Deck 11: College and University Accounting Private Institutions

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/125

Play

Full screen (f)

Deck 11: College and University Accounting Private Institutions

1

Private colleges and universities use the same accounting and reporting standards as other private not-for-profit organizations.

True

2

According to the rules for accounting for colleges and universities under the jurisdiction of the FASB,revenues and expenses are reported at gross amounts and gains and losses are reported net.

True

3

Private colleges and universities are required to report net assets within the categories of unrestricted,temporarily restricted and permanently restricted.

True

4

Private colleges and universities are required to report net assets within the categories of unrestricted,restricted and invested in capital assets net of related debt.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

5

According to the rules for accounting for colleges and universities under the jurisdiction of the FASB,expenses are reported by function,either in the statements or in the notes.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

6

According to the rules for accounting for colleges and universities under the jurisdiction of the FASB,an institution may decide not to capitalize museum and other inexhaustible collections.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

7

According to the rules for accounting for colleges and universities under the jurisdiction of the FASB,multiyear pledges are recorded as restricted revenue for the present value pledge (net of estimates for uncollectible amounts)when the pledge is made.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

8

According to the rules for accounting for colleges and universities under the jurisdiction of the FASB,if both unrestricted and restricted resources are available for a restricted purpose,the FASB requires that the institution recognize the use of restricted resources first.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

9

The AICPA Audit Guide:

Not-for-Profit Organizations applies to private colleges and universities.

Not-for-Profit Organizations applies to private colleges and universities.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

10

Private colleges and universities are subject to the standards issued by the GASB

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

11

Investor-owned proprietary schools are subject to the standards issued by the FASB

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

12

Private colleges and universities are required to present a Statement of Cash Flows using the direct method.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

13

Private colleges and universities and investor-owned proprietary schools report the same categories of net assets.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

14

According to the rules for accounting for colleges and universities under the jurisdiction of the FASB,depreciation is recorded.When reporting by function,depreciation is allocated to functional categories.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

15

Public colleges and universities are subject to the standards issued by the GASB

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

16

According to the rules for accounting for colleges and universities under the jurisdiction of the FASB,contributed services should be recognized when the services create or enhance nonfinancial assets or require specialized skills,are provided by an individual possessing those skills,and would typically be purchased if not provided by donation.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

17

Private colleges and universities use encumbrances and report using the modified accrual basis of accounting.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

18

Private colleges and universities do not record depreciation expense.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

19

Private,Not-for-profit Colleges and Universities and Investor-owned Schools follow FASB standards and adhere to the accrual basis of accounting.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

20

Private colleges and universities use the same accounting and reporting standards as public colleges and universities.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

21

According to the rules for accounting for colleges and universities under the jurisdiction of the FASB,investments in stock with determinable fair values and all debt securities are reported at market value.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

22

With respect to colleges and universities,academic or athletic tuition waivers are accounted for as expenses.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

23

Financial statements prepared for private colleges and universities present net assets as:

unrestricted,restricted,or invested in capital assets net of related debt.

unrestricted,restricted,or invested in capital assets net of related debt.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

24

Academic or athletic scholarships that do not require service to the college or university are considered scholarship allowances and treated as reductions in revenue.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

25

FASB standards require private colleges and universities to present a Statement of Cash Flows.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

26

A Research grant program is a type of split-interest agreement.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

27

Under FASB standards,quasi-endowments are classified as Temporarily Restricted Net Assets.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

28

When a private college is the recipient of a perpetual trust held by a third party,the initial contribution revenue is recorded in the permanently restricted net asset class,and income received from the trust is recorded as either unrestricted or temporarily restricted investment income,depending on the trust agreement.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

29

Under FASB standards,true endowments are classified as Permanently Restricted Net Assets.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

30

A Pooled life income fund is a type of split-interest agreement.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

31

A tuition waiver for a student who works as a graduate assistant is treated as compensation expense.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

32

A charitable remainder trust and a charitable gift annuity differ in that no formal trust agreement exists for a charitable gift annuity.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

33

A tuition waiver for a student who works as a graduate assistant is treated as a reduction in revenue.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

34

FASB standards require private colleges and universities to present a Statement of Functional Expense.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

35

With respect to colleges and universities,if a tuition or fee reduction is an employee benefit it should be treated as a compensation expense,rather than a discount.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

36

With respect to colleges and universities,estimates of uncollectible accounts are accounted for as reductions in revenue rather than bad debt expense.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

37

An acceptable alternative to the Statement of Activities for a private college or university is to present a Statement of Unrestricted Revenues,Expenses and Other Changes in Unrestricted Net Assets and a Statement of Changes in Net Assets.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

38

Under NACUBO guidelines,tuition waivers resulting from work-study programs are deducted from revenue.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

39

A Charitable gift annuity is a type of split-interest agreement.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

40

A Charitable lead trust is a type of split-interest agreement.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

41

Tuition revenue for summer classes spanning two fiscal periods must be allocated on a pro-rata basis.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

42

Funds that are restricted for a certain number of years and then released are considered to be quasi-endowments and are classified as temporarily restricted funds by private colleges and universities.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

43

NACUBO guidelines require both revenues and expenses for split summer sessions to be apportioned to the two fiscal years.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

44

Unless acquired with restricted funds,plant acquired by a private college must be recorded as unrestricted.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

45

Private colleges and universities are (primarily)subject to financial reporting standards issued by?

A) GASB.

B) FASB.

C) AICPA.

D) None of the above.

A) GASB.

B) FASB.

C) AICPA.

D) None of the above.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

46

Museum and other inexhaustible collections held by a private college may or may not be capitalized and recorded in the accounts of a private college.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

47

Public Colleges and Universities are subject to standards issued by the GASB and most commonly report as special-purpose governments engaged in business-type activities.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

48

An unconditional pledge of support received by a private college is recorded as revenue when the promise to give is unconditional.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

49

Funds that are restricted for a certain number of years and then released are considered to be term endowments and are classified as temporarily restricted funds by private colleges and universities.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

50

College and universities treat uncollectible student accounts as bad debt expense.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

51

Public colleges and universities are (primarily)subject to financial reporting standards issued by:

A) GASB.

B) FASB.

C) AICPA.

D) None of the above.

A) GASB.

B) FASB.

C) AICPA.

D) None of the above.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

52

Inflows from self-supporting university operations,known as auxiliary enterprises,are restricted as to use.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

53

Universities treat athletic scholarships as a reduction in revenue.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

54

Plant acquired by a private college with either unrestricted or restricted resources may be (1)recorded initially as unrestricted OR (2)recorded initially as temporarily restricted and then classified in accordance with the depreciation schedule.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

55

Private colleges and universities recognize contribution revenue in the year in which the payment is received.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

56

Private colleges and universities recognize contribution revenue in the year in which the unconditional pledge is made.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

57

Private,Not-for-Profit Colleges and Universities must have Statement of Financial Position,Statement of Activities,Statement of Cash Flows,and Notes to the Financial Statements included in their financial report.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

58

Tuition revenue for summer classes spanning two fiscal periods must be recorded in the period when the drop date passes and refunds are no longer an option.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

59

College and universities treat uncollectible student accounts as reductions in revenue,rather than bad debt expense.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

60

NACUBO guidelines treat estimates of uncollectible accounts as reductions in revenue.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

61

Private universities follow the authoritative standards of _____ and use the _____ basis of accounting.

A) FASB, Accrual.

B) FASB, Modified-accrual.

C) GASB, Accrual.

D) GASB, Modified-accrual.

A) FASB, Accrual.

B) FASB, Modified-accrual.

C) GASB, Accrual.

D) GASB, Modified-accrual.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

62

If a donor were to contribute money with instructions that the funds be invested for a period of time and then released to be used for any purpose,this would be called a(n):

A) Permanent endowment

B) Term endowment

C) Quasi-endowment

D) Unrestricted endowment

A) Permanent endowment

B) Term endowment

C) Quasi-endowment

D) Unrestricted endowment

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

63

For private colleges and universities,reclassifications of temporarily restricted and unrestricted net assets could be made:

A) For satisfaction of purpose restrictions.

B) When time restrictions expire.

C) If the resources donated for fixed assets have been expended on such assets.

D) All of the above.

A) For satisfaction of purpose restrictions.

B) When time restrictions expire.

C) If the resources donated for fixed assets have been expended on such assets.

D) All of the above.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

64

Investment income on Endowments held by private colleges and classified as permanently restricted net assets should be recorded as an increase in:

A) Unrestricted net assets.

B) Temporarily restricted net assets.

C) Permanently restricted net assets.

D) Any of the above, depending on the terms of the trust agreement.

A) Unrestricted net assets.

B) Temporarily restricted net assets.

C) Permanently restricted net assets.

D) Any of the above, depending on the terms of the trust agreement.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

65

Which of the following would not be correct with respect to accounting for colleges and universities under the jurisdiction of the FASB?

A) Contributed services should be recognized only when the services create or enhance nonfinancial assets or require specialized skills, are provided by an individual possessing those skills, and would typically be purchased if not provided by donation

B) Multiyear pledges are recorded as restricted revenue and receivable for the gross amount of the pledge when the pledge is made

C) Depreciation is recorded

D) Investments in stock with determinable fair values and all debt securities are reported at market value

A) Contributed services should be recognized only when the services create or enhance nonfinancial assets or require specialized skills, are provided by an individual possessing those skills, and would typically be purchased if not provided by donation

B) Multiyear pledges are recorded as restricted revenue and receivable for the gross amount of the pledge when the pledge is made

C) Depreciation is recorded

D) Investments in stock with determinable fair values and all debt securities are reported at market value

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

66

Which of the following would not be correct with respect to accounting for colleges and universities under the jurisdiction of the FASB?

A) If both unrestricted and restricted resources are available for a restricted purpose, the FASB requires that the institution recognize the use of unrestricted resources first

B) Accrual accounting is used. Revenues and expenses are reported at gross amounts and gains and losses are reported net.

C) Expenses are reported by function, either in the statements or in the notes

D) If an institution decides not to capitalize museum and other inexhaustible collections, note disclosures are required regarding the collections

A) If both unrestricted and restricted resources are available for a restricted purpose, the FASB requires that the institution recognize the use of unrestricted resources first

B) Accrual accounting is used. Revenues and expenses are reported at gross amounts and gains and losses are reported net.

C) Expenses are reported by function, either in the statements or in the notes

D) If an institution decides not to capitalize museum and other inexhaustible collections, note disclosures are required regarding the collections

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

67

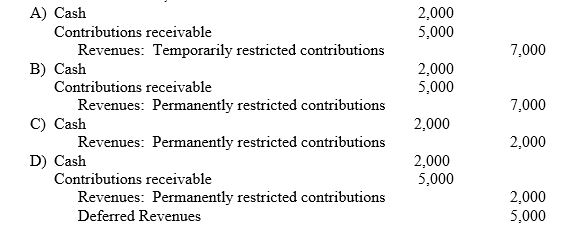

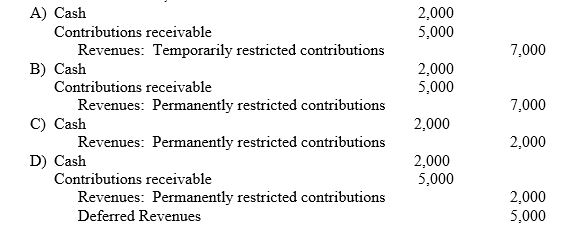

On December 1,2014 St.Sebastian University,a private college,received cash of $ 2,000 and a pledge for another $ 5,000 to be paid in January 2015.The amounts are to establish an endowment to provide scholarships for music majors.How should this event be recorded on December 1,2014?

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

68

A government owned college follows whose standards?

A) FASB because GASB doesn't have standards for universities.

B) GASB.

C) AICPA

D) None of the above.

A) FASB because GASB doesn't have standards for universities.

B) GASB.

C) AICPA

D) None of the above.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

69

Which of the following is true regarding the investments of private colleges in securities with determinable fair values?

A) Investments are to be carried at fair value; unrealized gains and losses are to be reported in the Statement of Activities along with realized gains and losses.

B) Investments are to be carried at fair value or amortized cost, depending upon whether the investments are in equity or debt securities.

C) Investments are to be carried at the lower of cost or market with unrealized losses reported in the Statement of Activities along with realized gains and losses.

D) None of the above.

A) Investments are to be carried at fair value; unrealized gains and losses are to be reported in the Statement of Activities along with realized gains and losses.

B) Investments are to be carried at fair value or amortized cost, depending upon whether the investments are in equity or debt securities.

C) Investments are to be carried at the lower of cost or market with unrealized losses reported in the Statement of Activities along with realized gains and losses.

D) None of the above.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

70

Which of the following types of college/university would have these components of the Financial Report?

•Statement of Financial Position..

•Statement of Activities.

•Statement of Cash Flows.

•Notes to the Financial Statements.

A) Investor Owned.

B) Public University.

C) Private Not-for-Profit.

D) None of the above.

•Statement of Financial Position..

•Statement of Activities.

•Statement of Cash Flows.

•Notes to the Financial Statements.

A) Investor Owned.

B) Public University.

C) Private Not-for-Profit.

D) None of the above.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

71

In addition to a Statement of Financial Position and a Statement of Activities,a private college or university is required to present:

A) A Statement of Functional Expense.

B) A Statement of Cash Flows.

C) Both (a) and (b).

D) Neither (a) nor (b).

A) A Statement of Functional Expense.

B) A Statement of Cash Flows.

C) Both (a) and (b).

D) Neither (a) nor (b).

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

72

The three classes of net assets required to be presented by a private college or university are:

A) Permanently Restricted, Temporarily Restricted, and Unrestricted.

B) Reserved, Unreserved, and Undesignated.

C) Invested in Capital Assets net of Related Debt, Restricted, and Unrestricted.

D) Educational and General, and Auxiliary Enterprises

A) Permanently Restricted, Temporarily Restricted, and Unrestricted.

B) Reserved, Unreserved, and Undesignated.

C) Invested in Capital Assets net of Related Debt, Restricted, and Unrestricted.

D) Educational and General, and Auxiliary Enterprises

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

73

Which of the following is a required statement for a private college?

A) Statement of Changes in Fund Balance.

B) Statement of Revenues and Expenditures.

C) Budgetary Comparison Statement.

D) None of the above is a required statement.

A) Statement of Changes in Fund Balance.

B) Statement of Revenues and Expenditures.

C) Budgetary Comparison Statement.

D) None of the above is a required statement.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

74

Private colleges are required to report net assets in the following categories:

A) Unrestricted and Restricted

B) Temporarily Restricted , Permanently Restricted and Unrestricted

C) Unrestricted, Temporarily Restricted and board designated

D) Restricted, Unrestricted and Temporarily Restricted

A) Unrestricted and Restricted

B) Temporarily Restricted , Permanently Restricted and Unrestricted

C) Unrestricted, Temporarily Restricted and board designated

D) Restricted, Unrestricted and Temporarily Restricted

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

75

How should the following revenues be reported by a private college?

-$1,500 state appropriations,

-$5,600 in unrestricted contributions,

-$600 unrestricted investment income on endowment investments,

-$11,600 sales of services by auxiliary enterprises.

Unrestricted Restricted

A) 19,300 0

B) 17,800 1,500

C) 17,200 2,100

D) 5,600 13,700

-$1,500 state appropriations,

-$5,600 in unrestricted contributions,

-$600 unrestricted investment income on endowment investments,

-$11,600 sales of services by auxiliary enterprises.

Unrestricted Restricted

A) 19,300 0

B) 17,800 1,500

C) 17,200 2,100

D) 5,600 13,700

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

76

Which of the following is true of a Statement of Activities prepared for a private college or university?

A) All expenses are shown as unrestricted.

B) Reclassifications from unrestricted to permanently restricted net assets are reported when the governing board designates unrestricted funds for permanent investment in the endowment.

C) Only realized gains or losses on investments are reported.

D) All of the above are true.

A) All expenses are shown as unrestricted.

B) Reclassifications from unrestricted to permanently restricted net assets are reported when the governing board designates unrestricted funds for permanent investment in the endowment.

C) Only realized gains or losses on investments are reported.

D) All of the above are true.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

77

According to the FASB,plant acquired by colleges and universities with either unrestricted or restricted resources are recorded as:

A) Restricted

B) Unrestricted

C) Initially as temporarily restricted and reclassified as unrestricted in accordance with the depreciation schedule

D) Either B or C

A) Restricted

B) Unrestricted

C) Initially as temporarily restricted and reclassified as unrestricted in accordance with the depreciation schedule

D) Either B or C

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

78

When a private college or university has a foundation,and that foundation receives contributions specifically directed for the benefit of the college or university,

A) The college or university records no revenue until monies are received from the foundation

B) At the time of the contribution to the foundation, the college or university records an increase in net assets and unearned revenue. When the money is received the unearned revenue is reduced and revenue is recorded.

C) The college or university must recognize its interest in the contribution as an asset and revenue at the same time as the foundation.

D) None of the above

A) The college or university records no revenue until monies are received from the foundation

B) At the time of the contribution to the foundation, the college or university records an increase in net assets and unearned revenue. When the money is received the unearned revenue is reduced and revenue is recorded.

C) The college or university must recognize its interest in the contribution as an asset and revenue at the same time as the foundation.

D) None of the above

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

79

The FASB has the authority to set accounting standards for all of the following organizations except:

A) Public colleges.

B) Private colleges.

C) For profit proprietary schools.

D) Educational foundations established to support a private college or university.

A) Public colleges.

B) Private colleges.

C) For profit proprietary schools.

D) Educational foundations established to support a private college or university.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

80

Which of the following is true regarding accounting and financial reporting for private colleges and universities?

A) Expenses may be unrestricted or temporarily restricted depending on donor intent.

B) The Statement of Cash Flows must use the direct method.

C) A Statement of Unrestricted Revenues, Expenses and Other Changes in Unrestricted Net Assets and a Statement of Changes in Net Assets may be presented instead of a Statement of Activities.

D) None of the above are true.

A) Expenses may be unrestricted or temporarily restricted depending on donor intent.

B) The Statement of Cash Flows must use the direct method.

C) A Statement of Unrestricted Revenues, Expenses and Other Changes in Unrestricted Net Assets and a Statement of Changes in Net Assets may be presented instead of a Statement of Activities.

D) None of the above are true.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck