Deck 13: Weighing Net Present Value and Other Capital Budgeting Criteria

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

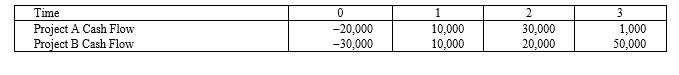

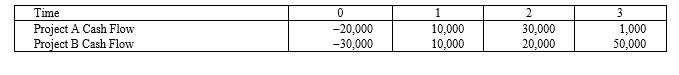

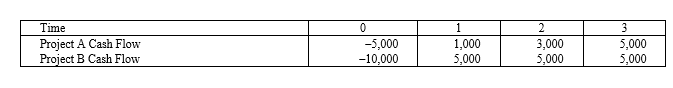

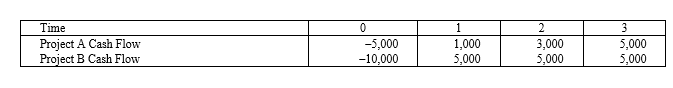

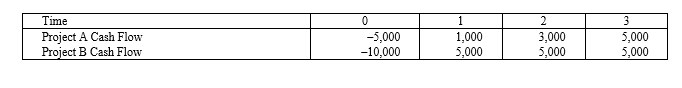

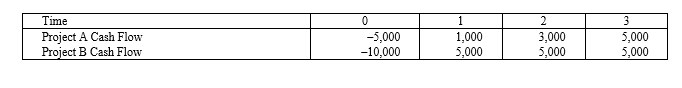

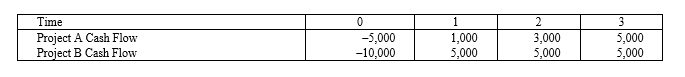

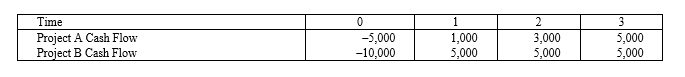

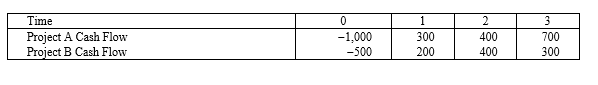

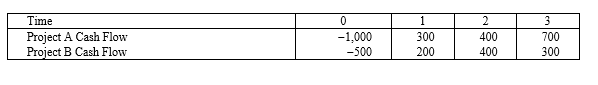

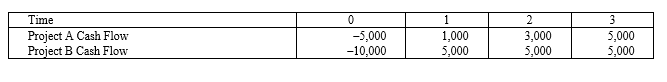

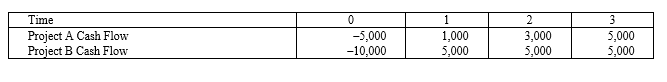

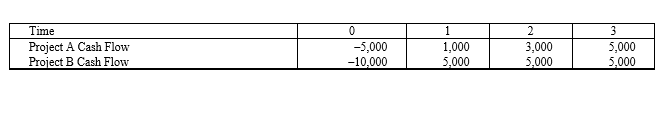

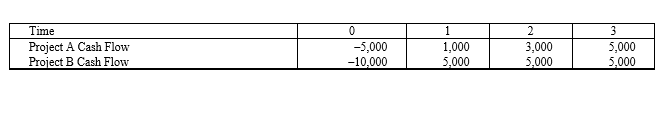

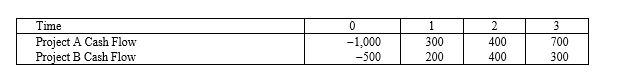

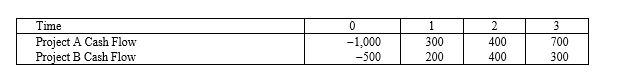

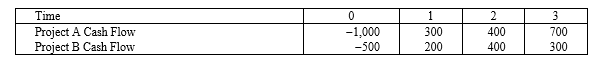

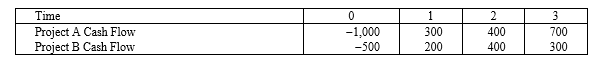

Question

Question

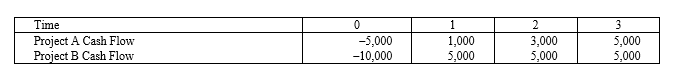

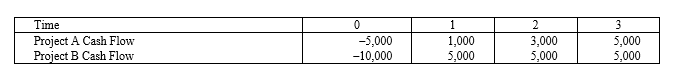

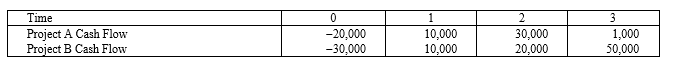

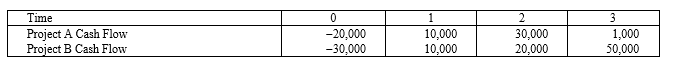

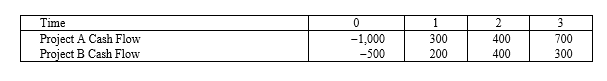

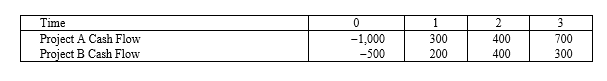

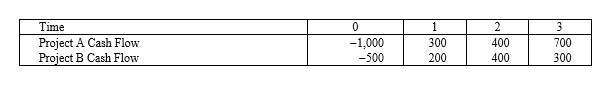

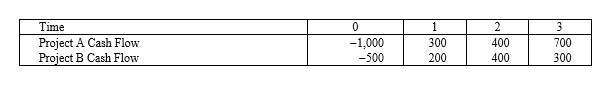

Question

Question

Question

Question

Question

Question

Question

Question

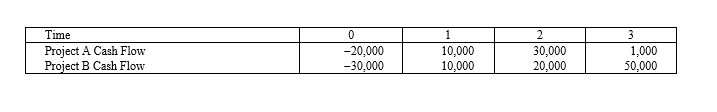

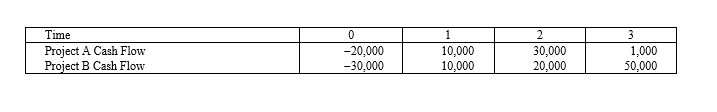

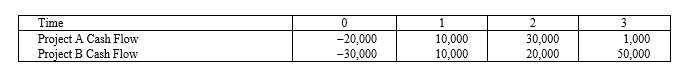

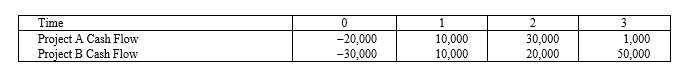

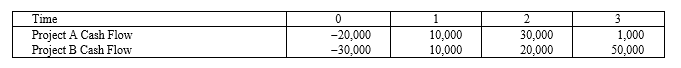

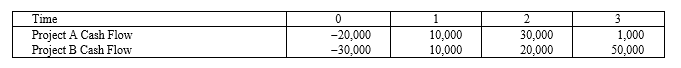

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/113

Play

Full screen (f)

Deck 13: Weighing Net Present Value and Other Capital Budgeting Criteria

1

All capital budgeting techniques:

A)render the same investment decision.

B)use the same measurement units.

C)include all crucial information.

D)exclude some crucial information.

A)render the same investment decision.

B)use the same measurement units.

C)include all crucial information.

D)exclude some crucial information.

exclude some crucial information.

2

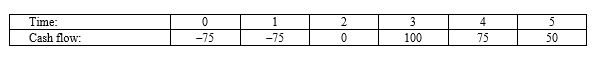

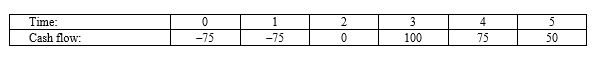

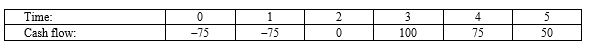

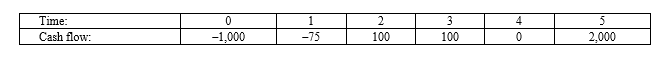

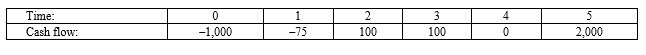

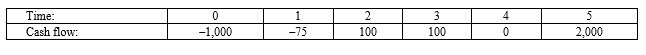

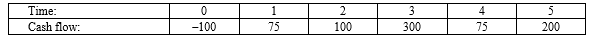

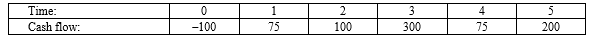

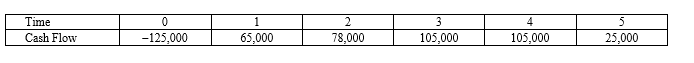

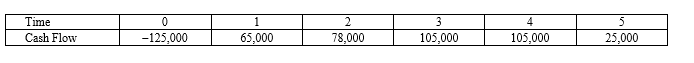

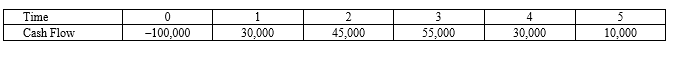

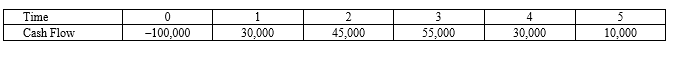

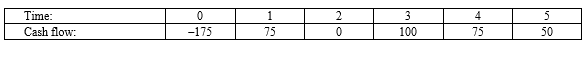

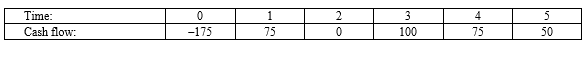

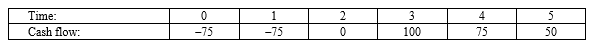

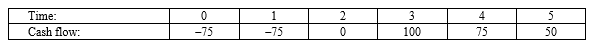

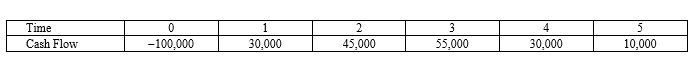

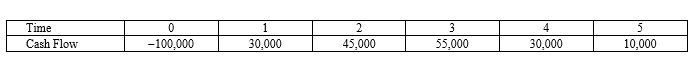

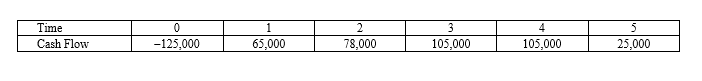

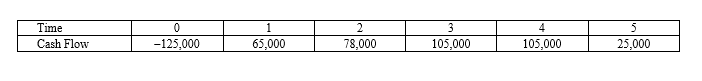

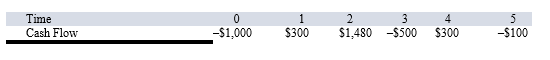

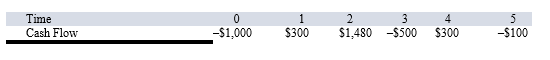

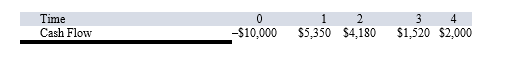

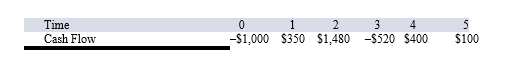

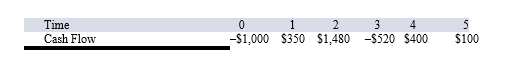

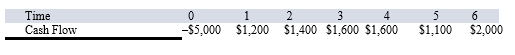

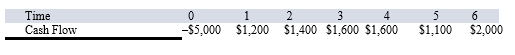

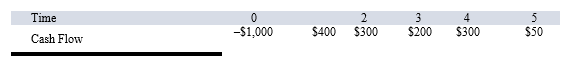

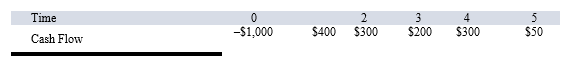

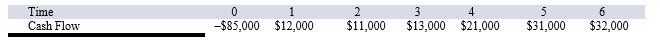

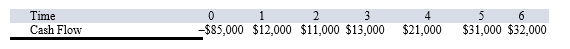

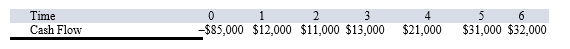

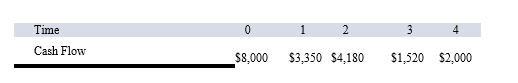

Compute the NPV for Project X and accept or reject the project with the cash flows shown as follows if the appropriate cost of capital is 10 percent. Time:

A)$12.93

B)$14.22

C)$62.07

D)$136.90

A)$12.93

B)$14.22

C)$62.07

D)$136.90

$14.22

3

Which rate-based decision statistic measures the excess return (the amount above and beyond the cost of capital for a project), rather than the gross return?

A)Internal rate of return (IRR)

B)Modified internal rate of return (MIRR)

C)Profitability index (PI)

D)Net present value (NPV)

A)Internal rate of return (IRR)

B)Modified internal rate of return (MIRR)

C)Profitability index (PI)

D)Net present value (NPV)

Profitability index (PI)

4

Of the capital budgeting techniques discussed, which works equally well with normal and non-normal cash flows and with independent and mutually exclusive projects?

A)Payback period

B)Discounted payback period

C)Modified internal rate of return

D)Net present value

A)Payback period

B)Discounted payback period

C)Modified internal rate of return

D)Net present value

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

5

Which of these are sets of cash flows where all the initial cash flows are negative and all the subsequent ones are either zero or positive?

A)Expected cash flows

B)Time line cash flows

C)Non-normal cash flows

D)Normal cash flows

A)Expected cash flows

B)Time line cash flows

C)Non-normal cash flows

D)Normal cash flows

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

6

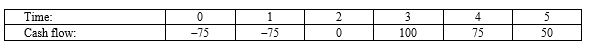

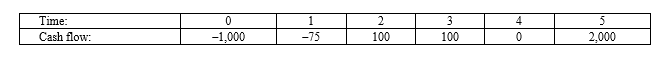

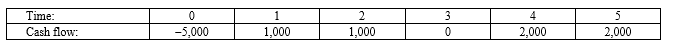

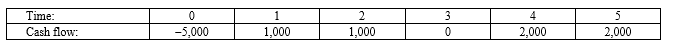

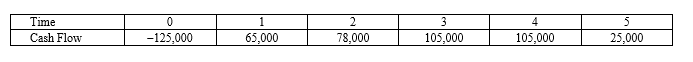

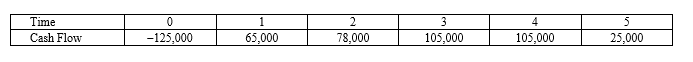

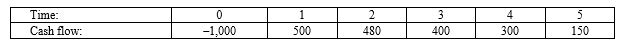

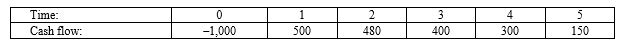

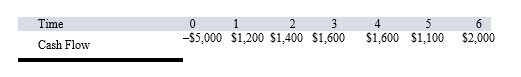

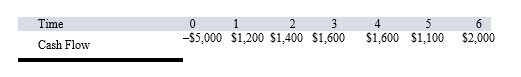

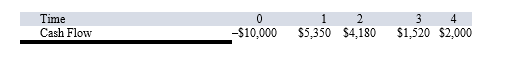

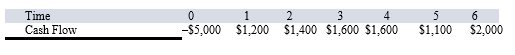

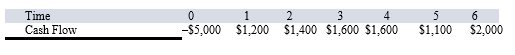

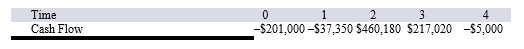

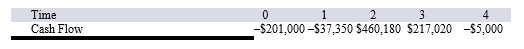

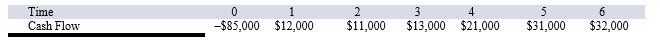

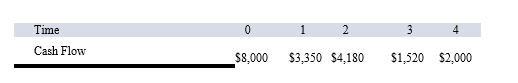

Compute the NPV for Project X with the cash flows shown as follows if the appropriate cost of capital is 9 percent.

A)(-$639.96)

B)$360.04

C)$392.44

D)$486.29

A)(-$639.96)

B)$360.04

C)$392.44

D)$486.29

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

7

Neither payback period nor discounted payback period techniques for evaluating capital projects account for:

A)time value of money.

B)market rates of return.

C)cash flows that occur after payback.

D)cash flows that occur during payback.

A)time value of money.

B)market rates of return.

C)cash flows that occur after payback.

D)cash flows that occur during payback.

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

8

The net present value decision technique may not be the only pertinent unit of measure if the firm is facing:

A)time or resource constraints.

B)a labor union.

C)the election of a new board of directors.

D)a major investment.

A)time or resource constraints.

B)a labor union.

C)the election of a new board of directors.

D)a major investment.

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

9

Which of these is a capital budgeting technique that generates decision rules and associated metrics for choosing projects based upon the implicit expected geometric average of a project's rate of return?

A)Discounted payback

B)Net present value

C)Internal rate of return

D)Profitability index

A)Discounted payback

B)Net present value

C)Internal rate of return

D)Profitability index

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

10

Which of the following is a technique for evaluating capital projects that tells how long it will take a firm to earn back the money invested in a project plus interest at market rates?

A)Payback

B)Discounted payback

C)Net present value

D)Profitability index

A)Payback

B)Discounted payback

C)Net present value

D)Profitability index

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

11

Which of these is a capital budgeting technique that generates a decision rule and associated metric for choosing projects based on the total discounted value of their cash flows?

A)Discounted payback

B)Net present value

C)Internal rate of return

D)Profitability index

A)Discounted payback

B)Net present value

C)Internal rate of return

D)Profitability index

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

12

The benchmark for the profitability index (PI) is the:

A)cost of capital.

B)managers' maximum number of years.

C)zero or anything larger than zero.

D)zero or anything less than zero.

A)cost of capital.

B)managers' maximum number of years.

C)zero or anything larger than zero.

D)zero or anything less than zero.

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

13

The net present value decision technique uses a statistic denominated in:

A)years.

B)currency.

C)a percentage.

D)time lines.

A)years.

B)currency.

C)a percentage.

D)time lines.

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

14

Which of the following is a technique for evaluating capital projects that tells how long it will take a firm to earn back the money invested in a project?

A)Payback

B)Internal rate of return

C)Net present value

D)Profitability index

A)Payback

B)Internal rate of return

C)Net present value

D)Profitability index

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

15

When choosing between two mutually exclusive projects using the payback period method for evaluating capital projects, one would choose:

A)either project if they both are more than managers' maximum payback period.

B)neither project if they both are less than managers' maximum payback period.

C)the project that pays back the soonest.

D)the project that pays back the soonest if it is equal to or less than managers' maximum payback period.

A)either project if they both are more than managers' maximum payback period.

B)neither project if they both are less than managers' maximum payback period.

C)the project that pays back the soonest.

D)the project that pays back the soonest if it is equal to or less than managers' maximum payback period.

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

16

Which of the following is a capital budgeting technique that converts a project's cash flows using a more consistent reinvestment rate prior to applying the Internal Rate of Return, IRR, decision rule?

A)Discounted payback

B)Net present value

C)Modified internal rate of return

D)Profitability index

A)Discounted payback

B)Net present value

C)Modified internal rate of return

D)Profitability index

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

17

Which of these describe groups or pairs of projects where you can accept one but not all?

A)Dependent

B)Independent

C)Mutually exclusive

D)Mutually dependent

A)Dependent

B)Independent

C)Mutually exclusive

D)Mutually dependent

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

18

A graph of a project's ________ is a function of cost of capital.

A)internal rate of return

B)net present value

C)modified internal rate of return

D)all choices are a function of cost of capital

A)internal rate of return

B)net present value

C)modified internal rate of return

D)all choices are a function of cost of capital

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

19

Rate-based statistics represent summary cash flows, and these summaries tend to lose which two important details?

A)The investment size and cash inflows that occur after the rather arbitrary testing period

B)The investment size and the cash inflows that occur before the testing period

C)The investment size and the cash outflows that occur before the testing period

D)The investment size and the cash inflows that occur during the testing period

A)The investment size and cash inflows that occur after the rather arbitrary testing period

B)The investment size and the cash inflows that occur before the testing period

C)The investment size and the cash outflows that occur before the testing period

D)The investment size and the cash inflows that occur during the testing period

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

20

Which of the following is a technique for evaluating capital projects that is particularly useful when firms face time constraints in repaying investors?

A)Payback

B)Internal rate of return

C)Net present value

D)Profitability index

A)Payback

B)Internal rate of return

C)Net present value

D)Profitability index

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

21

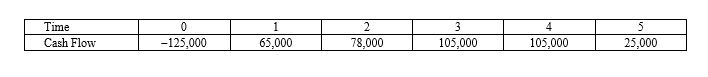

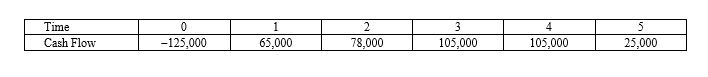

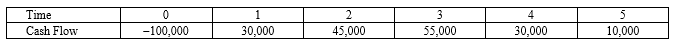

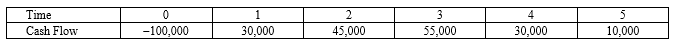

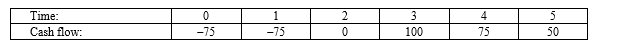

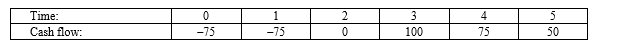

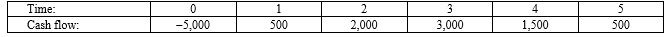

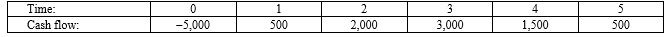

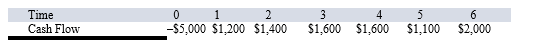

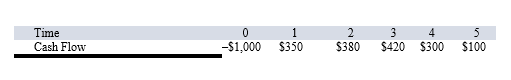

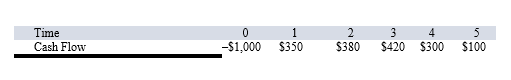

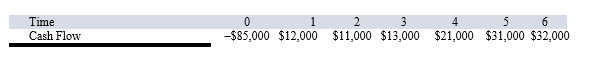

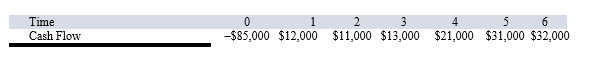

Suppose your firm is considering investing in a project with the cash flows shown as follows, that the required rate of return on projects of this risk class is 12 percent, and that the maximum allowable payback and discounted payback statistic for the project are two and two and a half years, respectively.

A)0.23 years, accept

B)1.77 years, accept

C)2 years, accept

D)4.33 years, reject

A)0.23 years, accept

B)1.77 years, accept

C)2 years, accept

D)4.33 years, reject

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

22

Compute the PI statistic for Project X and note whether the firm should accept or reject the project with the cash flows shown as follows if the appropriate cost of capital is 10 percent.

A)-0.0977 percent, reject

B)-9.77 percent, reject

C)-24.41 percent, reject

D)24.41 percent, accept

A)-0.0977 percent, reject

B)-9.77 percent, reject

C)-24.41 percent, reject

D)24.41 percent, accept

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

23

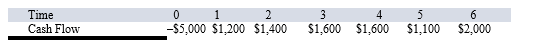

Suppose your firm is considering investing in a project with the cash flows shown as follows, that the required rate of return on projects of this risk class is 8 percent, and that the maximum allowable payback and discounted payback statistic for the project are three and three and a half years, respectively.

A)2.45 years, accept

B)2.83 years, accept

C)3.45 years, accept

D)3.83 years, reject

A)2.45 years, accept

B)2.83 years, accept

C)3.45 years, accept

D)3.83 years, reject

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

24

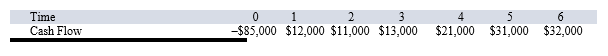

Compute the payback statistic for Project X and recommend whether the firm should accept or reject the project with the cash flows shown as follows if the appropriate cost of capital is 9 percent and the maximum allowable payback is four years.

A)3.4375 years, accept

B)3.78 years, reject

C)4.4375 years, reject

D)4.78 years, accept

A)3.4375 years, accept

B)3.78 years, reject

C)4.4375 years, reject

D)4.78 years, accept

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

25

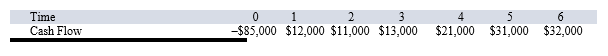

Compute the IRR for Project X and note whether the firm should accept or reject the project with the cash flows shown as follows if the appropriate cost of capital is 9 percent.

A)9 percent, accept

B)9 percent, reject

C)16.61 percent, accept

D)16.61 percent, reject

A)9 percent, accept

B)9 percent, reject

C)16.61 percent, accept

D)16.61 percent, reject

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

26

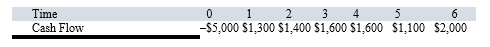

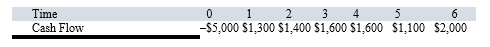

Compute the payback statistic for Project Y and recommend whether the firm should accept or reject the project with the cash flows shown as follows if the appropriate cost of capital is 11 percent and the maximum allowable payback is one year.

A)1.25 years, reject

B)1.25 years, accept

C)1.33 years, accept

D)2.25 years, accept

A)1.25 years, reject

B)1.25 years, accept

C)1.33 years, accept

D)2.25 years, accept

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

27

Compute the MIRR for Project Y and accept or reject the project with the cash flows shown as follows if the appropriate cost of capital is 12 percent.

A)7.62 percent, accept

B)7.62 percent, reject

C)47.09 percent, accept

D)47.09 percent, reject

A)7.62 percent, accept

B)7.62 percent, reject

C)47.09 percent, accept

D)47.09 percent, reject

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

28

Suppose your firm is considering investing in a project with the cash flows shown as follows, that the required rate of return on projects of this risk class is 12 percent, and that the maximum allowable payback and discounted payback statistic for the project are two and two and a half years, respectively.

A)1.77 years, reject

B)1.94 years, accept

C)2.06 years, accept

D)3.00 years, reject

A)1.77 years, reject

B)1.94 years, accept

C)2.06 years, accept

D)3.00 years, reject

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

29

Compute the PI statistic for Project X and note whether the firm should accept or reject the project with the cash flows shown as follows if the appropriate cost of capital is 10 percent.

A)(-0.0977 percent, reject)

B)(-9.77 percent, reject)

C)(-24.41 percent, reject)

D)24.41 percent, accept

A)(-0.0977 percent, reject)

B)(-9.77 percent, reject)

C)(-24.41 percent, reject)

D)24.41 percent, accept

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

30

Compute the payback statistic for Project X and recommend whether the firm should accept or reject the project with the cash flows shown as follows if the appropriate cost of capital is 10 percent and the maximum allowable payback is five years.

A)3.67 years, accept

B)4.67 years, accept

C)3.67 years, reject

D)4.67 years, reject

A)3.67 years, accept

B)4.67 years, accept

C)3.67 years, reject

D)4.67 years, reject

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

31

Suppose your firm is considering investing in a project with the cash flows shown as follows, that the required rate of return on projects of this risk class is 8 percent, and that the maximum allowable payback and discounted payback statistic for the project are three and three and a half years, respectively.

A)$35,995.86, reject

B)$38,875.53, accept

C)$138,875.53, accept

D)$238,875.53, accept

A)$35,995.86, reject

B)$38,875.53, accept

C)$138,875.53, accept

D)$238,875.53, accept

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

32

Compute the discounted payback statistic for Project Y and recommend whether the firm should accept or reject the project with the cash flows shown as follows if the appropriate cost of capital is 12 percent and the maximum allowable discounted payback is three years.

A)3.45 years, reject

B)3.86 years, reject

C)3.45 years, accept

D)3.86 years, accept

A)3.45 years, reject

B)3.86 years, reject

C)3.45 years, accept

D)3.86 years, accept

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

33

Suppose your firm is considering investing in a project with the cash flows shown as follows, that the required rate of return on projects of this risk class is 8 percent, and that the maximum allowable payback and discounted payback statistic for the project are three and three and a half years, respectively.

A)(-10.60 percent, reject)

B)10.60 percent, accept

C)(-15.33 percent, reject)

D)15.33 percent, accept

A)(-10.60 percent, reject)

B)10.60 percent, accept

C)(-15.33 percent, reject)

D)15.33 percent, accept

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

34

Compute the MIRR statistic for Project X and note whether the firm should accept or reject the project with the cash flows shown as follows if the appropriate cost of capital is 10 percent.

A)13.26 percent, accept

B)13.89 percent, accept

C)13.26 percent, reject

D)15.73 percent, accept

A)13.26 percent, accept

B)13.89 percent, accept

C)13.26 percent, reject

D)15.73 percent, accept

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

35

Suppose your firm is considering investing in a project with the cash flows shown as follows, that the required rate of return on projects of this risk class is 8 percent, and that the maximum allowable payback and discounted payback statistic for the project are three and three and a half years, respectively.

A)(-0.39 percent, reject)

B)0.39 percent, accept

C)(-38.88 percent, reject)

D)38.88 percent, accept

A)(-0.39 percent, reject)

B)0.39 percent, accept

C)(-38.88 percent, reject)

D)38.88 percent, accept

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

36

Suppose your firm is considering investing in a project with the cash flows shown as follows, that the required rate of return on projects of this risk class is 8 percent, and that the maximum allowable payback and discounted payback statistic for the project are three and three and a half years, respectively.

A)(-4.95 percent, reject)

B)4.95 percent, accept

C)(-23.18 percent, reject)

D)23.18 percent, accept

A)(-4.95 percent, reject)

B)4.95 percent, accept

C)(-23.18 percent, reject)

D)23.18 percent, accept

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

37

Suppose your firm is considering investing in a project with the cash flows shown as follows, that the required rate of return on projects of this risk class is 12 percent, and that the maximum allowable payback and discounted payback statistic for the project are two and two and a half years, respectively.

A)12.00 percent, reject

B)31.21 percent, accept

C)54.22 percent, accept

D)80.67 percent, accept

A)12.00 percent, reject

B)31.21 percent, accept

C)54.22 percent, accept

D)80.67 percent, accept

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

38

Compute the IRR statistic for Project X and note whether the firm should accept or reject the project with the cash flows shown as follows if the appropriate cost of capital is 10 percent.

A)10 percent, accept

B)10 percent, reject

C)13.26 percent, accept

D)13.26 percent, reject

A)10 percent, accept

B)10 percent, reject

C)13.26 percent, accept

D)13.26 percent, reject

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

39

Compute the discounted payback statistic for Project X and recommend whether the firm should accept or reject the project with the cash flows shown as follows if the appropriate cost of capital is 10 percent and the maximum allowable discounted payback is three years.

A)2.49 years, accept

B)2.98 years, accept

C)3.49 years, reject

D)4.98 years, reject

A)2.49 years, accept

B)2.98 years, accept

C)3.49 years, reject

D)4.98 years, reject

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

40

Suppose your firm is considering investing in a project with the cash flows shown as follows, that the required rate of return on projects of this risk class is 8 percent, and that the maximum allowable payback and discounted payback statistic for the project are three and three and a half years, respectively.

A)1.23 years, Accept

B)2.45 years, accept

C)2.77 years, accept

D)5.36 years, reject

A)1.23 years, Accept

B)2.45 years, accept

C)2.77 years, accept

D)5.36 years, reject

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

41

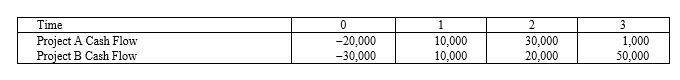

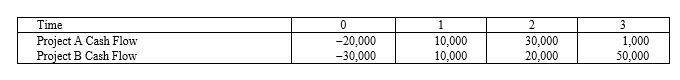

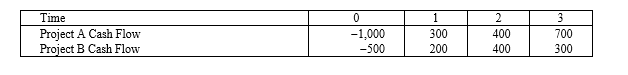

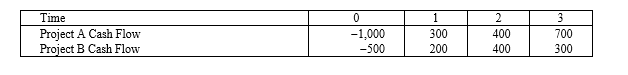

Suppose your firm is considering two mutually exclusive, required projects with the cash flows shown as follows. The required rate of return on projects of both of their risk class is 8 percent, and the maximum allowable payback and discounted payback statistic for the projects are two and three years, respectively.

A)Accept both A and B

B)Accept neither A nor B

C)Accept A, reject B

D)Reject A, accept B

A)Accept both A and B

B)Accept neither A nor B

C)Accept A, reject B

D)Reject A, accept B

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

42

Suppose your firm is considering two mutually exclusive, required projects with the cash flows shown as follows. The required rate of return on projects of both of their risk class is 8 percent, and the maximum allowable payback and discounted payback statistic for the projects are two and three years, respectively.

A)Accept both A and B

B)Accept neither A nor B

C)Accept A, reject B

D)Reject A, accept B

A)Accept both A and B

B)Accept neither A nor B

C)Accept A, reject B

D)Reject A, accept B

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

43

Suppose your firm is considering two independent projects with the cash flows shown as follows. The required rate of return on projects of both of their risk class is 12 percent, and the maximum allowable payback and discounted payback statistic for the projects are two and a half and three years, respectively.

A)Accept both A and B

B)Accept neither A nor B

C)Accept A, reject B

D)Reject A, accept B

A)Accept both A and B

B)Accept neither A nor B

C)Accept A, reject B

D)Reject A, accept B

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

44

Suppose your firm is considering two independent projects with the cash flows shown as follows. The required rate of return on projects of both of their risk class is 12 percent, and the maximum allowable payback and discounted payback statistic for the projects are two and a half and three years, respectively.

A)Accept both A and B

B)Accept neither A nor B

C)Accept A, reject B

D)Reject A, accept B

A)Accept both A and B

B)Accept neither A nor B

C)Accept A, reject B

D)Reject A, accept B

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

45

Suppose your firm is considering two mutually exclusive, required projects with the cash flows shown as follows. The required rate of return on projects of both of their risk class is 8 percent, and the maximum allowable payback and discounted payback statistic for the projects are two and three years, respectively.

A)Accept both A and B

B)Accept neither A nor B

C)Accept A, reject B

D)Reject A, accept B

A)Accept both A and B

B)Accept neither A nor B

C)Accept A, reject B

D)Reject A, accept B

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

46

Suppose your firm is considering two independent projects with the cash flows shown as follows. The required rate of return on projects of both of their risk class is 12 percent, and the maximum allowable payback and discounted payback statistic for the projects are two and a half and three years, respectively.

A)Accept both A and B

B)Accept neither A nor B

C)Accept A, reject B

D)Reject A, accept B

A)Accept both A and B

B)Accept neither A nor B

C)Accept A, reject B

D)Reject A, accept B

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

47

Suppose your firm is considering two mutually exclusive, required projects with the cash flows shown as follows. The required rate of return on projects of both of their risk class is 8 percent, and the maximum allowable payback and discounted payback statistic for the projects are two and three years, respectively.

A)Accept both A and B

B)Accept neither A nor B

C)Accept A, reject B

D)Reject A, accept B

A)Accept both A and B

B)Accept neither A nor B

C)Accept A, reject B

D)Reject A, accept B

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

48

Suppose your firm is considering two independent projects with the cash flows shown as follows. The required rate of return on projects of both of their risk class is 12 percent, and the maximum allowable payback and discounted payback statistic for the projects are two and a half and three years, respectively.

A)Accept both A and B

B)Accept neither A nor B

C)Accept A, reject B

D)Reject A, accept B

A)Accept both A and B

B)Accept neither A nor B

C)Accept A, reject B

D)Reject A, accept B

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

49

Suppose your firm is considering two mutually exclusive, required projects with the cash flows shown as follows. The required rate of return on projects of both of their risk class is 8 percent, and the maximum allowable payback and discounted payback statistic for the projects are two and three years, respectively.

A)Accept both A and B

B)Accept neither A nor B

C)Accept A, reject B

D)Reject A, accept B

A)Accept both A and B

B)Accept neither A nor B

C)Accept A, reject B

D)Reject A, accept B

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

50

Suppose your firm is considering investing in a project with the cash flows shown as follows, that the required rate of return on projects of this risk class is 12 percent, and that the maximum allowable payback and discounted payback statistic for the project are two and two and a half years, respectively.

A)(-1.21 percent, reject)

B)1.08 percent, accept

C)1.21 percent, accept

D)121 percent, accept

A)(-1.21 percent, reject)

B)1.08 percent, accept

C)1.21 percent, accept

D)121 percent, accept

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

51

Suppose your firm is considering two mutually exclusive, required projects with the cash flows shown as follows. The required rate of return on projects of both of their risk class is 10 percent, and the maximum allowable payback and discounted payback statistic for the projects are two and a half and three and a half years, respectively.

A)Accept both A and B

B)Accept neither A nor B

C)Accept A, reject B

D)Reject A, accept B

A)Accept both A and B

B)Accept neither A nor B

C)Accept A, reject B

D)Reject A, accept B

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

52

Suppose your firm is considering two mutually exclusive, required projects with the cash flows shown as follows. The required rate of return on projects of both of their risk class is 8 percent, and the maximum allowable payback and discounted payback statistic for the projects are two and three years, respectively.

A)Accept both A and B

B)Accept neither A nor B

C)Accept A, reject B

D)Reject A, accept B

A)Accept both A and B

B)Accept neither A nor B

C)Accept A, reject B

D)Reject A, accept B

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

53

Suppose your firm is considering two independent projects with the cash flows shown as follows. The required rate of return on projects of both of their risk class is 12 percent, and the maximum allowable payback and discounted payback statistic for the projects are two and a half and three years, respectively.

A)Accept both A and B

B)Accept neither A nor B

C)Accept A, reject B

D)Reject A, accept B

A)Accept both A and B

B)Accept neither A nor B

C)Accept A, reject B

D)Reject A, accept B

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

54

Suppose your firm is considering two mutually exclusive, required projects with the cash flows shown as follows. The required rate of return on projects of both of their risk class is 10 percent, and the maximum allowable payback and discounted payback statistic for the projects are two and a half and three and a half years, respectively.

A)Accept both A and B

B)Accept neither A nor B

C)Accept A, reject B

D)Reject A, accept B

A)Accept both A and B

B)Accept neither A nor B

C)Accept A, reject B

D)Reject A, accept B

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

55

Suppose your firm is considering two independent projects with the cash flows shown as follows. The required rate of return on projects of both of their risk class is 12 percent, and the maximum allowable payback and discounted payback statistic for the projects are two and a half and three years, respectively.

A)Accept both A and B

B)Accept neither A nor B

C)Accept A, reject B

D)Reject A, accept B

A)Accept both A and B

B)Accept neither A nor B

C)Accept A, reject B

D)Reject A, accept B

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

56

Suppose your firm is considering two mutually exclusive, required projects with the cash flows shown as follows. The required rate of return on projects of both of their risk class is 10 percent, and the maximum allowable payback and discounted payback statistic for the projects are two and a half and three and a half years, respectively.

A)Accept both A and B

B)Accept neither A nor B

C)Accept A, reject B

D)Reject A, accept B

A)Accept both A and B

B)Accept neither A nor B

C)Accept A, reject B

D)Reject A, accept B

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

57

Suppose your firm is considering two mutually exclusive, required projects with the cash flows shown as follows. The required rate of return on projects of both of their risk class is 10 percent, and the maximum allowable payback and discounted payback statistic for the projects are two and a half and three and a half years, respectively.

A)Accept both A and B

B)Accept neither A nor B

C)Accept A, reject B

D)Reject A, accept B

A)Accept both A and B

B)Accept neither A nor B

C)Accept A, reject B

D)Reject A, accept B

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

58

Suppose your firm is considering two mutually exclusive, required projects with the cash flows shown as follows. The required rate of return on projects of both of their risk class is 10 percent, and the maximum allowable payback and discounted payback statistic for the projects are two and a half and three and a half years, respectively.

A)Accept both A and B

B)Accept neither A nor B

C)Accept A, reject B

D)Reject A, accept B

A)Accept both A and B

B)Accept neither A nor B

C)Accept A, reject B

D)Reject A, accept B

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

59

Suppose your firm is considering investing in a project with the cash flows shown as follows, that the required rate of return on projects of this risk class is 12 percent, and that the maximum allowable payback and discounted payback statistic for the project are two and two and a half years, respectively.

A)$9,704.31, reject

B)$84,140.71, accept

C)$134,704.31, accept

D)$150,868.83, accept

A)$9,704.31, reject

B)$84,140.71, accept

C)$134,704.31, accept

D)$150,868.83, accept

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

60

Suppose your firm is considering two mutually exclusive, required projects with the cash flows shown as follows. The required rate of return on projects of both of their risk class is 10 percent, and the maximum allowable payback and discounted payback statistic for the projects are two and a half and three and a half years, respectively.

A)Accept both A and B

B)Accept neither A nor B

C)Accept A, reject B

D)Reject A, accept B

A)Accept both A and B

B)Accept neither A nor B

C)Accept A, reject B

D)Reject A, accept B

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

61

Compute the MIRR statistic for Project J and advise whether to accept or reject the project with the cash flows shown as follows if the appropriate cost of capital is 10 percent.

A) The project's MIRR is 14.77 percent and the project should be accepted.

B) The project's MIRR is 9.29 percent and the project should be rejected.

C) The project's MIRR is 13.76 percent and the project should be accepted.

D) The project's MIRR is 15.31 percent and the project should be accepted.

A) The project's MIRR is 14.77 percent and the project should be accepted.

B) The project's MIRR is 9.29 percent and the project should be rejected.

C) The project's MIRR is 13.76 percent and the project should be accepted.

D) The project's MIRR is 15.31 percent and the project should be accepted.

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

62

Suppose your firm is considering investing in a project with the cash flows shown as follows, that the required rate of return on projects of this risk class is 8 percent, and that the maximum allowable payback and discounted payback statistics for the project are 3.5 and 4.5 years, respectively. Use the IRR decision to evaluate this project; should it be accepted or rejected?

A)IRR = 16.92 percent; accept the project

B)IRR = 7.123 percent; reject the project

C)IRR = 18.32 percent; accept the project

D)IRR = 7.59 percent; reject the project

A)IRR = 16.92 percent; accept the project

B)IRR = 7.123 percent; reject the project

C)IRR = 18.32 percent; accept the project

D)IRR = 7.59 percent; reject the project

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

63

How many possible IRRs could you find for the following set of cash flows?

A)1

B)2

C)3

D)Unable to determine unless we have the cost of capital.

A)1

B)2

C)3

D)Unable to determine unless we have the cost of capital.

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

64

Suppose your firm is considering investing in a project with the cash flows shown as follows, that the required rate of return on projects of this risk class is 10 percent, and that the maximum allowable payback and discounted payback statistics for the project are three and a half and four and a half years, respectively. Use the discounted payback decision to evaluate this project; should it be accepted or rejected?

A)Discounted payback = 4.25 years; accept the project

B)Discounted payback = 3.50 years; accept the project

C)Discounted payback > 5 years; reject the project

D)Discounted payback = 4.67 years; reject the project

A)Discounted payback = 4.25 years; accept the project

B)Discounted payback = 3.50 years; accept the project

C)Discounted payback > 5 years; reject the project

D)Discounted payback = 4.67 years; reject the project

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

65

Compute the NPV statistic for Project U given the following cash flows if the appropriate cost of capital is 9 percent.

A) $201.69

B) $273.82

C) $383.63

D) $397.21

A) $201.69

B) $273.82

C) $383.63

D) $397.21

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

66

Suppose your firm is considering investing in a project with the cash flows shown as follows, that the required rate of return on projects of this risk class is 8 percent, and that the maximum allowable payback and discounted payback statistics for the project are three and a half and four and a half years, respectively. Use the PI decision to evaluate this project; should it be accepted or rejected?

A)PI = 6.94 percent; reject the project

B)PI = 7.52 percent; reject the project

C)PI = 23.61 percent; accept the project

D)PI = 35.33 percent; accept the project

A)PI = 6.94 percent; reject the project

B)PI = 7.52 percent; reject the project

C)PI = 23.61 percent; accept the project

D)PI = 35.33 percent; accept the project

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

67

Suppose your firm is considering investing in a project with the cash flows shown as follows, that the required rate of return on projects of this risk class is 8 percent, and that the maximum allowable payback and discounted payback statistics for the project are three and a half and four and a half years, respectively. Use the MIRR decision to evaluate this project; should it be accepted or rejected?

A)MIRR = 13.59 percent; accept the project

B)MIRR = 7.96 percent; reject the project

C)MIRR = 7.19 percent; reject the project

D)MIRR = 12.58 percent; accept the project

A)MIRR = 13.59 percent; accept the project

B)MIRR = 7.96 percent; reject the project

C)MIRR = 7.19 percent; reject the project

D)MIRR = 12.58 percent; accept the project

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

68

Suppose your firm is considering investing in a project with the cash flows shown as follows, that the required rate of return on projects of this risk class is 10 percent, and that the maximum allowable payback and discounted payback statistics for the project are three and a half and four and a half years, respectively. Use the NPV decision to evaluate this project; should it be accepted or rejected?

A)NPV = $1,766.55; accept the project

B)NPV =-$892.19; reject the project

C)NPV = $1,288.94; accept the project

D)NPV = -$3,577.90; reject the project

A)NPV = $1,766.55; accept the project

B)NPV =-$892.19; reject the project

C)NPV = $1,288.94; accept the project

D)NPV = -$3,577.90; reject the project

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

69

Compute the PI statistic for Project Z and advise the firm whether to accept or reject the project with the cash flows shown as follows if the appropriate cost of capital is 10 percent.

A) The project's PI is 8.48 percent and the project should be accepted.

B) The project's PI is 8.48 percent and the project should be rejected.

C) The project's PI is 16.48 percent and the project should be accepted.

D) The project's PI is 21.48 percent and the project should be accepted.

A) The project's PI is 8.48 percent and the project should be accepted.

B) The project's PI is 8.48 percent and the project should be rejected.

C) The project's PI is 16.48 percent and the project should be accepted.

D) The project's PI is 21.48 percent and the project should be accepted.

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

70

Compute the MIRR statistic for Project I and note whether to accept or reject the project with the cash flows shown as follows if the appropriate cost of

A)The project's MIRR is 10.29 percent and the project should be rejected.

B) The project's MIRR is 12.67 percent and the project should be rejected.

C) The project's MIRR is 17.17 percent and the project should be accepted.

D) The project's MIRR is 18.19 percent and the project should be accepted.

A)The project's MIRR is 10.29 percent and the project should be rejected.

B) The project's MIRR is 12.67 percent and the project should be rejected.

C) The project's MIRR is 17.17 percent and the project should be accepted.

D) The project's MIRR is 18.19 percent and the project should be accepted.

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

71

How many possible IRRs could you find for the following set of cash flows?

A)1

B)2

C)3

D)4

A)1

B)2

C)3

D)4

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

72

Suppose your firm is considering investing in a project with the cash flows shown as follows, that the required rate of return on projects of this risk class is 10 percent, and that the maximum allowable payback and discounted payback statistics for the project are three and a half and four and a half years, respectively. Use the IRR decision to evaluate this project; should it be accepted or rejected?

A)IRR = 16.92 percent; accept the project

B)IRR = 7.123 percent; reject the project

C)IRR = 8.81 percent; reject the project

D)IRR = 10.59 percent; accept the project

A)IRR = 16.92 percent; accept the project

B)IRR = 7.123 percent; reject the project

C)IRR = 8.81 percent; reject the project

D)IRR = 10.59 percent; accept the project

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

73

Suppose your firm is considering investing in a project with the cash flows shown as follows, that the required rate of return on projects of this risk class is 10 percent, and that the maximum allowable payback and discounted payback statistics for the project are three and three and a half years, respectively. Use the payback decision to evaluate this project; should it be accepted or rejected?

A)Payback = 4.90 years; reject

B)Payback = 4.40 years; reject

C)Payback = 5.80 years; reject

D)Payback > 6.00 years; reject

A)Payback = 4.90 years; reject

B)Payback = 4.40 years; reject

C)Payback = 5.80 years; reject

D)Payback > 6.00 years; reject

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

74

Suppose your firm is considering investing in a project with the cash flows shown as follows, that the required rate of return on projects of this risk class is 8 percent, and that the maximum allowable payback and discounted payback statistics for the project are three and a half and four and a half years, respectively. Use the NPV decision to evaluate this project; should it be accepted or rejected?

A)NPV = $1,766.55; accept the project

B)NPV = $892.19; accept the project

C)NPV = $1,288.94; accept the project

D)NPV = -$104.73; reject the project

A)NPV = $1,766.55; accept the project

B)NPV = $892.19; accept the project

C)NPV = $1,288.94; accept the project

D)NPV = -$104.73; reject the project

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

75

Suppose your firm is considering investing in a project with the cash flows shown as follows, that the required rate of return on projects of this risk class is 10 percent, and that the maximum allowable payback and discounted payback statistics for the project are three and a half and four and a half years, respectively. Use the MIRR decision to evaluate this project; should it be accepted or rejected?

A)MIRR = 11.59 percent; accept the project

B)MIRR = 9.21 percent; reject the project

C)MIRR = 7.19 percent; reject the project

D)MIRR = 10.58 percent; accept the project

A)MIRR = 11.59 percent; accept the project

B)MIRR = 9.21 percent; reject the project

C)MIRR = 7.19 percent; reject the project

D)MIRR = 10.58 percent; accept the project

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

76

Compute the PI statistic for Project Q and advise the firm whether to accept or reject the project with the cash flows shown as follows if the appropriate cost of capital is 12 percent.

A)The project's PI is-8.70 percent and the project should be rejected.

B)The project's PI is -11.70 percent and the project should be rejected.

C)The project's PI is 3.70 percent and the project should be accepted.

D)The project's PI is 5.70 percent and the project should be accepted.Step 1: Find NPV using financial calculator: NPV = -86.95;

A)The project's PI is-8.70 percent and the project should be rejected.

B)The project's PI is -11.70 percent and the project should be rejected.

C)The project's PI is 3.70 percent and the project should be accepted.

D)The project's PI is 5.70 percent and the project should be accepted.Step 1: Find NPV using financial calculator: NPV = -86.95;

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

77

Suppose your firm is considering investing in a project with the cash flows shown as follows, that the required rate of return on projects of this risk class is 8 percent, and that the maximum allowable payback and discounted payback statistics for the project are three and a half and four and a half years, respectively. Use the payback decision to evaluate this project; should it be accepted or rejected?

A)Payback = 4.44 years; reject

B)Payback = 3.44 years; accept

C)Payback = 3.54 years; reject

D)Payback = 3.24 years; reject

A)Payback = 4.44 years; reject

B)Payback = 3.44 years; accept

C)Payback = 3.54 years; reject

D)Payback = 3.24 years; reject

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

78

Compute the NPV statistic for Project Y given the following cash flows if the appropriate cost of capital is 10 percent.

A) $894.37

B) $993.97

C) $964.72

D) $1,008.03

A) $894.37

B) $993.97

C) $964.72

D) $1,008.03

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

79

Suppose your firm is considering investing in a project with the cash flows shown as follows, that the required rate of return on projects of this risk class is 10 percent, and that the maximum allowable payback and discounted payback statistics for the project are three and a half and four and a half years, respectively. Use the PI decision to evaluate this project; should it be accepted or rejected?

A)PI = 6.94 percent; reject the project

B)PI =-7.52 percent; reject the project

C)PI = -4.21 percent; reject the project

D)PI = 5.33 percent; accept the project

A)PI = 6.94 percent; reject the project

B)PI =-7.52 percent; reject the project

C)PI = -4.21 percent; reject the project

D)PI = 5.33 percent; accept the project

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

80

Suppose your firm is considering investing in a project with the cash flows shown as follows, that the required rate of return on projects of this risk class is 10 percent, and that the maximum allowable payback and discounted payback statistics for the project are three and a half and four and a half years, respectively. Use the discounted payback decision to evaluate this project; should it be accepted or rejected?

A)Discounted payback = 4.29 years; accept the project

B)Discounted payback = 3.97 years; accept the project

C)Discounted payback > 4.5 years; reject the project

D)Discounted payback = 4.4 years; accept the project

A)Discounted payback = 4.29 years; accept the project

B)Discounted payback = 3.97 years; accept the project

C)Discounted payback > 4.5 years; reject the project

D)Discounted payback = 4.4 years; accept the project

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck