Deck 5: Activity-Based Costing and Management

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/72

Play

Full screen (f)

Deck 5: Activity-Based Costing and Management

1

Wanda Florists uses an activity-based costing system to compute the cost of making floral bouquets and delivering the bouquets to its commercial customers. Company personnel who earn $90,000 typically perform both tasks; other firm-wide overhead is expected to total $50,000. These costs are allocated as follows: Wanda anticipates making 30,000 bouquets and 6,000 deliveries in the upcoming year. The cost of wages and salaries and other overhead that would be charged to each delivery is:

A)$3.89.

B)$7.50.

C)$9.58.

D)$14.00.

E)$23.33.

A)$3.89.

B)$7.50.

C)$9.58.

D)$14.00.

E)$23.33.

$9.58.

2

The following tasks are associated with an activity-based costing system: 1-Calculation of pool rates

2-Identification of cost drivers

3-Assignment of cost to products

4-Identification of cost pools

Which of the following choices correctly expresses the proper order of the preceding tasks?

A)1, 2, 3, 4.

B)2, 4, 1, 3.

C)3, 4, 2, 1.

D)4, 2, 1, 3.

E)4, 2, 3, 1.

2-Identification of cost drivers

3-Assignment of cost to products

4-Identification of cost pools

Which of the following choices correctly expresses the proper order of the preceding tasks?

A)1, 2, 3, 4.

B)2, 4, 1, 3.

C)3, 4, 2, 1.

D)4, 2, 1, 3.

E)4, 2, 3, 1.

D

3

Which of the following is not a broad cost classification category typically used in activity-based costing?

A)Unit-level.

B)Batch-level.

C)Product-sustaining level.

D)Facility-level.

E)Management-level.

A)Unit-level.

B)Batch-level.

C)Product-sustaining level.

D)Facility-level.

E)Management-level.

E

4

Which of the following is least likely to be classified as a facility-level activity in an activity-based costing system?

A)Plant maintenance.

B)Property taxes.

C)Machine processing cost.

D)Plant depreciation.

E)Plant management salaries.

A)Plant maintenance.

B)Property taxes.

C)Machine processing cost.

D)Plant depreciation.

E)Plant management salaries.

Unlock Deck

Unlock for access to all 72 flashcards in this deck.

Unlock Deck

k this deck

5

X-Ray Machines Ltd. manufactures three product lines: Standard, Deluxe, and Superior. The company, which uses activity-based costing, has identified five activities (and related cost drivers). Each activity, its budgeted cost, and related cost driver is identified below. The following information pertains to the three product lines for next year: What is X-Ray's pool rate for the packaging activity?

A)$100.00 per order shipped.

B)$100.00 per labour hour.

C)$100.00 per unit.

D)$100.00 per machine hour.

E)$200.00 per order shipped.

A)$100.00 per order shipped.

B)$100.00 per labour hour.

C)$100.00 per unit.

D)$100.00 per machine hour.

E)$200.00 per order shipped.

Unlock Deck

Unlock for access to all 72 flashcards in this deck.

Unlock Deck

k this deck

6

X-Ray Machines Ltd. manufactures three product lines: Standard, Deluxe, and Superior. The company, which uses activity-based costing, has identified five activities (and related cost drivers). Each activity, its budgeted cost, and related cost driver is identified below. The following information pertains to the three product lines for next year: What is X-Ray's pool rate for the finishing activity?

A)$3.13 per labour hour.

B)$3.13 per machine hour.

C)$3.13 per unit.

D)$3.13 per part.

E)$50,000.

A)$3.13 per labour hour.

B)$3.13 per machine hour.

C)$3.13 per unit.

D)$3.13 per part.

E)$50,000.

Unlock Deck

Unlock for access to all 72 flashcards in this deck.

Unlock Deck

k this deck

7

The division of activities into unit-level, batch-level, product-sustaining level, and facility-level categories is commonly known as a cost:

A)object.

B)application method.

C)hierarchy.

D)estimation method.

E)classification scheme that is useful in traditional, volume-based systems.

A)object.

B)application method.

C)hierarchy.

D)estimation method.

E)classification scheme that is useful in traditional, volume-based systems.

Unlock Deck

Unlock for access to all 72 flashcards in this deck.

Unlock Deck

k this deck

8

Which of the following is the proper sequence of events in an activity-based costing system?

A)Identification of cost drivers, identification of cost pools, calculation of pool rates, assignment of cost to products.

B)Identification of cost pools, identification of cost drivers, calculation of pool rates, assignment of cost to products.

C)Assignment of cost to products, identification of cost pools, identification of cost drivers, calculation of pool rates.

D)Calculation of pool rates, identification of cost drivers, identification of cost pools, assignment of cost to products.

E)Identification of cost drivers, assignment of costs to products, calculation of pool rates, identification of cost pools.

A)Identification of cost drivers, identification of cost pools, calculation of pool rates, assignment of cost to products.

B)Identification of cost pools, identification of cost drivers, calculation of pool rates, assignment of cost to products.

C)Assignment of cost to products, identification of cost pools, identification of cost drivers, calculation of pool rates.

D)Calculation of pool rates, identification of cost drivers, identification of cost pools, assignment of cost to products.

E)Identification of cost drivers, assignment of costs to products, calculation of pool rates, identification of cost pools.

Unlock Deck

Unlock for access to all 72 flashcards in this deck.

Unlock Deck

k this deck

9

Many traditional product costing systems:

A)trace manufacturing overhead to individual activities and require the development of numerous activity-costing rates.

B)write off manufacturing overhead as an expense of the current period.

C)combine widely varying elements of overhead into a single cost pool.

D)use a host of different cost drivers (e.g., number of production setups, inspection hours, orders processed) to improve the accuracy of product costing.

E)produce results far superior to those achieved with activity-based costing.

A)trace manufacturing overhead to individual activities and require the development of numerous activity-costing rates.

B)write off manufacturing overhead as an expense of the current period.

C)combine widely varying elements of overhead into a single cost pool.

D)use a host of different cost drivers (e.g., number of production setups, inspection hours, orders processed) to improve the accuracy of product costing.

E)produce results far superior to those achieved with activity-based costing.

Unlock Deck

Unlock for access to all 72 flashcards in this deck.

Unlock Deck

k this deck

10

X-Ray Machines Ltd. manufactures three product lines: Standard, Deluxe, and Superior. The company, which uses activity-based costing, has identified five activities (and related cost drivers). Each activity, its budgeted cost, and related cost driver is identified below. The following information pertains to the three product lines for next year: What is X-Ray's pool rate for the automated machinery activity?

A)$1.88 per machine hour.

B)$6.25 per machine hour.

C)$14.06 per labour hour.

D)$28.13 per unit.

E)$450.

A)$1.88 per machine hour.

B)$6.25 per machine hour.

C)$14.06 per labour hour.

D)$28.13 per unit.

E)$450.

Unlock Deck

Unlock for access to all 72 flashcards in this deck.

Unlock Deck

k this deck

11

Profile Incorporated, an appliance manufacturer, is developing a new line of ovens that uses controlled-laser technology. The research and testing costs associated with the new ovens is said to arise from a:

A)unit-level activity.

B)batch-level activity.

C)product-sustaining-level activity.

D)facility-level activity.

E)competitive-level activity.

A)unit-level activity.

B)batch-level activity.

C)product-sustaining-level activity.

D)facility-level activity.

E)competitive-level activity.

Unlock Deck

Unlock for access to all 72 flashcards in this deck.

Unlock Deck

k this deck

12

Which of the following choices correctly depicts the proper classification of direct materials used and management salaries?

A)1.

B)2.

C)3.

D)4.

E)5.

A)1.

B)2.

C)3.

D)4.

E)5.

Unlock Deck

Unlock for access to all 72 flashcards in this deck.

Unlock Deck

k this deck

13

Wanda Florists uses an activity-based costing system to compute the cost of making floral bouquets and delivering the bouquets to its commercial customers. Company personnel who earn $90,000 typically perform both tasks; other firm-wide overhead is expected to total $50,000. These costs are allocated as follows: Wanda anticipates making 30,000 bouquets and 6,000 deliveries in the upcoming year. The cost of wages and salaries and other overhead that would be charged to each bouquet made is:

A)$2.20.

B)$3.89.

C)$4.67.

D)$5.56.

E)$18.33.

A)$2.20.

B)$3.89.

C)$4.67.

D)$5.56.

E)$18.33.

Unlock Deck

Unlock for access to all 72 flashcards in this deck.

Unlock Deck

k this deck

14

In an activity-based costing system, plant depreciation would typically be classified as a:

A)unit-level activity.

B)batch-level activity.

C)product-sustaining activity.

D)facility-level activity.

E)period-level activity.

A)unit-level activity.

B)batch-level activity.

C)product-sustaining activity.

D)facility-level activity.

E)period-level activity.

Unlock Deck

Unlock for access to all 72 flashcards in this deck.

Unlock Deck

k this deck

15

X-Ray Machines Ltd. manufactures three product lines: Standard, Deluxe, and Superior. The company, which uses activity-based costing, has identified five activities (and related cost drivers). Each activity, its budgeted cost, and related cost driver is identified below. The following information pertains to the three product lines for next year: What is X-Ray's pool rate for the material-handling activity?

A)$1.26 per part.

B)$4.00 per part.

C)$9.38 per labour hour.

D)$18.75 per part.

E)$12,000.

A)$1.26 per part.

B)$4.00 per part.

C)$9.38 per labour hour.

D)$18.75 per part.

E)$12,000.

Unlock Deck

Unlock for access to all 72 flashcards in this deck.

Unlock Deck

k this deck

16

X-Ray Machines Ltd. manufactures three product lines: Standard, Deluxe, and Superior. The company, which uses activity-based costing, has identified five activities (and related cost drivers). Each activity, its budgeted cost, and related cost driver is identified below. The following information pertains to the three product lines for next year: Under an activity-based costing system, what is the per-unit cost of Standard?

A)$73.88.

B)$96.88.

C)$157.88.

D)$160.88.

E)165.88.

A)$73.88.

B)$96.88.

C)$157.88.

D)$160.88.

E)165.88.

Unlock Deck

Unlock for access to all 72 flashcards in this deck.

Unlock Deck

k this deck

17

Which of the following tasks is not normally associated with an activity-based costing system?

A)Calculation of pool rates.

B)Identification of cost pools.

C)Preparation of allocation matrices.

D)Identification of cost drivers.

E)Assignment of cost to products.

A)Calculation of pool rates.

B)Identification of cost pools.

C)Preparation of allocation matrices.

D)Identification of cost drivers.

E)Assignment of cost to products.

Unlock Deck

Unlock for access to all 72 flashcards in this deck.

Unlock Deck

k this deck

18

The salaries of a manufacturing plant's management are said to arise from:

A)unit-level activities.

B)batch-level activities.

C)product-sustaining activities.

D)facility-level activities.

E)direct-cost activities.

A)unit-level activities.

B)batch-level activities.

C)product-sustaining activities.

D)facility-level activities.

E)direct-cost activities.

Unlock Deck

Unlock for access to all 72 flashcards in this deck.

Unlock Deck

k this deck

19

Brown's customer service department follows up on customer complaints by telephone inquiry. During a recent period, the department initiated 9,000 calls and incurred costs of $303,000. If 3,780 of these calls were for the company's wholesale operation (the remainder were for the retail division), costs allocated to the retail division should amount to:

A)$0.

B)$127,260.

C)$175,740.

D)$219,414.

E)$303,000.

A)$0.

B)$127,260.

C)$175,740.

D)$219,414.

E)$303,000.

Unlock Deck

Unlock for access to all 72 flashcards in this deck.

Unlock Deck

k this deck

20

Which of the following choice of rows correctly depicts a cost that arises from a batch-level activity and one that arises from a facility-level activity?

A)1

B)2

C)3

D)4

E)5

A)1

B)2

C)3

D)4

E)5

Unlock Deck

Unlock for access to all 72 flashcards in this deck.

Unlock Deck

k this deck

21

Jackson Company manufactures products X and Y, applying overhead on the basis of labour hours. X, a low-volume product, requires a variety of complex manufacturing procedures. Y, on the other hand, is both a high-volume product and relatively simplistic in nature. What would an activity-based costing system likely disclose about products X and Y as a result of Jackson's current accounting procedures?

A)1.

B)2.

C)3.

D)4.

E)5.

A)1.

B)2.

C)3.

D)4.

E)5.

Unlock Deck

Unlock for access to all 72 flashcards in this deck.

Unlock Deck

k this deck

22

X-Ray Machines Ltd. manufactures three product lines: Standard, Deluxe, and Superior. The company, which uses activity-based costing, has identified five activities (and related cost drivers). Each activity, its budgeted cost, and related cost driver is identified below. The following information pertains to the three product lines for next year: Assume that X-Ray is using a volume-based costing system, and the preceding manufacturing costs are applied to all products based on direct labour hours. How much of the preceding cost, rounded to the nearest dollar, would be assigned to Deluxe?

A)$240,625.

B)$481,250.

C)$962,500.

D)$1,375,000.

E)$2,200,000.

A)$240,625.

B)$481,250.

C)$962,500.

D)$1,375,000.

E)$2,200,000.

Unlock Deck

Unlock for access to all 72 flashcards in this deck.

Unlock Deck

k this deck

23

Grossman Enterprises is converting to an activity-based costing system and needs to depict the various activities in its manufacturing process along with the activities' relationships. Which of the following is a possible tool that the company can use to accomplish this task?

A)Storyboards.

B)Activity relationship charts (ARCs).

C)Decision trees.

D)Simulation games.

E)Process organizers.

A)Storyboards.

B)Activity relationship charts (ARCs).

C)Decision trees.

D)Simulation games.

E)Process organizers.

Unlock Deck

Unlock for access to all 72 flashcards in this deck.

Unlock Deck

k this deck

24

X-Ray Machines Ltd. manufactures three product lines: Standard, Deluxe, and Superior. The company, which uses activity-based costing, has identified five activities (and related cost drivers). Each activity, its budgeted cost, and related cost driver is identified below. The following information pertains to the three product lines for next year: Under an activity-based costing system, what is the per-unit cost of Deluxe?

A)$96.88.

B)$111.94.

C)$155.94.

D)$165.94.

E)$168.00

A)$96.88.

B)$111.94.

C)$155.94.

D)$165.94.

E)$168.00

Unlock Deck

Unlock for access to all 72 flashcards in this deck.

Unlock Deck

k this deck

25

Activity-based costing systems:

A)use a single, volume-based cost driver.

B)assign overhead to products based on the products' relative usage of direct labour.

C)often reveal products that were undercosted or overcosted by traditional product costing systems.

D)typically use fewer cost drivers than more traditional costing systems.

E)have a tendency to distort product costs.

A)use a single, volume-based cost driver.

B)assign overhead to products based on the products' relative usage of direct labour.

C)often reveal products that were undercosted or overcosted by traditional product costing systems.

D)typically use fewer cost drivers than more traditional costing systems.

E)have a tendency to distort product costs.

Unlock Deck

Unlock for access to all 72 flashcards in this deck.

Unlock Deck

k this deck

26

Consumption ratios are useful in determining:

A)the existence of product line diversity.

B)overhead that is incurred at the unit level.

C)if overhead-producing activities are being utilized effectively.

D)if overhead costs are being applied to products.

E)if overhead-producing activities are being utilized efficiently.

A)the existence of product line diversity.

B)overhead that is incurred at the unit level.

C)if overhead-producing activities are being utilized effectively.

D)if overhead costs are being applied to products.

E)if overhead-producing activities are being utilized efficiently.

Unlock Deck

Unlock for access to all 72 flashcards in this deck.

Unlock Deck

k this deck

27

St. James, Inc., currently uses traditional costing procedures, applying $800,000 of overhead to products Beta and Zeta on the basis of direct labour hours. The company is considering a shift to activity-based costing and the creation of individual cost pools that will use direct labour hours (DLH), production setups (SU), and number of parts components (PC) as cost drivers. Data on the cost pools and respective driver volumes follow. The overhead cost allocated to Beta by using traditional costing procedures would be:

A)$240,000.

B)$360,000.

C)$440,000.

D)$560,000.

E)$800,000.

A)$240,000.

B)$360,000.

C)$440,000.

D)$560,000.

E)$800,000.

Unlock Deck

Unlock for access to all 72 flashcards in this deck.

Unlock Deck

k this deck

28

During a recent accounting period, Marty's shipping department processed 26 orders. Each order typically takes four hours to complete; however, the average time increased to five hours because of various departmental inefficiencies. If shipping labour is paid $14 per hour, the company's non-value-added cost would be:

A)$14.

B)$56.

C)$364.

D)$1,456.

E)$1,820.

A)$14.

B)$56.

C)$364.

D)$1,456.

E)$1,820.

Unlock Deck

Unlock for access to all 72 flashcards in this deck.

Unlock Deck

k this deck

29

Dreyfus Manufacturing sells a number of goods whose selling price is heavily influenced by cost. A recent study of product no. 519 revealed a traditionally-derived total cost of $1,019, a selling price of $1,850 based on that figure, and a newly computed activity-based total cost of $1,215. Which of the following statements is true?

A)All other things being equal, the company should consider a drop in its sales price.

B)The company may have been extremely competitive in the marketplace from a price perspective.

C)Product no. 519 could be labeled as being overcosted by the firm's traditional costing procedures.

D)If product no. 519 is undercosted by traditional accounting procedures, then all of the company's other products must be undercosted as well.

E)Generally speaking, the activity-based cost figure is "less accurate" than the traditionally-derived cost figure.

A)All other things being equal, the company should consider a drop in its sales price.

B)The company may have been extremely competitive in the marketplace from a price perspective.

C)Product no. 519 could be labeled as being overcosted by the firm's traditional costing procedures.

D)If product no. 519 is undercosted by traditional accounting procedures, then all of the company's other products must be undercosted as well.

E)Generally speaking, the activity-based cost figure is "less accurate" than the traditionally-derived cost figure.

Unlock Deck

Unlock for access to all 72 flashcards in this deck.

Unlock Deck

k this deck

30

In comparison with a system that uses a single volume-based cost driver, an activity-based costing system is preferred when a company has:

A)a small proportion of non-unit-level activities.

B)product line diversity or a large proportion of non-unit-level activities.

C)minimal product line diversity and a small proportion of non-unit-level activities.

D)existing variances from budgeted amounts.

E)uses a single overhead pool.

A)a small proportion of non-unit-level activities.

B)product line diversity or a large proportion of non-unit-level activities.

C)minimal product line diversity and a small proportion of non-unit-level activities.

D)existing variances from budgeted amounts.

E)uses a single overhead pool.

Unlock Deck

Unlock for access to all 72 flashcards in this deck.

Unlock Deck

k this deck

31

St. James, Inc., currently uses traditional costing procedures, applying $800,000 of overhead to products Beta and Zeta on the basis of direct labour hours. The company is considering a shift to activity-based costing and the creation of individual cost pools that will use direct labour hours (DLH), production setups (SU), and number of parts components (PC) as cost drivers. Data on the cost pools and respective driver volumes follow. The overhead cost allocated to Zeta by using traditional costing procedures would be:

A)$240,000.

B)$360,000.

C)$440,000.

D)$560,000.

E)$800,000.

A)$240,000.

B)$360,000.

C)$440,000.

D)$560,000.

E)$800,000.

Unlock Deck

Unlock for access to all 72 flashcards in this deck.

Unlock Deck

k this deck

32

St. James, Inc., currently uses traditional costing procedures, applying $800,000 of overhead to products Beta and Zeta on the basis of direct labour hours. The company is considering a shift to activity-based costing and the creation of individual cost pools that will use direct labour hours (DLH), production setups (SU), and number of parts components (PC) as cost drivers. Data on the cost pools and respective driver volumes follow. The overhead cost allocated to Zeta by using activity-based costing procedures would be:

A)$240,000.

B)$356,000.

C)$444,000.

D)$560,000.

E)$800,000.

A)$240,000.

B)$356,000.

C)$444,000.

D)$560,000.

E)$800,000.

Unlock Deck

Unlock for access to all 72 flashcards in this deck.

Unlock Deck

k this deck

33

Oliver and Sprung, an accounting firm, provides tax compliance and tax planning services. A recent analysis found that 65% of the firm's billable hours to clients resulted from tax planning and for many years, the firm's total administrative cost (currently $300,000) has been allocated to services on this basis. The firm, contemplating a change to activity-based costing, has identified three components of administrative cost, as follows: A recent analysis of staff support found a strong correlation with the number of clients served. In contrast, in-house IT and miscellaneous office expenditures varied directly with the number of computer hours logged and number of client transactions, respectively. Tax compliance clients served totaled 25% of the total client base, consumed 35% of the firm's computer hours, and accounted for 30% of the total client transactions.

If Oliver and Sprung switched from its current accounting method to an activity-based costing system, the amount of administrative cost chargeable to tax compliance services would:

A)decrease by $24,500.

B)increase by $24,500.

C)decrease by $114,500.

D)increase by $114,500.

E)decrease by $89,000.

If Oliver and Sprung switched from its current accounting method to an activity-based costing system, the amount of administrative cost chargeable to tax compliance services would:

A)decrease by $24,500.

B)increase by $24,500.

C)decrease by $114,500.

D)increase by $114,500.

E)decrease by $89,000.

Unlock Deck

Unlock for access to all 72 flashcards in this deck.

Unlock Deck

k this deck

34

St. James, Inc., currently uses traditional costing procedures, applying $800,000 of overhead to products Beta and Zeta on the basis of direct labour hours. The company is considering a shift to activity-based costing and the creation of individual cost pools that will use direct labour hours (DLH), production setups (SU), and number of parts components (PC) as cost drivers. Data on the cost pools and respective driver volumes follow. The overhead cost allocated to Beta by using activity-based costing procedures would be:

A)$240,000.

B)$356,000.

C)$444,000.

D)$560,000.

E)$800,000.

A)$240,000.

B)$356,000.

C)$444,000.

D)$560,000.

E)$800,000.

Unlock Deck

Unlock for access to all 72 flashcards in this deck.

Unlock Deck

k this deck

35

Vanguard combines all manufacturing overhead into a single cost pool and allocates this overhead to products by using machine hours. Activity-based costing would likely show that with Vanguard's current procedures:

A)all of the company's products are undercosted.

B)the company's high-volume products are undercosted.

C)all of the company's products are overcosted.

D)the company's high-volume products are overcosted.

E)the company's low-volume products are overcosted.

A)all of the company's products are undercosted.

B)the company's high-volume products are undercosted.

C)all of the company's products are overcosted.

D)the company's high-volume products are overcosted.

E)the company's low-volume products are overcosted.

Unlock Deck

Unlock for access to all 72 flashcards in this deck.

Unlock Deck

k this deck

36

X-Ray Machines Ltd. manufactures three product lines: Standard, Deluxe, and Superior. The company, which uses activity-based costing, has identified five activities (and related cost drivers). Each activity, its budgeted cost, and related cost driver is identified below. The following information pertains to the three product lines for next year: Assume that X-Ray is using a volume-based costing system, and the preceding manufacturing costs are applied to all products based on direct labour hours. How much of the preceding cost, rounded to the nearest dollar, would be assigned to Superior?

A)$34,375.

B)$240,625.

C)$481,250.

D)$962,500.

E)$2,200,000.

A)$34,375.

B)$240,625.

C)$481,250.

D)$962,500.

E)$2,200,000.

Unlock Deck

Unlock for access to all 72 flashcards in this deck.

Unlock Deck

k this deck

37

Which of the following activity cost pools and activity measures likely has the lowest degree of correlation?

A)1.

B)2.

C)3.

D)4.

E)5.

A)1.

B)2.

C)3.

D)4.

E)5.

Unlock Deck

Unlock for access to all 72 flashcards in this deck.

Unlock Deck

k this deck

38

Kelly and Logan, an accounting firm, provides consulting and tax planning services. A recent analysis found that 65% of the firm's billable hours to clients resulted from tax planning and for many years, the firm's total administrative cost (currently $250,000) has been allocated to services on the basis of billable hours to clients. The firm, contemplating a change to activity-based costing, has identified three components of administrative cost, as follows: A recent analysis of staff support found a strong correlation with the number of clients served (consulting, 20 clients; tax planning, 60 clients). In contrast, in-house computing and miscellaneous office cost varied directly with the number of computer hours logged and number of client transactions, respectively. Consulting consumed 30% of the firm's computer hours and had 20% of the total client transactions.

If Kelly and Logan switched from its current accounting method to an activity-based costing system, the amount of administrative cost chargeable to consulting services would:

A)decrease by $23,500.

B)increase by $23,500.

C)decrease by $32,500.

D)increase by $32,500.

E)decrease by $64,000.

If Kelly and Logan switched from its current accounting method to an activity-based costing system, the amount of administrative cost chargeable to consulting services would:

A)decrease by $23,500.

B)increase by $23,500.

C)decrease by $32,500.

D)increase by $32,500.

E)decrease by $64,000.

Unlock Deck

Unlock for access to all 72 flashcards in this deck.

Unlock Deck

k this deck

39

Kelly and Logan, an accounting firm, provides consulting and tax planning services. A recent analysis found that 65% of the firm's billable hours to clients resulted from tax planning and for many years, the firm's total administrative cost (currently $250,000) has been allocated to services on the basis of billable hours to clients. The firm, contemplating a change to activity-based costing, has identified three components of administrative cost, as follows: A recent analysis of staff support found a strong correlation with the number of clients served (consulting, 20 clients; tax planning, 60 clients). In contrast, in-house computing and miscellaneous office cost varied directly with the number of computer hours logged and number of client transactions, respectively. Consulting consumed 30% of the firm's computer hours and had 20% of the total client transactions.

Assuming the use of activity-based costing, the proper percentage to use in allocating staff support costs to tax planning services is:

A)20%.

B)60%.

C)65%.

D)75%.

E)80%.

Assuming the use of activity-based costing, the proper percentage to use in allocating staff support costs to tax planning services is:

A)20%.

B)60%.

C)65%.

D)75%.

E)80%.

Unlock Deck

Unlock for access to all 72 flashcards in this deck.

Unlock Deck

k this deck

40

X-Ray Machines Ltd. manufactures three product lines: Standard, Deluxe, and Superior. The company, which uses activity-based costing, has identified five activities (and related cost drivers). Each activity, its budgeted cost, and related cost driver is identified below. The following information pertains to the three product lines for next year: Under an activity-based costing system, what is the per-unit cost of Superior?

A)$50.15.

B)$52.15.

C)$60.15.

D)$100.15.

E)$220.15.

A)$50.15.

B)$52.15.

C)$60.15.

D)$100.15.

E)$220.15.

Unlock Deck

Unlock for access to all 72 flashcards in this deck.

Unlock Deck

k this deck

41

Steubenville Corporation recently abandoned its traditional production and inventory system in favor of a just-in-time system. The company typically ordered 700 units of raw material at a time and purchased units that scored a 7 on a 10-point quality scale, with 10 being very close to perfection. All other things being equal, which of the following choices denotes a likely scenario under the just-in-time system?

A)1.

B)2.

C)3.

D)4.

E)5.

A)1.

B)2.

C)3.

D)4.

E)5.

Unlock Deck

Unlock for access to all 72 flashcards in this deck.

Unlock Deck

k this deck

42

The pull method of coordinating steps in the production process would attempt to reduce or eliminate:

A)raw-material inventory.

B)raw-material inventory and work-in-process inventory.

C)raw-material inventory, work-in-process inventory, and finished-goods inventory.

D)work-in-process inventory between production steps.

E)finished-goods inventory.

A)raw-material inventory.

B)raw-material inventory and work-in-process inventory.

C)raw-material inventory, work-in-process inventory, and finished-goods inventory.

D)work-in-process inventory between production steps.

E)finished-goods inventory.

Unlock Deck

Unlock for access to all 72 flashcards in this deck.

Unlock Deck

k this deck

43

Which of the following can have a positive impact on a sale's profitability?

A)Number of required sales contacts (phone calls, visits, etc.).

B)Special shipping instructions.

C)Accounts receivable collection time.

D)Purchase-order changes.

E)Minimal contact with sales personnel.

A)Number of required sales contacts (phone calls, visits, etc.).

B)Special shipping instructions.

C)Accounts receivable collection time.

D)Purchase-order changes.

E)Minimal contact with sales personnel.

Unlock Deck

Unlock for access to all 72 flashcards in this deck.

Unlock Deck

k this deck

44

Which of the following statements about a just-in-time (JIT) purchasing system is false?

A)Since there is minimal backup, companies must acquire quality raw materials.

B)Raw materials are stockpiled to avoid production disruptions.

C)In comparison with experiences under traditional systems, manufacturers normally deal with a reduced number of suppliers.

D)Supplier reliability tends to be more important under the JIT system than under a traditional purchasing system.

E)The average purchase size is smaller with the JIT system than under the traditional purchasing system.

A)Since there is minimal backup, companies must acquire quality raw materials.

B)Raw materials are stockpiled to avoid production disruptions.

C)In comparison with experiences under traditional systems, manufacturers normally deal with a reduced number of suppliers.

D)Supplier reliability tends to be more important under the JIT system than under a traditional purchasing system.

E)The average purchase size is smaller with the JIT system than under the traditional purchasing system.

Unlock Deck

Unlock for access to all 72 flashcards in this deck.

Unlock Deck

k this deck

45

St. Helena Cellars produces wine in southwestern Ontario. Consider the following selected costs that arose during the current year:

1. Safety costs at winery

2. Truckload shipping costs

3. Building maintenance costs

4. Bottle and cork cost

5. Development cost of new, after-dinner wine

6. Tasting and testing costs

Required:

A. Briefly distinguish between unit-level and product-sustaining activities.

B. Classify the six costs listed as arising from a unit-level, batch-level, product-sustaining, or facility-level activity.

1. Safety costs at winery

2. Truckload shipping costs

3. Building maintenance costs

4. Bottle and cork cost

5. Development cost of new, after-dinner wine

6. Tasting and testing costs

Required:

A. Briefly distinguish between unit-level and product-sustaining activities.

B. Classify the six costs listed as arising from a unit-level, batch-level, product-sustaining, or facility-level activity.

Unlock Deck

Unlock for access to all 72 flashcards in this deck.

Unlock Deck

k this deck

46

Weston Enterprises uses a traditional-costing system to estimate quality-control costs for its PDA product line. Costs are estimated at 32% of direct-labour cost, and direct labour totalled $860,000 for the quarter just ended. Management is contemplating a change to activity-based costing, and has established three cost pools: incoming material inspection, in-process inspection, and final product certification. Number of parts, number of units, and number of orders have been selected as the respective cost drivers.

The following data show the pool rates that have been calculated by the company along with the quantity of driver units for the PDAs: Required:

Required:

A. Calculate the quarterly quality-control cost that is allocated to the PDA product line under Weston's traditional-costing system.

B. Calculate the quarterly quality-control cost that is allocated to the PDAs if activity-based costing is used.

C. Does the traditional approach undercost or overcost the product line? By how much?

The following data show the pool rates that have been calculated by the company along with the quantity of driver units for the PDAs:

Required:

Required:A. Calculate the quarterly quality-control cost that is allocated to the PDA product line under Weston's traditional-costing system.

B. Calculate the quarterly quality-control cost that is allocated to the PDAs if activity-based costing is used.

C. Does the traditional approach undercost or overcost the product line? By how much?

Unlock Deck

Unlock for access to all 72 flashcards in this deck.

Unlock Deck

k this deck

47

The controller for Precise Manufacturing has established the following overhead cost pools and cost drivers:  Required:

Required:

A. Compute the total overhead that should be assigned to Order No. 905 by using activity-based costing.

B. Suppose that Precise were to use a single, predetermined overhead rate based on machine hours. Compute the rate per hour and the total overhead assigned to Order No. 905.

C. Discuss the merits of an activity-based costing system in comparison with a traditional costing system.

Required:

Required:A. Compute the total overhead that should be assigned to Order No. 905 by using activity-based costing.

B. Suppose that Precise were to use a single, predetermined overhead rate based on machine hours. Compute the rate per hour and the total overhead assigned to Order No. 905.

C. Discuss the merits of an activity-based costing system in comparison with a traditional costing system.

Unlock Deck

Unlock for access to all 72 flashcards in this deck.

Unlock Deck

k this deck

48

When determining customer profitability, activity-based costing is not a useful tool to analyze:

A)orders processed.

B)sales visits.

C)special packaging and handling.

D)billing and collections.

E)cost drivers.

A)orders processed.

B)sales visits.

C)special packaging and handling.

D)billing and collections.

E)cost drivers.

Unlock Deck

Unlock for access to all 72 flashcards in this deck.

Unlock Deck

k this deck

49

Star Manufacturing, contemplating the adoption of an activity-based costing system, has established three activity-cost pools: machine setup, quality assurance, and engineering. These cost pools, the appropriate cost driver, and the percentage of each cost driver consumed by the company's products (H15, H16, and H17) follow:

Estimated costs for these three activities, which account for 80% of the firm's total overhead, are $400,000, $500,000, and $120,000, respectively. Star currently applies manufacturing overhead to products on the basis of machine hours.

Estimated costs for these three activities, which account for 80% of the firm's total overhead, are $400,000, $500,000, and $120,000, respectively. Star currently applies manufacturing overhead to products on the basis of machine hours.

Required:

A. Will activity-based costing systems require more or fewer cost pools than traditional costing systems? No explanation is necessary.

B. Calculate the cost of machine setup, quality assurance, and engineering to be charged to products H15, H16, and H17 respectively.

C. Consider the company's current overhead application procedure.

1. Is Star emphasizing unit-level activities, batch-level activities, product-sustaining activities, or facility-level activities? Explain.

2. How accurate will the current costing procedure be given the nature of most of the company's activities? Briefly discuss.

3. How accurate will the current costing procedure be given the consumption ratios of the firm? Briefly discuss.

Estimated costs for these three activities, which account for 80% of the firm's total overhead, are $400,000, $500,000, and $120,000, respectively. Star currently applies manufacturing overhead to products on the basis of machine hours.

Estimated costs for these three activities, which account for 80% of the firm's total overhead, are $400,000, $500,000, and $120,000, respectively. Star currently applies manufacturing overhead to products on the basis of machine hours.Required:

A. Will activity-based costing systems require more or fewer cost pools than traditional costing systems? No explanation is necessary.

B. Calculate the cost of machine setup, quality assurance, and engineering to be charged to products H15, H16, and H17 respectively.

C. Consider the company's current overhead application procedure.

1. Is Star emphasizing unit-level activities, batch-level activities, product-sustaining activities, or facility-level activities? Explain.

2. How accurate will the current costing procedure be given the nature of most of the company's activities? Briefly discuss.

3. How accurate will the current costing procedure be given the consumption ratios of the firm? Briefly discuss.

Unlock Deck

Unlock for access to all 72 flashcards in this deck.

Unlock Deck

k this deck

50

Mainville Corporation recently abandoned its traditional production and inventory system in favor of a just-in-time system. The company typically dealt with 50 suppliers and placed 450 orders throughout the year. All other things being equal, which of the following choices denotes a likely scenario under the just-in-time system?

A)1.

B)2

C)3.

D)4.

E)5.

A)1.

B)2

C)3.

D)4.

E)5.

Unlock Deck

Unlock for access to all 72 flashcards in this deck.

Unlock Deck

k this deck

51

Marion Corporation, which produces unique office furniture, recently installed a just-in-time production system. The various steps in the company's manufacturing process are coordinated by using a philosophy known as:

A)supply pull.

B)the pull method.

C)supply push.

D)demand push.

E)activity based management.

A)supply pull.

B)the pull method.

C)supply push.

D)demand push.

E)activity based management.

Unlock Deck

Unlock for access to all 72 flashcards in this deck.

Unlock Deck

k this deck

52

When a company adopts a just-in-time inventory system, it would expect:

A)higher inventories and less frequent purchases.

B)higher inventories and more frequent purchases.

C)lower inventories and less frequent purchases.

D)lower inventories and more frequent purchases.

E)lower inventories and more units purchased on a given order.

A)higher inventories and less frequent purchases.

B)higher inventories and more frequent purchases.

C)lower inventories and less frequent purchases.

D)lower inventories and more frequent purchases.

E)lower inventories and more units purchased on a given order.

Unlock Deck

Unlock for access to all 72 flashcards in this deck.

Unlock Deck

k this deck

53

A firm that uses a JIT purchasing philosophy probably:

A)has many suppliers.

B)has extensive inspection of purchased items at the receiving point.

C)has relatively few suppliers.

D)has deliveries of purchased items made in small lot sizes immediately before the goods are needed in production.

E)has relatively few suppliers and has deliveries of purchased items made in small lot sizes immediately before the goods are needed in production.

A)has many suppliers.

B)has extensive inspection of purchased items at the receiving point.

C)has relatively few suppliers.

D)has deliveries of purchased items made in small lot sizes immediately before the goods are needed in production.

E)has relatively few suppliers and has deliveries of purchased items made in small lot sizes immediately before the goods are needed in production.

Unlock Deck

Unlock for access to all 72 flashcards in this deck.

Unlock Deck

k this deck

54

Customer profitability analysis is tied closely to:

A)just-in-time systems.

B)activity-based costing.

C)job costing.

D)process costing.

E)operation costing.

A)just-in-time systems.

B)activity-based costing.

C)job costing.

D)process costing.

E)operation costing.

Unlock Deck

Unlock for access to all 72 flashcards in this deck.

Unlock Deck

k this deck

55

Horton Corporation's customers differ greatly with respect to number of required sales contacts (e.g., phone calls and sales visits), account payment patterns, and design/engineering change orders. Which of the following choices likely denotes an ideal customer from Horton's perspective?

A)1.

B)2.

C)3.

D)4.

E)5.

A)1.

B)2.

C)3.

D)4.

E)5.

Unlock Deck

Unlock for access to all 72 flashcards in this deck.

Unlock Deck

k this deck

56

Purdy Manufacturing produces flat-screen computer monitors. Consider the following selected costs that arose during the current year:

1. Direct materials used: $4,440,000

2. Plant rent, utilities, and taxes: $1,300,000

3. New technology design engineering: $2,030,000

4. Materials receiving: $418,000

5. Manufacturing-run/set-up charges: $215,000

6. Equipment depreciation: $92,000

7. General management salaries: $1,560,000

Required:

A. Briefly distinguish between batch-level and facility-level activities.

B. Determine the cost of the firm's unit-level, batch-level, product-sustaining, and facility-level activities.

1. Direct materials used: $4,440,000

2. Plant rent, utilities, and taxes: $1,300,000

3. New technology design engineering: $2,030,000

4. Materials receiving: $418,000

5. Manufacturing-run/set-up charges: $215,000

6. Equipment depreciation: $92,000

7. General management salaries: $1,560,000

Required:

A. Briefly distinguish between batch-level and facility-level activities.

B. Determine the cost of the firm's unit-level, batch-level, product-sustaining, and facility-level activities.

Unlock Deck

Unlock for access to all 72 flashcards in this deck.

Unlock Deck

k this deck

57

Generally speaking, companies prefer doing business with customers who:

A)order small quantities rather than large quantities.

B)often change their orders.

C)require special packaging or handling.

D)request normal delivery times.

E)need specialized engineering design changes.

A)order small quantities rather than large quantities.

B)often change their orders.

C)require special packaging or handling.

D)request normal delivery times.

E)need specialized engineering design changes.

Unlock Deck

Unlock for access to all 72 flashcards in this deck.

Unlock Deck

k this deck

58

Consider the following costs that relate to a bank and a manufacturer of software:

Bank

1. Review cost of commercial loan applications

2. Operating cost of human resources department

3. Immediate processing cost of a specific customer's cash deposit

4. Bank membership cost of joining local Chamber of Commerce

Software manufacturer

5. Label and packaging charges from a commercial printer for a new software release

6. Air conditioning/heating costs of the firm's production plant

7. Transport cost of moving the CD-output from production run no. 1 to the company's warehouse

8. Design, development, and coding cost of new spreadsheet software

Required:

A. Classify the eight costs listed as arising from either a unit-level, batch-level, product-sustaining, or facility-level activity.

B. Would number of loan applications or number of customers be a more appropriate cost-driver base for the review of loan applications? Briefly explain.

Bank

1. Review cost of commercial loan applications

2. Operating cost of human resources department

3. Immediate processing cost of a specific customer's cash deposit

4. Bank membership cost of joining local Chamber of Commerce

Software manufacturer

5. Label and packaging charges from a commercial printer for a new software release

6. Air conditioning/heating costs of the firm's production plant

7. Transport cost of moving the CD-output from production run no. 1 to the company's warehouse

8. Design, development, and coding cost of new spreadsheet software

Required:

A. Classify the eight costs listed as arising from either a unit-level, batch-level, product-sustaining, or facility-level activity.

B. Would number of loan applications or number of customers be a more appropriate cost-driver base for the review of loan applications? Briefly explain.

Unlock Deck

Unlock for access to all 72 flashcards in this deck.

Unlock Deck

k this deck

59

Factory Oak produces various wooden bookcases, tables, storage units, and chairs. Which of the following would be included in a listing of the company's non-value-added activities?

A)Assembly of tables.

B)Staining of storage units.

C)Gluing of chairs.

D)Transfer of chairs from the assembly line to the gluing department.

E)Assembly of tables, staining of storage units, and gluing of chairs.

A)Assembly of tables.

B)Staining of storage units.

C)Gluing of chairs.

D)Transfer of chairs from the assembly line to the gluing department.

E)Assembly of tables, staining of storage units, and gluing of chairs.

Unlock Deck

Unlock for access to all 72 flashcards in this deck.

Unlock Deck

k this deck

60

Which of the following is not a key feature of a JIT system?

A)Purchases of materials in relatively large amounts (i.e., lot sizes).

B)A smooth, uniform production rate.

C)Total quality control.

D)Multi-skilled workers and flexible production facilities.

E)A pull method of coordinating steps in the production process.

A)Purchases of materials in relatively large amounts (i.e., lot sizes).

B)A smooth, uniform production rate.

C)Total quality control.

D)Multi-skilled workers and flexible production facilities.

E)A pull method of coordinating steps in the production process.

Unlock Deck

Unlock for access to all 72 flashcards in this deck.

Unlock Deck

k this deck

61

Pitney Corporation manufactures two types of transponders-no. 156 and no. 157-and applies manufacturing overhead to all units at the rate of $76.50 per machine hour. Production information follows.

The controller, who is studying the use of activity-based costing, has determined that the firm's overhead can be identified with three activities: manufacturing setups, machine processing, and product shipping. Data on the number of setups, machine hours worked, and outgoing shipments, the activities' three respective cost drivers, follow.

The controller, who is studying the use of activity-based costing, has determined that the firm's overhead can be identified with three activities: manufacturing setups, machine processing, and product shipping. Data on the number of setups, machine hours worked, and outgoing shipments, the activities' three respective cost drivers, follow.  The firm's total overhead of $3,060,000 is subdivided as follows: manufacturing setups, $260,000; machine processing, $2,400,000; and product shipping, $400,000.

The firm's total overhead of $3,060,000 is subdivided as follows: manufacturing setups, $260,000; machine processing, $2,400,000; and product shipping, $400,000.

Required:

A. Compute the pool rates that would be used for manufacturing setups, machine processing, and product shipping in an activity-based costing system.

B. Assuming use of activity-based costing, compute the unit overhead costs of product nos. 156 and 157 if the expected manufacturing volume is attained.

C. Assuming use of activity-based costing, compute the total cost per unit of product no. 156.

D. If the company's selling price is based heavily on cost, would a switch to activity-based costing from the current traditional system result in a price increase or decrease for product no. 156? Show computations.

The controller, who is studying the use of activity-based costing, has determined that the firm's overhead can be identified with three activities: manufacturing setups, machine processing, and product shipping. Data on the number of setups, machine hours worked, and outgoing shipments, the activities' three respective cost drivers, follow.

The controller, who is studying the use of activity-based costing, has determined that the firm's overhead can be identified with three activities: manufacturing setups, machine processing, and product shipping. Data on the number of setups, machine hours worked, and outgoing shipments, the activities' three respective cost drivers, follow.  The firm's total overhead of $3,060,000 is subdivided as follows: manufacturing setups, $260,000; machine processing, $2,400,000; and product shipping, $400,000.

The firm's total overhead of $3,060,000 is subdivided as follows: manufacturing setups, $260,000; machine processing, $2,400,000; and product shipping, $400,000.Required:

A. Compute the pool rates that would be used for manufacturing setups, machine processing, and product shipping in an activity-based costing system.

B. Assuming use of activity-based costing, compute the unit overhead costs of product nos. 156 and 157 if the expected manufacturing volume is attained.

C. Assuming use of activity-based costing, compute the total cost per unit of product no. 156.

D. If the company's selling price is based heavily on cost, would a switch to activity-based costing from the current traditional system result in a price increase or decrease for product no. 156? Show computations.

Unlock Deck

Unlock for access to all 72 flashcards in this deck.

Unlock Deck

k this deck

62

Kenyon Company produces two products (F56 and F57), applying manufacturing overhead on the basis of direct labour hours. Anticipated unit production costs (material, labour, and overhead) and manufacturing volumes are:

F56: 2,000 units, $234

F57: 3,500 units, $271

Kenyon's overhead arises because of various activities, one of which is purchase-order processing. Budgeted cost for this activity is expected to be $70,000. The firm believes that the number of purchase orders processed is a key cost driver and expects the following activity for its products: F56, 10 purchase orders; F57, 40 purchase orders. Kenyon's selling prices are based heavily on cost.

Required:

A. Activity-based costing (ABC) is said to result in improved costing accuracy when compared with traditional costing procedures. Briefly explain how this improved accuracy is attained.

B. Compute:

1. the pool rate for purchase-order processing.2. the purchase-order processing cost to be charged to one unit of F56.3. Assume that Kenyon switched to activity-based costing and calculated total unit production costs as follows: F56, $285; F57, $220.1. Which of the two products, F56 or F57, was overcosted prior to the change to ABC? No explanation is necessary.2. Which of the two products, F56 or F57, may have been less competitive in the marketplace prior to the change to ABC? Briefly explain.

F56: 2,000 units, $234

F57: 3,500 units, $271

Kenyon's overhead arises because of various activities, one of which is purchase-order processing. Budgeted cost for this activity is expected to be $70,000. The firm believes that the number of purchase orders processed is a key cost driver and expects the following activity for its products: F56, 10 purchase orders; F57, 40 purchase orders. Kenyon's selling prices are based heavily on cost.

Required:

A. Activity-based costing (ABC) is said to result in improved costing accuracy when compared with traditional costing procedures. Briefly explain how this improved accuracy is attained.

B. Compute:

1. the pool rate for purchase-order processing.2. the purchase-order processing cost to be charged to one unit of F56.3. Assume that Kenyon switched to activity-based costing and calculated total unit production costs as follows: F56, $285; F57, $220.1. Which of the two products, F56 or F57, was overcosted prior to the change to ABC? No explanation is necessary.2. Which of the two products, F56 or F57, may have been less competitive in the marketplace prior to the change to ABC? Briefly explain.

Unlock Deck

Unlock for access to all 72 flashcards in this deck.

Unlock Deck

k this deck

63

Scott, Inc., manufactures two products, Regular and Deluxe, and applies overhead on the basis of direct labour hours. Anticipated overhead and direct labour time for the upcoming accounting period are $1,600,000 and 25,000 hours, respectively. Information about the company's products follows.

Regular-

Estimated production volume: 3,000 units

Direct materials cost: $28 per unit

Direct labour per unit: 3 hours at $15 per hour

Deluxe-

Estimated production volume: 4,000 units

Direct materials cost: $42 per unit

Direct labour per unit: 4 hours at $15 per hour

Scott's overhead of $1,600,000 can be identified with three major activities: order processing ($250,000), machine processing ($1,200,000), and product inspection ($150,000). These activities are driven by number of orders processed, machine hours worked, and inspection hours, respectively. Data relevant to these activities follow. Required:

Required:

A. Compute the pool rates that would be used for order processing, machine processing, and product inspection in an activity-based costing system.

B. Assuming use of activity-based costing, compute the unit manufacturing costs of Regular and Deluxe if the expected manufacturing volume is attained.

C. How much overhead would be applied to a unit of Regular and Deluxe if the company used traditional costing and applied overhead solely on the basis of direct labour hours? Which of the two products would be undercosted by this procedure? Overcosted?

Regular-

Estimated production volume: 3,000 units

Direct materials cost: $28 per unit

Direct labour per unit: 3 hours at $15 per hour

Deluxe-

Estimated production volume: 4,000 units

Direct materials cost: $42 per unit

Direct labour per unit: 4 hours at $15 per hour

Scott's overhead of $1,600,000 can be identified with three major activities: order processing ($250,000), machine processing ($1,200,000), and product inspection ($150,000). These activities are driven by number of orders processed, machine hours worked, and inspection hours, respectively. Data relevant to these activities follow.

Required:

Required:A. Compute the pool rates that would be used for order processing, machine processing, and product inspection in an activity-based costing system.

B. Assuming use of activity-based costing, compute the unit manufacturing costs of Regular and Deluxe if the expected manufacturing volume is attained.

C. How much overhead would be applied to a unit of Regular and Deluxe if the company used traditional costing and applied overhead solely on the basis of direct labour hours? Which of the two products would be undercosted by this procedure? Overcosted?

Unlock Deck

Unlock for access to all 72 flashcards in this deck.

Unlock Deck

k this deck

64

Deep Check

Heartland Bank & Trust operates in a very competitive marketplace, using a traditional labour-hour-based system to determine the cost of processing its mortgage loans. Recently, the firm explored a switch to activity-based costing to determine the wisdom of its previous ways. The following information is available: Two loan applications, among many others, were originated and closed during the year. No. 7439 consumed 3.5 hours in loan underwriting and 1.5 hours in loan closure, for a total of 5.0 hours. No. 7809 also required 5.0 hours of time, subdivided as follows: 2.0 hours in loan underwriting and 3.0 hours in loan closure. Conversations with management found that, on average, each application took nine labour hours of processing time, excluding underwriting and closure.

Two loan applications, among many others, were originated and closed during the year. No. 7439 consumed 3.5 hours in loan underwriting and 1.5 hours in loan closure, for a total of 5.0 hours. No. 7809 also required 5.0 hours of time, subdivided as follows: 2.0 hours in loan underwriting and 3.0 hours in loan closure. Conversations with management found that, on average, each application took nine labour hours of processing time, excluding underwriting and closure.

Required:

A. Use an activity-based-costing system and determine the cost of processing, underwriting, and closing the two loan applications.

B. Determine the cost of processing the two loans if Heartland uses the traditional labour-hour-based system.

C. Is Heartland making a mistake by continuing to use a traditional system that is based on an average labour cost per hour? Why?

Heartland Bank & Trust operates in a very competitive marketplace, using a traditional labour-hour-based system to determine the cost of processing its mortgage loans. Recently, the firm explored a switch to activity-based costing to determine the wisdom of its previous ways. The following information is available:

Two loan applications, among many others, were originated and closed during the year. No. 7439 consumed 3.5 hours in loan underwriting and 1.5 hours in loan closure, for a total of 5.0 hours. No. 7809 also required 5.0 hours of time, subdivided as follows: 2.0 hours in loan underwriting and 3.0 hours in loan closure. Conversations with management found that, on average, each application took nine labour hours of processing time, excluding underwriting and closure.

Two loan applications, among many others, were originated and closed during the year. No. 7439 consumed 3.5 hours in loan underwriting and 1.5 hours in loan closure, for a total of 5.0 hours. No. 7809 also required 5.0 hours of time, subdivided as follows: 2.0 hours in loan underwriting and 3.0 hours in loan closure. Conversations with management found that, on average, each application took nine labour hours of processing time, excluding underwriting and closure.Required:

A. Use an activity-based-costing system and determine the cost of processing, underwriting, and closing the two loan applications.

B. Determine the cost of processing the two loans if Heartland uses the traditional labour-hour-based system.

C. Is Heartland making a mistake by continuing to use a traditional system that is based on an average labour cost per hour? Why?

Unlock Deck

Unlock for access to all 72 flashcards in this deck.

Unlock Deck

k this deck

65

Define the term "cost driver" and discuss the factors that are important in the selection of appropriate cost drivers.

Unlock Deck

Unlock for access to all 72 flashcards in this deck.

Unlock Deck

k this deck

66

You have recently been hired by a manufacturing company. Two days ago, you met with the top management of the company to discuss future strategies for the firm. During the meeting, the president of the company expressed concern about the profitability of the company and the company's ability to compete effectively in the future. You responded to the president's concerns by mentioning some articles you had read in professional accounting journals regarding JIT. The president responded to your comments by saying that although the JIT concept sounded interesting, no one in the company was knowledgeable about JIT. The president then requested that you prepare a brief summary of JIT for the next strategic planning meeting.

Required:

A. List five major requirements for implementing a successful JIT system.

B. List at least five benefits cited of a JIT system.

Required:

A. List five major requirements for implementing a successful JIT system.

B. List at least five benefits cited of a JIT system.

Unlock Deck

Unlock for access to all 72 flashcards in this deck.

Unlock Deck

k this deck

67

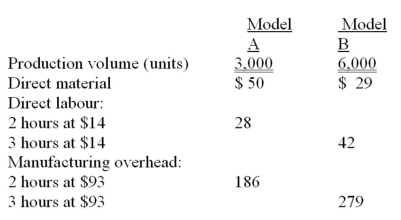

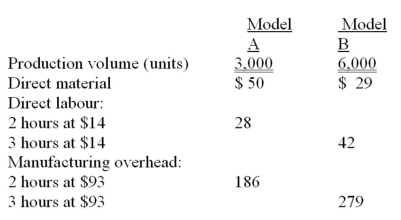

Goldstar Corporation manufactures two types of portable air conditioners: Model A, a 4,000 BTU unit and Model B, a 6,000 BTU unit. A review of the company's accounting records revealed the following per-unit costs and production volumes:

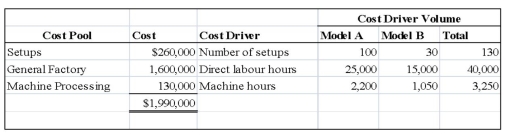

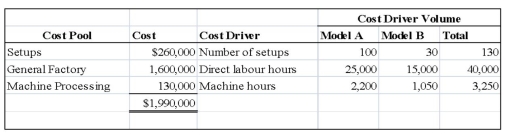

Manufacturing overhead is currently computed by spreading overhead of $2,060,000 over 40,000 direct labour hours. Management is considering a shift to activity-based costing in an effort to improve the firm's accounting procedures, and the following data are available.

Manufacturing overhead is currently computed by spreading overhead of $2,060,000 over 40,000 direct labour hours. Management is considering a shift to activity-based costing in an effort to improve the firm's accounting procedures, and the following data are available.  Goldstar determines selling prices by adding 60% to a product's total cost.

Goldstar determines selling prices by adding 60% to a product's total cost.

Required:

A. Compute the per-unit cost and selling price of Model B by using Goldstar's current costing procedures.

B. Compute the per-unit overhead cost of Model B if the company switches to activity-based costing.

C. Compute Model B's total per-unit cost and selling price under activity-based costing.

D. Goldstar has recently encountered significant international competition for Model B, with considerable business being lost to very aggressive suppliers. Will activity-based costing allow the company to be more competitive with Model B from a price perspective? Briefly explain.

E. Will the cost and selling price of Model A likely increase or decrease if Goldstar changes to activity-based costing? Why? Hint: No calculations are necessary.

Manufacturing overhead is currently computed by spreading overhead of $2,060,000 over 40,000 direct labour hours. Management is considering a shift to activity-based costing in an effort to improve the firm's accounting procedures, and the following data are available.

Manufacturing overhead is currently computed by spreading overhead of $2,060,000 over 40,000 direct labour hours. Management is considering a shift to activity-based costing in an effort to improve the firm's accounting procedures, and the following data are available.  Goldstar determines selling prices by adding 60% to a product's total cost.

Goldstar determines selling prices by adding 60% to a product's total cost.Required:

A. Compute the per-unit cost and selling price of Model B by using Goldstar's current costing procedures.

B. Compute the per-unit overhead cost of Model B if the company switches to activity-based costing.

C. Compute Model B's total per-unit cost and selling price under activity-based costing.

D. Goldstar has recently encountered significant international competition for Model B, with considerable business being lost to very aggressive suppliers. Will activity-based costing allow the company to be more competitive with Model B from a price perspective? Briefly explain.

E. Will the cost and selling price of Model A likely increase or decrease if Goldstar changes to activity-based costing? Why? Hint: No calculations are necessary.

Unlock Deck

Unlock for access to all 72 flashcards in this deck.

Unlock Deck

k this deck

68

Ippilito's Fresh Meats and Produce is a wholesale distributor that operates in central California. An analysis of two of the company's customers, Atriums Retirement Home and Sigma Sigma Fraternity, revealed the data that follow for a recent 12-month period.  Ippilito's uses activity-based costing to determine the cost of servicing its customers. The company had total delivery costs during the year of $576,000 and 8,000 deliveries, along with cost of $765,000 for the administrative processing of 90,000 invoices.

Ippilito's uses activity-based costing to determine the cost of servicing its customers. The company had total delivery costs during the year of $576,000 and 8,000 deliveries, along with cost of $765,000 for the administrative processing of 90,000 invoices.

Required:

A. Compute the pool rates for deliveries and invoice processing.

B. Compute the operating income that Ippilito's earned from these two customers.

C. Compute the total of customer-related costs (deliveries and invoice processing) for each customer as a percentage of gross margin, and analyze the results for management. Explain any significant differences that you find.

Ippilito's uses activity-based costing to determine the cost of servicing its customers. The company had total delivery costs during the year of $576,000 and 8,000 deliveries, along with cost of $765,000 for the administrative processing of 90,000 invoices.

Ippilito's uses activity-based costing to determine the cost of servicing its customers. The company had total delivery costs during the year of $576,000 and 8,000 deliveries, along with cost of $765,000 for the administrative processing of 90,000 invoices.Required:

A. Compute the pool rates for deliveries and invoice processing.

B. Compute the operating income that Ippilito's earned from these two customers.

C. Compute the total of customer-related costs (deliveries and invoice processing) for each customer as a percentage of gross margin, and analyze the results for management. Explain any significant differences that you find.

Unlock Deck

Unlock for access to all 72 flashcards in this deck.

Unlock Deck

k this deck

69

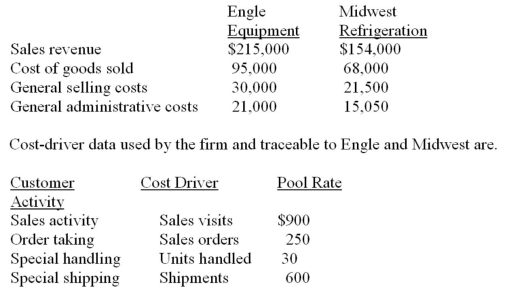

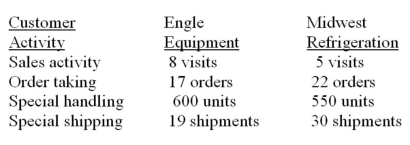

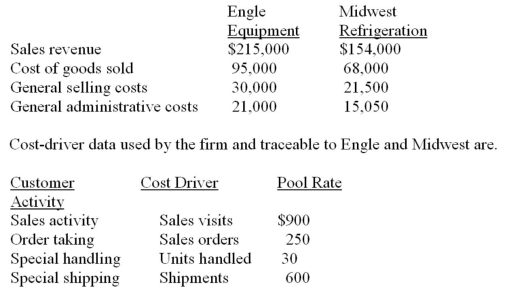

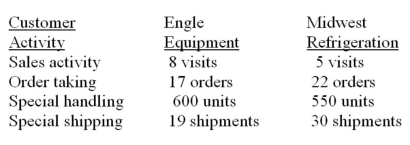

Clark Corporation manufactures cooling system components. The company has gathered the following information about two of its customers: Engle Equipment and Midwest Refrigeration.

Required:

Required:

A. Perform a customer profitability analysis for Clark. Compute the gross margin and operating income on transactions related to Engle Equipment and Midwest Refrigeration.

B. Compute gross margin as a percentage of sales revenue. Then compute (1) general selling and administrative costs as a percentage of gross margin and (2) total customer-related costs (i.e., costs that arise from sales visits, order taking, and special handling and shipping) as a percentage of gross margin.

C. On the basis of your calculations, which of the two customers is "more costly" to deal with? Briefly explain.

Required:

Required:A. Perform a customer profitability analysis for Clark. Compute the gross margin and operating income on transactions related to Engle Equipment and Midwest Refrigeration.

B. Compute gross margin as a percentage of sales revenue. Then compute (1) general selling and administrative costs as a percentage of gross margin and (2) total customer-related costs (i.e., costs that arise from sales visits, order taking, and special handling and shipping) as a percentage of gross margin.

C. On the basis of your calculations, which of the two customers is "more costly" to deal with? Briefly explain.

Unlock Deck

Unlock for access to all 72 flashcards in this deck.

Unlock Deck

k this deck

70

Non-value-added costs occur in non-manufacturing organizations as well as in manufacturing firms.

Required:

A. Explain what is meant by a non-value-added cost.

B. Identify two potential non-value-added costs for each of the following service providers: airlines, banks, and hotels.

Required:

A. Explain what is meant by a non-value-added cost.

B. Identify two potential non-value-added costs for each of the following service providers: airlines, banks, and hotels.

Unlock Deck

Unlock for access to all 72 flashcards in this deck.

Unlock Deck

k this deck

71

Indiglow Chapstars which sells books to college bookstores and individuals uses activity-based costing and activity-based management. The following information is available for the company's three cost pools.

Bookstore sales totaled $9,000,000, and sales to individuals amounted to $3,400,000. Costs for the three activities were: Incoming receipts, $500,000; warehousing, $620,000; and outgoing shipments, $620,000. A review of the company's activities found various inefficiencies with respect to the warehousing of textbooks (acquired for eventual sale to bookstores) and outgoing shipments to individuals. These inefficiencies resulted in an extra 600 moves and 800 shipments, respectively.

Bookstore sales totaled $9,000,000, and sales to individuals amounted to $3,400,000. Costs for the three activities were: Incoming receipts, $500,000; warehousing, $620,000; and outgoing shipments, $620,000. A review of the company's activities found various inefficiencies with respect to the warehousing of textbooks (acquired for eventual sale to bookstores) and outgoing shipments to individuals. These inefficiencies resulted in an extra 600 moves and 800 shipments, respectively.

Required:

A. What is a non-value-added activity?

B. How much did non-value-added activities cost Indiglow Chapstars this past year?

C. Which of the two markets-sales to bookstores or sales to individuals-resulted in lower overall costs for incoming receipts, warehousing, and outgoing shipments? Evaluate these costs in both absolute dollars and as a percentage of sales. In addition, present a possible explanation for your results. Note: Exclude costs that arose from inefficient operations.

Bookstore sales totaled $9,000,000, and sales to individuals amounted to $3,400,000. Costs for the three activities were: Incoming receipts, $500,000; warehousing, $620,000; and outgoing shipments, $620,000. A review of the company's activities found various inefficiencies with respect to the warehousing of textbooks (acquired for eventual sale to bookstores) and outgoing shipments to individuals. These inefficiencies resulted in an extra 600 moves and 800 shipments, respectively.

Bookstore sales totaled $9,000,000, and sales to individuals amounted to $3,400,000. Costs for the three activities were: Incoming receipts, $500,000; warehousing, $620,000; and outgoing shipments, $620,000. A review of the company's activities found various inefficiencies with respect to the warehousing of textbooks (acquired for eventual sale to bookstores) and outgoing shipments to individuals. These inefficiencies resulted in an extra 600 moves and 800 shipments, respectively.Required:

A. What is a non-value-added activity?

B. How much did non-value-added activities cost Indiglow Chapstars this past year?