Deck 5: Measurement Issues: Accounting for the Effects of Changing Prices and Market Conditions

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/29

Play

Full screen (f)

Deck 5: Measurement Issues: Accounting for the Effects of Changing Prices and Market Conditions

1

The reasons the promotion of alternative accounting models to historical cost did not succeed include:

A) There was a lack of agreement as to which model was the best

B) The fact that such a change would have been extremely radical and costly

C) The fact that such a change would create huge economical consequences, and therefore those affected would lobby to protect their self-interest

D) All of the given options are correct.

A) There was a lack of agreement as to which model was the best

B) The fact that such a change would have been extremely radical and costly

C) The fact that such a change would create huge economical consequences, and therefore those affected would lobby to protect their self-interest

D) All of the given options are correct.

D

2

The following procedures are required to apply the Current Purchasing Power Accounting (CPPA)model in order to adjust the financial statements to reflect price-level adjusted financial statements. 1.Determine the movement in net monetary assets from the beginning of the year compared with the end of the year.

2)Reconcile opening and closing net monetary assets with the reasons for the changes.

3)Determine when the movements in net monetary assets for each item took place,and then apply the appropriate price-level index to calculate current purchasing power adjusted amounts.

4)The difference between the adjusted and unadjusted amount totals in the reconciliation is the loss of purchasing power.

5)A price-adjusted Balance Sheet is then prepared,adjusting all the non-monetary assets with the end-of-year price index.

In applying the CPPA model,if the price level index was 120 at the beginning of the year,150 at end of the year,and averaged 135 during the year,which of the following price-level indexes would be incorrect?

A) 150/135 would be applied to sales, purchases of goods, and payment of expenses

B) 150/120 would be applied to opening net monetary assets

C) 150/135 would be applied to dividends and tax if they did not arise until the end of the year

D) All of the given options are correct.

2)Reconcile opening and closing net monetary assets with the reasons for the changes.

3)Determine when the movements in net monetary assets for each item took place,and then apply the appropriate price-level index to calculate current purchasing power adjusted amounts.

4)The difference between the adjusted and unadjusted amount totals in the reconciliation is the loss of purchasing power.

5)A price-adjusted Balance Sheet is then prepared,adjusting all the non-monetary assets with the end-of-year price index.

In applying the CPPA model,if the price level index was 120 at the beginning of the year,150 at end of the year,and averaged 135 during the year,which of the following price-level indexes would be incorrect?

A) 150/135 would be applied to sales, purchases of goods, and payment of expenses

B) 150/120 would be applied to opening net monetary assets

C) 150/135 would be applied to dividends and tax if they did not arise until the end of the year

D) All of the given options are correct.

C

3

Which of the following is not a valid criticism of historical cost accounting?

A) It is not relevant in times of changing prices.

B) It is not logical to add assets together that have been purchased in different periods, with dollars of different purchasing power.

C) It understates profit in times of rising prices.

D) It distorts the current year's operating results by including the current year's income, holding gains that accrued in previous periods.

A) It is not relevant in times of changing prices.

B) It is not logical to add assets together that have been purchased in different periods, with dollars of different purchasing power.

C) It understates profit in times of rising prices.

D) It distorts the current year's operating results by including the current year's income, holding gains that accrued in previous periods.

C

4

Which of the following characteristics is not included in Continuously Contemporary Accounting (CoCoA),as proposed by Chambers?

A) It provides information about an entity's capacity to adapt to changing circumstances using its cash and cash equivalents.

B) All assets are valued in the Balance Sheet based on their exit (net selling) prices.

C) Profit is defined as the amount that can be distributed while maintaining operating capacity intact.

D) Unlike CCA, CoCoA does not make a distinction between realised and unrealised gains (cost savings).

A) It provides information about an entity's capacity to adapt to changing circumstances using its cash and cash equivalents.

B) All assets are valued in the Balance Sheet based on their exit (net selling) prices.

C) Profit is defined as the amount that can be distributed while maintaining operating capacity intact.

D) Unlike CCA, CoCoA does not make a distinction between realised and unrealised gains (cost savings).

Unlock Deck

Unlock for access to all 29 flashcards in this deck.

Unlock Deck

k this deck

5

The following procedures are required to apply the Current Purchasing Power Accounting (CPPA)model in order to adjust the financial statements to reflect price-level adjusted financial statements. 1.Determine the movement in net monetary assets from the beginning of the year compared with the end of the year.

2)Reconcile opening and closing net monetary assets with the reasons for the changes.

3)Determine when the movements in net monetary assets for each item took place,and then apply the appropriate price-level index to calculate current purchasing power adjusted amounts.

4)The difference between the adjusted and unadjusted amount totals in the reconciliation is the loss of purchasing power.

5)A price-adjusted Balance Sheet is then prepared,adjusting all the non-monetary assets with the end-of-year price index.

In applying the CPPA model,where does the loss of purchasing power appear in the price-level adjusted financial statements?

A) It appears as a deduction from Retained Earnings in the Balance Sheet.

B) It appears as an expense in the income statement.

C) It appears as a deduction from profit after tax in the Income Statement.

D) It appears in the notes to the accounts.

2)Reconcile opening and closing net monetary assets with the reasons for the changes.

3)Determine when the movements in net monetary assets for each item took place,and then apply the appropriate price-level index to calculate current purchasing power adjusted amounts.

4)The difference between the adjusted and unadjusted amount totals in the reconciliation is the loss of purchasing power.

5)A price-adjusted Balance Sheet is then prepared,adjusting all the non-monetary assets with the end-of-year price index.

In applying the CPPA model,where does the loss of purchasing power appear in the price-level adjusted financial statements?

A) It appears as a deduction from Retained Earnings in the Balance Sheet.

B) It appears as an expense in the income statement.

C) It appears as a deduction from profit after tax in the Income Statement.

D) It appears in the notes to the accounts.

Unlock Deck

Unlock for access to all 29 flashcards in this deck.

Unlock Deck

k this deck

6

Which of the following is a unique characteristic of the CoCoA model in comparison with other alternative accounting models?

A) It attempts to recognise the changes in value of specific assets on the Balance Sheet.

B) All gains (realised or unrealised) are treated as part of the profits.

C) It includes an adjustment to take into account changes in purchasing power which it calls a 'capital maintenance adjustment'.

D) All of the given options are correct.

A) It attempts to recognise the changes in value of specific assets on the Balance Sheet.

B) All gains (realised or unrealised) are treated as part of the profits.

C) It includes an adjustment to take into account changes in purchasing power which it calls a 'capital maintenance adjustment'.

D) All of the given options are correct.

Unlock Deck

Unlock for access to all 29 flashcards in this deck.

Unlock Deck

k this deck

7

A limitation of Current Cost Accounting does not include the fact that:

A) Replacement costs are easily determined, and therefore the preparation cost is low

B) Replacement costs do not reflect what it would be worth if the firm decided to sell it

C) CCA assumes assets would in fact be replaced, or replaced with that type of asset and not another

D) There are too many versions of current cost accounting, making it confusing to preparers

A) Replacement costs are easily determined, and therefore the preparation cost is low

B) Replacement costs do not reflect what it would be worth if the firm decided to sell it

C) CCA assumes assets would in fact be replaced, or replaced with that type of asset and not another

D) There are too many versions of current cost accounting, making it confusing to preparers

Unlock Deck

Unlock for access to all 29 flashcards in this deck.

Unlock Deck

k this deck

8

Assuming a price index calculated 104.5 in 2013,compared with 100 in 2012,for a bundle of goods,what is the current purchasing power of every dollar,compared to 2012?

A) 95.5 cents in every dollar, on average

B) 95.69 cents in every dollar, on average

C) 96.5 cents in every dollar, on average

D) $1.045 in every dollar, on average

A) 95.5 cents in every dollar, on average

B) 95.69 cents in every dollar, on average

C) 96.5 cents in every dollar, on average

D) $1.045 in every dollar, on average

Unlock Deck

Unlock for access to all 29 flashcards in this deck.

Unlock Deck

k this deck

9

Which of the following best describes the basis of the accounting measurement model in use today?

A) Historical cost accounting

B) Current cost accounting

C) Historical cost, except where conceptual frameworks and accounting standards allow deviation from it

D) A mixed method accounting model

A) Historical cost accounting

B) Current cost accounting

C) Historical cost, except where conceptual frameworks and accounting standards allow deviation from it

D) A mixed method accounting model

Unlock Deck

Unlock for access to all 29 flashcards in this deck.

Unlock Deck

k this deck

10

Which of the following is not a reason why alternative methods have not gained acceptance or been formally implemented?

A) The arguments for the alternative methods were not logical.

B) There appeared to be more interest when inflation was a problem than when it was not.

C) Some alternative models were likely to incur significant costs, negative economic consequences and impacts.

D) Lack of support by the public or the government, and eventually by the accounting profession.

A) The arguments for the alternative methods were not logical.

B) There appeared to be more interest when inflation was a problem than when it was not.

C) Some alternative models were likely to incur significant costs, negative economic consequences and impacts.

D) Lack of support by the public or the government, and eventually by the accounting profession.

Unlock Deck

Unlock for access to all 29 flashcards in this deck.

Unlock Deck

k this deck

11

The following procedures are required to apply the Current Purchasing Power Accounting (CPPA)model in order to adjust the financial statements to reflect price-level adjusted financial statements. 1.Determine the movement in net monetary assets from the beginning of the year compared with the end of the year.

2)Reconcile opening and closing net monetary assets with the reasons for the changes.

3)Determine when the movements in net monetary assets for each item took place and then apply the appropriate price-level index to calculate current purchasing power adjusted amounts.

4)The difference between the adjusted and unadjusted amount total in the reconciliation is the loss on purchasing power.

5)A price-adjusted Balance Sheet is then prepared,adjusting all the non-monetary assets with the end-of-year price index.

In applying the CPPA model,if the price-level index was 120 at the beginning of the year,150 at end of the year,and averaged 135 during the year,what price-level index would be applied to sales that occurred uniformly during the year?

A) 150/135

B) 135/150

C) 150/120

D) 135/120

2)Reconcile opening and closing net monetary assets with the reasons for the changes.

3)Determine when the movements in net monetary assets for each item took place and then apply the appropriate price-level index to calculate current purchasing power adjusted amounts.

4)The difference between the adjusted and unadjusted amount total in the reconciliation is the loss on purchasing power.

5)A price-adjusted Balance Sheet is then prepared,adjusting all the non-monetary assets with the end-of-year price index.

In applying the CPPA model,if the price-level index was 120 at the beginning of the year,150 at end of the year,and averaged 135 during the year,what price-level index would be applied to sales that occurred uniformly during the year?

A) 150/135

B) 135/150

C) 150/120

D) 135/120

Unlock Deck

Unlock for access to all 29 flashcards in this deck.

Unlock Deck

k this deck

12

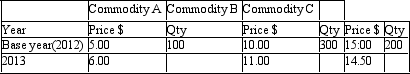

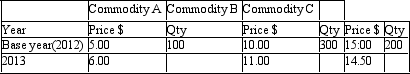

Assume that there are three types of commodities (A,B and C)that are consumed at the base-year quantities and prices as shown in the following table:  What is the price index at the end of 2013?

What is the price index at the end of 2013?

A) 1.0597281

B) 0.9588235

C) 1.0461538

D) None of the given options is correct.

What is the price index at the end of 2013?

What is the price index at the end of 2013?A) 1.0597281

B) 0.9588235

C) 1.0461538

D) None of the given options is correct.

Unlock Deck

Unlock for access to all 29 flashcards in this deck.

Unlock Deck

k this deck

13

The following procedures are required to apply the Current Purchasing Power Accounting (CPPA)model in order to adjust the financial statements to reflect price-level adjusted financial statements. 1.Determine the movement in net monetary assets from the beginning of the year compared with the end of the year.

2)Reconcile opening and closing net monetary assets with the reasons for the changes.

3)Determine when the movements in net monetary assets for each item took place,and then apply the appropriate price-level index to calculate current purchasing power adjusted amounts.

4)The difference between the adjusted and unadjusted amount totals in the reconciliation is the loss of purchasing power.

5)A price-adjusted Balance Sheet is then prepared,adjusting all the non-monetary assets with the end-of-year price index.

In applying the CPPA model,which of the following is correct in preparing the price-level adjusted financial statements?

A) Purchasing power losses only arise as a result of holding net monetary assets.

B) Non-monetary assets are restated in the Balance Sheet at their adjusted current purchasing power.

C) Monetary assets are not adjusted because they are already stated in current purchasing power dollars.

D) All of the given options are correct.

2)Reconcile opening and closing net monetary assets with the reasons for the changes.

3)Determine when the movements in net monetary assets for each item took place,and then apply the appropriate price-level index to calculate current purchasing power adjusted amounts.

4)The difference between the adjusted and unadjusted amount totals in the reconciliation is the loss of purchasing power.

5)A price-adjusted Balance Sheet is then prepared,adjusting all the non-monetary assets with the end-of-year price index.

In applying the CPPA model,which of the following is correct in preparing the price-level adjusted financial statements?

A) Purchasing power losses only arise as a result of holding net monetary assets.

B) Non-monetary assets are restated in the Balance Sheet at their adjusted current purchasing power.

C) Monetary assets are not adjusted because they are already stated in current purchasing power dollars.

D) All of the given options are correct.

Unlock Deck

Unlock for access to all 29 flashcards in this deck.

Unlock Deck

k this deck

14

How would the deprival value of an asset be determined?

A) It is the present value of the future cash flows to be generated by the asset, except where the current replacement cost or net selling price is less than that value.

B) It is the net selling price, except where the value to the business (present value) is less, or the current replacement cost greater.

C) It is the current replacement cost, where the present value is less than the current replacement cost and greater than the net selling price.

D) It is the value to the business of the asset (present value), within the bounds that this value is not less than the net selling price or greater than its current replacement cost.

A) It is the present value of the future cash flows to be generated by the asset, except where the current replacement cost or net selling price is less than that value.

B) It is the net selling price, except where the value to the business (present value) is less, or the current replacement cost greater.

C) It is the current replacement cost, where the present value is less than the current replacement cost and greater than the net selling price.

D) It is the value to the business of the asset (present value), within the bounds that this value is not less than the net selling price or greater than its current replacement cost.

Unlock Deck

Unlock for access to all 29 flashcards in this deck.

Unlock Deck

k this deck

15

Which of the following measurement models of accounting equate with perspectives of maintaining the purchasing power of capital intact?

A) General price-level adjustment accounting

B) Current cost accounting

C) Continuously contemporary accounting

D) None of the given options is correct

A) General price-level adjustment accounting

B) Current cost accounting

C) Continuously contemporary accounting

D) None of the given options is correct

Unlock Deck

Unlock for access to all 29 flashcards in this deck.

Unlock Deck

k this deck

16

Which of the following statements about holding gain (cost savings)in the CCA model is false?

A) Unrealised savings include gains (cost saving) from holding inventory that has increased in price, which have yet to be realised.

B) Realised savings relate to cost savings in inventory actually incurred, and gains (cost savings) relate to depreciation actually incurred.

C) Unrealised savings include gains (cost savings) from holding depreciable assets (with higher replacement costs) not yet realised through the process of depreciation.

D) All of the given options are correct.

A) Unrealised savings include gains (cost saving) from holding inventory that has increased in price, which have yet to be realised.

B) Realised savings relate to cost savings in inventory actually incurred, and gains (cost savings) relate to depreciation actually incurred.

C) Unrealised savings include gains (cost savings) from holding depreciable assets (with higher replacement costs) not yet realised through the process of depreciation.

D) All of the given options are correct.

Unlock Deck

Unlock for access to all 29 flashcards in this deck.

Unlock Deck

k this deck

17

Which of the following is not a feature of current cost accounting?

A) It uses current values which could be based on present value, entry value (replacement) costs or exit value (selling) prices.

B) It seeks to maintain the operating capability of capital.

C) It uses specific prices of assets rather than general price-level adjustments.

D) It seeks to maintain the purchasing power of capital.

A) It uses current values which could be based on present value, entry value (replacement) costs or exit value (selling) prices.

B) It seeks to maintain the operating capability of capital.

C) It uses specific prices of assets rather than general price-level adjustments.

D) It seeks to maintain the purchasing power of capital.

Unlock Deck

Unlock for access to all 29 flashcards in this deck.

Unlock Deck

k this deck

18

Which of the following is not a possible limitation with CPPA accounting?

A) The prices of the goods and services included in the general price index may not be reflective of the price movements (inflation) specific to that particular industry.

B) The information is simple, and easily understood by users.

C) Research has shown that the information provided by CPPA may not be decision-relevant.

D) Users might think that the price-level adjusted amounts might reflect the specific value of specific assets.

A) The prices of the goods and services included in the general price index may not be reflective of the price movements (inflation) specific to that particular industry.

B) The information is simple, and easily understood by users.

C) Research has shown that the information provided by CPPA may not be decision-relevant.

D) Users might think that the price-level adjusted amounts might reflect the specific value of specific assets.

Unlock Deck

Unlock for access to all 29 flashcards in this deck.

Unlock Deck

k this deck

19

Which of the following statements is not true in times of inflation?

A) Holders of monetary liabilities will gain.

B) Holders of monetary assets will lose.

C) If the amount of monetary assets is the same as monetary liabilities, no gains or losses would occur.

D) If the amount of monetary assets held is less than the amount of monetary liabilities held, a net loss would occur.

A) Holders of monetary liabilities will gain.

B) Holders of monetary assets will lose.

C) If the amount of monetary assets is the same as monetary liabilities, no gains or losses would occur.

D) If the amount of monetary assets held is less than the amount of monetary liabilities held, a net loss would occur.

Unlock Deck

Unlock for access to all 29 flashcards in this deck.

Unlock Deck

k this deck

20

If historical cost profits are all distributed in dividends during times of rising inventory prices,this will lead to (assuming other things being equal):

A) A reduction in financial capital

B) An erosion of operating capacity

C) No effect on capital

D) None of the given options is correct.

A) A reduction in financial capital

B) An erosion of operating capacity

C) No effect on capital

D) None of the given options is correct.

Unlock Deck

Unlock for access to all 29 flashcards in this deck.

Unlock Deck

k this deck

21

Which of the following aligns with CoCoA's definition of 'wealth'?

A) The present (selling) price is seen as the correct valuation of wealth at a point in time.

B) Profit is not tied to the increase (or decrease) in the current net selling prices of the entity's assets.

C) Wealth is the distinction between realised and unrealised gains-not all gains are treated as part of profit.

D) Profit is the amount that cannot be distributed, while maintaining the entity's adaptive ability (adaptive capital).

A) The present (selling) price is seen as the correct valuation of wealth at a point in time.

B) Profit is not tied to the increase (or decrease) in the current net selling prices of the entity's assets.

C) Wealth is the distinction between realised and unrealised gains-not all gains are treated as part of profit.

D) Profit is the amount that cannot be distributed, while maintaining the entity's adaptive ability (adaptive capital).

Unlock Deck

Unlock for access to all 29 flashcards in this deck.

Unlock Deck

k this deck

22

Which of the following is the advantage of using current purchasing power adjustment?

A) It relies on data already available under historical cost accounting.

B) There is no need to incur cost or effort to collect data about current asset values.

C) CPI data also readily available.

D) All of the given options are correct.

A) It relies on data already available under historical cost accounting.

B) There is no need to incur cost or effort to collect data about current asset values.

C) CPI data also readily available.

D) All of the given options are correct.

Unlock Deck

Unlock for access to all 29 flashcards in this deck.

Unlock Deck

k this deck

23

Which of the following statements is correct under our current accounting standards?

A) Many assets can, or must, be measured at historical cost.

B) Inventory must be measured at cost, or net realisable value if it is lower.

C) Property, plant and equipment can be valued at cost where an entity has adopted the 'cost model' for a class of property, plant and equipment.

D) All of the given options are correct.

A) Many assets can, or must, be measured at historical cost.

B) Inventory must be measured at cost, or net realisable value if it is lower.

C) Property, plant and equipment can be valued at cost where an entity has adopted the 'cost model' for a class of property, plant and equipment.

D) All of the given options are correct.

Unlock Deck

Unlock for access to all 29 flashcards in this deck.

Unlock Deck

k this deck

24

Assume that an entity acquired 150 items of inventory at a cost of $90 each,and sold 100 of the items for $160 each when the replacement cost to the entity was $120 each.Also assume that the replacement cost of the 50 remaining items of inventory at year end was $130.What would be the realised holding gain on the inventory that was sold?

A) $7 000 [100 x ($160 - $90)]

B) $4 000 [100 x ($130 - $90)]

C) $3 000 [100 x ($120 - $90)]

D) $500 [50 x ($130 - $120)]

A) $7 000 [100 x ($160 - $90)]

B) $4 000 [100 x ($130 - $90)]

C) $3 000 [100 x ($120 - $90)]

D) $500 [50 x ($130 - $120)]

Unlock Deck

Unlock for access to all 29 flashcards in this deck.

Unlock Deck

k this deck

25

Craig sold land for $1 200 000.He had initially purchased the land for $1 000 000,when the price index was 100.The price index at the end of the current period is 118.The adjusted cost is $1 180 000.The adjusted profit is $20 000 (compared with an historical cost profit of $200 000).This is an example of:

A) Financial capital maintenance perspective

B) Purchasing power maintenance perspective

C) Physical operating capital maintenance perspective

D) None of the given options is correct.

A) Financial capital maintenance perspective

B) Purchasing power maintenance perspective

C) Physical operating capital maintenance perspective

D) None of the given options is correct.

Unlock Deck

Unlock for access to all 29 flashcards in this deck.

Unlock Deck

k this deck

26

Assume that for Company X,the opening residual equity was $30 000 000 and the price index increased from 150 to 175.The capital maintenance adjustment would be calculated and classified as:

A) Calculation: $30 000 000 25/150 = $5 000 000 and classified as an income

B) Calculation: $30 000 000 25/175 = $4 285 714 and classified as an income

C) Calculation: $30 000 000 25/150 = $5 000 000 and classified as an expense

D) Calculation: $30 000 000 25/175 = $4 285 714 and classified as an expense

A) Calculation: $30 000 000 25/150 = $5 000 000 and classified as an income

B) Calculation: $30 000 000 25/175 = $4 285 714 and classified as an income

C) Calculation: $30 000 000 25/150 = $5 000 000 and classified as an expense

D) Calculation: $30 000 000 25/175 = $4 285 714 and classified as an expense

Unlock Deck

Unlock for access to all 29 flashcards in this deck.

Unlock Deck

k this deck

27

Assume that an entity acquired 150 items of inventory at a cost of $90 each,and sold 100 of the items for $160 each when the replacement cost to the entity was $120 each.Also assume that the replacement cost of the 50 remaining items of inventory at year end was $130.Under the Edwards and Bell approach to current cost accounting,what portion of operating profit would be available for dividends?

A) $4 000 [100 x ($160 - $120)]

B) $1 000 [100 x ($130 - $120)]

C) $3 000 [100 x ($160 - $130)]

D) $1 500 [50 x ($160 - $130)]

A) $4 000 [100 x ($160 - $120)]

B) $1 000 [100 x ($130 - $120)]

C) $3 000 [100 x ($160 - $130)]

D) $1 500 [50 x ($160 - $130)]

Unlock Deck

Unlock for access to all 29 flashcards in this deck.

Unlock Deck

k this deck

28

What is included in 'income' according to the IASB Conceptual Framework?

A) All events that result in an increase in the net assets of the reporting entity, other than owner contributions

B) All events that result in an increase in the net assets of the reporting entity

C) Events that relate to the central operations of the entity

D) All of the given options are correct.

A) All events that result in an increase in the net assets of the reporting entity, other than owner contributions

B) All events that result in an increase in the net assets of the reporting entity

C) Events that relate to the central operations of the entity

D) All of the given options are correct.

Unlock Deck

Unlock for access to all 29 flashcards in this deck.

Unlock Deck

k this deck

29

In the historical cost model there is an assumption that the monetary unit is fixed and constant over time.Which of the following components of the modern economy makes the assumption less valid than it was at the time the model was developed?

A) Specific price-level changes, occasioned by such things as technological advances and shifts in consumer preferences

B) General price-level changes (inflation)

C) Physical operating capital maintenance perspective

D) All of the given options are correct.

A) Specific price-level changes, occasioned by such things as technological advances and shifts in consumer preferences

B) General price-level changes (inflation)

C) Physical operating capital maintenance perspective

D) All of the given options are correct.

Unlock Deck

Unlock for access to all 29 flashcards in this deck.

Unlock Deck

k this deck