Deck 22: Long-Term Bonds

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/112

Play

Full screen (f)

Deck 22: Long-Term Bonds

1

To systematically accumulate cash for the retirement of bonds at maturity, a corporation may set up a bond sinking fund investment.

True

2

The Bond Sinking Fund Investment account is reported as an investment in the Assets section of the balance sheet.

True

3

Amortizing a bond premium over the period from the issue date to the maturity date reduces the amount of bond interest expense shown on the income statement.

True

4

Investors will pay an amount greater than the face amount of a bond if the interest rate on bonds is greater than the market rate of interest.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

5

In the case of liquidation, bondholders and other creditors must be paid in full before stockholders can receive monetary distributions.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

6

Bonds are often issued as a means of raising capital to pay off short-term debt.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

7

When a corporation pays the periodic interest payment on its bonds, Bond Interest Expense is debited.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

8

The Bond Interest Expense account is usually listed under Operating Expenses on the income statement.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

9

A corporation will pay the face value of its bonds if they are retired prior to the maturity date.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

10

Any gain or loss recognized from the early retirement of bonds should be reported on the income statement for the period in which the bonds were retired.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

11

If retained earnings are appropriated for bond retirement, a bond retirement sinking fund must be established.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

12

When bonds are issued at a price below face value, the Discount on Bonds Payable account is debited for the difference between the issue price and the face value.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

13

The adjusting entry to record interest accrued on bonds at the end of the accounting period can be reversed on the first day of the following period.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

14

The issuing corporation has the right to require the owner of a convertible bond to surrender the bond for payment before the maturity date of the bond.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

15

Bond interest is not deducted from revenue when a corporation calculates its taxable income.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

16

The Bonds Payable account would be credited for $104,000 to record the issuance of $100,000 face value, 10 percent bonds at a market price of 104.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

17

When bonds are issued at a premium, the annual interest expense reported for the bonds will be greater than the annual cash interest payments for the bonds.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

18

The IRS requires companies to issue coupon bonds in order to track taxable interest payments made to the bond holders.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

19

Interest on bonds must be paid in full as scheduled in the bond indenture even when the corporation operates at a loss.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

20

The face interest is the contractual interest specified on the bond.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

21

When bonds are sold at a market price of 105, the cash received for the bonds is 105 percent of the bonds' face value.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

22

The issuing corporation amortizes the bond discount from the date of issue to the maturity date, which will the bond interest expense shown on the income statement.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

23

Bonds on which a corporation has pledged property to guarantee payment to the bondholders are known as bonds.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

24

A bond is if the issuing corporation has the right to require the owner to surrender the bond for payment before the maturity date.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

25

The amortization method amortizes an equal amount of the discount or premium each month.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

26

The balance of the Bonds Payable account plus the balance of the Premium on Bonds Payable account or minus the balance of the Discount on Bonds Payable account is called the of the bonds.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

27

In the interest formula (I = Prt)the Prt stands for .

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

28

The Discount on Bonds Payable account will have a(n)balance.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

29

Using borrowed funds to earn a profit greater than the interest that must be paid on the borrowed funds is called trading on the equity, or .

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

30

To calculate the gain or loss on the retirement of bonds, the face amount of the bonds is subtracted from the repurchase price.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

31

To calculate the gain or loss on the retirement of bonds, the carrying value of the bonds is subtracted from the repurchase price.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

32

If bonds with a face value of $100,000 and a carrying value of $103,000 are retired early by paying cash of $101,000, a will be reported on the income statement for the period.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

33

The investment banker who acts to protect the bondholders' interests, as in the case of default, is called a .

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

34

To pay interest on bonds, the corporation must keep a record of the name of each bondholder.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

35

Coupon bonds are often referred to as bonds.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

36

Bond interest expense usually appears in the

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

37

If the market rate of interest on the day that bonds are issued is lower than the contract rate of interest, the bonds will sell at a discount.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

38

When bonds are issued at a price below face value, the Discount on Bonds Payable account is

for the difference between the issue price and the face value.

for the difference between the issue price and the face value.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

39

Retained earnings may be appropriated for bond retirement by order of the board of directors, by the bond contract, or by vote of the shareholders.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

40

A planned fund established to accumulate assets to pay off bonds when they mature is called a bond fund investment.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

41

A corporation paid $103,000 to retire bonds with a face value of $100,000 and an unamortized discount balance of $2,500. The entry to record the early retirement of the bonds will include the recognition of a loss of

A)$0.

B)$500.

C)$5,500.

D)$3,000.

A)$0.

B)$500.

C)$5,500.

D)$3,000.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

42

On December 31, 2019, a corporation issued $180,000 face value, 8 percent bonds that mature 10 years from the date of issue. The issue price was 104. If the firm uses the straight-line method of amortization, interest expense for 2020 will be reported at

A)$13,680.

B)$15,120.

C)$14,400.

D)$7,200.

A)$13,680.

B)$15,120.

C)$14,400.

D)$7,200.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

43

When bonds are issued at a premium, the bond premium

A)does not change the amount of interest expense over the life of the bonds.

B)increases the amount of interest expense over the life of the bonds.

C)reduces the amount of interest expense over the life of the bonds.

D)is charged to interest expense when the bonds are issued.

A)does not change the amount of interest expense over the life of the bonds.

B)increases the amount of interest expense over the life of the bonds.

C)reduces the amount of interest expense over the life of the bonds.

D)is charged to interest expense when the bonds are issued.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

44

When bonds mature, a corporation will pay the bondholders

A)the face amount of the bonds.

B)the face amount plus the original premium or minus the original discount.

C)the face amount plus the interest accrued since the date the bonds were issued.

D)the current market value of the bonds.

A)the face amount of the bonds.

B)the face amount plus the original premium or minus the original discount.

C)the face amount plus the interest accrued since the date the bonds were issued.

D)the current market value of the bonds.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

45

Bonds with a face value of $400,000 were issued at 102. The entry to record the issuance will include a debit to the Cash account for

A)$392,000.

B)$400,000.

C)$408,000.

D)$402,000.

A)$392,000.

B)$400,000.

C)$408,000.

D)$402,000.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

46

Which of the following is not a disadvantage of raising capital through the issue of bonds payable?

A)the bonds are classified as a long-term liability

B)interest must be paid even if the firm suffers a loss

C)the face amount must be repaid at maturity

D)interest is deductible for income tax purposes

A)the bonds are classified as a long-term liability

B)interest must be paid even if the firm suffers a loss

C)the face amount must be repaid at maturity

D)interest is deductible for income tax purposes

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

47

Unsecured Bonds:

A)represent a safer investment than secured bonds.

B)are called debentures.

C)are backed by the issuer's bank.

D)are the same as sinking bonds.

A)represent a safer investment than secured bonds.

B)are called debentures.

C)are backed by the issuer's bank.

D)are the same as sinking bonds.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

48

A bond that trades at 105 ½ means that:

A)the bond pays 5 ½% interest.

B)the market rate of interest is 5 ½%.

C)the bond traded at $1,055 per $1,000 bond.

D)the market rate of interest is 5 ½% higher than the contract rate.

A)the bond pays 5 ½% interest.

B)the market rate of interest is 5 ½%.

C)the bond traded at $1,055 per $1,000 bond.

D)the market rate of interest is 5 ½% higher than the contract rate.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

49

A company issued 5%, 10-year bonds with a par value of $500,000. The current market rate of interest is 5%. The journal entry to record each semiannual interest payment is:

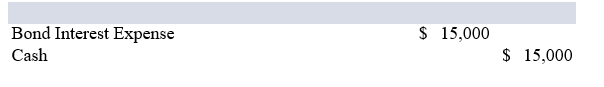

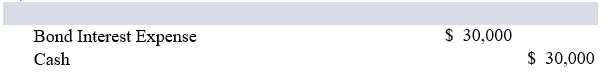

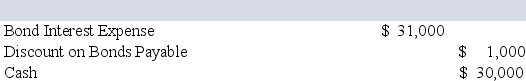

A)

B)

C)

D)

A)

B)

C)

D)

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

50

Bonds with a face value of $400,000 were issued at 98. The entry to record the issuance will include a credit to the Bonds Payable account for

A)$408,000.

B)$400,000.

C)$398,000.

D)$392,000.

A)$408,000.

B)$400,000.

C)$398,000.

D)$392,000.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

51

The entry to record the adjustment for accrued bond interest includes

A)a debit to Bond Interest Expense and a credit to Cash.

B)a debit to Bond Interest Payable and a credit to the Bond Interest Expense.

C)a debit to Bond Interest Expense and a credit to Bond Interest Payable.

D)a debit to Bond Interest Expense and a credit to Bonds Payable.

A)a debit to Bond Interest Expense and a credit to Cash.

B)a debit to Bond Interest Payable and a credit to the Bond Interest Expense.

C)a debit to Bond Interest Expense and a credit to Bond Interest Payable.

D)a debit to Bond Interest Expense and a credit to Bonds Payable.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

52

If bonds are issued for a price below their face value, the bond discount should be

A)charged to expense on the date the bonds are issued.

B)shown as an addition to Bonds Payable in the Long-Term Liabilities section of the balance sheet.

C)amortized over the life of the bond issue.

D)shown as a current liability on the balance sheet.

A)charged to expense on the date the bonds are issued.

B)shown as an addition to Bonds Payable in the Long-Term Liabilities section of the balance sheet.

C)amortized over the life of the bond issue.

D)shown as a current liability on the balance sheet.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

53

A company issues 9%, 20-year bonds with a face value of $400,000. The current market rate of interest is 8%. The amount of interest owed to the bondholders for each semiannual interest payment is:

A)$36,000.

B)$32,000.

C)$18,000.

D)$16,000.

A)$36,000.

B)$32,000.

C)$18,000.

D)$16,000.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

54

Bonds with a face value of $200,000 were issued at 103. The entry to record the issuance will include a credit to the Bonds Payable account for

A)$206,000.

B)$103,000.

C)$200,000.

D)$230,000.

A)$206,000.

B)$103,000.

C)$200,000.

D)$230,000.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

55

A corporation paid $104,000 to retire bonds with a face value of $100,000 and an unamortized premium balance of $3,000. The entry to record the early retirement of the bonds will include the recognition of a loss of

A)$7,000.

B)$4,000.

C)$3,000.

D)$1,000.

A)$7,000.

B)$4,000.

C)$3,000.

D)$1,000.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

56

The Premium on Bonds Payable account is shown

A)in the Current Assets section of the balance sheet.

B)in the Current Liabilities section of the balance sheet.

C)in the Long-Term Liabilities section of the balance sheet.

D)in the Revenue section of the income statement.

A)in the Current Assets section of the balance sheet.

B)in the Current Liabilities section of the balance sheet.

C)in the Long-Term Liabilities section of the balance sheet.

D)in the Revenue section of the income statement.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

57

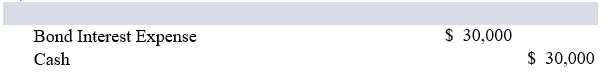

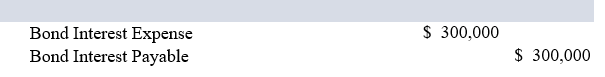

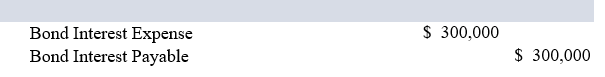

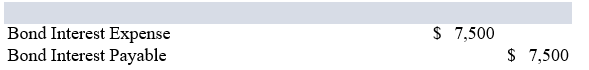

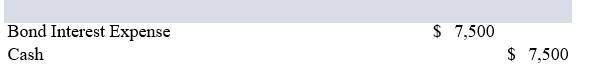

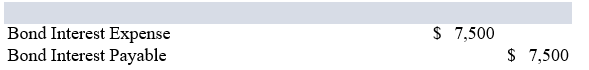

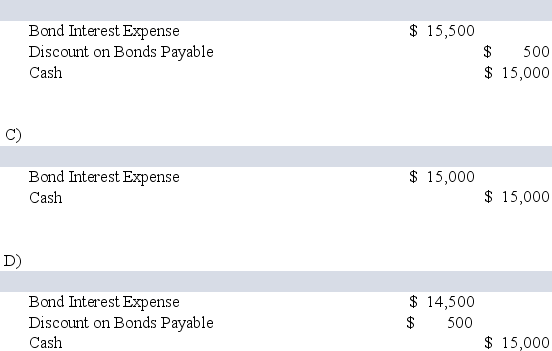

A company issued 6%, 10 year bonds with a par value of $500,000 on April 1. Interest is payable each Sept. 30 and March 31,2019. The journal entry to accrue interest expense as of December 31,2019, is:

A)

B)

C)

D)

A)

B)

C)

D)

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

58

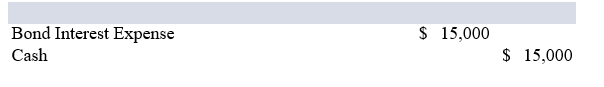

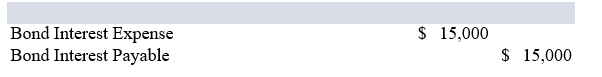

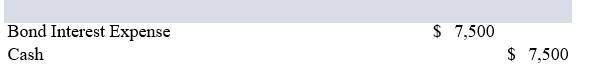

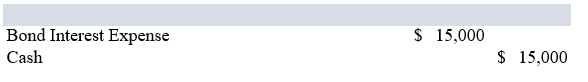

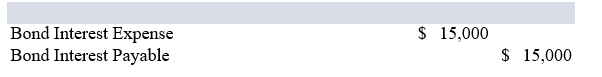

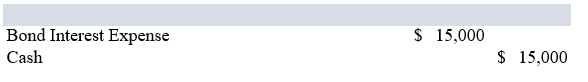

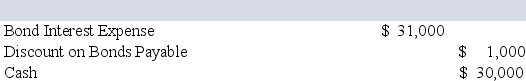

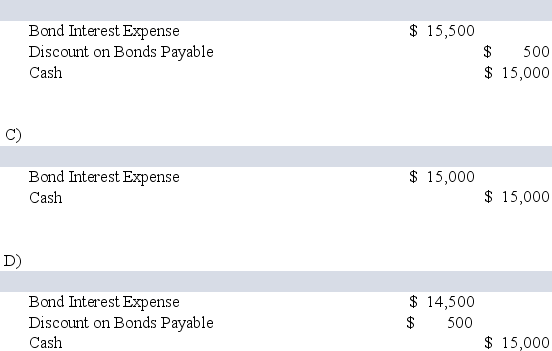

A company issues 6%, 10 year bonds with a par value of $500,000 at 98. The current market rate of interest is 7%. Interest is payable each June 30 and December 31. The company uses the straight-line method to amortize the discount. The journal entry to record the first interest payment is:

A)

B)

A)

B)

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

59

On December 31, 2019, a corporation issued $180,000 face value, 8 percent bonds that mature 10 years from the date of issue. The issue price was 98. If the firm uses the straight-line method of amortization, interest expense for 2020 will be reported at

A)$18,000.

B)$24,000.

C)$14,040.

D)$14,760.

E) $14,400.

A)$18,000.

B)$24,000.

C)$14,040.

D)$14,760.

E) $14,400.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

60

A company has $500,000 in equity and income before interest and taxes of $50,000. The corporate tax rate is 25 percent. If $200,000 of bonds are issued at 10 percent, what is the rate of profit on stockholders' equity?

A)10.0%.

B)7)7%.

C)6)0%.

D)4)5%.

A)10.0%.

B)7)7%.

C)6)0%.

D)4)5%.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

61

Bonds with a face value of $450,000 were issued at 97. The entry to record the issuance will include a debit to the Discount on Bonds Payable account for

A)$13,500.

B)$9,000.

C)$18,000.

D)$4,500.

A)$13,500.

B)$9,000.

C)$18,000.

D)$4,500.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

62

A bond sinking fund investment is started on January 5, 2019, by transferring $12,000 in cash to the fund. The company intends to accumulate $12,000 each year in the fund. This $12,000 is invested and earns $1,500 during 2019. On January 5, 2020, the amount of cash transferred to the sinking fund investment will be

A)$10,500.

B)$12,000.

C)$13,500.

D)$1,500.

A)$10,500.

B)$12,000.

C)$13,500.

D)$1,500.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

63

The entry to record the issuance of bonds at face value includes

A)a credit to Bond Interest Payable.

A)a debit to Bond Interest Expense.

B)a credit to Bond Payable.

D)a debit to Bond Interest Payable.

A)a credit to Bond Interest Payable.

A)a debit to Bond Interest Expense.

B)a credit to Bond Payable.

D)a debit to Bond Interest Payable.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

64

If the market rate of interest is higher than the contract rate of interest offered on the bonds being sold, they will be sold at

A)a discount.

B)a premium.

C)face value.

D)a loss.

A)a discount.

B)a premium.

C)face value.

D)a loss.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

65

In the interest formula I = Prt, the P stands for

A)Payment.

B)Premium.

C)Principal.

D)Prime number.

A)Payment.

B)Premium.

C)Principal.

D)Prime number.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

66

When the issuing corporation has the right to require the owners to surrender the bonds for payment before the maturity date of the bonds, the bonds are referred to as

A)serial bonds.

B)callable bonds.

C)registered bonds.

D)convertible bonds.

A)serial bonds.

B)callable bonds.

C)registered bonds.

D)convertible bonds.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

67

If a bond is a registered bond, it can NOT be a bond.

A)discount

B)callable

C)convertible

D)coupon

A)discount

B)callable

C)convertible

D)coupon

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

68

Twenty-year, 6% bonds with a face value of $550,000 are issued at 102 on January 1 of the current year. How much of the premium will be amortized under the straight-line method in the first

Semi-annual interest period?

A)$550.

B)$275.

C)$825.

D)$1,650.

Semi-annual interest period?

A)$550.

B)$275.

C)$825.

D)$1,650.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

69

Bonds issued at a premium are

A)traded for stock.

B)sold at face value.

C)sold for more than face value.

D)sold at less than face value.

A)traded for stock.

B)sold at face value.

C)sold for more than face value.

D)sold at less than face value.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

70

Retained earnings are often appropriated while the bonds are outstanding. Which of the following is a reason for the appropriation?

A)Corporation management wants to protect the bondholders.

B)The bond underwriters always require it.

C)Tax law requires it.

D)The buyers require it.

A)Corporation management wants to protect the bondholders.

B)The bond underwriters always require it.

C)Tax law requires it.

D)The buyers require it.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

71

A company issued 10-year, 8% bonds with a par value of $1,000,000. The company received

$980,000 upon issuance. Using the straight-line method, the amount of interest expense for the first semi-annual interest period is:

A)$41,000.

B)$42,000.

C)$40,000.

D)$39,000.

$980,000 upon issuance. Using the straight-line method, the amount of interest expense for the first semi-annual interest period is:

A)$41,000.

B)$42,000.

C)$40,000.

D)$39,000.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

72

The difference between the face value and the selling price of a 10-year discounted bond issued two years after authorization, is amortized for

A)10 years.

B)8 years.

C)2 years.

D)The difference is not amortized, only interest is amortized.

A)10 years.

B)8 years.

C)2 years.

D)The difference is not amortized, only interest is amortized.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

73

Retained Earnings Appropriated for Bond Retirement appears as a separate line item

A)on the Income Statement.

B)on the Balance Sheet.

C)on the Bond Interest Reconciliation Schedule.

D)on the Statement of Cash Flows.

A)on the Income Statement.

B)on the Balance Sheet.

C)on the Bond Interest Reconciliation Schedule.

D)on the Statement of Cash Flows.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

74

Corporations with many bondholders will open a separate checking account because

A)it is required by law.

B)the account earns interest.

C)it is easier to do the bookkeeping on the bond interest.

D)it keeps the bond interest records separate for tax purposes.

A)it is required by law.

B)the account earns interest.

C)it is easier to do the bookkeeping on the bond interest.

D)it keeps the bond interest records separate for tax purposes.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

75

A bond sinking fund investment is started on January 5, 2019, by transferring $10,000 in cash to the fund. This $10,000 is invested and earns $1,100 during 2019. The entry to record the earnings made on the sinking fund investment includes

A)a debit to Cash for $1,100 and a credit to Income from Sinking Fund Investment for $1,100.

B)a debit to Cash for $1,100 and a credit to Bond Sinking Fund Investment for $1,100.

C)a debit to Bond Sinking Fund Investment for $1,100 and a credit to Income from Sinking Fund Investment for $1,100.

D)a debit to Cash for $1,100 and a credit to Interest Income for $1,100.

A)a debit to Cash for $1,100 and a credit to Income from Sinking Fund Investment for $1,100.

B)a debit to Cash for $1,100 and a credit to Bond Sinking Fund Investment for $1,100.

C)a debit to Bond Sinking Fund Investment for $1,100 and a credit to Income from Sinking Fund Investment for $1,100.

D)a debit to Cash for $1,100 and a credit to Interest Income for $1,100.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

76

The corporation must maintain a subsidiary ledger showing who owns the bonds and is entitled to receive interest payments if the bonds are

A)coupon bonds.

B)bearer bonds.

C)registered bonds.

D)unregistered bonds.

A)coupon bonds.

B)bearer bonds.

C)registered bonds.

D)unregistered bonds.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

77

Ten-year bonds with a face value of $600,000 were issued at 96 on January 1, 2019. The carrying value of the bond on December 31, 2020, after two years of interest payments and straight-line amortization is:

A)$619,200.

B)$624,000.

C)$576,000.

D)$580,800.

A)$619,200.

B)$624,000.

C)$576,000.

D)$580,800.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

78

A company issued 10-year, 5% bonds with a par value of $1,000,000. The company received

$1,040,000 upon issuance. Using the straight-line method, the amount of interest expense for the first semi-annual interest period is:

A)$25,000.

B)$26,000.

C)$23,000.

D)$21,000.

$1,040,000 upon issuance. Using the straight-line method, the amount of interest expense for the first semi-annual interest period is:

A)$25,000.

B)$26,000.

C)$23,000.

D)$21,000.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

79

Bonds with a face value of $400,000 were issued at 98. The entry to record the issuance will include a debit to the Cash account for

A)$408,000.

B)$400,000.

C)$398,000.

D)$392,000.

A)$408,000.

B)$400,000.

C)$398,000.

D)$392,000.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

80

Using borrowed funds to earn a profit higher than the interest charged for borrowing is called

A)secured borrowing.

B)amortizing.

C)investing.

D)leveraging.

A)secured borrowing.

B)amortizing.

C)investing.

D)leveraging.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck