits to the exchange rate.

D)the sensitivity of the exchange rate to profits.

E)the frequency with which the exchange rate changes.

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

28

Hedging one commodity by using a futures contract on another commodity is called

A)surrogate hedging.

B)cross hedging.

C)alternative hedging.

D)correlative hedging.

E)proxy hedging.

A)surrogate hedging.

B)cross hedging.

C)alternative hedging.

D)correlative hedging.

E)proxy hedging.

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

29

If you took a short position in three S&P 500 futures contracts at a price of 900 and closed the position when the index futures was 885, you incurred:

A)a gain of $11,250.

B)a loss of $11,250.

C)a loss of $8,000.

D)a gain of $8,000.

E)None of the options

A)a gain of $11,250.

B)a loss of $11,250.

C)a loss of $8,000.

D)a gain of $8,000.

E)None of the options

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

30

One reason swaps are desirable is that

A)they are free of credit risk.

B)they have no transactions costs.

C)they increase interest rate volatility.

D)they increase interest rate risk.

E)they offer participants easy ways to restructure their balance sheets.

A)they are free of credit risk.

B)they have no transactions costs.

C)they increase interest rate volatility.

D)they increase interest rate risk.

E)they offer participants easy ways to restructure their balance sheets.

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

31

You hold a $50 million portfolio of par value bonds with a coupon rate of 10% paid annually and 15 years to maturity.How many T-bond futures contracts do you need to hedge the portfolio against an unanticipated change in the interest rate of 0.18% Assume the market interest rate is 10% and that T-bond futures contracts call for delivery of an 8% coupon (paid annually), 20-year maturity T-bond.

A)398 contracts long

B)524 contracts short

C)1048 contracts short

D)398 contracts short

A)398 contracts long

B)524 contracts short

C)1048 contracts short

D)398 contracts short

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

32

Suppose that the risk-free rates in the United States and in the Canada are 5% and 3%, respectively.The spot exchange rate between the dollar and the Canadian dollar (C$) is $0.80/C$.What should the futures price of the C$ for a one-year contract be to prevent arbitrage opportunities, ignoring transactions costs.

A)$1.00/C$

B)$0.82/ C$

C)$0.88/ C$

D)$0.78/ C$

E)$1.22/ C$

A)$1.00/C$

B)$0.82/ C$

C)$0.88/ C$

D)$0.78/ C$

E)$1.22/ C$

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

33

Commodity futures pricing

A)must be related to spot prices.

B)includes cost of carry.

C)converges to spot prices at maturity.

D)All of these

E)None of the options

A)must be related to spot prices.

B)includes cost of carry.

C)converges to spot prices at maturity.

D)All of these

E)None of the options

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

34

Which two indices had the highest correlation between them during the 2008-2012 period

A)S&P and DJIA; the correlation was 0.979

B)S&P and Russell 2000; the correlation was 0.948

C)DJIA and Russell 2000; the correlation was 0.908

D)S&P and NASDAQ 100; the correlation was 0.928

E)NASDAQ 100 and DJIA; the correlation was 0.876

A)S&P and DJIA; the correlation was 0.979

B)S&P and Russell 2000; the correlation was 0.948

C)DJIA and Russell 2000; the correlation was 0.908

D)S&P and NASDAQ 100; the correlation was 0.928

E)NASDAQ 100 and DJIA; the correlation was 0.876

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

35

Suppose that the risk-free rates in the United States and in the Canada are 3% and 5%, respectively.The spot exchange rate between the dollar and the Canadian dollar (C$) is $0.80/C$.What should the futures price of the C$ for a one-year contract be to prevent arbitrage opportunities, ignoring transactions costs.

A)$1.00/ C$

B)$1.70/ C$

C)$0.88/ C$

D)$0.78/ C$

E)$1.22/ C$

A)$1.00/ C$

B)$1.70/ C$

C)$0.88/ C$

D)$0.78/ C$

E)$1.22/ C$

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

36

You are given the following information about a portfolio you are to manage.For the long-term you are bullish, but you think the market may fall over the next month.  What is the dollar value of your expected loss

What is the dollar value of your expected loss

A)$142,900

B)$16,670

C)$85,700

D)$30,000

E)$64,200

What is the dollar value of your expected loss

What is the dollar value of your expected lossA)$142,900

B)$16,670

C)$85,700

D)$30,000

E)$64,200

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

37

Arbitrage proofs in futures market pricing relationships

A)rely on the CAPM.

B)demonstrate how investors can exploit misalignments.

C)incorporate transactions costs.

D)All of the options

E)None of the options

A)rely on the CAPM.

B)demonstrate how investors can exploit misalignments.

C)incorporate transactions costs.

D)All of the options

E)None of the options

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

38

You are given the following information about a portfolio you are to manage.For the long-term you are bullish, but you think the market may fall over the next month.  If the anticipated market value materializes, what will be your expected loss on the portfolio

If the anticipated market value materializes, what will be your expected loss on the portfolio

A)14.29%

B)16.67%

C)15.43%

D)8.57%

E)6.42%

If the anticipated market value materializes, what will be your expected loss on the portfolio

If the anticipated market value materializes, what will be your expected loss on the portfolioA)14.29%

B)16.67%

C)15.43%

D)8.57%

E)6.42%

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

39

Trading in stock index futures

A)now exceeds buying and selling of shares in most markets.

B)reduces transactions costs as compared to trading in stocks.

C)increases leverage as compared to trading in stocks.

D)generally results in faster execution than trading in stocks.

E)All of the options

A)now exceeds buying and selling of shares in most markets.

B)reduces transactions costs as compared to trading in stocks.

C)increases leverage as compared to trading in stocks.

D)generally results in faster execution than trading in stocks.

E)All of the options

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

40

A swap

A)obligates two counterparties to exchange cash flows at one or more future dates.

B)allows participants to restructure their balance sheets.

C)allows a firm to convert outstanding fixed rate debt to floating rate debt.

D)obligates two counterparties to exchange cash flows at one or more future dates and allows participants to restructure their balance sheets.

E)All of the options

A)obligates two counterparties to exchange cash flows at one or more future dates.

B)allows participants to restructure their balance sheets.

C)allows a firm to convert outstanding fixed rate debt to floating rate debt.

D)obligates two counterparties to exchange cash flows at one or more future dates and allows participants to restructure their balance sheets.

E)All of the options

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

41

A hedge ratio can be computed as

A)profit derived from one futures position for a given change in the exchange rate divided by the change in value of the unprotected position for the same exchange rate.

B)the change in value of the unprotected position for a given change in the exchange rate divided by the profit derived from one futures position for the same exchange rate.

C)profit derived from one futures position for a given change in the exchange rate plus the change in value of the unprotected position for the same exchange rate.

D)the change in value of the unprotected position for a given change in the exchange rate plus by the profit derived from one futures position for the same exchange rate.

A)profit derived from one futures position for a given change in the exchange rate divided by the change in value of the unprotected position for the same exchange rate.

B)the change in value of the unprotected position for a given change in the exchange rate divided by the profit derived from one futures position for the same exchange rate.

C)profit derived from one futures position for a given change in the exchange rate plus the change in value of the unprotected position for the same exchange rate.

D)the change in value of the unprotected position for a given change in the exchange rate plus by the profit derived from one futures position for the same exchange rate.

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

42

Why are commodity futures prices different from other futures prices

Explain the difference and give an example of a commodity and the factors involved.

Explain the difference and give an example of a commodity and the factors involved.

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

43

If covered interest arbitrage opportunities do not exist,

A)interest rate parity does not hold.

B)interest rate parity holds.

C)arbitragers will be able to make risk-free profits.

D)interest rate parity does not hold and arbitragers will be able to make risk-free profits.

E)interest rate parity holds and arbitragers will be able to make risk-free profits.

A)interest rate parity does not hold.

B)interest rate parity holds.

C)arbitragers will be able to make risk-free profits.

D)interest rate parity does not hold and arbitragers will be able to make risk-free profits.

E)interest rate parity holds and arbitragers will be able to make risk-free profits.

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

44

You are given the following information about a portfolio you are to manage.For the long-term you are bullish, but you think the market may fall over the next month.  If the anticipated market value materializes, what will be your expected loss on the portfolio

If the anticipated market value materializes, what will be your expected loss on the portfolio

A)7.58%

B)6.52%

C)15.43%

D)8.57%

E)6.42%

If the anticipated market value materializes, what will be your expected loss on the portfolio

If the anticipated market value materializes, what will be your expected loss on the portfolioA)7.58%

B)6.52%

C)15.43%

D)8.57%

E)6.42%

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

45

Suppose that the risk-free rate is 4% and the market risk premium is 6%.You are interested in a cocoa futures contract.The beta of cocoa is -0.291.

- What is the required annual rate of return on the cocoa contract

- You plan to hold the contract for three months, then take delivery of the cocoa.At that time you expect the spot price of cocoa to be $900 per ton.What is the present value of this three-month deferred claim

What would the proper price be for this contract

- What is the required annual rate of return on the cocoa contract

- You plan to hold the contract for three months, then take delivery of the cocoa.At that time you expect the spot price of cocoa to be $900 per ton.What is the present value of this three-month deferred claim

What would the proper price be for this contract

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

46

Covered interest arbitrage

A)ensures that currency futures prices are set correctly.

B)ensures that commodity futures prices are set correctly.

C)ensures that interest rate futures prices are set correctly.

D)ensures that currency futures prices and commodity futures prices are set correctly.

E)None of the options

A)ensures that currency futures prices are set correctly.

B)ensures that commodity futures prices are set correctly.

C)ensures that interest rate futures prices are set correctly.

D)ensures that currency futures prices and commodity futures prices are set correctly.

E)None of the options

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

47

If interest rate parity does not hold,

A)covered interest arbitrage opportunities will exist.

B)covered interest arbitrage opportunities will not exist.

C)arbitragers will be able to make risk-free profits.

D)covered interest arbitrage opportunities will exist and arbitragers will be able to make risk-free profits.

E)covered interest arbitrage opportunities will not exist and arbitragers will be able to make risk-free profits.

A)covered interest arbitrage opportunities will exist.

B)covered interest arbitrage opportunities will not exist.

C)arbitragers will be able to make risk-free profits.

D)covered interest arbitrage opportunities will exist and arbitragers will be able to make risk-free profits.

E)covered interest arbitrage opportunities will not exist and arbitragers will be able to make risk-free profits.

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

48

If covered interest arbitrage opportunities exist,

A)interest rate parity does not hold.

B)interest rate parity holds.

C)arbitragers will be able to make risk-free profits.

D)interest rate parity does not hold and arbitragers will be able to make risk-free profits.

E)interest rate parity holds and arbitragers will be able to make risk-free profits.

A)interest rate parity does not hold.

B)interest rate parity holds.

C)arbitragers will be able to make risk-free profits.

D)interest rate parity does not hold and arbitragers will be able to make risk-free profits.

E)interest rate parity holds and arbitragers will be able to make risk-free profits.

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

49

You are given the following information about a portfolio you are to manage.For the long-term you are bullish, but you think the market may fall over the next month.  For a 75-point drop in the S&P 500, by how much does the futures position change

For a 75-point drop in the S&P 500, by how much does the futures position change

A)$200,000

B)$50,000

C)$250,000

D)$500,000

E)$18,750

For a 75-point drop in the S&P 500, by how much does the futures position change

For a 75-point drop in the S&P 500, by how much does the futures position changeA)$200,000

B)$50,000

C)$250,000

D)$500,000

E)$18,750

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

50

Suppose that the risk-free rates in the United States and in the United Kingdom are 6% and 4%, respectively.The spot exchange rate between the dollar and the pound is $1.60/BP.What should the futures price of the pound for a one-year contract be to prevent arbitrage opportunities, ignoring transactions costs.

A)$1.60/BP

B)$1.70/BP

C)$1.66/BP

D)$1.63/BP

E)$1.57/BP

A)$1.60/BP

B)$1.70/BP

C)$1.66/BP

D)$1.63/BP

E)$1.57/BP

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

51

You are given the following information about a portfolio you are to manage.For the long-term you are bullish, but you think the market may fall over the next month.  How many contracts should you buy or sell to hedge your position Allow fractions of contracts in your answer.

How many contracts should you buy or sell to hedge your position Allow fractions of contracts in your answer.

A)Sell 3.477

B)Buy 3.477

C)Sell 4.236

D)Buy 4.236

E)Sell 11.235

How many contracts should you buy or sell to hedge your position Allow fractions of contracts in your answer.

How many contracts should you buy or sell to hedge your position Allow fractions of contracts in your answer.A)Sell 3.477

B)Buy 3.477

C)Sell 4.236

D)Buy 4.236

E)Sell 11.235

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

52

The most common short term interest rate used in the swap market is

A)the U.S.discount rate.

B)the U.S.prime rate.

C)the U.S.fed funds rate.

D)LIBOR.

E)None of the options

A)the U.S.discount rate.

B)the U.S.prime rate.

C)the U.S.fed funds rate.

D)LIBOR.

E)None of the options

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

53

E-Minis typically have a value of ____________ percent of the standard contract and exist for ____________.

A)50; individual stocks and commodities

B)50; stock indexes and foreign currencies

C)40; stock indexes and commodities

D)20; individual stocks and commodities

E)20; stock indexes and foreign currencies

A)50; individual stocks and commodities

B)50; stock indexes and foreign currencies

C)40; stock indexes and commodities

D)20; individual stocks and commodities

E)20; stock indexes and foreign currencies

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

54

Explain how a firm that has issued $1 million of long-term bonds with a fixed 6% interest rate can convert its fixed-rate debt into floating-rate debt.Give two numerical examples that show the possible outcomes, one favorable and one unfavorable.

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

55

You are given the following information about a portfolio you are to manage.For the long-term you are bullish, but you think the market may fall over the next month.  What is the dollar value of your expected loss

What is the dollar value of your expected loss

A)$142,900

B)$65,200

C)$85,700

D)$30,000

E)$64,200

What is the dollar value of your expected loss

What is the dollar value of your expected lossA)$142,900

B)$65,200

C)$85,700

D)$30,000

E)$64,200

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

56

If interest rate parity holds,

A)covered interest arbitrage opportunities will exist.

B)covered interest arbitrage opportunities will not exist.

C)arbitragers will be able to make risk-free profits.

D)covered interest arbitrage opportunities will exist and arbitragers will be able to make risk-free profits.

E)covered interest arbitrage opportunities will not exist and arbitragers will be able to make risk-free profits.

A)covered interest arbitrage opportunities will exist.

B)covered interest arbitrage opportunities will not exist.

C)arbitragers will be able to make risk-free profits.

D)covered interest arbitrage opportunities will exist and arbitragers will be able to make risk-free profits.

E)covered interest arbitrage opportunities will not exist and arbitragers will be able to make risk-free profits.

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck