Deck 26: Mergers and Corporate Control

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/49

Play

Full screen (f)

Deck 26: Mergers and Corporate Control

1

A spin-off is a type of divestiture in which the assets of a division are sold to another firm.

False

2

A congeneric merger is one where the merging firms operate in related businesses but do not necessarily produce the same products or have a producer-supplier relationship.

True

3

Since a manager's central goal is to maximize the firm's stock price,any merger offer that provides stockholders with significant gains over the current stock price will be approved by the current management team.

False

4

Post-merger control and the negotiated price paid by the acquirer are two of the most important issues in agreeing on the terms of a merger.

Unlock Deck

Unlock for access to all 49 flashcards in this deck.

Unlock Deck

k this deck

5

One of the main reasons why foreign firms are interested in buying U.S.companies is to gain entrance to the U.S.market.A decline in the value of the dollar relative to most foreign currencies makes this competitive strategy especially attractive.

Unlock Deck

Unlock for access to all 49 flashcards in this deck.

Unlock Deck

k this deck

6

In a merger with true synergies,the post-merger value exceeds the sum of the separate companies' pre-merger values.

Unlock Deck

Unlock for access to all 49 flashcards in this deck.

Unlock Deck

k this deck

7

Most defensive mergers occur as a result of managers' actions to maximize shareholders' wealth.

Unlock Deck

Unlock for access to all 49 flashcards in this deck.

Unlock Deck

k this deck

8

Borrowing funds on terms that would require immediate repayment of all funds if the firm is acquired,selling off valuable assets,and granting huge "golden parachutes" that open if the firm is acquired are three procedures used to defend against hostile takeovers.These strategies are known as "poison pills."

Unlock Deck

Unlock for access to all 49 flashcards in this deck.

Unlock Deck

k this deck

9

A joint venture is one in which two,or sometimes more,independent companies agree to combine resources in order to achieve a specific objective,usually limited in scope.

Unlock Deck

Unlock for access to all 49 flashcards in this deck.

Unlock Deck

k this deck

10

The purchase of assets at below their replacement cost and tax considerations are two factors that motivate mergers.

Unlock Deck

Unlock for access to all 49 flashcards in this deck.

Unlock Deck

k this deck

11

Since managers' central goal is to maximize stock price,managerial control issues do not interfere with mergers that would benefit the target firm's stockholders.

Unlock Deck

Unlock for access to all 49 flashcards in this deck.

Unlock Deck

k this deck

12

The two principal advantages of holding companies are (1)the holding company can control a great deal of assets with limited equity and (2)the dividends received by the parent from the subsidiary are not taxed if the parent holds at least 50% of the subsidiary's stock.

Unlock Deck

Unlock for access to all 49 flashcards in this deck.

Unlock Deck

k this deck

13

If a petrochemical firm that used oil as feedstock merged with an oil producer that had large oil reserves and a drilling subsidiary,this would be a vertical merger.

Unlock Deck

Unlock for access to all 49 flashcards in this deck.

Unlock Deck

k this deck

14

Currently (2012),mergers can be accounted for using either the purchase method or the pooling method.

Unlock Deck

Unlock for access to all 49 flashcards in this deck.

Unlock Deck

k this deck

15

A company seeking to fight off a hostile takeover might employ the services of an investment banking firm to develop a defensive strategy.

Unlock Deck

Unlock for access to all 49 flashcards in this deck.

Unlock Deck

k this deck

16

Merger activity is likely to heat up when interest rates are high because target firms can expect to receive an especially high premium over the pre-announcement stock price.

Unlock Deck

Unlock for access to all 49 flashcards in this deck.

Unlock Deck

k this deck

17

A conglomerate merger occurs when two firms with either a horizontal or a vertical business relationship combine.

Unlock Deck

Unlock for access to all 49 flashcards in this deck.

Unlock Deck

k this deck

18

Synergistic benefits can arise from a number of different sources,including operating economies of scale,financial economies,and increased managerial efficiency.

Unlock Deck

Unlock for access to all 49 flashcards in this deck.

Unlock Deck

k this deck

19

Since the primary rationale for any operating merger is synergy,in planning such mergers,the development of accurate pro forma cash flows is the single most important action.

Unlock Deck

Unlock for access to all 49 flashcards in this deck.

Unlock Deck

k this deck

20

The primary reason managers give for most mergers is to acquire more assets so as to increase sales and market share.

Unlock Deck

Unlock for access to all 49 flashcards in this deck.

Unlock Deck

k this deck

21

Coca-Cola's acquisition of Columbia Pictures and its announcement that it would operate its new subsidiary separately could be described as primarily a financial merger.

Unlock Deck

Unlock for access to all 49 flashcards in this deck.

Unlock Deck

k this deck

22

The present value of the free cash flows discounted at the unlevered cost of equity is the value of the firm's operations if it had no debt.

Unlock Deck

Unlock for access to all 49 flashcards in this deck.

Unlock Deck

k this deck

23

Which of the following statements is most CORRECT?

A)Financial theory says that the choice of how to pay for a merger is really irrelevant because, although it may affect the firm's capital structure, it will not affect its overall required rate of return.

B)The basic rationale for any financial merger is synergy and, thus, the estimation of pro forma cash flows is the single most important part of the analysis.

C)In most mergers, the benefits of synergy and the premium the acquirer pays over the market price are summed and then divided equally between the shareholders of the acquiring and target firms.

D)The primary rationale for most operating mergers is synergy.

E)The acquiring firm's required rate of return in most horizontal mergers will not be affected, because the 2 firms will have similar betas.

A)Financial theory says that the choice of how to pay for a merger is really irrelevant because, although it may affect the firm's capital structure, it will not affect its overall required rate of return.

B)The basic rationale for any financial merger is synergy and, thus, the estimation of pro forma cash flows is the single most important part of the analysis.

C)In most mergers, the benefits of synergy and the premium the acquirer pays over the market price are summed and then divided equally between the shareholders of the acquiring and target firms.

D)The primary rationale for most operating mergers is synergy.

E)The acquiring firm's required rate of return in most horizontal mergers will not be affected, because the 2 firms will have similar betas.

Unlock Deck

Unlock for access to all 49 flashcards in this deck.

Unlock Deck

k this deck

24

Which of the following statements is most CORRECT?

A)The smaller the synergistic benefits of a particular merger, the greater the scope for striking a bargain in negotiations, and the higher the probability that the merger will be completed.

B)Since mergers are frequently financed by debt rather than equity, a lower cost of debt or a greater debt capacity are rarely relevant considerations when considering a merger.

C)Managers who purchase other firms often assert that the new combined firm will enjoy benefits from diversification, including more stable earnings. However, since shareholders are free to diversify their own holdings, and at what's probably a lower cost, diversification benefits is generally not a valid motive for a publicly held firm.

D)Operating economies are never a motive for mergers.

E)Tax considerations often play a part in mergers. If one firm has excess cash, purchasing another firm exposes the purchasing firm to additional taxes. Thus, firms with excess cash rarely undertake mergers.

A)The smaller the synergistic benefits of a particular merger, the greater the scope for striking a bargain in negotiations, and the higher the probability that the merger will be completed.

B)Since mergers are frequently financed by debt rather than equity, a lower cost of debt or a greater debt capacity are rarely relevant considerations when considering a merger.

C)Managers who purchase other firms often assert that the new combined firm will enjoy benefits from diversification, including more stable earnings. However, since shareholders are free to diversify their own holdings, and at what's probably a lower cost, diversification benefits is generally not a valid motive for a publicly held firm.

D)Operating economies are never a motive for mergers.

E)Tax considerations often play a part in mergers. If one firm has excess cash, purchasing another firm exposes the purchasing firm to additional taxes. Thus, firms with excess cash rarely undertake mergers.

Unlock Deck

Unlock for access to all 49 flashcards in this deck.

Unlock Deck

k this deck

25

Which of the following statements is most CORRECT?

A)A defensive merger is one where the firm's managers decide to merge with another firm to avoid or lessen the possibility of being acquired through a hostile takeover.

B)Acquiring firms send a signal that their stock is undervalued if they choose to use stock to pay for the acquisition.

C)Cash payments are used in takeovers but never in mergers.

D)Managers often are fired in takeovers, but never in mergers.

E)If a company that produces military equipment merges with a company that manages a chain of motels, this is an example of a horizontal merger.

A)A defensive merger is one where the firm's managers decide to merge with another firm to avoid or lessen the possibility of being acquired through a hostile takeover.

B)Acquiring firms send a signal that their stock is undervalued if they choose to use stock to pay for the acquisition.

C)Cash payments are used in takeovers but never in mergers.

D)Managers often are fired in takeovers, but never in mergers.

E)If a company that produces military equipment merges with a company that manages a chain of motels, this is an example of a horizontal merger.

Unlock Deck

Unlock for access to all 49 flashcards in this deck.

Unlock Deck

k this deck

26

The three main advantages of holding companies are (1)control with fractional ownership, (2)taxation benefits,and (3)isolation of operating risks.

Unlock Deck

Unlock for access to all 49 flashcards in this deck.

Unlock Deck

k this deck

27

Which of the following are legal and acceptable reasons for the high level of merger activity in the U.S.during the 1980s?

A)A profitable firm acquires a firm with large accumulated tax losses that may be carried forward.

B)Attempts to stabilize earnings by diversifying.

C)Purchase of assets below their replacement costs.

D)Reduction in competition resulting from mergers.

E)Synergistic benefits arising from mergers.

A)A profitable firm acquires a firm with large accumulated tax losses that may be carried forward.

B)Attempts to stabilize earnings by diversifying.

C)Purchase of assets below their replacement costs.

D)Reduction in competition resulting from mergers.

E)Synergistic benefits arising from mergers.

Unlock Deck

Unlock for access to all 49 flashcards in this deck.

Unlock Deck

k this deck

28

Discounted cash flow methods are not appropriate for evaluating mergers because the cash flows are uncertain and the discount rate can only be determined after the merger is consummated.

Unlock Deck

Unlock for access to all 49 flashcards in this deck.

Unlock Deck

k this deck

29

Although goodwill created in a merger may not be amortized for shareholder reporting purposes,it may be amortized for Federal tax purposes.

Unlock Deck

Unlock for access to all 49 flashcards in this deck.

Unlock Deck

k this deck

30

If the capital structure is stable,and free cash flows are expected to be growing at a constant rate at the horizon date,then the horizon value is calculated by discounting the free cash flows plus the expected future tax shields at the weighted average cost of capital.

Unlock Deck

Unlock for access to all 49 flashcards in this deck.

Unlock Deck

k this deck

31

Any goodwill created in a merger must be amortized over its expected life,usually 40 years,for shareholder reporting purposes.

Unlock Deck

Unlock for access to all 49 flashcards in this deck.

Unlock Deck

k this deck

32

Which of the following statements is most CORRECT?

A)Regulations in the United States prohibit acquiring firms from using common stock to purchase another firm.

B)Defensive mergers are designed to make a company less vulnerable to a takeover.

C)Hostile mergers always create value for the acquiring firm.

D)In a tender offer, the target firm's management always remain after the merger is completed.

E)A conglomerate merger is one where a firm combines with another firm in the same industry.

A)Regulations in the United States prohibit acquiring firms from using common stock to purchase another firm.

B)Defensive mergers are designed to make a company less vulnerable to a takeover.

C)Hostile mergers always create value for the acquiring firm.

D)In a tender offer, the target firm's management always remain after the merger is completed.

E)A conglomerate merger is one where a firm combines with another firm in the same industry.

Unlock Deck

Unlock for access to all 49 flashcards in this deck.

Unlock Deck

k this deck

33

Only if a target firm's value is greater to the acquiring firm than its market value as a separate entity will a merger be financially justified.

Unlock Deck

Unlock for access to all 49 flashcards in this deck.

Unlock Deck

k this deck

34

In a financial merger,the relevant post-merger cash flows are simply the sum of the expected cash flows of the two companies,measured as if they were operated independently.

Unlock Deck

Unlock for access to all 49 flashcards in this deck.

Unlock Deck

k this deck

35

The rate used to discount projected merger cash flows should be the cost of capital of the new consolidated firm because it incorporates the actual capital structure of the new firm.

Unlock Deck

Unlock for access to all 49 flashcards in this deck.

Unlock Deck

k this deck

36

Which of the following statements about valuing a firm using the APV approach is most CORRECT?

A)The value of equity is calculated by discounting the horizon value, the tax shields, and the free cash flows at the cost of equity.

B)The value of operations is calculated by discounting the horizon value, the tax shields, and the free cash flows before the horizon date at the unlevered cost of equity.

C)The value of equity is calculated by discounting the horizon value and the free cash flows at the cost of equity.

D)The APV approach stands for the accounting pre-valuation approach.

E)The value of operations is calculated by discounting the horizon value, the tax shields, and the free cash flows at the cost of equity.

A)The value of equity is calculated by discounting the horizon value, the tax shields, and the free cash flows at the cost of equity.

B)The value of operations is calculated by discounting the horizon value, the tax shields, and the free cash flows before the horizon date at the unlevered cost of equity.

C)The value of equity is calculated by discounting the horizon value and the free cash flows at the cost of equity.

D)The APV approach stands for the accounting pre-valuation approach.

E)The value of operations is calculated by discounting the horizon value, the tax shields, and the free cash flows at the cost of equity.

Unlock Deck

Unlock for access to all 49 flashcards in this deck.

Unlock Deck

k this deck

37

Which of the following statements about valuing a firm using the APV approach is most CORRECT?

A)The horizon value is calculated by discounting the free cash flows beyond the horizon date and any tax savings at the cost of debt.

B)The horizon value is calculated by discounting the expected earnings at the WACC.

C)The horizon value is calculated by discounting the free cash flows beyond the horizon date and any tax savings at the WACC.

D)The horizon value must always be more than 20 years in the future.

E)The horizon value is calculated by discounting the free cash flows beyond the horizon date and any tax savings at the levered cost of equity.

A)The horizon value is calculated by discounting the free cash flows beyond the horizon date and any tax savings at the cost of debt.

B)The horizon value is calculated by discounting the expected earnings at the WACC.

C)The horizon value is calculated by discounting the free cash flows beyond the horizon date and any tax savings at the WACC.

D)The horizon value must always be more than 20 years in the future.

E)The horizon value is calculated by discounting the free cash flows beyond the horizon date and any tax savings at the levered cost of equity.

Unlock Deck

Unlock for access to all 49 flashcards in this deck.

Unlock Deck

k this deck

38

A two-tier merger offer is one where the acquiring company offers to purchase the target company in a two-part transaction.Cash is paid to some stockholders,bonds are issued to others,but the total values of each part of the transaction are equal.

Unlock Deck

Unlock for access to all 49 flashcards in this deck.

Unlock Deck

k this deck

39

The distribution of synergistic gains between the stockholders of two merged firms is almost always based strictly on their respective market values before the announcement of the merger.

Unlock Deck

Unlock for access to all 49 flashcards in this deck.

Unlock Deck

k this deck

40

Firms use defensive tactics to fight off undesired mergers.These tactics do not include

A)getting a white squire to purchase stock in the firm.

B)getting white knights to bid for the firm.

C)repurchasing their own stock.

D)changing the bylaws to eliminate supermajority voting requirements.

E)raising antitrust issues.

A)getting a white squire to purchase stock in the firm.

B)getting white knights to bid for the firm.

C)repurchasing their own stock.

D)changing the bylaws to eliminate supermajority voting requirements.

E)raising antitrust issues.

Unlock Deck

Unlock for access to all 49 flashcards in this deck.

Unlock Deck

k this deck

41

Exhibit 26.1

Best Window & Door Corporation is considering the acquisition of Glassmakers Inc. Glassmakers has a capital structure consisting of $5 million (market value) of 11% bonds and $10 million (market value) of common stock. Glassmakers' pre-merger beta is 1.36. Best's beta is 1.02, and both it and Glassmakers face a 40% tax rate. Best's capital structure is 40% debt and 60% equity. The free cash flows from Glassmakers are estimated to be $3.0 million for each of the next 4 years and a horizon value of $10.0 million in Year 4. Tax savings are estimated to be $1 million for each of the next 4 years and a horizon value of $5 million in Year 4. New debt would be issued to finance the acquisition and retire the old debt, and this new debt would have an interest rate of 8%. Currently, the risk-free rate is 6.0% and the market risk premium is 4.0%.

Refer to Exhibit 26.1.What is the value of Glassmakers' equity to Best? (Round your answer to the closest thousand dollars.)

A)$16,019,000

B)$17,111,000

C)$18,916,000

D)$22,111,000

E)$22,916,000

Best Window & Door Corporation is considering the acquisition of Glassmakers Inc. Glassmakers has a capital structure consisting of $5 million (market value) of 11% bonds and $10 million (market value) of common stock. Glassmakers' pre-merger beta is 1.36. Best's beta is 1.02, and both it and Glassmakers face a 40% tax rate. Best's capital structure is 40% debt and 60% equity. The free cash flows from Glassmakers are estimated to be $3.0 million for each of the next 4 years and a horizon value of $10.0 million in Year 4. Tax savings are estimated to be $1 million for each of the next 4 years and a horizon value of $5 million in Year 4. New debt would be issued to finance the acquisition and retire the old debt, and this new debt would have an interest rate of 8%. Currently, the risk-free rate is 6.0% and the market risk premium is 4.0%.

Refer to Exhibit 26.1.What is the value of Glassmakers' equity to Best? (Round your answer to the closest thousand dollars.)

A)$16,019,000

B)$17,111,000

C)$18,916,000

D)$22,111,000

E)$22,916,000

Unlock Deck

Unlock for access to all 49 flashcards in this deck.

Unlock Deck

k this deck

42

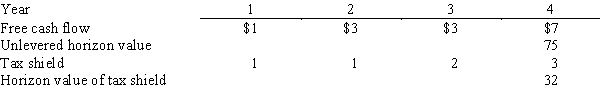

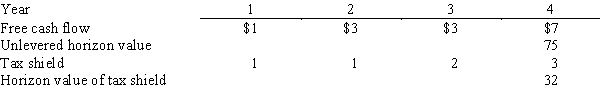

Raymond Supply,a national hardware chain,is considering purchasing a smaller chain,Strauss & Glazer Parts (SGP).Raymond's analysts project that the merger will result in the following incremental free cash flows,tax shields,and horizon values:  Assume that all cash flows occur at the end of the year.SGP is currently financed with 30% debt at a rate of 10%.The acquisition would be made immediately,and if it is undertaken,SGP would retain its current $15 million of debt and issue enough new debt to continue at the 30% target level.The interest rate would remain the same.SGP's pre-merger beta is 2.0,and its post-merger tax rate would be 34%.The risk-free rate is 8% and the market risk premium is 4%.What is the value of SGP to Raymond?

Assume that all cash flows occur at the end of the year.SGP is currently financed with 30% debt at a rate of 10%.The acquisition would be made immediately,and if it is undertaken,SGP would retain its current $15 million of debt and issue enough new debt to continue at the 30% target level.The interest rate would remain the same.SGP's pre-merger beta is 2.0,and its post-merger tax rate would be 34%.The risk-free rate is 8% and the market risk premium is 4%.What is the value of SGP to Raymond?

A)$53.40 million

B)$61.96 million

C)$64.64 million

D)$76.96 million

E)$79.64 million

Assume that all cash flows occur at the end of the year.SGP is currently financed with 30% debt at a rate of 10%.The acquisition would be made immediately,and if it is undertaken,SGP would retain its current $15 million of debt and issue enough new debt to continue at the 30% target level.The interest rate would remain the same.SGP's pre-merger beta is 2.0,and its post-merger tax rate would be 34%.The risk-free rate is 8% and the market risk premium is 4%.What is the value of SGP to Raymond?

Assume that all cash flows occur at the end of the year.SGP is currently financed with 30% debt at a rate of 10%.The acquisition would be made immediately,and if it is undertaken,SGP would retain its current $15 million of debt and issue enough new debt to continue at the 30% target level.The interest rate would remain the same.SGP's pre-merger beta is 2.0,and its post-merger tax rate would be 34%.The risk-free rate is 8% and the market risk premium is 4%.What is the value of SGP to Raymond?A)$53.40 million

B)$61.96 million

C)$64.64 million

D)$76.96 million

E)$79.64 million

Unlock Deck

Unlock for access to all 49 flashcards in this deck.

Unlock Deck

k this deck

43

A regional restaurant chain,Club Café,is considering purchasing a smaller chain,Sally's Sandwiches,which is currently financed using 20% debt at a cost of 8%.Club Café's analysts project that the merger will result in incremental free cash flows and interest tax savings of $2 million in Year 1,$4 million in Year 2,$5 million in Year 3,and $117 million in Year 4.(The Year 4 cash flow includes a horizon value of $107 million.)The acquisition would be made immediately,if it is to be undertaken.Sally's pre-merger beta is 2.0,and its post-merger tax rate would be 34%.The risk-free rate is 8%,and the market risk premium is 4%.What is the appropriate rate for use in discounting the free cash flows and the interest tax savings?

A)12.0%

B)13.9%

C)14.4%

D)16.0%

E)16.9%

A)12.0%

B)13.9%

C)14.4%

D)16.0%

E)16.9%

Unlock Deck

Unlock for access to all 49 flashcards in this deck.

Unlock Deck

k this deck

44

Holland Auto Parts is considering a merger with Workman Car Parts.Workman's market-determined beta is 0.9,and the firm currently is financed with 20% debt,at an interest rate of 8%,and its tax rate is 25%.If Holland acquires Workman,it will increase the debt to 60%,at an interest rate of 9%,and the tax rate will increase to 35%.The risk-free rate is 6% and the market risk premium is 4%.What will Workman's required rate of return on equity be after it is acquired?

A)7.4%

B)8.9%

C)9.3%

D)9.6%

E)9.7%

A)7.4%

B)8.9%

C)9.3%

D)9.6%

E)9.7%

Unlock Deck

Unlock for access to all 49 flashcards in this deck.

Unlock Deck

k this deck

45

Exhibit 26.1

Best Window & Door Corporation is considering the acquisition of Glassmakers Inc. Glassmakers has a capital structure consisting of $5 million (market value) of 11% bonds and $10 million (market value) of common stock. Glassmakers' pre-merger beta is 1.36. Best's beta is 1.02, and both it and Glassmakers face a 40% tax rate. Best's capital structure is 40% debt and 60% equity. The free cash flows from Glassmakers are estimated to be $3.0 million for each of the next 4 years and a horizon value of $10.0 million in Year 4. Tax savings are estimated to be $1 million for each of the next 4 years and a horizon value of $5 million in Year 4. New debt would be issued to finance the acquisition and retire the old debt, and this new debt would have an interest rate of 8%. Currently, the risk-free rate is 6.0% and the market risk premium is 4.0%.

Refer to Exhibit 26.1.What is Glassmakers' pre-merger WACC?

A)9.02%

B)9.50%

C)9.83%

D)10.01%

E)11.29%

Best Window & Door Corporation is considering the acquisition of Glassmakers Inc. Glassmakers has a capital structure consisting of $5 million (market value) of 11% bonds and $10 million (market value) of common stock. Glassmakers' pre-merger beta is 1.36. Best's beta is 1.02, and both it and Glassmakers face a 40% tax rate. Best's capital structure is 40% debt and 60% equity. The free cash flows from Glassmakers are estimated to be $3.0 million for each of the next 4 years and a horizon value of $10.0 million in Year 4. Tax savings are estimated to be $1 million for each of the next 4 years and a horizon value of $5 million in Year 4. New debt would be issued to finance the acquisition and retire the old debt, and this new debt would have an interest rate of 8%. Currently, the risk-free rate is 6.0% and the market risk premium is 4.0%.

Refer to Exhibit 26.1.What is Glassmakers' pre-merger WACC?

A)9.02%

B)9.50%

C)9.83%

D)10.01%

E)11.29%

Unlock Deck

Unlock for access to all 49 flashcards in this deck.

Unlock Deck

k this deck

46

Juicers Inc.is thinking of acquiring Fast Fruit Company.Juicers expects Fast Fruit's NOPAT to be $9 million the first year,with no net new investment in operating capital and no interest expense.For the second year,Fast Fruit is expected to have NOPAT of $25 million and interest expense of $5 million.Also,in the second year only,Fast Fruit will need $10 million of net new investment in operating capital.Fast Fruit's marginal tax rate is 40%.After the second year,the free cash flows and the tax shields from Fast Fruit to Juicers will both grow at a constant rate of 4%.Juicers has determined that Fast Fruit's cost of equity is 17.5%,and Fast Fruit currently has no debt outstanding.Assume that all cash flows occur at the end of the year,Juicers must pay $45 million to acquire Fast Fruit.What it the NPV of the proposed acquisition? Note that you must first calculate the value to Juicers of Fast Fruit's equity.

A)$45.0 million

B)$68.2 million

C)$86.5 million

D)$113.2 million

E)$133.0 million

A)$45.0 million

B)$68.2 million

C)$86.5 million

D)$113.2 million

E)$133.0 million

Unlock Deck

Unlock for access to all 49 flashcards in this deck.

Unlock Deck

k this deck

47

A parent holding company sells shares in its subsidiary such that the parent now owns only 65% of the subsidiary and,thus,the tax returns of the parent and its subsidiary can't be consolidated.The parent receives annual dividends from the subsidiary of $2,500,000.If the parent's marginal tax rate is 34% and if the exclusion on intercompany dividends is 70%,what is the effective tax rate on the intercompany dividends,and how much net dividends are received?

A)10.2%; $2,245,000

B)10.2%; $2,135,000

C)23.8%; $1,905,000

D)10.2%; $1,750,000

E)34.0%; $1,650,000

A)10.2%; $2,245,000

B)10.2%; $2,135,000

C)23.8%; $1,905,000

D)10.2%; $1,750,000

E)34.0%; $1,650,000

Unlock Deck

Unlock for access to all 49 flashcards in this deck.

Unlock Deck

k this deck

48

The owners of Arthouse Inc.,a national artist supplies chain,are contemplating purchasing Craftworks Inc,a smaller chain.Arthouse's analysts project that the merger will result in incremental free flows and interest tax savings with a combined present value of $72.52 million,and they have determined that the appropriate discount rate for valuing Craftworks is 16%.Craftworks has 4 million shares outstanding and no debt.Craftworks' current price is $16.25.What is the maximum price per share that Arthouse should offer?

A)$16.25

B)$16.97

C)$17.42

D)$18.13

E)$19.00

A)$16.25

B)$16.97

C)$17.42

D)$18.13

E)$19.00

Unlock Deck

Unlock for access to all 49 flashcards in this deck.

Unlock Deck

k this deck

49

Exhibit 26.1

Best Window & Door Corporation is considering the acquisition of Glassmakers Inc. Glassmakers has a capital structure consisting of $5 million (market value) of 11% bonds and $10 million (market value) of common stock. Glassmakers' pre-merger beta is 1.36. Best's beta is 1.02, and both it and Glassmakers face a 40% tax rate. Best's capital structure is 40% debt and 60% equity. The free cash flows from Glassmakers are estimated to be $3.0 million for each of the next 4 years and a horizon value of $10.0 million in Year 4. Tax savings are estimated to be $1 million for each of the next 4 years and a horizon value of $5 million in Year 4. New debt would be issued to finance the acquisition and retire the old debt, and this new debt would have an interest rate of 8%. Currently, the risk-free rate is 6.0% and the market risk premium is 4.0%.

Refer to Exhibit 26.1.What discount rate should you use to discount Glassmakers' free cash flows and interest tax savings?

A)10.01%

B)10.06%

C)11.29%

D)11.44%

E)13.49%

Best Window & Door Corporation is considering the acquisition of Glassmakers Inc. Glassmakers has a capital structure consisting of $5 million (market value) of 11% bonds and $10 million (market value) of common stock. Glassmakers' pre-merger beta is 1.36. Best's beta is 1.02, and both it and Glassmakers face a 40% tax rate. Best's capital structure is 40% debt and 60% equity. The free cash flows from Glassmakers are estimated to be $3.0 million for each of the next 4 years and a horizon value of $10.0 million in Year 4. Tax savings are estimated to be $1 million for each of the next 4 years and a horizon value of $5 million in Year 4. New debt would be issued to finance the acquisition and retire the old debt, and this new debt would have an interest rate of 8%. Currently, the risk-free rate is 6.0% and the market risk premium is 4.0%.

Refer to Exhibit 26.1.What discount rate should you use to discount Glassmakers' free cash flows and interest tax savings?

A)10.01%

B)10.06%

C)11.29%

D)11.44%

E)13.49%

Unlock Deck

Unlock for access to all 49 flashcards in this deck.

Unlock Deck

k this deck