Deck 20: Understanding Options

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/75

Play

Full screen (f)

Deck 20: Understanding Options

1

The value of a put option at expiration equals the

A)market price of the share minus the exercise price.

B)higher of the exercise price minus market price of the share and zero.

C)exercise price.

D)share price.

A)market price of the share minus the exercise price.

B)higher of the exercise price minus market price of the share and zero.

C)exercise price.

D)share price.

higher of the exercise price minus market price of the share and zero.

2

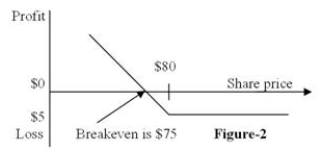

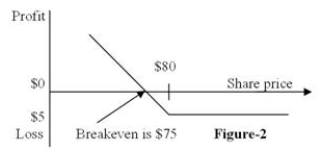

Figure 2 depicts the

A)position diagram for the buyer of a call option.

B)profit diagram for the buyer of a call option.

C)position diagram for the buyer of a put option.

D)profit diagram for the buyer of a put option.

A)position diagram for the buyer of a call option.

B)profit diagram for the buyer of a call option.

C)position diagram for the buyer of a put option.

D)profit diagram for the buyer of a put option.

profit diagram for the buyer of a put option.

3

In June 2017, an investor buys call options on Amgen stock with an exercise of price of $65 and expiring in January 2019.If the stock price in June 2018 is $60, then these options are

A)in-the-money.

B)out-of-the-money.

C)a LEAPS option.

D)out-of-the-money and a LEAPS option.

A)in-the-money.

B)out-of-the-money.

C)a LEAPS option.

D)out-of-the-money and a LEAPS option.

out-of-the-money and a LEAPS option.

4

From a geometric viewpoint, how is the position diagram for a put option related to the diagram of a call option on the same stock having the same exercise price and maturity?

A)The inverse of the call diagram

B)Unrelated to the call diagram no matter what the exercise price

C)The mirror image of the call diagram, reflected around the exercise price

D)Exactly the same as the call diagram for the given exercise price

A)The inverse of the call diagram

B)Unrelated to the call diagram no matter what the exercise price

C)The mirror image of the call diagram, reflected around the exercise price

D)Exactly the same as the call diagram for the given exercise price

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

5

In June 2017, an investor buys a put option on Genentech stock with an exercise price of $75 and expiring in January 2019.If the stock price in July 2017 is $80, then this option is

A)in-the-money.

B)out-of-the-money.

C)a LEAPS option.

D)out-of-the-money and a LEAPS option.

A)in-the-money.

B)out-of-the-money.

C)a LEAPS option.

D)out-of-the-money and a LEAPS option.

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

6

The two principal options exchanges in the United States are the

A)New York Stock Exchange and NASDAQ.

B)International Securities Exchange and New York Stock Exchange.

C)International Securities Exchange and Chicago Board of Options Exchange.

D)NASDAQ and Chicago Board of Options Exchange.

A)New York Stock Exchange and NASDAQ.

B)International Securities Exchange and New York Stock Exchange.

C)International Securities Exchange and Chicago Board of Options Exchange.

D)NASDAQ and Chicago Board of Options Exchange.

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

7

An option that can be exercised any time before its expiration date is called a(n)

A)European option.

B)American option.

C)call option.

D)put option.

A)European option.

B)American option.

C)call option.

D)put option.

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

8

The owner of a regular exchange-listed call-option on a stock

A)has the right to buy 100 shares of the underlying stock at the exercise price.

B)has the right to sell 100 shares of the underlying stock at the exercise price.

C)has the obligation to buy 100 shares of the underlying stock at the exercise price.

D)has the obligation to sell 100 shares of the underlying stock at the exercise price.

A)has the right to buy 100 shares of the underlying stock at the exercise price.

B)has the right to sell 100 shares of the underlying stock at the exercise price.

C)has the obligation to buy 100 shares of the underlying stock at the exercise price.

D)has the obligation to sell 100 shares of the underlying stock at the exercise price.

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

9

The buyer of a call option has the right to exercise the option, but the writer of the call option has the

A)choice to offset with a put option upon exercise.

B)obligation to deliver the shares at the exercise price.

C)choice to deliver shares or take a cash payoff.

D)obligation to deliver a put option upon exercise.

A)choice to offset with a put option upon exercise.

B)obligation to deliver the shares at the exercise price.

C)choice to deliver shares or take a cash payoff.

D)obligation to deliver a put option upon exercise.

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

10

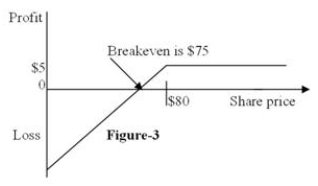

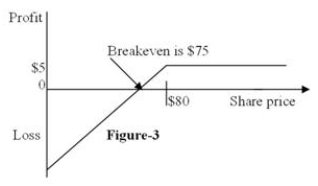

Figure 3 depicts the

A)position diagram for the writer (seller) of a call option.

B)profit diagram for the writer (seller) of a call option.

C)position diagram for the writer (seller) of a put option.

D)profit diagram for the writer (seller) of a put option.

A)position diagram for the writer (seller) of a call option.

B)profit diagram for the writer (seller) of a call option.

C)position diagram for the writer (seller) of a put option.

D)profit diagram for the writer (seller) of a put option.

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

11

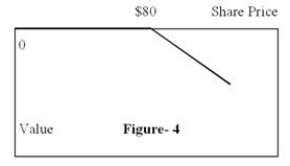

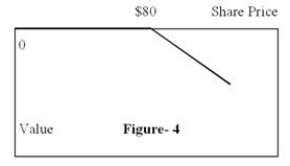

Figure 4 depicts the

A)position diagram for the writer (seller) of a call option.

B)profit diagram for the writer (seller) of a call option.

C)position diagram for the writer (seller) of a put option.

D)profit diagram for the writer (seller) of a put option.

A)position diagram for the writer (seller) of a call option.

B)profit diagram for the writer (seller) of a call option.

C)position diagram for the writer (seller) of a put option.

D)profit diagram for the writer (seller) of a put option.

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

12

The writer (seller) of a regular exchange-listed put-option on a stock

A)has the right to buy 100 shares of the underlying stock at the exercise price.

B)has the right to sell 100 shares of the underlying stock at the exercise price.

C)has the obligation to buy 100 shares of the underlying stock at the exercise price.

D)has the obligation to sell 100 shares of the underlying stock at the exercise price.

A)has the right to buy 100 shares of the underlying stock at the exercise price.

B)has the right to sell 100 shares of the underlying stock at the exercise price.

C)has the obligation to buy 100 shares of the underlying stock at the exercise price.

D)has the obligation to sell 100 shares of the underlying stock at the exercise price.

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

13

The owner of a regular exchange-listed put-option on a stock

A)has the right to buy 100 shares of the underlying stock at the exercise price.

B)has the right to sell 100 shares of the underlying stock at the exercise price.

C)has the obligation to buy 100 shares of the underlying stock at the exercise price.

D)has the obligation to sell 100 shares of the underlying stock at the exercise price.

A)has the right to buy 100 shares of the underlying stock at the exercise price.

B)has the right to sell 100 shares of the underlying stock at the exercise price.

C)has the obligation to buy 100 shares of the underlying stock at the exercise price.

D)has the obligation to sell 100 shares of the underlying stock at the exercise price.

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

14

An investor, in practice, can buy

A)an option on a single share of stock only.

B)an option on a single share of stock and blocks of 100 options.

C)blocks of 100 options only.

D)None of the options.

A)an option on a single share of stock only.

B)an option on a single share of stock and blocks of 100 options.

C)blocks of 100 options only.

D)None of the options.

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

15

The writer (seller) of a regular exchange-listed call-option on a stock

A)has the right to buy 100 shares of the underlying stock at the exercise price.

B)has the right to sell 100 shares of the underlying stock at the exercise price.

C)has the obligation to buy 100 shares of the underlying stock at the exercise price.

D)has the obligation to sell 100 shares of the underlying stock at the exercise price.

A)has the right to buy 100 shares of the underlying stock at the exercise price.

B)has the right to sell 100 shares of the underlying stock at the exercise price.

C)has the obligation to buy 100 shares of the underlying stock at the exercise price.

D)has the obligation to sell 100 shares of the underlying stock at the exercise price.

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

16

Firms regularly use the following to reduce risk:

A)currency options.

B)interest-rate options.

C)commodity options.

D)currency options, interest-rate options, and commodity options.

A)currency options.

B)interest-rate options.

C)commodity options.

D)currency options, interest-rate options, and commodity options.

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

17

The following are examples of "disguised options":

A)acquiring growth opportunities.

B)ability of the firm to terminate a project when it is no longer profitable.

C)acquiring growth opportunities and covenants within corporate securities that provide flexibility to change the terms of the securities.

D)acquiring growth opportunities, ability of the firm to terminate a project when it is no longer profitable, and covenants within corporate securities that provide flexibility to change the terms of the securities.

A)acquiring growth opportunities.

B)ability of the firm to terminate a project when it is no longer profitable.

C)acquiring growth opportunities and covenants within corporate securities that provide flexibility to change the terms of the securities.

D)acquiring growth opportunities, ability of the firm to terminate a project when it is no longer profitable, and covenants within corporate securities that provide flexibility to change the terms of the securities.

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

18

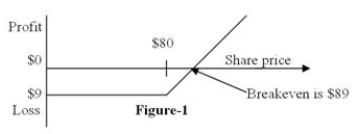

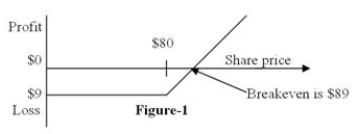

Figure 1 depicts the

A)position diagram for the buyer of a call option.

B)profit diagram for the buyer of a call option.

C)position diagram for the buyer of a put option.

D)profit diagram for the buyer of a put option.

A)position diagram for the buyer of a call option.

B)profit diagram for the buyer of a call option.

C)position diagram for the buyer of a put option.

D)profit diagram for the buyer of a put option.

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

19

A put option gives the owner the right

A)and the obligation to buy an asset at a given price.

B)and the obligation to sell an asset at a given price.

C)but not the obligation to buy an asset at a given price.

D)but not the obligation to sell an asset at a given price.

A)and the obligation to buy an asset at a given price.

B)and the obligation to sell an asset at a given price.

C)but not the obligation to buy an asset at a given price.

D)but not the obligation to sell an asset at a given price.

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

20

Suppose an investor sells (writes) a put option.What will happen if the stock price on the exercise date exceeds the exercise price?

A)The seller will need to deliver stock to the owner of the option.

B)The seller will be obliged to buy stock from the owner of the option.

C)The owner will not exercise the option.

D)The option will extend for nine more months.

A)The seller will need to deliver stock to the owner of the option.

B)The seller will be obliged to buy stock from the owner of the option.

C)The owner will not exercise the option.

D)The option will extend for nine more months.

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

21

If the volatility of the underlying asset decreases, then the

A)value of the put option will increase, but the value of the call option will decrease.

B)value of the put option will decrease, but the value of the call option will increase.

C)value of both the put and call option will increase.

D)value of both the put and call option will decrease.

A)value of the put option will increase, but the value of the call option will decrease.

B)value of the put option will decrease, but the value of the call option will increase.

C)value of both the put and call option will increase.

D)value of both the put and call option will decrease.

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

22

For European options, the value of a put is equal to

A)the value of a call minus the value of a share plus the present value of the exercise price.

B)the value of a call plus the value of a share plus the present value of the exercise price.

C)the value of the share minus the value of a call plus the present value of the exercise price.

D)the value of the share minus the present value of the exercise price plus the value of a call.

A)the value of a call minus the value of a share plus the present value of the exercise price.

B)the value of a call plus the value of a share plus the present value of the exercise price.

C)the value of the share minus the value of a call plus the present value of the exercise price.

D)the value of the share minus the present value of the exercise price plus the value of a call.

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

23

Suppose an investor buys one share of stock and a put option on the stock.What will be the value of her investment on the final exercise date if the stock price is below the exercise price? (Ignore transaction costs.)

A)The value of two shares of stock

B)The value of one share of stock plus the exercise price

C)The exercise price

D)The value of one share of stock minus the exercise price

A)The value of two shares of stock

B)The value of one share of stock plus the exercise price

C)The exercise price

D)The value of one share of stock minus the exercise price

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

24

A call option has an exercise price of $150.At the option expiration date, the stock price could be either $100 or $200.Which investment would combine to give the same payoff as the stock?

A)Lend PV of $100 and buy two calls.

B)Lend PV of $100 and sell two calls.

C)Borrow $100 and buy two calls.

D)Borrow $100 and sell two calls.

A)Lend PV of $100 and buy two calls.

B)Lend PV of $100 and sell two calls.

C)Borrow $100 and buy two calls.

D)Borrow $100 and sell two calls.

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

25

Buying a call option, investing the present value of the exercise price in T-bills, and short-selling the underlying share is the same as

A)buying a call and a put.

B)buying a put and a share.

C)buying a put.

D)selling a call.

A)buying a call and a put.

B)buying a put and a share.

C)buying a put.

D)selling a call.

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

26

Buying the stock and the put option on the stock provides the same payoff as

A)investing the present value of the exercise price in T-bills and buying the call option on the stock.

B)short-selling the stock and buying a call option on the stock.

C)writing (selling) a put option and buying a call option on the stock.

D)a T-bill.

A)investing the present value of the exercise price in T-bills and buying the call option on the stock.

B)short-selling the stock and buying a call option on the stock.

C)writing (selling) a put option and buying a call option on the stock.

D)a T-bill.

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

27

Which of the following features increase(s) the value of a call option?

A)A high interest rate

B)A long time to maturity

C)A higher volatility of the underlying stock price

D)A high interest rate, a long time to maturity, and a higher volatility of the underlying stock price

A)A high interest rate

B)A long time to maturity

C)A higher volatility of the underlying stock price

D)A high interest rate, a long time to maturity, and a higher volatility of the underlying stock price

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

28

Put-call parity can be used to show

A)how valuable in-the-money put options can get.

B)how valuable in-the-money call options can get.

C)the precise relationship between put and call option prices, given equal exercise prices and equal expiration dates.

D)that the value of a call option is always twice that of a put, given equal exercise prices and equal expiration dates.

A)how valuable in-the-money put options can get.

B)how valuable in-the-money call options can get.

C)the precise relationship between put and call option prices, given equal exercise prices and equal expiration dates.

D)that the value of a call option is always twice that of a put, given equal exercise prices and equal expiration dates.

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

29

Relative to the underlying stock, a call option always has

A)a higher beta and a higher standard deviation of return.

B)a lower beta and a higher standard deviation of return.

C)a higher beta and a lower standard deviation of return.

D)a lower beta and a lower standard deviation of return.

A)a higher beta and a higher standard deviation of return.

B)a lower beta and a higher standard deviation of return.

C)a higher beta and a lower standard deviation of return.

D)a lower beta and a lower standard deviation of return.

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

30

For European options, the value of a call minus the value of a put is equal to

A)the present value of the exercise price minus the value of a share.

B)the present value of the exercise price plus the value of a share.

C)the value of a share plus the present value of the exercise price.

D)the value of a share minus the present value of the exercise price.

A)the present value of the exercise price minus the value of a share.

B)the present value of the exercise price plus the value of a share.

C)the value of a share plus the present value of the exercise price.

D)the value of a share minus the present value of the exercise price.

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

31

All else equal, as the underlying stock price increases,

A)the put price increases.

B)the put price decreases.

C)there is no effect on put price.

D)the put price can either increase, decrease, or remain the same.

A)the put price increases.

B)the put price decreases.

C)there is no effect on put price.

D)the put price can either increase, decrease, or remain the same.

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

32

If the stock makes a dividend payment before the expiration date, then the put-call parity relation is

A)Value of call = value of put + share price - present value (PV) of dividend - PV of exercise price.

B)Value of call = value of put - share price + PV of dividend - PV of exercise price.

C)Value of call = value of put + share price + PV of dividend + PV of exercise price.

D)Value of call = value of put + share price + PV of dividend - PV of exercise price.

A)Value of call = value of put + share price - present value (PV) of dividend - PV of exercise price.

B)Value of call = value of put - share price + PV of dividend - PV of exercise price.

C)Value of call = value of put + share price + PV of dividend + PV of exercise price.

D)Value of call = value of put + share price + PV of dividend - PV of exercise price.

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

33

If the risk-free interest rate increases, then

A)call option prices increase.

B)call option prices decrease.

C)call option prices remain the same.

D)call option prices can either increase, decrease, or remain the same.

A)call option prices increase.

B)call option prices decrease.

C)call option prices remain the same.

D)call option prices can either increase, decrease, or remain the same.

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

34

Suppose an investor buys one share of stock and a put option on the stock and simultaneously sells a call option on the stock with the same exercise price.What will be the value of his investment on the final exercise date?

A)Above the exercise price if the stock price rises and below the exercise price if it falls

B)Equal to the exercise price regardless of the stock price

C)Equal to zero regardless of the stock price

D)Below the exercise price if the stock price rises and above if it falls

A)Above the exercise price if the stock price rises and below the exercise price if it falls

B)Equal to the exercise price regardless of the stock price

C)Equal to zero regardless of the stock price

D)Below the exercise price if the stock price rises and above if it falls

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

35

Suppose the underlying stock pays a dividend before the expiration of options on that stock.This will

A)increase the value of a call option and increase the value of a put option.

B)decrease the value of a call option and decrease the value of a put option.

C)increase the value of a call option and decrease the value of a put option.

D)increase the value of a put option and decrease the value of a call option.

A)increase the value of a call option and increase the value of a put option.

B)decrease the value of a call option and decrease the value of a put option.

C)increase the value of a call option and decrease the value of a put option.

D)increase the value of a put option and decrease the value of a call option.

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

36

Which of the following investors would be happy to see the stock price rise sharply?

A)An investor who owns the stock and a put option and an investor who has sold a put option and bought a call option

B)An investor who owns the stock and has sold a call option and an investor who has sold a call option

C)An investor who owns the stock and has sold a call option

D)An investor who has sold a call option

A)An investor who owns the stock and a put option and an investor who has sold a put option and bought a call option

B)An investor who owns the stock and has sold a call option and an investor who has sold a call option

C)An investor who owns the stock and has sold a call option

D)An investor who has sold a call option

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

37

Consider the following data for a European option: Expiration = 6 months; Stock price = $80; Exercise price = $75; Call option price = $12; Risk-free rate = 5 percent per year.Using put-call parity, calculate the price of a put option having the same exercise price and expiration date.

A)$3.07

B)$5.19

C)$11.43

D)$3.42

A)$3.07

B)$5.19

C)$11.43

D)$3.42

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

38

All else equal, as the underlying stock price increases,

A)the call price decreases.

B)the call price increases.

C)there is no effect on call price.

D)the call price can either increase, decrease, or remain the same.

A)the call price decreases.

B)the call price increases.

C)there is no effect on call price.

D)the call price can either increase, decrease, or remain the same.

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

39

Suppose you buy a call and lend the present value of its exercise price.You could match the payoffs of this strategy by

A)buying the underlying stock and selling a call.

B)selling a put and lending the present value of the exercise price.

C)buying the underlying stock and buying a put.

D)buying the underlying stock and selling a put.

A)buying the underlying stock and selling a call.

B)selling a put and lending the present value of the exercise price.

C)buying the underlying stock and buying a put.

D)buying the underlying stock and selling a put.

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

40

For European options, the value of a call plus the present value of the exercise price is equal to

A)the value of a put minus the value of a share.

B)the value of a share minus the value of a call.

C)the value of a put plus the value of a share.

D)the value of a share minus the value of a put.

A)the value of a put minus the value of a share.

B)the value of a share minus the value of a call.

C)the value of a put plus the value of a share.

D)the value of a share minus the value of a put.

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

41

It is possible to replicate an investment in a call option by a levered investment in the underlying asset.

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

42

An increase in the underlying stock price results in an increase in a call option's price.

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

43

The value of a put option is positively related to the

A)exercise price, time to expiration, and volatility of the underlying stock price.

B)time to expiration, volatility of the underlying stock price, and risk-free rate.

C)exercise price, time to expiration, and risk-free rate.

D)risk-free rate.

A)exercise price, time to expiration, and volatility of the underlying stock price.

B)time to expiration, volatility of the underlying stock price, and risk-free rate.

C)exercise price, time to expiration, and risk-free rate.

D)risk-free rate.

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

44

The value of a put option is negatively related to the

A)stock price.

B)volatility of the underlying stock price.

C)stock price and volatility of the underlying stock price.

D)exercise price.

A)stock price.

B)volatility of the underlying stock price.

C)stock price and volatility of the underlying stock price.

D)exercise price.

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

45

The value of a call option is negatively related to the

A)exercise price.

B)risk-free rate.

C)time to expiration.

D)risk-free rate and time to expiration.

A)exercise price.

B)risk-free rate.

C)time to expiration.

D)risk-free rate and time to expiration.

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

46

An increase in exercise price results in an equal increase in the call option's price.

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

47

If you write a put option, you acquire the right to buy stock at a fixed strike price.

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

48

Buying a stock and a put option and lending the present value of the exercise price provide the same payoff as buying a call option.

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

49

The value of a call option increases as the volatility of the underlying stock price increases.

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

50

A profit diagram implicitly neglects the time value of money.

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

51

An investor can get downside protection on the purchase of stock by buying a put option.

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

52

The value of any option (both call and put options) is positively related to the

A)volatility of the underlying stock price and time to expiration.

B)time to expiration and risk-free rate.

C)volatility of the underlying stock price and risk-free rate.

D)risk-free rate.

A)volatility of the underlying stock price and time to expiration.

B)time to expiration and risk-free rate.

C)volatility of the underlying stock price and risk-free rate.

D)risk-free rate.

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

53

Call options can have a positive value at expiration even when the underlying stock is worthless.

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

54

The value of a call option is positively related to the following:

A)underlying stock price.

B)risk-free rate.

C)time to expiration.

D)underlying stock price, risk-free rate, time to expiration, and volatility of the underlying stock price.

A)underlying stock price.

B)risk-free rate.

C)time to expiration.

D)underlying stock price, risk-free rate, time to expiration, and volatility of the underlying stock price.

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

55

A European option gives its owner the right to exercise the option at any time before expiration.

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

56

If the stock price follows a random walk, successive price changes are statistically independent.If σ2 is the variance of the daily price change, and there are t days until expiration, the variance of the cumulative price change is

A)"σ2"

B)" (σ2) × (t)."

C)" (σ2)/t."

D)" (σ2) × (t2)."

A)"σ2"

B)" (σ2) × (t)."

C)" (σ2)/t."

D)" (σ2) × (t2)."

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

57

Position diagrams and profit diagrams are one and the same.

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

58

An American call option gives its owner the right to buy stock at a fixed strike price during a specified period of time.

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

59

For a European option: Value of call + PV(exercise price) = Value of put + Share price.

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

60

The writer of a put option loses if the stock price declines.

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

61

Define the term call option.

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

62

Explain the difference between a European option and an American option.

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

63

Briefly discuss the usefulness of position diagrams.

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

64

Briefly explain what is meant by protective put.

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

65

Explain the main differences between position diagrams and profit diagrams.

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

66

All else equal, options written on volatile assets are worth more than options written on safer assets.

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

67

Discuss the factors that determine the value of a call option.

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

68

Briefly explain what is meant by put-call parity.

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

69

Briefly explain the relationship between risk and option values.

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

70

Why would an option holder almost never exercise an option early?

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

71

Buying an in-the-money option will almost always produce a profit.

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

72

Define the term put option.

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

73

Briefly explain how an option holder gains from an increase in the volatility of the underlying stock price.

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

74

Define the term option.

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

75

All else equal, the closer an option gets to expiration, the lower the option price.

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck