Deck 6: The Foreign Exchange Market

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/50

Play

Full screen (f)

Deck 6: The Foreign Exchange Market

1

Foreign exchange ________ earn a profit by a bid-ask spread on currencies they purchase and sell. Foreign exchange ________, on the other hand, earn a profit by bringing together buyers and sellers of foreign currencies and earning a commission on each sale and purchase.

A)central banks; treasuries

B)dealers; brokers

C)brokers; dealers

D)speculators; arbitragers

A)central banks; treasuries

B)dealers; brokers

C)brokers; dealers

D)speculators; arbitragers

dealers; brokers

2

Define spot, forward, and swap transactions in the foreign exchange market and give an example of how each could be used.

Spot transactions are exchanging one currency for another right now. Spot transactions are typically entered into because the parties need to exchange foreign currencies that they have received into their domestic currency, or because they have an obligation that requires them to obtain foreign currency.

Forward foreign exchange transactions are agreements entered into today to exchange currencies at a particular price at some point in the future. Forwards may be speculative or a hedge against unexpected changes in the price of the other currency.

Swaps are the simultaneous purchase and sale of a given amount of a foreign exchange for two different dates. Both transactions are conducted with the same counterparty. A swap may be considered a technique for borrowing another currency on a fully collateralized basis.

Forward foreign exchange transactions are agreements entered into today to exchange currencies at a particular price at some point in the future. Forwards may be speculative or a hedge against unexpected changes in the price of the other currency.

Swaps are the simultaneous purchase and sale of a given amount of a foreign exchange for two different dates. Both transactions are conducted with the same counterparty. A swap may be considered a technique for borrowing another currency on a fully collateralized basis.

3

________ seek to profit from trading in the market itself rather than having the foreign exchange transaction being incidental to the execution of a commercial or investment transaction.

A)Speculators and arbitragers

B)Foreign exchange brokers

C)Central banks

D)Treasuries

A)Speculators and arbitragers

B)Foreign exchange brokers

C)Central banks

D)Treasuries

Speculators and arbitragers

4

The primary motive of foreign exchange activities by most central banks is profit.

Unlock Deck

Unlock for access to all 50 flashcards in this deck.

Unlock Deck

k this deck

5

Because the market for foreign exchange is worldwide, the volume of foreign exchange currency transactions is level throughout the 24-hour day.

Unlock Deck

Unlock for access to all 50 flashcards in this deck.

Unlock Deck

k this deck

6

________ are NOT one of the three categories reported for foreign exchange.

A)Spot transactions

B)Swap transactions

C)Strip transactions

D)Futures transactions

A)Spot transactions

B)Swap transactions

C)Strip transactions

D)Futures transactions

Unlock Deck

Unlock for access to all 50 flashcards in this deck.

Unlock Deck

k this deck

7

Daily trading volume in the foreign exchange market was about ________ per ________ in 2007.

A)$3,200 billion; month

B)$1,000 billion; month

C)$3,200 billion; day

D)$1,000 billion; day

A)$3,200 billion; month

B)$1,000 billion; month

C)$3,200 billion; day

D)$1,000 billion; day

Unlock Deck

Unlock for access to all 50 flashcards in this deck.

Unlock Deck

k this deck

8

A/An ________ is an agreement between a buyer and seller that a fixed amount of one currency will be delivered at a specified rate for some other currency.

A)Eurodollar transaction

B)import/export exchange

C)foreign exchange transaction

D)interbank market transaction

A)Eurodollar transaction

B)import/export exchange

C)foreign exchange transaction

D)interbank market transaction

Unlock Deck

Unlock for access to all 50 flashcards in this deck.

Unlock Deck

k this deck

9

It is characteristic of foreign exchange dealers to

A)bring buyers and sellers of currencies together but never to buy and hold an inventory of currency for resale.

B)act as market makers, willing to buy and sell the currencies in which they specialize.

C)trade only with clients in the retail market and never operate in the wholesale market for foreign exchange.

D)All of the above are characteristics of foreign exchange dealers.

A)bring buyers and sellers of currencies together but never to buy and hold an inventory of currency for resale.

B)act as market makers, willing to buy and sell the currencies in which they specialize.

C)trade only with clients in the retail market and never operate in the wholesale market for foreign exchange.

D)All of the above are characteristics of foreign exchange dealers.

Unlock Deck

Unlock for access to all 50 flashcards in this deck.

Unlock Deck

k this deck

10

Which of the following is NOT a motivation identified by the authors as a function of the foreign exchange market?

A)The transfer of purchasing power between countries.

B)Obtaining or providing credit for international trade transactions.

C)Minimizing the risks of exchange rate changes.

D)All of the above were identified as functions of the foreign exchange market.

A)The transfer of purchasing power between countries.

B)Obtaining or providing credit for international trade transactions.

C)Minimizing the risks of exchange rate changes.

D)All of the above were identified as functions of the foreign exchange market.

Unlock Deck

Unlock for access to all 50 flashcards in this deck.

Unlock Deck

k this deck

11

Dealers in foreign exchange departments at large international banks act as market makers and maintain inventories of the securities in which they specialize.

Unlock Deck

Unlock for access to all 50 flashcards in this deck.

Unlock Deck

k this deck

12

While trading in foreign exchange takes place worldwide, the major currency trading centers are located in

A)London, New York, and Tokyo.

B)New York, Zurich, and Bahrain.

C)Paris, Frankfurt, and London.

D)Los Angeles, New York, and London.

A)London, New York, and Tokyo.

B)New York, Zurich, and Bahrain.

C)Paris, Frankfurt, and London.

D)Los Angeles, New York, and London.

Unlock Deck

Unlock for access to all 50 flashcards in this deck.

Unlock Deck

k this deck

13

The authors identify two tiers of foreign exchange markets:

A)bank and nonbank foreign exchange.

B)commercial and investment transactions.

C)interbank and client markets.

D)client and retail market.

A)bank and nonbank foreign exchange.

B)commercial and investment transactions.

C)interbank and client markets.

D)client and retail market.

Unlock Deck

Unlock for access to all 50 flashcards in this deck.

Unlock Deck

k this deck

14

Currency trading lacks profitability for large commercial and investment banks but is maintained as a service for corporate and institutional customers.

Unlock Deck

Unlock for access to all 50 flashcards in this deck.

Unlock Deck

k this deck

15

Foreign exchange markets are a relatively recent phenomenon, beginning with the agreement at Bretton Woods.

Unlock Deck

Unlock for access to all 50 flashcards in this deck.

Unlock Deck

k this deck

16

Which of the following is NOT true regarding the market for foreign exchange?

A)The market provides the physical and institutional structure through which the money of one country is exchanged for another.

B)The rate of exchange is determined in the market.

C)Foreign exchange transactions are physically completed in the foreign exchange market.

D)All of the above are true.

A)The market provides the physical and institutional structure through which the money of one country is exchanged for another.

B)The rate of exchange is determined in the market.

C)Foreign exchange transactions are physically completed in the foreign exchange market.

D)All of the above are true.

Unlock Deck

Unlock for access to all 50 flashcards in this deck.

Unlock Deck

k this deck

17

The ________ is the mechanism by which participants transfer purchasing power between countries, obtain or provide credit for international trade transactions, and minimize exposure to the risks of exchange rate changes.

A)futures market

B)federal open market

C)foreign exchange market

D)LIBOR

A)futures market

B)federal open market

C)foreign exchange market

D)LIBOR

Unlock Deck

Unlock for access to all 50 flashcards in this deck.

Unlock Deck

k this deck

18

Which of the following may be participants in the foreign exchange markets?

A)Bank and nonbank foreign exchange dealers.

B)Central banks and treasuries.

C)Speculators and arbitragers.

D)All of the above.

A)Bank and nonbank foreign exchange dealers.

B)Central banks and treasuries.

C)Speculators and arbitragers.

D)All of the above.

Unlock Deck

Unlock for access to all 50 flashcards in this deck.

Unlock Deck

k this deck

19

In the foreign exchange market, ________ seek all of their profit from exchange rate changes while ________ seek to profit from simultaneous exchange rate differences in different markets.

A)wholesalers; retailers

B)central banks; treasuries

C)speculators; arbitragers

D)dealers; brokers

A)wholesalers; retailers

B)central banks; treasuries

C)speculators; arbitragers

D)dealers; brokers

Unlock Deck

Unlock for access to all 50 flashcards in this deck.

Unlock Deck

k this deck

20

What are some of the reasons central banks and treasuries enter the foreign exchange markets, and in what important ways are they different from other foreign exchange participants?

Unlock Deck

Unlock for access to all 50 flashcards in this deck.

Unlock Deck

k this deck

21

If the direct quote for a U.S. investor for British pounds is $1.43/£, then the indirect quote for the U.S. investor would be ________ and the direct quote for the British investor would be ________.

A)£0.699/$; £0.699/$

B)$0.699/£; £0.699/$

C)£1.43/£; £0.699/$

D)£0.699/$; $1.43/£

A)£0.699/$; £0.699/$

B)$0.699/£; £0.699/$

C)£1.43/£; £0.699/$

D)£0.699/$; $1.43/£

Unlock Deck

Unlock for access to all 50 flashcards in this deck.

Unlock Deck

k this deck

22

The ________ is a derivative forward contract that was created in the 1990s. It has the same characteristics and documentation requirements as traditional forward contracts except that they are only settled in U.S. dollars and the foreign currency involved in the transaction is not delivered.

A)nondeliverable forward

B)dollar only forward

C)virtual forward

D)internet forward

A)nondeliverable forward

B)dollar only forward

C)virtual forward

D)internet forward

Unlock Deck

Unlock for access to all 50 flashcards in this deck.

Unlock Deck

k this deck

23

A spot transaction in the interbank market for foreign exchange would typically involve a two-day delay in the actual delivery of the currencies, while such a transaction between a bank and its commercial customer would not necessarily involve a two-day wait.

Unlock Deck

Unlock for access to all 50 flashcards in this deck.

Unlock Deck

k this deck

24

A forward contract to deliver British pounds for U.S. dollars could be described either as ________ or ________.

A)buying dollars forward; buying pounds forward.

B)selling pounds forward; selling dollars forward.

C)selling pounds forward; buying dollars forward.

D)selling dollars forward; buying pounds forward.

A)buying dollars forward; buying pounds forward.

B)selling pounds forward; selling dollars forward.

C)selling pounds forward; buying dollars forward.

D)selling dollars forward; buying pounds forward.

Unlock Deck

Unlock for access to all 50 flashcards in this deck.

Unlock Deck

k this deck

25

Most foreign exchange transactions are through the U.S. dollar. If the transaction is expressed as the foreign currency per dollar this known as ________ whereas ________ are expressed as dollars per foreign unit.

A)European terms; indirect

B)American terms; direct

C)American terms; European terms

D)European terms; American terms

A)European terms; indirect

B)American terms; direct

C)American terms; European terms

D)European terms; American terms

Unlock Deck

Unlock for access to all 50 flashcards in this deck.

Unlock Deck

k this deck

26

The greatest amount of foreign exchange trading takes place in the following three cities:

A)New York, London, and Tokyo.

B)New York, Singapore, and Zurich.

C)London, Frankfurt, and Paris.

D)London, Tokyo, and Zurich.

A)New York, London, and Tokyo.

B)New York, Singapore, and Zurich.

C)London, Frankfurt, and Paris.

D)London, Tokyo, and Zurich.

Unlock Deck

Unlock for access to all 50 flashcards in this deck.

Unlock Deck

k this deck

27

A ________ transaction in the foreign exchange market requires an almost immediate delivery (typically within two days)of foreign exchange.

A)spot

B)forward

C)futures

D)none of the above

A)spot

B)forward

C)futures

D)none of the above

Unlock Deck

Unlock for access to all 50 flashcards in this deck.

Unlock Deck

k this deck

28

American and British meanings differ for the word billion. Therefore, when traders refer to an American billion, they call it a/an ________.

A)Kiwi

B)Loony

C)Uncle Sam

D)Yard

A)Kiwi

B)Loony

C)Uncle Sam

D)Yard

Unlock Deck

Unlock for access to all 50 flashcards in this deck.

Unlock Deck

k this deck

29

NDFs are traded and settled inside the country of the subject currency, and therefore are within the control of the country's government.

Unlock Deck

Unlock for access to all 50 flashcards in this deck.

Unlock Deck

k this deck

30

A foreign exchange ________ is the price of one currency expressed in terms of another currency. A foreign exchange ________ is a willingness to buy or sell at the announced rate.

A)quote; rate

B)quote; quote

C)rate; quote

D)rate; rate

A)quote; rate

B)quote; quote

C)rate; quote

D)rate; rate

Unlock Deck

Unlock for access to all 50 flashcards in this deck.

Unlock Deck

k this deck

31

A ________ transaction in the foreign exchange market requires delivery of foreign exchange at some future date.

A)spot

B)forward

C)swap

D)currency

A)spot

B)forward

C)swap

D)currency

Unlock Deck

Unlock for access to all 50 flashcards in this deck.

Unlock Deck

k this deck

32

The four currencies that constitute about 80% of all foreign exchange trading are

A)U.K pound, Chinese yuan, euro, and Japanese yen.

B)U.S. dollar, euro, Chinese yuan, and U.K. pound.

C)U.S. dollar, Japanese yen, euro, and U.K. pound.

D)U.S. dollar, U.K. pound, yen, and Chinese yuan.

A)U.K pound, Chinese yuan, euro, and Japanese yen.

B)U.S. dollar, euro, Chinese yuan, and U.K. pound.

C)U.S. dollar, Japanese yen, euro, and U.K. pound.

D)U.S. dollar, U.K. pound, yen, and Chinese yuan.

Unlock Deck

Unlock for access to all 50 flashcards in this deck.

Unlock Deck

k this deck

33

Swap and forward transactions account for an insignificant portion of the foreign exchange market.

Unlock Deck

Unlock for access to all 50 flashcards in this deck.

Unlock Deck

k this deck

34

A/an ________ quote in the United States would be foreign units per dollar, while a/an ________ quote would be in dollars per foreign currency unit.

A)direct; direct

B)direct; indirect

C)indirect; indirect

D)indirect; direct

A)direct; direct

B)direct; indirect

C)indirect; indirect

D)indirect; direct

Unlock Deck

Unlock for access to all 50 flashcards in this deck.

Unlock Deck

k this deck

35

In general, NDF markets normally develop for country currencies having large cross-border capital movements, but still subject to convertibility restrictions.

Unlock Deck

Unlock for access to all 50 flashcards in this deck.

Unlock Deck

k this deck

36

Nondeliverable Forwards were originally envisioned as a method of currency speculation, but it is now estimated that 70% of NDFs are trading for hedging purposes.

Unlock Deck

Unlock for access to all 50 flashcards in this deck.

Unlock Deck

k this deck

37

The following is an example of an American term foreign exchange quote:

A)$20/£.

B)€0.85/$.

C)100¥/€.

D)None of the above.

A)$20/£.

B)€0.85/$.

C)100¥/€.

D)None of the above.

Unlock Deck

Unlock for access to all 50 flashcards in this deck.

Unlock Deck

k this deck

38

A common type of swap transaction in the foreign exchange market is the ________ where the dealer buys the currency in the spot market and sells the same amount back to the same bank in the forward market.

A)"forward against spot"

B)"forspot"

C)"repurchase agreement"

D)"spot against forward"

A)"forward against spot"

B)"forspot"

C)"repurchase agreement"

D)"spot against forward"

Unlock Deck

Unlock for access to all 50 flashcards in this deck.

Unlock Deck

k this deck

39

Which of the following is NOT true regarding nondeliverable forward (NDF)contracts?

A)NDFs are used primarily for emerging market currencies.

B)Pricing of NDFs reflects basic interest rate differentials plus an additional premium charged for dollar settlement.

C)NDFs can only be traded by central banks.

D)All of the above are true.

A)NDFs are used primarily for emerging market currencies.

B)Pricing of NDFs reflects basic interest rate differentials plus an additional premium charged for dollar settlement.

C)NDFs can only be traded by central banks.

D)All of the above are true.

Unlock Deck

Unlock for access to all 50 flashcards in this deck.

Unlock Deck

k this deck

40

From the viewpoint of a British investor, which of the following would be a direct quote in the foreign exchange market?

A)SF2.40/£

B)$1.50/£

C)£0.55/€

D)$0.90/€

A)SF2.40/£

B)$1.50/£

C)£0.55/€

D)$0.90/€

Unlock Deck

Unlock for access to all 50 flashcards in this deck.

Unlock Deck

k this deck

41

Given the following exchange rates, which of the multiple-choice choices represents a potentially profitable intermarket arbitrage opportunity? ¥129.87/$

€1.1226/$

€0.00864/¥

A)¥115.69/€

B)¥114.96/€

C)$0.8908/€

D)$0.0077/¥

€1.1226/$

€0.00864/¥

A)¥115.69/€

B)¥114.96/€

C)$0.8908/€

D)$0.0077/¥

Unlock Deck

Unlock for access to all 50 flashcards in this deck.

Unlock Deck

k this deck

42

The European and American terms for foreign currency exchange are square roots of one another.

Unlock Deck

Unlock for access to all 50 flashcards in this deck.

Unlock Deck

k this deck

43

Most transactions in the interbank foreign exchange trading are primarily conducted via telecommunication techniques and little is conducted face-to-face.

Unlock Deck

Unlock for access to all 50 flashcards in this deck.

Unlock Deck

k this deck

44

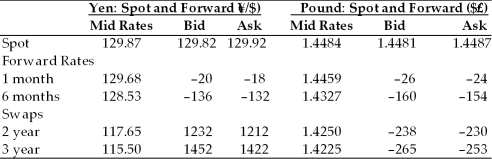

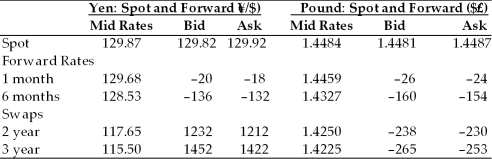

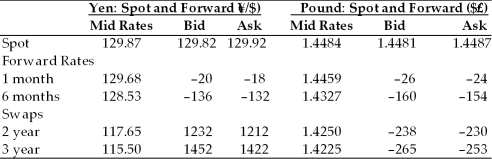

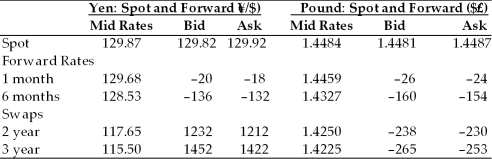

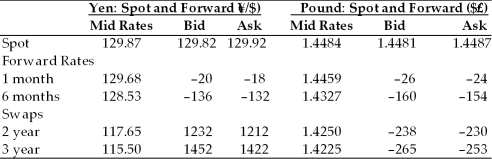

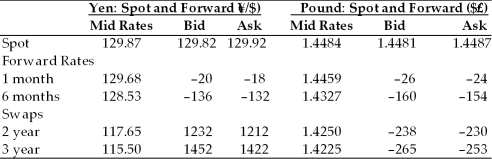

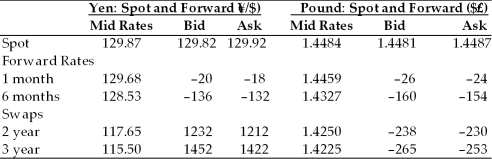

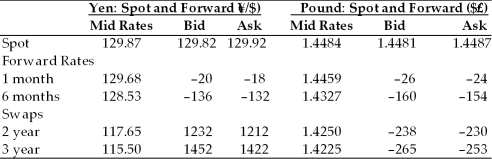

TABLE 6.1

Use the table to answer following question(s).

Refer to Table 6.1. The one-month forward bid price for dollars as denominated in Japanese yen is ________.

A)-¥20

B)-¥18

C)¥129.74/$

D)¥129.62/$

Use the table to answer following question(s).

Refer to Table 6.1. The one-month forward bid price for dollars as denominated in Japanese yen is ________.

A)-¥20

B)-¥18

C)¥129.74/$

D)¥129.62/$

Unlock Deck

Unlock for access to all 50 flashcards in this deck.

Unlock Deck

k this deck

45

TABLE 6.1

Use the table to answer following question(s).

Refer to Table 6.1. The ask price for the two-year swap for a British pound is ________.

A)$1.4250/£

B)$1.4257/£

C)-$230

D)-$238

Use the table to answer following question(s).

Refer to Table 6.1. The ask price for the two-year swap for a British pound is ________.

A)$1.4250/£

B)$1.4257/£

C)-$230

D)-$238

Unlock Deck

Unlock for access to all 50 flashcards in this deck.

Unlock Deck

k this deck

46

________ make money on currency exchanges by the difference between the ________ price, or the price they offer to pay, and the ________ price, or the price at which they offer to sell the currency.

A)Dealers; ask; bid

B)Dealers; bid; ask

C)Brokers; ask; bid

D)Brokers; bid; ask

A)Dealers; ask; bid

B)Dealers; bid; ask

C)Brokers; ask; bid

D)Brokers; bid; ask

Unlock Deck

Unlock for access to all 50 flashcards in this deck.

Unlock Deck

k this deck

47

The U.S. dollar suddenly changes in value against the euro moving from an exchange rate of $0.8909/euro to $0.08709/€. Thus, the dollar has ________ by ________.

A)appreciated; 2.30%

B)depreciated; 2.30%

C)appreciated; 2.24%

D)depreciated; 2.24%

A)appreciated; 2.30%

B)depreciated; 2.30%

C)appreciated; 2.24%

D)depreciated; 2.24%

Unlock Deck

Unlock for access to all 50 flashcards in this deck.

Unlock Deck

k this deck

48

When the cross rate for currencies offered by two banks differs from the exchange rate offered by a third bank, a triangular arbitrage opportunity exists.

Unlock Deck

Unlock for access to all 50 flashcards in this deck.

Unlock Deck

k this deck

49

TABLE 6.1

Use the table to answer following question(s).

Refer to Table 6.1. The current spot rate of dollars per pound as quoted in a newspaper is ________ or ________.

A)£1.4484/$; $0.6904/£

B)$1.4481/£; £0.6906/$

C)$1.4484/£; £0.6904/$

D)£1.4487/$; $0.6903/£

Use the table to answer following question(s).

Refer to Table 6.1. The current spot rate of dollars per pound as quoted in a newspaper is ________ or ________.

A)£1.4484/$; $0.6904/£

B)$1.4481/£; £0.6906/$

C)$1.4484/£; £0.6904/$

D)£1.4487/$; $0.6903/£

Unlock Deck

Unlock for access to all 50 flashcards in this deck.

Unlock Deck

k this deck

50

TABLE 6.1

Use the table to answer following question(s).

Refer to Table 6.1. According to the information provided in the table, the 6-month yen is selling at a forward ________ of approximately ________ per annum. (Use the mid rates to make your calculations.)

A)discount; 2.09%

B)discount; 2.06%

C)premium; 2.09%

D)premium; 2.06%

Use the table to answer following question(s).

Refer to Table 6.1. According to the information provided in the table, the 6-month yen is selling at a forward ________ of approximately ________ per annum. (Use the mid rates to make your calculations.)

A)discount; 2.09%

B)discount; 2.06%

C)premium; 2.09%

D)premium; 2.06%

Unlock Deck

Unlock for access to all 50 flashcards in this deck.

Unlock Deck

k this deck