Deck 21: Accounting for the Extractive Industries

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/60

Play

Full screen (f)

Deck 21: Accounting for the Extractive Industries

1

AASB 6 effectively permits entities to choose between the full-cost method and the area-of-interest method.

False

2

Firms engaged in the extractive industries are solely engaged in the search for natural substances of commercial value:

False

3

AASB 6 only allows a choice between capitalisation or expensing of exploration and evaluation costs when the rights to tenure of the area of interest is current and these expenditures are expected to be recouped through successful development or sale.

False

4

The full-cost method is permitted in the US despite the fact that it may involve the matching of past costs with future revenue and current period costs against revenue from previously discovered reserves in an entirely different area.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

5

The costs-written-off-and-reinstated method permits the reversal of exploration and evaluation expenses recorded in an earlier period in order to record an asset,and it is consistent with the AASB Framework:

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

6

Costs in the exploration phase are incurred to discover economically recoverable reserves,while costs in the evaluation phase are incurred to prepare the areas of interest for effective exploitation of the reserves:

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

7

AASB 6 "Exploration for and Evaluation of Mineral Resources" allows an entity to apply either the cost model or the revaluation model to the exploration and evaluation assets.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

8

Australian companies who voluntarily adopt the Australian Minerals Code for Environmental Management are required to report their performance against specifically nominated environmental performance indicators,such as greenhouse gas emissions.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

9

Positive accounting theory predicts that large sized entities will choose not to capitalise their exploration and evaluation expenditures to reduce likelihood of violating debt covenants.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

10

There are potentially five alternative methods to account for pre-production costs for extractive industries:

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

11

Exploration and evaluation assets are depreciated when facts and circumstances suggest that the carrying amount of an exploration and evaluation asset may exceed its recoverable amount.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

12

AASB 6 requires deferred evaluation and exploration costs to be assessed for impairment when there is reason to suspect that the carrying amount may exceed its recoverable amount.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

13

Key issues in accounting for entities in the extractive industries include:

A) Determining the size of the deposits of natural substances in the area of interest.

B) Determining whether an asset has been acquired through the expenditures associated with exploration, evaluation and development.

C) Allocating revenues to the periods in which they are earned.

D) Determining the cost of capital in such a high-risk industry.

E) All of the given answers.

A) Determining the size of the deposits of natural substances in the area of interest.

B) Determining whether an asset has been acquired through the expenditures associated with exploration, evaluation and development.

C) Allocating revenues to the periods in which they are earned.

D) Determining the cost of capital in such a high-risk industry.

E) All of the given answers.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

14

AASB 6 deals with the financial recording and performance of an entity and must be applied by all companies:

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

15

The costs incurred in the development and construction phases require more judgement in determining whether or not they constitute an asset for the entity than other stages in the operation:

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

16

Positive accounting theory predicts that large sized entities will choose not to capitalise their exploration and evaluation expenditures to reduce political costs.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

17

AASB 6 provides guidance to cover costs incurred in the five phases listed in AASB 1022 namely: exploration,evaluation,development,construction and production:

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

18

AASB 6 "Exploration for and Evaluation of Mineral Resources" requires exploration and evaluation assets be measured at fair value at recognition.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

19

AASB 1022,a predecessor to AASB 6,divides extractive industry operations into five phases.These are:

A) Exploitation, feasibility, establishment, commissioning and manufacturing.

B) Identification, valuation, development, construction and production.

C) Exploration, assessment, research, development and production.

D) Exploration, evaluation, development, construction and production.

E) None of the given answers.

A) Exploitation, feasibility, establishment, commissioning and manufacturing.

B) Identification, valuation, development, construction and production.

C) Exploration, assessment, research, development and production.

D) Exploration, evaluation, development, construction and production.

E) None of the given answers.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

20

By allowing a choice about the treatment of pre-production costs relating to an area of interest,AASB 6 reduces the level of comparability that could otherwise have been achieved through the Standard.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

21

The possible methods for accounting for pre-production costs in the extractive industries include:

A) Costs-written-off-and-reinstated method and ABC-cost method.

B) Successful-effort method and area-of-interest method.

C) Reserve-accounting method and successful-effort method.

D) Percentage-of-completion method and costs-written-off-and-reinstated method.

E) None of the given answers.

A) Costs-written-off-and-reinstated method and ABC-cost method.

B) Successful-effort method and area-of-interest method.

C) Reserve-accounting method and successful-effort method.

D) Percentage-of-completion method and costs-written-off-and-reinstated method.

E) None of the given answers.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

22

The development phase is described in AASB 1022 as including:

A) The establishment of the existence of a technically feasible and commercially viable deposit that is capable of extraction.

B) The establishment and commissioning of facilities and infrastructure to enable the development of the area of interest.

C) The establishment of access to the deposit or field and other activities involved in establishing access for commercial production.

D) The establishment of infrastructure to permit the day-to-day activities necessary to bring the natural substance to a state in which it becomes a saleable product.

E) None of the given answers.

A) The establishment of the existence of a technically feasible and commercially viable deposit that is capable of extraction.

B) The establishment and commissioning of facilities and infrastructure to enable the development of the area of interest.

C) The establishment of access to the deposit or field and other activities involved in establishing access for commercial production.

D) The establishment of infrastructure to permit the day-to-day activities necessary to bring the natural substance to a state in which it becomes a saleable product.

E) None of the given answers.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

23

Consistent with AASB 116 the costs of facilities that are depreciable assets associated with an area of interest should be:

A) Depreciated over the life of the area of interest for which they were acquired unless they can be transported to another site or can otherwise be of further use not necessarily connected with any particular area of interest, in which case they should be depreciated over their own specific useful lives.

B) Depreciated over the expected life of the associated mining rights.

C) Depreciated using a method that matches the recovery of future benefits and the pattern of revenue streams generated by the area of interest.

D) Depreciated straight-line over the expected useful life of the particular asset except where the expected life of the area of interest is less than that of the non-current asset. In that case the asset should be depreciated for a period matching the expected life of the area of interest.

E) None of the given answers.

A) Depreciated over the life of the area of interest for which they were acquired unless they can be transported to another site or can otherwise be of further use not necessarily connected with any particular area of interest, in which case they should be depreciated over their own specific useful lives.

B) Depreciated over the expected life of the associated mining rights.

C) Depreciated using a method that matches the recovery of future benefits and the pattern of revenue streams generated by the area of interest.

D) Depreciated straight-line over the expected useful life of the particular asset except where the expected life of the area of interest is less than that of the non-current asset. In that case the asset should be depreciated for a period matching the expected life of the area of interest.

E) None of the given answers.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

24

How are the proceeds of the sale of product from the pre-production stage to be treated under AASB 6?

A) Material revenues earned from the sale of product at the pre-production stage should be transferred to a reserve and recognised when the production revenues come on line. Immaterial revenues from sales at the pre-production stage are to be netted against costs incurred in the period for the area of interest.

B) Revenue earned from pre-production sales is to be treated as a reserve and recognised once production revenues come on stream so that the accumulated costs for an area can be amortised against the total revenues earned from the area.

C) Immaterial proceeds should be offset against the relevant pre-production costs, while material proceeds should be treated as production revenue and the costs of producing the product sold deducted from the revenue as cost of sales.

D) Any revenue earned at any stage of production should be recognised as revenue in the period earned. When the revenue is earned at the pre-production stage and costs are being capitalised, those costs may continue to be capitalised until revenues from production are generated. The accumulated costs are then to be amortised against the post-production revenues.

E) None of the given answers.

A) Material revenues earned from the sale of product at the pre-production stage should be transferred to a reserve and recognised when the production revenues come on line. Immaterial revenues from sales at the pre-production stage are to be netted against costs incurred in the period for the area of interest.

B) Revenue earned from pre-production sales is to be treated as a reserve and recognised once production revenues come on stream so that the accumulated costs for an area can be amortised against the total revenues earned from the area.

C) Immaterial proceeds should be offset against the relevant pre-production costs, while material proceeds should be treated as production revenue and the costs of producing the product sold deducted from the revenue as cost of sales.

D) Any revenue earned at any stage of production should be recognised as revenue in the period earned. When the revenue is earned at the pre-production stage and costs are being capitalised, those costs may continue to be capitalised until revenues from production are generated. The accumulated costs are then to be amortised against the post-production revenues.

E) None of the given answers.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

25

An area of interest is defined in AASB 6 as:

A) A specific type of exploration activity as defined by either the production process, type of mineral or gas extracted, or expected future pattern of cash inflows.

B) A cost centre as defined for the purposes of tracking expenses and revenues and which is also used as a basis for completing taxation returns.

C) A specific geological area as defined by the initial geological surveys or as grouped according to the nature of the natural substance to be extracted.

D) An individual geological area which is considered to constitute a favourable environment where there may be a mineral deposit or natural gas field, or which has been proved to contain such a deposit or field.

E) None of the given answers.

A) A specific type of exploration activity as defined by either the production process, type of mineral or gas extracted, or expected future pattern of cash inflows.

B) A cost centre as defined for the purposes of tracking expenses and revenues and which is also used as a basis for completing taxation returns.

C) A specific geological area as defined by the initial geological surveys or as grouped according to the nature of the natural substance to be extracted.

D) An individual geological area which is considered to constitute a favourable environment where there may be a mineral deposit or natural gas field, or which has been proved to contain such a deposit or field.

E) None of the given answers.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

26

The costs-written-off method is to:

A) Write off all exploration and evaluation costs and not reinstate them if economically recoverable reserves are subsequently discovered.

B) Write off all evaluation and development costs unless it is considered likely that economically recoverable reserves will be identified within the next financial period.

C) Write off all exploration and evaluation costs but reinstate them if economically recoverable reserves are subsequently discovered.

D) Write off all deferred exploration and development costs as soon as it is determined that the reserves in the area of interest are not economically recoverable.

E) None of the given answers.

A) Write off all exploration and evaluation costs and not reinstate them if economically recoverable reserves are subsequently discovered.

B) Write off all evaluation and development costs unless it is considered likely that economically recoverable reserves will be identified within the next financial period.

C) Write off all exploration and evaluation costs but reinstate them if economically recoverable reserves are subsequently discovered.

D) Write off all deferred exploration and development costs as soon as it is determined that the reserves in the area of interest are not economically recoverable.

E) None of the given answers.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

27

The successful-effort method of accounting for pre-production costs does not:

A) Permit the carrying forward of any exploration and evaluation costs.

B) Match the total costs of exploration and evaluation against the revenue arising from the few successful projects.

C) Prohibit the creation of reserves to smooth income by delaying the recognition of expenses and matching them against unrelated revenues.

D) Involve the immediate write-off of any exploration and evaluation costs.

E) All of the given answers.

A) Permit the carrying forward of any exploration and evaluation costs.

B) Match the total costs of exploration and evaluation against the revenue arising from the few successful projects.

C) Prohibit the creation of reserves to smooth income by delaying the recognition of expenses and matching them against unrelated revenues.

D) Involve the immediate write-off of any exploration and evaluation costs.

E) All of the given answers.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

28

Extractor Ltd has carried forward costs of $16 million relating to a gold mine in Western Australia.It owns the site and has completed the first year of production.The revenues from the year's sales are 12 per cent of the total expected revenues based on expected future sales and prices.Five thousand tonnes of gold-bearing deposits were mined during the period out of a total estimate of 70,000 tonnes of reserves.It is expected that it will take 20 years to fully deplete the existing reserves.How much of the carried-forward costs should be allocated to production this period (round to the nearest dollar)?

A) $1,142,857

B) $800,000

C) $1 920,000

D) $685,714

E) None of the given answers.

A) $1,142,857

B) $800,000

C) $1 920,000

D) $685,714

E) None of the given answers.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

29

At what point of the production phase of an extractive operation should inventories be recognised?

A) Inventories may be brought to account at the earliest stage at which their value and quantity may be reliably measured or estimated.

B) Inventories should be brought to account at the earliest stage at which materials representing, or expected to be converted by further processing to, saleable product can be measured with reliability and the quantities of such materials can be determined by physical measurement or reliable estimate.

C) Inventories should be brought to account at the point that their recovery from the ground is considered to be virtually certain and the extent of the reserves can be measured reliably.

D) Inventories should be brought to account only at the latest stage at which materials representing saleable product can be measured with reliability in terms of their recoverable value and cost.

E) None of the given answers.

A) Inventories may be brought to account at the earliest stage at which their value and quantity may be reliably measured or estimated.

B) Inventories should be brought to account at the earliest stage at which materials representing, or expected to be converted by further processing to, saleable product can be measured with reliability and the quantities of such materials can be determined by physical measurement or reliable estimate.

C) Inventories should be brought to account at the point that their recovery from the ground is considered to be virtually certain and the extent of the reserves can be measured reliably.

D) Inventories should be brought to account only at the latest stage at which materials representing saleable product can be measured with reliability in terms of their recoverable value and cost.

E) None of the given answers.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

30

AASB 6 defines economically recoverable reserves to be:

A) The only source of revenue for firms in the extractive industries.

B) The quantity of product that can be extracted before the firm makes a loss.

C) The quantity of product that can be extracted, processed and sold at a profit based on past economic conditions.

D) Any reserves that can be extracted and will provide a future economic benefit to the entity.

E) The estimated quantity of the product in the area-of-interest that can be expected to be profitably extracted and sold under current and foreseeable economic conditions.

A) The only source of revenue for firms in the extractive industries.

B) The quantity of product that can be extracted before the firm makes a loss.

C) The quantity of product that can be extracted, processed and sold at a profit based on past economic conditions.

D) Any reserves that can be extracted and will provide a future economic benefit to the entity.

E) The estimated quantity of the product in the area-of-interest that can be expected to be profitably extracted and sold under current and foreseeable economic conditions.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

31

The differences between the treatment that would be most consistent with the AASB Framework and the method required by AASB 6 for the treatment of pre-production costs include:

A) The AASB Framework requires future benefits to be probable so virtually all exploration and evaluation costs would be written off. Under AASB 1022 these costs may be reinstated if economically viable reserves are discovered.

B) AASB 6 requires future benefits to be probable so virtually all exploration and evaluation costs are to be written off. Under the AASB Framework these costs may be reinstated if economically viable reserves are discovered.

C) The AASB Framework requires future benefits to be probable so virtually all exploration and evaluation costs would initially be written off and only reinstated when economically viable reserves had been discovered. AASB 6 allows the capitalisation of these costs provided active and significant operations in the area are continuing.

D) AASB 6 requires future benefits to be likely and permits the capitalisation of exploration and evaluation costs to the extent that this requirement is met and there are continuing operations in the area of interest. The AASB Framework would require the future benefit to be probable and so the two sources of regulations would result in very similar outcomes in terms of asset and expense recognition.

E) None of the given answers.

A) The AASB Framework requires future benefits to be probable so virtually all exploration and evaluation costs would be written off. Under AASB 1022 these costs may be reinstated if economically viable reserves are discovered.

B) AASB 6 requires future benefits to be probable so virtually all exploration and evaluation costs are to be written off. Under the AASB Framework these costs may be reinstated if economically viable reserves are discovered.

C) The AASB Framework requires future benefits to be probable so virtually all exploration and evaluation costs would initially be written off and only reinstated when economically viable reserves had been discovered. AASB 6 allows the capitalisation of these costs provided active and significant operations in the area are continuing.

D) AASB 6 requires future benefits to be likely and permits the capitalisation of exploration and evaluation costs to the extent that this requirement is met and there are continuing operations in the area of interest. The AASB Framework would require the future benefit to be probable and so the two sources of regulations would result in very similar outcomes in terms of asset and expense recognition.

E) None of the given answers.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

32

Sales revenue may be brought to account when the product is in the form in which it is to be sold even though the property to the product has not passed to the purchaser under certain conditions.These conditions include:

A) A firm order has been placed by a regular customer with a consistent track record of paying on time.

B) The market for the product is liquid enough that the product may be considered to be effectively equivalent to cash when it is ready for sale.

C) The product has moved from the physical control of the vendor under an enforceable contract.

D) The product is in the nature of precious gems or gold.

E) None of the given answers.

A) A firm order has been placed by a regular customer with a consistent track record of paying on time.

B) The market for the product is liquid enough that the product may be considered to be effectively equivalent to cash when it is ready for sale.

C) The product has moved from the physical control of the vendor under an enforceable contract.

D) The product is in the nature of precious gems or gold.

E) None of the given answers.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

33

Where an area of interest contracts in size and subsequently becomes two distinct operations:

A) All costs to date must be apportioned equally between the two new operations.

B) All future costs must be accounted for separately.

C) Only the costs up to and including production should be apportioned between the two sites.

D) Pre-production cost should be accumulated and then apportioned between the two operations based on the size of the new areas of interest.

E) None of the given answers.

A) All costs to date must be apportioned equally between the two new operations.

B) All future costs must be accounted for separately.

C) Only the costs up to and including production should be apportioned between the two sites.

D) Pre-production cost should be accumulated and then apportioned between the two operations based on the size of the new areas of interest.

E) None of the given answers.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

34

Guidance regarding an entity's responsibility for restoration costs is embodied in:

A) AASB 6 "Exploration for and evaluation of mineral resources".

B) AASB 110 "Events after the balance sheet date".

C) AASB 137 "Provisions, Contingent Liabilities and Contingent Assets".

D) AASB 6, AASB 110 and AASB 137.

E) AASB 6 and AASB 137.

A) AASB 6 "Exploration for and evaluation of mineral resources".

B) AASB 110 "Events after the balance sheet date".

C) AASB 137 "Provisions, Contingent Liabilities and Contingent Assets".

D) AASB 6, AASB 110 and AASB 137.

E) AASB 6 and AASB 137.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

35

Costs that have been carried forward for a specific area of interest are to be amortised against revenue earned during the production phase.How is the amortisation of the costs to be calculated?

A) Any generally accepted amortisation method may be used except for the inverse-of-the-sum-of-the-years'-digits method.

B) The costs should be amortised in proportion to the expected revenue stream, so that a higher proportion of costs are matched against higher revenue streams, especially where they occur as a result of greater quality product in the early years of production.

C) The costs should be amortised straight-line over a period of not greater than 20 years.

D) The costs should be allocated over the life of the economically recoverable reserve in terms of production output or in terms of time in circumstances such as where there is a fixed period of tenure or the limiting factor is the length of the mining right.

E) None of the given answers.

A) Any generally accepted amortisation method may be used except for the inverse-of-the-sum-of-the-years'-digits method.

B) The costs should be amortised in proportion to the expected revenue stream, so that a higher proportion of costs are matched against higher revenue streams, especially where they occur as a result of greater quality product in the early years of production.

C) The costs should be amortised straight-line over a period of not greater than 20 years.

D) The costs should be allocated over the life of the economically recoverable reserve in terms of production output or in terms of time in circumstances such as where there is a fixed period of tenure or the limiting factor is the length of the mining right.

E) None of the given answers.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

36

When deciding to what extent costs should be written off or carried forward AASB 6 requires that:

A) All activities should be considered to best reflect the position of the firm.

B) Each area of interest as delimited by the firm to be considered separately.

C) Exploration and evaluation costs must be carried forward.

D) Each area of interest as delimited by the firm to be considered separately and exploration and evaluation costs must be carried forward.

E) None of the given answers.

A) All activities should be considered to best reflect the position of the firm.

B) Each area of interest as delimited by the firm to be considered separately.

C) Exploration and evaluation costs must be carried forward.

D) Each area of interest as delimited by the firm to be considered separately and exploration and evaluation costs must be carried forward.

E) None of the given answers.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

37

If expenditures in any of the five phases of the extractive industry are not considered likely to lead to an economically viable project:

A) A post-balance-date adjustment to the amounts recorded as assets in the earlier period should be made to recognise that they were not assets at that time.

B) The costs should be written off against a reserve created by revaluing the non-current assets held in relation to projects based on a similar natural substance.

C) The costs should be deferred and amortised against the total revenue earned from all projects based on a similar natural substance.

D) The costs should be written off as a loss.

E) None of the given answers.

A) A post-balance-date adjustment to the amounts recorded as assets in the earlier period should be made to recognise that they were not assets at that time.

B) The costs should be written off against a reserve created by revaluing the non-current assets held in relation to projects based on a similar natural substance.

C) The costs should be deferred and amortised against the total revenue earned from all projects based on a similar natural substance.

D) The costs should be written off as a loss.

E) None of the given answers.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

38

Greasy Ltd has a mining operation in Western Australia.It has reached the production stage with $10 million in costs carried forward.The company is leasing the mining rights to the area and at the beginning of this period the remaining term on the lease is 99 years.The expected production in tonnes from the area is 8 million.In the current period 500,000 tonnes were extracted.Revenues are expected to be highest in the early years of the mine's life and to decline at a rate of 15 per cent per annum.How much of the accumulated costs should be allocated to production this period (round to the nearest dollar)?

A) $101,010

B) $625,000

C) $75,000

D) $150,000

E) None of the given answers.

A) $101,010

B) $625,000

C) $75,000

D) $150,000

E) None of the given answers.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

39

The full-cost method involves:

A) The writing off of the full cost of exploration and evaluation in each period.

B) The capitalisation of the full cost of exploration and evaluation in order to amortise it against total production revenue.

C) Including overhead costs in the amount of exploration and evaluation costs written off or capitalised in each period.

D) Tracing the full cost of pre-production costs to the product by using a process costing system to track and report the costs as they are incurred.

E) None of the given answers.

A) The writing off of the full cost of exploration and evaluation in each period.

B) The capitalisation of the full cost of exploration and evaluation in order to amortise it against total production revenue.

C) Including overhead costs in the amount of exploration and evaluation costs written off or capitalised in each period.

D) Tracing the full cost of pre-production costs to the product by using a process costing system to track and report the costs as they are incurred.

E) None of the given answers.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

40

Factors to be considered in reassessing the estimate of recoverable reserves each year include:

A) The past production rate compared to total estimated reserves.

B) The possibility that technological developments or discoveries may make the product obsolete or uneconomical at some future time.

C) Changes in technology, market or economic conditions affecting either sales prices or production costs, with a consequent impact on cut-off grades.

D) The possibility that technological developments or discoveries may make the product obsolete or uneconomical at some future time and changes in technology, market or economic conditions affecting either sales prices or production costs, with a consequent impact on cut-off grades.

E) All of the given answers.

A) The past production rate compared to total estimated reserves.

B) The possibility that technological developments or discoveries may make the product obsolete or uneconomical at some future time.

C) Changes in technology, market or economic conditions affecting either sales prices or production costs, with a consequent impact on cut-off grades.

D) The possibility that technological developments or discoveries may make the product obsolete or uneconomical at some future time and changes in technology, market or economic conditions affecting either sales prices or production costs, with a consequent impact on cut-off grades.

E) All of the given answers.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

41

Research conducted in Australia suggests that only a limited number of companies involved in the extractive industries choose to revalue their reserves to their expected fair value.Reasons suggested by the researchers for the low number of revaluing firms include:

A) Since firms in the extractive industries are generally considered to be subject to low levels of political scrutiny, they would prefer to record lower asset levels and higher profits.

B) The increase in value would never be reflected as income under AASB 1041.

C) The companies in the industry generally have high levels of debt so maintaining the carrying value of reserves at cost improves their leverage measures.

D) Maintaining the carrying value of reserves at cost makes the company a less attractive take-over target.

E) All of the given answers.

A) Since firms in the extractive industries are generally considered to be subject to low levels of political scrutiny, they would prefer to record lower asset levels and higher profits.

B) The increase in value would never be reflected as income under AASB 1041.

C) The companies in the industry generally have high levels of debt so maintaining the carrying value of reserves at cost improves their leverage measures.

D) Maintaining the carrying value of reserves at cost makes the company a less attractive take-over target.

E) All of the given answers.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

42

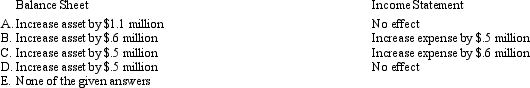

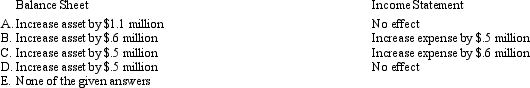

What is the effect of the above transactions on the balance sheet and on the income statement of Berrill Ltd using the full cost method?

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

43

Which of thefollowing expenditures is not an example of expenditures that form part of the initial cost of exploration and evaluation assets?

A) Acquisition of rights to explore;

B) Exploratory drilling;

C) Construction of roads and tunnels to the mine site;

D) Activities in relation to evaluating the technical feasibility and commercial viability of extracting a mineral resource;

E) None of the given answers.

A) Acquisition of rights to explore;

B) Exploratory drilling;

C) Construction of roads and tunnels to the mine site;

D) Activities in relation to evaluating the technical feasibility and commercial viability of extracting a mineral resource;

E) None of the given answers.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

44

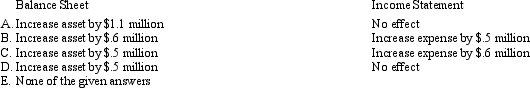

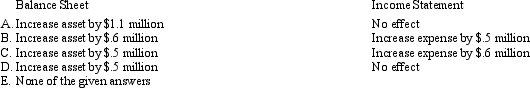

What is the effect of the above transactions on the balance sheet and on the income statement of Berrill Ltd using the area-of-interest method?

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

45

Mirza and Zimmer (1999)found that only a small number of companies were undertaking upward asset revaluations.The reasons for their reluctance to undertake this practice included.

A) A desire to remain 'small' in keeping with the political-cost hypothesis.

B) Any revaluations made are not permitted to be recognised as income by the relevant accounting standard.

C) In an attempt not to overstate assets management preferred not to revalue items which are subject to a great deal of uncertainty.

D) All of the given answers.

E) Any revaluations made are not permitted to be recognised as income by the relevant accounting standard; and, in an attempt not to overstate assets, management preferred not to revalue items which are subject to a great deal of uncertainty.

A) A desire to remain 'small' in keeping with the political-cost hypothesis.

B) Any revaluations made are not permitted to be recognised as income by the relevant accounting standard.

C) In an attempt not to overstate assets management preferred not to revalue items which are subject to a great deal of uncertainty.

D) All of the given answers.

E) Any revaluations made are not permitted to be recognised as income by the relevant accounting standard; and, in an attempt not to overstate assets, management preferred not to revalue items which are subject to a great deal of uncertainty.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

46

Which of the following statements is not in accordance with AASB 6 "Exploration for and Evaluation of Mineral Resources"?

A) Expenditures incurred in the exploration for and evaluation of mineral resources may be expensed as incurred;

B) Expenditures incurred in the exploration for and evaluation of mineral resources may be partially or fully capitalised, and recognised as an exploration and evaluation asset;

C) Exploration and evaluation assets may be measured at fair value at recognition;

D) Exploration and evaluation assets may be measured at either cost or revalued amount after recognition;

E) None of the given answers.

A) Expenditures incurred in the exploration for and evaluation of mineral resources may be expensed as incurred;

B) Expenditures incurred in the exploration for and evaluation of mineral resources may be partially or fully capitalised, and recognised as an exploration and evaluation asset;

C) Exploration and evaluation assets may be measured at fair value at recognition;

D) Exploration and evaluation assets may be measured at either cost or revalued amount after recognition;

E) None of the given answers.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

47

Which of the following statements is not in accordance with AASB 6 "Exploration for and Evaluation of Mineral Resources"?

A) An entity shall classify exploration and evaluation assets as tangible or intangible according to the nature of the assets acquired and apply the classification consistently;

B) Exploration and evaluation assets shall be assessed for impairment when facts and circumstances suggest that the carrying amount of an exploration and evaluation asset may exceed its recoverable amount.

C) When the carrying amount exceeds the recoverable amount, an entity shall measure, present and disclose any resulting impairment loss.

D) An entity is not permitted to change its accounting policies for exploration and evaluation expenditures even if the change makes the financial report more relevant to the economic decision-making needs of users.

E) None of the given answers.

A) An entity shall classify exploration and evaluation assets as tangible or intangible according to the nature of the assets acquired and apply the classification consistently;

B) Exploration and evaluation assets shall be assessed for impairment when facts and circumstances suggest that the carrying amount of an exploration and evaluation asset may exceed its recoverable amount.

C) When the carrying amount exceeds the recoverable amount, an entity shall measure, present and disclose any resulting impairment loss.

D) An entity is not permitted to change its accounting policies for exploration and evaluation expenditures even if the change makes the financial report more relevant to the economic decision-making needs of users.

E) None of the given answers.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

48

Which of the following activities is within the scope of AASB 6 "Exploration for and Evaluation of Mineral Resources"?

A) Expenditures incurred before the exploration for and evaluation of mineral resources, such as expenditures incurred before the entity has obtained the legal rights to explore a specific area;

B) Expenditures incurred after the technical feasibility and commercial viability of extracting a mineral resource are demonstrable;

C) Expenditures incurred after the exploration for and evaluation of mineral resources, such as expenditures incurred for the establishment of access to the deposit or field;

D) Expenditures incurred in the determination of the technical feasibility and commercial viability of a particular prospect, such as determining the volume and grade of the deposit or field;

E) None of the given answers.

A) Expenditures incurred before the exploration for and evaluation of mineral resources, such as expenditures incurred before the entity has obtained the legal rights to explore a specific area;

B) Expenditures incurred after the technical feasibility and commercial viability of extracting a mineral resource are demonstrable;

C) Expenditures incurred after the exploration for and evaluation of mineral resources, such as expenditures incurred for the establishment of access to the deposit or field;

D) Expenditures incurred in the determination of the technical feasibility and commercial viability of a particular prospect, such as determining the volume and grade of the deposit or field;

E) None of the given answers.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

49

Which of the following statement(s)is/are correct?

A) AASB 6 requires disclosure of accounting policies for exploration and evaluation expenditures.

B) AASB 137 "Provisions, contingent liabilities and contingent assets" provides guidance on obligations of an entity for restoration costs.

C) Exploration and evaluation assets are required in AASB 6 to be classified as intangible assets.

D) All of the given answers.

E) AASB 6 requires disclosure of accounting policies for exploration and evaluation expenditures and AASB 137 "Provisions, contingent liabilities and contingent assets" provides guidance on obligations of an entity for restoration costs.

A) AASB 6 requires disclosure of accounting policies for exploration and evaluation expenditures.

B) AASB 137 "Provisions, contingent liabilities and contingent assets" provides guidance on obligations of an entity for restoration costs.

C) Exploration and evaluation assets are required in AASB 6 to be classified as intangible assets.

D) All of the given answers.

E) AASB 6 requires disclosure of accounting policies for exploration and evaluation expenditures and AASB 137 "Provisions, contingent liabilities and contingent assets" provides guidance on obligations of an entity for restoration costs.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

50

AASB 6 requires the separate disclosure of:

A) Amounts recognised in its financial report arising from the exploration for and evaluation of mineral resources;

B) Its accounting policies for exploration and evaluation expenditures including the recognition of exploration and evaluation assets;

C) Amounts of assets, liabilities, income and expense and operating and investing cash flows arising from the exploration for and evaluation of mineral resources.

D) That recoverability of the carrying amount of the exploration and evaluation assets is dependent on successful development and commercial exploitation, or alternatively, sale of the respective areas of interest;

E) All of the given answers.

A) Amounts recognised in its financial report arising from the exploration for and evaluation of mineral resources;

B) Its accounting policies for exploration and evaluation expenditures including the recognition of exploration and evaluation assets;

C) Amounts of assets, liabilities, income and expense and operating and investing cash flows arising from the exploration for and evaluation of mineral resources.

D) That recoverability of the carrying amount of the exploration and evaluation assets is dependent on successful development and commercial exploitation, or alternatively, sale of the respective areas of interest;

E) All of the given answers.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

51

AASB 6 requires disclosure of information that identifies and explains the amounts recognised in the financial report arising from the exploration for and evaluation of mineral resources.To comply with this prescription,required disclosures include:

A) The accounting policies for exploration and evaluation expenditures including the recognition of exploration and evaluation assets.

B) The basis for determining the amount of restoration expense for the period.

C) The amount of assets, liabilities, income and expense and operating and investing cash flows arising from the exploration for and evaluation of mineral resources.

D) All of the given answers.

E) The accounting policies for exploration and evaluation expenditures including the recognition of exploration and evaluation assets; and the amount of assets, liabilities, income and expense and operating and investing cash flows arising from the exploration for and evaluation of mineral resources.

A) The accounting policies for exploration and evaluation expenditures including the recognition of exploration and evaluation assets.

B) The basis for determining the amount of restoration expense for the period.

C) The amount of assets, liabilities, income and expense and operating and investing cash flows arising from the exploration for and evaluation of mineral resources.

D) All of the given answers.

E) The accounting policies for exploration and evaluation expenditures including the recognition of exploration and evaluation assets; and the amount of assets, liabilities, income and expense and operating and investing cash flows arising from the exploration for and evaluation of mineral resources.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

52

Which of the following costs is not an element of cost of exploration for and evaluation of mineral assets in AASB 6"Exploration for and Evaluation of Mineral Resources"?

A) The costs of acquiring leases or other rights of tenure in the area of interest are included in the cost of the exploration and evaluation asset if they are acquired as part of the exploration for and evaluation of mineral resources;

B) Charges for depreciation of equipment used in exploration and evaluation activities;

C) General and administrative costs directly attributed to the operational activities in the area of interest to which the exploration and evaluation asset relates;

D) Salaries and other expenses of general management allocated by head office to the area of interest

E) None of the given answers.

A) The costs of acquiring leases or other rights of tenure in the area of interest are included in the cost of the exploration and evaluation asset if they are acquired as part of the exploration for and evaluation of mineral resources;

B) Charges for depreciation of equipment used in exploration and evaluation activities;

C) General and administrative costs directly attributed to the operational activities in the area of interest to which the exploration and evaluation asset relates;

D) Salaries and other expenses of general management allocated by head office to the area of interest

E) None of the given answers.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

53

Which of the following statement(s)is/are correct?

A) Entities engage in extractive operations should adopt AASB 116 "Property, Plant and Equipment" in the amortisation of capitalised costs.

B) Entities engage in extractive operations should adopt AASB 6 in accounting for its inventories.

C) The obligations of entities engage in extractive operation with respect to restoration costs are outlined in AASB 6.

D) All of the given answers.

E) Entities engage in extractive operations should adopt AASB 116 "Property, Plant and Equipment" in the amortisation of capitalised costs and entities engage in extractive operations should adopt AASB 6 in accounting for its inventories.

A) Entities engage in extractive operations should adopt AASB 116 "Property, Plant and Equipment" in the amortisation of capitalised costs.

B) Entities engage in extractive operations should adopt AASB 6 in accounting for its inventories.

C) The obligations of entities engage in extractive operation with respect to restoration costs are outlined in AASB 6.

D) All of the given answers.

E) Entities engage in extractive operations should adopt AASB 116 "Property, Plant and Equipment" in the amortisation of capitalised costs and entities engage in extractive operations should adopt AASB 6 in accounting for its inventories.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

54

If an area-of interest is abandoned,which of the following actions is consistent with AASB 6 "Exploration for and Evaluation of Mineral Resources"?

A) Write-off carrying amount of exploration and evaluation assets and recognize an impairment loss;

B) Reclassify carrying amount of exploration and evaluation assets to another other area-of-interest;

C) Re-instatement of previously written off exploration and evaluation assets is not permitted.

D) Machinery that can be dismantled and used on another area of interest should not be expensed.

E) None of the given answers.

A) Write-off carrying amount of exploration and evaluation assets and recognize an impairment loss;

B) Reclassify carrying amount of exploration and evaluation assets to another other area-of-interest;

C) Re-instatement of previously written off exploration and evaluation assets is not permitted.

D) Machinery that can be dismantled and used on another area of interest should not be expensed.

E) None of the given answers.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

55

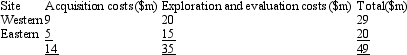

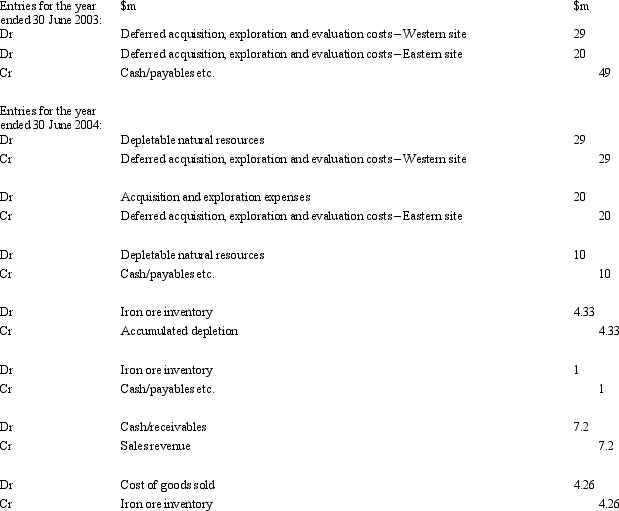

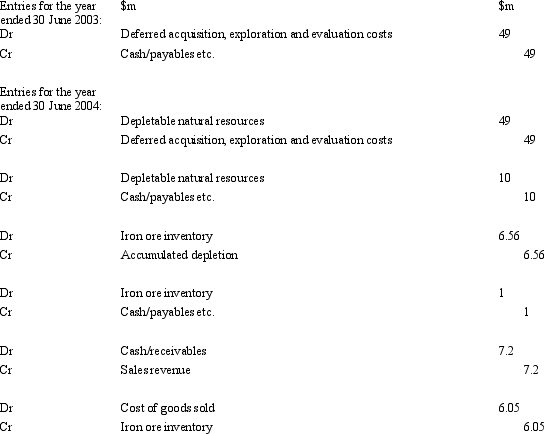

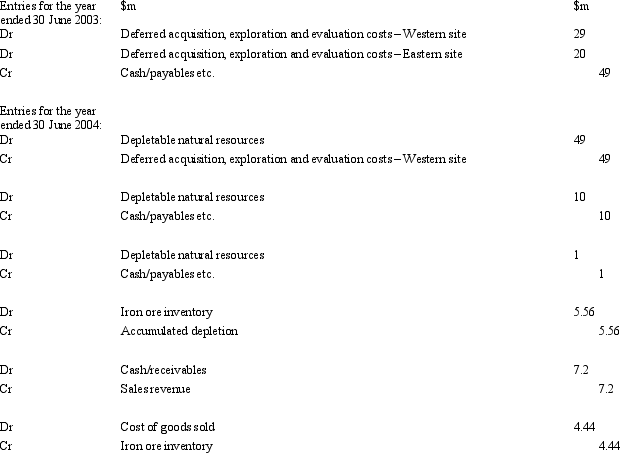

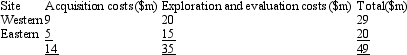

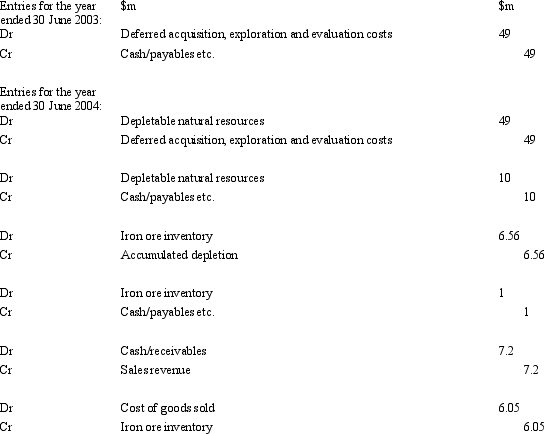

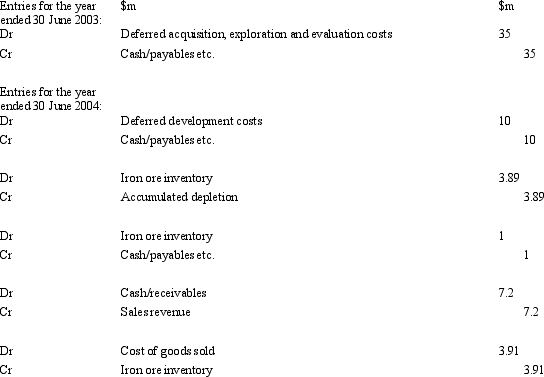

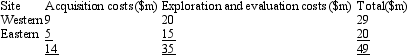

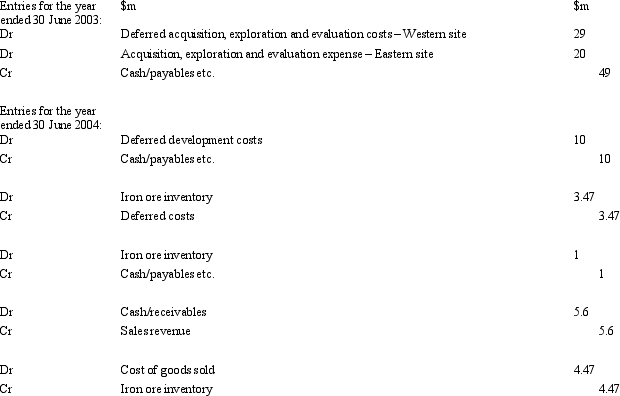

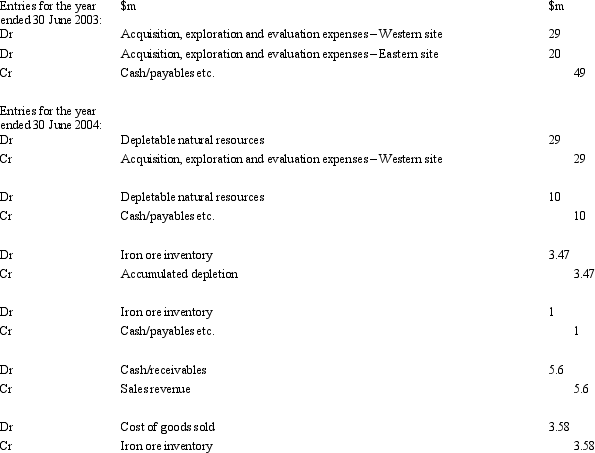

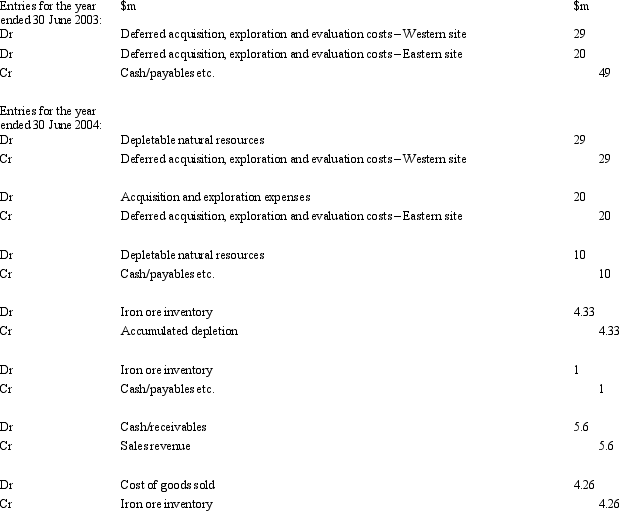

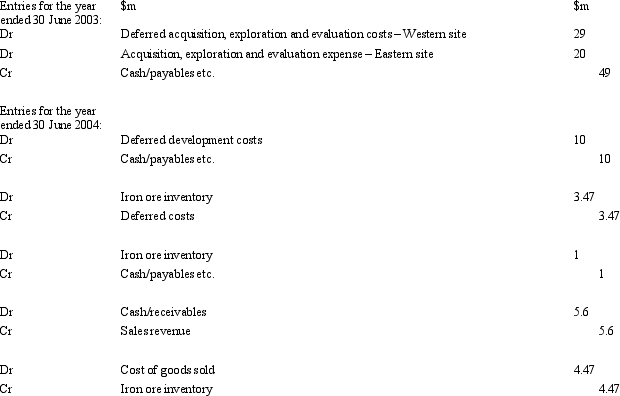

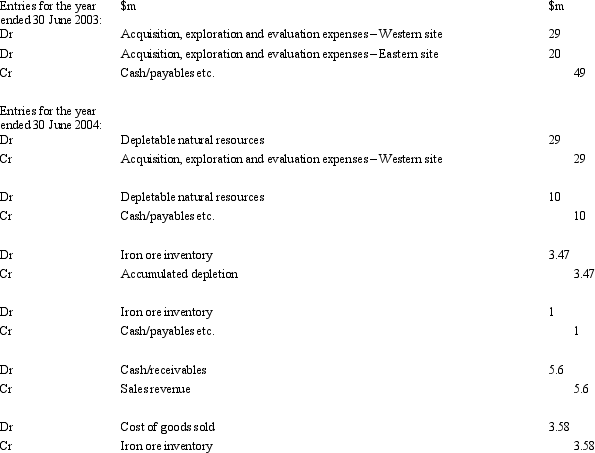

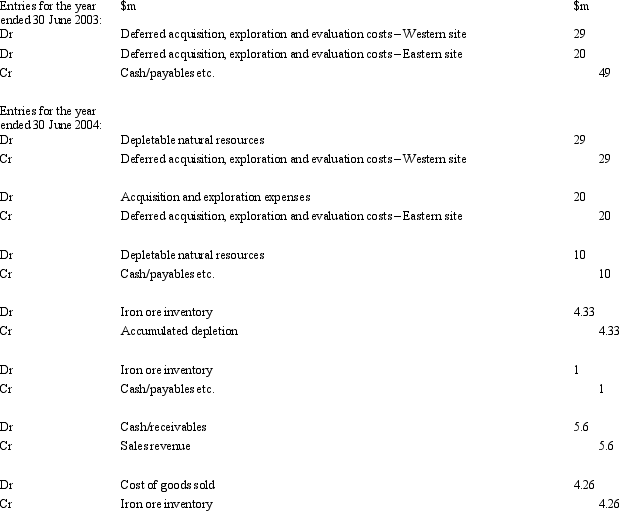

On 1 July 2002 Honies Ltd commenced an operation to extract iron ore from two sites believed to have potential in Northern Australia.During the financial period ended 30 June 2003 the following costs were incurred.  The Eastern site is found not to be economically viable and is abandoned in the second half of 2003.Development costs of $10 million are incurred at the Western site.The reserves at this site are estimated to be 90,000 tonnes.The market price is currently $900 per tonne.In the financial year ended 30 June 2004,10,000 tonnes are extracted with associated production costs of $1 million and 8,000 tonnes are sold at the market price.There are no effective limits on the time over which Honies Ltd may extract the ore.What are the journal entries to record the relevant transactions and events for 2003 and 2004 using the full-cost method (round to the nearest $10,000)?

The Eastern site is found not to be economically viable and is abandoned in the second half of 2003.Development costs of $10 million are incurred at the Western site.The reserves at this site are estimated to be 90,000 tonnes.The market price is currently $900 per tonne.In the financial year ended 30 June 2004,10,000 tonnes are extracted with associated production costs of $1 million and 8,000 tonnes are sold at the market price.There are no effective limits on the time over which Honies Ltd may extract the ore.What are the journal entries to record the relevant transactions and events for 2003 and 2004 using the full-cost method (round to the nearest $10,000)?

A)

B)

C)

D)

E) None of the given answers.

The Eastern site is found not to be economically viable and is abandoned in the second half of 2003.Development costs of $10 million are incurred at the Western site.The reserves at this site are estimated to be 90,000 tonnes.The market price is currently $900 per tonne.In the financial year ended 30 June 2004,10,000 tonnes are extracted with associated production costs of $1 million and 8,000 tonnes are sold at the market price.There are no effective limits on the time over which Honies Ltd may extract the ore.What are the journal entries to record the relevant transactions and events for 2003 and 2004 using the full-cost method (round to the nearest $10,000)?

The Eastern site is found not to be economically viable and is abandoned in the second half of 2003.Development costs of $10 million are incurred at the Western site.The reserves at this site are estimated to be 90,000 tonnes.The market price is currently $900 per tonne.In the financial year ended 30 June 2004,10,000 tonnes are extracted with associated production costs of $1 million and 8,000 tonnes are sold at the market price.There are no effective limits on the time over which Honies Ltd may extract the ore.What are the journal entries to record the relevant transactions and events for 2003 and 2004 using the full-cost method (round to the nearest $10,000)?A)

B)

C)

D)

E) None of the given answers.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

56

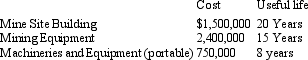

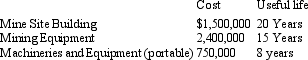

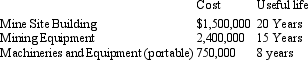

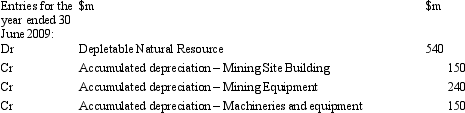

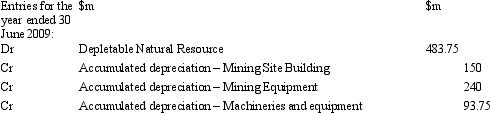

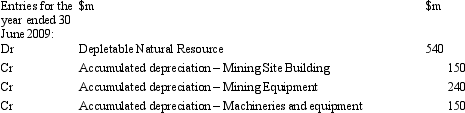

On 1 April 2008,Ulladulla Mining Ltd assessed that its Mollymook area of interest contained economically recoverable reserves of 50,000 ounces of gold.On the same day the entity installed the following assets:  The above assets were ready for use on 1 July 2008.Ulladulla Mining Ltd expects to extract the entire reserves in 5 years.For the year ending 30 June 2009 the entity had extracted 5,000 ounces of gold.

The above assets were ready for use on 1 July 2008.Ulladulla Mining Ltd expects to extract the entire reserves in 5 years.For the year ending 30 June 2009 the entity had extracted 5,000 ounces of gold.

What is the total depreciation/amortisation expense for the capitalised development costs for the year ending 30 June 2008?

A) $465,000

B) $483,750

C) $540,000

D) $930,000

E) None of the given answers.

The above assets were ready for use on 1 July 2008.Ulladulla Mining Ltd expects to extract the entire reserves in 5 years.For the year ending 30 June 2009 the entity had extracted 5,000 ounces of gold.

The above assets were ready for use on 1 July 2008.Ulladulla Mining Ltd expects to extract the entire reserves in 5 years.For the year ending 30 June 2009 the entity had extracted 5,000 ounces of gold.What is the total depreciation/amortisation expense for the capitalised development costs for the year ending 30 June 2008?

A) $465,000

B) $483,750

C) $540,000

D) $930,000

E) None of the given answers.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

57

Disclosures related to restoration costs:

A) Are not covered by AASB 6 and are therefore not required.

B) Should only be reported in the notes to the accounts once they have been completed.

C) Are required by AASB 137.

D) Must include the reason why restoration is being undertaken - legal, voluntary etc.

E) Should only be reported in the notes to the accounts once they have been completed and are required by AASB 137.

A) Are not covered by AASB 6 and are therefore not required.

B) Should only be reported in the notes to the accounts once they have been completed.

C) Are required by AASB 137.

D) Must include the reason why restoration is being undertaken - legal, voluntary etc.

E) Should only be reported in the notes to the accounts once they have been completed and are required by AASB 137.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

58

Since the late 1980s,an increasing number of minerals and energy companies are making environmental and social disclosures.The majority of these are voluntary; however,there is a requirement to disclose:

A) A separate environmental report that details the company's environmental management system where it is extracting minerals under licence from an international mineral rights holder.

B) Details of compliance with government environmental regulations relevant to the company in line with best practice corporate governance.

C) Details of the entity's performance in relation to environmental regulation in the company's Directors' Report if it is subject to any particular and significant environmental regulation under a law of the Commonwealth or of a State or Territory.

D) Disclosure of corporate environmental and social performance in a separate report where the shares of the company are less than 50 per cent Australian owned.

E) None of the given answers.

A) A separate environmental report that details the company's environmental management system where it is extracting minerals under licence from an international mineral rights holder.

B) Details of compliance with government environmental regulations relevant to the company in line with best practice corporate governance.

C) Details of the entity's performance in relation to environmental regulation in the company's Directors' Report if it is subject to any particular and significant environmental regulation under a law of the Commonwealth or of a State or Territory.

D) Disclosure of corporate environmental and social performance in a separate report where the shares of the company are less than 50 per cent Australian owned.

E) None of the given answers.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

59

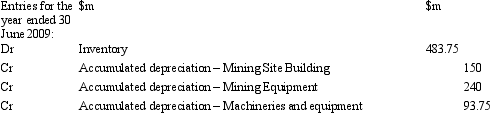

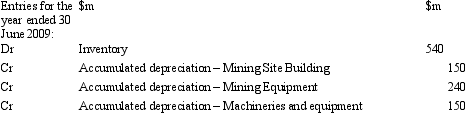

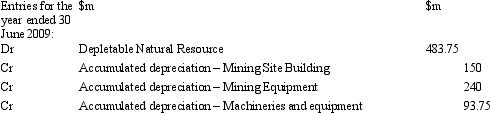

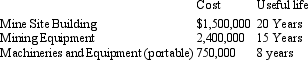

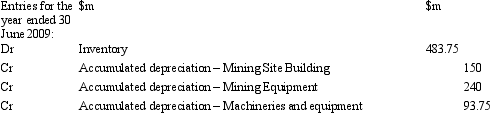

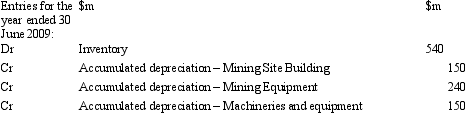

On 1 April 2008,Ulladulla Mining Ltd assessed that its Mollymook area of interest contained economically recoverable reserves of 50,000 ounces of gold.On the same day the entity installed the following assets:  The above assets were ready for use on 1 July 2008.Ulladulla Mining Ltd expects to extract the entire reserves in 5 years.For the year ending 30 June 2009 the entity had extracted 5,000 ounces of gold.

The above assets were ready for use on 1 July 2008.Ulladulla Mining Ltd expects to extract the entire reserves in 5 years.For the year ending 30 June 2009 the entity had extracted 5,000 ounces of gold.

What is the journal entry to recognise amortisation and depreciation expense of above capitalised developments costs?

A)

B)

C)

D)

E) None of the given answers.

The above assets were ready for use on 1 July 2008.Ulladulla Mining Ltd expects to extract the entire reserves in 5 years.For the year ending 30 June 2009 the entity had extracted 5,000 ounces of gold.

The above assets were ready for use on 1 July 2008.Ulladulla Mining Ltd expects to extract the entire reserves in 5 years.For the year ending 30 June 2009 the entity had extracted 5,000 ounces of gold.What is the journal entry to recognise amortisation and depreciation expense of above capitalised developments costs?

A)

B)

C)

D)

E) None of the given answers.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

60

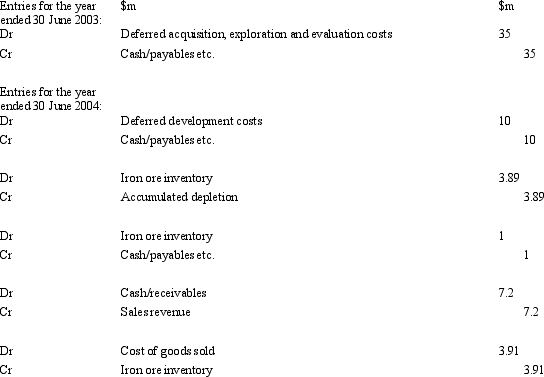

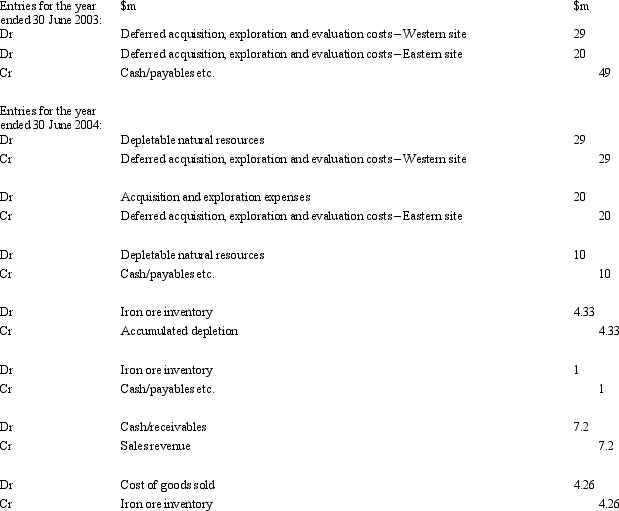

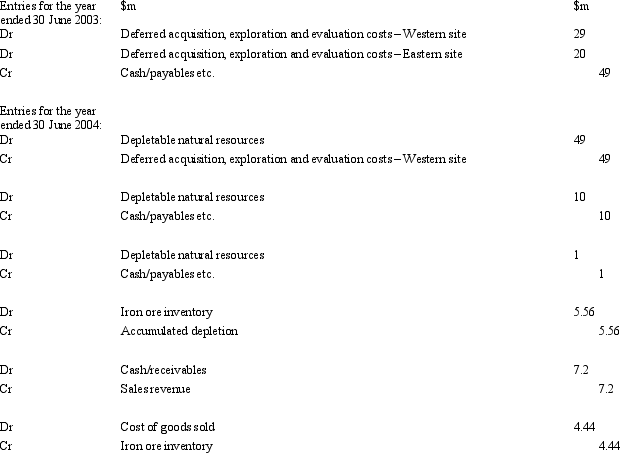

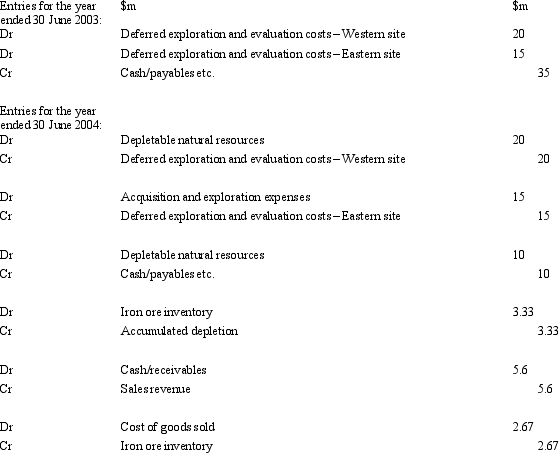

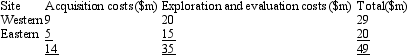

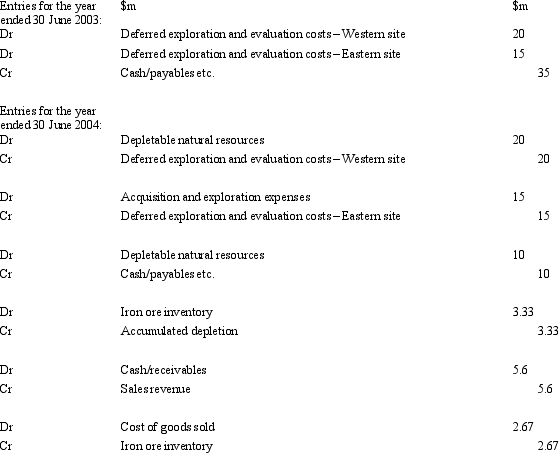

On 1 July 2002 Brumbles Ltd commenced an operation to extract iron ore from two sites believed to have potential in Northern Australia.During the financial period ended 30 June 2003 the following costs were incurreD.  The Eastern site is found not to be economically viable and is abandoned in the second half of 2003.Development costs of $10 million are incurred at the Western site.The reserves at this site are estimated to be 90,000 tonnes.The market price is currently $700 per tonne.In the financial year ended 30 June 2004,10,000 tonnes are extracted with associated production costs of $1 million and 8,000 tonnes are sold at the market price.There are no effective limits on the time over which Brumbles Ltd may extract the ore.What are the journal entries to record the relevant transactions and events for 2003 and 2004 using the method required by AASB 1022 (round to the nearest $10,000)?

The Eastern site is found not to be economically viable and is abandoned in the second half of 2003.Development costs of $10 million are incurred at the Western site.The reserves at this site are estimated to be 90,000 tonnes.The market price is currently $700 per tonne.In the financial year ended 30 June 2004,10,000 tonnes are extracted with associated production costs of $1 million and 8,000 tonnes are sold at the market price.There are no effective limits on the time over which Brumbles Ltd may extract the ore.What are the journal entries to record the relevant transactions and events for 2003 and 2004 using the method required by AASB 1022 (round to the nearest $10,000)?

A)

B)

C)

D)

E) None of the given answers.

The Eastern site is found not to be economically viable and is abandoned in the second half of 2003.Development costs of $10 million are incurred at the Western site.The reserves at this site are estimated to be 90,000 tonnes.The market price is currently $700 per tonne.In the financial year ended 30 June 2004,10,000 tonnes are extracted with associated production costs of $1 million and 8,000 tonnes are sold at the market price.There are no effective limits on the time over which Brumbles Ltd may extract the ore.What are the journal entries to record the relevant transactions and events for 2003 and 2004 using the method required by AASB 1022 (round to the nearest $10,000)?

The Eastern site is found not to be economically viable and is abandoned in the second half of 2003.Development costs of $10 million are incurred at the Western site.The reserves at this site are estimated to be 90,000 tonnes.The market price is currently $700 per tonne.In the financial year ended 30 June 2004,10,000 tonnes are extracted with associated production costs of $1 million and 8,000 tonnes are sold at the market price.There are no effective limits on the time over which Brumbles Ltd may extract the ore.What are the journal entries to record the relevant transactions and events for 2003 and 2004 using the method required by AASB 1022 (round to the nearest $10,000)?A)

B)

C)

D)

E) None of the given answers.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck