Deck 22: International Financial Management

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/117

Play

Full screen (f)

Deck 22: International Financial Management

1

The forward exchange rate for foreign currency is the rate for immediate exchanges.

False

2

The law of one price implies that the same commodity should be sold at the same price in all countries.

False

3

If real interest rates are different across countries,investors will shift their money into countries with high real interest rates.

True

4

Forward rates are always equal to the actual future exchange rates.

Unlock Deck

Unlock for access to all 117 flashcards in this deck.

Unlock Deck

k this deck

5

When the value of the U.S.dollar fell dramatically in 2006 and 2007,Volkswagen faced significant economic exposure.

Unlock Deck

Unlock for access to all 117 flashcards in this deck.

Unlock Deck

k this deck

6

The nominal interest rate is the difference between real interest rate and inflation.

Unlock Deck

Unlock for access to all 117 flashcards in this deck.

Unlock Deck

k this deck

7

Interest rate parity tells us that the cost of buying yen forward is exactly the same as the cost of borrowing dollars,buying yen in the spot market,and leaving them on yen deposit.

Unlock Deck

Unlock for access to all 117 flashcards in this deck.

Unlock Deck

k this deck

8

Even if a firm neither owes nor is owed foreign currency,it still may be affected by currency fluctuations.

Unlock Deck

Unlock for access to all 117 flashcards in this deck.

Unlock Deck

k this deck

9

Forward contracts are standardized contracts sold in organized exchanges.

Unlock Deck

Unlock for access to all 117 flashcards in this deck.

Unlock Deck

k this deck

10

The difference in interest rates between countries is believed to be equal to the expected change in spot exchange rates.

Unlock Deck

Unlock for access to all 117 flashcards in this deck.

Unlock Deck

k this deck

11

History has shown a positive relationship between higher interest rates and higher subsequent rates of inflation.

Unlock Deck

Unlock for access to all 117 flashcards in this deck.

Unlock Deck

k this deck

12

The International Fisher effect stated that "if expected real interest rates are the same everywhere,then differences in the nominal interest rate must reflect differences in expected inflation rates."

Unlock Deck

Unlock for access to all 117 flashcards in this deck.

Unlock Deck

k this deck

13

If the mark is trading at a forward discount relative to the dollar,then you'll receive less marks per dollar in the future.

Unlock Deck

Unlock for access to all 117 flashcards in this deck.

Unlock Deck

k this deck

14

The direct exchange rate quotes the number of U.S.dollars that can be exchanged for one unit of a foreign currency.

Unlock Deck

Unlock for access to all 117 flashcards in this deck.

Unlock Deck

k this deck

15

According to interest rate parity,the interest rate differential must be equal to the differential between forward and spot exchange rates.

Unlock Deck

Unlock for access to all 117 flashcards in this deck.

Unlock Deck

k this deck

16

Made-to-measure currency options can be bought from the major banks,and standardized options are traded on the options exchange.

Unlock Deck

Unlock for access to all 117 flashcards in this deck.

Unlock Deck

k this deck

17

Interest rate parity suggests that you may assume that it is cheaper to borrow in a currency with a low nominal rate of interest.

Unlock Deck

Unlock for access to all 117 flashcards in this deck.

Unlock Deck

k this deck

18

The New York Stock Exchange is one of few markets to have a higher daily volume than the foreign exchange market.

Unlock Deck

Unlock for access to all 117 flashcards in this deck.

Unlock Deck

k this deck

19

Futures contracts represent a low-cost method of buying foreign currency forward.

Unlock Deck

Unlock for access to all 117 flashcards in this deck.

Unlock Deck

k this deck

20

Indirect quotes are rates of foreign currency expressed in U.S.dollars.

Unlock Deck

Unlock for access to all 117 flashcards in this deck.

Unlock Deck

k this deck

21

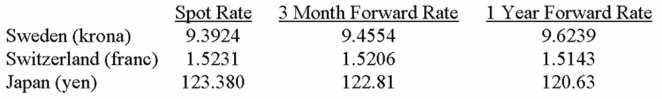

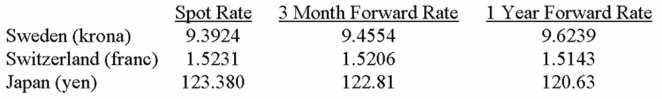

Suppose that:  What rate do you think a Japanese bank would quote for buying or selling Swiss francs?

What rate do you think a Japanese bank would quote for buying or selling Swiss francs?

A) 81.01 yen

B) 83.01 yen

C) 85.01 yen

D) 87.01 yen

What rate do you think a Japanese bank would quote for buying or selling Swiss francs?

What rate do you think a Japanese bank would quote for buying or selling Swiss francs?A) 81.01 yen

B) 83.01 yen

C) 85.01 yen

D) 87.01 yen

Unlock Deck

Unlock for access to all 117 flashcards in this deck.

Unlock Deck

k this deck

22

Buying currency in the forward market is a costly way of hedging the currency risk.

Unlock Deck

Unlock for access to all 117 flashcards in this deck.

Unlock Deck

k this deck

23

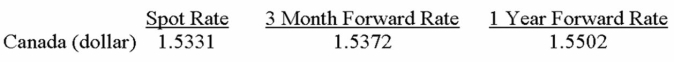

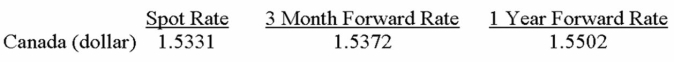

Suppose that:  If no other information is available,what will your guess about the spot rate in 1 year be?

If no other information is available,what will your guess about the spot rate in 1 year be?

A) 1.5331

B) 1.5372

C) 1.5502

D) 2.0000

If no other information is available,what will your guess about the spot rate in 1 year be?

If no other information is available,what will your guess about the spot rate in 1 year be?A) 1.5331

B) 1.5372

C) 1.5502

D) 2.0000

Unlock Deck

Unlock for access to all 117 flashcards in this deck.

Unlock Deck

k this deck

24

If the indirect exchange rate between French francs and U.S.dollars is 6.8/1,then the direct exchange rate between these currencies is:

A) $.1471/FFr.

B) $/6.8FFr.

C) FFr/$6.8.

D) FFr/$.1471.

A) $.1471/FFr.

B) $/6.8FFr.

C) FFr/$6.8.

D) FFr/$.1471.

Unlock Deck

Unlock for access to all 117 flashcards in this deck.

Unlock Deck

k this deck

25

If the exchange rate of euros/U.S.dollars is 2.04/1,then:

A) it takes $2.04 to buy each euro.

B) the euro is worth more than one U.S. dollar.

C) each euro is worth approximately 49 cents.

D) 20 cents will purchase one euro.

A) it takes $2.04 to buy each euro.

B) the euro is worth more than one U.S. dollar.

C) each euro is worth approximately 49 cents.

D) 20 cents will purchase one euro.

Unlock Deck

Unlock for access to all 117 flashcards in this deck.

Unlock Deck

k this deck

26

The theory that goods in a foreign country should be priced approximately equal after currency translation to goods in a host country is referred to as the law of:

A) exchange rates.

B) large numbers.

C) spot rates.

D) one price.

A) exchange rates.

B) large numbers.

C) spot rates.

D) one price.

Unlock Deck

Unlock for access to all 117 flashcards in this deck.

Unlock Deck

k this deck

27

How many dollars will it take for a U.S.citizen to purchase a Japanese product priced at 60,000 yen if the indirect exchange rate is 104/1?

A) $577

B) $700

C) $5,769

D) $62,400

A) $577

B) $700

C) $5,769

D) $62,400

Unlock Deck

Unlock for access to all 117 flashcards in this deck.

Unlock Deck

k this deck

28

If the spot exchange rate between euros and dollars is €1.5/$ before the dollar depreciates by 10%,how many dollars will it now (after the depreciation has occurred)take to pay an invoice of €500?

A) $366.67

B) $370.37

C) $750.00

D) $825.00

A) $366.67

B) $370.37

C) $750.00

D) $825.00

Unlock Deck

Unlock for access to all 117 flashcards in this deck.

Unlock Deck

k this deck

29

If the direct exchange rate between U.S.dollars and pounds sterling is 1.50/1,how much should you be willing to pay to receive 350 pounds?

A) $175.00

B) $233.33

C) $367.50

D) $525.00

A) $175.00

B) $233.33

C) $367.50

D) $525.00

Unlock Deck

Unlock for access to all 117 flashcards in this deck.

Unlock Deck

k this deck

30

Which of the following is correct if you have contracted to purchase 1,000 Swiss francs 3 months forward at a rate of SFr1.6/$?

A) You pay approximately $625 today for the francs.

B) You pay $1,600 today for the francs.

C) You pay approximately $625 3 months from now for the francs.

D) You pay $1,600 3 months from now for the francs.

A) You pay approximately $625 today for the francs.

B) You pay $1,600 today for the francs.

C) You pay approximately $625 3 months from now for the francs.

D) You pay $1,600 3 months from now for the francs.

Unlock Deck

Unlock for access to all 117 flashcards in this deck.

Unlock Deck

k this deck

31

Assuming that the international Fisher effect is holding,what will be the effect of an increase in nominal interest rate on the currency?

A) Currency will appreciate.

B) Currency will depreciate.

C) There will be no significant change in exchange rate.

D) Currency will sell at a forward premium.

A) Currency will appreciate.

B) Currency will depreciate.

C) There will be no significant change in exchange rate.

D) Currency will sell at a forward premium.

Unlock Deck

Unlock for access to all 117 flashcards in this deck.

Unlock Deck

k this deck

32

You can value overseas investments using the NPV of the cash flows.Which of the following adjustment is necessary to calculate the NPV?

A) Convert the opportunity cost of capital and cash flows into foreign currency.

B) Convert the foreign cash flows into domestic currency and use the domestic opportunity cost of capital for discounting.

C) Use domestic discount rate to discount foreign cash flows.

D) Convert the foreign cash flow into domestic currency and use the foreign cost of capital for discounting.

A) Convert the opportunity cost of capital and cash flows into foreign currency.

B) Convert the foreign cash flows into domestic currency and use the domestic opportunity cost of capital for discounting.

C) Use domestic discount rate to discount foreign cash flows.

D) Convert the foreign cash flow into domestic currency and use the foreign cost of capital for discounting.

Unlock Deck

Unlock for access to all 117 flashcards in this deck.

Unlock Deck

k this deck

33

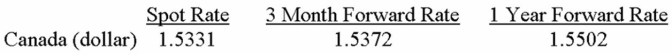

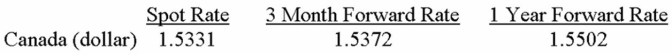

Suppose that:  What is the annualized percentage discount or premium of the Canadian dollar on the U.S.dollar?

What is the annualized percentage discount or premium of the Canadian dollar on the U.S.dollar?

A) 1.10% premium

B) 1.10% discount

C) 2.20% premium

D) 2.20% discount

What is the annualized percentage discount or premium of the Canadian dollar on the U.S.dollar?

What is the annualized percentage discount or premium of the Canadian dollar on the U.S.dollar?A) 1.10% premium

B) 1.10% discount

C) 2.20% premium

D) 2.20% discount

Unlock Deck

Unlock for access to all 117 flashcards in this deck.

Unlock Deck

k this deck

34

A U.S.importer of Japanese product should sell Japanese yen forward to avoid the risk of an appreciation of the yen.

Unlock Deck

Unlock for access to all 117 flashcards in this deck.

Unlock Deck

k this deck

35

Transaction risk is easily identified and hedged.

Unlock Deck

Unlock for access to all 117 flashcards in this deck.

Unlock Deck

k this deck

36

The main purpose in contracting to purchase foreign currency in the forward market is to:

A) earn a premium (interest) on the exchange.

B) lock into a price now.

C) take advantage of future price reductions.

D) avoid the more expensive spot rates.

A) earn a premium (interest) on the exchange.

B) lock into a price now.

C) take advantage of future price reductions.

D) avoid the more expensive spot rates.

Unlock Deck

Unlock for access to all 117 flashcards in this deck.

Unlock Deck

k this deck

37

If the interest rate of one country increases,then the value of that country's currency increases in the forward market.

Unlock Deck

Unlock for access to all 117 flashcards in this deck.

Unlock Deck

k this deck

38

Risk-free strategies that take advantage of misalignments in two prices (e.g.,the spot and forward exchange rates)are called arbitrage strategies.

Unlock Deck

Unlock for access to all 117 flashcards in this deck.

Unlock Deck

k this deck

39

If the international Fisher effect is valid,then real interest rates in all countries should be equal.

Unlock Deck

Unlock for access to all 117 flashcards in this deck.

Unlock Deck

k this deck

40

If the spot indirect exchange rate of Mexican pesos for U.S.dollars is 9.8/1 and the peso is trading at a forward premium of 3%,then you will receive:

A) more than 9.8 pesos per dollar in the future.

B) less than 9.8 pesos per dollar in the future.

C) 9.83 pesos per dollar in the future.

D) 10.09 pesos per dollar in the future.

A) more than 9.8 pesos per dollar in the future.

B) less than 9.8 pesos per dollar in the future.

C) 9.83 pesos per dollar in the future.

D) 10.09 pesos per dollar in the future.

Unlock Deck

Unlock for access to all 117 flashcards in this deck.

Unlock Deck

k this deck

41

Which of the following would you expect to be nearly equal across countries?

A) Nominal interest rates

B) Real interest rates

C) Inflation rates

D) Forward premium

A) Nominal interest rates

B) Real interest rates

C) Inflation rates

D) Forward premium

Unlock Deck

Unlock for access to all 117 flashcards in this deck.

Unlock Deck

k this deck

42

How much wealthier would you be 1 year from now if you exchange $100,000 into Hong Kong dollars today at an indirect rate of HK$7.8/$,earn 7% on your Hong Kong investment,and exchange back at a rate of HK$8.0/$,as compared to investing in the United States at 4.0%?

A) -$2,600

B) $325

C) $2,000

D) $5,744

A) -$2,600

B) $325

C) $2,000

D) $5,744

Unlock Deck

Unlock for access to all 117 flashcards in this deck.

Unlock Deck

k this deck

43

If you are a currency speculator,you will always make money by:

A) buying currency with high interest rate.

B) buying currency with low interest rate.

C) accurately predicting whether exchange rate will change more or less than the interest rate differential.

D) buying the currency with the highest interest rate differential.

A) buying currency with high interest rate.

B) buying currency with low interest rate.

C) accurately predicting whether exchange rate will change more or less than the interest rate differential.

D) buying the currency with the highest interest rate differential.

Unlock Deck

Unlock for access to all 117 flashcards in this deck.

Unlock Deck

k this deck

44

The spot exchange rate for the Canadian dollar (C$)is U.S.$0.68/C$.The 6-month interest rate in the United States is 2.5%,and 3.0% in Canada.What is the 6-month forward rate for the Canadian dollar?

A) US$0.6734/C$

B) US$0.6767/C$

C) US$0.6833/C$

D) US$0.6866/C$

A) US$0.6734/C$

B) US$0.6767/C$

C) US$0.6833/C$

D) US$0.6866/C$

Unlock Deck

Unlock for access to all 117 flashcards in this deck.

Unlock Deck

k this deck

45

That Italian antique was priced at 3 million lire which,fortunately,does not have to be paid for 3 months.The lira has a spot exchange rate of L2,000/$ but is trading 3 months forward at a 5% discount.If you contract ahead now,how many dollars will the antique cost?

A) $1,425

B) $1,429

C) $1,575

D) $1,579

A) $1,425

B) $1,429

C) $1,575

D) $1,579

Unlock Deck

Unlock for access to all 117 flashcards in this deck.

Unlock Deck

k this deck

46

Which of the following is correct when foreign currency is contracted in the forward market?

A) A fixed amount is paid when initiating the contract.

B) A fixed amount is paid at the end of the contract.

C) The amount to be paid is determined and paid at the end of the contract.

D) The amount to be paid is determined periodically and paid in installments during the contract.

A) A fixed amount is paid when initiating the contract.

B) A fixed amount is paid at the end of the contract.

C) The amount to be paid is determined and paid at the end of the contract.

D) The amount to be paid is determined periodically and paid in installments during the contract.

Unlock Deck

Unlock for access to all 117 flashcards in this deck.

Unlock Deck

k this deck

47

If you buy yen forward when the yen is selling at a forward premium,you will get:

A) more yen than if you buy on spot market.

B) fewer yen than if you buy on spot market.

C) the same number of yen as on the spot market, but with a lower commission.

D) the expectation of more yen, but the difference is not locked in.

A) more yen than if you buy on spot market.

B) fewer yen than if you buy on spot market.

C) the same number of yen as on the spot market, but with a lower commission.

D) the expectation of more yen, but the difference is not locked in.

Unlock Deck

Unlock for access to all 117 flashcards in this deck.

Unlock Deck

k this deck

48

Which of the following appears to be a safe assumption when there is no difference between the forward and spot exchange rates between two currencies?

A) The countries have equal nominal interest rates.

B) The spot rate is expected to change.

C) Expected inflation is less than the nominal rate.

D) Both currencies are selling at a premium relative to the other.

A) The countries have equal nominal interest rates.

B) The spot rate is expected to change.

C) Expected inflation is less than the nominal rate.

D) Both currencies are selling at a premium relative to the other.

Unlock Deck

Unlock for access to all 117 flashcards in this deck.

Unlock Deck

k this deck

49

Consider the following spot exchange rates: $1.60/£,¥105/$,€1.6/$,and L2,020/$.Which of the following seems to violate the law of one price if gold sells for $290 per ounce in the United States?

A) 1 troy oz. gold = £181.25

B) 1 troy oz. gold = ¥30,450

C) 1 troy oz. gold = €405

D) 1 troy oz. gold = L585,800

A) 1 troy oz. gold = £181.25

B) 1 troy oz. gold = ¥30,450

C) 1 troy oz. gold = €405

D) 1 troy oz. gold = L585,800

Unlock Deck

Unlock for access to all 117 flashcards in this deck.

Unlock Deck

k this deck

50

Yesterday the spot exchange rate of yen-to-dollar was 105.What is today's spot exchange rate if the yen has appreciated 10% against the dollar today?

A) ¥94.5/$

B) ¥94.5/$1.10

C) ¥115.5/$

D) ¥115.5/$1.10

A) ¥94.5/$

B) ¥94.5/$1.10

C) ¥115.5/$

D) ¥115.5/$1.10

Unlock Deck

Unlock for access to all 117 flashcards in this deck.

Unlock Deck

k this deck

51

If prices in the United States rise less rapidly than in Canada,which of the following would be expected according to purchasing power parity?

A) The value of the Canadian dollar will decline, relative to the U.S. dollar.

B) The value of the U.S. dollar will decline, relative to the Canadian dollar.

C) Inflation will increase in Canada.

D) The price of gold will decline.

A) The value of the Canadian dollar will decline, relative to the U.S. dollar.

B) The value of the U.S. dollar will decline, relative to the Canadian dollar.

C) Inflation will increase in Canada.

D) The price of gold will decline.

Unlock Deck

Unlock for access to all 117 flashcards in this deck.

Unlock Deck

k this deck

52

If interest rates are higher in Italy than in the United States,the market expects that the Euro will:

A) appreciate against the dollar.

B) depreciate against the dollar.

C) offer a higher real rate of return than the dollar.

D) be selling at a forward discount.

A) appreciate against the dollar.

B) depreciate against the dollar.

C) offer a higher real rate of return than the dollar.

D) be selling at a forward discount.

Unlock Deck

Unlock for access to all 117 flashcards in this deck.

Unlock Deck

k this deck

53

U.S.investments with a 1-year maturity can be made for 6% and Swiss 1-year investments can be made for 3%.If the spot exchange rate is SFr1.6/$,which of the following 1-year forward exchange rates would convince you to invest in Switzerland?

A) SFr1.55/$

B) SFr1.60/$

C) SFr1.65/$

D) SFr1.70/$

A) SFr1.55/$

B) SFr1.60/$

C) SFr1.65/$

D) SFr1.70/$

Unlock Deck

Unlock for access to all 117 flashcards in this deck.

Unlock Deck

k this deck

54

If the difference between forward and spot exchange rates is positive,interest rate parity would predict that:

A) the difference in interest rates between countries will be negative.

B) the difference in interest rates between countries will be positive.

C) there will be no difference in interest rates between countries.

D) the difference will be quickly eliminated.

A) the difference in interest rates between countries will be negative.

B) the difference in interest rates between countries will be positive.

C) there will be no difference in interest rates between countries.

D) the difference will be quickly eliminated.

Unlock Deck

Unlock for access to all 117 flashcards in this deck.

Unlock Deck

k this deck

55

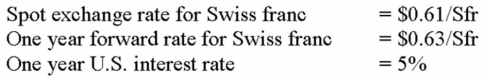

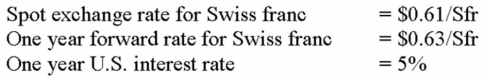

The following information is provided to you:  What is the 1-year interest rate for the Swiss franc?

What is the 1-year interest rate for the Swiss franc?

A) 2.00%

B) 1.67%

C) 1.50%

D) 1.33%

What is the 1-year interest rate for the Swiss franc?

What is the 1-year interest rate for the Swiss franc?A) 2.00%

B) 1.67%

C) 1.50%

D) 1.33%

Unlock Deck

Unlock for access to all 117 flashcards in this deck.

Unlock Deck

k this deck

56

According to the expectations theory of exchange rates,what change is expected in the future spot exchange rate if the current spot rate is 8% lower than the forward exchange rate?

A) Future spot rate is expected to increase by 8%.

B) Future spot rate is expected to decrease by 8%.

C) Future spot rate is expected to decrease by 4%.

D) No change is expected in the future spot rate.

A) Future spot rate is expected to increase by 8%.

B) Future spot rate is expected to decrease by 8%.

C) Future spot rate is expected to decrease by 4%.

D) No change is expected in the future spot rate.

Unlock Deck

Unlock for access to all 117 flashcards in this deck.

Unlock Deck

k this deck

57

Which of the following would you expect to improve the dollar NPV of a foreign capital budgeting proposal?

A) The risk-free rate in the foreign country is higher than in the United States.

B) Lower inflation is expected in the foreign country than in the United States.

C) The foreign country has a less stable political environment.

D) All of these.

A) The risk-free rate in the foreign country is higher than in the United States.

B) Lower inflation is expected in the foreign country than in the United States.

C) The foreign country has a less stable political environment.

D) All of these.

Unlock Deck

Unlock for access to all 117 flashcards in this deck.

Unlock Deck

k this deck

58

What can be said about the spot exchange rate of dollars for pounds if nominal interest rates are higher in the United States than in the United Kingdom?

A) It should exceed the forward rate of dollars for pounds.

B) It should be less than the forward rate of dollars for pounds.

C) It is expected to increase.

D) It is expected to remain constant.

A) It should exceed the forward rate of dollars for pounds.

B) It should be less than the forward rate of dollars for pounds.

C) It is expected to increase.

D) It is expected to remain constant.

Unlock Deck

Unlock for access to all 117 flashcards in this deck.

Unlock Deck

k this deck

59

An indirect exchange rate can be converted to a direct exchange rate by:

A) dividing the indirect rate by number of U.S. dollars required to purchase one unit of the other currency.

B) dividing the indirect rate by 100.

C) multiplying the indirect rate by the spot rate.

D) taking the inverse of the indirect rate.

A) dividing the indirect rate by number of U.S. dollars required to purchase one unit of the other currency.

B) dividing the indirect rate by 100.

C) multiplying the indirect rate by the spot rate.

D) taking the inverse of the indirect rate.

Unlock Deck

Unlock for access to all 117 flashcards in this deck.

Unlock Deck

k this deck

60

Which of the following is correct when contracting ahead in the forward exchange market?

A) At contract close you pay either the forward rate that was contracted or the then-current rate.

B) Contracting ahead is always cheaper than waiting to pay spot rates.

C) Your cost is locked in from the beginning of the contract, regardless of market changes.

D) Paying spot price is safer than contracting forward.

A) At contract close you pay either the forward rate that was contracted or the then-current rate.

B) Contracting ahead is always cheaper than waiting to pay spot rates.

C) Your cost is locked in from the beginning of the contract, regardless of market changes.

D) Paying spot price is safer than contracting forward.

Unlock Deck

Unlock for access to all 117 flashcards in this deck.

Unlock Deck

k this deck

61

What would you expect to occur if the rate of expected inflation in the United States is considerably lower than expected inflation in Germany?

A) The expected spot rate of €/$ will increase.

B) The current spot rate of €/$ will increase.

C) The dollar should appreciate against the euro.

D) The dollar should depreciate against the euro.

A) The expected spot rate of €/$ will increase.

B) The current spot rate of €/$ will increase.

C) The dollar should appreciate against the euro.

D) The dollar should depreciate against the euro.

Unlock Deck

Unlock for access to all 117 flashcards in this deck.

Unlock Deck

k this deck

62

What is the expected German inflation rate if 3% inflation is expected in the United States,the spot exchange rate is €1.5/$ and the expected spot rate is €1.6/$?

A) 2.81%

B) 7.10%

C) 9.87%

D) 11.43%

A) 2.81%

B) 7.10%

C) 9.87%

D) 11.43%

Unlock Deck

Unlock for access to all 117 flashcards in this deck.

Unlock Deck

k this deck

63

You have the opportunity to invest in the United States at 6% or invest in an equally risky Australian investment that offers 20%.This is too good to be true! The current exchange rate is A$1.65/$.Which of the following do you suspect about this 1-year investment?

A) Expected inflation is higher in the United States.

B) The 1-year forward exchange rate is A$1.8679/$.

C) Real interest rates are higher in the United States.

D) The Australian dollar is selling forward at an 8.48% premium relative to the dollar.

A) Expected inflation is higher in the United States.

B) The 1-year forward exchange rate is A$1.8679/$.

C) Real interest rates are higher in the United States.

D) The Australian dollar is selling forward at an 8.48% premium relative to the dollar.

Unlock Deck

Unlock for access to all 117 flashcards in this deck.

Unlock Deck

k this deck

64

The international Fisher effect predicts that differences in nominal interest rates between countries reflect differences in:

A) real rates of interest.

B) purchasing power parity.

C) the standard of living.

D) expected inflation.

A) real rates of interest.

B) purchasing power parity.

C) the standard of living.

D) expected inflation.

Unlock Deck

Unlock for access to all 117 flashcards in this deck.

Unlock Deck

k this deck

65

If the direct quote for the euro (€)is $0.51/€,then the indirect quote for the euro will be:

A) €0.0051/US$.

B) €1.0000/US$.

C) €1.0049/US$.

D) €1.9608/US$.

A) €0.0051/US$.

B) €1.0000/US$.

C) €1.0049/US$.

D) €1.9608/US$.

Unlock Deck

Unlock for access to all 117 flashcards in this deck.

Unlock Deck

k this deck

66

High inflation rates are usually associated with:

A) low nominal interest rates.

B) high nominal interest rates.

C) high real interest rates.

D) low real interest rates.

A) low nominal interest rates.

B) high nominal interest rates.

C) high real interest rates.

D) low real interest rates.

Unlock Deck

Unlock for access to all 117 flashcards in this deck.

Unlock Deck

k this deck

67

The ratio of expected spot rate to current spot rate for $/£ is 1.02 and the inflation rate in the United States is 5%.What is the approximate inflation rate in the United Kingdom?

A) 1.3%

B) 2.9%

C) 4.1%

D) 7.0%

A) 1.3%

B) 2.9%

C) 4.1%

D) 7.0%

Unlock Deck

Unlock for access to all 117 flashcards in this deck.

Unlock Deck

k this deck

68

According to the theory of purchasing power parity,exchange rates will adjust so that differences in:

A) interest rates across countries are offset.

B) forward rates across countries are offset.

C) expected inflation across countries are offset.

D) international Fisher rates are offset.

A) interest rates across countries are offset.

B) forward rates across countries are offset.

C) expected inflation across countries are offset.

D) international Fisher rates are offset.

Unlock Deck

Unlock for access to all 117 flashcards in this deck.

Unlock Deck

k this deck

69

Predict the expected spot exchange rate between the Japanese yen and U.S.dollar,given that inflation in Japan,at 8%,is 4% higher than in the United States and that the current spot rate is ¥107/$.

A) ¥102.72/$

B) ¥103.04/$

C) ¥111.12/$

D) ¥111.28/$

A) ¥102.72/$

B) ¥103.04/$

C) ¥111.12/$

D) ¥111.28/$

Unlock Deck

Unlock for access to all 117 flashcards in this deck.

Unlock Deck

k this deck

70

If exchange rates adjust to reflect inflation differentials across countries,then:

A) the law of one price will always hold.

B) no one will use forward currency markets.

C) interest rates will be equal across countries.

D) PPP is said to hold.

A) the law of one price will always hold.

B) no one will use forward currency markets.

C) interest rates will be equal across countries.

D) PPP is said to hold.

Unlock Deck

Unlock for access to all 117 flashcards in this deck.

Unlock Deck

k this deck

71

Countries with high inflation will have the:

A) weakest currency.

B) highest nominal interest rate.

C) strongest currency.

D) highest real interest rate.

A) weakest currency.

B) highest nominal interest rate.

C) strongest currency.

D) highest real interest rate.

Unlock Deck

Unlock for access to all 117 flashcards in this deck.

Unlock Deck

k this deck

72

How much would you expect to receive for a nominal interest rate in Holland if funds can be invested in the United States at a rate of 7% when inflation is expected to be 4% in the United States and 8% in Holland?

A) 5.19%

B) 7.93%

C) 9.08%

D) 11.11%

A) 5.19%

B) 7.93%

C) 9.08%

D) 11.11%

Unlock Deck

Unlock for access to all 117 flashcards in this deck.

Unlock Deck

k this deck

73

If the correlation of returns between foreign projects and domestic projects is less than 1.0,then:

A) foreign projects should be discounted with a higher rate.

B) the domestic firm would be better off without the foreign projects.

C) the foreign project may not add much risk to the existing domestic operation.

D) the foreign projects will experience a higher degree of inflation.

A) foreign projects should be discounted with a higher rate.

B) the domestic firm would be better off without the foreign projects.

C) the foreign project may not add much risk to the existing domestic operation.

D) the foreign projects will experience a higher degree of inflation.

Unlock Deck

Unlock for access to all 117 flashcards in this deck.

Unlock Deck

k this deck

74

The 6-month forward quote for the euro is €1.6/US$,and the spot price of the euro is €1.7/US$.Which of the following statements is true?

A) Forward discount on the euro is 6.25%.

B) Forward premium on the euro is 6.25%.

C) Forward discount on US$ is 6.25%.

D) Forward premium on US$ is 6.25%.

A) Forward discount on the euro is 6.25%.

B) Forward premium on the euro is 6.25%.

C) Forward discount on US$ is 6.25%.

D) Forward premium on US$ is 6.25%.

Unlock Deck

Unlock for access to all 117 flashcards in this deck.

Unlock Deck

k this deck

75

What would you expect to be the relationship between real rates of interest in Japan and the United States if inflation is expected to be 3% in Japan and 6% in the United States?

A) Japan's real interest rate should be 3% higher than in the United States.

B) Japan's real interest rate should be 3% lower than in the United States.

C) Japan's real interest rate should be half as high as in the United States.

D) Real interest rates should be equal in both countries.

A) Japan's real interest rate should be 3% higher than in the United States.

B) Japan's real interest rate should be 3% lower than in the United States.

C) Japan's real interest rate should be half as high as in the United States.

D) Real interest rates should be equal in both countries.

Unlock Deck

Unlock for access to all 117 flashcards in this deck.

Unlock Deck

k this deck

76

If managers intend to adjust the projections of foreign investments,it is probably better to make the adjustments in:

A) the discount rate used.

B) the cash flows projected.

C) both the discount rate and cash flows.

D) the exchange rate, but never in the discount rate.

A) the discount rate used.

B) the cash flows projected.

C) both the discount rate and cash flows.

D) the exchange rate, but never in the discount rate.

Unlock Deck

Unlock for access to all 117 flashcards in this deck.

Unlock Deck

k this deck

77

The international Fisher effect is valid in the long run because:

A) inflation rates are equal in different countries.

B) investors will move their money into countries with high real interest rates.

C) investors will move their money into countries with high nominal interest rates.

D) investors will move their money into countries with low inflation.

A) inflation rates are equal in different countries.

B) investors will move their money into countries with high real interest rates.

C) investors will move their money into countries with high nominal interest rates.

D) investors will move their money into countries with low inflation.

Unlock Deck

Unlock for access to all 117 flashcards in this deck.

Unlock Deck

k this deck

78

If purchasing power parity is holding,what will happen to the currency of a country with high inflation?

A) Currency will appreciate.

B) Currency will depreciate.

C) There will be no significant change in exchange rate.

D) Currency will sell at a forward premium.

A) Currency will appreciate.

B) Currency will depreciate.

C) There will be no significant change in exchange rate.

D) Currency will sell at a forward premium.

Unlock Deck

Unlock for access to all 117 flashcards in this deck.

Unlock Deck

k this deck

79

What do you expect to happen to prices in Japan,given nominal interest rates of 10% in the United States and 6% in Japan,and expected U.S.inflation of 6%?

A) Expected Japanese inflation is 1.79%.

B) Expected Japanese inflation is 2.15%.

C) Expected Japanese inflation is 6.22%.

D) Expected Japanese inflation is 10.00%.

A) Expected Japanese inflation is 1.79%.

B) Expected Japanese inflation is 2.15%.

C) Expected Japanese inflation is 6.22%.

D) Expected Japanese inflation is 10.00%.

Unlock Deck

Unlock for access to all 117 flashcards in this deck.

Unlock Deck

k this deck

80

Where would you prefer to invest,and why,if nominal rates are 10% in the United States and 25% in Holland,while the expected rates of inflation are 5% and 19%,respectively? Assume investments of equal risk.

A) Invest in Holland due to higher nominal rate.

B) Invest in United States; real return is 1.1% higher.

C) Invest in United States; real return is 0.1% higher.

D) Invest in Holland; real return is 0.24% higher.

A) Invest in Holland due to higher nominal rate.

B) Invest in United States; real return is 1.1% higher.

C) Invest in United States; real return is 0.1% higher.

D) Invest in Holland; real return is 0.24% higher.

Unlock Deck

Unlock for access to all 117 flashcards in this deck.

Unlock Deck

k this deck