Deck 6: Taxable Income From Business Operations

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/116

Play

Full screen (f)

Deck 6: Taxable Income From Business Operations

1

Mr. Stern, a cash basis taxpayer, was notified by his bank that he earned $1,193 of interest on his savings account in 2015. Mr. Stern has not withdrawn any funds from this account for eight years and did not receive the notification until January 26, 2016. Mr. Stern does not recognize the interest as income in 2015.

False

2

PPQ Inc. wants to change from a hybrid method of accounting to the accrual method of accounting for tax purposes. PPQ can't make this change without receiving permission from the IRS.

True

3

Elcox Company, a calendar year, cash basis taxpayer, paid a $6,340 premium to purchase a casualty insurance policy with a 36-month term. Elcox can deduct $6,340 in the year of payment.

False

4

Marz Services Inc. is a personal service corporation with $60 million average annual gross receipts. Marz must use the accrual method of accounting for tax purposes.

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

5

A cash basis taxpayer must account for any prepayment of interest expense under the accrual method.

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

6

A taxpayer that wants to change its taxable year from a fiscal year to a calendar year is not required to receive permission from the IRS to make the change.

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

7

A firm's choice of taxable year is usually dictated by the annual operating cycle of the firm's business.

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

8

Federal and state political lobbying expenses are nondeductible.

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

9

Taxpayers that sell merchandise to their customers must use the accrual method to account for purchases and sales of merchandise.

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

10

Rydel Inc. was incorporated on August 9 and elected to use a calendar year for tax purposes. Rydel must annualize the income reported on its first tax return for the short period from August 9 to December 31.

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

11

Taxable income is defined as gross income minus allowable deductions and credits.

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

12

A taxpayer that operates more than one business may use a different method of accounting for each business.

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

13

The after-tax cost of a dollar of meal and entertainment expense is 80 cents for a taxpayer with a 40% marginal tax rate.

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

14

Elcox Company, a calendar year, cash basis taxpayer, paid $950 to purchase eight months' worth of office supplies on December 12. Elcox can deduct $950 in the year of payment.

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

15

Accurate measurement of taxable income is the only objective of the federal income tax laws.

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

16

Poole Services, a calendar year taxpayer, billed a client for $1,675 of services on November 30, 2015, and received a check in full payment from the client on January 12, 2016. If Poole is a cash basis taxpayer, it reports $1,675 taxable income in 2015.

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

17

For federal tax purposes, gross income from the sale of tangible goods is reduced by the seller's cost of goods sold.

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

18

Taxpayers that sell merchandise to their customers must use the accrual method as their overall method of accounting.

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

19

Poole Company, a calendar year taxpayer, incurred $589 of long-distance telephone charges in December 2015 and mailed a check to the telephone company on January 4, 2016. If Poole is a cash basis taxpayer, it reports a $589 tax deduction in 2016.

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

20

Taxpayers may adopt the cash receipts and disbursements method, the accrual method, or a hybrid method of accounting for tax purposes.

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

21

According to the GAAP principle of conservatism, firms should delay the realization of uncertain revenues and gains and accelerate the realization of uncertain expenses and losses.

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

22

Keagan Company, a calendar year taxpayer, incurred $1,490 of long-distance telephone charges in December 2015 and mailed a check to the telephone company on January 4, 2016. If Poole is an accrual basis taxpayer, it reports a $1,490 tax deduction in 2016.

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

23

Laine Services, a calendar year taxpayer, billed a client for $8,450 of services on November 30, 2015, and received a check in full payment from the client on January 12, 2016. If Poole is an accrual basis taxpayer, it reports $8,450 taxable income in 2015.

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

24

If an accrual basis taxpayer prepays interest expense, the payment results in an unfavorable temporary book/tax difference.

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

25

Bolton Inc., a calendar year taxpayer, generated a $296,400 net operating loss this year. Bolton can carry the loss back five years and forward 20 years for tax purposes.

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

26

An accrual basis taxpayer that accrues a liability at year-end for unpaid state income tax can deduct the accrued tax expense in the computation of federal taxable income.

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

27

Molton Inc., which operates a chain of retail toy stores, prepares GAAP based financial statements. Molton must use the allowance method to account for business bad debts for both book and tax purposes.

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

28

Income tax expense per books is based on book income adjusted for all book/tax differences.

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

29

Murray Inc., a calendar year, accrual basis corporation, accrued $946,000 accrued salary and wage expense at the end of 2015. Murray paid the entire amount of the accrued liability on January 13, 2016. Murray can deduct the entire $946,000 accrued expense in 2015.

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

30

An unfavorable temporary book/tax difference generates a deferred tax asset.

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

31

At the end of its taxable year, Gong Company accrued an expense for an account payable to Mexance Inc. Even if Gong and Mexance are related parties, Gong can deduct the accrued expense if Mexance also uses the accrual method of accounting for tax purposes.

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

32

The tax law does not allows deductions based on estimated expenses that result in an allowance or reserve for financial statement purposes.

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

33

A temporary difference between book income and taxable income results when an item of income reflected on the books is never included in taxable income.

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

34

Huml Inc. could not deduct an accrued expense because of the all-events test. As a result, Huml has a permanent unfavorable book/tax difference.

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

35

For tax purposes, income is recognized when all events have occurred that fix the taxpayer's right to receive the income and the amount of income can be determined with reasonable accuracy.

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

36

A corporation can't have an increase in deferred tax assets and an increase in deferred tax liabilities in the same year.

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

37

An accrual basis taxpayer must account the expense of a legal settlement resulting from a tort under the cash method.

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

38

If an accrual basis taxpayer receives a prepayment of rent income, the receipt results in an unfavorable temporary book/tax difference.

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

39

A permanent difference between book income and taxable income affects only one taxable year.

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

40

The principle of conservatism reflected by GAAP is identical to the principle of conservatism reflected in the tax law.

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

41

Jethro Company, an accrual basis taxpayer, had a $10,000 overdue account payable to a major supplier. The supplier agreed to settle the account for $9,000 cash from Jethro. Which of the following statements is true?

A) Jethro recognizes $1,000 income because of the settlement.

B) Jethro recognizes no income because of the settlement.

C) Jethro can deduct the $9,000 payment.

D) Jethro can deduct a $1,000 bad debt expense.

A) Jethro recognizes $1,000 income because of the settlement.

B) Jethro recognizes no income because of the settlement.

C) Jethro can deduct the $9,000 payment.

D) Jethro can deduct a $1,000 bad debt expense.

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

42

Pozzi Company, a cash basis business, received $16,930 cash as payment on a loan Pozzi made to a business associate two years ago. The payment consisted of a $15,000 principal payment and $1,930 interest. On receipt of the cash, Pozzi recognizes:

A) No taxable income.

B) $1,930 taxable income.

C) $15,000 taxable income.

D) $16,930 taxable income.

A) No taxable income.

B) $1,930 taxable income.

C) $15,000 taxable income.

D) $16,930 taxable income.

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

43

Which of the following statements about the domestic production activities deduction is false?

A) This deduction is a tax preference.

B) This deduction is intended to help U.S. businesses compete in the global marketplace.

C) This deduction improves the measurement of taxable business income.

D) This deduction creates a permanent difference between book income and taxable income.

A) This deduction is a tax preference.

B) This deduction is intended to help U.S. businesses compete in the global marketplace.

C) This deduction improves the measurement of taxable business income.

D) This deduction creates a permanent difference between book income and taxable income.

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

44

Which of the following statements about methods of accounting is false?

A) The IRS has the right to determine if a taxpayer's method of accounting clearly reflects the taxpayer's income.

B) A taxpayer must request permission from the IRS to change its method of accounting for tax purposes.

C) A taxpayer engaged in more than one business can use a different method of accounting for each business.

D) Taxpayers must use the same method of accounting to compute taxable income as they use to compute financial statement income.

A) The IRS has the right to determine if a taxpayer's method of accounting clearly reflects the taxpayer's income.

B) A taxpayer must request permission from the IRS to change its method of accounting for tax purposes.

C) A taxpayer engaged in more than one business can use a different method of accounting for each business.

D) Taxpayers must use the same method of accounting to compute taxable income as they use to compute financial statement income.

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

45

Why does the federal tax law disallow a business deduction for a fine or penalty paid to any government?

A) A deduction for the payment of a fine or penalty would be a subsidy for bad behavior.

B) The payment of a fine or penalty is not an ordinary business expense.

C) The payment of a fine or penalty is not an expense for financial reporting purposes.

D) A deduction for the payment of a fine or penalty would distort the measurement of taxable income.

A) A deduction for the payment of a fine or penalty would be a subsidy for bad behavior.

B) The payment of a fine or penalty is not an ordinary business expense.

C) The payment of a fine or penalty is not an expense for financial reporting purposes.

D) A deduction for the payment of a fine or penalty would distort the measurement of taxable income.

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

46

HHF Corporation received permission from the IRS to change its taxable year from a fiscal year ending August 31 to a calendar year. Consequently, HHF filed a short-period return for the four-month period from September 1 through December 31. The taxable income reported on the return was $56,000. Use the corporate tax rates in Appendix C of the text to compute HHF's tax on this income (to the nearest dollar).

A) $9,000

B) $14,000

C) $16,257

D) $48,770

A) $9,000

B) $14,000

C) $16,257

D) $48,770

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

47

Lawes Company, a cash basis business, mailed a $24,500 invoice to MWQ Partnership for professional services rendered. MWQ offered to pay the invoice by transferring 250 shares of ConAgri common stock to Lawes. The shares are selling on the NYSE at $98 per share. If Lawes accepts the shares in payment, it recognizes:

A) No taxable income.

B) No taxable income until it sells the ConAgri shares for cash.

C) $24,500 taxable income.

D) It is illegal for a cash basis taxpayer to accept a noncash payment.

A) No taxable income.

B) No taxable income until it sells the ConAgri shares for cash.

C) $24,500 taxable income.

D) It is illegal for a cash basis taxpayer to accept a noncash payment.

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

48

Which of the following methods of accounting is never permissible for computing taxable income?

A) Cash receipts and disbursements method

B) Accrual method

C) Hybrid method that combines the cash and accrual methods

D) All of the above are permissible methods of accounting.

A) Cash receipts and disbursements method

B) Accrual method

C) Hybrid method that combines the cash and accrual methods

D) All of the above are permissible methods of accounting.

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

49

Which of the following statements about the cash method of accounting is false?

A) Under the cash method, annual taxable income equals annual net cash inflow.

B) The revenue from a sale of goods is recognized when payment is received.

C) An expense is recognized when the expense is paid.

D) None of the above is false.

A) Under the cash method, annual taxable income equals annual net cash inflow.

B) The revenue from a sale of goods is recognized when payment is received.

C) An expense is recognized when the expense is paid.

D) None of the above is false.

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

50

Which of the following statements most accurately defines taxable income from business operations?

A) Gross income from the sales of goods or performance of services less allowable deductions.

B) Gross income from whatever source derived less allowable deductions.

C) Revenues from business transactions less expenses.

D) Gross income from whatever source derived less expenses.

A) Gross income from the sales of goods or performance of services less allowable deductions.

B) Gross income from whatever source derived less allowable deductions.

C) Revenues from business transactions less expenses.

D) Gross income from whatever source derived less expenses.

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

51

Which of the following statements about short-period returns is true?

A) If a taxpayer must file a short-period return because the IRS granted permission for a change in the taxpayer's year, the tax for the year must be based on annualized income.

B) The tax on a short-period return must be based on annualized income only if the taxpayer failed to obtain permission from the IRS to change its taxable year.

C) The tax on every short-period return must be based on annualized income.

D) None of the above is true.

A) If a taxpayer must file a short-period return because the IRS granted permission for a change in the taxpayer's year, the tax for the year must be based on annualized income.

B) The tax on a short-period return must be based on annualized income only if the taxpayer failed to obtain permission from the IRS to change its taxable year.

C) The tax on every short-period return must be based on annualized income.

D) None of the above is true.

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

52

Stack Inc. owns a $1 million insurance policy on the life of Mary Stack, the corporate CEO. The corporation is the policy beneficiary. Stack's annual premium on the policy is $3,160. Which of the following statements is true?

A) Stack Inc. can deduct the annual premium as a business expense. If Stack ever collects the $1 million death benefit, the benefit is excluded from gross income.

B) Stack Inc. can deduct the annual premium as a business expense. If Stack ever collects the $1 million death benefit, the benefit is included in gross income.

C) Stack Inc. can't deduct the annual premium as a business expense. If Stack ever collects the $1 million death benefit, the benefit is included in gross income.

D) Stack Inc. can't deduct the annual premium as a business expense. If Stack ever collects the $1 million death benefit, the benefit is excluded from gross income.

A) Stack Inc. can deduct the annual premium as a business expense. If Stack ever collects the $1 million death benefit, the benefit is excluded from gross income.

B) Stack Inc. can deduct the annual premium as a business expense. If Stack ever collects the $1 million death benefit, the benefit is included in gross income.

C) Stack Inc. can't deduct the annual premium as a business expense. If Stack ever collects the $1 million death benefit, the benefit is included in gross income.

D) Stack Inc. can't deduct the annual premium as a business expense. If Stack ever collects the $1 million death benefit, the benefit is excluded from gross income.

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

53

Welch Inc. has used a fiscal ending September 30 as its taxable year since its incorporation in 1988. The shareholders have decided to shut down Welch's business and dissolve the corporation on March 31. Which of the following statements is false?

A) Welch's final tax return will be a short-period return.

B) Welch's final tax return will include its income from October 1 to March 31.

C) Welch must annualize its taxable income on its final tax return.

D) None of the above is false.

A) Welch's final tax return will be a short-period return.

B) Welch's final tax return will include its income from October 1 to March 31.

C) Welch must annualize its taxable income on its final tax return.

D) None of the above is false.

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

54

Which of the following business expenses always results in a difference between taxable income and book income?

A) Rent expense

B) Interest expense

C) Client entertainment

D) Salary expense

A) Rent expense

B) Interest expense

C) Client entertainment

D) Salary expense

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

55

For its first taxable year, UY Products Inc. generated a $124,950 net operating loss. The loss resulted in a deferred tax liability that will reverse over future years in which UY is allowed an NOL carryforward deduction.

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

56

JKL Inc. and Matthew Inc. enter into a business transaction. The two corporations are related parties for tax purposes. Which of the following statements is true?

A) JKL and Matthew must account for the transaction using the same method of accounting.

B) The IRS has the right to reallocate income from the transaction to prevent distortion.

C) The cash method of accounting must be used to account for such transactions.

D) JKL and Matthew must request permission from the IRS to engage in the related party transaction.

A) JKL and Matthew must account for the transaction using the same method of accounting.

B) The IRS has the right to reallocate income from the transaction to prevent distortion.

C) The cash method of accounting must be used to account for such transactions.

D) JKL and Matthew must request permission from the IRS to engage in the related party transaction.

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

57

Pim Inc. operates a business with a natural annual operating cycle ending August 31. Which of the following can Pim adopt as its taxable year?

A) A calendar year.

B) Fiscal year ending June 30.

C) Fiscal year ending August 31.

D) Pim can adopt a calendar year or any fiscal year as its taxable year.

A) A calendar year.

B) Fiscal year ending June 30.

C) Fiscal year ending August 31.

D) Pim can adopt a calendar year or any fiscal year as its taxable year.

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

58

Why does the federal tax law disallow a business deduction for political contributions?

A) A deduction for the payment of a political contribution would be a subsidy for bad behavior.

B) A deduction for the payment of a political contribution would subsidize partisan political activities.

C) The payment of a political contribution is not an expense for financial reporting purposes.

D) A deduction for the payment of a fine or penalty would distort the measurement of taxable income.

A) A deduction for the payment of a political contribution would be a subsidy for bad behavior.

B) A deduction for the payment of a political contribution would subsidize partisan political activities.

C) The payment of a political contribution is not an expense for financial reporting purposes.

D) A deduction for the payment of a fine or penalty would distort the measurement of taxable income.

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

59

Toro Inc. received permission from the IRS to change its taxable year from a fiscal year ending July 31 to a calendar year. Consequently, Toro filed a short-period return for the five-month period from August 1 through December 31. The taxable income reported on the return was $65,000. Use the corporate tax rates in Appendix C of the text to compute Toro's tax on this income (to the nearest dollar).

A) $11,250

B) $18,371

C) $25,350

D) $44,090

A) $11,250

B) $18,371

C) $25,350

D) $44,090

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

60

Tonto Inc. has used a calendar year as its taxable year since its incorporation in 1990. Tonto has an excellent business reason for changing to a fiscal year ending May 31. Which of the following statements is true?

A) Because it has a good business reason, Tonto can change to a fiscal year ending May 31 without IRS permission.

B) If Tonto changes to a fiscal year ending May 31, it must file a short-period return for the seven-month period from June 1 to December 31 of the year of change.

C) If Tonto changes to a fiscal year ending May 31, it must file a short-period return for the five-month period from January 1 to May 31 of the year of change.

D) Because it has a good business reason, Tonto can change to a fiscal year ending May 31 without IRS permission and if Tonto changes to a fiscal year ending May 31, it must file a short-period return for the seven-month period from June 1 to December 31 of the year of change.

A) Because it has a good business reason, Tonto can change to a fiscal year ending May 31 without IRS permission.

B) If Tonto changes to a fiscal year ending May 31, it must file a short-period return for the seven-month period from June 1 to December 31 of the year of change.

C) If Tonto changes to a fiscal year ending May 31, it must file a short-period return for the five-month period from January 1 to May 31 of the year of change.

D) Because it has a good business reason, Tonto can change to a fiscal year ending May 31 without IRS permission and if Tonto changes to a fiscal year ending May 31, it must file a short-period return for the seven-month period from June 1 to December 31 of the year of change.

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

61

Which of the following businesses can't use the cash receipts and disbursement method of accounting for tax purposes?

A) Sole proprietorship with $8 million average annual gross receipts

B) Corporation with $15 million average annual gross receipts

C) Partnership of individuals with $20 million average annual gross receipts

D) Personal service corporation with $50 million average annual gross receipts

A) Sole proprietorship with $8 million average annual gross receipts

B) Corporation with $15 million average annual gross receipts

C) Partnership of individuals with $20 million average annual gross receipts

D) Personal service corporation with $50 million average annual gross receipts

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

62

Which of the following does not result in a permanent book/tax difference?

A) Tax-exempt interest on state and local bonds

B) NOL carryforwards

C) Domestic production activities deduction

D) Lobbying expenses

A) Tax-exempt interest on state and local bonds

B) NOL carryforwards

C) Domestic production activities deduction

D) Lobbying expenses

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

63

Which of the following statements about the accrual method of accounting is false?

A) The accrual method is the required method of accounting under GAAP.

B) Every publicly held corporation must use the accrual method of accounting to prepare financial statements.

C) The accrual method of accounting under GAAP and the accrual method of accounting for computing taxable income are identical.

D) Corporations with more than $5 million average annual gross receipts are required to use the accrual method to compute taxable income.

A) The accrual method is the required method of accounting under GAAP.

B) Every publicly held corporation must use the accrual method of accounting to prepare financial statements.

C) The accrual method of accounting under GAAP and the accrual method of accounting for computing taxable income are identical.

D) Corporations with more than $5 million average annual gross receipts are required to use the accrual method to compute taxable income.

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

64

Which of the following statements describes a permanent book/tax difference?

A) An expense reported on the current income statement but deducted on next year's tax return

B) A revenue item included in current taxable income but not reported on the income statement until next year

C) An expense that is never deductible

D) A revenue item reported on the current income statement but not included in taxable income until an indefinite future year

A) An expense reported on the current income statement but deducted on next year's tax return

B) A revenue item included in current taxable income but not reported on the income statement until next year

C) An expense that is never deductible

D) A revenue item reported on the current income statement but not included in taxable income until an indefinite future year

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

65

Which of the following businesses is prohibited from using the cash receipts and disbursement method of accounting for tax purposes?

A) Partnership with two individual partners with $9 million average annual gross receipts

B) Personal service corporation with $8 million average annual gross receipts

C) Corporation with $3 million average annual gross receipts

D) None of the businesses are prohibited from using the cash method

A) Partnership with two individual partners with $9 million average annual gross receipts

B) Personal service corporation with $8 million average annual gross receipts

C) Corporation with $3 million average annual gross receipts

D) None of the businesses are prohibited from using the cash method

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

66

Addis Company operates a retail men's clothing store. Because Addis has merchandise inventory, it must use:

A) The accrual method as its overall method of accounting.

B) The accrual method to account only for sales of merchandise.

C) The accrual method to account only for purchases of merchandise.

D) The accrual method to account for both sales and purchases of merchandise.

A) The accrual method as its overall method of accounting.

B) The accrual method to account only for sales of merchandise.

C) The accrual method to account only for purchases of merchandise.

D) The accrual method to account for both sales and purchases of merchandise.

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

67

Which of the following does not result in a permanent book/tax difference?

A) Business meal and entertainment expense

B) Domestic production activities deduction

C) Premiums paid on key-person life insurance policies

D) All of the above result in a permanent book/tax difference.

A) Business meal and entertainment expense

B) Domestic production activities deduction

C) Premiums paid on key-person life insurance policies

D) All of the above result in a permanent book/tax difference.

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

68

On December 12, 2015, Hook Company, a calendar year, cash basis business, mailed a $5,600 bill to Mrs. Gilder for professional services rendered during the month of November. Mrs. Gilder dropped off her $5,600 check at Hook's office on December 28, but the company secretary did not deposit the check in Hook's bank account until January 3. Which of the following statements is true?

A) According to the constructive receipt doctrine, Hook must recognize $5,600 income in 2015.

B) According to the substance over form doctrine, Hook does not recognize $5,600 income until 2015.

C) As a cash basis taxpayer, Hook does not recognize $5,600 income until 2016.

D) As a cash basis taxpayer, Hook can elect to recognize $5,600 income in either 2015 or 2016.

A) According to the constructive receipt doctrine, Hook must recognize $5,600 income in 2015.

B) According to the substance over form doctrine, Hook does not recognize $5,600 income until 2015.

C) As a cash basis taxpayer, Hook does not recognize $5,600 income until 2016.

D) As a cash basis taxpayer, Hook can elect to recognize $5,600 income in either 2015 or 2016.

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

69

Which of the following statements concerning the cash method of accounting is true?

A) A cash basis taxpayer who is in constructive receipt of an income item must recognize that income, even if the item is not in the taxpayer's actual possession.

B) A cash basis taxpayer can deduct the purchase cost of business equipment.

C) A cash basis taxpayer does not recognize gross income on receipt of an economic benefit unless that benefit consists of money.

D) A cash basis taxpayer can deduct interest when it is paid, regardless of the time period for which the interest is charged.

A) A cash basis taxpayer who is in constructive receipt of an income item must recognize that income, even if the item is not in the taxpayer's actual possession.

B) A cash basis taxpayer can deduct the purchase cost of business equipment.

C) A cash basis taxpayer does not recognize gross income on receipt of an economic benefit unless that benefit consists of money.

D) A cash basis taxpayer can deduct interest when it is paid, regardless of the time period for which the interest is charged.

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

70

According to your textbook, business managers prefer to:

A) Report as much income as possible for book and tax purposes.

B) Report as much income as possible for book purposes and as little income as possible for tax purposes.

C) Report as little income as possible for book and tax purposes.

D) Report the same amount of income for book and tax purposes.

A) Report as much income as possible for book and tax purposes.

B) Report as much income as possible for book purposes and as little income as possible for tax purposes.

C) Report as little income as possible for book and tax purposes.

D) Report the same amount of income for book and tax purposes.

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

71

Which of the following statements about the constructive receipt doctrine is false?

A) The doctrine applies to cash basis taxpayers.

B) The doctrine relates to the time period variable in tax planning.

C) Application of the doctrine by the IRS is subjective and depends on the facts and circumstances of each case.

D) None of the above is false.

A) The doctrine applies to cash basis taxpayers.

B) The doctrine relates to the time period variable in tax planning.

C) Application of the doctrine by the IRS is subjective and depends on the facts and circumstances of each case.

D) None of the above is false.

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

72

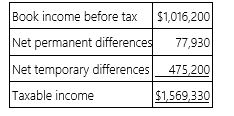

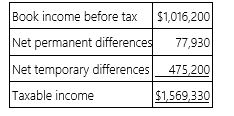

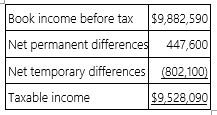

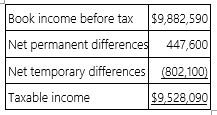

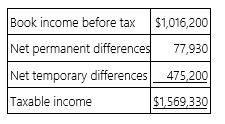

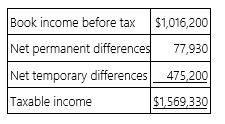

Goff Inc.'s taxable income is computed as follows.  Using a 34% rate, compute Goff's tax expense per books and tax payable.

Using a 34% rate, compute Goff's tax expense per books and tax payable.

A) Tax expense per books $345,508; tax payable $372,004

B) Tax expense per books $345,508; tax payable $533,572

C) Tax expense per books $507,076; tax payable $372,004

D) Tax expense per books $372,004; tax payable $533,572

Using a 34% rate, compute Goff's tax expense per books and tax payable.

Using a 34% rate, compute Goff's tax expense per books and tax payable.A) Tax expense per books $345,508; tax payable $372,004

B) Tax expense per books $345,508; tax payable $533,572

C) Tax expense per books $507,076; tax payable $372,004

D) Tax expense per books $372,004; tax payable $533,572

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

73

Which of the following statements regarding book/tax differences is false?

A) A permanent book/tax difference affects only the year in which it occurs.

B) A temporary book/tax difference affects two or more tax years.

C) Temporary book/tax differences arising in the current tax year will reverse in the future in one or more tax years.

D) The tax cost or benefit of a permanent book/tax difference is recouped over time.

A) A permanent book/tax difference affects only the year in which it occurs.

B) A temporary book/tax difference affects two or more tax years.

C) Temporary book/tax differences arising in the current tax year will reverse in the future in one or more tax years.

D) The tax cost or benefit of a permanent book/tax difference is recouped over time.

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

74

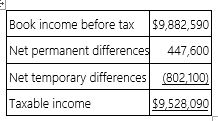

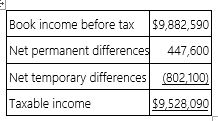

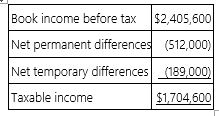

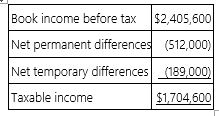

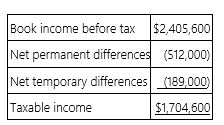

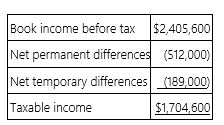

B&B Inc.'s taxable income is computed as follows.  Using a 34% rate, compute B&B's tax expense per books and tax payable.

Using a 34% rate, compute B&B's tax expense per books and tax payable.

A) Tax expense per books $3,360,081; tax payable $3,239,551

B) Tax expense per books $3,512,265; tax payable $3,239,551

C) Tax expense per books $3,512,265; tax payable $3,512,265

D) Tax expense per books $3,087,367; tax payable $3,087,367

Using a 34% rate, compute B&B's tax expense per books and tax payable.

Using a 34% rate, compute B&B's tax expense per books and tax payable.A) Tax expense per books $3,360,081; tax payable $3,239,551

B) Tax expense per books $3,512,265; tax payable $3,239,551

C) Tax expense per books $3,512,265; tax payable $3,512,265

D) Tax expense per books $3,087,367; tax payable $3,087,367

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

75

B&B Inc.'s taxable income is computed as follows.  B&B's tax rate is 34%. Which of the following statements is true?

B&B's tax rate is 34%. Which of the following statements is true?

A) The temporary differences caused a $272,714 net decrease in B&B's deferred tax liabilities.

B) The permanent differences caused a $152,184 net increase in B&B's deferred tax assets.

C) The permanent differences caused a $152,184 net decrease in B&B's deferred tax assets.

D) The temporary differences caused a $272,714 net increase in B&B's deferred tax liabilities.

B&B's tax rate is 34%. Which of the following statements is true?

B&B's tax rate is 34%. Which of the following statements is true?A) The temporary differences caused a $272,714 net decrease in B&B's deferred tax liabilities.

B) The permanent differences caused a $152,184 net increase in B&B's deferred tax assets.

C) The permanent differences caused a $152,184 net decrease in B&B's deferred tax assets.

D) The temporary differences caused a $272,714 net increase in B&B's deferred tax liabilities.

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

76

Southlawn Inc.'s taxable income is computed as follows.  Southlawn's tax rate is 34%. Which of the following statements is true?

Southlawn's tax rate is 34%. Which of the following statements is true?

A) The permanent differences caused a $174,080 net increase in Southlawn's deferred tax liabilities.

B) The permanent differences caused a $174,080 net decrease in Southlawn's deferred tax liabilities.

C) The temporary differences caused a $64,260 net increase in Southlawn's deferred tax liabilities.

D) The temporary differences caused a $64,260 net decrease in Southlawn's deferred tax liabilities.

Southlawn's tax rate is 34%. Which of the following statements is true?

Southlawn's tax rate is 34%. Which of the following statements is true?A) The permanent differences caused a $174,080 net increase in Southlawn's deferred tax liabilities.

B) The permanent differences caused a $174,080 net decrease in Southlawn's deferred tax liabilities.

C) The temporary differences caused a $64,260 net increase in Southlawn's deferred tax liabilities.

D) The temporary differences caused a $64,260 net decrease in Southlawn's deferred tax liabilities.

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

77

Goff Inc.'s taxable income is computed as follows.  Goff's tax rate is 34%. Which of the following statements is true?

Goff's tax rate is 34%. Which of the following statements is true?

A) The permanent differences caused a $26,496 net increase in Goff's deferred tax liabilities.

B) The permanent differences caused a $26,496 net increase in Goff's deferred tax assets.

C) The temporary differences caused a $161,568 net increase in Goff's deferred tax assets.

D) The temporary differences caused a $161,568 net increase in Goff's deferred tax liabilities.

Goff's tax rate is 34%. Which of the following statements is true?

Goff's tax rate is 34%. Which of the following statements is true?A) The permanent differences caused a $26,496 net increase in Goff's deferred tax liabilities.

B) The permanent differences caused a $26,496 net increase in Goff's deferred tax assets.

C) The temporary differences caused a $161,568 net increase in Goff's deferred tax assets.

D) The temporary differences caused a $161,568 net increase in Goff's deferred tax liabilities.

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

78

Which of the following statements concerning the principle of accounting conservatism is true?

A) According to the GAAP principle of conservatism, financial statements should report expenses and losses in the earliest reasonable year.

B) The GAAP principle of conservatism tries to prevent the overstatement of book income and the understatement of taxable income.

C) According to the tax law principle of conservatism, taxpayers should deduct expenses and losses in the earliest reasonable year.

D) According to the tax law principle of conservatism, taxpayers should deduct expenses and losses in the same year as they are reported on the taxpayers' financial statements.

A) According to the GAAP principle of conservatism, financial statements should report expenses and losses in the earliest reasonable year.

B) The GAAP principle of conservatism tries to prevent the overstatement of book income and the understatement of taxable income.

C) According to the tax law principle of conservatism, taxpayers should deduct expenses and losses in the earliest reasonable year.

D) According to the tax law principle of conservatism, taxpayers should deduct expenses and losses in the same year as they are reported on the taxpayers' financial statements.

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

79

Eaton Inc. is a calendar year, cash basis taxpayer. On October 1, 2015, Eaton paid $4,800 to a security firm for night-time and weekend security services for the 24-month period beginning with October. Which of the following is true?

A) As a cash basis taxpayer, Eaton can deduct the $4,800 expense in 2015.

B) Eaton can deduct $600 in 2015, and the remaining $4,200 in 2016.

C) Eaton can deduct $600 in 2015, $2,400 in 2016, and $1,800 in 2017.

D) None of the above is true.

A) As a cash basis taxpayer, Eaton can deduct the $4,800 expense in 2015.

B) Eaton can deduct $600 in 2015, and the remaining $4,200 in 2016.

C) Eaton can deduct $600 in 2015, $2,400 in 2016, and $1,800 in 2017.

D) None of the above is true.

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

80

Southlawn Inc.'s taxable income is computed as follows.  Using a 34% rate, compute Southlawn's tax expense per books and tax payable.

Using a 34% rate, compute Southlawn's tax expense per books and tax payable.

A) Tax expense per books $643,824; tax payable $579,564

B) Tax expense per books $579,564; tax payable $643,824

C) Tax expense per books $817,904; tax payable $579,564

D) None of the above

Using a 34% rate, compute Southlawn's tax expense per books and tax payable.

Using a 34% rate, compute Southlawn's tax expense per books and tax payable.A) Tax expense per books $643,824; tax payable $579,564

B) Tax expense per books $579,564; tax payable $643,824

C) Tax expense per books $817,904; tax payable $579,564

D) None of the above

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck