Deck 17: Activity-Based Costing

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Match between columns

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/64

Play

Full screen (f)

Deck 17: Activity-Based Costing

1

Which method for allocating manufacturing overhead costs is usually more accurate?

A) Job order costing

B) Activity-based costing

C) Process costing

D) Unit-based costing

A) Job order costing

B) Activity-based costing

C) Process costing

D) Unit-based costing

B

2

Traditional product costing systems (e.g. job order costing and process costing) usually assume that:

A) Products consume overhead costs

B) Activities consume overhead costs

C) Overhead costs are insignificant

D) All of these are correct

A) Products consume overhead costs

B) Activities consume overhead costs

C) Overhead costs are insignificant

D) All of these are correct

A

3

Historically, a plant-wide manufacturing overhead rate would usually be assigned on the basis of:

A) Either direct tracing of overhead or direct labor hours

B) Either direct labor hours or number of products produced

C) Either cost pools or cost drivers

D) Either cost drivers or direct tracing of overhead

A) Either direct tracing of overhead or direct labor hours

B) Either direct labor hours or number of products produced

C) Either cost pools or cost drivers

D) Either cost drivers or direct tracing of overhead

B

4

Which of the following costs is usually NOT directly attributable to specific products?

A) Direct materials

B) Sales commissions

C) Direct labor

D) Property taxes

A) Direct materials

B) Sales commissions

C) Direct labor

D) Property taxes

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

5

If activity-based costing is used, assembly would be classified as a:

A) Unit-level activity

B) Batch-level activity

C) Product line activity

D) Facility support activity

A) Unit-level activity

B) Batch-level activity

C) Product line activity

D) Facility support activity

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

6

If activity-based costing is used, purchase orders would be classified as a:

A) Unit-level activity

B) Batch-level activity

C) Product line activity

D) Facility support activity

A) Unit-level activity

B) Batch-level activity

C) Product line activity

D) Facility support activity

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

7

Which of the following types of costing systems identifies business activities that create overhead costs and then assigns overhead to products or divisions according to these activities?

A) Unit-based costing

B) Job order costing

C) Activity-based costing

D) Process costing

A) Unit-based costing

B) Job order costing

C) Activity-based costing

D) Process costing

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

8

For greater accuracy when using activity-based costing, management accountants should:

A) Use the just-in-time inventory system

B) Carefully estimate the total amount of overhead costs

C) Compute a plant-wide rate of allocation based on volume

D) Have a larger number of cost pools

A) Use the just-in-time inventory system

B) Carefully estimate the total amount of overhead costs

C) Compute a plant-wide rate of allocation based on volume

D) Have a larger number of cost pools

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

9

Which of the following is the correct sequence of the five steps of implementing and using an activity-based costing system?

A) Identify overhead cost activities, identify measurable cost drivers, assign overhead, analyze individual overhead costs in terms of those cost activities, and use the cost data to make decisions

B) Use the cost data to make decisions, analyze individual overhead costs in terms of those cost activities, identify measurable cost drivers, assign overhead, and identify overhead cost activities

C) Identify overhead cost activities, analyze individual overhead costs in terms of those cost activities, identify measurable cost drivers, assign overhead, and use the cost data to make decisions

D) Identify measurable cost drivers, assign overhead, identify overhead cost activities, analyze individual overhead costs in terms of those cost activities, and use the cost data to make decisions

A) Identify overhead cost activities, identify measurable cost drivers, assign overhead, analyze individual overhead costs in terms of those cost activities, and use the cost data to make decisions

B) Use the cost data to make decisions, analyze individual overhead costs in terms of those cost activities, identify measurable cost drivers, assign overhead, and identify overhead cost activities

C) Identify overhead cost activities, analyze individual overhead costs in terms of those cost activities, identify measurable cost drivers, assign overhead, and use the cost data to make decisions

D) Identify measurable cost drivers, assign overhead, identify overhead cost activities, analyze individual overhead costs in terms of those cost activities, and use the cost data to make decisions

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

10

Activity-based costing systems assume that:

A) Products consume overhead costs

B) Activities consume overhead costs

C) Overhead costs are insignificant

D) All of these are correct

A) Products consume overhead costs

B) Activities consume overhead costs

C) Overhead costs are insignificant

D) All of these are correct

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

11

Assume that direct labor and direct materials are the major cost components of a product and that the small amount of overhead cost can easily be associated with products using a simple overhead allocation basis such as direct labor hours. Which one of the following statements is the most correct?

A) Activity-based costing should probably be used in this situation.

B) Activity-based costing is probably too expensive to justify using it in this situation.

C) Job order costing is probably too expensive to justify using it in this situation.

D) None of these are correct

A) Activity-based costing should probably be used in this situation.

B) Activity-based costing is probably too expensive to justify using it in this situation.

C) Job order costing is probably too expensive to justify using it in this situation.

D) None of these are correct

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

12

Activity-based costing deals with the allocation of:

A) Direct labor costs

B) Manufacturing overhead costs

C) Direct material costs

D) Indirect materials costs

A) Direct labor costs

B) Manufacturing overhead costs

C) Direct material costs

D) Indirect materials costs

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

13

If activity-based costing is used, property taxes would be classified as a:

A) Unit-level activity

B) Batch-level activity

C) Product line activity

D) Facility support activity

A) Unit-level activity

B) Batch-level activity

C) Product line activity

D) Facility support activity

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

14

Which of the following activities would most likely NOT be considered a batch activity:

A) Hours required for set-up

B) Accounting for materials

C) Storage in warehouse

D) Hours required for inspection

A) Hours required for set-up

B) Accounting for materials

C) Storage in warehouse

D) Hours required for inspection

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

15

If activity-based costing is used, receiving docks would be classified as a:

A) Unit-level activity

B) Batch-level activity

C) Product line activity

D) Facility support activity

A) Unit-level activity

B) Batch-level activity

C) Product line activity

D) Facility support activity

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

16

The allocation of which of the following can cause the greatest errors when computing product costs?

A) Direct labor

B) Manufacturing overhead

C) Direct materials

D) All of these are correct

A) Direct labor

B) Manufacturing overhead

C) Direct materials

D) All of these are correct

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

17

Activity-based costing is most useful when there are variations in:

A) Production volume

B) Size of products

C) Complexity of products

D) All of these are correct

A) Production volume

B) Size of products

C) Complexity of products

D) All of these are correct

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

18

Activity-based costing differs from traditional product costing in the allocation of:

A) Direct labor costs

B) Direct material costs

C) Manufacturing overhead costs

D) All of these are correct

A) Direct labor costs

B) Direct material costs

C) Manufacturing overhead costs

D) All of these are correct

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

19

Tracing overhead costs to activities involves dividing overhead costs into:

A) Cost pools

B) Cost drivers

C) Pool rates

D) Overhead rates

A) Cost pools

B) Cost drivers

C) Pool rates

D) Overhead rates

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

20

Usually activity-based costing would be significantly more accurate than traditional product costing in a:

A) One-product firm

B) Multiple-product firm that has separate manufacturing facilities for each product

C) Multiple-product firm where products are quite similar

D) Multiple-product firm where products are quite different

A) One-product firm

B) Multiple-product firm that has separate manufacturing facilities for each product

C) Multiple-product firm where products are quite similar

D) Multiple-product firm where products are quite different

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

21

When assigning cost drivers to facility support activities, an appropriate cost driver would be:

A) Production output

B) Labor hours

C) Floor space

D) No cost driver should be assigned

A) Production output

B) Labor hours

C) Floor space

D) No cost driver should be assigned

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

22

The traditional overhead cost allocation system focuses the accumulation of overhead cost on:

A) Cost pools

B) Cost drivers

C) Products

D) Pool rate

A) Cost pools

B) Cost drivers

C) Products

D) Pool rate

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

23

If a cost activity does NOT have any production-related cost driver that matches up with changes in the amount of overhead cost associated with the activity then:

A) Any basis can be selected as a cost driver

B) Direct labor hours should be used as the cost driver

C) No cost driver should be selected; the costs should be treated as common costs

D) Number of items produced should be the cost driver.

A) Any basis can be selected as a cost driver

B) Direct labor hours should be used as the cost driver

C) No cost driver should be selected; the costs should be treated as common costs

D) Number of items produced should be the cost driver.

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

24

Which of the following would most likely NOT be considered a facility support activity?

A) Property taxes

B) Factory equipment

C) Depreciation on headquarters building

D) Executive salaries

A) Property taxes

B) Factory equipment

C) Depreciation on headquarters building

D) Executive salaries

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

25

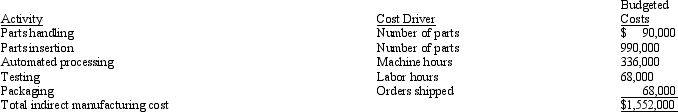

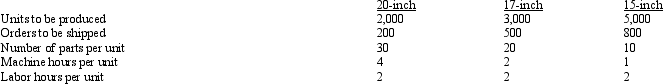

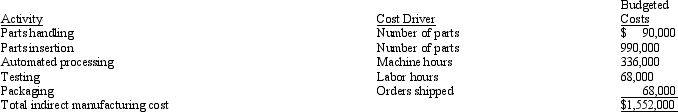

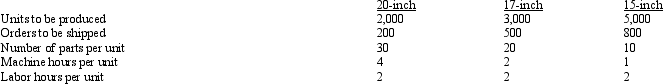

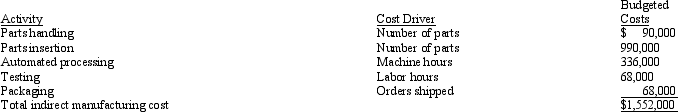

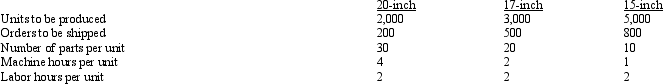

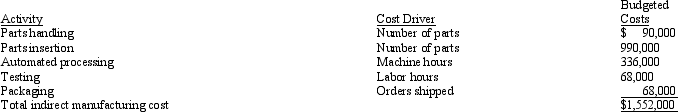

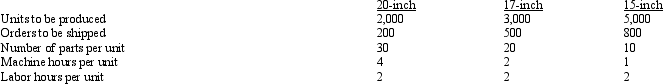

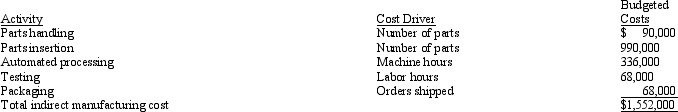

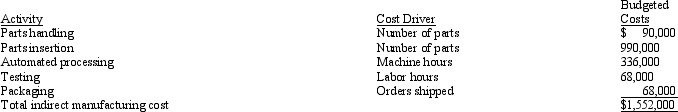

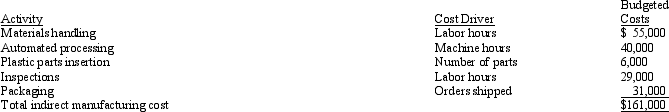

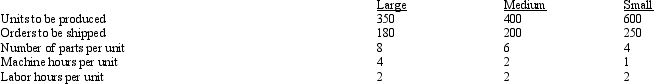

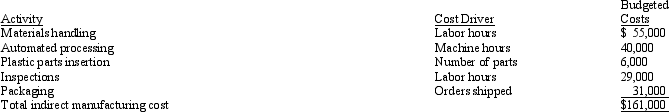

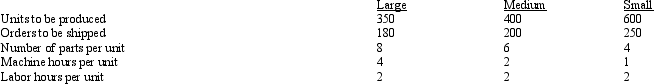

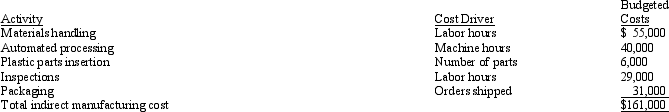

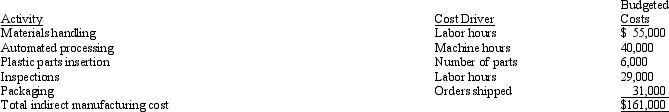

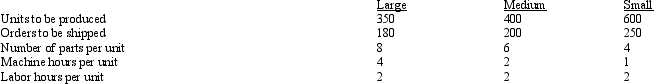

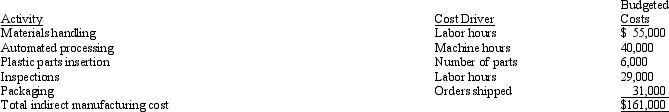

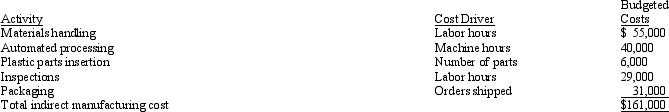

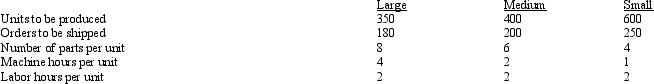

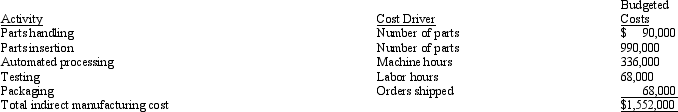

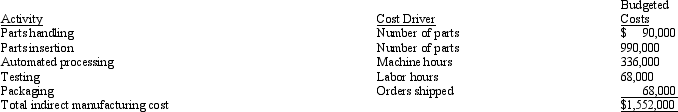

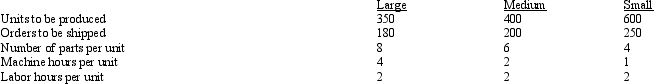

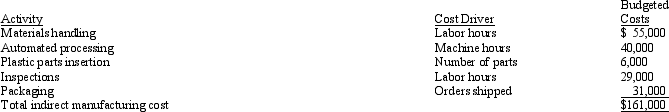

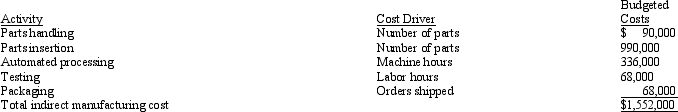

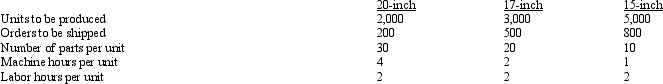

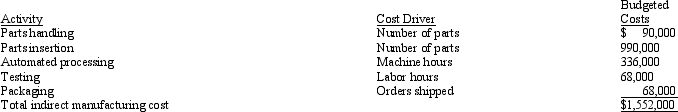

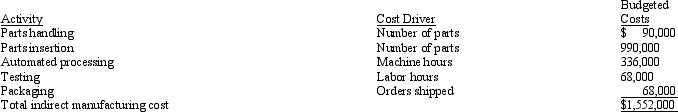

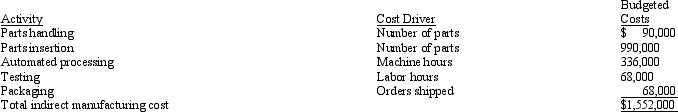

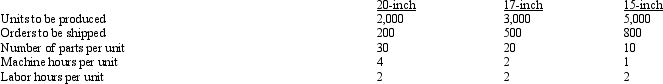

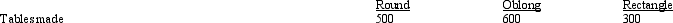

Exhibit 17-2 BigView Monitors manufactures three different sizes of computer monitors: 15-inch, 17-inch, and 20-inch. The company has recently implemented an activity-based costing system. BigView has identified five different production activities as well as the best cost driver for each activity. Each activity and driver is listed below, along with the budgeted amount that is associated with each activity for next year.

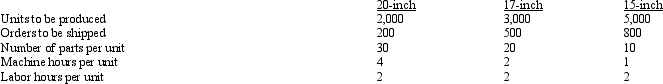

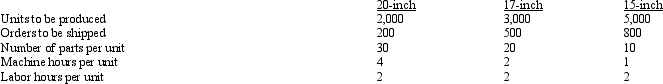

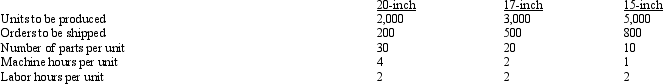

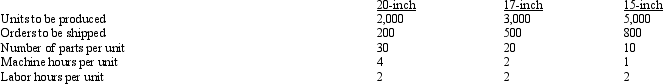

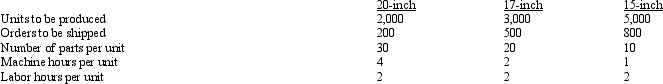

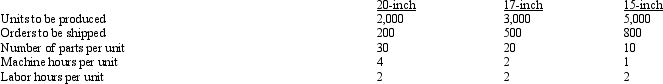

The following information relates to each size of monitor and next year's anticipated manufacturing operations:

The following information relates to each size of monitor and next year's anticipated manufacturing operations:

Refer to Exhibit 17-2. What is BigView's cost per cost driver for automated processing for next year (rounded)?

Refer to Exhibit 17-2. What is BigView's cost per cost driver for automated processing for next year (rounded)?

A) $9.00 per machine hour

B) $16.80 per machine hour

C) $17.68 per machine hour

D) $33.60 per machine hour

The following information relates to each size of monitor and next year's anticipated manufacturing operations:

The following information relates to each size of monitor and next year's anticipated manufacturing operations: Refer to Exhibit 17-2. What is BigView's cost per cost driver for automated processing for next year (rounded)?

Refer to Exhibit 17-2. What is BigView's cost per cost driver for automated processing for next year (rounded)?A) $9.00 per machine hour

B) $16.80 per machine hour

C) $17.68 per machine hour

D) $33.60 per machine hour

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

26

An appropriate cost driver for inspection costs is:

A) Number of inspected products sold

B) Quantity of items produced

C) Direct labor hours

D) Number of inspections completed

A) Number of inspected products sold

B) Quantity of items produced

C) Direct labor hours

D) Number of inspections completed

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

27

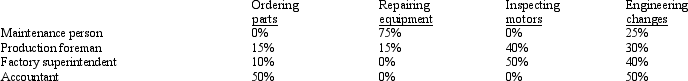

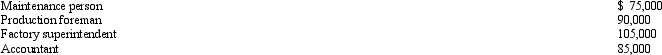

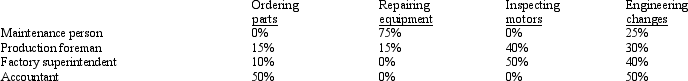

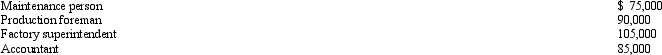

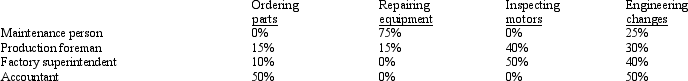

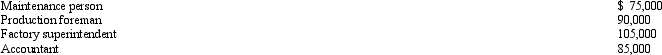

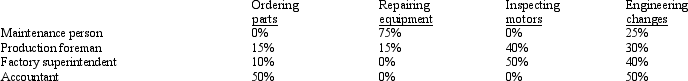

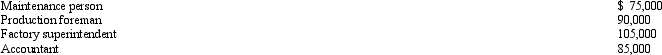

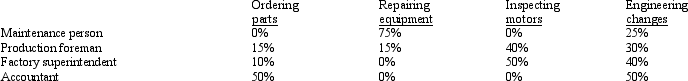

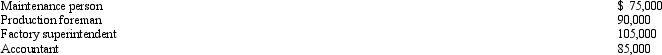

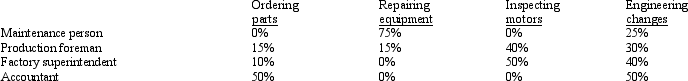

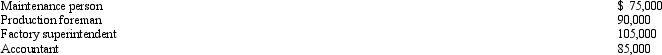

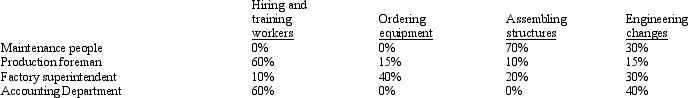

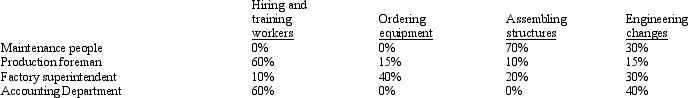

Exhibit 17-1 Maggie's Motors manufactures boat motors. Maggie is shifting from a traditional costing system to an activity-based costing system. She has started by identifying four overhead cost activities. Listed below is the table that Maggie created identifying the cost activities and the percentage of time spent on each activity by various factory employees.

Maggie also gathered the total overhead cost associated with each factory employee which is shown below:

Maggie also gathered the total overhead cost associated with each factory employee which is shown below:

Refer to Exhibit 17-1. Using the information above, compute the amount of the cost pool associated with ordering parts.

Refer to Exhibit 17-1. Using the information above, compute the amount of the cost pool associated with ordering parts.

A) $88,500

B) $69,750

C) $85,000

D) $66,500

Maggie also gathered the total overhead cost associated with each factory employee which is shown below:

Maggie also gathered the total overhead cost associated with each factory employee which is shown below: Refer to Exhibit 17-1. Using the information above, compute the amount of the cost pool associated with ordering parts.

Refer to Exhibit 17-1. Using the information above, compute the amount of the cost pool associated with ordering parts.A) $88,500

B) $69,750

C) $85,000

D) $66,500

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

28

Number of purchase orders is an example of a(n):

A) Cost driver

B) Cost pool

C) Allocation rate

D) Pool rate

A) Cost driver

B) Cost pool

C) Allocation rate

D) Pool rate

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

29

Exhibit 17-1 Maggie's Motors manufactures boat motors. Maggie is shifting from a traditional costing system to an activity-based costing system. She has started by identifying four overhead cost activities. Listed below is the table that Maggie created identifying the cost activities and the percentage of time spent on each activity by various factory employees.

Maggie also gathered the total overhead cost associated with each factory employee which is shown below:

Maggie also gathered the total overhead cost associated with each factory employee which is shown below:

Refer to Exhibit 17-1. Using the information above, compute the amount of the cost pool associated with engineering changes.

Refer to Exhibit 17-1. Using the information above, compute the amount of the cost pool associated with engineering changes.

A) $130,250

B) $105,000

C) $88,500

D) $66,500

Maggie also gathered the total overhead cost associated with each factory employee which is shown below:

Maggie also gathered the total overhead cost associated with each factory employee which is shown below: Refer to Exhibit 17-1. Using the information above, compute the amount of the cost pool associated with engineering changes.

Refer to Exhibit 17-1. Using the information above, compute the amount of the cost pool associated with engineering changes.A) $130,250

B) $105,000

C) $88,500

D) $66,500

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

30

When using activity-based costing, the cost associated with producing each batch is an example of a:

A) Cost driver

B) Cost pool

C) Pool rate

D) Unit cost

A) Cost driver

B) Cost pool

C) Pool rate

D) Unit cost

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

31

Which of the following would most likely NOT be considered a source of a product line activity?

A) Product manager

B) In-house training for special services

C) Depreciation on the product warehouse

D) Maintenance of machinery

A) Product manager

B) In-house training for special services

C) Depreciation on the product warehouse

D) Maintenance of machinery

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

32

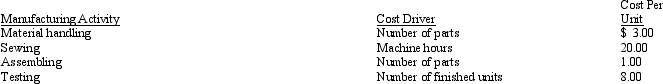

Exhibit 17-2 BigView Monitors manufactures three different sizes of computer monitors: 15-inch, 17-inch, and 20-inch. The company has recently implemented an activity-based costing system. BigView has identified five different production activities as well as the best cost driver for each activity. Each activity and driver is listed below, along with the budgeted amount that is associated with each activity for next year.

The following information relates to each size of monitor and next year's anticipated manufacturing operations:

The following information relates to each size of monitor and next year's anticipated manufacturing operations:

Refer to Exhibit 17-2. What is BigView's cost per cost driver for parts handling for next year (rounded)?

Refer to Exhibit 17-2. What is BigView's cost per cost driver for parts handling for next year (rounded)?

A) $0.17 per part

B) $0.53 per part

C) $9.00 per part

D) $15.00 per part

The following information relates to each size of monitor and next year's anticipated manufacturing operations:

The following information relates to each size of monitor and next year's anticipated manufacturing operations: Refer to Exhibit 17-2. What is BigView's cost per cost driver for parts handling for next year (rounded)?

Refer to Exhibit 17-2. What is BigView's cost per cost driver for parts handling for next year (rounded)?A) $0.17 per part

B) $0.53 per part

C) $9.00 per part

D) $15.00 per part

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

33

Company A allocates one type of overhead cost on the basis of movement of materials. The number of movement of materials processed is an example of a(n):

A) Cost driver

B) Pool rate

C) Overhead rate

D) Cost pool

A) Cost driver

B) Pool rate

C) Overhead rate

D) Cost pool

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

34

An activity that affects a particular cost is a(n):

A) Cost pool

B) Cost driver

C) Pool rate

D) Overhead rate

A) Cost pool

B) Cost driver

C) Pool rate

D) Overhead rate

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

35

Exhibit 17-2 BigView Monitors manufactures three different sizes of computer monitors: 15-inch, 17-inch, and 20-inch. The company has recently implemented an activity-based costing system. BigView has identified five different production activities as well as the best cost driver for each activity. Each activity and driver is listed below, along with the budgeted amount that is associated with each activity for next year.

The following information relates to each size of monitor and next year's anticipated manufacturing operations:

The following information relates to each size of monitor and next year's anticipated manufacturing operations:

Refer to Exhibit 17-2. What is BigView's cost per cost driver for testing for next year (rounded)?

Refer to Exhibit 17-2. What is BigView's cost per cost driver for testing for next year (rounded)?

A) $1.33 per labor hour

B) $3.40 per labor hour

C) $3.58 per labor hour

D) $6.80 per labor hour

The following information relates to each size of monitor and next year's anticipated manufacturing operations:

The following information relates to each size of monitor and next year's anticipated manufacturing operations: Refer to Exhibit 17-2. What is BigView's cost per cost driver for testing for next year (rounded)?

Refer to Exhibit 17-2. What is BigView's cost per cost driver for testing for next year (rounded)?A) $1.33 per labor hour

B) $3.40 per labor hour

C) $3.58 per labor hour

D) $6.80 per labor hour

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

36

An appropriate cost driver for engineering changes is:

A) Number of employees

B) Number of set-ups performed

C) Direct labor hours

D) Quantity of items produced

A) Number of employees

B) Number of set-ups performed

C) Direct labor hours

D) Quantity of items produced

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

37

A more accurate allocation of manufacturing overhead and product costing can take place when costs are assigned on the basis of:

A) Direct labor hours

B) Machine setups

C) Cost drivers

D) Production volume

A) Direct labor hours

B) Machine setups

C) Cost drivers

D) Production volume

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

38

Exhibit 17-1 Maggie's Motors manufactures boat motors. Maggie is shifting from a traditional costing system to an activity-based costing system. She has started by identifying four overhead cost activities. Listed below is the table that Maggie created identifying the cost activities and the percentage of time spent on each activity by various factory employees.

Maggie also gathered the total overhead cost associated with each factory employee which is shown below:

Maggie also gathered the total overhead cost associated with each factory employee which is shown below:

Refer to Exhibit 17-1. Using the information above, compute the amount of the cost pool associated with repairing equipment.

Refer to Exhibit 17-1. Using the information above, compute the amount of the cost pool associated with repairing equipment.

A) $88,500

B) $69,750

C) $85,000

D) $66,500

Maggie also gathered the total overhead cost associated with each factory employee which is shown below:

Maggie also gathered the total overhead cost associated with each factory employee which is shown below: Refer to Exhibit 17-1. Using the information above, compute the amount of the cost pool associated with repairing equipment.

Refer to Exhibit 17-1. Using the information above, compute the amount of the cost pool associated with repairing equipment.A) $88,500

B) $69,750

C) $85,000

D) $66,500

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

39

Which of the following is an example of a cost driver?

A) Engineering

B) Machine setups

C) Maintenance

D) Procurement

A) Engineering

B) Machine setups

C) Maintenance

D) Procurement

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

40

With activity-based costing, overhead costs are assigned using:

A) Product costs

B) Cash flows

C) Cost drivers

D) Direct labor hours

A) Product costs

B) Cash flows

C) Cost drivers

D) Direct labor hours

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

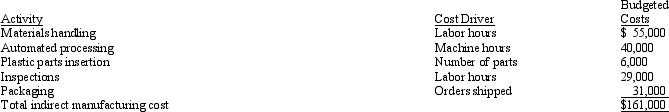

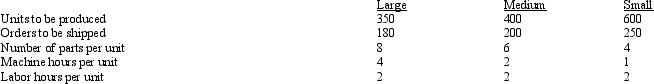

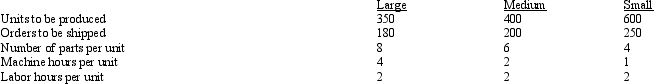

41

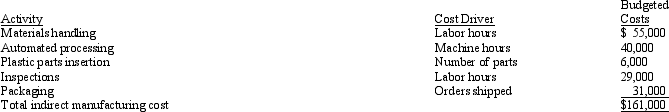

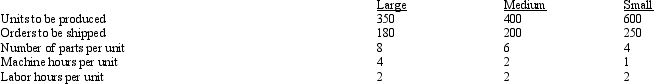

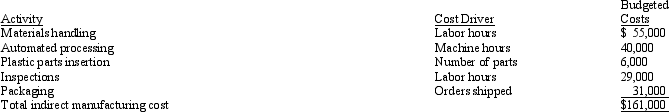

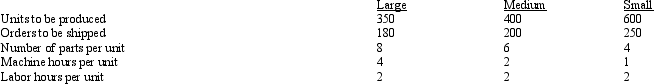

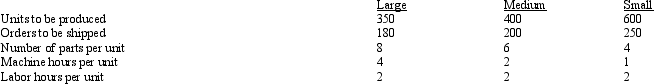

Exhibit 17-3 Bird's Eye View manufactures three different sizes of bird cages: small (for finches and canaries), medium (for cockatiels and small parrots), and large (for cockatoos and other large parrots). The company has recently implemented an activity-based costing system. Bird's Eye View has identified five different production activities as well as the best cost driver for each activity. Each activity and driver is listed below, along with the budgeted amount that is associated with each activity for next year.

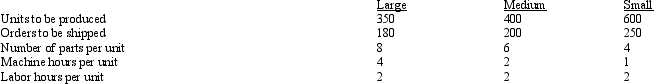

The following information relates to each size of bird cage and next year's anticipated manufacturing operations:

The following information relates to each size of bird cage and next year's anticipated manufacturing operations:

Refer to Exhibit 17-3. What is Bird's Eye View cost per cost driver for inspections for next year (rounded)?

Refer to Exhibit 17-3. What is Bird's Eye View cost per cost driver for inspections for next year (rounded)?

A) $1.18 per part

B) $3.58 per part

C) $10.74 per part

D) $11.48 per part

The following information relates to each size of bird cage and next year's anticipated manufacturing operations:

The following information relates to each size of bird cage and next year's anticipated manufacturing operations: Refer to Exhibit 17-3. What is Bird's Eye View cost per cost driver for inspections for next year (rounded)?

Refer to Exhibit 17-3. What is Bird's Eye View cost per cost driver for inspections for next year (rounded)?A) $1.18 per part

B) $3.58 per part

C) $10.74 per part

D) $11.48 per part

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

42

Match between columns

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

43

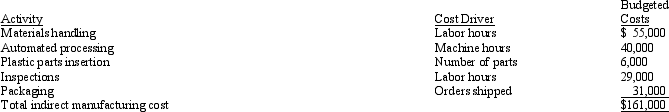

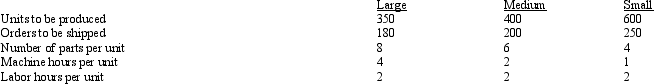

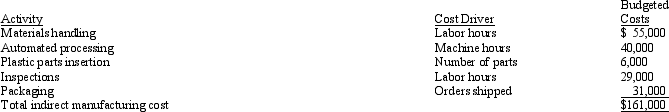

Exhibit 17-3 Bird's Eye View manufactures three different sizes of bird cages: small (for finches and canaries), medium (for cockatiels and small parrots), and large (for cockatoos and other large parrots). The company has recently implemented an activity-based costing system. Bird's Eye View has identified five different production activities as well as the best cost driver for each activity. Each activity and driver is listed below, along with the budgeted amount that is associated with each activity for next year.

The following information relates to each size of bird cage and next year's anticipated manufacturing operations:

The following information relates to each size of bird cage and next year's anticipated manufacturing operations:

Refer to Exhibit 17-3. Under an activity-based costing system, what is the per unit cost for manufacturing overhead of a medium cage (rounded)?

Refer to Exhibit 17-3. Under an activity-based costing system, what is the per unit cost for manufacturing overhead of a medium cage (rounded)?

A) $100

B) $119

C) $120

D) $151

The following information relates to each size of bird cage and next year's anticipated manufacturing operations:

The following information relates to each size of bird cage and next year's anticipated manufacturing operations: Refer to Exhibit 17-3. Under an activity-based costing system, what is the per unit cost for manufacturing overhead of a medium cage (rounded)?

Refer to Exhibit 17-3. Under an activity-based costing system, what is the per unit cost for manufacturing overhead of a medium cage (rounded)?A) $100

B) $119

C) $120

D) $151

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

44

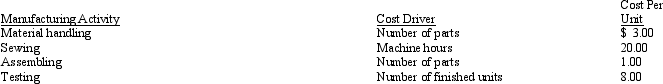

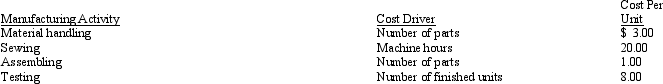

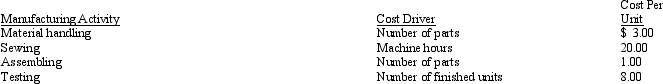

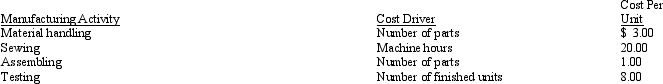

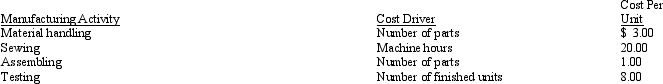

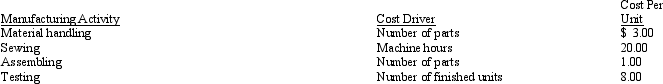

Exhibit 17-4 The Dormir Company uses an activity-based costing system to account for its process of manufacturing camping tents. Each tent has $140 of direct materials, includes 15 parts, and requires 3 hours of machine time. Information on conversion costs, manufacturing activities, and cost drivers is listed below.

Refer to Exhibit 17-4. The cost of material handling per tent is:

Refer to Exhibit 17-4. The cost of material handling per tent is:

A) $3.00

B) $15.00

C) $45.00

D) $120.00

Refer to Exhibit 17-4. The cost of material handling per tent is:

Refer to Exhibit 17-4. The cost of material handling per tent is:A) $3.00

B) $15.00

C) $45.00

D) $120.00

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

45

Exhibit 17-3 Bird's Eye View manufactures three different sizes of bird cages: small (for finches and canaries), medium (for cockatiels and small parrots), and large (for cockatoos and other large parrots). The company has recently implemented an activity-based costing system. Bird's Eye View has identified five different production activities as well as the best cost driver for each activity. Each activity and driver is listed below, along with the budgeted amount that is associated with each activity for next year.

The following information relates to each size of bird cage and next year's anticipated manufacturing operations:

The following information relates to each size of bird cage and next year's anticipated manufacturing operations:

Refer to Exhibit 17-3. Under an activity-based costing system, what is the per unit cost for manufacturing overhead of a large cage (rounded)?

Refer to Exhibit 17-3. Under an activity-based costing system, what is the per unit cost for manufacturing overhead of a large cage (rounded)?

A) $100

B) $119

C) $120

D) $151

The following information relates to each size of bird cage and next year's anticipated manufacturing operations:

The following information relates to each size of bird cage and next year's anticipated manufacturing operations: Refer to Exhibit 17-3. Under an activity-based costing system, what is the per unit cost for manufacturing overhead of a large cage (rounded)?

Refer to Exhibit 17-3. Under an activity-based costing system, what is the per unit cost for manufacturing overhead of a large cage (rounded)?A) $100

B) $119

C) $120

D) $151

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

46

Define activity-based costing and list the five steps in implementing and using an activity-based costing system.

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

47

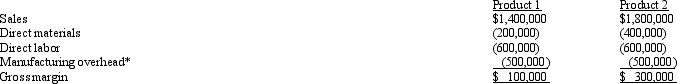

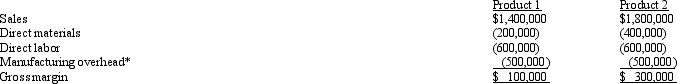

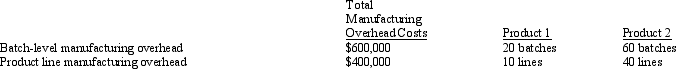

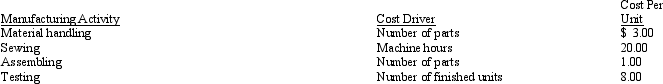

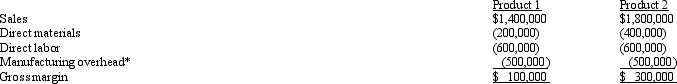

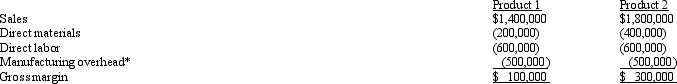

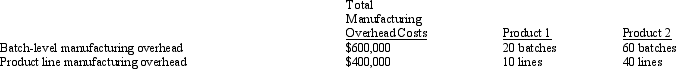

Exhibit 17-5 The following information is available for Dakota Company:

*allocated based on direct labor hours

*allocated based on direct labor hours

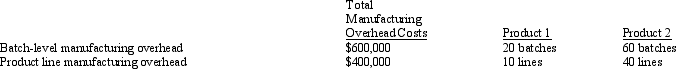

Dakota Company has decided to allocate its manufacturing overhead cost using activity-based costing. Manufacturing overhead will be allocated based on batch-level and product line manufacturing as follows:

Refer to Exhibit 17-5. What is Dakota Company's gross margin for Product 1 using activity based costing?

Refer to Exhibit 17-5. What is Dakota Company's gross margin for Product 1 using activity based costing?

A) $400,000

B) $370,000

C) $450,000

D) $520,000

*allocated based on direct labor hours

*allocated based on direct labor hoursDakota Company has decided to allocate its manufacturing overhead cost using activity-based costing. Manufacturing overhead will be allocated based on batch-level and product line manufacturing as follows:

Refer to Exhibit 17-5. What is Dakota Company's gross margin for Product 1 using activity based costing?

Refer to Exhibit 17-5. What is Dakota Company's gross margin for Product 1 using activity based costing?A) $400,000

B) $370,000

C) $450,000

D) $520,000

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

48

Exhibit 17-3 Bird's Eye View manufactures three different sizes of bird cages: small (for finches and canaries), medium (for cockatiels and small parrots), and large (for cockatoos and other large parrots). The company has recently implemented an activity-based costing system. Bird's Eye View has identified five different production activities as well as the best cost driver for each activity. Each activity and driver is listed below, along with the budgeted amount that is associated with each activity for next year.

The following information relates to each size of bird cage and next year's anticipated manufacturing operations:

The following information relates to each size of bird cage and next year's anticipated manufacturing operations:

Refer to Exhibit 17-3. What is Bird's Eye View cost per cost driver for parts insertion for next year (rounded)?

Refer to Exhibit 17-3. What is Bird's Eye View cost per cost driver for parts insertion for next year (rounded)?

A) $0.25 per part

B) $0.79 per part

C) $7.56 per part

D) $21.18 per part

The following information relates to each size of bird cage and next year's anticipated manufacturing operations:

The following information relates to each size of bird cage and next year's anticipated manufacturing operations: Refer to Exhibit 17-3. What is Bird's Eye View cost per cost driver for parts insertion for next year (rounded)?

Refer to Exhibit 17-3. What is Bird's Eye View cost per cost driver for parts insertion for next year (rounded)?A) $0.25 per part

B) $0.79 per part

C) $7.56 per part

D) $21.18 per part

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

49

BigPlay Company manufactures playground equipment. BigPlay is shifting from a traditional costing system to an activity-based costing system. The company started by identifying four overhead cost activities. Listed below is the table that the controller for BigPlay created identifying the cost activities and the percentage of time spent on each activity by various factory employees.

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

50

Which of the following products usually consumes the highest amount of overhead costs per unit?

A) High-volume standard products

B) Low-volume standard products

C) High-volume unique products

D) Low-volume unique products

A) High-volume standard products

B) Low-volume standard products

C) High-volume unique products

D) Low-volume unique products

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

51

Exhibit 17-3 Bird's Eye View manufactures three different sizes of bird cages: small (for finches and canaries), medium (for cockatiels and small parrots), and large (for cockatoos and other large parrots). The company has recently implemented an activity-based costing system. Bird's Eye View has identified five different production activities as well as the best cost driver for each activity. Each activity and driver is listed below, along with the budgeted amount that is associated with each activity for next year.

The following information relates to each size of bird cage and next year's anticipated manufacturing operations:

The following information relates to each size of bird cage and next year's anticipated manufacturing operations:

Refer to Exhibit 17-3. Under an activity-based costing system, what is the per unit cost for manufacturing overhead of a small cage (rounded)?

Refer to Exhibit 17-3. Under an activity-based costing system, what is the per unit cost for manufacturing overhead of a small cage (rounded)?

A) $100

B) $119

C) $120

D) $151

The following information relates to each size of bird cage and next year's anticipated manufacturing operations:

The following information relates to each size of bird cage and next year's anticipated manufacturing operations: Refer to Exhibit 17-3. Under an activity-based costing system, what is the per unit cost for manufacturing overhead of a small cage (rounded)?

Refer to Exhibit 17-3. Under an activity-based costing system, what is the per unit cost for manufacturing overhead of a small cage (rounded)?A) $100

B) $119

C) $120

D) $151

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

52

Exhibit 17-2 BigView Monitors manufactures three different sizes of computer monitors: 15-inch, 17-inch, and 20-inch. The company has recently implemented an activity-based costing system. BigView has identified five different production activities as well as the best cost driver for each activity. Each activity and driver is listed below, along with the budgeted amount that is associated with each activity for next year.

The following information relates to each size of monitor and next year's anticipated manufacturing operations:

The following information relates to each size of monitor and next year's anticipated manufacturing operations:

Refer to Exhibit 17-2. Under an activity-based product costing system, what is the per unit cost for manufacturing overhead of 20-inch monitors (rounded)?

Refer to Exhibit 17-2. Under an activity-based product costing system, what is the per unit cost for manufacturing overhead of 20-inch monitors (rounded)?

A) $95

B) $155

C) $177

D) $273

The following information relates to each size of monitor and next year's anticipated manufacturing operations:

The following information relates to each size of monitor and next year's anticipated manufacturing operations: Refer to Exhibit 17-2. Under an activity-based product costing system, what is the per unit cost for manufacturing overhead of 20-inch monitors (rounded)?

Refer to Exhibit 17-2. Under an activity-based product costing system, what is the per unit cost for manufacturing overhead of 20-inch monitors (rounded)?A) $95

B) $155

C) $177

D) $273

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

53

The result of cross-subsidization is that:

A) Some products look less profitable than they really are

B) Some products look more profitable than they really are

C) Both a and b

D) Neither a nor b

A) Some products look less profitable than they really are

B) Some products look more profitable than they really are

C) Both a and b

D) Neither a nor b

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

54

Exhibit 17-4 The Dormir Company uses an activity-based costing system to account for its process of manufacturing camping tents. Each tent has $140 of direct materials, includes 15 parts, and requires 3 hours of machine time. Information on conversion costs, manufacturing activities, and cost drivers is listed below.

Refer to Exhibit 17-4. The cost of assembling per tent is:

Refer to Exhibit 17-4. The cost of assembling per tent is:

A) $3.00

B) $15.00

C) $20.00

D) $45.00

Refer to Exhibit 17-4. The cost of assembling per tent is:

Refer to Exhibit 17-4. The cost of assembling per tent is:A) $3.00

B) $15.00

C) $20.00

D) $45.00

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

55

Exhibit 17-3 Bird's Eye View manufactures three different sizes of bird cages: small (for finches and canaries), medium (for cockatiels and small parrots), and large (for cockatoos and other large parrots). The company has recently implemented an activity-based costing system. Bird's Eye View has identified five different production activities as well as the best cost driver for each activity. Each activity and driver is listed below, along with the budgeted amount that is associated with each activity for next year.

The following information relates to each size of bird cage and next year's anticipated manufacturing operations:

The following information relates to each size of bird cage and next year's anticipated manufacturing operations:

Refer to Exhibit 17-3. What is Bird's Eye View cost per cost driver for automated processing for next year (rounded)?

Refer to Exhibit 17-3. What is Bird's Eye View cost per cost driver for automated processing for next year (rounded)?

A) $4.23 per part

B) $10.36 per part

C) $14.29 per part

D) $29.63 per part

The following information relates to each size of bird cage and next year's anticipated manufacturing operations:

The following information relates to each size of bird cage and next year's anticipated manufacturing operations: Refer to Exhibit 17-3. What is Bird's Eye View cost per cost driver for automated processing for next year (rounded)?

Refer to Exhibit 17-3. What is Bird's Eye View cost per cost driver for automated processing for next year (rounded)?A) $4.23 per part

B) $10.36 per part

C) $14.29 per part

D) $29.63 per part

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

56

Exhibit 17-4 The Dormir Company uses an activity-based costing system to account for its process of manufacturing camping tents. Each tent has $140 of direct materials, includes 15 parts, and requires 3 hours of machine time. Information on conversion costs, manufacturing activities, and cost drivers is listed below.

Refer to Exhibit 17-4. The cost of sewing per tent is:

Refer to Exhibit 17-4. The cost of sewing per tent is:

A) $20.00

B) $60.00

C) $160.00

D) $300.00

Refer to Exhibit 17-4. The cost of sewing per tent is:

Refer to Exhibit 17-4. The cost of sewing per tent is:A) $20.00

B) $60.00

C) $160.00

D) $300.00

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

57

Exhibit 17-4 The Dormir Company uses an activity-based costing system to account for its process of manufacturing camping tents. Each tent has $140 of direct materials, includes 15 parts, and requires 3 hours of machine time. Information on conversion costs, manufacturing activities, and cost drivers is listed below.

Refer to Exhibit 17-4. The total manufacturing cost per tent is:

Refer to Exhibit 17-4. The total manufacturing cost per tent is:

A) $128

B) $140

C) $255

D) $268

Refer to Exhibit 17-4. The total manufacturing cost per tent is:

Refer to Exhibit 17-4. The total manufacturing cost per tent is:A) $128

B) $140

C) $255

D) $268

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

58

Exhibit 17-5 The following information is available for Dakota Company:

*allocated based on direct labor hours

*allocated based on direct labor hours

Dakota Company has decided to allocate its manufacturing overhead cost using activity-based costing. Manufacturing overhead will be allocated based on batch-level and product line manufacturing as follows:

Refer to Exhibit 17-5. What is Dakota Company's gross margin for Product 2 using activity based costing?

Refer to Exhibit 17-5. What is Dakota Company's gross margin for Product 2 using activity based costing?

A) $300,000

B) $350,000

C) $480,000

D) $30,000

*allocated based on direct labor hours

*allocated based on direct labor hoursDakota Company has decided to allocate its manufacturing overhead cost using activity-based costing. Manufacturing overhead will be allocated based on batch-level and product line manufacturing as follows:

Refer to Exhibit 17-5. What is Dakota Company's gross margin for Product 2 using activity based costing?

Refer to Exhibit 17-5. What is Dakota Company's gross margin for Product 2 using activity based costing?A) $300,000

B) $350,000

C) $480,000

D) $30,000

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

59

Exhibit 17-2 BigView Monitors manufactures three different sizes of computer monitors: 15-inch, 17-inch, and 20-inch. The company has recently implemented an activity-based costing system. BigView has identified five different production activities as well as the best cost driver for each activity. Each activity and driver is listed below, along with the budgeted amount that is associated with each activity for next year.

The following information relates to each size of monitor and next year's anticipated manufacturing operations:

The following information relates to each size of monitor and next year's anticipated manufacturing operations:

Refer to Exhibit 17-2. Under an activity-based product costing system, what is the per unit cost for manufacturing overhead of 15-inch monitors (rounded)?

Refer to Exhibit 17-2. Under an activity-based product costing system, what is the per unit cost for manufacturing overhead of 15-inch monitors (rounded)?

A) $95

B) $155

C) $177

D) $273

The following information relates to each size of monitor and next year's anticipated manufacturing operations:

The following information relates to each size of monitor and next year's anticipated manufacturing operations: Refer to Exhibit 17-2. Under an activity-based product costing system, what is the per unit cost for manufacturing overhead of 15-inch monitors (rounded)?

Refer to Exhibit 17-2. Under an activity-based product costing system, what is the per unit cost for manufacturing overhead of 15-inch monitors (rounded)?A) $95

B) $155

C) $177

D) $273

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

60

Exhibit 17-2 BigView Monitors manufactures three different sizes of computer monitors: 15-inch, 17-inch, and 20-inch. The company has recently implemented an activity-based costing system. BigView has identified five different production activities as well as the best cost driver for each activity. Each activity and driver is listed below, along with the budgeted amount that is associated with each activity for next year.

The following information relates to each size of monitor and next year's anticipated manufacturing operations:

The following information relates to each size of monitor and next year's anticipated manufacturing operations:

Refer to Exhibit 17-2. Under an activity-based product costing system, what is the per unit cost for manufacturing overhead of 17-inch monitors (rounded)?

Refer to Exhibit 17-2. Under an activity-based product costing system, what is the per unit cost for manufacturing overhead of 17-inch monitors (rounded)?

A) $95

B) $155

C) $177

D) $273

The following information relates to each size of monitor and next year's anticipated manufacturing operations:

The following information relates to each size of monitor and next year's anticipated manufacturing operations: Refer to Exhibit 17-2. Under an activity-based product costing system, what is the per unit cost for manufacturing overhead of 17-inch monitors (rounded)?

Refer to Exhibit 17-2. Under an activity-based product costing system, what is the per unit cost for manufacturing overhead of 17-inch monitors (rounded)?A) $95

B) $155

C) $177

D) $273

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

61

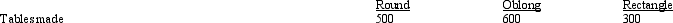

Jantar Company makes three different styles of kitchen tables: round, oblong, and rectangle. The following information is provided about the company's costs:

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

62

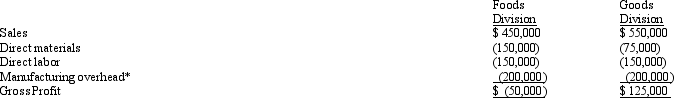

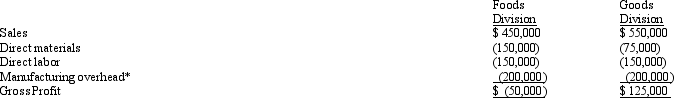

Westvaco Inc. has two divisions. Gross profit computations for these two divisions for the year 2012 are given below:

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

63

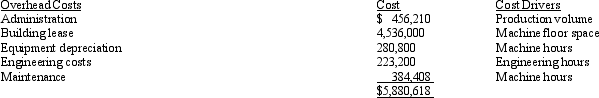

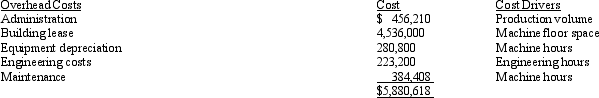

Carolina manufactures two products. The following information is available concerning the manufacturing overhead costs:

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

64

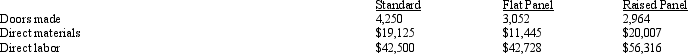

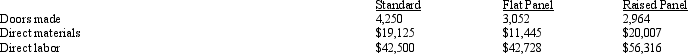

Custom Woods Inc. makes three different door styles for kitchen cabinets: standard, flat panel, and raised panel. The following information is provided about the company's costs:

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck