Deck 13: Jurisdictional Issues in Business Taxation

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/102

Play

Full screen (f)

Deck 13: Jurisdictional Issues in Business Taxation

1

The sales factor in the UDITPA state income tax apportionment formula equals in-state sales divided by total sales.

True

2

A corporation is usually subject to tax by any state in which it engages in any business transactions.

False

3

If Gamma Inc. is incorporated in Ohio and has its commercial domicile in Cleveland, the state of Ohio has jurisdiction to tax 100% of Gamma's business income.

False

4

In the United States, corporations are subject only to taxes imposed by the federal government.

Unlock Deck

Unlock for access to all 102 flashcards in this deck.

Unlock Deck

k this deck

5

All states assessing an income tax use the same formula for apportionment purposes.

Unlock Deck

Unlock for access to all 102 flashcards in this deck.

Unlock Deck

k this deck

6

Non-resident firms selling tangible goods to in-state residents can use P.L. 86-272 to avoid having income tax nexus in a state.

Unlock Deck

Unlock for access to all 102 flashcards in this deck.

Unlock Deck

k this deck

7

Article 1 of the U.S. Constitution, referred to as the commerce clause, prohibits state governments from using a tax to discriminate against interstate commerce.

Unlock Deck

Unlock for access to all 102 flashcards in this deck.

Unlock Deck

k this deck

8

Luttrix Inc. does business in Nebraska (6% tax rate) and Colorado (3% tax rate). All other factors being equal, Luttrix will minimize state taxes if it constructs a new manufacturing plant in Colorado.

Unlock Deck

Unlock for access to all 102 flashcards in this deck.

Unlock Deck

k this deck

9

The sales factor in the UDITPA state income tax apportionment formula equals out-of-state sales divided by total sales.

Unlock Deck

Unlock for access to all 102 flashcards in this deck.

Unlock Deck

k this deck

10

The payroll factor in the UDITPA state income tax apportionment formula always includes executive compensation.

Unlock Deck

Unlock for access to all 102 flashcards in this deck.

Unlock Deck

k this deck

11

The UDITPA formula for apportioning income among states is based on four equally weighted factors.

Unlock Deck

Unlock for access to all 102 flashcards in this deck.

Unlock Deck

k this deck

12

Article 1 of the U.S. Constitution, referred to as the commerce clause, prohibits a state from charging an extra 10 cent tax per gallon on gasoline sold to trucks with out-of-state license plates.

Unlock Deck

Unlock for access to all 102 flashcards in this deck.

Unlock Deck

k this deck

13

BiState Inc. conducts business in North Carolina and South Carolina. If BiState's apportionment percentage in North Carolina is 63%, its apportionment percentage in South Carolina can be no more than 37%.

Unlock Deck

Unlock for access to all 102 flashcards in this deck.

Unlock Deck

k this deck

14

International tax treaties generally allow a government to tax a non-resident firm that maintains a permanent residence in the treaty country.

Unlock Deck

Unlock for access to all 102 flashcards in this deck.

Unlock Deck

k this deck

15

Multi-State, Inc. does business in two states. Its apportionment percentage in state A is 63%. Its apportionment percentage in the other state can be no more than 37%.

Unlock Deck

Unlock for access to all 102 flashcards in this deck.

Unlock Deck

k this deck

16

The federal income tax deduction allowed for state income taxes paid decreases the cost of the state taxes.

Unlock Deck

Unlock for access to all 102 flashcards in this deck.

Unlock Deck

k this deck

17

The UDITPA formula for state income tax apportionment consists of three factors: sales, payroll, and profit.

Unlock Deck

Unlock for access to all 102 flashcards in this deck.

Unlock Deck

k this deck

18

According to Public Law 86-272, the sale of tangible goods to residents of a state is not sufficient to establish nexus in that state.

Unlock Deck

Unlock for access to all 102 flashcards in this deck.

Unlock Deck

k this deck

19

If a corporation with a 35% marginal federal income tax rate pays $20,000 state income tax, the after-tax cost of the state tax is $13,000.

Unlock Deck

Unlock for access to all 102 flashcards in this deck.

Unlock Deck

k this deck

20

Supplies, Inc. does business in Georgia (6% tax rate) and Alabama (5% tax rate). All other factors being equal, the company will minimize state taxes if it increases the compensation paid to its employees in Alabama.

Unlock Deck

Unlock for access to all 102 flashcards in this deck.

Unlock Deck

k this deck

21

The deemed paid foreign tax credit is available only to U.S. corporations that own 30% or more of the voting stock of a foreign corporation that paid dividends during the taxable year.

Unlock Deck

Unlock for access to all 102 flashcards in this deck.

Unlock Deck

k this deck

22

A foreign branch operation of a U.S. corporation is not a separate legal entity.

Unlock Deck

Unlock for access to all 102 flashcards in this deck.

Unlock Deck

k this deck

23

The income earned by a foreign branch operation of a U.S. corporation is taxable by the United States only when repatriated.

Unlock Deck

Unlock for access to all 102 flashcards in this deck.

Unlock Deck

k this deck

24

The foreign tax credit can reduce a corporation's alternative minimum tax.

Unlock Deck

Unlock for access to all 102 flashcards in this deck.

Unlock Deck

k this deck

25

Under most tax treaties, income attributable to a permanent establishment through which a foreign taxpayer conducts business can be taxed only by the taxpayer's country of residence.

Unlock Deck

Unlock for access to all 102 flashcards in this deck.

Unlock Deck

k this deck

26

Cross-crediting allows multinational corporations to use excess credits generated in low- tax jurisdictions to offset excess limitations generated in high-tax jurisdictions.

Unlock Deck

Unlock for access to all 102 flashcards in this deck.

Unlock Deck

k this deck

27

Foreign value-added taxes and excise taxes are eligible for the U.S. foreign tax credit.

Unlock Deck

Unlock for access to all 102 flashcards in this deck.

Unlock Deck

k this deck

28

The deemed paid foreign tax credit treats a U.S. corporation that receives a foreign source dividend as if the corporation paid tax directly to a foreign jurisdiction.

Unlock Deck

Unlock for access to all 102 flashcards in this deck.

Unlock Deck

k this deck

29

The foreign tax credit is available for income taxes paid to a foreign country.

Unlock Deck

Unlock for access to all 102 flashcards in this deck.

Unlock Deck

k this deck

30

A U.S. taxpayer can make an annual election to take a credit or a deduction for foreign income taxes paid.

Unlock Deck

Unlock for access to all 102 flashcards in this deck.

Unlock Deck

k this deck

31

Excess foreign tax credits can only be carried to future tax years.

Unlock Deck

Unlock for access to all 102 flashcards in this deck.

Unlock Deck

k this deck

32

The foreign subsidiaries of a U.S. corporation cannot be included in a U.S. consolidated tax return.

Unlock Deck

Unlock for access to all 102 flashcards in this deck.

Unlock Deck

k this deck

33

A foreign source dividend received by a U.S. corporation is eligible for the 70% dividends-received deduction.

Unlock Deck

Unlock for access to all 102 flashcards in this deck.

Unlock Deck

k this deck

34

The United States has jurisdiction to tax income earned by any foreign corporation that is a controlled subsidiary of a U.S. parent corporation.

Unlock Deck

Unlock for access to all 102 flashcards in this deck.

Unlock Deck

k this deck

35

A bilateral agreement between the governments of England and France defining and limiting each party's respective tax jurisdiction is an example of a tax treaty.

Unlock Deck

Unlock for access to all 102 flashcards in this deck.

Unlock Deck

k this deck

36

The United States taxes its citizens on their worldwide incomes.

Unlock Deck

Unlock for access to all 102 flashcards in this deck.

Unlock Deck

k this deck

37

The term "tax haven" refers to a foreign country that imposes an income tax at a rate higher than the U.S. rate.

Unlock Deck

Unlock for access to all 102 flashcards in this deck.

Unlock Deck

k this deck

38

Under the U.S. tax system, a domestic corporation pays U.S. tax only on the portion of its business income earned in the United States.

Unlock Deck

Unlock for access to all 102 flashcards in this deck.

Unlock Deck

k this deck

39

The foreign tax credit is available for both income and property taxes paid to a foreign jurisdiction.

Unlock Deck

Unlock for access to all 102 flashcards in this deck.

Unlock Deck

k this deck

40

A U.S. parent corporation that receives a dividend from a wholly-owned foreign subsidiary that pays a 45% income tax to its home country does not owe any U.S. tax on the dividend.

Unlock Deck

Unlock for access to all 102 flashcards in this deck.

Unlock Deck

k this deck

41

Section 482 of the Internal Revenue Code gives the IRS the authority to apportion or allocate gross income, deductions, or credits between/among related parties to correct any distortion resulting from unrealistic prices charged by members of the group to each other for goods or services.

Unlock Deck

Unlock for access to all 102 flashcards in this deck.

Unlock Deck

k this deck

42

Economic nexus:

A) May exist even though a firm has no physical presence in a state.

B) Does not create taxing jurisdiction under the Commerce Clause of the U.S. Constitution.

C) Requires a greater physical presence than traditional definitions of nexus.

D) Applies only to Internet business activities.

A) May exist even though a firm has no physical presence in a state.

B) Does not create taxing jurisdiction under the Commerce Clause of the U.S. Constitution.

C) Requires a greater physical presence than traditional definitions of nexus.

D) Applies only to Internet business activities.

Unlock Deck

Unlock for access to all 102 flashcards in this deck.

Unlock Deck

k this deck

43

GAAP-based consolidated financial statements include only income earned by the consolidated group's domestic subsidiaries.

Unlock Deck

Unlock for access to all 102 flashcards in this deck.

Unlock Deck

k this deck

44

A controlled foreign corporation is a foreign corporation in which U.S. shareholders own more than 50% of the voting power or stock value.

Unlock Deck

Unlock for access to all 102 flashcards in this deck.

Unlock Deck

k this deck

45

Verdi Inc. has before-tax income of $500,000. Verdi operates entirely in state Q, which has a 10% corporate income tax. Compute Verdi's combined federal and state tax burden as a percentage of its before-tax income.

A) 44%

B) 45%

C) 41.5%

D) 40.6%

A) 44%

B) 45%

C) 41.5%

D) 40.6%

Unlock Deck

Unlock for access to all 102 flashcards in this deck.

Unlock Deck

k this deck

46

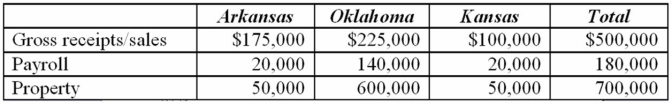

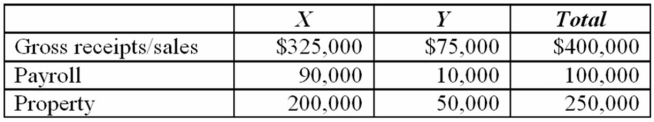

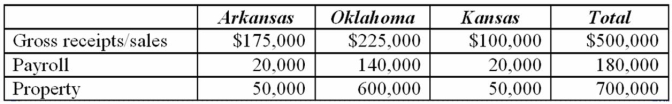

Tri-State's, Inc. operates in Arkansas, Oklahoma, and Kansas. Assume that each state has adopted the UDITPA formula. During the corporation's tax year ended December 31, the apportionment data indicated:  Tri-State's income for the current year is $250,000. Approximately how much income will be taxed by Oklahoma?

Tri-State's income for the current year is $250,000. Approximately how much income will be taxed by Oklahoma?

A) $250,000

B) $218,125

C) $44,375

D) $173,750

Tri-State's income for the current year is $250,000. Approximately how much income will be taxed by Oklahoma?

Tri-State's income for the current year is $250,000. Approximately how much income will be taxed by Oklahoma?A) $250,000

B) $218,125

C) $44,375

D) $173,750

Unlock Deck

Unlock for access to all 102 flashcards in this deck.

Unlock Deck

k this deck

47

Albany, Inc. does business in states C and D. State C uses an apportionment formula that double-weights the sales factor; state D apportions income using an equally-weighted three-factor formula. Albany's before tax income is $3,000,000, and its sales, payroll, and property factors are as follows.

A) State C, $1,100,000; State D, $1,800,000

B) State C, $1,100,000; State D, $1,900,000

C) State C, $1,200,000; State D, $1,800,000

D) State C, $1,200,000; State D, $1,900,001

A) State C, $1,100,000; State D, $1,800,000

B) State C, $1,100,000; State D, $1,900,000

C) State C, $1,200,000; State D, $1,800,000

D) State C, $1,200,000; State D, $1,900,001

Unlock Deck

Unlock for access to all 102 flashcards in this deck.

Unlock Deck

k this deck

48

Which of the following statements concerning the nexus required for a state to tax income is false?

A) Maryland has nexus if the corporate headquarters is located in Baltimore.

B) Company-owned trucks driving through Arizona to deliver goods to customers residing in California creates nexus in Arizona.

C) Maine has nexus if a company has retail outlets located in Maine malls.

D) A New York corporation can send traveling salespeople into Massachusetts to solicit orders for tangible goods without creating nexus in Massachusetts.

A) Maryland has nexus if the corporate headquarters is located in Baltimore.

B) Company-owned trucks driving through Arizona to deliver goods to customers residing in California creates nexus in Arizona.

C) Maine has nexus if a company has retail outlets located in Maine malls.

D) A New York corporation can send traveling salespeople into Massachusetts to solicit orders for tangible goods without creating nexus in Massachusetts.

Unlock Deck

Unlock for access to all 102 flashcards in this deck.

Unlock Deck

k this deck

49

Which of the following could result in a corporation having more than 100% of its income subject to state taxation?

A) Some of the states in which the corporation conducts business have not adopted the Uniform Division of Income for Tax Purposes Act formula.

B) The states in which the corporation conducts business have adopted different definitions of the specific components of the UDITPA formula.

C) Some of the states in which the corporation conducts business strictly apply the UDITPA formula while others double-weight the sales factor.

D) All of these factors could result in a corporation having more than 100% of its income subject to state taxation.

A) Some of the states in which the corporation conducts business have not adopted the Uniform Division of Income for Tax Purposes Act formula.

B) The states in which the corporation conducts business have adopted different definitions of the specific components of the UDITPA formula.

C) Some of the states in which the corporation conducts business strictly apply the UDITPA formula while others double-weight the sales factor.

D) All of these factors could result in a corporation having more than 100% of its income subject to state taxation.

Unlock Deck

Unlock for access to all 102 flashcards in this deck.

Unlock Deck

k this deck

50

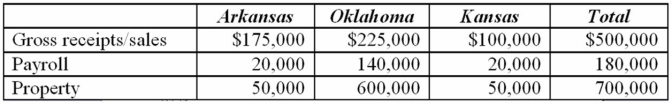

Tri-State's, Inc. operates in Arkansas, Oklahoma, and Kansas. Assume that each state has adopted the UDITPA formula. During the corporation's tax year ended December 31, the apportionment data indicated:  Which of the following statements is true?

Which of the following statements is true?

A) The sales factor for Arkansas is approximately 35%.

B) Arkansas payroll percentage is approximately 11.1%.

C) The property factor for Arkansas is approximately 7.14%.

D) All of the above factors for Arkansas are correct.

Which of the following statements is true?

Which of the following statements is true?A) The sales factor for Arkansas is approximately 35%.

B) Arkansas payroll percentage is approximately 11.1%.

C) The property factor for Arkansas is approximately 7.14%.

D) All of the above factors for Arkansas are correct.

Unlock Deck

Unlock for access to all 102 flashcards in this deck.

Unlock Deck

k this deck

51

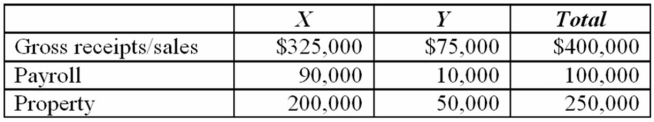

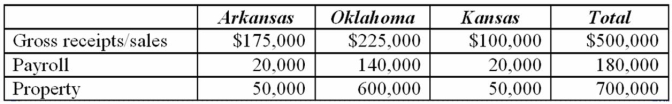

Cambridge, Inc. conducts business in states X and Y. This year, its before-tax income was $150,000. Below is information regarding its sales, payroll, and property factors in both states.  Both states apply an equally-weighted three-factor formula to apportion income. State X has a 10% corporate income tax and state Y has a 5% corporate income tax. Compute the state tax savings if Cambridge could relocate $100,000 of property and $50,000 of payroll from state X to state Y.

Both states apply an equally-weighted three-factor formula to apportion income. State X has a 10% corporate income tax and state Y has a 5% corporate income tax. Compute the state tax savings if Cambridge could relocate $100,000 of property and $50,000 of payroll from state X to state Y.

A) $2,250

B) $12,563

C) $11,532

D) $9,094Before any shifting, X tax = $12,563 = 10% * $150,000 * (325/400 + 90/100 + 200/250)/3. Y tax = $1,219 = 5% * $150,000 * (75/400 + 10/100 * 50/250)/3. Total state tax before shifting = $13,782. After shifting, X tax = $8,063 = 10% * $150,000 * (325/400 + 40/100 + 100/250)/3. Y tax = $3,469 = 5% * $150,000 *(75/400 + 60/100 + 150/250)/3. Total state tax after shifting = $11,532. Savings = $2,250.

Both states apply an equally-weighted three-factor formula to apportion income. State X has a 10% corporate income tax and state Y has a 5% corporate income tax. Compute the state tax savings if Cambridge could relocate $100,000 of property and $50,000 of payroll from state X to state Y.

Both states apply an equally-weighted three-factor formula to apportion income. State X has a 10% corporate income tax and state Y has a 5% corporate income tax. Compute the state tax savings if Cambridge could relocate $100,000 of property and $50,000 of payroll from state X to state Y.A) $2,250

B) $12,563

C) $11,532

D) $9,094Before any shifting, X tax = $12,563 = 10% * $150,000 * (325/400 + 90/100 + 200/250)/3. Y tax = $1,219 = 5% * $150,000 * (75/400 + 10/100 * 50/250)/3. Total state tax before shifting = $13,782. After shifting, X tax = $8,063 = 10% * $150,000 * (325/400 + 40/100 + 100/250)/3. Y tax = $3,469 = 5% * $150,000 *(75/400 + 60/100 + 150/250)/3. Total state tax after shifting = $11,532. Savings = $2,250.

Unlock Deck

Unlock for access to all 102 flashcards in this deck.

Unlock Deck

k this deck

52

Korn, Co. was incorporated in Delaware. It has production, distribution, and sales facilities in Kansas and Nebraska. All of Korn's customers reside in Kansas or Nebraska. Assume that both states use the UDITPA formula for apportionment of income. The corporation is investing in new equipment that cost $900,000. The equipment could be used in either the Kansas or Nebraska production facilities. Assume that Kansas' corporate income tax rate is 7% and Nebraska's is 8.5%. Should the equipment be placed in Kansas or Nebraska to minimize Korn's state income tax?

A) Kansas.

B) Nebraska.

C) Either state, because state income tax will be unaffected by this choice.

D) Korn should place the equipment in a third state in which it does not have nexus.

A) Kansas.

B) Nebraska.

C) Either state, because state income tax will be unaffected by this choice.

D) Korn should place the equipment in a third state in which it does not have nexus.

Unlock Deck

Unlock for access to all 102 flashcards in this deck.

Unlock Deck

k this deck

53

Lexington Corporation conducts business in four states. In state A, its sales factor is 50%, its payroll factor is 14%, and its property factor is 29%. State A uses an equally-weighted three-factor apportionment formula, but plans to change to a formula that double-weight the sales factor. Which is of the following statements is true?

A) Lexington's tax liability to state A will increase.

B) Any increase in Lexington's tax liability to state A will be offset by a decline in tax liability to other states.

C) Lexington's tax liability to state A will decrease.

D) Lexington's tax liability to state A will be unaffected by this change.

A) Lexington's tax liability to state A will increase.

B) Any increase in Lexington's tax liability to state A will be offset by a decline in tax liability to other states.

C) Lexington's tax liability to state A will decrease.

D) Lexington's tax liability to state A will be unaffected by this change.

Unlock Deck

Unlock for access to all 102 flashcards in this deck.

Unlock Deck

k this deck

54

Harris Corporation's before-tax income was $400,000. It does business entirely in Pennsylvania, which has a 6% corporate income tax. Compute Harris' federal income tax.

A) $24,000

B) $136,000

C) $131,600

D) $127,840

A) $24,000

B) $136,000

C) $131,600

D) $127,840

Unlock Deck

Unlock for access to all 102 flashcards in this deck.

Unlock Deck

k this deck

55

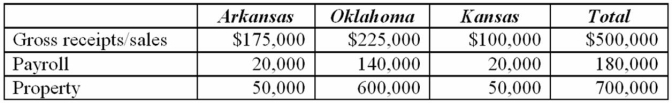

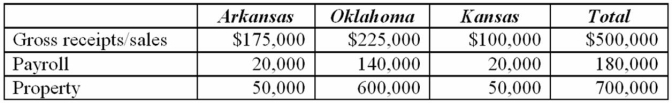

Tri-State's, Inc. operates in Arkansas, Oklahoma, and Kansas. Assume that each state has adopted the UDITPA formula. During the corporation's tax year ended December 31, the apportionment data indicated:  Tri-State's income for the current year is $250,000. Approximately how much will be taxed by Kansas?

Tri-State's income for the current year is $250,000. Approximately how much will be taxed by Kansas?

A) $83,000

B) $95,000

C) $32,000

D) $170,000

Tri-State's income for the current year is $250,000. Approximately how much will be taxed by Kansas?

Tri-State's income for the current year is $250,000. Approximately how much will be taxed by Kansas?A) $83,000

B) $95,000

C) $32,000

D) $170,000

Unlock Deck

Unlock for access to all 102 flashcards in this deck.

Unlock Deck

k this deck

56

This year, Sutton Corporation's before-tax income was $2,000,000. It paid $175,000 income tax to Nebraska and $300,000 income tax to Iowa. Compute Sutton's federal income tax.

A) $680,000

B) $518,500

C) $700,000

D) $533,750

A) $680,000

B) $518,500

C) $700,000

D) $533,750

Unlock Deck

Unlock for access to all 102 flashcards in this deck.

Unlock Deck

k this deck

57

Which of the following activities create state income tax nexus?

A) Selling products over the Internet to customers in the state. The products are delivered by U.S. mail.

B) Traveling salespersons soliciting orders for tangible goods from customers in the state.

C) Ownership of manufacturing and distribution facilities within the state.

D) All of the above activities create state income tax nexus

A) Selling products over the Internet to customers in the state. The products are delivered by U.S. mail.

B) Traveling salespersons soliciting orders for tangible goods from customers in the state.

C) Ownership of manufacturing and distribution facilities within the state.

D) All of the above activities create state income tax nexus

Unlock Deck

Unlock for access to all 102 flashcards in this deck.

Unlock Deck

k this deck

58

Albany, Inc. does business in states C and D. State C apportions income using an equally-weighted three-factor formula; state D uses an apportionment formula that double-weights the sales factor. Albany's before tax income is $3,000,000, and its sales, payroll, and property factors are as follows.

A) State C, $1,100,000; State D, $1,800,000

B) State C, $1,100,000; State D, $1,900,000

C) State C, $1,200,000; State D, $1,800,000

D) State C, $1,300,000; State D, $1,700,001

A) State C, $1,100,000; State D, $1,800,000

B) State C, $1,100,000; State D, $1,900,000

C) State C, $1,200,000; State D, $1,800,000

D) State C, $1,300,000; State D, $1,700,001

Unlock Deck

Unlock for access to all 102 flashcards in this deck.

Unlock Deck

k this deck

59

Which of the following statements about the Uniform Division of Income for Tax Purposes Act (UDITPA) is false?

A) UDITPA requires all states to use the same method for apportioning income of multistate businesses.

B) UDITPA recommends an equally-weighted three-factor formula for apportioning income of multistate businesses.

C) The UDITPA property factor equals the cost of real or tangible personal property located in a state divided by the total cost of such property.

D) The UDITPA payroll factor equals the compensation paid to employees working in a state divided by total compensation.

A) UDITPA requires all states to use the same method for apportioning income of multistate businesses.

B) UDITPA recommends an equally-weighted three-factor formula for apportioning income of multistate businesses.

C) The UDITPA property factor equals the cost of real or tangible personal property located in a state divided by the total cost of such property.

D) The UDITPA payroll factor equals the compensation paid to employees working in a state divided by total compensation.

Unlock Deck

Unlock for access to all 102 flashcards in this deck.

Unlock Deck

k this deck

60

Transfer prices cannot be used by U.S. corporations and their foreign affiliates to shift income between taxing jurisdictions.

Unlock Deck

Unlock for access to all 102 flashcards in this deck.

Unlock Deck

k this deck

61

Which of the following statements about the foreign tax credit limitation is false?

A) The foreign tax credit cannot exceed the U.S. tax on foreign source income.

B) Foreign tax credits in excess of the limit can be carried forward indefinitely.

C) Cross-crediting of taxes paid in high-tax and low-tax foreign jurisdictions can increase allowable foreign tax credits.

D) The foreign tax credit limitation is based on the ratio of foreign source income to total taxable income.

A) The foreign tax credit cannot exceed the U.S. tax on foreign source income.

B) Foreign tax credits in excess of the limit can be carried forward indefinitely.

C) Cross-crediting of taxes paid in high-tax and low-tax foreign jurisdictions can increase allowable foreign tax credits.

D) The foreign tax credit limitation is based on the ratio of foreign source income to total taxable income.

Unlock Deck

Unlock for access to all 102 flashcards in this deck.

Unlock Deck

k this deck

62

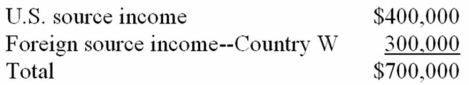

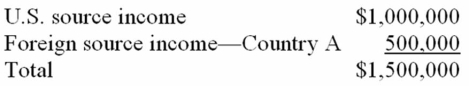

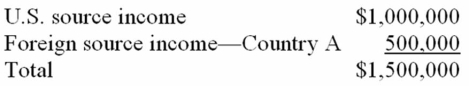

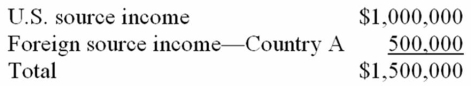

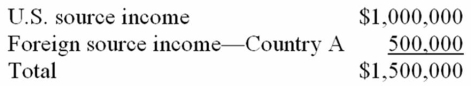

San Carlos Corporation, a U.S. multinational, had pretax U.S. source income and foreign source income as follows.  San Carlos paid $100,000 income tax to Country W. Calculate San Carlos' tax savings if it takes a foreign tax credit rather than deducting this tax.

San Carlos paid $100,000 income tax to Country W. Calculate San Carlos' tax savings if it takes a foreign tax credit rather than deducting this tax.

A) $100,000

B) $66,000

C) $34,000

D) $0

San Carlos paid $100,000 income tax to Country W. Calculate San Carlos' tax savings if it takes a foreign tax credit rather than deducting this tax.

San Carlos paid $100,000 income tax to Country W. Calculate San Carlos' tax savings if it takes a foreign tax credit rather than deducting this tax.A) $100,000

B) $66,000

C) $34,000

D) $0

Unlock Deck

Unlock for access to all 102 flashcards in this deck.

Unlock Deck

k this deck

63

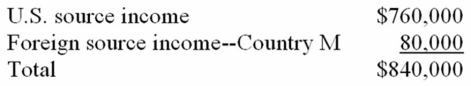

Mega, Inc., a U.S. multinational, has pretax U.S. source income and foreign source income as follows.  Mega paid $20,000 income tax to Country M. Mega has a $25,000 foreign tax credit carryforward. What is Mega's U.S. tax liability if it takes the foreign tax credit?

Mega paid $20,000 income tax to Country M. Mega has a $25,000 foreign tax credit carryforward. What is Mega's U.S. tax liability if it takes the foreign tax credit?

A) $265,600

B) $240,600

C) $285,600

D) $258,400

Mega paid $20,000 income tax to Country M. Mega has a $25,000 foreign tax credit carryforward. What is Mega's U.S. tax liability if it takes the foreign tax credit?

Mega paid $20,000 income tax to Country M. Mega has a $25,000 foreign tax credit carryforward. What is Mega's U.S. tax liability if it takes the foreign tax credit?A) $265,600

B) $240,600

C) $285,600

D) $258,400

Unlock Deck

Unlock for access to all 102 flashcards in this deck.

Unlock Deck

k this deck

64

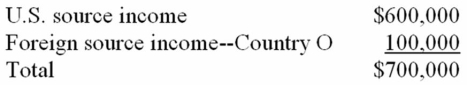

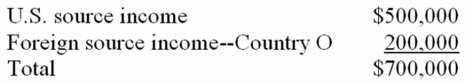

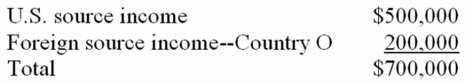

Jokar Inc., a U.S. multinational, began operations this year. Jokar had pretax U.S. source income and foreign source income as follows.  Jokar paid $50,000 income tax to Country O. Compute Jokar's U.S. tax liability if it takes the foreign tax credit.

Jokar paid $50,000 income tax to Country O. Compute Jokar's U.S. tax liability if it takes the foreign tax credit.

A) $213,000

B) $221,000

C) $204,000

D) $238,000

Jokar paid $50,000 income tax to Country O. Compute Jokar's U.S. tax liability if it takes the foreign tax credit.

Jokar paid $50,000 income tax to Country O. Compute Jokar's U.S. tax liability if it takes the foreign tax credit.A) $213,000

B) $221,000

C) $204,000

D) $238,000

Unlock Deck

Unlock for access to all 102 flashcards in this deck.

Unlock Deck

k this deck

65

Which of the following statements about organizational forms for conducting foreign operations is false?

A) Income from a foreign branch office is reported on the consolidated U.S. income tax return.

B) Income from foreign operations conducted through a domestic subsidiary is reported on the consolidated U.S. income tax return.

C) Income from foreign operations conducted through a foreign subsidiary is reported on the consolidated U.S. income tax return.

D) Dividends received by a U.S. multinational corporation from a foreign subsidiary are reported on the consolidated U.S. income tax return.

A) Income from a foreign branch office is reported on the consolidated U.S. income tax return.

B) Income from foreign operations conducted through a domestic subsidiary is reported on the consolidated U.S. income tax return.

C) Income from foreign operations conducted through a foreign subsidiary is reported on the consolidated U.S. income tax return.

D) Dividends received by a U.S. multinational corporation from a foreign subsidiary are reported on the consolidated U.S. income tax return.

Unlock Deck

Unlock for access to all 102 flashcards in this deck.

Unlock Deck

k this deck

66

Which of the following would qualify as a permanent establishment for income tax treaty purposes?

A) The presence of corporate employees in the host country for a limited time period.

B) Shipment of goods by the foreign corporation to customers in the host country.

C) Maintenance of a sales office in the host country.

D) All of the above would qualify as a permanent establishment.

A) The presence of corporate employees in the host country for a limited time period.

B) Shipment of goods by the foreign corporation to customers in the host country.

C) Maintenance of a sales office in the host country.

D) All of the above would qualify as a permanent establishment.

Unlock Deck

Unlock for access to all 102 flashcards in this deck.

Unlock Deck

k this deck

67

Which of the following statements about the foreign tax credit is true?

A) The foreign tax credit allows U.S. companies to defer U.S. tax on foreign source income.

B) The foreign tax credit is available to foreign corporations doing business in the U.S.

C) The foreign tax credit is allowed for all types of foreign taxes.

D) By permitting a foreign tax credit, the U.S. relinquishes its taxing jurisdiction on foreign source income earned by U.S. corporations to the extent that income is taxed by a foreign jurisdiction.

A) The foreign tax credit allows U.S. companies to defer U.S. tax on foreign source income.

B) The foreign tax credit is available to foreign corporations doing business in the U.S.

C) The foreign tax credit is allowed for all types of foreign taxes.

D) By permitting a foreign tax credit, the U.S. relinquishes its taxing jurisdiction on foreign source income earned by U.S. corporations to the extent that income is taxed by a foreign jurisdiction.

Unlock Deck

Unlock for access to all 102 flashcards in this deck.

Unlock Deck

k this deck

68

If a U.S. multinational corporation incurs start-up losses from foreign operations, which of the following organizational forms provide immediate U.S. tax savings from the deduction of the losses?

A) Operation through a foreign subsidiary

B) Operation through a foreign branch

C) Operation through a domestic subsidiary

D) Both b. and c.

A) Operation through a foreign subsidiary

B) Operation through a foreign branch

C) Operation through a domestic subsidiary

D) Both b. and c.

Unlock Deck

Unlock for access to all 102 flashcards in this deck.

Unlock Deck

k this deck

69

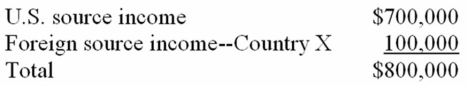

Global Corporation, a U.S. multinational, began operations this year. Global had pretax U.S. source income and foreign source income as follows.  Global paid $25,000 income tax to Country X. What is Global's U.S. tax liability if it takes the foreign tax credit?

Global paid $25,000 income tax to Country X. What is Global's U.S. tax liability if it takes the foreign tax credit?

A) $247,000

B) $238,000

C) $222,000

D) $272,000

Global paid $25,000 income tax to Country X. What is Global's U.S. tax liability if it takes the foreign tax credit?

Global paid $25,000 income tax to Country X. What is Global's U.S. tax liability if it takes the foreign tax credit?A) $247,000

B) $238,000

C) $222,000

D) $272,000

Unlock Deck

Unlock for access to all 102 flashcards in this deck.

Unlock Deck

k this deck

70

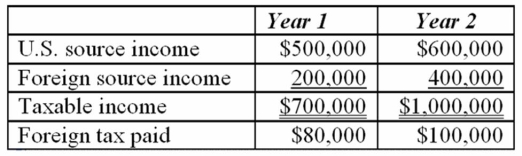

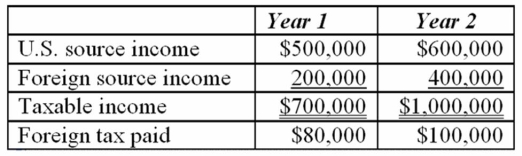

Jenkin Corporation reported the following for its first two taxable years.  Calculate Jenkin's U.S. tax liability for Year 2.

Calculate Jenkin's U.S. tax liability for Year 2.

A) $340,000

B) $240,000

C) $228,000

D) $204,000

Calculate Jenkin's U.S. tax liability for Year 2.

Calculate Jenkin's U.S. tax liability for Year 2.A) $340,000

B) $240,000

C) $228,000

D) $204,000

Unlock Deck

Unlock for access to all 102 flashcards in this deck.

Unlock Deck

k this deck

71

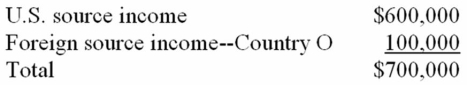

World Sales, Inc., a U.S. multinational, had pretax U.S. source income and foreign source income as follows.  World Sales paid $50,000 income taxes to Country O. What is World Sale's U.S. tax liability if it deducts the foreign taxes paid?

World Sales paid $50,000 income taxes to Country O. What is World Sale's U.S. tax liability if it deducts the foreign taxes paid?

A) $213,000

B) $204,000

C) $221,000

D) $238,000

World Sales paid $50,000 income taxes to Country O. What is World Sale's U.S. tax liability if it deducts the foreign taxes paid?

World Sales paid $50,000 income taxes to Country O. What is World Sale's U.S. tax liability if it deducts the foreign taxes paid?A) $213,000

B) $204,000

C) $221,000

D) $238,000

Unlock Deck

Unlock for access to all 102 flashcards in this deck.

Unlock Deck

k this deck

72

Fleming Corporation, a U.S. multinational, has pretax U.S. source income and foreign source income as follows.  Fleming paid $50,000 income tax to Country A. If Fleming takes the foreign tax credit, compute its worldwide tax burden as a percentage of its pretax income.

Fleming paid $50,000 income tax to Country A. If Fleming takes the foreign tax credit, compute its worldwide tax burden as a percentage of its pretax income.

A) 34%

B) 35%

C) 44%

D) 45%

Fleming paid $50,000 income tax to Country A. If Fleming takes the foreign tax credit, compute its worldwide tax burden as a percentage of its pretax income.

Fleming paid $50,000 income tax to Country A. If Fleming takes the foreign tax credit, compute its worldwide tax burden as a percentage of its pretax income.A) 34%

B) 35%

C) 44%

D) 45%

Unlock Deck

Unlock for access to all 102 flashcards in this deck.

Unlock Deck

k this deck

73

Which of the following statements concerning the taxation of a U.S. multinational corporation is true?

A) A U.S. corporation is taxed by the United States only on its U.S. source income.

B) The foreign tax credit ensures that a U.S. corporation will never pay taxes at a higher rate than the one imposed by the U.S. tax law.

C) Cross-crediting allows a U.S. corporation to maximize its foreign tax credit.

D) The foreign tax credit allows a U.S. corporation to defer taxation of its foreign source income until the earnings are repatriated.

A) A U.S. corporation is taxed by the United States only on its U.S. source income.

B) The foreign tax credit ensures that a U.S. corporation will never pay taxes at a higher rate than the one imposed by the U.S. tax law.

C) Cross-crediting allows a U.S. corporation to maximize its foreign tax credit.

D) The foreign tax credit allows a U.S. corporation to defer taxation of its foreign source income until the earnings are repatriated.

Unlock Deck

Unlock for access to all 102 flashcards in this deck.

Unlock Deck

k this deck

74

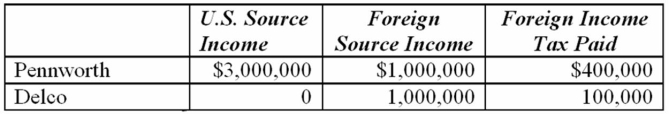

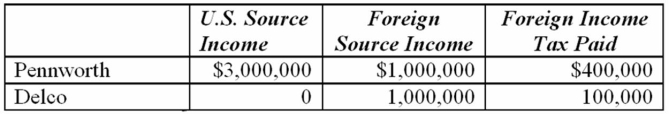

Pennworth Corporation operates in the United States and foreign country M. Its domestic subsidiary Delco, Inc. operates in foreign country N. This year, the two corporations report the following.  If Pennworth and Delco file a consolidated U.S. tax return, compute consolidated income tax liability.

If Pennworth and Delco file a consolidated U.S. tax return, compute consolidated income tax liability.

A) $1,200,000

B) $1,260,000

C) $1,700,000

D) $1,020,000

If Pennworth and Delco file a consolidated U.S. tax return, compute consolidated income tax liability.

If Pennworth and Delco file a consolidated U.S. tax return, compute consolidated income tax liability.A) $1,200,000

B) $1,260,000

C) $1,700,000

D) $1,020,000

Unlock Deck

Unlock for access to all 102 flashcards in this deck.

Unlock Deck

k this deck

75

Galaxy Corporation conducts business in the U.S. and in Country X. In which of the following situations will Galaxy not be allowed a foreign tax credit for income taxes paid to Country X?

A) Country X operations are conducted through a domestic subsidiary included in Galaxy's consolidate tax return.

B) Country X operations are conducted through a foreign subsidiary that paid no dividends.

C) Country X operations are conducted through a foreign subsidiary that distributed 100% of its after-tax earnings as a dividend to Galaxy.

D) Country X operations are conducted through a foreign branch.

A) Country X operations are conducted through a domestic subsidiary included in Galaxy's consolidate tax return.

B) Country X operations are conducted through a foreign subsidiary that paid no dividends.

C) Country X operations are conducted through a foreign subsidiary that distributed 100% of its after-tax earnings as a dividend to Galaxy.

D) Country X operations are conducted through a foreign branch.

Unlock Deck

Unlock for access to all 102 flashcards in this deck.

Unlock Deck

k this deck

76

Fleming Corporation, a U.S. multinational, has pretax U.S. source income and foreign source income as follows.  Fleming paid $200,000 income tax to Country A. If Fleming takes the foreign tax credit, compute its worldwide tax burden as a percentage of its pretax income.

Fleming paid $200,000 income tax to Country A. If Fleming takes the foreign tax credit, compute its worldwide tax burden as a percentage of its pretax income.

A) 34%

B) 35%

C) 36%

D) 44%

Fleming paid $200,000 income tax to Country A. If Fleming takes the foreign tax credit, compute its worldwide tax burden as a percentage of its pretax income.

Fleming paid $200,000 income tax to Country A. If Fleming takes the foreign tax credit, compute its worldwide tax burden as a percentage of its pretax income.A) 34%

B) 35%

C) 36%

D) 44%

Unlock Deck

Unlock for access to all 102 flashcards in this deck.

Unlock Deck

k this deck

77

Which of the following taxes is eligible for the foreign tax credit?

A) Property taxes paid to a foreign country on the value of property owned in that country.

B) Value-added taxes assessed on the value of inventory manufactured in a foreign country.

C) Income tax assessed by a local government within a foreign country.

D) Sales tax assessed on the purchase of consumer goods in a foreign country.

A) Property taxes paid to a foreign country on the value of property owned in that country.

B) Value-added taxes assessed on the value of inventory manufactured in a foreign country.

C) Income tax assessed by a local government within a foreign country.

D) Sales tax assessed on the purchase of consumer goods in a foreign country.

Unlock Deck

Unlock for access to all 102 flashcards in this deck.

Unlock Deck

k this deck

78

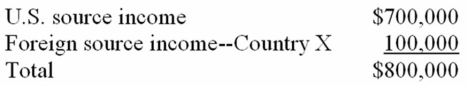

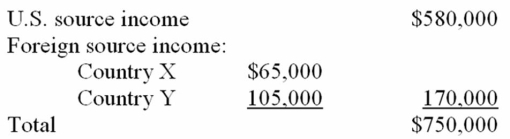

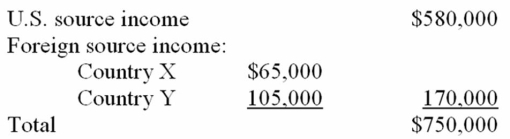

Many Mountains, Inc. is a U.S. multinational corporation. This year, it had the following income.  Many Mountains paid $15,000 income tax to Country X and $28,500 income tax to Country Y. Compute Many Mountains' allowable foreign tax credit.

Many Mountains paid $15,000 income tax to Country X and $28,500 income tax to Country Y. Compute Many Mountains' allowable foreign tax credit.

A) $57,800

B) $49,550

C) $43,500

D) $49,650

Many Mountains paid $15,000 income tax to Country X and $28,500 income tax to Country Y. Compute Many Mountains' allowable foreign tax credit.

Many Mountains paid $15,000 income tax to Country X and $28,500 income tax to Country Y. Compute Many Mountains' allowable foreign tax credit.A) $57,800

B) $49,550

C) $43,500

D) $49,650

Unlock Deck

Unlock for access to all 102 flashcards in this deck.

Unlock Deck

k this deck

79

Which of the following statements about income tax treaties is false?

A) An income tax treaty is a bilateral agreement between the governments of two countries defining and limiting each country's respective tax jurisdiction.

B) The provisions of income tax treaties pertain only to individuals and corporations that are residents of either treaty country.

C) Under a typical treaty, the non-resident country would only tax a firm's profits if the firm maintained a permanent establishment in that country.

D) Under a typical treaty, a firm's profits would be allocated to the countries in a manner similar to the apportionment of income among states under the UDITPA formula.

A) An income tax treaty is a bilateral agreement between the governments of two countries defining and limiting each country's respective tax jurisdiction.

B) The provisions of income tax treaties pertain only to individuals and corporations that are residents of either treaty country.

C) Under a typical treaty, the non-resident country would only tax a firm's profits if the firm maintained a permanent establishment in that country.

D) Under a typical treaty, a firm's profits would be allocated to the countries in a manner similar to the apportionment of income among states under the UDITPA formula.

Unlock Deck

Unlock for access to all 102 flashcards in this deck.

Unlock Deck

k this deck

80

Southern, an Alabama corporation, has a $7 million excess FTC carryforward attributable to its foreign branch manufacturing operations. Which of the following strategies should increase Southern's use of its FTC carryforward to reduce U.S. tax?

A) Southern could open a branch manufacturing operation in a foreign country with a 27% corporate income tax.

B) Southern could open a branch manufacturing operation in a foreign country with a 40% corporate income tax.

C) Southern could repatriate foreign source income in the form of dividends from its controlled subsidiary operating in a country with a 38% corporate income tax.

D) None of these strategies would increase the use of the FTC carryforward.

A) Southern could open a branch manufacturing operation in a foreign country with a 27% corporate income tax.

B) Southern could open a branch manufacturing operation in a foreign country with a 40% corporate income tax.

C) Southern could repatriate foreign source income in the form of dividends from its controlled subsidiary operating in a country with a 38% corporate income tax.

D) None of these strategies would increase the use of the FTC carryforward.

Unlock Deck

Unlock for access to all 102 flashcards in this deck.

Unlock Deck

k this deck