Deck 4: Income Statement

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/55

Play

Full screen (f)

Deck 4: Income Statement

1

Andromeda Industries had 300,000 shares of common stock with a $3 par value and retained earnings of $180,000 at January 1,2011.In 2011,the stock was split 3 for 1.In 2010,earnings per share were $1.80.Which of the following would not result from the stock split?

A)The new shares would total 900,000.

B)The total amount in the capital stock account would remain the same.

C)The par value would become $1.

D)Retained earnings would be reduced.

E)The earnings per share for 20 years prior to the split would be reduced.

A)The new shares would total 900,000.

B)The total amount in the capital stock account would remain the same.

C)The par value would become $1.

D)Retained earnings would be reduced.

E)The earnings per share for 20 years prior to the split would be reduced.

D

2

Which of the following will not affect retained earnings?

A)Declaration of a stock dividend

B)Payment of a cash dividend previously disclosed

C)Adjustment for an error of a prior period

D)Net income

E)Net loss

A)Declaration of a stock dividend

B)Payment of a cash dividend previously disclosed

C)Adjustment for an error of a prior period

D)Net income

E)Net loss

B

3

Gross profit is the difference between:

A)net income and operating income.

B)revenues and expenses.

C)sales and cost of goods sold.

D)income from continuing operations and discontinued operations.

E)gross sales and sales discounts.

A)net income and operating income.

B)revenues and expenses.

C)sales and cost of goods sold.

D)income from continuing operations and discontinued operations.

E)gross sales and sales discounts.

C

4

Which of the following is a recurring item?

A)Equity in earnings of nonconsolidated subsidiaries

B)Error of a prior period

C)Discontinued operations

D)Extraordinary gain

E)Cumulative effect of change in accounting principle

A)Equity in earnings of nonconsolidated subsidiaries

B)Error of a prior period

C)Discontinued operations

D)Extraordinary gain

E)Cumulative effect of change in accounting principle

Unlock Deck

Unlock for access to all 55 flashcards in this deck.

Unlock Deck

k this deck

5

The following relate to Data Original in 2012.What is the ending inventory?

A)$120,000

B)$140,000

C)$210,000

D)$260,000

E)none of the answers are correct

A)$120,000

B)$140,000

C)$210,000

D)$260,000

E)none of the answers are correct

Unlock Deck

Unlock for access to all 55 flashcards in this deck.

Unlock Deck

k this deck

6

The stockholders' equity of Anamanda Company at September 30,2012,is presented below:

On October 1,2012,the Board of Directors of Anamanda declared a 10% stock dividend to be distributed on November 10.The market price of the common stock was $15 on October 1 and $17 on November 10.What is the amount of the charge to retained earnings as a result of the declaration and distribution of this stock dividend?

A)$0

B)$200,000

C)$300,000

D)$340,000

E)$750,000

On October 1,2012,the Board of Directors of Anamanda declared a 10% stock dividend to be distributed on November 10.The market price of the common stock was $15 on October 1 and $17 on November 10.What is the amount of the charge to retained earnings as a result of the declaration and distribution of this stock dividend?

A)$0

B)$200,000

C)$300,000

D)$340,000

E)$750,000

Unlock Deck

Unlock for access to all 55 flashcards in this deck.

Unlock Deck

k this deck

7

Which of the following is not a category within accumulated other comprehensive income?

A)Post retirement commitments on health plans

B)Foreign currency translation adjustments

C)Unrealized holding gains and losses on available-for-sale marketable securities

D)Changes to stockholders equity resulting from additional minimum pension liability adjustments

E)Unrealized gains and losses from derivative instruments

A)Post retirement commitments on health plans

B)Foreign currency translation adjustments

C)Unrealized holding gains and losses on available-for-sale marketable securities

D)Changes to stockholders equity resulting from additional minimum pension liability adjustments

E)Unrealized gains and losses from derivative instruments

Unlock Deck

Unlock for access to all 55 flashcards in this deck.

Unlock Deck

k this deck

8

Which of the following will be disclosed in the reconciliation of retained earnings?

A)Adjustment for an error of a prior period

B)Net income

C)Net loss

D)Dividends

E)All of the answers are correct.

A)Adjustment for an error of a prior period

B)Net income

C)Net loss

D)Dividends

E)All of the answers are correct.

Unlock Deck

Unlock for access to all 55 flashcards in this deck.

Unlock Deck

k this deck

9

Fisher Company has 1,000,000 share of common stock with a par value of $10.Additional paid-in capital totals $10,000,000 and retained earnings is $12,000,000.The directors declare a 6% stock dividend when the market value is $5.The reduction of retained earnings as a result of the declaration will be:

A)$0.

B)$300,000.

C)$600,000.

D)$500,000.

E)None of the answers are correct.

A)$0.

B)$300,000.

C)$600,000.

D)$500,000.

E)None of the answers are correct.

Unlock Deck

Unlock for access to all 55 flashcards in this deck.

Unlock Deck

k this deck

10

If a firm consolidates subsidiaries that are not wholly owned,an income statement item is created that is termed:

A)dividend income.

B)minority share of earnings.

C)equity income.

D)extraordinary.

E)gain from sale of subsidiary.

A)dividend income.

B)minority share of earnings.

C)equity income.

D)extraordinary.

E)gain from sale of subsidiary.

Unlock Deck

Unlock for access to all 55 flashcards in this deck.

Unlock Deck

k this deck

11

If the disposal of a segment meets the criteria of a disposal of a segment,then:

A)the loss on disposal is an extraordinary item.

B)the loss on disposal is categorized as "other expense".

C)the results of operations of the segment will be reported in conjunction with the gain or loss on disposal.

D)the disposal qualifies as a change in entity,and prior years' statements presented on comparative purposes must be restated.

E)the effects of the disposal are shown as part of operations.

A)the loss on disposal is an extraordinary item.

B)the loss on disposal is categorized as "other expense".

C)the results of operations of the segment will be reported in conjunction with the gain or loss on disposal.

D)the disposal qualifies as a change in entity,and prior years' statements presented on comparative purposes must be restated.

E)the effects of the disposal are shown as part of operations.

Unlock Deck

Unlock for access to all 55 flashcards in this deck.

Unlock Deck

k this deck

12

Which of the following would be classified as an extraordinary item on the income statement?

A)Loss on disposal of a segment of business

B)Cumulative effect of a change in accounting principle

C)A sale of land

D)An error correction that relates to a prior year

E)A loss from a flood in a location that would not be expected to flood

A)Loss on disposal of a segment of business

B)Cumulative effect of a change in accounting principle

C)A sale of land

D)An error correction that relates to a prior year

E)A loss from a flood in a location that would not be expected to flood

Unlock Deck

Unlock for access to all 55 flashcards in this deck.

Unlock Deck

k this deck

13

If Investor Company owns 20% of the stock of Investee Company and Investee Company reports profits of $100,000,then Investor Company reports equity income of:

A)$80,000.

B)$20,000.

C)$40,000.

D)$60,000.

E)None of the answers are correct.

A)$80,000.

B)$20,000.

C)$40,000.

D)$60,000.

E)None of the answers are correct.

Unlock Deck

Unlock for access to all 55 flashcards in this deck.

Unlock Deck

k this deck

14

Which of the following would be included in operating income?

A)Interest income for a manufacturing firm

B)Rent income for a leasing subsidiary

C)Gain from sale of marketable securities for a retailer

D)Dividend income for a service firm

E)None of the answers are correct.

A)Interest income for a manufacturing firm

B)Rent income for a leasing subsidiary

C)Gain from sale of marketable securities for a retailer

D)Dividend income for a service firm

E)None of the answers are correct.

Unlock Deck

Unlock for access to all 55 flashcards in this deck.

Unlock Deck

k this deck

15

Changes in account balances of Multi-Plus Inc.during 2012 were:

Assuming that there were no charges to retained earnings other than dividends of $62,000,the net income for 2010 was:

A)($7,000)

B)$55,000

C)$117,000

D)$257,000

E)none of the answers are correct

Assuming that there were no charges to retained earnings other than dividends of $62,000,the net income for 2010 was:

A)($7,000)

B)$55,000

C)$117,000

D)$257,000

E)none of the answers are correct

Unlock Deck

Unlock for access to all 55 flashcards in this deck.

Unlock Deck

k this deck

16

Which of the following would be classified as an extraordinary item on the income statement?

A)Loss from a strike

B)Correction of an error related to a prior period

C)Write-off of obsolete inventory

D)Loss on disposal of a segment of business

E)Loss from prohibition of a product

A)Loss from a strike

B)Correction of an error related to a prior period

C)Write-off of obsolete inventory

D)Loss on disposal of a segment of business

E)Loss from prohibition of a product

Unlock Deck

Unlock for access to all 55 flashcards in this deck.

Unlock Deck

k this deck

17

Which of the following items on the income statement is not disclosed net of tax?

A)Unusual or infrequent item disclosed separately

B)Discontinued operations

C)Extraordinary loss

D)Cumulative effect of change in accounting principle

E)Unusual or infrequent item disclosed separately and discontinued operations are both not disclosed net of tax

A)Unusual or infrequent item disclosed separately

B)Discontinued operations

C)Extraordinary loss

D)Cumulative effect of change in accounting principle

E)Unusual or infrequent item disclosed separately and discontinued operations are both not disclosed net of tax

Unlock Deck

Unlock for access to all 55 flashcards in this deck.

Unlock Deck

k this deck

18

When a company discontinues and disposes of a component segment of its operations,the gain or loss from disposal should be reported as:

A)an adjustment to retained earnings.

B)a sale of fixed assets in "other" expense.

C)an extraordinary item.

D)an accounting change.

E)a special item after continuing operations and before extraordinary items.

A)an adjustment to retained earnings.

B)a sale of fixed assets in "other" expense.

C)an extraordinary item.

D)an accounting change.

E)a special item after continuing operations and before extraordinary items.

Unlock Deck

Unlock for access to all 55 flashcards in this deck.

Unlock Deck

k this deck

19

Which of the following is not true about a stock dividend?

A)With a stock dividend,the firm issues a percentage of outstanding stock as new shares to existing shareholders.

B)The overall effect of a stock dividend is to leave total stockholders' equity and each owner's share of stockholders' equity unchanged.

C)In theory,with a stock dividend,total market value considering all outstanding shares should not change.

D)Since the number of shares changes under a stock dividend,any ratio based on the number of shares must be restated.

E)The accounting for a stock dividend,assuming the distribution is relatively small,requires that the par value of the stock be removed from retained earnings.

A)With a stock dividend,the firm issues a percentage of outstanding stock as new shares to existing shareholders.

B)The overall effect of a stock dividend is to leave total stockholders' equity and each owner's share of stockholders' equity unchanged.

C)In theory,with a stock dividend,total market value considering all outstanding shares should not change.

D)Since the number of shares changes under a stock dividend,any ratio based on the number of shares must be restated.

E)The accounting for a stock dividend,assuming the distribution is relatively small,requires that the par value of the stock be removed from retained earnings.

Unlock Deck

Unlock for access to all 55 flashcards in this deck.

Unlock Deck

k this deck

20

Anchor Company has 1,000,000 shares of common stock with a par value of $5.Additional paid-in capital totals $5,000,000 and retained earnings is $8,000,000.The directors declare a 10% stock dividend when the market value is $15.The reduction of retained earnings as a result of the declaration will be:

A)$0.

B)$500,000.

C)$800,000.

D)$1,000,000.

E)$1,500,000.

A)$0.

B)$500,000.

C)$800,000.

D)$1,000,000.

E)$1,500,000.

Unlock Deck

Unlock for access to all 55 flashcards in this deck.

Unlock Deck

k this deck

21

An income statement is a summary of revenues and expenses and gains and losses,ending with net income for a particular period of time.

Unlock Deck

Unlock for access to all 55 flashcards in this deck.

Unlock Deck

k this deck

22

A stock split merely increases the number of shares of stock;it usually does not change retained earnings or paid-in capital.

Unlock Deck

Unlock for access to all 55 flashcards in this deck.

Unlock Deck

k this deck

23

It is the date of the declaration of dividends,not the date of dividend payment,that affects retained earnings and creates the liability.

Unlock Deck

Unlock for access to all 55 flashcards in this deck.

Unlock Deck

k this deck

24

In analysis of income,for purposes of determining a trend,extraordinary items should be included.

Unlock Deck

Unlock for access to all 55 flashcards in this deck.

Unlock Deck

k this deck

25

Equity earnings (losses)are the proportionate share of the earnings (losses)of the investee.

Unlock Deck

Unlock for access to all 55 flashcards in this deck.

Unlock Deck

k this deck

26

In practice,the income statement is frequently considered to be the least important financial statement.

Unlock Deck

Unlock for access to all 55 flashcards in this deck.

Unlock Deck

k this deck

27

Advertising expense would be an administrative expense.

Unlock Deck

Unlock for access to all 55 flashcards in this deck.

Unlock Deck

k this deck

28

Ideally,income from continuing operations would be the better income figure to use to project the future from the analysis of historical statements.

Unlock Deck

Unlock for access to all 55 flashcards in this deck.

Unlock Deck

k this deck

29

Other income and other expense are categories under which secondary activities of the firm not directly related to the operations are classified.

Unlock Deck

Unlock for access to all 55 flashcards in this deck.

Unlock Deck

k this deck

30

Presenting an item after tax,with the related tax deducted,is called net-of-tax presentation.

Unlock Deck

Unlock for access to all 55 flashcards in this deck.

Unlock Deck

k this deck

31

Comprehensive income is net income plus the periods change in accumulated other comprehensive income.

Unlock Deck

Unlock for access to all 55 flashcards in this deck.

Unlock Deck

k this deck

32

Gross profit will be a prominent figure on a single-step income statement.

Unlock Deck

Unlock for access to all 55 flashcards in this deck.

Unlock Deck

k this deck

33

The legality of distributions to stockholders is governed by federal law.

Unlock Deck

Unlock for access to all 55 flashcards in this deck.

Unlock Deck

k this deck

34

The term primary analysis is used to describe consistent and conservative analysis.

Unlock Deck

Unlock for access to all 55 flashcards in this deck.

Unlock Deck

k this deck

35

Earnings per share is the earnings per share of outstanding common stock.

Unlock Deck

Unlock for access to all 55 flashcards in this deck.

Unlock Deck

k this deck

36

Accountants have not accepted the role of disclosing the firm's capacity to make distributions to stockholders.

Unlock Deck

Unlock for access to all 55 flashcards in this deck.

Unlock Deck

k this deck

37

Equity earnings can distort the reported results of a business's operations.

Unlock Deck

Unlock for access to all 55 flashcards in this deck.

Unlock Deck

k this deck

38

Retained earnings,an account on the balance sheet,represents the undistributed earnings of the corporation.

Unlock Deck

Unlock for access to all 55 flashcards in this deck.

Unlock Deck

k this deck

39

With a stock dividend,total market value considering all outstanding shares should decline.

Unlock Deck

Unlock for access to all 55 flashcards in this deck.

Unlock Deck

k this deck

40

Extraordinary items are always presented gross of applicable income taxes.

Unlock Deck

Unlock for access to all 55 flashcards in this deck.

Unlock Deck

k this deck

41

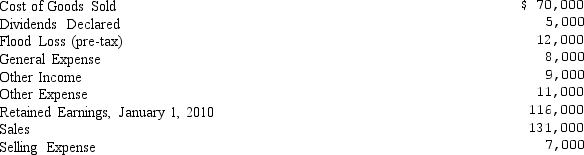

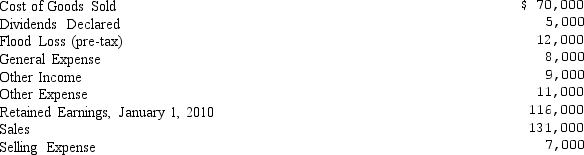

Information for Scandinavian Products at the end of Year 4 follows.

Required:

a.Find the ending balance in Retained Earnings as of December 31,Year 4.

b.Find the beginning balance in Retained Earnings as of January 1,Year 4.

Required:

a.Find the ending balance in Retained Earnings as of December 31,Year 4.

b.Find the beginning balance in Retained Earnings as of January 1,Year 4.

Unlock Deck

Unlock for access to all 55 flashcards in this deck.

Unlock Deck

k this deck

42

IFRS allows for alternative performance measures to be presented in the income statement that are not allowed by U.S.GAAP.

Unlock Deck

Unlock for access to all 55 flashcards in this deck.

Unlock Deck

k this deck

43

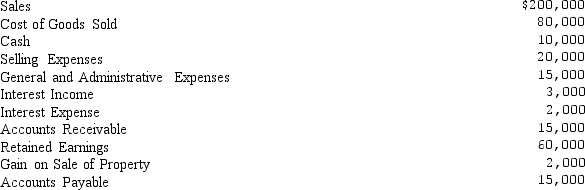

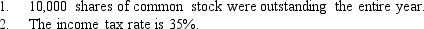

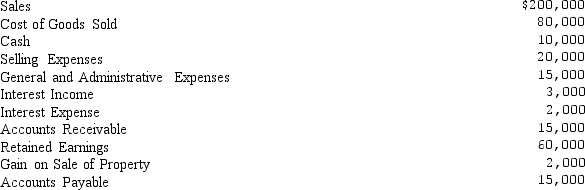

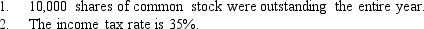

Forta Company presents you with the following account balances taken from the December 31,2012,trial balance.Required:

Prepare a single-step income statement in proper form.

Additional data:

Prepare a single-step income statement in proper form.

Additional data:

Unlock Deck

Unlock for access to all 55 flashcards in this deck.

Unlock Deck

k this deck

44

Patricia Company owns 25% of Sandra Company and accounts for the investment on the equity basis and does not consolidate.At the beginning of 2012,the investment in Sandra Company was $180,000.In 2012,Sandra Company earned $70,000 and paid dividends of $10,000.Required:

a.How much will Patricia Company report as equity in earnings of Sandra Company in 2012?

b.How much cash flow will Patricia Company receive from Sandra Company in 2012?

c.Why does recognition of equity earnings cause problems in analysis?

a.How much will Patricia Company report as equity in earnings of Sandra Company in 2012?

b.How much cash flow will Patricia Company receive from Sandra Company in 2012?

c.Why does recognition of equity earnings cause problems in analysis?

Unlock Deck

Unlock for access to all 55 flashcards in this deck.

Unlock Deck

k this deck

45

For the income statement under IFRS,there is a required format.

Unlock Deck

Unlock for access to all 55 flashcards in this deck.

Unlock Deck

k this deck

46

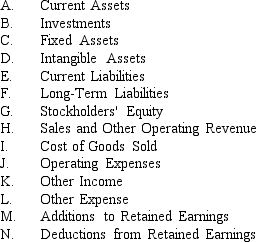

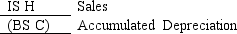

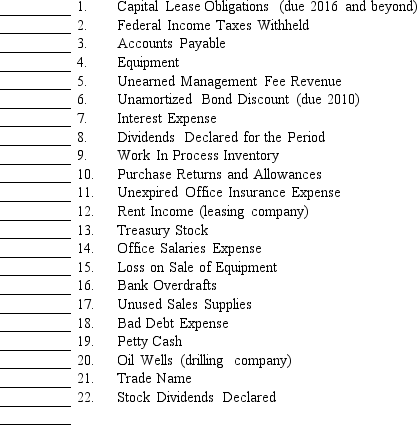

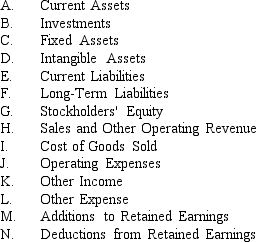

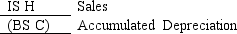

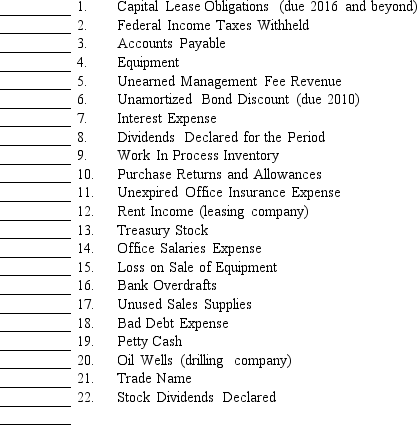

Assume that Algary,Inc.uses the following financial statements for the year ended December 31,2012.

Categories on these statements follow:

Required:

Indicate by the statement abbreviation and category number how each of the following is best classified or where it is included in the computation.If an item is not reported anywhere,use the letter "X" to indicate this.Only the best answer should be selected.For balance sheet accounts only,if the account balance is normally opposite that of a typical account (contra),set off the answer in parentheses.Samples:

Categories on these statements follow:

Required:

Indicate by the statement abbreviation and category number how each of the following is best classified or where it is included in the computation.If an item is not reported anywhere,use the letter "X" to indicate this.Only the best answer should be selected.For balance sheet accounts only,if the account balance is normally opposite that of a typical account (contra),set off the answer in parentheses.Samples:

Unlock Deck

Unlock for access to all 55 flashcards in this deck.

Unlock Deck

k this deck

47

The accounting standard provides considerable flexibility in reporting comprehensive income.

Unlock Deck

Unlock for access to all 55 flashcards in this deck.

Unlock Deck

k this deck

48

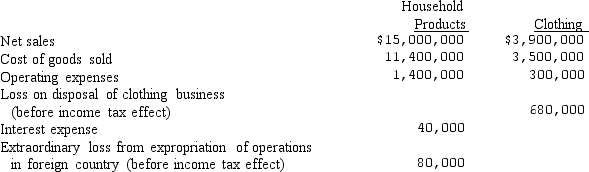

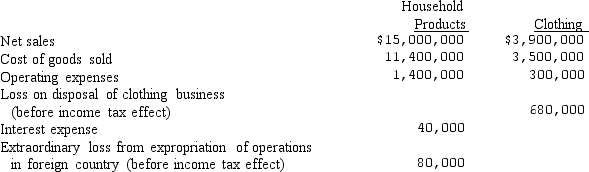

Oregm Imports engages in the retail sale of household products and clothing.During 2012,the company disposed of the clothing segment.Oregm Imports had 150,000 shares of stock outstanding all year.The results of operations for 2012 follow.

Income taxes of 40% apply to all items.Required:

Prepare a multiple-step income statement for the year ended December 31,2012,in good format.

Income taxes of 40% apply to all items.Required:

Prepare a multiple-step income statement for the year ended December 31,2012,in good format.

Unlock Deck

Unlock for access to all 55 flashcards in this deck.

Unlock Deck

k this deck

49

Information related to Batavia Furniture Company for the year ended December 31,2012,follows.

Required:

Prepare in good form a multiple-step income statement for the year 2012.Assume a 50% tax rate and that 5,000 shares of common stock were outstanding during the year.

Required:

Prepare in good form a multiple-step income statement for the year 2012.Assume a 50% tax rate and that 5,000 shares of common stock were outstanding during the year.

Unlock Deck

Unlock for access to all 55 flashcards in this deck.

Unlock Deck

k this deck

50

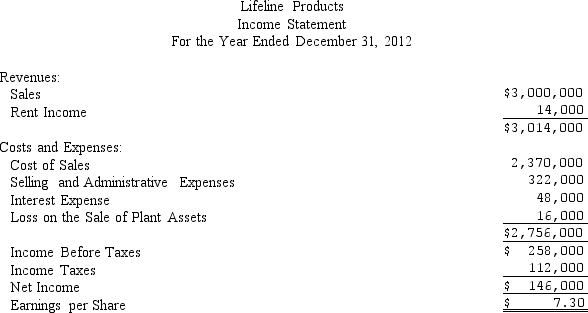

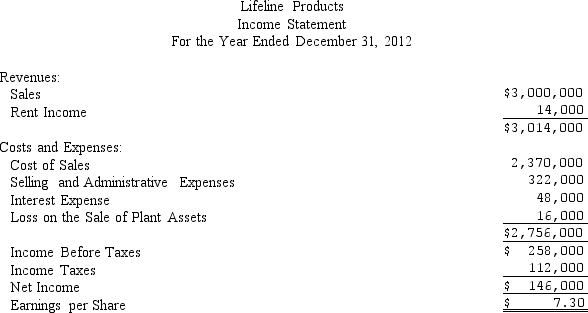

The income statement for Lifeline Products in single-step format follows.

Required:

a.Convert the statement to multiple-step format.

b.Recompute net income with the unusual loss removed.

c.Why may net income with the unusual loss removed be preferable to use for trend analysis?

d.Speculate on why this loss is not considered extraordinary or as a disposal of a segment.

Required:

a.Convert the statement to multiple-step format.

b.Recompute net income with the unusual loss removed.

c.Why may net income with the unusual loss removed be preferable to use for trend analysis?

d.Speculate on why this loss is not considered extraordinary or as a disposal of a segment.

Unlock Deck

Unlock for access to all 55 flashcards in this deck.

Unlock Deck

k this deck

51

Under IFRS,equipment may be revalved.

Unlock Deck

Unlock for access to all 55 flashcards in this deck.

Unlock Deck

k this deck

52

Noncontrolling interest relects income from ownership of noncontrolling shareholders in the equity of consolidated subsidaries less than wholly owned.

Unlock Deck

Unlock for access to all 55 flashcards in this deck.

Unlock Deck

k this deck

53

Canco Inc.owns 70% of Supersonics and consolidates this subsidiary.In 2012,Supersonics earned $100,000 after tax and Canco earned $1,000,000.Without consideration of minority interests,the stockholders' equity of Supersonics at the end of 2012 was $1,200,000.Required:

a.Determine the minority share of earnings in 2012.

b.Determine the consolidated net income.

c.Determine the minority interest at the end of 2012 on the balance sheet.

d.How should minority interest be classified on the balance sheet for analysis?

a.Determine the minority share of earnings in 2012.

b.Determine the consolidated net income.

c.Determine the minority interest at the end of 2012 on the balance sheet.

d.How should minority interest be classified on the balance sheet for analysis?

Unlock Deck

Unlock for access to all 55 flashcards in this deck.

Unlock Deck

k this deck

54

Since the number of shares changes under both a stock dividend and a stock split,any ratio based on the number of shares must be restated.

Unlock Deck

Unlock for access to all 55 flashcards in this deck.

Unlock Deck

k this deck

55

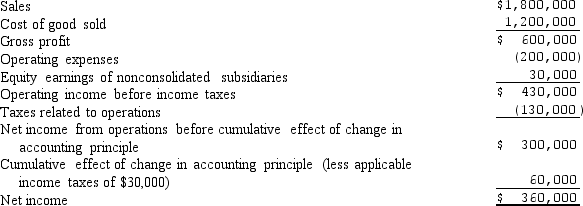

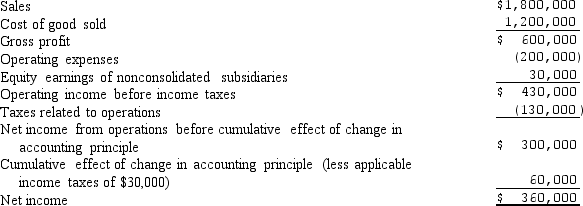

The income statement of Jones Company for the year ended December 31,2012,shows:

Required:

a.Compute the net earnings after removing nonrecurring items.

b.Determine the earnings from the nonconsolidated subsidiary.

c.Determine the total tax amount.

Required:

a.Compute the net earnings after removing nonrecurring items.

b.Determine the earnings from the nonconsolidated subsidiary.

c.Determine the total tax amount.

Unlock Deck

Unlock for access to all 55 flashcards in this deck.

Unlock Deck

k this deck