Deck 11: Credit Risk II: Loan Portfolio and Concentration Risk

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/63

Play

Full screen (f)

Deck 11: Credit Risk II: Loan Portfolio and Concentration Risk

1

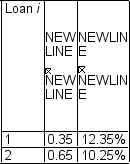

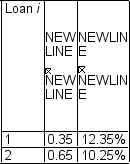

Consider the following table with information on the weightings and expected returns of two assets held by an FI.

What is the expected return on the portfolio (round to two decimals)?

A) (0.35 + 12.35) - (0.65 + 10.25) = 1.80%

B) (0.35 + 0.65)* (12.35 + 10.25) = 22.60%

C) (12.35 + 10.25) / 2 = 11.30%

D) 0.35 * 12.35 + 0.65* 10.25 = 10.99%

What is the expected return on the portfolio (round to two decimals)?

A) (0.35 + 12.35) - (0.65 + 10.25) = 1.80%

B) (0.35 + 0.65)* (12.35 + 10.25) = 22.60%

C) (12.35 + 10.25) / 2 = 11.30%

D) 0.35 * 12.35 + 0.65* 10.25 = 10.99%

0.35 * 12.35 + 0.65* 10.25 = 10.99%

1

Financial institutions do not use options to hedge credit risk exposures as credit risk is a natural risk that comes with the core activities of the bank, namely lending.

False

2

Migration analysis is a method to:

A) manage loan concentration risk by tracking credit ratings of firms in particular sectors or ratings class for unusual declines.

B) measure loan concentration risk by tracking credit ratings of firms in particular sectors or ratings class for unusual declines.

C) measure loan concentration risk by tracking credit ratings of firms in particular sectors or ratings class for normal declines.

D) manage loan concentration risk by tracking credit ratings of firms in particular sectors or ratings class for normal declines.

A) manage loan concentration risk by tracking credit ratings of firms in particular sectors or ratings class for unusual declines.

B) measure loan concentration risk by tracking credit ratings of firms in particular sectors or ratings class for unusual declines.

C) measure loan concentration risk by tracking credit ratings of firms in particular sectors or ratings class for normal declines.

D) manage loan concentration risk by tracking credit ratings of firms in particular sectors or ratings class for normal declines.

B

3

Which of the following statements is true?

A) The fundamental lesson of modern portfolio theory (MPT) is that by taking advantage of its profitability, an FI can diversify considerable amounts of credit risk as long as the returns on different assets are imperfectly correlated.

B) The fundamental lesson of modern portfolio theory (MPT) is that by taking advantage of its size, an FI can diversify considerable amounts of credit risk as long as the returns on different assets are imperfectly correlated.

C) The fundamental lesson of modern portfolio theory (MPT) is that by taking advantage of its profitability, an FI can diversify considerable amounts of credit risk as long as the returns on different assets are perfectly correlated.

D) The fundamental lesson of modern portfolio theory (MPT) is that by taking advantage of its profitability, an FI can diversify considerable amounts of credit risk as long as the returns on different assets are imperfectly correlated.

A) The fundamental lesson of modern portfolio theory (MPT) is that by taking advantage of its profitability, an FI can diversify considerable amounts of credit risk as long as the returns on different assets are imperfectly correlated.

B) The fundamental lesson of modern portfolio theory (MPT) is that by taking advantage of its size, an FI can diversify considerable amounts of credit risk as long as the returns on different assets are imperfectly correlated.

C) The fundamental lesson of modern portfolio theory (MPT) is that by taking advantage of its profitability, an FI can diversify considerable amounts of credit risk as long as the returns on different assets are perfectly correlated.

D) The fundamental lesson of modern portfolio theory (MPT) is that by taking advantage of its profitability, an FI can diversify considerable amounts of credit risk as long as the returns on different assets are imperfectly correlated.

B

4

KMV Portfolio Manager is a model that:

A) was developed by the KMV Corporation and purchased by Moody's in 2002.

B) measures the expected return on a loan to a borrower, the risk of a loan to a borrower and the correlation of default risks between loans made to a borrower and other borrowers.

C) seeks to estimate an efficient frontier for loans.

D) All of the listed options are correct.

A) was developed by the KMV Corporation and purchased by Moody's in 2002.

B) measures the expected return on a loan to a borrower, the risk of a loan to a borrower and the correlation of default risks between loans made to a borrower and other borrowers.

C) seeks to estimate an efficient frontier for loans.

D) All of the listed options are correct.

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

5

Which of the following statements is true?

A) Systematic loan loss risk is a measure of the sensitivity of loan losses in personal loans relative to the losses in commercial loans.

B) Systematic loan loss risk is a measure of the sensitivity of loan losses of a particular borrower relative to the losses in an FI's loan portfolio.

C) Systematic loan loss risk is a measure of the sensitivity of loan losses in commercial loans relative to the losses in personal loans.

D) Systematic loan loss risk is a measure of the sensitivity of loan losses in a particular business sector relative to the losses in an FI's loan portfolio.

A) Systematic loan loss risk is a measure of the sensitivity of loan losses in personal loans relative to the losses in commercial loans.

B) Systematic loan loss risk is a measure of the sensitivity of loan losses of a particular borrower relative to the losses in an FI's loan portfolio.

C) Systematic loan loss risk is a measure of the sensitivity of loan losses in commercial loans relative to the losses in personal loans.

D) Systematic loan loss risk is a measure of the sensitivity of loan losses in a particular business sector relative to the losses in an FI's loan portfolio.

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

6

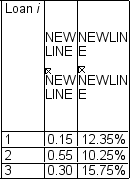

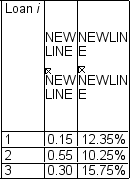

Consider the following table with information on the weightings and expected returns of three assets held by an FI.

What is the expected return on the portfolio (round to two decimals)?

A) (0.15 * 12.35 + 0.55 *10.25 + 0.30 * 15.75) / 3 = 4.07%

B) (0.15 * 12.35 + 0.55 * 10.25 + 0.30 * 15.75) * 3 = 36.66%

C) 0.15 * 12.35 + 0.55 * 10.25 + 0.30 *15.75 = 12.22%

D) (12.35 + 10.25 + 15.75) / 3 = 12.78%

What is the expected return on the portfolio (round to two decimals)?

A) (0.15 * 12.35 + 0.55 *10.25 + 0.30 * 15.75) / 3 = 4.07%

B) (0.15 * 12.35 + 0.55 * 10.25 + 0.30 * 15.75) * 3 = 36.66%

C) 0.15 * 12.35 + 0.55 * 10.25 + 0.30 *15.75 = 12.22%

D) (12.35 + 10.25 + 15.75) / 3 = 12.78%

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

6

The most important swap contract in terms of quantity is the credit swap.

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

7

Assume that the maximum loss as a percentage of capital is 12 per cent of an FI's capital to a particular sector. The FI's concentration limit on this sector 35 per cent. What is the sector's loss rate (round to two decimals)?

A) 4.20 per cent

B) 23.00 per cent

C) 34.29 per cent

D) 2.92 per cent.

A) 4.20 per cent

B) 23.00 per cent

C) 34.29 per cent

D) 2.92 per cent.

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

8

The term 'transition matrix' refers to a matrix that provides a measurement of the probability of a loan:

A) being upgraded over some period.

B) being downgraded over some period.

C) defaulting over some period.

D) All of the listed options are correct.

A) being upgraded over some period.

B) being downgraded over some period.

C) defaulting over some period.

D) All of the listed options are correct.

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

9

Limits set on the maximum loan size that can be made to an individual borrower are referred to as:

A) maximum damage limits.

B) concentration limits.

C) syndication limits.

D) minimisation limits.

A) maximum damage limits.

B) concentration limits.

C) syndication limits.

D) minimisation limits.

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

10

Which of the following statements is true?

A) The concentration limit on a portfolio can be calculated as the maximum loss as a percentage of capital divided by (one divided by the loss rate).

B) The concentration limit on a portfolio can be calculated as the maximum loss as a percentage of capital divided by (one multiplied by the loss rate).

C) The concentration limit on a portfolio can be calculated as the maximum loss as a percentage of capital multiplied by (one divided by the loss rate).

D) The concentration limit on a portfolio can be calculated as the maximum loss as a percentage of capital multiplied by (one multiplied by the loss rate).

A) The concentration limit on a portfolio can be calculated as the maximum loss as a percentage of capital divided by (one divided by the loss rate).

B) The concentration limit on a portfolio can be calculated as the maximum loss as a percentage of capital divided by (one multiplied by the loss rate).

C) The concentration limit on a portfolio can be calculated as the maximum loss as a percentage of capital multiplied by (one divided by the loss rate).

D) The concentration limit on a portfolio can be calculated as the maximum loss as a percentage of capital multiplied by (one multiplied by the loss rate).

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

11

Which of the following statements is true?

A) FIs can reduce profitability by taking advantage of the law of small numbers in their investment decisions.

B) FIs can reduce profitability by taking advantage of the law of large numbers in their investment decisions.

C) FIs can reduce risk by taking advantage of the law of small numbers in their investment decisions.

D) FIs can reduce risk by taking advantage of the law of large numbers in their investment decisions.

A) FIs can reduce profitability by taking advantage of the law of small numbers in their investment decisions.

B) FIs can reduce profitability by taking advantage of the law of large numbers in their investment decisions.

C) FIs can reduce risk by taking advantage of the law of small numbers in their investment decisions.

D) FIs can reduce risk by taking advantage of the law of large numbers in their investment decisions.

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

12

Minimum risk portfolio refers to a combination of assets:

A) and liabilities that reduces the variance of portfolio returns to the lowest feasible level.

B) that leverages the variance of portfolio returns to the optimal level.

C) that reduces the variance of portfolio returns to the lowest feasible level.

D) that reduces the variance of portfolio returns to zero.

A) and liabilities that reduces the variance of portfolio returns to the lowest feasible level.

B) that leverages the variance of portfolio returns to the optimal level.

C) that reduces the variance of portfolio returns to the lowest feasible level.

D) that reduces the variance of portfolio returns to zero.

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

13

The Basel Committee on Banking Supervision considers regulatory loan concentration limits to individual borrowers as an issue of granularity. Which of the following statements is true in this context?

A) The issue of granularity means that if banks hold relatively large exposures to an individual borrower or sector to a reference portfolio they have devised, then risk weightings required in the capital to be held will be adjusted by the FI to reflect its levels of portfolio concentration or diversification.

B) The issue of granularity means that if banks hold relatively large exposures to an individual borrower or sector to a reference portfolio they have devised, then risk weightings required in the capital to be held will be adjusted up or down to reflect the levels of portfolio concentration or diversification.

C) The issue of granularity means that if banks hold relatively large exposures to an individual borrower or sector to a reference portfolio they have devised, then risk weightings required in the capital to be held will be adjusted up to reflect the levels of portfolio diversification.

D) The issue of granularity means that if banks hold relatively large exposures to an individual borrower or sector to a reference portfolio they have devised, then risk weightings required in the capital to be held will be adjusted down to reflect the levels of portfolio concentration.

A) The issue of granularity means that if banks hold relatively large exposures to an individual borrower or sector to a reference portfolio they have devised, then risk weightings required in the capital to be held will be adjusted by the FI to reflect its levels of portfolio concentration or diversification.

B) The issue of granularity means that if banks hold relatively large exposures to an individual borrower or sector to a reference portfolio they have devised, then risk weightings required in the capital to be held will be adjusted up or down to reflect the levels of portfolio concentration or diversification.

C) The issue of granularity means that if banks hold relatively large exposures to an individual borrower or sector to a reference portfolio they have devised, then risk weightings required in the capital to be held will be adjusted up to reflect the levels of portfolio diversification.

D) The issue of granularity means that if banks hold relatively large exposures to an individual borrower or sector to a reference portfolio they have devised, then risk weightings required in the capital to be held will be adjusted down to reflect the levels of portfolio concentration.

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

14

Assume that the maximum loss as a percentage of capital is 12 per cent of an FI's capital to a particular sector and that the amount lost per dollar of defaulted loans in this sector is 35 per cent. What is the concentration limit (round to two decimals)?

A) 12% (1/0.35) = 34.29%

B) 35% (1/0.12) = 4.2%

C) 12% / (1 + 0.35) = 8.89%

D) 35% / (1 + 0.12) = 31.25%

A) 12% (1/0.35) = 34.29%

B) 35% (1/0.12) = 4.2%

C) 12% / (1 + 0.35) = 8.89%

D) 35% / (1 + 0.12) = 31.25%

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

15

Assume that the maximum loss as a percentage of capital is 9 per cent of an FI's capital to a particular sector and that the amount recovered per dollar of defaulted loans in this sector is 70 per cent. What is the concentration limit (round to two decimals)?

A) 9% (1/0.7) = 12.86%

B) 9% [1/(1-0.7)] = 30.00%

C) 70% / (1/0.09) = 6.30%

D) (100% - 70%) / (1/0.09) = 2.70%

A) 9% (1/0.7) = 12.86%

B) 9% [1/(1-0.7)] = 30.00%

C) 70% / (1/0.09) = 6.30%

D) (100% - 70%) / (1/0.09) = 2.70%

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

16

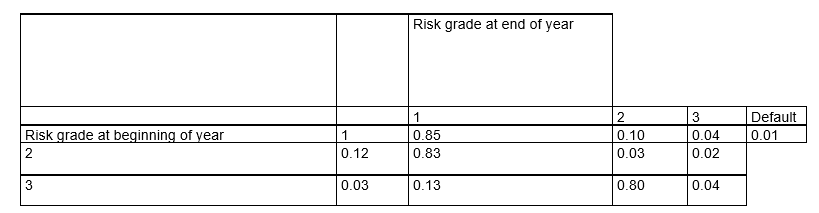

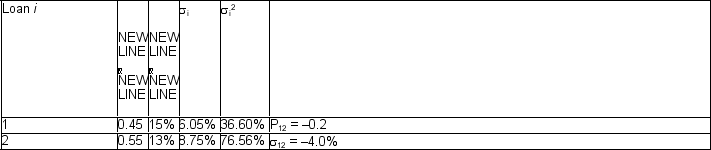

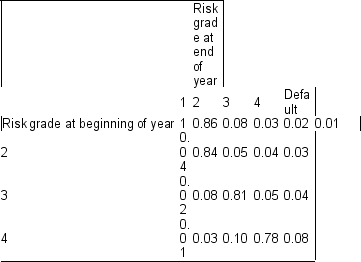

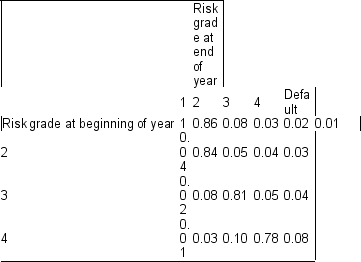

Consider the following hypothetical transition matrix:  Which of the following statements is true?

Which of the following statements is true?

A) A borrower with a risk grade of 2 at the beginning of the year has a 3 per cent probability of being downgraded to a risk grade of 3.

B) A borrower with a risk grade of 3 at the beginning of the year has a 0.04 per cent probability of being upgraded to a risk grade of 1.

C) A borrower with a risk grade of 2 at the beginning of the year has a 12 per cent probability of being downgraded to a risk grade of 1.

D) A borrower with a risk grade of 2 at the beginning of the year has an 85 per cent probability of being upgraded to a risk grade of 1.

Which of the following statements is true?

Which of the following statements is true?A) A borrower with a risk grade of 2 at the beginning of the year has a 3 per cent probability of being downgraded to a risk grade of 3.

B) A borrower with a risk grade of 3 at the beginning of the year has a 0.04 per cent probability of being upgraded to a risk grade of 1.

C) A borrower with a risk grade of 2 at the beginning of the year has a 12 per cent probability of being downgraded to a risk grade of 1.

D) A borrower with a risk grade of 2 at the beginning of the year has an 85 per cent probability of being upgraded to a risk grade of 1.

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

17

Which of the following statements is true?

A) FIs typically increase their concentration limits to increase exposures to others.

B) FIs typically set concentration limits to reduce exposures to certain industries and increase exposures to others.

C) FIs typically set concentration limits to reduce their exposure to individual borrowers.

D) FIs typically decrease their concentration limits to decrease exposures to others.

A) FIs typically increase their concentration limits to increase exposures to others.

B) FIs typically set concentration limits to reduce exposures to certain industries and increase exposures to others.

C) FIs typically set concentration limits to reduce their exposure to individual borrowers.

D) FIs typically decrease their concentration limits to decrease exposures to others.

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

18

Which of the following statements is true?

A) The correlation coefficient reflects the joint movement of asset returns or default risk in the case of loans and lies between the values -1 r + 1, where r is the correlation coefficient.

B) The correlation coefficient reflects the joint movement of asset returns or default risk in the case of loans and lies between the values 0 r + 1, where r is the correlation coefficient.

C) The correlation coefficient reflects the joint movement of asset returns or default risk in the case of loans and lies between the values +1 r + 2, where r is the correlation coefficient.

D) The correlation coefficient reflects the joint movement of asset returns or default risk in the case of loans and lies between the values -1 r 0, where r is the correlation coefficient.

A) The correlation coefficient reflects the joint movement of asset returns or default risk in the case of loans and lies between the values -1 r + 1, where r is the correlation coefficient.

B) The correlation coefficient reflects the joint movement of asset returns or default risk in the case of loans and lies between the values 0 r + 1, where r is the correlation coefficient.

C) The correlation coefficient reflects the joint movement of asset returns or default risk in the case of loans and lies between the values +1 r + 2, where r is the correlation coefficient.

D) The correlation coefficient reflects the joint movement of asset returns or default risk in the case of loans and lies between the values -1 r 0, where r is the correlation coefficient.

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

19

Which of the following statements is true?

A) FIs may set an aggregate limit of less than the sum of two individual industry limits if two industry groups' performance are negatively correlated.

B) FIs may set an aggregate limit of less than the sum of two individual industry limits if two industry groups' performance are highly correlated.

C) FIs may set an aggregate limit of less than the sum of two individual industry limits if two industry groups' performance are not correlated.

D) FIs may set an aggregate limit of more than the sum of two individual industry limits if two industry groups' performance are negatively correlated.

A) FIs may set an aggregate limit of less than the sum of two individual industry limits if two industry groups' performance are negatively correlated.

B) FIs may set an aggregate limit of less than the sum of two individual industry limits if two industry groups' performance are highly correlated.

C) FIs may set an aggregate limit of less than the sum of two individual industry limits if two industry groups' performance are not correlated.

D) FIs may set an aggregate limit of more than the sum of two individual industry limits if two industry groups' performance are negatively correlated.

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

20

Assume that an FI's concentration limit on a particular sector is 15 per cent and that the sector's loss rate is 25 per cent. What is the maximum loss as a percentage of the FI's capital (round to two decimals)?

A) 1.67 per cent

B) 0.60 per cent

C) 10.00 per cent

D) 3.75 per cent

A) 1.67 per cent

B) 0.60 per cent

C) 10.00 per cent

D) 3.75 per cent

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

21

Which of the following statements is true?

A) If many loans have negative correlations of returns the sum of the individual credit risks of loans viewed independently exactly estimates the risk of the whole portfolio.

B) If many loans have negative correlations of returns the sum of the individual credit risks of loans viewed independently underestimates the risk of the whole portfolio.

C) If many loans have positive correlations of returns the sum of the individual credit risks of loans viewed independently overestimates the risk of the whole portfolio.

D) If many loans have negative correlations of returns the sum of the individual credit risks of loans viewed independently overestimates the risk of the whole portfolio.

A) If many loans have negative correlations of returns the sum of the individual credit risks of loans viewed independently exactly estimates the risk of the whole portfolio.

B) If many loans have negative correlations of returns the sum of the individual credit risks of loans viewed independently underestimates the risk of the whole portfolio.

C) If many loans have positive correlations of returns the sum of the individual credit risks of loans viewed independently overestimates the risk of the whole portfolio.

D) If many loans have negative correlations of returns the sum of the individual credit risks of loans viewed independently overestimates the risk of the whole portfolio.

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

22

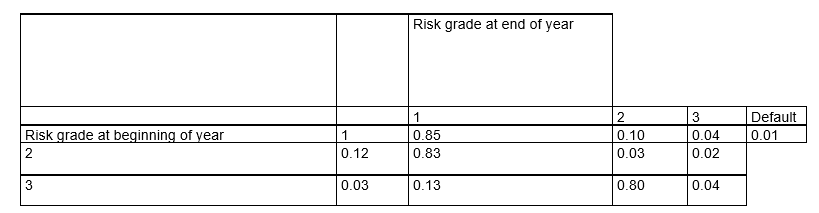

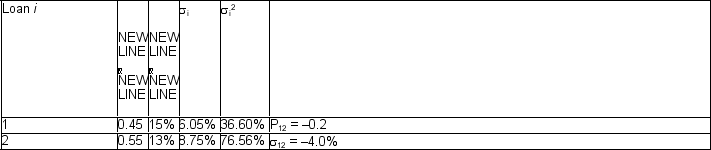

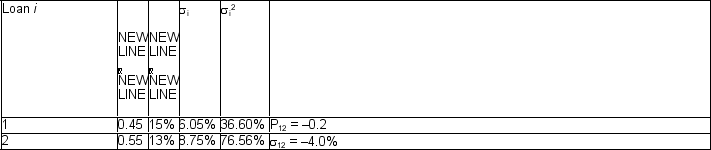

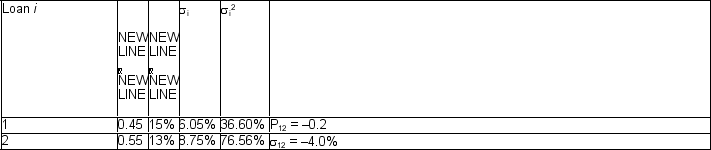

Consider the following portfolio of assets:  What is the standard deviation of the portfolio (round to two decimals)?

What is the standard deviation of the portfolio (round to two decimals)?

A) (0.45)( 36.60) + (0.55)( 76.56) = 7.51%

B) ( 36.60) + ( 76.56) = 14.80%

C) 57.28 = 7.57%

D) 25.33 = 5.03%

What is the standard deviation of the portfolio (round to two decimals)?

What is the standard deviation of the portfolio (round to two decimals)?A) (0.45)( 36.60) + (0.55)( 76.56) = 7.51%

B) ( 36.60) + ( 76.56) = 14.80%

C) 57.28 = 7.57%

D) 25.33 = 5.03%

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

22

Using the KMV Portfolio Manager Model, the return on a loan can be calculated as the annual all-in-spread minus the loss in the event of default.

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

23

Which of the following statements is true?

A) Partial applications of portfolio theory include loan volume based models and loan loss ratio based models.

B) Partial applications of portfolio theory include loan portfolio profitability based models and regulatory models.

C) Partial applications of portfolio theory include loan volume based models, loan loss ratio based models and regulatory models.

D) Partial applications of portfolio theory include loan portfolio profitability based models and loan loss minimisation based models.

A) Partial applications of portfolio theory include loan volume based models and loan loss ratio based models.

B) Partial applications of portfolio theory include loan portfolio profitability based models and regulatory models.

C) Partial applications of portfolio theory include loan volume based models, loan loss ratio based models and regulatory models.

D) Partial applications of portfolio theory include loan portfolio profitability based models and loan loss minimisation based models.

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

24

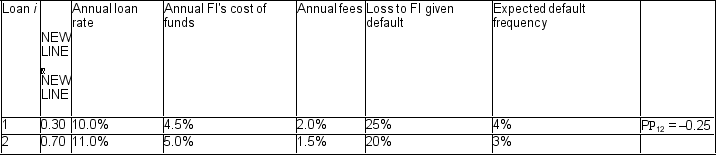

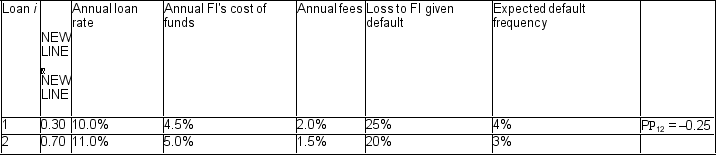

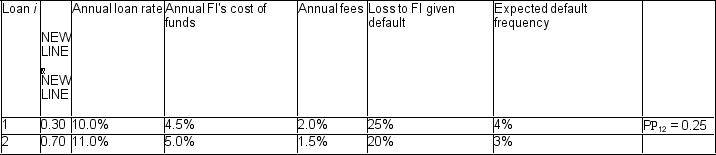

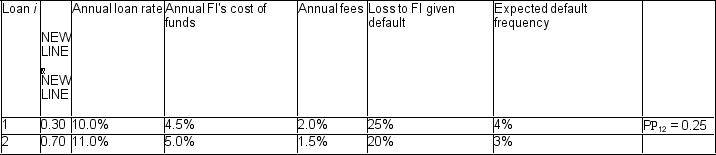

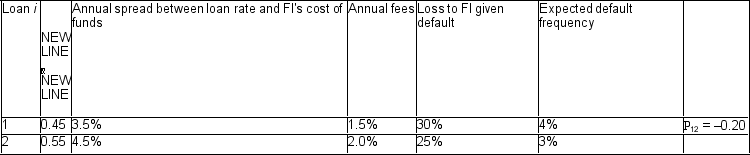

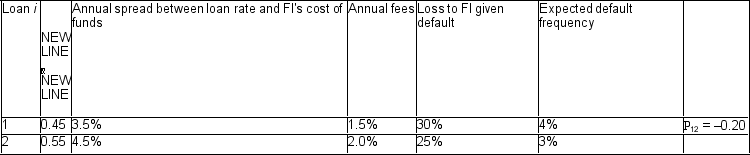

Consider an FI that holds two loans with the following characteristics:  What is the return on the loan portfolio (round to two decimals)?

What is the return on the loan portfolio (round to two decimals)?

A) 6.50 per cent

B) 6.90 per cent

C) 13.40 per cent

D) 6.78 per cent

What is the return on the loan portfolio (round to two decimals)?

What is the return on the loan portfolio (round to two decimals)?A) 6.50 per cent

B) 6.90 per cent

C) 13.40 per cent

D) 6.78 per cent

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

24

A transition matrix can be used to establish the probabilities that a currently rated borrower will be upgraded, downgraded or will default over time.

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

25

The return (Ri) on a loan can be measured as follows:

A) AISi - E(Li), whereby E(Li) = (EDFi LGDi)

B) AISi - E(Li), whereby E(Li) = (EDFi / LGDi)

C) AISi + E(Li), whereby E(Li) = (EDFi LGDi)

D) AISi + E(Li), whereby E(Li) = (EDFi / LGDi)

A) AISi - E(Li), whereby E(Li) = (EDFi LGDi)

B) AISi - E(Li), whereby E(Li) = (EDFi / LGDi)

C) AISi + E(Li), whereby E(Li) = (EDFi LGDi)

D) AISi + E(Li), whereby E(Li) = (EDFi / LGDi)

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

26

Consider the following portfolio of assets: ![<strong>Consider the following portfolio of assets: What is the expected return on the portfolio (round to two decimals)?</strong> A) (15% + 13%) / 2 = 14.00% B) (0.45)<sup>2</sup>(15%) + (0.7)<sup>2</sup>(13%) = 9.41% C) [(0.45)<sup>2</sup>(15%) + (0.7)<sup>2</sup>(13%)] * 2 = 18.82% D) 0.45(15%) + 0.7(13%) = 15.85%](https://storage.examlex.com/TB2399/11ea6e9e_24aa_2611_8f54_3f1b8fc2f0a7_TB2399_00.jpg) What is the expected return on the portfolio (round to two decimals)?

What is the expected return on the portfolio (round to two decimals)?

A) (15% + 13%) / 2 = 14.00%

B) (0.45)2(15%) + (0.7)2(13%) = 9.41%

C) [(0.45)2(15%) + (0.7)2(13%)] * 2 = 18.82%

D) 0.45(15%) + 0.7(13%) = 15.85%

![<strong>Consider the following portfolio of assets: What is the expected return on the portfolio (round to two decimals)?</strong> A) (15% + 13%) / 2 = 14.00% B) (0.45)<sup>2</sup>(15%) + (0.7)<sup>2</sup>(13%) = 9.41% C) [(0.45)<sup>2</sup>(15%) + (0.7)<sup>2</sup>(13%)] * 2 = 18.82% D) 0.45(15%) + 0.7(13%) = 15.85%](https://storage.examlex.com/TB2399/11ea6e9e_24aa_2611_8f54_3f1b8fc2f0a7_TB2399_00.jpg) What is the expected return on the portfolio (round to two decimals)?

What is the expected return on the portfolio (round to two decimals)?A) (15% + 13%) / 2 = 14.00%

B) (0.45)2(15%) + (0.7)2(13%) = 9.41%

C) [(0.45)2(15%) + (0.7)2(13%)] * 2 = 18.82%

D) 0.45(15%) + 0.7(13%) = 15.85%

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

26

The relationship limit on diversification has also been called the 'paradox of credit'.

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

27

Which of the following statements is true?

A) Loan loss ratio based models rely on actual data and involve the estimation of the systematic loan loss risk of a particular industry relative to the loan loss risk of an FI's total loan portfolio.

B) Loan loss ratio based models rely on historic data and involve the estimation of the systematic loan loss risk of a particular industry relative to the loan loss risk of an FI's total loan portfolio.

C) Loan loss ratio based models rely on historic data and involve the estimation of the systematic loan loss risk of a particular borrower relative to the loan loss risk of an FI's total loan portfolio.

D) Loan loss ratio based models rely on actual data and involve the estimation of the systematic loan loss risk of a particular borrower relative to the loan loss risk of an FI's total loan portfolio.

A) Loan loss ratio based models rely on actual data and involve the estimation of the systematic loan loss risk of a particular industry relative to the loan loss risk of an FI's total loan portfolio.

B) Loan loss ratio based models rely on historic data and involve the estimation of the systematic loan loss risk of a particular industry relative to the loan loss risk of an FI's total loan portfolio.

C) Loan loss ratio based models rely on historic data and involve the estimation of the systematic loan loss risk of a particular borrower relative to the loan loss risk of an FI's total loan portfolio.

D) Loan loss ratio based models rely on actual data and involve the estimation of the systematic loan loss risk of a particular borrower relative to the loan loss risk of an FI's total loan portfolio.

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

28

Which of the following statements is true?

A) The risk of a loan reflects the volatility of the loan's default rate around its expected value times the amount lost given default.

B) The product of the volatility of the default rate and the loss give default (LGD) is called the 'unexpected loss'.

C) The product of the volatility of the default rate and the loss give default (LGD) is a measure of the loan's risk.

D) All of the listed options are correct.

A) The risk of a loan reflects the volatility of the loan's default rate around its expected value times the amount lost given default.

B) The product of the volatility of the default rate and the loss give default (LGD) is called the 'unexpected loss'.

C) The product of the volatility of the default rate and the loss give default (LGD) is a measure of the loan's risk.

D) All of the listed options are correct.

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

29

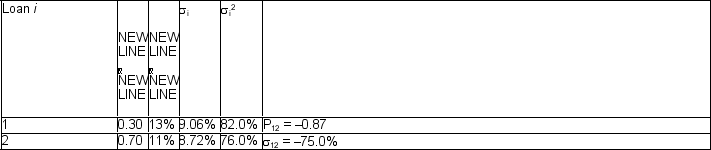

Consider the following portfolio of assets:  What is the standard deviation of the portfolio (round to two decimals)?

What is the standard deviation of the portfolio (round to two decimals)?

A) (0.3)( 82.00) + (0.7)( 76.00) = 8.82%

B) ( 82.00) + ( 76.00) = 17.77%

C) 15.75 = 3.97%

D) 48.93 = 6.99%

What is the standard deviation of the portfolio (round to two decimals)?

What is the standard deviation of the portfolio (round to two decimals)?A) (0.3)( 82.00) + (0.7)( 76.00) = 8.82%

B) ( 82.00) + ( 76.00) = 17.77%

C) 15.75 = 3.97%

D) 48.93 = 6.99%

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

29

Minimum risk portfolios generally generate the highest returns.

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

30

Consider the following portfolio of assets:  What is the variance of the portfolio (round to two decimals)?

What is the variance of the portfolio (round to two decimals)?

A) (0.45)2(36.60%) + (0.55)2(76.56%) + (0.45)(0.55)(-0.2) * (6.05%)(8.75%) = 27.95

B) (0.45)2(36.60%) + (0.55)2(76.56%) + 2(0.45)(0.55)(-0.2) * (6.05%) (8.75%) = 25.33

C) (0.45)(36.60%) + (0.55)(76.56%) + 2(0.45)2(0.55)2

What is the variance of the portfolio (round to two decimals)?

What is the variance of the portfolio (round to two decimals)?A) (0.45)2(36.60%) + (0.55)2(76.56%) + (0.45)(0.55)(-0.2) * (6.05%)(8.75%) = 27.95

B) (0.45)2(36.60%) + (0.55)2(76.56%) + 2(0.45)(0.55)(-0.2) * (6.05%) (8.75%) = 25.33

C) (0.45)(36.60%) + (0.55)(76.56%) + 2(0.45)2(0.55)2

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

30

Which of the following is not a reason for the credit risk on a swap to be less than the credit risk on a loan?

A) Swap contracts often extend beyond the maturity of normal loan contracts.

B) Swap payments can be netted across more than on contract.

C) Interest rate swaps involve interest, but not principal.

D) Swap contracts often extend beyond the maturity of normal loan contracts, swap payments can be netted across more than on contract and Interest rate swaps involve interest, but not principal.

A) Swap contracts often extend beyond the maturity of normal loan contracts.

B) Swap payments can be netted across more than on contract.

C) Interest rate swaps involve interest, but not principal.

D) Swap contracts often extend beyond the maturity of normal loan contracts, swap payments can be netted across more than on contract and Interest rate swaps involve interest, but not principal.

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

31

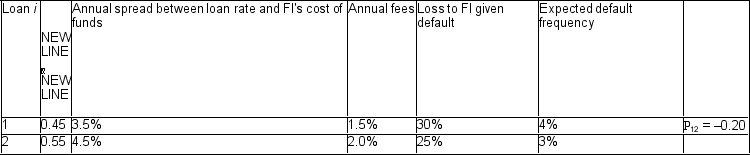

Consider an FI that holds two loans with the following characteristics:  What is the risk of the loan portfolio (round to two decimals)?

What is the risk of the loan portfolio (round to two decimals)?

A) 4.90 per cent

B) 3.41 per cent

C) 4.16 per cent

D) 6.10 per cent

What is the risk of the loan portfolio (round to two decimals)?

What is the risk of the loan portfolio (round to two decimals)?A) 4.90 per cent

B) 3.41 per cent

C) 4.16 per cent

D) 6.10 per cent

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

31

Concentration limits are external limits set on the maximum loan size that can be made to an individual borrower.

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

32

Consider an FI that holds two loans with the following characteristics:  What is the risk of the loan portfolio (round to two decimals)?

What is the risk of the loan portfolio (round to two decimals)?

A) 5.88 per cent

B) 10.01 per cent

C) 3.16 per cent

D) 4.26 per cent

What is the risk of the loan portfolio (round to two decimals)?

What is the risk of the loan portfolio (round to two decimals)?A) 5.88 per cent

B) 10.01 per cent

C) 3.16 per cent

D) 4.26 per cent

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

32

Pure credit swaps are swaps by which an FI receives the:

A) par value of the loan on default in return for paying a periodic swap fee.

B) current value of the loan on default in return for paying a periodic swap fee.

C) residual value of the loan on default in return for paying a periodic swap fee.

D) outstanding interest payments on the loan on default in return for paying a periodic swap fee.

A) par value of the loan on default in return for paying a periodic swap fee.

B) current value of the loan on default in return for paying a periodic swap fee.

C) residual value of the loan on default in return for paying a periodic swap fee.

D) outstanding interest payments on the loan on default in return for paying a periodic swap fee.

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

33

Which of the following statements is true?

A) The annual all-in-spread (AIS) measures annual fees earned on the loan by the FI less the annual spread between the loan rate paid by the borrower and the FI's cost of funds.

B) The annual all-in-spread (AIS) measures annual fees earned on the loan by the FI plus the annual spread between the loan rate paid by the borrower and the FI's cost of funds.

C) The annual all-in-spread (AIS) measures annual fees earned on the loan by the FI plus the loan rate paid by the borrowers.

D) The annual all-in-spread (AIS) measures annual fees earned on the loan by the FI less the FI's cost of funds.

A) The annual all-in-spread (AIS) measures annual fees earned on the loan by the FI less the annual spread between the loan rate paid by the borrower and the FI's cost of funds.

B) The annual all-in-spread (AIS) measures annual fees earned on the loan by the FI plus the annual spread between the loan rate paid by the borrower and the FI's cost of funds.

C) The annual all-in-spread (AIS) measures annual fees earned on the loan by the FI plus the loan rate paid by the borrowers.

D) The annual all-in-spread (AIS) measures annual fees earned on the loan by the FI less the FI's cost of funds.

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

34

Consider an FI holds two loans with the following characteristics:  What is the return on the loan portfolio (round to two decimals)?

What is the return on the loan portfolio (round to two decimals)?

A) 3.80 per cent

B) 5.75 per cent

C) 9.55 per cent

D) 4.87 per cent

What is the return on the loan portfolio (round to two decimals)?

What is the return on the loan portfolio (round to two decimals)?A) 3.80 per cent

B) 5.75 per cent

C) 9.55 per cent

D) 4.87 per cent

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

34

A forward contract:

A) has more credit risk than a futures contract.

B) is more standardised than a futures contract.

C) is marked to market more frequently than a futures contract.

D) has a shorter time to delivery than a futures contract.

A) has more credit risk than a futures contract.

B) is more standardised than a futures contract.

C) is marked to market more frequently than a futures contract.

D) has a shorter time to delivery than a futures contract.

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

35

Which of the following statements is true?

A) The objective of risk-indifferent FI managers is to minimise portfolio risk regardless of the portfolio's return.

B) The objective of risk-indifferent FI managers is to minimise portfolio risk in turn for higher returns on the portfolio.

C) The objective of risk-averse FI managers is to minimise portfolio risk in turn for higher returns on the portfolio.

D) The objective of risk-averse FI managers is to minimise portfolio risk regardless of the portfolio's return.

A) The objective of risk-indifferent FI managers is to minimise portfolio risk regardless of the portfolio's return.

B) The objective of risk-indifferent FI managers is to minimise portfolio risk in turn for higher returns on the portfolio.

C) The objective of risk-averse FI managers is to minimise portfolio risk in turn for higher returns on the portfolio.

D) The objective of risk-averse FI managers is to minimise portfolio risk regardless of the portfolio's return.

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

36

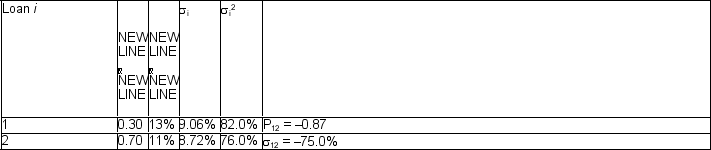

Consider the following portfolio of assets: ![<strong>Consider the following portfolio of assets: What is the variance of the portfolio (round to two decimals)?</strong> A) (0.3)<sup>2</sup>(82.0%) + (0.7)<sup>2</sup>(76.0%) + (0.3)(0.7)(-0.87) * (9.06%)(8.72%) = 30.19 B) (0.3)<sup>2</sup>(82.0%) + (0.7)<sup>2</sup>(76.0%) + [(0.3)(0.7)]<sup>2</sup> * (-0.87) * (9.06%)(8.72%) = 41.59 C) (0.3)<sup>2</sup>(82.0%) + (0.7)<sup>2</sup>(76.0%) + 2(0.3)(0.7)(-0.87) * (9.06%)(8.72%) = 15.75 D) (0.3)(82.0%) + (0.7)(76.0%) + 2(0.3)(0.7)(-0.87) * (9.06%)(8.72%) = 48.93](https://storage.examlex.com/TB2399/11ea6e9e_24a9_d7ee_8f54_8fdb0b12d155_TB2399_00.jpg) What is the variance of the portfolio (round to two decimals)?

What is the variance of the portfolio (round to two decimals)?

A) (0.3)2(82.0%) + (0.7)2(76.0%) + (0.3)(0.7)(-0.87) * (9.06%)(8.72%) = 30.19

B) (0.3)2(82.0%) + (0.7)2(76.0%) + [(0.3)(0.7)]2 * (-0.87) * (9.06%)(8.72%) = 41.59

C) (0.3)2(82.0%) + (0.7)2(76.0%) + 2(0.3)(0.7)(-0.87) * (9.06%)(8.72%) = 15.75

D) (0.3)(82.0%) + (0.7)(76.0%) + 2(0.3)(0.7)(-0.87) * (9.06%)(8.72%) = 48.93

![<strong>Consider the following portfolio of assets: What is the variance of the portfolio (round to two decimals)?</strong> A) (0.3)<sup>2</sup>(82.0%) + (0.7)<sup>2</sup>(76.0%) + (0.3)(0.7)(-0.87) * (9.06%)(8.72%) = 30.19 B) (0.3)<sup>2</sup>(82.0%) + (0.7)<sup>2</sup>(76.0%) + [(0.3)(0.7)]<sup>2</sup> * (-0.87) * (9.06%)(8.72%) = 41.59 C) (0.3)<sup>2</sup>(82.0%) + (0.7)<sup>2</sup>(76.0%) + 2(0.3)(0.7)(-0.87) * (9.06%)(8.72%) = 15.75 D) (0.3)(82.0%) + (0.7)(76.0%) + 2(0.3)(0.7)(-0.87) * (9.06%)(8.72%) = 48.93](https://storage.examlex.com/TB2399/11ea6e9e_24a9_d7ee_8f54_8fdb0b12d155_TB2399_00.jpg) What is the variance of the portfolio (round to two decimals)?

What is the variance of the portfolio (round to two decimals)?A) (0.3)2(82.0%) + (0.7)2(76.0%) + (0.3)(0.7)(-0.87) * (9.06%)(8.72%) = 30.19

B) (0.3)2(82.0%) + (0.7)2(76.0%) + [(0.3)(0.7)]2 * (-0.87) * (9.06%)(8.72%) = 41.59

C) (0.3)2(82.0%) + (0.7)2(76.0%) + 2(0.3)(0.7)(-0.87) * (9.06%)(8.72%) = 15.75

D) (0.3)(82.0%) + (0.7)(76.0%) + 2(0.3)(0.7)(-0.87) * (9.06%)(8.72%) = 48.93

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

36

Which of the following statements is true?

A) Total return swaps are typically structured in a way that any capital gains or losses are paid at the end of the swap and alternative arrangements do not exist.

B) Total return swaps are typically structured in a way that any capital gains or losses are paid at the end of the swap, but alternative arrangements exist.

C) Pure credit swaps are typically structured in a way that any capital gains or losses are paid at the end of the swap and alternative arrangements do not exist.

D) Pure credit swaps are typically structured in a way that any capital gains or losses are paid at the end of the swap, but alternative arrangements exist.

A) Total return swaps are typically structured in a way that any capital gains or losses are paid at the end of the swap and alternative arrangements do not exist.

B) Total return swaps are typically structured in a way that any capital gains or losses are paid at the end of the swap, but alternative arrangements exist.

C) Pure credit swaps are typically structured in a way that any capital gains or losses are paid at the end of the swap and alternative arrangements do not exist.

D) Pure credit swaps are typically structured in a way that any capital gains or losses are paid at the end of the swap, but alternative arrangements exist.

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

37

Which of the following statements is true?

A) One advantage of using MPT for loans is that the returns on individual loans are normally distributed, meaning that the upside returns are equal to the downside risks.

B) One objection to using MPT for loans is that the returns on individual loans are not normally distributed, meaning that most loans have unlimited upside returns and long-tail downside risks.

C) One advantage of using MPT for loans is that the returns on individual loans are normally distributed, meaning that most loans have unlimited upside returns and unlimited downside risks.

D) One objection to using MPT for loans is that the returns on individual loans are not normally distributed, meaning that most loans have limited upside returns and long-tail downside risks.

A) One advantage of using MPT for loans is that the returns on individual loans are normally distributed, meaning that the upside returns are equal to the downside risks.

B) One objection to using MPT for loans is that the returns on individual loans are not normally distributed, meaning that most loans have unlimited upside returns and long-tail downside risks.

C) One advantage of using MPT for loans is that the returns on individual loans are normally distributed, meaning that most loans have unlimited upside returns and unlimited downside risks.

D) One objection to using MPT for loans is that the returns on individual loans are not normally distributed, meaning that most loans have limited upside returns and long-tail downside risks.

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

38

Which of the following statements is true?

A) The minimum risk portfolio generates the highest returns and is thus likely to be chosen by risk-seeking FI managers.

B) The minimum risk portfolio does not generate the highest returns and is thus likely to be chosen by risk-averse FI managers.

C) The minimum risk portfolio does not generate the highest returns and is thus likely to be chosen by risk-seeking FI managers.

D) The minimum risk portfolio does not generate the highest returns and is thus likely to be chosen by risk-indifferent FI managers.

A) The minimum risk portfolio generates the highest returns and is thus likely to be chosen by risk-seeking FI managers.

B) The minimum risk portfolio does not generate the highest returns and is thus likely to be chosen by risk-averse FI managers.

C) The minimum risk portfolio does not generate the highest returns and is thus likely to be chosen by risk-seeking FI managers.

D) The minimum risk portfolio does not generate the highest returns and is thus likely to be chosen by risk-indifferent FI managers.

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

39

Consider the following portfolio of assets: ![<strong>Consider the following portfolio of assets: What is the expected return on the portfolio (round to two decimals)?</strong> A) 0.3(13%) + 0.7(11%) = 11.60% B) (13% + 11%) / 2 = 12.00% C) (0.3)<sup>2</sup>(13%) + (0.7)<sup>2</sup>(11%) = 6.56% D) [(0.3)<sup>2</sup>(13%) + (0.7)<sup>2</sup>(11%)] * 2 = 13.12%](https://storage.examlex.com/TB2399/11ea6e9e_24a9_ff00_8f54_11d76d96b3ed_TB2399_00.jpg) What is the expected return on the portfolio (round to two decimals)?

What is the expected return on the portfolio (round to two decimals)?

A) 0.3(13%) + 0.7(11%) = 11.60%

B) (13% + 11%) / 2 = 12.00%

C) (0.3)2(13%) + (0.7)2(11%) = 6.56%

D) [(0.3)2(13%) + (0.7)2(11%)] * 2 = 13.12%

![<strong>Consider the following portfolio of assets: What is the expected return on the portfolio (round to two decimals)?</strong> A) 0.3(13%) + 0.7(11%) = 11.60% B) (13% + 11%) / 2 = 12.00% C) (0.3)<sup>2</sup>(13%) + (0.7)<sup>2</sup>(11%) = 6.56% D) [(0.3)<sup>2</sup>(13%) + (0.7)<sup>2</sup>(11%)] * 2 = 13.12%](https://storage.examlex.com/TB2399/11ea6e9e_24a9_ff00_8f54_11d76d96b3ed_TB2399_00.jpg) What is the expected return on the portfolio (round to two decimals)?

What is the expected return on the portfolio (round to two decimals)?A) 0.3(13%) + 0.7(11%) = 11.60%

B) (13% + 11%) / 2 = 12.00%

C) (0.3)2(13%) + (0.7)2(11%) = 6.56%

D) [(0.3)2(13%) + (0.7)2(11%)] * 2 = 13.12%

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

39

Which of the following statements is true?

A) As with loans, swap participants deal with the credit risk of counterparties by setting bilateral limits on the notional amount of swaps entered into.

B) As with loans, swap participants deal with the credit risk of counterparties by adjusting the fixed and/or floating rates by including credit risk premiums.

C) As with loans, swap participants deal with the credit risk of counterparties by using Monte Carlo simulations to model potential default risk.

D) As with loans, swap participants deal with the credit risk of counterparties by setting bilateral limits on the notional amount of swaps entered into and as with loans, swap participants deal with the credit risk of counterparties by adjusting the fixed and/or floating rates by including credit risk premiums.

A) As with loans, swap participants deal with the credit risk of counterparties by setting bilateral limits on the notional amount of swaps entered into.

B) As with loans, swap participants deal with the credit risk of counterparties by adjusting the fixed and/or floating rates by including credit risk premiums.

C) As with loans, swap participants deal with the credit risk of counterparties by using Monte Carlo simulations to model potential default risk.

D) As with loans, swap participants deal with the credit risk of counterparties by setting bilateral limits on the notional amount of swaps entered into and as with loans, swap participants deal with the credit risk of counterparties by adjusting the fixed and/or floating rates by including credit risk premiums.

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

40

Which of the following statements is true?

A) According to KMV, default correlations tend to be low and lie between 0.002 and 0.15.

B) According to KMV, default correlations tend to be high and lie between 0.42 and 0.65.

C) According to KMV, default correlations vary and thus no particular range can be stated.

D) None of the listed options are correct.

A) According to KMV, default correlations tend to be low and lie between 0.002 and 0.15.

B) According to KMV, default correlations tend to be high and lie between 0.42 and 0.65.

C) According to KMV, default correlations vary and thus no particular range can be stated.

D) None of the listed options are correct.

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

41

Loan sales and securitisation are increasingly seen as valuable tools in the management of credit risk. Which of the following are not advantageous to FIs?

A) Loan sales and securitisation allow FIs to better manage their customer relationships.

B) Loan sales and securitisation create moral hazard issues and reduce scrutiny of off-balance sheet activities of FIs.

C) Loan sales and securitisation reduce FIs industry and/or geographical concentration risk.

D) Loan sales and securitisation allow FIs to separate their credit risk exposure from the lending process itself.

A) Loan sales and securitisation allow FIs to better manage their customer relationships.

B) Loan sales and securitisation create moral hazard issues and reduce scrutiny of off-balance sheet activities of FIs.

C) Loan sales and securitisation reduce FIs industry and/or geographical concentration risk.

D) Loan sales and securitisation allow FIs to separate their credit risk exposure from the lending process itself.

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

42

Using the KMV Portfolio Manager Model, the risk on a loan can be calculated as the volatility of the loan's default rate times the loss in the event of default.

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

43

An FI that invests 40 per cent of funds in a loan with an expected return of 10 per cent and 60 per cent of funds in a loan with an expected return of 12 per cent can expect to earn 11 per cent on its portfolio.

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

44

Loan loss ratio based models estimate systematic loan losses by running a time-series regression of quarterly losses of the ith sector's loss rate on the quarterly loss rate of an FI's total loans.

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

45

Which of the following is a major difference between a pure credit swap and a default option?

A) In a pure credit swap the premium payment on the swap is paid up front, while the fees of a default option are paid over the life of the default option.

B) In a pure credit swap the premium payments on the swap are paid over the life of the swap, while the fee of a default option is paid up front.

C) In a pure credit swap the premium payment on the swap is paid at maturity, while the fees of a default option are paid over the life of the default option.

D) In a pure credit swap the premium payments on the swap are paid over the life of the swap, while the fee of a default option is paid at maturity.

A) In a pure credit swap the premium payment on the swap is paid up front, while the fees of a default option are paid over the life of the default option.

B) In a pure credit swap the premium payments on the swap are paid over the life of the swap, while the fee of a default option is paid up front.

C) In a pure credit swap the premium payment on the swap is paid at maturity, while the fees of a default option are paid over the life of the default option.

D) In a pure credit swap the premium payments on the swap are paid over the life of the swap, while the fee of a default option is paid at maturity.

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

46

Which of the following is incorrect in relation to debt recovery rates?

A) Macro-economic factors are found to be significant in explaining recovery rates on defaulted bonds.

B) Macro-economic factors are found to be insignificant in explaining recovery rates on defaulted bonds.

C) Senior securities tend to have higher recovery rates than subordinated securities.

D) Industrial revenue bonds tend to have higher recovery rates than subordinated securities.

A) Macro-economic factors are found to be significant in explaining recovery rates on defaulted bonds.

B) Macro-economic factors are found to be insignificant in explaining recovery rates on defaulted bonds.

C) Senior securities tend to have higher recovery rates than subordinated securities.

D) Industrial revenue bonds tend to have higher recovery rates than subordinated securities.

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

47

Which of the following is a major difference between forwards and futures?

A) Forwards are marked-to-market, while futures are not.

B) Futures are tailor made, while forwards are standardised.

C) The default risk of futures is significantly reduced by the futures exchange guaranteeing to indemnify counterparties against credit risk, while this is not the case for forwards.

D) Forwards are marked-to-market, while futures are not, futures are tailor made, while forwards are standardised and the default risk of futures is significantly reduced by the futures exchange guaranteeing to indemnify counterparties against credit risk, while this is not the case for forwards.

A) Forwards are marked-to-market, while futures are not.

B) Futures are tailor made, while forwards are standardised.

C) The default risk of futures is significantly reduced by the futures exchange guaranteeing to indemnify counterparties against credit risk, while this is not the case for forwards.

D) Forwards are marked-to-market, while futures are not, futures are tailor made, while forwards are standardised and the default risk of futures is significantly reduced by the futures exchange guaranteeing to indemnify counterparties against credit risk, while this is not the case for forwards.

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

48

A pure credit swap:

A) is like buying credit insurance.

B) is like buying a multi-period credit option.

C) eliminates the interest rate risk contained in the total return swap.

D) is like buying credit insurance, is like buying a multi-period credit option and eliminates the interest rate risk contained in the total return swap.

A) is like buying credit insurance.

B) is like buying a multi-period credit option.

C) eliminates the interest rate risk contained in the total return swap.

D) is like buying credit insurance, is like buying a multi-period credit option and eliminates the interest rate risk contained in the total return swap.

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

49

FIs can reduce risk by taking advantage of the law of large numbers in their investment decisions.

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

50

The concentration limit for a loan portfolio is calculated as the expected default frequency of the borrower multiplied by (one divided by the loss rate).

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

61

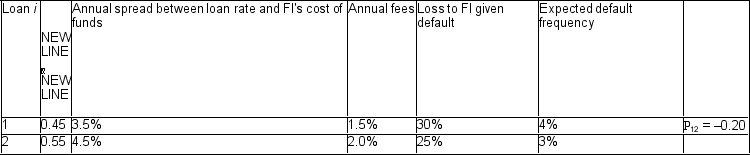

Explain the following hypothetical table:

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck