Deck 20: Optimum Currency Areas and the European Experience

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/95

Play

Full screen (f)

Deck 20: Optimum Currency Areas and the European Experience

1

The German central bank in the European Monetary System, 1979-1998,

A) was very inflation-averse.

B) was moderately inflation-averse.

C) was willing to accept inflation.

D) lacked control over inflation since it had fixed its exchange rate.

E) lacked sufficient reserves.

A) was very inflation-averse.

B) was moderately inflation-averse.

C) was willing to accept inflation.

D) lacked control over inflation since it had fixed its exchange rate.

E) lacked sufficient reserves.

A

2

The birth of the Euro

A) resulted in fixed exchange rates between all EMU member countries.

B) resulted in flexible exchange rates between all EMU member countries.

C) resulted in crawling-peg exchange rates between all EMU member countries.

D) resulted in non currency board exchange rates between all EMU member countries.

E) resulted in floating exchange rates between all EMU member countries.

A) resulted in fixed exchange rates between all EMU member countries.

B) resulted in flexible exchange rates between all EMU member countries.

C) resulted in crawling-peg exchange rates between all EMU member countries.

D) resulted in non currency board exchange rates between all EMU member countries.

E) resulted in floating exchange rates between all EMU member countries.

A

3

Which of the following is true?

A) All European countries are part of the EMU.

B) All Western European countries are part of the EMU.

C) Originally, 20 countries joined the EMU on January 1999.

D) All Western European countries are part of the EMU.

E) Not all Western European countries are part of the EMU.

A) All European countries are part of the EMU.

B) All Western European countries are part of the EMU.

C) Originally, 20 countries joined the EMU on January 1999.

D) All Western European countries are part of the EMU.

E) Not all Western European countries are part of the EMU.

E

4

The credibility theory of the EMS implies in effect that the political costs of violating international exchange rate agreements

A) cannot restrain governments from depreciating their currency to gain the short-term advantage of an economic boom at the long-term cost of higher inflation.

B) can restrain governments from depreciating their currency to gain the short-term advantage of an economic boom at the long-term cost of higher inflation.

C) cannot restrain governments from depreciating their currency in the short run.

D) cannot restrain governments from depreciating their currency in the long run.

E) cannot restrain governments from depreciating their currency to gain the long-term advantage of an economic boom.

A) cannot restrain governments from depreciating their currency to gain the short-term advantage of an economic boom at the long-term cost of higher inflation.

B) can restrain governments from depreciating their currency to gain the short-term advantage of an economic boom at the long-term cost of higher inflation.

C) cannot restrain governments from depreciating their currency in the short run.

D) cannot restrain governments from depreciating their currency in the long run.

E) cannot restrain governments from depreciating their currency to gain the long-term advantage of an economic boom.

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

5

The most important feature of the Single European Act of 1986, which amended the founding Treaty of Rome, was dropping the requirement of

A) unanimous consent for measures related to market completion and making it a decision that only Germany and France agreed about.

B) unanimous consent for measures related to market completion.

C) majority consent for measures related to market completion and making it a decision that only Germany and France agreed about.

D) unanimous consent for measures related to agricultural policies only.

E) unanimous consent for measures related only to fiscal policies.

A) unanimous consent for measures related to market completion and making it a decision that only Germany and France agreed about.

B) unanimous consent for measures related to market completion.

C) majority consent for measures related to market completion and making it a decision that only Germany and France agreed about.

D) unanimous consent for measures related to agricultural policies only.

E) unanimous consent for measures related only to fiscal policies.

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

6

Under the EMS, Germany set the system's

A) monetary policy while the other European countries pegged their currencies to the DM.

B) fiscal policy while the other European countries pegged their currencies to the DM.

C) monetary policy while the other European countries kept their currencies fluctuating relative to the DM.

D) fiscal policy while the other European countries kept their currencies fluctuating relative to the DM.

E) monetary policy, while other European countries maintained their traditional policies.

A) monetary policy while the other European countries pegged their currencies to the DM.

B) fiscal policy while the other European countries pegged their currencies to the DM.

C) monetary policy while the other European countries kept their currencies fluctuating relative to the DM.

D) fiscal policy while the other European countries kept their currencies fluctuating relative to the DM.

E) monetary policy, while other European countries maintained their traditional policies.

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

7

The EMU created a currency area with more than

A) 200 million consumers.

B) 250 million consumers.

C) about a billion.

D) 500 million consumers.

E) 300 million consumers.

A) 200 million consumers.

B) 250 million consumers.

C) about a billion.

D) 500 million consumers.

E) 300 million consumers.

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

8

How and why did Europe set up its single currency?

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

9

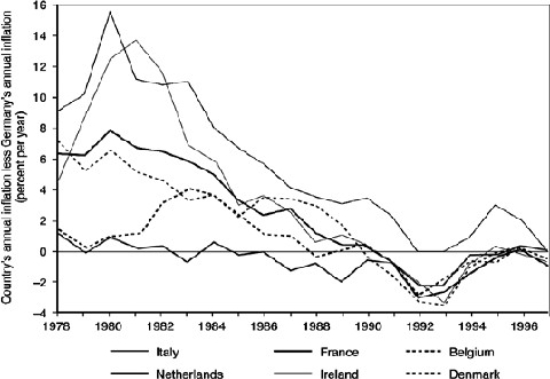

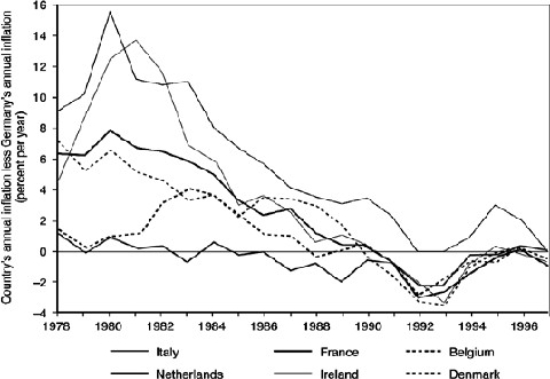

On average, from 1978-1996, the country with the highest rate of annual inflation was

A) France.

B) Ireland.

C) Italy.

D) Belgium.

E) Netherlands.

A) France.

B) Ireland.

C) Italy.

D) Belgium.

E) Netherlands.

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

10

The credibility theory of the EMS implies in effect that the political costs of violating international exchange rate agreements

A) cannot restrain governments from depreciating their currency.

B) can restrain governments from depreciating their currency.

C) cannot restrain governments from depreciating their currency in the short run.

D) cannot restrain governments from depreciating their currency in the long run.

E) can control the political policies of member nations.

A) cannot restrain governments from depreciating their currency.

B) can restrain governments from depreciating their currency.

C) cannot restrain governments from depreciating their currency in the short run.

D) cannot restrain governments from depreciating their currency in the long run.

E) can control the political policies of member nations.

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

11

How many countries are in the EU as of January 1, 2011?

A) 9

B) 15

C) 17

D) 18

E) 25

A) 9

B) 15

C) 17

D) 18

E) 25

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

12

An inflation-prone country

A) gains from vesting its monetary policy decisions with a "conservative" central bank.

B) loses from vesting its monetary policy decisions with a "conservative" central bank.

C) gains from vesting its fiscal policy decisions with a "conservative" central bank.

D) loses from vesting its fiscal policy decisions with a "conservative" central bank.

E) remains constant when vesting its fiscal policy decisions with a "conservative central bank.

A) gains from vesting its monetary policy decisions with a "conservative" central bank.

B) loses from vesting its monetary policy decisions with a "conservative" central bank.

C) gains from vesting its fiscal policy decisions with a "conservative" central bank.

D) loses from vesting its fiscal policy decisions with a "conservative" central bank.

E) remains constant when vesting its fiscal policy decisions with a "conservative central bank.

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

13

How the European single currency evolved?

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

14

Which of the following statements is true?

A) The 1957 Treaty of Rome founded the EU and created a custom union.

B) The 1957 Treaty of Rome founded the EU.

C) The 1957 Treaty of Rome founded the euro.

D) The 1957 Treaty of Rome founded the European Central Bank.

E) The 1957 Treaty of Rome founded the Stability and Growth Pact. known as SGP.

A) The 1957 Treaty of Rome founded the EU and created a custom union.

B) The 1957 Treaty of Rome founded the EU.

C) The 1957 Treaty of Rome founded the euro.

D) The 1957 Treaty of Rome founded the European Central Bank.

E) The 1957 Treaty of Rome founded the Stability and Growth Pact. known as SGP.

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

15

The result of the reunification of eastern and western Germany in 1990

A) was a boom in Germany and higher inflation, with no effect on nearby countries.

B) was a recession in Germany and lower inflation, with no effect on nearby countries.

C) was a boom in Germany and higher inflation, and, with other EMS countries' commitment to fixed exchange rates, a deep recession in nearby countries.

D) was a recession in Germany and lower inflation, and, with other EMS countries' commitment to fixed exchange rates, a deep recession in nearby countries.

E) was a recession in Germany and lower inflation, causing a boom in nearby countries.

A) was a boom in Germany and higher inflation, with no effect on nearby countries.

B) was a recession in Germany and lower inflation, with no effect on nearby countries.

C) was a boom in Germany and higher inflation, and, with other EMS countries' commitment to fixed exchange rates, a deep recession in nearby countries.

D) was a recession in Germany and lower inflation, and, with other EMS countries' commitment to fixed exchange rates, a deep recession in nearby countries.

E) was a recession in Germany and lower inflation, causing a boom in nearby countries.

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

16

The European Economic and Monetary Union

A) set up a single currency and sole bank for European economic monetary policy.

B) eliminated all barriers to trade such as tax differentials between borders.

C) produced a single government for handling European affairs.

D) created the Common Agricultural Pact.

E) eliminated all local currencies in Western Europe.

A) set up a single currency and sole bank for European economic monetary policy.

B) eliminated all barriers to trade such as tax differentials between borders.

C) produced a single government for handling European affairs.

D) created the Common Agricultural Pact.

E) eliminated all local currencies in Western Europe.

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

17

The 1991 Maastricht Treaty can be best described as

A) a peace treaty between Europe and the United States.

B) an agreement for the accession of the Netherlands into the EU.

C) an agreement for the creation of a free trade area.

D) a provision for the introduction of a single European currency and European central bank.

E) the beginning of a floating exchange rate European monetary system.

A) a peace treaty between Europe and the United States.

B) an agreement for the accession of the Netherlands into the EU.

C) an agreement for the creation of a free trade area.

D) a provision for the introduction of a single European currency and European central bank.

E) the beginning of a floating exchange rate European monetary system.

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

18

Did the 1957 Treaty of Rome turn the EU into a truly unified market?

A) Yes, it paved the way for the current EMU.

B) No, although it established a customs union, it failed to remove barriers to the movement of goods and factors within Europe.

C) No, it was only after the German unification and locating the ECB in Frankfurt that unity was achieved.

D) No, since the Northern members of the EU had larger endowments of capital and skilled labor.

E) No, the Treaty of Rome created more trade barriers between European countries.

A) Yes, it paved the way for the current EMU.

B) No, although it established a customs union, it failed to remove barriers to the movement of goods and factors within Europe.

C) No, it was only after the German unification and locating the ECB in Frankfurt that unity was achieved.

D) No, since the Northern members of the EU had larger endowments of capital and skilled labor.

E) No, the Treaty of Rome created more trade barriers between European countries.

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

19

The EU countries were prompted to seek closer coordination of monetary policies and greater exchange rate stability in order

A) to enhance Europe's role in the world monetary system.

B) to turn the European Union into a truly unified market.

C) both to enhance Europe's role in the world monetary system and to turn the European Union into a truly unified market.

D) both to turn the European Union into a truly unified market and to counter the rise of Japan in international financial markets.

E) to homogenize all European cultures.

A) to enhance Europe's role in the world monetary system.

B) to turn the European Union into a truly unified market.

C) both to enhance Europe's role in the world monetary system and to turn the European Union into a truly unified market.

D) both to turn the European Union into a truly unified market and to counter the rise of Japan in international financial markets.

E) to homogenize all European cultures.

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

20

The credibility theory of EMS had as an effect

A) the inflation rates of member countries converging to the low German levels, a result that was not matched by similar countries who did not fix their exchange rates.

B) the inflation rates of member countries failing to converge to the low German levels.

C) the inflation rates of member countries converging to the low German levels, but other countries including U.S. and Britain also reduced inflation in this time period without fixing exchange rates.

D) the inflation rate in Germany rose to match the inflation rates of other member countries.

E) the inflation rate in the U.S. dropped to the low German levels.

A) the inflation rates of member countries converging to the low German levels, a result that was not matched by similar countries who did not fix their exchange rates.

B) the inflation rates of member countries failing to converge to the low German levels.

C) the inflation rates of member countries converging to the low German levels, but other countries including U.S. and Britain also reduced inflation in this time period without fixing exchange rates.

D) the inflation rate in Germany rose to match the inflation rates of other member countries.

E) the inflation rate in the U.S. dropped to the low German levels.

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

21

What prompted the EU countries to seek closer coordination of monetary policies and greater exchange rate stability in the late 1960s?

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

22

The European Central Bank has its headquarter in:

A) London.

B) Berlin.

C) Frankfurt.

D) Paris.

E) Brussels.

A) London.

B) Berlin.

C) Frankfurt.

D) Paris.

E) Brussels.

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

23

Explain why the EMS countries decided to fix their exchange rates against the German DM?

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

24

Explain what was the credibility theory of the EMS.

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

25

What are the biggest advantages the U.S. has above the EU in terms of being an Optimum Currency Area?

A) low mobility of labor, higher labor productivity, lower level of intra-regional trade

B) high unionization of U.S. Labor force

C) high mobility of labor force, more transfer payments between regions

D) higher uniformity of population's taste in consumption

E) more specialized labor force and natural resource advantages.

A) low mobility of labor, higher labor productivity, lower level of intra-regional trade

B) high unionization of U.S. Labor force

C) high mobility of labor force, more transfer payments between regions

D) higher uniformity of population's taste in consumption

E) more specialized labor force and natural resource advantages.

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

26

Explain how the German Bundesbank gained its low-inflation reputation?

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

27

The efficiency

A) gain from a fixed exchange rate with the euro is smaller when trade between say, Norway and the euro zone, is extensive than when it is small.

B) gain from a fixed exchange rate with euro is greater when trade between say, Norway and the euro zone, is extensive than when it is small.

C) loss from a fixed exchange rate with the euro is smaller when trade between say, Norway and the euro zone, is extensive than when it is small.

D) gain from a fixed exchange rate with euro is the same as when trade between say, Norway and the euro zone, is extensive than when it is small.

E) gain from a fixed exchange rate with euro is the same as when trade between say, Norway and the euro zone, is small than when it is small.

A) gain from a fixed exchange rate with the euro is smaller when trade between say, Norway and the euro zone, is extensive than when it is small.

B) gain from a fixed exchange rate with euro is greater when trade between say, Norway and the euro zone, is extensive than when it is small.

C) loss from a fixed exchange rate with the euro is smaller when trade between say, Norway and the euro zone, is extensive than when it is small.

D) gain from a fixed exchange rate with euro is the same as when trade between say, Norway and the euro zone, is extensive than when it is small.

E) gain from a fixed exchange rate with euro is the same as when trade between say, Norway and the euro zone, is small than when it is small.

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

28

To join the EMU, a country must have

A) a public-sector deficit no higher than 3 percent of its GDP in general.

B) a public-sector deficit no higher than 2 percent of its GDP in general.

C) a public-sector deficit no higher than 1 percent of its GDP in general.

D) a zero public-sector deficit.

E) a public-sector deficit no higher than 4 percent of its GDP in general.

A) a public-sector deficit no higher than 3 percent of its GDP in general.

B) a public-sector deficit no higher than 2 percent of its GDP in general.

C) a public-sector deficit no higher than 1 percent of its GDP in general.

D) a zero public-sector deficit.

E) a public-sector deficit no higher than 4 percent of its GDP in general.

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

29

Describe the effects of the reunification of eastern and western Germany in 1990 on both Germany and its neighboring European countries using the AA-DD framework.

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

30

To join the EMU, a country must have a public debt below or approaching a reference level of

A) 50 percent of its GDP.

B) 10 percent of its GDP.

C) 60 percent of its GDP.

D) 100 percent of its GDP.

E) 5 percent of its GDP.

A) 50 percent of its GDP.

B) 10 percent of its GDP.

C) 60 percent of its GDP.

D) 100 percent of its GDP.

E) 5 percent of its GDP.

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

31

Describe the main provisions of the Maastricht Treaty of 1991.

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

32

Discuss the effects of the reunification of eastern and western Germany in 1990 on both Germany and its neighboring European countries.

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

33

How were the initial members of EMU chosen? How will new members be admitted? What is the structure of the complex of financial and political institutions that govern economic policy in the euro zone?

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

34

To join the EMU, a country should have no more than

A) 1.5 percent inflation rate above the average of the three EU member states with the highest inflation.

B) 3 percent inflation rate above the average of the three EU member states with the lowest inflation.

C) 4 percent inflation rate above the average of the three EU member states with the lowest inflation.

D) 1.5 percent inflation rate above the average of the three EU member states with the lowest inflation.

E) 2 percent inflation rate above the average of the three EU member states with the lowest inflation.

A) 1.5 percent inflation rate above the average of the three EU member states with the highest inflation.

B) 3 percent inflation rate above the average of the three EU member states with the lowest inflation.

C) 4 percent inflation rate above the average of the three EU member states with the lowest inflation.

D) 1.5 percent inflation rate above the average of the three EU member states with the lowest inflation.

E) 2 percent inflation rate above the average of the three EU member states with the lowest inflation.

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

35

The main function of the 1997 Stability and Growth Pact (SGP) was to

A) exclude a highly indebted EMU country

B) enhance cooperation between France and Germany.

C) make the Euro a weak currency.

D) distribute the Euro banknote among European central banks and to create a timetable for the imposition of financial penalties on countries that fail to correct situations of "excessive" deficits and debt promptly enough.

E) determine specialized penalties for each member nation.

A) exclude a highly indebted EMU country

B) enhance cooperation between France and Germany.

C) make the Euro a weak currency.

D) distribute the Euro banknote among European central banks and to create a timetable for the imposition of financial penalties on countries that fail to correct situations of "excessive" deficits and debt promptly enough.

E) determine specialized penalties for each member nation.

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

36

Why did the EU countries move away from the EMS toward the goal of a single shared currency?

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

37

A major economic

A) benefit of fixed exchange rates is that they simplify economic calculations and provide a more predictable basis for decisions that involve international transactions than do floating rates.

B) benefit of floating exchange rates it that they simplify economic calculations and provide a more predictable basis for decisions that involve international transactions than do fixed rates.

C) cost of fixed exchange rates it that they simplify economic calculations and provide a more predictable basis for decisions that involve international transactions than do currency board rates.

D) benefit of flexible exchange rates it that they simplify economic calculations and provide a more predictable basis for decisions that involve international transactions than do crawling peg rates.

E) benefit of fixed exchange rates is that the value of goods will remain constant across a large region of consumers.

A) benefit of fixed exchange rates is that they simplify economic calculations and provide a more predictable basis for decisions that involve international transactions than do floating rates.

B) benefit of floating exchange rates it that they simplify economic calculations and provide a more predictable basis for decisions that involve international transactions than do fixed rates.

C) cost of fixed exchange rates it that they simplify economic calculations and provide a more predictable basis for decisions that involve international transactions than do currency board rates.

D) benefit of flexible exchange rates it that they simplify economic calculations and provide a more predictable basis for decisions that involve international transactions than do crawling peg rates.

E) benefit of fixed exchange rates is that the value of goods will remain constant across a large region of consumers.

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

38

Under ERM 2 rules, the national central bank of an EU member with its own currency can suspend euro intervention operations

A) if there is a civil war.

B) if they result in money supply changes that threaten to destabilize the domestic price level.

C) if there is a current account deficit.

D) if there is a current account surplus.

E) if they result in a weakened current account.

A) if there is a civil war.

B) if they result in money supply changes that threaten to destabilize the domestic price level.

C) if there is a current account deficit.

D) if there is a current account surplus.

E) if they result in a weakened current account.

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

39

The monetary efficiency

A) loss from pegging the Norwegian krone to the euro (for example) will be higher if factors of production can migrate freely between Norway and the euro area.

B) gain from pegging the Norwegian krone to the euro (for example) will be lower if factors of production can migrate freely between Norway and the euro area.

C) gain from pegging the Norwegian krone to the euro (for example) will be higher if factors of production can not migrate freely between Norway and the euro area.

D) gain from pegging say the Norwegian krone to the euro (for example) will be higher if factors of production can migrate freely between Norway and the euro area.

E) gain or loss from pegging the Norwegian krone to the Euro cannot be predicted using the available information.

A) loss from pegging the Norwegian krone to the euro (for example) will be higher if factors of production can migrate freely between Norway and the euro area.

B) gain from pegging the Norwegian krone to the euro (for example) will be lower if factors of production can migrate freely between Norway and the euro area.

C) gain from pegging the Norwegian krone to the euro (for example) will be higher if factors of production can not migrate freely between Norway and the euro area.

D) gain from pegging say the Norwegian krone to the euro (for example) will be higher if factors of production can migrate freely between Norway and the euro area.

E) gain or loss from pegging the Norwegian krone to the Euro cannot be predicted using the available information.

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

40

What is the purpose of the following figure?

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

41

A country that joins an exchange rate area

A) gives up its ability to use the exchange rate for the purpose of stabilizing output and employment.

B) does not give up its ability to use the exchange rate and monetary policy for the purpose of stabilizing output and employment.

C) gives up its ability to use the exchange rate and monetary policy for the purpose of stabilizing output and employment.

D) gives up its ability to use only monetary policy for the purpose of stabilizing output and employment.

E) does not gives up its ability to use only monetary policy for the purpose of stabilizing output and employment.

A) gives up its ability to use the exchange rate for the purpose of stabilizing output and employment.

B) does not give up its ability to use the exchange rate and monetary policy for the purpose of stabilizing output and employment.

C) gives up its ability to use the exchange rate and monetary policy for the purpose of stabilizing output and employment.

D) gives up its ability to use only monetary policy for the purpose of stabilizing output and employment.

E) does not gives up its ability to use only monetary policy for the purpose of stabilizing output and employment.

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

42

Which one of the following statements is true for Norway, a non-euro country?

A) Of course, owners of capital that cannot be moved cannot avoid more of the economic stability loss due to fixed exchange rates when Norway's economy is open to capital flows.

B) Even owners of capital that cannot be moved can avoid more of the economic stability loss due to fixed exchange rates when Norway's economy is open to capital flows.

C) Owners of capital that cannot be moved can avoid more of the economic stability loss due to fixed exchange rates when Norway's economy is closed to capital flows.

D) Even owners of capital that can be moved can avoid more of the economic stability loss due to fixed exchange rates when Norway's economy is closed to capital flows.

E) Only owners of capital that can be moved can avoid more of the economic stability loss due to fixed exchange rates when Norway's economy is open to capital flows.

A) Of course, owners of capital that cannot be moved cannot avoid more of the economic stability loss due to fixed exchange rates when Norway's economy is open to capital flows.

B) Even owners of capital that cannot be moved can avoid more of the economic stability loss due to fixed exchange rates when Norway's economy is open to capital flows.

C) Owners of capital that cannot be moved can avoid more of the economic stability loss due to fixed exchange rates when Norway's economy is closed to capital flows.

D) Even owners of capital that can be moved can avoid more of the economic stability loss due to fixed exchange rates when Norway's economy is closed to capital flows.

E) Only owners of capital that can be moved can avoid more of the economic stability loss due to fixed exchange rates when Norway's economy is open to capital flows.

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

43

Shortly after their admission into the EMU, Ireland and the Netherlands

A) both seceded from the EMU.

B) were expelled due to high levels of debt.

C) breached the inflation convergence criterion that had qualified them for admission to the EMU in the first place.

D) achieved inflation rates of zero percent.

E) abandoned the Euro as their national currency.

A) both seceded from the EMU.

B) were expelled due to high levels of debt.

C) breached the inflation convergence criterion that had qualified them for admission to the EMU in the first place.

D) achieved inflation rates of zero percent.

E) abandoned the Euro as their national currency.

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

44

After Norway unilaterally pegs the krone to the euro, domestic money market disturbances will

A) no longer affect domestic output despite the continuation of float-rate regime against non-euro currencies.

B) now have major effect on domestic output despite the continuation of float-rate regime against non-euro currencies.

C) have some effect on domestic output despite the continuation of float-rate regime against non-euro currencies.

D) have major effect on domestic employment despite the continuation of float-rate regime against non-euro currencies.

E) no longer affect foreign imports despite the continuation of float-rate regime against non-euro currencies.

A) no longer affect domestic output despite the continuation of float-rate regime against non-euro currencies.

B) now have major effect on domestic output despite the continuation of float-rate regime against non-euro currencies.

C) have some effect on domestic output despite the continuation of float-rate regime against non-euro currencies.

D) have major effect on domestic employment despite the continuation of float-rate regime against non-euro currencies.

E) no longer affect foreign imports despite the continuation of float-rate regime against non-euro currencies.

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

45

A key barrier to labor mobility within Europe is

A) the laziness of Germans.

B) full employment in most European countries.

C) differences in language and culture.

D) lack of transportation.

E) the physical barriers in the landscape.

A) the laziness of Germans.

B) full employment in most European countries.

C) differences in language and culture.

D) lack of transportation.

E) the physical barriers in the landscape.

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

46

When the economy is disturbed by a change in the output market,

A) a fixed exchange rate has an advantage over a flexible rate.

B) a floating exchange rate has an advantage over a fixed rate.

C) a crawling peg exchange rate has an advantage over a flexible rate.

D) a floating exchange rate has the same effect as fixed rate.

E) a flexible exchange rate is not as effective as a fixed exchange rate.

A) a fixed exchange rate has an advantage over a flexible rate.

B) a floating exchange rate has an advantage over a fixed rate.

C) a crawling peg exchange rate has an advantage over a flexible rate.

D) a floating exchange rate has the same effect as fixed rate.

E) a flexible exchange rate is not as effective as a fixed exchange rate.

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

47

If Norway's labor and capital markets are highly correlated with those of its euro zone neighbors,

A) unemployed workers can easily move abroad to find work and domestic capital can be shifted to more profitable uses in other countries.

B) unemployed workers cannot easily move abroad to find work and domestic capital cannot be shifted to more profitable uses in other countries.

C) while unemployed workers can easily move abroad to find work, domestic capital cannot be shifted to more profitable uses in other countries.

D) while capital can easily move abroad to be put to a more profitable use, unemployed workers cannot easily move abroad to find work.

E) unemployment will rise, thanks to competition from foreign labor.

A) unemployed workers can easily move abroad to find work and domestic capital can be shifted to more profitable uses in other countries.

B) unemployed workers cannot easily move abroad to find work and domestic capital cannot be shifted to more profitable uses in other countries.

C) while unemployed workers can easily move abroad to find work, domestic capital cannot be shifted to more profitable uses in other countries.

D) while capital can easily move abroad to be put to a more profitable use, unemployed workers cannot easily move abroad to find work.

E) unemployment will rise, thanks to competition from foreign labor.

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

48

Which one of the following statements is true?

A) A fixed exchange rate automatically cushions the economy's output and employment by allowing an immediate change in the relative price of domestic and foreign goods.

B) A flexible exchange rate does not automatically cushions the economy's output and employment by allowing an immediate change in the relative price of domestic and foreign goods.

C) A flexible exchange rate automatically cushions the economy's output and employment by allowing an immediate change in the relative price of domestic and foreign goods.

D) A flexible exchange rate automatically cushions the economy's output and employment by allowing an immediate change in the absolute price of domestic and foreign goods.

E) A fixed exchange rate automatically cushions the economy's output and employment by allowing an immediate change in the absolute price of domestic and foreign goods.

A) A fixed exchange rate automatically cushions the economy's output and employment by allowing an immediate change in the relative price of domestic and foreign goods.

B) A flexible exchange rate does not automatically cushions the economy's output and employment by allowing an immediate change in the relative price of domestic and foreign goods.

C) A flexible exchange rate automatically cushions the economy's output and employment by allowing an immediate change in the relative price of domestic and foreign goods.

D) A flexible exchange rate automatically cushions the economy's output and employment by allowing an immediate change in the absolute price of domestic and foreign goods.

E) A fixed exchange rate automatically cushions the economy's output and employment by allowing an immediate change in the absolute price of domestic and foreign goods.

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

49

A good measure of a country's level of economic integration with a currency area is

A) the intersection of DD and GG.

B) the country's price level.

C) the compatibility of economic policies.

D) the intersection of AA and GG.

E) the extent of trade between the joining country and the currency area and the ease with which labor and capital can migrate between the joining country and the currency area.

A) the intersection of DD and GG.

B) the country's price level.

C) the compatibility of economic policies.

D) the intersection of AA and GG.

E) the extent of trade between the joining country and the currency area and the ease with which labor and capital can migrate between the joining country and the currency area.

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

50

Since Norway has close trading links with the euro zone,

A) a small reduction in its price will lead to an increase in euro zone demand for Norwegian goods that is large relative to Norway's output. Thus, full employment can be restored fairly quickly.

B) a small reduction in its price will lead to a decrease in euro zone demand for Norwegian goods that is large relative to Norway's output. Thus, full employment can be restored fairly quickly.

C) a small reduction in its price will lead to an increase in euro zone demand for Norwegian goods that is small relative to Norway's output. Thus, full employment can be restored fairly quickly.

D) a big reduction in its price will lead to an increase in euro zone demand for Norwegian goods that is large relative to Norway's output. Thus, full employment can be restored fairly quickly.

E) a big reduction in its price will lead to a decrease in euro zone demand for Norwegian goods that is small relative to Norway's output. Thus, full employment can be restored fairly quickly.

A) a small reduction in its price will lead to an increase in euro zone demand for Norwegian goods that is large relative to Norway's output. Thus, full employment can be restored fairly quickly.

B) a small reduction in its price will lead to a decrease in euro zone demand for Norwegian goods that is large relative to Norway's output. Thus, full employment can be restored fairly quickly.

C) a small reduction in its price will lead to an increase in euro zone demand for Norwegian goods that is small relative to Norway's output. Thus, full employment can be restored fairly quickly.

D) a big reduction in its price will lead to an increase in euro zone demand for Norwegian goods that is large relative to Norway's output. Thus, full employment can be restored fairly quickly.

E) a big reduction in its price will lead to a decrease in euro zone demand for Norwegian goods that is small relative to Norway's output. Thus, full employment can be restored fairly quickly.

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

51

A recent study by Andrew Rose of the University of California showed that, on average, two countries that are members of the same currency union

A) trade three times as much with each other as countries that do not share a currency.

B) trade twenty times as much with each other as countries that do not share a currency.

C) trade ten times as much with each other as countries that do not share a currency.

D) trade six times as much with each other as countries that do not share a currency.

E) trade twice as much with each other as countries that do not share a currency.

A) trade three times as much with each other as countries that do not share a currency.

B) trade twenty times as much with each other as countries that do not share a currency.

C) trade ten times as much with each other as countries that do not share a currency.

D) trade six times as much with each other as countries that do not share a currency.

E) trade twice as much with each other as countries that do not share a currency.

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

52

The ability of factors to migrate abroad

A) reduces the severity of unemployment and the fall in the rate of return available to investors.

B) increases the severity of unemployment and the fall in the rate of return available to investors.

C) reduces the severity of unemployment but increases the fall in the rate of return available to investors.

D) cannot change the severity of unemployment and the constant rate of return available to investors.

E) reduces the migration of highly-skilled workers.

A) reduces the severity of unemployment and the fall in the rate of return available to investors.

B) increases the severity of unemployment and the fall in the rate of return available to investors.

C) reduces the severity of unemployment but increases the fall in the rate of return available to investors.

D) cannot change the severity of unemployment and the constant rate of return available to investors.

E) reduces the migration of highly-skilled workers.

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

53

When the exchange rate is

A) flexible, purposeful stabilization is more difficult because monetary policy has no power at all to affect domestic output and employment.

B) fixed, purposeful stabilization is less difficult because monetary policy has no power at all to affect domestic output and employment.

C) fixed, purposeful stabilization is more difficult because monetary policy has no power at all to affect domestic output and employment.

D) a crawling peg, rather than fixed, purposeful stabilization is more difficult because monetary policy has no power at all to affect domestic output and employment.

E) fixed rather than crawling peg purposeful stabilization is more difficult because fiscal policy has no power at all to affect domestic output and employment.

A) flexible, purposeful stabilization is more difficult because monetary policy has no power at all to affect domestic output and employment.

B) fixed, purposeful stabilization is less difficult because monetary policy has no power at all to affect domestic output and employment.

C) fixed, purposeful stabilization is more difficult because monetary policy has no power at all to affect domestic output and employment.

D) a crawling peg, rather than fixed, purposeful stabilization is more difficult because monetary policy has no power at all to affect domestic output and employment.

E) fixed rather than crawling peg purposeful stabilization is more difficult because fiscal policy has no power at all to affect domestic output and employment.

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

54

Which of the following statements is most accurate?

A) The countries of southern Europe are better endowed with capital and skilled labor than the countries of northern Europe.

B) The countries of northern Europe are better endowed with capital and skilled labor than the countries of southern Europe.

C) EU products that make intensive use of high-skill labor are most likely to come from Portugal.

D) EU products that make intensive use of low-skill labor are most likely to come from Great Britain.

E) The countries of eastern Europe are better endowed with capital and skilled labor than the countries of western Europe.

A) The countries of southern Europe are better endowed with capital and skilled labor than the countries of northern Europe.

B) The countries of northern Europe are better endowed with capital and skilled labor than the countries of southern Europe.

C) EU products that make intensive use of high-skill labor are most likely to come from Portugal.

D) EU products that make intensive use of low-skill labor are most likely to come from Great Britain.

E) The countries of eastern Europe are better endowed with capital and skilled labor than the countries of western Europe.

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

55

Fiscal federalism in the EU refers to

A) one nation's control of the monetary policy of all the other nations.

B) freedom of member countries to leave the EU at any time.

C) the transfer of economic resources from members with healthy economies to those suffering economic setbacks.

D) one nation's freedom to abandon the Euro and use its own currency.

E) the transfer of economic resources between members with healthy economies.

A) one nation's control of the monetary policy of all the other nations.

B) freedom of member countries to leave the EU at any time.

C) the transfer of economic resources from members with healthy economies to those suffering economic setbacks.

D) one nation's freedom to abandon the Euro and use its own currency.

E) the transfer of economic resources between members with healthy economies.

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

56

A krone/euro peg alone is

A) not enough to provide automatic stability in the face of any monetary shocks that shift the AA schedule.

B) enough to provide automatic stability in the face of any monetary shocks that shift the AA schedule.

C) not enough to provide automatic stability in the face of any monetary shocks that shift the AA schedule, provided fiscal policy will be used as well.

D) enough to provide automatic stability in the face of any monetary shocks that shift the AA schedule, provided the government runs a budget deficit.

E) enough to provide partial stability in the face of smaller monetary shocks that shift the AA schedule.

A) not enough to provide automatic stability in the face of any monetary shocks that shift the AA schedule.

B) enough to provide automatic stability in the face of any monetary shocks that shift the AA schedule.

C) not enough to provide automatic stability in the face of any monetary shocks that shift the AA schedule, provided fiscal policy will be used as well.

D) enough to provide automatic stability in the face of any monetary shocks that shift the AA schedule, provided the government runs a budget deficit.

E) enough to provide partial stability in the face of smaller monetary shocks that shift the AA schedule.

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

57

The intersection of GG and LL determines

A) the optimal level of integration desired by Norway.

B) the maximum integration level desired by Norway.

C) the minimum level of integration that will cause Norway to join the fixed exchange rate regime.

D) the maximum level of integration that will cause Norway to join the fixed exchange rate regime.

E) the maximum level of integration that can aid Norway if it joins the fixed exchange rate regime.

A) the optimal level of integration desired by Norway.

B) the maximum integration level desired by Norway.

C) the minimum level of integration that will cause Norway to join the fixed exchange rate regime.

D) the maximum level of integration that will cause Norway to join the fixed exchange rate regime.

E) the maximum level of integration that can aid Norway if it joins the fixed exchange rate regime.

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

58

Which one of the following statements is true?

A) The less extensive are cross-border trade and factor movements, the greater is the gain from a fixed cross-border exchange rate.

B) The more extensive are cross-border trade and factor movements, the greater is the loss from a fixed cross-border exchange rate.

C) The more extensive are cross-border trade and factor movements, the greater is the gain from a fixed cross-border exchange rate.

D) The more extensive are cross-border trade, the greater is the loss from a fixed cross-border exchange rate.

E) The more extensive are factor movements, the greater is the loss from a fixed cross-border exchange rate.

A) The less extensive are cross-border trade and factor movements, the greater is the gain from a fixed cross-border exchange rate.

B) The more extensive are cross-border trade and factor movements, the greater is the loss from a fixed cross-border exchange rate.

C) The more extensive are cross-border trade and factor movements, the greater is the gain from a fixed cross-border exchange rate.

D) The more extensive are cross-border trade, the greater is the loss from a fixed cross-border exchange rate.

E) The more extensive are factor movements, the greater is the loss from a fixed cross-border exchange rate.

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

59

The level of fiscal federalism in the European Union is

A) too big to cushion member countries from adverse economic events.

B) too small to cushion member countries from adverse economic events.

C) appropriate to cushion member countries from adverse economic events.

D) too big relative to the one in the U.S.

E) similar in its level to that of the U.S.

A) too big to cushion member countries from adverse economic events.

B) too small to cushion member countries from adverse economic events.

C) appropriate to cushion member countries from adverse economic events.

D) too big relative to the one in the U.S.

E) similar in its level to that of the U.S.

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

60

When Norway unilaterally fixes its exchange rate against the euro and leaves the krone

A) free to float against the non-euro currencies, it is able to keep at least some monetary independence.

B) free to float against the non-euro currencies, it is unable to keep at least some monetary independence.

C) free to float against the non-euro currencies, it is able to keep its monetary independence.

D) run by crawling peg against the non-euro currencies, it is able to keep at least some monetary independence.

E) fixed against the non-euro currencies, it is unable to keep its monetary independence.

A) free to float against the non-euro currencies, it is able to keep at least some monetary independence.

B) free to float against the non-euro currencies, it is unable to keep at least some monetary independence.

C) free to float against the non-euro currencies, it is able to keep its monetary independence.

D) run by crawling peg against the non-euro currencies, it is able to keep at least some monetary independence.

E) fixed against the non-euro currencies, it is unable to keep its monetary independence.

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

61

How mobile is Europe's labor force?

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

62

Who described 5 economic tests that must be passed before Britain would adopt the Euro?

A) Tony Blair

B) Robert Mundell

C) Gordon Brown

D) Charles Bean

E) none of the above

A) Tony Blair

B) Robert Mundell

C) Gordon Brown

D) Charles Bean

E) none of the above

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

63

Which of the following statements is most accurate?

A) A low degree of economic integration between a country and the fixed exchange rate area that it joins reduces the resulting economic stability loss due to output market disturbances.

B) A high degree of economic integration between a country and the fixed exchange rate area that it joins reduces the resulting economic stability loss due to output market disturbances.

C) A high degree of economic integration between a country and the fixed exchange rate area that it joins increases the resulting economic stability loss due to output market disturbances.

D) A complete lack of economic integration between a country and the fixed exchange rate area that it joins reduces the resulting economic stability loss due to output market disturbances.

E) A low degree of economic integration between a country and the fixed exchange rate area that it joins increases the resulting economic stability loss due to output market disturbances.

A) A low degree of economic integration between a country and the fixed exchange rate area that it joins reduces the resulting economic stability loss due to output market disturbances.

B) A high degree of economic integration between a country and the fixed exchange rate area that it joins reduces the resulting economic stability loss due to output market disturbances.

C) A high degree of economic integration between a country and the fixed exchange rate area that it joins increases the resulting economic stability loss due to output market disturbances.

D) A complete lack of economic integration between a country and the fixed exchange rate area that it joins reduces the resulting economic stability loss due to output market disturbances.

E) A low degree of economic integration between a country and the fixed exchange rate area that it joins increases the resulting economic stability loss due to output market disturbances.

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

64

Why does the LL schedule have a negative slope?

A) The economic stability loss from pegging to the area's currencies rises as the degree of economic interdependence rises.

B) The economic stability loss from pegging to the area's currencies falls as the degree of economic interdependence rises.

C) The economic stability loss from pegging to the area's currencies falls as the degree of economic interdependence falls.

D) The economic stability loss from pegging to the area's currencies rises as the degree of economic activity increases.

E) The economic stability loss from pegging to the area's currencies is constant, even as the degree of economic activity increases.

A) The economic stability loss from pegging to the area's currencies rises as the degree of economic interdependence rises.

B) The economic stability loss from pegging to the area's currencies falls as the degree of economic interdependence rises.

C) The economic stability loss from pegging to the area's currencies falls as the degree of economic interdependence falls.

D) The economic stability loss from pegging to the area's currencies rises as the degree of economic activity increases.

E) The economic stability loss from pegging to the area's currencies is constant, even as the degree of economic activity increases.

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

65

Richard Baldwin's estimate was that the euro increased the trade level of its users by

A) only 5 percent.

B) only 9 percent.

C) over 30 percent.

D) over 50 percent.

E) only 12 percent.

A) only 5 percent.

B) only 9 percent.

C) over 30 percent.

D) over 50 percent.

E) only 12 percent.

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

66

Explain why when Norway unilaterally fixes its exchange rate against the euro but leaves the krone free to float against the non-euro currencies, it is unable to keep at least some monetary independence.

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

67

Which of the following statements is the most accurate?

A) Trade of EU countries with other EU countries has increased since the euro was introduced.

B) Trade of EU countries with other EU countries has decreased since the euro was introduced.

C) Trade of EU countries with other EU countries has increased in some years and decreased in other years since the euro was introduced.

D) Trade of EU countries with other EU countries can no longer be measured since both trading parties have the same currency.

E) Trade of EU countries with North American countries has decreased since the euro was introduced.

A) Trade of EU countries with other EU countries has increased since the euro was introduced.

B) Trade of EU countries with other EU countries has decreased since the euro was introduced.

C) Trade of EU countries with other EU countries has increased in some years and decreased in other years since the euro was introduced.

D) Trade of EU countries with other EU countries can no longer be measured since both trading parties have the same currency.

E) Trade of EU countries with North American countries has decreased since the euro was introduced.

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

68

Discuss the benefits and costs of joining a fixed-exchange area.

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

69

Which of the following statements is most accurate?

A) A rise in the size and frequency of country-specific disturbances to the joining country's product markets raises the critical level of economic integration at which the exchange rate area is joined.

B) A rise in the size and frequency of country-specific disturbances to the joining country's product markets lowers the critical level of economic integration at which the exchange rate area is joined.

C) A decline in the size and frequency of country-specific disturbances to the joining country's product markets raises the critical level of economic integration at which the exchange rate area is joined.

D) A rise in the size and frequency of country-specific disturbances to the joining country's product markets has no effect on the critical level of economic integration at which the exchange rate area is joined.

E) A decline in the size and frequency of country-specific disturbances to the joining country's product markets does not affect the level of economic integration at which the exchange rate area is joined.

A) A rise in the size and frequency of country-specific disturbances to the joining country's product markets raises the critical level of economic integration at which the exchange rate area is joined.

B) A rise in the size and frequency of country-specific disturbances to the joining country's product markets lowers the critical level of economic integration at which the exchange rate area is joined.

C) A decline in the size and frequency of country-specific disturbances to the joining country's product markets raises the critical level of economic integration at which the exchange rate area is joined.

D) A rise in the size and frequency of country-specific disturbances to the joining country's product markets has no effect on the critical level of economic integration at which the exchange rate area is joined.

E) A decline in the size and frequency of country-specific disturbances to the joining country's product markets does not affect the level of economic integration at which the exchange rate area is joined.

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

70

Explain why after, say Norway unilaterally pegs the krone to the euro, domestic money market disturbances will no longer affect domestic output despite the continuation of float-rate regime against non-euro currencies.

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

71

Explain why the oil price shocks after 1973 made countries unwilling to revive the Bretton Woods system of fixed exchange rates. See also Chapter 19.

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

72

How much trade do currency unions create?

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

73

Why does the GG schedule have a positive slope?

A) The monetary efficiency gain a country gets by joining a fixed exchange rate area falls as its economic integration with the area increases.

B) The monetary efficiency gain a country gets by joining a fixed exchange rate area rises as its economic integration with the area decreases.

C) The monetary efficiency gain a country gets by joining a fixed exchange rate area rises as its economic integration with the area increases.

D) The monetary efficiency gain a country gets by joining a floating exchange rate area rises as its economic integration with the area increases.

E) The monetary efficiency gain a country gets by joining a fixed exchange rate area is constant after their integration into the area.

A) The monetary efficiency gain a country gets by joining a fixed exchange rate area falls as its economic integration with the area increases.

B) The monetary efficiency gain a country gets by joining a fixed exchange rate area rises as its economic integration with the area decreases.

C) The monetary efficiency gain a country gets by joining a fixed exchange rate area rises as its economic integration with the area increases.

D) The monetary efficiency gain a country gets by joining a floating exchange rate area rises as its economic integration with the area increases.

E) The monetary efficiency gain a country gets by joining a fixed exchange rate area is constant after their integration into the area.

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

74

The theory of optimum currency areas predicts that

A) floating exchange rates are most appropriate for areas closely integrated through international trade and factor movements.

B) fixed exchange rates are most appropriate for areas that are loosely integrated through international trade and factor movements.

C) fixed exchange rates are most appropriate for areas closely integrated through international trade and factor movements.

D) floating exchange rates are most appropriate for all countries in Europe.

E) fixed exchange rates are most appropriate for all countries in Europe.

A) floating exchange rates are most appropriate for areas closely integrated through international trade and factor movements.

B) fixed exchange rates are most appropriate for areas that are loosely integrated through international trade and factor movements.

C) fixed exchange rates are most appropriate for areas closely integrated through international trade and factor movements.

D) floating exchange rates are most appropriate for all countries in Europe.

E) fixed exchange rates are most appropriate for all countries in Europe.

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

75

Explain why it may make sense for the United States, Japan, and Europe to allow their mutual exchange rate to float?

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

76

"The costs and benefits for a country from joining a fixed-exchange rate area such as the EMS depend on how well-integrated its economy is with those of its potential partners." Discuss.

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

77

Which of the following best defines an optimum currency area?

A) a group of nations sharing the same currency

B) a group of regions in close proximity to each other.

C) a group of regions who operate under similar economic policies.

D) a group of regions with economies closely linked by factor mobility and by trade in goods and services

E) a group of nations that engage in free trade with each other

A) a group of nations sharing the same currency

B) a group of regions in close proximity to each other.

C) a group of regions who operate under similar economic policies.

D) a group of regions with economies closely linked by factor mobility and by trade in goods and services

E) a group of nations that engage in free trade with each other

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

78

Is Europe an optimum currency area?

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

79

Explain why even owners of capital that cannot be moved can avoid more of the economic stability loss due to fixed exchange rates when Norway's economy is open to capital flows.

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

80

In 2003,

A) the UK became a member of EMU since the 5 economic tests were passed.

B) the UK became a member of EMU despite not passing the 5 economic tests.

C) the UK did not become a member of EMU even though all 5 economic tests were shown to be satisfied.

D) the UK did not become a member of EMU since it was not clear that the 5 economic tests were passed.

E) the UK became a member of EMU after prolonged negotiations.

A) the UK became a member of EMU since the 5 economic tests were passed.

B) the UK became a member of EMU despite not passing the 5 economic tests.

C) the UK did not become a member of EMU even though all 5 economic tests were shown to be satisfied.

D) the UK did not become a member of EMU since it was not clear that the 5 economic tests were passed.

E) the UK became a member of EMU after prolonged negotiations.

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck