Deck 3: Understanding Financial Statements and Cash Flows

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/110

Play

Full screen (f)

Deck 3: Understanding Financial Statements and Cash Flows

1

Company A and Company B both report the same level of sales and net income.Therefore,

A) both A and B will report the same Earnings Per Share.

B) both A and B will report the same Gross Profit Margin.

C) both A and B will report the same Net Profit Margin.

D) both A and C are true.

A) both A and B will report the same Earnings Per Share.

B) both A and B will report the same Gross Profit Margin.

C) both A and B will report the same Net Profit Margin.

D) both A and C are true.

both A and B will report the same Net Profit Margin.

2

If two companies have the same revenues and operating expenses,their net incomes will still be different if one company finances its assets with more debt and the other company with more equity.

True

3

The A corporation has an operating profit margin of 20%,operating expenses of $500,000,and financing costs of $15,000.Therefore,

A) the corporation's gross profit margin is less than 20%.

B) the corporation's net profit margin is greater than 20%.

C) the corporation's gross profit margin is greater than 20%.

D) the corporation's gross profit margin is equal to 20% because gross profit is not affected by operating expenses or financing costs.

A) the corporation's gross profit margin is less than 20%.

B) the corporation's net profit margin is greater than 20%.

C) the corporation's gross profit margin is greater than 20%.

D) the corporation's gross profit margin is equal to 20% because gross profit is not affected by operating expenses or financing costs.

the corporation's gross profit margin is greater than 20%.

4

The more debt a company uses to finance its assets,the lower will be its operating income due to higher interest expense.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

5

Li Retailing reported the following items for the current year: Sales = $3,000,000; Cost of Goods Sold = $1,500,000; Depreciation Expense = $170,000; Administrative Expenses = $150,000; Interest Expense = $30,000; Marketing Expenses = $80,000; and Taxes = $300,000.Li's gross profit is equal to

A) $770,000.

B) $1,070,000.

C) $1,100,000.

D) $1,500,000.

A) $770,000.

B) $1,070,000.

C) $1,100,000.

D) $1,500,000.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

6

Li Retailing reported the following items for the current year: Sales = $3,000,000; Cost of Goods Sold = $1,500,000; Depreciation Expense = $170,000; Administrative Expenses = $150,000; Interest Expense = $30,000; Marketing Expenses = $80,000; and Taxes = $300,000; Li's operating profit margin is equal to

A) 25.67%

B) 35.67%

C) 36.67%

D) 50.00%

A) 25.67%

B) 35.67%

C) 36.67%

D) 50.00%

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

7

Li Retailing reported the following items for the current year: Sales = $3,000,000; Cost of Goods Sold = $1,500,000; Depreciation Expense = $170,000; Administrative Expenses = $150,000; Interest Expense = $30,000; Marketing Expenses = $80,000; and Taxes = $300,000.Li's net profit margin is equal to

A) 25.67%.

B) 35.67%.

C) 36.67%.

D) 50.00%.

A) 25.67%.

B) 35.67%.

C) 36.67%.

D) 50.00%.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

8

Common-sized income statements are used to compare companies that have the same amount of revenues.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

9

Common-sized income statements restate the numbers in the income statement as a percentage of sales to assist in the comparison of a firm's financial performance across time and with competitors.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

10

An income statement reports a firm's cumulative revenues and expenses from the inception of the firm through the income statement date.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

11

Net profit margin is equal to the gross profit margin times the operating profit margin.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

12

The basic format of an income statement is

A) Sales - Expenses = Profits.

B) Income - Expenses = EBIT.

C) Sales - Liabilities = Profits.

D) Assets - Liabilities = Profits.

A) Sales - Expenses = Profits.

B) Income - Expenses = EBIT.

C) Sales - Liabilities = Profits.

D) Assets - Liabilities = Profits.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

13

Earnings available to common shareholders is equal to a corporation's positive net cash flow over a given period,typically one year.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

14

Profits-to-Sales relationships are defined as profit margins.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

15

Earnings before taxes,or taxable income,is equal to operating income minus financing costs.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

16

Earnings available to common shareholders represents income that may be reinvested in the firm or distributed to its owners.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

17

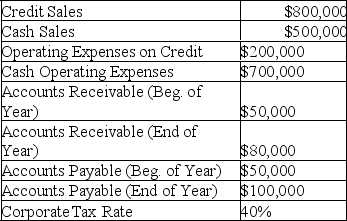

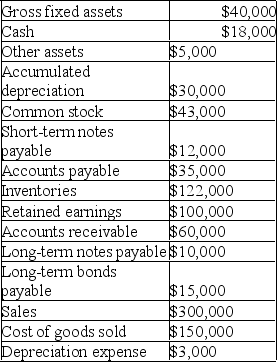

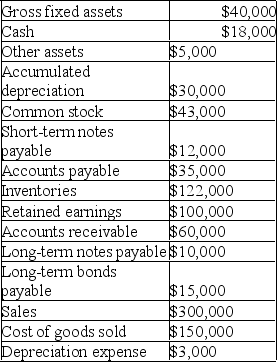

Use the following information to calculate the company's accounting net income for the year.

A) $300,000

B) $240,000

C) $125,000

D) $120,000

A) $300,000

B) $240,000

C) $125,000

D) $120,000

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

18

Li Retailing reported the following items for the current year: Sales = $3,000,000; Cost of Goods Sold = $1,500,000; Depreciation Expense = $170,000; Administrative Expenses = $150,000; Interest Expense = $30,000; Marketing Expenses = $80,000; and Taxes = $300,000.Li's operating income is equal to

A) $770,000.

B) $1,070,000.

C) $1,100,000.

D) $1,500,000.

A) $770,000.

B) $1,070,000.

C) $1,100,000.

D) $1,500,000.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

19

Owners equity increases each period by the amount of the corporation's positive net cash flow.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

20

Changes in depreciation expense do not affect operating income because depreciation is a non-cash expense.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

21

An income statement may be represented as follows:

A) Sales - Liabilities = Profits.

B) Revenues - Liabilities = Net Income.

C) Sales - Expenses = Retained Earnings.

D) Sales - Expenses = Profits.

A) Sales - Liabilities = Profits.

B) Revenues - Liabilities = Net Income.

C) Sales - Expenses = Retained Earnings.

D) Sales - Expenses = Profits.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

22

What information does a firm's income statement provide to the viewing public?

A) an itemization of all of a firm's assets and liabilities for a defined period of time

B) a complete listing of all of a firm's cash receipts and cash expenditures for a defined period of time

C) a report of revenues and expenses for a defined period of time

D) a report of investments made and their cost for a specific period of time

A) an itemization of all of a firm's assets and liabilities for a defined period of time

B) a complete listing of all of a firm's cash receipts and cash expenditures for a defined period of time

C) a report of revenues and expenses for a defined period of time

D) a report of investments made and their cost for a specific period of time

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

23

Fixed assets are assets whose balances will remain the same throughout the year.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

24

The increase in owners equity for a given period is equal to

A) positive net cash flow minus dividends.

B) net income minus dividends.

C) sales minus dividends.

D) gross profit minus distributions to shareholders.

A) positive net cash flow minus dividends.

B) net income minus dividends.

C) sales minus dividends.

D) gross profit minus distributions to shareholders.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

25

The balance sheet equation is Total Assets = Total Revenues - Total Liabilities.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

26

Which of the following statements concerning net income is most correct?

A) Net income represents cash available to pay dividends.

B) Net income represents sales minus operating expenses at a specific point in time.

C) Negative net income reduces a company's cash balance.

D) Net income represents income that may be reinvested in the firm or distributed to its owners.

A) Net income represents cash available to pay dividends.

B) Net income represents sales minus operating expenses at a specific point in time.

C) Negative net income reduces a company's cash balance.

D) Net income represents income that may be reinvested in the firm or distributed to its owners.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

27

If a company's cash balance increases during the year,and the company also reports positive net income,then the company's retained earnings balance must increase.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

28

A firm's financing costs include

A) depreciation expense.

B) interest exposure.

C) costs of goods sold.

D) both A and B.

A) depreciation expense.

B) interest exposure.

C) costs of goods sold.

D) both A and B.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

29

Intangible assets such as copyrights and goodwill are not included on the balance sheet because they are impossible to value objectively.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

30

PDQ Corp.has sales of $4,000,000; the firm's cost of goods sold is $2,500,000; and its total operating expenses are $600,000.The firm's interest expense is $250,000,and the corporate tax rate is 40%.What is PDQ's net income?

A) $288,000

B) $350,000

C) $377,000

D) $390,000

A) $288,000

B) $350,000

C) $377,000

D) $390,000

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

31

Corporation A decides to borrow $1,000,000 and use the money to buy back $1,000,000 of its common stock.The corporation pays 6% interest on its borrowed funds which exactly equals the amount of the dividend it used to pay on the common stock it repurchased.Therefore,

A) Corporation A's operating income will decrease due to higher interest expense.

B) Corporation A's net income will increase due to the tax deductibility of interest expense.

C) Corporation A will have no change in its operating income since the interest expense exactly offsets the prior dividend payment.

D) Corporation A's gross profit will decrease.

A) Corporation A's operating income will decrease due to higher interest expense.

B) Corporation A's net income will increase due to the tax deductibility of interest expense.

C) Corporation A will have no change in its operating income since the interest expense exactly offsets the prior dividend payment.

D) Corporation A's gross profit will decrease.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

32

Common-sized balance sheets show each account as a percentage of total sales to help analysts in comparing companies of difference sizes.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

33

Corporation B reported earnings per share of $10.Corporation B has 100,000 shares of common stock outstanding and reported an increase in owners equity of $400,000 for the period.Corporation B paid $50,000 in interest expense during the period.Corporation B paid dividends per share of

A) $6.00.

B) $5.50.

C) $6.50.

D) $14.003.

A) $6.00.

B) $5.50.

C) $6.50.

D) $14.003.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

34

PDQ Corp.has sales of $4,000,000; the firm's cost of goods sold is $2,500,000; and its total operating expenses are $600,000.What is PDQ's EBIT?

A) $850,000

B) $875,000

C) $900,000

D) $1,300,000

A) $850,000

B) $875,000

C) $900,000

D) $1,300,000

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

35

The accounting book value of an asset represents the historical cost of the asset rather than its current market value or replacement cost.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

36

Which of the following represents an attempt to measure the net results of the firm's operations (revenues versus expenses)over a given time period?

A) Balance Sheet

B) Statement of Cash Flows

C) Income Statement

D) Sources and Uses of Funds Statement

A) Balance Sheet

B) Statement of Cash Flows

C) Income Statement

D) Sources and Uses of Funds Statement

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

37

Gross profit is equal to

A) profits plus depreciation.

B) revenues - expenses.

C) earnings before taxes minus taxes payable.

D) sales - cost of goods sold.

A) profits plus depreciation.

B) revenues - expenses.

C) earnings before taxes minus taxes payable.

D) sales - cost of goods sold.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

38

A corporation's operating profit margin is equal to

A) Net Income divided by Sales.

B) EBIT divided by Sales.

C) EBIT divided by Net Income.

D) Sales divided by EBIT.

A) Net Income divided by Sales.

B) EBIT divided by Sales.

C) EBIT divided by Net Income.

D) Sales divided by EBIT.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

39

Additional Paid in Capital on the balance sheet equals the amount paid by investors for the company's common stock that exceeds the market price of the stock at the time of purchase.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

40

A firm's income statement reports the results from operating the business for a period of time,while the firm's balance sheet provides a snapshot of the firm's financial position at a specific point in time.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

41

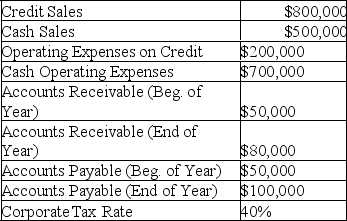

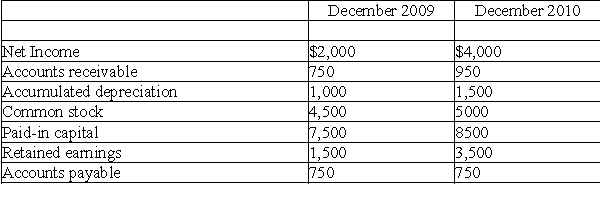

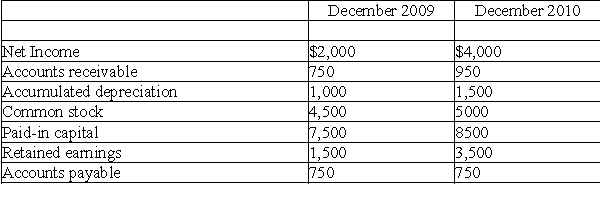

Please refer to Table 3-1 for the following questions.

Table 3-1

Jones Company

Financial Information

Based on the information in Table 3-1,assuming that no common stock was repurchased during the year,the firm issued how much new common stock during 2010?

A) $500

B) $1,000

C) $1,500

D) $2,000

Table 3-1

Jones Company

Financial Information

Based on the information in Table 3-1,assuming that no common stock was repurchased during the year,the firm issued how much new common stock during 2010?

A) $500

B) $1,000

C) $1,500

D) $2,000

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

42

An income statement reports the firm's revenues and expenses for a specific period of time such as one year.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

43

All of the following would result in an increase in stockholders equity except:

A) the company sold common stock at par value.

B) the company sold common stock above par value.

C) the company purchased treasury stock.

D) the company had positive net income greater than dividends paid.

A) the company sold common stock at par value.

B) the company sold common stock above par value.

C) the company purchased treasury stock.

D) the company had positive net income greater than dividends paid.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

44

Net working capital is equal to gross working capital minus depreciation.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

45

Finished goods held for sale are inventory,but raw materials to be used in the production process are considered other assets.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

46

The income statement describes the financial position of a firm on a given date.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

47

The December 31,2009 balance sheet shows net fixed assets of $150,000 and the December 31,2010 balance sheet shows net fixed assets of $250,000.Depreciation expense for 2009 is $25,000 and depreciation expense for 2010 is $35,000.Based on this information,the cost of fixed assets purchased during 2010 is

A) $100,000.

B) $110,000.

C) $135,000.

D) $160,000.

A) $100,000.

B) $110,000.

C) $135,000.

D) $160,000.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

48

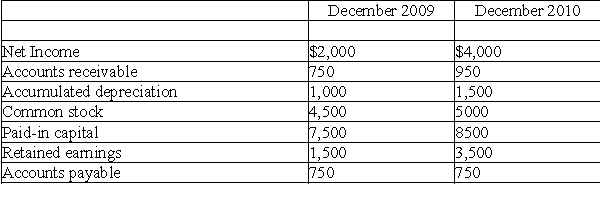

Please refer to Table 3-1 for the following questions.

Table 3-1

Jones Company

Financial Information

Based on the information in Table 3-1,calculate the amount of dividends paid by Jones Company in 2010 (no assets were disposed of during the year,and there was no change in interest payable or taxes payable).

A) $2,000

B) $2,500

C) $3,500

D) $4,000

Table 3-1

Jones Company

Financial Information

Based on the information in Table 3-1,calculate the amount of dividends paid by Jones Company in 2010 (no assets were disposed of during the year,and there was no change in interest payable or taxes payable).

A) $2,000

B) $2,500

C) $3,500

D) $4,000

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

49

On an accrual basis income statement,revenues equal cash receipts and expenses equal cash expenditures.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

50

The profit and loss (income)statement is compiled on a cash basis.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

51

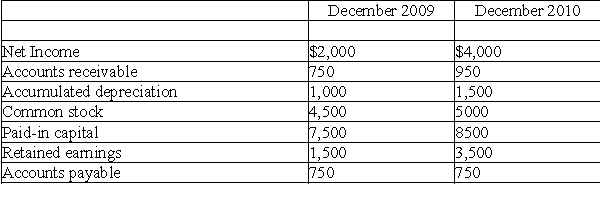

Please refer to Table 3-1 for the following questions.

Table 3-1

Jones Company

Financial Information

Based on the information in Table 3-1,assuming that no assets were disposed of during 2010,the amount of depreciation expense was

A) $375.

B) $500.

C) $2,500.

D) $3,500.

Table 3-1

Jones Company

Financial Information

Based on the information in Table 3-1,assuming that no assets were disposed of during 2010,the amount of depreciation expense was

A) $375.

B) $500.

C) $2,500.

D) $3,500.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

52

A balance sheet is a statement of the financial position of the firm on a given date,including its asset holdings,liabilities,and equity.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

53

Under current accounting rules,the plant and equipment account shows the historical cost (purchase price)of,plus any subsequent improvements to,the plant and equipment.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

54

A balance sheet reflects the current market value of a firm's assets and liabilities.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

55

Common stockholders' equity equals common stock issued minus treasury stock.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

56

Accounting rules specify that assets on the balance sheet must be reported at current market value,because this is the valuation most useful to potential investors.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

57

Financing activities have no impact on the income statement,but rather are reflected in changes in long-term debt and short-term debt on the balance sheet.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

58

The balance sheet reflects the accounting equation:

Assets = Liabilities + Owners' Equity.

Assets = Liabilities + Owners' Equity.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

59

Inventories are considered fixed assets because inventory levels remain fairly constant throughout the year.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

60

The retained earnings balance on IBM's balance sheet at the end of 2010 is equal to IBM's 2010 net income minus dividends paid in 2010.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

61

All of the following are equity accounts on a balance sheet except:

A) retained earnings.

B) cash.

C) common stock.

D) paid-in capital.

A) retained earnings.

B) cash.

C) common stock.

D) paid-in capital.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

62

Net working capital is equal to

A) total assets minus total liabilities.

B) current assets minus total liabilities.

C) total operating capital minus net income.

D) current assets minus current liabilities.

A) total assets minus total liabilities.

B) current assets minus total liabilities.

C) total operating capital minus net income.

D) current assets minus current liabilities.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

63

Prepare a balance sheet using the information given below.Make sure to identify current assets,net fixed assets,total assets,current liabilities,long-term debt,total equity,and total liabilities and equity.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

64

The two principal sources of financing for corporations are

A) debt and accounts payable.

B) debt and equity.

C) common equity and preferred equity.

D) cash and common equity.

A) debt and accounts payable.

B) debt and equity.

C) common equity and preferred equity.

D) cash and common equity.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

65

Which of the following accounts does not belong in the liability section of a balance sheet?

A) accruals

B) short-term debt

C) additional paid-in capital

D) long-term debt

A) accruals

B) short-term debt

C) additional paid-in capital

D) long-term debt

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

66

Generally accepted accounting principles (GAAP)require finance statements prepared on a cash basis because these statements are most useful for investors and managers.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

67

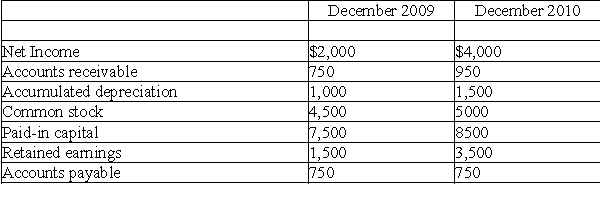

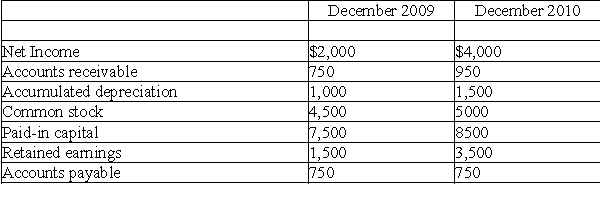

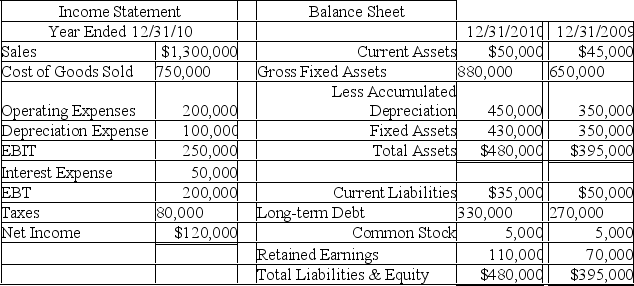

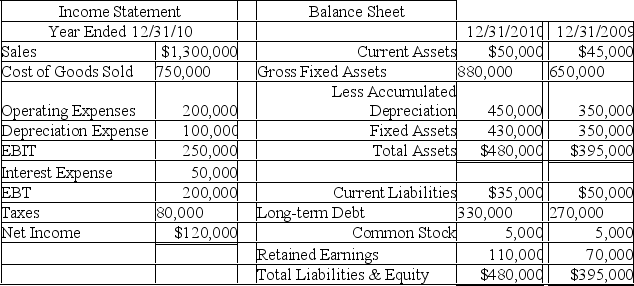

Given the following financial statements for ACME Corporation,what amount did the company pay in dividends for 2010?

A) $45,000

B) $25,000

C) $100,000

D) $80,000

A) $45,000

B) $25,000

C) $100,000

D) $80,000

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

68

Which of the following accounts belongs in the equity section of a balance sheet?

A) retained earnings

B) cash

C) long-term debt

D) dividends

A) retained earnings

B) cash

C) long-term debt

D) dividends

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

69

Which of the following accounts belong in the liability section of a balance sheet?

A) interest expense

B) accumulated depreciation

C) accounts payable

D) preferred stock

A) interest expense

B) accumulated depreciation

C) accounts payable

D) preferred stock

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

70

Global.Com has cash of $75,000; short-term notes payable of $100,000; accounts receivables of $275,000; accounts payable of $135,000: inventories of $350,000; and accrued expenses of $75,000.What is Global's net working capital?

A) $390,000

B) $175,000

C) $700,000

D) $210,000

A) $390,000

B) $175,000

C) $700,000

D) $210,000

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

71

Baron,Inc.has total current assets of $1,200,000; long-term debt of $600,000; total current liabilities of $500,000; and long-term assets of $800,000.How much is the firm's net working capital?

A) $1,000,000

B) $900,000

C) $600,000

D) $700,000

A) $1,000,000

B) $900,000

C) $600,000

D) $700,000

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

72

PDQ Corp.has sales of $4,000,000; the firm's cost of goods sold is $2,500,000; and its total operating expenses are $600,000.The firm's interest expense is $250,000,and the corporate tax rate is 40%.The firm paid dividends to preferred stockholders of $40,000,and the firm distributed $60,000 in dividend payments to common stockholders.What is PDQ's "Addition to Retained Earnings? "

A) $650,000

B) $390,000

C) $330,000

D) $290,000

A) $650,000

B) $390,000

C) $330,000

D) $290,000

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

73

All of the following are income statement items except:

A) accrued expenses.

B) depreciation expense.

C) cost of goods sold.

D) interest expense.

A) accrued expenses.

B) depreciation expense.

C) cost of goods sold.

D) interest expense.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

74

Which of the following accounts does not belong in the equity section of a balance sheet?

A) retained earnings

B) paid-in-Surplus

C) long-term debt

D) preferred stock

A) retained earnings

B) paid-in-Surplus

C) long-term debt

D) preferred stock

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

75

Which of the following accounts does not belong on the asset side of a balance sheet?

A) accounts receivable

B) marketable securities

C) cash

D) common stock

A) accounts receivable

B) marketable securities

C) cash

D) common stock

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

76

Wheeler Corporation had retained earnings as of 12/31/10 of $15 million.During 2011,Wheeler's net income was $7 million.The retained earnings balance at the end of 2011 was equal to $20 million.Therefore,

A) Wheeler paid a dividend in 2010 of $5 million.

B) Wheeler paid a dividend in 2010 of $2 million.

C) Wheeler sold common stock during 2010 for $5 million.

D) Wheeler purchased treasury stock in 2010 for $2 million.

A) Wheeler paid a dividend in 2010 of $5 million.

B) Wheeler paid a dividend in 2010 of $2 million.

C) Wheeler sold common stock during 2010 for $5 million.

D) Wheeler purchased treasury stock in 2010 for $2 million.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

77

Which of the following accounts belongs on the asset side of a balance sheet?

A) depreciation expense

B) accounts payable

C) inventory

D) accruals

A) depreciation expense

B) accounts payable

C) inventory

D) accruals

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

78

What information does a firm's balance sheet provide to the viewing public?

A) a report of investments made and their cost for a specific period of time

B) a complete listing of all of a firm's cash receipts and cash expenditures for a defined period of time

C) a report of revenues and expenses for a defined period of time

D) an itemization of all of a firm's assets, liabilities, and equity as of the balance sheet date

A) a report of investments made and their cost for a specific period of time

B) a complete listing of all of a firm's cash receipts and cash expenditures for a defined period of time

C) a report of revenues and expenses for a defined period of time

D) an itemization of all of a firm's assets, liabilities, and equity as of the balance sheet date

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

79

Which of the following accounts does not belong on the asset side of a balance sheet?

A) accounts receivable

B) accumulated depreciation

C) cash

D) accruals

A) accounts receivable

B) accumulated depreciation

C) cash

D) accruals

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

80

All of the following statements about balance sheets are true except:

A) Assets - Liabilities = Shareholders' Equity.

B) assets are reported at historical cost.

C) balance sheets show average asset balances over a one-year period.

D) a balance sheet reports a company's financial position at a specific point in time.

A) Assets - Liabilities = Shareholders' Equity.

B) assets are reported at historical cost.

C) balance sheets show average asset balances over a one-year period.

D) a balance sheet reports a company's financial position at a specific point in time.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck