Deck 5: Sales and Receivables

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/158

Play

Full screen (f)

Deck 5: Sales and Receivables

1

Because the allowance method results in better matching, accounting standards require its use rather than the direct write-off method, unless bad debts are immaterial.

True

2

A balance sheet approach to estimating bad debt expense is not permitted under GAAP (Generally Accepted Accounting Principles).

False

3

Net Sales = Total credit sales - Sales Discounts - Sales Returns and Allowances

False

4

A primary advantage of the allowance method to account for bad debts is that it supports the matching principle.

Unlock Deck

Unlock for access to all 158 flashcards in this deck.

Unlock Deck

k this deck

5

The accounts receivable turnover ratio is used to evaluate how well a company does in collecting its accounts receivable.

Unlock Deck

Unlock for access to all 158 flashcards in this deck.

Unlock Deck

k this deck

6

A sale and its associated receivable are recorded only when the order, shipping, and billing documents are all present.

Unlock Deck

Unlock for access to all 158 flashcards in this deck.

Unlock Deck

k this deck

7

The lender of a note recognizes a note payable on the balance sheet and interest expense on its income statement.

Unlock Deck

Unlock for access to all 158 flashcards in this deck.

Unlock Deck

k this deck

8

Under the allowance method of accounting for bad debts, the company estimates the amount of bad debts before those debts actually occur.

Unlock Deck

Unlock for access to all 158 flashcards in this deck.

Unlock Deck

k this deck

9

Selling on credit protects a company from the risk that some of its receivables will never be collected.

Unlock Deck

Unlock for access to all 158 flashcards in this deck.

Unlock Deck

k this deck

10

If a company accepts a major credit card such as VISA from a customer, then the company is responsible for the amount of the sale in a case of nonpayment from a cardholder.

Unlock Deck

Unlock for access to all 158 flashcards in this deck.

Unlock Deck

k this deck

11

The amount of interest paid is a function of three variables, the amount borrowed, the interest rate, and the length of the loan period.

Unlock Deck

Unlock for access to all 158 flashcards in this deck.

Unlock Deck

k this deck

12

The account, "Allowance for Doubtful Accounts" is an expense account (the cost of making bad credit sales)that is reported on the income statement.

Unlock Deck

Unlock for access to all 158 flashcards in this deck.

Unlock Deck

k this deck

13

The longer a customer's account balance remains outstanding, the greater the likelihood that it will be collected in the near future.

Unlock Deck

Unlock for access to all 158 flashcards in this deck.

Unlock Deck

k this deck

14

The higher the accounts receivable turnover the better because it indicates that the company is more quickly collecting cash (through sales).

Unlock Deck

Unlock for access to all 158 flashcards in this deck.

Unlock Deck

k this deck

15

If a company estimates its bad debt expense on the basis of a receivables aging, the balance in the Allowance for Doubtful Accounts account will not affect the amount of the end-of-period adjusting entry for bad debts.

Unlock Deck

Unlock for access to all 158 flashcards in this deck.

Unlock Deck

k this deck

16

Accounts receivable are shown on the balance sheet at their net realizable value.

Unlock Deck

Unlock for access to all 158 flashcards in this deck.

Unlock Deck

k this deck

17

The lender of a note recognizes a note receivable on the balance sheet and interest revenue on its income statement.

Unlock Deck

Unlock for access to all 158 flashcards in this deck.

Unlock Deck

k this deck

18

The use of the allowance method is an attempt by accountants to match bad debts as an expense with the revenue of the period in which a sale on credit takes place.

Unlock Deck

Unlock for access to all 158 flashcards in this deck.

Unlock Deck

k this deck

19

The terms "realized" and "realizable" mean that the selling price is fixed and determinable and collectibility is reasonably assured.

Unlock Deck

Unlock for access to all 158 flashcards in this deck.

Unlock Deck

k this deck

20

Trade receivables represent a stronger legal claim against the debtor than do non-trade receivables.

Unlock Deck

Unlock for access to all 158 flashcards in this deck.

Unlock Deck

k this deck

21

The basis of accounting that recognizes revenue when it is realizable and earned is called the ____________________.

Unlock Deck

Unlock for access to all 158 flashcards in this deck.

Unlock Deck

k this deck

22

____________________ are receivables that generally specify an interest rate and a maturity date at which any interest and principal must be repaid.

Unlock Deck

Unlock for access to all 158 flashcards in this deck.

Unlock Deck

k this deck

23

According to the ____________________ principle, bad debt expense must be recorded in the period in which the sale was made.

Unlock Deck

Unlock for access to all 158 flashcards in this deck.

Unlock Deck

k this deck

24

A sales invoice that bears the notation 2/10 means ____________________.

Unlock Deck

Unlock for access to all 158 flashcards in this deck.

Unlock Deck

k this deck

25

How efficiently a company is using the resources at its disposal is called ____________________.

Unlock Deck

Unlock for access to all 158 flashcards in this deck.

Unlock Deck

k this deck

26

Special forms of factoring are called ____________________.

Unlock Deck

Unlock for access to all 158 flashcards in this deck.

Unlock Deck

k this deck

27

Gross profit divided by net sales is called the ____________________ ratio.

Unlock Deck

Unlock for access to all 158 flashcards in this deck.

Unlock Deck

k this deck

28

A(n)____________________ is the buyer of receivables, who acquires the right to collect the receivables and assumes the risk of uncollectibility.

Unlock Deck

Unlock for access to all 158 flashcards in this deck.

Unlock Deck

k this deck

29

MATCHING

Select the term that matches each of the following descriptions.

a.Interest

b.Maturity Value

c.Principal

d.Lender

e.Factoring

f.Fraction of year

g.Maturity date

h.Implicit

i.Maker

The party that receives payment due from a note

Select the term that matches each of the following descriptions.

a.Interest

b.Maturity Value

c.Principal

d.Lender

e.Factoring

f.Fraction of year

g.Maturity date

h.Implicit

i.Maker

The party that receives payment due from a note

Unlock Deck

Unlock for access to all 158 flashcards in this deck.

Unlock Deck

k this deck

30

MATCHING

Select the term that matches each of the following descriptions.

a.Interest

b.Maturity Value

c.Principal

d.Lender

e.Factoring

f.Fraction of year

g.Maturity date

h.Implicit

i.Maker

The length of time a note is outstanding--the period of time between the date it is issued and the date the note is due to be paid

Select the term that matches each of the following descriptions.

a.Interest

b.Maturity Value

c.Principal

d.Lender

e.Factoring

f.Fraction of year

g.Maturity date

h.Implicit

i.Maker

The length of time a note is outstanding--the period of time between the date it is issued and the date the note is due to be paid

Unlock Deck

Unlock for access to all 158 flashcards in this deck.

Unlock Deck

k this deck

31

The ____________________ order is necessary for the buyer to be obligated to accept and pay for the ordered goods.

Unlock Deck

Unlock for access to all 158 flashcards in this deck.

Unlock Deck

k this deck

32

The amount of money borrowed when a promissory note is issued is called the ____________________.

Unlock Deck

Unlock for access to all 158 flashcards in this deck.

Unlock Deck

k this deck

33

MATCHING

Select the term that matches each of the following descriptions.

a.Interest

b.Maturity Value

c.Principal

d.Lender

e.Factoring

f.Fraction of year

g.Maturity date

h.Implicit

i.Maker

The difference between the principal amount of the note and its maturity value

Select the term that matches each of the following descriptions.

a.Interest

b.Maturity Value

c.Principal

d.Lender

e.Factoring

f.Fraction of year

g.Maturity date

h.Implicit

i.Maker

The difference between the principal amount of the note and its maturity value

Unlock Deck

Unlock for access to all 158 flashcards in this deck.

Unlock Deck

k this deck

34

MATCHING

Select the term that matches each of the following descriptions.

a.Interest

b.Maturity Value

c.Principal

d.Lender

e.Factoring

f.Fraction of year

g.Maturity date

h.Implicit

i.Maker

The amount borrowed

Select the term that matches each of the following descriptions.

a.Interest

b.Maturity Value

c.Principal

d.Lender

e.Factoring

f.Fraction of year

g.Maturity date

h.Implicit

i.Maker

The amount borrowed

Unlock Deck

Unlock for access to all 158 flashcards in this deck.

Unlock Deck

k this deck

35

Net sales is total sales less sales discounts and ________________.

Unlock Deck

Unlock for access to all 158 flashcards in this deck.

Unlock Deck

k this deck

36

The method of recording bad debts that results in a bad debt expense before the actual default is the ____________________.

Unlock Deck

Unlock for access to all 158 flashcards in this deck.

Unlock Deck

k this deck

37

To encourage prompt payment, sellers offer a(n)____________________.

Unlock Deck

Unlock for access to all 158 flashcards in this deck.

Unlock Deck

k this deck

38

MATCHING

Select the term that matches each of the following descriptions.

a.Interest

b.Maturity Value

c.Principal

d.Lender

e.Factoring

f.Fraction of year

g.Maturity date

h.Implicit

i.Maker

Date which the total interest and principal must be repaid

Select the term that matches each of the following descriptions.

a.Interest

b.Maturity Value

c.Principal

d.Lender

e.Factoring

f.Fraction of year

g.Maturity date

h.Implicit

i.Maker

Date which the total interest and principal must be repaid

Unlock Deck

Unlock for access to all 158 flashcards in this deck.

Unlock Deck

k this deck

39

The difference between the principal amount of a note and its maturity value is called ____________________.

Unlock Deck

Unlock for access to all 158 flashcards in this deck.

Unlock Deck

k this deck

40

A(n)____________________ categorizes the various accounts receivable amounts by the length of time outstanding.

Unlock Deck

Unlock for access to all 158 flashcards in this deck.

Unlock Deck

k this deck

41

Match each statement to the item listed below

a.Bad debt expense

d.Percentage of credit sales

b.Net sales revenue

e.Profitability ratios

c.Nontrade receivables

f.Trade receivables

A way to estimate bad debt expense.

a.Bad debt expense

d.Percentage of credit sales

b.Net sales revenue

e.Profitability ratios

c.Nontrade receivables

f.Trade receivables

A way to estimate bad debt expense.

Unlock Deck

Unlock for access to all 158 flashcards in this deck.

Unlock Deck

k this deck

42

Select the term that matches each of the following descriptions.

a.Sales Discount

b.Trade Discount

c.Sales Allowance

d.Sales Returns

Used to encourage prompt payment

a.Sales Discount

b.Trade Discount

c.Sales Allowance

d.Sales Returns

Used to encourage prompt payment

Unlock Deck

Unlock for access to all 158 flashcards in this deck.

Unlock Deck

k this deck

43

Select the term that matches each of the following descriptions.

a.Sales Discount

b.Trade Discount

c.Sales Allowance

d.Sales Returns

Reduction of price granted by the seller for a particular class of customers

a.Sales Discount

b.Trade Discount

c.Sales Allowance

d.Sales Returns

Reduction of price granted by the seller for a particular class of customers

Unlock Deck

Unlock for access to all 158 flashcards in this deck.

Unlock Deck

k this deck

44

Match each statement to the item listed below

a.Bank credit card

c.Sears card

b.Debit card

d.American Express

Just a special form of factoring.

a.Bank credit card

c.Sears card

b.Debit card

d.American Express

Just a special form of factoring.

Unlock Deck

Unlock for access to all 158 flashcards in this deck.

Unlock Deck

k this deck

45

Match each statement to the item listed below

a.Accounts receivable

e.Notes receivable

b.Aging method

f.Realized

c.Allowance for Doubtful Accounts

g.Securitization

d.Earned

Generally entitle the holder to interest.

a.Accounts receivable

e.Notes receivable

b.Aging method

f.Realized

c.Allowance for Doubtful Accounts

g.Securitization

d.Earned

Generally entitle the holder to interest.

Unlock Deck

Unlock for access to all 158 flashcards in this deck.

Unlock Deck

k this deck

46

Match each statement to the item listed below

a.Bank credit card

c.Sears card

b.Debit card

d.American Express

No service charge expense is incurred by the issuer when this card is used.

a.Bank credit card

c.Sears card

b.Debit card

d.American Express

No service charge expense is incurred by the issuer when this card is used.

Unlock Deck

Unlock for access to all 158 flashcards in this deck.

Unlock Deck

k this deck

47

Match each statement to the item listed below

a.Bad debt expense

d.Percentage of credit sales

b.Net sales revenue

e.Profitability ratios

c.Nontrade receivables

f.Trade receivables

Receivables that the company is not able to collect.

a.Bad debt expense

d.Percentage of credit sales

b.Net sales revenue

e.Profitability ratios

c.Nontrade receivables

f.Trade receivables

Receivables that the company is not able to collect.

Unlock Deck

Unlock for access to all 158 flashcards in this deck.

Unlock Deck

k this deck

48

Match each statement to the item listed below

a.Accounts receivable

e.Notes receivable

b.Aging method

f.Realized

c.Allowance for Doubtful Accounts

g.Securitization

d.Earned

A way to estimate bad debts.

a.Accounts receivable

e.Notes receivable

b.Aging method

f.Realized

c.Allowance for Doubtful Accounts

g.Securitization

d.Earned

A way to estimate bad debts.

Unlock Deck

Unlock for access to all 158 flashcards in this deck.

Unlock Deck

k this deck

49

Match each statement to the item listed below

a.Accounts receivable

e.Notes receivable

b.Aging method

f.Realized

c.Allowance for Doubtful Accounts

g.Securitization

d.Earned

Money due the company from another business or individual.

a.Accounts receivable

e.Notes receivable

b.Aging method

f.Realized

c.Allowance for Doubtful Accounts

g.Securitization

d.Earned

Money due the company from another business or individual.

Unlock Deck

Unlock for access to all 158 flashcards in this deck.

Unlock Deck

k this deck

50

Match each statement to the item listed below

a.Accounts receivable

e.Notes receivable

b.Aging method

f.Realized

c.Allowance for Doubtful Accounts

g.Securitization

d.Earned

Indicates that the earnings process is substantially complete.

a.Accounts receivable

e.Notes receivable

b.Aging method

f.Realized

c.Allowance for Doubtful Accounts

g.Securitization

d.Earned

Indicates that the earnings process is substantially complete.

Unlock Deck

Unlock for access to all 158 flashcards in this deck.

Unlock Deck

k this deck

51

Match each statement to the item listed below

a.Accounts receivable

e.Notes receivable

b.Aging method

f.Realized

c.Allowance for Doubtful Accounts

g.Securitization

d.Earned

The packaging of receivables as financial instruments or securities for sale to investors.

a.Accounts receivable

e.Notes receivable

b.Aging method

f.Realized

c.Allowance for Doubtful Accounts

g.Securitization

d.Earned

The packaging of receivables as financial instruments or securities for sale to investors.

Unlock Deck

Unlock for access to all 158 flashcards in this deck.

Unlock Deck

k this deck

52

Select the term that matches each of the following descriptions.

a.Sales Discount

b.Trade Discount

c.Sales Allowance

d.Sales Returns

Used to induce the customer to keep damaged goods

a.Sales Discount

b.Trade Discount

c.Sales Allowance

d.Sales Returns

Used to induce the customer to keep damaged goods

Unlock Deck

Unlock for access to all 158 flashcards in this deck.

Unlock Deck

k this deck

53

Match each statement to the item listed below

a.Bad debt expense

d.Percentage of credit sales

b.Net sales revenue

e.Profitability ratios

c.Nontrade receivables

f.Trade receivables

Money due from customers purchasing inventory in the ordinary course of business

a.Bad debt expense

d.Percentage of credit sales

b.Net sales revenue

e.Profitability ratios

c.Nontrade receivables

f.Trade receivables

Money due from customers purchasing inventory in the ordinary course of business

Unlock Deck

Unlock for access to all 158 flashcards in this deck.

Unlock Deck

k this deck

54

Match each statement to the item listed below

a.Bad debt expense

d.Percentage of credit sales

b.Net sales revenue

e.Profitability ratios

c.Nontrade receivables

f.Trade receivables

Measure the return the company is earning on sales.

a.Bad debt expense

d.Percentage of credit sales

b.Net sales revenue

e.Profitability ratios

c.Nontrade receivables

f.Trade receivables

Measure the return the company is earning on sales.

Unlock Deck

Unlock for access to all 158 flashcards in this deck.

Unlock Deck

k this deck

55

MATCHING

Select the term that matches each of the following descriptions.

a.Interest

b.Maturity Value

c.Principal

d.Lender

e.Factoring

f.Fraction of year

g.Maturity date

h.Implicit

i.Maker

The amount of cash the maker is to pay the payee on the maturity date of the note

Select the term that matches each of the following descriptions.

a.Interest

b.Maturity Value

c.Principal

d.Lender

e.Factoring

f.Fraction of year

g.Maturity date

h.Implicit

i.Maker

The amount of cash the maker is to pay the payee on the maturity date of the note

Unlock Deck

Unlock for access to all 158 flashcards in this deck.

Unlock Deck

k this deck

56

Match each statement to the item listed below

a.Bank credit card

c.Sears card

b.Debit card

d.American Express

A non-bank credit card.

a.Bank credit card

c.Sears card

b.Debit card

d.American Express

A non-bank credit card.

Unlock Deck

Unlock for access to all 158 flashcards in this deck.

Unlock Deck

k this deck

57

Match each statement to the item listed below

a.Accounts receivable

e.Notes receivable

b.Aging method

f.Realized

c.Allowance for Doubtful Accounts

g.Securitization

d.Earned

A contra-asset account.

a.Accounts receivable

e.Notes receivable

b.Aging method

f.Realized

c.Allowance for Doubtful Accounts

g.Securitization

d.Earned

A contra-asset account.

Unlock Deck

Unlock for access to all 158 flashcards in this deck.

Unlock Deck

k this deck

58

Match each statement to the item listed below

a.Bad debt expense

d.Percentage of credit sales

b.Net sales revenue

e.Profitability ratios

c.Nontrade receivables

f.Trade receivables

Arise from transactions not involving inventory (e.g., interest receivable).

a.Bad debt expense

d.Percentage of credit sales

b.Net sales revenue

e.Profitability ratios

c.Nontrade receivables

f.Trade receivables

Arise from transactions not involving inventory (e.g., interest receivable).

Unlock Deck

Unlock for access to all 158 flashcards in this deck.

Unlock Deck

k this deck

59

Match each statement to the item listed below

a.Accounts receivable

e.Notes receivable

b.Aging method

f.Realized

c.Allowance for Doubtful Accounts

g.Securitization

d.Earned

Indicates that non-cash resources have been exchanged for cash.

a.Accounts receivable

e.Notes receivable

b.Aging method

f.Realized

c.Allowance for Doubtful Accounts

g.Securitization

d.Earned

Indicates that non-cash resources have been exchanged for cash.

Unlock Deck

Unlock for access to all 158 flashcards in this deck.

Unlock Deck

k this deck

60

Match each statement to the item listed below

a.Bank credit card

c.Sears card

b.Debit card

d.American Express

Results in an immediate electronic withdrawal from the owner's bank account when used.

a.Bank credit card

c.Sears card

b.Debit card

d.American Express

Results in an immediate electronic withdrawal from the owner's bank account when used.

Unlock Deck

Unlock for access to all 158 flashcards in this deck.

Unlock Deck

k this deck

61

A company had sales of $40,000, sales discounts of $800, sales returns of $1,600 and commissions owed to sales people of $600. Compute net sales.

A)$37,600

B)$37,000

C)$38,400

D)$39,000

A)$37,600

B)$37,000

C)$38,400

D)$39,000

Unlock Deck

Unlock for access to all 158 flashcards in this deck.

Unlock Deck

k this deck

62

A company receiving payment of a $20,000 accounts receivable within 10 days with terms of 2/10, n/30, would record a sales discount of:

A)10% of $20,000

B)2% of $20,000

C)(100% - 10%)x $20,000

D)(100% - 2%)x $20,000

A)10% of $20,000

B)2% of $20,000

C)(100% - 10%)x $20,000

D)(100% - 2%)x $20,000

Unlock Deck

Unlock for access to all 158 flashcards in this deck.

Unlock Deck

k this deck

63

A company's accounts receivable balance after posting net collections from customers for 2013 is $150,000. Management feels that uncollected accounts should be based on the following aging of accounts receivable and uncollected percentages. There are $100,000 that are 1-30 past due at 2% and $50,000 that are 31 to 60 days past due at 10%. The net realizable value of the accounts receivable is

A)$147,500

B)$148,000

C)$150,000

D)$143,000

A)$147,500

B)$148,000

C)$150,000

D)$143,000

Unlock Deck

Unlock for access to all 158 flashcards in this deck.

Unlock Deck

k this deck

64

Which one of the approaches for the allowance procedure emphasizes the net realizable value of accounts receivable on the balance sheet?

A)The aging of accounts receivable method

B)The percentage of net credit sales method

C)The percentage of accounts written off method

D)The direct write-off method

A)The aging of accounts receivable method

B)The percentage of net credit sales method

C)The percentage of accounts written off method

D)The direct write-off method

Unlock Deck

Unlock for access to all 158 flashcards in this deck.

Unlock Deck

k this deck

65

Match each statement to the item listed below

a.Bad debt expense

d.Percentage of credit sales

b.Net sales revenue

e.Profitability ratios

c.Nontrade receivables

f.Trade receivables

The amount of sales expected to be collectible after deducting discounts and returns and allowances.

a.Bad debt expense

d.Percentage of credit sales

b.Net sales revenue

e.Profitability ratios

c.Nontrade receivables

f.Trade receivables

The amount of sales expected to be collectible after deducting discounts and returns and allowances.

Unlock Deck

Unlock for access to all 158 flashcards in this deck.

Unlock Deck

k this deck

66

Action Signs recorded credit sales of $10,000 on the gross method. Terms are 2/20, n/30. Select the correct statement about the entry to record this sale.

A)Accounts receivable increases $10,000.

B)Sales increase $9,800

C)Sales discounts increase $200

D)All of the above are correct

A)Accounts receivable increases $10,000.

B)Sales increase $9,800

C)Sales discounts increase $200

D)All of the above are correct

Unlock Deck

Unlock for access to all 158 flashcards in this deck.

Unlock Deck

k this deck

67

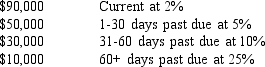

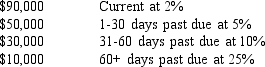

All Star Auto has an accounts receivable balance after posting net collections from customers for 2013 of $180,000. The customers took advantage of sales discounts of $15,000. Management aged the accounts receivable and estimate for uncollected account percentages as follows:  The net realizable value of the accounts receivable is

The net realizable value of the accounts receivable is

A)$173,200

B)$170,200

C)$172,700

D)$180,000

The net realizable value of the accounts receivable is

The net realizable value of the accounts receivable isA)$173,200

B)$170,200

C)$172,700

D)$180,000

Unlock Deck

Unlock for access to all 158 flashcards in this deck.

Unlock Deck

k this deck

68

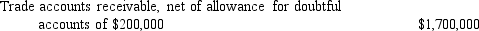

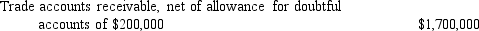

The following information was presented in the balance sheet of Acworth Pools as of December 31, 2013:  Select the incorrect statement from the following.

Select the incorrect statement from the following.

A)The company expects to actually collect $1,700,000 of its receivables.

B)The balance in the Accounts Receivable account in the company's general ledger is $1,700,000.

C)The net realizable value of the company's receivables is $1,700,000.

D)The company expects uncollectibles to total $200,000.

Select the incorrect statement from the following.

Select the incorrect statement from the following.A)The company expects to actually collect $1,700,000 of its receivables.

B)The balance in the Accounts Receivable account in the company's general ledger is $1,700,000.

C)The net realizable value of the company's receivables is $1,700,000.

D)The company expects uncollectibles to total $200,000.

Unlock Deck

Unlock for access to all 158 flashcards in this deck.

Unlock Deck

k this deck

69

Which one of the following statements is true if a company's collection period for accounts receivable is unacceptably long?

A)The collection cost would be reduced.

B)The company may offer sales discounts to shorten the collection period.

C)Cash flows from operations may be higher than expected for the company's sales.

D)The company should expand operations with its excess cash.

A)The collection cost would be reduced.

B)The company may offer sales discounts to shorten the collection period.

C)Cash flows from operations may be higher than expected for the company's sales.

D)The company should expand operations with its excess cash.

Unlock Deck

Unlock for access to all 158 flashcards in this deck.

Unlock Deck

k this deck

70

Alco Roofing Company's beginning accounts receivable were $200,000 and ending accounts receivable were $270,000. During the period, credit sales totaled $570,000, How much cash was collected from customers?

A)$470,000

B)$500,000

C)$570,000

D)$640,000

A)$470,000

B)$500,000

C)$570,000

D)$640,000

Unlock Deck

Unlock for access to all 158 flashcards in this deck.

Unlock Deck

k this deck

71

If a company uses the allowance method to account for doubtful accounts, when will the company's Stockholders' equity decrease?

A)At the date a customer's account is written off

B)At the end of the accounting period when an adjusting entry for bad debts is recorded

C)At the date a customer's account is determined to be uncollected

D)When the accounts receivable amount becomes past due

A)At the date a customer's account is written off

B)At the end of the accounting period when an adjusting entry for bad debts is recorded

C)At the date a customer's account is determined to be uncollected

D)When the accounts receivable amount becomes past due

Unlock Deck

Unlock for access to all 158 flashcards in this deck.

Unlock Deck

k this deck

72

If a company uses the direct write-off method of accounting for bad debts,

A)It establishes an estimate for the allowance for doubtful accounts.

B)It will record bad debt expense only when an account is determined to be uncollected.

C)It will reduce the accounts receivable account at the end of the accounting period for estimated uncollected accounts.

D)When an account is written off, total assets will stay the same.

A)It establishes an estimate for the allowance for doubtful accounts.

B)It will record bad debt expense only when an account is determined to be uncollected.

C)It will reduce the accounts receivable account at the end of the accounting period for estimated uncollected accounts.

D)When an account is written off, total assets will stay the same.

Unlock Deck

Unlock for access to all 158 flashcards in this deck.

Unlock Deck

k this deck

73

On December 15, 2013, the accounts receivable balance was $50,000 and the balance in the allowance for doubtful accounts was $5,000. That morning, a $1,000 uncollected account was written-off. The net realizable value of accounts receivable immediately after the write-off is:

A)$49,000

B)$46,000

C)$45,000

D)$44,000

A)$49,000

B)$46,000

C)$45,000

D)$44,000

Unlock Deck

Unlock for access to all 158 flashcards in this deck.

Unlock Deck

k this deck

74

Which allowance method approach is considered to be an income statement approach to estimating bad debts?

A)The percentage of accounts receivable approach

B)The percentage of accounts written off approach

C)The percentage of net credit sales approach

D)The direct write off method

A)The percentage of accounts receivable approach

B)The percentage of accounts written off approach

C)The percentage of net credit sales approach

D)The direct write off method

Unlock Deck

Unlock for access to all 158 flashcards in this deck.

Unlock Deck

k this deck

75

All of the following are true for a company that uses the allowance method of accounting for bad debts, EXCEPT:

A)It uses a contra-asset account called the allowance for doubtful accounts.

B)It records bad debt expense each time an account is determined to be uncollectible.

C)It reduces its accounts receivable balance when the account is written off.

D)It reports accounts receivable in the balance sheet at their net realizable value.

A)It uses a contra-asset account called the allowance for doubtful accounts.

B)It records bad debt expense each time an account is determined to be uncollectible.

C)It reduces its accounts receivable balance when the account is written off.

D)It reports accounts receivable in the balance sheet at their net realizable value.

Unlock Deck

Unlock for access to all 158 flashcards in this deck.

Unlock Deck

k this deck

76

Beginning accounts receivable were $200,000 and ending accounts receivable were $300,000. Assuming cash collections totaled $1,100,000, what were credit sales?

A)$1,200,000

B)$1,100,000

C)$1,300,000

D)$1,500,000

A)$1,200,000

B)$1,100,000

C)$1,300,000

D)$1,500,000

Unlock Deck

Unlock for access to all 158 flashcards in this deck.

Unlock Deck

k this deck

77

A company had beginning accounts receivable of $175,000. All sales were on account and totaled $550,000. Cash collected from customers totaled $650,000. Calculate the ending accounts receivable balance.

A)$725,000

B)$275,000

C)$ 75,000

D)$175,000

A)$725,000

B)$275,000

C)$ 75,000

D)$175,000

Unlock Deck

Unlock for access to all 158 flashcards in this deck.

Unlock Deck

k this deck

78

Which one of the following is an accurate description of the Allowance for Doubtful Accounts?

A)Contra Account

B)Liability Account

C)Revenue Account

D)Expense Account

A)Contra Account

B)Liability Account

C)Revenue Account

D)Expense Account

Unlock Deck

Unlock for access to all 158 flashcards in this deck.

Unlock Deck

k this deck

79

A company uses the direct write-off method to account for bad debts. What are the effects on the accounting equation of the entry to record the write-off of a customer's account balance?

A)Assets and liabilities decrease

B)Assets and Stockholders' equity decrease

C)Stockholders' equity and liabilities decrease

D)Assets increase and Stockholders' equity decrease

A)Assets and liabilities decrease

B)Assets and Stockholders' equity decrease

C)Stockholders' equity and liabilities decrease

D)Assets increase and Stockholders' equity decrease

Unlock Deck

Unlock for access to all 158 flashcards in this deck.

Unlock Deck

k this deck

80

What is the distinguishing characteristic between accounts receivable and notes receivable?

A)Accounts receivable are usually current assets while notes receivable are usually long-term assets.

B)Accounts receivable require payment of interest while notes receivable does not have payment of interest.

C)Notes receivable result from credit sale transactions for merchandising companies, while accounts receivable result from credit sale transactions for service companies.

D)Notes receivable generally specify an interest rate and a maturity date at which any interest and principle must be repaid.

A)Accounts receivable are usually current assets while notes receivable are usually long-term assets.

B)Accounts receivable require payment of interest while notes receivable does not have payment of interest.

C)Notes receivable result from credit sale transactions for merchandising companies, while accounts receivable result from credit sale transactions for service companies.

D)Notes receivable generally specify an interest rate and a maturity date at which any interest and principle must be repaid.

Unlock Deck

Unlock for access to all 158 flashcards in this deck.

Unlock Deck

k this deck