Deck 21: Interest Rate Swaps, Cross-Currency Swaps and Credit Default

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/96

Play

Full screen (f)

Deck 21: Interest Rate Swaps, Cross-Currency Swaps and Credit Default

1

The growth of the interest rate swaps market has been due to firms wanting to:

A) lower the cost of funds.

B) hedge interest rate risk.

C) lock in profit margins.

D) All of the given choices.

A) lower the cost of funds.

B) hedge interest rate risk.

C) lock in profit margins.

D) All of the given choices.

D

2

One hundred basis points equal:

A) 100%

B) 10%

C) 1%

D) 0.1%

A) 100%

B) 10%

C) 1%

D) 0.1%

C

3

The size of one basis point is:

A) 0.01

B) 0.001

C) 0.0001

D) 0.00001

A) 0.01

B) 0.001

C) 0.0001

D) 0.00001

C

4

A credit default swap means:

A) initial payment of a periodic premium by the buyer of a credit default swap.

B) the buyer of a credit default swap obtains protection against credit risk exposures associated with specified debt issues.

C) if the specified debt issuer defaults then the credit default swap protection seller assumes the risk.

D) all of the given answers are correct.

A) initial payment of a periodic premium by the buyer of a credit default swap.

B) the buyer of a credit default swap obtains protection against credit risk exposures associated with specified debt issues.

C) if the specified debt issuer defaults then the credit default swap protection seller assumes the risk.

D) all of the given answers are correct.

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

5

In an interest rate swap,the party who is the fixed-rate payer:

A) currently has fixed-rate obligations, but prefers floating.

B) currently has floating-rate obligations, but prefers fixed.

C) receives a fixed-rate payment if interest rates increase.

D) pays a floating-rate payment if interest rates increase.

A) currently has fixed-rate obligations, but prefers floating.

B) currently has floating-rate obligations, but prefers fixed.

C) receives a fixed-rate payment if interest rates increase.

D) pays a floating-rate payment if interest rates increase.

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

6

In relation to an interest rate swap transaction when the one of the two parties is a financial institution this is called a:

A) bank swap.

B) direct swap.

C) intermediated swap.

D) credit swap.

A) bank swap.

B) direct swap.

C) intermediated swap.

D) credit swap.

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

7

The fictional principal on which an interest rate swap is based is called the:

A) swap dealer's call rate.

B) notional principal.

C) LIBOR.

D) basis rate.

A) swap dealer's call rate.

B) notional principal.

C) LIBOR.

D) basis rate.

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

8

The advantages(s)for a company to use an interest rate swap is:

A) it may lower the cost of funds if comparative advantages exist.

B) it may hedge interest rate risk.

C) it may gain access to otherwise inaccessible debt markets.

D) all of the given answers.

A) it may lower the cost of funds if comparative advantages exist.

B) it may hedge interest rate risk.

C) it may gain access to otherwise inaccessible debt markets.

D) all of the given answers.

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

9

The two parties contracting to exchange their respective interest payments in an interest rate swap are formally called:

A) options holders.

B) counterparties.

C) exchange parties.

D) long and short positions.

A) options holders.

B) counterparties.

C) exchange parties.

D) long and short positions.

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

10

In an interest rate swap,the notional principal:

A) is the principal relating only to the fixed rate payer.

B) is the principal relating only to the floating rate payer.

C) does not receive any interest payments.

D) is equal to the amount of the underlying debt borrowed.

A) is the principal relating only to the fixed rate payer.

B) is the principal relating only to the floating rate payer.

C) does not receive any interest payments.

D) is equal to the amount of the underlying debt borrowed.

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

11

When two parties exchange their respective interest payments associated with existing debt borrowed in the capital markets,this is called a/an:

A) interest exchange.

B) financial switch.

C) swap.

D) financial transfer.

A) interest exchange.

B) financial switch.

C) swap.

D) financial transfer.

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

12

A financial agreement between two parties to exchange a series of cash flows similar to those resulting from an exchange of different types of bonds is called a/an:

A) credit swap.

B) interest rate swap.

C) yield curve swap.

D) notional spread.

A) credit swap.

B) interest rate swap.

C) yield curve swap.

D) notional spread.

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

13

An interest rate swap is:

A) another name for a call option.

B) another name for a put option.

C) an agreement between two or more persons to exchange cash flows over some future period.

D) the name for the exchange of a bond futures contract for an option contract.

A) another name for a call option.

B) another name for a put option.

C) an agreement between two or more persons to exchange cash flows over some future period.

D) the name for the exchange of a bond futures contract for an option contract.

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

14

The first interest rate swap involving the World Bank and IBM was arranged in:

A) August 1961.

B) August 1971.

C) August 1981.

D) August 1991.

A) August 1961.

B) August 1971.

C) August 1981.

D) August 1991.

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

15

In relation to an interest rate swap transaction when the two parties are each entering into a swap to manage a particular interest rate risk exposure,this is called a:

A) bank swap.

B) direct swap.

C) intermediated swap.

D) credit swap.

A) bank swap.

B) direct swap.

C) intermediated swap.

D) credit swap.

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

16

Which of the following about interest rate swaps is NOT correct?

A) An interest rate swap allows a company to change the net characteristics of its interest rate cash flows.

B) An interest rate swap is based on interest rates worked out on a notional principal.

C) If a company has a fixed-rate loan it can enter into an interest rate swap whereby the bank lender will pay it a variable rate to net out the fixed rate from the company.

D) A cross-currency swap involves the exchange and interest payments based on a fixed exchange rate.

A) An interest rate swap allows a company to change the net characteristics of its interest rate cash flows.

B) An interest rate swap is based on interest rates worked out on a notional principal.

C) If a company has a fixed-rate loan it can enter into an interest rate swap whereby the bank lender will pay it a variable rate to net out the fixed rate from the company.

D) A cross-currency swap involves the exchange and interest payments based on a fixed exchange rate.

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

17

When two parties agree to exchange a set of interest rate cash flows based on a notional principal,this transaction is called:

A) cross-hedging.

B) interest rate swap.

C) cash flow swap.

D) fixed-for floating swap.

A) cross-hedging.

B) interest rate swap.

C) cash flow swap.

D) fixed-for floating swap.

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

18

The main type of interest rate:

A) is a direct swap between two parties.

B) involves accompany entering into a swap with a financial intermediary whereby the company swaps fixed for floating payments.

C) is a basis swap.

D) involves a swap of floating for floating interest payments.

A) is a direct swap between two parties.

B) involves accompany entering into a swap with a financial intermediary whereby the company swaps fixed for floating payments.

C) is a basis swap.

D) involves a swap of floating for floating interest payments.

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

19

The main type of interest rate:

A) is a direct swap between two parties.

B) is known as a vanilla swap.

C) is a basis swap.

D) involves a swap of floating for floating interest payments.

A) is a direct swap between two parties.

B) is known as a vanilla swap.

C) is a basis swap.

D) involves a swap of floating for floating interest payments.

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

20

An interest rate swap is similar to which of the following transactions?

A) Borrowing money at one floating rate and lending it at a higher floating rate

B) The purchase of a share and the sale of a bond

C) A series of forward rate agreements (FRAs)

D) All of the given choices

A) Borrowing money at one floating rate and lending it at a higher floating rate

B) The purchase of a share and the sale of a bond

C) A series of forward rate agreements (FRAs)

D) All of the given choices

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

21

A key motive for companies and financial institutions to participate in an interest rate swap is:

A) the low information costs of swaps, compared with other financial derivatives.

B) to transfer interest-rate risk to parties more willing to bear it.

C) the greater liquidity of swaps, compared with other financial derivatives.

D) the favourable tax implications of swaps, compared with other financial derivatives.

A) the low information costs of swaps, compared with other financial derivatives.

B) to transfer interest-rate risk to parties more willing to bear it.

C) the greater liquidity of swaps, compared with other financial derivatives.

D) the favourable tax implications of swaps, compared with other financial derivatives.

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

22

These days,the majority of swaps require a/an _______ to act as an intermediary.

A) commercial bank

B) investment bank

C) merchant bank

D) Any of the given choices

A) commercial bank

B) investment bank

C) merchant bank

D) Any of the given choices

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

23

In an interest rate swap,______ gains/gain when the three-month BBSW rises.

A) the floating-rate payer

B) the fixed-rate payer

C) both floating- and fixed-rate payers

D) neither floating- nor fixed-rate payers

A) the floating-rate payer

B) the fixed-rate payer

C) both floating- and fixed-rate payers

D) neither floating- nor fixed-rate payers

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

24

If a company with a fixed-rate debt of 11% enters into a swap and pays floating-rate debt of BBSW+1.20% and receives fixed-rate payments of 9%,its net cost of debt becomes:

A) 11%

B) BBSW+0.20%

C) BBSW+2.20%

D) 12%

A) 11%

B) BBSW+0.20%

C) BBSW+2.20%

D) 12%

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

25

In a vanilla interest rate swap:

A) the amounts payable between parties depend on a specified principal that is exchanged at the outset.

B) one party pays another party an amount calculated according to a floating interest rate on a notional principal, in exchange for an amount calculated on the basis of a fixed interest rate.

C) only interest flows are exchanged until maturity, when the principal is exchanged according to the difference in the interest rates over the lifetime of the swap.

D) the amounts payable between parties depends on a specified principal that is exchanged at the beginning and at the end.

A) the amounts payable between parties depend on a specified principal that is exchanged at the outset.

B) one party pays another party an amount calculated according to a floating interest rate on a notional principal, in exchange for an amount calculated on the basis of a fixed interest rate.

C) only interest flows are exchanged until maturity, when the principal is exchanged according to the difference in the interest rates over the lifetime of the swap.

D) the amounts payable between parties depends on a specified principal that is exchanged at the beginning and at the end.

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

26

In an interest rate swap ______ gains/gain when the three-month BBSW falls.

A) the floating-rate payer

B) the fixed-rate payer

C) both floating- and fixed-rate payers

D) neither floating- nor fixed-rate payers

A) the floating-rate payer

B) the fixed-rate payer

C) both floating- and fixed-rate payers

D) neither floating- nor fixed-rate payers

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

27

When a financial intermediary is involved as an interest rate swap counterparty,it often seeks to arrange an offsetting swap called a:

A) counterparty swap.

B) simultaneous swap.

C) synchronised swap.

D) matched swap.

A) counterparty swap.

B) simultaneous swap.

C) synchronised swap.

D) matched swap.

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

28

In a swap arrangement,both parties may be able to receive more favourable funding rates than they would have done without the swap,and the swap dealer receives a spread as well.Where does the cost saving originate from?

A) The bank swap dealer effectively guarantees payments of all obligations.

B) The parties involved in the swap are able to borrow where each has a relative cost advantage.

C) The party paying floating cash flows always pays less than the party paying fixed cash flows.

D) With the bank always acting as a swap counterparty, each party is able to reduce the risk profile.

A) The bank swap dealer effectively guarantees payments of all obligations.

B) The parties involved in the swap are able to borrow where each has a relative cost advantage.

C) The party paying floating cash flows always pays less than the party paying fixed cash flows.

D) With the bank always acting as a swap counterparty, each party is able to reduce the risk profile.

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

29

If a company that had a floating-rate liability wanted to enter into a swap to achieve a fixed-rate cost of funds,it would pay a:

A) fixed rate to the counterparty and receive a floating rate in return from the counterparty.

B) floating rate to the counterparty and pay a floating rate to the fixed-rate lender.

C) floating rate to the counterparty and pay a fixed-rate to the fixed-rate lender.

D) floating rate to the counterparty and receive a fixed-rate in return from the counterparty.

A) fixed rate to the counterparty and receive a floating rate in return from the counterparty.

B) floating rate to the counterparty and pay a floating rate to the fixed-rate lender.

C) floating rate to the counterparty and pay a fixed-rate to the fixed-rate lender.

D) floating rate to the counterparty and receive a fixed-rate in return from the counterparty.

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

30

If a company that had a fixed-rate liability wanted to achieve a floating-rate cost of funds through a swap,it would pay a:

A) fixed rate to the counterparty and receive a floating rate in return from the counterparty.

B) floating rate to the counterparty and pay a floating rate to the fixed-rate lender.

C) floating rate to the counterparty and pay a fixed rate to the fixed-rate lender.

D) floating rate to the counterparty and receive a fixed rate in return from the counterparty.

A) fixed rate to the counterparty and receive a floating rate in return from the counterparty.

B) floating rate to the counterparty and pay a floating rate to the fixed-rate lender.

C) floating rate to the counterparty and pay a fixed rate to the fixed-rate lender.

D) floating rate to the counterparty and receive a fixed rate in return from the counterparty.

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

31

If one company has better access to fixed-term financing than another company,it may be said that this company has a _____ than the other company.

A) lower credit rating

B) comparative advantage

C) greater market share

D) higher credit risk

A) lower credit rating

B) comparative advantage

C) greater market share

D) higher credit risk

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

32

An interest rate swap that obligates traders to enter a swap at some date in the future,with terms agreed today,is a:

A) term swap.

B) forward swap.

C) flexible swap.

D) long swap.

A) term swap.

B) forward swap.

C) flexible swap.

D) long swap.

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

33

Which of the following statements regarding interest rate swaps is incorrect?

A) In contrast with a forward contract, the exact terms of exchange of an interest rate swap will change with interest rates.

B) The two parties exchange net interest difference in an interest rate swap.

C) An interest rate swap is similar to a forward contract in that it guarantees the exchange of two items of value at some future point in time.

D) The two parties in an interest rate swap generally have the same level of default risk.

A) In contrast with a forward contract, the exact terms of exchange of an interest rate swap will change with interest rates.

B) The two parties exchange net interest difference in an interest rate swap.

C) An interest rate swap is similar to a forward contract in that it guarantees the exchange of two items of value at some future point in time.

D) The two parties in an interest rate swap generally have the same level of default risk.

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

34

Which of the following is NOT an advantage of having an interest rate swap market?

A) As it is generally liquid, it benefits both borrowers and lenders.

B) As most swaps involve banks, their credit departments can carry out credit assessments more easily than potential lenders.

C) As the banks are involved in most swaps, banks require a spread between the two interest rates.

D) Swaps enable companies to carry out regulatory and tax arbitrage.

A) As it is generally liquid, it benefits both borrowers and lenders.

B) As most swaps involve banks, their credit departments can carry out credit assessments more easily than potential lenders.

C) As the banks are involved in most swaps, banks require a spread between the two interest rates.

D) Swaps enable companies to carry out regulatory and tax arbitrage.

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

35

Which of the following statements is NOT an advantage of a swap transaction?

A) It usually allows the company to achieve a lower cost of funds.

B) It is used to hedge both interest rate risk and foreign exchange risk.

C) It facilitates the restructuring of cash flows associated with existing borrowings.

D) It transfers the credit risk to the counterparty.

A) It usually allows the company to achieve a lower cost of funds.

B) It is used to hedge both interest rate risk and foreign exchange risk.

C) It facilitates the restructuring of cash flows associated with existing borrowings.

D) It transfers the credit risk to the counterparty.

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

36

An interest rate swap in which all the fixed payments are paid in one lump sum is called a/an:

A) amortised swap.

B) term swap.

C) zero-coupon swap.

D) none of the given choices.

A) amortised swap.

B) term swap.

C) zero-coupon swap.

D) none of the given choices.

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

37

If a company with a fixed-rate debt of 11% enters into a swap and pays floating-rate debt of 8% and receives fixed-rate payments of 9%,its net cost of debt becomes:

A) 9%

B) 10%

C) 11%

D) 12%

A) 9%

B) 10%

C) 11%

D) 12%

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

38

An interest rate swap in which the notional principal declines over time is called a/an:

A) amortised swap.

B) term swap.

C) zero-coupon swap.

D) none of the given choices.

A) amortised swap.

B) term swap.

C) zero-coupon swap.

D) none of the given choices.

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

39

Which of the following is a way to change the basic structure of a swap?

A) Vary the notional principal over the lifetime of the swap.

B) Change the timing of when the swap begins or ends.

C) Reverse the swap if market conditions change.

D) All of the given answers are correct.

A) Vary the notional principal over the lifetime of the swap.

B) Change the timing of when the swap begins or ends.

C) Reverse the swap if market conditions change.

D) All of the given answers are correct.

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

40

Which of the following statements regarding interest rate swaps is incorrect?

A) The principal involved is called notional.

B) Parties involved borrow funds where they have a comparative advantage.

C) The two parties in the swap always share equally the cost of the spread that the intermediary receives.

D) The financial intermediary involved often engages in an offsetting swap, known as a matched swap.

A) The principal involved is called notional.

B) Parties involved borrow funds where they have a comparative advantage.

C) The two parties in the swap always share equally the cost of the spread that the intermediary receives.

D) The financial intermediary involved often engages in an offsetting swap, known as a matched swap.

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

41

Which of the following statements regarding a cross-currency swap is incorrect?

A) There is an exchange of principal amounts between counterparties at the beginning and end of the swap.

B) The re-exchange at the conclusion of a cross-currency swap usually takes place at the initial exchange rate.

C) As the cross-currency swap is arranged through a bank, there is no credit risk.

D) Once the cross-currency swap rate is determined, cash flows are known with certainty.

A) There is an exchange of principal amounts between counterparties at the beginning and end of the swap.

B) The re-exchange at the conclusion of a cross-currency swap usually takes place at the initial exchange rate.

C) As the cross-currency swap is arranged through a bank, there is no credit risk.

D) Once the cross-currency swap rate is determined, cash flows are known with certainty.

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

42

A company is concerned that the cost of its long-term debt facilities is based on a fixed interest rate that is considerably above current market rates,and that rates will continue to fall.The company decides to use a swap to manage its risk exposure.using the data provided below,which of the following statements is incorrect?

Data:

Existing debt fixed interest rate:

13)50% per annum

Current long-term fixed swap rate:

11)75% per annum

Current long-term floating swap rate:

BBSW+0.50% per annum

A) The company has created a synthetic fixed rate liability.

B) Short-term interest rates are expected to remain below the existing fixed cost of debt.

C) The effective cost of borrowing is lower, as long as BBSW averages less than 11.25% per annum.

D) This strategy assumes a 'normal' yield curve, on average, over the life of the swap.

Data:

Existing debt fixed interest rate:

13)50% per annum

Current long-term fixed swap rate:

11)75% per annum

Current long-term floating swap rate:

BBSW+0.50% per annum

A) The company has created a synthetic fixed rate liability.

B) Short-term interest rates are expected to remain below the existing fixed cost of debt.

C) The effective cost of borrowing is lower, as long as BBSW averages less than 11.25% per annum.

D) This strategy assumes a 'normal' yield curve, on average, over the life of the swap.

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

43

If two firms have the following cost of borrowing,what is the net differential for an interest rate swap?

Firm A:

Fixed rate 10.8% per annum; floating rate BBSW+0.3% per annum

Firm B:

Fixed rate 11.6% per annum; floating rate BBSW+1.7% per annum

A) 2.2%

B) 1.4%

C) 0.7%

D) 0.6%

Firm A:

Fixed rate 10.8% per annum; floating rate BBSW+0.3% per annum

Firm B:

Fixed rate 11.6% per annum; floating rate BBSW+1.7% per annum

A) 2.2%

B) 1.4%

C) 0.7%

D) 0.6%

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

44

Which of the following may be said to create a debt market environment,whereby one company may obtain a comparative interest rate advantage over another company in the fixed interest rate market,compared with the floating interest rate market?

A) The existence of market segmentation between the fixed and floating rate markets.

B) Typically, fixed-rate market risk premiums are based on external credit rating agency reports.

C) Professional institutional lenders, such as banks and merchant banks, apply their own internal credit risk premiums.

D) All of the given answers.

A) The existence of market segmentation between the fixed and floating rate markets.

B) Typically, fixed-rate market risk premiums are based on external credit rating agency reports.

C) Professional institutional lenders, such as banks and merchant banks, apply their own internal credit risk premiums.

D) All of the given answers.

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

45

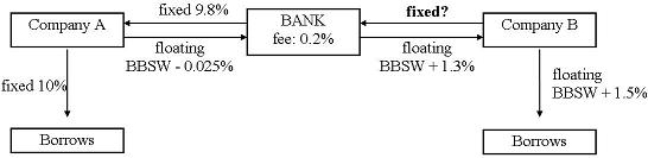

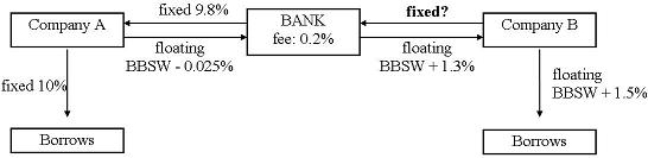

Using the data below,calculate the fixed interest rate payable by company B in the swap transaction.

A) 11.075% per annum

B) 11.275% per annum

C) 11.325% per annum

D) 11.550% per annum

A) 11.075% per annum

B) 11.275% per annum

C) 11.325% per annum

D) 11.550% per annum

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

46

One of the key motives for a cross-currency swap is:

A) the need to evade the domestic country's regulations.

B) the need to obtain the actual use of the foreign currency.

C) to gain risk exposure.

D) to make money from interest rate differences between countries.

A) the need to evade the domestic country's regulations.

B) the need to obtain the actual use of the foreign currency.

C) to gain risk exposure.

D) to make money from interest rate differences between countries.

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

47

An Australian company has issued USD paper into the US debt markets.The company is investigating the possibility of entering into a cross-currency swap.Which of the following generally form the basic mechanics of a cross-currency swap?

I)Re-exchange of principal normally takes place at the same exchange rate as that used at the commencement of the swap.

Ii)At the conclusion of the swap,principal amounts are re-exchanged.

Iii)Principal amounts,in the currency of debt,are exchanged at the start of the swap.

Iv)Interest payment commitments are swapped.

V)Involves the exchange between two parties of debt denominated in one currency,for debt denominated in another currency.

A) i, ii, iii, v

B) ii, iii, iv, v

C) i, ii, iii, iv, v

D) i, ii, iii, iv

I)Re-exchange of principal normally takes place at the same exchange rate as that used at the commencement of the swap.

Ii)At the conclusion of the swap,principal amounts are re-exchanged.

Iii)Principal amounts,in the currency of debt,are exchanged at the start of the swap.

Iv)Interest payment commitments are swapped.

V)Involves the exchange between two parties of debt denominated in one currency,for debt denominated in another currency.

A) i, ii, iii, v

B) ii, iii, iv, v

C) i, ii, iii, iv, v

D) i, ii, iii, iv

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

48

Consider the following five statements:

I)Swaps may be used to achieve a lower cost of funds for a company.

Ii)In an interest rate swap,the two parties swap the principal amount plus the ongoing associated interest obligations.

Iii)An intermediated swap is said to be 'matched' when a bank enters into swaps with both firms involved in an interest rate swap.

Iv)A 'plain vanilla' swap is the fixed AUD to floating AUD swap.

V)If an intermediary is involved in a swap between two parties,the intermediary will also provide the initial loan to both parties.

How many of these statements are true and how many are false?

A) 3 statements are true and 2 are false

B) 2 statements are true and 3 are false

C) 4 statements are true and 1 is false

D) 1 statement is true and 4 are false

I)Swaps may be used to achieve a lower cost of funds for a company.

Ii)In an interest rate swap,the two parties swap the principal amount plus the ongoing associated interest obligations.

Iii)An intermediated swap is said to be 'matched' when a bank enters into swaps with both firms involved in an interest rate swap.

Iv)A 'plain vanilla' swap is the fixed AUD to floating AUD swap.

V)If an intermediary is involved in a swap between two parties,the intermediary will also provide the initial loan to both parties.

How many of these statements are true and how many are false?

A) 3 statements are true and 2 are false

B) 2 statements are true and 3 are false

C) 4 statements are true and 1 is false

D) 1 statement is true and 4 are false

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

49

For an ordinary interest rate swap already in place,if counterparty A's obligation for one year is $100 000 and counterparty B's obligation is $120 000:

A) counterparty A will pay counterparty B $20 000

B) counterparty A will pay counterparty B $100 000

C) counterparty B will pay counterparty A $20 000

D) counterparty B will pay counterparty A $120 000

A) counterparty A will pay counterparty B $20 000

B) counterparty A will pay counterparty B $100 000

C) counterparty B will pay counterparty A $20 000

D) counterparty B will pay counterparty A $120 000

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

50

Growth in the interest rate swaps market has occurred as a consequence of:

A) companies looking for ways to manage risk or lower total funding costs.

B) swaps creating a link between segmented markets.

C) swaps minimising the costs of regulation and tax laws.

D) all of the given answers.

A) companies looking for ways to manage risk or lower total funding costs.

B) swaps creating a link between segmented markets.

C) swaps minimising the costs of regulation and tax laws.

D) all of the given answers.

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

51

As a foreign exchange hedge,cross-currency swaps have all of the following features,except:

A) each party pays the other's interest payment.

B) principal amounts are reversed at a pre-specified rate at maturity.

C) an initial exchange of the two principal amounts by the two parties in the two different currencies.

D) principal amounts are reversed at the spot rate at maturity.

A) each party pays the other's interest payment.

B) principal amounts are reversed at a pre-specified rate at maturity.

C) an initial exchange of the two principal amounts by the two parties in the two different currencies.

D) principal amounts are reversed at the spot rate at maturity.

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

52

If the exchange rate alters during the lifetime of a cross-currency swap,this:

A) has no impact as all FX risk has been eliminated.

B) will impact only on the interest payments during the swap's lifetime.

C) will impact only when the principal amounts are re-exchanged at maturity.

D) will impact on both interest payments and principal repayments.

A) has no impact as all FX risk has been eliminated.

B) will impact only on the interest payments during the swap's lifetime.

C) will impact only when the principal amounts are re-exchanged at maturity.

D) will impact on both interest payments and principal repayments.

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

53

Which of the following is considered a factor on the supply side in the growth of the swaps market?

A) Interest rate swaps provide a linkage between segmented markets.

B) Interest rate swaps can minimise the costs of regulation and tax laws.

C) The efficiency and technology of financial intermediaries in providing risk management.

D) All of the given answers.

A) Interest rate swaps provide a linkage between segmented markets.

B) Interest rate swaps can minimise the costs of regulation and tax laws.

C) The efficiency and technology of financial intermediaries in providing risk management.

D) All of the given answers.

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

54

Consider the following five statements:

I)Swaps may be used to achieve a lower cost of funds for a company.

Ii)In an interest rate swap,the two parties swap the principal amount plus the ongoing associated interest obligations.

Iii)An intermediated swap is said to be 'matched' when a bank enters into swaps with both firms involved in an interest rate swap

Iv)A 'plain vanilla' swap is the fixed AUD to floating AUD swap.

V)If an intermediary is involved in a swap between two parties,the intermediary will also provide the initial loan to both parties.

Which of the following are correct?

A) i, ii, iii and iv are true

B) ii, iii, iv and v are true

C) ii, and iv are true

D) i and iii are true

I)Swaps may be used to achieve a lower cost of funds for a company.

Ii)In an interest rate swap,the two parties swap the principal amount plus the ongoing associated interest obligations.

Iii)An intermediated swap is said to be 'matched' when a bank enters into swaps with both firms involved in an interest rate swap

Iv)A 'plain vanilla' swap is the fixed AUD to floating AUD swap.

V)If an intermediary is involved in a swap between two parties,the intermediary will also provide the initial loan to both parties.

Which of the following are correct?

A) i, ii, iii and iv are true

B) ii, iii, iv and v are true

C) ii, and iv are true

D) i and iii are true

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

55

Ossie Ltd is about to establish a new funding arrangement.It is able to borrow in either the fixed-rate or floating-rate debt markets.The company wishes to lower its cost of borrowing by entering into a swap transaction with Battler Ltd.Based on the following data for the two companies,in which interest rate market will Ossie Ltd borrow,and swap into?

A) Borrow at fixed interest rate; swap into floating rate

B) Borrow at floating interest rate; swap into fixed rate

C) Borrow at fixed interest rate; no advantage in swap transaction

D) Borrow at floating interest rate; no advantage in swap transaction

A) Borrow at fixed interest rate; swap into floating rate

B) Borrow at floating interest rate; swap into fixed rate

C) Borrow at fixed interest rate; no advantage in swap transaction

D) Borrow at floating interest rate; no advantage in swap transaction

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

56

An investment bank is to advise two client companies on the establishment of a mutually beneficial swap facility.Both companies are able to access funding within the fixed interest rate debt markets and the floating interest rate debt markets.However,company X has a comparative advantage over company Y within one of the debt markets.Based on the following data,what is the comparative advantage of company X?

Company X:

Fixed rate 10.8% per annum; floating rate BBSW+ .3% per annum

Company Y:

Fixed rate 11.5% per annum; floating rate BBSW+1.7% per annum

A) Fixed interest rate debt market, 0.7% per annum

B) Floating interest rate debt market, 1.4% per annum

C) Fixed interest rate debt market, 10.8% per annum

D) Floating interest rate debt market, BBSW + 0.3% per annum

Company X:

Fixed rate 10.8% per annum; floating rate BBSW+ .3% per annum

Company Y:

Fixed rate 11.5% per annum; floating rate BBSW+1.7% per annum

A) Fixed interest rate debt market, 0.7% per annum

B) Floating interest rate debt market, 1.4% per annum

C) Fixed interest rate debt market, 10.8% per annum

D) Floating interest rate debt market, BBSW + 0.3% per annum

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

57

Bosie Ltd is about to establish a new funding arrangement.It is able to borrow in either the fixed-rate or floating-rate debt markets.The company wishes to lower its cost of borrowing by entering into a swap transaction with Matlock Ltd.Based on the following data for the two companies,in which interest rate market will Matlock Ltd borrow,and swap into?

A) Borrow at fixed interest rate; swap into floating rate

B) Borrow at floating interest rate; swap into fixed rate

C) Borrow at fixed interest rate; no advantage in swap transaction

D) Borrow at floating interest rate; no advantage in swap transaction

A) Borrow at fixed interest rate; swap into floating rate

B) Borrow at floating interest rate; swap into fixed rate

C) Borrow at fixed interest rate; no advantage in swap transaction

D) Borrow at floating interest rate; no advantage in swap transaction

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

58

A bank has intermediated a matched swap facility with two client companies.Which of the following statements best describes a matched swap?

A) The role of the bank is that of an agent in bringing the two companies together.

B) The notional principal amounts are exchanged and matched by currency and maturity.

C) The bank as intermediary effectively engineers separate offsetting contracts.

D) All of the given answers.

A) The role of the bank is that of an agent in bringing the two companies together.

B) The notional principal amounts are exchanged and matched by currency and maturity.

C) The bank as intermediary effectively engineers separate offsetting contracts.

D) All of the given answers.

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

59

An interest rate swap can effectively be hedged against interest rate risk by:

A) selling out to another party.

B) entering into another swap agreement that has the opposite transactions to the first swap.

C) setting floating-rate obligations equal to fixed-rate obligations.

D) matching durations of assets and liabilities.

A) selling out to another party.

B) entering into another swap agreement that has the opposite transactions to the first swap.

C) setting floating-rate obligations equal to fixed-rate obligations.

D) matching durations of assets and liabilities.

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

60

Interest rate swap transactions may be used by a multinational corporation as part of a funding strategy to:

A) lower the cost of borrowing, using a comparative advantage in a particular debt market.

B) spread debt issues across a range of currencies.

C) diversify funding sources across a range of debt markets.

D) all of the given answers.

A) lower the cost of borrowing, using a comparative advantage in a particular debt market.

B) spread debt issues across a range of currencies.

C) diversify funding sources across a range of debt markets.

D) all of the given answers.

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

61

Interest rate swaps and cross-currency swaps permit a counterparty to exchange a:

A) floating interest rate payment or currency value for a lower floating payment value over the term.

B) fixed interest rate position for a currency position over the contract term.

C) floating interest rate payment or currency value for a fixed payment value over the contract term.

D) fixed interest rate payment or currency value for a fixed value over the contract term.

A) floating interest rate payment or currency value for a lower floating payment value over the term.

B) fixed interest rate position for a currency position over the contract term.

C) floating interest rate payment or currency value for a fixed payment value over the contract term.

D) fixed interest rate payment or currency value for a fixed value over the contract term.

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

62

The risk owing to a timing difference in an interest rate swap transaction,when one party defaults on a payment to another before the other realises it,is called:

A) basis risk.

B) mismatch risk.

C) settlement risk.

D) front-end risk.

A) basis risk.

B) mismatch risk.

C) settlement risk.

D) front-end risk.

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

63

Consider these five statements:

I)Swaps can be used to create a synthetic floating rate debt for a company's fixed rate debt.

Ii)If an intermediary has arranged a matched swap,it has no net exposure to interest rate risk.

Iii)A cross-currency swap differs from an interest rate swap in that,for a cross-currency swap,the principals,as well as the agreed interest obligations,are swapped for the duration of the swap agreement.

Iv)With a cross-currency swap,the exchange rate used at the principal re-exchange date is based on the current spot rate at that time.

V)If a bank acts as an intermediary in a swap and does not fund the swap parties' underlying loan facilities,it has no obligation under the bank capital adequacy requirements.

How many of the statements are true and how many are false?

A) 3 statements are true and 2 are false

B) 2 statements are true and 3 are false

C) 4 statements are true and 1 is false

D) 1 statement is true and 4 are false

I)Swaps can be used to create a synthetic floating rate debt for a company's fixed rate debt.

Ii)If an intermediary has arranged a matched swap,it has no net exposure to interest rate risk.

Iii)A cross-currency swap differs from an interest rate swap in that,for a cross-currency swap,the principals,as well as the agreed interest obligations,are swapped for the duration of the swap agreement.

Iv)With a cross-currency swap,the exchange rate used at the principal re-exchange date is based on the current spot rate at that time.

V)If a bank acts as an intermediary in a swap and does not fund the swap parties' underlying loan facilities,it has no obligation under the bank capital adequacy requirements.

How many of the statements are true and how many are false?

A) 3 statements are true and 2 are false

B) 2 statements are true and 3 are false

C) 4 statements are true and 1 is false

D) 1 statement is true and 4 are false

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

64

When a bond investor buys a credit default swap (CDS),they will:

A) pay a premium to the seller.

B) receive compensation from the protection seller if a default occurs.

C) retain their original bonds.

D) do all of the given answers.

A) pay a premium to the seller.

B) receive compensation from the protection seller if a default occurs.

C) retain their original bonds.

D) do all of the given answers.

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

65

While both the international and AUD swap markets have matured,growth may still be expected.Which of the following factors is a determinant in the future growth of the swaps markets?

A) Periodic nervousness from a lack of clear direction of interest rates

B) Speculative trading transactions to take advantage of future price movements

C) Development of new, sophisticated products to hedge interest rate and currency risk

D) All of the given choices

A) Periodic nervousness from a lack of clear direction of interest rates

B) Speculative trading transactions to take advantage of future price movements

C) Development of new, sophisticated products to hedge interest rate and currency risk

D) All of the given choices

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

66

Consider these five statements:

I)Swaps can be used to create a synthetic floating rate debt for a company's fixed rate debt.

Ii)If an intermediary has arranged a matched swap,it has no net exposure to interest rate risk.

Iii)A cross-currency swap differs from an interest rate swap in that,for a cross-currency swap,the principals,as well as the agreed interest obligations,are swapped for the duration of the swap agreement.

Iv)With a cross-currency swap,the exchange rate used at the principal re-exchange date is based on the current spot rate at that time.

V)If a bank acts as an intermediary in a swap and does not fund the swap parties' underlying loan facilities,it has no obligation under the bank capital adequacy requirements.

Which of the following are correct?

A) i, ii, iii and iv are true

B) ii, iii and iv are true

C) i, ii and iii are true

D) i, ii, iii and v are true

I)Swaps can be used to create a synthetic floating rate debt for a company's fixed rate debt.

Ii)If an intermediary has arranged a matched swap,it has no net exposure to interest rate risk.

Iii)A cross-currency swap differs from an interest rate swap in that,for a cross-currency swap,the principals,as well as the agreed interest obligations,are swapped for the duration of the swap agreement.

Iv)With a cross-currency swap,the exchange rate used at the principal re-exchange date is based on the current spot rate at that time.

V)If a bank acts as an intermediary in a swap and does not fund the swap parties' underlying loan facilities,it has no obligation under the bank capital adequacy requirements.

Which of the following are correct?

A) i, ii, iii and iv are true

B) ii, iii and iv are true

C) i, ii and iii are true

D) i, ii, iii and v are true

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

67

Which of the following statements regarding interest rate swaps is incorrect?

A) The practice of marking-to market is carried out in the swaps market (similar to the futures market).

B) In contrast with a forward contract, the exact terms of exchange of a swap will change with interest rates.

C) The swap market is similar to the futures market in that if the market moves against the contract, a maintenance margin call is required.

D) The two parties in a swap generally have the same level of default risk.

A) The practice of marking-to market is carried out in the swaps market (similar to the futures market).

B) In contrast with a forward contract, the exact terms of exchange of a swap will change with interest rates.

C) The swap market is similar to the futures market in that if the market moves against the contract, a maintenance margin call is required.

D) The two parties in a swap generally have the same level of default risk.

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

68

If a company expects interest rates to increase,which of the following strategies should the company consider?

A) A short interest rate call

B) A swap involving paying fixed rate and receiving floating rate

C) A short forward rate agreement

D) All of the given choices

A) A short interest rate call

B) A swap involving paying fixed rate and receiving floating rate

C) A short forward rate agreement

D) All of the given choices

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

69

All of the following are factors that directly affect swap pricing,except:

A) the availability of extra counterparties.

B) the credit risk of the swap counterparty.

C) the term structure of interest rates.

D) current government regulation.

A) the availability of extra counterparties.

B) the credit risk of the swap counterparty.

C) the term structure of interest rates.

D) current government regulation.

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

70

Cash settlement for a credit default swap (CDS)means the:

A) protection buyer delivers the agreed notional value of the debt to the protection seller.

B) protection buyer transfers the specified debt to the protection seller.

C) protection seller pays a net cash amount to the protection buyer.

D) protection buyer delivers the face value of the debt to the protection seller.

A) protection buyer delivers the agreed notional value of the debt to the protection seller.

B) protection buyer transfers the specified debt to the protection seller.

C) protection seller pays a net cash amount to the protection buyer.

D) protection buyer delivers the face value of the debt to the protection seller.

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

71

When the normal relationship between fixed and floating interest rates alters in an interest rate swap,this risk is called:

A) basis risk.

B) exchange risk.

C) mismatch risk.

D) front-end risk.

A) basis risk.

B) exchange risk.

C) mismatch risk.

D) front-end risk.

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

72

Interest rate swaps and cross-currency swaps:

A) appear on the balance sheets of commercial banks as current assets.

B) appear on the balance sheets of commercial banks as current liabilities.

C) appear on the balance sheets of commercial banks as long-term liabilities.

D) represent a contingent liability for an intermediary.

A) appear on the balance sheets of commercial banks as current assets.

B) appear on the balance sheets of commercial banks as current liabilities.

C) appear on the balance sheets of commercial banks as long-term liabilities.

D) represent a contingent liability for an intermediary.

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

73

In order to measure and manage interest rate swap risk exposures,a financial intermediary may:

A) practise marking-to market.

B) seek security collateral.

C) require a written performance guarantee from the counterparty's sponsor.

D) do all of the given answers.

A) practise marking-to market.

B) seek security collateral.

C) require a written performance guarantee from the counterparty's sponsor.

D) do all of the given answers.

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

74

If a party in a matched swap defaults,the financial intermediary faces:

A) credit risk.

B) default risk.

C) settlement risk.

D) default and settlement risk.

A) credit risk.

B) default risk.

C) settlement risk.

D) default and settlement risk.

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

75

In order to reduce interest rate swap risk exposures,a financial intermediary may:

A) practise marking-to market.

B) use margin calls.

C) ask for security collateral.

D) do all of the given answers.

A) practise marking-to market.

B) use margin calls.

C) ask for security collateral.

D) do all of the given answers.

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

76

Whereas in the mid-1980s swap spreads might have been 50 basis points,a/an _______ basis-point spread is more common today.

A) 80

B) 60

C) 30

D) 10

A) 80

B) 60

C) 30

D) 10

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

77

The advantage of over-the-counter products such as swaps or forwards contracts,relative to exchange-traded products such as options or futures,is:

A) standardisation.

B) regulation.

C) flexibility.

D) all of the given answers.

A) standardisation.

B) regulation.

C) flexibility.

D) all of the given answers.

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

78

During a swap,the risk of one party not forwarding its payment while the other party does fulfil its payment obligation is called:

A) Herstatt risk.

B) swap risk.

C) settlement risk.

D) repayment risk.

A) Herstatt risk.

B) swap risk.

C) settlement risk.

D) repayment risk.

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

79

Interest rate swaps and cross-currency swaps:

A) appear on the balance sheets of commercial banks as current assets.

B) appear on the balance sheets of commercial banks as current liabilities.

C) appear on the balance sheets of commercial banks as long-term liabilities.

D) do not appear on the balance sheet.

A) appear on the balance sheets of commercial banks as current assets.

B) appear on the balance sheets of commercial banks as current liabilities.

C) appear on the balance sheets of commercial banks as long-term liabilities.

D) do not appear on the balance sheet.

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

80

Which of the following regarding the role of a financial intermediary in an interest rate swap is incorrect?

A) Most swaps involve a financial intermediary as counterparty.

B) The financial intermediary will most often seek to engage in an offsetting swap.

C) The intermediary makes its profit by maintaining a spread between the rates offered to the two counterparties.

D) The financial intermediary, by establishing a matched swap, ends up with a positive net exposure in the swap market.

A) Most swaps involve a financial intermediary as counterparty.

B) The financial intermediary will most often seek to engage in an offsetting swap.

C) The intermediary makes its profit by maintaining a spread between the rates offered to the two counterparties.

D) The financial intermediary, by establishing a matched swap, ends up with a positive net exposure in the swap market.

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck