Deck 18: Determination of Tax

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/152

Play

Full screen (f)

Deck 18: Determination of Tax

1

Taxpayers have the choice of claiming either the personal and dependency exemption or the standard deduction.

False

Explanation:Taxpayers claim the greater of itemized deductions or the standard deduction.In addition,taxpayers will reduce taxable income by personal and dependency exemptions.

Explanation:Taxpayers claim the greater of itemized deductions or the standard deduction.In addition,taxpayers will reduce taxable income by personal and dependency exemptions.

2

All of the following items are deductions for adjusted gross income except

A)alimony paid.

B)trade or business expenses.

C)rent and royalty expenses.

D)state and local income taxes.

A)alimony paid.

B)trade or business expenses.

C)rent and royalty expenses.

D)state and local income taxes.

D

Explanation:D)State and local income taxes are itemized deductions.

Explanation:D)State and local income taxes are itemized deductions.

3

Refundable tax credits are allowed to reduce or totally eliminate a taxpayer's tax liability but any credits in excess of the tax liability are lost.

False

Explanation:Refundable tax credits may reduce the tax liability to zero and,if some credit still remains,are refundable or paid by the government to the taxpayer.

Explanation:Refundable tax credits may reduce the tax liability to zero and,if some credit still remains,are refundable or paid by the government to the taxpayer.

4

Nonrefundable tax credits are allowed to reduce or totally eliminate a taxpayer's tax liability but any credits in excess of the tax liability are lost.

Unlock Deck

Unlock for access to all 152 flashcards in this deck.

Unlock Deck

k this deck

5

Bill and Tessa have two children whom they support and who live in their home.Timmy is 17 and has earned income of $5,000 for the year.Their other child,Tommy,is 15.Tessa's mother also lives with them and may be claimed as their dependent.She is 89 years old.Their adjusted gross income is $130,000.

Required: Compute Bill and Tessa's taxable income for 2017 if they file a joint return and they do not itemize deductions.

Required: Compute Bill and Tessa's taxable income for 2017 if they file a joint return and they do not itemize deductions.

Unlock Deck

Unlock for access to all 152 flashcards in this deck.

Unlock Deck

k this deck

6

Generally,itemized deductions are personal expenses specifically allowed by the tax law.

Unlock Deck

Unlock for access to all 152 flashcards in this deck.

Unlock Deck

k this deck

7

Taxable income for an individual is defined as

A)AGI reduced by itemized deductions.

B)AGI reduced by personal and dependency exemptions.

C)total income reduced by the standard deduction.

D)AGI reduced by deductions from AGI and personal and dependency exemptions.

A)AGI reduced by itemized deductions.

B)AGI reduced by personal and dependency exemptions.

C)total income reduced by the standard deduction.

D)AGI reduced by deductions from AGI and personal and dependency exemptions.

Unlock Deck

Unlock for access to all 152 flashcards in this deck.

Unlock Deck

k this deck

8

All of the following items are generally excluded from income except

A)child support payments.

B)interest on corporate bonds.

C)interest on state and local government bonds.

D)life insurance proceeds paid by reason of death.

A)child support payments.

B)interest on corporate bonds.

C)interest on state and local government bonds.

D)life insurance proceeds paid by reason of death.

Unlock Deck

Unlock for access to all 152 flashcards in this deck.

Unlock Deck

k this deck

9

Which of the following credits is considered a refundable credit?

A)child and dependent care credit

B)earned income credit

C)adoption expense credit

D)lifetime learning credit

A)child and dependent care credit

B)earned income credit

C)adoption expense credit

D)lifetime learning credit

Unlock Deck

Unlock for access to all 152 flashcards in this deck.

Unlock Deck

k this deck

10

Hannah is single with no dependents and has a salary of $102,000 for 2017,along with tax exempt interest income of $3,000 from a municipality.Her itemized deductions total $6,600.

Required: Compute her taxable income.

Required: Compute her taxable income.

Unlock Deck

Unlock for access to all 152 flashcards in this deck.

Unlock Deck

k this deck

11

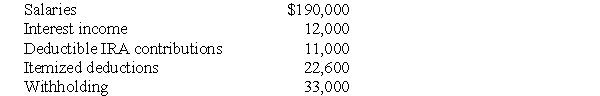

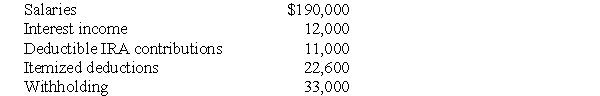

The following information is available for Bob and Brenda Horton,a married couple filing a joint return,for 2017.Both Bob and Brenda are age 32 and have no dependents.

a.What is the amount of their gross income?

a.What is the amount of their gross income?

b.What is the amount of their adjusted gross income?

c.What is the amount of their taxable income?

d.What is the amount of their tax liability (gross tax),rounded to the nearest dollar?

e.What is the amount of their tax due or (refund due)?

a.What is the amount of their gross income?

a.What is the amount of their gross income?b.What is the amount of their adjusted gross income?

c.What is the amount of their taxable income?

d.What is the amount of their tax liability (gross tax),rounded to the nearest dollar?

e.What is the amount of their tax due or (refund due)?

Unlock Deck

Unlock for access to all 152 flashcards in this deck.

Unlock Deck

k this deck

12

All of the following items are included in gross income except

A)alimony received.

B)rent income.

C)interest earned on a bank account.

D)child support payments received.

A)alimony received.

B)rent income.

C)interest earned on a bank account.

D)child support payments received.

Unlock Deck

Unlock for access to all 152 flashcards in this deck.

Unlock Deck

k this deck

13

Generally,deductions for (not from)adjusted gross income are personal expenses specifically allowed by tax law.

Unlock Deck

Unlock for access to all 152 flashcards in this deck.

Unlock Deck

k this deck

14

All of the following items are deductions for adjusted gross income except

A)moving expenses.

B)unreimbursed employee business expenses.

C)qualifying contributions to individual retirement accounts.

D)one-half of self-employment taxes on year's earnings.

A)moving expenses.

B)unreimbursed employee business expenses.

C)qualifying contributions to individual retirement accounts.

D)one-half of self-employment taxes on year's earnings.

Unlock Deck

Unlock for access to all 152 flashcards in this deck.

Unlock Deck

k this deck

15

Although exclusions are usually not reported on an individual's income tax return,interest income on state and local government bonds must be reported on the tax return.

Unlock Deck

Unlock for access to all 152 flashcards in this deck.

Unlock Deck

k this deck

16

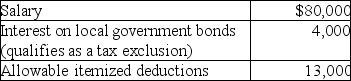

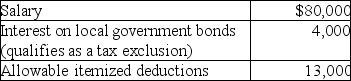

A single taxpayer provided the following information for 2017:  What is taxable income?

What is taxable income?

A)$58,950

B)$62,950

C)$66,950

D)$67,000

What is taxable income?

What is taxable income?A)$58,950

B)$62,950

C)$66,950

D)$67,000

Unlock Deck

Unlock for access to all 152 flashcards in this deck.

Unlock Deck

k this deck

17

Taxpayers have the choice of claiming either the personal and dependency exemption or itemized deductions.

Unlock Deck

Unlock for access to all 152 flashcards in this deck.

Unlock Deck

k this deck

18

The term "gross income" means the total of all income from any source,but after reduction for exclusions.

Unlock Deck

Unlock for access to all 152 flashcards in this deck.

Unlock Deck

k this deck

19

Kadeisha is single with no dependents and has a salary of $102,000 for 2017,along with tax exempt interest income of $3,000 from a municipality.Her itemized deductions total $6,100.

Required: Compute her taxable income.

Required: Compute her taxable income.

Unlock Deck

Unlock for access to all 152 flashcards in this deck.

Unlock Deck

k this deck

20

The standard deduction is the maximum amount of itemized deductions which may be claimed by a taxpayer,and is based on an individual's filing status,age,and vision.

Unlock Deck

Unlock for access to all 152 flashcards in this deck.

Unlock Deck

k this deck

21

On June 1,2017,Ellen turned 65.Ellen has been a widow for five years and has no dependents.Her standard deduction is

A)$4,050.

B)$6,350.

C)$7,900.

D)$12,700.

A)$4,050.

B)$6,350.

C)$7,900.

D)$12,700.

Unlock Deck

Unlock for access to all 152 flashcards in this deck.

Unlock Deck

k this deck

22

In 2017,Brett and Lashana (both 50 years old)file a joint tax return claiming as a dependent their son who is blind.Their standard deduction is

A)$12,700.

B)$13,950.

C)$14,250.

D)$7,900.

A)$12,700.

B)$13,950.

C)$14,250.

D)$7,900.

Unlock Deck

Unlock for access to all 152 flashcards in this deck.

Unlock Deck

k this deck

23

A qualifying child of the taxpayer must meet the gross income test.

Unlock Deck

Unlock for access to all 152 flashcards in this deck.

Unlock Deck

k this deck

24

Parents must provide more than half the support of their child under the age of 19 in order to claim her as a dependent qualifying child.

Unlock Deck

Unlock for access to all 152 flashcards in this deck.

Unlock Deck

k this deck

25

In 2017,the standard deduction for a married taxpayer filing a joint return and who is 67 years old with a spouse who is 65 years old is

A)$12,700.

B)$13,950.

C)$15,200.

D)$15,800.

A)$12,700.

B)$13,950.

C)$15,200.

D)$15,800.

Unlock Deck

Unlock for access to all 152 flashcards in this deck.

Unlock Deck

k this deck

26

For purposes of the dependency exemption,a qualifying child may not provide more than one-half of his or her own support during the year.

Unlock Deck

Unlock for access to all 152 flashcards in this deck.

Unlock Deck

k this deck

27

The amount of Social Security tax paid by the taxpayer will be a consideration in determining the refundable component of the child credit for larger families.

Unlock Deck

Unlock for access to all 152 flashcards in this deck.

Unlock Deck

k this deck

28

An individual who is claimed as a dependent by another person is not entitled to a personal exemption on his or her own return.

Unlock Deck

Unlock for access to all 152 flashcards in this deck.

Unlock Deck

k this deck

29

A child credit is a partially refundable credit.

Unlock Deck

Unlock for access to all 152 flashcards in this deck.

Unlock Deck

k this deck

30

The standard deduction may not be claimed by one married taxpayer filing a separate return if the other spouse itemizes deductions.

Unlock Deck

Unlock for access to all 152 flashcards in this deck.

Unlock Deck

k this deck

31

One requirement for claiming a dependent as a qualifying relative is that the taxpayer provides more than 50 percent of the dependent's support (assuming it is not a multiple support agreement situation).

Unlock Deck

Unlock for access to all 152 flashcards in this deck.

Unlock Deck

k this deck

32

The person claiming a dependency exemption under a multiple support declaration must provide more than 25% of the dependent's support.

Unlock Deck

Unlock for access to all 152 flashcards in this deck.

Unlock Deck

k this deck

33

Taquin,age 67 and single,paid home mortgage interest of $4,000,charitable contributions of $2,000 and property taxes of $3,000 in 2017.He has no dependents.In addition to the personal exemption,Taquin will claim a deduction from AGI of

A)$7,900.

B)$6,350.

C)$10,550.

D)$9,000.

A)$7,900.

B)$6,350.

C)$10,550.

D)$9,000.

Unlock Deck

Unlock for access to all 152 flashcards in this deck.

Unlock Deck

k this deck

34

Generally,in the case of a divorced couple,the parent who has physical custody of a child for the greater part of the year is entitled to the dependency exemption.

Unlock Deck

Unlock for access to all 152 flashcards in this deck.

Unlock Deck

k this deck

35

Annisa,who is 28 and single,has adjusted gross income of $55,000 and itemized deductions of $5,000.In 2017,Annisa will have taxable income of

A)$44,600.

B)$45,950.

C)$50,000.

D)$43,600.

A)$44,600.

B)$45,950.

C)$50,000.

D)$43,600.

Unlock Deck

Unlock for access to all 152 flashcards in this deck.

Unlock Deck

k this deck

36

For purposes of the dependency exemption,a qualifying child must be under age 19,a full-time student under age 24,or a permanently and totally disabled child.

Unlock Deck

Unlock for access to all 152 flashcards in this deck.

Unlock Deck

k this deck

37

Which of the following types of itemized deductions are included in the category of miscellaneous expenses that are deductible only if the aggregate amount of such expenses exceeds 2% of the taxpayer's adjusted gross income?

A)unreimbursed employee business expenses

B)charitable contributions

C)medical expenses

D)home mortgage interest expense

A)unreimbursed employee business expenses

B)charitable contributions

C)medical expenses

D)home mortgage interest expense

Unlock Deck

Unlock for access to all 152 flashcards in this deck.

Unlock Deck

k this deck

38

An individual may not qualify for the dependency exemption as a qualifying child but may still qualify as a dependent.

Unlock Deck

Unlock for access to all 152 flashcards in this deck.

Unlock Deck

k this deck

39

When two or more people qualify to claim the same person as a dependent,a taxpayer who is entitled to the exemption through the qualified child rules has priority over a taxpayer who meets the requirements for other relatives.

Unlock Deck

Unlock for access to all 152 flashcards in this deck.

Unlock Deck

k this deck

40

Nonresident aliens are allowed a full standard deduction.

Unlock Deck

Unlock for access to all 152 flashcards in this deck.

Unlock Deck

k this deck

41

The child credit is for taxpayers with dependent children under the age of

A)14.

B)17.

C)19.

D)24.

A)14.

B)17.

C)19.

D)24.

Unlock Deck

Unlock for access to all 152 flashcards in this deck.

Unlock Deck

k this deck

42

Charlie is claimed as a dependent on his parents' tax return in 2017.He received $8,000 during the year from a part-time acting job,which was his only income.What is his standard deduction?

A)$1,050

B)$6,350

C)$8,000

D)$8,350

A)$1,050

B)$6,350

C)$8,000

D)$8,350

Unlock Deck

Unlock for access to all 152 flashcards in this deck.

Unlock Deck

k this deck

43

David's father is retired and receives $14,000 per year in Social Security benefits.David's father saves $4,000 of the benefits and spends the remaining $10,000 for his support.How much support must David provide for his father to meet the dependent support requirement?

A)$10,000

B)$10,001

C)$14,000

D)$14,001

A)$10,000

B)$10,001

C)$14,000

D)$14,001

Unlock Deck

Unlock for access to all 152 flashcards in this deck.

Unlock Deck

k this deck

44

Anita,who is divorced,maintains a home in which she and her 16-year-old daughter live.Anita provides the majority of the support for her daughter and for a son,age 23,who is enrolled part-time at the university and lives in the dorm.The son also works in the campus bookstore and earns spending money of $4,500.How many personal and dependency exemptions may Anita claim?

A)1

B)2

C)3

D)4

A)1

B)2

C)3

D)4

Unlock Deck

Unlock for access to all 152 flashcards in this deck.

Unlock Deck

k this deck

45

Husband and wife,who live in a common law state,are eligible to file a joint return for 2017,but elect to file separately.They do not have dependents.Wife has adjusted gross income of $25,000 and has $2,200 of expenditures which qualify as itemized deductions.She is entitled to one exemption.Husband deducts itemized deductions of $11,200.What is the taxable income for the wife?

A)$14,600

B)$18,750

C)$20,950

D)None of the above.

A)$14,600

B)$18,750

C)$20,950

D)None of the above.

Unlock Deck

Unlock for access to all 152 flashcards in this deck.

Unlock Deck

k this deck

46

The regular standard deduction is available to which one of the following taxpayers?

A)a married taxpayer filing a separate return where the other spouse itemizes

B)a person who has only unearned income and is a dependent of another

C)a nonresident alien

D)a same sex couple married under New York state law.

A)a married taxpayer filing a separate return where the other spouse itemizes

B)a person who has only unearned income and is a dependent of another

C)a nonresident alien

D)a same sex couple married under New York state law.

Unlock Deck

Unlock for access to all 152 flashcards in this deck.

Unlock Deck

k this deck

47

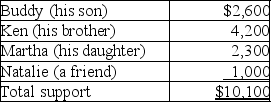

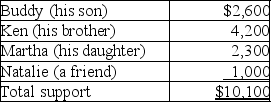

Blaine Greer lives alone.His support comes from the following sources:  Assuming a multiple support declaration exists,which of the individuals may claim Blaine as a dependent?

Assuming a multiple support declaration exists,which of the individuals may claim Blaine as a dependent?

A)Ken or Martha

B)Buddy,Ken,or Martha

C)Ken,Martha,or Natalie

D)None of them.

Assuming a multiple support declaration exists,which of the individuals may claim Blaine as a dependent?

Assuming a multiple support declaration exists,which of the individuals may claim Blaine as a dependent?A)Ken or Martha

B)Buddy,Ken,or Martha

C)Ken,Martha,or Natalie

D)None of them.

Unlock Deck

Unlock for access to all 152 flashcards in this deck.

Unlock Deck

k this deck

48

Julia provides more than 50 percent of the support for three individuals: Theresa,an unrelated child who lives with Julia all year long; Margaret,Julia's cousin,who lives in another city; and Emma,Julia's daughter,who lives in her own home.Each of the potential dependents earned less than $4,050.How many dependency exemptions can Julia claim on her 2017 tax return?

A)0

B)1

C)2

D)3

A)0

B)1

C)2

D)3

Unlock Deck

Unlock for access to all 152 flashcards in this deck.

Unlock Deck

k this deck

49

Ben,age 67,and Karla,age 58,have two children who live with them and for whom they provide total support.Their daughter is 21 years old,blind,is not a full-time student and has no income.Her twin brother is 21 years old,has good sight,is a full-time student and has income of $4,500.Ben and Karla can claim how many personal and dependency exemptions on their tax return?

A)2

B)3

C)4

D)5

A)2

B)3

C)4

D)5

Unlock Deck

Unlock for access to all 152 flashcards in this deck.

Unlock Deck

k this deck

50

Which of the following is not considered support for the dependent support test?

A)food

B)clothing

C)rental value of lodging

D)value of services rendered by the taxpayer for the dependent

A)food

B)clothing

C)rental value of lodging

D)value of services rendered by the taxpayer for the dependent

Unlock Deck

Unlock for access to all 152 flashcards in this deck.

Unlock Deck

k this deck

51

Sarah,who is single,maintains a home in which she,her 15-year-old brother,and her 21-year-old niece live.Sarah provides the majority of the support for her brother,her niece,and her cousin,age 18,who is enrolled full-time at the university and lives in an apartment.While the niece and cousin have no income,her brother has a part-time job and earns $4,000 per year.How many personal and dependency exemptions may Sarah claim?

A)1

B)2

C)3

D)4

A)1

B)2

C)3

D)4

Unlock Deck

Unlock for access to all 152 flashcards in this deck.

Unlock Deck

k this deck

52

Amber supports four individuals: Erin,her stepdaughter,who lives with her; Amy,her cousin,who lives in another state; Britney,her friend,who lives legally in Amber's home all year long; and Charlie,her father,who lives in another state.Assume that the dependency requirements other than residence are all met.How many personal and dependency exemptions may Amber claim?

A)2

B)3

C)4

D)5

A)2

B)3

C)4

D)5

Unlock Deck

Unlock for access to all 152 flashcards in this deck.

Unlock Deck

k this deck

53

Cheryl is claimed as a dependent on her parents' tax return.She had a part-time job during 2017 and earned $4,900 during the year,in addition to $600 of interest income.What is her standard deduction?

A)$1,050

B)$4,900

C)$5,250

D)$6,350

A)$1,050

B)$4,900

C)$5,250

D)$6,350

Unlock Deck

Unlock for access to all 152 flashcards in this deck.

Unlock Deck

k this deck

54

Juanita's mother lives with her.Juanita purchased clothing for her mother costing $1,000 and provided her with a room that Juanita estimates she could have rented for $4,000.Juanita spent $5,000 on groceries she shared with her mother.Juanita also paid $700 for her mother's health insurance coverage.How much of these costs is considered support?

A)$5,000

B)$8,200

C)$10,000

D)$10,700

A)$5,000

B)$8,200

C)$10,000

D)$10,700

Unlock Deck

Unlock for access to all 152 flashcards in this deck.

Unlock Deck

k this deck

55

John supports Kevin,his cousin,who lived with him throughout 2017.John also supports three other individuals who do not live with him: Donna,who is John's mother

Melissa,who John's stepsister

Morris,who is Kevin's brother

Assume that Donna,Melissa,Morris and Kevin each earn less than $4,050.How many personal and dependency exemptions may John claim?

A)2

B)3

C)4

D)5

Melissa,who John's stepsister

Morris,who is Kevin's brother

Assume that Donna,Melissa,Morris and Kevin each earn less than $4,050.How many personal and dependency exemptions may John claim?

A)2

B)3

C)4

D)5

Unlock Deck

Unlock for access to all 152 flashcards in this deck.

Unlock Deck

k this deck

56

Tony supports the following individuals during the current year: Miranda,his former mother-in-law who lives in her own home and has no gross income; his cousin,Jeff,age 23,who is a full-time student,earns $7,000 during the year,and lives with Tony all year long; and Matt,age 22,who is Tony's brother,is a full-time student living on campus and earns $8,000 during the year.How many dependency exemptions may Tony claim?

A)0

B)1

C)2

D)3

A)0

B)1

C)2

D)3

Unlock Deck

Unlock for access to all 152 flashcards in this deck.

Unlock Deck

k this deck

57

A married person who files a separate return can claim a personal exemption for his spouse if the spouse is not the dependent of another and has

A)gross income that is less than the personal exemption.

B)adjusted gross income that is less than the personal exemption.

C)no gross income.

D)no taxable income.

A)gross income that is less than the personal exemption.

B)adjusted gross income that is less than the personal exemption.

C)no gross income.

D)no taxable income.

Unlock Deck

Unlock for access to all 152 flashcards in this deck.

Unlock Deck

k this deck

58

Deborah,who is single,is claimed as a dependent on her parents' tax return.She had a part-time job during 2017 and earned $850 during the year,which was her only income.What is her standard deduction?

A)$850

B)$1,050

C)$1,200

D)$6,350

A)$850

B)$1,050

C)$1,200

D)$6,350

Unlock Deck

Unlock for access to all 152 flashcards in this deck.

Unlock Deck

k this deck

59

Anna is supported entirely by her three sons John,James,and Joseph who provide for her support in the following percentages: John: 10%,James: 40%,Joseph: 50%

Assuming a multiple support declaration exists,which of the brothers may claim his mother as a dependent?

A)any of the sons

B)James or Joseph

C)Joseph only

D)None of them.

Assuming a multiple support declaration exists,which of the brothers may claim his mother as a dependent?

A)any of the sons

B)James or Joseph

C)Joseph only

D)None of them.

Unlock Deck

Unlock for access to all 152 flashcards in this deck.

Unlock Deck

k this deck

60

Lewis,who is single,is claimed as a dependent on his parents' tax return.He received $2,000 during the year in dividends,which was his only income.What is his standard deduction for 2017?

A)$1,050

B)$2,000

C)$2,350

D)$6,350

A)$1,050

B)$2,000

C)$2,350

D)$6,350

Unlock Deck

Unlock for access to all 152 flashcards in this deck.

Unlock Deck

k this deck

61

A married couple need not live together to file a joint return.

Unlock Deck

Unlock for access to all 152 flashcards in this deck.

Unlock Deck

k this deck

62

Ryan and Edith file a joint return showing $130,000 of AGI.They have three dependent children ages 7,9,and 13.What is the amount of their child credit?

A)$0

B)$1,000

C)$2,000

D)$3,000

A)$0

B)$1,000

C)$2,000

D)$3,000

Unlock Deck

Unlock for access to all 152 flashcards in this deck.

Unlock Deck

k this deck

63

Steven and Susie Tyler have three dependent children ages 13,15,and 17.Their modified AGI is $108,000.What is the amount of the child credit to which they are entitled?

A)$0

B)$1,000

C)$2,000

D)$3,000

A)$0

B)$1,000

C)$2,000

D)$3,000

Unlock Deck

Unlock for access to all 152 flashcards in this deck.

Unlock Deck

k this deck

64

Paul and Hannah,who are married and file a joint return,are in the process of adopting a child who is born in December 2017.The child,a son,comes to live with them a week after his birth on December 12.The adoption is not finalized until February of 2018.What tax issues are present in this situation?

Unlock Deck

Unlock for access to all 152 flashcards in this deck.

Unlock Deck

k this deck

65

Amanda has two dependent children,ages 10 and 12.She earned $15,000 from her waitress job.How much of her child credit is refundable?

A)$1,200

B)$1,500

C)$1,800

D)$2,000

A)$1,200

B)$1,500

C)$1,800

D)$2,000

Unlock Deck

Unlock for access to all 152 flashcards in this deck.

Unlock Deck

k this deck

66

An unmarried taxpayer may file as head of household if he maintains a home for his qualifying child.

Unlock Deck

Unlock for access to all 152 flashcards in this deck.

Unlock Deck

k this deck

67

A widow or widower may file a joint tax return and claim an exemption for the deceased spouse in the year of the spouse's death as long as the surviving spouse does not remarry before the end of the year.

Unlock Deck

Unlock for access to all 152 flashcards in this deck.

Unlock Deck

k this deck

68

Eliza Smith's father,Victor,lives with Eliza who is a single taxpayer.During the year,Eliza purchased clothing for her father costing $1,200 and provided him with a room that could have been rented for $6,000.In addition,Eliza spent $4,000 for groceries she shared with her father.Eliza purchased a new computer for $900 which she placed in the living room for both her father and her use.

What is the amount of support provided by Eliza to her father?

What is the amount of support provided by Eliza to her father?

Unlock Deck

Unlock for access to all 152 flashcards in this deck.

Unlock Deck

k this deck

69

Nate and Nikki have three dependent children ages 12,15,and 17.Their modified AGI is $120,000.What is the amount of the child credit to which they are entitled?

A)$0

B)$500

C)$1,500

D)$2,000

A)$0

B)$500

C)$1,500

D)$2,000

Unlock Deck

Unlock for access to all 152 flashcards in this deck.

Unlock Deck

k this deck

70

In 2017,Sam is single and rents an apartment for which he pays $800 per month and makes charitable contributions of $1,000.Sam's adjusted gross income is $47,000.

Required: Compute his taxable income.Show all calculations.

Required: Compute his taxable income.Show all calculations.

Unlock Deck

Unlock for access to all 152 flashcards in this deck.

Unlock Deck

k this deck

71

For each of the following independent cases,indicate the total number of exemptions (personal and dependents)that may be claimed by the taxpayer in 2017.

a.Cassie is a single mother providing the sole support of her three children,who all live with her.Her 16-year-old daughter,Tammy,earned $15,200 modeling during the year and her two sons,R.J.and Will,ages 10 and 8,have no income.

b.Olivia,35 years old,provided eighty percent of the support of her grandmother who lived in another state.Her grandmother's only income was from non-taxable social security of $9,500.

c.Vanessa and Matt Reardon are married and under 65 years of age.During 2017,they furnish more than half of the support of their 25-year-old son,Bill,who lives with them.Bill earns $2,000 from a part-time job,most of which he sets aside for future college expenses.Bill is not currently a student.Vanessa's father,Henry,who died on January 3,2017,at age 80,had for many years qualified as their dependent.

d.Douglas and Marjorie are husband and wife and file a joint return.Both are under 65 years of age.They provide more than half of the support of their daughter,Ellen (age 23),who is a full-time medical student.Ellen receives a $3,400 taxable scholarship covering her room and board at college.They furnish all of the support of Henry (Douglas's grandfather),who is age 85 and lives in a nursing home.They also support Meg (age 69),who is a friend of the family and lives with them.

e.Blair,who is divorced,maintains a home in which she,her twin sons,and her baby daughter live all year.The children's father,Ross,provides over half their support.No special arrangements exist between Blair and Ross.

a.Cassie is a single mother providing the sole support of her three children,who all live with her.Her 16-year-old daughter,Tammy,earned $15,200 modeling during the year and her two sons,R.J.and Will,ages 10 and 8,have no income.

b.Olivia,35 years old,provided eighty percent of the support of her grandmother who lived in another state.Her grandmother's only income was from non-taxable social security of $9,500.

c.Vanessa and Matt Reardon are married and under 65 years of age.During 2017,they furnish more than half of the support of their 25-year-old son,Bill,who lives with them.Bill earns $2,000 from a part-time job,most of which he sets aside for future college expenses.Bill is not currently a student.Vanessa's father,Henry,who died on January 3,2017,at age 80,had for many years qualified as their dependent.

d.Douglas and Marjorie are husband and wife and file a joint return.Both are under 65 years of age.They provide more than half of the support of their daughter,Ellen (age 23),who is a full-time medical student.Ellen receives a $3,400 taxable scholarship covering her room and board at college.They furnish all of the support of Henry (Douglas's grandfather),who is age 85 and lives in a nursing home.They also support Meg (age 69),who is a friend of the family and lives with them.

e.Blair,who is divorced,maintains a home in which she,her twin sons,and her baby daughter live all year.The children's father,Ross,provides over half their support.No special arrangements exist between Blair and Ross.

Unlock Deck

Unlock for access to all 152 flashcards in this deck.

Unlock Deck

k this deck

72

Kelly is age 23 and a full-time student with interest and dividend income of $2,600 in the current year.The total cost of her support for the year is $19,000.She is not subject to the kiddie tax.

Unlock Deck

Unlock for access to all 152 flashcards in this deck.

Unlock Deck

k this deck

73

Foreign exchange student Yung lives with Harold and Betty while he studies in the United States.He moved into their home January 5,2017,and has resided with them for the remainder of the year.Yung does not pay anything for his room and board.Harold and Betty provide all of Yung's meals.Yung receives a scholarship to pay for his tuition,books and fees.He works on campus,earning $4,000 a year.What tax issues should Harold and Betty consider?

Unlock Deck

Unlock for access to all 152 flashcards in this deck.

Unlock Deck

k this deck

74

Kate is single and a homeowner.In 2017,she has property taxes on her home of $3,000,makes charitable contributions of $2,000,and pays home mortgage interest of $7,000.Kate's adjusted gross income for 2017 is $77,000.

Required: Compute her taxable income for 2017.

Required: Compute her taxable income for 2017.

Unlock Deck

Unlock for access to all 152 flashcards in this deck.

Unlock Deck

k this deck

75

If a 13-year-old has earned income of $500 and unearned income of $2,500,all of the income can be reported on the parent's return.

Unlock Deck

Unlock for access to all 152 flashcards in this deck.

Unlock Deck

k this deck

76

Paul and Sally file a joint return showing $87,000 of AGI.They have three dependent children ages 6,8,and 13.What is the amount of their child credit?

A)$0

B)$1,000

C)$2,000

D)$3,000

A)$0

B)$1,000

C)$2,000

D)$3,000

Unlock Deck

Unlock for access to all 152 flashcards in this deck.

Unlock Deck

k this deck

77

A legally married same-sex couple can file a joint return.

Unlock Deck

Unlock for access to all 152 flashcards in this deck.

Unlock Deck

k this deck

78

For 2017,unearned income in excess of $2,100 of a child under age 18 is generally taxed at the parents' rate.

Unlock Deck

Unlock for access to all 152 flashcards in this deck.

Unlock Deck

k this deck

79

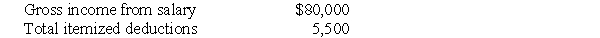

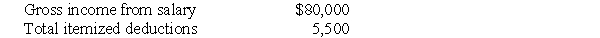

Steve Greene,age 66,is divorced with no dependents.In 2017 Steve had income and expenses as follows:

Compute Steve's taxable income for 2017.Show all calculations.

Compute Steve's taxable income for 2017.Show all calculations.

Compute Steve's taxable income for 2017.Show all calculations.

Compute Steve's taxable income for 2017.Show all calculations.

Unlock Deck

Unlock for access to all 152 flashcards in this deck.

Unlock Deck

k this deck

80

Sean and Martha are both over age 65 and Martha is considered blind by tax law standards.Their total income in 2017 from part-time jobs and interest income from a bank savings account is $60,000.Their itemized deductions are $12,000.

Required: Compute their taxable income.

Required: Compute their taxable income.

Unlock Deck

Unlock for access to all 152 flashcards in this deck.

Unlock Deck

k this deck