Deck 6: Inventories

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

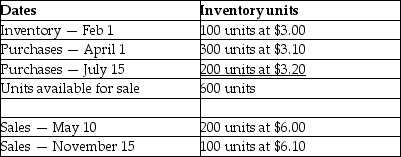

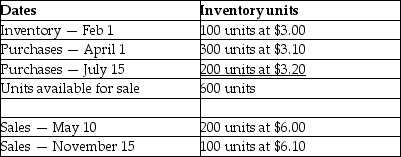

Question

Question

Question

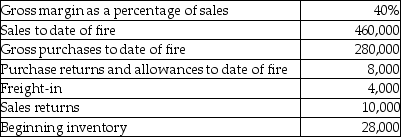

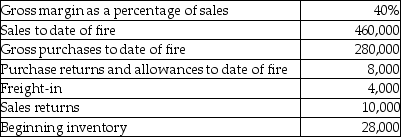

Question

Question

Question

Question

Question

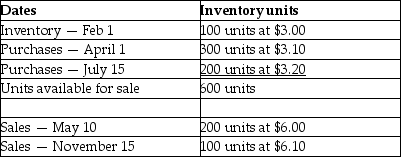

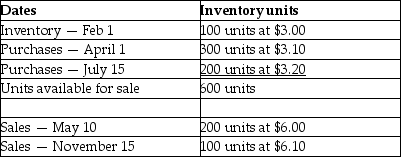

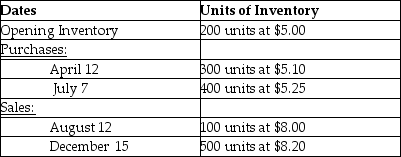

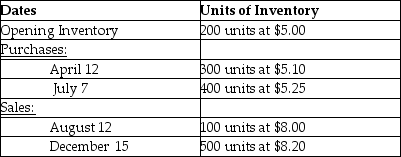

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/156

Play

Full screen (f)

Deck 6: Inventories

1

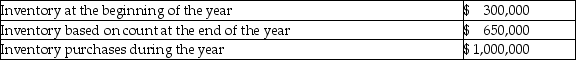

Using the following information, what amount of "shrinkage" would be identified under the periodic inventory system?

A)$ 0

B)$300,000

C)$650,000

D)$700,000

A)$ 0

B)$300,000

C)$650,000

D)$700,000

A

2

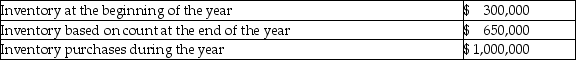

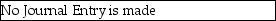

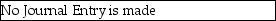

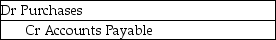

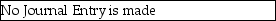

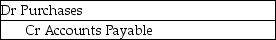

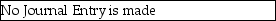

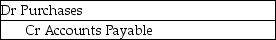

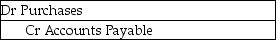

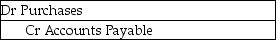

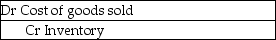

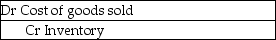

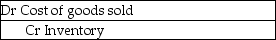

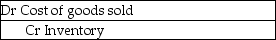

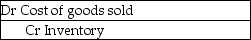

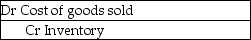

What journal entry is required when inventory is sold during the year under the periodic inventory system?

A)

B)

C)

D)

A)

B)

C)

D)

C

3

What costs are not included in the cost of inventories?

A)Raw materials.

B)Labour used to make the finished product.

C)Costs to deliver raw materials to the company.

D)Costs to ship goods to customers.

A)Raw materials.

B)Labour used to make the finished product.

C)Costs to deliver raw materials to the company.

D)Costs to ship goods to customers.

D

4

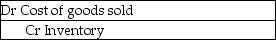

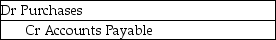

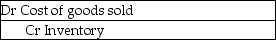

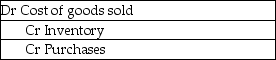

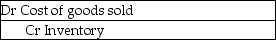

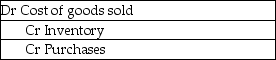

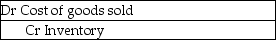

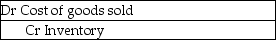

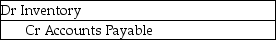

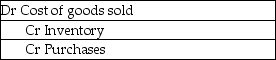

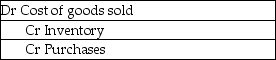

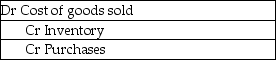

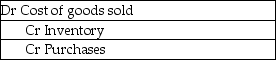

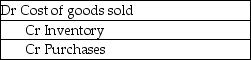

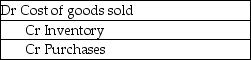

What journal entry is required when inventory is sold during the year under the perpetual inventory system?

A)

B)

C)

D)

A)

B)

C)

D)

Unlock Deck

Unlock for access to all 156 flashcards in this deck.

Unlock Deck

k this deck

5

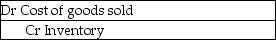

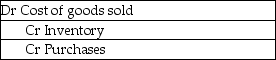

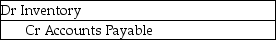

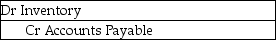

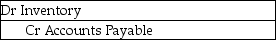

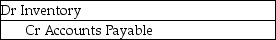

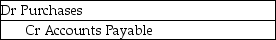

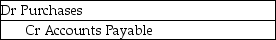

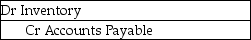

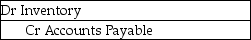

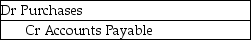

What journal entry is required when inventory is purchased under the periodic inventory system?

A)

B)

C)

D)

A)

B)

C)

D)

Unlock Deck

Unlock for access to all 156 flashcards in this deck.

Unlock Deck

k this deck

6

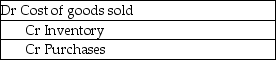

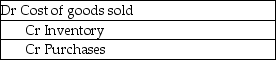

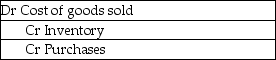

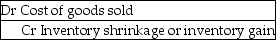

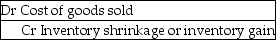

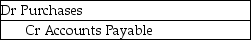

Which of the following is a potential journal entry required after the inventory count under the periodic inventory system?

A)

B)

C)

D)

A)

B)

C)

D)

Unlock Deck

Unlock for access to all 156 flashcards in this deck.

Unlock Deck

k this deck

7

Which statement is not correct about the periodic inventory system for inventory management?

A)The periodic inventory system keeps continuous information about the amount of inventory on hand.

B)The cost of goods sold is a calculated number under the periodic inventory system.

C)Under both the periodic and perpetual systems, the final amounts reported in financial statements are the same.

D)The perpetual inventory system provides more information to allow an enterprise to better manage its inventories.

A)The periodic inventory system keeps continuous information about the amount of inventory on hand.

B)The cost of goods sold is a calculated number under the periodic inventory system.

C)Under both the periodic and perpetual systems, the final amounts reported in financial statements are the same.

D)The perpetual inventory system provides more information to allow an enterprise to better manage its inventories.

Unlock Deck

Unlock for access to all 156 flashcards in this deck.

Unlock Deck

k this deck

8

What issues arise on the initial recognition and measurement of inventory?

A)Determining which expenditures to capitalize into the "inventory" account.

B)Determining which expenditures to expense into the "cost of goods sold" account.

C)Determining how much of the costs recognized in inventory should be expensed in the year.

D)Determining the appropriate valuation of inventories that remain on hand.

A)Determining which expenditures to capitalize into the "inventory" account.

B)Determining which expenditures to expense into the "cost of goods sold" account.

C)Determining how much of the costs recognized in inventory should be expensed in the year.

D)Determining the appropriate valuation of inventories that remain on hand.

Unlock Deck

Unlock for access to all 156 flashcards in this deck.

Unlock Deck

k this deck

9

Which statement is correct for about inventory systems?

A)The periodic inventory system provides more information to allow an enterprise to better manage its inventories.

B)Cost of goods sold is a not a calculated number under the periodic inventory system.

C)The final amounts reported in statements are the same under both the periodic and perpetual systems.

D)The periodic inventory system continuously updates information about the amount of inventory on hand.

A)The periodic inventory system provides more information to allow an enterprise to better manage its inventories.

B)Cost of goods sold is a not a calculated number under the periodic inventory system.

C)The final amounts reported in statements are the same under both the periodic and perpetual systems.

D)The periodic inventory system continuously updates information about the amount of inventory on hand.

Unlock Deck

Unlock for access to all 156 flashcards in this deck.

Unlock Deck

k this deck

10

Which statement is correct about the system used to account for inventories?

A)Organizations must use the perpetual system to determine the amount of inventory and cost of goods sold.

B)The perpetual system is used to determine the amount of inventory and the periodic system is used to determine the cost of goods sold.

C)The perpetual and periodic system are both acceptable methods to use for inventory control.

D)The balance sheet under the perpetual system is different than that under the periodic system.

A)Organizations must use the perpetual system to determine the amount of inventory and cost of goods sold.

B)The perpetual system is used to determine the amount of inventory and the periodic system is used to determine the cost of goods sold.

C)The perpetual and periodic system are both acceptable methods to use for inventory control.

D)The balance sheet under the perpetual system is different than that under the periodic system.

Unlock Deck

Unlock for access to all 156 flashcards in this deck.

Unlock Deck

k this deck

11

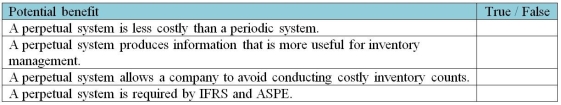

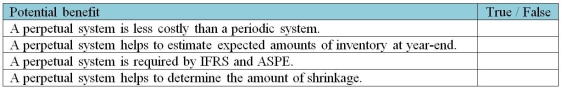

Identify whether the following are benefits of using a perpetual inventory system (in comparison to a periodic system).

Unlock Deck

Unlock for access to all 156 flashcards in this deck.

Unlock Deck

k this deck

12

Explain how a manufacturing company can manipulate earnings by including non-production costs in inventories. What does an auditor or financial statement user do to detect this type of manipulation?

Unlock Deck

Unlock for access to all 156 flashcards in this deck.

Unlock Deck

k this deck

13

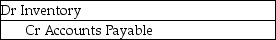

What journal entry is required when inventory is purchased under the perpetual inventory system?

A)

B)

C)

D)

A)

B)

C)

D)

Unlock Deck

Unlock for access to all 156 flashcards in this deck.

Unlock Deck

k this deck

14

Which statement is not correct about the perpetual inventory system for inventory management?

A)This system keeps track of additions to and withdrawals from inventory.

B)It is not necessary to conduct an inventory count if the perpetual system is used.

C)This method produces timely information for management.

D)With this method, the company knows the inventory on hand and the related cost of goods sold at any point in time.

A)This system keeps track of additions to and withdrawals from inventory.

B)It is not necessary to conduct an inventory count if the perpetual system is used.

C)This method produces timely information for management.

D)With this method, the company knows the inventory on hand and the related cost of goods sold at any point in time.

Unlock Deck

Unlock for access to all 156 flashcards in this deck.

Unlock Deck

k this deck

15

Explain how manufacturing companies can manipulate earnings through its production process. What should an auditor or financial statement user do to detect this type of manipulation?

Unlock Deck

Unlock for access to all 156 flashcards in this deck.

Unlock Deck

k this deck

16

What is the meaning of the terms "F.O.B. destination point"?

A)The buyer has ownership of the goods only when they arrive.

B)The point at which the buyer takes legal possession of the goods.

C)The buyer has ownership of the goods as soon as they are shipped.

D)The buyer remains liable for any loss during shipment.

A)The buyer has ownership of the goods only when they arrive.

B)The point at which the buyer takes legal possession of the goods.

C)The buyer has ownership of the goods as soon as they are shipped.

D)The buyer remains liable for any loss during shipment.

Unlock Deck

Unlock for access to all 156 flashcards in this deck.

Unlock Deck

k this deck

17

What journal entry is required after the inventory count under the perpetual inventory system when shrinkage has been detected?

A)

B)

C)

D)

A)

B)

C)

D)

Unlock Deck

Unlock for access to all 156 flashcards in this deck.

Unlock Deck

k this deck

18

Compare the perpetual inventory control system and the periodic inventory control system. Which system provides better information for inventory management?

Unlock Deck

Unlock for access to all 156 flashcards in this deck.

Unlock Deck

k this deck

19

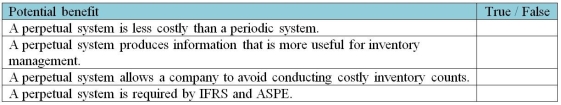

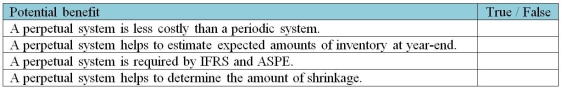

Identify whether the following are benefits of using a perpetual inventory system (in comparison to a periodic system).

Unlock Deck

Unlock for access to all 156 flashcards in this deck.

Unlock Deck

k this deck

20

Which goods in transit would be recorded in inventory at year end?

A)Goods purchased with terms F.O.B. destination point that were received after year end.

B)Goods sold with terms F.O.B. shipping point that were shipped before year end.

C)Goods purchased with terms F.O.B. shipping point that were received after year end.

D)Goods sold with terms F.O.B. destination point that were shipped before year end.

A)Goods purchased with terms F.O.B. destination point that were received after year end.

B)Goods sold with terms F.O.B. shipping point that were shipped before year end.

C)Goods purchased with terms F.O.B. shipping point that were received after year end.

D)Goods sold with terms F.O.B. destination point that were shipped before year end.

Unlock Deck

Unlock for access to all 156 flashcards in this deck.

Unlock Deck

k this deck

21

Which statement is not correct about overhead?

A)Fixed overhead is capitalized under absorption costing.

B)Fixed overhead is expensed under variable costing.

C)Variable overhead is expensed under both absorption and variable costing.

D)Both fixed and variable overhead are capitalized under absorption costing.

A)Fixed overhead is capitalized under absorption costing.

B)Fixed overhead is expensed under variable costing.

C)Variable overhead is expensed under both absorption and variable costing.

D)Both fixed and variable overhead are capitalized under absorption costing.

Unlock Deck

Unlock for access to all 156 flashcards in this deck.

Unlock Deck

k this deck

22

Explain what problems are created for the auditor by the use of the absorption costing method under GAAP.

Unlock Deck

Unlock for access to all 156 flashcards in this deck.

Unlock Deck

k this deck

23

Which transaction would be included in the year end inventory?

A)Goods received on consignment at year end.

B)Goods shipped out on consignment at year end.

C)Goods shipped out F.O.B. shipping point at year end.

D)Goods received after year end, shipped FOB destination.

A)Goods received on consignment at year end.

B)Goods shipped out on consignment at year end.

C)Goods shipped out F.O.B. shipping point at year end.

D)Goods received after year end, shipped FOB destination.

Unlock Deck

Unlock for access to all 156 flashcards in this deck.

Unlock Deck

k this deck

24

What is the meaning of the terms "F.O.B. shipping point"?

A)The buyer takes ownership of the goods once they arrive at their receiving location.

B)The point at which the buyer takes legal possession of the goods.

C)The buyer takes ownership of the goods as soon as they are shipped to the buyer.

D)The seller remains liable for any loss or damage incurred during shipment.

A)The buyer takes ownership of the goods once they arrive at their receiving location.

B)The point at which the buyer takes legal possession of the goods.

C)The buyer takes ownership of the goods as soon as they are shipped to the buyer.

D)The seller remains liable for any loss or damage incurred during shipment.

Unlock Deck

Unlock for access to all 156 flashcards in this deck.

Unlock Deck

k this deck

25

Explain the meaning of product costs and period costs. Discuss which costs should be included in the cost of inventories.

Unlock Deck

Unlock for access to all 156 flashcards in this deck.

Unlock Deck

k this deck

26

Which goods in transit would not be recorded in the seller's inventory at year end?

A)Goods sold with terms F.O.B. destination point that were shipped at year end.

B)Goods sold with terms F.O.B. shipping point that were shipped one day before year end.

C)Goods sold F.O.B. destination point that remained on the shipping dock until one day after year end.

D)Goods sold F.O.B. shipping point that were shipped two days after year end.

A)Goods sold with terms F.O.B. destination point that were shipped at year end.

B)Goods sold with terms F.O.B. shipping point that were shipped one day before year end.

C)Goods sold F.O.B. destination point that remained on the shipping dock until one day after year end.

D)Goods sold F.O.B. shipping point that were shipped two days after year end.

Unlock Deck

Unlock for access to all 156 flashcards in this deck.

Unlock Deck

k this deck

27

Which statement is correct about overhead?

A)Fixed overhead is capitalized under absorption costing.

B)Fixed overhead is capitalized under variable costing.

C)Variable overhead is always expensed.

D)Selling costs are part of fixed overhead.

A)Fixed overhead is capitalized under absorption costing.

B)Fixed overhead is capitalized under variable costing.

C)Variable overhead is always expensed.

D)Selling costs are part of fixed overhead.

Unlock Deck

Unlock for access to all 156 flashcards in this deck.

Unlock Deck

k this deck

28

Which goods in transit would not be recorded in the buyer's inventory at year end?

A)Goods purchased with terms F.O.B. destination point that were received at year end.

B)Goods purchased with terms F.O.B. shipping point that were received at year end.

C)Goods purchased with terms F.O.B. destination point that were received after year end.

D)Goods purchased F.O.B. shipping point that were lost in shipment.

A)Goods purchased with terms F.O.B. destination point that were received at year end.

B)Goods purchased with terms F.O.B. shipping point that were received at year end.

C)Goods purchased with terms F.O.B. destination point that were received after year end.

D)Goods purchased F.O.B. shipping point that were lost in shipment.

Unlock Deck

Unlock for access to all 156 flashcards in this deck.

Unlock Deck

k this deck

29

Which statement is correct about variable costing?

A)Under this method, fixed overhead is considered a product cost because production cannot take place without these costs.

B)Under this method, fixed overhead is considered a period cost because such costs do not vary according to production level.

C)Under this method, variable overhead is considered a period cost because production cannot take place without these costs.

D)Under this method, selling costs are considered a product cost because production cannot take place without these costs.

A)Under this method, fixed overhead is considered a product cost because production cannot take place without these costs.

B)Under this method, fixed overhead is considered a period cost because such costs do not vary according to production level.

C)Under this method, variable overhead is considered a period cost because production cannot take place without these costs.

D)Under this method, selling costs are considered a product cost because production cannot take place without these costs.

Unlock Deck

Unlock for access to all 156 flashcards in this deck.

Unlock Deck

k this deck

30

Which goods in transit would be recorded in inventory at year end?

A)Goods purchased with terms F.O.B. destination point that were received after year end.

B)Goods purchased with terms F.O.B. shipping point that were received after year end.

C)Goods sold F.O.B. shipping point that were shipped two weeks before year end.

D)Goods returned for credit, with terms F.O.B. destination point, received two days after year end.

A)Goods purchased with terms F.O.B. destination point that were received after year end.

B)Goods purchased with terms F.O.B. shipping point that were received after year end.

C)Goods sold F.O.B. shipping point that were shipped two weeks before year end.

D)Goods returned for credit, with terms F.O.B. destination point, received two days after year end.

Unlock Deck

Unlock for access to all 156 flashcards in this deck.

Unlock Deck

k this deck

31

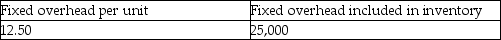

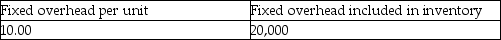

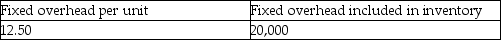

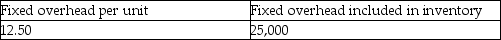

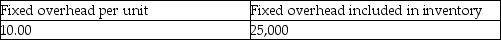

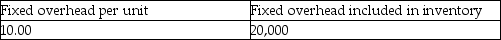

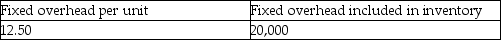

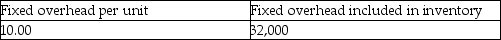

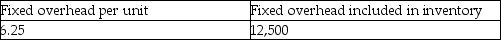

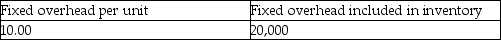

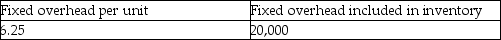

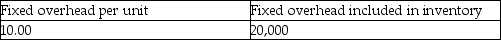

A company has fixed production overhead costs totalling $25,000. The normal production level is 2,500 units per year, yielding a standard fixed overhead rate of $10.00 per unit. If the actual production level is 2,000 units, how much would be the amount of fixed overhead per unit and the amount of total fixed overhead included in inventory? Select the letter for the best answer:

A)

B)

C)

D)

A)

B)

C)

D)

Unlock Deck

Unlock for access to all 156 flashcards in this deck.

Unlock Deck

k this deck

32

When can inventory be overstated under the absorption costing method? Explain the precautions within GAAP to prevent a potential overstatement of inventory under the absorption costing method.

Unlock Deck

Unlock for access to all 156 flashcards in this deck.

Unlock Deck

k this deck

33

Explain why the absorption costing method is appropriate under GAAP.

Unlock Deck

Unlock for access to all 156 flashcards in this deck.

Unlock Deck

k this deck

34

Lean Ltd. had a balance of $52,300 in the office supplies account at the start of the year. During the year, purchases of $141,700 were made and debited to office supplies account. At the end of the year, a physical count of the office supplies indicated $41,800 on hand. What was the office supplies expense for the year?

A)$141,700

B)$152,200

C)$183,500

D)$194,000

A)$141,700

B)$152,200

C)$183,500

D)$194,000

Unlock Deck

Unlock for access to all 156 flashcards in this deck.

Unlock Deck

k this deck

35

Which goods in transit would be recorded in inventory at year end?

A)Goods sold with terms F.O.B. destination point that were shipped at year end.

B)Goods sold with terms F.O.B. shipping point that were shipped before year end.

C)Goods purchased F.O.B. destination that have not been received by year-end.

D)Goods returned for credit before year-end, with terms F.O.B. shipping point.

A)Goods sold with terms F.O.B. destination point that were shipped at year end.

B)Goods sold with terms F.O.B. shipping point that were shipped before year end.

C)Goods purchased F.O.B. destination that have not been received by year-end.

D)Goods returned for credit before year-end, with terms F.O.B. shipping point.

Unlock Deck

Unlock for access to all 156 flashcards in this deck.

Unlock Deck

k this deck

36

Which transaction would not be included in year end inventory?

A)Goods received on consignment at year end.

B)Goods shipped out on consignment at year end.

C)Goods shipped FOB shipping point after year end.

D)Goods received at year end.

A)Goods received on consignment at year end.

B)Goods shipped out on consignment at year end.

C)Goods shipped FOB shipping point after year end.

D)Goods received at year end.

Unlock Deck

Unlock for access to all 156 flashcards in this deck.

Unlock Deck

k this deck

37

Which statement is correct about overhead?

A)Fixed overhead is expensed under absorption costing.

B)Fixed overhead is never capitalized.

C)Variable overhead is always capitalized.

D)Fixed overhead is capitalized under absorption costing.

A)Fixed overhead is expensed under absorption costing.

B)Fixed overhead is never capitalized.

C)Variable overhead is always capitalized.

D)Fixed overhead is capitalized under absorption costing.

Unlock Deck

Unlock for access to all 156 flashcards in this deck.

Unlock Deck

k this deck

38

What costs are not included in the cost of manufactured inventories?

A)Raw materials.

B)Labour to make the finished product.

C)Administrative costs.

D)Manufacturing overhead.

A)Raw materials.

B)Labour to make the finished product.

C)Administrative costs.

D)Manufacturing overhead.

Unlock Deck

Unlock for access to all 156 flashcards in this deck.

Unlock Deck

k this deck

39

Which statement is correct about absorption costing?

A)Under this method, fixed overhead is considered a product cost because production cannot take place without these costs.

B)Under this method, fixed overhead is considered a period cost because such costs do not vary according to production level.

C)Under this method, variable overhead is considered a period cost because such costs do not vary according to production level.

D)Under this method, selling costs are considered a product cost because such costs do not vary according to production level.

A)Under this method, fixed overhead is considered a product cost because production cannot take place without these costs.

B)Under this method, fixed overhead is considered a period cost because such costs do not vary according to production level.

C)Under this method, variable overhead is considered a period cost because such costs do not vary according to production level.

D)Under this method, selling costs are considered a product cost because such costs do not vary according to production level.

Unlock Deck

Unlock for access to all 156 flashcards in this deck.

Unlock Deck

k this deck

40

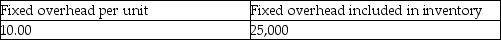

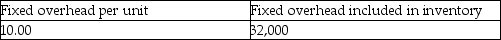

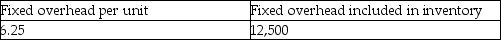

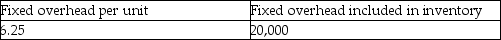

A company has fixed production overhead costs totalling $20,000. The normal production level is 2,000 units per year, yielding a standard fixed overhead rate of $10.00 per unit. If the actual production level is 3,200 units, how much would be the amount of fixed overhead per unit and the amount of total fixed overhead included in inventory? Select the letter for the best answer:

A)

B)

C)

D)

A)

B)

C)

D)

Unlock Deck

Unlock for access to all 156 flashcards in this deck.

Unlock Deck

k this deck

41

Which statement best explains the LIFO cost flow assumption?

A)A method that uses the most recent costs in the calculation of cost of sales.

B)A method that uses the cost of goods available for sale divided by the number of units available for sale.

C)A method that assigns costs to inventories and cost of sales based on actual costs of each item.

D)A method that uses the oldest costs in the calculation of cost of sales.

A)A method that uses the most recent costs in the calculation of cost of sales.

B)A method that uses the cost of goods available for sale divided by the number of units available for sale.

C)A method that assigns costs to inventories and cost of sales based on actual costs of each item.

D)A method that uses the oldest costs in the calculation of cost of sales.

Unlock Deck

Unlock for access to all 156 flashcards in this deck.

Unlock Deck

k this deck

42

Which inventory method provides the highest quality information for the balance sheet?

A)LIFO.

B)FIFO.

C)Weighted average.

D)Retail inventory.

A)LIFO.

B)FIFO.

C)Weighted average.

D)Retail inventory.

Unlock Deck

Unlock for access to all 156 flashcards in this deck.

Unlock Deck

k this deck

43

Which statement is correct about using a cost flow assumption?

A)An organization must use the same cost flow assumption as other organizations in its industry.

B)There is only one acceptable cost flow assumption under GAAP in Canada.

C)In Canada, organizations can use the FIFO or weighted average cost flow assumptions.

D)In Canada, organizations can use the FIFO, LIFO or weighted average cost flow assumptions.

A)An organization must use the same cost flow assumption as other organizations in its industry.

B)There is only one acceptable cost flow assumption under GAAP in Canada.

C)In Canada, organizations can use the FIFO or weighted average cost flow assumptions.

D)In Canada, organizations can use the FIFO, LIFO or weighted average cost flow assumptions.

Unlock Deck

Unlock for access to all 156 flashcards in this deck.

Unlock Deck

k this deck

44

Muscle Concrete mixes concrete and trucks it to construction sites. The company uses a standard costing system for the batches of concrete produced. The company has a fleet of 10 mixing trucks, each of which goes on three runs per day, 350 days per year under normal circumstances. The standard costs are as follows:

Standard costs per batch based on 1,050 batches per year Amount

Raw material - gravel, sand, cement, chemicals $1,000

Wages 400

Variable overhead - mixing truck depreciation, diesel fuel, etc. 450

Fixed overhead - depreciation on raw materials silo 400

Total production cost per batch $2,250

Opening inventory cost - all raw materials 1,000,000

Ending inventory cost - all raw material 450,000

During 2013, the company received an unusually large order for a big construction project. As a result, Muscle Concrete had to extend its operating hours and days, temporarily increasing output to 1,250 batches for the year. The company used the first-in, first-out cost flow assumption. Actual variable costs approximated standard costs per batch. Depreciation rates established at the beginning of the year remain valid for the year.

Required:

Determine the amount of cost of goods sold for 2013.

Standard costs per batch based on 1,050 batches per year Amount

Raw material - gravel, sand, cement, chemicals $1,000

Wages 400

Variable overhead - mixing truck depreciation, diesel fuel, etc. 450

Fixed overhead - depreciation on raw materials silo 400

Total production cost per batch $2,250

Opening inventory cost - all raw materials 1,000,000

Ending inventory cost - all raw material 450,000

During 2013, the company received an unusually large order for a big construction project. As a result, Muscle Concrete had to extend its operating hours and days, temporarily increasing output to 1,250 batches for the year. The company used the first-in, first-out cost flow assumption. Actual variable costs approximated standard costs per batch. Depreciation rates established at the beginning of the year remain valid for the year.

Required:

Determine the amount of cost of goods sold for 2013.

Unlock Deck

Unlock for access to all 156 flashcards in this deck.

Unlock Deck

k this deck

45

Explain how a merchandising company can manipulate earnings through its year-end inventories. What can an auditor do to detect this type of manipulation?

Unlock Deck

Unlock for access to all 156 flashcards in this deck.

Unlock Deck

k this deck

46

Which statement is correct about cost allocation methods under GAAP?

A)FIFO method expenses the oldest costs first.

B)FIFO method has the oldest costs on the balance sheet.

C)FIFO method has the most recent costs in the income statement.

D)FIFO is not an acceptable cost allocation method.

A)FIFO method expenses the oldest costs first.

B)FIFO method has the oldest costs on the balance sheet.

C)FIFO method has the most recent costs in the income statement.

D)FIFO is not an acceptable cost allocation method.

Unlock Deck

Unlock for access to all 156 flashcards in this deck.

Unlock Deck

k this deck

47

Explain how fixed overhead costs should be accounted for if a plant is made idle due to a prolonged strike.

Unlock Deck

Unlock for access to all 156 flashcards in this deck.

Unlock Deck

k this deck

48

Which statement best explains the FIFO cost flow assumption?

A)A method that uses the most recent costs in the calculation of cost of sales.

B)A method that uses the cost of goods available for sale divided by the number of units available for sale.

C)A method that assigns costs to inventories and cost of sales based on actual costs of each item.

D)A method that uses the oldest costs in the calculation of cost of sales.

A)A method that uses the most recent costs in the calculation of cost of sales.

B)A method that uses the cost of goods available for sale divided by the number of units available for sale.

C)A method that assigns costs to inventories and cost of sales based on actual costs of each item.

D)A method that uses the oldest costs in the calculation of cost of sales.

Unlock Deck

Unlock for access to all 156 flashcards in this deck.

Unlock Deck

k this deck

49

Which statement best depicts the inventory cost flow equation?

A)Beginning inventory + Sales = Cost of sales + Ending inventory.

B)Beginning inventory + Goods manufactured = Cost of sales + Ending inventory.

C)Beginning inventory - Purchase returns = Cost of sales + Ending inventory.

D)Ending inventory + Purchases = Cost of sales + Beginning inventory.

A)Beginning inventory + Sales = Cost of sales + Ending inventory.

B)Beginning inventory + Goods manufactured = Cost of sales + Ending inventory.

C)Beginning inventory - Purchase returns = Cost of sales + Ending inventory.

D)Ending inventory + Purchases = Cost of sales + Beginning inventory.

Unlock Deck

Unlock for access to all 156 flashcards in this deck.

Unlock Deck

k this deck

50

What is the purpose of using a "cost allocation system" such as FIFO?

A)Determining which expenditures to capitalize into the "inventory" account.

B)Determining which expenditures to expense into the "cost of goods sold" account.

C)Determining how much of the costs recognized in inventory should be expensed in the year.

D)Determining the appropriate valuation of inventories that remain on hand.

A)Determining which expenditures to capitalize into the "inventory" account.

B)Determining which expenditures to expense into the "cost of goods sold" account.

C)Determining how much of the costs recognized in inventory should be expensed in the year.

D)Determining the appropriate valuation of inventories that remain on hand.

Unlock Deck

Unlock for access to all 156 flashcards in this deck.

Unlock Deck

k this deck

51

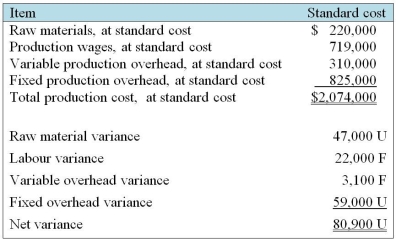

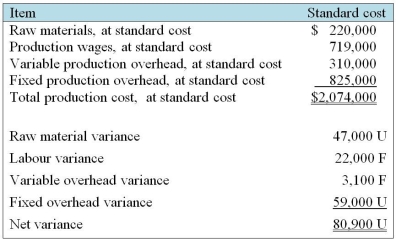

Outdoor Devices Inc. manufactures sport hunting equipment. The company's operations had the following results for 2012. Actual production volume approximated normal levels. F = favourable variance, meaning actual costs were below standard; U = unfavourable variance, meaning actual costs exceeded standard. Assume all variances are considered to be material.  Required:

Required:

a. Determine the amount that Outdoor should include in the cost of inventories produced in the year.

b. If actual production volume were higher than normal, what would be the effect on the cost of inventories on a per unit basis? What if actual production volume were lower than normal?

Required:

Required:a. Determine the amount that Outdoor should include in the cost of inventories produced in the year.

b. If actual production volume were higher than normal, what would be the effect on the cost of inventories on a per unit basis? What if actual production volume were lower than normal?

Unlock Deck

Unlock for access to all 156 flashcards in this deck.

Unlock Deck

k this deck

52

Which statement best depicts the inventory cost flow equation?

A)Cost of goods available for sale = Beginning inventory + Ending inventory.

B)Beginning inventory + Purchases = Cost of sales + Ending inventory.

C)Sales - Cost of goods sold = Gross margin.

D)Gross margin - Operating expenses = Operating income.

A)Cost of goods available for sale = Beginning inventory + Ending inventory.

B)Beginning inventory + Purchases = Cost of sales + Ending inventory.

C)Sales - Cost of goods sold = Gross margin.

D)Gross margin - Operating expenses = Operating income.

Unlock Deck

Unlock for access to all 156 flashcards in this deck.

Unlock Deck

k this deck

53

Why is a cost flow assumption used?

A)This is a systematic method for allocating costs between beginning inventory and ending inventory.

B)This is a systematic method for allocating costs between cost of goods available for sale and ending inventory.

C)This is a systematic method for allocating costs between cost of goods sold and ending inventory.

D)This is a systematic method for allocating costs between cost of goods manufactured and cost of goods sold.

A)This is a systematic method for allocating costs between beginning inventory and ending inventory.

B)This is a systematic method for allocating costs between cost of goods available for sale and ending inventory.

C)This is a systematic method for allocating costs between cost of goods sold and ending inventory.

D)This is a systematic method for allocating costs between cost of goods manufactured and cost of goods sold.

Unlock Deck

Unlock for access to all 156 flashcards in this deck.

Unlock Deck

k this deck

54

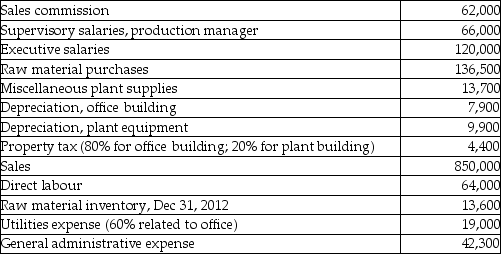

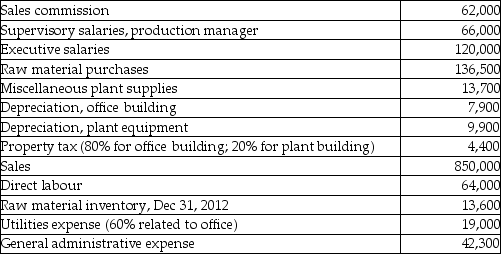

Inventive Controls Ltd. was incorporated and started business early in January 2012 to manufacture electronic control devices to monitor traffic. Inventive purchased a small manufacturing plant and office building in a new industrial park and was in operation immediately. General ledger account balances at December 31, 2012 are as follows:

At December 31, 2012, there was no work-in-process, but 30% of the units manufactured remained in ending finished goods inventory. Inventive uses the straight-line method to calculate depreciation.

At December 31, 2012, there was no work-in-process, but 30% of the units manufactured remained in ending finished goods inventory. Inventive uses the straight-line method to calculate depreciation.

Required:

a. Calculate the value of cost of goods sold and ending finished goods inventory under IFRS.

b. Prepare an income statement for Inventive for the year ended December 31, 2012.

At December 31, 2012, there was no work-in-process, but 30% of the units manufactured remained in ending finished goods inventory. Inventive uses the straight-line method to calculate depreciation.

At December 31, 2012, there was no work-in-process, but 30% of the units manufactured remained in ending finished goods inventory. Inventive uses the straight-line method to calculate depreciation.Required:

a. Calculate the value of cost of goods sold and ending finished goods inventory under IFRS.

b. Prepare an income statement for Inventive for the year ended December 31, 2012.

Unlock Deck

Unlock for access to all 156 flashcards in this deck.

Unlock Deck

k this deck

55

Which statement is correct about using a cost flow assumption?

A)This is an assumption about the flow of goods through the various departments in an organization.

B)This is an assumption about the flow of costs between the income statement and the balance sheet.

C)There is only one acceptable cost flow assumption under GAAP in Canada.

D)Specific identification and LIFO are both acceptable cost flow assumptions in Canada.

A)This is an assumption about the flow of goods through the various departments in an organization.

B)This is an assumption about the flow of costs between the income statement and the balance sheet.

C)There is only one acceptable cost flow assumption under GAAP in Canada.

D)Specific identification and LIFO are both acceptable cost flow assumptions in Canada.

Unlock Deck

Unlock for access to all 156 flashcards in this deck.

Unlock Deck

k this deck

56

Which statement is correct about cost allocation methods under GAAP?

A)LIFO method expenses the oldest costs first.

B)LIFO method has the most recent costs on the balance sheet.

C)LIFO method has the most recent costs in the income statement.

D)LIFO is an acceptable cost allocation method.

A)LIFO method expenses the oldest costs first.

B)LIFO method has the most recent costs on the balance sheet.

C)LIFO method has the most recent costs in the income statement.

D)LIFO is an acceptable cost allocation method.

Unlock Deck

Unlock for access to all 156 flashcards in this deck.

Unlock Deck

k this deck

57

Which method cannot be used in Canada to allocate inventory costs between the income statement and the balance sheet?

A)Specific identification.

B)FIFO.

C)Retail inventory method.

D)LIFO.

A)Specific identification.

B)FIFO.

C)Retail inventory method.

D)LIFO.

Unlock Deck

Unlock for access to all 156 flashcards in this deck.

Unlock Deck

k this deck

58

Which statement is correct about the various cost allocation methods available in GAAP?

A)FIFO is used in the initial recognition and measurement of inventory.

B)LIFO is used to measure the ending inventory balance on the balance sheet.

C)Weighted average is not an acceptable allocation method for the income statement.

D)Moving weighted average is the perpetual weighted average cost method.

A)FIFO is used in the initial recognition and measurement of inventory.

B)LIFO is used to measure the ending inventory balance on the balance sheet.

C)Weighted average is not an acceptable allocation method for the income statement.

D)Moving weighted average is the perpetual weighted average cost method.

Unlock Deck

Unlock for access to all 156 flashcards in this deck.

Unlock Deck

k this deck

59

Which inventory method provides the highest quality information for the income statement?

A)LIFO.

B)FIFO.

C)Weighted average.

D)Retail inventory.

A)LIFO.

B)FIFO.

C)Weighted average.

D)Retail inventory.

Unlock Deck

Unlock for access to all 156 flashcards in this deck.

Unlock Deck

k this deck

60

Which statement is correct about the specific identification method?

A)It is prone to earnings management if used for distinguishable items.

B)This method is most appropriate for low-value inventory items.

C)It is inexpensive to maintain inventory records under this method.

D)This method is most appropriate for high-value inventory items.

A)It is prone to earnings management if used for distinguishable items.

B)This method is most appropriate for low-value inventory items.

C)It is inexpensive to maintain inventory records under this method.

D)This method is most appropriate for high-value inventory items.

Unlock Deck

Unlock for access to all 156 flashcards in this deck.

Unlock Deck

k this deck

61

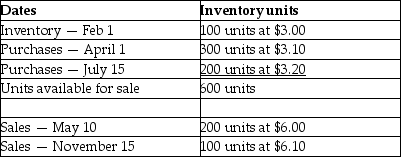

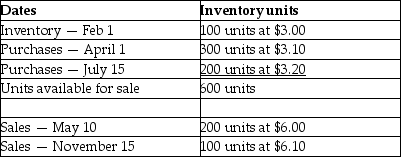

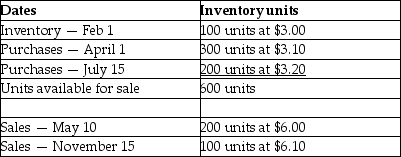

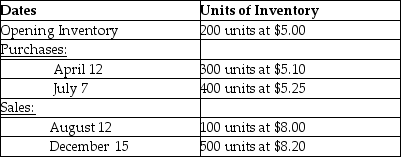

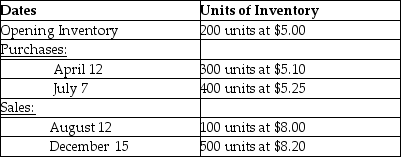

The following information was taken from the inventory records of Hari Ltd.:  What would be the cost of goods sold, assuming that the LIFO method is used in a perpetual inventory system?

What would be the cost of goods sold, assuming that the LIFO method is used in a perpetual inventory system?

A)$920

B)$930

C)$940

D)$950

What would be the cost of goods sold, assuming that the LIFO method is used in a perpetual inventory system?

What would be the cost of goods sold, assuming that the LIFO method is used in a perpetual inventory system?A)$920

B)$930

C)$940

D)$950

Unlock Deck

Unlock for access to all 156 flashcards in this deck.

Unlock Deck

k this deck

62

The following information was taken from the inventory records of Penelope Ltd.:  What would be the gross margin, assuming that the weighted-average method is used in a periodic inventory system?

What would be the gross margin, assuming that the weighted-average method is used in a periodic inventory system?

A)$310

B)$875

C)$935

D)$1,810

What would be the gross margin, assuming that the weighted-average method is used in a periodic inventory system?

What would be the gross margin, assuming that the weighted-average method is used in a periodic inventory system?A)$310

B)$875

C)$935

D)$1,810

Unlock Deck

Unlock for access to all 156 flashcards in this deck.

Unlock Deck

k this deck

63

Which statement best explains the gross margin method?

A)A method for estimating cost of goods sold by applying an average gross margin to the amount of sales recorded in a period.

B)A method that assigns costs to inventories and cost of sales based on actual costs of each item.

C)A method of estimating the cost of ending inventory by applying an average sales margin to the retail price of products.

D)This method is least appropriate for inventory items that are not distinguishable from one another.

A)A method for estimating cost of goods sold by applying an average gross margin to the amount of sales recorded in a period.

B)A method that assigns costs to inventories and cost of sales based on actual costs of each item.

C)A method of estimating the cost of ending inventory by applying an average sales margin to the retail price of products.

D)This method is least appropriate for inventory items that are not distinguishable from one another.

Unlock Deck

Unlock for access to all 156 flashcards in this deck.

Unlock Deck

k this deck

64

Given the following information, what would the ending inventory value per unit be on April 30 under the weighted-average method in a perpetual inventory system?

A)$5.05

B)$5.06

C)$5.075

D)$5.15

A)$5.05

B)$5.06

C)$5.075

D)$5.15

Unlock Deck

Unlock for access to all 156 flashcards in this deck.

Unlock Deck

k this deck

65

Which statement is correct about the retail inventory method?

A)It represents a cost flow assumption.

B)It estimates cost of goods sold by applying an average gross margin to the amount of sales recorded in the period.

C)It can misstate inventory values if unreliable information is used about profit margins.

D)It provides direct information about actual cost of goods sold or ending inventory.

A)It represents a cost flow assumption.

B)It estimates cost of goods sold by applying an average gross margin to the amount of sales recorded in the period.

C)It can misstate inventory values if unreliable information is used about profit margins.

D)It provides direct information about actual cost of goods sold or ending inventory.

Unlock Deck

Unlock for access to all 156 flashcards in this deck.

Unlock Deck

k this deck

66

Under which cost flow assumption is it the easiest for management to manipulate income?

A)LIFO.

B)FIFO.

C)Weighted average.

D)Income manipulation is not possible through any of these methods.

A)LIFO.

B)FIFO.

C)Weighted average.

D)Income manipulation is not possible through any of these methods.

Unlock Deck

Unlock for access to all 156 flashcards in this deck.

Unlock Deck

k this deck

67

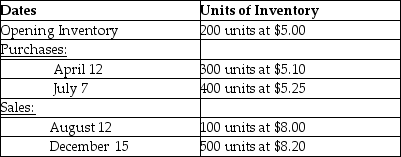

Given the following information, what would the ending inventory value be on December 31 under the LIFO method in a periodic inventory system?

A)$1,510

B)$1,575

C)$2,075

D)$3,120

A)$1,510

B)$1,575

C)$2,075

D)$3,120

Unlock Deck

Unlock for access to all 156 flashcards in this deck.

Unlock Deck

k this deck

68

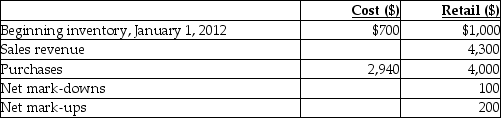

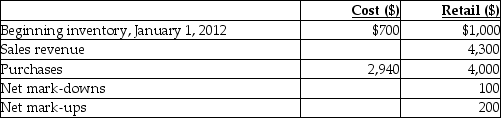

West Retail uses the retail method of inventory valued at average cost, lower of cost and market. The following information relates to 2012:  What is the retail value of the 2012 ending inventory?

What is the retail value of the 2012 ending inventory?

A)$560

B)$700

C)$800

D)$1,000

What is the retail value of the 2012 ending inventory?

What is the retail value of the 2012 ending inventory?A)$560

B)$700

C)$800

D)$1,000

Unlock Deck

Unlock for access to all 156 flashcards in this deck.

Unlock Deck

k this deck

69

Which statement best explains the retail inventory method?

A)A method for estimating cost of goods sold by applying an average gross margin to the amount of sales recorded in a period.

B)A method that assigns costs to inventories and cost of sales based on actual costs of each item.

C)A method of estimating the cost of ending inventory by applying an average sales margin to the retail price of products.

D)This method is least appropriate for inventory items that are not distinguishable from one another.

A)A method for estimating cost of goods sold by applying an average gross margin to the amount of sales recorded in a period.

B)A method that assigns costs to inventories and cost of sales based on actual costs of each item.

C)A method of estimating the cost of ending inventory by applying an average sales margin to the retail price of products.

D)This method is least appropriate for inventory items that are not distinguishable from one another.

Unlock Deck

Unlock for access to all 156 flashcards in this deck.

Unlock Deck

k this deck

70

A fire destroyed the inventory of Mantis Company in June. Reconstructed data follows:  What was the cost of the inventory lost in the fire?

What was the cost of the inventory lost in the fire?

A)$50,000

B)$34,000

C)$30,000

D)$26,000

What was the cost of the inventory lost in the fire?

What was the cost of the inventory lost in the fire?A)$50,000

B)$34,000

C)$30,000

D)$26,000

Unlock Deck

Unlock for access to all 156 flashcards in this deck.

Unlock Deck

k this deck

71

Which statement best explains the difference between the retail inventory and gross margin methods?

A)The gross margin method estimates cost of goods sold by applying an average gross margin to the amount of sales recorded for the period.

B)The gross margin method estimates ending inventory cost using retail prices and an average gross margin.

C)The retail inventory method estimates cost of goods sold by applying an average gross margin to the amount of sales recorded for the period.

D)The retail inventory method estimates ending inventory cost using purchase prices and an average gross margin.

A)The gross margin method estimates cost of goods sold by applying an average gross margin to the amount of sales recorded for the period.

B)The gross margin method estimates ending inventory cost using retail prices and an average gross margin.

C)The retail inventory method estimates cost of goods sold by applying an average gross margin to the amount of sales recorded for the period.

D)The retail inventory method estimates ending inventory cost using purchase prices and an average gross margin.

Unlock Deck

Unlock for access to all 156 flashcards in this deck.

Unlock Deck

k this deck

72

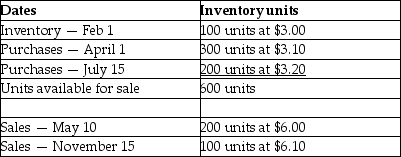

The following information was taken from the inventory records of Helena Ltd.:  What would be the cost of goods sold, assuming that the FIFO method is used in a periodic inventory system?

What would be the cost of goods sold, assuming that the FIFO method is used in a periodic inventory system?

A)$920

B)$930

C)$940

D)$950

What would be the cost of goods sold, assuming that the FIFO method is used in a periodic inventory system?

What would be the cost of goods sold, assuming that the FIFO method is used in a periodic inventory system?A)$920

B)$930

C)$940

D)$950

Unlock Deck

Unlock for access to all 156 flashcards in this deck.

Unlock Deck

k this deck

73

Which statement is not correct about the retail inventory method?

A)It is an alternative to using a cost flow assumption.

B)It is acceptable for annual financial reporting in Canada.

C)It should only be used if reliable information is available about profit margins.

D)It is a method that estimates ending inventory by applying an average sales margin.

A)It is an alternative to using a cost flow assumption.

B)It is acceptable for annual financial reporting in Canada.

C)It should only be used if reliable information is available about profit margins.

D)It is a method that estimates ending inventory by applying an average sales margin.

Unlock Deck

Unlock for access to all 156 flashcards in this deck.

Unlock Deck

k this deck

74

Which statement best explains the specific identification method?

A)A method that uses the most recent costs in the calculation of cost of sales.

B)A method that uses the cost of goods available for sale divided by the number of units available for sale.

C)A method that assigns costs to inventories and cost of sales based on actual costs of each item.

D)A method that uses the oldest costs in the calculation of cost of sales.

A)A method that uses the most recent costs in the calculation of cost of sales.

B)A method that uses the cost of goods available for sale divided by the number of units available for sale.

C)A method that assigns costs to inventories and cost of sales based on actual costs of each item.

D)A method that uses the oldest costs in the calculation of cost of sales.

Unlock Deck

Unlock for access to all 156 flashcards in this deck.

Unlock Deck

k this deck

75

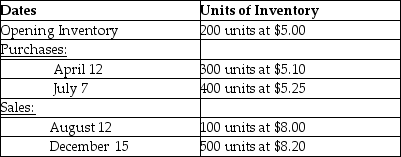

Given the following information, what would the gross margin be for the December 15 sale under the FIFO method in a perpetual inventory system?

A)$1,490

B)$1,545

C)$1,570

D)$2,075

A)$1,490

B)$1,545

C)$1,570

D)$2,075

Unlock Deck

Unlock for access to all 156 flashcards in this deck.

Unlock Deck

k this deck

76

The following information was taken from the inventory records of Hope Corp.:  What would be the ending inventory, assuming that the LIFO method is used in a periodic inventory system?

What would be the ending inventory, assuming that the LIFO method is used in a periodic inventory system?

A)$920

B)$930

C)$940

D)$950

What would be the ending inventory, assuming that the LIFO method is used in a periodic inventory system?

What would be the ending inventory, assuming that the LIFO method is used in a periodic inventory system?A)$920

B)$930

C)$940

D)$950

Unlock Deck

Unlock for access to all 156 flashcards in this deck.

Unlock Deck

k this deck

77

If the gross margin percentage used in the gross margin method were overstated (for example, 36% instead of 32%), what would happen?

A)Cost of goods sold would be overstated.

B)Ending inventory would be understated.

C)Ending inventory would be overstated.

D)Ending inventory would be correctly stated, but beginning inventory would be incorrect.

A)Cost of goods sold would be overstated.

B)Ending inventory would be understated.

C)Ending inventory would be overstated.

D)Ending inventory would be correctly stated, but beginning inventory would be incorrect.

Unlock Deck

Unlock for access to all 156 flashcards in this deck.

Unlock Deck

k this deck

78

Which statement is correct?

A)The retail inventory method estimates ending inventory cost using wholesale prices and an average gross margin.

B)The retail inventory method estimates cost of goods sold using the inventory cost flow equation.

C)The gross margin method estimates ending inventory cost using retail prices and an average gross margin.

D)The gross margin method estimates cost of goods sold using the inventory cost flow equation.

A)The retail inventory method estimates ending inventory cost using wholesale prices and an average gross margin.

B)The retail inventory method estimates cost of goods sold using the inventory cost flow equation.

C)The gross margin method estimates ending inventory cost using retail prices and an average gross margin.

D)The gross margin method estimates cost of goods sold using the inventory cost flow equation.

Unlock Deck

Unlock for access to all 156 flashcards in this deck.

Unlock Deck

k this deck

79

Which statement best explains the difference between the retail inventory and gross margin methods?

A)The retail inventory method estimates cost of goods sold by applying an average gross margin to the amount of sales recorded for the period.

B)The retail inventory method estimates ending inventory cost using wholesale prices and an average gross margin.

C)The gross margin method calculates an estimated ending inventory balance by using the inventory cost flow equation.

D)The gross margin method calculates an estimate of cost of goods sold using the inventory cost flow equation.

A)The retail inventory method estimates cost of goods sold by applying an average gross margin to the amount of sales recorded for the period.

B)The retail inventory method estimates ending inventory cost using wholesale prices and an average gross margin.

C)The gross margin method calculates an estimated ending inventory balance by using the inventory cost flow equation.

D)The gross margin method calculates an estimate of cost of goods sold using the inventory cost flow equation.

Unlock Deck

Unlock for access to all 156 flashcards in this deck.

Unlock Deck

k this deck

80

Which statement best explains the weighted average cost flow assumption?

A)A method that uses the most recent costs in the calculation of cost of sales.

B)A method that uses the cost of goods available for sale divided by the number of units available for sale.

C)A method that assigns costs to inventories and cost of sales based on actual costs of each item.

D)A method that uses the oldest costs in the calculation of cost of sales.

A)A method that uses the most recent costs in the calculation of cost of sales.

B)A method that uses the cost of goods available for sale divided by the number of units available for sale.

C)A method that assigns costs to inventories and cost of sales based on actual costs of each item.

D)A method that uses the oldest costs in the calculation of cost of sales.

Unlock Deck

Unlock for access to all 156 flashcards in this deck.

Unlock Deck

k this deck