Deck 18: Options and Contingent Claims

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/59

Play

Full screen (f)

Deck 18: Options and Contingent Claims

1

For a put option (bought)with an exercise price of $9.50,the maximum payoff is:

A)$5.00

B)Zero

C)$9.50

D)None of the given options.

A)$5.00

B)Zero

C)$9.50

D)None of the given options.

$9.50

2

Which of the following enables an arbitrage profit to be made (excluding transaction costs)from a call option if the market price of the underlying share is $5 50,the price of the call is $1 50,and the exercise price is $3 80?

A)Buy the call option,exercise it and sell the underlying share.

B)Buy a put option,exercise it and buy the underlying share.

C)Buy a call option and hold onto it until expiry.

D)Sell a put option now and realise the profit.

A)Buy the call option,exercise it and sell the underlying share.

B)Buy a put option,exercise it and buy the underlying share.

C)Buy a call option and hold onto it until expiry.

D)Sell a put option now and realise the profit.

Buy the call option,exercise it and sell the underlying share.

3

A call option gives a buyer:

A)an asset whose value depends on the value of another asset.

B)the obligation to buy an asset at a predetermined price.

C)the right to buy an asset at a predetermined price.

D)the right to sell an asset at a predetermined price.

A)an asset whose value depends on the value of another asset.

B)the obligation to buy an asset at a predetermined price.

C)the right to buy an asset at a predetermined price.

D)the right to sell an asset at a predetermined price.

the right to buy an asset at a predetermined price.

4

Which option gives the right to buy an underlying asset at a fixed price?

A)Put option.

B)American option.

C)Call option.

D)Binomial option.

A)Put option.

B)American option.

C)Call option.

D)Binomial option.

Unlock Deck

Unlock for access to all 59 flashcards in this deck.

Unlock Deck

k this deck

5

The value of an option,if exercised immediately,is known as:

A)time value.

B)strike value.

C)intrinsic value.

D)none of the given options as the option cannot be exercised immediately.

A)time value.

B)strike value.

C)intrinsic value.

D)none of the given options as the option cannot be exercised immediately.

Unlock Deck

Unlock for access to all 59 flashcards in this deck.

Unlock Deck

k this deck

6

At expiry,a call option is worth:

A)the maximum of the exercise price minus the share price and zero.

B)at least the exercise price.

C)at least the share price.

D)the maximum of the share price minus the exercise price and zero.

A)the maximum of the exercise price minus the share price and zero.

B)at least the exercise price.

C)at least the share price.

D)the maximum of the share price minus the exercise price and zero.

Unlock Deck

Unlock for access to all 59 flashcards in this deck.

Unlock Deck

k this deck

7

If the share price at the expiry of a call option is less than the exercise price,the call is worth:

A)zero.

B)the difference between the exercise price and the share price.

C)the market price of the share.

D)an undefined amount.

A)zero.

B)the difference between the exercise price and the share price.

C)the market price of the share.

D)an undefined amount.

Unlock Deck

Unlock for access to all 59 flashcards in this deck.

Unlock Deck

k this deck

8

The exercise price of an option is:

A)the price at which an option holder has the right to buy or sell an asset.

B)not the strike price but the market price of an option.

C)the traded price of an option.

D)the market price of a put option.

A)the price at which an option holder has the right to buy or sell an asset.

B)not the strike price but the market price of an option.

C)the traded price of an option.

D)the market price of a put option.

Unlock Deck

Unlock for access to all 59 flashcards in this deck.

Unlock Deck

k this deck

9

Ratio of the change in an option price that results from a change in the price of the underlying assets is known as the option's:

A)beta.

B)delta.

C)theta.

D)gamma.

A)beta.

B)delta.

C)theta.

D)gamma.

Unlock Deck

Unlock for access to all 59 flashcards in this deck.

Unlock Deck

k this deck

10

What is the payoff of a call option (bought)with an exercise price of $15.00,if the underlying share price is $16.50,at the expiry date of the option?

A)$15.00

B)Zero

C)$1.00

D)$1.50

A)$15.00

B)Zero

C)$1.00

D)$1.50

Unlock Deck

Unlock for access to all 59 flashcards in this deck.

Unlock Deck

k this deck

11

A right to discontinue an investment project is the:

A)option to defer.

B)option to study.

C)option to abandon.

D)none of the given options.

A)option to defer.

B)option to study.

C)option to abandon.

D)none of the given options.

Unlock Deck

Unlock for access to all 59 flashcards in this deck.

Unlock Deck

k this deck

12

The figure '12.00' of a September series of call options refers to the:

A)date upon which the option must be exercised.

B)market price of the underlying asset.

C)price at which the underlying asset can be sold.

D)price at which the underlying asset can be purchased.

A)date upon which the option must be exercised.

B)market price of the underlying asset.

C)price at which the underlying asset can be sold.

D)price at which the underlying asset can be purchased.

Unlock Deck

Unlock for access to all 59 flashcards in this deck.

Unlock Deck

k this deck

13

Which of the following is a potential disadvantage of privately negotiated options?

A)It is often difficult to find a party with whom to contract.

B)It is not possible to reverse out of a contract before the agreed expiry date.

C)It may be necessary to investigate the creditworthiness of the other party.

D)All of the given options.

A)It is often difficult to find a party with whom to contract.

B)It is not possible to reverse out of a contract before the agreed expiry date.

C)It may be necessary to investigate the creditworthiness of the other party.

D)All of the given options.

Unlock Deck

Unlock for access to all 59 flashcards in this deck.

Unlock Deck

k this deck

14

Which of the following statements regarding call options is true?

A)The price paid for a call option should reflect,amongst other factors,the probability that the underlying share price will rise above the exercise price.

B)The price paid for a call option should reflect,amongst other factors,the expected future direction of the share price.

C)The price paid for a call option should reflect,amongst other factors,the probability that the underlying share price will equal the exercise price.

D)None of the given options.

A)The price paid for a call option should reflect,amongst other factors,the probability that the underlying share price will rise above the exercise price.

B)The price paid for a call option should reflect,amongst other factors,the expected future direction of the share price.

C)The price paid for a call option should reflect,amongst other factors,the probability that the underlying share price will equal the exercise price.

D)None of the given options.

Unlock Deck

Unlock for access to all 59 flashcards in this deck.

Unlock Deck

k this deck

15

Which option gives the right to sell an underlying asset at a fixed price?

A)Put option.

B)American option.

C)Call option.

D)European option.

A)Put option.

B)American option.

C)Call option.

D)European option.

Unlock Deck

Unlock for access to all 59 flashcards in this deck.

Unlock Deck

k this deck

16

A contingent claim is best described as:

A)a contract readily traded on an exchange.

B)an asset whose value depends on the value of some other asset.

C)an asset readily traded on an exchange.

D)a liability.

A)a contract readily traded on an exchange.

B)an asset whose value depends on the value of some other asset.

C)an asset readily traded on an exchange.

D)a liability.

Unlock Deck

Unlock for access to all 59 flashcards in this deck.

Unlock Deck

k this deck

17

Which of the following statements regarding 'American-type' call options is false?

A)The higher the current share price,the greater the call price.

B)The higher the exercise price,the lower the call price.

C)The call price is greater,the longer the term to expiry.

D)The lower the risk-free interest rate,the higher the call price.

A)The higher the current share price,the greater the call price.

B)The higher the exercise price,the lower the call price.

C)The call price is greater,the longer the term to expiry.

D)The lower the risk-free interest rate,the higher the call price.

Unlock Deck

Unlock for access to all 59 flashcards in this deck.

Unlock Deck

k this deck

18

The value of an option in excess of its intrinsic value is known as:

A)time value.

B)strike value.

C)current value.

D)none of the given options.

A)time value.

B)strike value.

C)current value.

D)none of the given options.

Unlock Deck

Unlock for access to all 59 flashcards in this deck.

Unlock Deck

k this deck

19

An option that gives the buyer the right to exercise at any time up to the expiry date is called:

A)a put option.

B)an American-type option.

C)a call option.

D)a European-type option.

A)a put option.

B)an American-type option.

C)a call option.

D)a European-type option.

Unlock Deck

Unlock for access to all 59 flashcards in this deck.

Unlock Deck

k this deck

20

The Chicago Board Options Exchange opened in:

A)1970.

B)1971.

C)1972.

D)1973.

A)1970.

B)1971.

C)1972.

D)1973.

Unlock Deck

Unlock for access to all 59 flashcards in this deck.

Unlock Deck

k this deck

21

The put-call parity theorem suggests that:

A)arbitrage opportunities exist.

B)the call price equals the put price,less the share price,plus the present value of the exercise price.

C)options should not be exercised early unless there are dividends.

D)the put price equals the call price,less the share price,plus the present value of the exercise price.

A)arbitrage opportunities exist.

B)the call price equals the put price,less the share price,plus the present value of the exercise price.

C)options should not be exercised early unless there are dividends.

D)the put price equals the call price,less the share price,plus the present value of the exercise price.

Unlock Deck

Unlock for access to all 59 flashcards in this deck.

Unlock Deck

k this deck

22

Calculate the hedge ratio for the following: call option with exercise price of $3.20,current share price of $3.10 and an expected price at the expiry of the option of either $3.40 or $2.80.

A)3

B)1/3

C)1/2

D)2/3

A)3

B)1/3

C)1/2

D)2/3

Unlock Deck

Unlock for access to all 59 flashcards in this deck.

Unlock Deck

k this deck

23

Calculate the price of a one-month European call option given the following information: the exercise price is $19,the current share price is $20 and the risk-free interest rate is 15% p.a.Furthermore,the share price is expected to be either $25 or $15 at the end of the month.Assume a risk-neutral world.

A)$2.35

B)$2.59

C)$2.81

D)$3.11

A)$2.35

B)$2.59

C)$2.81

D)$3.11

Unlock Deck

Unlock for access to all 59 flashcards in this deck.

Unlock Deck

k this deck

24

The term 'default risk structure of interest rates' refers to the fact that:

A)there is a premium due to uncertainty about the future level of interest rates.

B)interest rates for different maturity ranges are determined independently.

C)at any point in time as the probability of default increases,the required yield on debt decreases.

D)at any point in time as the probability of default increases,the required yield on debt increases.

A)there is a premium due to uncertainty about the future level of interest rates.

B)interest rates for different maturity ranges are determined independently.

C)at any point in time as the probability of default increases,the required yield on debt decreases.

D)at any point in time as the probability of default increases,the required yield on debt increases.

Unlock Deck

Unlock for access to all 59 flashcards in this deck.

Unlock Deck

k this deck

25

Calculate the price of a European put option if the price of the equivalent European call option is $6 and the share price,exercise price and risk-free rate (continuously compounded)are $30,$28 and 15% p.a. ,respectively.The options have six months to expiry.Assume that put-call parity holds.

A)$10.02

B)$2.05

C)$1.98

D)$9.95

E)$2.97

A)$10.02

B)$2.05

C)$1.98

D)$9.95

E)$2.97

Unlock Deck

Unlock for access to all 59 flashcards in this deck.

Unlock Deck

k this deck

26

Calculate the price of a European call option if the price of the equivalent European put option is $5 and the share price,exercise price and risk-free rate (continuously compounded)are $31,$28 and 12% p.a. ,respectively.The options have three months to expiry.

A)$1.17

B)$8.83

C)$8.82

D)$9.63

E)$1.18

A)$1.17

B)$8.83

C)$8.82

D)$9.63

E)$1.18

Unlock Deck

Unlock for access to all 59 flashcards in this deck.

Unlock Deck

k this deck

27

A rights issue is an example of:

A)a contingent claim that does not affect a company's capital structure.

B)a put option issued by a company.

C)a call option issued by a company.

D)a redeemable preference share.

A)a contingent claim that does not affect a company's capital structure.

B)a put option issued by a company.

C)a call option issued by a company.

D)a redeemable preference share.

Unlock Deck

Unlock for access to all 59 flashcards in this deck.

Unlock Deck

k this deck

28

A problem with the net present value approach to project valuation is that:

A)the opportunity to intervene in a project has a negative NPV.

B)the opportunity to intervene in a project is worthless.

C)it assumes that there is no opportunity for the investing company to intervene in the project after it has begun.

D)it is inferior to the IRR method of project evaluation.

A)the opportunity to intervene in a project has a negative NPV.

B)the opportunity to intervene in a project is worthless.

C)it assumes that there is no opportunity for the investing company to intervene in the project after it has begun.

D)it is inferior to the IRR method of project evaluation.

Unlock Deck

Unlock for access to all 59 flashcards in this deck.

Unlock Deck

k this deck

29

Calculate the price of a European put option if the price of the equivalent European call option is $1.05 and the share price,exercise price and risk-free rate are $3.00,$2.50 and 10% p.a. ,respectively,given the option has three months to expiry.

A)$0.49

B)$0.32

C)$0.55

D)$1.05

A)$0.49

B)$0.32

C)$0.55

D)$1.05

Unlock Deck

Unlock for access to all 59 flashcards in this deck.

Unlock Deck

k this deck

30

American put options are worth more than European put options because:

A)a put would not be exercised unless the share price exceeded the exercise price.

B)it can be rational to exercise an American put option before expiry.

C)they are more volatile.

D)they are less volatile.

A)a put would not be exercised unless the share price exceeded the exercise price.

B)it can be rational to exercise an American put option before expiry.

C)they are more volatile.

D)they are less volatile.

Unlock Deck

Unlock for access to all 59 flashcards in this deck.

Unlock Deck

k this deck

31

Using the Black-Scholes formula,calculate the price of a put option from the following information: exercise price $3.00;current share price $3.30;term to expiry three months;standard deviation 0.30 p.a. ;and risk-free interest rate 10% p.a.continuously compounded.

A)$0.1586

B)$1.029

C)$1.9875

D)$0.0559

A)$0.1586

B)$1.029

C)$1.9875

D)$0.0559

Unlock Deck

Unlock for access to all 59 flashcards in this deck.

Unlock Deck

k this deck

32

Which of the following regarding 'American-type' put options is false?

A)The higher the current share price,the more valuable the option.

B)The higher the exercise price,the more valuable the option.

C)The greater the put price,the longer the term to expiry.

D)The more volatile the underlying share price,the more valuable the option.

A)The higher the current share price,the more valuable the option.

B)The higher the exercise price,the more valuable the option.

C)The greater the put price,the longer the term to expiry.

D)The more volatile the underlying share price,the more valuable the option.

Unlock Deck

Unlock for access to all 59 flashcards in this deck.

Unlock Deck

k this deck

33

Assume that the current price of an XYZ share is $4 00 and that the price of a call option on these shares is $0 80 If we know that a 10 c movement in share price will be accompanied in the same direction by a 5c movement in the call price,then an appropriate risk-free hedge will be:

A)writing five calls for every share held.

B)writing four calls for every share held.

C)writing three calls for every share held.

D)writing two calls for every share held.

A)writing five calls for every share held.

B)writing four calls for every share held.

C)writing three calls for every share held.

D)writing two calls for every share held.

Unlock Deck

Unlock for access to all 59 flashcards in this deck.

Unlock Deck

k this deck

34

A convertible note is equivalent to ordinary debt plus:

A)a call option on the assets of the company.

B)a call option on the shares of the company.

C)a put option on the assets of the company.

D)a put option on the shares of the company.

A)a call option on the assets of the company.

B)a call option on the shares of the company.

C)a put option on the assets of the company.

D)a put option on the shares of the company.

Unlock Deck

Unlock for access to all 59 flashcards in this deck.

Unlock Deck

k this deck

35

Calculate the price of a one-month European put option given the following information: the exercise price is $19,the current share price is $15 and the risk-free interest rate is 12% p.a.Furthermore,the share price is expected to be either $20 or $13 at the end of the month.Assume a risk-neutral world.

A)$2.74

B)$4.12

C)$1.82

D)$1.22

A)$2.74

B)$4.12

C)$1.82

D)$1.22

Unlock Deck

Unlock for access to all 59 flashcards in this deck.

Unlock Deck

k this deck

36

Calculate the hedge ratio for the following: call option with exercise price of $10.40,current share price of $9.80 and an expected price at the expiry of the option of either $9.60 or $11.00.

A)1/2

B)7/3

C)3/7

D)2

A)1/2

B)7/3

C)3/7

D)2

Unlock Deck

Unlock for access to all 59 flashcards in this deck.

Unlock Deck

k this deck

37

A payoff structure resembling that of a short futures position can be created by:

A)buying a call option and selling a put option,with the same exercise price and premium for both options.

B)selling a call option and buying a put option,with the same exercise price and premium for both options.

C)buying a call option and buying a put option,with the same exercise price and premium for both options.

D)selling a call option and selling a put option,with the same exercise price and premium for both options.

A)buying a call option and selling a put option,with the same exercise price and premium for both options.

B)selling a call option and buying a put option,with the same exercise price and premium for both options.

C)buying a call option and buying a put option,with the same exercise price and premium for both options.

D)selling a call option and selling a put option,with the same exercise price and premium for both options.

Unlock Deck

Unlock for access to all 59 flashcards in this deck.

Unlock Deck

k this deck

38

Calculate the price of a European call option if the price of the equivalent put option is $2.00 and the share price,exercise price and risk-free rate are $5.00,$4.50 and 10% p.a. ,respectively,given the option has three months to expiry.

A)$2.50

B)$1.39

C)$2.61

D)$2.91

A)$2.50

B)$1.39

C)$2.61

D)$2.91

Unlock Deck

Unlock for access to all 59 flashcards in this deck.

Unlock Deck

k this deck

39

A payoff structure resembling that of a long futures position can be created by:

A)buying a call option and selling a put option,with the same exercise price and premium for both options.

B)selling a call option and buying a put option,with the same exercise price and premium for both options.

C)buying a call option and buying a put option,with the same exercise price and premium for both options.

D)selling a call option and selling a put option,with the same exercise price and premium for both options.

A)buying a call option and selling a put option,with the same exercise price and premium for both options.

B)selling a call option and buying a put option,with the same exercise price and premium for both options.

C)buying a call option and buying a put option,with the same exercise price and premium for both options.

D)selling a call option and selling a put option,with the same exercise price and premium for both options.

Unlock Deck

Unlock for access to all 59 flashcards in this deck.

Unlock Deck

k this deck

40

Use the Black-Scholes formula to find the value of a European call expiring in one year with an exercise price of $100 for a share currently selling for $90.Assume the standard deviation of the continuous rate of return is 30% p.a.and the risk-free interest rate is 10% p.a.

A)$0.55

B)$0.43

C)$10.52

D)$9.93

A)$0.55

B)$0.43

C)$10.52

D)$9.93

Unlock Deck

Unlock for access to all 59 flashcards in this deck.

Unlock Deck

k this deck

41

There is a ________________ relationship between the price of a call option and the magnitude of expected future dividends.

Unlock Deck

Unlock for access to all 59 flashcards in this deck.

Unlock Deck

k this deck

42

An option creates the obligation for delivery of the underlying asset at a pre-determined point of time in the future.

Unlock Deck

Unlock for access to all 59 flashcards in this deck.

Unlock Deck

k this deck

43

A call option can have a negative payoff,however the payoff on a put option is always positive.

Unlock Deck

Unlock for access to all 59 flashcards in this deck.

Unlock Deck

k this deck

44

Calculate the price of a two-month European call option given the following information: the exercise price is $19,the current share price is $20 and the risk-free interest rate is 15% p.a.Furthermore,the share price may go up by 15 per cent or down by 15 per cent at the end of each month.Assume a risk-neutral world and time periods of one month each.

A)$2.40

B)$1.79

C)$2.43

D)$1.82

A)$2.40

B)$1.79

C)$2.43

D)$1.82

Unlock Deck

Unlock for access to all 59 flashcards in this deck.

Unlock Deck

k this deck

45

A convertible bond is an example of a ____________ claim.

Unlock Deck

Unlock for access to all 59 flashcards in this deck.

Unlock Deck

k this deck

46

The call price can be expected to be higher:

A)the lower the current share price

B)the higher the expected dividend

C)the higher the exercise price

D)the higher the risk-free interest rate

A)the lower the current share price

B)the higher the expected dividend

C)the higher the exercise price

D)the higher the risk-free interest rate

Unlock Deck

Unlock for access to all 59 flashcards in this deck.

Unlock Deck

k this deck

47

In most instances an American call option should not be exercised early.

Unlock Deck

Unlock for access to all 59 flashcards in this deck.

Unlock Deck

k this deck

48

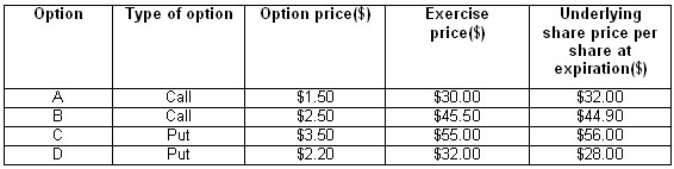

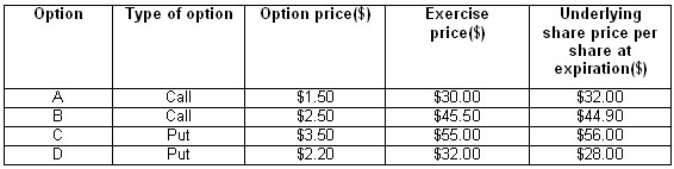

For each of the options shown in the following table,use the cost of underlying share price at expiration along with the other information to determine the amount of profit or loss an investor would have had,ignoring transaction/brokerage costs.

Unlock Deck

Unlock for access to all 59 flashcards in this deck.

Unlock Deck

k this deck

49

A __________ option provides the right,but not the obligation,to undertake some business decisions.

Unlock Deck

Unlock for access to all 59 flashcards in this deck.

Unlock Deck

k this deck

50

The call price can be expected to be higher:

A)the lower the current share price

B)the lower the expected dividend

C)the higher the exercise price

D)the lower the risk-free interest rate

A)the lower the current share price

B)the lower the expected dividend

C)the higher the exercise price

D)the lower the risk-free interest rate

Unlock Deck

Unlock for access to all 59 flashcards in this deck.

Unlock Deck

k this deck

51

The __________________ model is a mathematical model that expresses the price of a call as a function of five variables.

Unlock Deck

Unlock for access to all 59 flashcards in this deck.

Unlock Deck

k this deck

52

All things being equal,the more ________________ is the underlying share price,call prices should be higher.

Unlock Deck

Unlock for access to all 59 flashcards in this deck.

Unlock Deck

k this deck

53

Calculate the price of a two-month European put option given the following information: the exercise price is $19,the current share price is $15 and the risk-free interest rate is 12% p.a.Furthermore,the share price may go up by 10 per cent or down by 10 per cent at the end of each month.Assume a risk-neutral world and time periods of one month each.

A)$4.26

B)$3.66

C)$4.21

D)$3.63

A)$4.26

B)$3.66

C)$4.21

D)$3.63

Unlock Deck

Unlock for access to all 59 flashcards in this deck.

Unlock Deck

k this deck

54

Put-call parity demonstrates that the cash flows derived from holding a European put option on a share that does not pay dividends can be replicated by a combination of purchasing the share,borrowing at the risk-free rate and selling the counterpart call.

Unlock Deck

Unlock for access to all 59 flashcards in this deck.

Unlock Deck

k this deck

55

The price of an option is affected by the risk-free interest rate.

Unlock Deck

Unlock for access to all 59 flashcards in this deck.

Unlock Deck

k this deck

56

A _______________ call option can only be exercised on maturity.

Unlock Deck

Unlock for access to all 59 flashcards in this deck.

Unlock Deck

k this deck

57

The Black-Scholes model of call option pricing is only valid for American type call options.

Unlock Deck

Unlock for access to all 59 flashcards in this deck.

Unlock Deck

k this deck

58

Which of the following is not a factor that affects the price of an option:

A)the exercise price.

B)capital structure of the underlying share.

C)expected future dividends.

D)volatility of the underlying share.

A)the exercise price.

B)capital structure of the underlying share.

C)expected future dividends.

D)volatility of the underlying share.

Unlock Deck

Unlock for access to all 59 flashcards in this deck.

Unlock Deck

k this deck

59

A 'collar' is a combination of options that involves holding an underlying asset and purchasing a put and selling a call on that asset.

Unlock Deck

Unlock for access to all 59 flashcards in this deck.

Unlock Deck

k this deck