Deck 25: Standard Cost Systems: a Financial Reporting Perspective Using Microsoft Excel

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/138

Play

Full screen (f)

Deck 25: Standard Cost Systems: a Financial Reporting Perspective Using Microsoft Excel

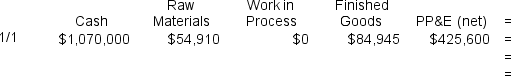

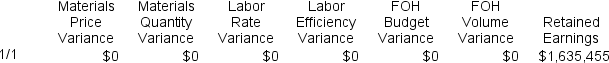

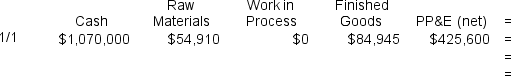

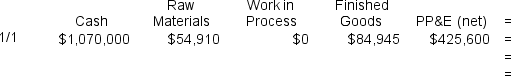

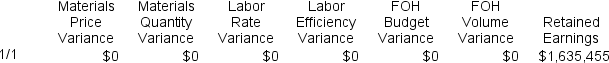

1

Newbery Corporation manufactures one product.It does not maintain any beginning or ending Work in Process inventories.The company uses a standard cost system in which inventories are recorded at their standard costs and any variances are closed directly to Cost of Goods Sold.There is no variable manufacturing overhead.The fixed manufacturing overhead standards for the company's only product specify 0.60 hours per unit at $9.50 per hour.The standard fixed manufacturing overhead rate was based on budgeted fixed manufacturing overhead of $199,500 and budgeted activity of 21,000 hours.During the year,44,000 units were started and completed.Actual fixed overhead costs for the year were $216,200. Assume that all transactions are recorded on a worksheet as shown in the text.On the left-hand side of the equals sign in the worksheet are columns for Cash,Raw Materials,Work in Process,Finished Goods,and PP&E (net).All of the variance columns are on the right-hand-side of the equals sign along with the column for Retained Earnings.

When the fixed manufacturing overhead cost is recorded,which of the following entries will be made?

A) ($16,700) in the FOH Budget Variance column

B) ($16,700) in the FOH Volume Variance column

C) $16,700 in the FOH Volume Variance column

D) $16,700 in the FOH Budget Variance column

When the fixed manufacturing overhead cost is recorded,which of the following entries will be made?

A) ($16,700) in the FOH Budget Variance column

B) ($16,700) in the FOH Volume Variance column

C) $16,700 in the FOH Volume Variance column

D) $16,700 in the FOH Budget Variance column

A

Explanation:

Budget variance = Actual fixed overhead - Budgeted fixed overhead

= $216,200 - $199,500

= $16,700 U

Favorable variances are entered in the worksheet as positive entries and unfavorable variances as negative entries.

Explanation:

Budget variance = Actual fixed overhead - Budgeted fixed overhead

= $216,200 - $199,500

= $16,700 U

Favorable variances are entered in the worksheet as positive entries and unfavorable variances as negative entries.

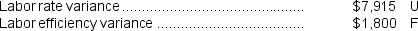

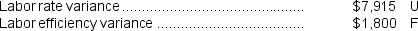

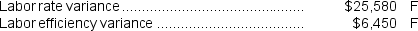

2

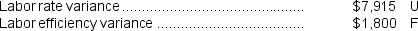

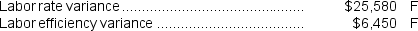

Loos Corporation uses a standard cost system in which inventories are recorded at their standard costs and any variances are closed directly to Cost of Goods Sold.The direct labor standards for the company's only product specify 0.90 hours per unit at $21.50 per hour.During the year,the company started and completed 26,800 units.Direct labor employees worked 25,220 hours at an average cost of $22.50 per hour. Assume that all transactions are recorded on a worksheet as shown in the text.On the left-hand side of the equals sign in the worksheet are columns for Cash,Raw Materials,Work in Process,Finished Goods,and PP&E (net).All of the variance columns are on the right-hand-side of the equals sign along with the column for Retained Earnings.

When the direct labor cost is recorded,which of the following entries will be made?

A) ($25,220) in the Labor Rate Variance column

B) $25,220 in the Labor Rate Variance column

C) $25,220 in the Labor Efficiency Variance column

D) ($25,220) in the Labor Efficiency Variance column

When the direct labor cost is recorded,which of the following entries will be made?

A) ($25,220) in the Labor Rate Variance column

B) $25,220 in the Labor Rate Variance column

C) $25,220 in the Labor Efficiency Variance column

D) ($25,220) in the Labor Efficiency Variance column

A

Explanation:

Labor rate variance = AH × (AR - SR)

= 25,220 hours × ($22.50 per hour - $21.50 per hour)

= 25,220 hours × ($1.00 per hour)

= $25,220 U

Favorable variances are entered in the worksheet as positive entries and unfavorable variances as negative entries.

Explanation:

Labor rate variance = AH × (AR - SR)

= 25,220 hours × ($22.50 per hour - $21.50 per hour)

= 25,220 hours × ($1.00 per hour)

= $25,220 U

Favorable variances are entered in the worksheet as positive entries and unfavorable variances as negative entries.

3

When Raw Materials,Work in Process,and Finished Goods are recorded and carried at their standard cost,the fixed overhead applied to work in process is calculated by multiplying the predetermined overhead rate by the actual direct labor-hours worked.

False

4

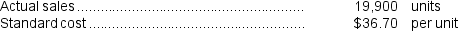

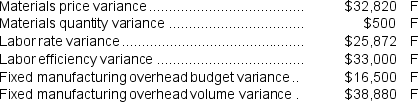

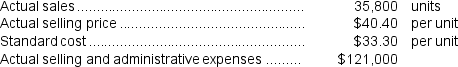

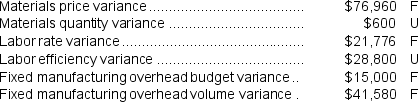

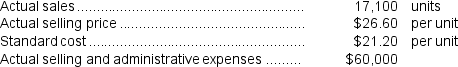

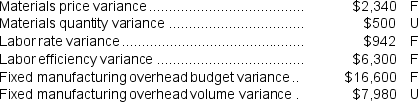

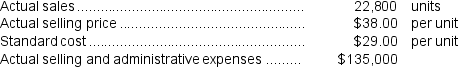

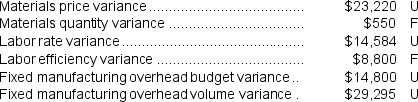

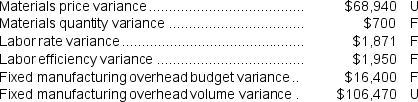

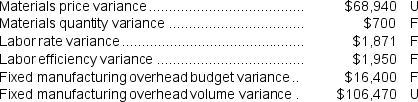

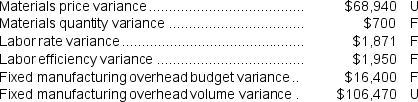

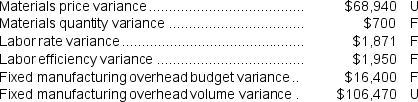

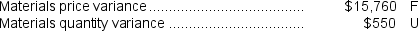

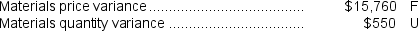

Ciresi Corporation manufactures one product.It does not maintain any beginning or ending Work in Process inventories.The company uses a standard cost system in which inventories are recorded at their standard costs and any variances are closed directly to Cost of Goods Sold.The company has provided the following information:

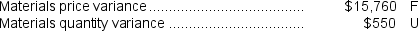

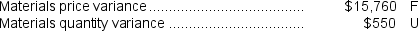

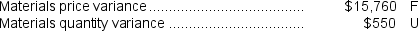

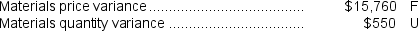

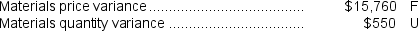

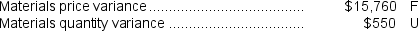

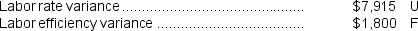

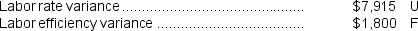

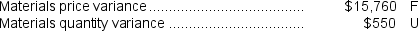

The company does not have any variable manufacturing overhead costs and it recorded the following variances during the year:

The company does not have any variable manufacturing overhead costs and it recorded the following variances during the year:

The adjusted Cost of Goods Sold after closing all of the variances to Cost of Goods Sold will be closest to:

The adjusted Cost of Goods Sold after closing all of the variances to Cost of Goods Sold will be closest to:

A) $1,066,952

B) $877,902

C) $730,330

D) $582,758

The company does not have any variable manufacturing overhead costs and it recorded the following variances during the year:

The company does not have any variable manufacturing overhead costs and it recorded the following variances during the year: The adjusted Cost of Goods Sold after closing all of the variances to Cost of Goods Sold will be closest to:

The adjusted Cost of Goods Sold after closing all of the variances to Cost of Goods Sold will be closest to:A) $1,066,952

B) $877,902

C) $730,330

D) $582,758

Unlock Deck

Unlock for access to all 138 flashcards in this deck.

Unlock Deck

k this deck

5

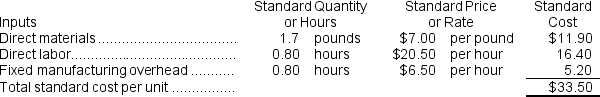

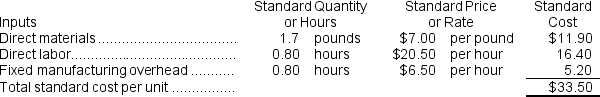

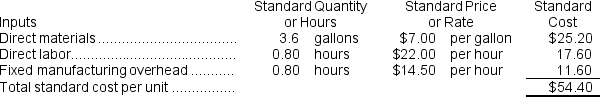

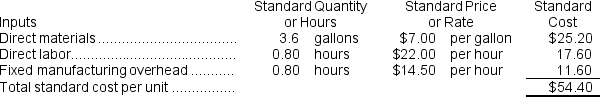

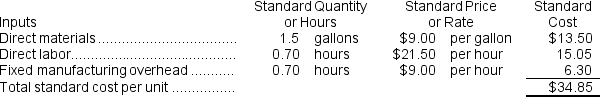

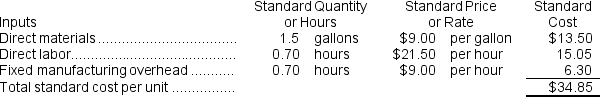

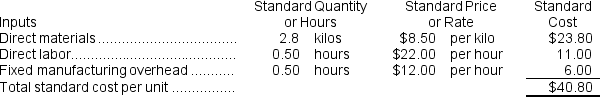

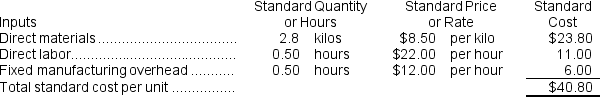

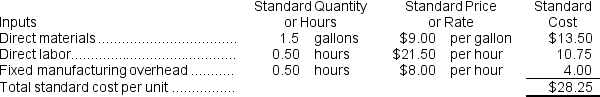

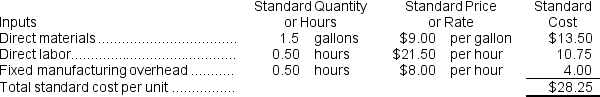

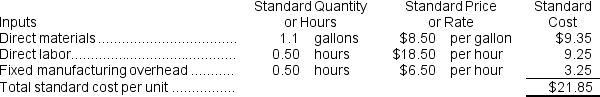

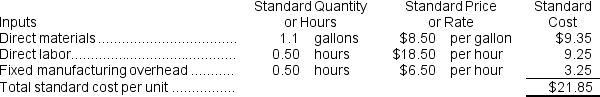

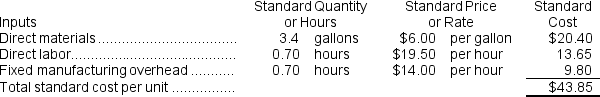

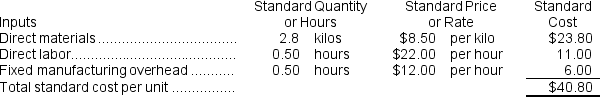

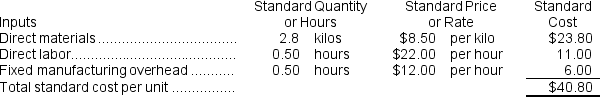

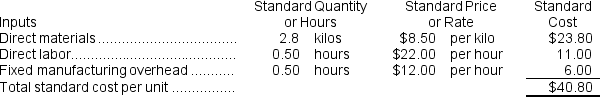

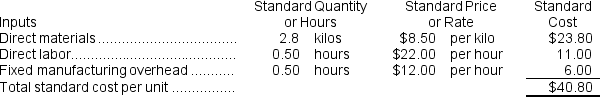

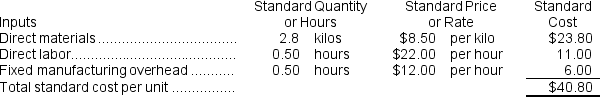

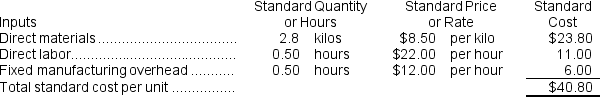

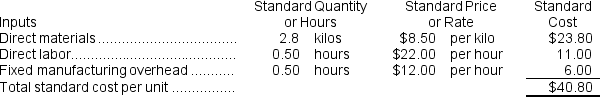

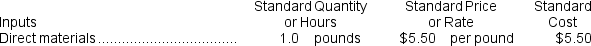

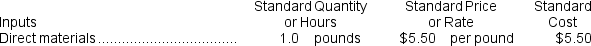

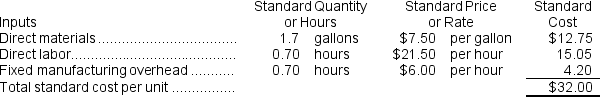

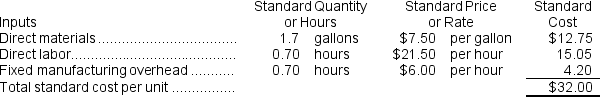

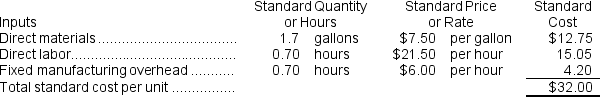

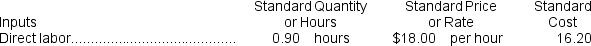

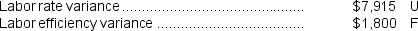

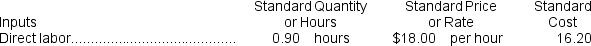

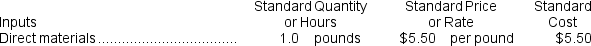

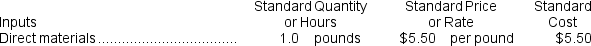

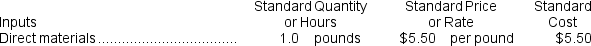

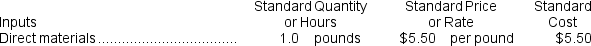

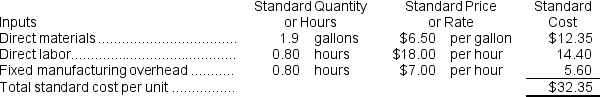

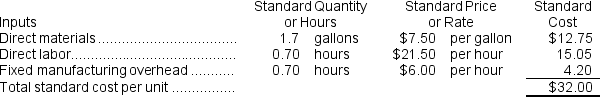

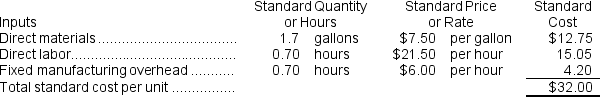

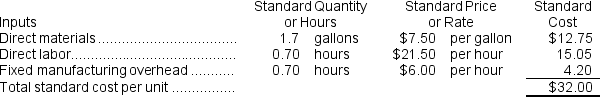

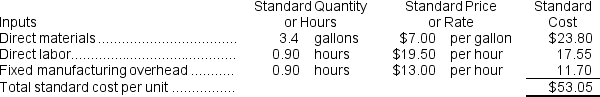

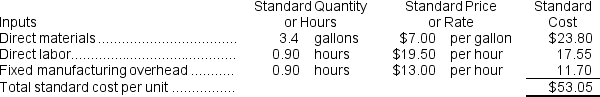

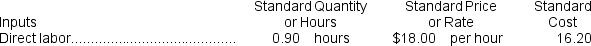

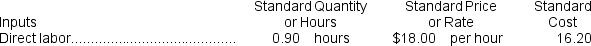

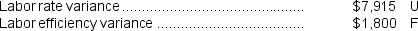

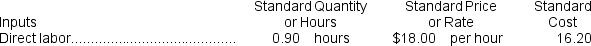

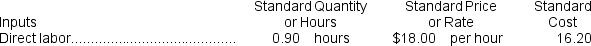

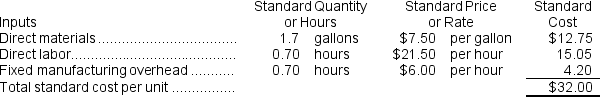

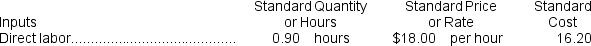

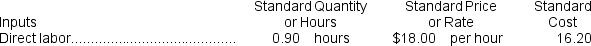

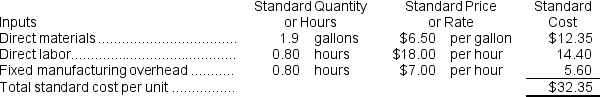

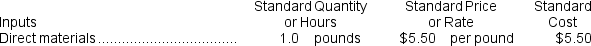

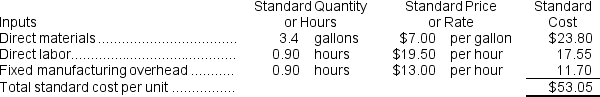

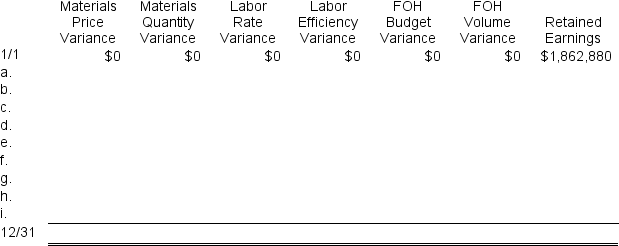

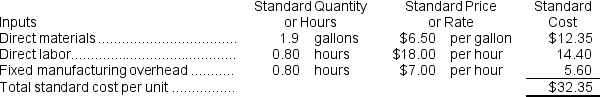

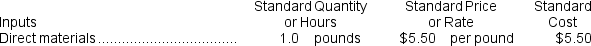

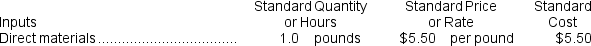

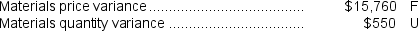

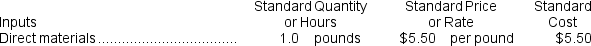

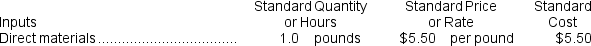

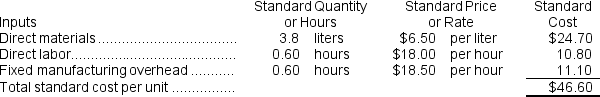

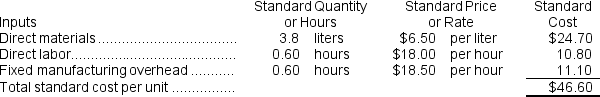

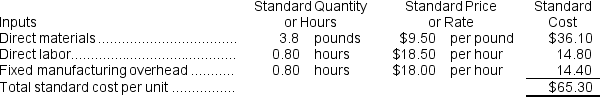

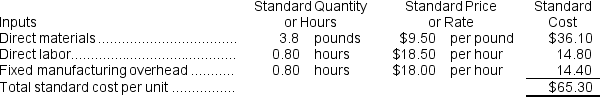

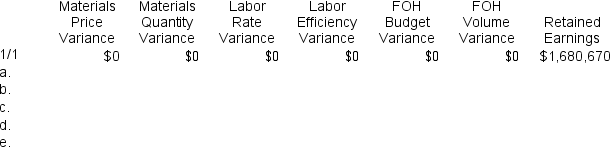

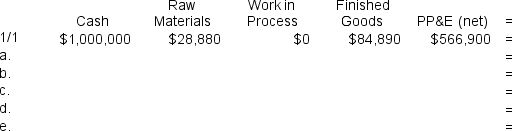

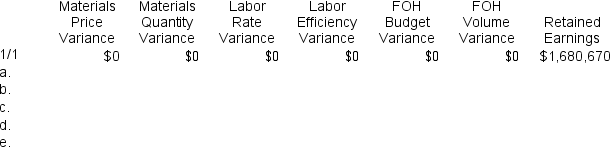

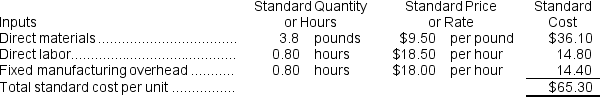

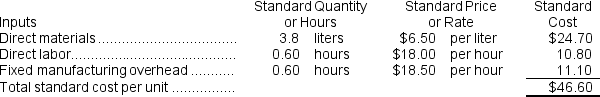

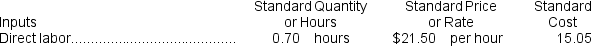

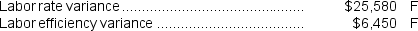

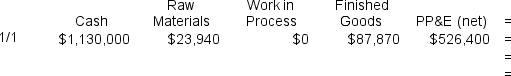

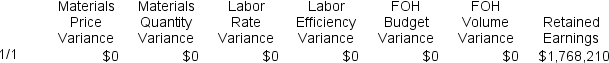

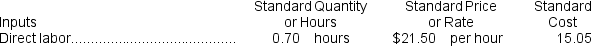

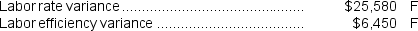

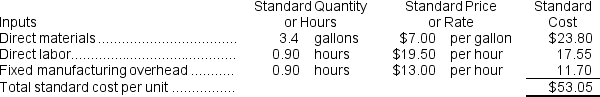

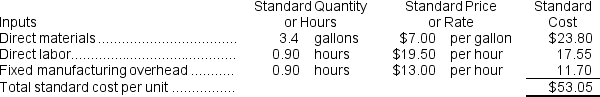

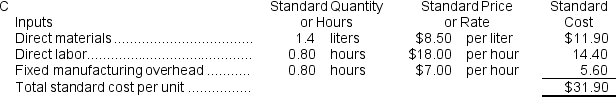

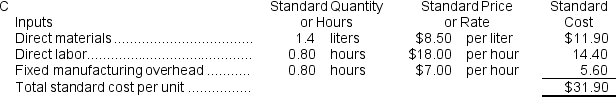

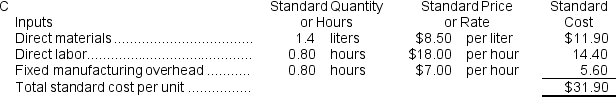

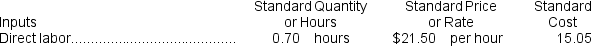

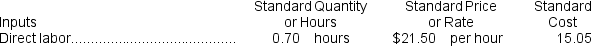

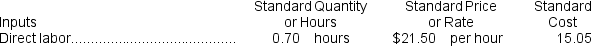

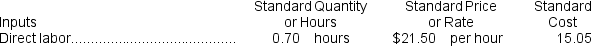

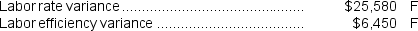

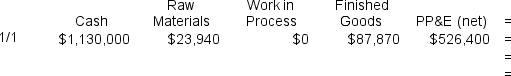

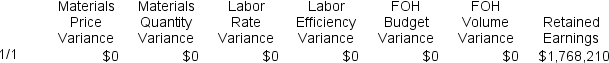

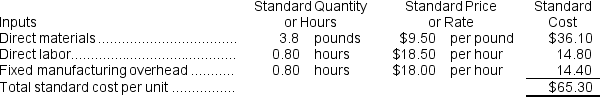

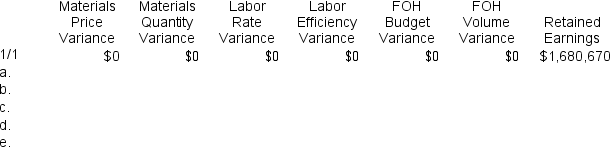

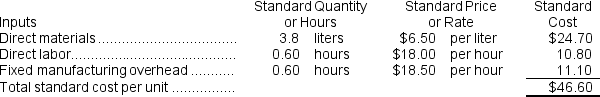

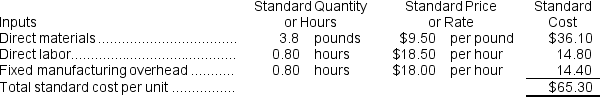

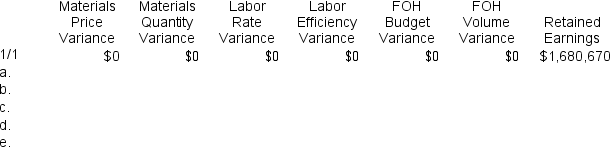

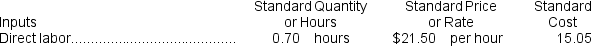

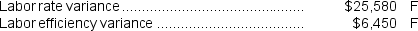

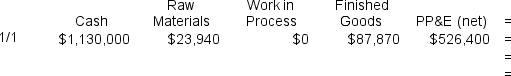

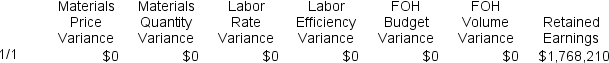

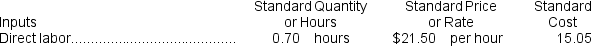

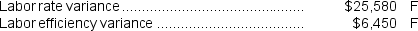

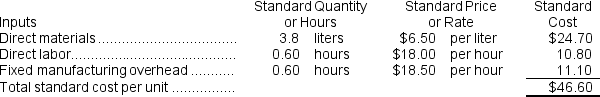

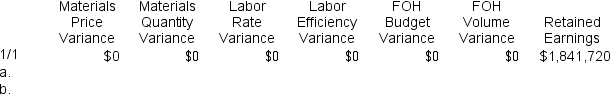

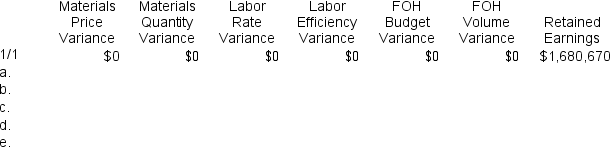

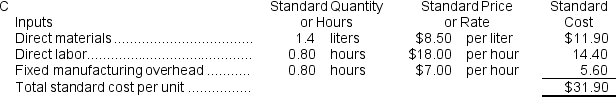

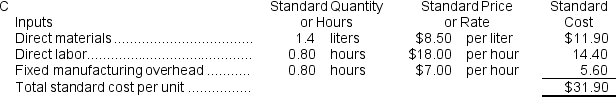

Lemke Corporation uses a standard cost system in which inventories are recorded at their standard costs and any variances are closed directly to Cost of Goods Sold.The standard cost card for the company's only product is as follows:

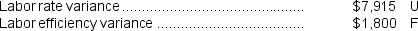

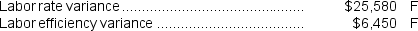

During the year,the company started and completed 12,300 units.Direct labor employees worked 10,540 hours at an average cost of $22.40 per hour.

During the year,the company started and completed 12,300 units.Direct labor employees worked 10,540 hours at an average cost of $22.40 per hour.

Assume that all transactions are recorded on a worksheet as shown in the text.On the left-hand side of the equals sign in the worksheet are columns for Cash,Raw Materials,Work in Process,Finished Goods,and PP&E (net).All of the variance columns are on the right-hand-side of the equals sign along with the column for Retained Earnings.

When the direct labor cost is recorded,which of the following entries will be made?

A) $20,026 in the Labor Efficiency Variance column

B) $20,026 in the Labor Rate Variance column

C) ($20,026) in the Labor Rate Variance column

D) ($20,026) in the Labor Efficiency Variance column

During the year,the company started and completed 12,300 units.Direct labor employees worked 10,540 hours at an average cost of $22.40 per hour.

During the year,the company started and completed 12,300 units.Direct labor employees worked 10,540 hours at an average cost of $22.40 per hour.Assume that all transactions are recorded on a worksheet as shown in the text.On the left-hand side of the equals sign in the worksheet are columns for Cash,Raw Materials,Work in Process,Finished Goods,and PP&E (net).All of the variance columns are on the right-hand-side of the equals sign along with the column for Retained Earnings.

When the direct labor cost is recorded,which of the following entries will be made?

A) $20,026 in the Labor Efficiency Variance column

B) $20,026 in the Labor Rate Variance column

C) ($20,026) in the Labor Rate Variance column

D) ($20,026) in the Labor Efficiency Variance column

Unlock Deck

Unlock for access to all 138 flashcards in this deck.

Unlock Deck

k this deck

6

Shankland Corporation manufactures one product.It does not maintain any beginning or ending Work in Process inventories.The company uses a standard cost system in which inventories are recorded at their standard costs and any variances are closed directly to Cost of Goods Sold.There is no variable manufacturing overhead.The standard cost card for the company's only product is as follows:

The standard fixed manufacturing overhead rate was based on budgeted fixed manufacturing overhead of $67,500 and budgeted activity of 7,500 hours.During the year,24,600 units were started and completed.Actual fixed overhead costs for the year were $84,800.

The standard fixed manufacturing overhead rate was based on budgeted fixed manufacturing overhead of $67,500 and budgeted activity of 7,500 hours.During the year,24,600 units were started and completed.Actual fixed overhead costs for the year were $84,800.

Assume that all transactions are recorded on a worksheet as shown in the text.On the left-hand side of the equals sign in the worksheet are columns for Cash,Raw Materials,Work in Process,Finished Goods,and PP&E (net).All of the variance columns are on the right-hand-side of the equals sign along with the column for Retained Earnings.

When applying fixed manufacturing overhead to production,the Work in Process inventory account will increase (decrease)by:

A) $110,700

B) ($6,800)

C) ($110,700)

D) $6,800

The standard fixed manufacturing overhead rate was based on budgeted fixed manufacturing overhead of $67,500 and budgeted activity of 7,500 hours.During the year,24,600 units were started and completed.Actual fixed overhead costs for the year were $84,800.

The standard fixed manufacturing overhead rate was based on budgeted fixed manufacturing overhead of $67,500 and budgeted activity of 7,500 hours.During the year,24,600 units were started and completed.Actual fixed overhead costs for the year were $84,800.Assume that all transactions are recorded on a worksheet as shown in the text.On the left-hand side of the equals sign in the worksheet are columns for Cash,Raw Materials,Work in Process,Finished Goods,and PP&E (net).All of the variance columns are on the right-hand-side of the equals sign along with the column for Retained Earnings.

When applying fixed manufacturing overhead to production,the Work in Process inventory account will increase (decrease)by:

A) $110,700

B) ($6,800)

C) ($110,700)

D) $6,800

Unlock Deck

Unlock for access to all 138 flashcards in this deck.

Unlock Deck

k this deck

7

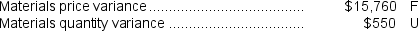

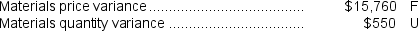

Sousa Corporation uses a standard cost system in which inventories are recorded at their standard costs and any variances are closed directly to Cost of Goods Sold.The standards for direct materials for the company's only product specify 2.8 kilos per unit at $7.50 per kilo or $21.00 per unit.During the year,the company purchased 82,100 kilos of raw material at a price of $7.40 per kilo and used 78,020 kilos of the raw material to produce 27,900 units of work in process. Assume that all transactions are recorded on a worksheet as shown in the text.On the left-hand side of the equals sign in the worksheet are columns for Cash,Raw Materials,Work in Process,Finished Goods,and PP&E (net).All of the variance columns are on the right-hand-side of the equals sign along with the column for Retained Earnings.

When the raw materials used in production are recorded,which of the following entries will be made?

A) $750 in the Materials Quantity Variance column

B) $750 in the Materials Price Variance column

C) ($750) in the Materials Quantity Variance column

D) ($750) in the Materials Price Variance column

When the raw materials used in production are recorded,which of the following entries will be made?

A) $750 in the Materials Quantity Variance column

B) $750 in the Materials Price Variance column

C) ($750) in the Materials Quantity Variance column

D) ($750) in the Materials Price Variance column

Unlock Deck

Unlock for access to all 138 flashcards in this deck.

Unlock Deck

k this deck

8

Platko Corporation manufactures one product.It does not maintain any beginning or ending Work in Process inventories.The company uses a standard cost system in which inventories are recorded at their standard costs and any variances are closed directly to Cost of Goods Sold.There is no variable manufacturing overhead.The standard cost card for the company's only product is as follows:

The standard fixed manufacturing overhead rate was based on budgeted fixed manufacturing overhead of $348,000 and budgeted activity of 24,000 hours.During the year,38,900 units were started and completed.Actual fixed overhead costs for the year were $335,900.

The standard fixed manufacturing overhead rate was based on budgeted fixed manufacturing overhead of $348,000 and budgeted activity of 24,000 hours.During the year,38,900 units were started and completed.Actual fixed overhead costs for the year were $335,900.

Assume that all transactions are recorded on a worksheet as shown in the text.On the left-hand side of the equals sign in the worksheet are columns for Cash,Raw Materials,Work in Process,Finished Goods,and PP&E (net).All of the variance columns are on the right-hand-side of the equals sign along with the column for Retained Earnings.

When the fixed manufacturing overhead cost is recorded,which of the following entries will be made?

A) $12,100 in the FOH Volume Variance column

B) ($12,100) in the FOH Volume Variance column

C) $12,100 in the FOH Budget Variance column

D) ($12,100) in the FOH Budget Variance column

The standard fixed manufacturing overhead rate was based on budgeted fixed manufacturing overhead of $348,000 and budgeted activity of 24,000 hours.During the year,38,900 units were started and completed.Actual fixed overhead costs for the year were $335,900.

The standard fixed manufacturing overhead rate was based on budgeted fixed manufacturing overhead of $348,000 and budgeted activity of 24,000 hours.During the year,38,900 units were started and completed.Actual fixed overhead costs for the year were $335,900.Assume that all transactions are recorded on a worksheet as shown in the text.On the left-hand side of the equals sign in the worksheet are columns for Cash,Raw Materials,Work in Process,Finished Goods,and PP&E (net).All of the variance columns are on the right-hand-side of the equals sign along with the column for Retained Earnings.

When the fixed manufacturing overhead cost is recorded,which of the following entries will be made?

A) $12,100 in the FOH Volume Variance column

B) ($12,100) in the FOH Volume Variance column

C) $12,100 in the FOH Budget Variance column

D) ($12,100) in the FOH Budget Variance column

Unlock Deck

Unlock for access to all 138 flashcards in this deck.

Unlock Deck

k this deck

9

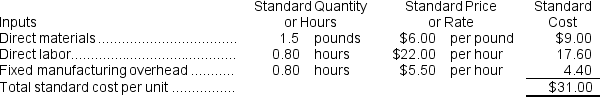

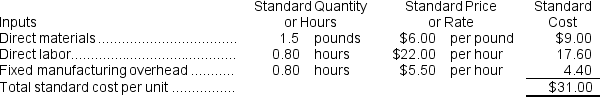

Juliano Corporation uses a standard cost system in which inventories are recorded at their standard costs and any variances are closed directly to Cost of Goods Sold.The standard cost card for the company's only product is as follows:

During the year,the company purchased 29,700 pounds of raw material at a price of $5.20 per pound and used 25,700 pounds of the raw material to produce 17,200 units of work in process.

During the year,the company purchased 29,700 pounds of raw material at a price of $5.20 per pound and used 25,700 pounds of the raw material to produce 17,200 units of work in process.

Assume that all transactions are recorded on a worksheet as shown in the text.On the left-hand side of the equals sign in the worksheet are columns for Cash,Raw Materials,Work in Process,Finished Goods,and PP&E (net).All of the variance columns are on the right-hand-side of the equals sign along with the column for Retained Earnings.

When the raw materials used in production are recorded,which of the following entries will be made?

A) $600 in the Materials Price Variance column

B) $600 in the Materials Quantity Variance column

C) ($600) in the Materials Price Variance column

D) ($600) in the Materials Quantity Variance column

During the year,the company purchased 29,700 pounds of raw material at a price of $5.20 per pound and used 25,700 pounds of the raw material to produce 17,200 units of work in process.

During the year,the company purchased 29,700 pounds of raw material at a price of $5.20 per pound and used 25,700 pounds of the raw material to produce 17,200 units of work in process.Assume that all transactions are recorded on a worksheet as shown in the text.On the left-hand side of the equals sign in the worksheet are columns for Cash,Raw Materials,Work in Process,Finished Goods,and PP&E (net).All of the variance columns are on the right-hand-side of the equals sign along with the column for Retained Earnings.

When the raw materials used in production are recorded,which of the following entries will be made?

A) $600 in the Materials Price Variance column

B) $600 in the Materials Quantity Variance column

C) ($600) in the Materials Price Variance column

D) ($600) in the Materials Quantity Variance column

Unlock Deck

Unlock for access to all 138 flashcards in this deck.

Unlock Deck

k this deck

10

Dews Corporation manufactures one product.It does not maintain any beginning or ending Work in Process inventories.The company uses a standard cost system in which inventories are recorded at their standard costs and any variances are closed directly to Cost of Goods Sold.There is no variable manufacturing overhead.The fixed manufacturing overhead standards for the company's only product specify 0.90 hours per unit at $20.50 per hour.The standard fixed manufacturing overhead rate was based on budgeted fixed manufacturing overhead of $369,000 and budgeted activity of 18,000 hours.During the year,14,100 units were started and completed.Actual fixed overhead costs for the year were $386,200. Assume that all transactions are recorded on a worksheet as shown in the text.On the left-hand side of the equals sign in the worksheet are columns for Cash,Raw Materials,Work in Process,Finished Goods,and PP&E (net).All of the variance columns are on the right-hand-side of the equals sign along with the column for Retained Earnings.

When the fixed manufacturing overhead cost is recorded,which of the following entries will be made?

A) $108,855 in the FOH Volume Variance column

B) ($108,855) in the FOH Budget Variance column

C) $108,855 in the FOH Budget Variance column

D) ($108,855) in the FOH Volume Variance column

When the fixed manufacturing overhead cost is recorded,which of the following entries will be made?

A) $108,855 in the FOH Volume Variance column

B) ($108,855) in the FOH Budget Variance column

C) $108,855 in the FOH Budget Variance column

D) ($108,855) in the FOH Volume Variance column

Unlock Deck

Unlock for access to all 138 flashcards in this deck.

Unlock Deck

k this deck

11

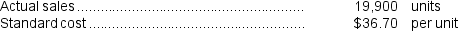

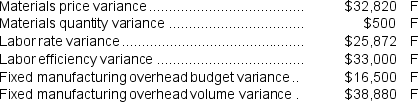

Ferrero Corporation manufactures one product.It does not maintain any beginning or ending Work in Process inventories.The company uses a standard cost system in which inventories are recorded at their standard costs and any variances are closed directly to Cost of Goods Sold.The company has provided the following information:

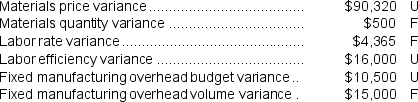

The company does not have any variable manufacturing overhead costs and it recorded the following variances during the year:

The company does not have any variable manufacturing overhead costs and it recorded the following variances during the year:

When the company closes its standard cost variances,the Cost of Goods Sold will increase (decrease)by:

When the company closes its standard cost variances,the Cost of Goods Sold will increase (decrease)by:

A) $56,580

B) ($125,916)

C) ($56,580)

D) $125,916

The company does not have any variable manufacturing overhead costs and it recorded the following variances during the year:

The company does not have any variable manufacturing overhead costs and it recorded the following variances during the year: When the company closes its standard cost variances,the Cost of Goods Sold will increase (decrease)by:

When the company closes its standard cost variances,the Cost of Goods Sold will increase (decrease)by:A) $56,580

B) ($125,916)

C) ($56,580)

D) $125,916

Unlock Deck

Unlock for access to all 138 flashcards in this deck.

Unlock Deck

k this deck

12

As defined it the text,the ending balance in retained earnings equals the beginning balance in retained earnings plus net operating income minus dividends.

Unlock Deck

Unlock for access to all 138 flashcards in this deck.

Unlock Deck

k this deck

13

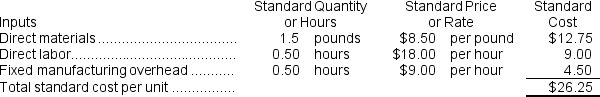

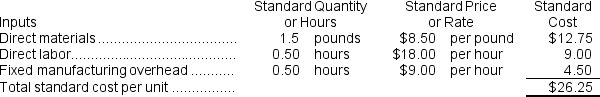

Karim Corporation uses a standard cost system in which inventories are recorded at their standard costs and any variances are closed directly to Cost of Goods Sold.The standard cost card for the company's only product is as follows:

During the year,the company started and completed 31,500 units.Direct labor employees worked 23,650 hours at an average cost of $19.50 per hour.

During the year,the company started and completed 31,500 units.Direct labor employees worked 23,650 hours at an average cost of $19.50 per hour.

Assume that all transactions are recorded on a worksheet as shown in the text.On the left-hand side of the equals sign in the worksheet are columns for Cash,Raw Materials,Work in Process,Finished Goods,and PP&E (net).All of the variance columns are on the right-hand-side of the equals sign along with the column for Retained Earnings.

When recording the direct labor costs,the Work in Process inventory account will increase (decrease)by:

A) $474,075

B) ($474,075)

C) ($461,175)

D) $461,175

During the year,the company started and completed 31,500 units.Direct labor employees worked 23,650 hours at an average cost of $19.50 per hour.

During the year,the company started and completed 31,500 units.Direct labor employees worked 23,650 hours at an average cost of $19.50 per hour.Assume that all transactions are recorded on a worksheet as shown in the text.On the left-hand side of the equals sign in the worksheet are columns for Cash,Raw Materials,Work in Process,Finished Goods,and PP&E (net).All of the variance columns are on the right-hand-side of the equals sign along with the column for Retained Earnings.

When recording the direct labor costs,the Work in Process inventory account will increase (decrease)by:

A) $474,075

B) ($474,075)

C) ($461,175)

D) $461,175

Unlock Deck

Unlock for access to all 138 flashcards in this deck.

Unlock Deck

k this deck

14

In the Excel spreadsheet approach in Appendix 10B in the text,each variance has its own clearing account that appears on the right-hand side of the "=" sign.This enables us to record all favorable variances as increases to their respective clearing accounts and all unfavorable variances as decreases to their accounts.

Unlock Deck

Unlock for access to all 138 flashcards in this deck.

Unlock Deck

k this deck

15

Johanson Corporation uses a standard cost system in which inventories are recorded at their standard costs and any variances are closed directly to Cost of Goods Sold.The standard cost card for the company's only product is as follows:

During the year,the company purchased 89,600 pounds of raw material at a price of $7.80 per pound and used 79,120 pounds of the raw material to produce 23,300 units of work in process.

During the year,the company purchased 89,600 pounds of raw material at a price of $7.80 per pound and used 79,120 pounds of the raw material to produce 23,300 units of work in process.

Assume that all transactions are recorded on a worksheet as shown in the text.On the left-hand side of the equals sign in the worksheet are columns for Cash,Raw Materials,Work in Process,Finished Goods,and PP&E (net).All of the variance columns are on the right-hand-side of the equals sign along with the column for Retained Earnings.

When recording the raw materials purchases,the Raw Materials inventory account will increase (decrease)by:

A) $698,880

B) ($716,800)

C) ($698,880)

D) $716,800

During the year,the company purchased 89,600 pounds of raw material at a price of $7.80 per pound and used 79,120 pounds of the raw material to produce 23,300 units of work in process.

During the year,the company purchased 89,600 pounds of raw material at a price of $7.80 per pound and used 79,120 pounds of the raw material to produce 23,300 units of work in process.Assume that all transactions are recorded on a worksheet as shown in the text.On the left-hand side of the equals sign in the worksheet are columns for Cash,Raw Materials,Work in Process,Finished Goods,and PP&E (net).All of the variance columns are on the right-hand-side of the equals sign along with the column for Retained Earnings.

When recording the raw materials purchases,the Raw Materials inventory account will increase (decrease)by:

A) $698,880

B) ($716,800)

C) ($698,880)

D) $716,800

Unlock Deck

Unlock for access to all 138 flashcards in this deck.

Unlock Deck

k this deck

16

Bialas Corporation uses a standard cost system in which inventories are recorded at their standard costs and any variances are closed directly to Cost of Goods Sold.The standards for direct materials for the company's only product specify 1.6 liters per unit at $7.00 per liter or $11.20 per unit.During the year,the company purchased 36,400 liters of raw material at a price of $7.40 per liter and used 32,060 liters of the raw material to produce 20,100 units of work in process. Assume that all transactions are recorded on a worksheet as shown in the text.On the left-hand side of the equals sign in the worksheet are columns for Cash,Raw Materials,Work in Process,Finished Goods,and PP&E (net).All of the variance columns are on the right-hand-side of the equals sign along with the column for Retained Earnings.

When the purchase of raw materials is recorded,which of the following entries will be made?

A) ($14,560) in the Materials Quantity Variance column

B) ($14,560) in the Materials Price Variance column

C) $14,560 in the Materials Price Variance column

D) $14,560 in the Materials Quantity Variance column

When the purchase of raw materials is recorded,which of the following entries will be made?

A) ($14,560) in the Materials Quantity Variance column

B) ($14,560) in the Materials Price Variance column

C) $14,560 in the Materials Price Variance column

D) $14,560 in the Materials Quantity Variance column

Unlock Deck

Unlock for access to all 138 flashcards in this deck.

Unlock Deck

k this deck

17

Dalgleish Corporation manufactures one product.It does not maintain any beginning or ending Work in Process inventories.The company uses a standard cost system in which inventories are recorded at their standard costs and any variances are closed directly to Cost of Goods Sold.There is no variable manufacturing overhead.The standard cost card for the company's only product is as follows:

The standard fixed manufacturing overhead rate was based on budgeted fixed manufacturing overhead of $358,750 and budgeted activity of 17,500 hours.During the year,32,900 units were started and completed.Actual fixed overhead costs for the year were $347,350.

The standard fixed manufacturing overhead rate was based on budgeted fixed manufacturing overhead of $358,750 and budgeted activity of 17,500 hours.During the year,32,900 units were started and completed.Actual fixed overhead costs for the year were $347,350.

Assume that all transactions are recorded on a worksheet as shown in the text.On the left-hand side of the equals sign in the worksheet are columns for Cash,Raw Materials,Work in Process,Finished Goods,and PP&E (net).All of the variance columns are on the right-hand-side of the equals sign along with the column for Retained Earnings.

When the fixed manufacturing overhead cost is recorded,which of the following entries will be made?

A) ($113,365) in the FOH Budget Variance column

B) ($113,365) in the FOH Volume Variance column

C) $113,365 in the FOH Budget Variance column

D) $113,365 in the FOH Volume Variance column

The standard fixed manufacturing overhead rate was based on budgeted fixed manufacturing overhead of $358,750 and budgeted activity of 17,500 hours.During the year,32,900 units were started and completed.Actual fixed overhead costs for the year were $347,350.

The standard fixed manufacturing overhead rate was based on budgeted fixed manufacturing overhead of $358,750 and budgeted activity of 17,500 hours.During the year,32,900 units were started and completed.Actual fixed overhead costs for the year were $347,350.Assume that all transactions are recorded on a worksheet as shown in the text.On the left-hand side of the equals sign in the worksheet are columns for Cash,Raw Materials,Work in Process,Finished Goods,and PP&E (net).All of the variance columns are on the right-hand-side of the equals sign along with the column for Retained Earnings.

When the fixed manufacturing overhead cost is recorded,which of the following entries will be made?

A) ($113,365) in the FOH Budget Variance column

B) ($113,365) in the FOH Volume Variance column

C) $113,365 in the FOH Budget Variance column

D) $113,365 in the FOH Volume Variance column

Unlock Deck

Unlock for access to all 138 flashcards in this deck.

Unlock Deck

k this deck

18

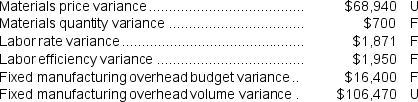

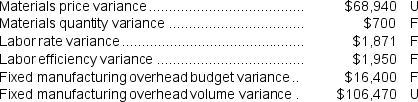

Isenberg Corporation manufactures one product.It does not maintain any beginning or ending Work in Process inventories.The company uses a standard cost system in which inventories are recorded at their standard costs and any variances are closed directly to Cost of Goods Sold.The company does not have any variable manufacturing overhead costs.It recorded the following variances during the year:

When the company closes its standard cost variances,the Cost of Goods Sold will increase (decrease)by:

When the company closes its standard cost variances,the Cost of Goods Sold will increase (decrease)by:

A) ($4,500)

B) $4,500

C) $96,955

D) ($96,955)

When the company closes its standard cost variances,the Cost of Goods Sold will increase (decrease)by:

When the company closes its standard cost variances,the Cost of Goods Sold will increase (decrease)by:A) ($4,500)

B) $4,500

C) $96,955

D) ($96,955)

Unlock Deck

Unlock for access to all 138 flashcards in this deck.

Unlock Deck

k this deck

19

When Raw Materials,Work in Process,and Finished Goods are recorded and carried at their standard cost,the actual prices paid for inputs and the actual quantities of inputs that are used in production affect the costs recorded in the inventory accounts.

Unlock Deck

Unlock for access to all 138 flashcards in this deck.

Unlock Deck

k this deck

20

Ladue Corporation uses a standard cost system in which inventories are recorded at their standard costs and any variances are closed directly to Cost of Goods Sold.The standards for direct materials for the company's only product specify 3.6 kilos per unit at $7.00 per kilo.During the year,the company purchased 67,600 kilos of raw material at a price of $6.40 per kilo and used 60,220 kilos of the raw material to produce 16,700 units of work in process. Assume that all transactions are recorded on a worksheet as shown in the text.On the left-hand side of the equals sign in the worksheet are columns for Cash,Raw Materials,Work in Process,Finished Goods,and PP&E (net).All of the variance columns are on the right-hand-side of the equals sign along with the column for Retained Earnings.

When recording the raw materials used in production,the Work in Process inventory account will increase (decrease)by:

A) $421,540

B) ($421,540)

C) $420,840

D) ($420,840)

When recording the raw materials used in production,the Work in Process inventory account will increase (decrease)by:

A) $421,540

B) ($421,540)

C) $420,840

D) ($420,840)

Unlock Deck

Unlock for access to all 138 flashcards in this deck.

Unlock Deck

k this deck

21

Kellems Corporation manufactures one product.It does not maintain any beginning or ending Work in Process inventories.The company uses a standard cost system in which inventories are recorded at their standard costs and any variances are closed directly to Cost of Goods Sold.The company has provided the following information:

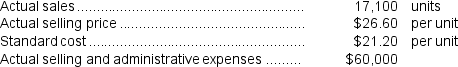

The company does not have any variable manufacturing overhead costs and it recorded the following variances during the year:

The company does not have any variable manufacturing overhead costs and it recorded the following variances during the year:

The adjusted Cost of Goods Sold after closing all of the variances to Cost of Goods Sold will be closest to:

The adjusted Cost of Goods Sold after closing all of the variances to Cost of Goods Sold will be closest to:

A) $380,222

B) $344,818

C) $362,520

D) $472,562

The company does not have any variable manufacturing overhead costs and it recorded the following variances during the year:

The company does not have any variable manufacturing overhead costs and it recorded the following variances during the year: The adjusted Cost of Goods Sold after closing all of the variances to Cost of Goods Sold will be closest to:

The adjusted Cost of Goods Sold after closing all of the variances to Cost of Goods Sold will be closest to:A) $380,222

B) $344,818

C) $362,520

D) $472,562

Unlock Deck

Unlock for access to all 138 flashcards in this deck.

Unlock Deck

k this deck

22

Isaman Corporation uses a standard cost system in which inventories are recorded at their standard costs and any variances are closed directly to Cost of Goods Sold.The direct labor standards for the company's only product specify 0.60 hours per unit at $21.50 per hour.During the year,the company started and completed 11,500 units.Direct labor employees worked 7,500 hours at an average cost of $19.50 per hour. During the year,the company started and completed 11,500 units.Direct labor employees worked 7,500 hours at an average cost of $19.50 per hour.

Assume that all transactions are recorded on a worksheet as shown in the text.On the left-hand side of the equals sign in the worksheet are columns for Cash,Raw Materials,Work in Process,Finished Goods,and PP&E (net).All of the variance columns are on the right-hand-side of the equals sign along with the column for Retained Earnings.

When the direct labor cost is recorded,which of the following entries will be made?

A) ($12,900) in the Labor Rate Variance column

B) $12,900 in the Labor Efficiency Variance column

C) $12,900 in the Labor Rate Variance column

D) ($12,900) in the Labor Efficiency Variance column

Assume that all transactions are recorded on a worksheet as shown in the text.On the left-hand side of the equals sign in the worksheet are columns for Cash,Raw Materials,Work in Process,Finished Goods,and PP&E (net).All of the variance columns are on the right-hand-side of the equals sign along with the column for Retained Earnings.

When the direct labor cost is recorded,which of the following entries will be made?

A) ($12,900) in the Labor Rate Variance column

B) $12,900 in the Labor Efficiency Variance column

C) $12,900 in the Labor Rate Variance column

D) ($12,900) in the Labor Efficiency Variance column

Unlock Deck

Unlock for access to all 138 flashcards in this deck.

Unlock Deck

k this deck

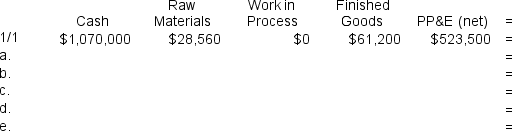

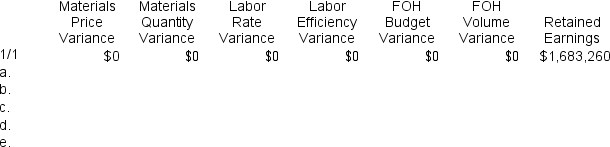

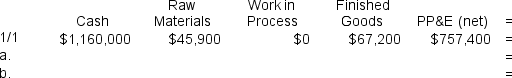

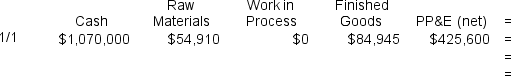

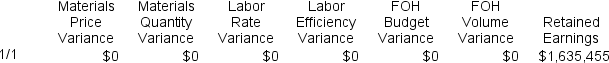

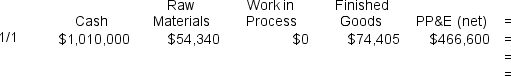

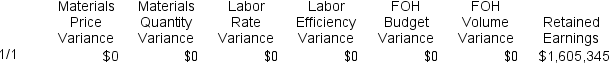

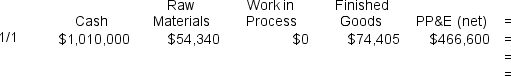

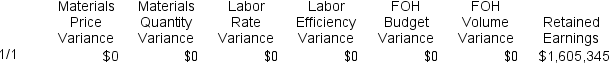

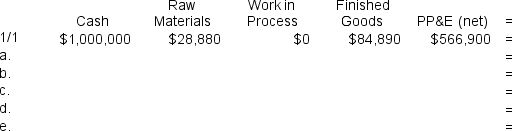

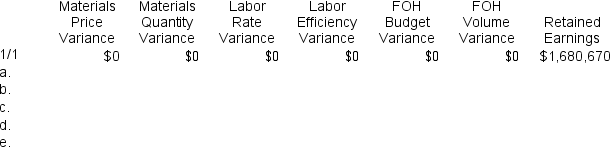

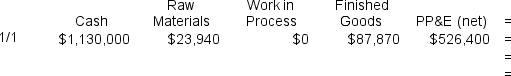

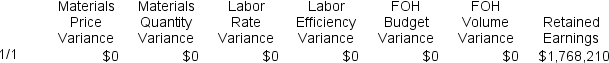

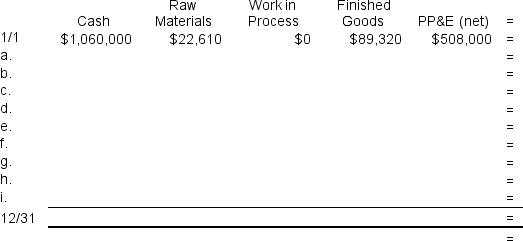

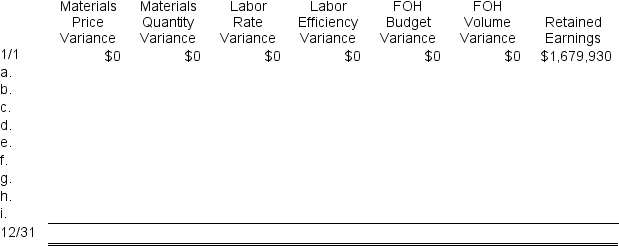

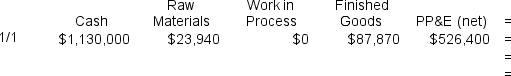

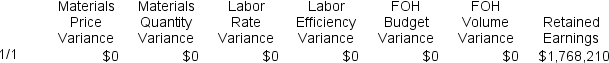

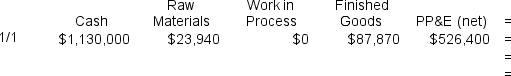

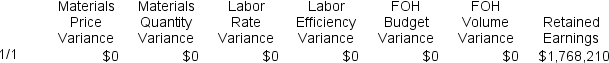

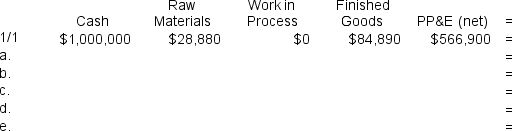

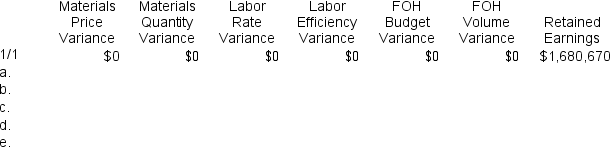

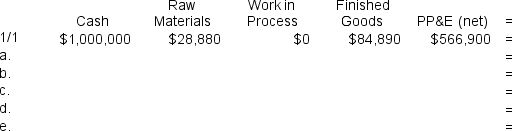

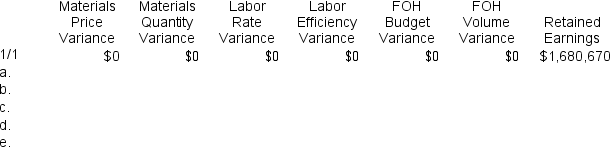

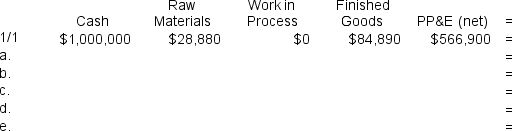

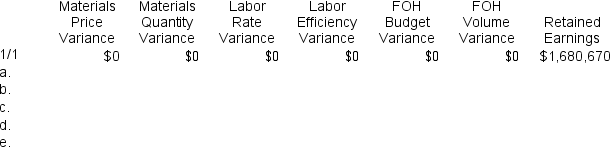

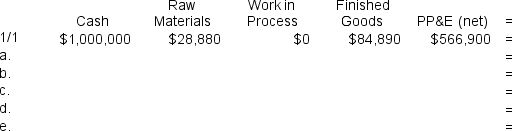

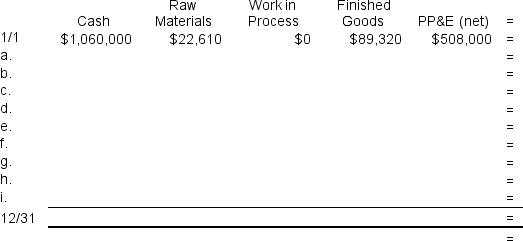

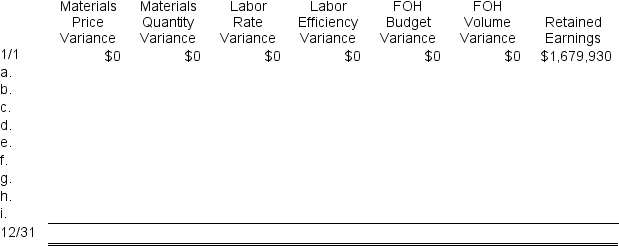

23

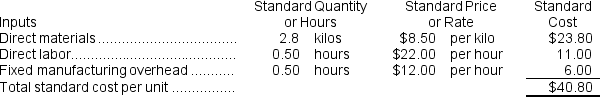

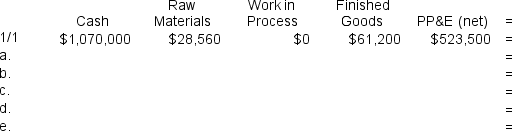

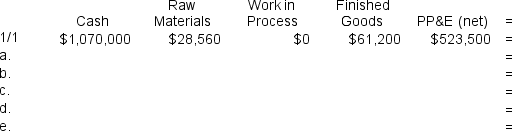

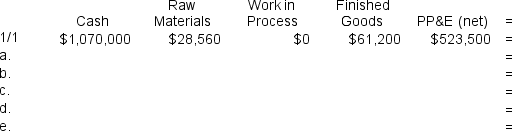

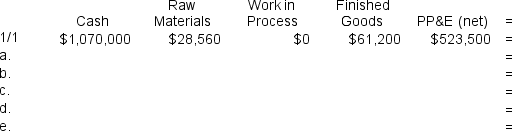

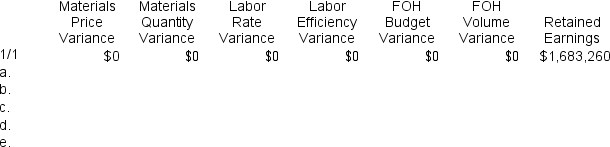

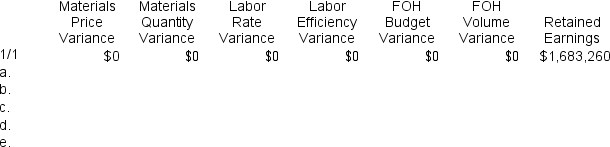

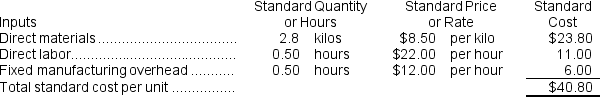

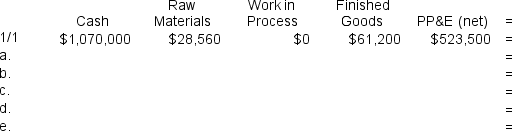

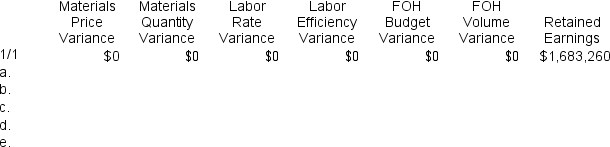

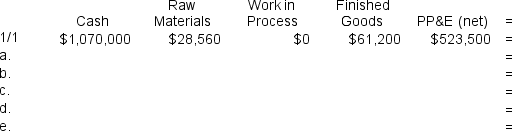

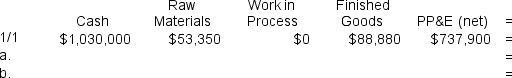

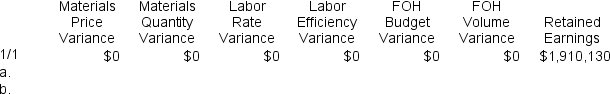

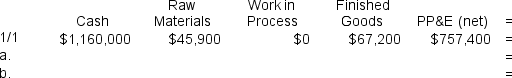

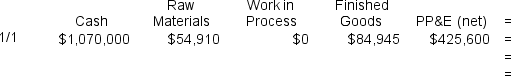

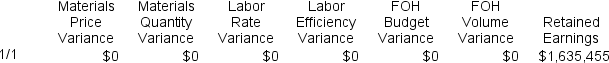

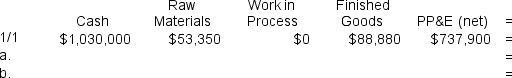

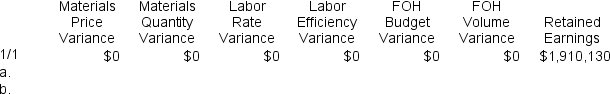

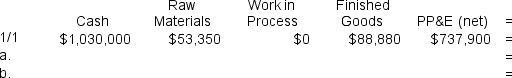

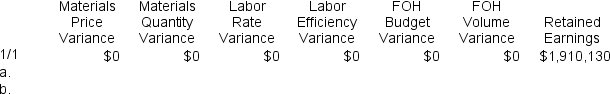

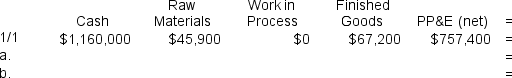

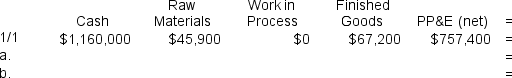

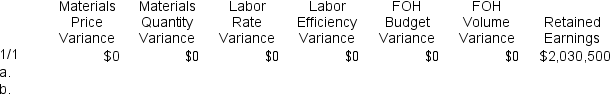

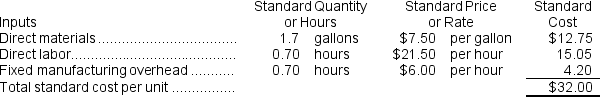

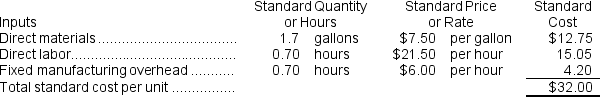

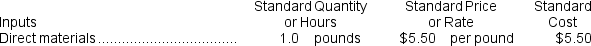

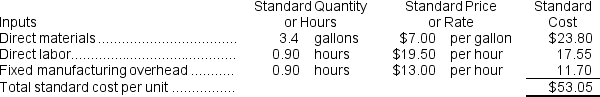

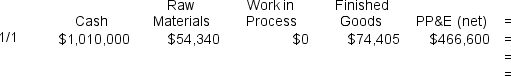

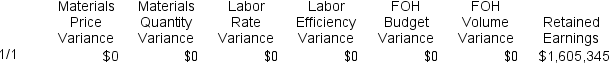

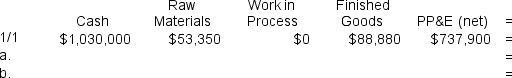

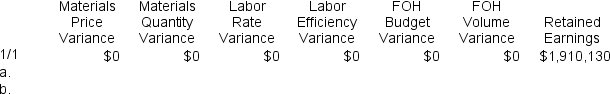

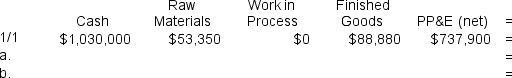

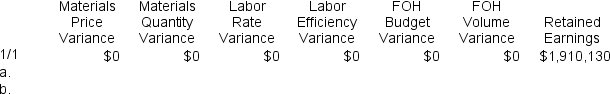

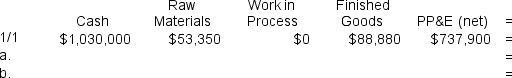

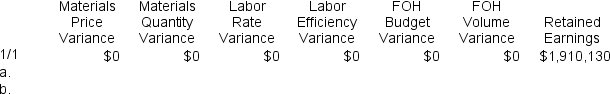

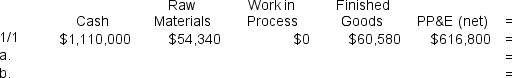

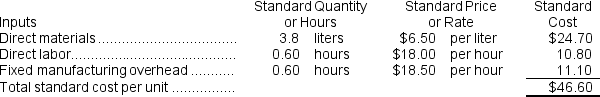

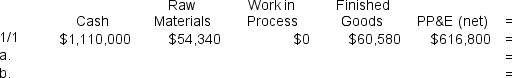

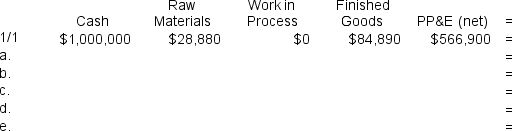

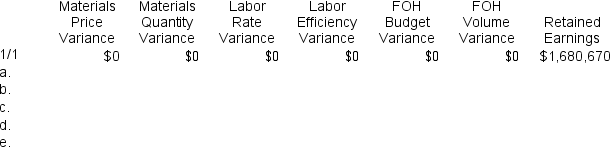

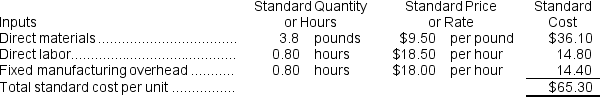

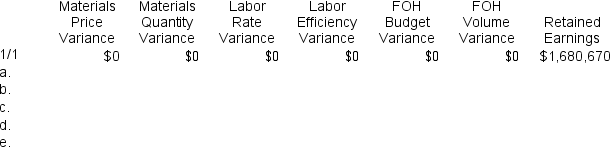

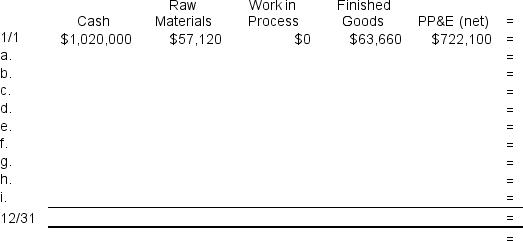

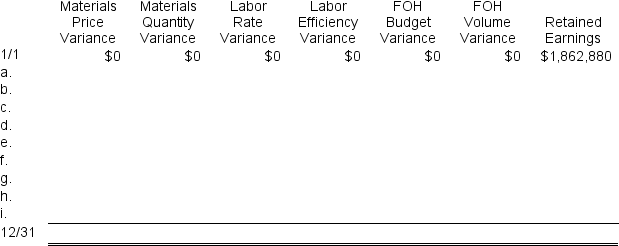

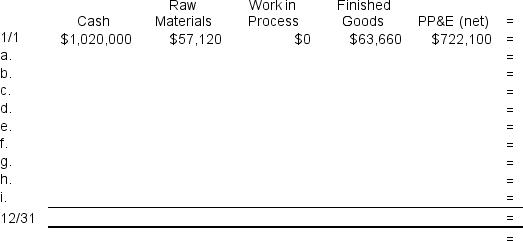

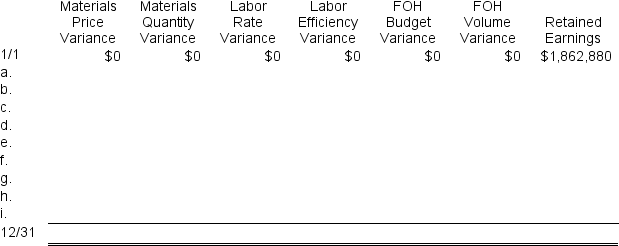

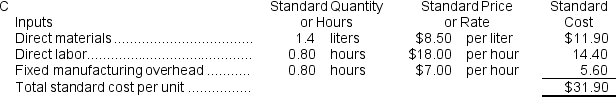

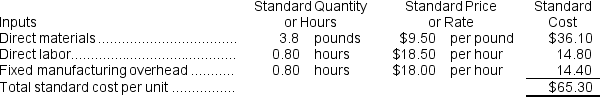

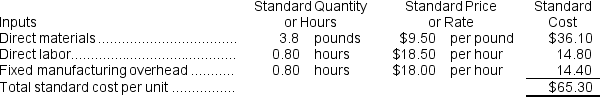

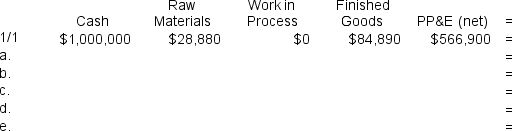

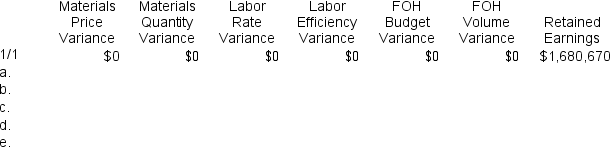

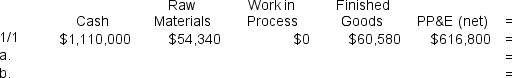

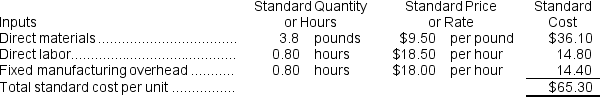

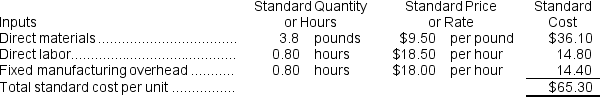

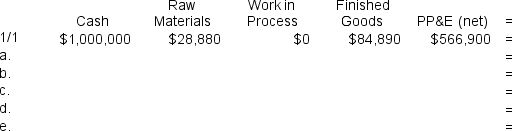

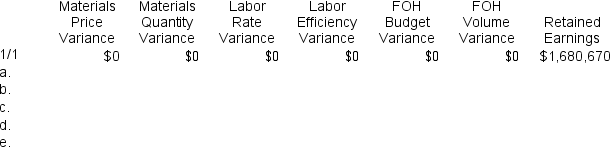

Phann Corporation manufactures one product. It does not maintain any beginning or ending Work in Process inventories. The company uses a standard cost system in which inventories are recorded at their standard costs and any variances are closed directly to Cost of Goods Sold. There is no variable manufacturing overhead. The standard cost card for the company's only product is as follows:

The standard fixed manufacturing overhead rate was based on budgeted fixed manufacturing overhead of $90,000 and budgeted activity of 7,500 hours.

The standard fixed manufacturing overhead rate was based on budgeted fixed manufacturing overhead of $90,000 and budgeted activity of 7,500 hours.

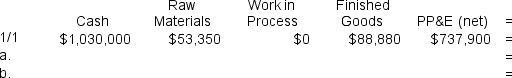

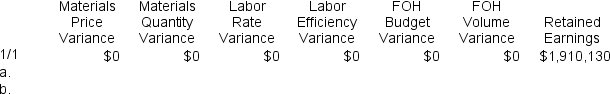

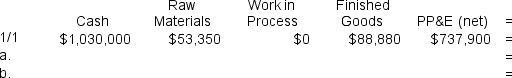

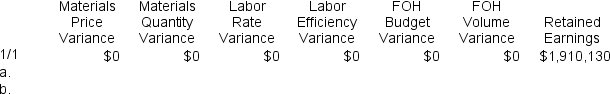

During the year, the company completed the following transactions:

a. Purchased 59,000 kilos of raw material at a price of $9.20 per kilo.

b. Used 51,340 kilos of the raw material to produce 18,300 units of work in process.

c. Assigned direct labor costs to work in process. The direct labor workers (who were paid in cash) worked 8,850 hours at an average cost of $23.70 per hour.

d. Applied fixed overhead to the 18,300 units in work in process inventory using the predetermined overhead rate multiplied by the number of direct labor-hours allowed. Actual fixed overhead costs for the year were $79,400. Of this total, $22,400 related to items such as insurance, utilities, and indirect labor salaries that were all paid in cash and $57,000 related to depreciation of manufacturing equipment.

e. Completed and transferred 18,300 units from work in process to finished goods.

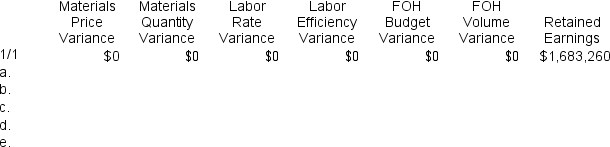

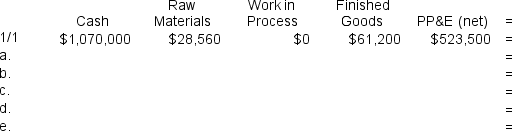

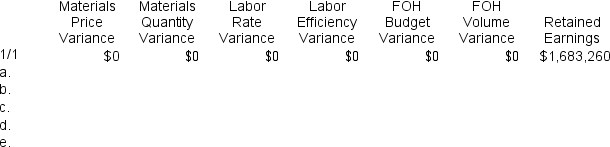

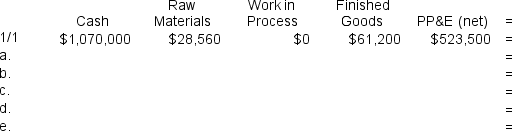

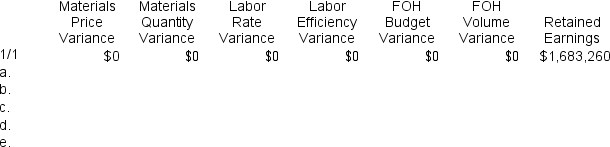

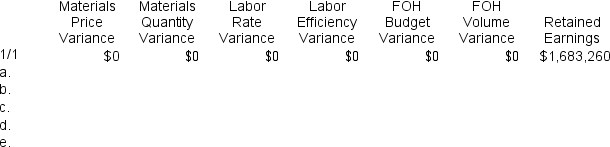

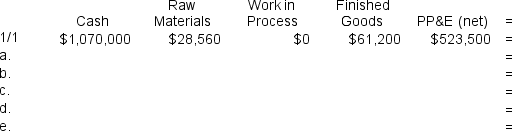

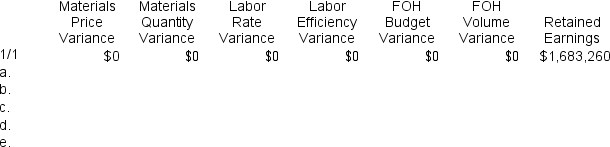

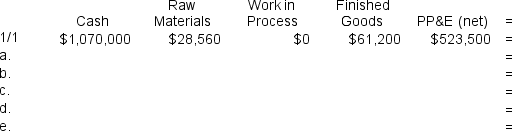

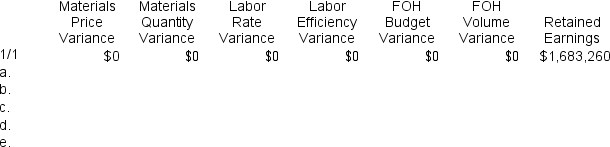

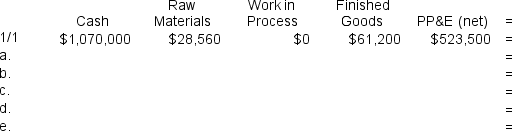

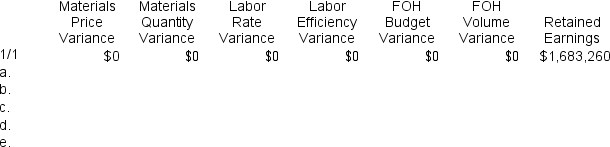

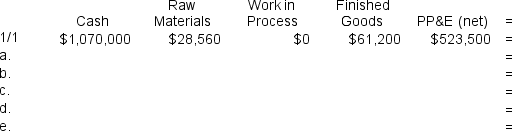

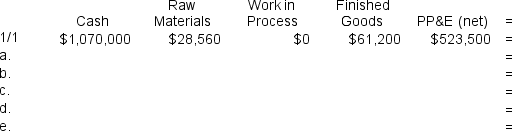

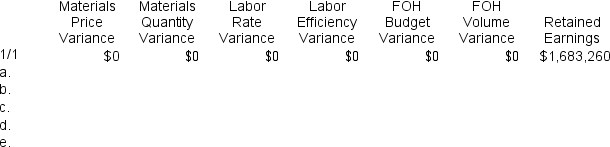

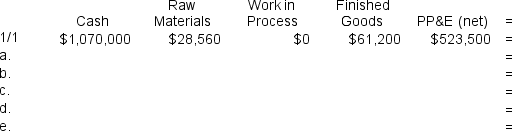

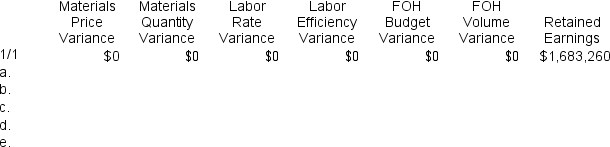

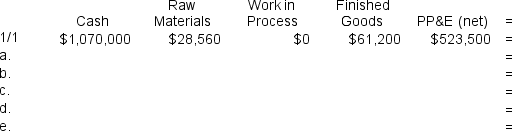

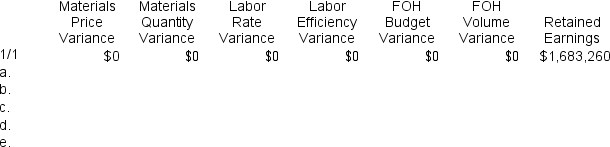

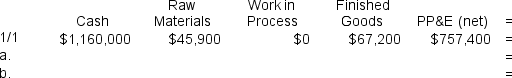

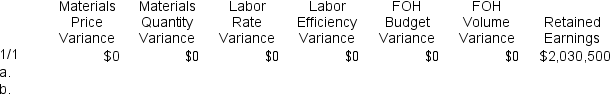

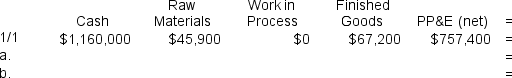

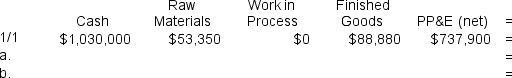

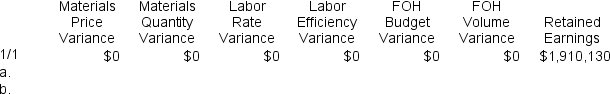

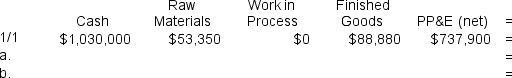

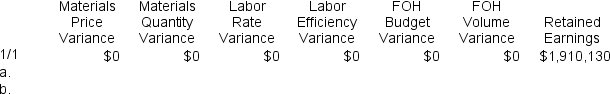

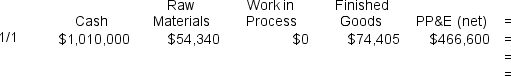

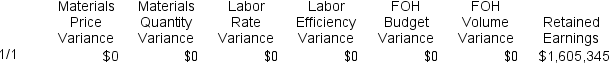

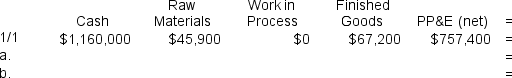

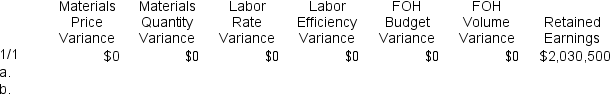

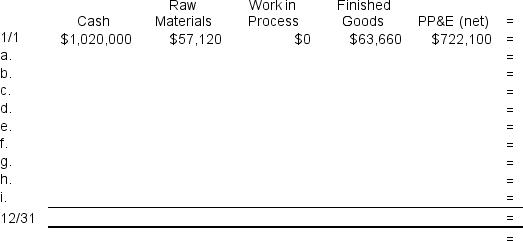

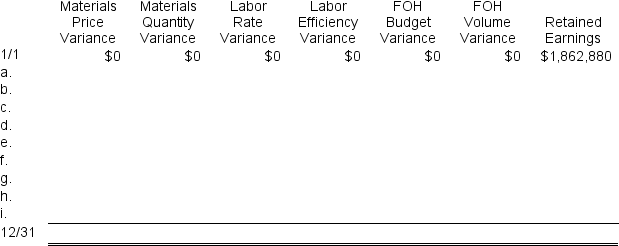

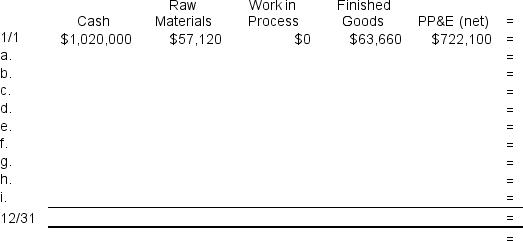

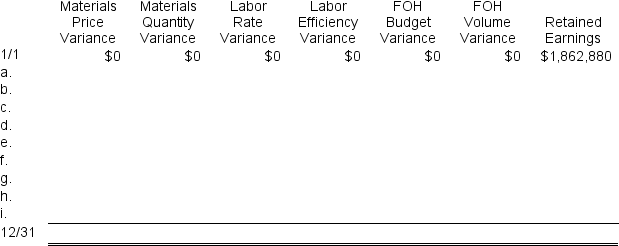

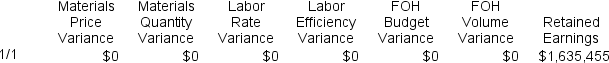

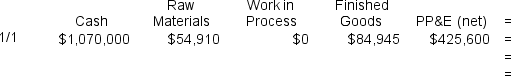

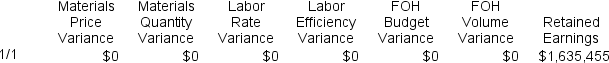

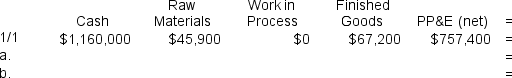

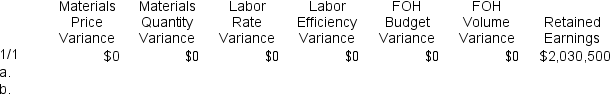

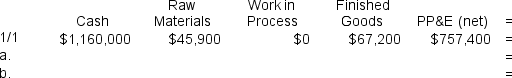

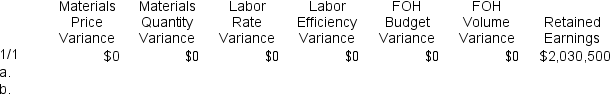

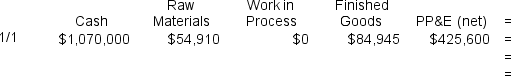

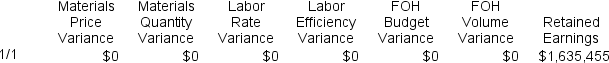

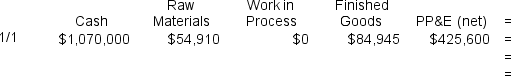

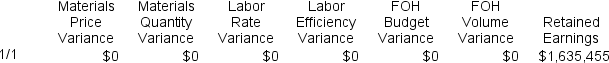

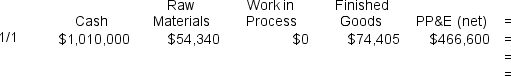

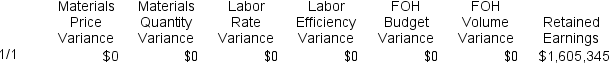

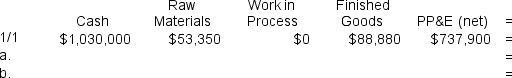

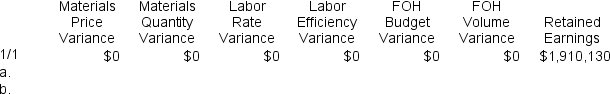

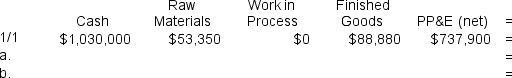

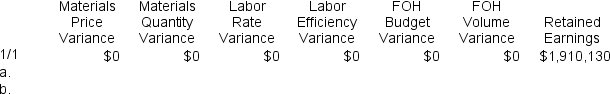

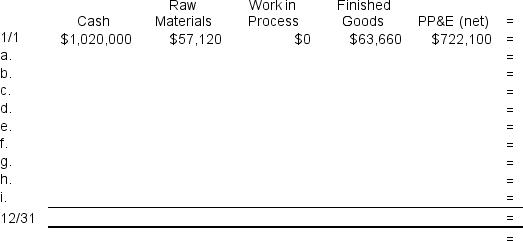

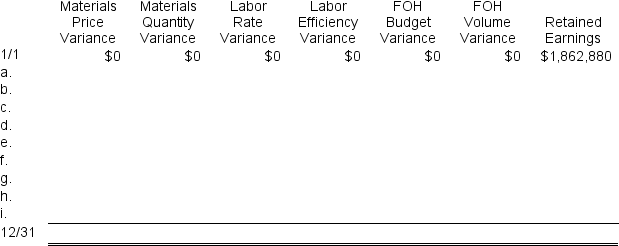

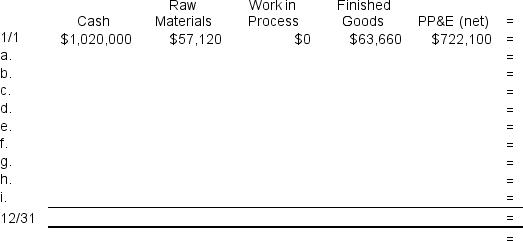

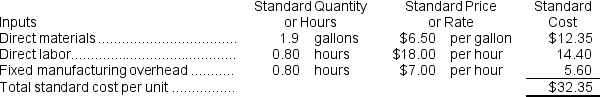

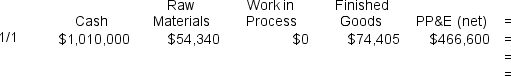

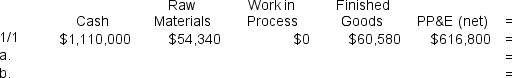

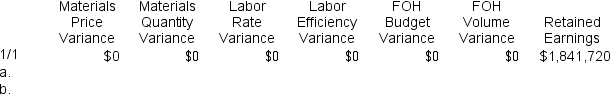

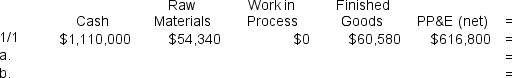

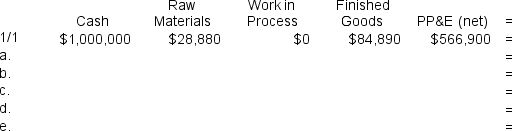

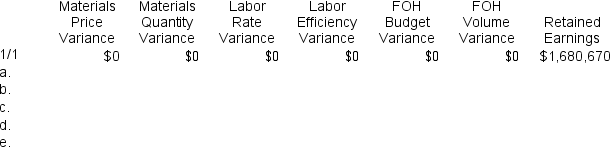

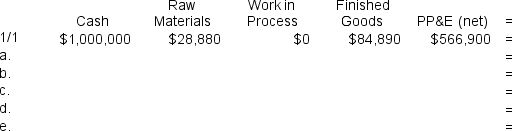

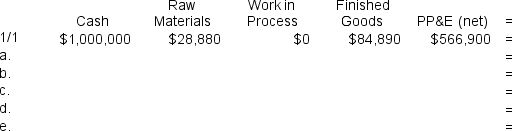

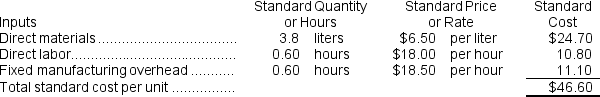

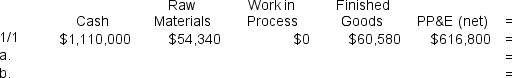

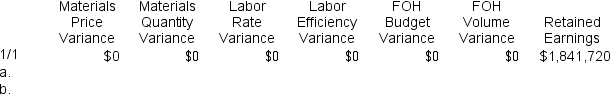

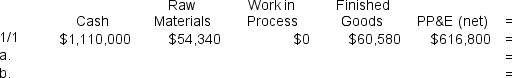

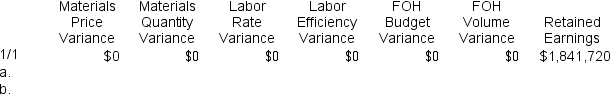

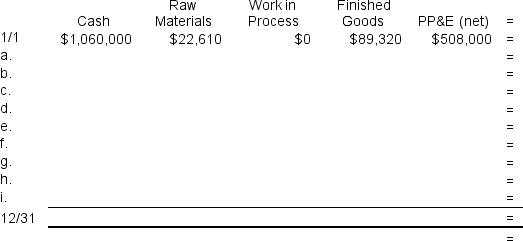

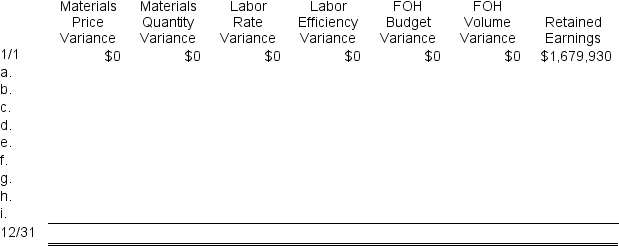

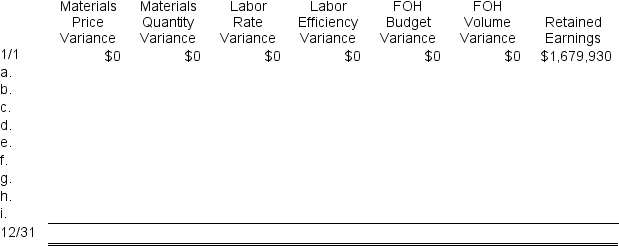

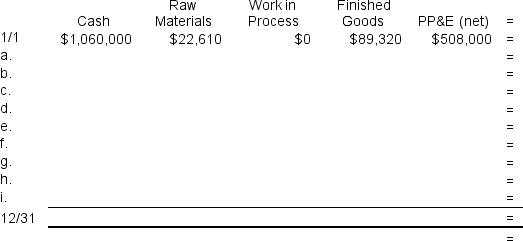

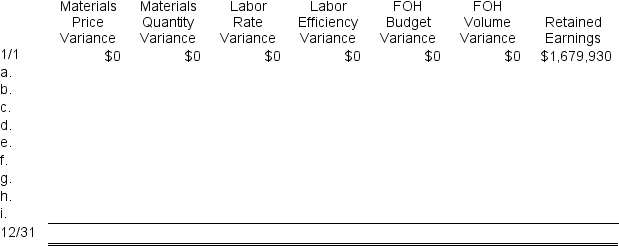

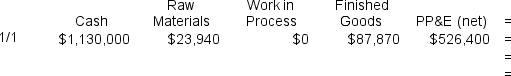

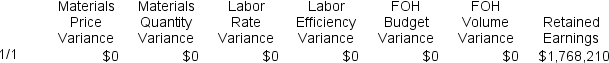

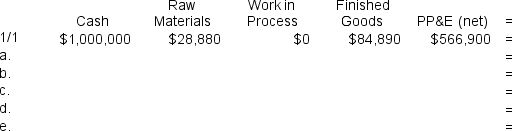

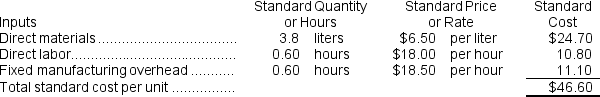

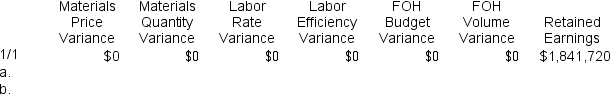

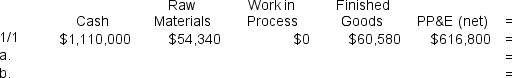

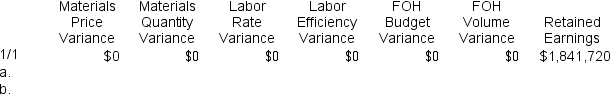

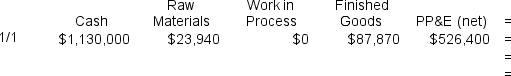

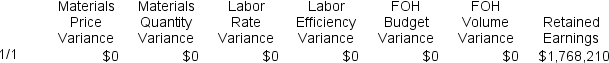

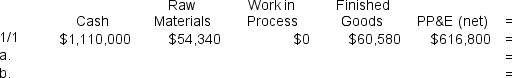

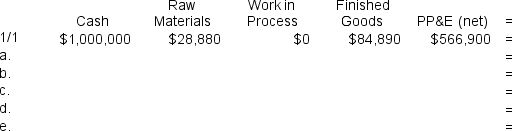

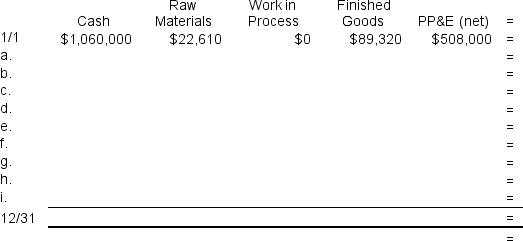

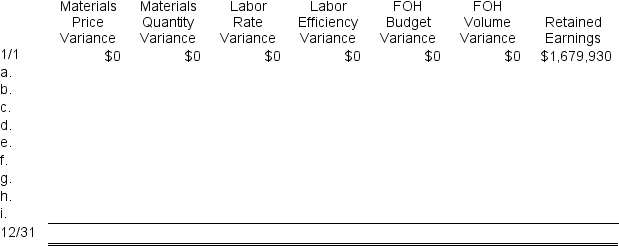

Assume that all transactions are recorded on the below worksheet, which is similar to the worksheet shown in your text except that it has been divided into two parts so that it fits on one page. The beginning balances in each of the accounts have been given. PP&E (net) stands for Property, Plant, and Equipment net of depreciation.

When recording the raw materials used in production in transaction (b)above,the Work in Process inventory account will increase (decrease)by:

A) $436,390

B) ($436,390)

C) ($435,540)

D) $435,540

The standard fixed manufacturing overhead rate was based on budgeted fixed manufacturing overhead of $90,000 and budgeted activity of 7,500 hours.

The standard fixed manufacturing overhead rate was based on budgeted fixed manufacturing overhead of $90,000 and budgeted activity of 7,500 hours.During the year, the company completed the following transactions:

a. Purchased 59,000 kilos of raw material at a price of $9.20 per kilo.

b. Used 51,340 kilos of the raw material to produce 18,300 units of work in process.

c. Assigned direct labor costs to work in process. The direct labor workers (who were paid in cash) worked 8,850 hours at an average cost of $23.70 per hour.

d. Applied fixed overhead to the 18,300 units in work in process inventory using the predetermined overhead rate multiplied by the number of direct labor-hours allowed. Actual fixed overhead costs for the year were $79,400. Of this total, $22,400 related to items such as insurance, utilities, and indirect labor salaries that were all paid in cash and $57,000 related to depreciation of manufacturing equipment.

e. Completed and transferred 18,300 units from work in process to finished goods.

Assume that all transactions are recorded on the below worksheet, which is similar to the worksheet shown in your text except that it has been divided into two parts so that it fits on one page. The beginning balances in each of the accounts have been given. PP&E (net) stands for Property, Plant, and Equipment net of depreciation.

When recording the raw materials used in production in transaction (b)above,the Work in Process inventory account will increase (decrease)by:

A) $436,390

B) ($436,390)

C) ($435,540)

D) $435,540

Unlock Deck

Unlock for access to all 138 flashcards in this deck.

Unlock Deck

k this deck

24

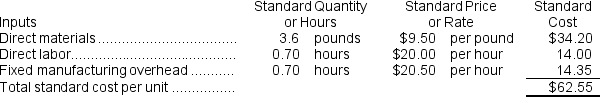

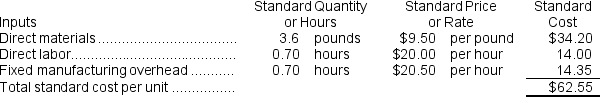

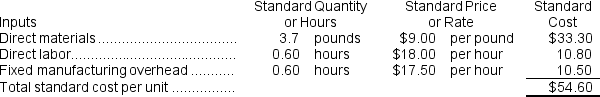

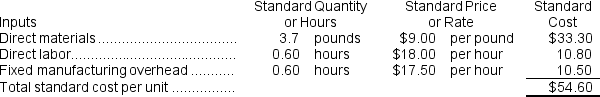

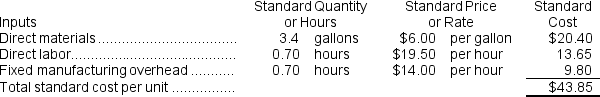

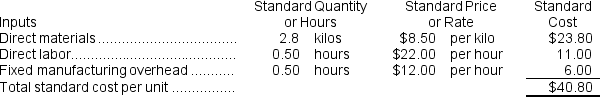

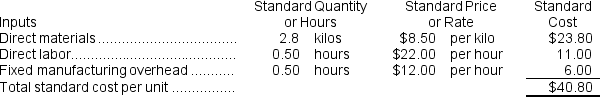

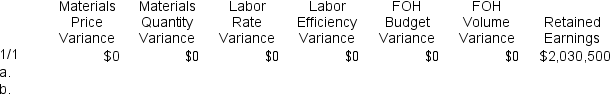

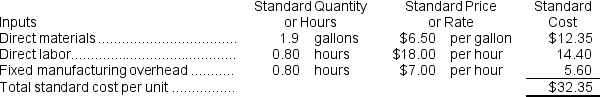

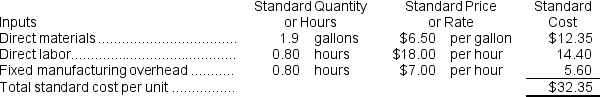

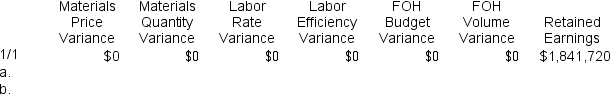

Phann Corporation manufactures one product. It does not maintain any beginning or ending Work in Process inventories. The company uses a standard cost system in which inventories are recorded at their standard costs and any variances are closed directly to Cost of Goods Sold. There is no variable manufacturing overhead. The standard cost card for the company's only product is as follows:

The standard fixed manufacturing overhead rate was based on budgeted fixed manufacturing overhead of $90,000 and budgeted activity of 7,500 hours.

The standard fixed manufacturing overhead rate was based on budgeted fixed manufacturing overhead of $90,000 and budgeted activity of 7,500 hours.

During the year, the company completed the following transactions:

a. Purchased 59,000 kilos of raw material at a price of $9.20 per kilo.

b. Used 51,340 kilos of the raw material to produce 18,300 units of work in process.

c. Assigned direct labor costs to work in process. The direct labor workers (who were paid in cash) worked 8,850 hours at an average cost of $23.70 per hour.

d. Applied fixed overhead to the 18,300 units in work in process inventory using the predetermined overhead rate multiplied by the number of direct labor-hours allowed. Actual fixed overhead costs for the year were $79,400. Of this total, $22,400 related to items such as insurance, utilities, and indirect labor salaries that were all paid in cash and $57,000 related to depreciation of manufacturing equipment.

e. Completed and transferred 18,300 units from work in process to finished goods.

Assume that all transactions are recorded on the below worksheet, which is similar to the worksheet shown in your text except that it has been divided into two parts so that it fits on one page. The beginning balances in each of the accounts have been given. PP&E (net) stands for Property, Plant, and Equipment net of depreciation.

When recording the direct labor costs in transaction (c)above,the Cash account will increase (decrease)by:

A) ($201,300)

B) $201,300

C) ($209,745)

D) $209,745

The standard fixed manufacturing overhead rate was based on budgeted fixed manufacturing overhead of $90,000 and budgeted activity of 7,500 hours.

The standard fixed manufacturing overhead rate was based on budgeted fixed manufacturing overhead of $90,000 and budgeted activity of 7,500 hours.During the year, the company completed the following transactions:

a. Purchased 59,000 kilos of raw material at a price of $9.20 per kilo.

b. Used 51,340 kilos of the raw material to produce 18,300 units of work in process.

c. Assigned direct labor costs to work in process. The direct labor workers (who were paid in cash) worked 8,850 hours at an average cost of $23.70 per hour.

d. Applied fixed overhead to the 18,300 units in work in process inventory using the predetermined overhead rate multiplied by the number of direct labor-hours allowed. Actual fixed overhead costs for the year were $79,400. Of this total, $22,400 related to items such as insurance, utilities, and indirect labor salaries that were all paid in cash and $57,000 related to depreciation of manufacturing equipment.

e. Completed and transferred 18,300 units from work in process to finished goods.

Assume that all transactions are recorded on the below worksheet, which is similar to the worksheet shown in your text except that it has been divided into two parts so that it fits on one page. The beginning balances in each of the accounts have been given. PP&E (net) stands for Property, Plant, and Equipment net of depreciation.

When recording the direct labor costs in transaction (c)above,the Cash account will increase (decrease)by:

A) ($201,300)

B) $201,300

C) ($209,745)

D) $209,745

Unlock Deck

Unlock for access to all 138 flashcards in this deck.

Unlock Deck

k this deck

25

Signore Corporation uses a standard cost system in which inventories are recorded at their standard costs and any variances are closed directly to Cost of Goods Sold.The standard cost card for the company's only product is as follows:

During the year,the company purchased 34,600 gallons of raw material at a price of $9.10 per gallon and used 30,050 gallons of the raw material to produce 20,100 units of work in process.

During the year,the company purchased 34,600 gallons of raw material at a price of $9.10 per gallon and used 30,050 gallons of the raw material to produce 20,100 units of work in process.

Assume that all transactions are recorded on a worksheet as shown in the text.On the left-hand side of the equals sign in the worksheet are columns for Cash,Raw Materials,Work in Process,Finished Goods,and PP&E (net).All of the variance columns are on the right-hand-side of the equals sign along with the column for Retained Earnings.

When the purchase of raw materials is recorded,which of the following entries will be made?

A) $3,460 in the Materials Quantity Variance column

B) ($3,460) in the Materials Price Variance column

C) $3,460 in the Materials Price Variance column

D) ($3,460) in the Materials Quantity Variance column

During the year,the company purchased 34,600 gallons of raw material at a price of $9.10 per gallon and used 30,050 gallons of the raw material to produce 20,100 units of work in process.

During the year,the company purchased 34,600 gallons of raw material at a price of $9.10 per gallon and used 30,050 gallons of the raw material to produce 20,100 units of work in process.Assume that all transactions are recorded on a worksheet as shown in the text.On the left-hand side of the equals sign in the worksheet are columns for Cash,Raw Materials,Work in Process,Finished Goods,and PP&E (net).All of the variance columns are on the right-hand-side of the equals sign along with the column for Retained Earnings.

When the purchase of raw materials is recorded,which of the following entries will be made?

A) $3,460 in the Materials Quantity Variance column

B) ($3,460) in the Materials Price Variance column

C) $3,460 in the Materials Price Variance column

D) ($3,460) in the Materials Quantity Variance column

Unlock Deck

Unlock for access to all 138 flashcards in this deck.

Unlock Deck

k this deck

26

Dougher Corporation uses a standard cost system in which inventories are recorded at their standard costs and any variances are closed directly to Cost of Goods Sold.The standard cost card for the company's only product is as follows:

During the year,the company started and completed 26,900 units.Direct labor employees worked 14,250 hours at an average cost of $20.20 per hour.

During the year,the company started and completed 26,900 units.Direct labor employees worked 14,250 hours at an average cost of $20.20 per hour.

Assume that all transactions are recorded on a worksheet as shown in the text.On the left-hand side of the equals sign in the worksheet are columns for Cash,Raw Materials,Work in Process,Finished Goods,and PP&E (net).All of the variance columns are on the right-hand-side of the equals sign along with the column for Retained Earnings.

When the direct labor cost is recorded,which of the following entries will be made?

A) ($14,800) in the Labor Efficiency Variance column

B) $14,800 in the Labor Rate Variance column

C) ($14,800) in the Labor Rate Variance column

D) $14,800 in the Labor Efficiency Variance column

During the year,the company started and completed 26,900 units.Direct labor employees worked 14,250 hours at an average cost of $20.20 per hour.

During the year,the company started and completed 26,900 units.Direct labor employees worked 14,250 hours at an average cost of $20.20 per hour.Assume that all transactions are recorded on a worksheet as shown in the text.On the left-hand side of the equals sign in the worksheet are columns for Cash,Raw Materials,Work in Process,Finished Goods,and PP&E (net).All of the variance columns are on the right-hand-side of the equals sign along with the column for Retained Earnings.

When the direct labor cost is recorded,which of the following entries will be made?

A) ($14,800) in the Labor Efficiency Variance column

B) $14,800 in the Labor Rate Variance column

C) ($14,800) in the Labor Rate Variance column

D) $14,800 in the Labor Efficiency Variance column

Unlock Deck

Unlock for access to all 138 flashcards in this deck.

Unlock Deck

k this deck

27

Scogin Corporation uses a standard cost system in which inventories are recorded at their standard costs and any variances are closed directly to Cost of Goods Sold.The standard cost card for the company's only product is as follows:

During the year,the company purchased 76,500 pounds of raw material at a price of $8.70 per pound and used 71,880 pounds of the raw material to produce 19,400 units of work in process.

During the year,the company purchased 76,500 pounds of raw material at a price of $8.70 per pound and used 71,880 pounds of the raw material to produce 19,400 units of work in process.

Assume that all transactions are recorded on a worksheet as shown in the text.On the left-hand side of the equals sign in the worksheet are columns for Cash,Raw Materials,Work in Process,Finished Goods,and PP&E (net).All of the variance columns are on the right-hand-side of the equals sign along with the column for Retained Earnings.

When recording the raw materials used in production,the Work in Process inventory account will increase (decrease)by:

A) ($646,020)

B) $646,020

C) ($646,920)

D) $646,920

During the year,the company purchased 76,500 pounds of raw material at a price of $8.70 per pound and used 71,880 pounds of the raw material to produce 19,400 units of work in process.

During the year,the company purchased 76,500 pounds of raw material at a price of $8.70 per pound and used 71,880 pounds of the raw material to produce 19,400 units of work in process.Assume that all transactions are recorded on a worksheet as shown in the text.On the left-hand side of the equals sign in the worksheet are columns for Cash,Raw Materials,Work in Process,Finished Goods,and PP&E (net).All of the variance columns are on the right-hand-side of the equals sign along with the column for Retained Earnings.

When recording the raw materials used in production,the Work in Process inventory account will increase (decrease)by:

A) ($646,020)

B) $646,020

C) ($646,920)

D) $646,920

Unlock Deck

Unlock for access to all 138 flashcards in this deck.

Unlock Deck

k this deck

28

Colbeck Corporation uses a standard cost system in which inventories are recorded at their standard costs and any variances are closed directly to Cost of Goods Sold.The standard cost card for the company's only product is as follows:

During the year,the company purchased 68,000 gallons of raw material at a price of $5.40 per gallon and used 62,660 gallons of the raw material to produce 18,400 units of work in process.

During the year,the company purchased 68,000 gallons of raw material at a price of $5.40 per gallon and used 62,660 gallons of the raw material to produce 18,400 units of work in process.

Assume that all transactions are recorded on a worksheet as shown in the text.On the left-hand side of the equals sign in the worksheet are columns for Cash,Raw Materials,Work in Process,Finished Goods,and PP&E (net).All of the variance columns are on the right-hand-side of the equals sign along with the column for Retained Earnings.

When recording the raw materials used in production,the Raw Materials inventory account will increase (decrease)by:

A) ($375,960)

B) $375,960

C) ($338,364)

D) $338,364

During the year,the company purchased 68,000 gallons of raw material at a price of $5.40 per gallon and used 62,660 gallons of the raw material to produce 18,400 units of work in process.

During the year,the company purchased 68,000 gallons of raw material at a price of $5.40 per gallon and used 62,660 gallons of the raw material to produce 18,400 units of work in process.Assume that all transactions are recorded on a worksheet as shown in the text.On the left-hand side of the equals sign in the worksheet are columns for Cash,Raw Materials,Work in Process,Finished Goods,and PP&E (net).All of the variance columns are on the right-hand-side of the equals sign along with the column for Retained Earnings.

When recording the raw materials used in production,the Raw Materials inventory account will increase (decrease)by:

A) ($375,960)

B) $375,960

C) ($338,364)

D) $338,364

Unlock Deck

Unlock for access to all 138 flashcards in this deck.

Unlock Deck

k this deck

29

Sobus Corporation manufactures one product.It does not maintain any beginning or ending Work in Process inventories.The company uses a standard cost system in which inventories are recorded at their standard costs and any variances are closed directly to Cost of Goods Sold.There is no variable manufacturing overhead.The fixed manufacturing overhead standards for the company's only product specify 0.70 hours per unit at $4.00 per hour.The standard fixed manufacturing overhead rate was based on budgeted fixed manufacturing overhead of $70,000 and budgeted activity of 17,500 hours.During the year,19,700 units were started and completed.Actual fixed overhead costs for the year were $57,700. Assume that all transactions are recorded on a worksheet as shown in the text.On the left-hand side of the equals sign in the worksheet are columns for Cash,Raw Materials,Work in Process,Finished Goods,and PP&E (net).All of the variance columns are on the right-hand-side of the equals sign along with the column for Retained Earnings.

When applying fixed manufacturing overhead to production,the Work in Process inventory account will increase (decrease)by:

A) $55,160

B) ($26,300)

C) $26,300

D) ($55,160)

When applying fixed manufacturing overhead to production,the Work in Process inventory account will increase (decrease)by:

A) $55,160

B) ($26,300)

C) $26,300

D) ($55,160)

Unlock Deck

Unlock for access to all 138 flashcards in this deck.

Unlock Deck

k this deck

30

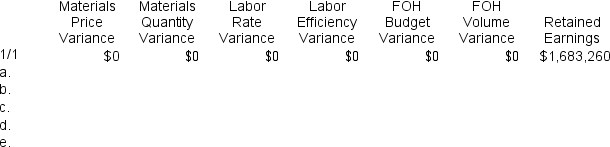

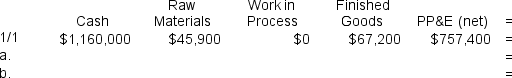

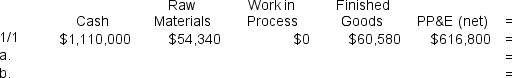

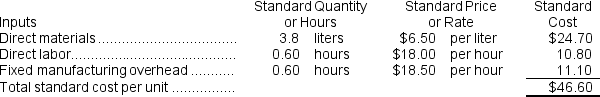

Phann Corporation manufactures one product. It does not maintain any beginning or ending Work in Process inventories. The company uses a standard cost system in which inventories are recorded at their standard costs and any variances are closed directly to Cost of Goods Sold. There is no variable manufacturing overhead. The standard cost card for the company's only product is as follows:

The standard fixed manufacturing overhead rate was based on budgeted fixed manufacturing overhead of $90,000 and budgeted activity of 7,500 hours.

The standard fixed manufacturing overhead rate was based on budgeted fixed manufacturing overhead of $90,000 and budgeted activity of 7,500 hours.

During the year, the company completed the following transactions:

a. Purchased 59,000 kilos of raw material at a price of $9.20 per kilo.

b. Used 51,340 kilos of the raw material to produce 18,300 units of work in process.

c. Assigned direct labor costs to work in process. The direct labor workers (who were paid in cash) worked 8,850 hours at an average cost of $23.70 per hour.

d. Applied fixed overhead to the 18,300 units in work in process inventory using the predetermined overhead rate multiplied by the number of direct labor-hours allowed. Actual fixed overhead costs for the year were $79,400. Of this total, $22,400 related to items such as insurance, utilities, and indirect labor salaries that were all paid in cash and $57,000 related to depreciation of manufacturing equipment.

e. Completed and transferred 18,300 units from work in process to finished goods.

Assume that all transactions are recorded on the below worksheet, which is similar to the worksheet shown in your text except that it has been divided into two parts so that it fits on one page. The beginning balances in each of the accounts have been given. PP&E (net) stands for Property, Plant, and Equipment net of depreciation.

When applying fixed manufacturing overhead to production in transaction (d)above,the Work in Process inventory account will increase (decrease)by:

A) ($109,800)

B) $22,400

C) $109,800

D) ($22,400)

The standard fixed manufacturing overhead rate was based on budgeted fixed manufacturing overhead of $90,000 and budgeted activity of 7,500 hours.

The standard fixed manufacturing overhead rate was based on budgeted fixed manufacturing overhead of $90,000 and budgeted activity of 7,500 hours.During the year, the company completed the following transactions:

a. Purchased 59,000 kilos of raw material at a price of $9.20 per kilo.

b. Used 51,340 kilos of the raw material to produce 18,300 units of work in process.

c. Assigned direct labor costs to work in process. The direct labor workers (who were paid in cash) worked 8,850 hours at an average cost of $23.70 per hour.

d. Applied fixed overhead to the 18,300 units in work in process inventory using the predetermined overhead rate multiplied by the number of direct labor-hours allowed. Actual fixed overhead costs for the year were $79,400. Of this total, $22,400 related to items such as insurance, utilities, and indirect labor salaries that were all paid in cash and $57,000 related to depreciation of manufacturing equipment.

e. Completed and transferred 18,300 units from work in process to finished goods.

Assume that all transactions are recorded on the below worksheet, which is similar to the worksheet shown in your text except that it has been divided into two parts so that it fits on one page. The beginning balances in each of the accounts have been given. PP&E (net) stands for Property, Plant, and Equipment net of depreciation.

When applying fixed manufacturing overhead to production in transaction (d)above,the Work in Process inventory account will increase (decrease)by:

A) ($109,800)

B) $22,400

C) $109,800

D) ($22,400)

Unlock Deck

Unlock for access to all 138 flashcards in this deck.

Unlock Deck

k this deck

31

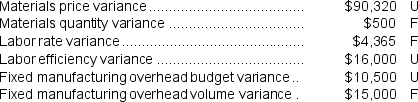

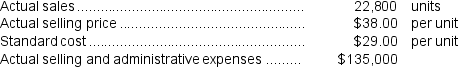

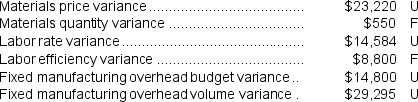

Gersbach Corporation manufactures one product.It does not maintain any beginning or ending Work in Process inventories.The company uses a standard cost system in which inventories are recorded at their standard costs and any variances are closed directly to Cost of Goods Sold.The company has provided the following information:

The company does not have any variable manufacturing overhead costs and it recorded the following variances during the year:

The company does not have any variable manufacturing overhead costs and it recorded the following variances during the year:

The net operating income for the year is closest to:

The net operating income for the year is closest to:

A) ($2,349)

B) $85,915

C) $70,200

D) $145,368

The company does not have any variable manufacturing overhead costs and it recorded the following variances during the year:

The company does not have any variable manufacturing overhead costs and it recorded the following variances during the year: The net operating income for the year is closest to:

The net operating income for the year is closest to:A) ($2,349)

B) $85,915

C) $70,200

D) $145,368

Unlock Deck

Unlock for access to all 138 flashcards in this deck.

Unlock Deck

k this deck

32

Rhudy Corporation uses a standard cost system in which inventories are recorded at their standard costs and any variances are closed directly to Cost of Goods Sold.The direct labor standards for the company's only product specify 0.60 hours per unit at $20.00 per hour.During the year,the company started and completed 20,700 units.Direct labor employees worked 12,120 hours at an average cost of $18.90 per hour. Assume that all transactions are recorded on a worksheet as shown in the text.On the left-hand side of the equals sign in the worksheet are columns for Cash,Raw Materials,Work in Process,Finished Goods,and PP&E (net).All of the variance columns are on the right-hand-side of the equals sign along with the column for Retained Earnings.

When recording the direct labor costs,the Work in Process inventory account will increase (decrease)by:

A) ($229,068)

B) ($248,400)

C) $229,068

D) $248,400

When recording the direct labor costs,the Work in Process inventory account will increase (decrease)by:

A) ($229,068)

B) ($248,400)

C) $229,068

D) $248,400

Unlock Deck

Unlock for access to all 138 flashcards in this deck.

Unlock Deck

k this deck

33

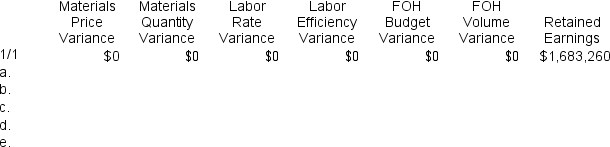

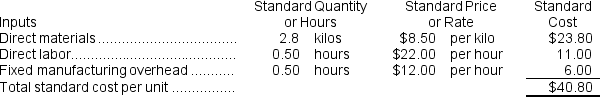

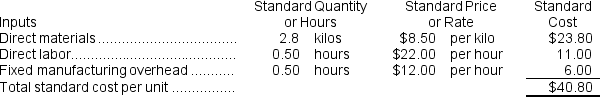

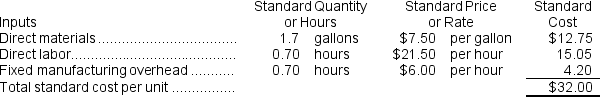

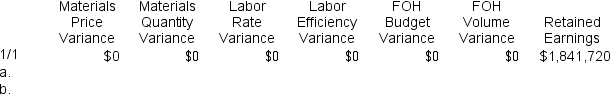

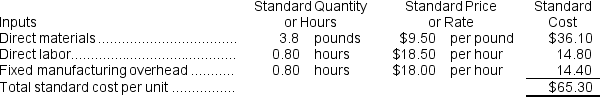

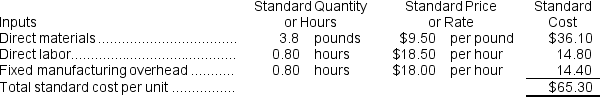

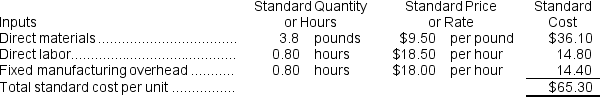

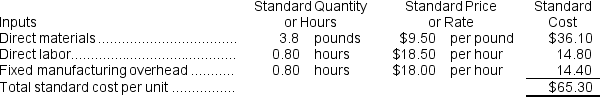

Phann Corporation manufactures one product. It does not maintain any beginning or ending Work in Process inventories. The company uses a standard cost system in which inventories are recorded at their standard costs and any variances are closed directly to Cost of Goods Sold. There is no variable manufacturing overhead. The standard cost card for the company's only product is as follows:

The standard fixed manufacturing overhead rate was based on budgeted fixed manufacturing overhead of $90,000 and budgeted activity of 7,500 hours.

The standard fixed manufacturing overhead rate was based on budgeted fixed manufacturing overhead of $90,000 and budgeted activity of 7,500 hours.

During the year, the company completed the following transactions:

a. Purchased 59,000 kilos of raw material at a price of $9.20 per kilo.

b. Used 51,340 kilos of the raw material to produce 18,300 units of work in process.

c. Assigned direct labor costs to work in process. The direct labor workers (who were paid in cash) worked 8,850 hours at an average cost of $23.70 per hour.

d. Applied fixed overhead to the 18,300 units in work in process inventory using the predetermined overhead rate multiplied by the number of direct labor-hours allowed. Actual fixed overhead costs for the year were $79,400. Of this total, $22,400 related to items such as insurance, utilities, and indirect labor salaries that were all paid in cash and $57,000 related to depreciation of manufacturing equipment.

e. Completed and transferred 18,300 units from work in process to finished goods.

Assume that all transactions are recorded on the below worksheet, which is similar to the worksheet shown in your text except that it has been divided into two parts so that it fits on one page. The beginning balances in each of the accounts have been given. PP&E (net) stands for Property, Plant, and Equipment net of depreciation.

When recording the raw materials purchases in transaction (a)above,the Raw Materials inventory account will increase (decrease)by:

A) $501,500

B) $542,800

C) ($501,500)

D) ($542,800)

The standard fixed manufacturing overhead rate was based on budgeted fixed manufacturing overhead of $90,000 and budgeted activity of 7,500 hours.

The standard fixed manufacturing overhead rate was based on budgeted fixed manufacturing overhead of $90,000 and budgeted activity of 7,500 hours.During the year, the company completed the following transactions:

a. Purchased 59,000 kilos of raw material at a price of $9.20 per kilo.

b. Used 51,340 kilos of the raw material to produce 18,300 units of work in process.

c. Assigned direct labor costs to work in process. The direct labor workers (who were paid in cash) worked 8,850 hours at an average cost of $23.70 per hour.

d. Applied fixed overhead to the 18,300 units in work in process inventory using the predetermined overhead rate multiplied by the number of direct labor-hours allowed. Actual fixed overhead costs for the year were $79,400. Of this total, $22,400 related to items such as insurance, utilities, and indirect labor salaries that were all paid in cash and $57,000 related to depreciation of manufacturing equipment.

e. Completed and transferred 18,300 units from work in process to finished goods.

Assume that all transactions are recorded on the below worksheet, which is similar to the worksheet shown in your text except that it has been divided into two parts so that it fits on one page. The beginning balances in each of the accounts have been given. PP&E (net) stands for Property, Plant, and Equipment net of depreciation.

When recording the raw materials purchases in transaction (a)above,the Raw Materials inventory account will increase (decrease)by:

A) $501,500

B) $542,800

C) ($501,500)

D) ($542,800)

Unlock Deck

Unlock for access to all 138 flashcards in this deck.

Unlock Deck

k this deck

34

Lisser Corporation uses a standard cost system in which inventories are recorded at their standard costs and any variances are closed directly to Cost of Goods Sold.The standards for direct materials for the company's only product specify 2.7 liters per unit at $7.50 per liter or $20.25 per unit.During the year,the company purchased 67,300 liters of raw material at a price of $8.00 per liter and used 61,660 liters of the raw material to produce 22,800 units of work in process. Assume that all transactions are recorded on a worksheet as shown in the text.On the left-hand side of the equals sign in the worksheet are columns for Cash,Raw Materials,Work in Process,Finished Goods,and PP&E (net).All of the variance columns are on the right-hand-side of the equals sign along with the column for Retained Earnings.

When recording the raw materials used in production,the Raw Materials inventory account will increase (decrease)by:

A) ($493,280)

B) $493,280

C) $462,450

D) ($462,450)

When recording the raw materials used in production,the Raw Materials inventory account will increase (decrease)by:

A) ($493,280)

B) $493,280

C) $462,450

D) ($462,450)

Unlock Deck

Unlock for access to all 138 flashcards in this deck.

Unlock Deck

k this deck

35

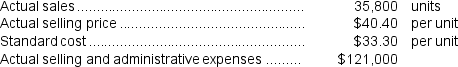

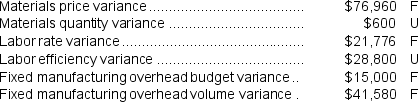

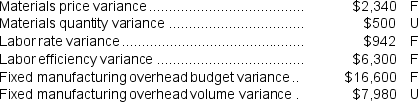

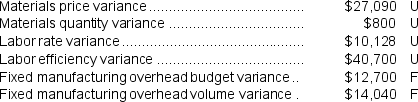

Mccreary Corporation manufactures one product.It does not maintain any beginning or ending Work in Process inventories.The company uses a standard cost system in which inventories are recorded at their standard costs and any variances are closed directly to Cost of Goods Sold.The standard cost of the company's product is $28.00per unit.During the year the company sold 27,500 units at $36.30 per unit.The actual selling and administrative expenses were $121,000 for the year.The company does not have any variable manufacturing overhead costs and it recorded the following variances during the year:

The net operating income for the year is closest to:

The net operating income for the year is closest to:

A) $107,250

B) $55,272

C) $118,446

D) $79,816

The net operating income for the year is closest to:

The net operating income for the year is closest to:A) $107,250

B) $55,272

C) $118,446

D) $79,816

Unlock Deck

Unlock for access to all 138 flashcards in this deck.

Unlock Deck

k this deck

36

Landoni Corporation uses a standard cost system in which inventories are recorded at their standard costs and any variances are closed directly to Cost of Goods Sold.The standards for direct materials for the company's only product specify 2.7 kilos per unit at $5.00 per kilo or $13.50 per unit.During the year,the company purchased 75,200 kilos of raw material at a price of $4.90 per kilo and used 69,290 kilos of the raw material to produce 25,700 units of work in process. Assume that all transactions are recorded on a worksheet as shown in the text.On the left-hand side of the equals sign in the worksheet are columns for Cash,Raw Materials,Work in Process,Finished Goods,and PP&E (net).All of the variance columns are on the right-hand-side of the equals sign along with the column for Retained Earnings.

When recording the raw materials purchases,the Raw Materials inventory account will increase (decrease)by:

A) ($368,480)

B) $376,000

C) ($376,000)

D) $368,480

When recording the raw materials purchases,the Raw Materials inventory account will increase (decrease)by:

A) ($368,480)

B) $376,000

C) ($376,000)

D) $368,480

Unlock Deck

Unlock for access to all 138 flashcards in this deck.

Unlock Deck

k this deck

37

Phann Corporation manufactures one product. It does not maintain any beginning or ending Work in Process inventories. The company uses a standard cost system in which inventories are recorded at their standard costs and any variances are closed directly to Cost of Goods Sold. There is no variable manufacturing overhead. The standard cost card for the company's only product is as follows:

The standard fixed manufacturing overhead rate was based on budgeted fixed manufacturing overhead of $90,000 and budgeted activity of 7,500 hours.

The standard fixed manufacturing overhead rate was based on budgeted fixed manufacturing overhead of $90,000 and budgeted activity of 7,500 hours.

During the year, the company completed the following transactions:

a. Purchased 59,000 kilos of raw material at a price of $9.20 per kilo.

b. Used 51,340 kilos of the raw material to produce 18,300 units of work in process.

c. Assigned direct labor costs to work in process. The direct labor workers (who were paid in cash) worked 8,850 hours at an average cost of $23.70 per hour.

d. Applied fixed overhead to the 18,300 units in work in process inventory using the predetermined overhead rate multiplied by the number of direct labor-hours allowed. Actual fixed overhead costs for the year were $79,400. Of this total, $22,400 related to items such as insurance, utilities, and indirect labor salaries that were all paid in cash and $57,000 related to depreciation of manufacturing equipment.

e. Completed and transferred 18,300 units from work in process to finished goods.

Assume that all transactions are recorded on the below worksheet, which is similar to the worksheet shown in your text except that it has been divided into two parts so that it fits on one page. The beginning balances in each of the accounts have been given. PP&E (net) stands for Property, Plant, and Equipment net of depreciation.

When recording the direct labor costs in transaction (c)above,the Work in Process inventory account will increase (decrease)by:

A) $201,300

B) ($201,300)

C) $209,745

D) ($209,745)

The standard fixed manufacturing overhead rate was based on budgeted fixed manufacturing overhead of $90,000 and budgeted activity of 7,500 hours.

The standard fixed manufacturing overhead rate was based on budgeted fixed manufacturing overhead of $90,000 and budgeted activity of 7,500 hours.During the year, the company completed the following transactions:

a. Purchased 59,000 kilos of raw material at a price of $9.20 per kilo.

b. Used 51,340 kilos of the raw material to produce 18,300 units of work in process.

c. Assigned direct labor costs to work in process. The direct labor workers (who were paid in cash) worked 8,850 hours at an average cost of $23.70 per hour.

d. Applied fixed overhead to the 18,300 units in work in process inventory using the predetermined overhead rate multiplied by the number of direct labor-hours allowed. Actual fixed overhead costs for the year were $79,400. Of this total, $22,400 related to items such as insurance, utilities, and indirect labor salaries that were all paid in cash and $57,000 related to depreciation of manufacturing equipment.

e. Completed and transferred 18,300 units from work in process to finished goods.

Assume that all transactions are recorded on the below worksheet, which is similar to the worksheet shown in your text except that it has been divided into two parts so that it fits on one page. The beginning balances in each of the accounts have been given. PP&E (net) stands for Property, Plant, and Equipment net of depreciation.

When recording the direct labor costs in transaction (c)above,the Work in Process inventory account will increase (decrease)by:

A) $201,300

B) ($201,300)

C) $209,745

D) ($209,745)

Unlock Deck

Unlock for access to all 138 flashcards in this deck.

Unlock Deck

k this deck

38

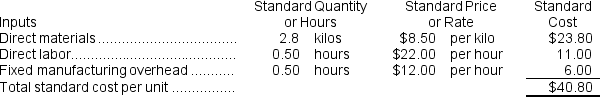

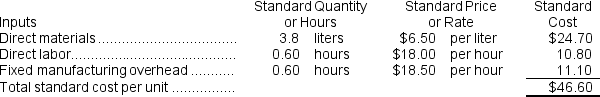

Phann Corporation manufactures one product. It does not maintain any beginning or ending Work in Process inventories. The company uses a standard cost system in which inventories are recorded at their standard costs and any variances are closed directly to Cost of Goods Sold. There is no variable manufacturing overhead. The standard cost card for the company's only product is as follows:

The standard fixed manufacturing overhead rate was based on budgeted fixed manufacturing overhead of $90,000 and budgeted activity of 7,500 hours.

The standard fixed manufacturing overhead rate was based on budgeted fixed manufacturing overhead of $90,000 and budgeted activity of 7,500 hours.

During the year, the company completed the following transactions:

a. Purchased 59,000 kilos of raw material at a price of $9.20 per kilo.

b. Used 51,340 kilos of the raw material to produce 18,300 units of work in process.

c. Assigned direct labor costs to work in process. The direct labor workers (who were paid in cash) worked 8,850 hours at an average cost of $23.70 per hour.

d. Applied fixed overhead to the 18,300 units in work in process inventory using the predetermined overhead rate multiplied by the number of direct labor-hours allowed. Actual fixed overhead costs for the year were $79,400. Of this total, $22,400 related to items such as insurance, utilities, and indirect labor salaries that were all paid in cash and $57,000 related to depreciation of manufacturing equipment.

e. Completed and transferred 18,300 units from work in process to finished goods.

Assume that all transactions are recorded on the below worksheet, which is similar to the worksheet shown in your text except that it has been divided into two parts so that it fits on one page. The beginning balances in each of the accounts have been given. PP&E (net) stands for Property, Plant, and Equipment net of depreciation.

When recording the raw materials used in production in transaction (b)above,the Raw Materials inventory account will increase (decrease)by:

A) ($436,390)

B) ($472,328)

C) $472,328

D) $436,390

The standard fixed manufacturing overhead rate was based on budgeted fixed manufacturing overhead of $90,000 and budgeted activity of 7,500 hours.

The standard fixed manufacturing overhead rate was based on budgeted fixed manufacturing overhead of $90,000 and budgeted activity of 7,500 hours.During the year, the company completed the following transactions:

a. Purchased 59,000 kilos of raw material at a price of $9.20 per kilo.

b. Used 51,340 kilos of the raw material to produce 18,300 units of work in process.

c. Assigned direct labor costs to work in process. The direct labor workers (who were paid in cash) worked 8,850 hours at an average cost of $23.70 per hour.

d. Applied fixed overhead to the 18,300 units in work in process inventory using the predetermined overhead rate multiplied by the number of direct labor-hours allowed. Actual fixed overhead costs for the year were $79,400. Of this total, $22,400 related to items such as insurance, utilities, and indirect labor salaries that were all paid in cash and $57,000 related to depreciation of manufacturing equipment.

e. Completed and transferred 18,300 units from work in process to finished goods.

Assume that all transactions are recorded on the below worksheet, which is similar to the worksheet shown in your text except that it has been divided into two parts so that it fits on one page. The beginning balances in each of the accounts have been given. PP&E (net) stands for Property, Plant, and Equipment net of depreciation.

When recording the raw materials used in production in transaction (b)above,the Raw Materials inventory account will increase (decrease)by:

A) ($436,390)

B) ($472,328)

C) $472,328

D) $436,390

Unlock Deck

Unlock for access to all 138 flashcards in this deck.

Unlock Deck

k this deck

39