Deck 1: Review of Arithmetic

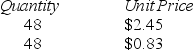

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/144

Play

Full screen (f)

Deck 1: Review of Arithmetic

1

Simplify: 9(8 - 5) + 5(6 + 4)

9 ∗ 3 + 5 ∗ 10 = 27 + 50 = 77

2

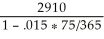

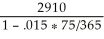

Evaluate:

268/(4400 ∗ .4262295) = 268/1875.4098 = .1429021

3

Evaluate: 400(1 + .10 ∗ 100/365)

400 * (1 + .10 ∗ .2739726) = 400 ∗ (1 + .02739726) = 400 ∗ (1.02739726) = 410.959

4

Simplify: 5(4 + 3)

Unlock Deck

Unlock for access to all 144 flashcards in this deck.

Unlock Deck

k this deck

5

Simplify: 3 + 8 ∗ 4

Unlock Deck

Unlock for access to all 144 flashcards in this deck.

Unlock Deck

k this deck

6

Simplify: 30 + 8  - 6

- 6

- 6

- 6

Unlock Deck

Unlock for access to all 144 flashcards in this deck.

Unlock Deck

k this deck

7

Evaluate: 395(2 + .15 ∗ 290/365)

Unlock Deck

Unlock for access to all 144 flashcards in this deck.

Unlock Deck

k this deck

8

Evaluate:

Unlock Deck

Unlock for access to all 144 flashcards in this deck.

Unlock Deck

k this deck

9

Simplify: 8 + 6 ∗ 2

Unlock Deck

Unlock for access to all 144 flashcards in this deck.

Unlock Deck

k this deck

10

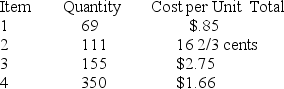

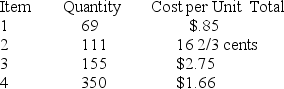

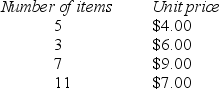

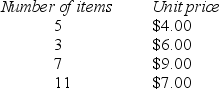

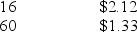

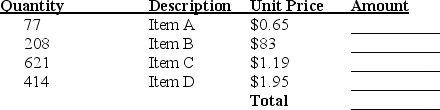

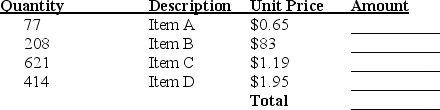

Complete the following inventory sheet and find the total value.

Unlock Deck

Unlock for access to all 144 flashcards in this deck.

Unlock Deck

k this deck

11

Simplify:

Unlock Deck

Unlock for access to all 144 flashcards in this deck.

Unlock Deck

k this deck

12

Three mechanics worked 15  , 14

, 14  , 18

, 18  hours respectively. What was the total cost of labor if the mechanics were paid $14.75 per hour?

hours respectively. What was the total cost of labor if the mechanics were paid $14.75 per hour?

, 14

, 14  , 18

, 18  hours respectively. What was the total cost of labor if the mechanics were paid $14.75 per hour?

hours respectively. What was the total cost of labor if the mechanics were paid $14.75 per hour?

Unlock Deck

Unlock for access to all 144 flashcards in this deck.

Unlock Deck

k this deck

13

Evaluate:

Unlock Deck

Unlock for access to all 144 flashcards in this deck.

Unlock Deck

k this deck

14

Evaluate:

Unlock Deck

Unlock for access to all 144 flashcards in this deck.

Unlock Deck

k this deck

15

A retailer returned 300 defective items to the manufacturer and received a credit for the retail price of $0.75 less a discount of 1/3 of the retail price. What was the amount of the credit received by the retailer?

Unlock Deck

Unlock for access to all 144 flashcards in this deck.

Unlock Deck

k this deck

16

Spade Realty sold lots for $23 240 per hectare. What is the total sales value if the lot sizes, in hectares, were 2  , 3

, 3  , 4

, 4  ?

?

, 3

, 3  , 4

, 4  ?

?

Unlock Deck

Unlock for access to all 144 flashcards in this deck.

Unlock Deck

k this deck

17

Evaluate: 8600(1 - .27 * 226/360)

Unlock Deck

Unlock for access to all 144 flashcards in this deck.

Unlock Deck

k this deck

18

Three workers worked 10  , 15

, 15  , 20

, 20  hours respectively. What was the total cost of labour if the workers were paid $20.00 per hour?

hours respectively. What was the total cost of labour if the workers were paid $20.00 per hour?

, 15

, 15  , 20

, 20  hours respectively. What was the total cost of labour if the workers were paid $20.00 per hour?

hours respectively. What was the total cost of labour if the workers were paid $20.00 per hour?

Unlock Deck

Unlock for access to all 144 flashcards in this deck.

Unlock Deck

k this deck

19

Simplify:

Unlock Deck

Unlock for access to all 144 flashcards in this deck.

Unlock Deck

k this deck

20

Simplify: (14 + 7)/3

Unlock Deck

Unlock for access to all 144 flashcards in this deck.

Unlock Deck

k this deck

21

Scott Rae had gross earnings of $554.30 for last week. Scott earns a base salary of $350.00 on a weekly quota of $4 500.00. If his sales for the week were $6124.00, what is his commission rate?

Unlock Deck

Unlock for access to all 144 flashcards in this deck.

Unlock Deck

k this deck

22

Noriko's final mark for her Financial Mathematics course was based on four tests with different weightings. Test one counted for 10% of the final grade, test two for 20%, test three for 30% and test four for 40%. If Clara received 70% on test one, 85% on test two, 64% on test three and 72% on test four, calculate her final mark.

Unlock Deck

Unlock for access to all 144 flashcards in this deck.

Unlock Deck

k this deck

23

Corrine Davis had gross earnings of $937.50 for the week. If she receives a base salary of $664.00 on a quota of $7800.00 and a commission of 6.75% on sales exceeding the quota, what were Corrine's sales for the week?

Unlock Deck

Unlock for access to all 144 flashcards in this deck.

Unlock Deck

k this deck

24

A salesperson is paid a weekly salary of $350.00 or a commission of 14.5% of his sales, whichever is the greater. What is his earnings for a week in which his sales were

a) $2480.00?

b) $3780.00?

a) $2480.00?

b) $3780.00?

Unlock Deck

Unlock for access to all 144 flashcards in this deck.

Unlock Deck

k this deck

25

Tommy Hughes invested $10 000 in a business on January 1. He withdrew $1000 on March 1, reinvested $5000 on July 1, and withdrew $4000 on October 1. What is Tommy's average monthly investment balance for the year?

Unlock Deck

Unlock for access to all 144 flashcards in this deck.

Unlock Deck

k this deck

26

Beth's annual salary is $42 120.00. Her regular work-week is 36 hours and she is paid semi-monthly.

a) Calculate her gross pay period

b) Calculate her hourly rate of pay

c) Calculate her gross pay for a period in which she works 12 hours of overtime at time and one-half regular pay.

a) Calculate her gross pay period

b) Calculate her hourly rate of pay

c) Calculate her gross pay for a period in which she works 12 hours of overtime at time and one-half regular pay.

Unlock Deck

Unlock for access to all 144 flashcards in this deck.

Unlock Deck

k this deck

27

A sales representative selling computer parts receives a commission of 3.5% on net sales up to $15 000.00, 7% on the next $6000.00, and 9% on any further sales. If his sales for a month were $34 250.00 and sales returns were $1055.00, what was his commission for the month?

Unlock Deck

Unlock for access to all 144 flashcards in this deck.

Unlock Deck

k this deck

28

Sarah receives a semi-monthly salary of $933.20 and works a regular workweek of 40 hours.

a) What is Sarah's hourly rate of pay?

b) If Sarah's gross earnings in one pay period were $1090.19, for how many hours of overtime was she paid at time and one-half regular pay?

a) What is Sarah's hourly rate of pay?

b) If Sarah's gross earnings in one pay period were $1090.19, for how many hours of overtime was she paid at time and one-half regular pay?

Unlock Deck

Unlock for access to all 144 flashcards in this deck.

Unlock Deck

k this deck

29

A salesperson had gross earnings of $943.25 for last week on gross sales of $8320.00. If returns and allowances were 5.5% of gross sales, what is his rate of commission based on net sales?

Unlock Deck

Unlock for access to all 144 flashcards in this deck.

Unlock Deck

k this deck

30

The following information is shown in your investment account for last year. The balance on January 1 was $6200.00. A withdrawal of $880.00 was made on March 1. A deposit of $1600.00 was made on May 1 and another deposit of $320.00 was made on September 1. What was the average monthly balance for the year in your account?

Unlock Deck

Unlock for access to all 144 flashcards in this deck.

Unlock Deck

k this deck

31

A.J. is paid an annual salary of $41 840.00. She is paid monthly on a 40-hour work week. What is the gross pay for a pay period in which she works 9 hours overtime at time-and-a-half regular pay?

Unlock Deck

Unlock for access to all 144 flashcards in this deck.

Unlock Deck

k this deck

32

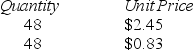

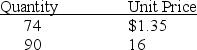

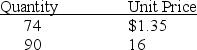

Purchases of an inventory item during the last accounting period were as follows:

What was the weighted average price per item?

What was the weighted average price per item?

What was the weighted average price per item?

What was the weighted average price per item?

Unlock Deck

Unlock for access to all 144 flashcards in this deck.

Unlock Deck

k this deck

33

S. Wall receives a yearly salary of $33 868.00. She is paid bi-weekly and her regular workweek is 37.5 hours.

a) What is the gross pay per pay period?

b) What is the hourly rate of pay?

c) What is the gross pay for a pay period in which she works 9 1/2 hours overtime at time and one-half regular pay?

a) What is the gross pay per pay period?

b) What is the hourly rate of pay?

c) What is the gross pay for a pay period in which she works 9 1/2 hours overtime at time and one-half regular pay?

Unlock Deck

Unlock for access to all 144 flashcards in this deck.

Unlock Deck

k this deck

34

A salesperson receives a commission of 5% on the first $1500.00 of sales during a week. On the next $5000.00 she receives a commission of 10.5%. On any additional sales, the commission rate is 11.75%. Find her gross earnings for a week during which her sales amount to $12 400.00.

Unlock Deck

Unlock for access to all 144 flashcards in this deck.

Unlock Deck

k this deck

35

Extend each of the following and determine the total.

Unlock Deck

Unlock for access to all 144 flashcards in this deck.

Unlock Deck

k this deck

36

R.J. earns $11.70 an hour, with time-and-a-half for hours worked over 36 a week. His clock hours for a week are 10.5, 7.5, 11, 13, and 9.75. Determine his gross earnings for a week.

Unlock Deck

Unlock for access to all 144 flashcards in this deck.

Unlock Deck

k this deck

37

Don Blair invested $11 500 in a business on January 1. She withdrew $700 on March 1, reinvested $1800 on August 1, and withdrew $500 on September 1. What is Don's average monthly investment balance for the year?

Unlock Deck

Unlock for access to all 144 flashcards in this deck.

Unlock Deck

k this deck

38

On a trip, a motorist purchased gasoline as follows: 66 litres at 69.0 cents per litre; 69 litres at 70.5 cents per litres; 80 litres at 71.5 cents per litre; and 57 litres at 74.5 cents per litre.

a) What was the average number of litres per purchase?

b) What was the average cost per litre?

c) If the motorist averaged 9.75 km per litre, what was her average cost of gasoline per kilometre?

a) What was the average number of litres per purchase?

b) What was the average cost per litre?

c) If the motorist averaged 9.75 km per litre, what was her average cost of gasoline per kilometre?

Unlock Deck

Unlock for access to all 144 flashcards in this deck.

Unlock Deck

k this deck

39

Florence Lamb is paid a commission of 10 3/4% on her net sales and is authorized to draw up to $900.00 a month. What is the amount due to Florence at the end of a month in which she drew $820.00, had sales of $14 660.00, and sales returns of $331.20?

Unlock Deck

Unlock for access to all 144 flashcards in this deck.

Unlock Deck

k this deck

40

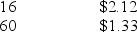

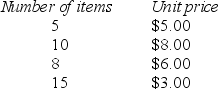

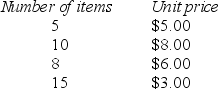

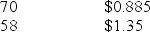

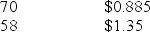

Purchases of an inventory item during last month were as follows:

What was the weighted average price per item?

What was the weighted average price per item?

What was the weighted average price per item?

What was the weighted average price per item?

Unlock Deck

Unlock for access to all 144 flashcards in this deck.

Unlock Deck

k this deck

41

Emily's residence is assessed by the local taxation department at $249 500.00. Calculate the property taxes paid on this property if the existing mill rate is 15.

Unlock Deck

Unlock for access to all 144 flashcards in this deck.

Unlock Deck

k this deck

42

Tom is employed at an annual salary of $50 292.48. His regular workweek is 37.5 hours and he is paid semi-monthly.

a) What is Tom's gross pay per period?

b) What is his hourly rate of pay?

c) What is his gross pay for a period in which he worked 12 1/2 hours overtime at time and one-half regular pay?

a) What is Tom's gross pay per period?

b) What is his hourly rate of pay?

c) What is his gross pay for a period in which he worked 12 1/2 hours overtime at time and one-half regular pay?

Unlock Deck

Unlock for access to all 144 flashcards in this deck.

Unlock Deck

k this deck

43

Last week Dana worked 46 hours. For the regular workweek of 40 hours she is paid $12.40 per hour, and for every hour over 40 hours she is paid at time and one-half regular pay. How much did she earn last week?

Unlock Deck

Unlock for access to all 144 flashcards in this deck.

Unlock Deck

k this deck

44

Last week April worked 44 hours. She is paid $11.20 per hour for a regular workweek of 40 hours and overtime at time and one-half regular pay.

a) What were April's gross wages for last week?

b) What is the amount of the overtime premium?

a) What were April's gross wages for last week?

b) What is the amount of the overtime premium?

Unlock Deck

Unlock for access to all 144 flashcards in this deck.

Unlock Deck

k this deck

45

An employee receives a gross pay of $750.73 for 47.25 hours of work. What is the hourly rate of pay if a regular work week is 37.5 hours and overtime is paid at time-and-a-half the regular rate of pay?

Unlock Deck

Unlock for access to all 144 flashcards in this deck.

Unlock Deck

k this deck

46

Extend and total the following invoice.

Unlock Deck

Unlock for access to all 144 flashcards in this deck.

Unlock Deck

k this deck

47

Carla is paid a semi-monthly salary of $1870.80. Her regular workweek is 40 hours. Overtime is paid at time and one-half regular pay.

a) What is Carla's hourly rate of pay?

b) What is Carla's gross pay if she worked 7 1/2 hours overtime in one pay period?

a) What is Carla's hourly rate of pay?

b) What is Carla's gross pay if she worked 7 1/2 hours overtime in one pay period?

Unlock Deck

Unlock for access to all 144 flashcards in this deck.

Unlock Deck

k this deck

48

A pay stub shows gross earnings of $447.00 for 47 hours of work. What is the hourly rate of pay if the regular workweek is 40 hours and overtime is paid at time and one-half the regular rate of pay?

Unlock Deck

Unlock for access to all 144 flashcards in this deck.

Unlock Deck

k this deck

49

Sean's residence is assessed by the local taxation department at $160 000. Calculate the property taxes paid on this property if the existing mill rate is 20.

Unlock Deck

Unlock for access to all 144 flashcards in this deck.

Unlock Deck

k this deck

50

C.O. is paid a semi-monthly salary of 2 754.30. If his regular work week is 42 hours, what is his hourly rate of pay?

Unlock Deck

Unlock for access to all 144 flashcards in this deck.

Unlock Deck

k this deck

51

Jessica Hughes invested $40 000 on January 1 in a partnership. She withdrew $15 000 on June 1, withdrew a further $2000 on August 1, and reinvested $8 000 on November 1. What was her average monthly investment balance for the year?

Unlock Deck

Unlock for access to all 144 flashcards in this deck.

Unlock Deck

k this deck

52

Barb's Home Income Tax business operates only during tax season. Last season Barb grossed $38 790 including GST. During that season she spent $9500 before GST on her paper and supply purchases. How much does Barb owe Revenue Canada for GST?

Unlock Deck

Unlock for access to all 144 flashcards in this deck.

Unlock Deck

k this deck

53

A retail chain sells snowboards for $855.00 plus GST and PST. What is the price difference for consumers in London, Ontario, and Lethbridge, Alberta?

Unlock Deck

Unlock for access to all 144 flashcards in this deck.

Unlock Deck

k this deck

54

C.O. is paid a semi-monthly salary of $1 250.00. If his regular work week is 35 hours, what is his hourly rate of pay?

Unlock Deck

Unlock for access to all 144 flashcards in this deck.

Unlock Deck

k this deck

55

Calculate the property tax on a property located in the City of Brampton and assessed at $326 500 if the current tax rate is 1.05351%.

Unlock Deck

Unlock for access to all 144 flashcards in this deck.

Unlock Deck

k this deck

56

The town of Pandora assesses property at market value. How much will the owner of a house valued at $325 000 owe in taxes if this year's mill rate has been set at 21.386?

Unlock Deck

Unlock for access to all 144 flashcards in this deck.

Unlock Deck

k this deck

57

"Save the PST" is a popular advertising gimmick. How much would you save on the purchase of a T-shirt with a list price of $45.00 in a Manitoba store during a "Save the PST" promotion?

Unlock Deck

Unlock for access to all 144 flashcards in this deck.

Unlock Deck

k this deck

58

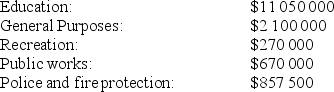

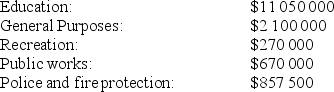

A town has an assessed residential property value of $350 000 000. The town council must meet the following expenditures:

a) Suppose 70% of the expenditures are charged against residential real estate. Calculate the total property taxes that must be raised.

a) Suppose 70% of the expenditures are charged against residential real estate. Calculate the total property taxes that must be raised.

b) What is the mill rate?

c) What is the property tax on a property assessed at $235 000?

a) Suppose 70% of the expenditures are charged against residential real estate. Calculate the total property taxes that must be raised.

a) Suppose 70% of the expenditures are charged against residential real estate. Calculate the total property taxes that must be raised.b) What is the mill rate?

c) What is the property tax on a property assessed at $235 000?

Unlock Deck

Unlock for access to all 144 flashcards in this deck.

Unlock Deck

k this deck

59

Denise Jantz invested $35 000 on January 1 in a partnership. She withdrew $5000 on June 1, withdrew a further $1900 on August 1, and reinvested $6 000 on November 1. What was her average monthly investment balance for the year?

Unlock Deck

Unlock for access to all 144 flashcards in this deck.

Unlock Deck

k this deck

60

Kim Farrena earns $17.60 per hour. Overtime from Monday to Friday is paid at time and one-half regular pay for any hours over 7 1/2 per day. Overtime on weekends is paid at double the regular rate of pay. Last week Kim worked regular hours on Monday, Wednesday, and Friday, 8.5 hours on Tuesday, 11.75 hours on Thursday, and 5 hours on Saturday. Determine Kim's gross wages by each of the two methods.

Unlock Deck

Unlock for access to all 144 flashcards in this deck.

Unlock Deck

k this deck

61

Yanping receives a monthly salary of $1931.54 paid semi-monthly. The regular workweek is 38 hours.

a) Calculate the hourly rate of pay.

b) If the gross earnings for one pay period is 1270.75, for how many hours of overtime was Yanping paid at double-time regular pay.

a) Calculate the hourly rate of pay.

b) If the gross earnings for one pay period is 1270.75, for how many hours of overtime was Yanping paid at double-time regular pay.

Unlock Deck

Unlock for access to all 144 flashcards in this deck.

Unlock Deck

k this deck

62

Mark's gross wages for a week were $711.20. His regular workweek is 40 hours and overtime is paid at time and one-half regular pay. What is Mark's regular hourly wage if he worked 45 1/2 hours?

Unlock Deck

Unlock for access to all 144 flashcards in this deck.

Unlock Deck

k this deck

63

September is paid on a weekly commission basis. She is paid a base salary of $370.00 on a weekly quota of $9500.00 and a commission of 5.75% on any sales in excess of the quota.

a) If September's sales for last week were $11 340.00, what were her gross earnings?

b) What are September's average hourly earnings if she worked 35 hours?

a) If September's sales for last week were $11 340.00, what were her gross earnings?

b) What are September's average hourly earnings if she worked 35 hours?

Unlock Deck

Unlock for access to all 144 flashcards in this deck.

Unlock Deck

k this deck

64

Levi earns $19.60 an hour with time and one-half for hours worked over 8 a day. His hours for a week are 9.25, 8.5, 10.5, 13.5, and 6.25. Determine his gross earnings for a week.

Unlock Deck

Unlock for access to all 144 flashcards in this deck.

Unlock Deck

k this deck

65

Alicia Helm of Wawanesa, Manitoba, bought a ring for $5700. Since the jeweller is shipping the ring, Alicia must pay a shipping charge of $30.00. She must also pay PST and GST on the ring. Find the total purchase price of Alicia's ring.

Unlock Deck

Unlock for access to all 144 flashcards in this deck.

Unlock Deck

k this deck

66

Heart of Gold Realty sold lots for $50 000 per hectare. What is the total sales value if the lot sizes, in hectares, were 1 3/4, 2 1/3, 3 5/8, and 4 1/6?

Unlock Deck

Unlock for access to all 144 flashcards in this deck.

Unlock Deck

k this deck

67

Spade Realty sold lots for $17 120 per hectare. What is the total sales value if the lot sizes, in hectares, were 5 3/4, 7 1/3, 5 5/8, and 4 1/6?

Unlock Deck

Unlock for access to all 144 flashcards in this deck.

Unlock Deck

k this deck

68

A salesperson earned a commission of $926.59 for last week on gross sales of $7880. If returns and allowances were 10.5% of gross sales, what is his rate of commission based on net sales?

Unlock Deck

Unlock for access to all 144 flashcards in this deck.

Unlock Deck

k this deck

69

A clothing salesperson receives a weekly base salary of $200.00 on a quota of $3 000. On the next $1000, he receives a commission of 25%. On any additional sales, the commission rate is 40%. Find her gross earnings for a week in which her sales total $6000.

Unlock Deck

Unlock for access to all 144 flashcards in this deck.

Unlock Deck

k this deck

70

Rola's Dry Cleaning shows sales revenue (exclusive of GST) of $176 000 for the year. Rola's GST taxable expenses were (exclusive of GST) $17 960. How much should she remit to the government at the end of the year?

Unlock Deck

Unlock for access to all 144 flashcards in this deck.

Unlock Deck

k this deck

71

A salesperson receives a weekly base salary of $800.00 on a quota of $2900. On the next $2100, she receives a commission of 14%. On any additional sales, the commission rate is 19%. Find her gross earnings for a week in which her sales total $8455.

Unlock Deck

Unlock for access to all 144 flashcards in this deck.

Unlock Deck

k this deck

72

Extend each of the following and determine the total.

Unlock Deck

Unlock for access to all 144 flashcards in this deck.

Unlock Deck

k this deck

73

Mohammad is paid a weekly commission of 2% on net sales of $6000.00, 4% on the next $3 000.00 and 6.25% on all further sales. His gross sales for a week were 11 160.00 and sales returns and allowances were $120.00.

a) Calculate his gross earnings for the week.

b) Calculate the average hourly rate of pay for the week if he worked 40 hours.

a) Calculate his gross earnings for the week.

b) Calculate the average hourly rate of pay for the week if he worked 40 hours.

Unlock Deck

Unlock for access to all 144 flashcards in this deck.

Unlock Deck

k this deck

74

A computer store located in Oakville, Ont., sells a laptop for $1000.00 plus HST. If the same model is sold at the same price in a store in Victoria, B.C.., what is the difference in the prices paid by consumers in the two stores?

Unlock Deck

Unlock for access to all 144 flashcards in this deck.

Unlock Deck

k this deck

75

Two people living in different communities build houses of the same design on lots of equal size. If the person in Airdrie has his house and lot assessed at $165 000 with a mill rate of 22.051 mills, will his taxes be more or less than the person in Kimberly with an assessment of $145 000 and a mill rate of 25.124 mills?

Unlock Deck

Unlock for access to all 144 flashcards in this deck.

Unlock Deck

k this deck

76

Bill earned a gross commission of $2551.05 during August. What were his gross sales if his rate of commission is 14.5% of net sales and sales returns and allowances for the month were 6% of his sales?

Unlock Deck

Unlock for access to all 144 flashcards in this deck.

Unlock Deck

k this deck

77

Norm Bates is paid a semi-monthly salary of $792.50. Regular hours are 37 1/2 per week and overtime is paid at time and one-half regular pay.

a) What is Norm's hourly rate of pay?

b) How many hours overtime did Norm work in a pay period for which his gross pay was $946.30?

a) What is Norm's hourly rate of pay?

b) How many hours overtime did Norm work in a pay period for which his gross pay was $946.30?

Unlock Deck

Unlock for access to all 144 flashcards in this deck.

Unlock Deck

k this deck

78

A store located in Penticton, B.C., sells a computer for $2975.00 plus HST. If the same model is sold at the same price in a store in Thunder Bay, Ontario, what is the difference in the prices paid by consumers in the two stores?

Unlock Deck

Unlock for access to all 144 flashcards in this deck.

Unlock Deck

k this deck

79

Nick's gross earnings for one week was $698.10. His regular rate of pay is $15.60 for a 35 hour week and overtime is paid at time and one-half regular pay. Calculate the number of hours that Nick worked.

Unlock Deck

Unlock for access to all 144 flashcards in this deck.

Unlock Deck

k this deck

80

Esther's flower shop had sales revenue of $152 000.00 for the year. If the shop's GST taxable expenses were 29 920.00. Calculate how much Colleen should remit to the government at the end of the year.

Unlock Deck

Unlock for access to all 144 flashcards in this deck.

Unlock Deck

k this deck